Bridge Report:(8860)Fuji Fiscal Year ended March 2024

President Nobutsuna Miyawaki | Fuji Corporation Ltd. (8860) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Real Estate |

President | Nobutsuna Miyawaki |

HQ Address | 1-4-23 Habucho, Kishiwada-shi, Osaka |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding(excluding treasury stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥747 | 36,073,023 shares | ¥26,947 million | 9.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥27.00 | 3.6% | ¥124.75 | 6.0x | ¥1,413.94 | 0.5x |

* The share price is the closing price on June 10, 2024. The number of shares issued at the end of the most recent quarter excludes its treasury shares.

* ROE and BPS are based on FY 3/24 earnings results. EPS and DPS are based on FY 3/25 earnings estimates.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income attributable to owners of the parent | EPS | Dividend |

March 2021 Act. | 121,541 | 3,986 | 3,558 | 2,358 | 66.00 | 27.00 |

March 2022 Act. | 118,698 | 5,871 | 5,627 | 3,869 | 107.68 | 27.00 |

March 2023 Act. | 114,473 | 6,091 | 5,744 | 3,817 | 106.65 | 27.00 |

March 2024 Act. | 120,388 | 7,264 | 6,643 | 4,559 | 126.69 | 30.00 |

March 2025 Est. | 123,000 | 7,400 | 6,700 | 4,500 | 124.75 | 27.00 |

*Units: million yen, EPS and dividend are yen.

This Bridge Report provides information about Fiscal Year ended March 2024 Earnings Results of Fuji Corporation Ltd.

Table of Contents

Key Points

1. Company Overview

2. Mid-Term Management Plan (FY 3/23 to FY 3/25) and Progress

3. Fiscal Year ended March 2024 Earnings Results

4. Fiscal Year ending March 2025 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2024, sales and ordinary income grew 5.0% and 15.7%, respectively, year on year. In terms of sales, the segment of residential properties for sale and the housing distribution segment saw a decline in sales as the number of units delivered decreased, but the sales in the effective land utilization segment increased thanks to the steady progress of construction and the healthy progress of handover, and also the property leasing and management segment, which is linked to the healthy effective land utilization segment, saw a sales growth. In terms of profit, the housing distribution segment saw a decline in profit as gross profit margin dropped, but the profits in the effective land utilization segment and the property leasing and management segment increased as sales grew, and also the segment of residential properties for sale saw a profit growth as profitability improved. All kinds of profits hit a record high.

- For the fiscal year ending March 2025, sales and ordinary income are expected to grow 2.2% and 0.9%, respectively, year on year. The performance of the effective land utilization segment is projected to keep improving thanks to the strong needs of wealthy people and investors for acquisition and construction of buildings for investment, and also the performance of the property leasing and management segment is forecast to improve thanks to the increase and high occupancy rate of real estate managed by the company.The company plans to pay an interim dividend of 14 yen/share and a year-end dividend of 13 yen/share for a total of 27 yen/share per year. As the company paid a special dividend of 3 yen/share in the previous fiscal year, the annual dividend amount will decrease 3 yen/share, but the common dividend amount will be unchanged from the previous fiscal year.

- As the well-balanced business administration, which is the forte of the corporate group, performed well, the sales and all kinds of profits in fiscal year ended March 2023 and fiscal year ended March 2024 exceeded the figures in the medium-term business plan. For fiscal year ending March 2025, too, there is an increasing possibility that sales and all kinds of profits will exceed the numerical goals in the final fiscal year of the medium-term management plan, hitting a record high. On the other hand, the hurdle to the further improvement in performance is becoming higher, as their business scale is expanding. It is noteworthy what kinds of measures will be launched for expanding their business scale further.

1. Company Overview

Fuji Corporation Ltd. provides various real estate related services including sales of new and used condominiums and detached homes primarily in Osaka Prefecture (where the Company is based), between Osaka and Kobe, and within Wakayama City. Their main business is the sale of detached homes, albeit a built-for-sale type, that would maximize customer satisfaction by allowing for the “free-design home” regarding layout, specifications, etc. within the boundaries of Japan’s Building Standards Act. Fuji also boasts of strengths in the development of properties where 50 to 200 homes are constructed in coordination with the surrounding environment and each other to provide uniformity in neighborhoods. The other main pillars of the Company’s business include renovation and sale of used residential properties, collaboration with financial institutions for effective land utilization, sales of rental apartments for sale to individual investors, property leasing and management services.

Fuji boasts of unique knowhow developed in various businesses realms derived from its sales agency and detached home services. Furthermore, the complementary and synergistic effects that occur between its various business divisions allow the Company as a Complete Home Provider to respond with solutions that match the needs of home owners and residents in various geographic regions and times.

Taking advantage of its strength in community-based management, the company aims to create homes that deliver high customer satisfaction by a special relationship with customers that doesn’t end just after sell or build them a home.

In addition, each of the company's businesses, consisting of residential properties for sale, housing distribution, effective land utilization, leasing and management, and construction-related businesses, has its own know-how and promotes balanced management that complements each other’s business segments. Starting with the sublease business of rental apartment buildings for individual investors and serviced housing for seniors for individual investors, the company has been diversifying the business, operating the asset business of existing residential properties and the business of owning serviced rental housing for seniors, and expanding its recurring-revenue business that will withstand any change in economic trends.

1-1 Management ethos

The company operates for the sake of:

・Employees,

・Employees’ families,

・Customers and business partners,

・Shareholders,

・Local communities, and

・Ultimately, the nation.

The company's management ethos begins with “for employees and their families” because it believes that if employees or their families are not happy, they cannot do work that would truly please customers. By treasuring employees and their families and providing them with a sense of gratitude, pride in their work, motivation, and a sense of purpose in life, the employees will be able to value customers truly, which the company believes will lead to the happiness of all stakeholders, including business partners, shareholders, local communities, and the nation.

1-2 Business Description

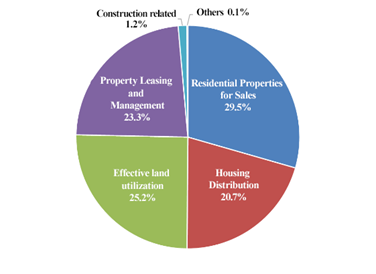

*The percentage represents the ratio of sales in each business segment to the total sales of the reporting segments (excluding internal sales).

Residential Properties for Sales (accounting for 29.5% of total sales in FY 3/2024)

Sales of detached homes and condominiums are conducted in this business. A characteristic of this business is Fuji’s ability to develop neighborhoods of new detached homes in 50 to 200 units that match the local neighborhoods, and to allow its customers to participate in the designing of the property. It is developing a town with an emphasis on freedom, safety, communities, and landscapes. More specifically, these “free-design” homes respond to the needs of individual customers by allowing them to customize the layout and specification of the homes to suit their tastes and needs. Furthermore, new condominiums for sale are also included in the residential properties for sales business segment. Fuji halted the condominium for sale business in spring of 2005, based upon the outlook for a weakening in pricing due to declines in demand and increases in supplies. However, in the aftermath of the Lehman Shock, declines in land prices and improvements in supply and demand conditions in the condominiums for sale market led Fuji to restart the condominiums for sale business in February 2012. Another feature of Fuji is its focus upon condominiums and residential properties that are carefully selected (such as their convenient proximity to stations) and that are attractively priced for first-time buyers.

(Taken from the website of the company. Left: “Architectural rendering of “Branneed Tower Nagai Garden Square” Right: “Hill of Asumo-Green Central Sakai” (Sakai-shi, Osaka)

Housing Distribution (accounting for 20.7% of total sales in FY 3/2024)

Sales of refurbished used residential property called "Kaizo Kun" is conducted in this business segment. "Kaizo Kun" refurbished used residential properties are used residential properties purchased for renovation and sales. The company's strength is its own know-how based on community-based property management and manualization of renovation. The company conducts business activities in this segment mainly in the region between Osaka City and Kobe City.

Property library on the first floor

The library always displays information on more than 1,000 properties, including those not disclosed to the public on the Internet. It is arranged so you can easily search for properties using conditions such as desired areas and preferences for new or used properties.

(Taken from the website of the company)

Housing information exhibition hall where you can look around and choose freely, "Ouchikan Main Branch" (Kishiwada, Osaka)

Effective Land Utilization (accounting for 25.2% of total sales in FY 3/2024)

Contract construction for leased properties and sales of rental apartment for sale to individual investors are conducted in this business. Construction work is performed for construction of rental residential properties sold on a proposal basis and leverages Fuji’s know-how developed in its property leasing and management business. In addition, Fuji purchases lands and then constructs rental apartment buildings for sale to individual investor in this business. The highly price competitive wooden structure apartments called “Fuji Palace” were launched in November 2008, subsequently affordable apartments for seniors with nursing-care service, which are called “Fuji Palace Senior” as a means of differentiation. With regards to rental apartments for sales to individual investors, the price for apartments is roughly 100 million yen, and the demand for these types of rental properties remains strong as a fund management method. In addition, recently, the Company has been proactively developing affordable rental apartments for seniors with nursing-care services.

(Taken from the website of the company. Left: Fuji Palace series, rental apartments for individual investors Right: “Fuji Palace Senior,” a rental apartment building for seniors with nursing-care services (Sakai-shi, Osaka)

Property Leasing and Management (accounting for 23.3% of total sales in FY 3/2024)

The fully owned subsidiary Fuji Amenity Services Co., Ltd. provides rental apartment structure management, tenant solicitation, rent collection and other management services, in addition to consigned management of condominiums. Superior rental and management related services not only act as stable source of earnings, but also provide opportunities to achieve high synergy with contract construction of rental income properties, sales of rental apartments for sale to individual investors, and sales of condominiums.

Construction related (accounting for 1.2% of total sales in FY 3/2024)

This business consists of the sales of Yuuken Kensetsu Co., Ltd., and Kansai Densetsu Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly owned subsidiaries of the company. It became a reporting segment in the first quarter of the fiscal year ended March 2021.

To further meet the demand for effective land utilization projects, the company welcomed the Yuuken Kensetsu Group as a partner in constructing steel frames and reinforced concrete structures. Yuuken Kensetsu Group has a wide range of construction achievements for government offices and private companies, mainly in Osaka prefecture. The company aims to stabilize and expand its business performance by enhancing its project lineup by providing non-wooden housing.

Other business (accounting for 0.1% of total sales in FY 3/2024)

This business segment is not included in segments to be reported, but includes the insurance agency business operated by the company.

1-3 Strengths of Fuji Corporation

◎ Creating customer-oriented homes that can take responsibility for meeting customer needs

The company’s name is derived from Mt. Fuji, with the aim of becoming "the most beloved company in Japan.” The company believes that a house is a once-or-twice-in-a-lifetime purchase, and that it must be a business that satisfies its customers to the very end. The company believes that providing safe and reliable products and services, and meeting the expectations and trust of its customers are of utmost importance, so that all its customers will be happy to say, "Fuji will take care of everything right through to the end, and I am glad I bought a house from Fuji." Since the company's founding, it has continued to build homes that are customer-focused and responsible. As a result, the company has been highly recognized by customers. This is evident through the many introductions of new customers by existing customers and cooperating companies and the repeat contracts from existing customers. Moreover, in the 2024 Oricon Customer Satisfaction ® Survey, the company has been ranked first overall for "Kinki" and "Osaka Prefecture".

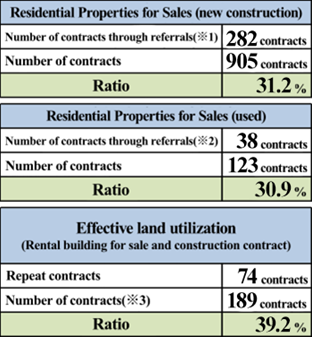

【High rate of conclusion of contracts through referrals and high rate of conclusion of repeat contracts (FY 3/2024)】

※1 The number of contracts concluded through referrals for newly constructed homes for sale is calculated based on the number of lots when multiple lots are purchased at the same time (excluding sales of land).

※2 The number of used homes is for the homes sold directly by the company without an intermediary.

※3 The number of contracts is calculated based on the date of loan approval from the purchaser's financial institution.

(Taken from the reference material of the company)

◎ Stable Business Structure with Balanced Management

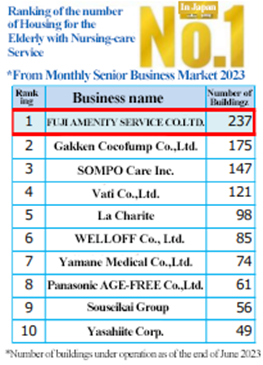

Although the company's sales area is limited to Osaka and parts of Hyogo and Wakayama Prefectures, each of its divisions boasts a national level or the largest market share within its sales area. The company's Residential Housing Division has ranked first in Osaka area builder ranking for 17 consecutive years in terms of the number of housings starts; the Residential Distribution Division ranks seventh in Japan in terms of the number of used homes purchased and resold; and the Land Use Division including a whopping 237 serviced residences, making it the No. 1 operator in Japan. “Source: Reform Industry Newspaper, Annual Ranking of Units Sold for Purchase and Resale 2023 (issued on July 31, 2023); the Elderly Housing Newspaper dated summer extra-large, 2023." The company was certified as No. 1 in the ranking of local builders in terms of housing starts in Osaka Prefecture, excluding Osaka City (Osaka City is out of scope for this survey.) (surveyed by Jutaku Sangyo Kenkyusho Co., Ltd.)

In addition, (1) the ability to conduct business that meets the needs of a wide range of customers, (2) the expansion of business opportunities by responding to a wide variety of commercialization, and (3) a high tolerance for changes in the economy and market conditions are strengths of balanced management.

【Sales composition by business segment in balance (FY 3/24)】

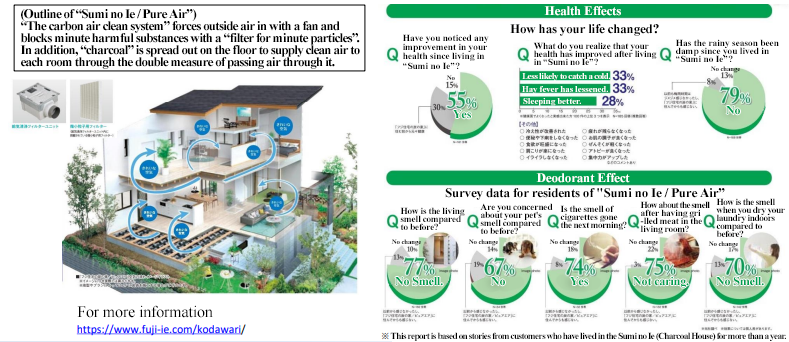

◎ Sumi no Ie(House of Charcoal) / Pure Air

Pollens, bacteria, and viruses are becoming grave problems in addition to air pollution due to such factors as exhaust gas. Fuji Corporation’s “Sumi no Ie / Pure Air” was born through its efforts of putting together the technologies that it has cultivated and focusing thoroughly on air and quality. The company has gained the right to use the patented system “Sumi no Ie” within the corporate group’s sales area, and offers safe housing as a product that differentiates it from other companies and possesses added value.

Sumi no Ie (a house with a system for purifying air with charcoal)/Pure Air is a carbon air clean system that forcibly draws in outdoor air with a fan, and blocks minute harmful substances with a microparticle filter. By putting charcoal under the floor and passing air through it, clean air is supplied to each room.

In some lots of land for sale, they hold an event for experiencing a stay at “Sumi no Ie (a house with a system for purifying air with charcoal).” This event has been held since 2019, and many people have experienced a stay at “Sumi no Ie.” In this event, those who are thinking of buying a detached house and interested in the effects of charcoal stay at a model house of “Sumi no Ie,” a detached house, for a day free of charge, to experience the effects of charcoal and the latest housing equipment.

(Taken from the reference material of the company)

*Examples of the effects felt by customers

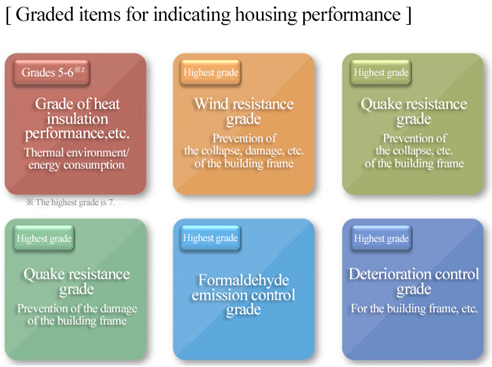

◎Provision of high-performance housing

The company considers that its mission is to provide high-quality housing where people can live while being filled with a sense of satisfaction throughout life. As one of the approaches to the mission, Fuji has obtained the housing performance assessment report for all its free design houses, and this means that the company has established a corporate system that enables it to earn the highest grades for all the housing performance indication items (having six kinds). Furthermore, the company has adopted “TRC Damper”, a vibration control system that dampens seismic vibrations, to achieve more effective prevention of walls from being damaged and furniture from falling down.

(Taken from the reference material of the company)

*The above contents are as of March 31, 2024.

*All housing units of the company got Grade 5 or higher grades for heat insulation performance, etc. according to the ZEH standards. The company also provides residential properties with Grade 6 to meet the needs of customers.

Considering the trends of the needs of customers and the market, the company plan to provide residential properties with Grade 7, too.

◎ Building a home that can be built because of their close ties to the local community

The company's founding spirit is to "keep taking care of a house after sold or built." The company is committed to continuing its dense business within the scope of its customers' face-to-face contact, and to ensuring a complete after-sales follow-up system, which is why it does not expand its business nationwide. In line with its founding spirit, the company aims to create high-quality housing that is community-based so that customers who have been with the company for decades can continue to live with peace of mind.

◎ Used asset business in collaboration with the leasing management division

The used asset business acquires used condominiums that are already rented. This business model profits by collecting rents until tenants move out, and then the company renovates and resells the properties by collaborating with the leasing management business division. The company is one of the leading companies in Japan in the property purchase and resale business that renovates and resells vacant, used homes. The company owns 848 properties in Osaka Prefecture and the Hanshinkan area. Namely, it holds a significant number of properties in Kansai, being comparable to the largest companies in the same industry. In addition, the company has diversified exit strategies, such as re-leasing properties with existing tenants as investment properties or selling them with the tenants living in them. Using the corporate group's leasing management division enables the company to manage the properties flexibly according to their attributes. The average area of properties owned as of the end of March 2024 is 64.03m2, and the average building age is about 30 years. Regarding the location of the properties, 58% of them are in Osaka prefecture, and 33% are in Hyogo prefecture, making them the regions with the largest number of properties.

Number of Owned Properties and Percentage of Owned Properties | ||

Region | Number of owned properties (houses) | Percentage of owned properties |

Osaka | 488 | 58% |

Hyogo | 283 | 33% |

Kyoto | 59 | 7% |

Nara | 18 | 2% |

Total | 848 | 100% |

*Properties owned at the end of March 2024

◎ No sales consignment. The company’s employees handle all sales.

The company sells about 1,000 new condominium units annually, and the company's employees conduct sales activities at all sales sites. The company's employees handle land purchase, sales, plan design, construction site management, and after-sales follow-up. The company conducts face-to-face sales activities in an intensive and responsible manner aiming for the best customer satisfaction in Japan and pursuing customer happiness. In the sales department, there are no sales performance graphs for individual employees, but customer reviews and report graphs. The company places great importance on the positive reviews it receives from its customers and is promoting its sales activities by upholding the principles of " a special relationship with customers that doesn’t end just after sell or build them a home."

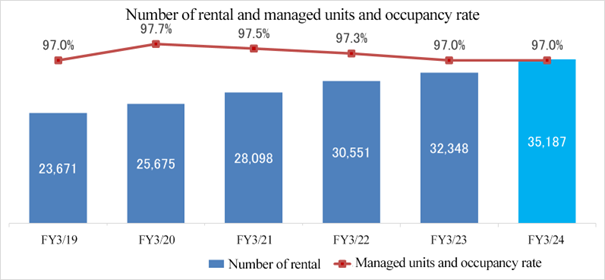

◎ Leasing management that has maintained a high occupancy rate of 97% or higher for the past five consecutive years

As of the end of March 2024, the number of rental housing units managed by the company is 35,187 (the number of rental residential buildings managed by the company is 2,436), the number of rental housing units managed by the company after renting whole buildings is 31,275 (the number of rental residential buildings rented and managed by the company is 2,293), and occupancy rate is 97.0%. In the past 5 years, occupancy rate has been as high as 97% or higher. This is thanks to the company carefully selecting the location of each property so that its buyer can manage the property with peace of mind over the long term, as well as (1) the company's ability to attract customers through strong cooperation with brokerage companies, (2) its high level of property management, and (3) the rapid and flexible management system due to division of labor.

◎ Stable supply of high-quality housing based on deep trusting relationships with cooperative firms

In order to provide high-quality housing, the company holds a meeting of the council for safety and health every month and a conference of the association for on-site cooperation once a year, to share the management philosophy of the company and carry out the thoroughgoing management of safety and quality. At the conference of the association for on-site cooperation in fiscal year 2023, approx. 900 people of cooperative firms got together, and held a ceremony for commending companies and artisans who aim to “bring happiness to customers” together with Fuji Corporation. In addition, they hold a ceremony for offering letters of appreciation to cooperative firms that make daily efforts to satisfy customers three times a year to express their thanks. Fuji Corporation and cooperative firms join hands to provide high-quality housing in a stable manner.

1-4 Efforts for ESG and SDGs

Fuji Corporation aims to become a corporate group that continues growing sustainably together with the society and builds up trust by contributing to the society while being conscious of the relationship of its community-based property management activities with Environmental, Social, and Corporate Governance (ESG) and the Sustainable Development Goals (SDGs).

Environment | ||

Activity | Fuji Group’s efforts | SDGs |

Environmentally friendly business activities | Efforts in the refurbished used residential properties business Renovation of used residential properties produces significantly less CO2 and waste than house reconstruction, which directly results in conservation of resources.

Total heat exchange system that comes with the indoor air quality (IAQ) control system Fuji’s “Sumi no Ie / Pure Air” is energy-saving houses equipped with the total heat exchange system that prevents loss of thermal energy due to ventilation.

Precut technique Fuji lightens environmental burdens by reducing waste materials with the precut technique in which wood, which is machined at factories in advance, is assembled on site.

Cellulose fiber (heat insulation) Cellulose fibers that Fuji adopts as heat insulation are made by recycling old newspapers that were not delivered and can be produced with significantly less energy than glass wool, the general internal heat insulation.

Participation in OSAKA Zero Carbon Smart City Foundation The company participated in the OSAKA Zero Carbon Smart City Foundation to play a leading role in realizing a decarbonized society by 2050 by materializing even more ambitious and advanced initiatives related to the SDGs from Osaka and spreading them nationwide. | 6. Clean water and sanitation

7.Affordable and clean energy

9. Industry, Innovation and infrastructure

11.Sustainable cities and communities

12.Responsible consumption and production

13. Climate action

15.Life on land |

Promoting the use of sustainable wood | Aiming for a sustainable society with wooden detached housing In November 2022, the company became an SDGs member of the Japan Wood-Housing Association because the objective of the initiatives of Japan Wood-Housing Association, "Establishing a sustainable and developmental cycle of domestic timber and solving environmental problems," is in line with the company's basic sustainability policy, and the company can strongly support it as a wooden house manufacturer. | |

Environment conservation activities by employees | Volunteer Tree-Planting "Fuji Housing Forest" (Hidakagawa-cho, Hidaka-gun, Wakayama Prefecture) A 2.16-hectare forest in Hidakagawa-cho, Hidaka-gun, Wakayama Prefecture, has been named "Fuji Housing Forest.” The company's employees and their families volunteer to plant and nurture trees. Through these activities, as a member of the local community, the company is contributing to the preservation of the local natural environment and raising environmental awareness. | 6. Clean water and sanitation

7. Affordable and clean energy

9. Industries, innovation and infrastructure

12.Responsible consumption and production

13. Climate action

15. Life on land |

Improvement of the environmental friendliness in the office environment | Various Internal Initiatives for Environmental Conservation -Fuji has replaced all its company vehicles for sales activities with hybrid vehicles. -Fuji has gone paperless (abolished the practice of putting seals) for internal documents by adopting an electronic approval system. -Replace the lamps at offices and the advertisement tower of the headquarters building with LED lamps -Fuji promotes energy conservation by maintaining the room temperature constant through its proactive cool-biz campaign. -Fuji dissolves internally used paper to use them as recycled paper. -Fuji has installed a demand monitoring system that monitors the maximum electric power demanded in its offices and controls electric power. | |

Establishment of TCFD Working Group | Promotion of initiatives with an awareness of the relationship between ESG and SDGs and the Company's business activities with community-based management TCFD Working Group was established on April 12, 2022. Based on the framework proposed by the TCFD recommendations regarding the impact of climate change on the company's business, the group is examining future changes in the external environment and promoting initiatives based on the Basic Sustainability Policy. | |

Social | ||

Activity | Fuji Group’s efforts | SDGs |

Establishment of a comfortable work environment (1) | Health Management Initiatives “A company’s performance is determined by its personnel. Without the health and happiness of employees, customer satisfaction or company growth cannot be achieved.” The company has believed this since its establishment, and for its customers to be truly happy, it is important for its employees to be healthy in mind and body, to take pride in their work, to have a sense of fulfillment, and to lead fulfilling lives both in their professional and personal lives. The company considers the health management of its employees from a managerial perspective and is committed to creating a workplace environment that will lead to increased corporate value over the long term. For the seventh consecutive year, the company has been recognized by the Ministry of Economy, Trade and Industry (METI) in collaboration with the Japan Health Council as a "White 500" company in the category of "Large Corporations for Excellent Health Management 2023." In March 2024, the company was commended by the Ministry of Health, Labour and Welfare as “an excellent enterprise promoting anticancer measures” for the second time after last year.

Specific Health Management Measures The company's Board of Directors has adopted a policy of priority measures for health promotion. Among the various priority measures, the company has positioned health checkups for all employees, including part-timers, as an important issue. In addition to the legally required medical checkups, many additional items are added (tumor marker test, H. pylori test, breast cancer echo test for all female employees, and CA19-9 cancer marker test to detect pancreatic cancer, bile duct cancer, and gall bladder cancer starting in April 2022). Employees are now able to monitor their own health daily by undergoing health checkups and seeing the results. The company has set a goal of 100% of employees undergoing health checkups, including the added items, and has achieved a 100% health checkup rate for the past 10 years. The company aims to improve long-term business performance through ongoing efforts to maintain and promote employee health. | 1. No Poverty

3. Good Health & Wellbeing

4. Quality Education

5. Gender Equality

8. Decent Work and Economic Growth

10. Reduced Inequalities

|

Establishment of a comfortable work environment (2) | Promoting Workplace Reform through the Introduction of Telework The Company promotes telework as a flexible work style that is not restricted by location or time, utilizing ICT (Information and Communication Technology), and received the "Minister of Internal Affairs and Communications Award for the 100 Pioneers of Telework" in 2018 and selected for the "Telework Promotion Award for Excellence" in 2020 and 2022. The company believes that the promotion of telework will lead to the balancing of work and childcare/nursing care, help people with disabilities who have difficulty commuting, secure excellent human resources in rural areas, and establish a business continuity plan (BCP), which will lead to the enhancement of their corporate value.

A proactive approach to sports In support of the idea that the inherent value of sports is that they support "people's lifelong commitment to a healthy and cultured lifestyle in both mind and body," the company has been involved in a variety of sports-related initiatives, including the installation of a box-type hyperbaric oxygen box (maximum capacity of 10 people) for stretching and training, holding walking events, and encouraging people to walk to work in sneakers (the company was recognized as Bronze of "Sports Yell Company 2024" on January 23, 2024). | 1.No poverty

3.Good health and well-being

4.Quality education

5.Gender equality

8. Decent work and economic growth

10.Reduced inequalities

|

Establishment of a comfortable work environment (3) | Operation of Shirahama Recreation Center The company owns a recreation facility in Shirahama-cho, Nishimuro-gun, Wakayama Prefecture, which can be used by all employees, including part-time and temporary employees, including those of group companies. The sanatorium is conveniently located just a 2-minute walk from Shirahama Beach, and offers a hot spring with natural spring water and delicious food using local specialties at a reasonable price. The facility is operated with the aim of "for employees and their families" so that employees can spend a relaxing time with their families and loved ones. | |

Residential development with consideration for safety and security, beautiful scenery, and local community revitalization

| Safe and secure community development The open exterior of the house gives an open, bright, and beautiful impression. In addition, it has the advantage in terms of crime prevention that it is difficult for suspicious people to enter the house because it has a sweeping view. The roads in the town are curved lines based on gentle curves, which naturally reduce the speed of cars and make the town safer.

Community Revitalization Town parks and meeting places have been established as community spaces where anyone, from children to the elderly, can casually drop by, aiming to create a "connected" town where the smiles of the people who live there abound. | 1. No Poverty

2. Zero Hunger

3. Good Health & Wellbeing

10. Reduced Inequalities

11. Sustainable Cities and Communities |

Development of health-oriented homes | Fuji Charcoal House/Pure Air In contrast to the general 24-hour ventilation system of "natural air supply + forced exhaust," Fuji employs a "forced air supply + forced exhaust" system with a fan. In addition, the house is equipped with a double measure to block harmful substances by using a "filter for minute particles" when supplying air, and to pass air through charcoal installed under the floor to remove harmful substances with a particle diameter of 0.5 μm or greater (PM2.5, yellow sand, bacteria, pollen, etc.), keeping clean and clean air in the house 24 hours a day. The company strives to build houses that are healthy and comfortable. | |

Cooperation in support activities for Asian countries | Support activities through Asia Child Support In March 2024, the company received a letter of appreciation from Asian Child Support. The company has set up donation boxes at its head office building and offices, and sends donations received from employees, customers who visit the company, and subcontractors. The company plans to continue its support for the relief efforts. | |

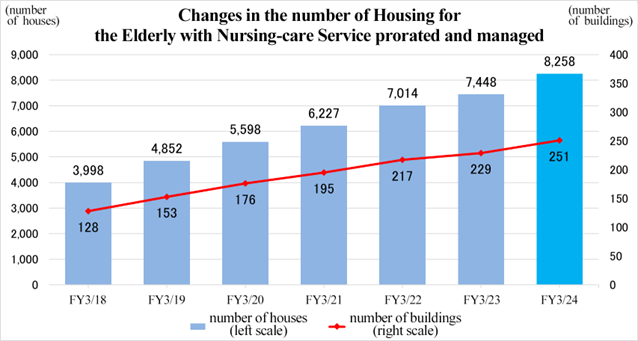

Efforts against the aging society | Development of affordable rental apartments for seniors with nursing-care services The birthrate has been decreasing and the population has been aging rapidly in recent years, and the ratio of people aged 65 and older to the total population is expected to exceed 30% in 2025. Under these circumstances, how houses as final abodes should be and enrichment of such services as nursing care and medical treatment are crucial social issues. The corporate group provides affordable and quality affordable rental apartments for seniors with nursing-care services based on a concept of housing at which people can entrust their parents with a sense of safety, and the number of the rental housings that it operates is more than 250 and No. 1 in Japan. It aims to continue building rental housings in which elderly can continuously lead safe, healthy, and enriched life.

Use of "ESG Target Setting Loan Try Now" On December 24, 2021, the company received a 500 million yen loan from Minato Bank, Kansai Mirai Financial Group, using the "ESG Target Setting Loan Try Now." This loan was set with the goal of increasing the number of serviced senior housing units supplied above a certain number, with the aim of contributing to the spread of safe and secure housing in an aging society.

Utilization of Sustainability Linked Loans The company received a loan of 1 billion yen from Kiyo Bank on Oct. 31, 2022, and a Sustainability Linked Loan of 500 million yen from Chugoku Bank on Apr. 3, 2023 and 500 million yen from Senshu Ikeda Bank on Mar. 29, 2024. The company aims to enhance its sustainability management by setting a target value for sustainability activities aimed at contributing to the resolution of social issues, which is "To increase the number of houses for the elderly that provide services (such as nursing care) by approximately 5% annually." | 3. Good Health & Wellbeing

11. Sustainable Cities and Communities |

Contribution to local community | Blue crime prevention patrol Fuji Corporation has formed the Fuji Blue Crime Prevention Patrol Team in cooperation with Kishiwada Police Station with the aim of protecting the safety of the children in the area and eliminating street crimes, and strives to prevent local crimes in the school zones in Kishiwada City as a company. For this activity contributing to crime prevention, the company was commended by the chief of Osaka Prefectural Police and Osaka Federation of Associations for Crime Prevention in the occupational section on September 30, 2023.

Donation to the Osaka Nursing Association Fuji gratefully donated to healthcare workers who have been devoting themselves to providing medical services and those who have been committed to continuing the medical system amid the COVID-19 pandemic.

Environmental beautification activities Fuji’s employees clean the roads around the headquarters building, Higashi-Kishiwada building, and each “Ouchi Kan” shop, including the roads in front of the buildings and shops, which has allowed the sidewalk in front of the Higashi-Kishiwada building to be recognized by Osaka Prefecture as Adopt Road Habu-cho 2-Chome. The company has won a number of awards for its efforts for road beautification and contribution to cleanup activities in the community.

Promotion of e-Tax The Regional Taxation Bureau proactively promotes e-Tax, a system that allows its users to file final tax returns using the Internet. Fuji encourages all its officers and employees to use e-Tax for filing tax returns and received a letter of appreciation for the effort from the superintendent of Kishiwada Tax Office in May of 2021. | 4. Quality education

11.Sustainable cities and communities

15.Life on land |

Governance | ||

Activity | Fuji Group’s efforts | SDGs |

Governance enhancement based on the organizational structures | The Board of Directors, the Audit & Supervisory Board, and other organizational structures for enhancing corporate governance Fuji’s Board of Directors consists of seven directors (including two outside directors) and its Audit & Supervisory Board is composed of three auditors (including two outside auditors), and the company has set up a risk compliance promotion committee and an internal control promotion committee, established an internal reporting system, and TCFD working group. | 4.Quality education

5.Gender equality

8.Decent work and economic growth

12.Responsible consumption and production

16. Peace, justice and strong institutions |

Governance enhancement through human resources development | Booklet of the management philosophy and policies Exactly as stated by the words “The enterprise is its people,” Fuji Corporation gives the top priority to development of human resources. It requires all its employees to carry the booklet of the management philosophy and policies so that they can move forward unwaveringly toward the same goal and purpose, and strives to develop human resources so that all the officers and employees fully understand and follow the management philosophy and policies and to raise the ratio of such human resources.

Direct dialogue between the management and the employees Fuji regularly holds meetings for asking questions for the chairman and the president in which employees can have direct dialogue with the chairman and the president. The chairman and the president themselves are committed to settling not only the employees’ work-related issues, but also troubles and issues in their private life through telephone meetings with each employee who has questions. The company believes that direct dialogue between the employees and the management helps cement the relationship of trust and increase a sense of belonging among its employees, and thus it is essential for enhancing corporate governance through understanding and implementation of the management philosophy and policies.

360-degree personnel assessment system Believing that development of human resources that have excellent insight, boldness, and judgment, and thoroughly follow the management philosophy and policies contributes to long-term improvement of its corporate value, Fuji has adopted a fair and equitable personal assessment system, 360-degree personnel assessment system, that assesses the employees from all viewpoints, including not only their direct bosses but their co-workers, subordinates, and the officers in other departments. | |

Governance enhancement through customer satisfaction improvement | Insatiable pursuit of customer satisfaction Fuji records words of joy and appreciation from customers on its “Bravo Card” and “Thank You Report,” and complaints and words of scolding on the “Yellow Card.” They are shared among the internal departments concerned and used for resolving issues arising in the worksites and assessing personnel, and the company believes that these efforts to gain greater customer satisfaction with a focus on the worksites will help identify true needs and fundamental issues and problems, and will directly result in enhanced governance.

In the "2024 Oricon Customer Satisfaction® Survey," the company was awarded double honors for the fourth year in a ro No. 1 in the "2024 Oricon Customer Satisfaction® Survey for Builders of Built-for-Sale Housing in the Kinki Region" and No. 1 in the "2024 Oricon Customer Satisfaction® Survey for Builders of Built-for-Sale Housing in the Kinki Region, Osaka Prefecture. They ranked No. 1 overall in the Kinki region for the fourth consecutive year and No. 1 in Osaka Prefecture for the fifth consecutive year. | 4.Quality education

8.Decent work and economic growth

10.Reduced inequalities

12. Responsible consumption and production

16. Peace, justice, and strong institutions |

Proactive dialogue with the stakeholders | Holding IR events and dialogue with the shareholders and institutional investors Fuji holds company information sessions for individual investors and for analysts and institutional investors as necessary in Osaka and Tokyo, accepts requests from its institutional investors and other parties concerned for interviews and telephone meetings to a reasonable extent, and holds an online session for describing the company, which is hosted by a securities firm, several times per year. It endeavors to give as clear explanations as possible in understandable words to inquiries from its individual investors, and has proactive dialogue with them via the shareholder questionnaire enclosed in the shareholder newsletters published twice a year. Fuji Corporation believes that constructive dialogue with the shareholders and investors will contribute to its medium- and long-term corporate value enhancement and sustainable growth. | |

Strengthening relationships with business partners | Holding of a session for explaining the consumption tax invoice system Before the launch of the invoice system in October 2023 due to the revision to the consumption tax law, the company invited the staff of the Kishiwada tax office and held a briefing session for the company's business partners, and a large number of people (about 200 people) participated. | |

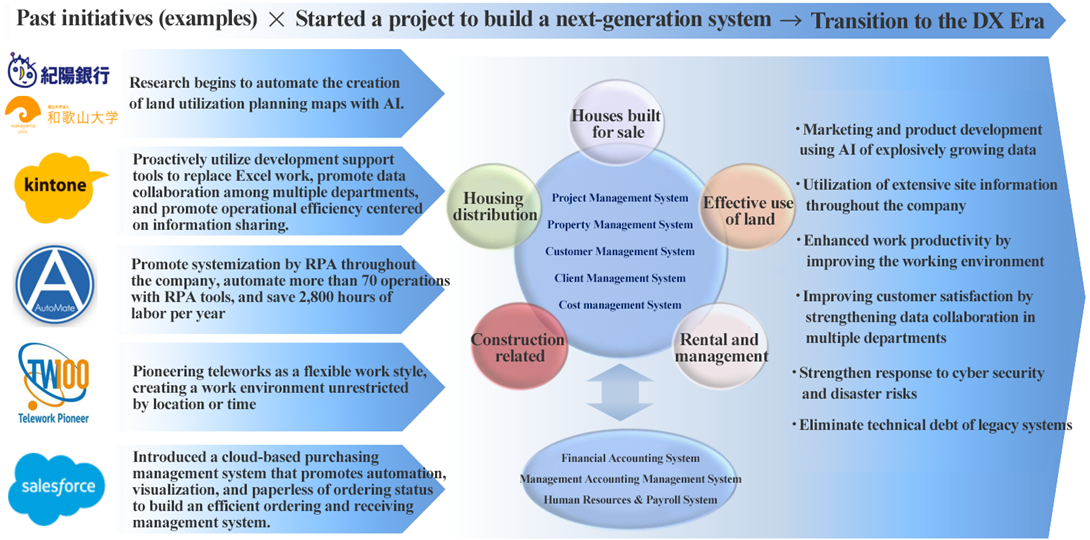

1-5 DX (Digital Transformation) Initiatives

To promote next-generation system construction projects to dramatically accelerate the improvement of duplicated operations through overall optimization and the improvement of operational efficiency through information sharing, with the aim of building a system infrastructure that is resistant to change.

(Taken from the reference material of the company)

2. Mid-Term Management Plan (FY 3/23 to FY 3/25) and Progress

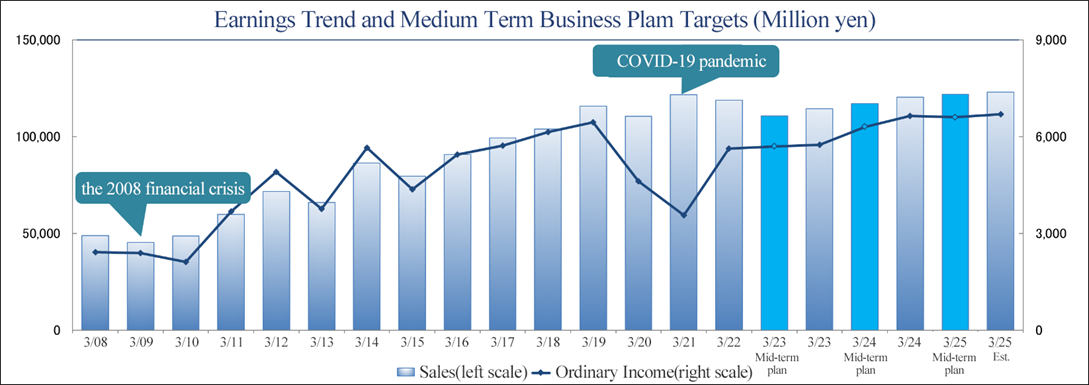

The company formulated a medium-term management plan for the next three years from the fiscal year ended March 2023. The business environment surrounding the real estate industry, the rise in land prices over the past several years, the increase in timber prices due to the lumber shortage and the rise in building costs due to a series of price hikes in housing equipment are expected to be reflected in selling prices, and the increasingly uncertain economic conditions are expected to exacerbate the severity of the sales environment. In this environment, the company aims to maximize its synergy effect by strengthening cooperation among the five business segments of the group, making efforts to further create a stable earnings structure with an emphasis on recurring revenues that can withstand unexpected changes in the economic environment, and contributing to the realization of a sustainable society through human resources development. In fiscal year ending March 2025, the final year of the medium-term management plan, the company aims to set new records in sales as well as all kinds of profits. The company is aiming for 121.8 billion yen in sales and 7 billion yen in operating income for fiscal year ending March 2025.

Medium Term Business Plan Targets

| FY 3/23 Mid-Term Plan | FY3/23 Act. | FY3/24 Plan | FY3/24 Act. | FY 3/25 Mid-Term Plan | FY 3/25 The company’s plan |

Sales | 110,600 | 114,473 | 117,000 | 120,388 | 121,800 | 123,000 |

Operating Income | 6,000 | 6,286 | 6,800 | 7,264 | 7,000 | 7,400 |

Ordinary Income | 5,700 | 5,744 | 6,300 | 6,643 | 6,600 | 6,700 |

Net Income | 3,800 | 3,817 | 4,200 | 4,559 | 4,400 | 4,500 |

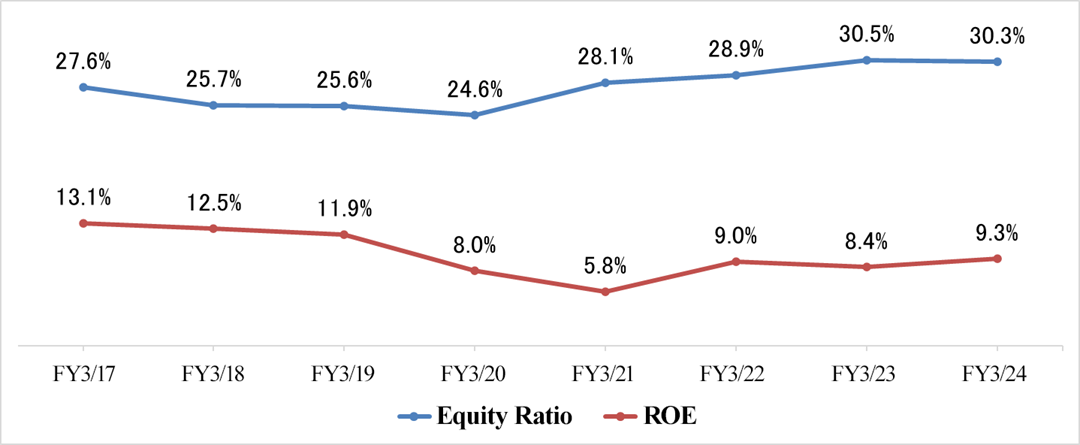

ROE | 8.4% | 8.4% | 8.7% | 9.3% | 8.4% | - |

Capital adequacy ratio | Over 25% | 30.5% | Over 25% | 30.3% | Over 25% | - |

*Units: million yen

The sales and all kinds of profits in fiscal year ended March 2023 and fiscal year ended March 2024 exceeded the figures in the medium-term business plan. For fiscal year ending March 2025, which is the final fiscal year of the plan, it was forecast at the beginning of the fiscal year that sales and all kinds of profits would exceed the figures in the medium-term business plan.

2-1 Assumptions for the Medium-Term Management Plan and Progress

Plan for FY 3/23

Profit is expected to increase year on year due to the development of a stable revenue structure based on recurring revenues.

Although the number of new detached houses delivered decreased year on year due to a decrease of orders received in the second half of the previous fiscal year as a result of the shrinkage of the special demand brought about by the COVID-19 pandemic, profit in the property leasing and management business is expected to exceed 3 billion yen due to an increase in the number of housing units under management accompanying the steady delivery of rental apartments and construction contracts for individual investors, thereby stabilizing the revenue base. The company plans to complete and deliver three condominium buildings to compensate for the decline in the number of newly built detached houses. Regarding construction contracts, sales based on percentage of completion because of favorable orders in the previous term contributed to profit. In the construction-related segment, the renovated apartment building for seniors with nursing-care services (Nishinomiya City), the second one since the Yuuken Kensetsu Group became a subsidiary, will be completed, and delivered.

In the fiscal year ended March 2023, all goals in the plan were achieved.

Plan for FY 3/24

Performance recovered to the level of the fiscal year ended March 2022 due to the completion and delivery of three condominium buildings as well as steady growth in the leasing and management segment.

Three condominium buildings are scheduled to be completed and delivered, driving the performance of the residential housing segment. In the housing distribution segment, the company will continue to adopt selective purchasing policies and focus on the highly competitive and profitable existing housing asset business. Regarding construction contracts, 54 buildings are scheduled to be delivered, which will drive the performance of the effective land utilization segment. In the leasing and management segment, sales will exceed 25 billion yen due to a steady increase in the number of housing units under management, contributing to the stabilization of the revenue base.

In the fiscal year ended March 2023, all goals in the plan were achieved.

Plan for FY 3/25

Consolidated sales and consolidated operating income reached record highs due to an increase in the delivery of condominiums and rental apartment buildings for individual investors.

Five condominium buildings are scheduled to be completed and delivered, and consolidated net sales and consolidated operating income are expected to reach record highs due to the recovery of sales in the residential housing segment to the level of 40 billion yen and an increase in the delivery of rental apartment buildings for individual investors. The company plans to increase the number of residences with health and welfare services for the elderly to 50. In the leasing and management segment, the number of housing units under management has exceeded 35,000, and the construction of long-term stable infrastructure is progressing steadily.

For fiscal year ending March 2025, the company forecasts that sales and all kinds of profits will exceed the figures in the medium-term business plan.

2-2 Performance Trends and a Medium-Term Management Plan

Despite the worsening of the external environment, including the skyrocketing of costs for procuring land due to the rise in land prices and the hovering of construction costs due to the soaring of prices of materials, sales and all kinds of profits exceeded the figures in the medium-term business plan in fiscal year ended March 2023 and fiscal year ended March 2024, while all kinds of profits hit a record high in fiscal year ended March 2024. For fiscal year ending March 2025, which is the final fiscal year of the plan, the company forecasted at the beginning of the fiscal year that sales and all kinds of profits would exceed the figures in the medium-term business plan.

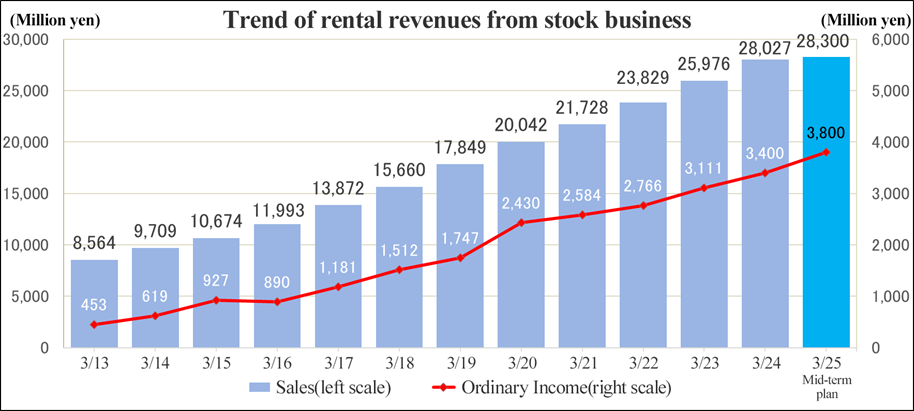

2-3 Variation in Rental Income from Recurring-Revenue Business

Revenues from the recurring-revenue business are expected to remain strong in the current plan period as a result of steady growth in construction contracts and rental apartment buildings for individual investors in the effective land utilization business and the sale and delivery of condominiums in the residential housing business. The company will continue with its efforts to create a stable revenue structure with an emphasis on recurring revenues and aim to establish a business foundation that can withstand unexpected changes in the economic environment.

2-4 Business Strategies by Segment

Medium-Term Management Plan Targets for each Industry Segment

Segment Sales | FY 3/23 Mid-Term | FY 3/23 Act | FY 3/24 Mid-Term | FY 3/24 Act | FY 3/25 Mid-Term |

Residential Properties for Sales | 34,900 | 36,495 | 39,100 | 35,461 | 41,300 |

Housing Distribution | 25,700 | 25,628 | 25,400 | 24,881 | 26,500 |

Effective Land Utilization | 25,100 | 25,133 | 26,000 | 30,342 | 25,900 |

Property Leasing and Management | 24,400 | 25,976 | 26,300 | 28,027 | 28,300 |

Construction related | 2,100 | 1,239 | 2,100 | 1,500 | 2,200 |

Segment Profits | FY 3/23 Mid-Term | FY 3/23 Act | FY 3/24 Mid-Term | FY 3/24 Act | FY 3/25 Mid-Term |

Residential Properties for Sales | 700 | 1,237 | 1,300 | 1,856 | 1,300 |

Housing Distribution | 1,400 | 1,370 | 1,400 | 909 | 1,500 |

Effective Land Utilization | 2,300 | 2,217 | 2,400 | 2,952 | 2,300 |

Property Leasing and Management | 3,300 | 3,111 | 3,500 | 3,400 | 3,800 |

Construction related | 60 | -14 | 60 | -19 | 70 |

* Units: million yen

* Segment profits before adjustments. Intersegment transactions are included.

* Derived from Fuji Corporation’s Medium-Term Management Plan announced on May 10, 2022.

Residential Properties for Sales Business

The current plan calls for the completion and delivery condominium buildings: 3 in the fiscal year ending March 2023, 4 in the fiscal year ending March 2024 and 4 in the fiscal year ending March 2025, driving one-shot revenues in each fiscal year. The aim of the project will continue to be “Creation of Homes that Bring Happiness,” providing residential areas with higher added value that will serve as landmarks in the surrounding areas with beautiful scenery, safety, and community.

Housing Distribution Business

Continuing with the inventory optimization and profit-oriented selective procurement policies established in the previous plan period, the company aims to further stabilize its revenue base, centered on the existing housing asset business, which has competitive advantages and is highly profitable. The existing housing asset business is a business that acquires existing housing units with tenants, and collects rental income as profit-yielding real estate and profit through resale. This business model, which requires rental management and long-term funding, has a higher barrier to entry than the purchase and resale business, in which competition is intensifying. This will serve as collateral against the risk of a decline in resale prices due to rental income, lead to the diversification of exit strategies in anticipation of sales to investors as well as actual demand, and contribute to further stabilization of the profit base. Under the current plan, the number of owned units will be kept about 1,000 and the annual rental income will be about 1.1 billion yen.

Effective Land Utilization Business

The demand for residences with health and welfare services for the elderly is expected to increase further as property inheritance and inheritance tax measures are taken and as the population ages. The demand for rental apartment buildings for individual investors is also expected to continue due to the impact of monetary easing.

The company will aim to build a more trustworthy relationship with owners and those who introduce them (tax accountants, financial institutions, etc.) and to improve the rates of repeat orders and referrals.

【Delivery Plan】

| FY 3/22 Act | FY 3/23 Mid-Term | FY 3/23 Act. | FY 3/24 Mid-Term | FY 3/24 Act. | FY 3/25 Mid-Term |

No. of Rental Apartment Buildings | 130 | 130 | 125 | 128 | 137 | 147 |

No. of Construction Contracts | 40 | 32 | 29 | 54 | 59 | 43 |

Property Leasing and Management Business

This business is expected to remain strong in the current plan period, too, due to construction contracts and rental apartment buildings for individual investors in the effective land utilization business and the sale and delivery of condominiums in the residential housing business. The ratio of the profit in the property leasing and management business has been increasing year by year and is expected to remain steady.

【Number of Housing Units Under Management and Occupancy Rate Forecast】

| FY 3/22 Act | FY 3/23 Mid-Term | FY 3/23 Act. | FY 3/24 Mid-Term | FY 3/24 Act. | FY 3/25 Mid-Term |

Number of Housing Units Under Management (houses) | 30,551 | 32,500 | 32,348 | 34,700 | 35,187 | 37,000 |

Occupancy Rate | 97.3% | 97.0% | 97.0% | 97.0% | 97.0% | 97.0% |

Construction-related Businesses

In January 2020, the company invited the Yuuken Kensetsu Group, which has a track record in steel frame and reinforced concrete construction, as a partner. In addition to providing steel frame houses in the "Fuji Palace Senior" apartment for seniors with nursing-care services, the company is also engaged in public works, mainly in construction and civil engineering. The company aims to expand its business lineup through in-house construction of steel frame and reinforced concrete structures and to achieve stable earnings growth. In February 2022, in its first cooperation with Yuuken Kensetsu Group, the company finished the construction of a steel-frame apartment building for seniors with nursing-care services in Minamisuita, Suita City, Osaka Prefecture. During the current plan period, the company plans to complete the renovation and delivery of the second apartment building for seniors with nursing-care services (Nishinomiya City) since the Yuuken Kensetsu Group became a subsidiary. The company plans to further enhance the synergy effects of such collaborations.

3. Fiscal Year ended March 2024 Earnings Results

3-1 Consolidated Results

| FY 3/23 | Ratio to sales | FY 3/24 | Ratio to sales | YoY | The company’s forecast | Ratio to forecasts |

Sales | 114,669 | 100.0% | 120,388 | 100.0% | +5.0% | 120,000 | +0.3% |

Gross Income | 17,146 | 15.0% | 18,619 | 15.5% | +8.6% | - | - |

SG&A | 10,859 | 9.5% | 11,354 | 9.4% | +4.6% | - | - |

Operating Income | 6,286 | 5.5% | 7,264 | 6.0% | +15.6% | 6,400 | +13.5% |

Ordinary Income | 5,744 | 5.0% | 6,643 | 5.5% | +15.7% | 6,000 | +10.7% |

Profit attributable to owners of parent | 3,817 | 3.3% | 4,559 | 3.8% | +19.4% | 4,000 | +14.0% |

* Data in this table and other parts of this report include figures which have been calculated by Investment Bridge, and may differ from those of the Company (same as below)

* Units: million yen

*Created by Investment Bridge based on disclosed material of the company.

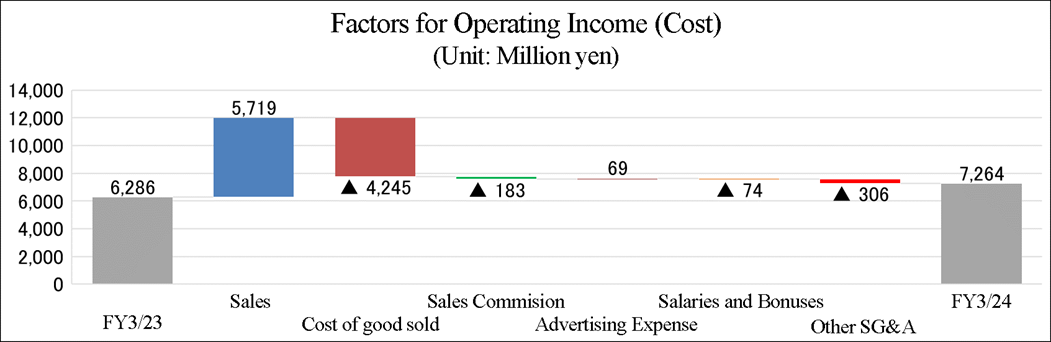

*▲ of expense account indicates that the expense has increased.

Sales and ordinary income grew 5.0% and 15.7%, respectively, year on year.

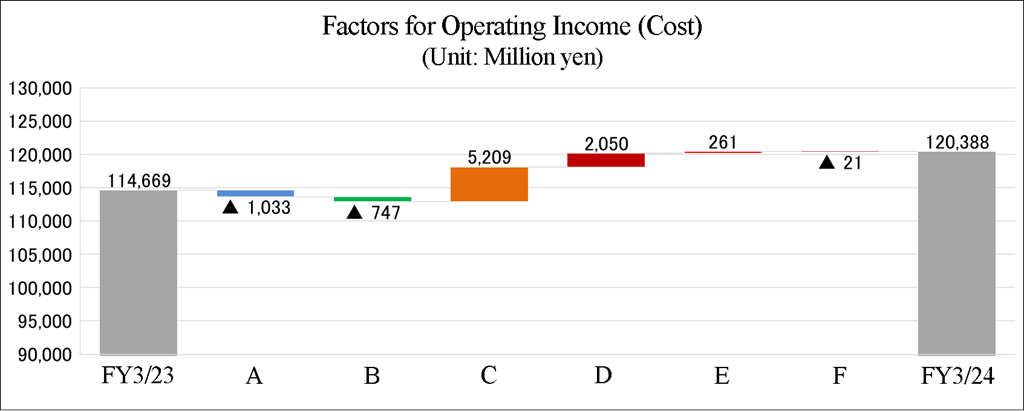

In the fiscal year ended March 2024, sales grew 5.0% year on year to 120,388 million yen. In terms of sales, the segment of residential properties for sale and the housing distribution segment saw a decline in sales as the number of units delivered decreased, but the sales in the effective land utilization segment increased significantly as the commissioned construction of residential properties for rental, etc., the construction of rental apartments for seniors with nursing-care services, and the handover of rental apartment buildings for individual investors progressed healthily. Accordingly, the sales of the property leasing and management segment linked with the healthy effective land utilization segment increased as planned.

Ordinary income rose 15.7% year on year to 6,643 million yen. In terms of profit, the housing distribution segment saw a decline in profit as gross profit margin dropped, but the profit in the effective land utilization segment increased through the improvement in profitability although the number of units delivered decreased. In the effective land utilization segment and the property leasing and management segment, profit grew as sales increased. Namely, overall performance improved from the previous fiscal year. Gross profit margin rose 0.5 points year on year to 15.5%. SG&A expenses augmented 4.6% year on year, due to the increases in sales commissions, personnel expenses, bonuses, etc., but operating income increased 15.6% year on year to 7,264 million yen. Operating income margin increased 0.5 points year on year to 6.0%. The growth rate of ordinary income exceeded that of operating income slightly, as commitment fees in non-operating expenses decreased. In the section of extraordinary income or loss, a gain on sale of fixed assets of 12 million yen was dominant, and there was a tax break due to the tax system for promoting employers to increase salaries. Accordingly, net income attributable to shareholders of the parent company increased 19.4% year on year.

Sales were the second largest following those in fiscal year ended March 2021. Considering the fact that the company sold undeveloped land for large-scale sale of residential properties in Kakogawa-shi, Hyogo Prefecture and posted sales of about 4 billion yen for it in fiscal year ended March 2021, the sales in fiscal year ended March 2024 can be said to be virtually record-high. All kinds of profits hit a record high, thanks to the improvement in profitability, although SG&A expenses augmented mainly because of the rise in base salaries in February 2023. Furthermore, both sales and all kinds of profits exceeded the full-year earnings forecast, because the handover of real estate, which was conducted mainly in the fourth quarter (Jan. to Mar.), progressed smoothly, commissioned construction of buildings progressed more rapidly than expected, and the company had estimated costs and expenses conservatively.

Year-end order backlog reached 55.5 billion yen, exceeding that in fiscal year ended March 2021, in which there was special demand for housing amid the COVID-19 pandemic, and hitting a record high.

3-2 Segment Earnings (FY3/24)

Results by Segment and Topics

| Sales | Share | YoY | Segment Profits | Share | YoY |

Residential Properties for Sale | 35,461 | 29.5% | -2.8% | 1,856 | 20.1% | +50.1% |

Housing Distribution | 24,881 | 20.7% | -2.9% | 909 | 9.9% | -33.6% |

Effective Land Utilization | 30,342 | 25.2% | +20.7% | 2,952 | 32.0% | +33.2% |

Property Leasing and Management | 28,027 | 23.3% | +7.9% | 3,400 | 36.8% | +9.3% |

Construction Related | 1,500 | 1.2% | +21.1% | -19 | -0.2% | - |

Others | 174 | 0.1% | -10.7% | 129 | 1.4% | -14.2% |

Adjustment | - | - | - | -1,963 | - | - |

Total | 120,388 | 100.00% | +5.0% | 7,264 | 100.00% | +15.6% |

* Units: million yen

*Sales mean sales to external clients, while segment profit means operating income.

*The composition ratio of segment profit means the ratio to operating income before adjustments.

*The revenue from the insurance agency business had been posted in “non-operating revenue,” but they adopted the method for posting it in “sales” in the first quarter of this fiscal year, so that in the same period of the previous year, too, was posted in “sales.”

*A: Residential Properties for Sale, B: Housing Distribution, C: Effective Land Utilization, D: Property Leasing and Management, E: Construction Related, F: Other

*Created by Investment Bridge based on disclosed material of the company.

In the segment of residential properties for sale, sales declined 2.8% year on year to 35,461 million yen and profit rose 50.1% year on year to 1,856 million yen.

In the segment of residential properties for sale, sales declined slightly year on year, but profit increased significantly year on year. The sales of freely designed houses declined due to the decrease of houses delivered, but the decrease in overall sales was slight, as the company handed over 4 condominium buildings (3 condominium buildings in the previous fiscal year), which were completed in fiscal year ended March 2024, and sold part of undeveloped land for sale. On the other hand, profit grew 50.1% year on year, because gross profit margin improved as the company concentrated on meticulous sales activities without haste and sold properties at reasonable prices while reducing advertisement costs.

| FY 3/23 | FY 3/24 | |||

Volume | Value | Volume | Value | YOY | |

Free-design Homes, etc. | 623 homes | 25,527 | 537 homes | 22,393 | -12.3% |

Condominiums for Sales | 214 homes | 9,323 | 239 homes | 10,757 | +15.4% |

Sale of Residential Land | 70 homes | 1,595 | 67 homes | 1,890 | +18.5% |

Land sales | 268㎡ | 49 | 1,766㎡ | 420 | +755.8% |

Net Sales in the Residential Properties for Sales Segment | 907 homes 268㎡ | 36,495 | 843 homes 1,766㎡ | 35,461 | -2.8% |

Profit in the Residential Properties for Sales Segment | 1,237 | 1,856 | +50.1% | ||

* Units: million yen

Large-scale project for delivering detached homes in FY 3/24 | |

Asmo Town Higashi-Kishiwada | 144 homes (Kishiwada -shi, Osaka-fu) |

Afujir Ishibashihanndaimae | 37 homes (Ikeda-shi, Osaka -pref) |

Condominium projects scheduled for delivery in FY 3/2024 | |

Branneed Amagasaki Tachibana | 15-story, 78 residences, completed and delivered on October 31, 2023 |

Charmant Fuji Wakayamashi Station Regitage | 14-story, 82 residences, completed and delivered on December 15, 2023 |

Branneed Yao Sakuragaoka 1tyoume | 13-story, 48 residences, completed and delivered on March 29, 2024 |

Charmant Fuji Sakaiekimae frontier terrace | 15-story, 57 residences, completed and delivered on March 29, 2024 |

(Taken from the reference material of the company)

In the housing distribution segment, sales dropped 2.9% year on year to 24,881 million yen and profit decreased 33.6% year on year to 909 million yen.

The sales of used residential properties decreased mainly because the number of detached houses delivered dropped from the previous fiscal year, and profit, too, declined year on year.

The sales of condominiums were almost unchanged year on year, but overall sales declined slightly, as the number of detached houses delivered decreased. Profit decrease rate exceeded sales decrease rate significantly, because the number of residential properties delivered decreased in the used asset business, whose profitability is higher than that of the business of purchase and resale.

From the following fiscal year, they plan to further concentrate on the procurement and sales activities of the used asset business, which has high profitability and significant competitive advantages.

| FY 3/23 | FY 3/24 | |||

Volume | Value | Volume | Value | YOY | |

Used Residential Properties (Detached Homes) | 114 homes | 3,048 | 80 homes | 2,091 | -31.4% |

Used Residential Properties (Condominiums) | 963 homes | 22,563 | 936 homes | 22,773 | +0.9% |

Others | - | 16 | - | 15 | -7.3% |

Net Sales in Housing Distribution Segment | 1,077 homes | 25,628 | 1,016 homes | 24,881 | -2.9% |

Profit in Housing Distribution Segment | 1,370 | 909 | -33.6% | ||

*Units: million yen

According to Japan Journal of Remodeling’s Annual Ranking of Resale Units Sold 2023 (issued on July 31, 2023), the company ranked seventh in Japan in the annual ranking of resale units sold. The company's housing distribution business takes place mainly in the Hanshin region, and although its sales activities are limited to this area, it boasts one of the largest purchase and resale volumes in Japan.

Fuji Home Bank operates the assets business with a significant competitive advantage, buying and reselling used condominiums and acquiring used condominiums occupied by tenants as real estate for investment and reselling them after occupants move out. As of the end of March 2024, the company holds 848 units.

【Variation in the used condominium business】

| FY3/20 | FY3/21 | FY3/22 | FY3/23 | FY3/24 |

No. of units held [contracts] | 1,052 | 946 | 891 | 845 | 848 |

Acquisition price [million yen] | 14,130 | 12,985 | 13,043 | 13,867 | 15,025 |

Annual revenues from rents [million yen] | 1,146 | 1,050 | 1,000 | 993 | 996 |

In addition, “Ouchi Kan” main store is a general housing exhibition hall that always displays information on more than 1,000 properties and is arranged by area, new construction, and used house to make it easier to search for properties.

In the effective land utilization segment, sales rose 20.7% year on year to 30,342 million yen and profit grew 33.2% year on year to 2,952 million yen.

In the effective land utilization segment, sales and profit increased significantly from the previous fiscal year.

Sales grew significantly by 20.7% year on year, as the ordered construction of rental residential properties and rental apartments for seniors with nursing-care services progressed smoothly, the company received a healthy number of new orders, and the handover of rental apartment buildings for individual investors, which had been conducted mainly in the fourth quarter, progressed as planned as a whole. Profit rose considerably by 33.2% year on year, thanks to the significant sales growth and the improvement in gross profit margin per building.

| FY 3/23 | FY 3/24 | |||

Volume | Value | Volume | Value | YOY | |

Contract Construction of Rental Properties | 23 contacts | 3,335 | 42 contacts | 4,769 | +43.0% |

Affordable Apartments for Seniors with Nursing-care Services | 6 contacts | 3,147 | 17 contacts | 4,400 | +39.8% |

Rental Apartments for Sale to Individual Investors | 125 buildings | 18,651 | 137 buildings | 21,173 | +13.5% |

Net Sales in the Effective Land Utilization Segment (External Sales) | 29 contacts 125 buildings | 25,133 | 59 contacts 137 buildings | 30,342 | +20.7% |

Intersegment sales and transfers | - | 1,442 | - | 1,564 | +8.5% |

Net Sales in the Effective Land Utilization Segment | 29 contacts 125 buildings | 26,576 | 59 contacts 137 buildings | 31,907 | +20.1% |

Profit in the Effective Land Utilization Segment | 2,217 | 2,952 | +33.2% | ||

* Units: million yen

* Table sales are before deducting intersegment sales or transfers.

Regarding rental apartment buildings for individual investors, the company rigorously selects and procures rare profitable buildings based on abundant information accumulated as a general real estate industry, and keeps occupancy rate as high as 97.0% as of the end of March 2024, based on the advanced management and tenant attracting capabilities of group companies. Owners highly evaluate their capabilities of developing products, managing properties in good faith, and attracting tenants as well as the contents of contracts beneficial for owners. Accordingly, the average number of would-be buyers is five or more times that of available properties at the time of sales.

Construction Cases from the Fuji Palace Series | |

Fuji Palace Stairwell Type | Urban compact designers' residential rental housing. |

Fuji Palace Senior (The largest number of residential buildings for elderly people with nursing-care services in Japan) | A new form of land utilization in an aging society Housing for the elderly with nursing care services |

Fuji Palace Detached Homes for Rent | A savior of suburban land utilization that opens new possibilities for valuable assets that had almost been disregarded for utilization. |

Fuji Palace Three Herbs | All-unit maisonette-type rental housing that achieves high occupancy and high profitability. |

Fuji Palace Loft Type | A loft type to meet the new needs of single people. |

(Taken from the reference material of the company)

Sales in the property leasing and management segment increased 7.9% year on year to 28,027 million yen, and profit increased 9.3% year on year to 3,400 million yen.

Both sales and segment profit increased year on year as initially forecast, because the number of managed properties increased through the delivery of rental residential properties in the effective land utilization business and the operation of their own affordable apartments for seniors with nursing-care services progressed.

| FY 3/23 | FY 3/24 | |

Value | Value | YOY | |

Rental Income | 18,867 | 20,308 | +7.6% |

Income from Affordable Apartments for Seniors with Nursing-care Services | 6,165 | 6,738 | +9.3% |

Management Fee Income | 943 | 979 | +3.9% |

Net Sales in the Property Leasing and Management Segment | 25,976 | 28,027 | +7.9% |

Profit from Property Leasing and Management | 3,111 | 3,400 | +9.3% |

*Units: million yen

About 88% of rental residential properties managed by the company are based on the system in which the company rents whole buildings from owners (as of the end of March 2024). The occupancy rate of rented residential properties has been stably in the order of 97%. As of the end of March 2024, the number of rental apartment buildings for seniors with nursing-care services was 251, and the number of rental apartment units for seniors with nursing-care services was 8,258. According to the bumper summer issue of Koureisha-juutaku-shinbun (Newspaper on housing for elderly people) in 2023, the number of rental apartment buildings for seniors with nursing-care services managed by the company stood at 237 as of the end of June 2023, being the largest in Japan.

|

|

*Number of buildings in operated and managed as of March 2024 (Made by Investment Bridge Co., Ltd. based on the reference material of the company.)

In the construction-related segment, sales grew 21.2% year on year to 1.5 billion yen and loss augmented 5 million yen year on year to 19 million yen.

In the construction-related segment, sales grew year on year, but profit declined.

Internal sales decreased year on year, as there were many contracts for construction work between group companies, including those for renovation of rental apartments for seniors with nursing-care services in Shishigaguchi-cho, Nishinomiya-shi in the previous fiscal year, although the construction of Branneed Kawachieiwa (a condominium building) progressed smoothly. On the other hand, external sales (related to construction) increased slightly year on year, as ordered construction progressed steadily and the company received a healthy number of new orders. Profit dropped year on year, as the skyrocketing of construction costs was not offset by sales and gross profit margin declined although sales grew.

| FY 3/23 | FY 3/24 | |

Value | Value | YOY | |

Construction Related Segment | 1,239 | 1,500 | +21.1% |

Intersegment sales and transfers | 1,059 | 805 | -24.0% |

Net Sales in the Construction Related Segment | 2,299 | 2,305 | +0.3% |

Profit in the Construction Related Segment | -14 | -19 | - |

* Units: million yen

* Table sales are before deducting intersegment sales or transfers.

In January 2020, the company welcomed the renowned Yuuken Kensetsu Group as a partner in constructing steel-framed and reinforced concrete structures. After that, the company worked on the construction of a large-sized RC apartment for seniors with nursing-care services for the first time and transformed an old company-owned condominium building into an affordable apartment for seniors with nursing-care services. At present, they engage in the construction of condominiums that will be sold by the corporate group and large-scale repairs of the company’s building, indicating a steady expansion of the scope of cooperation.

(Taken from the reference material of the company)

Sales in the other segment decreased 10.7% year on year to 174 million yen, and profit decreased 14.2% yen year on year to 129 million yen.

The other segment is a business segment not included in segments to be reported but includes the insurance agency business operated by Fuji Corporation. The revenue from the insurance agency business had been posted in “non-operating revenue,” but they adopted the method for posting it in “sales” in the first quarter of this fiscal year.

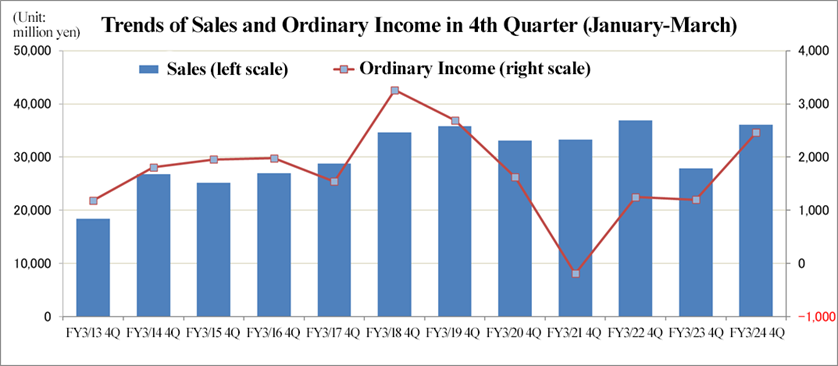

3-3 Quarterly Earnings Trends

Consolidated sales and ordinary income for the fourth quarter (January - March)

*Created by Investment Bridge based on disclosed material of the company.

In the fourth quarter (Jan. to Mar.) of fiscal year ended March 2024, sales and profit grew year on year, and both sales and ordinary income were high compared with those in the past fourth quarters.

3-4. Status of order backlog

| FY 3/23 Term-end | FY 3/24 Term-end | |||

Volume | Value | Volume | Value | YOY | |

Free Design Houses, etc. | 324 homes | 13,928 | 303 homes | 12,887 | -7.5% |

Condominiums for Sale | 195 homes | 8,576 | 275 homes | 11,381 | +32.7% |

Sale of Residential Land | 16 homes | 443 | 12 homes | 227 | -48.7% |

Land Sales | 1,765㎡ | 420 | 148㎡ | 8 | -98.0% |

Residential Properties for Sales | 535 homes/1,765㎡ | 23,368 | 590 homes/148㎡ | 24,504 | +4.9% |

Used Residential Properties (Detached Homes) | 10 homes | 276 | 7 homes | 161 | -41.6% |

Used Residential Properties (Condominiums) | 131 homes | 3,105 | 106 homes | 2,681 | -13.7% |

Housing Distribution | 141 homes | 3,382 | 113 homes | 2,842 | -15.9% |

Contract Construction of Rental Properties | 62 contacts | 5,920 | 71 contacts | 7,417 | +25.3% |

Affordable Apartments for Seniors with Nursing-care services | 32 contacts | 6,710 | 26 contacts | 5,426 | -19.1% |

Rental Apartments for Sale to Individual Investors | 91 buildings | 13,930 | 95 buildings | 14,761 | +6.0% |

Effective Land Utilization | 94 contacts/91 buildings | 26,561 | 97 contacts/95 buildings | 27,604 | +3.9% |

Construction Related | 16 contacts | 465 | 18 contacts | 604 | +30.0% |

Total | - | 53,777 | - | 55,557 | +3.3% |

* Units: million yen

(Taken from the reference material of the company)

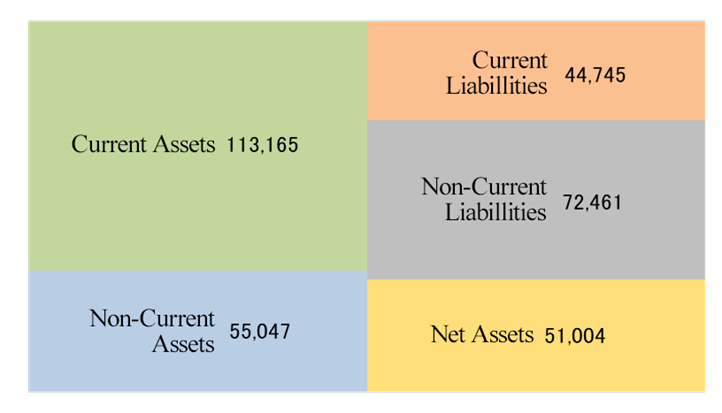

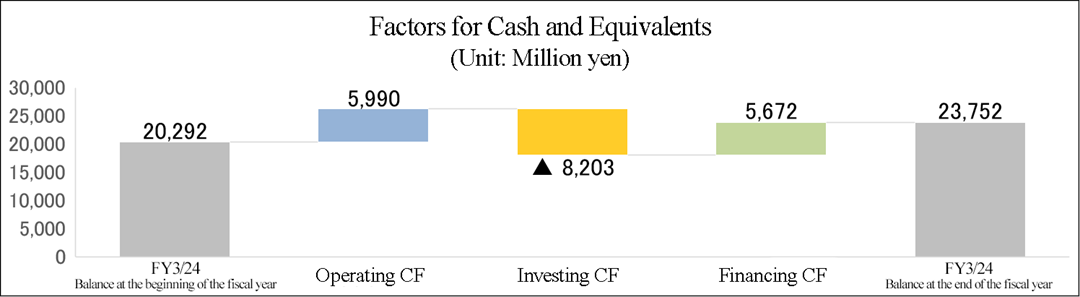

The order backlog as of the end of fiscal year ended March 2024 was up 3.3% from the end of the previous fiscal year, hitting a record high, as the order backlogs in the segment of residential properties for sale and the effective land utilization segment.