Bridge Report:(6890)Ferrotec The second quarter of the fiscal year ending March 2025

President He Xian Han | Ferrotec Holdings Corporation (6890) |

|

Company Information

Exchange | TSE Standard Market |

Industry | Electric Equipment (Manufacturing) |

President | He Xian Han |

HQ Address | Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding (Term end) | Market Cap. | ROE (Act.) | Trading Unit | |

¥2,584 | 47,018,542 shares | ¥121,496 million | 7.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥110.00 | 4.3% | ¥340.29 | 7.6x | ¥5,059.77 | 0.5x |

*Share price as of closing on December 30. Shares outstanding (Excluding Treasury Shares), DPS, EPS, and BPS are taken from the summary of financial results for the second quarter of the fiscal year ending March 2025. ROE is the actual result of the previous term.

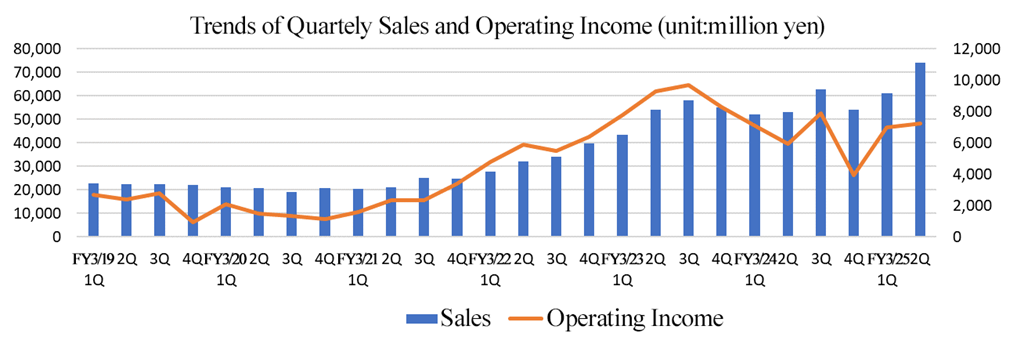

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2019 (Act.) | 89,478 | 8,782 | 8,060 | 2,845 | 76.90 | 24.00 |

March 2020 (Act.) | 81,613 | 6,012 | 4,263 | 1,784 | 48.12 | 24.00 |

March 2021 (Act.) | 91,312 | 9,640 | 8,227 | 8,280 | 222.93 | 30.00 |

March 2022 (Act.) | 133,821 | 22,600 | 25,994 | 26,659 | 668.06 | 50.00 |

March 2023 (Act.) | 210,810 | 35,042 | 42,448 | 29,702 | 644.81 | 105.00 |

March 2024 (Act.) | 222,430 | 24,872 | 26,537 | 15,154 | 322.65 | 100.00 |

March 2025 (Est.) | 265,000 | 26,000 | 26,000 | 16,000 | 340.29 | 110.00 |

*The forecast is from the company. Unit: million-yen, yen. The dividend for fiscal year ended March 2021 includes a commemorative dividend of 4.00 yen/share. The dividend for fiscal year ended March 2022 includes a special dividend of 9.00 yen/share. Net income is net income attributed to parent shareholders. The same shall apply hereafter.

This Bridge Report reviews the overview of Ferrotec’s earnings results of the second quarter of the fiscal year ending March 2025 and full-year earnings estimates for the fiscal year ending March 2025.

Table of Contents

Key Points

1. Company Overview

2. 2Q of Fiscal Year ending March 2025 Earnings Results

3. Fiscal Year ending March 2025 Earnings Forecasts

4. New Mid-Term Management Plan

5. Measures for Achieving Management Conscious of Capital Costs and Stock Price

6. Conclusions

<Reference: Regarding corporate governance>

Key Point

- In the cumulative second quarter of the fiscal year ending March 2025, sales grew 28% year on year and operating income rose 9% year on year. In the semiconductor and other equipment-related business, the demand from Chinese manufacturers was strong, and the demand for thermo-electric modules was stronger than assumed in the telecommunication field, so their performance exceeded the forecast (sales of 120 billion yen and an operating income of 13 billion yen) revised upwardly after seeing the results in the first quarter in August 2024. Seeing the results in the second quarter, they have revised the forecast annual sales upwardly.

- As the semiconductor market has been on a recovery track, the performance of the semiconductor and other equipment-related business has been healthy. In particular, they received more orders for vacuum seals and metal processing from manufacturing equipment manufacturers, the sales of machined quartz products recovered, the number of orders for ceramic products from equipment manufacturers recovered, and the start of operation of Changshan Plant contributed. Kulim Factory in Malaysia started operations for metal processing, quartz products, ceramics, and equipment assembly, enabling them to meet the needs of U.S. clients and others for manufacturing outside China, so it can be expected that more clients will approve the products and services in the second half or later. However, there is concern over the significant decline in profitability of quartz crucibles.

- In the electronic device business, thermos-electric modules sold well, thanks to the growth of demand related to generative AI. The sales of substrates for power semiconductors decreased from the previous second half due to the inventory of clients, but the company considers that it is possible to grow sales in the medium or long term. In 2025, Johor Factory in Malaysia is scheduled to start operations. In the automotive related business, thermos-electric modules sold well, as the demand for products for Chinese automobiles was stirred, and the sales of power semiconductor substrates kept growing thanks to the increase of active metal brazing (AMB) substrates for automobiles.

- In the revised forecast for the fiscal year ending March 2025, the company forecasts that sales and operating income will rise 19% and 5%, respectively, year on year. This forecast is based on the premise that the external business environment will be on an upward trend. The demand in the semiconductor industry is expected to pick up gradually from the situation that required device inventory adjustment, which lasted until 2023, and particularly, demand for Graphics Processing Units (GPUs), which are essential for generative AI, and investment in servers are projected to increase in the logic semiconductor field. In addition, prices of memory-related products have recently been on the rise. Therefore, the company keeps expecting that factory operating rate will improve and the level of capital investment will go up from the second half of the fiscal year ending March 2025 onward. In the mobile telecommunication system industry, the company projects that demand for high-capacity optical transceivers for servers will grow significantly while investment in the 5th-generation network will be made continuously, which will drive steady demand in general. In the automobile-related market, demand for electric vehicles (EVs) and self-driving systems is expected to increase on a continuous basis. From the geopolitical perspective, the regulations regarding advanced semiconductor technology that the United States has tightened against China are encouraging semiconductor manufacturers to relocate their manufacturing bases to other countries than China, but demand is expected to grow in Southeast Asian regions, mainly Malaysia, as manufacturing capacity is being increased there as planned.

- The semiconductor market is gently recovering, but there remain uncertainties over the stock market, because Mr. Trump assumed the presidency. While there are growing uncertainties over some fields, including solar panels and EVs, demand is strong in many fields, including vacuum seals, metal processing, and thermos-electric modules for generative AI. We hope to realize again that Ferrotec Holdings Corporation operates business in a broad range of fields, so it can control its product portfolio according to market conditions. Regarding production sites, not only Changshan Plant in China, but also Kulim Factory in Malaysia started operations, so they can meet a variety of demand from global enterprises. The market is cyclical, but they have carried out upfront investment, so stable growth became more feasible. This is noteworthy.

- From the viewpoint of the portfolio of their corporate group, they are making efforts to enable the diversification of fund procurement through diverse purchase structures. Regarding FTSVA, which is a parts cleaning subsidiary listed in China, it will be possible to circulate funds by selling part of the shares listed on December 30, 2022 from 2026. We would like to pay attention to the diversification of fund procurement and the improvement in share value based on the capital market. The Chinese regulations limit the number of shares a controlling shareholders can sell in a certain period of time, so it is necessary to keep in mind that they must follow the regulations when selling shares.

1. Company Overview

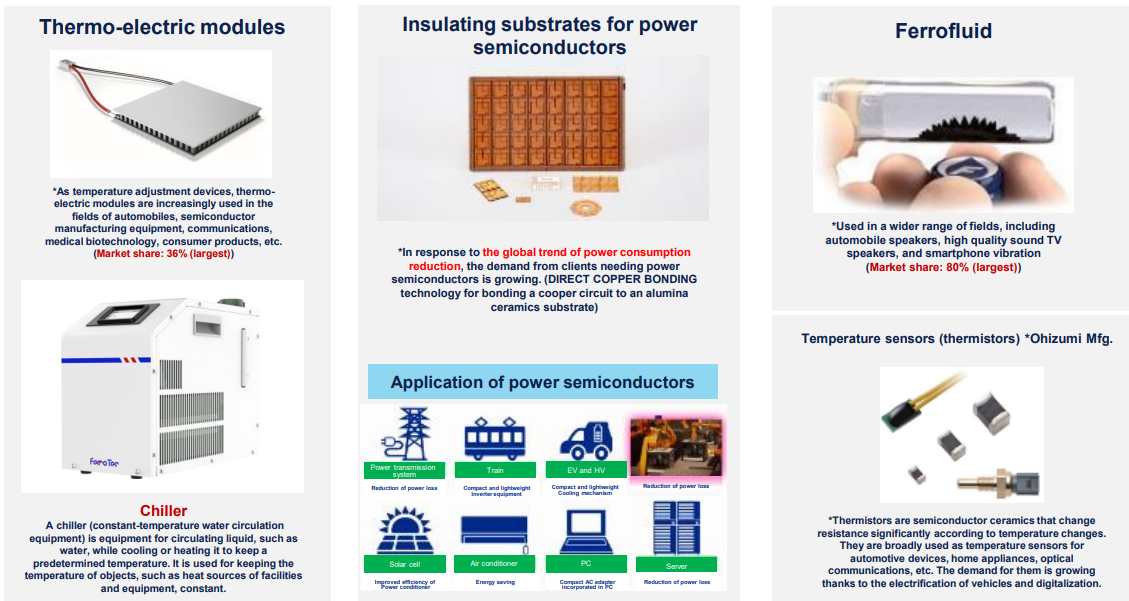

Ferrotec Holdings Corporation develops, manufactures, and sells silicon products, magnetic fluid, sensors, and products to which such items are applied, as well as Vacuum Feedthroughs that are used in equipment for manufacturing semiconductors and flat panel displays (FPDs), quartz products, ceramics products, CVD-SiC products, silicon parts, crucibles, and thermo-electric modules used in temperature controllers.

These products are categorized roughly into either the “semiconductor and other equipment-related businesses,” “the electronic device business,” or “the automotive related business.” The core products and the major companies in each segment are as follows:

| Segment | Core products | Major companies | |

| Semiconductor and other equipment-related businesses | Vacuum Feedthroughs | Development, manufacturing, sale | Ferrotec Material Technologies CorporationFerrotec (USA) Corporation |

| Development, sale | Hangzhou Dahe Thermo-Magnetics Co., Ltd. (FTH)Ferrotec Taiwan CO., LTD.KSM FerroTec Co., Ltd. | ||

| Sale | FERROTEC CORPORATION SINGAPORE PTE LTD | ||

| Quartz products | Development, sale | Hangzhou Dahe Thermo-Magnetics Co., Ltd. (FTH) Ferrotec (Zhejiang) Quartz Technology Co., Ltd.Aliontek Corporation. | |

| Sale | Ferrotec Material Technologies Corporation Ferrotec (USA) CorporationFERROTEC CORPORATION SINGAPORE PTE LTDFerrotec Taiwan CO., LTD. | ||

| Ceramics products | Development, manufacturing, sale | Ferrotec Material Technologies CorporationHangzhou Dahe New Material Technology Co., Ltd.Ferrotec (Zhejiang) Semiconductor Material Technology Co., Ltd. | |

| Sale | Ferrotec (USA) CorporationFERROTEC CORPORATION SINGAPORE PTE LTD | ||

| CVD-SiC products | Development, manufacturing, sale | Ferrotec Material Technologies Corporation | |

| Equipment parts cleaners | Development, sale | Ferrotec (Anhui) Technology Development Co., Ltd. | |

| Silicon parts | Development, sale | Hangzhou Dunyuan Juxin Semiconductor Technology Co., Ltd. (FTHS)Zhejiang Dunyuan Juxin Semiconductor Technology Co., Ltd. | |

| Quartz crucibles | Development, manufacturing, sale | Ningxia Dunyuan Juxin Semiconductor Technology Corporation (FTNC) | |

| Others | Development, sale | Ferrotec (USA) Corporation Ferrotec Europe GmbHHangzhou Dahe Thermo-Magnetics Co., Ltd. (FTH)Anhui Changjiang Reclaim Semiconductor Material Co., Ltd.Hangzhou Semiconductor Wafer Co., Ltd. (CCMC) | |

| Electronic device business | Thermo-electric modules | Development, sale | Ferrotec Material Technologies CorporationFerrotec (USA) Corporation Ferrotec Nord Corporation |

| Sale | Ferrotec Europe GmbH | ||

| Manufacturing | Hangzhou Dahe Thermo-Magnetics Co., Ltd. (FTH)Shanghai Shenhe Investment Co., Ltd. (FTS) | ||

| Power semiconductor substrates | Development, manufacturing, sale | Jiangsu Ferrotec Semiconductor Technology Co., Ltd. (FLH)Ferrotec (Sichuan) Semiconductor Technology Co., Ltd. (FLHC) | |

| Magnetic fluid | Development, manufacturing, sale | Ferrotec Material Technologies CorporationFerrotec (USA) Corporation | |

| Sale | Shanghai Shenhe Investment Co., Ltd. (FTS)FERROTEC CORPORATION SINGAPORE PTE LTD | ||

| Sensors | Development, manufacturing, sale | Ohizumi Mfg. Co., Ltd. Ferrotec (Zhejiang) Sensor Technology Co., Ltd. | |

| Others | Development, manufacturing, sale | Ferrotec (USA) CorporationShanghai Shenhe Investment Co., Ltd. (FTS)Shanghai Hanhong Precision Machinery Co., Ltd.Hong Kong First Semiconductor Technology Co., Ltd.Ningxia Shenhe New Material Technology Co., Ltd. MES Ferrotec China Co., Ltd. | |

(From the company’s materials)

Ferrotec was born as a company with highly unique technologies including thermo-electric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in 1980. A wide range of diverse technologies cultivated over more than 40 years were applied in the electronics, automobile, next generation energy, and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and involves in marketing, development, manufacturing, sales, and management while taking advantage of the strengths of each country and region. A holding company structure was implemented from April 2017. In April 2022, due to market reorganization, the company got listed on the Standard Market of TSE.

【Business Segments】

Ferrotec’s operations includes semiconductor seal related products such as Vacuum Feedthrough, quartz products, ceramic products, etc. used in manufacturing equipment of semiconductor, FPD, LED etc., electronic device business centering on thermo-electric modules, “the automotive related business,” which handles mainly thermos-electric modules for in-vehicle systems, substrates for power semiconductors, and sensors, and business segments that are not included in the reportable segments. Other businesses, which handle silicon crystal and solar cell wafers, saw blades, machine tools, surface treatment, industrial washing machines etc.

Semiconductor and other equipment-related business

Ferrotec provides total engineering services in the Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, quartz crucibles, silicon wafer processing and equipment cleaning services.

Vacuum Feedthroughs, which are the company’s mainstay products, are functional parts that transmit rotational motion to the inside of manufacturing equipment while preventing foreign substances, including gas and dust, from entering the inside of equipment. This Vacuum Feedthrough boasts the top market share in the world. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. All of the business fields, however, are easily affected by capital investment, and the company focuses also on entering general fields with relatively stable demand, including conveyers and precision robots. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment).

At the same time, quartz products, ceramic products, CVD-SiC products, and quartz crucibles are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec’s core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this CVD-SiC. CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted. With regard to silicon wafer processing, the company manufactures wafers in sizes of 6 inches (diameter), 8 inches, and 12 inches. It has a large market share accounting for more than half of the manufacturing equipment cleaning market in China.

(From the company’s materials)

Electronic Device Business

Thermal element “thermo-electric modules” are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business.

Thermo-electric modules are mainly used for automotive temperature control seats and many other purposes, including wafer temperature control in semiconductor manufacturing equipment, genetic testing apparatus, optical communications, home appliances, and other application products such as power semiconductor substrates. The company has the largest share in the global market of thermo-electric modules. By developing new products using high-performance materials and reducing costs and improving quality by adopting automated manufacturing lines, the company is stirring new demand and diversifying purposes of use of its products.

The company has the biggest share in the global market of magnetic fluid, which is increasingly used for such newly developed applications as linear vibration motors for smartphones, speakers for 4K-resolution televisions and automobiles, and high-sound-quality headphones. Furthermore, Ohizumi Mfg. Co., Ltd., one of its consolidated subsidiaries, engages in a business of temperature sensors.

Thermos-electric modules for in-vehicle systems, substrates for power semiconductors, and sensors had been included in the electronic device business, but in the first quarter of the fiscal year ending March 2025, they started including them in the automotive related business.

(From the company’s materials)

2. 2Q of Fiscal Year ending March 2025 Earnings Results

【2-1.Consolidated Earnings】

| FY 3/24 2Q | Ratio to sales | FY 3/25 2Q | Ratio to sales | YoY | FY 3/25 (Plan) | Progress rate |

Sales | 105,494 | 100.0% | 135,157 | 100.0% | 28.1% | 265,000 | 51.0% |

Gross Income | 34,311 | 32.5% | 38,111 | 28.2% | 11.1% | - | - |

SG&A | 21,276 | 20.2% | 23,859 | 17.7% | 12.1% | - | - |

Operating Income | 13,035 | 12.4% | 14,251 | 10.5% | 9.3% | 26,000 | 54.8% |

Ordinary Income | 15,217 | 14.4% | 15,470 | 11.4% | 1.7% | 26,000 | 59.5% |

Net Income | 8,390 | 8.0% | 9,190 | 6.8% | 9.5% | 16,000 | 57.4% |

*Unit: million yen.

Performance Exceeding the Initial Forecast of the Company

In the second quarter (2Q) of the fiscal year ending March 2025, they reported a 28.1% year-on-year (YoY) increase in revenue to 135,157 million yen and a 9.3% YoY rise in operating income to 14,251 million yen. The electronics industry as a whole continues to show a steady recovery trend, partially thanks to the strong demand from Chinese local manufacturers. In this environment, the company actively pursued aggressive sales strategies, accurately capturing customer demand, which led to solid revenue growth. Specifically, strong demand from Chinese local manufacturers in the semiconductor manufacturing equipment business and robust demand for thermoelectric modules in the telecommunications sector contributed to sales exceeding the company’s initial projections.

In terms of profit, gross profit margin declined 4.3 points year-on-year, primarily due to increased depreciation in new factories and a decline in quartz crucibles’ profitability amid the downturn in the solar photovoltaic (PV) market, both of which weighed on overall profitability. While selling, general, and administrative (SG&A) expenses increased due to higher research and labor costs, the impact of revenue growth led to a 2.5-point decrease in the ratio of SG&A to sales, allowing the company to maintain an operating income margin of 10.5%. However, due to equity-method investment losses related to wafers and other factors recorded as non-operating expenses, the increase in ordinary income was limited to 1.7% year-on-year.

The rate of progress toward its initial forecast (sales: 120,000 million yen, operating income: 13,000 million yen, ordinary income: 14,500 million yen, and net income: 8,500 million yen) was 112.6% for sales, 109.6% for operating income, 106.7% for ordinary income, and 108.1% for net income.

In light of its performance in 2Q, the company has upwardly revised its full-year forecast, raising its sales target from 235.0 billion yen to 265.0 billion yen, while keeping the forecasts of all kinds of profits unchanged. This revision reflects both stronger-than-expected sales in the cumulative 2Q and anticipated sales growth in the second half across semiconductor and other equipment-related, electronic devices, and automotive related business. However, the initial forecasts of all kinds of profits remain unchanged, as the company has factored in declining profitability due to the sluggish solar panel market and intensifying competition in the power semiconductor sector. Additionally, the assumed average exchange rate for the U.S. dollar during the period has been revised from 150 yen to 152 yen. The company has also raised its interim dividend per share from 50 yen to 55 yen, and its annual dividend forecast from 100 yen to 110 yen.

【2-2.Business Segment Trends】

Business Segment Sales and Profits

| FY 3/24 2Q | Ratio to sales Profit margin | FY 3/25 2Q | Ratio to sales Profit margin | YoY |

Semiconductor and other equipment -related | 60,257 | 57.1% | 84,042 | 62.2% | 39.5% |

Electronic Device | 18,834 | 17.9% | 23,085 | 17.1% | 22.6% |

Automotive related | 14,006 | 13.3% | 14,304 | 10.6% | 2.1% |

Others | 12,396 | 11.8% | 13,723 | 10.2% | 10.7% |

Consolidated Sales | 105,494 | 100.0% | 135,157 | 100.0% | 28.1% |

Semiconductor and other equipment -related | 7,788 | 12.9% | 8,363 | 10.0% | 7.4% |

Electronic Device | 3,335 | 17.7% | 3,992 | 17.3% | 19.7% |

Automotive related | 2,745 | 19.6% | 1,323 | 9.2% | -51.8% |

Others | -179 | - | 793 | 5.8% | - |

Adjustments | -654 | - | -220 | - | - |

Consolidated Operating Income | 13,035 | 12.4% | 14,251 | 10.5% | 9.3% |

*Unit: million yen.

In 1Q of FY 3/2025, the company restructured its reporting segments. Specifically, automotive thermo-electric modules, power semiconductor substrates, and sensors, which were previously included in the electronic device business, have been reclassified and are now included in the automotive related business. The figures for 2Q of FY 3/2024 have been retrospectively adjusted to reflect this new segmentation.

(1) Semiconductor and Other Equipment-Related Business

Sales in the semiconductor and other equipment-related business increased 39.5% year-on-year (YoY) to 84,042 million yen, while operating income rose 7.4% YoY to 8,363 million yen. However, profit margin declined 2.9 points to 10.0%. The business maintained strong sales performance, supported by the recovery trend in the semiconductor market. Notably, orders from manufacturing equipment manufacturers increased for vacuum seals and metal processing, while demand for machined quartz products rebounded. In the ceramics segment, both the recovery of orders from equipment manufacturers and the launch of operations at Changshan Factory contributed to growth. The sales of quartz crucibles surged by 79% YoY, but profitability declined significantly, raising concerns.

Kulim Factory in Malaysia, which handles metal processing, quartz products, ceramics, and equipment assembly, has commenced operations, enabling the company to meet the growing demand from U.S. and other customers for production outside China. More customers are expected to approve their products or services in the second half of the fiscal year.

(2) Electronic Device Business

The sales in the electronic device business increased 22.6% year-on-year (YoY) to 23,085 million yen, while operating income rose 19.7% YoY to 3,992 million yen. However, profit margin declined 0.4 points to 17.3%. Additionally, the consolidated subsidiary Ohizumi Manufacturing (categorized under sensors) recorded a nine-month financial period due to a fiscal year change, with only three months included in the current results. Strong demand driven by generative AI applications boosted sales of thermo-electric modules, while power semiconductor substrates saw a revenue decline from the previous half-year, primarily due to customer inventory adjustments. However, the company expects continued long-term growth in this segment. Furthermore, Johor Plant in Malaysia is scheduled to begin operations in 2025.

(3) Automotive Related Business

Sales in the automotive related business (including thermo-electric modules, power semiconductor substrates, and sensors) increased 2.1% year-on-year (YoY) to 14,304 million yen, while operating income declined sharply 51.8% YoY to 1,323 million yen. As with the electronic device business, the consolidated subsidiary Ohizumi Manufacturing recorded a nine-month financial period due to a fiscal year change, with only three months included in the current results, which should be noted. Thermo-electric module sales surged 73% YoY, driven by expanding demand in the Chinese automotive market, while power semiconductor substrates saw a 9% YoY increase, supported by the growth of AMB substrates for automotive applications.

(4) Other Businesses

Sales in the other business segment, which includes saw blades, machine tools, and silicon products for solar cells, increased 10.7% year-on-year (YoY) to 13,723 million yen, while operating income turned positive, reaching 793 million yen. Although shipments of silicon products for solar cells continued to decline, shipments of machine tools and commercial laundry equipment showed signs of recovery.

【2-3.Financial Condition】

◎Financial Condition

| Mar, 24 | Sep, 24 | Increase Decrease |

| Mar, 24 | Sep, 24 | Increase Decrease |

Current Assets | 248,408 | 289,842 | +41,434 | Current liabilities | 122,148 | 142,651 | +20,503 |

Cash | 117,254 | 120,196 | +2,942 | Payable | 38,334 | 49,747 | +11,413 |

Receivable | 61,940 | 89,046 | +27,106 | ST Interest-Bearing | 47,476 | 50,528 | +3,052 |

Inventory | 56,909 | 68,457 | +11,548 | Noncurrent liabilities | 109,712 | 125,558 | +15,846 |

Noncurrent Assets | 261,618 | 302,947 | +41,329 | LT Interest-Bearing | 87,684 | 101,462 | +13,778 |

Tangible Asses | 201,339 | 239,137 | +37,798 | Total Liabilities | 231,860 | 268,209 | +36,349 |

Intangible Assets | 6,611 | 7,016 | +405 | Net Assets | 278,166 | 324,580 | +46,414 |

Investments and Other Assets | 53,666 | 56,794 | +3,128 | Retained earnings | 79,881 | 86,721 | +6,840 |

Total Asset | 510,026 | 592,790 | +82,764 | Total Assets | 510,026 | 592,790 | +82,764 |

*Unit: million yen.

Total assets increased to 592,790 million yen, up 82,764 million yen from the end of the previous fiscal year. The main factors behind this increase were an increase in accounts receivable and contract assets due to sales increase and an increase in tangible fixed assets due to continued active investment in each business. Current assets grew due to an increase in notes and accounts receivable-trade and inventories in line with sales growth, as well as fundraising.

Total liabilities augmented 36,349 million yen year on year to 268,209 million yen. The main factors behind this increase were an increase in accounts payable and long-term borrowings.

Net assets rose 46,414 million yen year on year to 324,580 million yen due to the 6,840 million yen increase in retained earnings, the 27,233 million yen increase in foreign currency translation adjustments, and the 12,921 million yen increase in noncontrolling shareholders' equity.

◎Cash Flow

| FY 3/24 2Q | FY 3/24 2Q | Increase Decrease |

Operating cash flow | +6,789 | +4,151 | -2,638 |

Investing cash flow | -29,101 | -17,736 | +11,365 |

Free Cash Flow | -22,312 | -13,585 | +8,727 |

Financing cash flow | +41,659 | +12,169 | -29,490 |

Cash and Equivalents at the end of term | 119,666 | 104,368 | -15,298 |

*Unit: million yen.

As of the end of the interim period of FY 3/2025, the balance of cash and cash equivalents stood at 104,368 million yen, representing a year-on-year decrease of 15,298 million yen. The company continues to pursue proactive investments for future growth, with capital expenditures for tangible fixed assets amounting to 22,781 million yen, (33,235 million yen in the same period last year.) To secure funding, the company utilized a pre-tax interim net profit of 15,475 million yen, depreciation expenses of 11,241 million yen, and proceeds from long-term borrowings totaling 20,031 million yen.

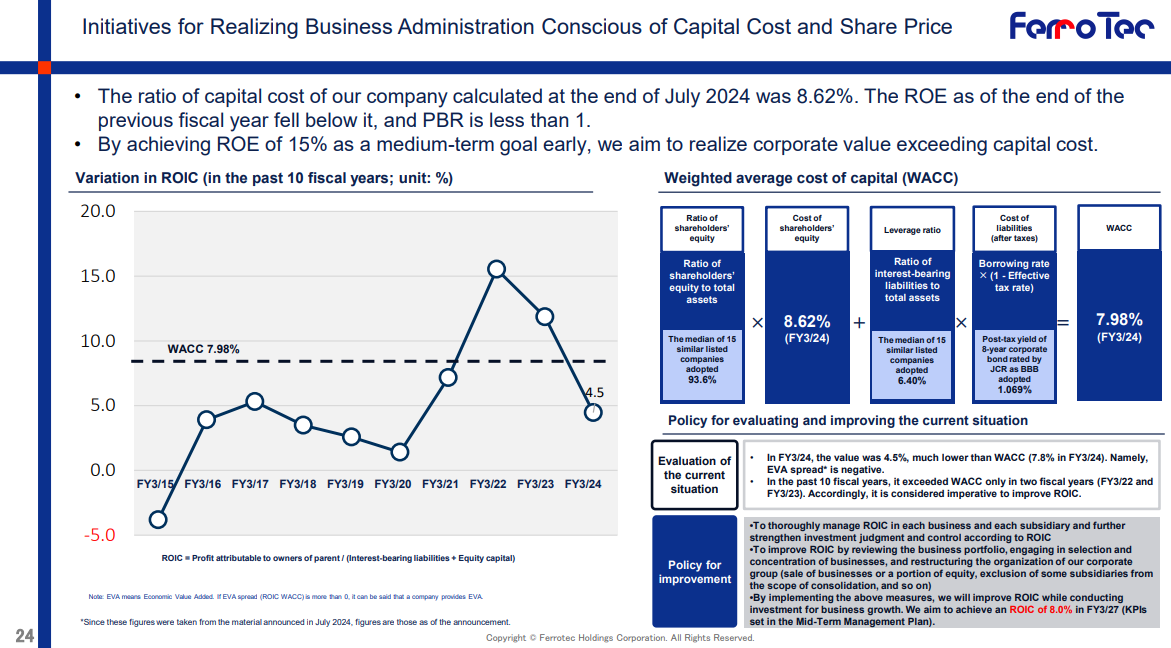

In July 2024, the company disclosed its initiative on "Efforts to Achieve Management Conscious of Capital Costs and Stock Price." As part of this, it calculated its capital cost at 8.62% (WACC: 8.62%) and identified that the primary reason for its PBR (Price-to-Book Ratio) falling below 1 is that its ROE (Return on Equity) is below this capital cost. The company is currently implementing various measures to achieve an ROE of 15%. Additionally, the company has announced dividend increases and share buybacks for FY 3/2025, targeting a total shareholder return ratio of 30%. With a strong focus on capital allocation efficiency, the company’s future strategies and developments will remain a key area of interest.

(From the company’s materials)

3. Fiscal Year ending March 2025 Earnings Forecasts

【3-1.Full Year Consolidated Earnings】

| FY 3/24 | Ratio to sales | FY 3/25 (Initial plan) | Ratio to sales | FY 3/25 (Revised plan) | Ratio to sales | YoY |

Sales | 222,430 | 100.0% | 235,000 | 100.0% | 265,000 | 100.0% | +19.1% |

Operating Income | 24,872 | 11.2% | 26,000 | 11.1% | 26,000 | 9.8% | +4.5% |

Ordinary Income | 26,537 | 11.9% | 26,000 | 11.1% | 26,000 | 9.8% | -2.0% |

Net Income | 15,154 | 6.8% | 16,000 | 6.8% | 16,000 | 6.0% | +5.6% |

*Unit: million yen

It is assumed that overall business performance will be on an upward trend.

The company forecasts that sales will be 265 billion yen (up 19.1% year on year) and operating income will stand at 26 billion yen (up 4.5% year on year) in the full fiscal year ending March 2025. At the time of the disclosure for 1Q of FY 3/2025, the company’s forecast for the cumulative 2Q was revised upwardly, with forecast sales increased by 10 billion yen, operating income by 500 million yen, and ordinary income by 2 billion yen. However, the full-year forecast remained unchanged from the initial forecast. Following the release of the results in 2Q, the full-year forecast has been raised. Regarding all kinds of profits, the company has maintained its previous projections, taking into account concerns over declining profitability in quartz crucibles for solar panels, increased costs associated with new factory start-ups, and intensifying competition in the power semiconductor substrate market.

Meanwhile, the overall assumption remains unchanged that the external environment continues to follow a recovery trend. The demand in the semiconductor industry is expected to pick up gradually from the situation that required device inventory adjustment, which lasted until 2023. Particularly, demand for Graphics Processing Units (GPUs), which are essential for generative AI, and investment in servers are projected to increase in the logic semiconductor field. In addition, prices of memory-related products have recently been on the rise. Therefore, the company expects that factory operating rate will improve and the level of capital investment will go up from the second half of the fiscal year ending March 2025 onward. In the mobile telecommunication system industry, the company projects that demand for high-capacity optical transceivers for servers will grow significantly while investment in the 5th- generation network will be made continuously, which will drive steady demand in general. In the automobile-related market, demand for EVs and self-driving systems is expected to increase on a continuous basis. From the geopolitical perspective, the regulations regarding advanced semiconductor technology that the United States has tightened against China are encouraging semiconductor manufacturers to relocate their manufacturing bases to other countries than China, so they are expanding their manufacturing capacity in Southeast Asian regions in order to relocate their bases to the regions. Demand is expected to grow there in the future. With regard to procurement of raw materials, the company has taken into account some adverse impacts, such as pressure on procurement due to soaring material prices and logistics disruption caused by Russia’s invasion of Ukraine, to a certain extent. The expected exchange rates are 152 yen (changed from 150 yen) for a U.S. dollar and 21 yen for a Chinese yuan.

The reason why ordinary income will decline from the previous fiscal year is that the company will not record a gain on foreign exchange as it did in the previous fiscal year (1,383 million yen).

4. New Mid-Term Management Plan (Reposted)

【4-1 Basic policies of the new mid-term management plan】

The basic policies of the new mid-term management plan with the aforementioned points taken into account are as follows:

Business growth | ➣Pursue growth of businesses related to semiconductors and automobiles, and expand the businesses that have a large share in the industries. ➣Enhance a system in which the plants in Malaysia and Japan accommodate demand for products manufactured in countries other than China and the plants in China handle demand for products manufactured in China. |

Enhancement of production efficiency and competitiveness | ➣Pursue enhancement of production efficiency and competitiveness of the plants by propelling forward digitization and automation in order to further increase the company’s mass production capacity. ➣Continue thorough quality control based on a belief that “quality is our priority,” enhance the research and development system, and propel forward development of new products and technologies. |

Enhancement of human resources and corporate culture | ➣Proceed with recruitment of highly skilled human resources, enrichment of training and education programs, and adoption of share-based compensation plans (restricted share units (RSUs) and performance share units (PSUs)) while considering it as an important business strategy to attach focus on human resources. ➣Instill the guidelines for action, which are “respect our customers, respect our employees, respect diligence and reliability, steadily take action, and pursue innovation,” because corporate culture is the base for a company. |

Financial and shareholder returns | ➣Strive to increase revenues by establishing new plants and allowing them to contribute to business performance as swiftly as possible. ➣Give attention to increasing shareholder returns and endeavor to raise shareholder returns with an eye on a dividend payout ratio of 20-30%. |

*Produced by Investment Bridge Co., Ltd. with reference to disclosed material.

【4-2 Numerical Targets of Mid-term Management Plan】

(million yen) | Mid-term management plan (FY 3/25 – FY 3/27) | |||

FY 3/24 (Act.) | FY 3/25 (Est.) | FY 3/26 (Est.) | FY3/27 (Est.) | |

Sales | 222,431 | 235,000 | 300,000 | 380,000 |

Operating income | 24,873 | 26,000 | 40,000 | 60,000 |

Operating income margin | 11.2% | 11.1% | 13.3% | 15.8% |

Net income | 14,953 | 16,000 | 22,000 | 30,000 |

ROE | 7.7% |

|

| 15.0% |

ROIC | 4.4% |

|

| 8.0% |

Shareholder’s equity ratio | 40% | 40% | ||

Investment amount | 75,227 | 60,000 | 40,000 | 40,000 |

Dividend per share (yen) | 100.0 | 100.0 | Ferrotec Holdings sets its eye on a payout ratio of 20% - 30%. | |

*ROIC = Net income attributable to owners of the parent / (interest-bearing liabilities + net assets); Net assets do not include share acquisition rights or non-controlling shareholders’ equity.

*The investment amount is a sum of tangible fixed assets, intangible fixed assets, securities to be acquired, and any other relevant factors. It varies depending on investment opportunities for mergers and acquisitions.

(Produced by Investment Bridge Co., Ltd. with reference to disclosed material.)

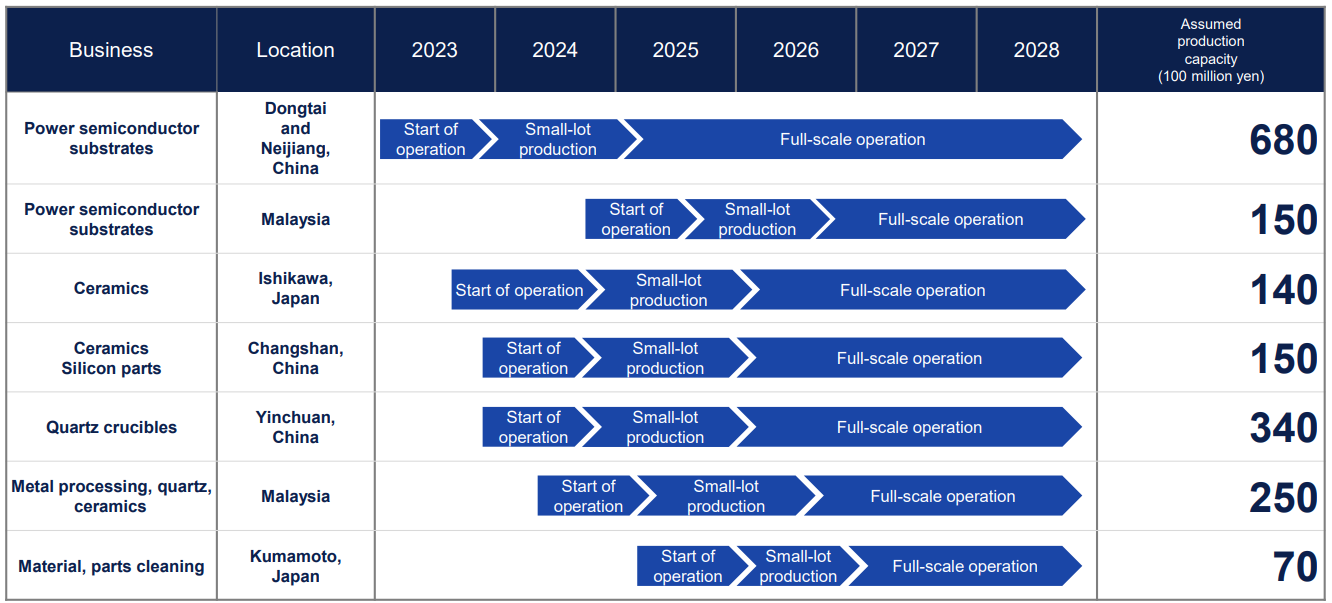

Regarding the compound annual growth rate (CAGR) for the three fiscal years starting in the fiscal year ended March 2024, the company forecasts that sales will grow 19.5% and operating income will rise 34.1%. While the semiconductor market declined in 2023, it rallied in 2024 and the market scale in 2030 is expected to be 1.7 times larger than that in 2024. Manufacturing equipment-related demand is projected to get on an upward trend in 2024. The company believes that the Chinese market can boom for a certain extent while the semiconductor trade friction between the United States and China still has an impact.

Ferrotec Holdings plans to make a capital investment of a cumulative total of 140 billion yen for the three fiscal years. In addition, the estimated amount of mergers and acquisitions is 10 billion yen although it may change depending on investment opportunities. It is based on the fact that the company has received requests from semiconductor-related clients to increase its capacity from 2025 onward, strengthening of manufacturing systems in other countries than China, and continued investment in the automobile segment, including power semiconductor substrates. The company expects that it will improve free cash flow by steadily increasing cash flow from operating activities.

【4-3 Results and Targets by Category】

(million yen) | FY 3/23 (Act.) | FY 3/24 (Act.) | FY 3/25 (Est.) | Plan for FY 3/26 | Plan for FY 3/27 |

Quartz products | 28,837 | 28,242 | 28,849 | 35,000 | 40,000 |

Ceramics | 27,194 | 24,314 | 23,913 | 36,000 | 44,000 |

CVD-SiC | 4,812 | 6,837 | 7,555 | 11,000 | 15,000 |

Silicon parts | 17,542 | 14,604 | 14,333 | 20,000 | 25,000 |

Thermo-electric modules | 23,226 | 22,893 | 24,015 | 29,000 | 39,000 |

Power semiconductors | 20,010 | 32,527 | 35,411 | 44,000 | 66,000 |

(Produced by Investment Bridge Co., Ltd. with reference to disclosed material.)

<Quartz>

In the fiscal year ended March 2024, sales of quartz products shrank only 2.0% year on year because the company endeavored to make recovery from the adverse impact of the downturn in the semiconductor market by taking advantage of the booming Chinese market. While it is projected that sales in the fiscal year ending March 2025 will be almost at the same level because users are expected to use up their stocks, the company believes that sales will fully get on the rise after the fiscal year ending March 2026. Accordingly, it intends to increase its manufacturing capacity in Malaysia and Kumamoto Prefecture in Japan (with an amount to be invested being over 20 billion yen). It will deal with needs of European and American clients for products manufactured in other countries than China at its Malaysian plant.

<Ceramics>

The Chinese market boomed, but sales dropped 10.6% year on year in the fiscal year ended March 2024 due to the downturn in the semiconductor market. The company continued proactive investment in increasing its manufacturing capacity through such measures as establishment of new plants in Changshan in China, Ishikawa Prefecture in Japan, and Malaysia. Regarding the future outlook, the company projects that this segment will fully get on an upward trend after the fiscal year ending March 2026 while taking into account the impact of users’ plans to use up their stocks as in the quartz segment.

<CVD-SiC>

Demand for CVD-SiC was strong, allowing sales to grow 42.1% year on year in the fiscal year ended March 2024. With demand by semiconductor-related clients is expected to grow on a continuous basis, the company will strive to increase the manufacturing capacity by enhancing plants in Changshan in China and Okayama Prefecture in Japan.

<Silicon parts>

The company is increasing its manufacturing capacity through such measures as establishment of a new plant in Changshan in China because demand is expected to grow in the medium term. It, however, considers it difficult to raise sales in the fiscal year ending March 2025 owing to the potential impact of changes in the market value of inventory.

<Thermo-electric modules>

Sales shrank only 1.6% year on year in the fiscal year ended March 2024. The principal reasons are that sales of thermo-electric modules for bio equipment, such as PCR equipment, peaked out and manufacturing of thermo-electric modules for 5th-generation (5G) telecommunication equipment has reached a phase of adjustment. Optical transceivers related to generative AI grew in sales. From now on, it is expected that demand for generative AI-related thermo-electric modules will become strong and that for thermo-electric modules for 5th-generation telecommunication equipment will get on an upward trend. In addition, the company has a high hope for increases in investment by China in the 5G-Advance technology and demand for it.

<Power semiconductors>

In the second half of the fiscal year ended March 2024, the company needed to adjust manufacturing of power semiconductors, but medium-term demand continues to be on an upward trend. It intends to make proactive investment in increasing its capacity on a continuous basis. Believing that demand for power semiconductor substrates will continue to grow in the medium term, the company plans to broaden its product range of DCB, AMB, and DPC.

【4-4 Details of major plants newly established and increases in principal manufacturing capacities】

(From the company’s materials)

◎Shareholder Return

Focusing on increasing shareholder returns, the company will set its eye on a dividend payout ratio of 20-30% for the time being. Accordingly, a dividend is to be 110 yen per share (with a payout ratio being 29.4%) in the fiscal year ending March 2025.

◎ Long-term goals

The company has not revised its numerical goals set in the long-term vision, that is, sales of 500 billion yen and a net income of 50 billion yen in fiscal year ending March 2031.

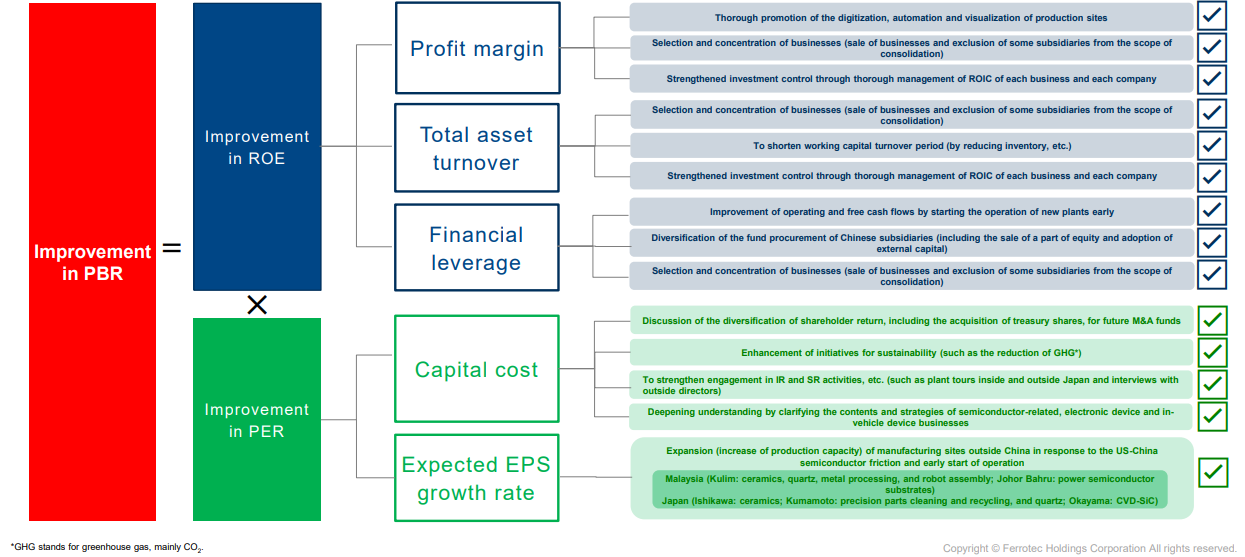

5. Measures for Achieving Management Conscious of Capital Costs and Stock Price

On July 31, the company disclosed its initiative on "Measures for Achieving Management Conscious of Capital Costs and Stock Price." This section outlines the key points of that disclosure.

The company has defined its shareholder equity cost at 8.62% for FY 3/2024, calculated using the Capital Asset Pricing Model (CAPM). The assumptions for this calculation include a risk-free rate of 1.735% (20-year government bond yield), a β of 1.043 (for the semiconductor manufacturing equipment industry), and an equity risk premium of 6.60%. The company's ROE for FY 3/2024 was 7.8%, falling below its shareholder equity cost, which is considered as the primary reason for its PBR (Price-to-Book Ratio) remaining below 1. Recognizing the urgent need to enhance profitability above its shareholder equity cost, the company has set a target of achieving an ROE of 15%. To reach this goal, it plans to drive business and profit growth, strengthen profitability, implement effective ROIC management, focus on business selection and concentration to improve total asset turnover, and optimize financial leverage. Additionally, the company aims to improve its PER (Price-to-Earnings Ratio) through enhanced shareholder return policies and the further strengthening of non-financial strategies. The specific initiatives to achieve these goals are outlined below.

(From the company’s materials)

As achieving the medium-term management plan is essential to meeting these targets, the company has also announced a transition to a performance-linked compensation system, which strengthens both short-term and medium-to-long-term incentives, further aligning executive remuneration with business performance.

6. Conclusions

The semiconductor market is gently recovering, but there remain uncertainties over the stock market, because Mr. Trump assumed the presidency. While there are growing uncertainties over some fields, including solar panels and EVs, demand is strong in many fields, including vacuum seals, metal processing, and thermos-electric modules for generative AI. We hope to realize again that Ferrotec Holdings Corporation operates business in a broad range of fields, so it can control its product portfolio according to market conditions. Regarding production sites, not only Changshan Plant in China, but also Kulim Factory in Malaysia started operations, so they can meet a variety of demand from global enterprises. The market is cyclical, but they have carried out upfront investment, so stable growth became more feasible. This is noteworthy.

From the viewpoint of the portfolio of their corporate group, they are making efforts to enable the diversification of fund procurement through diverse purchase structures. Regarding FTSVA, which is a parts cleaning subsidiary listed in China, it will be possible to circulate funds by selling some shares listed on December 30, 2022 from 2026. We would like to pay attention to the diversification of fund procurement and the improvement in share value based on the capital market. The Chinese regulations limit the number of shares a controlling shareholders can sell in a certain period of time, so it is necessary to keep in mind that they must follow the regulations when selling shares.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 9 directors, including outside ones 3 |

Auditors | 3 auditors, including outside ones 2 |

◎ Corporate Governance Report (Updated on August 6, 2024)

Basic policy

While pursuing our corporate principles: “Strong commitment to our customers,” “Excellence in engineering precision solutions,” and “Delivering superior quality, value and service,” our corporate group has drawn up a code of conduct as follows: From a global perspective, Ferrotec always operates in harmony with the international community and acts in good faith with unwavering corporate ethics and social decency, as well as in compliance with the laws of each country as a company that provides products and services that contribute to everyday life of the people all over the world who are related to us; Ferrotec earns customer trust and satisfies our customers by proposing high-quality products and services and providing cost-competitive products and services mainly in the new energy and electronics industries; Considering proactive eco-friendly activities to be one of our high-profile business issues, Ferrotec contributes to solving global environmental problems by adapting ourselves to the requirements of the latest environmental regulations one by one and developing materials and products that can be used in the new energy industry; and Ferrotec contributes to society through manufacturing based on our core technology, continues to be a company whose stakeholders, including customers, shareholders, employees, business partners, and local communities, are looking forward to seeing it grow, and engages in business activities based on social decency, such as laws, social order, and international rules.

Our company not only proactively promotes environmental preservation activities and our corporate group’s governance pursuant to the aforementioned corporate principles and code of conduct, but also strives to continue being a company whose stakeholders look forward to its growth. We have also formulated a quality philosophy saying that we focus on developing new materials and production technologies, such as semiconductor materials, and pursue customer satisfaction improvement by giving top priority to quality, and are moving forward with automation, digitalization, and standardization of our production processes. Our basic business policies are to increase our share in the global market and form a corporate group with a stable profit structure.

Based on the above corporate principles, code of conduct, and basic management policy, the company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code>

<Supplementary Principle 1-1-1: Analysis of Reasons Behind a Considerable Number of Opposing Votes at a General Shareholders’ Meeting> While our company has not set the criterion for a “considerable number” in case a considerable number of opposing votes was cast at a general shareholders’ meeting, we shall consider defining the criterion from now on. In case a considerable number of opposing votes was cast, we shall swiftly analyze the reasons behind the opposition and the cause for the increase of opposing votes and present our view of the issue, such as making a press release of the analysis results.

<Supplementary Principle 1-2-3: Appropriate Setting of Dates for General Shareholders’ Meetings and Associated Events> Viewing constructive dialogue with all shareholders as important, we endeavor to disclose and send notices of convocation of general shareholders’ meetings at an early point and organize these meetings to avoid holding them on the same days as such meetings held by other companies. However, as a result of taking into account the dates for producing statutory documents, the fact that we wish to proceed with administrative work for the settlement of accounts while securing sufficient time for a high-quality audit, the period for convocation procedures and the venue’s availability, the latest four meetings were inevitably held on days on which such meetings are usually held. We shall keep considering dates for these meetings to avoid holding them on the same days as such meetings held by other companies while taking into consideration the aforementioned points.

<Principle 1-7: Transactions Among Parties Concerned> In case our company is to engage in transactions among parties concerned, deliberation and resolution by the Board of Directors in accordance with the Board of Directors regulations and authority rules in addition to laws and regulations are deemed necessary, and directors with interests in the relevant transaction may not participate in passing the resolution. Transactions among parties concerned are based on the same conditions as transactions among companies with no capital ties, and we make sure that these transactions are not detrimental to the interests of minority shareholders in terms of their propriety. Every transaction among concerned parties is explained in writing at a Board of Directors’ meeting before the transaction is performed, entailing the amount of the transaction, the propriety and reasonableness of transaction conditions and pros and cons of engaging in the transaction. Only transactions judged to be appropriate following a discussion are approved. Moreover, in case of long-term contracts, continuous transactions, etc., we make sure to pass a resolution by the Board of Directors concerning the amount of the transaction, the propriety and reasonableness of transaction conditions and pros and cons of engaging in the transaction at least once a year. On the other hand, as the in-house rules do not clearly mention a prompt report to the Board of Directors after the relevant transaction, the post-transaction report is forgotten at times. We shall revise the in-house rules or formulate new management rules that clearly state not only approval before the transaction is performed, but also the obligation of a post-transaction report, and work on spreading this knowledge, striving to implement reasonable procedures concerning transactions among concerned parties free of any omission.

<Supplementary Principle 2-4-1: Ensuring diversity in promotion to core human resources>

As a basic policy for human capital, the group operates under two major policies regarding organizations and human resources. The first is to create a company and organization, in which each employee, regardless of their attributes, can act autonomously and with ambition and have a sense of fulfillment in their work. The second is to localize management, make decisions quickly, and manage the business and the organization according to the characteristics of each region.

While our business is expanding on a global basis, our corporate group drastically strengthens our human resources and organization and proactively employs women, foreign nationals, and mid-career workers with extensive skills and experience to raise our corporate value in the medium/long term. In addition, we actively promote women, foreign nationals, and mid-career hires to managerial positions by comprehensively considering and evaluating such factors as their skills and valuable experience cultivated in companies outside of our corporate group.

We, however, have not disclosed our medium- and long-term policies on promoting women, foreign nationals, and mid-career hires to managerial positions and ensuring diversity, policies on human resources development, policies on internal environment development, and our progress and achievement in this regard.

In the future, in order to contribute to the medium/long-term enhancement of corporate value in line with the expansion of the global corporate scale, the company will proactively have discussions to set policies for personnel development and the internal environment and disclose the progress of them, under its basic policy on human capital.

<Supplementary Principle 3-1-3: Disclosure of initiatives on sustainability and business strategies, such as investment in human capital and intellectual property>Following our corporate principles: “Strong commitment to our customers, excellence in engineering precision solutions, and delivering superior quality, value and service,” our company has framed a basic policy on materiality and sustainability in 2021 because we consider ESG (Environment, Social, and Governance) to be extremely important for medium- and long-term improvement of our corporate value. We will build an organizational structure, enlighten our employees, and set quantitative goals for promoting ESG. Regarding investment in human capital and intellectual property, our Japanese subsidiaries proactively promote young employees to the position of executive officer and flatten their organizations. Meanwhile, our Chinese subsidiaries actively invest in intellectual property by, as necessary, founding research institutes related to semiconductors, employ a greater number of human resources who have degrees equivalent to doctor’s degrees, and granting their employees awards and rewards for superb patent applications. We will monitor quantitative goals that we set and announce our progress with them via our website, IR material, and other means.

<Supplementary Principle 4-12-1: Stimulation of Deliberation at Board of Directors’ Meetings> At our company, materials for the Board of Directors meetings are distributed beforehand (two days before the meeting) by e-mail, etc., and a preliminary briefing is held on the day before or on the day of the meeting. Matters to be reported or brought up for discussion to the Board of Directors are presented at the Executive Officers’ meeting (held at the end of every month), which functions as a management meeting, and shared with participating directors and auditors. A report of the Executive Officers’ meeting is distributed to directors and auditors who did not attend this meeting. Regarding the schedule of Board of Directors’ meetings, Executive Officer meetings, etc., we distribute a meeting calendar every year, scheduling the Board of Directors’ meeting on financial results, etc. beforehand. As a truly substantial number of items is raised for deliberation, directors including external directors are requesting us to secure a preparation period for the deliberation by distributing materials for the Board of Directors’ meetings earlier than two days before the meeting and revise the scope of items brought up for a resolution or report. Regarding additional questions concerning the materials for passing a resolution, the awareness and system for reporting at our company, including the swift collection of information by the responsible person in each department, have been acknowledged by external directors. Resolutions in writing in accordance with Article 370 of the Companies Act are performed as required. As it has been pointed out that the time for deliberating on each matter is insufficient, we recognize it as a challenge that calls for improvement.

<Supplementary Principle 4-14-2: Policy Concerning the Training of Directors and Auditors> Our basic policy lies in explaining the general role and duties of directors and auditors as well as the details of our business, financial affairs, organization, etc. to directors and auditors when they are appointed. Furthermore, we arrange their attendance at important meetings, such as the Executive Officers’ meetings, management strategy meetings and global meetings, as well as inspections of manufacturing sites to deepen their understanding of our company. Moreover, directors and auditors respectively attend external seminars in addition to the training in accordance with our basic policy. From now on, we shall stipulate the policy on this training for directors and auditors and disclose it on our website, etc.

<Main Disclosure Based on the Principles of the Corporate Governance Code>

<Principle 1-1: Securing the Rights of Shareholders> While making sure that the rights of shareholders, such as the voting right at general shareholders’ meetings, are rightly secured, we arrange the system for fulfilling the role and duties concerning corporate governance. Moreover, we are sufficiently considerate in order to secure the equality of rights of minority shareholders, such as organizing briefing sessions after general shareholders’ meetings and securing opportunities and points of contact for dialogue, for example, individual phone calls handled by the IR and PR department.

<Principle 1-3: Basic Policy for Capital Strategy> [Basic philosophy] We believe that sustainable growth is necessary for elevating our stock value in the medium to long term. In order to achieve it, we aim to elevate profitability and maximize our capability to generate cash, which will lead to the maximization of stock value, while thoroughly pursuing business and profit growth. Moreover, we make it a policy to strive for enriching shareholder return while securing the balance between investments toward growth in the medium to long term, and capital efficiency and financial soundness.

<Principle 1-4, Supplementary Principle 1-4-1, Supplementary Principle 1-4-2: Strategically Held Shares> We define and operate the policy regarding strategically held shares and the criteria for exercising the voting rights stemming from strategically held shares as follows.

1. Our policy regarding strategic shareholding

Our basic policy lies in holding no shares strategically. However, we hold the shares of other companies only in cases where we judged that it is highly reasonable to hold the relevant shares in terms of the relationship with the issuing company, such as shares of our business partners. The president’s office regularly inspects the reasonableness of holding these shares and presents the findings to the Board of Directors. Regarding the concrete inspection method, the Board of Directors inspects whether the objective for holding the shares is appropriate or not, whether the benefits and risks stemming from holding the shares correspond with the capital cost, etc., and forges ahead with reducing strategically held shares based on the inspection results. On a Board of Directors’ meeting held in June 2024, we decided to conditionally hold the shares of one company and keep holding the shares of five companies as a result of a careful examination.

2.Our criteria for exercising the voting rights stemming from strategically held shares

With regard to exercising voting rights, we respect the judgment of the Board of Directors of the company that issued the relevant shares as a general rule, and make affirmative judgments in voting unless the matter in question negatively impacts the relationship and transactions with our corporate group, or it can be surmised that it will clearly degrade common interests of shareholders.

3.Response to strategically held shares of our company

Apart from the aforementioned, in case a company that strategically holds our shares expresses the intention to sell these shares, we respond appropriately to the sale, etc., without making any obstructions to the sale, such as implying a reduction in transactions.

<Principle 1-5: The So-Called Anti-Takeover Measures> We have not adopted any so-called anti-takeover measures at our company. In case our shares are offered in a takeover bid, our Board of Directors carefully examines its objective and content, and announces our company’s opinion. In case the Board of Directors judges that it is necessary from the viewpoint of maintaining and elevating corporate value, we suggest appropriate measures while taking care so as not to unjustly hinder the right of the shareholder to accept the takeover bid.

<Principle 1-6: Capital Policy that May Harm Shareholder Interests> With regard to drafting and implementing the capital policy, our Board of Directors passes the resolution following a sufficient consideration of the necessity and reasonableness so as not to unjustly harm existing shareholders.

<Principle 2-1: Formulation of Management Philosophy as the Foundation for Elevating Corporate Value in the Medium to Long Term> We engage in business activities in accordance with the three pillars of our management philosophy, which are “being trusted by customers and gaining their satisfaction,” “contributing to resolving global climate issues” and “contributing to the society through craftsmanship,” in order to pursue harmony between the global society and local societies from a global standpoint and act in a sincere way as a company offering products and services that can contribute to the lives of all kinds of people.

<Principle 2-2: Formulation and Implementation of Regulations for Corporate Conduct> In order to realize our management philosophy, we have expressed our values as a company and defined the following code of conduct as regulations to be complied with by the company members.

1. “As a company that constantly pursues harmony with the global society and offers products and services that can contribute to the lives of people in local societies and other worlds that are relevant to us, we shall not only adhere to the laws and regulations of each country, but also act earnestly in accordance with firm corporate ethics and social common sense.”

2. “We uphold being trusted by our customers and gaining their satisfaction by proposing high-quality products and services mainly in the new energy industry and electronics industry, and offering cost-competitive products and services.”

3. “We view the proactive promotion of activities considerate toward global climate as an important challenge in terms of management and will gradually adapt to the latest demand for environmental restrictions. Moreover, we uphold the development of materials and products that can be used in the new energy industry, contributing to resolving global climate issues.”

4. “We will contribute to the society through craftsmanship utilizing core technologies and keep being a company whose growth can be anticipated by stakeholders such as our clients, shareholders, employees, business partners and local communities. Furthermore, we will follow social common sense, complying with laws and regulations, social order and global rules in our corporate activities.”

<Principle 2-3: Issues related to sustainability, mainly social and environmental issues>The semiconductor manufacturing process has a significant environmental load, and solving this is a challenge for the entire industry. The company sells products such as thermo-electric modules, which are CFC-free temperature control devices, and power semiconductor substrates and ferrofluids that effectively reduce power consumption. The company also relies on clean energy, using solar panels in power generation at our plants in Japan and China. Thus, our business activities contribute to reducing greenhouse gases, leading to environmental pollution reduction. In March 2023, the "Sustainability Committee" was established as a committee under the Company's Board of Executive Officers to check the status of sustainability initiatives, review and deliberate on them, and report to the Board of Directors and other relevant bodies when necessary in order to examine and promote sustainability on a company-wide basis. The number of university students in financial distress is increasing due to the COVID-19 crisis. Therefore, the company supports the Akira Yamamura Scholarship Foundation, which provides scholarships to engineering students to develop talented human resources who can contribute to society in the future.

<Principle 2-4: Ensuring diversity, including active participation of women>

Believing that working with employees who have different experiences and senses of values within a company is an advantage in ensuring sustainable business growth especially when companies operate globally like our company, we endeavor to ensure diversity, including active participation of women, based on our policy of entrusting each of our local subsidiaries with management of their own companies.

<Principle 2-5, Supplementary Principle 2-5-1: Whistleblowing> We have arranged the whistleblowing system, clearly stating that whistleblowing will not be met with any unfavorable treatment. We have posted a notice concerning whistleblowing on our in-house intranet with the objective of understanding and spreading the knowledge of the whistleblowing system. Furthermore, we have set up a consultation desk inside and outside the company and respond accordingly in compliance with the whistleblowing system.

<Principle 2-6: Fulfilling the Function as the Asset Owner of Corporate Pension> Corporate pension is operated by the corporate pension fund (hereinafter referred to as the “Corporate Pension Fund”). We have confirmed that the Corporate Pension Fund fulfils the function as the asset owner of corporate pension. The Corporate Pension Fund has confirmed that all domestic institutions responsible for stock management have accepted the Stewardship Code. Furthermore, it monitors institutions responsible for management in terms of constructive dialogue with investees and the situation concerning the exercising of voting rights, and also confirms concrete cases of Stewardship activities at this point. Moreover, it checks the accuracy and transparency of information provided by the corporate pension consultant, etc. Conflicts of interest are appropriately managed by concluding a contract for entrusting the selection of individual investees and the exercise of voting rights to an institution responsible for management.

<Principle 3-1: Enrichment of information disclosure>

(i) Our company’s corporate principles, medium-term business plans, corporate governance, and ESG/SDGs

In addition to appropriately disclosing information in accordance with relevant laws and regulations, our company discloses on our website information relating to our corporate principles, medium-term business plans, corporate governance, Environment, Social, and Governance (ESG), and Sustainable Development Goals (SDGs) with the aim of ensuring transparency and fairness of our company’s decision-making and realizing an effective corporate governance system.

1) Corporate principles: https://www.ferrotec.co.jp/company/company_philosophy.php

2) Medium-term business plans: https://www.ferrotec.co.jp/ir/ir_ml_plans.php

3) Corporate governance: https://www.ferrotec.co.jp/esg/esg_governance.php

4) ESGhttps://www.ferrotec.co.jp/esg//SDGs:

(ii) Basic views and basic policies on corporate governance

Our company’s views and policies on corporate governance are as described in “1. Basic views on corporate governance, capital structure, corporate attributes, and other basic information” of this report.

(iii) Policies and procedures followed by the Board of Directors when determining compensation for management executives and directors

1. Basic policies

Our company attaches weight to the following points as the basic policies on compensation paid to the directors of our corporate group:

(1) Directors (excluding outside directors)

・Our company acquires talented human resources who are capable of contributing to fulfillment of our company’s mission from inside and outside our company.

・The compensation system shall be one that our company can maintain.

・The compensation system shall be one that motivates directors to attain business targets and raise medium- and long-term corporate value and contributes to sustainable growth of our corporate group.

・The compensation determination process shall be transparent, fair, and rational from the perspective of accountability to all stakeholders including shareholders.

(2) Outside directors

・The compensation system for outside directors shall be appropriate for their roles and duties of supervising our company’s business from an independent and objective standpoint.

2. Compensation composition and level

Compensation for the directors who serve concurrently as executive officers (hereinafter referred to as Executive Officers and Directors) consists of basic compensation (fixed compensation) that is determined according to such matters as the title, short-term performance-linked remuneration, and medium- and long-term performance-linked remuneration (hereinafter referred to as share-based remuneration). The ratio of basic compensation and short-term performance-linked remuneration and share-based remuneration is approximately 1:1:1 for the reference amount of compensation paid to the representative director and president (on a consolidated compensation basis), and the ratio for other Executive Officers and Directors is determined according to such factors as the significance of their duties. Our company does not have any system of retirement benefits for offices in place. Compensation for outside directors and Audit & Supervisory Board members shall be comprised only of basic compensation (fixed compensation) with their roles and responsibilities taken into account.

When determining compensation composition and levels, our company shall take into account results of comparison with the market levels by utilizing a variety of information and data, including objective data on compensation market research conducted by outside specialized organizations.

3. Incentive remuneration

Incentive remuneration shall be provided according to such factors as achievements in the indicators defined in medium-term business plans whose basic policies are designed to thoroughly pursue growth and shall consist of short-term performance-linked remuneration and medium- and long-term performance-linked remuneration that is paid through a share-based compensation system including restricted share units (RSUs) and performance share units (PSUs) in order to strongly encourage directors to execute their duties in accordance with the business principles and business strategies under a compensation system that is linked with such achievements as business results and the corporate value.

4. Compensation governance

Based on a resolution made by the Board of Directors, our company delegates to the representative director and president the responsibility to determine compensation by convening the compensation committee, consulting it, and respecting the opinions given during the consultation pursuant to the provisions set forth in relevant regulations in order to ensure fairness and transparency. The majority of our company’s compensation committee are made up by independent outside directors. The compensation committee provides opinions or submits reports to the Board of Directors as necessary by taking into account the latest situation and market trends regarding the environment surrounding compensation for officers, results of compensation comparisons with other companies, and other advice. Furthermore, our company has appointed an outside compensation consulting company (Willis Towers Watson or WTW for short) as our advisor.

5. Compensation for outside directors and others

Compensation paid to our company’s outside directors consists only of fixed compensation (basic compensation) in light of their role in supervising our company’s business from an objective and independent standpoint. The level of the fixed compensation paid to our outside directors shall be determined in reference to the latest situation and market trends regarding the environment surrounding compensation for outside directors, results of compensation comparisons with other companies, and advice from the outside compensation consulting company while taking into account multifarious factors, including their roles in such committees as the compensation committee and experience that each outside director has gained.

(iv) Policies and procedures followed by the Board of Directors when electing and dismissing the management executives, and nominating candidates for directors and Audit & Supervisory Board members

Our company has defined criteria and a procedure for electing candidates for directors and criteria and a procedure for electing candidates for Audit & Supervisory Board members as follows:

(Criteria and a procedure for electing candidates for directors)

1. Criteria for electing candidates for directors

The Board of Directors must elect candidates for directors only after the nominating committee carefully considers the eligibility of each candidate as a director. Candidates shall be those who are believed to be capable of carrying out the roles and duties provided for in the Companies Act, our company’s articles of incorporation, and the regulations of our Board of Directors. Specifically, candidates shall be elected based on comprehensive judgment of such factors as personality, capabilities, and work history with the following points used as criteri

1) Candidates shall be highly motivated to expand, grow, manage, and operate our business through corporate activities

2) Candidates shall have convictions and abilities to take action that bring benefits to our corporate group, our shareholders, our employees, and the society.

3) Candidates shall have broad perspectives, foresight, decisiveness, and leadership.

4) Candidates shall have health conditions that do not prevent them from serving out their terms as directors

5) Two or more candidates shall, in principle, be elected as candidates for outside directors. From the perspective of corporate governance, candidates for outside directors shall be elected from those who satisfy the following conditions:

① Candidates shall have experience in managing other companies or organizations and have successively held positions as directors and other equivalent positions as senior executives, or candidates shall have such qualifications for lawyers and accountants.

② Candidates shall have no special interest with the representative director, other directors, or major employees and thus have no issue with ensuring independence.

③ Candidates shall be capable of expressing objective opinions to the representative director and the Board of Directors disinterestedly as outside directors.

④ Candidates shall be capable of supervising execution of duties by the directors.

2. Procedure for electing candidates for directors

Candidates shall, in principle, be elected in accordance with the following procedure:

Candidates shall be identified after the representative director considers the quality and brief personal record of each candidate recommended by the representative director or any of the directors and holds an interview with him or her, and the nominating committee shall deliberate about each candidate. Then, the Board of Directors shall begin deliberations and determine whether to present proposals to resolve to elect them as candidates for directors at ordinary general meetings of shareholders.

(Criteria and procedure for electing candidates for Audit & Supervisory Board members)

1. Criteria for electing candidates for Audit & Supervisory Board members

Candidates shall be those who are believed to be capable of carrying out the roles and duties specified in the Companies Act, our company’s articles of incorporation, the regulations of the Audit & Supervisory Board. Specifically, candidates shall be elected based on comprehensive judgment of such factors as personality, capabilities, and work history with the following points used as criteri

1) Candidates shall have health conditions that do not prevent them from serving out their terms as audit & supervisory committee members.

2) Independence from the owner of our company and the executive members shall be ensured.

3) Candidates shall satisfy one of the following:

① Candidates shall have thorough knowledge and experience regarding such subjects as accounting and legal affairs relating to company management.

② Candidates shall have thorough knowledge and experience, and any other relevant abilities regarding the business areas specified in our company’s articles of incorporation.

③ Candidates shall have thorough knowledge and experience, and any other relevant abilities that allow them to be familiar with administrative work and recognize the importance of business resources.

4) Over half of candidates for Audit & Supervisory Board members shall be elected as candidates for outside Audit & Supervisory Board members, and the candidates shall be elected with the following items, in particular, taken into account regarding their relationships with our company: