| Takasho Corporation (7590) |

|

||||||||

Company |

Takasho Corporation |

||

Code No. |

7590 |

||

Exchange |

JASDAQ |

||

Industry |

Retail (Commerce) |

||

President |

Nobuo Takaoka |

||

HQ Address |

Minami Akasaka 20-1, Kainan-shi, Wakayama-ken |

||

Year-end |

January 20 |

||

URL |

|||

* Stock price as of closing on 2017/4/3. Number of shares isuued at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

|

|

| Key Points |

|

| Company Overview |

<Sales Routes>

Takasho's marketing division can be divided into sales routes of "professional use" products used by home builders and midsized construction companies, "home use" products sold to home improvement centers on a wholesale basis for use by general consumers, "GARDENER'S," and "exports." Each of these routes accounted for 60%, 31%, 3%, and 6% of sales respectively in fiscal year January 2017."Professional use" products are products sold primarily through Takasho's "PROEX" catalog, which is the industry's largest catalog with approximately 250,000 copies printed and distributed by direct mail to gardening and landscaping companies, architects and designers, construction companies specializing in exterior construction, commercial facilities and other users. Pictures of actual gardens using Takasho's products are included in the catalogs, and customers can fill in diagrams provided within the catalogs to order products they want to use in actual landscapes and facilities they are creating. Customers send these diagrams by fax or email to Takasho. In turn, Takasho will then create image diagrams using CAD and CG technologies to be returned to customers along with estimates within the same day to show what the gardens and landscapes they are creating look like using Takasho products and how much they will cost. The Company also boasts of the ability to supply ordered products in a very short period of time.  |

| Business Strategy |

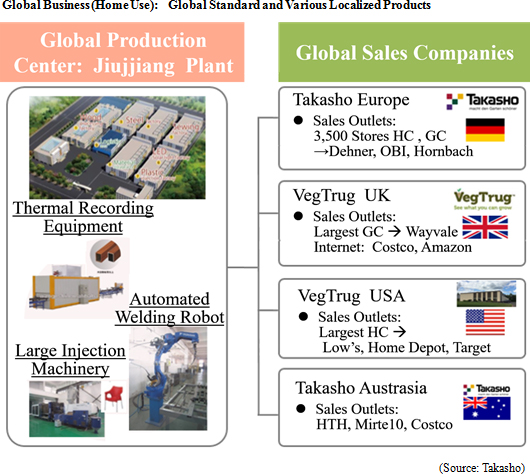

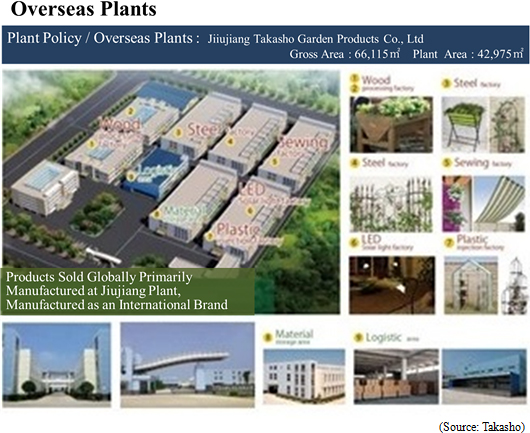

<Global Business>

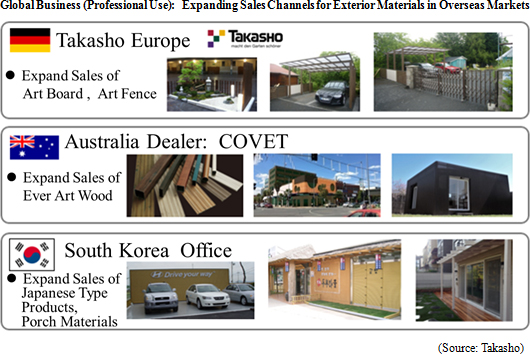

Takasho imports products with high cultural value from overseas markets, while at the same time manufacturing products including wood products, solar lighting, wire products and others at its plant in Jiangxi, China to be exported to various parts of the world. Products for the United Kingdom gardening market, which is estimated to amount to ¥4 trillion and compares with the Japanese market at only ¥600.0 billion, are exported from Japan. Efforts will be made to fortify sales within the United States market along with the establishment of "VegTrug USA" on February 3, 2015, which has been fully funded by the United Kingdom sales subsidiary (VegTrug).In addition to these regions, the Company also conducts business in Germany, Australia, and Korea. In order to pursue its worldwide business expansion, Takasho needs to establish sales subsidiaries in large markets like the United Kingdom. As part of new business development, a showroom was established in Vietnam in May 2016.   <Total Business Solutions>

Takasho focuses upon exterior (New construction exterior siding), gardening (Garden lifestyle solutions), and contracting (Non-residential building materials, exterior siding) products. It develops highly unique products based upon the unique concept that "gardens are a paradise that exists in harmony with homes they surround."

As a group of professionals in the realm of gardens, the "Reform Gardening Club" seeks to increase communication between distributors and construction services providers. Furthermore, the "Exterior and Gardening Meister System" and "Water Garden Meister System" certification systems were established in February 2010, and "Exterior and Garden Meister System" was also established in May 2014 with the goal of rejuvenating the industry. Visitors to Takasho's Garden and Exterior Fair held in July 2016 rose by 5% from previous year to 3,716 people. The Company has also actively supports its network of construction companies. The number of the Takasho Reform Garden Club member companies is approximately 700. The Company also held over 200 networking and regional training events throughout Japan based upon their corporate theme of "learn together, grow together". In addition, Takasho will continue to conduct activities to educate the market. Showrooms were newly constructed in Hiroshima and the Tokyo metropolitan region in June 2014 and September 2015 respectively. The Tokyo showroom has been opened with the goal of improving services and strengthening sales in the Kanto region market, where its growth is anticipated, by enabling customers to see and feel the colors and texture qualities of various products. Also, the new Tokyo sample room has been established to allow customers to see and experience any kinds of materials and collaborative products, and various designs, layouts and constructions in a relatively intensive space. The sample room in Osaka moved for opening to Mino City in Osaka in April 1. Takasho has updated its website to make it easier for customers to use and see. The online construction materials catalog platform called "Catalabo" function has also been included in the updated website. <Modernization Business>

As part of the "Smart Living Garden" concept, Takasho is promoting development and sales of LED illumination, solar lighting, low voltage lighting and other products using natural energy and energy saving technologies to propose energy conserving themes in the garden. Takasho also proposes garden creation through the "Smart Living Garden" concept, which was born from the "Smart House" concept and fuses the GEMS energy management system starting in gardens, to realize "energy conserving", "energy creation", and "energy storage" in both the home and gardens. Moreover, 100% use of LED for outdoor lighting was achieved in October last year. Furthermore, the awarding of "Takasho Low Voltage Light System" with the "Best Selection Award" in the fourth award event hosted by the HEAD (Study Group on Home Environment and Advanced Design) contributed to an increase in consumer awareness of these products.

<Life Support Business>

Japan's first authentic garden center called "GARDENER'S JAPAN" was opened adjacent to the Takasho headquarter in April 2012. Half of the "GARDENER'S JAPAN" facility is surrounded by greenery, and it boasts of open gardens that allow customers to thoroughly enjoy their visit to the facilities. Takasho is expected to strengthen the connection between the mail order site "Aoyama Garden" (http://www.aoyama-g.co.jp/)  <Manufacturing Structure Expansion>

Takasho has used funds raised from financings undertaken in 2012 and 2013 to fortify its global manufacturing structure. Thanks to these investments, the Company is now better able to respond to future increases in demand.

|

| Fiscal Year January 2017 Earnings Results |

Sales, Current Profit Decline 3.5%, 46.0% Year-On-Year Respectively

Sales declined by 3.5% year-on-year to ¥17.223 billion during fiscal year January 2017. Sales of the professional use segment individually rose by 2.4% year-on-year to ¥9.087 billion. In fiscal year 2015, sales of "Ever Art Wood" artificial wood made from aluminum and other art exterior series of products and "Ever Art Wood" used in garden exterior applications trended strongly on the back of a 4.6% year-on-year rise in new housing starts. Sales of Art Board Wood used as exterior entry products (Car port, fence and other applications) rose by 8% year-on-year to ¥3.512 billion. Furthermore, reproduction of various natural products such as wood, stones, painted stone walls, and Japanese type natural products used in dry method applications including "Ever Art Board" and related product sales also trended favorably. In addition, distribution of "Light", lightning equipments which produce night garden including low voltage (12 and 24 volt) LED lighting products trended favorably due to the increased recognition received from the "Exterior and Gardening Meister System". Sales of garden lighting and garden furniture related new products rose by 29% year-on-year to ¥641 million. However, strengthened artificial bamboo and other Japanese type products suffered a decline due to the change of market such as a decline in Japanese style construction and despite revised pricing for some products in an effort to strengthen sales.Sales of the home use segment individually declined by 10.9% year-on-year to ¥4.771 billion. Sales of deck related products rose due to the introduction of new products, but inventory adjustments by mass retail stores led to declines in sales of wooden products. Additional orders declined due to inventory adjustments conducted throughout the full year by home centers. Furthermore, foreign exchange fluctuations and inclement weather also contributed to weaker sales. Sun shade sales rose strongly by 3.4%. The strengthening of the yen relative to various currencies contributed to a ¥100 million decline in sales. With regard to overseas expansion, Takasho has focused upon fortifying its global standard product lineup, and its branding and delivery structures with a goal of expanding sales. Consequently, the Company has been able to cultivate new business and sales withlarge home centers and new online sales. However, the influence of inclement weather in Europe and elimination of unprofitable business transactions led to a decline in sales and caused the share of overseas sales to fall from 10.7% to 9.0%. With regard to profits, a deterioration in foreign exchange rate for a foreign-currency sales led to a ¥120 million decline in gross profits of home use segment, but the gross profit margin actually improved by 0.4% points. The lower sales and subsequent increase in sales, general and administrative expense margin led to a 30.4% year-on-year decline in operating profit to ¥503 million. A valuation loss arising from foreign exchange fluctuation with valuation of ¥205 million (Influence of foreign denominated liabilities, cash and deposits amounted to ¥164 and ¥3 million respectively, and other transactions between consolidated subsidiaries amounted to rate differences with ¥38 million) within non-operating income and caused current profit to fall by 46.0% year-on-year to ¥322 million. Net profit attributable to shareholders of parent company also declined by 36.9% year-on-year to ¥152 million.     Current liabilities also rose by ¥910 million to ¥9.253 billion. While notes and accounts payables declined by ¥360 million to ¥3.065 billion due to a decrease in procurements, short term debt rose by ¥1.525 billion to ¥4.272 billion due to a switch from long term to short term debt arising from the use of commitment line to source funds for working capital. Noncurrent liabilities fell by ¥71 to ¥895 million. Acquisition of structures led to an increase in asset retirement obligations of ¥44 to ¥148 million. At the same time, long term debt declined by ¥88 to ¥665 million due to the shift from long to short term debt for use as working capital. Net assets declined by ¥124 million to ¥7.321 billion. Other comprehensive income fell by ¥57 to ¥417 million. Capital adequacy ratio fell by 2.5% points to 41.4%.  |

| Fiscal Year January 2018 Earnings Estimates |

Sales, Current Profits Expected to Rise 4.6%, 63.5%

Takasho's consolidated earnings estimates for fiscal year January 2018 call for sales and current profit to rise by 4.6% and 63.5% year-on-year to ¥18.010 billion and ¥527 million respectively. Within Japan, facilitation of showrooms, strengthened sales activities, and expansion of manufacturing capacity are expected to allow sales of the gardening and exterior products to grow. In the global business expansion, Takasho will conduct measures to strengthen its manufacturing function in China and its marketing activities for Europe, Oceania, and North America.The following measures to grow sales and improve profits will be implemented. ① Full operating sales force to implement more vigorous client relationship management

② Increase customer foot traffic by showroom expansion Newly add Osaka showroom following after Tokyo metropolitan new showroom and start full operation on new showrooms in other 5 citiesFull scale entry to housing industry (EX Package)

③ Reduce cost of sales by introducing mechanization to raise productivity

④ Reduce foreign currency fluctuation risk

⑤ Reduce costs with review on sales, general and administrative expenses

|

| Future Remarkable Points |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 by Investment Bridge Co., Ltd. All Rights Reserved |