Bridge Report:(9278)BOOKOFF GROUP The first quarter of the fiscal year ending May 2025

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE Prime Markets |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | May |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Actual) | Trading Unit | |

¥1, 463 | 20,547,413 shares | ¥30,060million | 8.7% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥25.00 | 1.7% | ¥106.22 | 13.8x | ¥1,023.60 | 1.4x |

*The share price is the closing price on November 6. The number of shares issued, DPS, and EPS are from 1Q of FY 5/25 financial results. ROE and BPS are previous results.

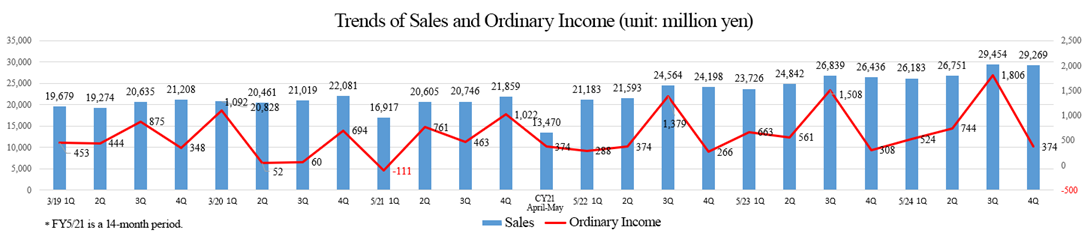

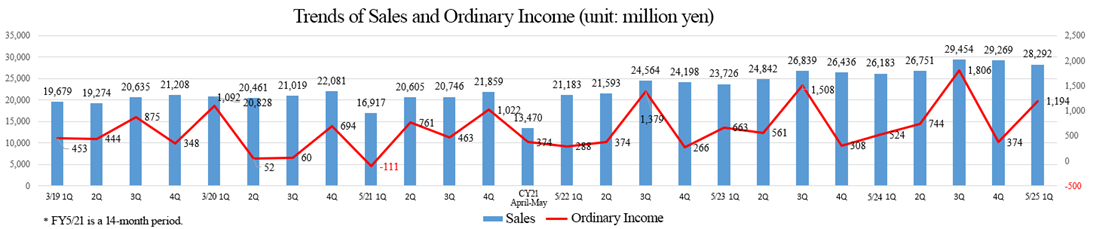

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2021 (Actual) | 93,597 | 1,936 | 2,509 | 157 | 9.03 | 6.00 |

May 2022 (Actual) | 91,538 | 1,766 | 2,307 | 1,449 | 82.07 | 20.00 |

May 2023 (Actual) | 101,843 | 2,578 | 3,040 | 2,769 | 140.15 | 25.00 |

May 2024 (Actual) | 111,657 | 3,051 | 3,448 | 1,705 | 86.26 | 25.00 |

May 2025 (Forecast) | 120,000 | 3,500 | 3,800 | 2,100 | 106.22 | 25.00 |

* The fiscal year ended May 2021 is 14 months accounting period. The forecasted values were provided by the company. Unit: million yen. Net income is profit attributable to the owners of the parent. The same applies hereafter.

We present this Bridge Report reviewing the fiscal year ended May 2024 financial results and the first quarter of the fiscal year ending May 2025 earnings forecasts of BOOKOFF GROUP HOLDINGS LIMITED.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended May 2024 Financial Results

3. 1Q of Fiscal Year ending May 2025 Financial Results

4. Fiscal Year ending May 2025 Financial Forecast

5. Mid-term Management Policy and its Progress

6. Interview with President Horiuchi

7. Conclusions

<Reference: Corporate Governance>

Key Points

- In the fiscal year ended May 2024, sales increased 9.6% year on year to 111.6 billion yen. Sales increased in the BOOKOFF operations in Japan, the premium services business, and the overseas business. Ordinary income increased 13.4% year on year to 3.4 billion yen. Despite slower growth in gross profit margin than revenue growth caused by a change in product mix, including the increase of lower-margin items other than books and software media, the company achieved double-digit growth in profit. This was driven by absorbing increased SG&A expenses for hiring and training personnel, and actively increasing stores. All of the three businesses saw a profit growth. Actual results were largely in line with the revised forecasts.

- For the fiscal year ending May 2025, the company forecasts sales of 120 billion yen, up 7.5% year on year, an operating income of 3.5 billion yen, up 14.7% year on year, and an ordinary income of 3.8 billion yen, up 10.2% year on year. In the second year of the mid-term management policy, the company will continue aggressively opening new stores in each of its businesses. It will accelerate the pace of new store openings in the premium services business and the overseas business, which are expected to grow. In the BOOKOFF operations in Japan, depreciation from the large IT investment in the previous fiscal year and personnel and other expenses in each business will increase. Additionally, SG&A expenses will rise due to the cost of measures to prevent the recurrence of fraud. However, the company expects an increase in profit due to new store openings in each business segment, the growth of existing BOOKOFF stores in Japan, and revisions to intersegment transaction prices. The dividend amount is expected to be 25.00 yen/share, unchanged from the previous fiscal year. The expected payout ratio is expected to be 23.5%.

- We asked President Horiuchi about an overview of the financial results for the fiscal year ended May 2024, the progress of the mid-term management plan, and his message to shareholders and investors. President Horiuchi stated, “I would like to express my deepest apologies to our shareholders, investors, and all other stakeholders for the inconvenience caused by the recent revelation of the fraud. We will use the lessons learned, such as the inadequacies of our checking system, as a catalyst to further strengthen our management philosophy, mission, and vision, which form the basis of our mid-term management policy, and we will work as one to achieve our goals of 130 billion yen in sales and 4.5 billion yen or more in ordinary income for the fiscal year ending May 2028. We hope you will support us in this endeavor.”

- In the BOOKOFF operations in Japan, which is the mainstay, the sales of books have been healthy. While annual sales of books decreased 1.3% year on year in the fiscal year ended May 2024, sales in the third and fourth quarters (December-February and March-May, respectively) exceeded year on year, and the first quarter of the fiscal year ending May 2025 (June-August) also showed year-on-year growth. There are the effects of the drop in the number of copies of new paper books sold, and a long-term downtrend is considered unavoidable, but books remain core products. Various measures implemented to reduce the decline, such as pricing strategies, online sales, and the option to order online and pick up ordered books at a store, have been effective.

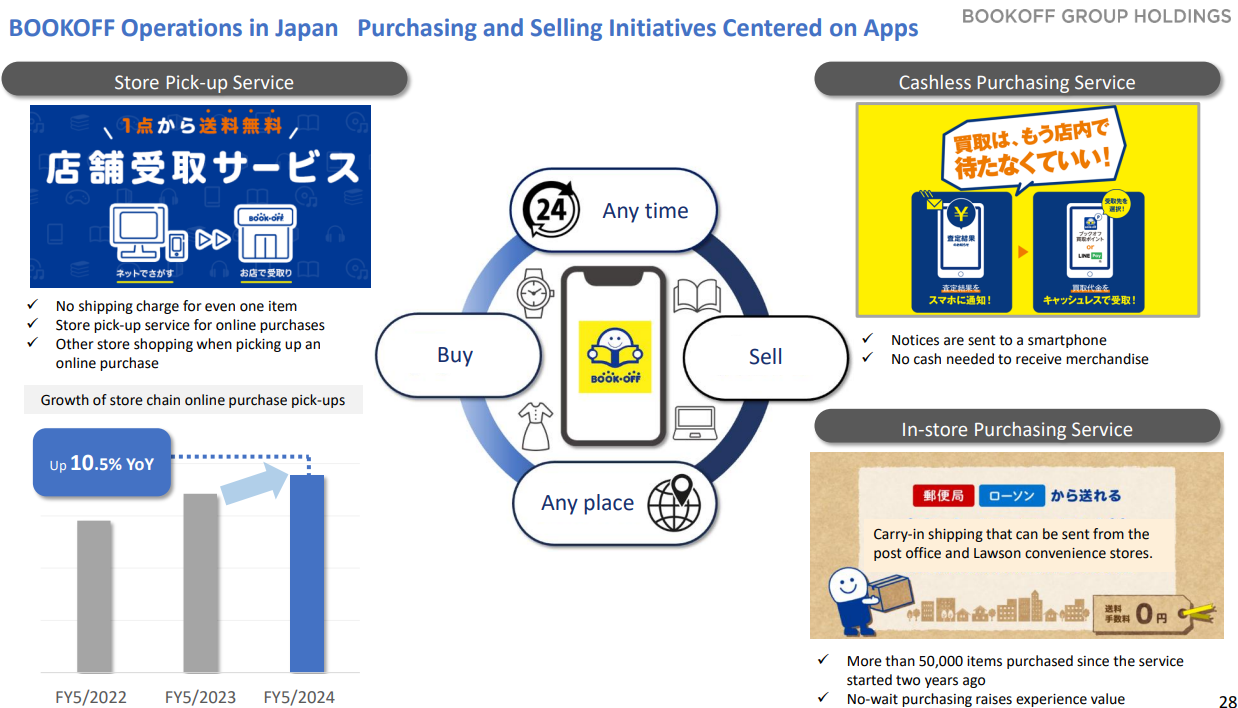

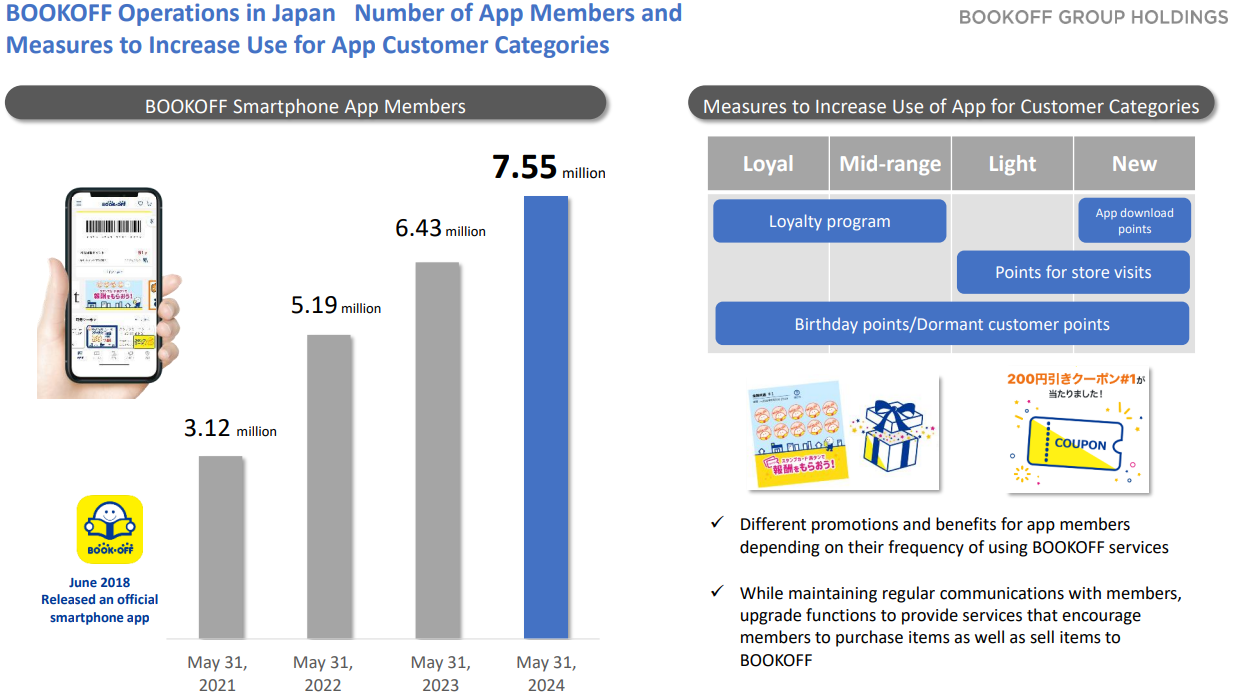

- The number of app users has increased, being 7.55 million as of the end of May 2024. This growth has led to the increase of use of various services and revenues. Services like cashless purchase and in-store purchase have been popular, and the in-store pickup services, where customers can search online and pick up items at a store, has been particularly successful. This service has been praised for its high level of convenience, and has seen double-digit growth year on year, with over 2 million items picked up at stores annually. Moreover, a third of customers using this service make additional purchases while in a store, leading to expand in sales. While the recent fraud incident is a setback, it presents an opportunity for the company to learn and grow, focusing on quality and sustainability.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including Books, CDs, DVDs, video games, apparel, sporting goods, baby goods, and miscellaneous goods. It has about 800 (directly managed + franchised) store networks covering all over the country. Also, they strengthen EC collaboration.

【1-1 Corporate Philosophies of the BOOKOFF Group】

・Contributing to society through our business activities.

・the pursuit of employees’ material and spiritual wellbeing.

With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of assorted items, with a focus on the purchase and sale of “books.” By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Be a source of an enjoyable and prosperous life for as many people as possible,” they aim to be a leading “reuse” company, and a company that can continue to grow while enabling all employees to do their jobs with confidence and enthusiasm.

【1-2 Business Description】

Their three core businesses are the BOOKOFF operations in Japan, the premium services business, and the overseas business. Other businesses include the operation of the trading card shop Japan TCG Center and the provision of a personal service called " BOOKOFF cleanout service" that declutters customers' homes. The company is working on various new business development initiatives to achieve medium-term revenue growth.

(1) BOOKOFF operations in Japan

As the chain headquarter of the reuse stores “BOOKOFF” for books, software media, and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores; 1) “BOOKOFF” (Books, CDs, DVDs, video games, trading cards, hobby goods, home appliances and mobile phones, etc.), 2) “BOOKOFF PLUS” (a medium-sized complex BOOKOFF with Apparel accessories), and 3) “BOOKOFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; Books, CDs, DVDs, video games, trading cards, hobby goods, home appliances (audio and visual devices, computers, etc.), apparel, luxury-brand goods, sporting goods, baby goods, watches, tableware, household products etc.) and “ASO-VIVA” specializing in the sale and purchase of “enjoyable items,” such as trading cards, game software, and hobby-related products.

The number of stores means the sum of the number of directly managed stores and the number of franchised stores as of the end of May 2024.

|

| ||

Avg. floor space, Number of stores | About 429.8 m2 614 stores | Avg. floor space, Number of stores | About 3,140 m2 50 stores |

Merchandise | Books, CDs, DVDs, video games, trading cards, hobby goods, home appliances, mobile phones, etc. | Merchandise | “BOOKOFF” + Apparel/luxury brand goods/household products/ sporting goods/kitchenware, etc. |

|

| ||

Avg. floor space, Number of stores | About 992 m2 67 stores | Avg. floor space, Number of stores | About 132 m2 5 stores |

Merchandise | “BOOKOFF”+ Apparel/accessories, etc. | Merchandise | Trading cards, video games, hobby goods |

(Source: the Company’s material)

“BOOKOFF” and “BOOKOFF PLUS,” which are conventional small and medium-sized stores of books software media, are important points of contact with customers and purchase sites, which cover the areas surrounding stations, downtown areas, and roadside areas.

“BOOKOFF SUPER BAZAAR (BSB),” a large-sized general store of reuse products with an area of 500-1,000 tsubo (1,650-3,300 m2), which deals in a variety of products, exerts unrivaled competitive advantages as a regional flagship store.

The sales of the BOOKOFF operations in Japan in the fiscal year ended May 2024 were about 99.0 billion yen, accounting for about 90% of total sales. “BOOKOFF” and “BOOKOFF PLUS” accounted for about 50%, and “BOOKOFF SUPER BAZAAR (BSB)” accounted for about 40% of the sales of the BOOKOFF operations in Japan.

The company is promoting the "One BOOKOFF" initiative, which aims to deliver unique, "once-in-a-lifetime encounters" with reused items to all customers in the most optimal way, utilizing the official smartphone app, the EC channel, and the nationwide store network. Efforts include expanding app users, operating an electronic purchasing system (reducing user reception time and increasing store operational efficiency), linking store inventory with e-commerce, implementing in-store pickup services for e-commerce products, and introducing cashless purchasing systems.

The number of app users was 7.55 million yen as of the end of May 2024.

Over 30% of our customers at the register are app users. App-based promotions have been effective in attracting customers, leading to an increase in the number of customers visiting the store.

The company will shift its focus to a phase that aims to increase the frequency of store visits and sales per member rather than to increase the number of members.

The company is enhancing CRM and enriching its loyalty program, which was introduced in May 2023, to visualize and reward customer engagement with BOOKOFF within the app. The company intends to closely connect with customers' daily lives and encourage them to return to the store and make purchases again.

At the same time, the company is also working on a large-scale development project to revamp its store POS and system.

(2) Premium Services Business

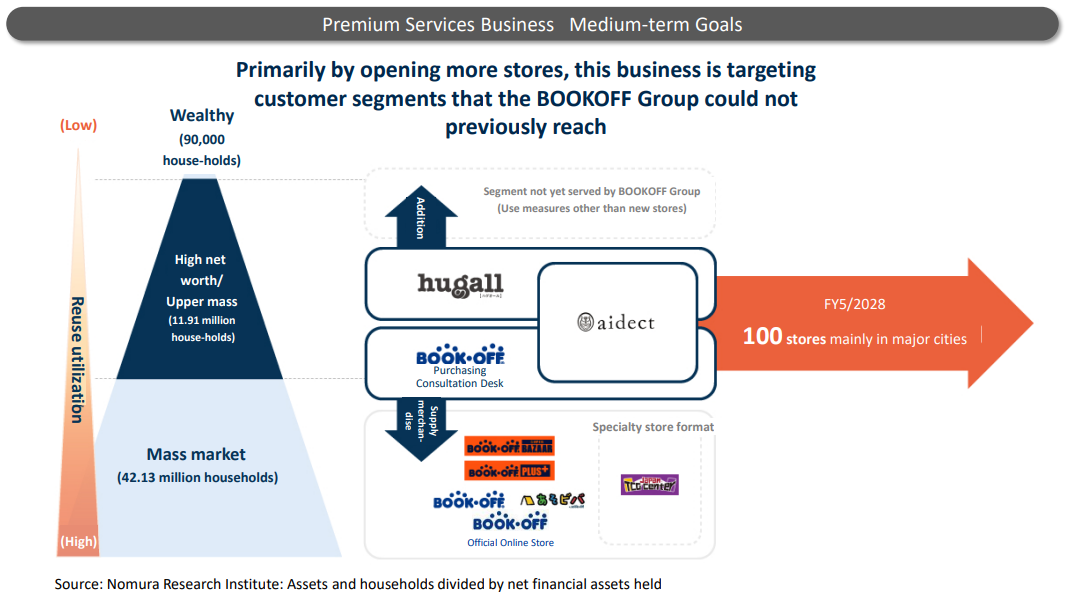

They aim to promote customers who own valuable items, to which BOOKOFF has not appealed enough, to use their reuse services with various brands.

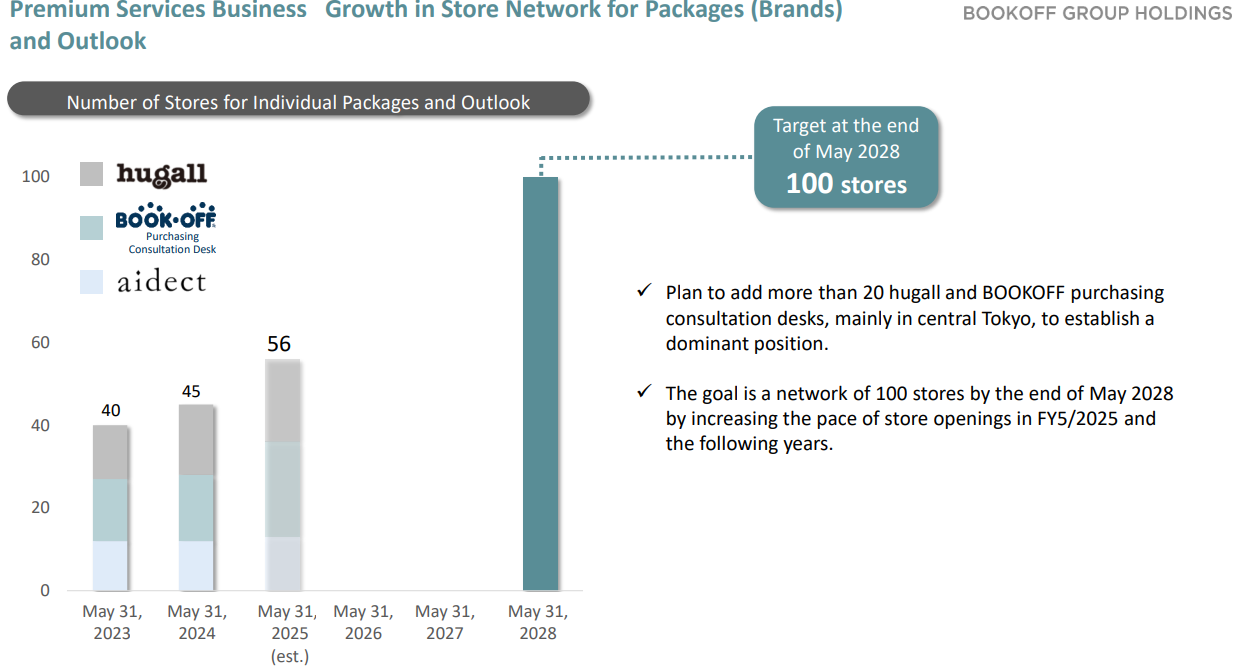

The company operates “hugall” (17 shops), which purchases secondhand products from wealthy people in major department stores, the BOOKOFF Purchasing Consultation Desks (16 stores), which purchases anything, including watches, luxury-brand goods, apparel, tableware, and sporting goods and “aidect” (12 shops) for offering comprehensive jewelry-related services, which buy and sell jewels, receive orders, repair and remake jewels. The total number of stores is 45 as of May 31, 2024.

The strengths of “hugall” include the rich know-how to operate shops in department stores, the swift recoupment of investment, and the purchase by a specialized team versed in various genres visiting each customer.

“BOOKOFF Purchasing Consultation Desks” handles not only used products of luxury brands, but also used books and software media, to differentiate its service from competitors’ services.

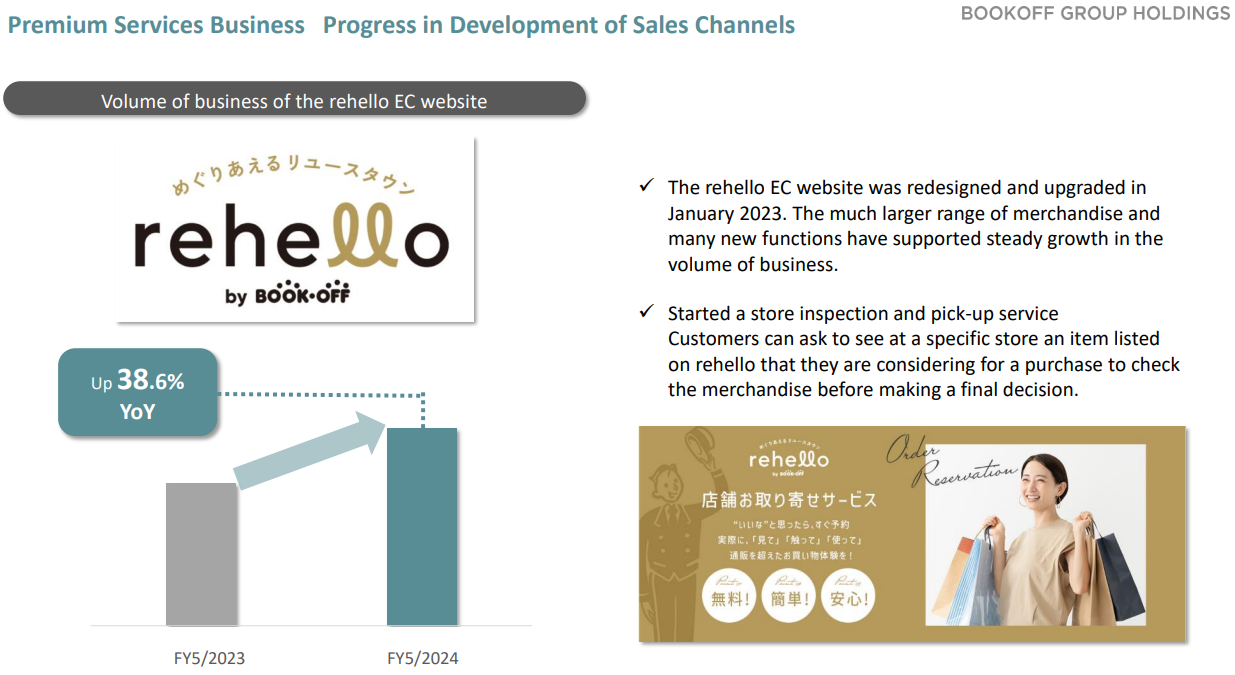

In January 2023, the company substantially expanded the product lineup and functions of its e-commerce website, which had been operating under the name "hugall fashion," and newly opened it as "rehello," a site handling the premium lines of the BOOKOFF Group.

The site aims to expand the breadth and depth of the customer experience by offering services such as ordering products from BOOKOFF Group stores (some stores), confirming products to be purchased, in-store pickup, fitting services, and accepting orders for refurbishing and repairing services through the site.

The premium services business supplies products to BOOKOFF SUPER BAZAAR, etc., contributing to the BOOKOFF group’s revenues, and opens shops in regions and places where it is difficult to open BOOKOFF stores, contributing to the brand development of the corporate group, and generates synergetic effects, such as the sale of apparel via the EC site “rehello.”

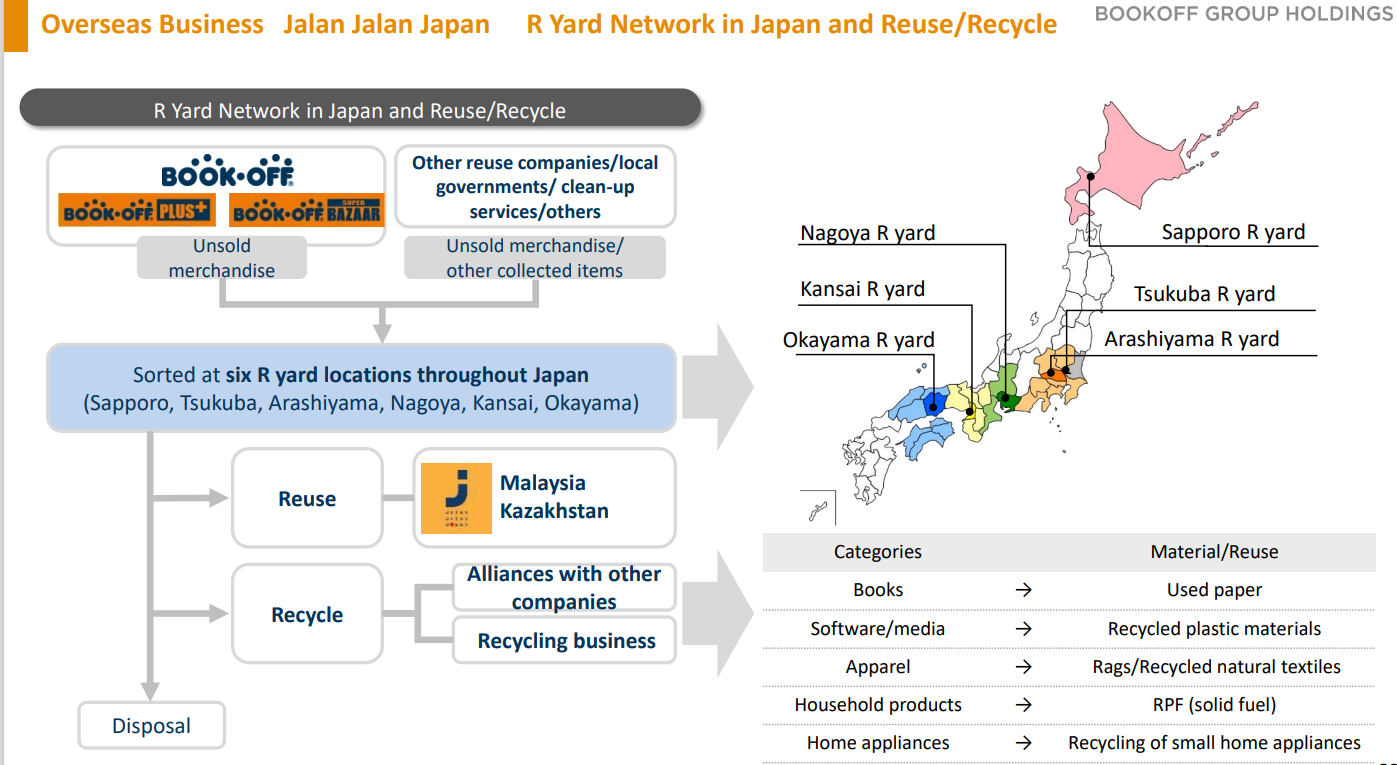

(3) Overseas Business

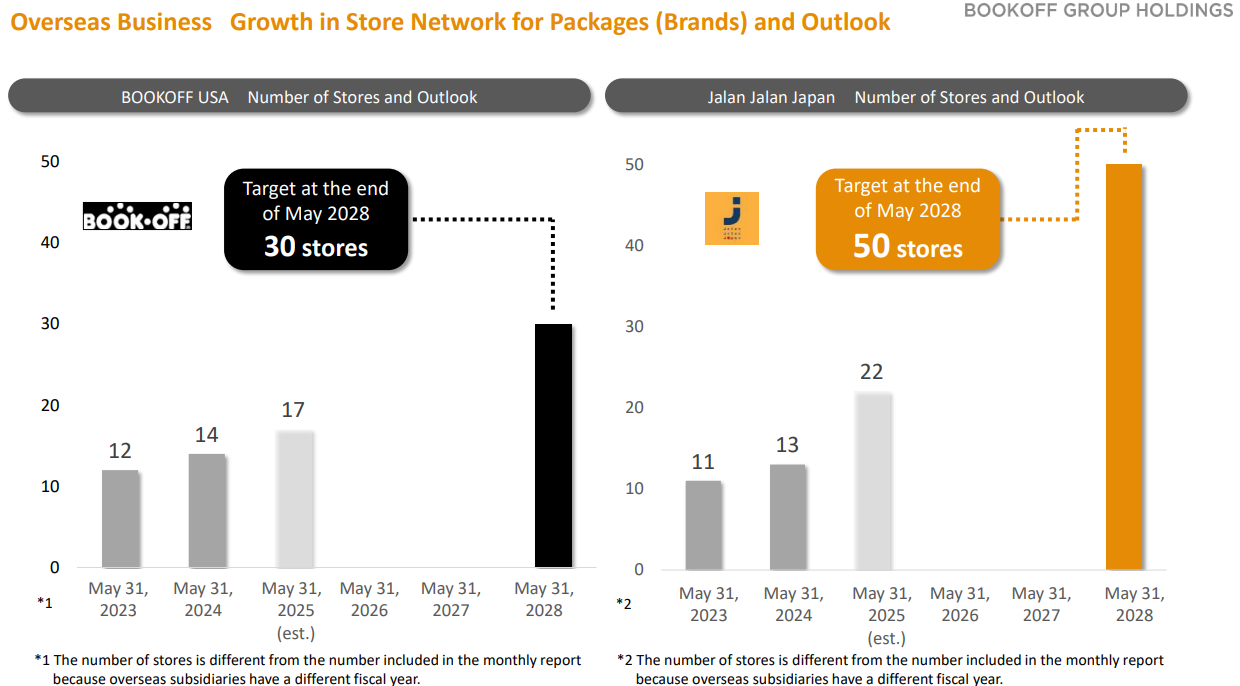

As for overseas business operations, BOOKOFF U.S.A. INC. runs “BOOKOFF” stores (14 direct stores) in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” (11 direct stores and 1 FC store) mainly in Malaysia. In addition, the company has three FC stores in France and two in Kazakhstan.

They have established a position as a unique, highly entertaining retailer in each region, and give top priority to “the development of native employees.”

The number of stores is as of the end of May 2024.

* Malaysia

The company entered the Malaysian market in 2016 and have released a Malaysian original package called “Jalan Jalan Japan.”, and 12 stores are operating as of the end of May 2024. It will focus on human resource development and work to further expand the store network.

The business in Malaysia is profitable, and it not only contributes to earnings, but also serves as an exit strategy for the Group (it sells products that could not be sold at stores in Japan locally). Previously, unsold products in Japan were often discarded as industrial waste. However, the Malaysian operations have provided a solution, enabling us to significantly reduce disposal costs. Store operations require securing a large number of products and operations to deal with a large number of products, making it difficult for other companies to develop similar businesses. As a result, this business is unique to the company, which boasts the best sales in the industry. Local subsidiaries are managed by expatriate employees, and stores are operated by mainly store managers and local staff who have been hired in each region.

In October 2022, the Jalan Jalan Japan Zhetysu-Semirechye store was opened in Almaty, Kazakhstan, as a perticipating store, by a local company.

Kazakhstan's capital, Almaty, is the largest city in Kazakhstan, located at roughly the same latitude as Hokkaido. By opening a store there, the company can develop it as an outlet for Japan's winter clothing and goods. Furthermore, in September 2023, the company opened its second store in the Republic of Kazakhstan: the Jalan Jalan Japan Gallereya Mall store (an FC store), which specializes in apparel.

* The U.S.

Made inroads into the U.S. market in 2000. The company operates 14 BOOKOFF stores, which purchase and sell books, software media, anime goods, hobby goods, etc. like BOOKOFF stores in Japan.

Like in Malaysia, local subsidiaries are managed by expatriate employees, and stores are operated by mainly local staff who have been hired in each region.

(4) Business development domain

Currently, they engage in mainly the following business development projects.

①Business of operating the shop specializing in trading cards “Japan TCG Center”

The trading card shop “Japan TCG Center” purchases and sells used cards, and deals in a wide array of brand-new packages and related goods. The shop has a “duel space” for playing trading cards and targets a broad range of customers, including beginners and experts. The number of shops was 2 as of the end of May 2024.

②Business of recycling CD plastics

With the technology provided through partnership with an external enterprise, the company recycles plastics from about 1,700 tons of unsold CDs and DVDs at BOOKOFF stores. They sell them to makers, etc. to provide new value.

③Cleanout business

This service is for meeting the needs for cleaning out rooms at the time of inheritance, disposal of goods before death, relocation, etc. In this service, they clean out rooms by sorting, removing, disposing of, and purchasing unnecessary items.

④“FOOD ReCO,” an EC site for processed food products whose best-before periods are about to expire

In “Rakuten Ichiba,” the company opened “FOOD ReCO,” an EC site for selling processed food products whose best-before periods are about to expire.

They contribute to the reduction of food loss by offering “edible food products to be discarded” and “products that have nowhere to go.”

【1-3 Company strengths】

The company believes that its strengths in the reuse market are primarily in the following areas.

(1)Recognition No.1

The results of a survey of domestic reuse chain users indicate that the company has 96% awareness. Almost all respondents are familiar with the company.

The company's long track record of operation and nationwide expansion of brick-and-mortar stores are the reasons for this, and are strong barriers to entry that cannot be easily followed by other companies.

(2)Number of customers No.1

The number of customers using the company's services is approximately 90 million per year (total number of customers).

The above recognition, coupled with a network of approximately 800 stores nationwide and the "One BOOKOFF" concept aimed at maximizing customer access both in-store and online, has garnered strong support from users for its convenience.

(3)Book inventory No.1

The number of books in stock exceeds 100 million. Books are core products of the company, which started its business with the purchase and sale of used books. Books are read by a broad range of people, so customers tend to start using the reuse-related service through books. Accordingly, it can be expected that customers will buy other products. Namely, books contribute significantly to the development of a stable customer base.

(4)Human Resource Development System

In order to realize its business mission of " Be a source of an enjoyable and prosperous life for as many people as possible." in mentioned above, the company believes that human resource development is essential.

The company is focusing on human resource development to support store operations through a human resource development curriculum based on its management philosophy and other philosophies and various manuals, as well as a career development system for all employees.

In addition to improving customer satisfaction through "smiling, courteous, and speedy responses" at stores, the company is also working to raise the awareness of each employee to participate in improving operational efficiency at the distribution center.

(5)Creating stores that offer peace of mind

The company is working to create stores where users can sell goods with peace of mind by providing purchase services from the user's perspective and ensuring compliance with laws and regulations.

In particular, with regard to the appropriateness of purchase prices, which is of greatest concern to users, the company has established a purchase price database at its head office based on a vast amount of transaction data, which no other company has, and uses this database as the basis for purchases at each of its stores.

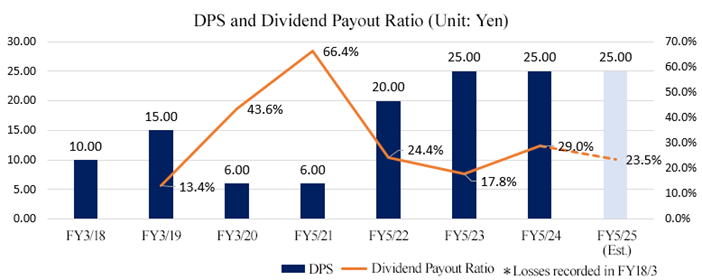

【1-4 Return to shareholders】

Considering profit allocation as one of the most important items, they will utilize internal reserve effectively for strategic investment and enhancement of the financial standing to improve corporate value.

Their basic policy is to keep paying dividends stably with a payout ratio of 20-30% with respect to consolidated net income.

【1-5 Sustainability】

(1) Fundamental Philosophy

Under the group's management philosophy, they treat sustainability as a crucial element of management. The company recognizes that their customers' activities of selling and buying at "BOOKOFF" contribute to the extension of product lifespans and waste reduction, aligning with the "vision of a circular society. "

In August 2023, the company articulated this stance by establishing a Basic Policy for Sustainability and a Human Rights Policy, reinforcing the dedication to ESG-focused management.

<Basic Sustainability Policy>

Environmental (E): | ・Foster eco-friendly business activities. ・Expand reuse/recycle initiatives to promote a circular society. |

Social (S): | ・Make jobs worthwhile and workplace ease ・Create comfortable environments for everyone ・Solidarity and harmony with local communities |

Governance (G): | ・Ensure decision-making from diverse perspectives, and maintain integrity in management ・Disclose information appropriately and conduct a responsible dialogue. |

<Human Rights Policy>

We believe that the protection of fundamental human rights is a prerequisite for creating a sustainable world. Therefore, in order to understand human rights and fulfill their responsibility to respect human rights, they have established the following human rights policy.

1. Basic Stance on Human Rights

We understand that corporate activities can potentially and overtly affect human rights. This policy conforms to international standards and will be put into practice in accordance with the United Nations "Guiding Principles on Business and Human Rights. "

2. Scope of this Policy

This policy applies to all directors and all employees (including part-time employees) of group companies.

3. Commitment to Addressing Human Rights Issues in Corporate Activities

① Elimination of Discrimination

We respect individual human rights and diversity. We do not discriminate on any grounds including gender, age, nationality, race, religion, social background, employment status, marital status, pregnancy, health condition, gender identity, physical characteristics, or the presence or absence of disabilities.

② Appropriate Workplace Environment

We strive to provide a workplace environment where the human rights of all directors and employees of group companies are respected. This includes providing a healthy and safe workplace environment free from all forms of harassment, whether mental or physical, ensuring proper management of working hours, guaranteeing minimum wages, protecting privacy, and respecting freedom of association and the right to collective bargaining. We also do not tolerate any form of forced labor, child labor, or human trafficking.

4. Human Rights Due Diligence

In line with the United Nations "Guiding Principles on Business and Human Rights," we conduct human rights due diligence to identify, assess, prevent, and mitigate the negative impacts of corporate activities on human rights. Should it become evident that we are causing or contributing to human rights abuses, we will strive to correct these issues.

5. Remedial Measures

They provide a reporting system that allows all stakeholders to report human rights concerns without suffering any disadvantage. In the event of an allegation of human rights violations, they will promptly investigate, take remedial action to correct the negative impact on human rights, take steps to reduce future risks, and approach related people.

6. Education and Training

To ensure the effectiveness of this policy, they continually provide appropriate education and training to all directors and employees of group companies.

(2) Main Initiatives

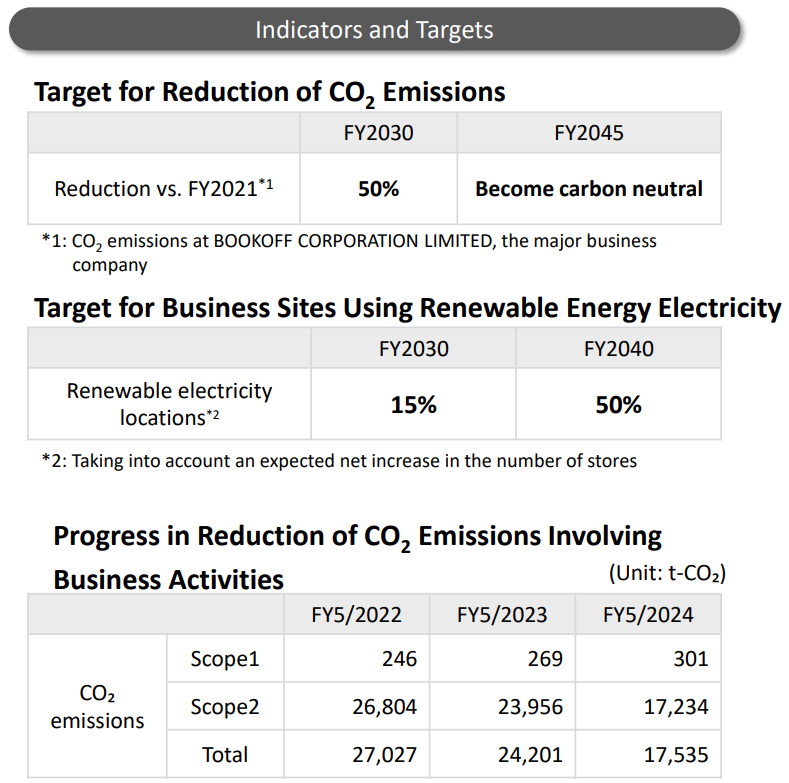

① E (environment)

In order to realize a recycling society, the company will enhance its approach to slow down and reduce the consumption of resources.

Through the domestic BOOKOFF chain, the company purchases about 400 million items per year and sells about 260 million items per year.

The reuse of CDs, DVDs, game software, and clothes is estimated to reduce CO2 emissions by about 460,000 tons per year.

In addition to the reuse (purchase and sale) of items, which is the mainstay, the company develops private-brand products by utilizing discarded books, recycles and sells plastics from discarded CDs and DVDs, and sells upcycled items through REMARKET, as activities for expanding reuse and recycling businesses.

In response to climate change issues, the company announced its support for the TCFD recommendations in August 2023.

(Source: the Company’s material)

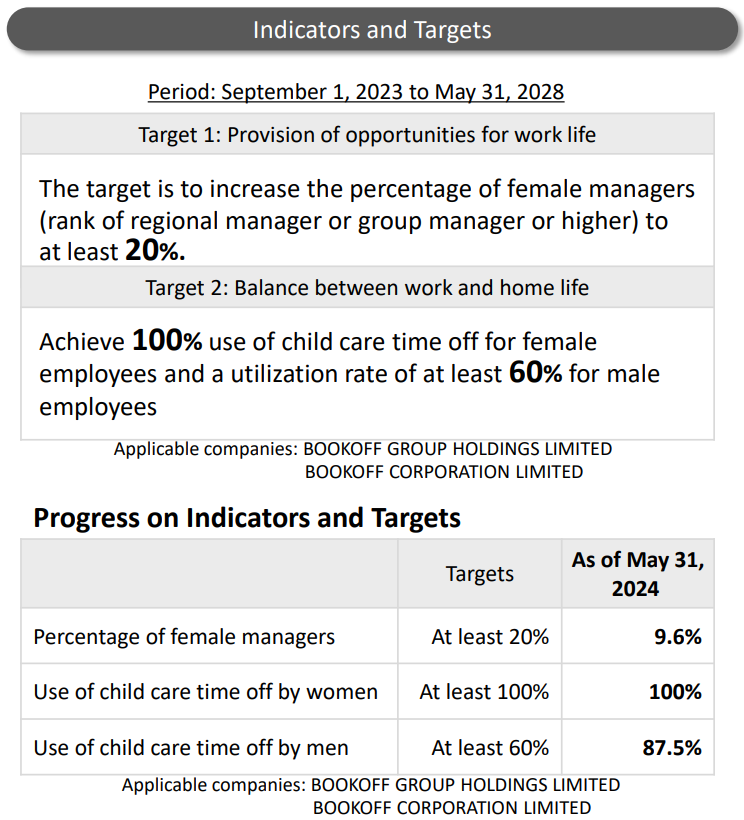

② S (society)

◎ Human Capital Enhancement

The company believes that promoting diversity, which is the foundation for achieving well-being, is the most critical challenge.

Under the diversity policy, the following approaches will be taken.

1. Commitment from the management team

2. Cultivating an inclusive corporate culture that welcomes and respects diversity

3. Fair, equitable, and transparent system flow

4. Evaluation and confirmation

5. Employee participation and engagement

(Source: the Company’s material)

◎ Initiatives

The company will collaborate with government agencies, companies and organizations to solve a wide range of social problems. By forming partnerships with related parties, it will lead the way in promoting a recycling-oriented society.

In April 2024, the second Furusato BOOKOFF store opened in Kisomisaki-cho, Kuwana-gun, Mie Prefecture, creating opportunities for children to read in municipalities that do not have bookstores. A regional cooperation agreement was concluded for regional development efforts through books, etc.

③ G (governance)

The company is striving to enrich the dialogue with shareholders and investors, by enriching the website contents, holding briefing sessions for individual investors, streaming the videos of briefing sessions online, holding general meetings of shareholders on Saturdays, involving President Horiuchi in meetings for institutional investors, and disclosing information in English.

For their governance structure, they established a sustainability strategy committee in 2022.

The representative director and president serves as chair of the committee, and holds a meeting once or more times per six months. The committee identifies various risks and opportunities regarding climate change, etc., discusses policies and strategies, and monitors the progress of action plans in each section.

(3) Efforts to achieve SDGs

In order to attain Sustainable Development Goals (SDGs), the company selected the SDGs goals and targets that are related to their business and have a social impact, and identified material issues.

In order to take initiatives for dealing with the identified material issues, the publicity and SDGs divisions organize a team for having group-wide discussions and implementing the initiatives, actively cooperate with external partners while utilizing the strengths of the BOOKOFF group, and strive to solve social issues through business.

materiality | summary | SDGs |

*Significant reduction of waste and sustainable management of forests

*Realization of a carbon-neutral society | The reuse business of the BOOKOFF group reduces CO2 emissions by 460,000 tons per year. In addition, the company recycles 28,000 tons of used paper per year in cooperation with business partners. This preserves about 600,000 trees in the forest environment per year (*estimated by the company).

Following the recommendations of TCFD, the company will qualitatively and quantitatively improve the disclosure of information on governance, strategies, risk control, and climate change based on the frameworks for indicators and goals. |

|

Provision of educational opportunities to the next generation | The company produces curricula regarding reuse business, tasks, and various measures, and implements a variety of educational support programs and gives lectures utilizing the reuse business, according to growth stages, including early childhood, and elementary, middle, and high schools. In education, they focus on nearby stores, so that children can think about social and environmental issues as familiar ones. |

|

Promoting diversity | The company launched “a project for developing a comfortable working environment” as a measure for developing a working environment in which female employees can work vigorously and flourish and realizing a good work-life balance, and engages in initiatives for enabling workstyles suited for various life stages, including childcare, child rearing, and nursing care, regardless of age and gender. Specifically, at the principal business entity, BOOKOFF CORPORATION LIMITED, they established two goals to be attained by the end of fiscal year 2028: "Goal 1: Increase the proportion of female managerial staff (Supervising Area Managers, and higher positions than group manager) to over 20.0%" and "Goal 2: To increase the ratio of male employees who have taken childcare leave to 60% or higher while keeping said ratio for female employees at 100%."

Furthermore, they established a special subsidiary for employing disabled people, to actively recruit disabled people and secure diversity. |

|

Private-public cooperation and inter-enterprise collaboration | The company engages in the initiative of extending the lifespan of each item by selling products that were not sold and to be discarded in Japan via “Jalan Jalan Japan,” a shop of used items outside Japan, and fosters partnership with related organizations, to promote the realization of a recycling society cooperatively. |

|

(Source: the Company’s material)

2. Fiscal Year ended May 2024 Financial Results

【2-1 Consolidated Results】

| FY 5/23 | Ratio to sales | FY 5/24 | Ratio to sales | YoY | Compared to the revised forecast |

Sales | 101,843 | 100.0% | 111,657 | 100.0% | +9.6% | +0.6% |

Gross profit | 58,416 | 57.4% | 62,771 | 56.2% | +7.5% | - |

SG&A expenses | 55,838 | 54.8% | 59,719 | 53.5% | +7.0% | - |

Operating income | 2,578 | 2.5% | 3,051 | 2.7% | +18.4% | -4.7% |

Ordinary income | 3,040 | 3.0% | 3,448 | 3.1% | +13.4% | -4.2% |

Profit attributable to owners of parent | 2,769 | 2.7% | 1,705 | 1.5% | -38.4% | -18.8% |

* Unit: million yen.

Sales and profit increased.

Sales increased 9.6% year on year to 111.6 billion yen. Sales increased in the BOOKOFF operations in Japan, the premium services business, and the overseas business.

Ordinary income increased 13.4% year on year to 3.4 billion yen. Despite slower growth in gross profit margin than revenue growth caused by a change in product mix, including the increase of lower-margin items other than books and software media, the company achieved double-digit growth in profit. This was driven by absorbing increased SG&A expenses for hiring and training personnel, and actively increasing stores. All of the three businesses saw a profit growth.

Net income decreased 38.4% year on year to 1.7 billion yen. In addition to the write-off of special tax factors recorded in the previous term, the company recorded extraordinary losses including a provision for special investigation expenses of 550 million yen to cover investigators' fees related to cases of fraud committed by employees of a subsidiary.

Actual results were largely in line with the revised forecasts.

◎ Number of Group stores

As of the end of May 2024, there were 755 stores in the BOOKOFF operations in Japan (387 directly managed stores and 368 FC stores), 45 stores in the premium services business, and 30 stores in the overseas business (24 directly managed stores and 6 FC stores).

14 (directly managed) stores were opened in Japan and 3 overseas in the fiscal year ended May 2024.

Opening of new stores (direct)

Classification | Store Name | Store Packages | OPEN | Location |

Domestic | Yoshizuya Shin-Inazawa Store | BOOKOFF PLUS | July 28 | Aichi Pref. |

Domestic | Hitachi-eki-mae Store | BOOKOFF PLUS | September 7 | Ibaraki Pref. |

Domestic | DCM Kamiiso Store | BOOKOFF | September 8 | Hokkaido |

Domestic | Musashi-Koganei Store | BOOKOFF | October 6 | Tokyo |

Domestic | Aeon-hashimoto Store | BOOKOFF | October 27 | Kanagawa Pref. |

Domestic | AeonMall-Omuta Store | BOOKOFF | November 11 | Fukuoka Pref. |

Domestic | Ito-Yokado-Mizonokuchi Store | BOOKOFF | November 17 | Kanagawa Pref. |

Domestic | AeonMall-Kusatsu Store | ASO-VIVA | November 22 | Shiga Pref. |

Domestic | AeonMall-Suzuka Store | ASO-VIVA | November 24 | Mie Pref. |

Overseas | IRVINE Store | BOOKOFF | November 29 | The U.S. |

Overseas | AEON MALL Bukit Raja Store | Jalan Jalan Japan | November 30 | Malaysia |

Domestic | Iyotetsu Takashimaya Store | hugall | February 15, 2024 | Ehime Pref. |

Overseas | MESA Store | BOOKOFF | February 22 | The U.S. |

Domestic | Seijogakuen-mae Store | BOOKOFF Purchasing Consultation Desk | April 1 | Tokyo |

Domestic | Takanawadai-eki-mae Store | BOOKOFF Purchasing Consultation Desk | April 15 | Tokyo |

Domestic | Kofu Kougawa Store | BOOKOFF SUPER BAZAAR | April 26 | Yamanashi Pref. |

Domestic | Kagurazaka Store | BOOKOFF Purchasing Consultation Desk | May 15 | Tokyo |

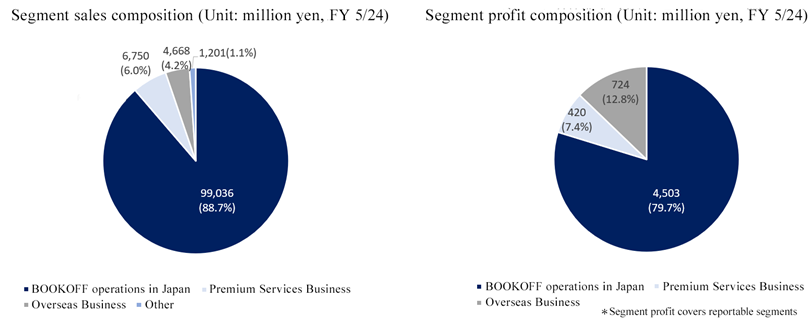

【2-2 Segment Trends】

| FY5/23 | Composition ratio | FY5/24 | Composition ratio | YoY |

Sales |

|

|

|

|

|

BOOKOFF operations in Japan | 91,549 | 89.9% | 99,036 | 88.7% | +8.2% |

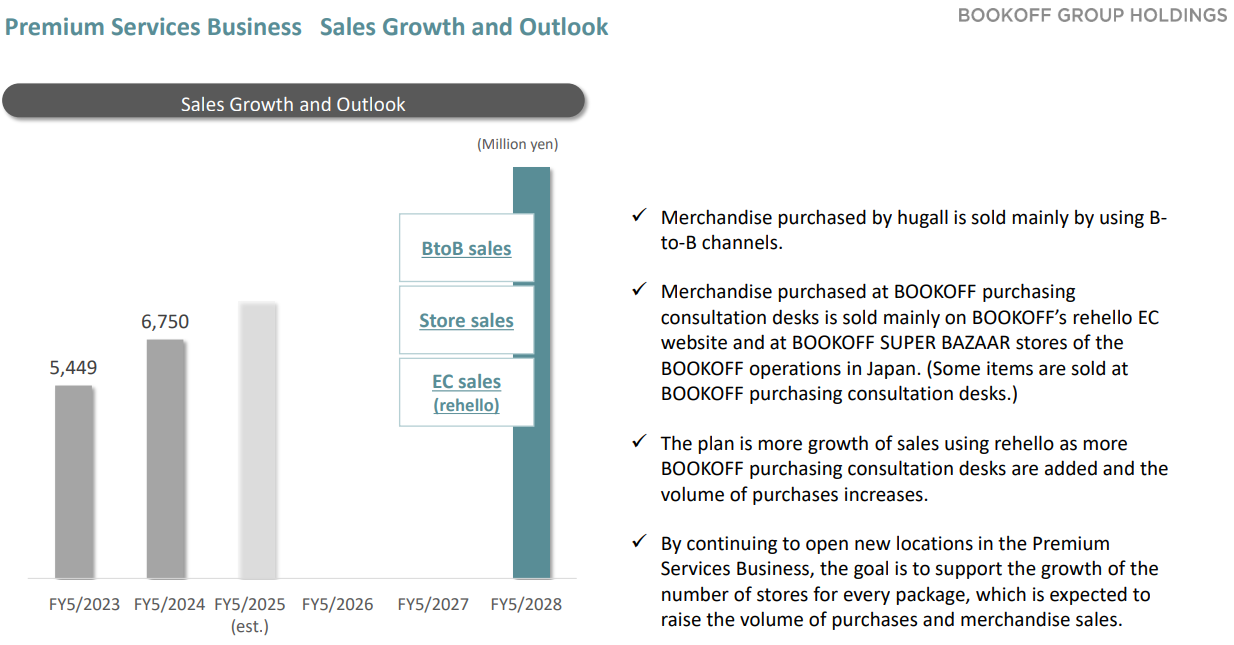

Premium services business | 5,449 | 5.4% | 6,750 | 6.0% | +23.9% |

Overseas business | 4,045 | 4.0% | 4,668 | 4.2% | +15.4% |

Others | 798 | 0.8% | 1,201 | 1.1% | +50.5% |

Total | 101,843 | 100.0% | 111,657 | 100.0% | +9.6% |

Segment income |

|

|

|

|

|

BOOKOFF operations in Japan | 3,774 | 4.1% | 4,503 | 4.5% | +19.3% |

Premium services business | 325 | 6.0% | 420 | 6.2% | +29.1% |

Overseas business | 631 | 15.6% | 724 | 15.5% | +14.7% |

Others | -123 | - | -175 | - | - |

Adjustment | -1,567 | - | -2,023 | - | - |

Total | 3,040 | 3.0% | 3,448 | 3.1% | +13.4% |

* Unit: million yen. Segment profit is composed of the ratio of profit to sales.

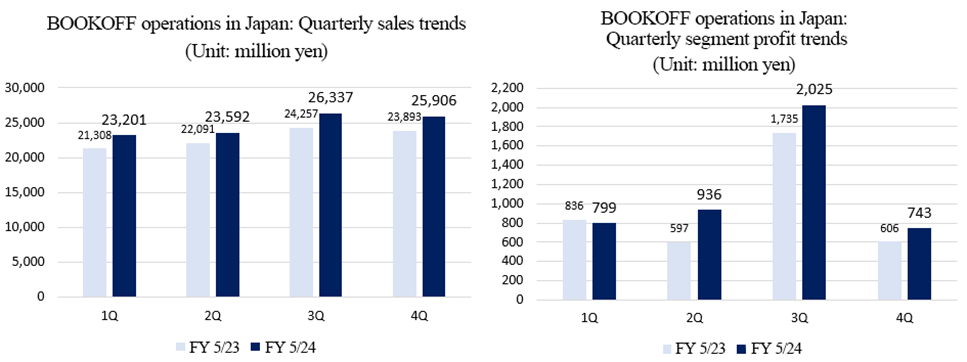

(1) BOOKOFF operations in Japan

Sales and profit increased.

At existing directly managed stores, sales of trading cards, hobby goods, apparel, precious metals, watches, and brand-name bags increased from the previous fiscal year. The opening of new stores also contributed to this. In terms of profit, existing directly managed stores performed well in the third quarter (December–February), which was the peak period of profit.

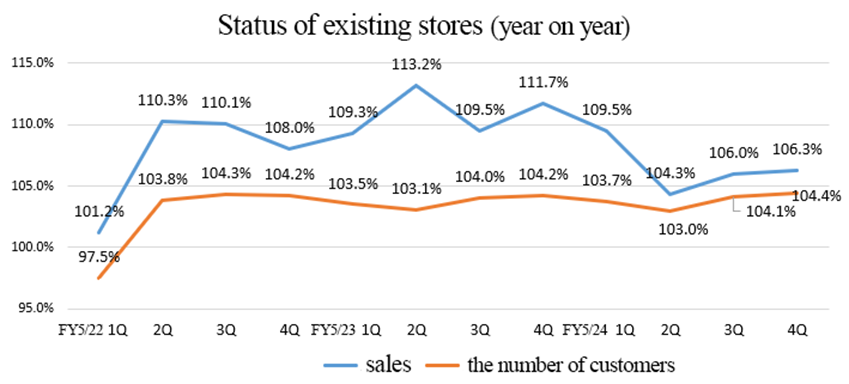

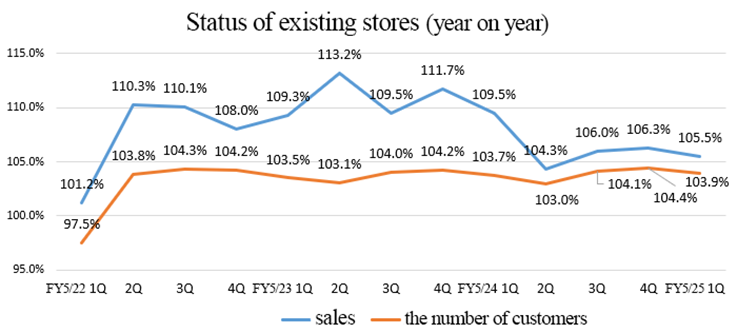

◎Existing Store Sales

As a result of marketing measures such as the renovation of existing stores and the maximization of the app subscriber base, sales at existing stores in the fiscal year ended May 2024 were up 6.5% year on year, and the number of customers was up 3.8% year on year. The company believes that the year-on-year growth rate of around 5% is steady considering the rebound from the COVID-19 pandemic two fiscal years ago and the previous fiscal year as well as the impact of the rapid expansion of trading cards.

Sales of all types of products other than books and soft media grew, and the average spending per customers also increased.

Renovation was carried out in existing 48 stores.

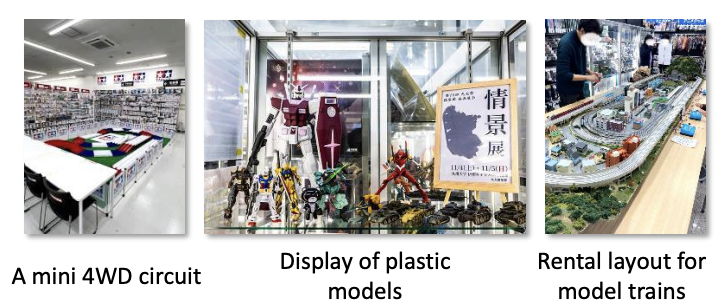

In order to strengthen the handling of trading cards and hobby goods, the company will continue to make strategic investments in two areas: "Transforming BOOKOFF into an entertainment destination" and "Strengthening the handling of trading cards and hobby goods." This will be accomplished primarily by increasing sales areas and creating a competitive environment.

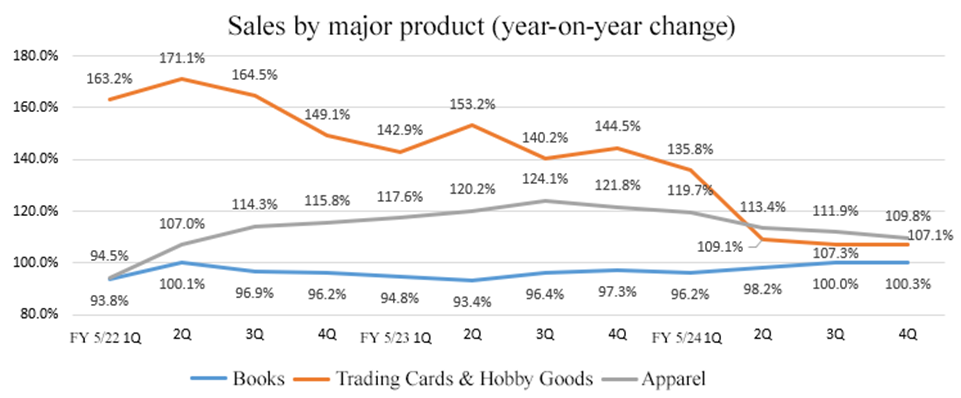

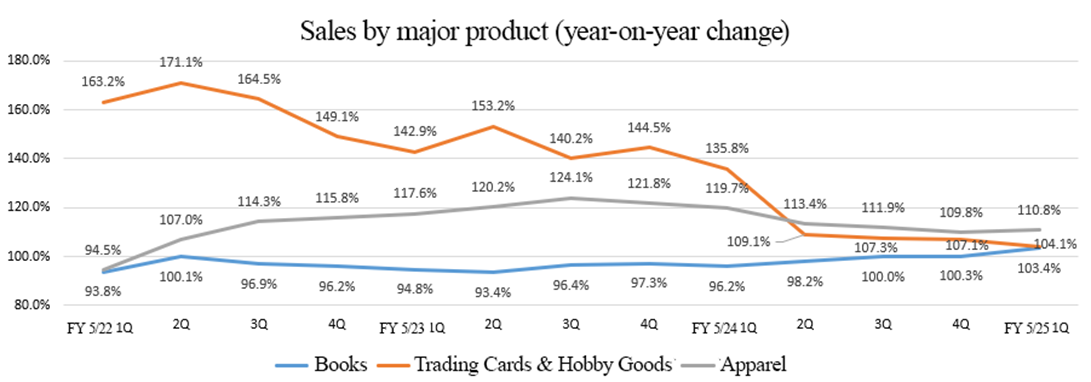

◎ Products

The sales of books only decreased 1.3% from the previous fiscal year, but on a quarterly basis, it increased in the third quarter (December-February) and the fourth quarter (March-May) consecutively. In addition to the rise in unit selling price, a number of strategies to curb the decrease, including online sales and online ordering with in-store pickup, are working.

There are the effects of the drop in the number of copies of new paper books sold, and a long-term downtrend is considered unavoidable, but books remain core products, and they were able to keep sales from dropping year on year.

Sales of trading cards and hobby goods increased 13.5% year on year, showing a double-digit increase. However, unit selling prices have decreased since the second half of the fiscal year in the wake of the surge in Pokémon card prices in the previous fiscal year, and demand, mainly from collectors, shrank.

The company is focusing on creating a store where players, not collectors, can enjoy; however, it is partly affected by the above trend.

However, the market of new products continues to expand, and in order to increase players in the future, the company will continue initiatives by holding real events such as "Trading Card Festivals" and expanding the number of stores with competition spaces.

The performance of hobby goods, which account for about half of the "trading cards and hobby goods" category, remains healthy.

In addition to selling and buying goods, the company is continuing to transform its stores into entertainment venues to create opportunities for customers to visit, such as "mini 4WD circuits," "plastic model displays," and "rental layouts for model trains." In addition, the company disseminate information through social media and mass media, and also implementation of initiatives for disseminate information about our stores and regions' unique initiatives through our own media, "BOOKOFF wo Tachiyomi!'"

(Source: the Company’s material)

Apparel sales, too, increased from the previous year. Despite the impact of the warm winter, sales continued to be strong due to the transportation of inventory between regions, the replacement of seasonal products, and the favorable trend of the reuse market. They keep improving efficiency by changing store operations, etc.

Sales of precious metals, watches, and brand-name bags, too, increased from the previous year. High market prices and increased demand from foreign visitors to Japan have contributed to this.

The demand from foreign visitors to Japan is strong. In the fiscal year ended May 2024, sales from foreign visitors grew more than 3.1 times from the pre-COVID-19 pandemic level. Regarding the performance in each region, East Asia accounts for the largest share. Regarding the performance of each product category, precious metals, watches, and brand-name bags account for the largest share at 44.7%, with trading cards, hobby goods, and soft media accounting for more than 30%.

Based on Japan's national policy to increase the number of foreign visitors to Japan, they plan to refine measures to meet their demand, mainly for trading cards and hobby goods.

(Domestic Directly Managed Stores, FY5/24 Trends by Product Category)

| YoY | Composition ratio |

Books | 98.7% | 23.6% |

Software media (music, videos, and video games) | 100.9% | 23.8% |

Apparel | 113.3% | 11.6% |

Precious metals, watches, brand-name bags | 116.5% | 9.2% |

Trading cards and hobby goods | 113.5% | 19.1% |

Home appliances, mobile phones | 113.4% | 4.9% |

Sports and outdoor equipment | 109.4% | 3.6% |

Other | 109.4% | 4.3% |

Total | 106.5% | 100.0% |

(2) Premium service business

Sales and profit increased.

A 20% increase in procurement amount from the previous fiscal year, primarily due to rising precious metal prices, the increase of events, and the contribution of stores opened in the fiscal year ended May 2023 and May 2024, led sales to rise from the previous fiscal year. The development of a model to increase sales by increasing purchases is progressing steadily.

The segment profit exceeded the previous year's level due to the sales promotion in line with market prices, despite a decline in gross profit margin caused by a rise in the ratio of sales of precious metals and an increase of personnel for business growth.

A total of four new stores were opened, including one "hugall" and three "BOOKOFF Purchasing Consultation Desk." As three stores were opened in the fourth quarter, the revenue effect of these stores is expected to appear from the fiscal year ending May 2025.

(3) Overseas business

Sales and profit increased.

The opening of "BOOKOFF" stores in the United States and "Jalan Jalan Japan" shops in Malaysia up until the previous year contributed to an 8.8% year on year increase in the United States and a 12.2% year on year increase in Malaysia, respectively. As they relocated a major warehouse in Malaysia to reinforce the product delivery system and the hiring of more staff for business expansion, profit rose despite higher expenses.Regarding directly managed stores, one store of "Jalan Jalan Japan" and two stores of "BOOKOFF" in the U.S. were newly opened.

Based on the strong economic prospects for the future, a joint venture was formed in Kazakhstan in April 2024, and two stores have been launched in Almaty City as franchisees. They intend to directly manage stores in order to expedite their opening.

【2-3 Topics】

◎ Summary of the Misconduct and Contents of the Investigation Report of the Special Investigation Committee

We formed a special investigation committee, primarily composed of external experts, to investigate the misconduct found in the physical inventory count in the fiscal year ended in May 2024.

The following is the summary of the misconduct and its impact on the business results.

(1) Summary

At several stores operated by a subsidiary of the company, it was discovered that there was a possibility of fictitious purchases by employees, inappropriate recording of inventory, and illegal acquisition of cash through these means.

Eight cases of improper acts involving cash stealing and internal product sales at seven stores and one business location were found as a result of the Special Investigation Committee's investigation. These improper acts had a total impact on the financial statements of 64 million yen, of which 56 million yen was caused by embezzlement and internal product sales. Furthermore, 19 stores had 21 instances of other improper acts discovered, which had a total impact of 17 million yen on the financial statements.

In all cases, there was no evidence of organizational wrongdoing, and it was confirmed that the perpetrators were doing so for personal gain or to achieve the store's numerical targets.

(2) Impact on business performance

The impact on consolidated operating and ordinary incomes for the fiscal year ended in May 2024 was 68 million yen due to a loss attributable to misconduct. This, along with a loss of 550 million yen on investigators' fees, resulted in an impact of 618 million yen for consolidated income before taxes and other adjustments.

(3) Prospective measures

The specific measures to prevent a recurrence and the disciplinary action to be taken against the officers and employees involved in this case will be determined and announced around early November.

3. 1Q of Fiscal Year ending May 2025 Financial Results

【3-1 Consolidated Results】

| 1Q of FY 5/24 | Ratio to sales | 1Q of FY 5/25 | Ratio to sales | YoY |

Sales | 26,183 | 100.0% | 28,292 | 100.0% | +8.1% |

Gross profit | 14,713 | 56.2% | 16,214 | 57.3% | +10.2% |

SG&A expenses | 14,304 | 54.6% | 15,101 | 53.4% | +5.6% |

Operating income | 409 | 1.6% | 1,112 | 3.9% | +171.9% |

Ordinary income | 524 | 2.0% | 1,194 | 4.2% | +127.9% |

Quarterly profit attributable to owners of parent | 308 | 1.2% | 577 | 2.0% | +87.4% |

* Unit: million yen.

Sales and profit increased.

Sales increased 8.1% year on year to 28.2 billion yen. All of the three businesses saw a sales growth.

Ordinary income increased 127.9% year on year to 1.1 billion yen. While the composition ratio of books, which have a high gross profit margin, increased, the composition ratio of trading cards, which have a low gross profit margin, decreased. As a result, gross profit margin improved by 1.1 points and gross profit also increased by 10.2% year on year. This was a significant increase in profits, absorbing the increase in SG&A expenses.

◎ Number of Group stores

As of the end of August 2024, there were 755 stores in the BOOKOFF operations in Japan (388 directly managed stores and 367 FC stores), 48 stores in the premium services business, and 31 stores in the overseas business (25 directly managed stores and 6 FC stores).

Newly-opened (directly managed) stores were 7 in Japan and 1 overseas in the first quarter of the fiscal year ending May 2025.

Opening of new stores (direct)

Classification | Store Name | Store Packages | OPEN | Location |

Domestic | Jambo Square Kashiba Store | BOOKOFF | March 22, 2024 | Nara Pref. |

Overseas | Berjaya Mega Mall Store | Jalan Jalan Japan | May 23 | Malaysia |

Other | Naha Okie Dori Store | Japan TCG Center | June 14 | Okinawa Pref. |

Premium | Omiya Takashimaya Store | hugall | July 11 | Saitama Pref. |

Domestic | Ito-Yokado-Higashimurayama Store | BOOKOFF | July 12 | Tokyo |

Premium | Sakura Shinmachi-eki-mae Store | BOOKOFF Purchasing Consultation Desk | July 12 | Tokyo |

Domestic | Cha Cha Town Kokura Store | BOOKOFF | July 13 | Fukuoka Pref. |

Premium | Denenchofu Store | BOOKOFF Purchasing Consultation Desk | August 2 | Tokyo |

Note: Since the account settlement periods of the domestic consolidated subsidiaries are different from the consolidated one, the BOOKOFF Jumbo Square Kashiba Store, which opened in March 2024, is classified as a new store opening in the first quarter of the fiscal year ending May 2025. Since the account settlement periods of the overseas consolidated subsidiaries are different from the consolidated one, Jalan Jalan Japan is classified as a newly opened store in the period of April to June 2024, and BOOKOFF USA is classified as a newly opened store in the period between March and May 2024.

【3-2 Segment Trends】

| 1Q of FY 5/24 | Composition ratio | 1Q of FY 5/25 | Composition ratio | YoY |

Sales |

|

|

|

|

|

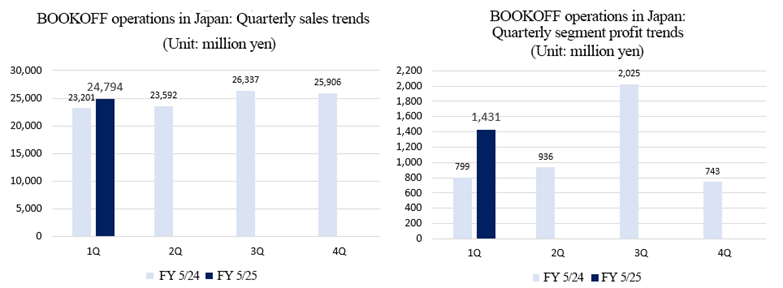

BOOKOFF operations in Japan | 23,201 | 88.6% | 24,794 | 87.6% | +6.9% |

Premium services business | 1,664 | 6.4% | 1,766 | 6.2% | +6.1% |

Overseas business | 1,057 | 4.0% | 1,398 | 4.9% | +32.3% |

Others | 259 | 1.0% | 333 | 1.2% | +28.6% |

Total | 26,183 | 100.0% | 28,292 | 100.0% | +8.1% |

Segment income |

|

|

|

|

|

BOOKOFF operations in Japan | 799 | 3.4% | 1,431 | 5.8% | +79.2% |

Premium services business | 114 | 6.9% | 31 | 1.8% | -72.7% |

Overseas business | 166 | 15.7% | 269 | 19.2% | +62.0% |

Others | -45 | - | -51 | - | - |

Adjustment | -510 | - | -486 | - | - |

Total | 524 | 2.0% | 1,194 | 4.2% | +127.9% |

* Unit: million yen. Segment profit is composed of the ratio of profit to sales.

(1) BOOKOFF operations in Japan

Sales and profit increased.

Sales of apparel, trading cards, hobby goods, home appliances, mobile phones, and books increased year on year at existing directly managed stores.

Profit, too, increased significantly.

◎Existing Store Sales

Existing stores continued to show strong performance in the first quarter of the fiscal year ending May 2025, with sales increasing to 5.5% year on year. The number of customers, too, grew 3.9%.

The company continues its strategic investments in two main areas: "making BOOKOFF entertaining" and "strengthening the line-up of trading cards and hobby goods." Renovation was carried out in existing three stores.

◎Products

Sales of all products increased year on year.

The sales of books grew year on year in the first quarter of the fiscal year ending May 2025, following the third and fourth quarters of the previous fiscal year. Although the company sees a decline in growth as inevitable in terms of long-term trends, it believes that each of the measures it is taking to achieve year-on-year growth, such as its pricing policy, is proving successful.

(Domestic Directly Managed Stores, first quarter of FY 5/25 Trends by Product Category)

| YoY | Composition ratio |

Books | 103.4% | 23.4% |

Software media (music, videos, and video games) | 100.8% | 23.1% |

Apparel | 110.8% | 10.8% |

Precious metals, watches, brand-name bags | 105.6% | 9.0% |

Trading cards and hobby goods | 104.1% | 20.4% |

Home appliances, mobile phones | 117.6% | 5.3% |

Sports and outdoor equipment | 117.4% | 3.5% |

Other | 114.9% | 4.5% |

Total | 105.5% | 100.0% |

(2) Premium Services Business

Sales increased, but profit decreased.

Sales increased as procurement volume grew year on year because of store openings in previous years. Still, profit decreased due to higher expenses associated with new store openings and personnel expansion to support business growth.

The company opened three new stores: one hugall store and two BOOKOFF Purchasing Consultation Desk stores.

(3) Overseas Business

Sales and profit increased.

In the United States "BOOKOFF", and in Malaysia "Jalan Jalan Japan" saw increased sales due to store openings in the previous fiscal year. Profit, too, increased significantly.

Regarding directly managed stores, one new directly managed store, "Jalan Jalan Japan," was opened.

【3-3 Financial Condition】

Financial Conditions

| May 2024 | August 2024 | YoY |

| May 2024 | August 2024 | YoY |

Current assets | 32,208 | 31,714 | -494 | Current liabilities | 20,551 | 17,230 | -3,321 |

Cash and deposits | 7,180 | 7,185 | +5 | Accounts payable-trade | 783 | 751 | -32 |

Accounts receivable-trade | 3,397 | 3,371 | -26 | Short-term debt | 11,580 | 9,077 | -2,503 |

Inventories | 18,825 | 18,032 | -793 | Non-current liabilities | 13,483 | 16,538 | +3,055 |

Non-current assets | 22,334 | 22,813 | +479 | Long-term debt | 10,801 | 13,839 | +3,038 |

| Property, plant and equipment | 9,854 | 10,709 | +855 | Total liabilities | 34,034 | 33,768 | -266 |

Intangible assets | 2,428 | 2,400 | -28 | Net assets | 20,507 | 20,759 | +252 |

Investments and other assets | 10,052 | 9,704 | -348 | Retained earnings | 13,534 | 13,617 | +83 |

Guarantee deposits | 7,311 | 7,340 | +29 | Treasury shares | -587 | -587 | 0 |

Total assets | 54,542 | 54,527 | -15 | Total liabilities and net assets | 54,542 | 54,527 | -15 |

* Unit: million yen. Borrowings and interest-bearing debt include lease obligations.

While inventory assets decreased, total assets were 54.5 billion yen, almost unchanged from the end of the previous fiscal year due to an increase in tangible fixed assets.

Total liabilities decreased by 0.2 billion yen from the end of the previous fiscal year to 33.7 billion yen.

Net assets increased by 0.2 billion yen from the end of the previous fiscal year to 20.7 billion yen due to an increase in retained earnings.

The equity ratio increased by 0.4 points from the end of the previous term to 37.5%.

4. Fiscal Year ending May 2025 Financial Forecast

【4-1 Earning Forecasts】

| FY 5/24 Act. | Ratio to sales | FY 5/25 Est. | Ratio to sales | YoY |

Sales | 111,657 | 100.0% | 120,000 | 100.0% | +7.5% |

Operating income | 3,051 | 2.7% | 3,500 | 2.9% | +14.7% |

Ordinary income | 3,448 | 3.1% | 3,800 | 3.2% | +10.2% |

Profit attributable to owners of parent | 1,705 | 1.5% | 2,100 | 1.8% | +23.2% |

* Unit: million yen.

Sales and profits are expected to increase.

The company forecasts sales of 120 billion yen, up 7.5% year on year, an operating income of 3.5 billion yen, up 14.7% year on year, and an ordinary income of 3.8 billion yen, up 10.2% year on year.

In the second year of the mid-term management policy, the company will continue aggressively opening new stores in each of its businesses. It will accelerate the pace of new store openings in the premium services business and the overseas business, which are expected to grow.

In the BOOKOFF operations in Japan, depreciation from the large IT investment in the previous fiscal year and personnel and other expenses in each business will increase. Additionally, SG&A expenses will rise due to the cost of measures to prevent the recurrence of fraud. However, the company expects an increase in profit due to new store openings in each business segment, the growth of existing BOOKOFF stores in Japan, and revisions to intersegment transaction prices.

The dividend amount is expected to be 25.00 yen/share, unchanged from the previous fiscal year. The expected payout ratio is 23.5%.

【4-2 Assumptions and forecasts】

(1) BOOKOFF operations in Japan

The company plans to open 6-8 new stores, including those replacing existing ones, across the BOOKOFF, BOOKOFF PLUS, and BOOKOFF SUPER BAZAAR brands.

In addition to new store openings, it will continue implementing renovations at existing stores to strengthen the trading card and hobby goods and optimize overall store layouts. Given the company’s focus on revitalizing existing trading card sales at existing stores, it will postpone new openings of its "ASO-VIVA" stores.

The company anticipates that the ratio of sales at directly managed stores to those in the previous year will be 105% in the first half, 102% in the second half, and 103.9% for the full year.

However, increased personnel costs due to aggressive store openings, higher software amortization expenses, and adjustments to intersegment transaction prices are projected to lead to a decrease in profit.

(2) Premium Services Business

The company plans to open a total of 11 new stores.

In addition to continuing to open new stores, the company will also focus on securing and training human resources, an important measure, and expects a decrease in profit due to the revision of transaction prices between segments.

(3) Overseas Business

The company plans to open a total of 12 new stores. This includes four in Malaysia, five in Kazakhstan, and three in the U.S., all of which are directly managed stores.

The company anticipates increased revenue and profits due to the positive impact of our previous store openings.

(4) Other

Japan TCG Center plans to open four new stores.

5. Mid-term Management Policy and its Progress

【5-1 Progress So Far and Business Environment】

The company started business as BOOKOFF CORPORATION LIMITED with purchase and sale of used books and had grown by proactively opening stores as well as expanding the product lineup since 2000, and it boosted profit by opening complex stores and larger stores even though there were only a few areas left where it could open stores.

Amid the expansion of e-commerce and customer-to-customer (CtoC) markets, however, the company did not generate sufficient earnings and ended up recording net loss in fiscal years 2016 to 2018.

In this context, the company is undergoing trial and error to restructure its business foundation by strengthening the collaboration between its e-commerce website, BOOKOFF Official Online Store, and its physical stores, launching a premium service for high-value items and establishing new BOOKOFF Purchasing Consultation Desk stores specialized in purchasing.

Although the COVID-19 pandemic affected the company’s performance, it has successfully built a business structure that can generate an ordinary income of 3 billion yen through re-strengthening of the BOOKOFF business in Japan, concentration on the premium services business and the overseas business, and development of new types of stores.

After a phase of major changes, it considers the current and succeeding terms to be a new phase of growth.

According to the company’s reference material (based on information by The Reuse Business Journal in 2023), the size of the Japanese reuse market increased from 1.1 trillion yen in 2009 to 2.9 trillion yen in 2022. The market scale is expected to expand further to reach 4.0 trillion yen in 2030.

【5-2 What we aim for】

The company aims to be a leading “reuse” company in the booming reuse market.

To do so, it will take such initiatives as development of an environment that allows customers of all ages and genders to get a good deal on buying and selling items with a sense of joy and safety, realization of a society that does not throw away things, popularization of reuse among people all over the world, and activities to encourage a greater number of people to reuse things.

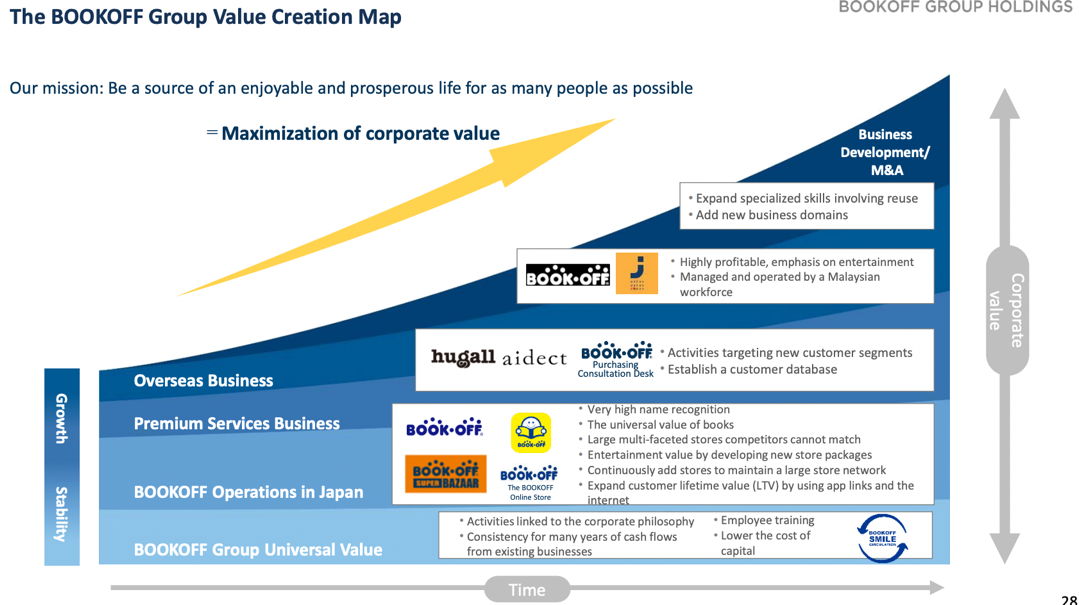

By fulfilling the company’s business mission of “Be a source of an enjoyable and prosperous life for as many people as possible,” the company is aiming for the maximization of its enterprise value.

The company propels its businesses forward and pursues growth on the basis of the BOOKOFF Group’s universal value that consists of “activities linked to the corporate philosophy,” “employee training,” “consistency for many years of cash flows from existing businesses,” and “lower cost of capital.”

In addition, the company will continue to consider new business development and M&A based on the following policies: "it must be in line with the management philosophy and mission," "it must be able to leverage the strengths created by the BOOKOFF Group's business development," and "it must lead to new career development for employees working for the BOOKOFF Group.”

(Source: the Company’s material)

【5-3 Business Policy】

(1) Overview

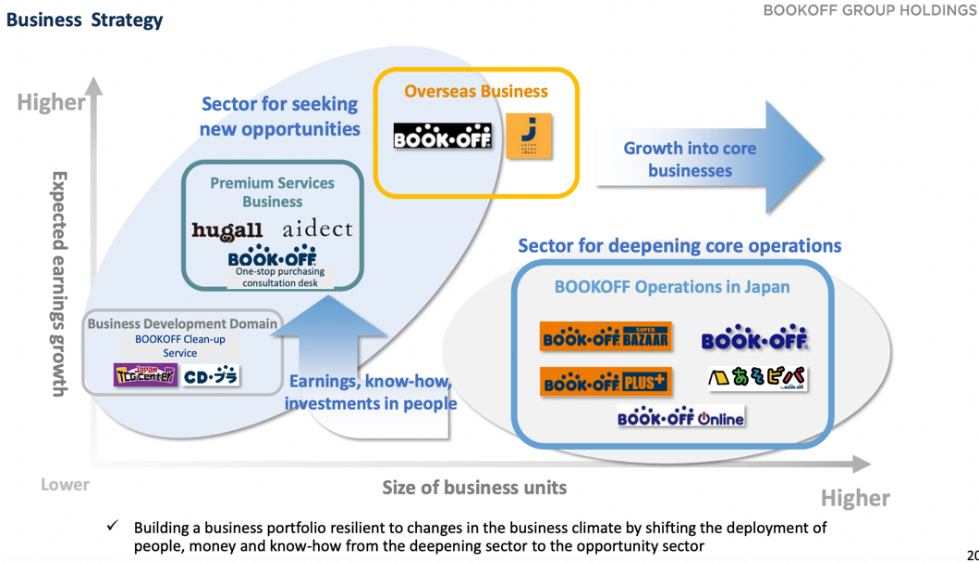

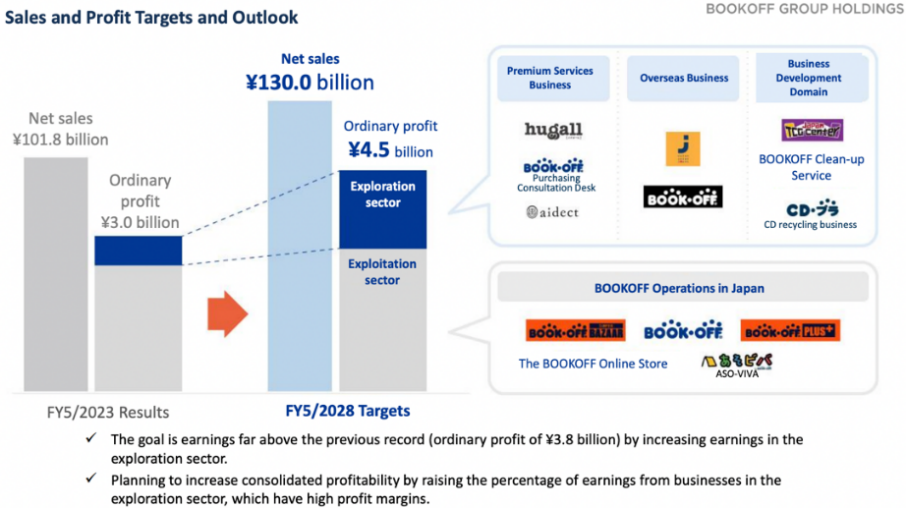

Their medium-term business policy is to become the “BOOKOFF Group that is much more than just BOOKOFF,” a step ahead of the former objective “BOOKOFF that handles not only books,” or “transform the business portfolio,” because the company considers this is essential for realizing sustainable growth while striking a balance between exploration and exploitation in the growing market under the “Corporate Philosophies,” “MISSION,” and “VISION” mentioned in “1. Company Overview.”

(2) Categorization of Each Business

Categorizing the BOOKOFF operations in Japan into “Exploitation” and the premium services business, the overseas business, and the realm of business development into “Exploration,” the company will invest the profit, know-how, and human resources generated in the Exploitation category in the businesses categorized in Exploration.

It will build a business portfolio that is capable of dealing with environmental changes by developing the businesses in the Exploration category to become its core businesses.

(Source: the Company’s material)

The company faced difficulty, which is the recording of loss, in the BOOKOFF operations in Japan, but overcame the difficulty, and it got back on track and is growing on a steady basis.

Within this context, the company has captured, as it were, the essence of personnel training, such as fundamental management skills, communication techniques, methods of building teams and motivating employees.

It will apply the excellent know-how of personnel training to the businesses categorized as Exploration. Although this approach will be challenging in some part because of the differences in business models between the categories of Exploitation and Exploration, the company will endeavor to achieve considerable growth by utilizing the system of personnel training, which is one of its fortes, in the Exploration businesses.

(3) Policies of Each Business

① BOOKOFF operations in Japan

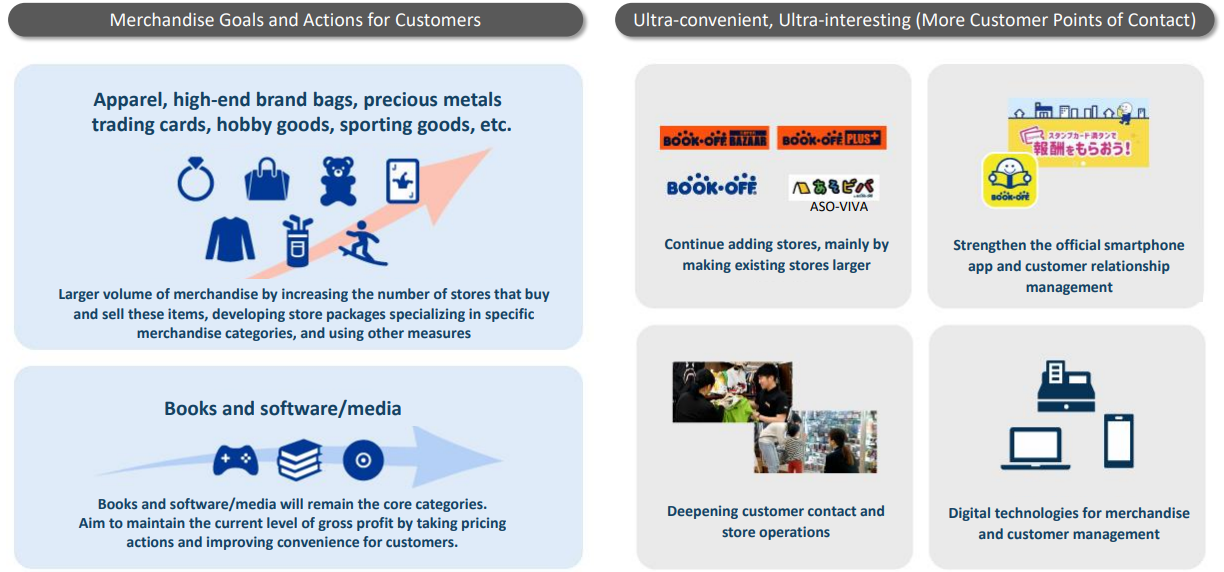

The medium-term policy for this business is “to provide customers with the best reuse experience,” and the company is committed to “expanding the variety of items in order to satisfy regional preferences with books being the core product” and “making BOOKOFF super-convenient and super-enjoyable.”

As the BOOKOFF Group’s core business, the company will improve capital efficiency while securing the current profit level, and continuously provide the personnel and know-how to the growing businesses.

It will strive to encourage customers to visit stores more frequently and provide customers with opportunities to visit stores in the customer-targeted strategy, enhance the value of experience, reduce customer cost, and ensure continuity of improvement in the purchase strategy, and improve usability, increase the variety of items to handle, and enrich its official app with more functions in the digital strategy.

In the personnel strategy, the company is aware of the importance of proactive employment and more diverse evaluation criteria and career path plans.

(Source: the Company’s material)

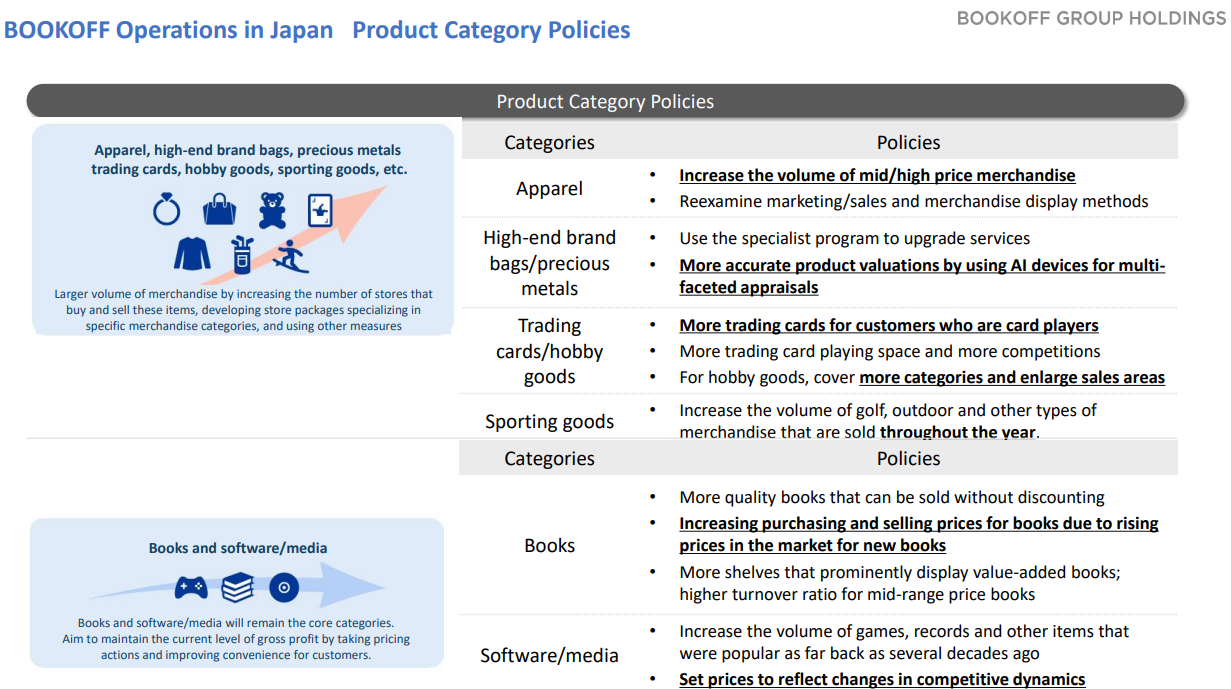

◎Products

The company will expand the diversity of items in order to satisfy regional preferences with books being the core product.

Sales of newly-published books are going down, and the company’s sales of books are lower than those of fiscal year ended May 2024. Books, however, are used by customers of all ages and genders, which means that they provide a broad customer base. Furthermore, gross margin for books is high. In the reuse industry, there are powerful category killers of each product category, such as apparel and brand-name goods. Therefore, the company has recognized that books are its strategically important product when it comes to differentiation from other companies.

In order to maintain the amount of gross profit generated from books, the company will strive to enforce appropriate pricing policies, improve purchase convenience, visualize the book inventory, and make it easier to check the inventory.

Regarding products whose sales are increasing on a continuous basis, such as apparel, brand-name bags, precious metals, trading cards, hobby-related goods, and sporting goods, the company will further strengthen sale with such efforts as increasing the number of stores that handle such items and developing store packages specializing in them.

Regarding brand-name bags and precious metals, the company operates a Specialist System, an in-house certification system.

In the purchase of brand-name bags and precious metals, not only the price but also the attitude of the clerk who deals with the customer is an important factor. Thus, the company has implemented certification exams for its staff on customer services and product knowledge (watches, brand-name bags) to enhance the overall quality of its service.

(Source: the Company’s material)

◎ Strengthening and expanding the contact points with customers

The company will strengthen and expand its touch points with customers with various efforts including continuously opening stores while focusing principally on making the size of the existing stores larger, developing new store packages, enhancing customer relationship management (CRM) policies using the official smartphone app, pursuing customer services and sales floor creation, and promoting digitization of product and customer management.

|

|

(Source: the Company’s material)

As of the end of May 2024, the company had 7.55 million app subscribers. The growth in the number of app users is beginning to translate into increased use of the company's various unique services and increased revenues.

In August 2024, sales to app subscribers accounted for 36% of total sales, showing a steady increase from 30% in August 2022 and 34% in August 2023.

Sales per app user and the repeat purchase rate have improved significantly compared to when they were unregistered cardholders prior to the introduction of the app.

The cashless purchase service and in-store purchase service have been well-received. Additionally, the in-store pickup service, which allows customers to search for products online and pick them up at a store, has been highly praised for its convenience. This service has seen annual transactions of approximately 2 million items across the chain stores, demonstrating double-digit growth each fiscal year. Furthermore, one out of every three customers who visit the stores to use this service makes additional purchases, contributing to increased sales.

The number of app users has increased from over 8 million to 10 million, and the company will continue to focus on expanding MAU (Monthly Active Users) by providing enhanced functions and high-quality customer experience rather than just focusing on increasing the number of subscribers.

◎IT Investment

(Source: the Company’s material)

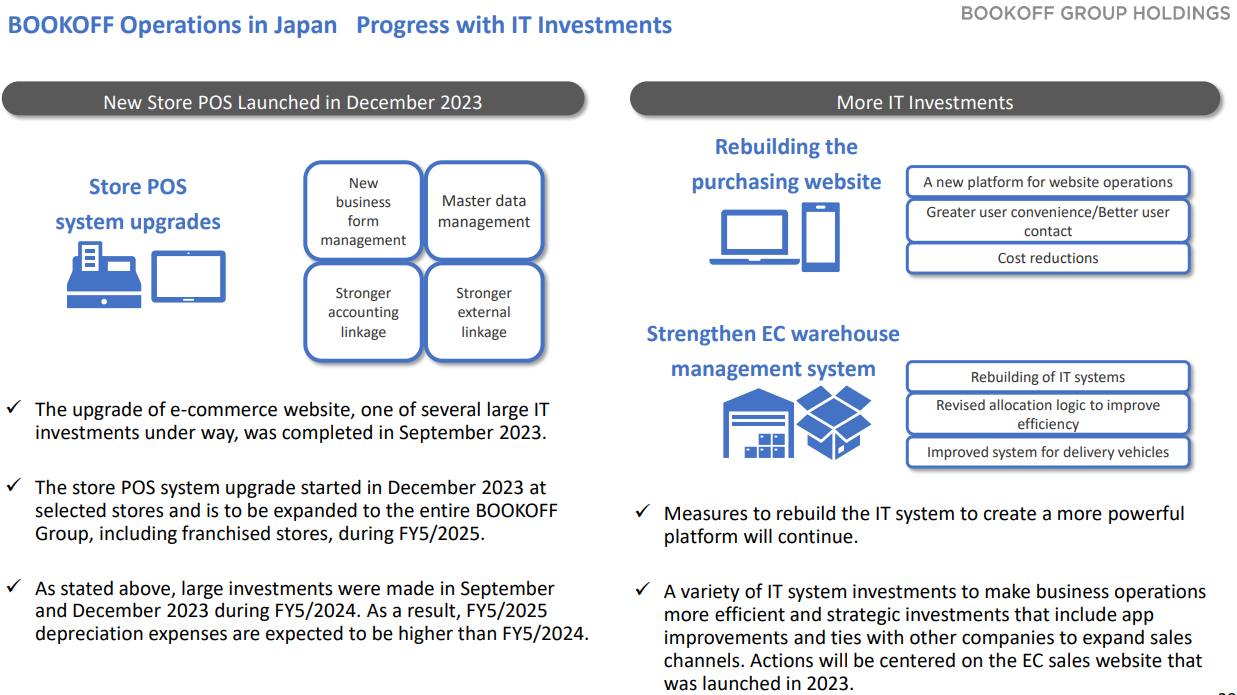

Among its major IT investment projects, the updating of the e-commerce site was completed in September 2023. The in-store POS system upgrade was released in December 2023 and has already been installed in pilot stores. The company plans to gradually roll out this system to all stores, including franchised stores, throughout the fiscal year ending May 2025.

Moving forward, it will focus on developing a purchase website and strengthening its e-commerce warehouse system.

Depreciation expenses related to these IT investments will peak in the fiscal year ending May 2025 and 2026 and then gradually decline.

② Premium Services Business

The medium-term policy for this business is to approach the customer segments that the BOOKOFF Group was not able to attract mainly by opening new stores.

The company plans to operate 100 stores primarily in major cities by the term ending May 2028.

In addition to opening new stores, it will not only retain a competitive edge by enhancing hospitality and responsiveness, but also expand its touch points with customers by implementing more proactive approaches, other than opening of new stores, through expansion of alliance partners, such as direct sales staff of department stores, real estate companies, and finance-related companies, with the aim of newly acquiring upper-class customers.

(Source: the Company’s material)

|

|

(Source: the Company’s material)

Products sourced from hugall are primarily sold BtoB, with a focus on quickly converting high-priced items into cash to improve turnover rather than pursuing high profit margins.

Products purchased at the BOOKOFF Purchasing Consultation Desk are sold mainly through the company's own e-commerce website “rehello” and through BOOKOFF SUPER BAZAAR, a BOOKOFF operations in Japan.

Since the revamping in January 2023, the e-commerce website “rehello” has seen a significant expansion in its product offerings and features. This has led to a 39% increase in sales in the fiscal year ended May 2024. To further enhance customer convenience and drive sales, the company introduced a new in-store pickup service that allows customers to view and purchase items they are considering on the “rehello” website at a designated store.

(Source: the Company’s material)

③ Overseas Business

The company will aggressively open new stores in both Malaysia and the United States.

◎Jalan Jalan Japan

The company considers expanding this business to new countries while continuing to open stores in Malaysia and Kazakhstan.

It plans to increase the number of stores to 50 by the fiscal year ending May 2028 and to 100 by the fiscal year ending May 2033.

Given the high level of trust and popularity of Japanese products in Kazakhstan, the company foresees growth. Thus, it plans to expand its presence there while implementing appropriate risk management measures.

◎ The United States

In addition to opening stores in the east and west coast areas of the United States so as to gain a dominant position there, the company will start to newly expand the business to inland megacities.

It aims to open 30 stores by the fiscal year ending May 2028 and 100 stores by the fiscal year ending May 2033.

(Source: the Company’s material)

Another important issue is to increase the capability of supplying products to follow the growth in the number of stores it opens.

The company will contribute to realizing a society that does not throw away things by increasing the number of chain Jalan Jalan Japan stores as well as promote reuse of unwanted items in collaboration not only with the BOOKOFF Group’s chain stores, but also with other companies and municipalities.

The company is considering expanding the number of its R yards, which are currently located at six sites nationwide and are used for sorting merchandise.

(Source: the Company’s material)

④ Business Development Domain

*Stores Specializing in Trading Cards

The company will begin to proactively open stores of “Japan TCG Center” primarily in Tokyo, Nagoya, Osaka, and ordinance-designated cities and operate franchise business.

It aims to increase the BOOKOFF Group’s market share and monetize the business by handling various brands in the growing trading card market.

The company plans to open four new stores in the fiscal year ending May 2025 and plans to operate about ten stores over the medium term while monitoring efficiency and profitability.

*CD Plastics Recycling Business

The company will take on a challenge of launching a business through which it not only reduces waste, but also encourages people all over the world to realize the high value it puts using its creativity.

*Cleanout Business

The company plans to increase the number of partner companies so that it can cover wider areas to offer the service in other regions than Tokyo and neighboring three prefectures.

It intends to fulfil customers’ expectations by reducing waste as much as possible, curtailing disposal cost, and subtracting the buying amount from the cleanout fee.

*Exploration of New Businesses

The company continues to consider developing new businesses and conducting mergers and acquisitions on the basis of its policies that businesses should “help the BOOKOFF Group follow the corporate philosophies and mission,” “allow the BOOKOFF Group to take advantage of the strengths produced through its business operations,” and “allow the BOOKOFF Group’s employees to carve out new careers.”

【5-4 Numerical Goals】

◎ Profit Expansion

The company’s numerical goals are “sales of 130 billion yen and an ordinary income of over 4.5 billion yen” in the fiscal year ending May 2028.

By steadily generating profit from core business areas and accelerating profit growth in high-profitability exploration areas to increase their contribution to overall profits, the company aims to significantly exceed its previous record-high ordinary income of 3.8 billion yen and improve its consolidated profit margin.

(Source: the Company’s material)

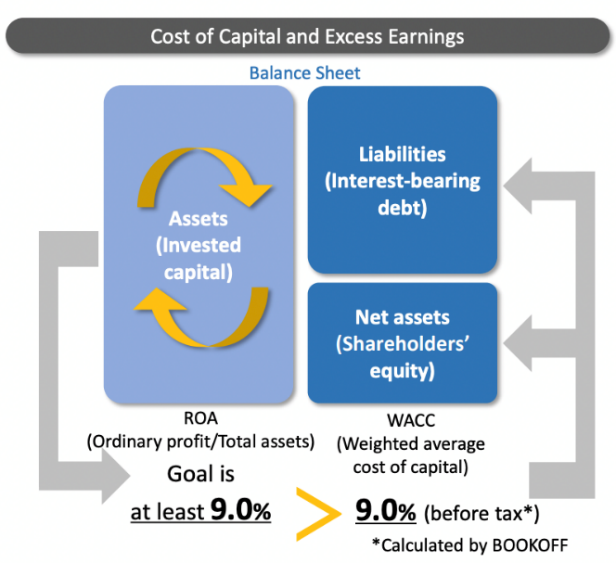

◎ Financial Policies with Capital Cost in Mind

The company’s target of return on asset (ROA) for the fiscal year ending May 2028 is 9.0% or higher.

Regarding capital cost, the company calculates that the Weighted Average Cost of Capital (WACC) will be around 9.0% and aims to generate excess profits (economic value added) by improving profitability as well as breaking its record profit (ordinary income of 3.8 billion yen) through proactive investment mainly in the growing businesses.

*The company has traditionally used ordinary income as a key performance indicator (KPI) for its business segments, so it adopts an ROA that uses ordinary income, which has taken deep root in the company’s business segments, as a key goal indicator (KGI). Furthermore, its ROA and Return on Invested Capital (ROIC) are almost the same because it holds relatively small surplus assets.

(Source: the Company’s material)

6. Interview with President Horiuchi

We asked President Horiuchi about an overview of the financial results for fiscal year ended May 2024, progress of the mid-term management plan, and his message to shareholders and investors.

Q: What was the President's own evaluation of the financial results for fiscal year ended May 2024?

In fiscal year ended May 2024, the first year of the mid-term management policy aimed at expanding business through the implementation of proactive measures based on the three pillars: the BOOKOFF operations in Japan, the premium services business and the overseas business for fiscal year ending May 2028. The fact that we were able to finish the year with increased sales and profit in each of our businesses and the entire group means a great achievement.

We were able to significantly improve our operating cash flow, not only in terms of PL (profit and loss statement), but also in terms of cash flow.

In fiscal year ended May 2023 , partly due to the impact of aggressive inventory investment, inventory turnover declined and operating cash flow remained at a low level of approximately 200 million yen compared to an operating income of 2.5 billion yen, which was recognized as a major challenge. As a result of our detailed inventory control efforts, we were able to improve operating cash flow by 3.8 billion yen year-on-year to 4 billion yen in fiscal year ended May 2024 and free cash flow improved by 4.8 billion yen from negative 3.2 billion yen in fiscal year ended May 2023 to positive 1.6 billion yen, which solved the problem.

Regarding the opening of new stores, a major pillar of our growth policy, we were able to actively open new stores almost as planned, although there were some delays in opening new stores overseas due to property contracts.

Q: Could you also comment briefly on each of your businesses?

(1) BOOKOFF operations in Japan

The annual sales of books decreased 1.3% from the previous fiscal year, but on a quarterly basis, sales increased in the third (December-February) and fourth (March-May) quarters in a row.

There are the effects of the drop in the number of copies of new paper books sold, and a long-term downtrend is considered unavoidable, but books remain core products. Various measures implemented to reduce the decline, such as pricing strategies, online sales, and the option to order online and pick up ordered books at a store, have been effective.

The demand from foreign visitors to Japan is strong. The sales from foreign visitors to Japan in fiscal year ended May 2024 were more than three times larger than they were before the COVID-19 pandemic. By product, the focus is on precious metals, watches, brand-name bags, trading cards, hobby goods, and software media, with the aim of refining measures to capture the demand from foreign visitors to Japan, particularly in the trading cards and hobby goods, which is based on the popularity of Japanese animation and characters.

(2) Premium service business

Steady progress is being made in building a model that increases sales by increasing purchases.

The opening of new stores is also going well, and we expect to see positive effects in fiscal year ending May 2025 or later. We will continue to focus on developing quality properties.

(3) Overseas business

Both the United States and Malaysia are performing well, with the opening of new stores up to the previous year contributing to the good performance. In Malaysia, a large warehouse was relocated to strengthen the product supply system with a view to establishing a 50-store network in fiscal year ending May 2028.

In Kazakhstan, where two franchised stores were opened in the capital Almaty, a joint venture was established in April 2024 considering the growth potential. The first step will be to form a dominant presence in Almaty with directly managed stores, followed by expansion in other major cities.

Q: Could you talk about the progress of the mid-term management policy?

Although this was a very good start for the first year of the mid-term management policy, we would like to deeply apologize again for the inconvenience caused to many people by the irregularities discovered in the physical inventory at the end of fiscal year ended May 2024.

There are many matters to reflect on, but one thing that became clear during the investigation process was that under the policy of “refining individual stores,” the misconduct was committed for the purpose of achieving numerical targets for the stores in addition to personal gain, and there was no data analysis to enable the head office to monitor that. In addition, although preventive measures against the occurrence of fraud had been established based on past experience, the stores where the frauds occurred this time were not thoroughly operational in terms of fraud prevention, as the company's overall performance was growing rapidly, and priority was given to increasing performance.

Based on these facts, the company has turned the matters to reflect on into an asset, and has adopted the management philosophy: “Contribute to society through our business activities and pursuit of employees’ material and spiritual wellbeing,” the mission: “Be a source of an enjoyable and prosperous life for as many people as possible” and the vision: “Aim to be a leading ‘reuse’ company, and a company that can continue to grow while enabling all employees to do their jobs with confidence and enthusiasm.” We are working hard every day with a renewed spirit to realize our vision in a stronger form.