Bridge Report:(7604)UMENOHANA Fiscal Year ended April 2024

President Yuji Honda | UMENOHANA Co., Ltd. (7604) |

|

Company Information

Market | TSE Standard Market |

Industry | Retail |

President | Yuji Honda |

HQ Address | 146 Tenjin-machi, Kurume-shi, Fukuoka Prefecture |

Year-end | April |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥978 | 8,209,200 shares | ¥8,028 million | 34.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥10.0 | 1.0% | ¥39.15 | 25.0x | ¥159.65 | 6.1x |

*The share price is the closing price on July 11. Each figure is based on the financial results of the fiscal year ended April 2024. BPS and ROE are actual results from the previous fiscal year.

Earning trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

April 2021 | 21,603 | -2,252 | -2,396 | -1,921 | - | 0.0 |

April 2022 | 22,591 | -1,630 | -1,792 | 217 | 19.58 | 0.0 |

April 2023 | 27,456 | 89 | 14 | -440 | - | 5.0 |

April 2024 | 29,816 | 819 | 739 | 1,020 | 117.30 | 10.0 |

April 2025 (Est.) | 30,250 | 906 | 727 | 420 | 39.15 | 10.0 |

*Forecast figures are those of the company. * Unit: million yen, yen.

This report includes the overview of the earnings results of Umenohana Co., Ltd. in the fiscal year ended April 2024.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended April 2024 Earnings Results

3. Fiscal Year ending April 2025 Earnings Forecasts

4. Interview with President Honda

5. Conclusions

<Reference: Regarding corporate governance>

Key Points

- Under the theme of fusion of food and culture, Umenohana operates the Restaurant Business, the To-go Meal Business, and the External Sales Business. In the Restaurant Business, they operate restaurants, such as “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” “Sushihan, a Japanese-cuisine restaurant,” “Sakura Suisan, a Japanese-style pub serving seafood dishes,” and “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” In the To-go Meal Business, they operate “Koichian,” a store of rolled sushi, inari sushi, etc., and “Umenohana,” a store of Japanese delicatessen and boxed meals. In the External Sales Business, they produce and sell processed seafood products, and sell the products of the Umenohana and Koichian brands. Their management philosophy is “be grateful to people and things,” which was the personal motto of the late Shigetoshi Umeno, who founded the company. In 1999, Umenohana became an over-the-counter company registered in Japan Securities Dealers Association. In 2002, the company got listed on the second section of Tokyo Stock Exchange. In April 2022, the company got listed on the Standard Market.

- In the fiscal year ended April 2024, sales grew 8.6% year on year to 29,816 million yen. With the aim of recovering their performance, which declined in the coronavirus pandemic, they made continuous efforts to improve productivity by brushing up the organizational operation capability in each business section and rationalizing the management operations through DX. In addition, they strove to improve their earning capacity by upgrading and installing manufacturing equipment at the central kitchen and improving the precision of production control. Operating income rose 812.5% to 819 million yen. Gross profit margin increased from 64.3% in the previous fiscal year to 65.5%. Considering the impact of the rise in commodity prices, the company raised wages, but the increase in SGA was only 6.5%, so operating income margin rose significantly from 0.3% in the previous fiscal year to 2.7%. The company paid a year-end dividend of 5.00 yen/share, as forecast by the company. The annual dividend amount was 10.00 yen/share, up 5.00 yen/share from the previous fiscal year.

- For the fiscal year ending April 2025, sales are expected to increase 1.5% year on year to 30,250 million yen and operating income is projected to rise 10.6% year on year to 906 million yen. COVID-19 has subsided, but the future outlook is forecast to remain unclear, due to the hovering of raw material prices and utility charges, the shortage of manpower, etc. Under these circumstances, they will raise wages while considering the impact of the rise in commodity prices, and revise selling prices and improve productivity in order to take advantage of the virtuous cycle of the rise in wages. They plan to pay dividends amounting to 10.00 yen/share per year (including an interim dividend of 5.00 yen/share) like in the previous fiscal year.

- The then senior managing director Honda received the baton from Mr. Umeno in 2018, taking the chair of the president. According to the interview with the president, they will stick to the policy of pursuing “delicious and healthy products.” Furthermore, they plan to expand their business scale through M&A. Amid the coronavirus pandemic, they reduced costs and reform their logistics systems, achieving a more profitable structure. The president mentioned his plan to enhance IR activities so that share price will rise through the improvement in business performance thanks to the above efforts.

- The fiscal year ended April 2024 is part of the recovery phase from the coronavirus pandemic, but it is noteworthy that profit margin has improved significantly. Operating income grew 812.5% year on year, exceeding the initial forecast (591 million yen) by around 40%. It can be said that the revision of selling prices and various measures implemented amid the coronavirus pandemic were effective. Profit margin is expected to improve also in the fiscal year ending April 2025. As President Honda insisted several times at a briefing session, they plan to streamline the operation of the central kitchen by strengthening the External Sales Business.

- It seems that President Honda is well aware of the current situation of the company and how he should implement strategies from now on. Although the president is not ostentatious, but discreet, he is very passionate about improving the satisfaction levels of employees and customers while contributing to society. The company has started full-scale IR activities for the first time. We would like to pay attention to the releases about “their measures for business administration conscious of capital cost and share price,” “their medium-term plan,” etc. as well as the trend of business performance.

1. Company Overview

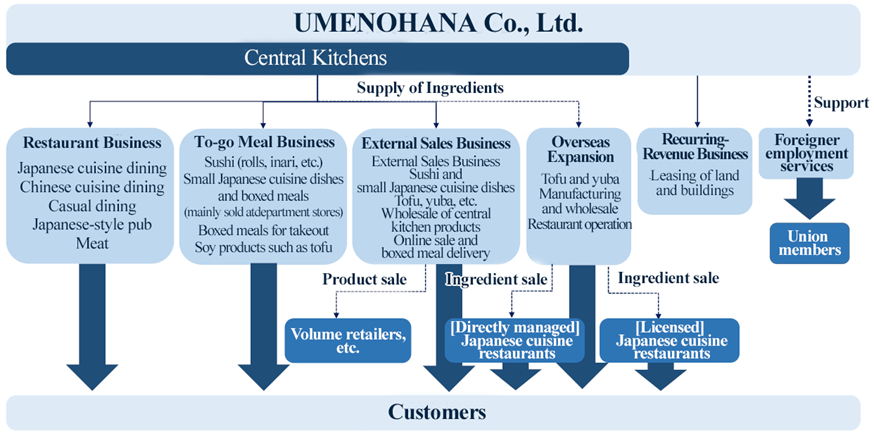

Umenohana Co., Ltd. engages in the Restaurant Business, the To-go Meal Business and the External Sales Business under the theme of “fusing food and culture.” In the Restaurant Business, they operate restaurants such as “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” “Sushihan, a Japanese-cuisine restaurant,” “Sakura Suisan, a Japanese-style pub serving seafood dishes” and “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” In the To-go Meal Business, they run “Koichian” stores selling rolled sushi, inari sushi, etc. and “Umenohana” stores selling small Japanese cuisine dishes and boxed meals. In the External Sales Business, they process and sell marine products and sell products from the Umenohana and Koichian brands. The Umenohana group is composed of the company and seven subsidiaries.

Their management philosophy is “be grateful to people and things,” which used to be the motto of the late founder Shigetoshi Umeno.

The company was registered under the Japan Securities Dealers Association in 1999 and listed on the 2nd Section of TSE in 2002. In April 2022, the company got listed on the Standard Market of TSE.

【1-1 History】

In 1976, Mr. Shigetoshi Umeno founded “Kanishige,” a restaurant specializing in crab dishes. After establishing the company, he served as President until 2018, expanding the business. In 2018, he was succeeded by Mr. Honda, the current President.

Year and month | Event |

October 1979 | Founded Kanishige Limited in Saga City, Saga Prefecture, to operate dining facilities |

April 1986 | Opened the first “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” in Kurume City, Fukuoka Prefecture (Kurume Restaurant) |

January 1990 | Founded UME CORPORATION Co., Ltd. in Kurume City, Fukuoka Prefecture |

July 1990 | UME CORPORATION Co., Ltd. absorbed Kanishige Limited. |

December 1992 | Newly established Kurume Central Kitchen in Kurume City, Fukuoka Prefecture. |

March 1996 | A building for the headquarters was acquired in and relocated to Kurume City, Fukuoka Prefecture. |

October 1997 | Renamed UME CORPORATION Co., Ltd. UMENOHANA Co., Ltd. |

April 1999 | The company’s stock was registered under the Japan Securities Dealers Association. |

June 2002 | Listed on the 2nd Section of TSE |

September 2003 | Founded UMENOHANA (THAILAND) CO., LTD in Bangkok, Thailand. |

September 2004 | Founded West Japan UMENOHANA Co., Ltd. and East Japan UMENOHANA Co., Ltd. through an incorporation-type demerger, taking over restaurant operation (Integrated in October 2008 due to organizational restructuring, changing the company name to Service Co., Ltd.) |

November 2004 | Founded UMENOHANA plus Limited in Kurume City, Fukuoka Prefecture (changed to UMENOHANA plus Co., Ltd. in October 2008). |

October 2007 | Turned Koichian Co., Ltd. into a subsidiary through share acquisition. |

November 2012 | Concluded a capital and business alliance agreement with H2O Retailing Corp. |

June 2013 | Founded UMENOHANA S&P CO., LTD. through a merger with S&P Syndicate Public CO., LTD., a local corporation in Bangkok, Thailand. |

October 2014 | Turned Koichian Co., Ltd. into a wholly-owned subsidiary through share exchange. |

October 2016 | Founded UMENOHANA Service East Japan Co., Ltd. through an incorporation-type demerger, in which UMENOHANA Service Co., Ltd. was the splitting company, and changed the company name of UMENOHANA Service Co., Ltd. to UMENOHANA Service West Japan Co., Ltd. |

| Turned Maruhira Shoten Co., Ltd. into a wholly-owned subsidiary through share acquisition. |

November 2016 | Concluded a memorandum on a capital and business alliance with Fujio Food System Co., Ltd. (the present name: FUJIO FOOD GROUP INC.). |

April 2017 | Turned Sushihan Co., Ltd. into a wholly-owned subsidiary through share acquisition. |

August 2018 | Newly established Kyoto Central Kitchen in Ide, Tsuzuki-gun, Kyoto Prefecture. |

December 2018 | Started closing accounts in April instead of September from the fiscal year ending April 2019. |

February 2019 | Established Sankyo UMENOHANA Co., Ltd. (which turned into a subsidiary) through a merger with the Agricultural Cooperative Association Kosei Farm (headquartered in Aso City, Kumamoto Prefecture). |

May 2019 | Turned TERAKEN Co., Ltd. into a subsidiary through share acquisition. |

January 2021 | Founded Plum Cooperative Union. |

May 2021 | Founded UMENOHANA Service Kyushu Co., Ltd. through an incorporation-type demerger, in which UMENOHANA Service West Japan Co., Ltd. was the splitting company. |

April 2022 | Got listed on the Standard Market of TSE in step with revisions to the TSE market classification. |

May 2022 | Performed an absorption-type merger in which Koichian Co., Ltd. was the surviving company and UMENOHANA plus Co., Ltd. was the absorbed company, and changed the company name to Koichian Plus Co., Ltd. |

March 2023 | Terminated the capital and business alliance agreement with H2O Retailing Corp. |

April 2023 | Terminated the joint venture with S&P Syndicate Public CO., LTD. by selling the shares of UMENOHANA S&P CO., LTD. |

【1-2 Business structure】

≪Central kitchens≫

Central kitchens are the origin of Umenohana’s delicious taste. Delivering “safe, secure and delicious taste” throughout Japan. Producing core ingredients for “Umenohana” and “Koichian” at central kitchens to achieve an unchanging delicious taste and stable supply

| Delivering “safe, secure and delicious taste” throughout Japan

|

(Taken from the reference material of the company)

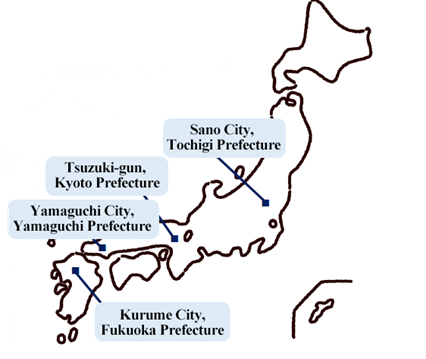

A central kitchen was newly established in Kurume City, Fukuoka Prefecture in 1992, and it has been the origin of Umenohana’s delicious taste ever since. In addition to Kurume City, central kitchens are currently located in Tsuzuki-gun, Kyoto Prefecture, Sano City, Tochigi Prefecture and Yamaguchi City, Yamaguchi Prefecture. Ingredients produced at central kitchens are shipped out or frozen for storage on the day of production and delivered to respective restaurants and stores preserving the freshness and flavor. As the shipped ingredients are made into final dishes at a restaurant or store, an ever-unchanging delicious cuisine is served to the customers of all restaurants and to-go meal stores.

(Taken from the reference material of the company)

【1-3 Business description】

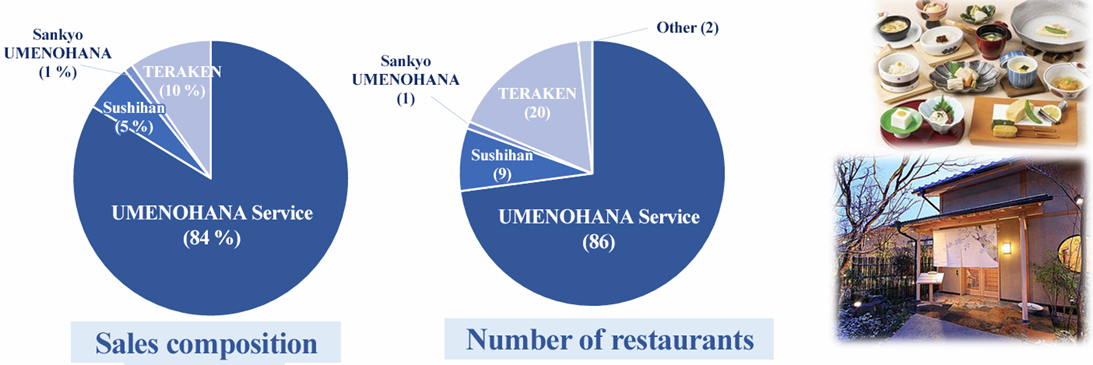

≪Restaurant Business≫

UMENOHANA Service Co., Ltd. (a consolidated subsidiary) operates dining facilities, mainly “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” Sushihan Co., Ltd. (a consolidated subsidiary) manages “Sushihan, a Japanese-cuisine restaurant,” TERAKEN Co., Ltd. (a consolidated subsidiary) runs dining facilities, mainly “Sakura Suisan, a Japanese-style pub serving seafood dishes,” and Sankyo UMENOHANA Co., Ltd. (a consolidated subsidiary) is responsible for the operation of “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto.” The company supplies ingredients, equipment, etc. and provides guidance concerning management, services for undertaking accounting paperwork, etc. to these subsidiaries.

The major product line-up for each dining style offered by the corporate group in the Restaurant Business is as follows.

Dining style | Major product line-up |

Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu | Traditional Japanese dishes including yuba (soy milk skin) and tofu, Japanese à la carte dishes, beverages, and boxed meals for takeout |

Sushihan, a Japanese-cuisine restaurant | Hot pot dishes, sushi, rice bowl dishes, Japanese dishes served on a tray, beverages, and boxed meals for takeout |

Sakura Suisan, a Japanese-style pub serving seafood dishes | Fish dishes, grilled chicken on skewers, à la carte dishes, and beverages |

Other | Other dining services |

“Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” – Kurume Restaurant | ||

|

|

|

(Taken from the company website)

The group’s mainstay “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” is operated under the theme of bringing a “time of relaxation, nourishing the spirit with delicious cuisine” to customers. It is differentiated by offering a sophisticated way of serving at elegantly decorated dining facilities reminiscent of high-class traditional Japanese restaurants, all at a reasonable price. Furthermore, the company has opened “Creative Chinese Cuisine Restaurant – CHINA Umenohana” and “Seasonal kamameshi - Hanakoume,” aiming for expanding the business. Moreover, they acquired Sushihan, which operates “Sushihan, a Japanese-cuisine restaurant,” and TERAKEN, which runs “Sakura Suisan, a Japanese-style pub serving seafood dishes,” as subsidiaries through M&A. In March 2020, they opened a new type of a high-end restaurant, “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto,” at “GINZA SIX.”

(Taken from the reference material of the company)

With regard to “Sakura Suisan, a Japanese-style pub serving seafood dishes,” they are forging ahead with renovations, changing the dining style from a general Japanese-style pub to “Sakana ga Ichiban” (Fish is the best option), an eatery specializing in fresh seafood.

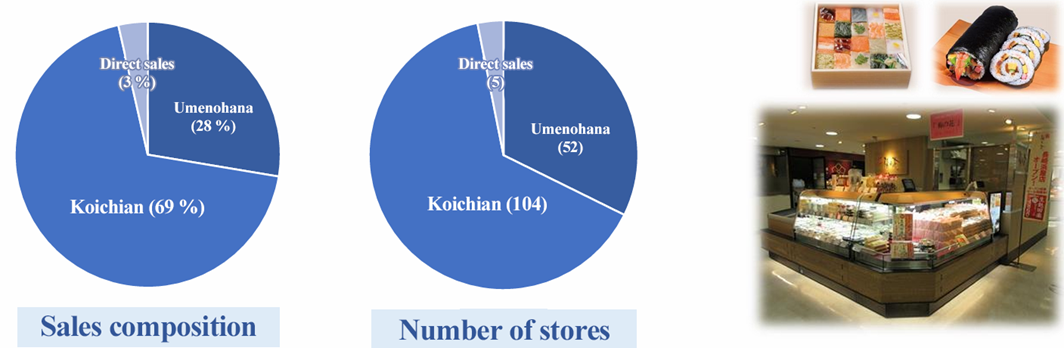

≪To-go Meal Business≫

Koichian Plus Co., Ltd. (a consolidated subsidiary) operates stores of mainly the “Koichian” and “Umenohana” brands. The company supplies ingredients, equipment, etc. and provides guidance concerning management, services for undertaking accounting paperwork, etc. to this subsidiary.

The major product line-up for each brand offered by the corporate group in the To-go Meal Business is as follows.

Brand | Major product line-up |

Koichian | Rolled sushi, inari sushi, pressed sushi, sushi assortment boxes, rice balls, okowa (steamed rice with vegetables or meat), etc. |

Umenohana | Boxed meals for takeout, small Japanese cuisine dishes, osechi (traditional food eaten during New Year holidays), soy products such as tofu, small frozen dishes |

Other | Boxed meals for takeout, small Japanese cuisine dishes, osechi (traditional food eaten during New Year holidays), soy products such as tofu, small frozen dishes, fresh products, etc. |

To-go meal stores of “Umenohana” sell products that allow everyone to enjoy the taste of “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” at home. “Koichian” is well known for its beautifully colorful sushi, rice balls, etc. Both are brands of to-go meals available at renowned department stores throughout Japan.

(Taken from the reference material of the company)

≪External Sales Business≫

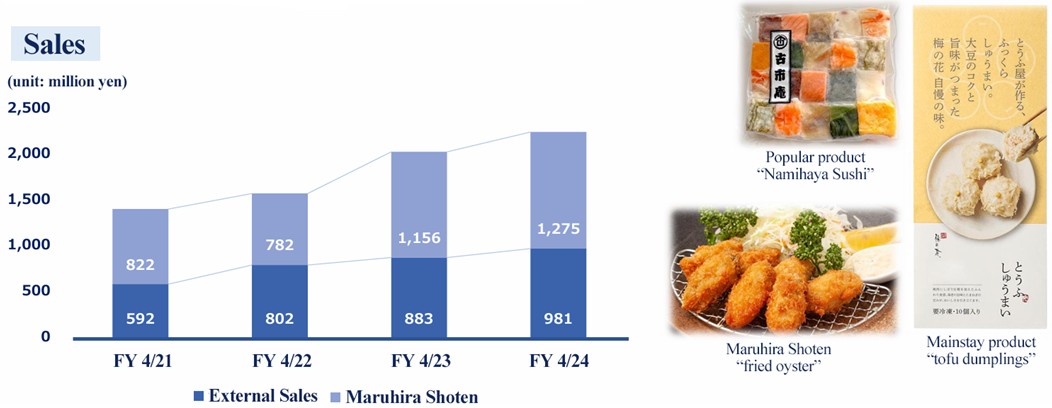

The company sells original products produced at central kitchens to approximately 270 companies, such as supermarkets and other companies that operate dining services. Furthermore, they engage in the production and sale of processed marine products, mainly oyster products, at former Maruhira Shoten Co., Ltd. (integrated into UMENOHANA in August 2023).

(Taken from the reference material of the company)

≪Other≫

UMENOHANA (THAILAND) CO., LTD. (a non-consolidated subsidiary accounted for by the equity method) engages in the production and sale of food products such as soy milk, tofu and yuba, as well as the operation of dining facilities in Bangkok, Thailand.

Plum Cooperative Union (a non-consolidated subsidiary accounted for by the equity method) engages in the businesses of joint acceptance of foreign technical interns, support of specified skilled workers and employment placement for such human resources.

Furthermore, the company leases real estate.

【1-4 Sustainability】

―Together with producers ― Delivering a safe and secure delicious taste together with producers

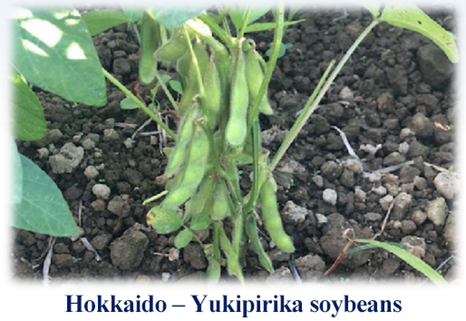

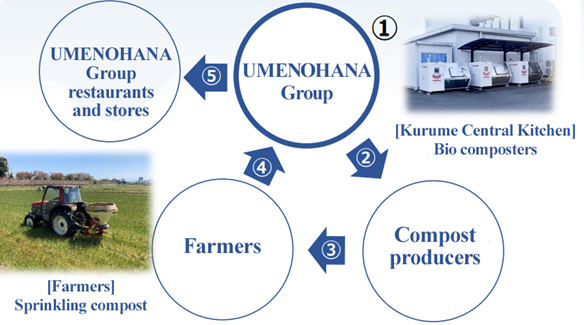

Reducing the annual waste from food residues at central kitchens by 100 % As an initiative for enhancing the prosperous coexistence with producers and addressing environmental issues, the company will reduce annual food residues, which amount to 273 tons at central kitchens, by 100 %. They have already launched the initiative at some restaurants and stores. ① Decomposition of food residues through fermentation, turning them into a product ② Collection and composting by partner companies ③ Provision of the compost to farmers ④ Direct purchase of all produce grown using the produced compost by the company ⑤ Used at UMENOHANA Group restaurants and stores | Contract farming of “Yumepirika soybeans” Contract farming of “Yumepirika soybeans,” which are indispensable for making tofu, the Umenohana specialty, in Hokkaido for prosperous coexistence with producers. Based on contracts with seven farms in the Sorachi and Tokachi Districts in Hokkaido, the company has been purchasing all produce since 2010, also striving for stable procurement of ingredients.

(Taken from the reference material of the company)

“Yukipirika soybeans” are characteristic in having a higher isoflavone content in comparison with other soybeans. Rare soybean variety grown in small amounts as it is difficult to cultivate. |

(Taken from the reference material of the company) |

―Consideration of the environment― Initiatives for reducing GHG emissions

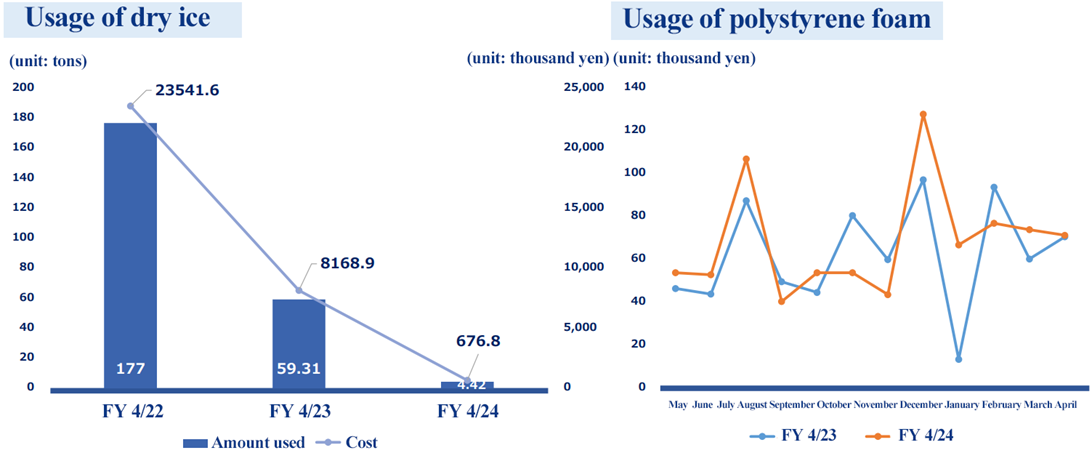

The company has replaced dry ice and polystyrene foam used for shipping from logistics centers to restaurants and stores to recyclable containers and reusable high-performance refrigerants, reducing the annual amount of dry ice used.

(Taken from the reference material of the company)

―Contribution to society―

Provision of food to volunteer-run children’s cafeterias

The company has provided boxed meals, etc. worth 930 thousand yen from Umenohana Group stores and 2.3 tons of food products from central kitchens to the NPO Children’s Cafeterias.

Support for areas affected by natural disasters

The company provided food to evacuation shelters during torrential rains in Kurume City, Fukuoka Prefecture for 11 days in July 2023.

Support for schools in Thailand

The company founded a specified nonprofit organization “The Flower of a Dream Association” in 2014.

The staff and the company contribute to the sound development of the global society by engaging in activities to support schools in Thailand as a way to support the operation of schools for children in Myanmar.

FY 4/2024

Total donated amount: 6,444 thousand yen

➤Staff: 3,222 thousand yen

➤The company donated the same amount as the staff

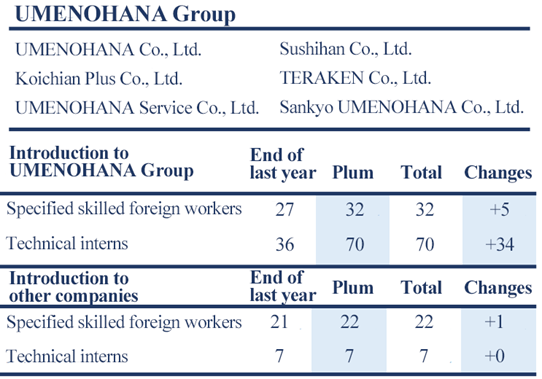

Plum Cooperative Union

The company founded “Plum Cooperative Union (a non-consolidated subsidiary)” with the objective of launching the business of “Joint Acceptance of Foreign Technical Interns” and engaging in the businesses of “Support for Specified Skilled Foreign Worker” and “Employment Placement.”

Plum Cooperative Union members – 22 companies (6 companies from UMENOHANA Group and 16 other companies)

|

The company employs 32 specified skilled workers (increasing by 5 from the previous fiscal year) and 70 technical interns (increasing by 34 from the previous fiscal year)

As of April 2024 |

(Taken from the reference material of the company)

2. Fiscal Year ended April 2024 Earnings Results

【2-1 Consolidated Earnings Results】

| FY 4/23 | Ratio to sales | FY 4/24 | Ratio to sales | YoY | The company’s forecast | Compared to forecast |

Sales | 27,456 | 100.0% | 29,816 | 100.0% | +8.6% | 29,690 | +0.4% |

Gross profit | 17,652 | 64.3% | 19,521 | 65.5% | +10.6% | 19,350 | +0.9% |

SG&A expenses | 17,563 | 64.0% | 18,701 | 62.7% | +6.5% | 18,626 | +0.4% |

Operating income | 89 | 0.3% | 819 | 2.7% | +812.5% | 723 | +13.3% |

Ordinary income | 14 | 0.1% | 739 | 2.5% | - | 639 | +15.6% |

Net income | -440 | - | 1,020 | 3.4% | - | 764 | +33.5% |

*Unit: million yen. The company’s forecast means the forecast revised in March 2024.

Sales grew and profit rose considerably, exceeding the revised forecasts.

Sales grew 8.6% year on year to 29,816 million yen. With the aim of recovering their performance, which declined in the coronavirus pandemic, they made continuous efforts to improve productivity by brushing up the organizational operation capability in each business section and rationalizing the management operations through DX. In addition, they strove to improve their earning capacity by upgrading and installing manufacturing equipment at the central kitchen and improving the precision of production control. Regarding the opening and closing of restaurants/stores, they opened 3 restaurants/stores and closed 7 restaurants/stores, so the number of restaurants/stores in the fiscal year ended April 2024 was 279.

Operating income rose 812.5% to 819 million yen. Gross profit margin increased from 64.3% in the previous fiscal year to 65.5%. Considering the impact of the rise in commodity prices, the company raised wages, but the increase in SGA was only 6.5%, so operating income margin rose significantly from 0.3% in the previous fiscal year to 2.7%. Sales and all kinds of profits exceeded the company’s forecasts that were revised upwardly in March.

The company paid a year-end dividend of 5.00 yen/share, as forecast by the company. The annual dividend amount was 10.00 yen/share, up 5.00 yen/share from the previous fiscal year.

【2-2 Sales and operating income in each segment】

| FY 4/23 | Composition Ratio | FY 4/24 | Composition Ratio | YoY |

Sales |

|

|

|

|

|

Restaurant Business | 15,233 | 55.5% | 16,999 | 57.0% | +11.6% |

To-go Meal Business | 10,439 | 38.0% | 10,541 | 35.4% | +1.0% |

External Sales Business | 1,768 | 6.4% | 2,254 | 7.6% | +27.5% |

Other | 15 | 0.1% | 21 | 0.1% | +37.9% |

Total | 27,456 | 100.0% | 29,816 | 100.0% | +8.6% |

Profit in each segment |

|

|

|

|

|

Restaurant Business | 219 | 1.4% | 931 | 5.5% | +324.3% |

To-go Meal Business | 683 | 6.5% | 761 | 7.2% | +11.5% |

External Sales Business | -77 | - | -84 | - | - |

Other/adjustment | -735 | - | -788 | - | - |

Total | 89 | 0.3% | 819 | 2.7% | +812.5% |

*Unit: million yen. The composition ratio of profit in each segment means profit margin.

* Restaurant Business

Sales rose 11.6% year on year to 16,999 million yen, and operating income grew 324.3% year on year to 931 million yen.

Sales remain on a recovery track, as the season of welcome and farewell parties with no restrictions on activities for coping with COVID-19 came for the first time in 4 years and the demand from foreign visitors to Japan remained strong. The sales at existing restaurants increased 1% year on year, and dropped 11% from the pre-pandemic level, but the average spending per customer rose about 10% although the number of customers declined about 20%.

Regarding “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” they promoted the menus including traditional Japanese dishes cooked with seasonal ingredients and to-go dishes for each season, and make continuous efforts to improve the customer satisfaction level and secure sales. Some restaurants were renovated to make them more comfortable for customers and employees. In addition, they made efforts to increase the points of contact with customers by continuously holding tasting sessions inviting the users of “Umeno App,” conducting a questionnaire survey regarding dishes targeting customers who have had a meal at a restaurant of Umenohana, reflecting the voices of customers, and so on. They also revised prices of dishes to improve cost of sales and secure operating income.

Regarding “Sushihan, a Japanese-cuisine restaurant,” they revised the menu to serve dishes that go well with alcoholic beverages and satisfy a broad range of generations. They also issued coupons while utilizing LINE and send direct mails to nearby enterprises to reel in customers, and revised the prices of dishes. As a result, the number of customers and the average spending per customer increased from the previous fiscal year.

Regarding “Sakura Suisan, a Japanese-style pub serving seafood dishes,” Yokohama-Nihon-ohdori Restaurant was renovated and opened as the Japanese-style pub “Sakanaga-ichiban Yokohama-Nihon-ohdori Restaurant,” which serves fresh seafood shipped from Toyosu at affordable prices, in October 2023, and is performing well. Furthermore, they held “a tuna cutting show” at Sakura Suisan Aeon Shinurayasu Restaurant and Kaisendokoro Uosama Hikarigaoka Restaurant, following Sakura Suisan Asakadai Kitaguchi Restaurant, to reel in customers and popularize the restaurants.

Regarding “Shabushabu Koubai, a restaurant serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto,” sales grew considerably from the previous fiscal year, as the demand from foreign visitors remained healthy.

Operating income improved significantly, as the menu was revised, the points of contact with customers were increased to popularize their restaurants and raise the number of customers visiting restaurants, the restaurant management system was fortified, and costs were reduced in each type of restaurant.

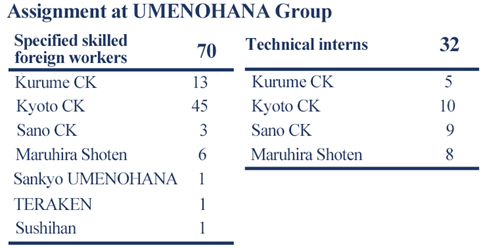

Variation in sales at existing restaurants in the Restaurant Business [unit: million yen, %]

“Compared to 2019” means comparison with May 2019 to January 2020 and February to April 2019

(Taken from the reference material of the company)

*To-go Meal Business

Sales grew 1.0% year on year to 10,541 million yen, and operating income rose 11.5% year on year to 761 million yen.

Since COVID-19 was reclassified into Class-5 infectious diseases, people started going out more frequently, so the business performance is recovering. The sales of the Umenohana and Koichian brands were healthy, as products for events, such as Setsubun (the day before the beginning of spring) and Hinamatsuri (Girls’ Day), sold well. The sales at existing stores increased 3% year on year, but dropped 8% from the pre-pandemic level. In terms of profit, they revised the prices of products for the Umenohana and Koichian brands like in the previous fiscal year, to cope with the skyrocketing of raw material prices. In addition, they improved cost of sales by producing products efficiently at stores, giving guidance about staffing, and curtailing losses due to disposal, discounting, etc., so profit margin improved.

Regarding the number of stores, they opened two to-go meal stores of Koichian and closed 4 stores, so the total number of to-go meal stores of Koichian became 104. They opened 1 to-go meal store of Umenohana, so the total number of to-go meal stores of Umenohana became 52. The number of other stores was 5. Accordingly, the total number of to-go meal stores became 161.

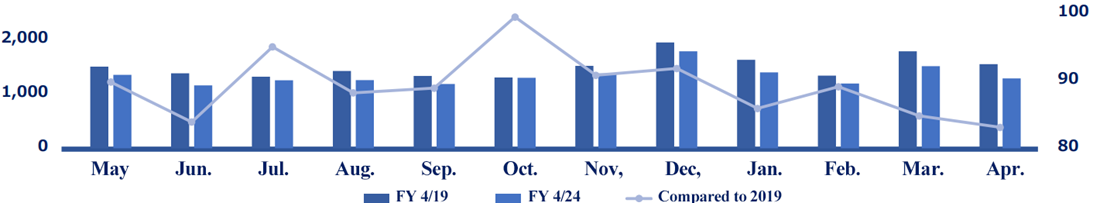

Variation in sales at existing restaurants in the To-go Meal Business [unit: million yen, %]

“Compared to 2019” means comparison with May 2019 to January 2020 and February to April 2019

(Taken from the reference material of the company)

*External Sales Business

Sales grew 27.5% year on year to 2,254 million yen, and an operating loss of 84 million was posted (a loss of 77 million yen in the previous fiscal year).

They are making efforts to expand sales channels by taking advantage of the reputation and uniqueness of tastes of frozen Namihaya sushi of “Koichian,” popular products of “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu,” frozen deep-fried oyster, etc. Regarding “Tsuuhan-honpo Ume Asobi,” they are striving to approach customers by continuing online advertisement while posting more products in other companies’ online shopping sites, such as Rakuten-ichiba. The subsidiary Maruhira Shoten Co., Ltd. was absorbed by Umenohana Co., Ltd. on August 1, 2023.

As part of efforts to tackle environmental issues and contribute to society, they adopted bio composters in two central kitchens in Kyoto and Kurume, to reduce waste food discharged from the central kitchens. They continue the operation of a recycling system in which the compost produced through the fermentation and decomposition of waste food is supplied to farmers and all of their agricultural products, including those out of specs, are directly purchased by the company. In the fiscal year ended April 2024, rice, Chinese cabbage, and daikon radish were supplied to stores as ingredients. They are preparing for expanding the amount and variety of agricultural products and the regions for farming.

In Hokkaido, they approached the producers of “Yukipirika,” the soybean for tofu, to entrust them with soybean production under the premise that the company will purchase all crops and stabilize the supply of ingredients.

As an initiative for realizing a decarbonized society, they changed the materials used for transporting refrigerated and frozen ingredients from distribution centers to restaurants/stores to recyclable containers that are excellent in cold storage and reusable refrigerants, to reduce CO2 emissions and costs.

As a measure for redeveloping brands, they launched a project for redeveloping brands, involving middle-level employees selected from various posts and sections, including marketing, production, and planning sections, worked on the improvement of their corporate image and value, and continue the project. As part of this measure, they started a service of producing an original photo frame, which was designed by the picture book artist Kimika Warabe, and presenting it to customers with children who have visited their restaurant on a special day as a memento together with a commemorative photo at some restaurants.

The original photo frame is produced from the paper made from “emergency rice stocks to be discarded” and “inedible rice,” to support the activities for reducing waste food.

In addition, they concentrate on increasing the points of contact with customers by distributing information on each brand in the Restaurant Business and the To-go Meal Business via “Umeno App” and enriching the content of the app so that customers will visit various restaurants and stores of the company.

【2-3 Financial Condition and Cash Flow】

◎Balance Sheet Summary

| April 2023 | April 2024 | Increase/ Decrease |

| April 2023 | April 2024 | Increase/ Decrease |

Current assets | 7,223 | 7,580 | +357 | Current liabilities | 15,674 | 9,411 | -6,262 |

Cash and deposits | 3,659 | 2,761 | -898 | Trade payables | 700 | 756 | +55 |

Trade receivable | 1,720 | 1,609 | -110 | Short-term debt | 12,299 | 6,049 | -6,249 |

Inventories | 1,287 | 2,121 | +833 | Noncurrent liabilities | 7,089 | 12,319 | +5,230 |

Noncurrent assets | 18,081 | 17,530 | -551 | Long-term debt | 5,268 | 10,806 | +5,537 |

Property, plant and equipment | 13,779 | 13,673 | -105 | Total liabilities | 22,763 | 21,730 | -1,032 |

Intangible assets | 114 | 137 | +23 | Net assets | 2,541 | 3,379 | +838 |

Investments and other assets | 4,187 | 3,718 | -469 | Total retained earnings | -1,201 | -180 | +1,020 |

Total assets | 25,304 | 25,110 | -194 | Total liabilities and net assets | 25,304 | 25,110 | -194 |

*Unit: million yen. Short-term debts include current portion of long-term debts.

The total assets as of the end of the fiscal year ended April 2024 stood at 25,110 million yen, down 194 million yen from the end of the previous fiscal year. This is mainly because inventory assets increased 833 million yen and current assets, etc. rose 532 million yen, while cash and deposits decreased 898 million yen and investment securities dropped 638 million yen.

Total liabilities decreased 1,032 million yen from the end of the previous fiscal year to 21,730 million yen. This is mainly because total debt dropped 711 million yen. Net assets grew 838 million yen from the end of the previous fiscal year to 3,379 million yen. This is mainly because a net income of 1,020 million yen was posted and capital surplus decreased 162 million yen through the payment of dividends for common shares and class-A preferred shares.

Capital-to-asset ratio improved from 9.9% at the end of the previous fiscal year to 13.4%.

◎Cash Flow

| FY 4/23 | FY 4/24 | Increase/Decrease |

Operating CF | 956 | 690 | -265 |

Investing CF | -844 | -132 | +711 |

Free CF | 111 | 557 | +445 |

Financing CF | -2,949 | -934 | +2,014 |

Balance of cash equivalents | 3,316 | 2,939 | -377 |

*Unit: million yen.

The cash and cash equivalents as of the end of the fiscal year ended April 2024 stood at 2,939 million yen, down 377 million yen from the end of the previous fiscal year.

The cash inflow from operating activities was 690 million yen (956 million yen in the previous fiscal year). The cash inflow declined from the previous fiscal year mainly because net income before taxes and other adjustments increased 1,499 million yen, inventory assets changed by 523 million yen, and the amount of subsidies received decreased 585 million yen. The cash outflow from investing activities was 132 million yen (844 million yen in the previous fiscal year). The cash outflow shrank from the previous fiscal year mainly because the revenue from sale of investment securities increased 711 million yen. The cash outflow from financing activities was 934 million yen (2,949 million yen in the previous fiscal year). The cash outflow decreased from the previous fiscal year mainly because the net change in short-term debt was 2,020 million yen, the revenue from long-term borrowing increased 229 million yen, and the expenditure for repaying long-term debt decreased 126 million yen.

3. Fiscal Year ending April 2025 Earnings Forecasts

【3-1 Earnings Forecasts】

| FY 4/24 | Ratio to sales | FY 4/25 (Est.) | Ratio to sales | YoY |

Sales | 29,816 | 100.0% | 30,250 | 100.0% | +1.5% |

Operating income | 819 | 2.7% | 906 | 3.0% | +10.6% |

Ordinary income | 739 | 2.5% | 727 | 2.4% | -1.6% |

Net income | 1,020 | 3.4% | 420 | 1.4% | -58.8% |

*Unit: million yen.

Projecting sales to increase 1.5% year on year and profit to grow 10.6% year on year for the fiscal year ending April 2025

For the fiscal year ending April 2025, the company is projecting sales to increase 1.5% year on year to 30,250 million yen and operating income to grow 10.6% year on year to 906 million yen.

Although the COVID-19 pandemic has subsided, the prices of raw materials and utility costs remain high due to the lasting conflict on Ukraine and the situation in the Middle East in addition to the persistent trend of the weak yen. Moreover, it is expected that the future outlook will remain uncertain due to labor shortage, etc. Amid such situation, the company raised wages with consideration toward the impact of rising prices of commodities and will work on the revision of selling prices and elevation of productivity to keep up with the virtuous cycle of rising wages. Furthermore, they will enhance the sale of the company products outside the corporate group and focus on improving the productivity and profitability of central kitchens. The company intends to keep engaging in social activities and addressing environmental issues while working toward prosperous coexistence with producers.

They plan to pay a dividend of 10.00 yen/share, like in the previous year (with the interim dividend being 5.00 yen/share).

The forecast for the first half of the year is as follows.

| FY 4/24 1H | Ratio to sales | FY 4/25 1H (Est.) | Ratio to sales | YoY |

Sales | 14,071 | 100.0% | 14,328 | 100.0% | +1.8% |

Operating income | 43 | 0.3% | 14 | 0.1% | -67.3% |

Ordinary income | -1 | - | -83 | - | - |

Net income | 287 | 2.0% | -78 | - | - |

*Unit: million yen.

Both sales and profit of the company tend to be larger in the second half of the year in step with seasonal events, such as year-end parties and New Year parties, osechi (traditional food eaten during New Year holidays), parties to welcome new employees and Setsubun (day of the bean scattering ceremony, usually February 3).

【3-2 Forecast and strategy for each segment】

Restaurant Business

The company projects sales of 17,468 million yen and an operating income of 883 million yen.

They plan to open one UMENOHANA Service restaurant and one Sankyo UMENOHANA restaurant. Furthermore, they will make plans to change the dining style at two Sakura Suisan restaurants.

■ Operation of restaurants with high added value

・Develop a high-end dining style, fusing “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” and “Kanishige, a restaurant specializing in crab dishes”

・Increase the number of restaurants of “Shabushabu Koubai, serving mainly lightly boiled beef from Japanese brown cattle grown in Kumamoto”

■ Recovery and added value of existing restaurants

・Change and update “Sakura Suisan, a Japanese-style pub serving seafood dishes” from a general Japanese-style pub into an eatery focused on fresh seafood

・Develop a menu with high added value

To-go Business

The company projects sales of 10,604 million yen and an operating income of 390 million yen.

They plan to open one Koichian brand store. Furthermore, they will make plans to renovate one Umenohana brand store and four Koichian brand stores.

・Achieve synergy by offering both Koichian and Umenohana brands at major department stores

・Operate stores in train station buildings, shopping areas within train stations and commercial facilities

・Enhance the sale of dishes with high added value

・Develop and promote planned products matching seasonal events, etc.

External Sales Business

The company projects sales of 2,278 million yen and an operating income of 16 million yen.

■ External Sales

・Reach out to new business partners

・Enhance the sale of existing products and elevate the productivity of central kitchens

・Propose products matching the needs of customers to expand sales channels

■ Maruhira Shoten

・Expand sales channels to retail stores and companies that operate dining facilities, mainly for deep-fried oysters made with oysters produced in Hiroshima Prefecture

・Sell steamed oysters as new products

・Stably secure oyster as an ingredient

■ Online Sales

・Update the online shop to make it more convenient for customers

・Develop products and enrich the lineup matching the needs of customers

Initiatives in other businesses

Recurring-Revenue Business

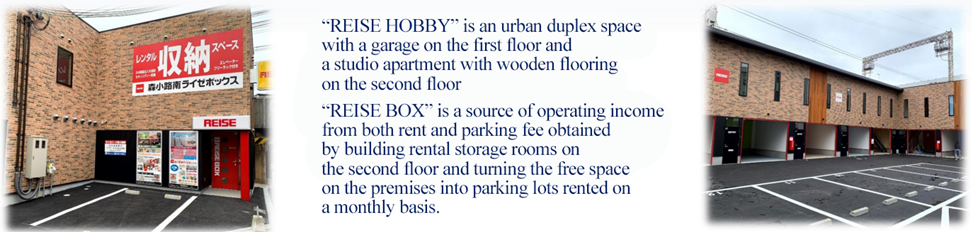

~REISE~ “REISE BOX,” “REISE HOBBY” and “REISE PARK” are services offered by REISE Co., Ltd.

It is a Recurring-Revenue Business where the corporate group leases its land and buildings to other companies, etc. to effectively utilize their assets and secure revenues. The company constructed properties for rental on the former site of Osaka Central Kitchen after the demolition, launching the leasing business.

Former site of Osaka Central Kitchen – Morishoji-Minami REISE BOX

(Taken from the reference material of the company)

Future initiatives

Overseas expansion | Foray into Asian countries other than the Kingdom of Thailand Operate brands other than “Umenohana, a restaurant specializing in yuba (soy milk skin) and tofu” overseas |

Brand development | Redevelopment of brands to improve the corporate image and corporate value The first stage consists of changing the company logo and creating a portal site by updating the company’s website |

DX | Promote DX including the reconstruction of information systems, reduce costs and elevate productivity to improve revenues Integrate the customer information from all brands as overall customer information of the group, leading to mutual customer introduction between different brands |

Umeno App | Post information on the Restaurant Business and the To-go Meal Business, forge ahead with enriching the app content to allow customers to navigate the app more easily, overcoming the boundaries between the group brands, and focus on enhancing interaction with customers |

Moreover, the company is working on strengthening interaction with their shareholders and business partners. Regarding interaction with shareholders, they will continue with food sampling events in the Restaurant Business and To-go Meal Business and tours at Kyoto Central Kitchen as an opportunity to hear opinions concerning the products, services, management, etc. With regard to interaction with business partners, they are making preparations to launch the “UMENOHANA Group Association of Mutual Prosperity” to engage in cooperation aiming for mutual development and make opportunities for building friendly relationships and interaction.

4. Interview with President Honda

We interviewed President Yuji Honda about the company's management policies, competitive advantages, future growth strategies and business developments, as well as his message to shareholders and investors.

President Honda was born in August 1952. He joined Sankaku Oil Gas (present name: Misumi) in 1981 and became a director in 1995. In 2001, he joined the current company and was appointed as senior managing director in the same year. After serving as representative director of a subsidiary, he assumed the position of representative director, president and COO of the company in 2018. The company's founder Shigetoshi Umeno passed away in January 2022 at the age of 71, concluding his 71-year life journey.

Q: Could you tell us about the management policies and philosophy of the founder Shigetoshi Umeno?

Basically, our management policy is our management philosophy, which is based on Mr. Umeno's mott "Be grateful to people and things." Additionally, we have several company mottos such as kindness, responsibility, and cooperation. Since I became senior managing director in 2001, I have worked together with Mr. Umeno to run the company. Mr. Umeno was in charge of store expansion and other such matters, while I was responsible for financial strategy and related areas.

Q: Please tell us what you want to inherit from Mr. Umeno, and what you want to transform and develop as President Honda.

Certainly, it's delicious food and healthy food. This is something that will never change and we will continue this focus indefinitely. Regarding transformation and development, I want to expand our scale through M&A. I strongly felt that relying solely on Umenohana wouldn't be sustainable without changing our revenue structure through M&A. Even in the restaurant industry, an average customer spend of 4,000 yen might be challenging. First, we want to expand into takeout options, and then we're looking to target businesses with lower average customer spending for M&A.

Q: After going through the COVID-19 pandemic, could you tell us what has changed compared to the pre-pandemic period?

I became president in 2018, partly due to Mr. Umeno's deteriorating health condition. After experiencing the COVID-19 pandemic, we've become more aware that a company shouldn't just focus on making profits, but should also be beneficial to society. While our intention to diversify our revenue structure hasn't changed, we now want to make environment-friendly agriculture producers and our employees happy within this context.

Furthermore, during the pandemic, we implemented cost reduction measures and logistics reforms. As a result, we can say that we've transformed into a more profitable entity. This is why we were able to show results exceeding the forecasts in FY 4/2024.

Q: Please tell us about your competitive advantages, distinctive features, strengths, and how you differentiate yourselves in the market.

Regarding differentiation from other companies, I believe our strength lies in our product development capabilities. Also, I think our commitment to health and taste is quite strong compared to others. However, what can be seen as an advantage from one perspective can also be a weakness from another. In this context, one important thing we're currently focusing on is improving the production efficiency of our factories. We aim to increase production efficiency not only through takeout options but also by steadily growing our external sales. We hope to turn this into a strength going forward.

Q: Could you share your thoughts on “business administration conscious of capital cost and stock price”?

Before the COVID-19 pandemic, our stock price was around 2,600 yen. Even though our performance has recovered since the pandemic, our stock price hasn't returned to that level. I believe this is partly due to the discontinuation of shareholder benefits announced in March 2020, which coincided with the onset of the pandemic. Additionally, financial institutions sold off a significant amount of our stock.

Moving forward, to ensure our performance is properly reflected in our stock price, we've decided to first focus on strengthening our investor relations (IR) activities. We also plan to formulate and announce a medium-term plan. Furthermore, as we continue to improve our performance, we intend to reflect this in our dividends as well.

Q: Finally, could you please give a message to your shareholders and investors?

While some shareholders are calling for the reinstatement of shareholder benefits, we can't easily commit to that. However, we can provide dividends when we make profits. We aim to improve our return on equity (ROE) and work on building a stronger revenue structure, with our first priority being to improve our financial standing. Our policy is to pay dividends while comprehensively considering dividend payout ratio and the enrichment of retained earnings.

5. Conclusions

The fiscal year ended April 2024 is part of the recovery phase from the coronavirus pandemic, but it is noteworthy that profit margin has improved significantly. Sales grew 8.6% year on year, but operating income grew 812.5% year on year, exceeding the initial forecast (591 million yen) by around 40%. It can be said that the revision of selling prices and various measures implemented amid the coronavirus pandemic were effective, despite the skyrocketing of raw material prices, the raise in wages, etc. Profit margin is expected to improve also in the fiscal year ending April 2025. As President Honda insisted several times at a briefing session, they plan to streamline the operation of the central kitchen by strengthening the External Sales Business.

Net assets decreased from over 8 billion yen to 3.3 billion yen at the end of FY 4/2024 as they kept incurring a loss due to the novel coronavirus. Capital-to-asset ratio improved from 9.9%, but it is still 13.4%. As the revenue structure has been strengthened, further improvement is expected, but they hope to first fortify their financial standing.

In the interview, President Honda said “Actually, I had no intention to become president,” but it seems that he was the right person while the health condition of the founder Umeno worsened. It seems that President Honda is well aware of the current situation of the company and how he should implement strategies from now on. Although the president is not ostentatious, but discreet, he is very passionate about improving the satisfaction levels of employees and customers while contributing to society.

The company has started full-scale IR activities for the first time. It is expected that their business performance will shift from the recovery phase to the growth phase and the company will be known further in the stock market. We would like to pay attention to the releases about “their measures for business administration conscious of capital cost and share price,” “their medium-term plan,” etc. as well as the trend of business performance.

<Reference: Regarding corporate governance>

◎ Organization type, and the composition of directors and audit and supervisory committee

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 4 external ones |

Audit and supervisory committee | 4 members, including 3 external ones |

◎ Corporate Governance Report (Last Update: September 12, 2023)

Basic Views

Based on the following basic policy and our corporate philosophy of “Be grateful to people and things,” we aim to ensure sound and transparent management, respond promptly to changes in the business environment, and realize mutual prosperity with local communities and business partners by improving corporate value through social contributions and sustainable growth, satisfying shareholders, customers, and the employees. We believe that this is the base for corporate governance.

<Basic Policy>

(1) Ensuring shareholders’ rights and equality

(2) Appropriate collaboration with stakeholders other than shareholders

(3) Ensuring transparency through appropriate information disclosure

(4) Ensuring transparency through separation of management and supervision

(5) Active dialogue with shareholders

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)> [Supplementary Principle 4-1 (ii) Making best efforts to achieve the medium-term management plan, taking measures if the plan is not achieved, and reflecting them in the next plan]

Recognizing that management strategies and management plans are a commitment to shareholders, the Board of Directors will do their best to achieve the plan. Should the company fail to deliver on its medium-term management plan, the reasons underlying the failure of achievement as well as the company’s actions will be fully analyzed, and disclosing the results of such analysis to the shareholders will be considered accordingly, while the analytic findings will be reflected in a plan for the ensuing years.

[Supplementary Principle 4-2 (ii) The Board of Directors formulates basic policies regarding the company’s sustainability initiatives and oversees the allocation of management strategies and the implementation of business portfolio strategies]

The Board of Directors does not set a basic policy on sustainability, but rather implements the initiatives described in Supplementary Principle 3-1 (iii), as deemed most appropriate by the divisions under its jurisdiction.

The Board of Directors will effectively oversee sustainability initiatives by approving management strategies and plans and checking their implementation status.

<Disclosure Based on Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4 Strategically Held Shares]

Basic Policy on Strategically Held Shares

We hold shares in companies that we have determined are suitable for investment after taking into consideration the benefits to be derived from the maintenance and development of business relationships.

Basic Policy for Verification

The Board of Directors annually reviews the appropriateness of holding strategically held shares.

Taking into consideration the maintenance of relationships with business partners and business benefits of holding the shares, we determine whether there is any significance to holding the shares and decide whether to continue holding them or dispose of them.

Basic Policy on Exercise of Voting Rights

Regarding the exercise of voting rights for strategically held shares, we will carefully examine the content of each proposal and decide whether to support or oppose it after comprehensively considering factors such as whether it contributes to improving shareholder value and whether it will impede business relations with our company.

[Principle 3-1 Enhancement of information disclosure]

In addition to appropriate disclosure in accordance with laws and regulations, we disseminate information on the following matters from the perspective of ensuring the transparency and fairness of our decision-making and realizing effective corporate governance.

(i) Our corporate philosophy is disclosed on our website as a message from the founder (https://www.umenohana.co.jp/company/message.html).

Management strategies and management plans will be prepared and disclosed in the future.

(ii) Basic Views and Policies Regarding Corporate Governance

Please refer to “1. Basic Views” in this report.

(iii) Policies and Procedures for Determining the Compensation of Directors and Audit & Supervisory Committee MembersThe basic policy for determining the compensation of directors (excluding audit and supervisory committee members) is to aim for the sustainable improvement of corporate value and to set an appropriate level taking into consideration factors such as position, responsibilities and years of service, and to make a comprehensive decision while taking into consideration the standards of other companies and employee salaries. The compensation for directors (excluding audit and supervisory committee members) consists solely of monthly fixed monetary compensation, which accounts for all of their individual compensation. The Representative Director and President is entrusted with the determination of the specific details of individual compensation based on a resolution of the Board of Directors, and as a measure to ensure that the Representative Director and President exercises his/her authority appropriately, the Representative Director and President seeks the opinion of the Audit and Supervisory Committee on a draft that is prepared within the framework of the compensation limit resolved at the general meeting of shareholders, and makes an appropriate decision while taking into consideration the opinion. Going forward, we will consider adopting stock-based compensation linked to business performance.

In addition, compensation for directors (members of the Audit and Supervisory Committee) is determined through discussions by the Audit and Supervisory Committee within the scope of the applicable compensation limits.

(iv) Policies and Procedures for the Board of Director’s Appointment and Dismissal of Senior Management Personnel and Nomination of Candidates for DirectorsIn accordance with the “Director Appointment Policy,” the Board of Directors deliberates on the appointment and dismissal of directors based on the opinions of the Audit and Supervisory Committee after comprehensively reviewing the skills required by the company, such as character, insight, and business and professional experience which are suited for the execution and supervision of management, through an exchange of opinions at Board of Directors meetings, including outside directors, and submits the results to the General Meeting of Shareholders.

In the event that a director candidate does not meet the required qualifications or ability to perform the duties of a director, or in the event that there is a suspicion of wrongful conduct or a material fact in violation of laws, regulations or the Articles of Incorporation, the Board of Directors shall deliberate on the matter.

(v) Explanation of the individual appointment and dismissal of the senior management personnel and the nomination of candidates for Directors by the Board of Directors based on (iv) above

An explanation of the appointment and nomination of individual candidates for Directors appointed by the Board of Directors is included in the reference documents of the Convocation Notice for the General Meeting of Shareholders.

[Supplementary Principle 3-1 (iii) Sustainability]Our company is committed to the following sustainability initiatives.

1. Consideration of global environmental issues・ Reducing energy consumption by joint delivery with other companies

・ Introducing solar power generation, switching to LED lighting, and power control

・ Reducing the number of deliveries and changing delivery materials to recyclable containers and switching from dry ice to high-performance refrigerants

・ Commercializing soy pulp and recycling residues

・ Reducing plastic use (using paper straws and wooden spoons), recycling waste oil, and conserving resources by reducing printed materials2. Respect for human rights・ Eliminating discrimination based on gender and nationality by promoting women to managerial positions and actively hiring foreign workers

3. Fair and appropriate treatment of employees and consideration for their health and working environment・ Improving the working environment by conducting DX and reviewing and improving operations

4. Fair and appropriate transactions with business partners・ Compliance with relevant laws and regulations such as the Subcontract Act and the Unfair Competition Prevention Act5. Crisis management for natural disasters・ Business continuity through decentralization of central kitchens

Regarding investment in human capital, we allocate resources appropriately according to our management strategies and issues and disclose the number of employees in each department and subsidiary in our financial statements. Regarding investment in intellectual property, we are considering revamping our entire business system, including the core business system, in order to improve productivity and increase contact points with customers.

[Principle 5-1 Policy on constructive dialogue with shareholders]

Our IR activities are based on the principle of providing timely, transparent, accurate and consistent information to shareholders, whether positive or negative.

The Corporate Planning Office, centered on the President and Representative Director, is in charge of IR activities based on this basic stance, and collects and compiles information necessary for IR activities from each business and administrative division. In addition, when we receive requests for dialogue (interviews) from shareholders, we will respond with sincerity within reasonable limits and share information such as requests obtained from shareholders through dialogue.

[IR activities]・ Annual general meeting of shareholders: once a year

・ Financial results announcement: twice a year

・ Tasting events and factory tours open only to shareholders: Approximately six times a year (which varies)

・ Dissemination of information via the company’s website: As needed

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |