Bridge Report:(9438)MTI Second Quarter of the Fiscal Year ending September 2024

President and CEO, Toshihiro Maeta | MTI Ltd. (9438) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and communication |

President and CEO | Toshihiro Maeta |

HQ Address | 35th Floor, Tokyo Opera City Tower 3-20-2 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Year-end | End of September |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

747yen | 61,269,900 shares | 45,768 million yen | 5.4% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

16.00yen | 2.1% | 31.99yen | 23.4x | 254.36yen | 2.9x |

*Share price as of closing on May 15,2024. Number of outstanding shares, DPS and EPS were taken from the financial statements for the second quarter of fiscal year ending September 2024. ROE and BPS were taken from the financial results for the previous fiscal year.

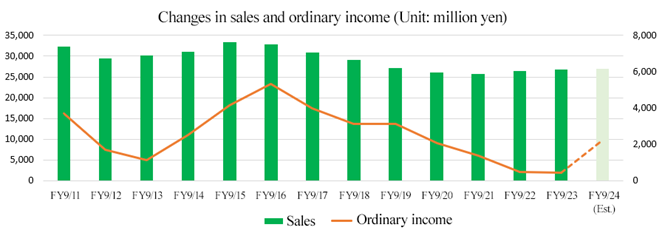

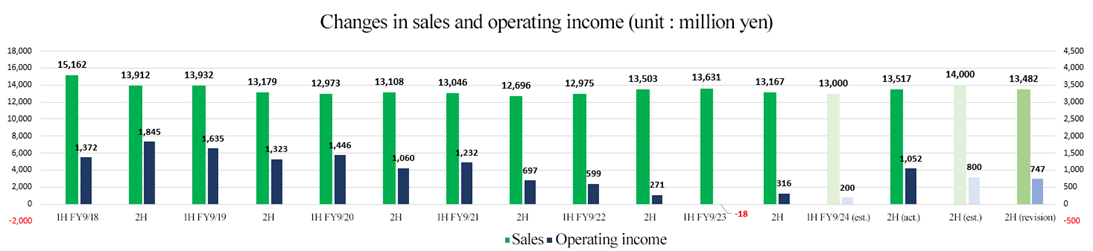

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

September 2020 Act. | 26,082 | 2,507 | 2,082 | 506 | 9.28 | 16.00 |

September 2021 Act. | 25,743 | 1,929 | 1,370 | -1,164 | -21.28 | 16.00 |

September 2022 Act. | 26,479 | 870 | 485 | -930 | -16.99 | 16.00 |

September 2023 Act. | 26,798 | 298 | 458 | 753 | 13.73 | 16.00 |

September 2024 Est. | 27,000 | 1,800 | 2,250 | 1,750 | 31.99 | 16.00 |

*Unit: million yen. Estimates are those of the Company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This Bridge Report includes the earning results for the second quarter of the fiscal year ending September 2024, the earnings forcasts for the fiscal year ending September 2024 and other information of MTI Ltd.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending September 2024 Earnings Results

3. Fiscal Year ending September 2024 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year ending September 2024, sales were 13,517 million yen, down 0.8% year on year. The Healthcare business, the School DX business, and other business achieved growth in sales. Operating income stood at 1,052 million yen (an operating loss of 18 million yen was recorded in the same period of the previous fiscal year). Sales shrank, but gross profit rose 8.3% year on year as unprofitable projects ended in the DX support business for corporate clients (with gross profit margin improving by 6.2 points year on year); meanwhile, the company proactively controlled costs and reduced the selling, general, and administrative (SG&A) expenses, including personnel and development expenses, by 3.4% year on year. Both sales and profit exceeded the earnings forecasts announced on February 9, 2024 after the second upward revision.

- The full-year earnings forecasts have been revised upwardly. It is projected that sales will increase 0.8% year on year to 27 billion yen and operating income will grow 503.2% year on year to 1.8 billion yen. While forecast sales remain as initially forecasted, forecast profit has been revised upward for the third time because the company takes into account the steadily growing number of schools adopting its system in the School DX business as well as the business results that significantly exceeded the forecast for the cumulative second quarter. No revision has been made to the dividend forecast. The company plans to pay a dividend of 16.00 yen/share like in the previous fiscal year. The expected dividend payout ratio is 50.0%.

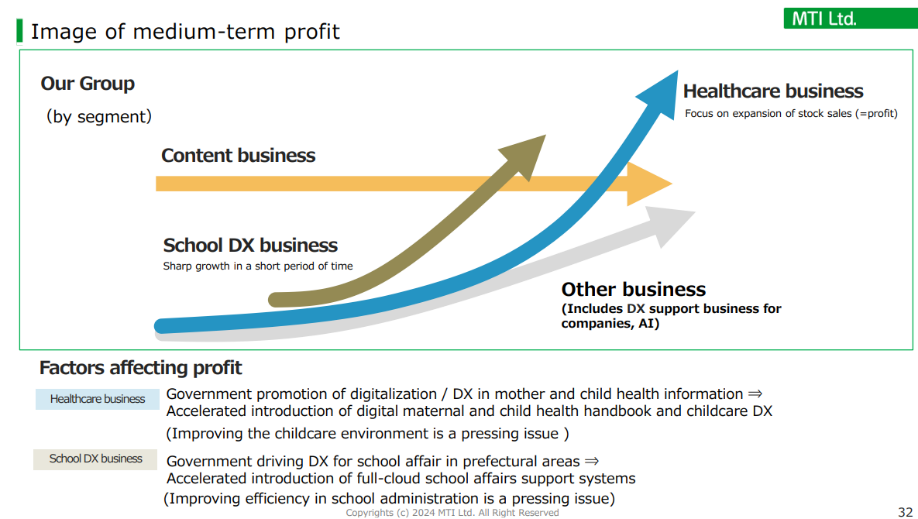

- Considering the market environment and characteristics of each segment, the company envisages a growth trajectory as follows: in the Content business, where the decrease of paying subscribers is subsiding, the company will concentrate on highly demanded content, such as the security-related application, and the original comic business in order to secure profit on a priority basis. The school DX business, in which the number of schools that have adopted the company’s products is rapidly growing, will serve as a growth driver for the foreseeable future. For the Healthcare business, which is positioned as the core business from the medium/long-term viewpoint, the company will concentrate on the expansion of “stock-type sales = profit” by taking advantage of its high profitability. In the other business, including the DX support for corporate clients and the AI business, the company will meet demand steadily by taking advantage of its forte.

- Substantial upward revisions have been made to the profit forecast for the full fiscal year ending September 2024. When the company achieves profit growth, it will be for the first time in five fiscal years (or for the first time virtually in eight fiscal years with the slight increase in profit in the fiscal year ended September 2019 taken into consideration), and the company is highly anticipated to bring a profit increase. Losses have shrunken considerably compared to the previous fiscal year in the School DX business, the growth driver for the time being, and the company has seemingly succeeded in keeping the Healthcare business, which is the medium/long-term business pillar, in the black on the quarterly basis.

- In the second half, however, both sales and profit are expected to decrease from the previous period (the first half of the fiscal year ending September 2024) while they are forecast to grow from the same period of the previous fiscal year. We would like to keep an eye on how much the company can increase sales and profit in the third and fourth quarters.

1. Company Overview

【1-1 History】

In 1996, the founder Toshihiro Maeta (currently the company's president) foresaw the further possibilities of mobile content-related services and established MTI to create various entertainment, lifestyle information, and solution services the world needs.

In addition to mobile phone sales and content distribution, the company has diversified its spot-type business for Internet-related services such as Internet payment systems and website system management leading to the expansion of the business backed by the fast growth of the mobile content market. In 1999, its stock was registered over the counter, and in 2004 it was listed on the JASDAQ stock exchange.

After that, as main mobile communication devices shifted from mobile phones to smartphones, the company shifted to the Content business for smartphones and further expanded earnings, and in 2015, the company was listed on the first section of the Tokyo Stock Exchange.

In 2016, the Ministry of Internal Affairs and Communications launched a plan to abolish 0-yen devices (a system that offsets the price of phones with campaigns and benefits). Thus, the total number of paying subscribers continues to decline*. The company is harnessing its strengths in UI/UX and marketing it has acquired through many years in the Content business to focus on expanding the Healthcare business, which has great potential for future growth.

In 2022, it got listed on the Prime Market of the Tokyo Stock Exchange through market restructuring.

*For the company, mobile phone shops were the center of attraction for paying subscribers. The company provided mobile shops with the funds for the discount amount associated with the purchase of content when changing models as a sales incentive. The Content business grew significantly with the spread of smartphones, but the abolishing of 0-yen devices in 2016 led to a significant decrease in the number of members.

【1-2 Philosophy】

As the world changes day by day, the MTI Group believes that it is important to create and deliver the services that are required at the time all over the world in order to realize a society where customers can live more freely and in their own way.

With a vision of "Taking the world a step forward," the company will continue to be a partner that accompanies its customers in their daily lives, and it will work to realize a better future society by providing services that make their lives more convenient and richer.

In the Healthcare business, on which the company is currently focusing, MTI aims to improve people's QOL and reduce medical expenses by maintaining health and preventing illness based on data analysis.

【1-3 Business description】

As of the end of September 2023, the company has 26 consolidated subsidiaries, and six affiliates, for a total of 32 companies.

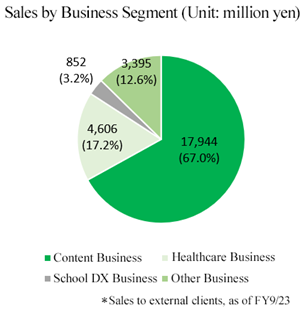

There are four reportable segments: the Content business, the Healthcare business, the School DX business, and other business.

(1) Content Business

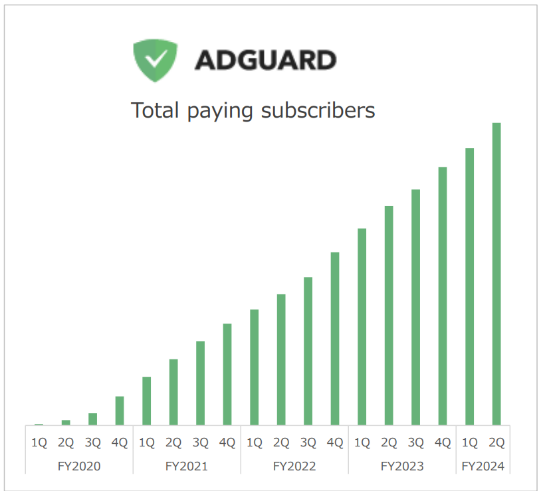

The Content business provides end users with mobile content services mainly for smartphones. These services include entertainment content, centering on videos, music, books, and comics. In addition, these services also include the security-related application “AdGuard,” weather, map and road information services, etc.

The company is also developing a BtoB original comic business that provides original comics to comic distribution companies.

It has been the company's original business since its founding and still accounts for 70% of sales, but as mentioned in the history section, the number of paying subscribers continues to decline. The number of paying subscribers at the end of March 2024 was 3.10 million.

Currently, the rate of decline is shrinking, and the company plans to reduce the decrease further and slow down its rate while prioritizing securing profit by concentrating on content with high demand.

◎ Main businesses and services

1) The security-related application “AdGuard”

“AdGuard” is a mobile security-related application featuring four functions: ad blocking, tracking blocking, threat blocking, and parental control function (child protection function).

The number of paid members as of the end of March 2024 is 780,000. The number of paying subscribers is steadily increasing, and further expansion is expected because the application is highly recognized for enabling one account to be used on multiple devices.

(Source: the company's documents)

2) Original comic business

Under a marketing strategy aimed at expanding sales, the company's staff plan and build stories, which are then turned into works by amateur and professional comics artists and offered to client publishers.

Currently, about 20 works have been published, and the business continues to grow steadily.

(2) Healthcare Business

Aside from distributing information useful for healthcare, the Healthcare business operates several services to promote "Taking the world a step forward," through which each user can utilize individual health data in various life aspects via smartphones in order to lead a more convenient and comfortable daily life.

In order to use the health data, the medical institutions and municipalities accumulated individually more effectively, the business is working on building a new system to link the data on the multiple different systems in each institution through the use of the group's healthcare services.

The number of paying subscribers as of the end of March 2024 is 530,000.

◎ Main business and services

1) The Cloud drug record service for dispensing pharmacies "CARADA electronic drug record Solamichi"

Dispensing pharmacies are increasingly important in improving regional medical care, as evidenced by the government's efforts to promote the spread of family pharmacies.

On the other hand, dispensing pharmacies require diverse and complex operations to provide users with safety, security, trust, and convenience. Therefore, the company wants to solve problems such as "I want to quickly write a complete drug record," "I want to add up things without leaving anything out," and "I want to strengthen interpersonal work."

The cloud drug record "CARADA electronic drug record Solamichi" mainly provides the following functions to solve the above problems, improve the operational efficiency of dispensing pharmacies, and provide an environment in which patients can take medicine safely and securely.

☆ | drug record history | Drug record can be easily created by simply checking the boxes to shorten the writing time and improve quality. |

☆ | Medication administration follow-up | By recording the answers from patients in the drug record, follow-up of the period of administration is conducted to support communication with the patients. |

☆ | Prescription audit | An automatic check for drug interactions is performed. Audit items that are often overlooked can be checked immediately to ensure safer medical treatment |

☆ | Operational analysis | In addition to aggregating the operating status of each store in real time, it is also possible to check whether there is an unrecorded item within the drug record. |

☆ | Home visit | Compilation of necessary documents for work from home |

☆ | Patient information management | Support for the creation of patient information without excess or deficiency through thorough information management for each patient |

(Based on the company's website)

In the future, the company will also promote the development of inventory management and receipt computers* and support the DX of pharmacies, which reforms all pharmacy operations with ICT.

*Receipt computer

It is a computer for creating receipts (medical fee statements). It can improve efficiency by linking data for issuance at medical institutions and collection at pharmacies instead of using paper.

◎ Features

Even if you are not good at operating a computer, you can intuitively use it without looking at the manual as it has easy-to-watch screen and simple operability. Anyone can use it without stress as it displays only the minimum necessary menus and buttons.

It not only creates the drug record quicker than by handwriting, but also uniforms the contents of the drug record in a way that does not rely on the experience level of pharmacists.

The system leverages the advanced UI/UX design the company cultivated in the Content business.

◎ Market development

As of the end of March 2024, 2,090 pharmacies have installed the system. Of the approximately 60,000 dispensing pharmacies across Japan, the company targets 10,000 small and medium-sized pharmacies (so-called pop-and-mom pharmacies), excluding major chains.

In terms of sales, the company is developing customers using the dispensing pharmacy network owned by MEDIPAL HOLDINGS Corporation (TSE Prime, 7459), a wholesaler of ethical pharmaceuticals, with which it formed a capital and business alliance in 2016.

The on-premise systems of other companies in the same industry already have a share of the market. However, the company will focus on expanding the number of pharmacies that have installed this system, leveraging its strengths as a cloud system.

◎ Fee system

The required cost for a dispensing pharmacy is the initial cost only for the first month of introduction and the monthly fee every month.

Depending on the manufacturer, additional terminal costs may be required based on the number of terminals that use the electronic drug record system, but "CARADA electronic drug record" does not require additional terminal costs when using it on several terminals.

2) “Boshimo”, a mother and child health handbook app for municipalities

“Boshimo” is an electronic mother and child health handbook application service that easily supports everything from records of the mother and child health handbook to local information using mobile phones.

It has various functions such as recording health data of pregnant and nursing mothers and children, displaying weight and growth graphs, managing vaccination schedules, giving advice on childbirth and childcare, childcare diaries with photos, functions for sharing information with families, and local childcare information. The service uses ICT to reduce the anxiety and burden of the childcare generation.

(Based on the company's website)

Customers (users) are municipalities, and as of the end of March 2024, 606 out of 1,741 municipalities nationwide have introduced this service.

A monthly fee of 50,000 ~100,000 yen is collected from municipalities, and app users can use the services for free.

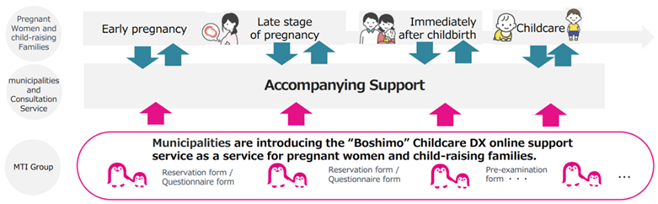

Believing that it is necessary to first increase the number of municipalities adopting the system, the company offers it at affordable prices; however, over 500 municipalities have already adopted it, so the company aims not only to stimulate adoption of the system by a greater number of municipalities, but also to proactively provide “Childcare DX” for further growing the business in the fiscal year ending September 2024. The business environment is becoming more favorable to the company with the accompanying support program (*) that was launched in January 2023 as well as the trend started by the Japanese government toward digitization and digital transformation (DX) being as a tailwind.

*Accompanying Support Program

It is a governmental support service for pregnancy and childcare launched in January 2023. The government will obtain a perspective on the childbirth and childcare alongside pregnant women and families rearing 2-year-old or younger children in order to support them. They will arrange an environment which eases worries in giving birth and raising children based on a connection with local consulting institutions nearby, in addition to holding a total of three interviews at the notification of pregnancy, near childbirth and after the birth, and providing a gift certificate worth 100,000 yen.

(Taken from the reference material of the company)

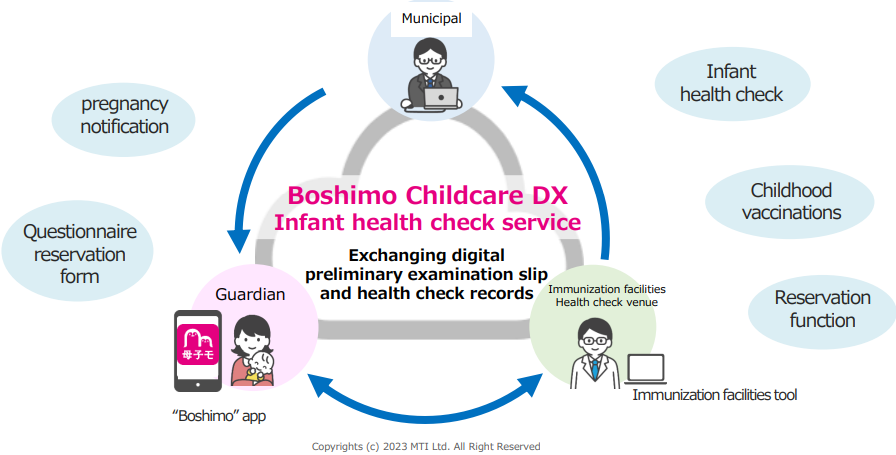

<Childcare DX>

The company aims to realize a safe, secure, and convenient childcare society by enhancing childcare support in the region through the spread of services that utilize digital technology and data. These services are called "Childcare DX."

The main service of "Childcare DX" is the mother and child health notebook application "Boshimo." In addition to the basic functions mentioned above, the company provides three services to support the use of the Internet by childcare businesses and solve various issues municipalities face.

(Based on the company's website)

Service | Overview | Provided functions | Target business |

“Boshimo” Childcare DX Consultation and home visit services | It provides efficient and high-quality consultations and home visits while avoiding contact. | Video calls, digitization of pre-questionnaires, online booking, etc. | Home visit guidance for pregnant and nursing mothers, home visits for newborn babies, home visits for infants, home visits for childcare support, home visits for premature babies, childcare counseling, infant counseling, pregnancy counseling (postpartum care), single parent counseling, etc. |

“Boshimo” Childcare DX Infant health checkup service | It switches to group or individual health checkups that offers a way to avoid crowds and reduce labor. | Digitalization of medical interviews, digitalization of medical examinations, online health guidance, etc. | Infant checkups |

“Boshimo” Childcare DX Pediatric vaccination Service | It provides efficient and safe vaccinations that reduce the time and cost for parents, municipalities, and medical institutions. | Digitization of vaccination procedures, etc. | Pediatric vaccinations |

In addition, the company is considering using the Internet in various childcare -related applications and maternal health checkups.

Rather than simply using an app, "Childcare DX" links the data of the parents, municipalities, and medical institutions not only to provide convenience to parents but also to effectively resolve the problems in conventional administrative processes at municipalities and medical institutions.

Regarding the fees for these services, the company set separate initial costs and monthly payments according to the number of births. Orders, including orders from ordinance-designated cities, are steadily increasing, and the company expects significant earnings growth in the future.

3) Others

The company offers a variety of services, including:

"Luna Luna," a health care service for women (free) | A health information service that supports women throughout their lives according to their life stages and concerns |

"CARADA" package for companies (paid) | A corporate service that supports corporate health management and employee health using smartphones |

“Luna Luna” online medical consultation (paid) | Online medical examination system for obstetricians and gynecologists in collaboration with "Luna Luna." |

“CARADA” online consultation (paid) | A system that can implement both online medical treatment and online medication guidance |

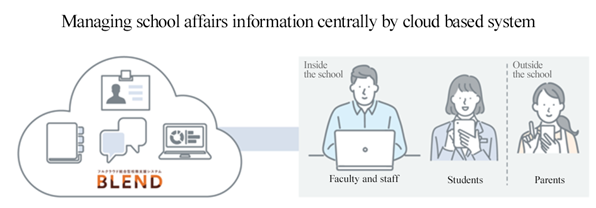

(3) School DX Business

◎ "BLEND," a full cloud-integrated school affairs support system

“BLEND” is a school affairs support system that streamlines the daily school affairs of teachers at nursery schools, kindergartens, elementary and middle schools, high schools, technical colleges, specialized training colleges, and universities. Motivation Works Co., Ltd., a subsidiary of MTI, provides a cloud-based school affairs support system mainly for private middle and high schools.

Due to the "GIGA School Concept" promoted by the Ministry of Education, Culture, Sports, Science, and Technology, many schools have developed an ICT environment, and the ICT environment for students is progressing. As for the work style reforms for teachers, many schools do not provide a remote work environment, and it is necessary to go to work even during the spread of infectious diseases. In addition, many school affairs, such as student attendance management, grade management, and form management, are processed on paper. Even school affairs that have been converted to ICT have usability issues due to network and security restrictions.

In addition, the average working hours of teachers and staff exceed 10 hours per day; thus, reducing schoolwork is an urgent issue.

"BLEND" is a service that solves these issues.

"BLEND" is equipped with all the functions necessary for school affairs, focusing on academic affairs such as attendance and grade registration and output of forms such as teaching records and survey reports.

Since the system links various data, it reflects it collectively, eliminating the need to fill in various forms and preventing repeating school work. Also, because it is a cloud-based system, it supports multiple OSs and multiple devices and can perform school duties without being limited to devices or locations; therefore, it supports the digital transformation of schools.

Motivation Works Co., Ltd. formed a business alliance with KDDI Corporation in June 2022. By collaborating with "KDDI Business Online Support" and "KDDI Business ID" provided by KDDI Corporation, the company can support both efficiency and security of school work for faculty and staff.

As of the end of April 2024, 775 schools had adopted the system, which indicates steady increases from 114 schools at the end of April 2021, 340 schools at the end of April 2022, and 541 schools at the end of April 2023. Demand for the service is enormous, and the company expects that the system will be adopted continuously by a large number of schools.

It covers 35% of private schools. The company is focusing on spreading the technology mainly among private high schools at the moment, but they are working on bringing it to some public middle and high schools as well. As for sales to municipalities, the company will also utilize its knowledge and know-how cultivated through “Boshimo”.

(Taken from the website of the company)

(4) Other Business

The company develops and operates systems for corporate clients, such as systems for the AI business, DX support business for corporate clients and solution business.

【1-4 Features, Strengths, and Competitive Advantages】

The following four items are the company’s strengths.

(1) Development speed that allows them to catch up with technological innovation speed

The speed of internet-related technological innovation is accelerating and complex data links between different systems are becoming possible through AI, clouds, API connections, and other technologies, but at the same time, the developers of those technologies have diverse needs for development technologies, including the indispensable building of solid security systems.

MTI hires excellent developers with advanced specialized skills both inside Japan and from overseas throughout the year, while also engaging in technological collaboration with various corporate partners so that MTI can generate new added value and continuously catch up with the speed of technological innovation in this field.

While growing with the Content business, the company has polished its development capacity for multiple devices, including PCs, cellphones, smartphones, and tablets.

Cloud-unique development capacity and compatibility with all devices, including security check ones, are the company’s major fortes.

(2) Advanced UI/UX design

For a content service to be used by many end users, it is important to develop UI design with excellent navigability, including button placement on the screen and explanatory text that is easy to use and understand for as many as possible, regardless of age or gender and produce high-quality UX for end users.

MTI is designing advanced UI/UX based on the experiences of planning and developing content services of all kinds of genres, such as videos, music, comics, and other forms of entertainment, maps, weather information, and other types of lifestyle information, and healthcare information.

(3) A business model that emphasizes stock

Many businesses in the MTI Group have a stock-type business model, with monthly billing making up the majority of sales. The company is able to invest accumulated profit generated by the solid revenue base into new growth businesses and the development of services that use the latest technologies.

(4) Marketing ability for communicating the merits of our services

Also, in the internet industry to which the company belongs, it is important to enhance the marketing and business ability so that the company can properly communicate the merits of the services to end users and convince them to keep using them. It is for this reason that the company has promoted content service sales in the cellphone stores across Japan as well as conducted active business activities based on an effective marketing strategy for many years, despite being a content provider.

At present, the company is working with municipalities, medical institutions, schools, companies, and others to introduce the services through business activities based on an effective marketing strategy, not just in the Content business, but also in the Healthcare business, School DX business, and other business.

2. The Second Quarter of the Fiscal Year ending September 2024 Earnings Results

【2-1 Business Results】

| 2Q cumulative of FY 9/23 | Ratio to sales | 2Q cumulative of FY 9/24 | Ratio to sales | YoY | Ratio to forecasts |

Sales | 13,631 | 100.0% | 13,517 | 100.0% | -0.8% | +4.0% |

Gross Profit | 9,150 | 67.1% | 9,905 | 73.3% | +8.3% | - |

SG&A | 9,168 | 67.3% | 8,852 | 65.5% | -3.4% | - |

Operating Income | -18 | - | 1,052 | 7.8% | - | +75.4% |

Ordinary Income | 187 | 1.4% | 1,518 | 11.2% | +711.3% | +51.8% |

Quarterly Net Income | -326 | - | 1,558 | 11.5% | - | +25.7% |

*Unit: million yen. Forecasts are ratios to the earnings forecasts announced in February 9, 2024.

Sales decreased while profit increased, and both sales and profit exceeded the forecast.

In the second quarter of the fiscal year ending September 2024, sales were 13,517 million yen, down 0.8% year on year. The Healthcare business, the School DX business, and other business achieved growth in sales.

Operating income stood at 1,052 million yen (an operating loss of 18 million yen was recorded in the same period of the previous fiscal year). Sales shrank, but gross profit rose 8.3% year on year as unprofitable projects ended in the DX support business for corporate clients (with gross profit margin improving by 6.2 points year on year); meanwhile, the company proactively controlled costs and reduced the selling, general, and administrative (SG&A) expenses, including personnel and development expenses, by 3.4% year on year.

Ordinary income stood at 1,518 million yen, up 711.3% year on year. Returns from investment accounted for using the equity method rose 335 million yen year on year.

Quarterly net income was 1,558 million yen (a loss of 326 million yen in the previous fiscal year). The company recorded 786 million yen as refundable consumption tax, etc., in extraordinary income.

Both sales and profit exceeded the earnings forecast announced on February 9, 2024 after the second upward revision.

【2-2 Trends by Segment】

| 2Q cumulative of FY 9/23 | Composition ratio | 2Q cumulative of FY 9/24 | Composition ratio | YoY |

Content Business | 9,413 | 69.1% | 8,350 | 61.8% | -11.3% |

Healthcare Business | 2,190 | 16.1% | 2,610 | 19.3% | +19.2% |

School DX Business | 309 | 2.3% | 521 | 3.9% | +68.6% |

Other Business | 1,718 | 12.6% | 2,034 | 15.1% | +18.4% |

Total sales | 13,631 | 100.0% | 13,517 | 100.0% | -0.8% |

Content Business | 2,794 | 29.7% | 2,261 | 27.1% | -19.1% |

Healthcare Business | -219 | - | 217 | 8.3% | - |

School DX Business | -461 | - | -161 | - | - |

Other Business | -807 | - | -31 | - | - |

Adjustments | -1,324 | - | -1,233 | - | - |

Total segment profit | -18 | - | 1,052 | 7.8% | - |

*Unit: million yen. The composition ratio of the segment profit is the ratio of profit to sales.

(1) Content business

Sales and profit declined.

There were 3,100,000 paying subscribers at the end of March 2024, down 30,000 from the end of September 2023. As the number of paying subscribers of the security-related application “AdGuard” keeps growing, the number of paying subscribers has been nearly flat.

Sales shrank because the company did not get any revenues from sale of videos by Video Market Corporation, one of its consolidated subsidiaries, like in the previous fiscal year and the number of paying subscribers went down.

SG&A expenses such as advertisement costs for encouraging more users to join “AdGuard” augmented, leading to a decrease in profit.

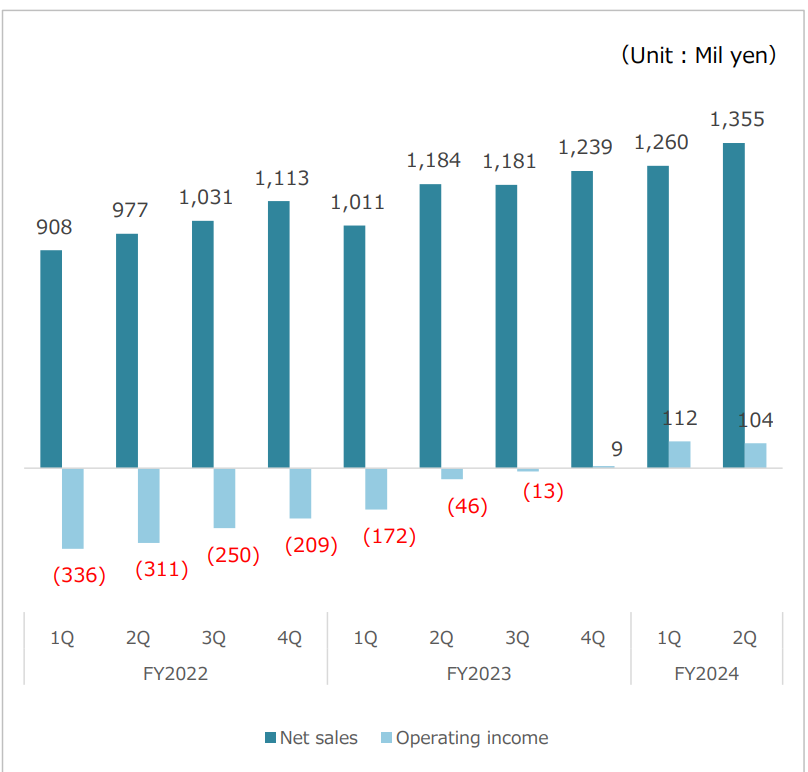

(2) Healthcare business

Sales grew, and the business moved into the black.

The number of monthly paying subscribers at the end of March 2024 decreased by 20,000 from the end of September 2023 to 530,000.

The number of “cloud drug record,” which dispensing pharmacies are increasingly interested in adopting, increased by 297 to 2,090 at the end of March 2024 from the end of September 2023.

Sales of the “cloud drug record,” childcare DX business, etc., grew, leading to an increase in sales. Business moved into the black owing to sales growth and cost curtailment.

(3) School DX business

Sales grew, and loss shrank

The number of schools adopting “BLEND”, a cloud-based support system for school duties, was 541 in April 2023 (up 201 from April 2022), and monthly usage fees that the company receives for the system went up, which resulted in a significant sales increase.

Schools adopting the system continue to be steadily increasing, with the number of schools using the system standing at 775 in April 2024, up 234 from April 2023. The company has increased its share to 35% in the private school market.

The loss was cut significantly thanks to a reduction in outsourcing expenses resulting from reduced development expenses, as well as a considerable sales increase.

(4) Other business

Sales grew, and loss shrank

Sales rose because the number of orders received in the AI business and the DX support business for corporate clients increased. The loss was cut considerably owing to the end of unprofitable projects in the DX support business for corporate clients, in addition to the sales increase.

【2-3 Financial Condition and Cash Flow】

◎Main BS

| End of September 2023 | End of March 2024 | Increase/ Decrease |

| End of September 2023 | End of March 2024 | Increase/ Decrease |

Current Assets | 18,940 | 18,795 | -145 | Current Liabilities | 7,330 | 6,532 | -798 |

Cash | 13,720 | 13,426 | -294 | Payables | 1,023 | 1,018 | -4 |

Receivables | 4,197 | 4,518 | +321 | Contract Liabilities | 2,567 | 2,137 | -430 |

Noncurrent Assets | 10,215 | 10,355 | +140 | Noncurrent Liabilities | 4,240 | 3,937 | -303 |

Intangible Assets | 2,856 | 2,602 | -253 | LT Borrowings | 2,431 | 2,062 | -368 |

Software | 1,894 | 1,956 | +62 | Total Liabilities | 11,571 | 10,469 | -1,101 |

Investment, Other Assets | 7,145 | 7,548 | +403 | Net Assets | 17,583 | 18,680 | +1,096 |

Investment Securities | 4,081 | 4,593 | +512 | Retained earnings | 5,143 | 6,261 | +1,118 |

Total Assets | 29,155 | 29,150 | -5 | Total Liabilities and Net Assets | 29,155 | 29,150 | -5 |

*Unit: million yen.

Total assets dropped 5 million yen from the end of the previous fiscal year to 29,150 million yen due to a decrease in cash and deposits.

Total liabilities decreased 1,101 million yen from the end of the previous fiscal year to 10,469 million yen due to a decrease in long-term borrowings.

Net assets increased 1,096 million yen from the end of the previous fiscal year to 18,680 million yen, due to the increase in retained earnings.

Capital-to-asset ratio increased 3.5% from the end of the previous fiscal year to 51.4%.

◎Cash Flow

| 2Q of FY 9/23 | 2Q of FY 9/24 | Increase/Decrease |

Operating cash flow | 2,105 | 1,241 | -864 |

Investing cash flow | -616 | -609 | +7 |

Free cash flow | 1,489 | 632 | -857 |

Financing cash flow | -798 | -928 | -130 |

Cash and equivalent | 12,763 | 13,426 | +663 |

*Unit: million yen.

While quarterly net income before taxes rose significantly, the cash inflow from operating activities and the free cash flow went down due to corporate taxes the company paid and other relevant payments.

The cash position improved.

3. Fiscal Year ending September 2024 Earnings Forecasts

【3-1 Earnings Forecast】

| FY 9/23 | Ratio to Sales | FY 9/24 Est. | Ratio to Sales | YoY | Revised ratio | Rate of Progress |

Sales | 26,798 | 100.0% | 27,000 | 100.0% | +0.8% | 0.0% | 50.1% |

Operating Income | 298 | 1.1% | 1,800 | 6.7% | +503.2% | +80.0% | 58.5% |

Ordinary Income | 458 | 1.7% | 2,250 | 8.3% | +390.8% | +60.7% | 67.5% |

Net Income | 753 | 2.8% | 1,750 | 6.5% | +132.3% | +30.6% | 89.1% |

* Unit: million yen. Forecasts are the figures announced by the company. The revision rate corresponds to the rate of change from the forecast announced on February 9, 2024 to the forecast announced on May 7, 2024.

Earnings forecasts have been revised upwardly. Sales flat, but profit expected to rise sharply

Earnings forecasts have been revised upward for the third time. It is projected that sales will increase 0.8% year on year to 27 billion yen and operating income will grow 503.2% year on year to 1.8 billion yen.

Sales remain as initially forecasted. In terms of profit, the company takes into account the steadily growing number of schools adopting its system in the School DX business as well as the business results that significantly exceeded the forecast for the cumulative second quarter.

No revision has been made to the dividend forecast. The company plans to pay a dividend of 16.00 yen/share like in the previous fiscal year. The expected dividend payout ratio is 50.0%.

【3-2 Activities in each business】

(1) Healthcare business

The company aims to grow sales by expanding the cloud drug record business further and implementing the platform strategy for the childcare DX “Boshimo.”

①Expansion of Cloud Drug Record

As of the end of March 2024, 2,090 stores adapted the system.

To expand the number of adapting stores, the company will keep reinforcing business alliances, by further enhancing the partnership with Mitsubishi Electric IT Solutions Corp. and FUJIFILM Healthcare Systems Corporation, large system companies targeting dispensing pharmacies with which they formed an alliance in 2021, while they further promote the sharing and streamlining of business information with MEDIPAL HOLDINGS, their partner.

Furthermore, the company will continue to focus on reinforcing the development of functions as a way of differentiation, such as a “function of linking drug record between different stores,” “functions for home-based and nursing care,” “additional logic, guidance navigation” and “availability of electronic prescriptions.”

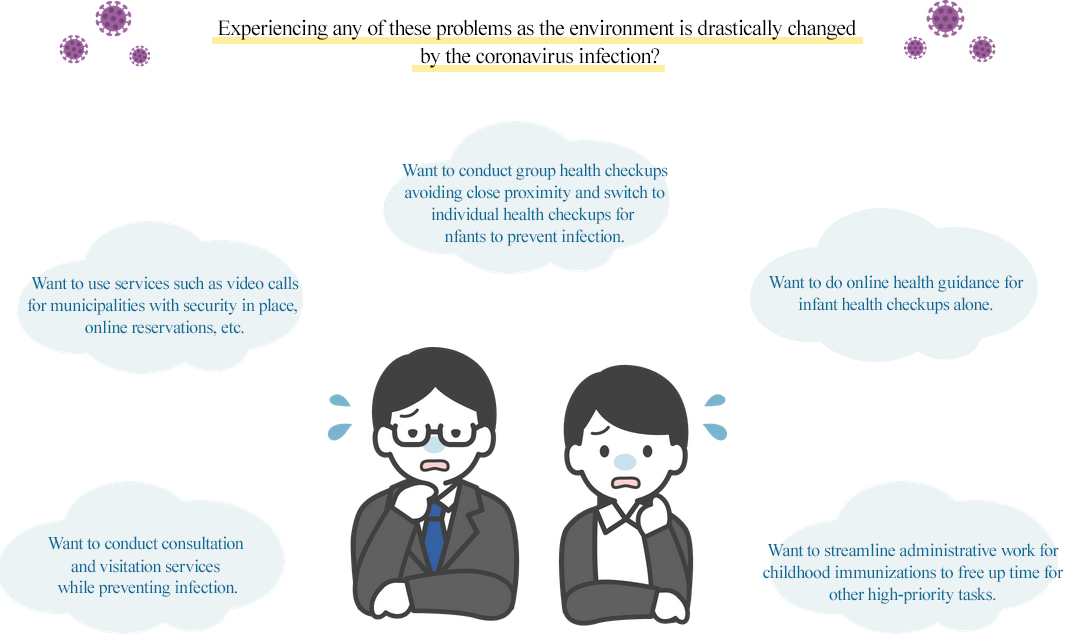

②Implementation of Platform strategy for the childcare DX “Boshimo”

Childcare support has been one of the most important social issues in Japan’s aging society with a declining birth rate. However, paper documents are still generally used in the procedures that must be completed for accessing childcare support services. Parents are required to visit offices with their small children and need to wait for some time there, parents are required to enter the same information in questionnaires and forms, or there are a number of clerical tasks that can be completed only by hand and specifications vary from municipality to municipality. These are a few examples representing the major issue of inefficiency of such procedures, and further digitization has been desired.

Under these circumstances, the concept of developing a platform business in the following three phases, starting with the Mother and Child Health Record application “Boshimo,” is progressing smoothly.

Phase 1: The mother and child health handbook app “Boshimo”

Phase 2: Online consultation

Phase 3: Childcare DX service

(Taken from the reference material of the company)

◎Phase 1, 2

The number of municipalities that have adopted the mother and child health handbook app “Boshimo” as of the end of March 2024 stood at 606, and the number of transactions for online consultation increased steadily to 94 through upselling.

◎Phase 3

The number of childcare DX services introduced by municipalities, including ordinance-designated cities, increased from 130 at the end of September 2023 to 163 at the end of March 2024.

The accompanying support program (*) launched by Ministry of Health, Labour and Welfare in January 2023 (managed by the Children and Families Agency since April 1st) being as a tailwind.

The company will continue to promote data integration among parents, municipalities, and medical institutions to seamlessly advance infant health checkups, childhood vaccinations, consultation appointments, and reservation functions to realize the “Childcare DX.”

(2) School DX business

Currently, schools face myriad issues relating to school duties, including huge burdens of management costs arising from use of multiple systems, long working hours due to different specifications that require entry of information by hand or on computers, and a great length of time required for data integration. This means that teachers are overwhelmed with excessive duties and required to go through inefficient processes in order to complete them, and consequently, they have to work overtime frequently, which causes many teachers to retire from the job.

Thus, full-scale use of the cloud technology has been desired fervently for school duties.

Under these circumstances, the company endeavors to further increase sales by upgrading “BLEND”, a cloud-based support system for school duties, and raising the number of schools adopting the system.

They are aiming to turn it into a standard educational IT platform.

By the end of April 2024, the number of schools introduced increased by 234 from April 2023 to 775. This is a significant increase of approximately seven times from the 114 schools in April 2021.

With digital transformation of school duties promoted by the Japanese government throughout Japan being as a tailwind, the company is engaging in proactive sales activities using the fully cloud-based comprehensive service as a factor that differentiates it from other companies and expects that a multitude of schools will adopt the system in the fiscal year ending April 2025.

Although a rapid growth of sales can be expected owing to the increase of schools adopting the technology, operating loss is projected in this term, same as in the last two terms, due to upfront investments for growth, including the development of a new version to accommodate the rapid growth of demand and enhancement of personnel to reinforce the system. After significantly reducing its deficit in the current fiscal year ending September 2024, the company plans to move into the black in the next fiscal year ending September 2025.

(3) Content business

The company aims to secure profit through the thriving original comic business and the growth of security-related apps.

(4) Other business (AI business and DX support business)

The company aims to increase sales by expanding the AI business and the DX support business.

【3-3 Envisioned growth】

Considering the market environment and characteristics of each segment, they envision the following growth path.

☆ | In the Content business, where the decrease of paying subscribers is subsiding, the company will concentrate on highly demanded content, such as original comics, and prioritize the securing of profit. |

☆ | The School DX business, in which the number of schools that have adopted the company’s products is rapidly growing, will serve as a growth driver for the foreseeable future. |

☆ | For the Healthcare business, which is positioned as the core business from the medium/long-term viewpoint, the company will concentrate on the expansion of “stock-type sales = profit” by taking advantage of its high profitability. |

☆ | In the other business, including the DX support for corporate clients and the AI business, the company will meet demand steadily by taking advantage of its forte.

|

(Taken from the reference material of the company)

4. Conclusions

Substantial upward revisions have been made to the profit forecast for the full fiscal year ending September 2024. When the company achieves profit growth, it will be for the first time in five fiscal years (or for the first time virtually in eight fiscal years with the slight increase in profit in the fiscal year ended September 2019 taken into consideration), and the company is highly anticipated to bring a profit increase.

Losses have shrunken considerably compared to the previous fiscal year in the School DX business, the growth driver for the time being, and the company has seemingly succeeded in keeping the Healthcare business, which is the medium/long-term business pillar, in the black on the quarterly basis.

In the second half, however, both sales and profit are expected to decrease from the previous period (the first half of the fiscal year ending September 2024) while they are forecast to grow from the same period of the previous fiscal year. We would like to keep an eye on how much the company can increase sales and profit in the third and fourth quarters.

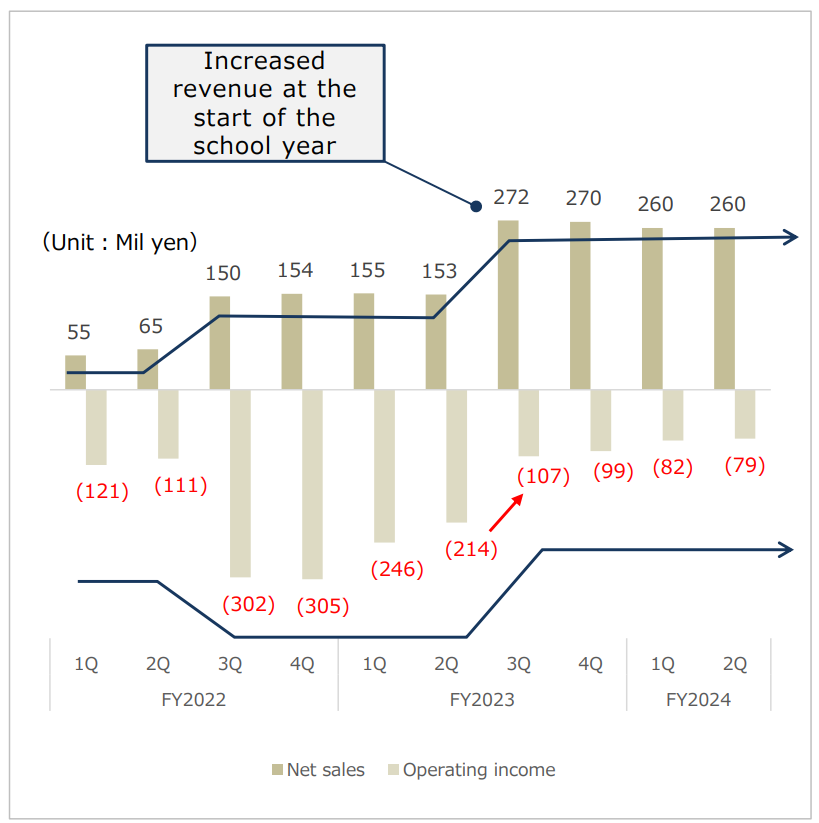

Healthcare business: Net sales and operating income

| School DX business: Net sales and operating income

|

(Taken from the reference material of the company)

<Reference: Regarding Corporate Governance>

◎Composition of the organizational structure, directors and auditors

Organizational structure | Company with corporate auditors |

Directors | 9 including 5 outside directors |

Auditors | 4 including 4 outside auditors |

◎Corporate Governance Report

Last update date: May 16, 2024

<Basic policy>

The company regards the establishment of a transparent and sound management structure and a prompt and accurate decision-making system that responds to changes in the business environment as its important management tasks.

As part of the effort, the term of office for directors is set at one year, and each year, there is an opportunity for shareholders to vote for their confidence in the company, ensuring that management is conducted with a sense of tension. In addition, the company is promoting the strengthening and establishment of legal compliance.

For financial results and important management information, the company strives to enhance management transparency and build trust with the market, by disclosing information in a timely and appropriate manner, as well as by engaging in two-way communication with stakeholders, in accordance with its IR policy.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The information is based on the Corporate Governance Code revised in June 2021.

[Principle 1-4] (Strategically Held Shares)

The policy on strategically held shares and the criteria for existing voting rights thereof are described in “Basic Policy on Corporate Governance 1. Ensuring the Rights and Equality of Shareholders (6).”

The policy stipulates that, for the major strategic shareholdings, the performance of the investee companies, the objective of such shareholdings, the status of their achievement, etc. shall be reported to the Board of Directors on a regular basis, and that the company shall appropriately exercise its voting rights as a shareholder from the perspective of the sustainable growth and the medium/long-term corporate value of such companies and the company.

With regard to particular strategically held shares, the company specifically examines and scrutinizes the medium/long-term economic reasonableness, appropriateness of the purpose of the shareholding, and whether the benefits and risks associated with the shareholding are commensurate with the cost of capital. If the significance of the shareholding is determined to be not necessarily adequate, the company will consider establishing a process to reduce the number of such shares.

[Supplementary Principle 3-1-3] (Sustainability Initiatives, Investment in Human Assets, Intellectual Capital, etc.)

The company has formulated management strategies to achieve sustainable growth and to enhance corporate value over the medium/long-term, however, it has not announced its medium-term management plan, while it publishes its outlook for the next fiscal year. It is because the company’s business environment has been changing rapidly, which is making it difficult to foresee the future. Nevertheless, the company recognizes that disclosing more specific details of its management strategy and indicating its long-term direction are important tasks for enhancing dialogue with its shareholders. Therefore, the company will establish an internal system to enhance disclosure information that takes into account factors including investment in human assets and intellectual property, as well as sustainability, in the process of formulating future management strategies.

In addition, with regard to sustainability, the company does not expect climate change to have a material impact on its business, as the business is based on Internet technology that has no significant environmental impact, and thus, it has not implemented initiatives based on the TCFD or equivalent framework imposed only on companies listed in the Prime Market. On the other hand, guided by the vision of “Taking the world a step forward,” the company has been creating and providing a variety of technology services. Furthermore, the company believes that the use of its services by clients and end users in various industries related to climate change will promote various IT systems to address climate change in the future. Based on the above approach, the company continues promoting sustainability in line with the company’s vision.

Our view and initiatives regarding sustainability are as described in “2. Our view and initiatives on sustainability” under “Chapter 2 Business situation” of the securities report.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Based on the basic approach stated in Section 1 above, the company has formulated the “Basic Policy on Corporate Governance” with the aim of realizing the management philosophy, achieving sustainable growth and enhancing its corporate value over the medium to long term, and constantly pursuing the best possible corporate governance and continuously working to improve it to earn the trust of its stakeholders including shareholders.

Basic Policy on Corporate Governance URL:

https://ir.mti.co.jp/wp-content/uploads/library/tse/2022/corporate20221227.pdf

[Principle 5-1] (Policy on Constructive Dialogue with Shareholders)

The company’s policy on the establishment of systems and initiatives to promote constructive dialogue with shareholders is described in “Basic Policy on Corporate Governance, 5. Dialogue with Shareholders,” as well as “III. Implementation Status of Measures Concerning Shareholders and Other Interested Parties, 2. Status of IR-Related Activities” of this report. Moreover, the company’s IR Policy is posted on its website (Investors Relations page).

IR Policy URL: https://ir.mti.co.jp/ir_policy/

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (MTI Ltd.: 9438) and the contents of the Bridge Salon (IR Seminar) can be found at: https://www.bridge-salon.jp/for more information.