Bridge Report:(6498)KITZ the second quarter of the Fiscal Year ending December 2020

President Yasuyuki Hotta | KITZ Corporation (6498) |

|

Company Information

Market | TSE 1st Section |

Industry | Machinery (Manufacturing) |

President | Yasuyuki Hotta |

HQ Address | 1-10-1 Nakase, Mihama-ku, Chiba, Japan |

Year-end | December |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥551 | 89,643,584 shares | ¥49,393 million | 6.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥8.00 | 1.5% | ¥22.17 | 24.9x | ¥819.75 | 0.7x |

*Share price is as of closing on November 20. The number of issued shares is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter. ROE is the results of the previous term.

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | Dividend (¥) |

March 2017 Act | 114,101 | 8,929 | 8,799 | 5,400 | 51.43 | 13.00 |

March 2018 Act | 124,566 | 10,117 | 9,733 | 6,518 | 65.50 | 17.00 |

March 2019 Act | 136,637 | 11,713 | 11,883 | 5,625 | 58.50 | 20.00 |

March 2020 Act | 127,090 | 6,950 | 7,241 | 4,937 | 53.06 | 20.00 |

December 2020 Est. | 82,500 | 3,300 | 3,000 | 2,000 | 22.17 | 8.00 |

*The estimated values are based on the forecasts made by the company. Unit: million-yen, yen. The fiscal year ending December 2020 will be a nine-month period due to the change of the closing month.

This Bridge Report presents details and analysis of KITZ Corporation’s earnings results for the second quarter of the Fiscal Year ending December 2020 and earnings estimates for the Fiscal Year ending December 2020.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of Fiscal Year ending December 2020 Earnings Results

3. Fiscal Year ending December 2020 Earnings Estimates

4. Conclusions

<Reference: Initiatives based on ESG and SDGs>

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year ending December 2020, sales and operating income fell 10.3% and 3.1% year on year, respectively. While all three business segments saw a decline in sales, performances were largely in line with the expectation. Meanwhile, the valve manufacturing business witnessed higher-than-anticipated profit, and losses for the brass bar manufacturing business and other business were offset more than the company expected.

- In the fiscal year ending December 2020, which will be an irregular nine-month period due to the change of the closing month, sales and operating income are forecasted to fall 12.3% and 34.1% year on year, respectively. The company raised its earnings estimates to reflect a higher-than-expected recovery of the brass bar manufacturing business and hotel business. The year-end dividend is to be 3 yen/share, with the annual dividend coming to a total of 8 yen/share when combined with the dividend of 5 yen/share paid at the end of the second quarter (estimated dividend payout ratio is 36.1%; total payout ratio is estimated to be 123.9% when factoring in the acquisition of treasury shares completed in August).

- In the fiscal year ending December 2021, earnings are projected to enter a moderate recovery after bottoming in the third quarter of this fiscal year. In the valve manufacturing business, demand for valves for domestic building facilities is weak. As such, performance for the third quarter is expected to be worse than the second quarter, but to recover moderately after significant progress is seen with inventory adjustments. In overseas, oil & gas-related operations in Europe and the U.S. continue to struggle amid the resurgence of the COVID-19 pandemic and sluggish crude oil prices, but negative impact on this front is unlikely to reach the scale seen in the spring earlier this year. In the ASEAN region, the company is revisioning its brand strategy. We thus expect new developments to emerge should people’s movements begin increasing. Meanwhile, the outlook for the brass bar manufacturing business is bright. The market price of copper is rising, and volumes are also recovering. In addition, through the licensing agreement with Mitsubishi Shindoh, the company will step up licensed sales of its lead-free free-cutting brass bar Eco Brass series.

1.Company Overview

KITZ is an integrated manufacturer of valves and other fluid control equipment and devices. In valve manufacturing, it ranks highest in Japan and within the top 10 worldwide. Valves are made of various materials depending on their application, including bronze, brass, cast iron, ductile cast iron (cast iron with greater strength and ductility) and stainless steel. KITZ in principle assumes integrated production (casting, processing, assembling, inspecting, packaging and shipping) of products from raw materials. The KITZ Group consists of 36 domestic and overseas subsidiaries. In addition to the production and sale of brass bars used for valves, water faucets and gas equipment (KITZ is ranked among the top manufacturers of brass bars within Japan), the Group also operates a hotel business.

[Corporate Philosophy: To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services.]

KITZ believes that corporate value is equivalent to shareholder value from a medium- to long-term perspective. To continue increasing this value, it says that it must achieve sustained growth accompanied by earnings through earning the trust of customers.

And by improving corporate value, the Company desires to help create a more prosperous and fulfilling society by providing many types of benefits to its shareholders, customers, employees, business partners, and society. Setting these goals in the KITZ Statement of Corporate Mission, the Company seeks to further progress in the future.

KITZ’ Statement of Corporate Mission |

To contribute to the global prosperity, KITZ is dedicated to continually enriching its corporate value by offering originality and quality in all products and services. |

1-1 Overview of KITZ’s Business Segments

KITZ’s businesses consist of the valve manufacturing, brass bar manufacturing and other (including hotel and restaurant management) segments. During the fiscal year ended March 2020, these segments accounted for 81.1%, 16.6%, and 2.3% of total sales, respectively.

Valve Manufacturing Business

Valves are used to pass, stop and adjust the flow of fluids in various pipe systems (water, air, gas and other substances). They are used in building facilities, residential utility systems, water supply facilities, fresh water and sewer systems, fire prevention equipment, machinery and industrial equipment manufacturing facilities, chemical, medical, and petrochemical product manufacturing facilities, semiconductor manufacturing facilities, oil refineries and other industrial complexes, among other applications. The Company operates an integrated production system that begins with the casting process (KITZ was the first Japanese company to acquire ISO 9001 international quality standard certification). The Company’s product offerings include commercial valves, which are made of corrosion-resistant bronze and highly economical brass for use in the building construction sector, including building facilities and residential utility systems, and industrial stainless-steel valves such as high-value-added ball valves. The Company has a high share of the domestic market in these mainstay product areas.

In terms of sales, the company covers the country nationwide by expanding marketing bases in the domestic major cities and an elaborate network of distributors. As for overseas, the company has a global sales network where the company did not only establish representative offices in India and U.A.E but also marketing bases in China, Hong Kong, South Korea, Singapore, Malaysia, Thailand, Vietnam, the U.S., Brazil, Germany, and Spain. Regarding the manufacturing, the company has a production network that helps achieve global cost and optimal production locations as the company has deployed production bases in China, Taiwan, Thailand, India, Germany, Spain, and Brazil in addition to the domestic factories.

Building facilities Valves, etc. used for air-conditioning, sanitary, and anti-disaster equipment when constructing hotels, hospitals, office buildings, and so on | Water supply/water supply facilities Devices and equipment for pipes for water supply and sewage systems, valves used for facilities for treating water and sludge, products for water supply equipment for detached house, housing complexes, etc. |

Gas/energy facilities Valves, etc. used for liquefied natural gas (LNG) production facilities, pipelines, and so on | Industrial machinery/production equipment All kinds of valves used for industrial machinery and production equipment |

Oil refining and oil complex facilities Valves, etc. used for the processing lines of oil refineries, petrochemical facilities, and chemical plants | Semiconductor manufacturing equipment Valves and joints for semiconductor manufacturing equipment (manufactured and sold by its group company, KITZ SCT Corporation) |

Brass Bar Manufacturing Business

Copper alloy can take many different shapes, including sheets, strips, pipes, bars and wires through hot or cold deformation processing such as dissolution, casting, rolling, extruding, and forging. It can be made with a range of different materials, including brass (copper with zinc), phosphor bronze (copper with tin and phosphorous), and nickel silver (copper with nickel and zinc). The KITZ Group's brass bar manufacturing business is led by KITZ Metal Works Corporation and Hokutoh Giken Kogyo Corporation. These companies manufacture and sell brass bars, which are used not only as material for valves, but also in the manufacture of water faucets, gas equipment, electrical appliances, and other brass-derived items.

Other

KITZ subsidiary Hotel Beniya Co., Ltd., operates a resort hotel in the city of Suwa, Nagano Prefecture. The hotel is located in a highly picturesque setting close to Lake Suwa with hot spring bathing facilities with sunset views and has a number of small and large banquet halls. The hotel also has a large convention hall, giving it the capacity to hold international conferences.

Business Segment Sales

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 |

Valve Manufacturing | 93,579 | 91,766 | 98,162 | 109,969 | 103,114 |

Brass Bar Manufacturing | 20,557 | 19,333 | 23,535 | 23,643 | 21,061 |

Other | 3,141 | 3,002 | 2,867 | 3,025 | 2,914 |

Total Sales | 117,278 | 114,101 | 124,566 | 136,637 | 127,090 |

(Units: ¥mn)

2.Second quarter of Fiscal Year Ending December 2020 Earnings Results

2-1 Consolidated Business Results for the second quarter(cumulative)

| 2Q of FY 3/20 (cumulative) | Composition | 2Q of FY 12/20 (cumulative) | Composition | YoY Change | Initial Est. | Divergence |

Sales | 62,199 | 100.0% | 55,799 | 100.0% | -10.3% | 55,300 | +0.9% |

Gross Income | 16,170 | 26.0% | 14,885 | 26.7% | -7.9% | - | - |

SG&A | 13,354 | 21.5% | 12,157 | 21.8% | -9.0% | - | - |

Operating Income | 2,816 | 4.5% | 2,728 | 4.9% | -3.1% | 2,400 | +13.7% |

Ordinary Income | 2,733 | 4.4% | 2,439 | 4.4% | -10.8% | 2,100 | +16.2% |

Net Income | 2,033 | 3.3% | 1,676 | 3.0% | -17.6% | 1,300 | +28.9% |

(Units: ¥mn)

Sales and operating income dropped 10.3% and 3.1%, respectively, year on year

Sales decreased 6.4 billion yen (or 10.3%) year on year to 55.79 billion yen. Sales dropped for all three business segments: the valve manufacturing, brass bar manufacturing, and other (including the hotel business) businesses. The overseas sales ratio was 30.1% (29.5% in the previous term).

Operating income fell 80 million yen (or 3.1%) year on year to 2.72 billion yen. While the brass bar manufacturing business and the other business reported operating losses, overall operating income fell only slightly on a consolidated basis, propped up by profit growth in the valve manufacturing business thanks to a pickup in sales of products for semiconductor manufacturing equipment and lower operating expenses. Net income dropped 350 million yen (or 17.6%) year on year to 1.67 billion yen, owing to (1) an increase in non-operating expenses stemming from the booking of bond issuance costs, an increase in losses for foreign exchange, and increase in losses on the valuation of derivatives (associated with hedging activities in the brass bar manufacturing business), and (2) deteriorating extraordinary profit/loss due partly to a decline in gains on the sale of investment securities, and the booking of extraordinary losses associated with the temporary closure of Hotel Beniya.

Exchange and raw materials

| 2Q of FY 3/20 (cumulative) | 2Q of FY 12/20 (cumulative) | 2Q(cumulative) Estimate |

Yen / US Dollar | 109.98 | 106.33 | 107.00 |

Yen / Euro | 124.07 | 121.65 | 125.00 |

Electrolytic Copper, Yen / Ton | 692,000 | 674,000 | 700,000 |

2-2 Business Segment Sales, Operating Income

| 2Q of FY 3/20 (cumulative) | Composition | 2Q of FY 12/20 (cumulative) | Composition | YoY Change | Estimate | Divergence |

Valve Manufacturing | 49,760 | 80.0% | 47,122 | 84.4% | -5.3% | 46,800 | +0.7% |

Brass Bar Manufacturing | 10,737 | 17.3% | 8,056 | 14.4% | -25.0% | 7,900 | +2.0% |

Other | 1,701 | 2.7% | 619 | 1.1% | -63.6% | 600 | +3.2% |

Total Sales | 62,199 | 100.0% | 55,799 | 100.0% | -10.3% | 55,300 | +0.9% |

Valve Manufacturing | 4,524 | 9.1% | 4,830 | 10.2% | +6.8% | 4,600 | +5.0% |

Brass Bar Manufacturing | 72 | 0.7% | -182 | -2.3% | - | -230 | - |

Other | 91 | 5.3% | -204 | -33.0% | - | -260 | - |

Adjustments | -1,872 | - | -1,715 | - | - | -1,710 | - |

Total Operating Income | 2,816 | 4.5% | 2,728 | 4.9% | -3.1% | 2,400 | +13.7% |

(Units: ¥mn)

Valve Manufacturing Business

Domestic sales decreased 1.12 billion yen (or 3.6%) year on year to 30.55 billion yen. Sales of valves for building facilities declined due to continued inventory buildup in the market amid the COVID-19 pandemic. For industrial valves, the boost from large-scale, regular maintenance work at plants was completed, and capital investments in the manufacturing industry were low. For valves for the water market, sales for water supply, sewage, and filter applications, mainly to the public sector, remained favorable. Sales of valves for semiconductor manufacturing equipment were brisk in the first quarter on the back of a recovery in the market, but leveled off in the second quarter.

Overseas sales fell 1.51 billion yen (or 8.4%) year on year to 16.56 billion yen. In China and South Korea, sales of valves for semiconductor manufacturing equipment hit a plateau in the second quarter, as in Japan. The number of orders plummeted in all areas due to the impact from the COVID-19 pandemic. In Europe and Americas, sluggish oil & gas-related demand caused continuous inventory adjustment at distributors, which resulted in a sharp drop in sales. Sales declined at the South American subsidiary MGA, but remained relatively healthy even amid the harsh operating environment. In the ASEAN region, South Korea, and other countries, sales fell without any signs of a full-scale economic reopening emerging. In China, performance has been solid thanks to the market recovery following the containment of COVID-19.

Operating income grew 300 million yen (or 6.8%) year on year to 4.83 billion yen. Positive factors such as lower COGS and expenses, offset the profit drag from changes in the product mix caused by the COVID-19 pandemic.

Brass Bar Manufacturing Business

Sales decreased 2.68 billion yen (or 25.0%) year on year to 8.05 billion yen. The market price of copper, which affects selling prices, has been on the rise after bottoming in April, but remained below year-earlier levels. Production volume also fell 17% year on year (down 24% for the industry as a whole) due to lower demand amid the COVID-19 pandemic.

The business reported a 180 million yen operating loss (an income of 70 million yen in the same period of the previous term). The poor performance owed to the decline of major sales volume, as well as impact from production adjustments (temporary layoffs).

Other

The company reported sales of 610 million yen, down 1.08 billion yen (or 63.6%) year on year, and an operating loss of 200 million yen (an income of 90 million yen in the same period of the previous term), with the hotel business hurt by (1) the temporary closure of hotels in April to May, (2) canceled fireworks festivals in August, and (3) a decrease of customers at service areas (two locations) amid the COVID-19 pandemic.

2-3 Financial Conditions and Cash Flows

Financial Conditions

| 3/20 | 9/20 |

| 3/20 | 9/20 |

Cash | 18,696 | 32,109 | Payables | 7,289 | 5,045 |

Receivables (Including Electronically Recorded Monetary Claims) | 27,561 | 23,942 | Income taxes payable | 750 | 792 |

Inventories | 23,975 | 23,205 | Bonus and Bonus Reserve for Directors | 2,393 | 2,160 |

Current Assets | 73,351 | 80,624 | Retirement Benefit Related | 1,264 | 1,139 |

Tangible Assets | 44,241 | 42,527 | Interest-bearing Liabilities | 39,148 | 49,645 |

Intangible Assets | 7,639 | 6,582 | Liabilities | 58,184 | 65,594 |

Investments, Others | 9,831 | 10,191 | Net Assets | 76,879 | 74,331 |

Noncurrent Assets | 61,712 | 59,301 | Total Liabilities, Net Assets | 135,063 | 139,925 |

(Units: ¥mn)

Total assets at the end of the second quarter were 139.92 billion yen, up 4.86 billion yen from the end of the previous term. The company increased cash through (1) securing free CF of 5.37 billion yen due to an increase in pre-tax income, etc., and a decrease in working capital and capital investments, and (2) the issuance of corporate bonds (worth 10 billion yen). The equity ratio was 52.5% (56.0% at the end of the previous term).

On October 23, 2020, the company retired 10,000,000 treasury shares (9.96% of the total number of shares outstanding before retirement).

Cash Flows

| 2Q of FY 3/20 (cumulative) | 2Q of FY 3/21 (cumulative) | YoY Change | |

Operating Cash Flow | 5,668 | 6,947 | +1,279 | +22.6% |

Investing Cash Flow | -5,713 | -1,571 | +4,142 | - |

Free Cash Flow | -45 | 5,376 | +5,421 | - |

Financing Cash Flow | -2,446 | 8,334 | +10,780 | - |

Cash and Equivalents at Term End | 10,193 | 31,755 | +21,562 | +211.5% |

(Units: ¥mn)

3.Fiscal Year Ending December 2020 Earnings Estimates

3-1 Full Year Consolidated Earnings Forecast (9 months)

| 3Q of FY 3/20 (cumulative) Act. | Composition | FY 12/20 Est. | Composition | YoY Change | Estimate | Divergence |

Sales | 94,083 | 100.0% | 82,500 | 100.0% | -12.3% | 81,500 | +1.2% |

Operating Income | 5,010 | 5.3% | 3,300 | 4.0% | -34.1% | 3,200 | +3.1% |

Ordinary Income | 4,842 | 5.1% | 3,000 | 3.6% | -38.0% | 2,800 | +7.1% |

Net Income | 3,494 | 3.7% | 2,000 | 2.4% | -42.8% | 1,700 | +17.6% |

(Units: ¥mn)

Compared to cumulative 3Q in the previous term, sales and operating income forecast to fall 12.3% and 34.1%, respectively, year on year

While profitability for the valve manufacturing business is expected to deteriorate due to a decline in sales volume, the company upgraded its full-year earnings estimates to reflect its expectation for the brass bar manufacturing business and hotel business to see a swifter recovery than initially anticipated.

All three business segments are expected to witness a decrease in sales, but the company raised its sales estimates, mainly for the brass bar manufacturing business and the other business. On the profit front, it downwardly revised the profit estimate for the valve manufacturing business, but narrowed the operating losses estimates in the brass bar manufacturing and other businesses.

The year-end dividend is to be 3 yen/share, with the annual dividend coming to a total of 8 yen/share when combined with the dividend of 5 yen/share paid at the end of the second quarter (estimated dividend payout ratio of 36.1%). The total payout ratio is estimated to be 123.9% when factoring in the acquisition of treasury shares completed in August.

Exchange and raw materials

| FY 3/19 Act. | FY 3/20 Act. | FY 12/20 Est. |

Yen / US Dollar | 110.37 | 109.22 | 107.00 |

Yen / Euro | 130.00 | 122.36 | 125.00 |

Electrolytic Copper, Yen / Ton | 748,000 | 689,000 | 700,000 |

3-2 Return to Shareholders

In the 4th mid-term management plan in progress, the desired range of dividend payout ratio is set at around 35%. Based on this policy, the company paid a dividend of 5 yen/share at the end of the second quarter (1 yen increased than initial announcement) and plans to pay a year-end dividend of 3 yen/share, bringing the annual dividend for the fiscal year ending December 2020 to 8 yen/share. This translates to a dividend payout ratio of 36.1%, but the estimated total payout ratio is 123.9% when combined with the acquisition of treasury shares (completed on August 24; 3,049,800 shares acquired for 1,999,969,500 yen).

3-3 Sales and Operating Income by Segment

| 3Q of FY 3/20 (cumulative) Act. | Composition | FY 12/20 | Composition | YoY | Estimate | Divergence |

Valve Manufacturing | 75,792 | 80.6% | 68,800 | 83.4% | -9.2% | 68,500 | +0.4% |

Brass Bar Manufacturing | 15,912 | 16.9% | 12,600 | 15.3% | -20.8% | 12,000 | +5.0% |

Other | 2,378 | 2.5% | 1,100 | 1.3% | -53.7% | 1,000 | +10.0% |

Total Sales | 94,083 | 100.0% | 82,500 | 100.0% | -12.3% | 81,500 | +1.2% |

Valve Manufacturing | 7,666 | 10.1% | 6,340 | 9.2% | -17.3% | 6,450 | -1.7% |

Brass Bar Manufacturing | 30 | 0.2% | -230 | - | - | -360 | - |

Other | 78 | 3.3% | -250 | - | - | -360 | - |

Adjustments | -2,764 | - | -2,560 | - | - | -2,530 | - |

Total Operating Income | 5,010 | 5.3% | 3,300 | 4.0% | -34.1% | 3,200 | +3.1% |

(Units: ¥mn)

Valve Manufacturing Business

In the domestic market, demand for valves used in building facilities, a core area for the company, has continued to decline amid the COVID-19 pandemic. In particular, demand for small/mid-sized properties has started to fall, causing a buildup of inventory at distributors. Shipments are also expected to remain at low levels in the third quarter. The company is focusing its efforts on capturing data center-related demand, where projects are on the rise. Meanwhile, valves for the water market are seeing robust demand centered on valves for water supply and sewage for areas such as Tokyo. Filters for the semiconductor industry are also continuing to fare well. Such trends are expected to continue into the third quarter. For industrial valves, the boost from large-scale, regular maintenance work at plants was completed in the first quarter, and capital investments in the manufacturing industry are on hold for now. Levels are expected to remain low for the time being, but some manufacturing companies are moving their manufacturing bases back to domestic plants. Valves for semiconductor manufacturing equipment leveled out in the second quarter, but are expected to enter a modest recovery path from the third quarter on the back of sustained 5G and IoT-related demand. In addition, the global expansion of initiatives for the realization of renewable energy and a carbon-free society is working as a tailwind for hydrogen-related operations. The company is working to win its first order for the hydrogen station business, with multiple projects open for bidding. Its valves for hydrogen stations are already used in many domestic hydrogen stations.

In the overseas market, sales to the semiconductor industry are solid in China and South Korea, but weak in Europe, the U.S., and Southeast Asia. In Americas, oil & gas-related investments are weak on impact from the COVID-19 pandemic and sluggish crude oil prices. In North America, orders from major distributors are decreasing. However, the company has entered into a new global agreement with a major distributor, and plans to begin transactions at non-North American marketing bases in the next term. Meanwhile, in South America, sales at the Brazilian subsidiary MGA are healthy. Although sales at MGA have fallen, its operations have remained in the black thanks partly to price revisions and market share gains. Operations in Europe are struggling overall due to the spread of COVID-19. Amid group companies, German subsidiary Perrin which sells industrial ball valves, secured sales in line with year-earlier levels, but the Spanish subsidiary KCE reported an operating loss caused by a decline in oil & gas-related demand. In the ASEAN region and South Korea, performance in Southeast Asia varies by country, but economic activities have stalled overall. The company expects economic activities to remain low this year, but with people gradually starting to travel for business, it also sees a possibility of the economy starting to pick up in these countries faster than in Europe and the U.S. In regards to South Korea, the semiconductor market is experiencing some project delays, but is solid overall. In China, the semiconductor market is healthy, with the COVID-19 pandemic having been contained. Data center-related demand has remained solid, too.

Brass Bar Manufacturing Business

The market price of copper plummeted in the first quarter, hurt by the COVID-19 pandemic, but has remained on an uptrend thereafter. Domestic brass bar demand also slumped, particularly for automotive applications, but bottomed in August. The company’s orders, such as for water faucet valves, have also been recovering since September after bottoming out in August. The market price of copper is expected to stay in line with recent levels in the third quarter.

Other

Due to impact from the COVID-19 pandemic, the numbers of hotel guests and service area customers were sluggish, but benefits from the government’s Go To Travel campaign have begun to emerge. Service area operations moved back into the black due to a return in customer traffic thanks to the campaign. For Hotel Beniya, winter is typically its slow season, and end-of-year parties are being canceled this year, but it is working to attract local customers within the prefecture using the Go To Travel campaign and also cut costs.

4.Conclusions

Earnings are projected to enter a moderate recovery after bottoming in the third quarter. In the valve manufacturing business, demand for valves for domestic building facilities is weak, with inventory adjustments continuing longer than anticipated. As such, performance for the third quarter is expected to be worse than the second quarter, but to recover moderately after significant progress is seen with inventory adjustments. The company does not expect performance in the first quarter of the next term to be weak as that anticipated in the third quarter of this term. In overseas, oil & gas-related operations in Europe and the U.S. continue to struggle amid the resurgence of the COVID-19 pandemic and sluggish crude oil prices, but negative impact on this front is unlikely to reach the scale seen in spring earlier this year. In the ASEAN region, the company is revisioning its brand strategy. We expect new developments to emerge if economic activities resume.

Meanwhile, the outlook for the brass bar manufacturing business is bright. The market price of copper is rising, and volumes are also recovering. If production volumes increase, benefits from capital investments made in the previous term for drastic productivity improvement should show. In addition, through the licensing agreement with Mitsubishi Materials, the company will step up licensed manufacturing and sales of its Eco Brass series. The Eco Brass series is a lead-free free-cutting brass bar with excellent machinability achieved without adding lead. As regulations for environmentally hazardous substances have become stricter around the world in recent years, demand for lead-free brass bar alloys is expected to grow sharply going forward.

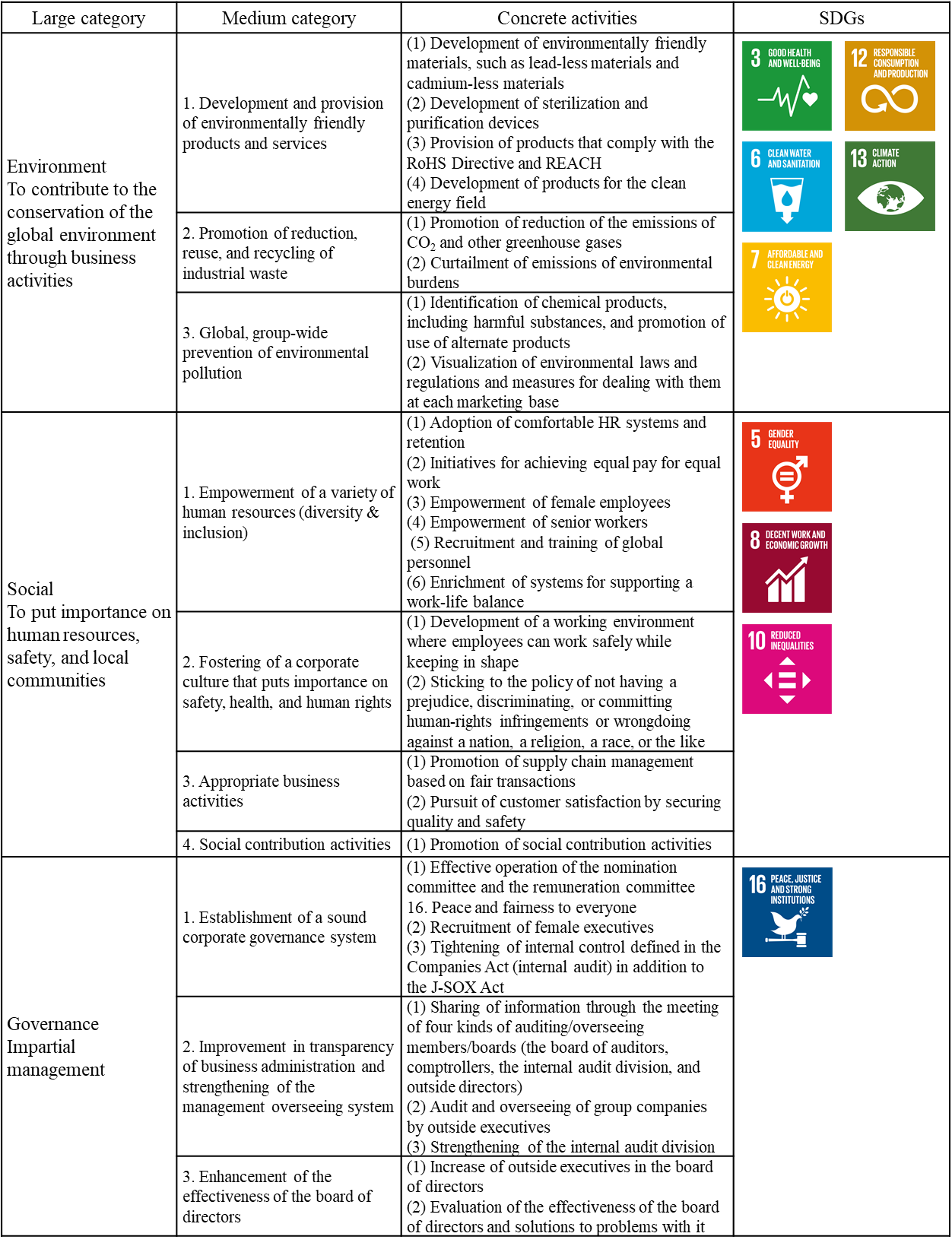

<Reference: Initiatives based on ESG and SDGs>

In the 4th mid-term management plan, whose initial year is fiscal 2019, “further enhancement of ESG” is one of important themes, and in March 2020, the company visualized the SDGs that are closely related to its important initiatives. The company plans to intensify ongoing initiatives and speed up sustainable business administration, to contribute to the attainment of SDGs.

Furthermore, the company agreed with “Nagano Prefecture’s system for registering enterprises that pursue SDGs,” and Ina and Chino Plants were registered by the prefecture as business establishments that pursue SDGs.

(Taken from the website of the company)

*The company has published a webpage on sustainability on its website:

https://www.kitz.co.jp/english/sustainability/

<Reference: Regarding Corporate Governance>

◎ Organizational structure, Composition of board of directors and company auditors

Organizational structure | Company with board of company auditors |

Board of directors | 8 directors (4 are outside directors) |

Company auditors | 5 auditors (3 are outside auditors) |

Corporate governance report (Updated on:July 1 2020)

Basic policy

Our corporate ethos is to continuously improve our corporate value by offering creative, high-quality products and services. Under this ethos, we strive to achieve business administration that takes care of the interests of shareholders and all other stakeholders as a socially responsible company. Moreover, in order to increase business administration efficiency and enhance our compliance with laws, we will listen to requests from stakeholders and consider the social trends, etc. in order to swiftly and efficiently achieve a sound and highly transparent business administration by implementing a variety of measures, and intend to enrich corporate governance.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code>

Kitz complies with all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

4. Full disclosure (Principle 3-1)

(3) We disclose our policies on determining the compensation of our directors and company auditors, etc., in our annual securities report, etc. Compensation for our directors (excluding outside directors) and executive officers is based on a performance-based stock compensation scheme. The compensation amount, methods of distribution and stock allocation are determined by internal rules. In addition, bonuses are paid if certain conditions required by the internal rules are met, and the company has secured enough profit. Regarding determining compensation, we have established a Compensation Committee, consisting mainly of outside directors, as a voluntary advisory body to the Board of Directors. The committee deliberates compensation policies and other matters of particular importance, and reports the results back to the Board of Directors.

(4) Regarding our policies for nominating director and company auditor candidates, dismissing directors and company auditors, and appointment or dismissal of officers, we have established a Nomination Committee, consisting mainly of outside directors, as a voluntary advisory body to the Board of Directors. Based on the “Policy on the composition of the Board of Directors and the Board of Company Auditors, and the appointment and dismissal of officers (directors, company auditors, CEO, executive officers),” determined by the company (hereinafter, “Officer Selection and Dismissal Policy”), candidates are examined from various perspectives such as personality, ability, insight, experience, expertise, achievements, fairness and age, as well as gender and internationality, and the Board of Directors makes a decision based on the Nomination Committee’s report.

Our Officer Selection and Dismissal Policy is disclosed on the company website.

(5) Regarding candidates for directors and company auditors, their brief histories and the reasons for their nomination are disclosed in the notice of convocation of shareholders’ meeting. When directors and company auditors are dismissed, these reasons will also be disclosed.

9. Details of initiatives to enhance the effectiveness of the Board of Directors (Supplementary principle 4-11-3)The company conducts a questionnaire survey on the effectiveness of the Board of Directors every year for the purpose of enhancing the effectiveness of corporate governance and improving the functions of the Board of Directors as a whole. The Board of Directors analyzes and evaluates these results. For the survey, the purpose of the evaluation is explained to all directors and company auditors in advance, and based on the principles of the Corporate Governance Code, a questionnaire on particularly important matters is handed out, in which respondents provide their name along with their answers. The Board of Directors analyzes and evaluates effectiveness based on the responses obtained, and also conducts open discussions on key issues. The survey on the effectiveness of the Board of Directors conducted in May 2020 asked about (1) the formulation and execution of management strategies, (2) the composition of the Board of Directors, (3) the nomination and compensation of directors, (4) encouraging lively discussion by company auditors, outside directors and the Board of Directors, and (5) meeting the interests of shareholders and other stakeholders. As a result, the Board of Directors was ensured to have its effectiveness overall. However, some constructive criticisms including areas for improvement were given in regards to the succession plan for the CEO and the diversity of the Board of Directors. As such, the Board of Directors will discuss these issues going forward and strive to ensure further effectiveness.

11. Policy for Constructive Dialogue with Shareholders (Principle 5-1)

We recognize that, in order to achieve sustainable growth and enhance medium- to long-term corporate values, it is important to be aware of the accountability as a trustee of management, disclose information to stakeholders such as shareholders and investors in a timely and appropriate manner, and maintain fairness and transparency in management.

We also believe that providing necessary information continuously, and conducting IR activities for improving management by utilizing the opinions and requests from outsiders are vital. As such, we have established an IR system centered on the President and the executive officer in charge of IR in order to promote constructive dialogue with shareholders so that they can understand our management strategies and plans, and are implementing the following measures.

(1) We have appointed an executive officer in charge of IR in order to realize constructive dialogue with shareholders.

(2) We are striving to achieve efficient coordination led by the executive officer in charge of IR, by holding meetings among the IR department, the corporate planning department, the accounting department, the general affairs personnel department, the legal department, etc., as necessary and such.

(3) The Company conducts meetings for institutional investors and analysts each quarter. At these company briefings, explanations are given by the president himself or the executive director of IR. In addition to information regarding financial results, such as summary of financial results and securities report, other information is also disclosed on the Company website, regarding IR topics such as management information, information on shares and shareholders meetings, and reports on corporate governance.

(4) The Company periodically reports opinions gathered from dialogue with institutional investors and analysts to the president and IR executive officer. If necessary, the president will inform the Board of Directors and management committee.

(5) The Company pays close attention to managing insider information and considers the executive officer in charge of the accounting department to be responsible for handling information. The accounting executive officer, IR department, and management planning department discuss details regarding information disclosure prior to opening a dialogue with institutional investors and analysts.

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on KITZ Corporation (6498) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/