Bridge Report:(7590)Takasho Fiscal Year January 2024

President Nobuo Takaoka | Takasho Co., Ltd. (7590) |

|

Company Information

Exchange | TSE Standard |

Industry | Retail (Commerce) |

President | Nobuo Takaoka |

HQ Address | Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

Year-end | January 20 |

Homepage |

Stock Information

Share Price | Share Outstanding (exc. Treasury Stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥523 | 16,858,456 shares | ¥8,816 million | - | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥8.00 | 1.5% | ¥19.16 | 27.3 x | ¥734.15 | 0.7 x |

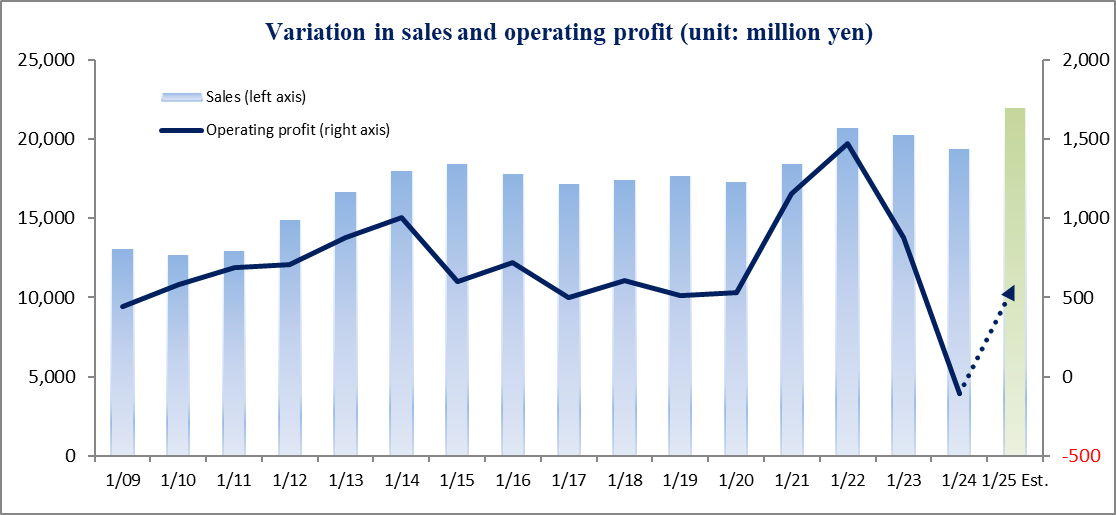

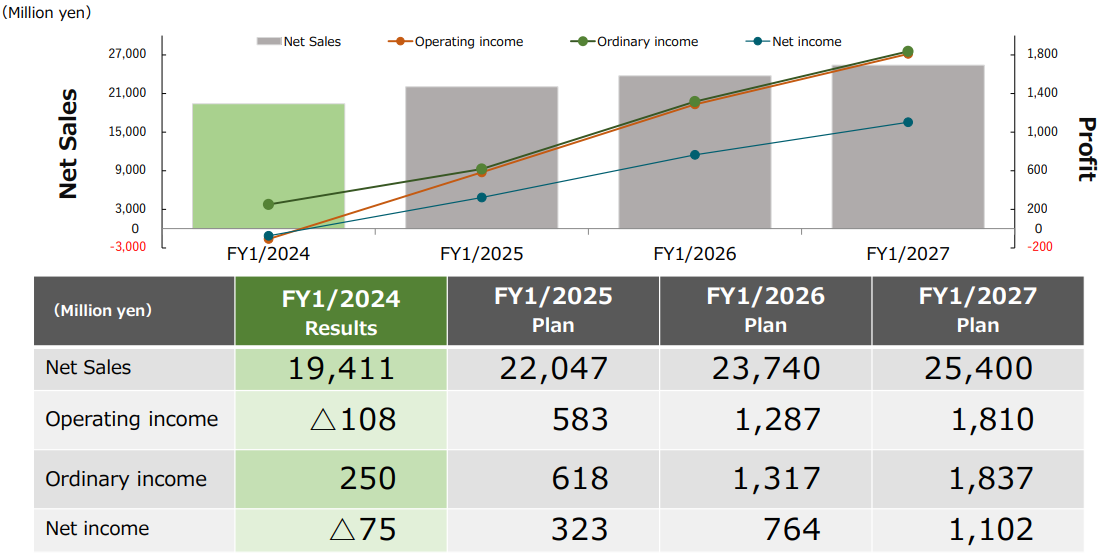

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

January 2021 | 18,486 | 1,156 | 1,152 | 952 | 65.36 | 20.00 |

January 2022 | 20,781 | 1,474 | 1,530 | 1,001 | 65.00 | 23.00 |

January 2023 | 20,351 | 880 | 982 | 518 | 29.60 | 23.00 |

January 2024 | 19,411 | -108 | 250 | -75 | - | 5.00 |

January 2025 Est. | 22,047 | 583 | 618 | 323 | 19.16 | 8.00 |

We present this Bridge Report along with the earnings results of Takasho Co., Ltd. for fiscal year January 2024.

Table of Contents

Key Points

1.Company Overview

2.Buisiness Development

3.Fiscal Year January 2024 Earnings Results

4.Fiscal Year January 2025 Earnings Forecasts

5.Mid/long-term Plan

6.Conclusion

<Reference: Concerning Corporate Governance>

Key Points

- In the fiscal year ended January 2024, sales and ordinary income declined 4.6% and 74.5%, respectively, year on year. In order to improve their brand value and facilitate growth, they took a variety of important measures. In particular, they continued the new strategy of sales promotion based on DX linking TV commercials and the online platform. Regarding the overseas business, the stores of business partners continued inventory adjustment and customers in Europe kept refraining from purchasing products. In terms of profit, procurement costs augmented as the yen weakened more significantly than assumed, while sales dropped. In addition, a temporary inventory write-down was posted in their overseas subsidiaries for selling products. SGA increased, as the company continued measures for expanding sales, including the holding of exhibitions, sales promotion based on DX, investment in equipment, and the securing of personnel, although variable costs decreased. The company paid a year-end dividend of 5.0 yen/share.

- For the fiscal year ending January 2025, sales and ordinary income are expected to grow 13.6% and 146.9%, respectively, year on year. In the professional use business, they will further combine offline and online services. They will strive to improve their brand power and enhance marketing activities through the new strategy of DX-based sales promotion linking TV commercials and the online platform. In addition, they will make efforts to improve the capabilities of marketing and giving proposals in the non-residential field by dealing with special orders and expand sales channels. In the home use business, they will produce products at their own factories for enhancing sales in the e-commerce field and promote the development of new products. In the overseas business, they will continue to make new transactions with leading garden centers and home improvement stores in the U.S. In addition, they will carry out sales activities in new regions where they were not able to conduct marketing activities in Europe. Regarding dividends, they plan to pay a year-end dividend of 8.0 yen/share, up 3.0 yen/share from the previous fiscal year.

- In the fiscal year ended January 2024, sales decreased and profit dropped considerably, mainly because of the prolongation of inventory adjustment outside Japan in addition to the recoil from the special demand caused by the COVID-19. On the other hand, the clearance of inventory at home improvement centers inside and outside Japan is progressing little by little. In the fiscal year ending January 2025, it is desirable that their inventory will become proper by the end of 1Q, which falls on the busy season in the spring. In this situation, Takasho Digitec is growing steadily in Japan. They have started full-scale overseas business operation. If the ratio of overseas sales increases, overseas sales will further contribute to revenues. For the overseas business, they are expanding sales channels, so sales, including online sales, are expected to increase. Recently, the company has been more active in returning profit to shareholders. They acquired treasury shares while raising payout ratio. In the fiscal year ending January 2025, the company plans to pay a dividend of 8.0 yen/share, as it is on a recovery track, but it can be expected that it will increase. Their medium-term plan has been revised, but if the target net income in the fiscal year ending January 2027 is achieved, EPS will be around 65 yen. We consider that there is a possibility that the share price of the company will rise, as PBR is much less than 1.

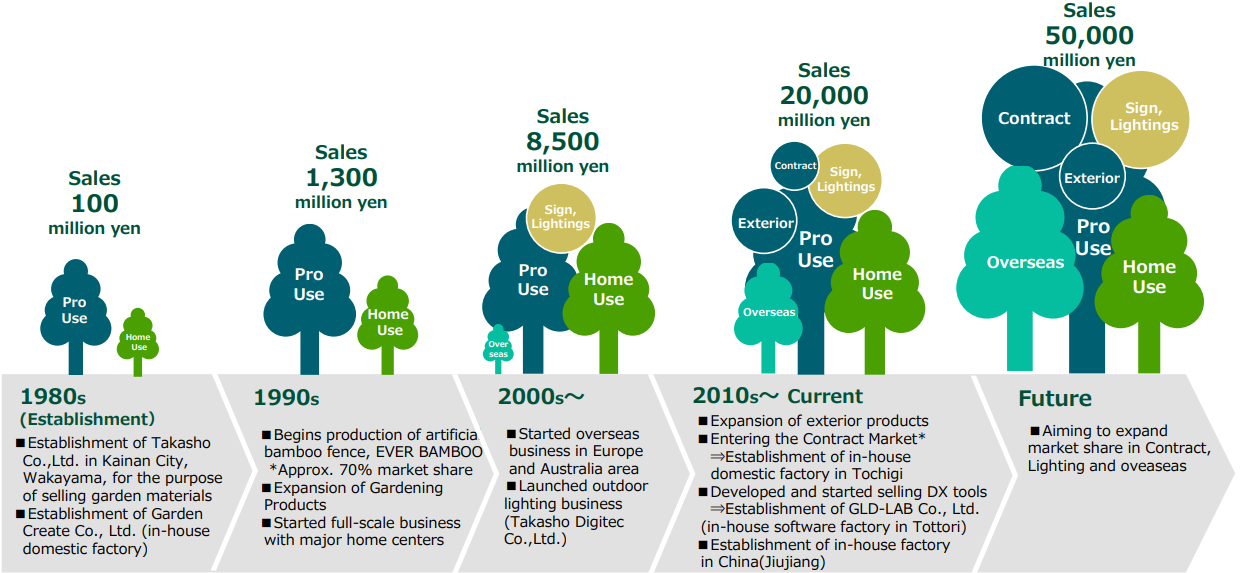

1. Company Overview

Takasho Co., Ltd. maintains a basic business concept of contributing to the “Creation of comfortable spaces” and handles garden exterior products. In the aftermath of the Second World War, Takasho changed its business style from sales of gardening materials to a gardening business, and then to a comprehensive lifestyle business, growing as a lifestyle maker that proposes better lifestyles with gardens. Its vision is to create mental and physical health and happy family lifestyles that bring smiles to the people. Takasho always forecasts future changes to accurately create new value that matches the market’s needs, and pursues its goal of becoming the “only global company” contributing broadly to gardening culture in urban environments.

The Takasho Group manufactures products in Japan and China for sale in Japan, Europe, Asia, Oceania and the United States. The Group’s integrated structure with the ability to plan, manufacture and sell products has allowed it to become the leading company within the “gardening market,” which is growing to become a firmly established market in Japan. The Company listed its shares on the JASDAQ market in September 1998, and after a capital increase in 2012 and 2013, moved its shares to the Second Section of the Tokyo Stock Exchange on October 19, 2017, and to the First Section of the Tokyo Stock Exchange on July 9, 2018. The company chose the Prime Market, in the new market classification of TSE, which became effective on April 4, 2022. On October 20, 2023, the company got listed on the Standard Market.

Company Overview

Date of establishment | August 1980 |

Listing date | September 1998 (JASDAQ) October 2017 Second Section market of the Tokyo Stock Exchange July 2018 First Section market of the Tokyo Stock ExchangeApril 2022 Prime Market of the Tokyo Stock ExchangeOctober 2023 Standard Market of the Tokyo Stock Exchange |

Capital | 3,043 million yen |

Number of employees | 1,173 employees (whole group) |

Group companies | 6 domestics, 13 overseas |

Corporate Mission

We, the Takasho Group, aim to become a one-of-a-kind global group that grasps changes earlier than anyone else, create new value, and contribute to the development and diffusion of an urban garden culture. | |

| 1. To create an affluent, peaceful garden-centric culture |

2. To aim to satisfy customers more profoundly than they expect with various proposals |

|

| 3. To pursue high-quality products and services by continuing R&D |

4. To respect the life of everything, and conserve the earth environment under the theme of coexistence with nature |

|

| 5. To realize a workplace as a personnel-based enterprise where it grows through the growth of personnel |

6. To conduct transparent corporate activities in accordance with laws, regulations, and fair commercial customs, while recognizing corporate social responsibilities |

|

(Taken from the company’s website)

To comprehensively produce the garden space with five mottoes

The wind rustles trees and flowers, brings seasons, and embraces nature and people. | Light colors the world, weaves dreams, and illuminates people and nature. | Water give life, enriches seasons, and moisturizes people and nature. | Greenery takes root in the earth, covers the earth, and heals people and nature. | We develop comforting gardens while keeping these five mottoes in mind. |

(Taken from the company’s website)

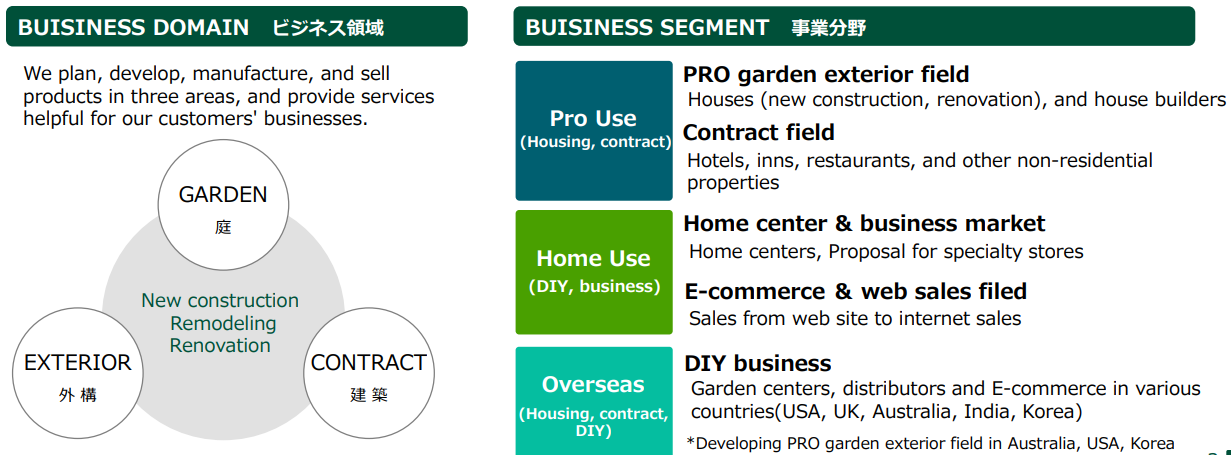

Business

In the fields of gardens, outdoor facilities, and construction, they provide products and services for construction, remodeling, and renovation inside and outside Japan.

|

(Taken from the material of the company)

Business Overview

(Taken from the material of the company)

Steps

They aim to become a one-of-a-kind company by globally operating business as a garden-centric lifestyle maker

(Taken from the material of the company)

2. Business Development

Future growth image

(Taken from the material of the company)

Growth strategy

Professional use |

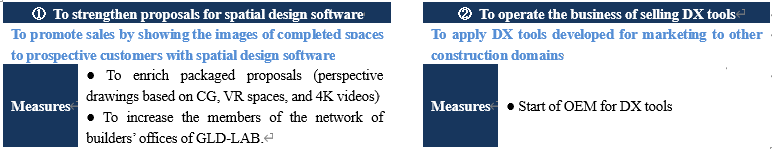

(1) Housing Promotion of hybrid marketing combining digital and real products through DX

(Taken from the material of the company)

③ To popularize products by using multiple media | To enhance promotion in order to make their products known to more customers To accumulate data mainly in local cities, and apply them to urban areas |

(Taken from the material of the company)

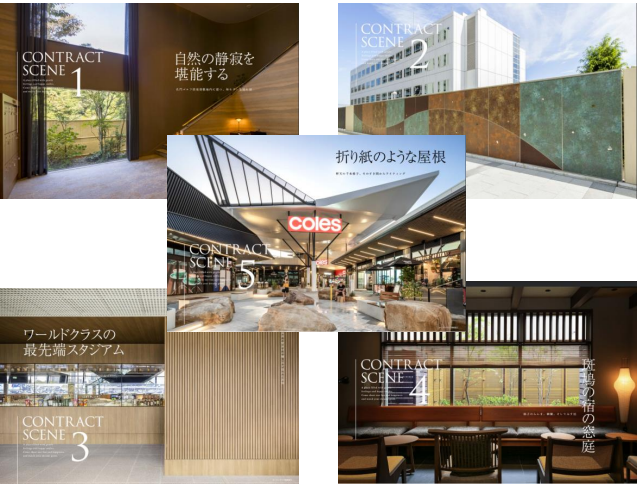

(2) Customization

④ To supply products to accommodation and commercial facilities, which are increasing thanks to the foreign visitors to Japan |

| ⑤ To supply more products to leading restaurant chains and stores |

|

|

|

(Taken from the material of the company)

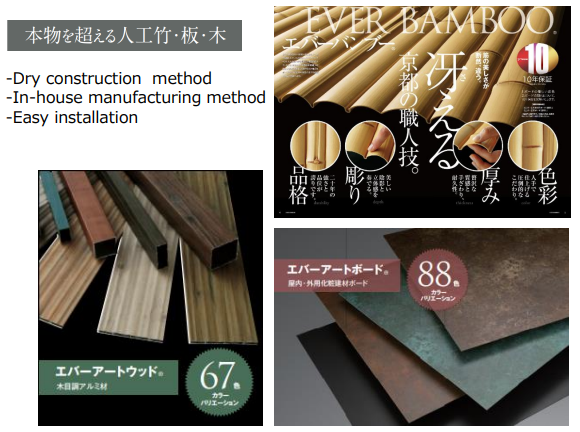

Outdoor lighting and signboards | To expand their market share globally by enhancing product development and honing their manufacturing capacity |

① To increase the ratio of products manufactured in house |

| ② To expand their production capacity and establish a supply chain |

|

|

|

(Taken from the material of the company)

③ To increase products for meeting special orders | Azabudai Hills, Skytree Tokyo Solamachi, Kabukicho Tower, etc. |

(Taken from the material of the company)

④ Initiatives for sustainability | Obtained the Eco First certification from the Ministry of the Environment In Japan, 66 companies obtained this certification. Takasho is the second company that obtained it in Wakayama. |

(Taken from the material of the company)

Home use | To review the decline in revenues due to the external environment, and redevelop their business model |

① To enhance the online business |

| ② To brush up the capacity to produce products for professional use and establish a supply chain |

|

|

|

(Taken from the material of the company)

③ Sale based on the alliance with a leading overseas maker |

| ④ Direct sale from their own factories |

|

|

|

(Taken from the material of the company)

Overseas | They aim to become the world’s largest maker in the garden field, by promoting their brand and expanding sales channels. |

① Promotion of new products |

| ② To expand sales channels with major chains, e-commerce, etc. |

|

|

|

(Taken from the material of the company)

③ To operate business in the professional market | To promote the sales of products for housing and special orders, for which demand is high and profit margin is high, in the U.S. market |

| |

(Taken from the material of the company)

3. Fiscal Year January 2024 Earnings Results

(1) Consolidated Earnings

| FY Jan. 23 | Ratio to sales | FY Jan. 24 | Ratio to sales | YoY | Forecast | Divergence |

Sales | 20,351 | 100.0% | 19,411 | 100.0% | -4.6% | 19,250 | +0.8% |

Gross Profit | 9,006 | 44.3% | 8,335 | 42.9% | -7.4% | 8,324 | +0.1% |

SG&A | 8,125 | 39.9% | 8,444 | 43.5% | +3.9% | 8,374 | -0.3% |

Operating Income | 880 | 4.3% | -108 | - | - | -150 | - |

Ordinary Income | 982 | 4.8% | 250 | 1.3% | -74.5% | 250 | +0.1% |

Net Income | 518 | 2.6% | -75 | - | - | -170 | - |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd. as reference values, so they may differ from actual figures (the same shall apply hereinafter). The company’s forecasts are those as of the announcement date of the financial results for 3Q (November)

Sales dropped 4.6%, and ordinary income decreased 74.5% year on year.

Sales declined 4.6% year on year to 19,411 million yen.

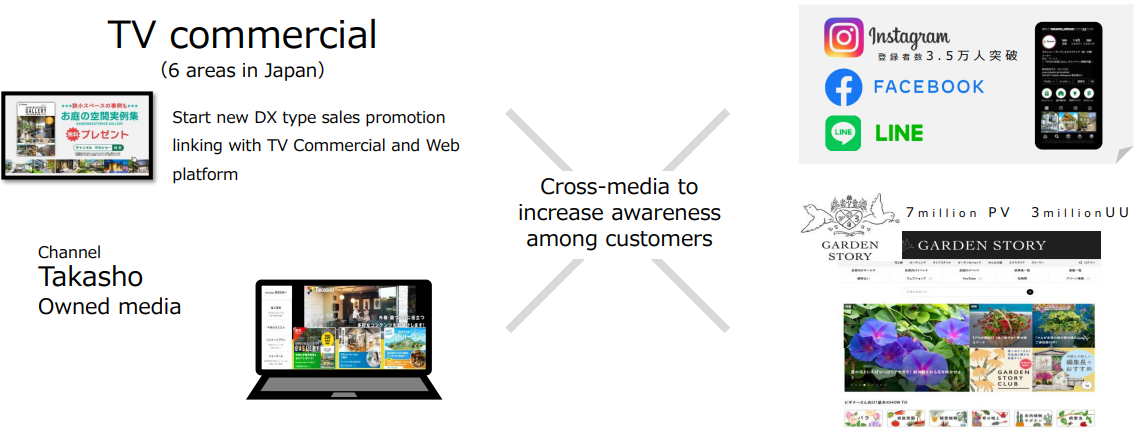

The company implemented a variety of important measures to enhance brand value in order to pursue future growth. In particular, the company continued adopting a new sales promotion approach that relies on digital technologies, which links TV commercials and online platforms. The company also increased the number of touch points with end-users and started offering "Virtual Homes & Gardens" utilizing cutting-edge technologies such as XR and Metaverse with AR, VR, and MR. In addition, the company promoted "5th Room," which offers more comfortable living, and strengthened sales promotion activities in anticipation of capital investment in hotels, inns, and restaurants to meet the demand from foreigners. Regarding overseas businesses, the number of customers visiting garden centers and home improvement centers in the U.S. is recovering. However, inventory adjustments due to overstocking continued at client stores, and in Europe, customers continued to refrain from buying due to soaring prices of energy and daily necessities. However, sales are gradually recovering due to the increase of customers and the easing of inventory adjustments.

Ordinary income declined 74.5% year on year to 250 million yen.

In terms of profit, procurement costs rose as the yen weakened by 3% to 11% compared with the assumed exchange rate, while sales declined. In addition, an overseas sales subsidiary recorded a one-time inventory write-down of 125 million yen by reducing the prices of high-cost stock and backlogged inventory purchased at a time of high ocean freight rates to saleable prices. SG&A expenses increased due to continued efforts to hold exhibitions and other events to expand sales, sales promotion activities that rely on digital technologies, capital investment, and personnel recruitment, despite a decrease in variable expenses. Operating loss was 108 million yen (the operating income in the previous fiscal year was 880 million yen). In non-operating income, foreign exchange gains of 322 million yen were recorded on foreign currency transactions due to the weaker yen. Net loss attributable to owners of the parent was 75 million yen (a profit of 518 million yen in the previous fiscal year) due to an impairment loss on fixed assets amounting to 62 million yen at an overseas sales subsidiary and an increase in tax burden rate.

The company paid a year-end dividend of 5.0 yen/share, which was in line with the company’s forecast.

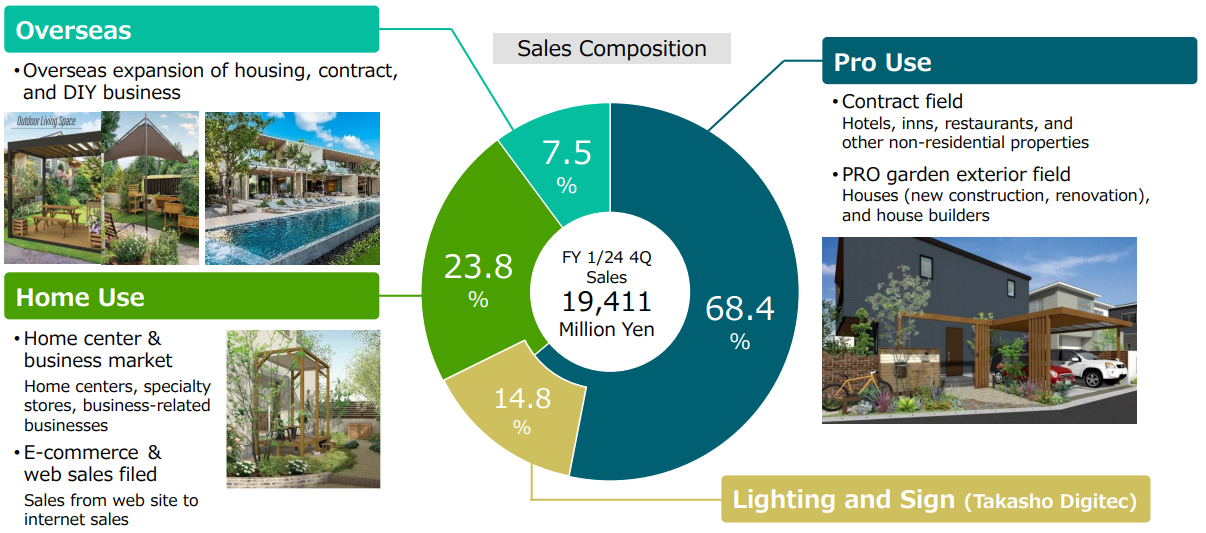

Sales status by business

| FY Jan. 23 | Ratio to sales | FY Jan. 24 | Ratio to sales | YoY |

Professional use business

| 13,193 | 64.8% | 13,277 | 68.4% | +0.6% |

Home use business | 5,586 | 27.4% | 4,620 | 23.8% | -17.3% |

Overseas business

| 1,545 | 7.6% | 1,465 | 7.5% | -5.2% |

Consolidated sales | 20,351 | 100.0% | 19,411 | 100.0% | -4.6% |

*Unit: million yen

*Since the company recorded a small amount of sales outside of the above three businesses, total sales do not match the net sales of the three businesses.

*The business area of overseas sales in the previous fiscal year's results has been transferred from the Professional Use Business and reflected in the Overseas Business.

Professional Use Business

Sales increased 0.6% year on year to 13,277 million yen.

Despite a challenging environment, including a decline in housing starts, the number of properties in the non-residential sector increased, and the unit price per site also rose. The company held its own exhibition, TGEF 2023 (Takasho Garden & Exterior Fair 2023), and actively engaged in sales promotion activities that rely on digital technologies by linking TV commercials and online platforms to improve brand value, resulting in an increase of orders from clients through brand designation. Sales of low-voltage lighting products, which are outdoor lighting for nighttime gardens, also grew steadily.

The subsidiary Takasho Digitec promoted its LED signboard and lighting/illumination business. Through strengthening its own sales activities and collaboration with the landscape & building materials group, the company continued to grow its efforts in the non-residential sector (public facilities and commercial facilities), resulting in a 19% year-on-year increase in sales. In addition, Takasho Digitec was the first company in the industry to be certified under the Eco-First Program launched by the Ministry of the Environment as a leading company in environmental activities. The company is also promoting sustainable initiatives, such as its environmentally friendly LED signboards, Re: SIGN, which won a Good Design Award in 2023.

Home Use Business

Sales declined 17.3% year on year to 4,620 million yen.

The number of customers visiting mass retailers declined significantly from the previous fiscal year due to the decline after the COVID-19 pandemic, rising prices, and the unfavorable weather. In addition, inventory adjustments due to overstocking at mass retailers continued, and despite efforts to strengthen online advertising and revise sales prices for mass retailers, sales declined. Under these circumstances, the company has launched new initiatives to meet business demand and will aggressively pursue establishing a new business model.

Overseas Business

Sales declined 5.2% year on year to 1,465 million yen. In the U.S., although the number of customers visiting garden centers and home improvement centers is recovering, customers continued to make inventory adjustments due to overstocking at their stores. In Europe, customers continued to refrain from buying due to soaring prices of energy and daily necessities. In the U.S., average per-household spending on gardening activities is on an upward trend due to rising demand for outdoor landscaping for residential use. In addition, the importance of landscaping is spreading due to the increasing need for home vegetable gardens driven by health consciousness and the desire for self-sufficiency in fruits and vegetables. Moreover, the company is expanding its successful Professional Use business model in Australia to the U.S., which is gradually increasing the number of orders received.

Sales by Segment |

|

|

| ||

| FY Jan. 23 | Ratio to sales | FY Jan. 24 | Ratio to sales | YoY |

Japan | 17,750 | 87.2% | 17,259 | 88.9% | -2.8% |

Europe | 499 | 2.5% | 432 | 2.2% | -13.5% |

China | 1,142 | 5.6% | 872 | 4.5% | -23.6% |

Korea | 181 | 0.9% | 214 | 1.1% | +18.6% |

US | 486 | 2.4% | 387 | 2.0% | -20.3% |

Others | 290 | 1.4% | 244 | 1.3% | -16.0% |

Total Consolidated Sales | 20,351 | 100.0% | 19,411 | 100.0% | -4.6% |

Japan | 885 | 5.0% | 502 | 2.9% | -43.3% |

Europe | -283 | - | -476 | - | - |

China | 221 | 19.4% | 56 | 6.4% | -74.7% |

Korea | -23 | - | -23 | - | - |

US | -254 | - | -231 | - | - |

Others | -11 | - | -47 | - | - |

Consolidated Adjustments | 345 | - | 111 | - | - |

Consolidated Operating Income | 880 | 4.3% | -108 | - | - |

*Unit: million yen

* Composition of operating income is on a consolidated basis before consolidation adjustments

(2) Financial Conditions and Cash Flow

Financial Conditions

| Jan. 23 | Jan. 24 |

| Jan. 23 | Jan. 24 |

Cash, Equivalents | 4,206 | 3,796 | Payables | 3,767 | 3,598 |

Receivables | 3,328 | 3,136 | Short Term Interest Bearing Liabilities | 4,113 | 4,201 |

Inventories | 7,044 | 6,994 | Current Liabilities | 9,386 | 9,505 |

Current Assets | 15,383 | 14,676 | Long Term Interest Bearing Liabilities | 583 | 843 |

Tangible Assets | 6,246 | 6,395 | Noncurrent Liabilities | 864 | 1,129 |

Intangible Assets | 511 | 566 | Net Assets | 13,389 | 12,499 |

Investments, Other Assets | 1,498 | 1,496 | Total Liabilities, Net Assets | 23,640 | 23,134 |

Noncurrent Assets | 8,256 | 8,458 | Total Interest Bearing Liabilities | 4,696 | 5,044 |

*Unit: million yen

*Interest Bearing Liabilities = Debt + Leases

Total assets at the end of the fiscal year ended January 2024 stood at 23,134 million yen, down 505 million yen from the end of the previous fiscal year.

Current assets decreased by 707 million yen from the end of the previous fiscal year to 14,676 million yen. The main factors behind this decline were a 410 million yen decrease in cash and deposits from the end of the previous fiscal year to 3,796 million yen and a 191 million yen decrease in notes and accounts receivables to 3,136 million yen. Fixed assets increased 202 million yen from the end of the previous fiscal year to 8,458 million yen, mainly due to a 398 million yen increase in construction in progress to 434 million yen.

Current liabilities increased 118 million yen to 9,505 million yen, primarily due to a 168 million yen decrease in trade payables to 3,598 million yen, a 99 million yen increase in current maturities of long-term loans payable to 135 million yen, and a 202 million yen increase in accrued expenses to 976 million yen. Fixed liabilities increased by 265 million yen from the end of the previous fiscal year to 1,129 million yen. This was mainly due to a 314 million yen increase in long-term loans to 389 million yen.

Net assets decreased by 889 million yen to 12,499 million yen. This was mainly due to treasury stock increasing by 481 million yen to 494 million yen, retained earnings decreasing by 479 million yen to 5,773 million yen, and accumulated other comprehensive income increasing by 65 million yen to 956 million yen.

Equity ratio was 53.5% (56.2% at the end of the previous fiscal year).

Cash Flow |

|

| (Unit: million yen) | |

| FY Jan. 23 | FY Jan. 24 | YoY | |

Operating Cash Flow | -465 | 1,132 | +1,597 | - |

Investing Cash Flow | -615 | -599 | +16 | - |

Free Cash Flow | -1,081 | 532 | +1,614 | - |

Financing Cash Flow | -470 | -701 | -231 | - |

Cash and Equivalents at the end of period | 4,206 | 3,796 | -410 | -9.8% |

Cash and cash equivalents at the end of the fiscal year ended January 2024 stood at 3,796 million yen, down 410 million yen from the end of the previous period.

Operating activities provided a cash inflow of 1,132 million yen (an outflow of 465 million yen in the previous fiscal year). The primary reasons for this increase were an income before income taxes and adjustments of 317 million yen (967 million yen in the previous fiscal year), a depreciation and amortization expense of 773 million yen (711 million yen in the previous fiscal year), a decrease in inventories of 279 million yen (an increase of 1,008 million yen in the previous fiscal year), and a decrease in accounts payables of 270 million yen (a decrease of 1,087 million yen in the previous fiscal year).

Investment activities resulted in a cash outflow of 599 million yen (an outflow of 615 million yen in the previous fiscal year). This was due to purchase of property, plant and equipment of 578 million yen (498 million yen in the previous fiscal year), purchase of intangible assets of 180 million yen (122 million yen in the previous fiscal year), and proceeds from sale of securities of 142 million yen (none in the previous fiscal year).

Financing activities resulted in a cash outflow of 701 million yen (an outflow of 470 million yen in the previous fiscal year). This was primarily a result of dividend payments of 403 million yen (403 million yen in the previous fiscal year), purchase of treasury shares of 492 million yen (56 million yen in the previous fiscal year), and income from long-term loans of 500 million yen (none in the previous fiscal year).

4. Fiscal Year January 2025 Earnings Forecasts

Consolidated Earnings

| FY Jan 24 Act. | Ratio to sales | FY Jan 25 Est. | Ratio to sales | YoY |

Sales | 19,411 | 100.0% | 22,047 | 100.0% | +13.6% |

Operating Income | -108 | - | 583 | 2.6% | - |

Ordinary Income | 250 | 1.3% | 618 | 2.8% | +146.9% |

Net Income | -75 | - | 323 | 1.5% | - |

*Unit: million yen

Sales are expected to increase 13.6%, and ordinary income to increase 146.9% in the fiscal year ending January 2025 from the previous fiscal year.

In the fiscal year ending January 2025, sales are expected to increase 13.6% year on year to 22,047 million yen, operating income is projected to reach 583 million yen (a loss of 108 million yen in the previous fiscal year), and ordinary income is forecast to rise 146.9% year on year to 618 million yen. The company forecasts net income attributable to owners of parent to be 323 million yen (a loss of 75 million yen in the previous fiscal year).

In the professional use business, the company will further fuse the offline and online operations. It will promote sales activities that rely on digital technologies such as AR and MR. It will also develop new sales promotions using digital technologies that link TV commercials and online platforms to improve brand power and strengthen sales activities. The company will also strengthen its sales and proposal capabilities in the non-residential sector (public facilities and commercial facilities) by responding to special orders, which is one of the company's strengths, and it will expand its sales channels. In addition, it will promote sales that contribute to GX initiatives, regional revitalization, and the realization of a sustainable economic society. In the home use business, the company will promote the development of new products produced at its factories to strengthen sales in the growing e-commerce field further. The company aims to expand sales by promoting the common sales of global products and partnering with major overseas manufacturers. Additionally, it will operate its own website, "Living Garden Store," and expand sales channels beyond home centers. In the overseas business, the company will review and revise the management structure of VegTrug and continue to promote new transactions with major garden centers and home improvement centers in the U.S. In addition, the company will conduct sales activities in regions where it has not yet been able to expand its business in Europe (such as France and Italy). For the deployment of new product lines, the company aims to expand sales through e-commerce, mainly through its own website, "VEGTRUG.COM." Also, the company will strengthen its promotion activities for exterior materials in the professional use business in Australia and the U.S.

The company expects to pay a year-end dividend of 8.0 yen per share, up 3.0 yen per share from the previous fiscal year.

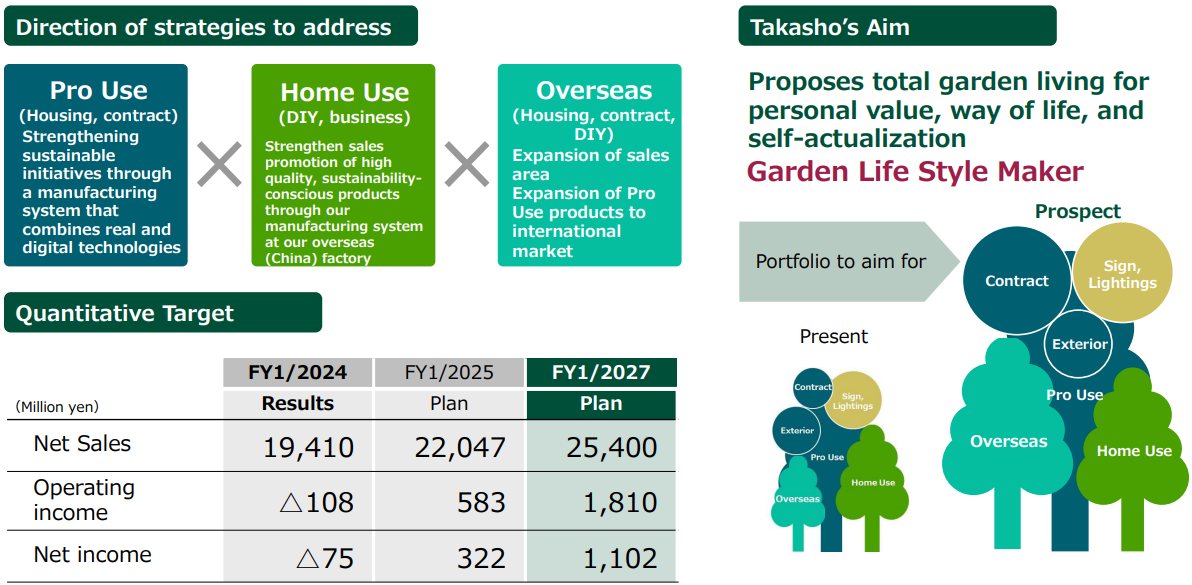

5. Mid/long-term Plan

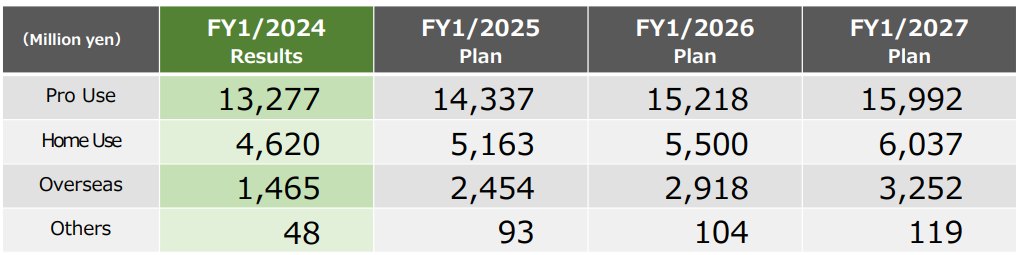

In the fiscal year ending January 2027, sales are expected to be 25.4 billion yen and ordinary income is projected to be 1,837 million yen.

Segment Sales Plan

(Taken from the material of the company)

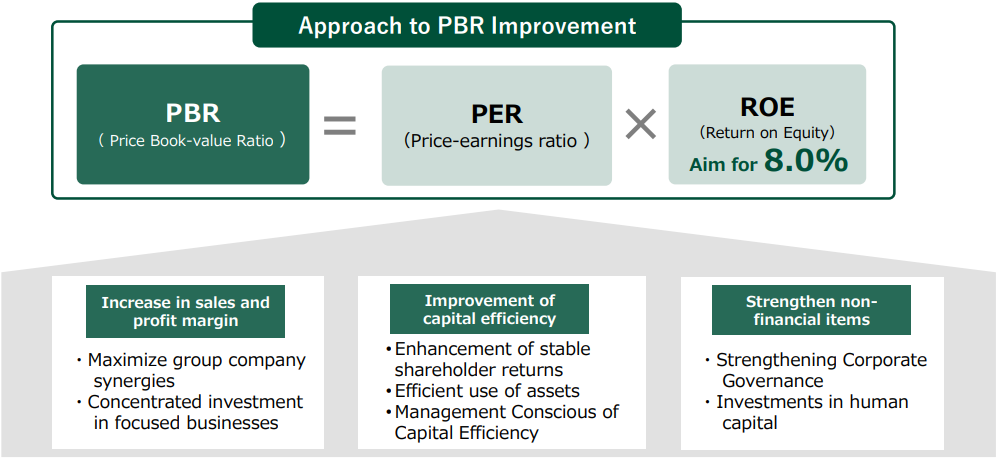

Policy for improving PBR

They will strive to optimize profitability, the efficiency of use of assets, and the composition of liabilities, and maximize revenues based on their business models and efficient cost management, with the aim of establishing an appropriate capital structure.

(Taken from the material of the company)

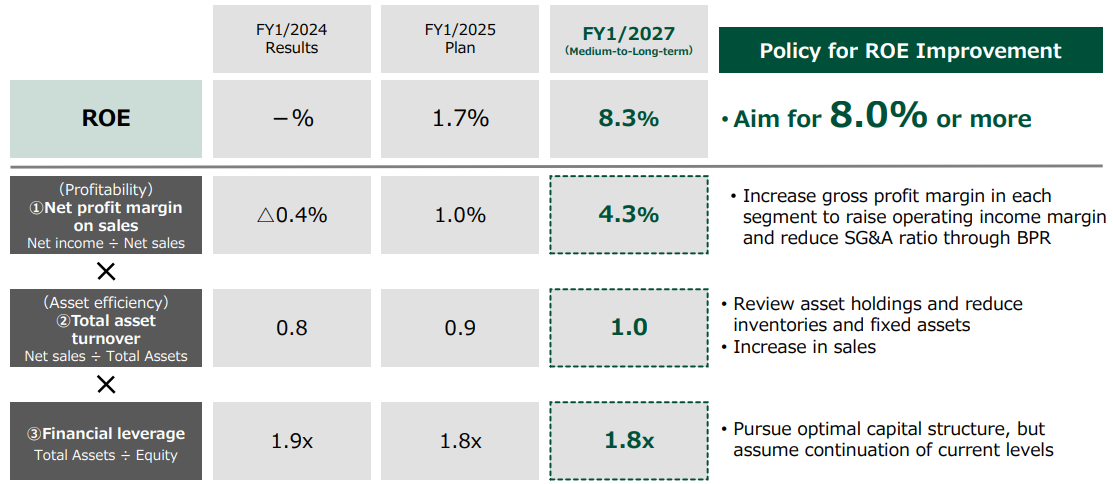

Policy for improving ROE

(Taken from the material of the company)

6. Conclusion

In the fiscal year ended January 2024, sales decreased and profit dropped considerably, mainly because of the prolongation of inventory adjustment outside Japan in addition to the recoil from the special demand caused by the COVID-19. On the other hand, the clearance of inventory at home improvement centers inside and outside Japan is progressing little by little. In the fiscal year ending January 2025, it is desirable that their inventory will become proper by the end of 1Q, which falls on the busy season in the spring. Sales are expected to recover once inventories return to normal. If demand recovers, the increase in sales and profits will likely be much larger than the company's forecasts. In this situation, Takasho Digitec is growing steadily. They have started full-scale overseas business operation. If the ratio of overseas sales increases, overseas sales will further contribute to revenues. For the overseas business, they are expanding sales channels, so sales, including online sales, are expected to increase.

Recently, the company has been more active in returning profit to shareholders. They acquired treasury shares equivalent to 4% of the total number of outstanding shares while raising payout ratio from 30% to 40%. In the fiscal year ending January 2025, the company plans to pay a dividend of 8.0 yen/share, as it is on a recovery track, but it can be expected that it will increase if business development progresses as described above. Their medium-term plan has been revised, but if the target net income of 1,102 million yen in the fiscal year ending January 2027 is achieved, EPS will be around 65 yen. We consider that there is room for reassessment of the share price of the company, as current PBR is much less than 1 when considering the expected recovery from this fiscal year onwards.

<Reference: Concerning Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with audit and supervisory board |

Directors | 5, out of which 2 are outside directors. |

Corporate auditors | 3, out of which 2 are outside directors. |

◎ Corporate Governance Report Last updated: April 21, 2023

<Basic policy> Takasho recognizes that the establishment of corporate governance that is sound and highly transparent and secures the efficiency of management decision-making to respond promptly and appropriately to changes in the business environment is an important matter and is working on it.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons for not implementing the principles |

【Supplementary Principle 2-4-1 Ensuring diversity in the appointment of core personnel, etc.】

| Our company is actively working to ensure diversity, for example, by promoting women to management positions, and has set targets for the percentage of women in management positions and stated them in the action plan based on the Act on the Promotion of Women’s Participation and Advancement in the Workplace. In addition, our company is striving to create an environment that ensures diversity by providing training and implementing various measures related to respecting diversity, etc. We have not formulated any medium/long-term strategies or policies that will serve as the basis for these initiatives, however, we will continue to consider the formulation of such strategies and policies to enhance corporate value. |

【Supplementary Principle 3-1-3 Sustainability initiatives】 【Supplementary Principle 4-2-2 Formulation of policies for sustainability initiatives and supervision】 | Our company actively engages in measures for sustainability, and the details are disclosed in our website. However, we have not formulated our basic policy for improving mid/long-term corporate value, and we will discuss it from now on. Regarding the development of methods and systems for effective supervision from the viewpoint of importance of investment in human capital and intellectual property, we will have discussions on it as well as the disclosure considering the consistency with management strategies for human capital and intellectual property. |

【Supplementary principle 4-8-1 Exchange of information and sharing of recognition by independent outside directors from the objective standpoint】 | At present, there are no regular meetings, etc. consisting of independent external directors only, but our outside directors exchange views with other directors and corporate auditors, and they actively participate in the Board of Directors and make remakes. Therefore, we believe that our external directors are fulfilling their roles and responsibilities. |

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons |

【Principle 1-4 Strategically held shares】 | (1) Policy on strategic shareholding Our company will hold shares strategically after comprehensively judging whether they will lead to the maintenance and strengthening of business relationships or whether they will lead to an improvement in our medium- to long-term corporate value through smooth promotion of business activities, etc.(2) Details of the check of the appropriateness of strategic shareholdingwe will examine the effects of strategic shareholding from the perspective of maintaining medium- to long-term economic rationality and maintaining and strengthening the overall relationship with our business partners and report the results to the Board of Directors. The company will reduce the number of shares that are considered not worth holding. (3) Criteria for exercising voting rights pertaining to strategic shareholdingWe will review the contents of the shareholder meeting agenda of the investee company based on the prospect of sustainable development and medium- to long-term corporate value enhancement for both investee company and our company and exercise the voting rights. |

【Principle 2-6 Functioning as an asset owner for corporate pensions】 | The company has a defined benefit corporate pension system and has entered into agreements with an asset management organization that has expressed acceptance of stewardship activities with respect to the administration and management of corporate pensions. A person from the General Affairs and Human Resources Department is assigned to receive regular reports from the entrusted organization on the soundness of the management, and the relevant departments conduct monitoring as appropriate. In addition, we have adopted a corporate defined contribution pension plan to build employees’ assets. At the time of hiring, employees are briefed on the investment period, selection of investment instruments, and asset management. |

【Supplementary principle 4-1-1 Roles and responsibilities of the Board of Directors】 | Our company has established the “Regulations for the Board of Directors,” the “Rules for Approval,” and the “Detailed Rules for Approval” as important decision-making items, in addition to matters stipulated by laws and regulations and the Articles of Incorporation, determining the scope of decision-making by the Board of Directors. In order to enhance the swiftness and flexibility of business execution and increase the vigor of management, the Board of Directors deliberates and makes decisions on business execution other than those matters stipulated by laws and regulations, the Articles of Incorporation, and the “Regulations for the Board of Directors” at the Executive Committee, which is also attended by the Representative Director. |

【Principle 4-8 Effective utilization of independent directors】 | Our company appoints two outside directors. They are the independent outside directors to keep an independent and neutral position in the discussions at the Board of Directors. We will continue to select candidates so that multiple independent outside directors with high expertise and rich experience can be appointed. |

【Supplementary Principle 4-11-1 General idea on the balance of knowledge, experience and capabilities, diversity and size of the Board of Directors】 | In order to respond appropriately and swiftly to changes in the business environment, the company appoints human resources with diverse backgrounds to its Board of Directors, taking into account the balance of knowledge, experience and capabilities. Outside directors, in particular, are selected based on their knowledge of the industry, experience in management, and professional abilities in their respective fields to ensure balance and diversity. In addition, considering the size of the company and other factors, the company’s articles of incorporation limit the number of directors to be not more than 15, and there are currently five directors (including two outside directors). |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. |