Bridge Report:(7604)UMENOHANA First Half of the Fiscal Year ending April 2025

President Yuji Honda | UMENOHANA Co., Ltd. (7604) |

|

Company Information

Market | TSE Standard Market |

Industry | Retail |

President | Yuji Honda |

HQ Address | 146 Tenjin-machi, Kurume-shi, Fukuoka Prefecture |

Year-end | April |

Homepage |

Stock Information

Share Price | Shares Outstanding (Interim) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥873 | 9,029,200 shares | ¥7,882 million | 34.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥10.0 | 1.1% | ¥39.15 | 22.3x | ¥159.65 | 5.5x |

*The share price is the closing price on January 30. BPS and ROE are actual results from the previous fiscal year. Taken from the brief report on the financial results for the fiscal year ended April 2024 and the brief report on the financial results for the interim period of the fiscal year ending April 2025.

Earning trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

April 2021 | 21,603 | -2,252 | -2,396 | -1,921 | - | 0.0 |

April 2022 | 22,591 | -1,630 | -1,792 | 217 | 19.58 | 0.0 |

April 2023 | 27,456 | 89 | 14 | -440 | - | 5.0 |

April 2024 | 29,816 | 819 | 739 | 1,020 | 117.30 | 10.0 |

April 2025 (Est.) | 30,250 | 906 | 727 | 420 | 39.15 | 10.0 |

*Forecast figures are those of the company. * Unit: million yen, yen.

This report includes the overview of the earnings results of UMENOHANA Co., Ltd. for the first half of the fiscal year ending April 2025.

Table of Contents

Key Points

1. Company Overview

2. First Half of the Fiscal Year ending April 2025 Earnings Results

3. Fiscal Year ending April 2025 Earnings Forecasts

4. Conclusions

<Reference: Regarding corporate governance>

Key Points

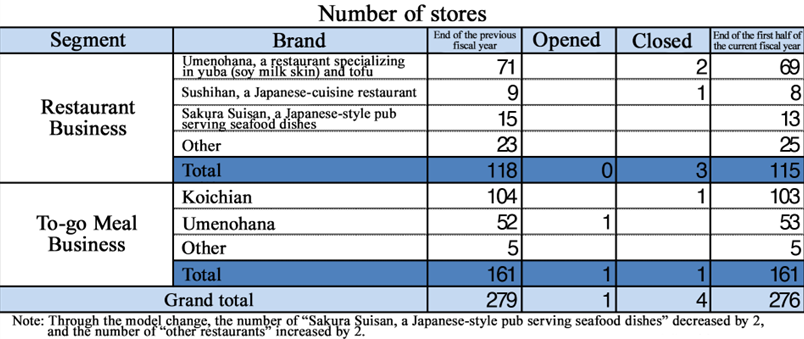

- Under the theme of fusion of food and culture, Umenohana operates the Restaurant Business, the To-go Meal Business, and the External Sales Business. In the Restaurant Business, they operate restaurants, such as “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” “Sushihan, a Japanese-cuisine restaurant,” “Sakura Suisan, a Japanese-style pub serving seafood dishes,” and “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” In the To-go Meal Business, they operate “Koichian,” a store of rolled sushi, inari sushi, etc., and “Umenohana,” a store of Japanese delicatessen and boxed meals. In the External Sales Business, they produce and sell processed seafood products, and sell the products of the Umenohana and Koichian brands. In 1999, Umenohana became an over-the-counter company registered in Japan Securities Dealers Association. In 2002, the company got listed on the second section of Tokyo Stock Exchange. In April 2022, the company got listed on the Standard Market.

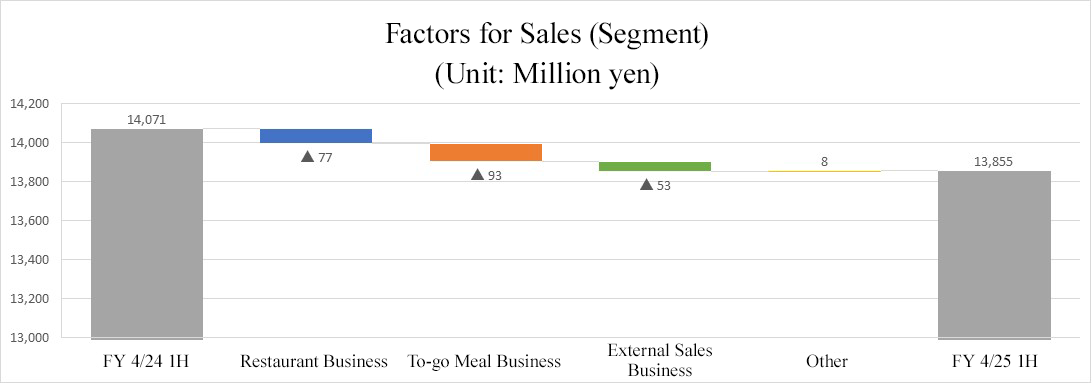

- In the first half of the fiscal year ending April 2025, sales declined 1.5% year on year to 13,855 million yen. There were favorable factors, such as the increase of the flow of people due to the normalization of economic activities and the growth of demand for restaurants from non-Japanese people. However, the Restaurant Business and the To-go Meal Business were affected by temporary closing, shortening of business hours, and closure of commercial facilities where their restaurants are operated for coping with typhoons. In addition, they failed to receive orders in large-scale transactions in the External Sales Business. In the first half of the fiscal year ending April 2025, the sales at existing stores increased 0.4% year on year. Operating loss was 133 million yen (an operating income of 43 million yen in the same period of the previous year). The prices of raw materials and packaging materials, utility costs, etc. rose, so they strove to control each expense. However, their performance was affected by the decline in sales, and repair costs for renovation of restaurants and stores, etc. augmented. Sales and all kinds of profits fell below the company’s forecasts.

- The full-year forecast was left unchanged. For the fiscal year ending April 2025, sales are expected to increase 1.5% year on year to 30,250 million yen and operating income is projected to rise 10.6% year on year to 906 million yen. In the first half of the fiscal year ending April 2025, their performance did not reach the company’s forecast, but their performance is better in the second half of each fiscal year. In the second half of this fiscal year, sales are expected to grow, due to the demand for year-end and New Year’s parties, the demand for outings, etc. In addition, they raised prices in October, November, and December, so it is expected that profit will rebound. Furthermore, they will improve productivity in order to take advantage of the virtuous cycle of the rise in wages. Dividends are also unchanged. They plan to pay dividends amounting to 10.00 yen/share per year (including an interim dividend of 5.00 yen/share) like in the previous fiscal year.

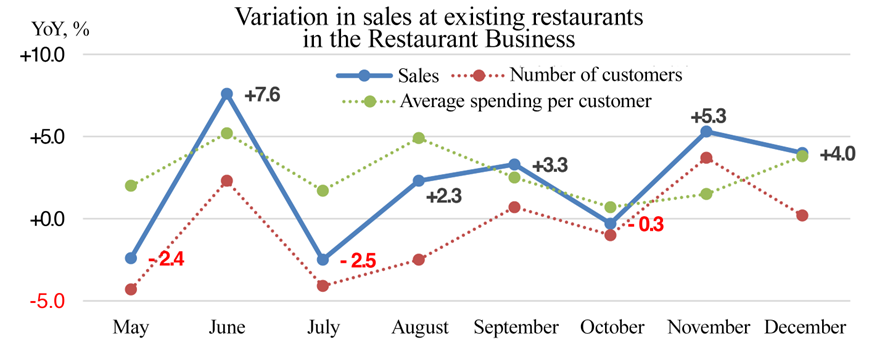

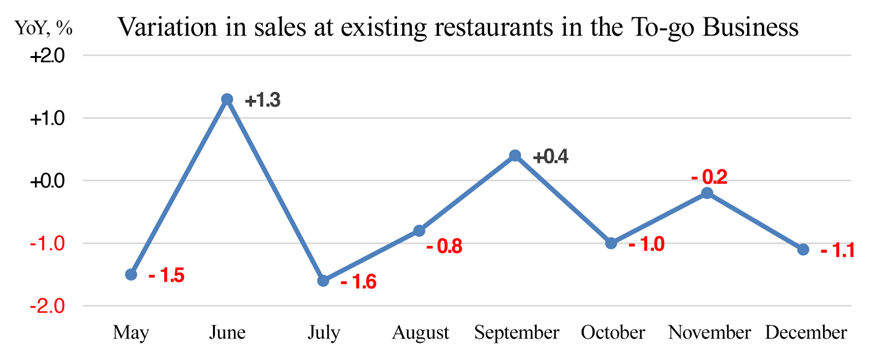

- The performance in the first half of this fiscal year fell below the company’s forecast, due to typhoons, etc. They have raised prices before the busy season in the second half of this fiscal year, so their performance can recover. Actually, the sales at existing restaurants in the Restaurant Business grew 5.3% in November and 4.0% in December, while the number of customers and average spending per customer increased. This indicates that they made a good start. The sales at existing stores in the To-go Meal Business decreased slightly by 0.2% in November and by 1.1% in December, and we can expect that the sales will recover. President Honda was promoted from a senior managing director to the president in 2018 as the founder got out of shape, and has made efforts to streamline business operations in the company, which had a high-cost structure. At a briefing session, they insisted that they need to improve the utilization rate of the central kitchen and streamline its operations in order to improve profit margin. They concentrate on measures for them, and we would like to pay attention to such measures.

1. Company Overview

UMENOHANA Co., Ltd. engages in the Restaurant Business, the To-go Meal Business and the External Sales Business under the theme of “fusing food and culture.” In the Restaurant Business, they operate restaurants such as “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” “Sushihan, a Japanese-cuisine restaurant,” “Sakura Suisan, a Japanese-style pub serving seafood dishes” and “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” In the To-go Meal Business, they run “Koichian” stores selling rolled sushi, inari sushi, etc. and “Umenohana” stores selling small Japanese cuisine dishes and boxed meals. In the External Sales Business, they process and sell marine products and sell products from the Umenohana and Koichian brands. The Umenohana group is composed of the company and seven subsidiaries.

Their management philosophy is “be grateful to people and things,” which used to be the motto of the late founder Shigetoshi Umeno.

The company was registered under the Japan Securities Dealers Association in 1999 and listed on the 2nd Section of TSE in 2002. In April 2022, the company got listed on the Standard Market of TSE.

[1-1 History]

In 1976, Mr. Shigetoshi Umeno founded “Kanishige,” a restaurant specializing in crab dishes. After establishing the company, he served as President until 2018, expanding the business. Mr. Honda, who currently serves as chairperson and CEO, took over presidency in 2018.

Year and month | Event |

October 1979 | Founded Kanishige Limited in Saga City, Saga Prefecture, to operate dining facilities |

April 1986 | Opened the first “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” in Kurume City, Fukuoka Prefecture (Kurume Restaurant) |

January 1990 | Founded UME CORPORATION Co., Ltd. in Kurume City, Fukuoka Prefecture |

July 1990 | UME CORPORATION Co., Ltd. absorbed Kanishige Limited. |

December 1992 | Newly established Kurume Central Kitchen in Kurume City, Fukuoka Prefecture. |

March 1996 | A building for the headquarters was acquired in and relocated to Kurume City, Fukuoka Prefecture. |

October 1997 | Renamed UME CORPORATION Co., Ltd. UMENOHANA Co., Ltd. |

April 1999 | The company’s stock was registered under the Japan Securities Dealers Association. |

June 2002 | Listed on the 2nd Section of TSE |

September 2003 | Founded UMENOHANA (THAILAND) CO., LTD in Bangkok, Thailand. |

September 2004 | Founded West Japan UMENOHANA Co., Ltd. and East Japan UMENOHANA Co., Ltd. through an incorporation-type demerger, taking over restaurant operation (Integrated in October 2008 due to organizational restructuring, changing the company name to Service Co., Ltd.) |

November 2004 | Founded UMENOHANA plus Limited in Kurume City, Fukuoka Prefecture (changed to UMENOHANA plus Co., Ltd. in October 2008). |

October 2007 | Turned Koichian Co., Ltd. into a subsidiary through share acquisition. |

November 2012 | Concluded a capital and business alliance agreement with H2O Retailing Corp. |

June 2013 | Founded UMENOHANA S&P CO., LTD. through a merger with S&P Syndicate Public CO., LTD., a local corporation in Bangkok, Thailand. |

October 2014 | Turned Koichian Co., Ltd. into a wholly-owned subsidiary through share exchange. |

October 2016 | Founded UMENOHANA Service East Japan Co., Ltd. through an incorporation-type demerger, in which UMENOHANA Service Co., Ltd. was the splitting company, and changed the company name of UMENOHANA Service Co., Ltd. to UMENOHANA Service West Japan Co., Ltd. |

| Turned Maruhira Shoten Co., Ltd. into a wholly-owned subsidiary through share acquisition. |

November 2016 | Concluded a memorandum on a capital and business alliance with Fujio Food System Co., Ltd. (the present name: FUJIO FOOD GROUP INC.). |

April 2017 | Turned Sushihan Co., Ltd. into a wholly-owned subsidiary through share acquisition. |

August 2018 | Newly established Kyoto Central Kitchen in Ide, Tsuzuki-gun, Kyoto Prefecture. |

December 2018 | Started closing accounts in April instead of September from the fiscal year ending April 2019. |

February 2019 | Established Sankyo UMENOHANA Co., Ltd. (which turned into a subsidiary) through a merger with the Agricultural Cooperative Association Kosei Farm (headquartered in Aso City, Kumamoto Prefecture). |

May 2019 | Turned TERAKEN Co., Ltd. into a subsidiary through share acquisition. |

January 2021 | Founded Plum Cooperative Union. |

May 2021 | Founded UMENOHANA Service Kyushu Co., Ltd. through an incorporation-type demerger, in which UMENOHANA Service West Japan Co., Ltd. was the splitting company. |

April 2022 | Got listed on the Standard Market of TSE in step with revisions to the TSE market classification. |

May 2022 | Performed an absorption-type merger in which Koichian Co., Ltd. was the surviving company and UMENOHANA plus Co., Ltd. was the absorbed company, and changed the company name to Koichian Plus Co., Ltd. |

March 2023 | Terminated the capital and business alliance agreement with H2O Retailing Corp. |

April 2023 | Terminated the joint venture with S&P Syndicate Public CO., LTD. by selling the shares of UMENOHANA S&P CO., LTD. |

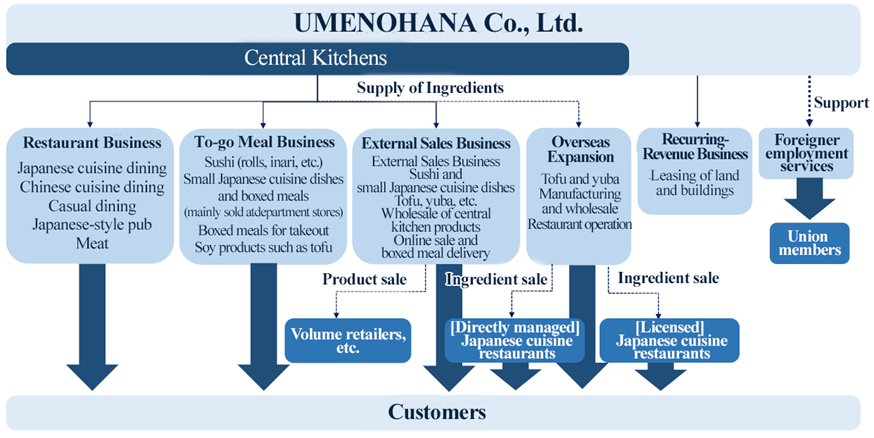

[1-2 Business structure]

≪Central kitchens≫

Central kitchens are the origin of Umenohana’s delicious taste. Delivering “safe, secure and delicious taste” throughout Japan. Producing core ingredients for “Umenohana” and “Koichian” at central kitchens to achieve an unchanging delicious taste and stable supply

| Delivering “safe, secure and delicious taste” throughout Japan

|

(Taken from the reference material of the company)

A central kitchen was newly established in Kurume City, Fukuoka Prefecture in 1992, and it has been the origin of Umenohana’s delicious taste ever since. In addition to Kurume City, central kitchens are currently located in Tsuzuki-gun, Kyoto Prefecture, Sano City, Tochigi Prefecture and Yamaguchi City, Yamaguchi Prefecture. Ingredients produced at central kitchens are shipped out or frozen for storage on the day of production and delivered to respective restaurants and stores preserving the freshness and flavor. As the shipped ingredients are made into final dishes at a restaurant or store, an ever-unchanging delicious cuisine is served to the customers of all restaurants and to-go meal stores.

(Taken from the reference material of the company)

[1-3 Business description]

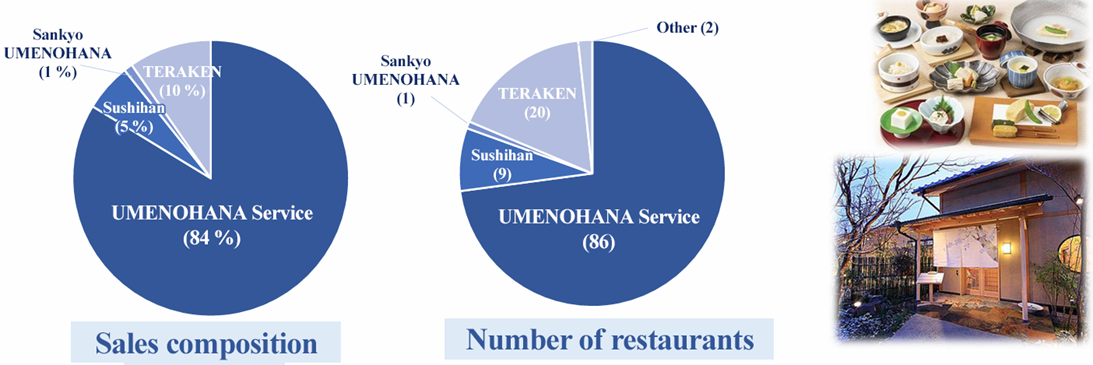

≪Restaurant Business≫

UMENOHANA Service Co., Ltd. (a consolidated subsidiary) operates dining facilities, mainly “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” Sushihan Co., Ltd. (a consolidated subsidiary) manages “Sushihan, a Japanese-cuisine restaurant,” TERAKEN Co., Ltd. (a consolidated subsidiary) runs dining facilities, mainly “Sakura Suisan, a Japanese-style pub serving seafood dishes,” and Sankyo UMENOHANA Co., Ltd. (a consolidated subsidiary) is responsible for the operation of “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” The company supplies ingredients, equipment, etc. and provides guidance concerning management, services for undertaking accounting paperwork, etc. to these subsidiaries.

The major product line-up for each dining style offered by the corporate group in the Restaurant Business is as follows.

Dining style | Major product line-up |

Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu | Traditional Japanese dishes including yuba (soy milk skin) and tofu, Japanese à la carte dishes, beverages, and boxed meals for takeout |

Sushihan, a Japanese-cuisine restaurant | Hot pot dishes, sushi, rice bowl dishes, Japanese dishes served on a tray, beverages, and boxed meals for takeout |

Sakura Suisan, a Japanese-style pub serving seafood dishes | Fish dishes, grilled chicken on skewers, à la carte dishes, and beverages |

Other | Other dining services |

“Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” – Kurume Restaurant | ||

|

|

|

(Taken from the company website)

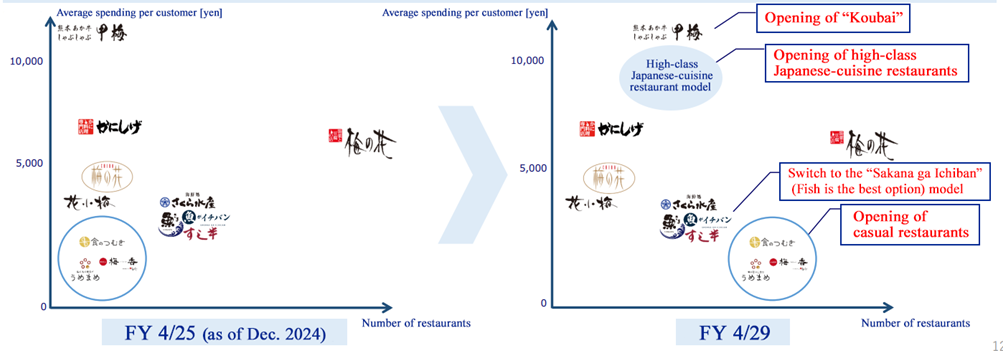

The group’s mainstay “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” is operated under the theme of bringing a “time of relaxation, nourishing the spirit with delicious cuisine” to customers. It is differentiated by offering a sophisticated way of serving at elegantly decorated dining facilities reminiscent of high-class traditional Japanese restaurants, all at a reasonable price. Furthermore, the company has opened “Creative Chinese Cuisine Restaurant – CHINA Umenohana” and “Seasonal kamameshi - Hanakoume,” aiming for expanding the business. Moreover, they acquired Sushihan, which operates “Sushihan, a Japanese-cuisine restaurant,” and TERAKEN, which runs “Sakura Suisan, a Japanese-style pub serving seafood dishes,” as subsidiaries through M&A. In March 2020, they opened a new type of a high-end restaurant, “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto,” at “GINZA SIX.”

(Taken from the reference material of the company)

With regard to “Sakura Suisan, a Japanese-style pub serving seafood dishes,” they are forging ahead with renovations, changing the dining style from a general Japanese-style pub to “Sakana ga Ichiban” (Fish is the best option), an eatery specializing in fresh seafood.

Initiatives for the future

◎ They opened a high-class Japanese-cuisine restaurant using fresh seasonal fish and vegetables, including crabs, in the Kansai area in fiscal year ending April 2026 and plan to open 4 restaurants by fiscal year ending April 2029.

◎ They plan to open a total of 13 restaurants of mainly “Umenohana-no-teishoku-ya Umemame,” “Chinese Cuisine Meishan,” and “Meifa” as casual restaurants by fiscal year ending April 2029.

◎ They plan to open 4 restaurants in the Kansai area, including a restaurant “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto” to be opened in fiscal year ending April 2026, by fiscal year ending April 2029.

◎ They plan to transform some restaurants of “Sakura Suisan” into “Sakana ga Ichiban” (Fish is the best option), whose sales are healthy.

Outlook for average spending per customer and the number of restaurants

(Taken from the reference material of the company)

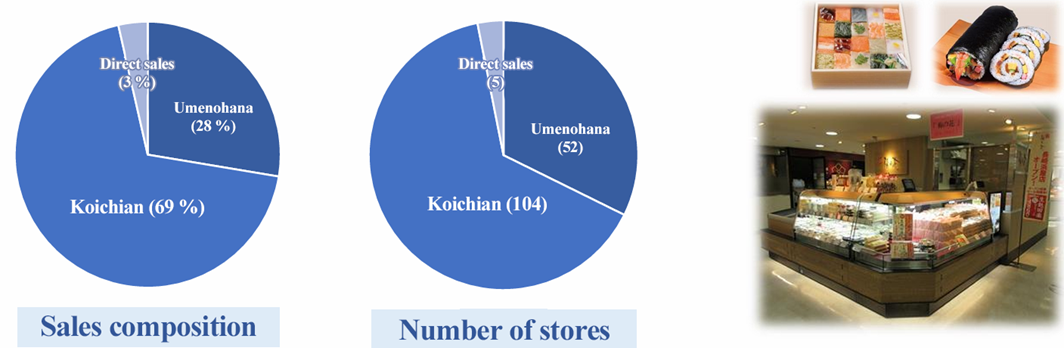

≪To-go Meal Business≫

Koichian Plus Co., Ltd. (a consolidated subsidiary) operates stores of mainly the “Koichian” and “Umenohana” brands. The company supplies ingredients, equipment, etc. and provides guidance concerning management, services for undertaking accounting paperwork, etc. to this subsidiary.

The major product line-up for each brand offered by the corporate group in the To-go Meal Business is as follows.

Brand | Major product line-up |

Koichian | Rolled sushi, inari sushi, pressed sushi, sushi assortment boxes, rice balls, okowa (steamed rice with vegetables or meat), etc. |

Umenohana | Boxed meals for takeout, small Japanese cuisine dishes, osechi (traditional food eaten during New Year holidays), soy products such as tofu, small frozen dishes |

Other | Boxed meals for takeout, small Japanese cuisine dishes, osechi (traditional food eaten during New Year holidays), soy products such as tofu, small frozen dishes, fresh products, etc. |

To-go meal stores of “Umenohana” sell products that allow everyone to enjoy the taste of “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” at home. “Koichian” is well known for its beautifully colorful sushi, rice balls, etc. Both are brands of to-go meals available at renowned department stores throughout Japan.

(Taken from the reference material of the company)

Initiatives for the future

◎With the aim of breaking away from the dependence on department stores, they launched a new model fusing Koichian and Umenohana, and plan to open 1 restaurant in fiscal year ending April 2025 and 5 restaurants by fiscal year ending April 2029.

◎ They plan to open 16 restaurants of the existing brands “Koichian” and “Umenohana” by fiscal year ending April 2029.

≪External Sales Business≫

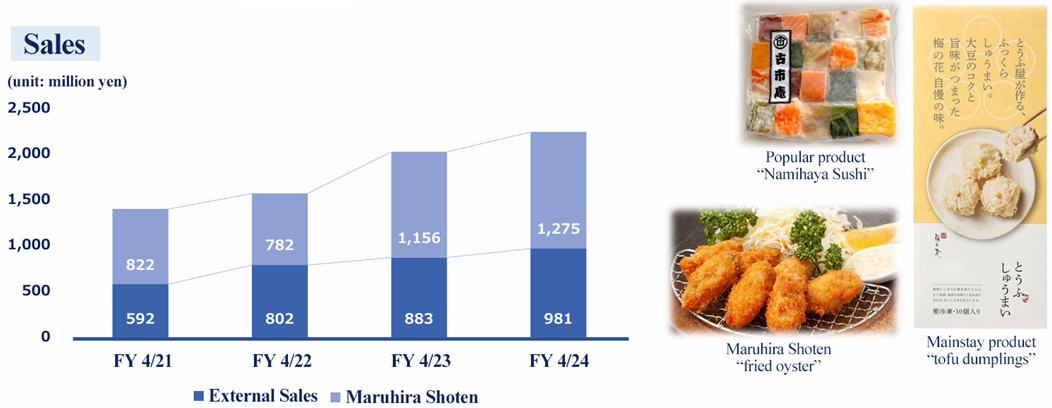

The company sells original products produced at central kitchens to approximately 270 companies, such as supermarkets and other companies that operate dining services. In addition, Maruhira Shoten (incorporated into Umenohana in August 2023) sells ingredients for business, such as deep-fried oyster, to restaurant operators.

(Taken from the reference material of the company)

Initiatives for the future

They aim to improve the utilization rate of the central kitchen by expanding the External Sales Business.

◎ For external sales, they aim to expand sales channels by increasing sales staff.

◎ For mail-order business, they will increase collaborative products of “Tsuuhan-honpo Ume Asobi” (an online site), and enhance the approach to members.

◎ For the business of delivering boxed meals, they will expand the area where they can deliver boxed meals.

They aim to achieve sales of 3 billion yen in fiscal year ending April 2029 (they earned sales of 2,254 million yen in fiscal year ended April 2024).

≪Other≫

UMENOHANA (THAILAND) CO., LTD. (a non-consolidated subsidiary accounted for by the equity method) engages in the production and sale of food products such as soy milk, tofu and yuba, as well as the operation of dining facilities in Bangkok, Thailand.

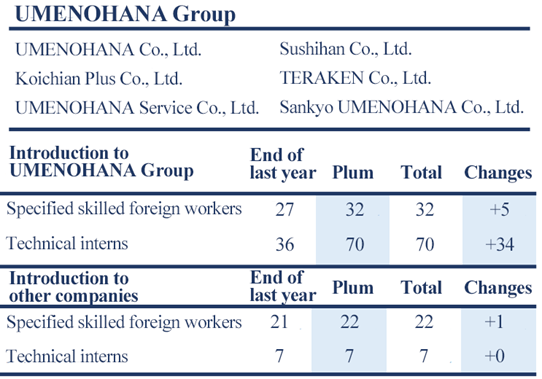

Plum Cooperative Union (a non-consolidated subsidiary accounted for by the equity method) engages in the businesses of joint acceptance of foreign technical interns, support of specified skilled workers and employment placement for such human resources.

Furthermore, the company leases real estate.

Initiatives for the future

Overseas business

◎ They plan to open “Ginza Shabushabu Koubai,” a meat-serving restaurant, as the second restaurant in Thailand in the autumn of 2025.

◎ They aim to establish a local corporation in Vietnam and open a restaurant in the format of “a Japanese-style pub” or “a Shabushabu (lightly boiled meat) restaurant” there by the end of fiscal year ending April 2026.

◎ From fiscal year ending April 2027, they will aim to operate multiple restaurants in Vietnam and make inroads into the markets of Southeast Asia, such as Indonesia and the Philippines.

Recurring-revenue business (real estate)

◎ They plan to start measures for utilizing 11 properties in Osaka and Hyogo and diversifying revenue sources.

◎ They started renting out a building they own in the vicinity of a station in Osaka as offices in February 2025.

◎ Since all properties are located in the vicinity of a station, they aim to draw up a plan for constructing a rental apartment building with a restaurant by fiscal year ending April 2026 and start the construction in or after fiscal year ending April 2027.

≪DX and brand development-Initiatives for the future≫

DX

◎ They will improve and streamline business operations through DX, to improve productivity. In addition, they will adopt cutting-edge technologies, such as AI, to save labor.

◎ In order to promote members to visit various restaurants and stores of the corporate group by utilizing their official app, they will strengthen the functions of the app and distribute information.

◎ In order to use the digital media, such as social media, effectively, they will increase staff in charge of digital technology and distribute comprehensive information on the corporate group.

Brand development

They changed the logo, in order to depict the meaning of existence of the corporate group: “To offer a lively, enjoyable mealtime.”

(Taken from the reference material of the company)

The corporate name “UMENOHANA Co., Ltd.” reminds us of mainly the restaurant “Umenohana, a restaurant specializing in tofu and yuba (soy milk skin).” Considering the actual situation where they operate a variety of businesses in various ways, they will rename the corporate name “UMENOHANA Group Co., Ltd.” on May 1, 2025 to promote strategies for further growth.

[1-4 Sustainability]

―Together with producers ― Delivering a safe and secure delicious taste together with producers

Reducing the annual waste from food residues at central kitchens by 100 % As an initiative for enhancing the prosperous coexistence with producers and addressing environmental issues, the company will reduce annual food residues, which amount to 273 tons at central kitchens, by 100 %. They have already launched the initiative at some restaurants and stores. ① Decomposition of food residues through fermentation, turning them into a product ② Collection and composting by partner companies ③ Provision of the compost to farmers ④ Direct purchase of all produce grown using the produced compost by the company ⑤ Used at UMENOHANA Group restaurants and stores

| Contract farming of “Yumepirika soybeans” Contract farming of “Yumepirika soybeans,” which are indispensable for making tofu, the Umenohana specialty, in Hokkaido for prosperous coexistence with producers. Based on contracts with seven farms in the Sorachi and Tokachi Districts in Hokkaido, the company has been purchasing all produce since 2010, also striving for stable procurement of ingredients.

(Taken from the reference material of the company) “Yukipirika soybeans” are characteristic in having a higher isoflavone content in comparison with other soybeans. Rare soybean variety grown in small amounts as it is difficult to cultivate. |

(Taken from the reference material of the company) |

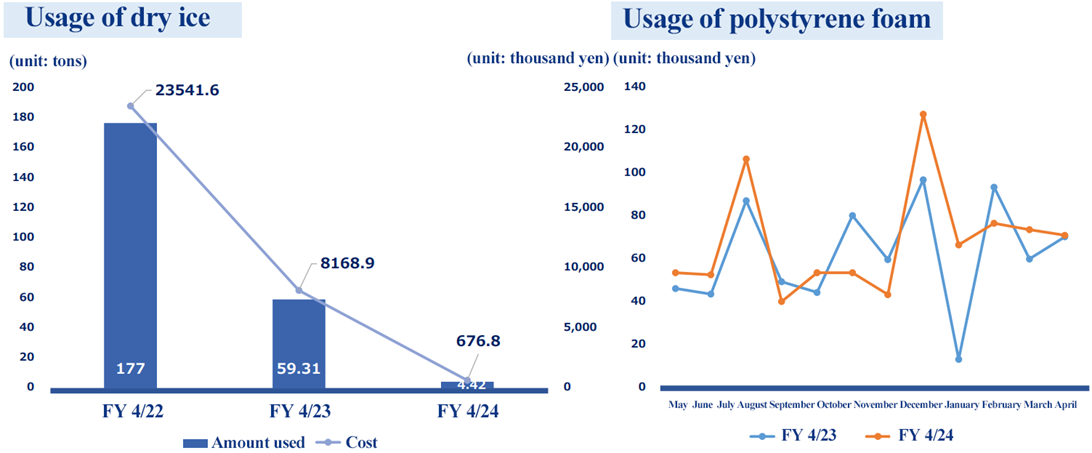

―Consideration of the environment― Initiatives for reducing GHG emissions

The company has replaced dry ice and polystyrene foam used for shipping from logistics centers to restaurants and stores to recyclable containers and reusable high-performance refrigerants, reducing the annual amount of dry ice used.

(Taken from the reference material of the company)

―Contribution to society―

Provision of food to volunteer-run children’s cafeterias

The company has provided boxed meals, etc. worth 930 thousand yen from Umenohana Group stores and 2.3 tons of food products from central kitchens to the NPO Children’s Cafeterias.

Support for areas affected by natural disasters

The company provided food to evacuation shelters during torrential rains in Kurume City, Fukuoka Prefecture for 11 days in July 2023.

Support for schools in Thailand

The company founded a specified nonprofit organization “The Flower of a Dream Association” in 2014.

The staff and the company contribute to the sound development of the global society by engaging in activities to support schools in Thailand as a way to support the operation of schools for children in Myanmar.

FY 4/24

Total donated amount: 6,444 thousand yen

➤Staff: 3,222 thousand yen

➤The company donated the same amount as the staff

Plum Cooperative Union

The company founded “Plum Cooperative Union (a non-consolidated subsidiary)” with the objective of launching the business of “Joint Acceptance of Foreign Technical Interns” and engaging in the businesses of “Support for Specified Skilled Foreign Worker” and “Employment Placement.”

|

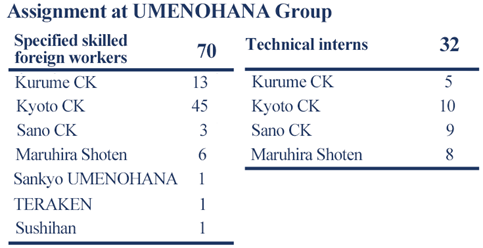

The company employs 32 specified skilled workers (increasing by 5 from the previous fiscal year) and 70 technical interns (increasing by 34 from the previous fiscal year)

As of April 2024 |

(Taken from the reference material of the company)

2. First Half of the Fiscal Year ending April 2025 Earnings Results

[2-1 Consolidated Earnings Results]

| FY 4/24 1H | Ratio to sales | FY 4/25 1H | Ratio to sales | YoY | The company’s forecast | Compared to forecast |

Sales | 14,071 | 100.0% | 13,855 | 100.0% | -1.5% | 14,328 | -3.3% |

Gross profit | 9,225 | 65.6% | 9,057 | 65.4% | -1.8% | - | - |

SG&A expenses | 9,181 | 65.3% | 9,190 | 66.3% | +0.1% | - | - |

Operating income | 43 | 0.3% | -133 | - | - | 14 | - |

Ordinary income | -1 | - | -223 | - | - | -83 | - |

Interim net income | 287 | 2.0% | -166 | - | - | -78 | - |

*Unit: million yen. The company’s forecast means the forecast revised in March 2024.

Sales dropped 1.5%, and an operating loss was posted, so their performance fell below the company’s forecast.

Sales declined 1.5% year on year to 13,855 million yen. There were favorable factors, such as the increase of the flow of people due to the normalization of economic activities and the growth of demand for restaurants from non-Japanese people. However, the Restaurant Business and the To-go Meal Business were affected by temporary closing, shortening of business hours, and closure of commercial facilities where their restaurants are operated for coping with typhoons. In addition, they failed to receive orders in large-scale transactions in the External Sales Business. As commodity prices rose, customers became more frugal and careful when selecting products. In the first half of this fiscal year, the sales at existing restaurants and stores increased 0.4% year on year (+1.2% for the Restaurant Business and -0.6% for the To-go Meal Business).

Operating loss was 133 million yen (an operating income of 43 million yen in the same period of the previous year). Gross profit margin decreased slightly year on year from 65.6% to 65.4%, SGA rose slightly, and profit/loss worsened. The prices of raw materials and packaging materials, utility costs, etc. rose, so they strove to control each expense. However, their performance was affected by the decline in sales, and repair costs for renovation of restaurants and stores, etc. augmented. Ordinary loss was 223 million yen (a loss of 1 million yen in the same period of the previous year) and net loss was 166 million yen (a profit of 287 million yen in the same period of the previous year). Sales and all kinds of profits fell below the company’s forecasts.

[2-2 Sales and operating income in each segment]

| FY 4/24 1H | Composition Ratio | FY 4/25 1H | Composition Ratio | YoY |

Sales |

|

|

|

|

|

Restaurant Business | 8,015 | 57.0% | 7,938 | 57.3% | -1.0% |

To-go Meal Business | 5,034 | 35.8% | 4,941 | 35.7% | -1.9% |

External Sales Business | 1,011 | 7.2% | 958 | 6.9% | -5.2% |

Other | 9 | 0.1% | 17 | 0.1% | +91.6% |

Total | 14,071 | 100.0% | 13,855 | 100.0% | -1.5% |

Profit in each segment |

|

|

|

|

|

Restaurant Business | 202 | 2.5% | 186 | 2.4% | -7.6% |

To-go Meal Business | 303 | 6.0% | 294 | 6.0% | -3.0% |

External Sales Business | -70 | - | -140 | - | - |

Other/adjustment | -391 | - | -474 | - | - |

Total | 43 | 0.3% | -133 | - | - |

*Unit: million yen. The composition ratio of profit in each segment means profit margin.

* Restaurant Business

Sales decreased 1.0% year on year to 7,938 million yen and operating income dropped 7.6% year on year to 186 million yen.

They engage in the enhancement of sale of dishes, such as kaiseki (tea-ceremony dishes) with seasonal ingredients, and seasonal to-go foods. In addition, they strove to meet the demand from foreign visitors to Japan by cooperating with travel agencies, posting ads in the media, announcing the dishes for vegans targeted at foreign visitors to Japan, and adopting kaiseki (tea-ceremony dishes) with high added value including seafood and meat. They renovated “Sakura Suisan, a Japanesestyle pub serving seafood dishes” into “Sakana ga Ichiban” (Fish is the best option), a Japanese-style tavern with high added value where customers can enjoy fresh seafood casually, for “Yokohama Nihondai Odori Restaurant,” “Nishi-Shinjuku-Ekimae Restaurant,” and “Kudan Yasukuni-dori Restaurant.” They renovated and repaired restaurants for the purposes of making them more comfortable and improving the working environment for employees in the second half of the previous fiscal year and in the first half of this fiscal year, so profit dropped.

*To-go Meal Business

Sales decreased 1.9% year on year to 4,941 million yen and operating income dropped 3.0% year on year to 294 million yen.

In order to secure sales, they strove to increase the number of customers and sales by taking measures for reducing stockout rate, enriching the product lineup, recommending products, and improving the layout of selling spaces. They distribute information on the results of questionnaire surveys at open tasting sessions, events to be held, etc. to customers via social media. The sales of event goods and new products as well as the Koichian store of Umenohana were healthy. However, sales and profit in the To-go Meal Business declined due to typhoons.

*External Sales Business

Sales declined 5.2% year on year to 958 million yen, and they posted an operating loss of 140 million yen (an operating loss of 70 million yen in the same period of the previous year).

They engage in sales promotion by increasing new business partners based on the reputation and uniqueness of the tastes of their popular products, such as “Frozen Namihaya-zushi” and “Kani-shumai.” The sales of “Frozen Namihaya-zushi” increased significantly from the previous year, thanks to the effects of coverage by a TV program. However, they failed to receive large-scale orders for frozen oyster, etc., which were recorded in the previous year, so sales dropped.

In the mail-order business, they updated the website for improving user-friendliness and convenience. They engage in the improvement of the website so that customers can browse and purchase products more easily.

[2-3 Financial Condition]

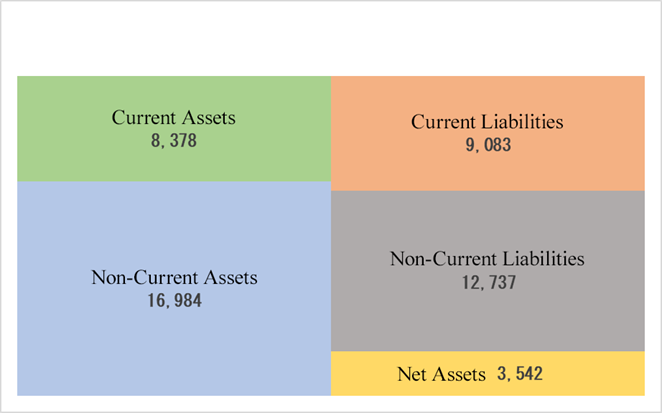

◎ Balance Sheet Summary

| April 2024 | October 2024 | Increase/ Decrease |

| April 2024 | October 2024 | Increase/ Decrease |

Current assets | 7,580 | 8,378 | +798 | Current liabilities | 9,411 | 9,083 | -327 |

Cash and deposits | 2,761 | 3,246 | +485 | Trade payables | 756 | 656 | -100 |

Trade receivable | 1,609 | 1,612 | +3 | Short-term interest-bearing debt | 6,049 | 6,183 | +134 |

Inventories | 2,121 | 2,098 | -22 | Noncurrent liabilities | 12,347 | 12,737 | +389 |

Noncurrent assets | 17,455 | 16,984 | -471 | Long-term interest-bearing debt | 10,806 | 11,261 | +455 |

Property, plant and equipment | 13,673 | 13,611 | -62 | Total liabilities | 21,759 | 21,821 | +62 |

Intangible assets | 137 | 122 | -15 | Net assets | 3,277 | 3,542 | +264 |

Investments and other assets | 3,644 | 3,250 | -393 | Total retained earnings | -180 | -347 | -166 |

Total assets | 25,036 | 25,363 | +327 | Total liabilities and net assets | 25,036 | 25,363 | +327 |

*Unit: million yen. Short-term debts include current portion of long-term debts.

The total assets as of the end of the first half of the fiscal year ending April 2025 stood at 25,363 million yen, up 327 million yen from the end of the previous fiscal year, due to the increase in cash and deposits, etc.

Current liabilities decreased, but fixed liabilities augmented, so total liabilities rose 62 million yen from the end of the previous fiscal year to 21,821 million yen.

Net assets grew 264 million yen from the end of the previous fiscal year to 3,542 million yen, due to the increases in capital stock and capital surplus through capital increase.

Capital-to-asset ratio rose from 13.0% at the end of the previous fiscal year to 14.0%.

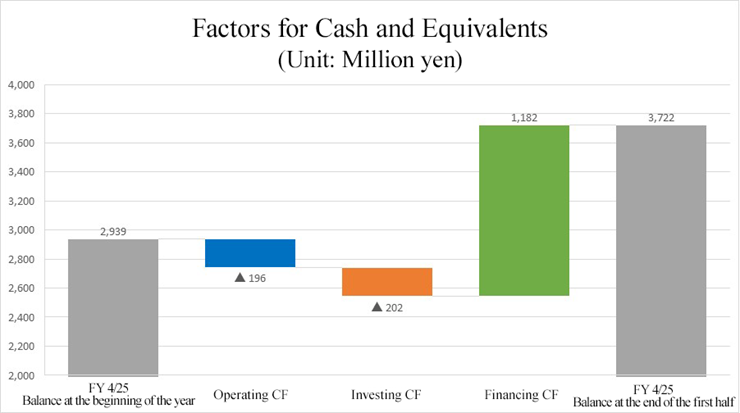

◎ Cash Flow

| FY 4/24 1H | FY 4/25 1H | Increase/Decrease |

Operating CF | -105 | -196 | -90 |

Investing CF | -13 | -202 | -189 |

Free CF | -119 | -398 | -279 |

Financing CF | -151 | 1,182 | +1,333 |

Balance of cash equivalents | 3,045 | 3,722 | +676 |

*Unit: million yen.

The cash and cash equivalents as of the end of the first half of the fiscal year ending April 2025 stood at 3,722 million yen, up 676 million yen from the end of the previous fiscal year.

There were cash outflows from operating and investment activities like in the same period of the previous year, but they posted a significant cash inflow from financial activities through the revenues from long-term borrowing and issuance of shares.

3. Fiscal Year ending April 2025 Earnings Forecasts

[3-1 Earnings Forecasts]

| FY 4/24 | Ratio to sales | FY 4/25 (Est.) | Ratio to sales | YoY |

Sales | 29,816 | 100.0% | 30,250 | 100.0% | +1.5% |

Operating income | 819 | 2.7% | 906 | 3.0% | +10.6% |

Ordinary income | 739 | 2.5% | 727 | 2.4% | -1.6% |

Net income | 1,020 | 3.4% | 420 | 1.4% | -58.8% |

*Unit: million yen.

Projecting sales to increase 1.5% year on year and profit to grow 10.6% year on year for the fiscal year ending April 2025

The full-year forecast was left unchanged. For the fiscal year ending April 2025, sales are expected to increase 1.5% year on year to 30,250 million yen and operating income is projected to rise 10.6% year on year to 906 million yen.

In the first half of the fiscal year ending April 2025, their performance did not reach the company’s forecast, but their performance is better in the second half of each fiscal year. In the second half of this fiscal year, sales are expected to grow, due to the demand for year-end and New Year’s parties, the demand for outings, etc. In addition, they raised prices in October, November, and December, so it is expected that profit will rebound. Furthermore, they will improve productivity in order to take advantage of the virtuous cycle of the rise in wages. By enhancing the sale of in-house products to clients outside the corporate group, they concentrate on the improvement in productivity and revenues of the central kitchen. They plan to work on social activities and address environmental issues while pursuing the coexistence and co-prosperity with producers.

Dividends are also unchanged. They plan to pay dividends amounting to 10.00 yen/share per year (including an interim dividend of 5.00 yen/share) like in the previous fiscal year.

[3-2 Forecast and initiatives for each segment]

Restaurant Business

The company projects sales of 17,468 million yen and an operating income of 883 million yen.

In the second half of this fiscal year, Sankyo Umenohana will open Tokyo Solamachi Restaurant of Koubai on March 17. In addition, they will transform Nishi-Shinjuku-Ekimae Restaurant and Kudan Yasukuni Dori Restaurant of Sakura Suisan into those of “Sakana ga Ichiban” (Fish is the best option).

■ Operation of restaurants with high added value

・Develop a high-end dining style, fusing “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” and “Kanishige, a restaurant specializing in crab dishes”

・Increase the number of restaurants of “Shabushabu Koubai, serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto”

■ Recovery and added value of existing restaurants

・Change and update “Sakura Suisan, a Japanese-style pub serving seafood dishes” from a general Japanese-style pub into an eatery focused on fresh seafood

・Develop a menu with high added value

To-go Business

The company projects sales of 10,604 million yen and an operating income of 390 million yen.

They opened “Kichijoji Tokyu Restaurant” of Koichian on January 21. Furthermore, they will renovate one Umenohana brand store and four Koichian brand stores.

・They aim to increase sales by inducing the synergy between the two brands: Koichian and Umenohana, by opening their restaurants in major department stores.

・Operate stores in train station buildings, shopping areas within train stations and commercial facilities

・Enhance the sale of dishes with high added value

・Develop and promote planned products matching seasonal events, etc.

External Sales Business

The company projects sales of 2,278 million yen and an operating income of 16 million yen.

■ External Sales

・Reach out to new business partners

・Enhance the sale of existing products and elevate the productivity of central kitchens

・Propose products matching the needs of customers to expand sales channels

■ Maruhira Shoten

・Expand sales channels to retail stores and companies that operate dining facilities, mainly for deep-fried oysters made with oysters produced in Hiroshima Prefecture

・Sell steamed oysters as new products

・Stably secure oyster as an ingredient

■ Online Sales

・Update the online shop to make it more convenient for customers

・Develop products and enrich the lineup matching the needs of customers

4. Conclusions

The performance in the first half of this fiscal year fell below the company’s forecast, due to typhoons, etc. They have raised prices before the busy season in the second half of this fiscal year, so their performance can recover. Actually, the sales at existing restaurants in the Restaurant Business grew 5.3% in November and 4.0% in December, while the number of customers and average spending per customer increased. This indicates that they made a good start. The sales at existing stores in the To-go Meal Business decreased slightly by 0.2% in November and by 1.1% in December, and we can expect that the sales will recover. President Honda was promoted from a senior managing director to the president in 2018 as the founder got out of shape, and has made efforts to streamline business operations in the company, which had a high-cost structure. At a briefing session, they insisted that they need to improve the utilization rate of the central kitchen and streamline its operations in order to improve profit margin. They concentrate on measures for them, and we would like to pay attention to such measures.

In addition to performance trends, we would like to keep an eye on the company's releases, which have not yet been announced, such as "Actions to Achieve Management Conscious of Cost of Capital and Stock Price" and "Medium-term plan."

<Reference: Regarding corporate governance>

◎ Organization type, and the composition of directors and audit and supervisory committee

Organization type | Company with audit and supervisory committee |

Directors | 11 directors, including 4 external ones |

Audit and supervisory committee | 4 members, including 3 external ones |

◎ Corporate Governance Report (Last Update: September 13, 2024)

Basic Views

Based on the following basic policy and our corporate philosophy of “Be grateful to people and things,” we aim to ensure sound and transparent management, respond promptly to changes in the business environment, and realize mutual prosperity with local communities and business partners by improving corporate value through social contributions and sustainable growth, satisfying shareholders, customers, and the employees. We believe that this is the base for corporate governance.

<Basic Policy>

(1) Ensuring shareholders’ rights and equality

(2) Appropriate collaboration with stakeholders other than shareholders

(3) Ensuring transparency through appropriate information disclosure

(4) Ensuring transparency through separation of management and supervision

(5) Active dialogue with shareholders

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)> [Supplementary Principle 4-1 (ii) Making best efforts to achieve the medium-term management plan, taking measures if the plan is not achieved, and reflecting them in the next plan]

Recognizing that management strategies and management plans are a commitment to shareholders, the Board of Directors will do their best to achieve the plan. Should the company fail to deliver on its medium-term management plan, the reasons underlying the failure of achievement as well as the company’s actions will be fully analyzed, and disclosing the results of such analysis to the shareholders will be considered accordingly, while the analytic findings will be reflected in a plan for the ensuing years.

[Supplementary Principle 4-2 (ii) The Board of Directors formulates basic policies regarding the company’s sustainability initiatives and oversees the allocation of management strategies and the implementation of business portfolio strategies]

The Board of Directors does not set a basic policy on sustainability, but rather implements the initiatives described in Supplementary Principle 3-1 (iii), as deemed most appropriate by the divisions under its jurisdiction.

The Board of Directors will effectively oversee sustainability initiatives by approving management strategies and plans and checking their implementation status.

<Disclosure Based on Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4 Strategically Held Shares]

Basic Policy on Strategically Held Shares

We hold shares in companies that we have determined are suitable for investment after taking into consideration the benefits to be derived from the maintenance and development of business relationships.

Basic Policy for Verification

The Board of Directors annually reviews the appropriateness of holding strategically held shares.

Taking into consideration the maintenance of relationships with business partners and business benefits of holding the shares, we determine whether there is any significance to holding the shares and decide whether to continue holding them or dispose of them.

Basic Policy on Exercise of Voting Rights

Regarding the exercise of voting rights for strategically held shares, we will carefully examine the content of each proposal and decide whether to support or oppose it after comprehensively considering factors such as whether it contributes to improving shareholder value and whether it will impede business relations with our company.

[Principle 3-1 Enhancement of information disclosure]

In addition to appropriate disclosure in accordance with laws and regulations, we disseminate information on the following matters from the perspective of ensuring the transparency and fairness of our decision-making and realizing effective corporate governance.

(i) Our corporate philosophy is disclosed on our website as a message from the founder.

()https://www.umenohana.co.jp/company/message.html

Management strategies and management plans will be prepared and disclosed in the future.

(ii) Basic Views and Policies Regarding Corporate Governance

Please refer to “1. Basic Views” in this report.

(iii) Policies and Procedures for Determining the Compensation of Directors and Audit & Supervisory Committee MembersThe basic policy for determining the compensation of directors (excluding audit and supervisory committee members) is to aim for the sustainable improvement of corporate value and to set an appropriate level taking into consideration factors such as position, responsibilities and years of service, and to make a comprehensive decision while taking into consideration the standards of other companies and employee salaries. The compensation for directors (excluding audit and supervisory committee members) consists solely of monthly fixed monetary compensation, which accounts for all of their individual compensation. The Representative Director and President is entrusted with the determination of the specific details of individual compensation based on a resolution of the Board of Directors, and as a measure to ensure that the Representative Director and President exercises his/her authority appropriately, the Representative Director and President seeks the opinion of the Audit and Supervisory Committee on a draft that is prepared within the framework of the compensation limit resolved at the general meeting of shareholders, and makes an appropriate decision while taking into consideration the opinion. Going forward, we will consider adopting stock-based compensation linked to business performance.

In addition, compensation for directors (members of the Audit and Supervisory Committee) is determined through discussions by the Audit and Supervisory Committee within the scope of the applicable compensation limits.

(iv) Policies and Procedures for the Board of Director’s Appointment and Dismissal of Senior Management Personnel and Nomination of Candidates for DirectorsIn accordance with the “Director Appointment Policy,” the Board of Directors deliberates on the appointment and dismissal of directors based on the opinions of the Audit and Supervisory Committee after comprehensively reviewing the skills required by the company, such as character, insight, and business and professional experience which are suited for the execution and supervision of management, through an exchange of opinions at Board of Directors meetings, including outside directors, and submits the results to the General Meeting of Shareholders.

In the event that a director candidate does not meet the required qualifications or ability to perform the duties of a director, or in the event that there is a suspicion of wrongful conduct or a material fact in violation of laws, regulations or the Articles of Incorporation, the Board of Directors shall deliberate on the matter.

(v) Explanation of the individual appointment and dismissal of the senior management personnel and the nomination of candidates for Directors by the Board of Directors based on (iv) above

An explanation of the appointment and nomination of individual candidates for Directors appointed by the Board of Directors is included in the reference documents of the Convocation Notice for the General Meeting of Shareholders.

[Supplementary Principle 3-1 (iii) Sustainability]Our company is committed to the following sustainability initiatives.

1. Consideration of global environmental issues・ Reducing energy consumption by joint delivery with other companies

・ Introducing solar power generation, switching to LED lighting, and power control

・ Reducing the number of deliveries and changing delivery materials to recyclable containers and switching from dry ice to high-performance refrigerants

・ Commercializing soy pulp and recycling residues

・ Reducing plastic use (using paper straws and wooden spoons), recycling waste oil, and conserving resources by reducing printed materials2. Respect for human rights・ Eliminating discrimination based on gender and nationality by promoting women to managerial positions and actively hiring foreign workers

3. Fair and appropriate treatment of employees and consideration for their health and working environment・ Improving the working environment by conducting DX and reviewing and improving operations

4. Fair and appropriate transactions with business partners・ Compliance with relevant laws and regulations such as the Subcontract Act and the Unfair Competition Prevention Act5. Crisis management for natural disasters・ Business continuity through decentralization of central kitchens

Regarding investment in human capital, we allocate resources appropriately according to our management strategies and issues and disclose the number of employees in each department and subsidiary in our financial statements. Regarding investment in intellectual property, we are considering revamping our entire business system, including the core business system, in order to improve productivity and increase contact points with customers.

[Principle 5-1 Policy on constructive dialogue with shareholders]

Our IR activities are based on the principle of providing timely, transparent, accurate and consistent information to shareholders, whether positive or negative.

The Corporate Planning Office, centered on the President and Representative Director, is in charge of IR activities based on this basic stance, and collects and compiles information necessary for IR activities from each business and administrative division. In addition, when we receive requests for dialogue (interviews) from shareholders, we will respond with sincerity within reasonable limits and share information such as requests obtained from shareholders through dialogue.

[IR activities]・ Annual general meeting of shareholders: once a year

・ Financial results announcement: twice a year

・ Tasting events and factory tours open only to shareholders: Approximately six times a year (which varies)

・ Dissemination of information via the company’s website: As needed

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |