Bridge Report:(8130)Sangetsu Second Quarter (Interim Period) of the Fiscal Year ending March 2025

Yasumasa Kondo, President | Sangetsu Corporation (8130) |

|

Company Information

Market | TSE Prime Market, NSE Premier Market |

Industry | Wholesale (Commerce) |

Executive Director and President Executive officer | Yasumasa Kondo |

HQ Address | 1-4-1 Habashita, Nishi-ku, Nagoya-shi, Aichi-ken |

Year-end | End of March |

URL |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥2,834 | 59,200,000 shares | ¥167,772 million | 14.1% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥150.00 | 5.3% | ¥187.34 | 15.1x | ¥1,816.16 | 1.6x |

*The share price is the closing price on December 4. Shares outstanding, DPS, and EPS is from the financial results from the second quarter for the fiscal year ending March 2025. ROE and BPS are the results in the previous fiscal year.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2021 Act. | 145,316 | 6,701 | 7,042 | 4,780 | 78.97 | 58.00 |

March 2022 Act. | 149,481 | 7,959 | 8,203 | 276 | 4.66 | 70.00 |

March 2023 Act. | 176,022 | 20,280 | 20,690 | 14,005 | 238.71 | 105.00 |

March 2024 Act. | 189,859 | 19,103 | 19,695 | 14,291 | 243.44 | 140.00 |

March 2025 Est. | 196,000 | 16,000 | 16,500 | 11,000 | 187.34 | 150.00 |

This Bridge Report presents earnings results for the second quarter (interim period) of the fiscal year ending March 2025 of Sangetsu Corporation (8130).

Table of Contents

Key Points

1. Company Overview

2. Second Quarter (Interim Period) of the Fiscal Year ending March 2025 Earnings Results

3. Fiscal Year ending March 2025 Earnings Forecasts

4. Progress of Medium-term Management Plan [BX 2025]

5. Interview with President Kondo

6. Conclusions

<Reference1: Medium-term Management Plan (2023-2025) [BX 2025]>

<Reference2: Long-term Vison of Sangetsu Group [DESIGN 2030]>

<Reference3: Regarding Corporate Governance>

Key Points

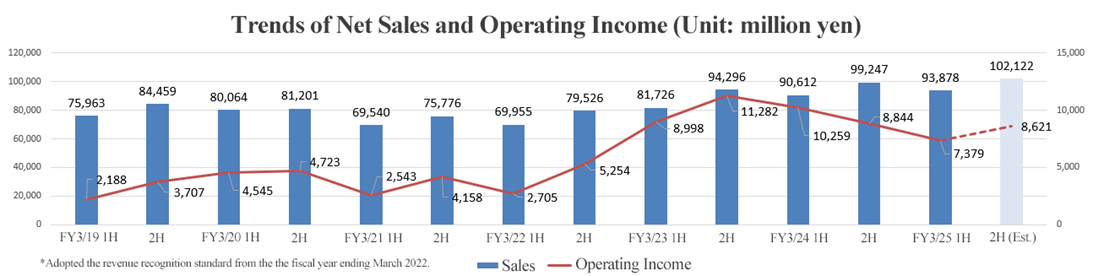

- In the second quarter (interim period) of the fiscal year ending March 2025, sales grew 3.6% year on year to 93.8 billion yen, hitting a record high for the first half of a fiscal year. The domestic interior segment and the overseas segment saw the growth of sales. Operating income dropped 28.1% year on year to 7.3 billion yen. Due to the augmentation of the cost of sales, the increase rate of gross profit was 0.2% year on year, falling below the sales growth rate. Gross profit margin dropped 1.0 point year on year. Profit declined, due to the 15.7% year on year increase in SG&A expenses, including the rise in personnel expenses for the enhancement of human capital.

- There are no revisions to the earnings forecasts. In the full-year of the fiscal year ending March 2025, sales are expected to increase 3.2% year on year to 196 billion yen. Operating income is expected to decline 16.2% year on year to 16 billion yen. The residential market is expected to remain stagnant for both new constructions and renovation. The non-residential market is also projected to remain sluggish in terms of new construction, but steady for renovation. The company expects to increase its share of the market, particularly for medium-sized products on which it is focusing. Gross profit is forecast to increase in line with sales growth, but gross profit margin is projected to decline 0.2 points year on year due to higher procurement costs and distribution costs. The company expects operating income to decline for the second consecutive year due to higher SG&A expenses, particularly personnel and sales expenses, etc.

- Their products ordered on December 1, 2024 or later have been sold at revised prices, but their effect on the business performance in the current fiscal year is assumed to be limited, so their earnings forecast has been left unchanged. The price hike is expected to contribute to their business performance on a full-scale basis in the next fiscal year. There is no revision to the dividend forecast. The expected annual dividend is 150.00 yen/share, up 10.00 yen/share from the previous fiscal year. As the dividend amount will increase for the 11th consecutive fiscal year, the expected payout ratio is 80.1%.

- We interviewed President Kondo about the points of the financial results in the first half of the fiscal year ending March 2025, the progress of the medium-term management plan, his message toward shareholders and investors, and so on. He said, “In order to transform into a space creating company, we will swiftly design concrete growth strategies and give explanations on the progress, etc. to shareholders and investors in a timely, transparent manner. We would appreciate your continued support for our endeavors.”

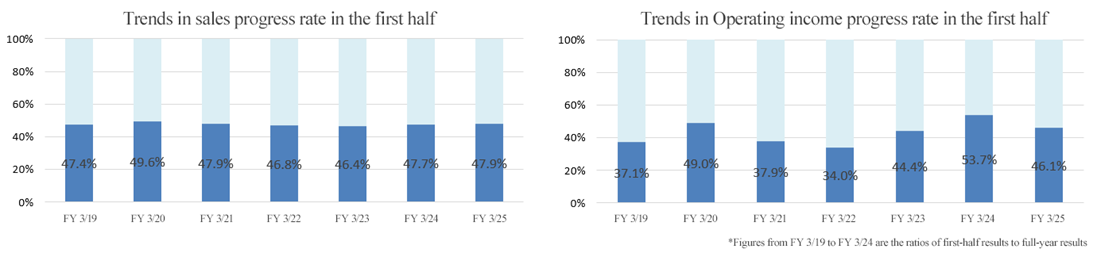

- In the first half of the fiscal year, the progress rate toward the annual forecast is 47.9% for sales and 46.1% for operating income, which are almost as usual. They revised the prices for products ordered on Dec. 1, 2024 or later, following the price revisions in 2021 and 2022. The company mentioned that the demand for newly built houses in Japan is weak compared with the initial forecast. We would like to see how much the price revisions will be applied and contribute to the growth of sales and profit.

- On the other hand, as commented by President Kondo, the path toward “the transformation into a space creating company,” which is pursued by the company from the medium/long-term perspective, is far from easy, but the improvement of the mindset of employees is apparently progressing steadily, through the diversification of employees through the employment of experienced personnel. We hope that you will read page 34 titled “Round-table Talk of Employees of the Sangetsu Group” of the integrated report “SANGETSU REPORT 2024.” https://ssl4.eir-parts.net/doc/8130/ir_material_for_fiscal_ym7/167419/00.pdf

1. Company Overview

Sangetsu Corporation is the largest among all Japanese trading companies specializing in wallcoverings, flooring materials, curtains and other interior decorating products. Being a trading firm, the company also operates as a “fabless company” that plans and develops interior decorating products except for some products. Sangetsu boasts of a business model that is able to produce stable earnings and top market share in its main product realms.

As of the end of March 2024, the group is composed of nine companies including “Sangetsu Okinawa Corporation,” which sells interior merchandise in the Okinawa area, “Sangetsu Vosne Corporation”, a distributor specializing in curtains “Sungreen Co., Ltd.”, a dedicated distributor of exterior products, “Goodrich Global Limited”, the company responsible for business in China and Hong Kong, “Koroseal Interior Products Holdings, Inc.,” the United States company conducting sales of wallcovering materials for non-residential applications, “Goodrich Global Holdings Pte., Ltd.,” the company selling interior merchandise in Southeast Asia, and “Fairtone Co., Ltd.”, which seeks to grow orders on the back of enhanced installation capabilities, Japan’s largest manufacturer of vinyl wallcovering, CREANATE Inc, “Kurosukikaku Corporation” which is a leading delivery firm in the Kyushu area. In July 2024, they acquired the shares of D’Perception Pte. Ltd., which designs spaces and offers comprehensive construction services in China, Southeast Asia, mainly Singapore, and other regions.

[1-1 Corporate History]

Sangetsu was founded in 1849 under the original name of “Sangetsudo” to sell various traditional Japanese interior decorating products including scrolls, wall scrolls, folding screens, sliding doors, partitioning screens, and other products made of cloth and paper. Sangetsu Corporation was incorporated in 1953 by the founding family. From the latter half of the 1970s onwards, the business was expanded into Tokyo, Osaka, Fukuoka and other parts of Japan. In 1980, Sangetsu was listed on the Second Section of the Nagoya Stock Exchange, and later in 1996 its shares were also listed on the First Section of the Tokyo Stock Exchange. Currently, Sangetsu is expanding its operations into overseas markets and has established itself as a large total interior decorating product provider.

In April 2022, through the restructuring of stock markets, the company got listed on the Prime Market of Tokyo Stock Exchange and the Premier Market of Nagoya Stock Exchange.

[1-2 Corporate Philosophy]

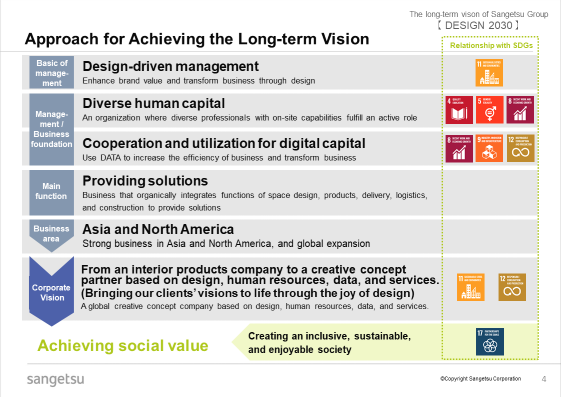

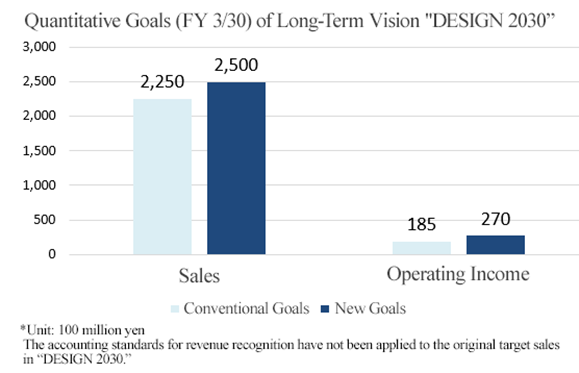

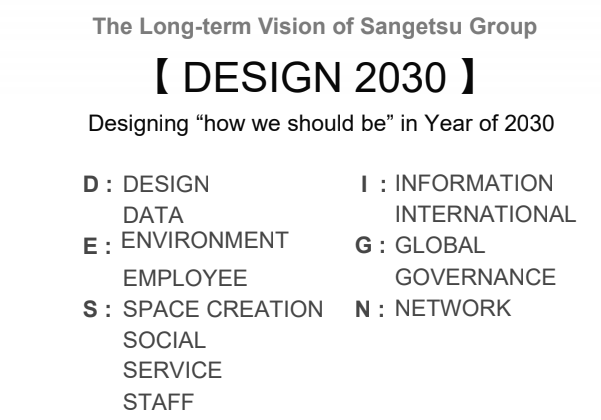

In Sangetsu Group’s Long-term Vision “DESIGN 2030,” which was formulated in 2020, the company set its ideal state as “a Space Creation Company.” However, as mentioned in Section Medium-term Management Plan (2023-2025) ‘BX 2025,” the company revised the long-term vision “DESIGN 2030” while considering the results until the fiscal year ended March 2023, the future environment surrounding the company, etc., and formulated a new Medium-term Management Plan “BX 2025” for long-term growth.

Accordingly, a task force composed of mainly employees of their group companies reviewed their corporate philosophies, and in January 2024, they set up new corporate philosophies: “Purpose: the supreme concept,” “Dream: a vision to realize based on the purpose,” “Belief: a belief as an enterprise for realizing the purpose,” and “Way: employees’ stance” with the aim of creating social value as an enterprise.

Purpose: meanings of existence | To create a space filled with peace of mind and hope, together with everyone |

Dream: Vision to realize | A world where anyone can talk about tomorrow’s dream |

Belief: Belief to cherish | The sincerity of each enterprise would become power to change our society. |

Way: our stance | Freedom & fairness, ego & co-creation, and change & a leap forward |

[1-3 Market Environment]

◎ Overview

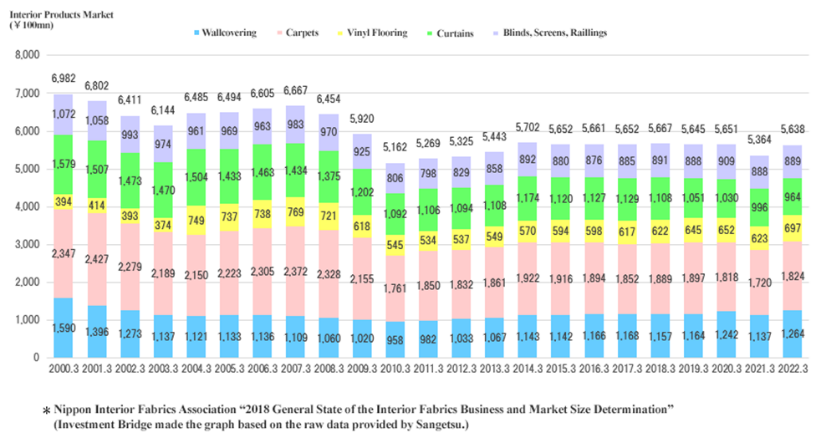

The market environment for the main wallcoverings and flooring materials is strongly influenced by trends in the Japanese construction market. Declines in new housing start arising from declining population and changing family structures within Japan, and deflationary trends have depressed sales of the interior products market as shown in the graph below.

(Source: the company)

At the same time, the graph below shows the correlation between sales of Sangetsu relative to sales of the Japanese interior market and new housing starts (Ministry of Land, Infrastructure, Transport, and Tourism data).

The company’s sales and trends in the domestic interior market have been largely linked to the number of new housing starts, but following the collapse of Lehman Brothers, while the overall market and new housing starts have remained at low levels, the company’s sales have been at record highs continuously until March 2020. In the fiscal year ended March 2021, sales dropped for the first time in 11 fiscal years, due to the COVID-19, but sales grew in the fiscal year ended March 2022, and hit a record high in consecutive years in the fiscal year ended March 2023 and the fiscal year ended March 2024.

Besides M&A, this strong recovery can be attributed to Sangetsu’s efforts to cultivate business in the non-residential realm in addition to private housing.

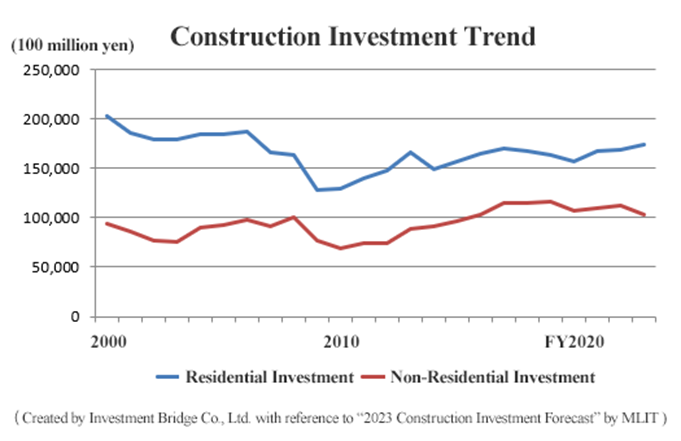

According to the “2023 Construction Investment Forecast” released by MLIT, private housing construction investment, which had been on a plateau since fiscal year 2017, is growing, while private non-residential construction investment is unchanged. Accordingly, it seems that they will not grow significantly.

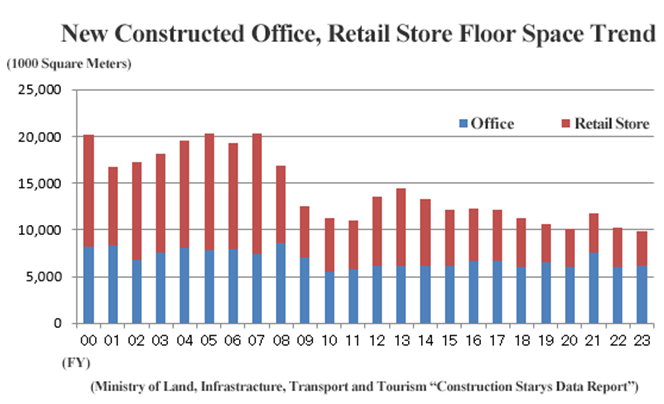

In addition, according to the “statistical survey on the start of construction” by MLIT, the total floor area of offices and (newly built) stores decreased after the bankruptcy of Lehman Brothers, and has been flat.

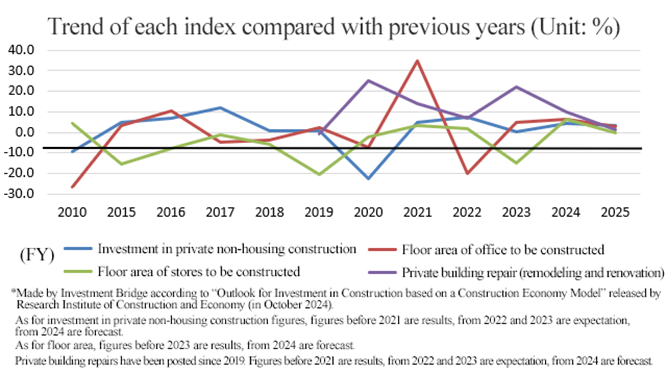

According to “Outlook for investment in construction based on a construction economy model” released by Research Institute of Construction and Economy on October 11, 2024, nominal private investment in non-housing construction increased steadily through fiscal year 2019, then dropped considerably by 22.3% in fiscal year 2020 due to the COVID-19 pandemic, but is expected to recover after that. In fiscal year 2025, it is 10.98 trillion yen, much less than 11.63 trillion yen in fiscal year 2019 before the outbreak of the pandemic. The floor area of offices and stores whose construction have been started and private building repairs (renovations and repairs) are described as follows.

Floor areas of facilities to be constructed

*Offices

In fiscal year 2021, floor area of new offices increased 34.6% from the previous fiscal year, showing a significant recovery from the previous fiscal year, in which their business was affected by the COVID-19 pandemic. However, in fiscal year 2022, floor area of new offices dropped considerably by 20.1% due to the recoil from that. A gentle recovery trend is forecast from fiscal year 2023.

They said, “After the supply of a large number of properties in 2025, the supply of new properties in metropolitan areas is expected to decline in 2026 and 2027, but it is projected to increase again in 2028. Accordingly, the total floor area of offices whose construction has started increased from the previous fiscal year in fiscal year 2024 and is expected to increase slightly from the previous fiscal year in fiscal year 2025.”

*Stores

The total floor area of stores whose construction has started decreased 20.5% in fiscal year 2019 and 2.0% in fiscal year 2020, rose 3.4% in fiscal year 2021 and 1.6% in fiscal year 2022, but declined 15.1% in fiscal year 2023. It is expected to increase 6.3% in fiscal year 2024 and decline 0.4% in fiscal year 2025. They said, “There is a sign of recovery of consumer spending and the demand from foreign visitors to Japan is expected to be healthy, so the total floor area of stores whose construction has started is projected to rise year on year in fiscal year 2024 and be unchanged year on year in fiscal year 2025.”

Private building repair (remodeling and renovation)

According to the “survey on the remodeling and renovation of buildings conducted by the Ministry of Land, Infrastructure, Transport and Tourism,” the number of orders received is increasing. In the residential field, it is expected that investments will be conducted by using subsidies provided through the energy-saving campaign of the government. In the non-residential field, too, investment activities are projected to be steady, due to the establishment of smart factories, the conversion of old production facilities into data centers, the renovation of hotels and stores for meeting the demand from foreign visitors to Japan, the implementation of energy-saving measures, the enhancement of interest in a comfortable office environment, etc. In both the residential and non-residential fields, investment activities are assumed to be steady, and the amount of orders is forecast to increase year on year in fiscal year 2024 and rise slightly year on year in fiscal year 2025.

Like this, private investment in non-housing construction is projected to be unstable yet healthy, after the decline due to the COVID-19 pandemic. Moreover, there is steady demand for renovations in the non-residential market, so Sangetsu is intending to meet the demand mainly through the Market Development Department and the contract department. They are also making efforts to develop Overseas Segment, pursuing further growth by reinforcing the advantages they have over other companies.

◎Competitors

In addition to Sangetsu, there are seven publicly traded competitors that operate in the interior decorating market.

Stock Code | Company | Net Sales | YY Change of Net Sales | Operating Income | YY Change of Operating Income | Operating Income Margin | Total Market Cap | PER | PBR | ROE |

3501 | SUMINOE | 105,300 | +1.8% | 3,300 | 0.0% | 3.1% | 15,310 | 9.0 | 0.4 | 2.9% |

4206 | Aica Kogyo Co., Ltd. | 250,000 | +5.7% | 27,200 | +7.6% | 10.9% | 218,115 | 12.7 | 1.3 | 9.9% |

4224 | LONSEAL Corporation | 21,500 | +2.3% | 600 | -44.0% | 2.8% | 6,692 | 14.8 | 0.3 | 4.5% |

5956 | TOSO COMPANY, LIMITED | 22,700 | +5.1% | 580 | +20.0% | 2.6% | 5,110 | 13.1 | 0.3 | 2.1% |

7971 | TOLI Corp. | 105,000 | +2.5% | 4,100 | -17.6% | 3.9% | 27,479 | 9.0 | 0.6 | 8.6% |

7989 | TACHIKAWA CORPORATION | 42,800 | +3.6% | 4,180 | +3.3% | 9.8% | 28,176 | 9.1 | 0.5 | 6.0% |

8130 | Sangetsu Corporation | 196,000 | +3.2% | 16,000 | -16.2% | 8.2% | 167,772 | 15.1 | 1.6 | 14.1% |

9827 | Lilycolor Co., Ltd. | 33,800 | +3.1% | 150 | -89.6% | 0.4% | 8,774 | 855.6 | 1.0 | 11.4% |

*Unit: million yen, times. Estimates are from those of the respective companies this term. Total market capitalization, PER and PBR are based upon the closing share price of each stock in December 4, 2024. The number of outstanding shares of each company that was used for calculation includes the number of treasury shares, and was taken from the latest brief report on financial results of each company, like EPS and BPS. ROE is based on the previous fiscal year.

[1-4 Business Description]

The main businesses include planning, development, and sales of wallcoverings, flooring materials, curtains, upholstery and other interior products. Although Sangetsu is fabless except for some products, it is not a typical trading firm as all the products it sells are planned, designed and developed in-house. Sangetsu also provides domestic exterior products through its subsidiary. The Overseas Segment is operated by four subsidiaries located in the U.S., Singapore, and China/Hong Kong.

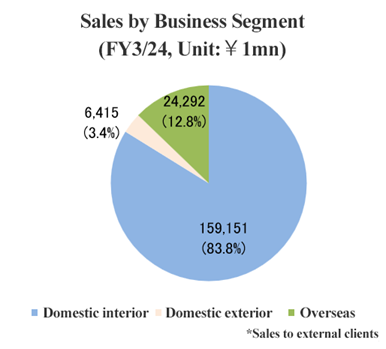

The company is using three business segments: "Domestic Interior," "Domestic Exterior," and "Overseas" Segments.

① “Domestic Interior Segment”

◎Main Products

Wallcoverings | Sangetsu’s main product, used in a wide range of residential and non-residential applications. High functionality products have become popular in recent years that are resistant to staining, odor absorbing, and scratch resistant. The product lineup also includes antivirus wallcovering. Also, “Accent Wall” a wallcovering with colorful designs being used to decorate one full wall or a part of a wall in homes, adds an appeal to the living space, and is increasingly adopted in general residences and rental residences. |

Cushion Vinyl Sheet | Sheet formed flooring materials that are commonly used in apartments and condominiums. They boast of wood grain, stone, and a wide range of other motif designs and have functionality and cushioning properties for use in a wide range of applications. |

Vinyl Sheets | Sheet formed flooring materials used in commercial applications including medical and welfare institutions, and educational institutions. This product boasts of high levels of safety and hygiene, and is designed to reduce maintenance costs, thanks to the excellent maintenance properties, such as the unnecessity of waxing. It also has been designed with the environment in mind and helps to reduce the environmental burden. |

PVC Tiles | Tile formed PVC flooring which has a wide range of applications, is used in commercial facilities, educational institutions, detached houses and apartments. One feature is its high design, in which the materials used as motifs such as wood and stone are expressed through high-tech printing technology and precise embossing. |

Carpets | Textile flooring materials used in a wide range of applications including ryokans (i.e. Japanese inns), hotels, residential and commercial facilities. Manufactured with variety of designs and high functionality. It also proposes original designs to each property. |

Carpet Tiles | Tile-like carpets used for mainly offices, hotels, commercial and educational facilities, etc. whose dominant size is 50 cm square. It excels in its feature of easy installation and superior maintenance. |

Curtains | All of the curtains sold by Sangetsu are custom made and boast of the ability to create unique designs and custom sizes of curtains to match room decorations in which they are used. In addition to highly fashionable designs and heavy materials, mirror-like insulating characteristic lace curtains, which make it difficult to see inside from the outside and reduce the amount of heat transferred into the rooms, have also become popular. |

Sangetsu boasts a diverse product lineup with about 12,000 different products in total There are about 4,300 different wallcovering products alone. Sample books are updated approximately every 3 years (those for curtains are updated every 3-4 years), with an existing product replacement rate for wallcoverings of 30% to 40%. Disposal of outdated products leads to producing wastes, but because keeping a sample book up-to-date is necessary to enhance customer satisfaction, the company has maintained a balance between efficiency and freshness through the company’s energetic engagement and long-cultivated know-how.

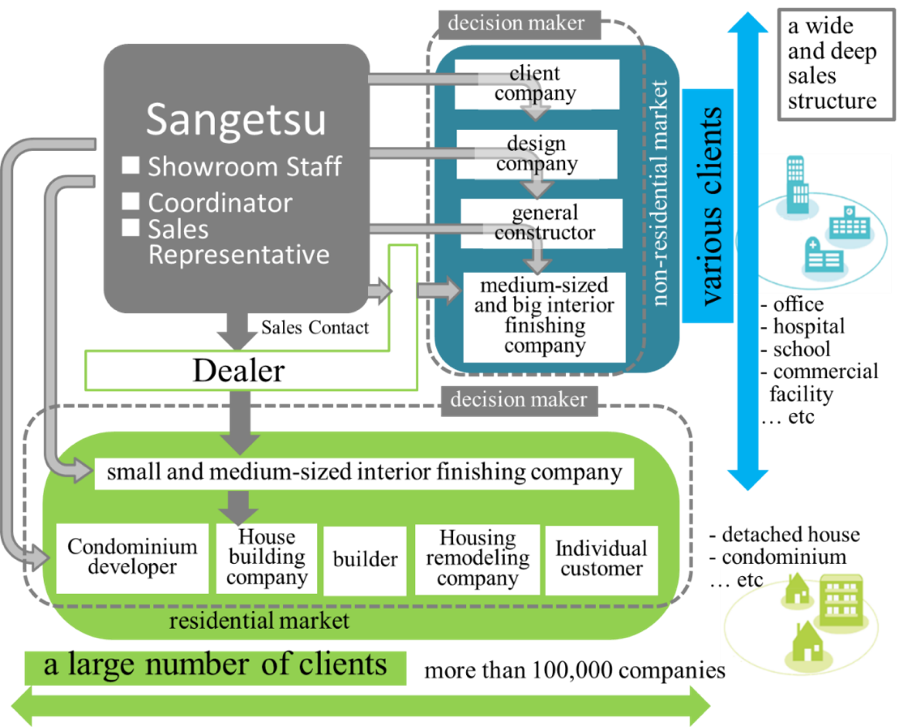

◎Sales Structure

In addition to the headquarters located in Nagoya, Sangetsu maintains 9 regional offices, and about 50 sales offices throughout Japan, with 8 of these sales offices also hosting showrooms as important sales offices. In March 2024, they opened PARCs Sangetsu Group Creative Hub (PARCs) in Hibiya, Tokyo, as a new base for value creation, and transferred some functions of Tokyo Branch, which was located in Shinagawa, to PARCs.

The interior finishing process (figure shown above) includes the final delivery of products, booking of sales, and receipt of cash. The main customers are interior construction companies and interior and building material shops that are serviced through dealers. Furthermore, public relations and advertising for products at the start of the process are also very important.By the time the residence or building is completed, a large number of players such as the client (facility owner), design office, design office, general contractor, subcontractor, residential manufacturer, etc. are involved, and the interior is finally selected from design and function. In many cases, decision making starts upstream.Therefore, Sangetsu conducts public relations and advertising for its products through its sample books, showrooms, and others. In addition to these “passive” sales activities, Sangetsu also conducts “proactive” sales of its products through its 700 sales staff which belongs to its Market Development Unit and its Contract Department, etc. to provide and gather information, and propose products to clients. While the main sales efforts are conducted through dealers (some sell directly), the number of customers totals 6,000 in Chubu area alone. While the number of customers dealt with through dealers is not known, the total number of customers is estimated to amount to several tens of thousands nationwide.

◎Distribution Structure/Delivery System

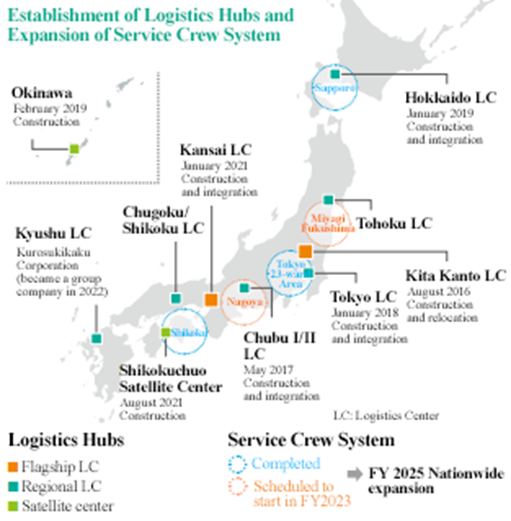

With the aim of streamlining logistics, they are developing a logistics system. They have two “flagship logistics centers,” which store stocks for each region and to backup broader areas, six “regional logistics centers,” which store stocks for each region, and two “satellite centers,” which are more community-based.

Most products are normally stocked at the company’s distribution centers in Tokyo, Nagoya, Osaka and Fukuoka, with the number of products shipped from these centers surpassing 60,000 per day, and the out-of-stock ratio is 0.9% in average. Sangetsu seldom asks their clients for backordering because the out-of-stocks are covered by surrounding distribution centers immediately. Sangetsu’s nationwide distribution network makes “Just-in-Time” provision of products to match the interior construction schedules of its clients possible. Products are sourced from a wide range of about 270 supplier companies.

As for delivery, the company is improving its own delivery system, to cope with the increase of logistics costs.

Following the establishment of a local delivery system in Tohoku, they are establishing local delivery systems one after another throughout Japan, while developing networks for delivering heavy objects and supplies to construction sites. In September 2022, the company acquired “Cloth Kikaku Ltd.,” which delivers products throughout Kyushu, and working to improve the delivery of small lots of products in the Kyushu region.

◎Space planning

Sangetsu creates and provides optimal spaces for clients, while utilizing the capabilities of designing spaces, coming up with new ideas, making concepts, giving proposals, offering consultation services, etc., adding comprehensive installation skills for woodworking, lighting, electricity, etc., and strengthening the installation management capability, based on the capabilities of designing the entire space and managing installation work of the planning and development unit of the Space Planning Department of Sangetsu, Space Design Unit, and Construction Unit, which was established within the business division in April 2024, and the interior finishing capability of the subsidiary Fairtone.

② “Domestic Exterior Segment”

Sungreen Co., Ltd., which was turned into a subsidiary in 2005, sells and constructs doors, fences, terraces and other exterior products within Japan. In the new medium-term management plan, the company will concentrate on the expansion of its business area in the Tokyo Metropolitan Area and the improvement of its capability of proposing interior and exterior spaces together and so on.

③ “Overseas Segment”

This segment is centered on Koroseal Interior Products Holdings, Inc. in North American, Goodrich Global Holdings Pte., Ltd., and D’Perception Pte. Ltd. in Southeast Asia, and Goodrich Global Limited in China/Hong Kong.

[1-5 Capital policy and return to shareholders]

According to the new Medium-term Management Plan “BX 2025,” their capital policies are “to have a net worth of 95-105 billion yen at the end of March 2026,” “to return profit to shareholders mainly by paying dividends and aim to keep increasing the dividend amount while setting the lower limit of the annual dividend amount at 130 yen/share,” and “to consider the acquisition of treasury shares according to the market situation.”

The equity capital as of the end of March 2024 stood at 106.6 billion yen, exceeding the upper limit, as profit increased more than expected and the market prices of shares they hold rose due to high share prices. They are discussing future policies in order to realize business administration for keeping a good balance between strategic investment for sustainable, progressive growth and shareholder return.

[1-6 ROE Analysis]

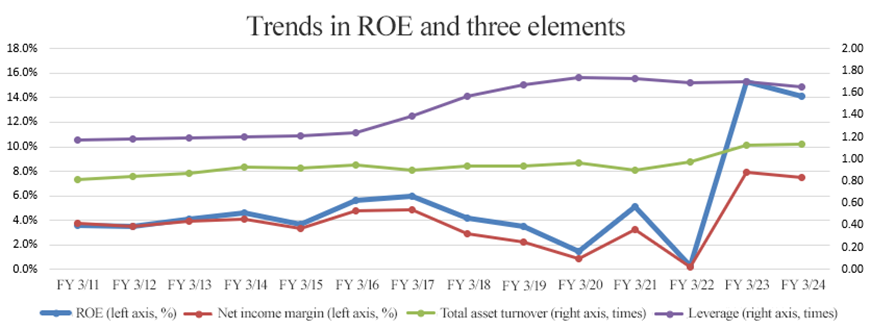

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 | FY 3/23 | FY 3/24 |

ROE (%) | 3.7 | 5.6 | 6.0 | 4.2 | 3.5 | 1.5 | 5.1 | 0.3 | 15.3 | 14.1 |

Net income margin (%) | 3.33 | 4.77 | 4.84 | 2.89 | 2.23 | 0.89 | 3.29 | 0.19 | 7.96 | 7.53 |

Total asset turnover [times] | 0.91 | 0.95 | 0.88 | 0.91 | 0.94 | 0.96 | 0.90 | 1.01 | 1.13 | 1.13 |

Leverage [times] | 1.21 | 1.24 | 1.41 | 1.60 | 1.67 | 1.74 | 1.73 | 1.69 | 1.70 | 1.66 |

*Net income margin = Net income attributable to owners of the parent ÷ Net sales

Total asset turnover = Net sales ÷ (Total assets as of the end of the previous fiscal year + Average of total assets as of the fiscal year under review)

Leverage = (Total assets as of the end of the previous fiscal year + Average of total assets as of the fiscal year under review) ÷ (Equity capital as of the end of the previous fiscal year + Average of equity capital as of the end of the fiscal year under review)

As net income margin improved significantly thanks to price revisions in fiscal year ended March 2023, ROE in fiscal year ended March 2024 considerably exceeded 8%, which is the value that should be targeted by Japanese enterprises.

[1-7 Competitive Advantage]

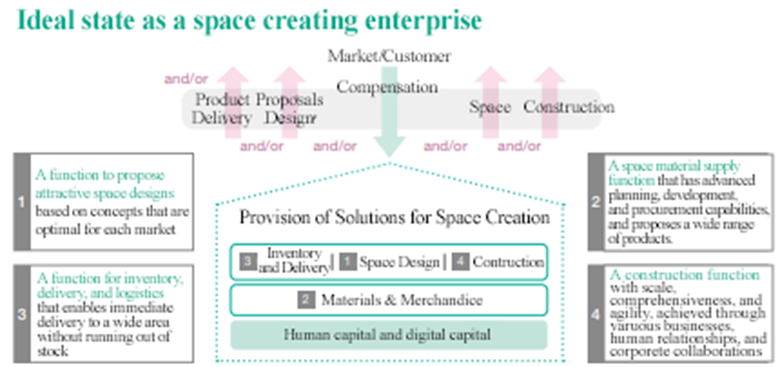

A business model that integrates manufacturing and sales, covering the entire value chain with continuous and complex functions, consisting of “the function to propose attractive space designs,” “the function to provide materials for creating spaces,” “the function to store, deliver, and distribute products,” and “the function to conduct interior finishing,” is the source of the Sangetsu Group's strong competitive advantage that cannot be imitated by other companies, and is a growth driver. The outline and features of each function are as follows.

Taken from the integrated report “SANGETSU REPORT 2024”)

(1) Function to propose spatial designs

While the economic value of experiences is getting higher through the diversification of lifestyles, the increase of flexibility of workstyles, etc., the necessity to design spaces is growing year by year.

The Sangetsu Group fuses interior and exterior designs based on the capability of proposing coordinates, which has been nurtured in the domestic interior business, and utilizes its ability to comprehensively propose spaces, including various products, such as furniture and lamps, which add color to scenes, in business.

In order to offer accurate and high-quality solutions to meet the needs of each customer, the company is increasing personnel for spatial design by recruiting external personnel and proactively improving the spatial design capability by developing the skills of internal personnel. The company employs designers in a broad range of fields, including housing, non-housing, new construction, renovation, interior, and exterior designs.

Proposing spatial designs is the source of added value. As people pursue comfort in their living, its importance is expected to increase, so the entire corporate group will keep improving its designing capability.

<Major resources, etc. (FY 2024)>

Space design professionals: about 86 employees |

Domestic interior marketing: 40 offices |

Domestic exterior marketing: 19 offices |

Overseas marketing bases: 7 areas |

(2) Function to provide space materials

Interior and exterior products are the final stage of the construction process, and as products that design spaces, they require high design quality and a prompt, stable supply system that prevents product shortages.

In addition to developing products that meet market-driven customer needs, the company group is also striving to improve its product design capabilities by expanding its product design staff and working with outside and overseas designers in order to supply the market with new products that are not bound by conventional ideas.

About 12,000 kinds of products are always in stock, and the company supplies about 1.5 million sample books to the market every year. In order to stably supply such diverse products, it is indispensable to maintain the relationships with about 270 companies for the interior business and about 150 companies for the exterior business. The company is developing and manufacturing a wide array of products with various business partners.

Regarding wallcoverings, which are core products, the company acquired Koroseal, a North American company, and CREANATE Inc. (former name: Wavelock Interior), which boasts the largest production number of wallcoverings in Japan, as a group company in November 2016 and March 2021, respectively, and is striving to strengthen and streamline its business based on the integrated system for manufacturing and selling products. The company implements measures for establishing a sustainable, stable supply system by cementing the alliance and cooperation with suppliers.

In addition, the company engages in design development based on the collaboration among group companies, including the product development based on the cooperation among the product development department of Sangetsu, overseas group companies and CREANATE, which manufactures products, and will continue the group-wide development and provision of products to meet the needs of the market while taking advantage of the strengths of each company.

< Major resources, etc. (FY 2024)>

Product design professionals 70 members |

Suppliers Domestic interior segment: approx. 270 companies Domestic exterior segment: approx. 150 companies |

Largest wallcovering manufacturing facility in Japan (CREANATE) |

State-of-the-art wallcovering manufacturing equipment (Koroseal) |

(3) Function to store, deliver, and distribute products

In the domestic interior business, the company ships 60,000 products and 40,000 samples per day. The systems for shipping and delivering products around Japan without fail contribute significantly to the flexible response to changes in deadlines for interior finishing and smooth discussions on interior designs and specifications.

As logistics bases, the company has established two flagship logistics centers (LCs), which function to back up inventory in each region by using a huge space and serve as an inventory base in each area, and 6 local LCs, which serve as an inventory base in each area, and is also proceeding with the establishment of satellite centers for developing more meticulous delivery networks. At Kansai LC, which was newly established and integrated in January 2021, the company plans to automate operations and save labor thoroughly in order to cope with the recent issues of the shortage of manpower and the aging population and develop a working environment where women, too, can work comfortably, and apply this model to other LCs around Japan.

Regarding delivery systems, the company is developing delivery systems for transporting and delivering products to each construction site and to each installation place in order to realize a last-mile service. The number of service crew members who offer various delivery-related services was 39 as of the end of fiscal year 2023, and the company plans to increase them around Japan, to maintain or improve the quality of delivery.

The company will enhance its logistics functions by improving its service level further and develop sustainable systems.

< Major resources, etc. (FY 2024)>

Specialist staff and contractors responsible for warehouse operations: approx. 800 people |

Flagship/regional LCs: 10 hubs, 236,000 m2 |

Domestic delivery trucks: approx. 500 trucks/day |

Service cre 44 workers |

(Taken from the integrated report “SANGETSU REPORT 2024” of Sangetsu)

(4) Interior finishing function

Interior finishing is an essential means for embodying a design, but the shortage of manpower in the construction industry is a serious challenge. It is conducted by a contractor, a subcontractor, or a second-tier subcontractor. The company had been conducting it as a second-tier subcontractor (assisting interior decorators). In the medium-term management plan “Next Stage Plan G” announced in 2014, the company aimed to improve its installation capability as a priority measures and has positioned it as an important function in the subsequent medium-term management plans. While utilizing the functions of Fairtone (acquired as a group company in 2017) and HEKISOU (acquired as a group company in 2021), which engage in installation work, the company is striving to maximize the installation function of the entire corporate group.

The organizational restructuring in July 2023 has improved not only the capacity of interior finishing, which has been dealt with by Sangetsu so far, but also the comprehensive interior design capacity for embodying the entire space at a position close to a business owner, establishing a system for undertaking tasks a primary contractor and a subcontractor. Fairtone has established Quality Control Section for improving the quality of wallcovering work, and is improving the quality of all functions, including supervision quality, process management, and cost control. In April 2024, they established Construction Unit, which controls the group-wide system and foundation for installation works, in order to hone not only the capability of putting up wallcoverings and installing flooring materials, but also the comprehensive interior finishing capacity to produce a whole space.

From now on, the company will recruit qualified installation supervisors and expand the network of firms that possess the ability to install products nationwide, in order to enhance the interior finishing capability (number of installation engineers) and the installation management capability and the comprehensive installation capability, which are important for undertaking tasks as a primary contractor or subcontractor, and then improve the functions based on the cooperation among group companies.

<Major resources, (FY 2024)>

First and second-class architects: 30 people |

Building operation and management engineers: 95 people |

2. Second Quarter (Interim Period) of the Fiscal Year ending March 2025 Earnings Result

[2-1 Earnings Results]

| FY 3/23 2Q | Ratio to sales | FY 3/24 2Q | Ratio to sales | YoY | Ratio to initial forecast |

Net Sales | 90,612 | 100.0% | 93,878 | 100.0% | +3.6% | +0.4% |

Gross profit | 28,922 | 31.9% | 28,977 | 30.9% | +0.2% | -0.2% |

SGA | 18,663 | 20.6% | 21,598 | 23.0% | +15.7% | +0.7% |

Operating Income | 10,259 | 11.3% | 7,379 | 7.9% | -28.1% | -2.9% |

Ordinary Income | 10,456 | 11.5% | 7,607 | 8.1% | -27.3% | -2.5% |

Interim Net Income | 7,121 | 7.9% | 4,995 | 5.3% | -29.9% | -3.9% |

*Unit: million yen. Interim net income is profit attributable to owners of the parent.

Operating income declined as increased sales did not absorb the increase in cost of sales and SG&A expenses. Sales reached record highs.

Sales grew 3.6% year on year to 93.8 billion yen, hitting a record high for the first half of a fiscal year. The domestic interior segment and the overseas segment saw the growth of sales.

Operating income dropped 28.1% year on year to 7.3 billion yen. Due to the augmentation of the cost of sales, the increase rate of gross profit was 0.2% year on year, falling below the sales growth rate. Gross profit margin dropped 1.0 point year on year. Profit declined, due to the 15.7% year on year increase in SG&A expenses, including the rise in personnel expenses for the enhancement of human capital.

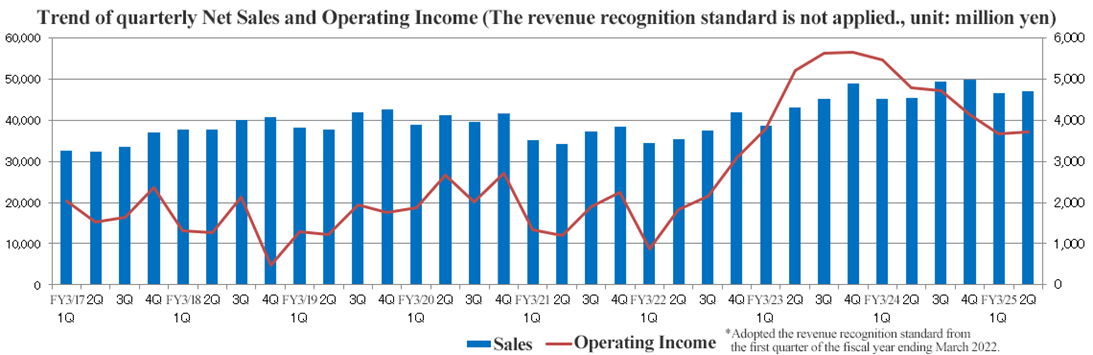

Quarterly sales and profit increased between the first quarter (Apr-Jun) and the second quarter (Jul-Sep), and quarterly sales grew while quarterly profit declined year on year.

[2-2 Business Segment Trends]

| FY 3/24 2Q | FY 3/25 2Q | YoY | Ratio to forecast |

Net Sales |

|

|

|

|

Domestic Interior Segment | 76,346 | 77,810 | +1.9% | -0.2% |

Wallcovering Unit | 37,527 | 37,768 | +0.6% | - |

Flooring Materials Unit | 26,703 | 27,736 | +3.9% | - |

Fabrics Unit | 4,517 | 4,466 | -1.1% | - |

Construction and others | 7,597 | 7,838 | +3.2% | - |

Domestic Exterior Segment | 3,215 | 3,139 | -2.4% | +4.6% |

Overseas Segment | 11,069 | 12,938 | +16.9% | +3.5% |

Adjustments | -18 | -10 | - | - |

Total | 90,612 | 93,878 | +3.6% | +0.4% |

Operating Income |

|

|

|

|

Domestic Interior Segment | 10,305 | 8,008 | -22.3% | +1.5% |

Domestic Exterior Segment | 110 | -40 | - | - |

Overseas Segment | -157 | -589 | - | - |

Adjustments | 1 | 1 | - | - |

Total | 10,259 | 7,379 | -28.1% | -2.9% |

*Unit: million yen.

➀ Domestic Interior Segment

Sales increased, but profit decreased.

While the domestic market, mainly that of newly built houses, was sluggish, the number of orders for wallcoverings and flooring materials and the installation of them was healthy. The sales quantities of wallcoverings and flooring materials, which are core products, fell below the forecasts, but the sales quantities of strategic medium-sized products, such as REATEC (adhesive decorative films) and glass films, grew thanks to meticulous marketing.

The market share of wallcoverings kept rising, as they engaged in activities for distributing sample books in the market and actively proposed spaces in cooperation with business sections and group companies in a comprehensive manner amid the harsh market environment. Regarding flooring materials, they plan to increase the market share of each product based on meticulous marketing and product strategies although the sales quantities of some products declined, through the marketing activities conscious of profitability especially in large-scale projects, etc.

On the other hand, operating income decreased, due to the augmentation of procurement costs, the rise in costs through the strengthening of infrastructure, the raise in base salaries following the policy for enhancing human capital, etc.

In order to transform into “a space creating company,” they are expanding and operating the business of offering solutions by utilizing the functions of group companies while appropriately combining the functions to produce, distribute, and install products and design spaces according to the characteristics of regions and clients.

Regarding the installation function, they established “Construction Unit” in the business section in April 2024, and enhanced activities for comprehensive interior finishing as well as wallpapering, involving mainly Fairtone Co., Ltd., which is a group company, developing a system for solving a variety of problems regarding installation work.

Regarding the function to distribute products, Logistics Department takes the initiative in improving supply chain management involving all departments and establishing meticulous delivery and quality control systems in each region, including a system for transporting goods between bases. In response to the logistics issues expected in 2024, they have accelerated the measures for enhancing supply chain management, including the increase of “service crew” members who conduct delivery services in house, the streamlining of procurement and distribution processes, and the adoption of a unit load system for saving labor for distribution and reducing loading time.

In the space planning department, they actively proposed spaces in cooperation with business sections and group companies in a comprehensive manner. Regarding product development, they have enriched the lineup of environmentally friendly products, such as “Biocloth,” which is produced by using a plant-derived plasticizer and has received the Good Design Award in fiscal year 2024, and “MEGUReWALL,” which is produced by pulverizing waste materials and recycling them as the surface materials of wallcoverings and also using recycled materials for backing paper. In the same period, they published some sample books, such as “STRINGS,” which lists curtains with advanced designs and functions, “RéSERVE,” which is focused on the installability and functionality of wallcoverings, and “REFORM UPTM,” which lists wallcoverings exclusively for the renovation or remodeling of residential properties. By making efforts to distribute these sample books in the market in cooperation with business sections, they expanded the market share of each product.

② Domestic Exterior Segment

Sales decreased, and a loss was recorded.

Regarding the external environment, the entire exterior market has been severe due to the stagnant number of housings starts, but Sungreen Co., Ltd. saw larger-than-expected sales in 2 Kanto branches, which were established through the strategy for geographical expansion. In addition, they submitted proposals for the spatial design and installation of outdoor facilities, and comprehensive proposals for exterior and interior items in cooperation with Sungreen and Sangetsu, approached new clients, such as design offices and general contractors, and so on. They also proceeded with the establishment of systems and in-group cooperation for expanding businesses other than the conventional sale of products.

Sales dropped, and a loss was recorded, due to the augmentation of costs through the increase of employees and the recruitment of specialized personnel based on growth strategies, but quarterly operating income/loss has been improving since the third quarter of the fiscal year ended March 2024.

③ Overseas Segment

Sales grew mainly in North America, but operating loss increased due to the sluggish performance in Singapore and the augmentation of SG&A expenses, including personnel expenses and temporary expenses for acquiring the shares of D’Perception Pte. Ltd. in Singapore (mainly in the first quarter of the fiscal year ending March 2025).

The results of overseas affiliates in the period from January to June 2024 have been included in the results in the second quarter (interim period) of the fiscal year ending March 2025.

<North American market>

Sales increased, as the hotel domain, which is the mainstay, was healthy, sales promotion progressed in the fields of educational facilities and collective housing, and there were effects of the revisions to the prices of wallcoverings produced by the company. In addition, their profitability has been improved steadily through the increase in productivity, marketing in priority markets, thoroughgoing management of profit and loss, etc., so operating income remains positive in the current fiscal year.

<Southeast Asian market>

In Malaysia and Vietnam, business performance has improved, but in Singapore, which is the primary market, sales dropped and an operating loss was posted. As they strove to reduce costs in the existing business and acquired D’Perception Pte. Ltd., which offers spatial design and comprehensive installation services, mainly in Singapore in July 2024, they will make efforts to improve business performance by improving the ability to offer comprehensive services according to regional characteristics and inducing synergy among business segments.

<Chinese and Hong Kong markets>

An operating loss was posted, due to the decline in consumer confidence caused by the downturn of the real estate market and the worsening of the employment environment, but the trend of improvement can be seen especially in the Chinese market. The business environment is severe, but they made efforts to brush up the function to propose spaces in a comprehensive manner by increasing clients and sales channels, showcasing products at exhibitions to enhance marketing, and recruiting local designers.

[2-3 Financial standing]

◎Main BS

| End of Mar.24 | End of Sep.24 | Increase/ Decrease |

| End of Mar.24 | End of Sep.24 | Increase/ Decrease |

Current Assets | 107,463 | 107,608 | +145 | Current Liabilities | 53,273 | 50,641 | -2,632 |

Cash, Equivalents | 25,096 | 28,764 | +3,668 | Payables | 32,762 | 32,692 | -70 |

Receivables | 59,248 | 53,885 | -5,363 | Short-Term Debt | 6,233 | 6,146 | -87 |

Marketable Securities | 300 | 300 | 0 | Noncurrent Liabilities | 10,767 | 12,636 | +1,869 |

Inventories | 21,787 | 22,724 | +937 | Long-Term Debt | 1,251 | 3,246 | +1,995 |

Noncurrent Assets | 63,287 | 64,891 | +1,604 | Total Liabilities | 64,040 | 63,277 | -763 |

Tangible Assets | 39,909 | 40,554 | +645 | Net Assets | 106,709 | 109,222 | +2,513 |

Intangible Assets | 3,228 | 4,447 | +1,219 | Retained earnings | 70,799 | 71,391 | +592 |

Investments, Others | 20,149 | 19,889 | -260 | Treasury Stock | -791 | -698 | +93 |

Total Assets | 170,750 | 172,500 | +1,750 | Total Liabilities, Net Assets | 170,750 | 172,500 | +1,750 |

|

|

|

| Capital Adequacy Ratio | 62.5% | 62.9% | +0.4pt |

*Unit: million yen. Accounts receivable is the sum of notes and accounts receivable-trade, contract assets, and electronically recorded monetary claims. Accounts payable is the sum of notes and accounts receivable-trade, contract liabilities, and electronically recorded liabilities. Debt includes lease obligations.

Total assets increased 1.7 billion yen from the end of the previous fiscal year to 172.5 billion yen, as cash equivalents, intangible assets, etc. grew while receivables decreased.

Total liabilities decreased 700 million yen from the end of the previous fiscal year to 63.2 billion yen, as reserve for bonuses decreased while debts augmented.

Net assets grew 2.5 billion yen from the end of the previous fiscal year to 109.2 billion yen, due to the increases in retained earnings and exchange conversion adjustment accounts, etc. As a result, capital-to-asset increased 0.4 points from the end of the previous term to 62.9%. Long- and short-term debt increased 1.9 billion yen from the end of the previous term to 9.3 billion yen.

[2-4 Topics]

◎ Initiatives for sustainability

① The environment

They steadily proceeded with the development of products with low environmental burdens, and listed new products produced by recycling waste curtain cloth of the company in the curtain sample book “STRINGS.” Supporting “Nagoya Nature Positive* Declaration” of Nagoya City, Aichi Prefecture, the company was recognized as a partner of Nagoya Nature Positive.

*Nature Positive

It is defined as the action to stop the loss of biodiversity to make nature start recovering. The “Kunming-Montreal Global Biodiversity Framework,” which indicates new global goals for biodiversity, and Japan’s strategy for biodiversity include this as a goal for the year 2030. This is a new global trend.

② Human capital

In order to attain the quantitative goals for social value set in the medium-term management plan, they have promoted health-oriented business administration and actively promoted female employees to managerial positions, so the ratio of female managers as of April 1, 2024 stood at 21.2%, while they aim to increase it to 25.0% or higher by April 2026.

As an initiative for diversity, equity, and inclusion (DEI), they became a gold sponsor of “HERALBONY Art Prize 2024,” an international art award for disabled artists, which was initiated by HERALBONY Co., Ltd., with which they have been collaborating in product development.

③ Social capital

They continue activities in which group companies and employees participate voluntarily, such as the support for renovation of orphanages, which started in 2014, the cooperation with NPOs that give aid to children in developing countries, and the participation in collaborative projects between industry and academia. They engaged in the renovation of the orphanage “Elizabeth Saunders Home” in cooperation with Habitat for Humanity Japan, an authorized NPO, which is one of groups they have been supporting. The company provided interior finishing materials (wallcoverings and flooring materials) and curtains required for repair. The company has renovated a cumulative total of about 260 facilities from 2014, including orphanages and facilities for supporting the living of mothers and children, etc., by utilizing the business of the corporate group.

For the sustainability-related website of the company that discloses the above activities, the company was selected as “an excellent enterprise with an ESG site” in “Gomez ESG Site Ranking 2024,” which is announced by BroadBand Security, Inc., for the first time.

3. Fiscal Year ending March 2025 Earnings Forecasts

[3-1 Earnings Forecasts]

| FY 3/24 | Ratio to sales | FY 3/25 (Est.) | Ratio to sales | YoY | Progress rate |

Net Sales | 189,859 | 100.0% | 196,000 | 100.0% | +3.2% | 47.9% |

Gross profit | 58,959 | 31.1% | 60,500 | 30.9% | +2.6% | 47.9% |

SGA | 39,856 | 21.0% | 44,500 | 22.7% | +11.7% | 48.5% |

Operating Income | 19,103 | 10.1% | 16,000 | 8.2% | -16.2% | 46.1% |

Ordinary Income | 19,695 | 10.4% | 16,500 | 8.4% | -16.2% | 46.1% |

Net Income | 14,291 | 7.5% | 11,000 | 5.6% | -23.0% | 45.4% |

*Unit: million yen.

No revisions to the earnings forecasts, the company forecasts an increase in sales and a decrease in profit.

The earnings forecast for the fiscal year ending March 2025 has not been revised, as the revisions to prices for products ordered on or after December 1, 2024 have just offset the augmentation of procurement costs. Sales are expected to increase 3.2% year on year to 196 billion yen. Operating income is expected to decline 16.2% year on year to 16 billion yen.

The residential market is expected to remain stagnant for both new constructions and renovation. The non-residential market is also projected to remain sluggish in terms of new construction, but steady for renovation. The company expects to increase its share of the market, particularly for medium-sized products on which it is focusing.

While the North American market remains healthy, the business environment of the Chinese market is harsh. In Southeast Asia, the business environment varies among countries, but the overall trend is sagging.

While the demand in the domestic market is projected to be weaker than initially forecast, they aim to increase sales by revising prices. Gross profit margin is forecast to decline 0.2 points from the previous fiscal year, as the revisions to prices expected mainly in the fourth quarter will offset only the augmentation of costs for procurement, distribution, etc. Operating income is projected to decrease for the second consecutive fiscal year, due to the rise in SG&A expenses, including personnel and marketing expenses. On the other hand, the price hike is expected to contribute to business performance on a full-scale basis next fiscal year.

The dividend forecast has not been revised. The annual dividend is expected to be 150.00 yen/share, up 10.00 yen/share from the previous fiscal year. They will increase the dividend for the 11th consecutive year, and the expected payout ratio is 80.1%.

[3-2 Business Segment Trends]

| FY 3/24 | FY 3/25 (Est.) | YoY | Before revision | Progress rate |

Net Sales |

|

|

|

|

|

Domestic Interior Segment | 159,157 | 161,200 | +1.3% | 161,000 | 48.3% |

Domestic Exterior Segment | 6,462 | 6,300 | -2.5% | 6,300 | 49.8% |

Overseas Segment | 24,292 | 28,500 | +17.3% | 28,700 | 45.4% |

Adjustment | -53 | – | - | - | - |

Total | 189,859 | 196,000 | +3.2% | 196,000 | 47.9% |

Operating Income |

|

|

|

|

|

Domestic Interior Segment | 19,489 | 16,750 | -14.1% | 16,250 | 47.8% |

Domestic Exterior Segment | -77 | 0 | - | 50 | - |

Overseas Segment | -311 | -750 | - | -300 | - |

Adjustment | 2 | - | - | - | - |

Total | 19,103 | 16,000 | -16.2% | 16,000 | 46.1% |

*Unit: million yen.

There are no revisions to the forecasts for consolidated sales or operating income, but they have revised the figures in each segment while focusing on profit.

They have revised the sales of the domestic interior segment upwardly, and the sales of the overseas segment downwardly. They have revised the operating income of the domestic interior segment upwardly, and the operating income of the overseas segment downwardly.

The upward revision for the domestic interior segment is attributable to the revisions to prices for products ordered on or after December 1 and strategic, effective cost control.

4. Progress of Medium-term Management Plan[BX 2025]

The progress of measures in the Medium-term Management Plan [BX 2025] is as follows:

(1) Supporting expansion, advancement, and active utilization of human capital

With the aim of transforming into a space creating company that possesses high profitability and growth potential, the company is actively recruiting experienced personnel in the domains that need to be improved, such as design & product development, design & installation management, and information systems. In the fiscal year ended March 2024, they recruited 49 people. In the fiscal year ending March 2025, they have recruited 28 people by the end of September or the end of the interim period. In order to fortify the business foundation, it is essential to secure diversity, so they will strive to marshal mid-career hires and employees who joined the company just after graduating from college.

The improvement in employees’ mindset is recognized as an important theme, and the score of the engagement survey that is conducted regularly was 55.0 (BBB) in September 2024, showing an improvement from 53.7 (BB) in December 2023.

Through the analysis from diverse aspects of respective items, organizations, job classes, and age groups, they aim to utilize data more effectively and achieve the goal of 58.0 (A) in fiscal year 2025.

(2) Accumulation, analysis, and utilization of digital capital

They engage in the initiatives for enhancing supply chain management, with the aim of improving profit through inventory optimization and cost reduction, rectifying the procurement process by improving the functions of procurement and enlisting cooperation, and receiving more orders and increasing sales by improving the level of delivery services. In this field, too, mid-career workers spearhead the initiatives.

The project has been divided into Steps 1 to 4. Currently, they are sophisticating and improving the logic for calculating proper inventory and the automatic replenishment process mainly in Kansai Logistics Center (LC), with the aim of “optimizing inventory at Sangetsu LC,” which is the most important in the supply chain, at Step 1.

At Kansai LC, the average volume and amount of stock and the number of orders for replenishment decreased, and rationalization and streamlining of business operations have been already seen. They will expand the scope of such efforts, proceed with the group-wide optimization of inventory involving suppliers, and are expected to complete Step 3 in 2026.

(3) Strengthening the ability to provide solutions

① Expansion of the business of “proposing spaces in a comprehensive manner and realizing them”

In addition to the formulation of spatial concepts, design, installation supervision, and product sale, they are striving to expand the business of “proposing spaces in a comprehensive manner and realizing them,” which is indispensable for a space creating company. They aim to give proposals with high added value unique to the Sangetsu group, such as integrated proposals for interior and exterior products, and proposals for installation.

In the first half of the fiscal year ending March 2025, they received about 130 orders, and in the second half, they had received 61 orders as of the end of October 2024 in the second half. The number of orders received is expected to grow. In the first half of the fiscal year ended March 2024, the number of orders received was around 50.

② Product development for addressing issues in the industry

In the construction field, there are evident issues, such as the shortage of manpower and the aging of workers. It is difficult to take effective measures for coping with the dynamics of population, but they are planning to develop new labor-saving products, including wallcoverings and flooring materials, as methods for dealing with the shortage of manpower are being researched in the entire industry. They are developing and promoting products in growing fields in cooperation with enterprises in other sectors while considering social issues, such as environmental friendliness, for which social interest and needs are growing.

They plan to enrich the lineup of environmentally friendly products by developing new products, including wallcoverings and flooring materials produced from recycled materials and products made from plant-derived materials.

③ Reform the market of mass-produced vinyl wallcoverings

The demand for mass-produced vinyl wallcoverings as interior finishing materials is healthy, because they are excellent in installability and durability, so their market scale has been growing from 390 million meters in 2011 to 430 million meters in 2018 to 450 million meters in 2024. On the other hand, some manufacturers downsized or withdrew from this business due to the worsening of profitability, so the number of manufacturers of vinyl wallcoverings in Japan decreased from 19 in 2011 to 13 in 2024.

Meanwhile, the market share of CREANATE Inc., which is one of leading manufacturers (which became a subsidiary of Sangetsu Corporation in 2021 and whose former name Wavelock Interior), rose from 11% in 2011 to 20% in 2024.

In order to develop and strengthen their product procurement system, Sangetsu is proceeding with the construction of Higashi-Hiroshima Factory of CREANATE, for the purposes of “developing a sustainable system for stable supply,” “conducting activities for reducing environmental burdens,” “developing a comfortable working environment,” “cutting down on procurement costs,” and “inducing synergy among group companies for developing and manufacturing products.”

Currently, they are installing manufacturing equipment one after another and conducting operation tests, and plan to start manufacturing and sale in fiscal year 2025 or later.

While pursuing operation stability, they will increase production output, establish supply bases in eastern and western regions of Japan, procure the raw materials for wallcoverings, and deliver products in an efficient way.

They will make efforts to strengthen SCM systems in cooperation with material makers and the Logistics Department of Sangetsu.

④ Adoption of the unit load system for coping with the logistics issues expected in 2024

Since April 2024, the regulation specifying that the upper limit of the overtime hours of truck drivers shall be 960 hours per year and the amended standards for improvement have been applied, so there is concern over the risk that working hours will decrease, the transportation capacity will degrade, and it will become impossible to transport some goods.

Under these circumstances, they developed the “unit load system” and started adopting it.

The “unit load system” is a system for streamlining transportation and storage processes by dividing a variety of cargoes into units, such as pallets and containers. With this system, manual loading and unloading processes are replaced by the method of loading and unloading pallets with forklifts, decreasing the required time for loading and unloading cargoes from a total of about 240 minutes to about 30 minutes. For this “unit load system,” the company was chosen as a subsidized enterprise for the Ministry of Economy, Trade and Industry's “advanced demonstration project for streamlining logistics processes.”

As a leading company in this industry, they will address issues in a proactive manner.

(4) Exterior and overseas business

① Domestic exterior business: Improvement in competitive advantages through the share expansion in each region

Sungreen has a market share of about 30% in the Chubu region, but about 2% in the Kanto region and about 5% nationwide. Regarding the business of wholesale of exterior goods, mainly community-based players have developed their trading areas, so it is necessary to establish a sales base in a region where the demand for exterior goods is high, in order to expand their market share. Accordingly, Sungreen established two branches in the Kanto region, where there is a huge market, in the fiscal year ended March 2024. The sales at these two branches exceeded the forecast.

In order to break away from the mere sale of goods, they will develop original products while involving all group companies, strengthen the capabilities of proposing and realizing spaces, and approach markets other than the housing market.

② Overseas business

*North America

In North America, their business performance is healthy, they are starting to earn a profit stably, and they engage in the strengthening of customer services based on their functions to manufacture and sell products.

In detail, they have improved the manufacturing function, reducing the loss in product manufacturing and shortening the leadtime from order receipt to delivery, from 3-4 weeks to around 1 week for major products.

In addition, they will conduct PR activities in the market by redeveloping their brands and using their selling function and strengthen customer services based on the forte of Koroseal, that is, the functions to manufacture and sell products.

*Southeast Asia

They will make efforts to expand their business by utilizing D’Perception Pte. Ltd., which became a group company.

The ratio between the governmental and private sectors in terms of the number of orders for construction in Singapore is about 6 : 4. D’Perception Pte. Ltd. excels at proposing spaces in a comprehensive manner and realizing them for offices in the public and private sectors. The ratio between the public and private sectors is 5 : 5, showing a well-balanced receipt of orders.

They also handle properties managed by public facilities, such as Central Provident Fund and Urban Redevelopment Authority. By utilizing their capability of proposing spaces in a comprehensive manner and realizing them, they will brush up the ability to offer comprehensive services throughout Asia in cooperation with Goodrich.

They highly evaluate the management skill of D’Perception Pte. Ltd. After conducting PMI steadily, they will pursue the improvement in corporate value and synergy through collaboration with existing overseas group companies, including Goodrich and Koroseal.

(5) Improvement in social value

① Environment: Development of products with low environmental burdens

The environmentally friendly wallcovering “Biocloth,” for which they rigorously selected textures and colors, received the Good Design Award in fiscal year 2024.

Oil resources are saved by using a plant-derived plasticizer and environmental burdens are reduced by using a fluorine-free water repellent. It is also characterized by colors in the motif of nature.

② Society: Social contribution activities, including the donation to external groups

They have completed the renovation of orphanages in cooperation with Habitat for Humanity Japan, which is one of 4 groups they have been supporting.

In order to offer comfortable living spaces to children, they have been supporting the renovation of orphanages in addition to collaborative activities with the above group, since 2014. The cumulative number of such cases is 260.

(6) Quantitative goals

① Capital profitability, capital costs, market evaluation, and recognition of issues

* | In the past two fiscal years, capital profitability exceeded the estimated capital cost significantly, thanks to the improvement in profitability due to the 3 price revisions, the shrinkage of capital through the enrichment of shareholder return, and the business administration conscious of asset efficiency. |

* | Seeing the average in the past five years, it can be considered that spread is not at a sufficient level at all. |

* | In the past five years, PBR has been over 1, thanks to the improvement in profitability, the enrichment of shareholder return, etc. |

* | Even after the revenue increase in the fiscal year ended March 2023, PER has been increasing stably, but due to the harsh external environment and the projected decline in profit due to the upfront investment, PER is now around 15, being close to the average in the Prime Market of Tokyo Stock Exchange. |

* | Seeing the above results of analysis of the current situation, the company considers that it is necessary to disclose more information while steadily earning profit by pursuing optimal BS and CF and implementing concrete growth strategies, in order to keep profitability high. |

② Capital policy

* | In the medium-term management plan, they plan to invest 20-25 billion yen for growth in 3 years. In the fiscal year ended March 2024, the investment amount of about 5 billion yen, almost in line with the assumption. |

* | In the fiscal year ending March 2025, they are investing in Higashi-Hiroshima Factory of CREANATE like in the previous fiscal year and acquiring the shares of D’Perception for growing the overseas business. The investment amount, including them, is expected to be 9-10 billion yen. |

* | Regarding shareholder return, they plan to return 25-35 billion yen in 3 years, and have returned 7.6 billion yen in the fiscal year ended March 2024. The progress rate toward the plan is 22-30%. In the current fiscal year, they are expected to pay an interim dividend of 75 yen/share and a year-end dividend of 75 yen/share for a total of 150 yen/share per year, up 10 yen/share from the previous fiscal year. |

* | Regarding net worth, as an item other than shareholders’ equity, unrealized gain increased about 5 billion yen due to the rise in share prices, which was not assumed at the time of formulation of the medium-term management plan, and accumulated other comprehensive income grew. They will stick to the stance of enhancing return while considering capital efficiency. They will proceed with business administration focused on the balance between the investment for realizing the capability of earning cash in a sustainable manner and shareholder return. |

5. Interview with President Kondo

We asked President Kondo about the key points of the financial results in the first half of the fiscal year ending March 2025, the progress of the medium-term management plan, and his message to shareholders and investors.

Q: First, I would like to ask a few questions about the results in the first half of the fiscal year ending March 2025. Strategic medium-sized products that you are focusing on, such as REATEC (adhesive decorative films) and glass films, continued to perform well. What is the background to this? What is the reason behind this?

In addition to our ability to develop products while emphasizing functionality, I think another factor behind our success is our detailed marketing, which has contributed to our strong performance.

Since our founding, we have expanded our business with an approach of developing and promoting products based on our own technologies and know-how while utilizing sample books. Our business expansion based on this rich product lineup will continue to be a strong competitive advantage for us, but we recognize that our challenge is to strengthen our marketing function for not only medium-sized products, but also other products in close collaboration with our business division, by strengthening our perspective of developing products and services based on customer needs to accurately respond to changes of the times and the market.

Q: The business in North America is doing well. Could you please comment on the overseas businesses, including the business in North America?

In addition to the stable business environment, Koroseal’s president, who assumed office in July 2022, is a highly proficient communicator who previously oversaw the U.S. branch of a Japanese company. Additionally, our company’s revenue base has been strengthened, and profitability has been made stable by conducting very conventional management and adhering to the timeline of what needs to be done as a manufacturer. We are also expected to earn an annual profit.

Despite the challenging business environment in China, orders are increasing, losses are decreasing, and we have made strides in expanding our clientele and building our business base. Our share remains very small in a huge market, so we will continue our efforts to grow our company and improve profitability.

In Southeast Asia, the performance in Malaysia and Vietnam improved, but sales in Singapore, our primary market, have declined, and the cost for expanding the workforce to strengthen functions was high, resulting in an increase in loss.

Nonetheless, D’Perception, which joined our group, is a prominent player in the Asian market for comprehensive interior finishing and spatial design, with a strong track record in both the public and private office sectors in Singapore and other Asian countries. By utilizing D’Perception’s strengths and inducing synergies with our current businesses, we hope to fortify our group’s “business of proposing spaces in a comprehensive manner and realizing them” while rebuilding the current distribution business.

Q: Next, I would like to ask you about the progress of the Medium-term Management Plan [BX 2025]. As raw material expenses and logistics costs are rising, I think the challenge is to improve profitability while continuing to make growth investments, mainly in strengthening human capital. Against this backdrop, you have embarked on strengthening supply chain management (SCM). Please tell us about your aims and progress.

It is crucial to improve our supply chain management (SCM) in order to increase our group’s competitiveness. This allows us to show our strength by coordinating all of our operations, including procurement, order receipt, logistics, and delivery. Our mid-career hires have been spearheading efforts to improve our supply chain management (SCM) since the beginning of this fiscal year. This includes improving delivery service levels, streamlining suppliers’ processes, improving procurement planning, and optimizing inventory. Seeing the improvements in average inventory volume, average inventory value, and the number of replenishment orders, we plan to apply this approach to the entire Kansai Logistics Center (LC) and other LCs across the country, while building on our success.

Working together with numerous suppliers is the foundation of our business, and we have about 270 suppliers in the domestic interior business and 150 suppliers in the domestic exterior business. Even though it is still difficult to cover every supplier, we will expand our focus and begin with those that will have a significant influence before moving forward with inventory optimization for the entire business, including our suppliers.

Q: A new facility is being built by CREANATE, but what is its purpose and aim?

While the domestic market size is gradually shrinking, demand for mass-produced vinyl coated wallpaper remains strong, and we have two aims: to ensure stable procurement of this product, and to strengthen SCM by securing a new manufacturing base in western Japan in addition to the two existing bases in eastern Japan. The construction of the building and installation of machinery are progressing smoothly, and the securing of personnel is also going as planned, with the aim of starting operations next year. Together with Koroseal in the U.S., CREANATE will be responsible for manufacturing within our group of companies, and we aim to create group synergies in product development and manufacturing, in addition to ensuring a stable supply and reducing procurement costs.

Q: As you aim to become a space creation company, what is your current and future outlook for “comprehensive spatial proposals”?

We are working to expand our “business of proposing spaces in a comprehensive manner and realizing them,” which is indispensable for a space creation company, beyond product sales, including space concept formulation, design, and construction supervision.

The number of orders for our group’s unique, high-value-added proposals and installation work, such as integrated interior and exterior proposals, is steadily increasing.

However, there are still many issues to be improved regarding profitability, so we would like to swiftly formulate a business plan such as specific monetization methods, for periods including the next medium-term management plan period, and manage it using the PDCA cycle.

Q:I would like to ask about your efforts for strengthening human capital. In recent years, you have been actively recruiting mid-career personnel from a wide range of fields. We would like to know your company’s characteristic that attracts people to join?

As we pursue our business strategy of improving and transforming our core businesses and exploring and creating new businesses, we are actively recruiting mid-career personnel with the aim of securing specialized personnel to strengthen each function and enhance our corporate functions to strengthen consolidated management. In particular, we are hiring an increasing number of specialized personnel for comprehensive space proposals and construction, and what attracts these people to our company seems to be our strengths in products, their expectations for proposal activities based on the synergy between products and spaces, and the fact that we are in a period of great change as we transform into a space creation company. In addition, we believe that another major factor is that we are aggressively investing in human resources, including the hiring of mid-career personnel and increasing salary levels.

Q:Thank you very much for your clear and concise comments on various points. Lastly, kindly convey a message to your investors and shareholders.

Even though we are only halfway through our transformation into a space creation company, we believe that by clearly defining the goals and process, we are making steady progress in increasing employees’ awareness. The space creation company we aim to realize is the one that not only further strengthens our interior business, which is the mainstay, but also quickly realizes profitability in four businesses: overseas, exterior, comprehensive space proposal & construction, and new businesses. We think it is crucial to broaden our product line beyond wallcoverings and flooring materials in order to accomplish this. We will quickly create concrete growth plans for both new and current businesses, and we will promptly and openly update investors and shareholders on our progress. We sincerely hope you will continue to support our efforts.

6. Conclusions

In the first half of the fiscal year, the progress rate toward the annual forecast is 47.9% for sales and 46.1% for operating income, which are almost as usual. This is the first price revision since 2021 and 2022, which began for products ordered on December 1st. The company mentioned that the demand for newly built houses in Japan is weak compared with the initial forecast. We would like to see how much the price revisions will be applied and contribute to the growth of sales and profit.

On the other hand, as commented by President Kondo, the path toward “the transformation into a space creating company,” which is pursued by the company is far from easy, but the improvement of the mindset of employees is apparently progressing steadily, through the diversification of employees through the employment of experienced personnel.