Bridge Report:(6191)AirTrip Corpthe Fiscal Year September 2023

President & CFO Yusuke Shibata | AirTrip Corp.(6191) |

|

Company Information

Exchange | TSE Prime |

Industry | Service industry |

President & CFO | Yusuke Shibata |

HQ Address | Atago green Hills MORI tower 19F, 2-5-1, Atago, Minato-ku, Tokyo |

Year-end | End of September |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE (Actual) | Trading Unit | |

¥2,657 | 22,210,465shares | ¥59,013million | 40.5% | 100shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

undecided | - | ¥90.05 | 29.5x | ¥419.44 | 6.3x |

*The share price is the closing price on June 2. EPS is from the second quarter of FY 9/23. ROE and BPS are from FY 9/22.

Earnings Trend

Fiscal Year | Sales | Operating Income | Profit before tax | Net Income | EPS | DPS |

September 2019 Act. | 24,306 | 680 | 588 | 733 | 39.07 | 10.00 |

September 2020 Act. | 21,191 | -8,760 | -8,956 | -8,380 | -433.80 | 10.00 |

September 2021 Act. | 17,524 | 3,142 | 3,043 | 2,372 | 112.15 | 10.00 |

September 2022 Act. | 13,510 | 2,193 | 1,979 | 1,901 | 85.90 | 10.00 |

September 2023 Est. | 24,000 | 3,000 | 2,900 | 2,000 | 90.05 | - |

*Unit: yen, million yen. The forecast of DPS for this term is still to be determined. IFRS is discretionally applied from FY 9/18. Net income is profit attributable to owners of parent. Hereinafter the same applies.

This report outlines the second quarter of the Fiscal Year September 2023 earnings results and other information about AirTrip Corporation.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of the Fiscal Year ending September 2023 Earnings Results

3. The Fiscal Year ending September 2023 Earnings Forecasts

4. Topics

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Point

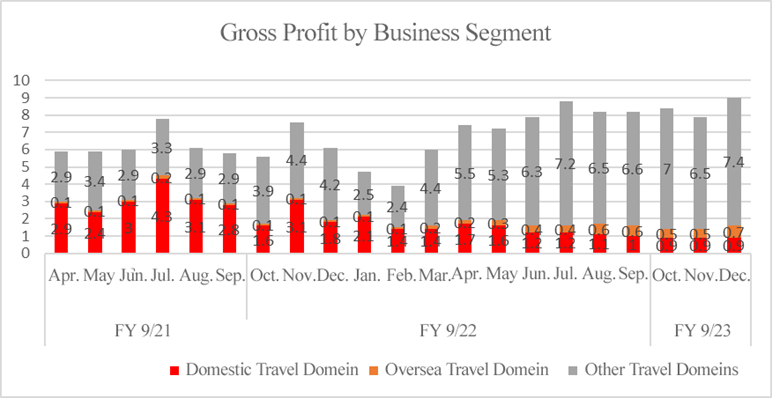

- In the second quarter of the fiscal year ending September 2023, transaction volume increased 2.2 times year on year to 43,297 million yen. Sales revenue grew 2.1 times year on year to 11,588 million yen due to the progress of the relaxation of movement restrictions in Japan and the relaxation of entry restrictions in various countries for inbound travel to Japan in the environment surrounding the travel industry. Gross profit rose 81.67% year on year to 5,903 million yen. Operating income increased 7.5% year on year to 1,588 million yen, mainly due to the revision to the business portfolio.

- For the fiscal year ending September 2023, the company has significantly revised its forecasts upwardly from sales of 19 billion yen and an operating income of 1.6 billion yen to sales of 24 billion yen and an operating income of 3 billion yen, due in part to the strong performance of the AirTrip travel business, especially in the domestic travel domain, driven by increased demand for travel triggered by the nationwide travel support program. In addition, the dividend amount remains undetermined, but the company is aiming for a dividend payout ratio at a level of 20%.

- Although the global infection status of the novel coronavirus and the government's response to it may have an impact, it is expected that the movement of people will become more active thanks to the relaxation of restrictions during various periods and the reclassification of the novel coronavirus from Category 2 to Category 5 on May 8. In addition, with the expected recovery of the number of foreign visitors to Japan, the company expects that the increase in transaction volume will lead to a further recovery in revenue.

1. Company Overview

AirTrip Corp. conducts a variety of businesses centered on the AirTrip online travel business, which operates the comprehensive travel platform "AirTrip," boasting the largest Internet ticket trading volume. In the IT offshore development business, the company employs approximately 700 IT engineers and is engaged in "the largest hybrid type offshore development among Japanese companies," in the inbound travel agency business/Wi-Fi rental business, the company provides various services to foreign visitors to Japan and private lodging management companies. Moreover, the company is focusing on the investment business (AirTrip CVC), aiming to expand service lines and improve profits by pursuing synergies through collaborations with investee companies by investing in growing companies.

The company set “Air Trip 5000” as their medium-term target to achieve a transaction volume of 500 billion yen.

【1-1 Corporate History】

In May 2007, Tabi Capital Co., Ltd. was established to provide online travel agency services.

Since then, the Company has been expanding its product line-up through M&A and business transfers.

In March 2012, the Company began IT offshore development business in Vietnam. Taking this opportunity, in order to clearly show the Company’s direction towards the integrated IT business, it changed its name to Evolable Asia Corp. in October 2013.

In March 2016, it was listed on the Mothers Section of the Tokyo Stock Exchange. One year later, in March 2017, it moved to the First Section of the Tokyo Stock Exchange.

In May 2018, the company achieved the largest Internet trading volume of airline tickets due to the reorganization of the former DeNA Travel into a subsidiary.

On January 1, 2020, as the operating company of "AirTrip," which has the largest Internet trading volume of airline tickets, the company unified its trade name and brand name to build a stronger business foundation and further improve the popularity of the "AirTrip" brand. Also, the company changed its name to AirTrip Corp. to demonstrate its stance of concentrating on various businesses centered on "AirTrip."

In April 2022, the company got listed on the Prime Market of the Tokyo Stock Exchange following the reorganization of the market.

【1-2 Mission, etc.】

Mission | Seizing every change that arises in the economic sphere as a business opportunity with the power of IT and continue to grow endlessly |

Code of conduct | *Always put customers first! We are always aware of our customers’ point of view and work for the customers

*Conscientiousness, peace of mind and trust are more important than anything! It is the core of our business to provide detailed work, give peace of mind to our customers and respond to their trust.

*Continue to improve as professionals! We cannot grow unless we improve each and every aspect of our work.

*Swift response, fast implementation, speed! We respond to our customers faster than any other companies and develop a system faster than any other companies.

* Timesaving by restricting time for dealing with visitors in 30 minutes, and for meetings in 20 minutes. Achieve work-life balance. |

【1-3 Business Description】

Regarding business domains, Regional Revitalization Business has been added to the five businesses: AirTrip Travel Business, IT Offshore Development Business, Inbound Travel Agency Business/Wi-Fi Business, Media Business and Investment Business (AirTrip CVC).

There are three reportable segments: online travel business, IT offshore development business, and investment business. Inbound travel agency business/Wi-Fi rental business and Media business are included in the online travel business segment.

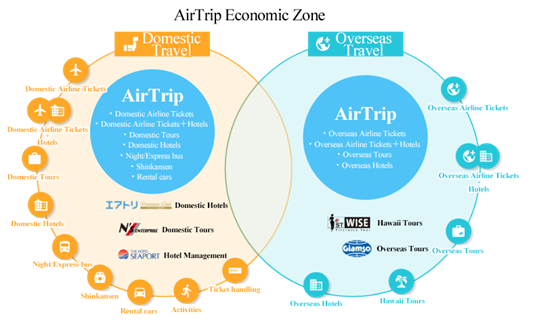

(1) Online Travel Business

① AirTrip travel Business

It sells travel products such as domestic airline tickets, domestic hotels, overseas airline tickets, overseas accommodations, AirTrip plus (Airline tickets + hotels), package tours, busses, rental cars, and Shinkansen through the comprehensive travel platform "AirTrip" and various sales channels.

(From the company's website)

Domestic airline tickets | ・Handling tickets for 13 domestic airlines |

Domestic accommodations | ・Handling more than 20,000 facilities in Japan |

Overseas airline tickets / accommodations | ・Issuing international airline tickets as an authorized IATA agent (※). ・600,000 overseas facilities also handled |

※IATA (International Air Transport Association): The IATA is a trade association of the world’s airlines.

Sales channels | Overview |

Direct managed site (B-to-C) | The Company operates integrated service platform at “AirTrip” which allows users to easily compare and book domestic and international travel contents. |

B-to-B-to-C | The Company provides travel content such as domestic airline tickets and travel, international airline tickets and hotels to other company’s online media. The media will enjoy benefits such as enriching original content, enhancing customer satisfaction, and creating new profit sources. |

Wholesale service (B-to-B) | The Company provides mainly domestic airline tickets and sales management systems to travel agencies. |

The comprehensive travel platform "AirTrip" handled domestic and international airline tickets, hotels, domestic and international tours, buses, rental cars, and the Japanese bullet train (Shinkansen).

Moreover, the company steadily increased the number of users by actively developing various advertising activities such as TV commercial to raise awareness, operating various campaigns, and improving UI and UX on a daily basis.

(Strengths of business)

The Company has the largest trading volume of airline tickets in the Japanese OTA industry.

The agreements with all domestic airline groups, a unique business condition enjoyed only by the Company, enable the Company to issue flight tickets. Advantageous procurement prices combined with self-issuing of tickets (no need to outsource) make its cost competitiveness overwhelmingly strong.

In addition, the Company has “competitive supply routes” based on strong relationships of trust with each airline company resulting from long-term business relationships, “diverse sales routes”, and “low-cost system development using its own offshore IT development capacity”. Because of these factors, the Company has created high barriers to entry.

②Inbound Travel Business/Wi-Fi Rental Business

The company uses the know-how nurtured in the AirTrip Travel Business to provide services for foreign visitors to Japan.

(Primary Services)

*Wi-Fi Rental for Foreign Visitors to Japan

Inbound Platform Corp., a subsidiary of AirTrip, has been providing a Wi-Fi router rental service for travelers visiting Japan, with a performance of over 800,000 rentals, establishing its brand through the long-standing trust and word-of-mouth.

③ Media Business

Working with MagMag Inc., which is a consolidated subsidiary with the ethos of “distributing what you want to convey to those who want to know,” the company collects creators’ contents from all over the world, develops and provides systems to deliver the information to those who see value in them. They operate the free and paid email newsletter service “MagMag!,” holding the country’s largest 7.5 million-member base, “mine” where users can purchase respective articles, the online media “MAG2 NEWS,” “MONEY VOICE,” “TRiP EDiTOR,” and “by them,” in which users can discover contents and deliver them to a number of people who want to know.

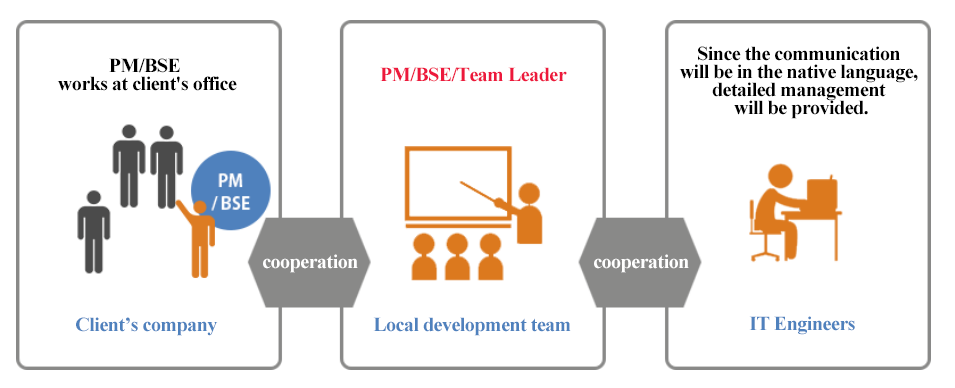

(2) IT offshore development business

The company provides lab-type development services mainly for development companies for e-commerce, web-solutions, games and systems, in 3 locations in Vietnam (Ho Chi Minh, Hanoi and Da Nang). The company forms a team with dedicated staff members hired for each customer of its lab-type development services, which allows customers to check the development status of the lab whenever they need to.

(From the company's website)

(Features of the IT Hybrid Development)

The company has a number of project managers with 5 to 10 years or longer of practical experience in Japan, and carries out upstream processes in Japan, including the requirement definition. They communicate with customers in Japanese, while they communicate with engineers in Vietnamese, therefore, the company can provide development solutions that are consistent from upstream processes to downstream processes, without any inconsistency between their understanding.

Furthermore, they accumulate know-how by assigning dedicated development staff members, so that they can improve the efficiency of their business operation in proportion to the operation period. In addition, they achieve optimum cooperation and management by having a Vietnamese project manager on the ordering side.

(3) Investment business

It is positioned as the business having characteristics of CVC (corporate venture capital). The company will pursue a synergistic effect as well as opportunities for capital gains. The company also engages in investment incubation business.

As of the end of April 2023, the company had invested in a cumulative total of 94 companies, and the total investment amount was 4.1 billion yen. A total of 12 companies in which AirTrip invested have made an IPO so far.

2. The second quarter of the Fiscal Year ending September 2023 Earnings Results

(1) Consolidated Business Results

| FY 9/22 2Q | Ratio to sales | FY 9/23 2Q | Ratio to sales | YoY |

Trading volume | 19,651 | - | 43,297 | - | 120.3% |

Sales revenue | 5,526 | 100.0% | 11,588 | 100.0% | 109.7% |

Gross profit | 3,251 | 58.8% | 5,903 | 50.9% | 81.6% |

Operating Income | 1,477 | 26.7% | 1,588 | 13.7% | 7.5% |

Real Operating Income | 530 | 9.6% | 1,000 | 8.6% | 88.7% |

Pre-tax income | 1,379 | 25.0% | 1,584 | 13.7% | 14.9% |

Net income for this quarter | 1,118 | 20.2% | 1,114 | 9.6% | -0.5% |

*Unit: million yen. IFRS is applied. Net income for this quarter means profit attributable to owners of parent.

Sales and profit increase significantly.

- In the second quarter of the fiscal year ending September 2023, transaction volume increased 2.2 times year on year to 43,297 million yen. Sales revenue grew 2.1 times year on year to 11,588 million yen due to the progress of the relaxation of movement restrictions in Japan and the relaxation of entry restrictions in various countries for inbound travel to Japan in the environment surrounding the travel industry. Gross profit rose 81.67% year on year to 5,903 million yen. Operating income increased 7.5% year on year to 1,588 million yen, mainly due to the revision to the business portfolio.

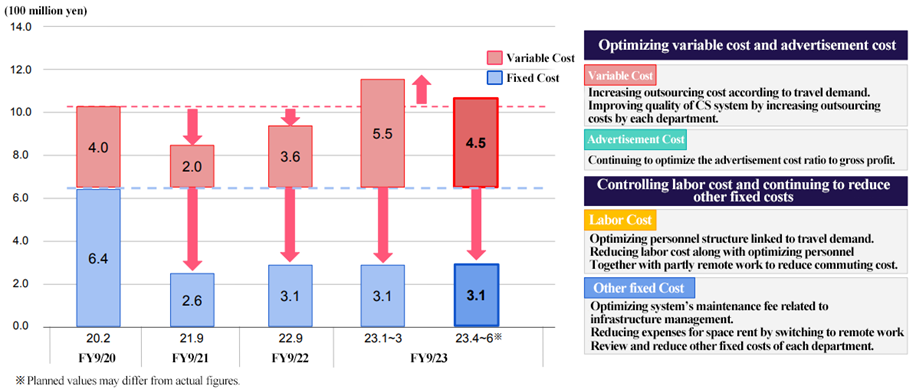

(From the company's material)

With increased travel demand, the company maximized its marketing investment. Other fixed costs were kept low, with monthly SG&A expenses kept at 700–900 million yen or slightly higher in the second quarter of the fiscal year ending September 2023.

(From the company's material)

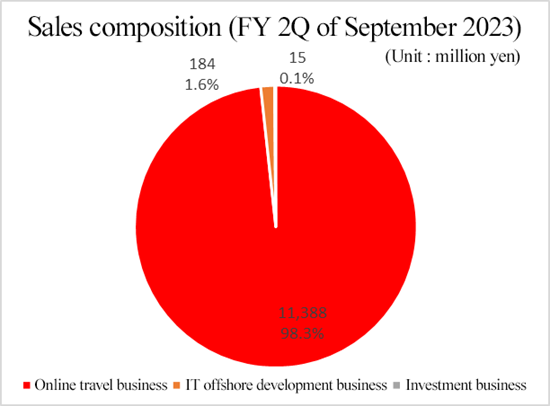

(2) Trends by segment

| FY 9/22 2Q | Ratio to sales | FY 9/23 2Q | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Online travel business | 4,897 | 88.6% | 11,388 | 98.3% | 132.5% |

IT off-shore development business | 291 | 5.3% | 184 | 1.6% | -36.7% |

Investment business | 336 | 6.1% | 15 | 0.1% | -95.4% |

Total | 5,526 | 100.0% | 11,588 | 100.0% | 109.7% |

Operating Income |

|

|

|

|

|

Online travel business | 1,256 | 25.6% | 1,637 | 14.4% | 30.2% |

IT off-shore development business | 368 | 126.5% | 0 | 0.0% | -99.8% |

Investment business | 308 | 91.7% | 366 | 2440.0% | 18.8% |

Total | 1,477 | 26.7% | 1,588 | 13.7% | 7.5% |

*Unit: million yen. The composition ratio of operating income means operating income margin on sales.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

①Online travel business

Both sales and profit increased significantly due to a recovery in demand for travel, especially domestic travel.

Profit rose 30.2% year on year to 1,637 million yen, partly due to the increased sales.

②IT offshore development business

Although profit temporarily declined from the previous year due to organizational strengthening, a new management structure aimed at growth in the second half of the year was established.

Profit declined 99.8% year on year to 0 million yen due to the decrease in sales.

③Investment business

The investee Prime Strategy Co Ltd (Securities code: 5250) was listed on the Tokyo Stock Exchange's Standard Market (12th IPO by a portfolio company). Profit increased 18.8% year on year to 366 million yen.

(3) Financial standing and cash flows

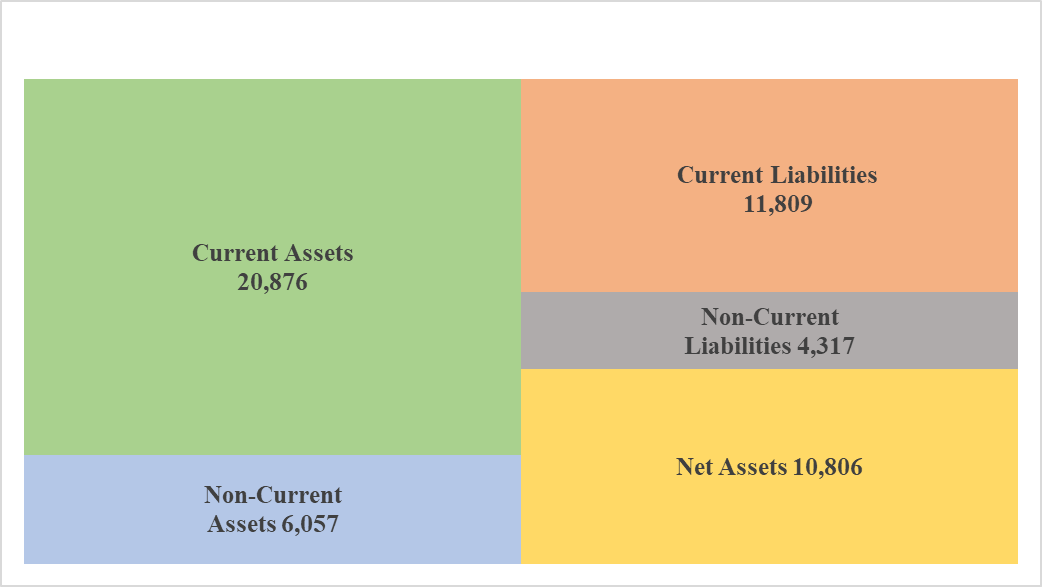

◎Summarized Balance Sheet

| End of Sep. 2022 | End of March. 2023 |

| End of Sep. 2022 | End of March. 2023 |

Current assets | 18,386 | 20,876 | Current liabilities | 9,680 | 11,809 |

Cash, etc. | 8,954 | 9,568 | Trade payables, etc. | 3,588 | 5,128 |

Trade receivables, etc. | 2,079 | 2,696 | Interest-bearing debts | 3,252 | 2,925 |

Other financial assets | 6,035 | 6,962 | Noncurrent liabilities | 4,545 | 4,317 |

Noncurrent assets | 5,748 | 6,057 | Interest-bearing debts | 2,764 | 2,609 |

Tangible fixed assets | 286 | 409 | Total liabilities | 14,226 | 16,126 |

Intangible fixed assets | 1,191 | 1,319 | Capital | 9,908 | 10,806 |

Goodwill | 1,189 | 1,188 | Capital surplus | 2,094 | 2,107 |

Other financial assets | 597 | 817 | Retained earnings | 5,335 | 6,228 |

Total assets | 24,135 | 26,933 | Total liabilities and net assets | 24,135 | 26,933 |

*Unit: million yen. “Cash, etc.” mean cash and cash equivalent. “Trade receivables, etc.” mean trade receivables and other credits. “Trade payables, etc.” mean trade payables and other liabilities. Interest-bearing debts include lease liabilities.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Total liabilities augmented 1.9 billion yen to 16,126 million yen, mainly due to an increase in trade payables despite a decrease in interest-bearing debt.

Retained earnings increased, and capital stock grew 898 million yen to 10,806 million yen.

As a result, equity ratio (the ratio to equity attributable to owners of the parent) declined 0.9 points from 41.0% at the end of the previous fiscal year to 40.1%.

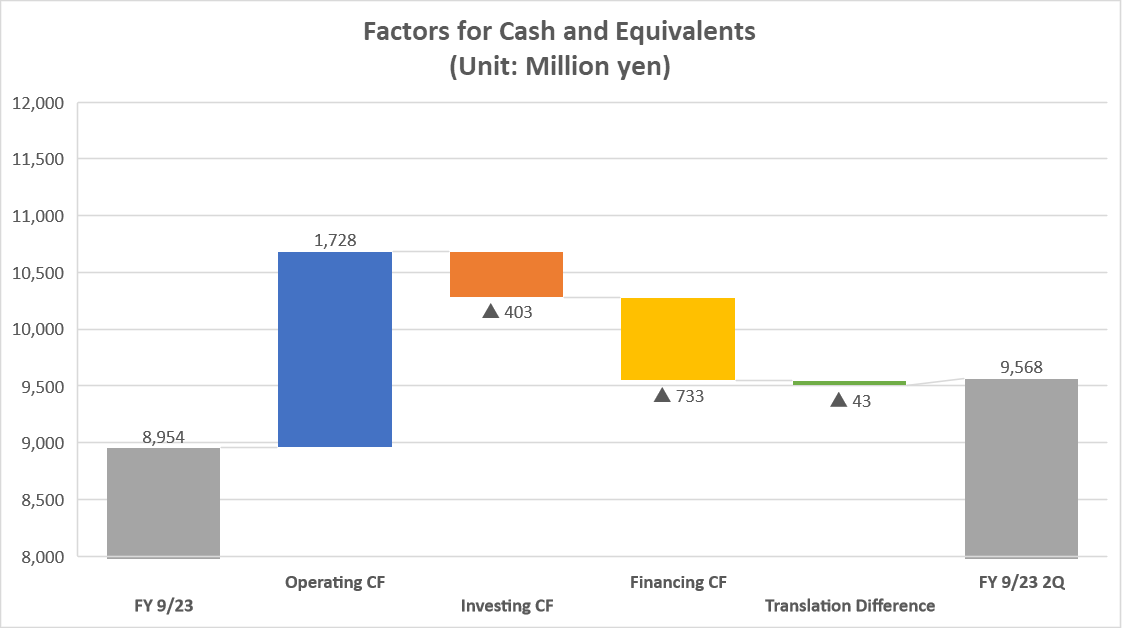

◎Cash Frow

| FY 9/22 2Q | FY 9/23 2Q | Increase/decrease |

Operating Cash Frow | 969 | 1,728 | +759 |

Investing Cash Frow | -280 | -403 | -123 |

Free Cash Frow | 689 | 1,325 | +636 |

Financing Cash Frow | -912 | -733 | +179 |

Cash and equivarents | 8,629 | 9,568 | +939 |

*Unit: million yen.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Free cash flow improved because of a increase in use of operating cash flow. The cash position kept improving.

3. The Fiscal Year ending September 2023 Earnings Forecasts

Consolidated Business Forecasts

| FY 9/22 | Ratio to sales | FY 9/23 | Ratio to sales | YoY |

Sales revenue | 43,297 | - | 75,000 | - | 73.2% |

Operating Income | 13,589 | 100.0% | 24,000 | 100.0% | 76.6% |

Pre-tax profit | 2,243 | 16.5% | 3,000 | 12.5% | 33.7% |

Net income for this period | 2,030 | 14.9% | 2,900 | 12.1% | 42.9% |

*Unit: million yen. IFRS is applied. Net income for this period means profit attributable to owners of parent.

The company revised earnings forecast.

For the fiscal year ending September 2023, the company has significantly revised its forecasts upwardly from sales of 19 billion yen and an operating income of 1.6 billion yen to sales of 24 billion yen and an operating income of 3 billion yen, due in part to the strong performance of the AirTrip travel business, especially in the domestic travel domain, driven by increased demand for travel triggered by the nationwide travel support program. In addition, the dividend amount remains undetermined, but the company is aiming for a dividend payout ratio at a level of 20%.

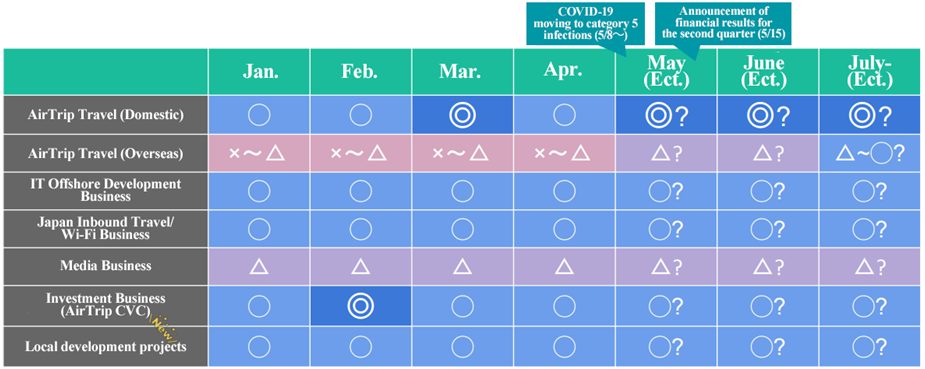

The domestic travel domain was healthy due to the demand growth thanks to nationwide travel support. All existing business areas other than travel performed well, and business progressed steadily. Recovery is expected due to the reclassification of the novel coronavirus to Category 5. Overseas travel in May was on a recovery track, being at 60-70% of the pre-pandemic level.

(From the company's material)

4. Topics

(1) Executed strategic advertising investment aimed at the "profit recovery phase" by utilizing the recognition acquired during the "advertising investment phase."

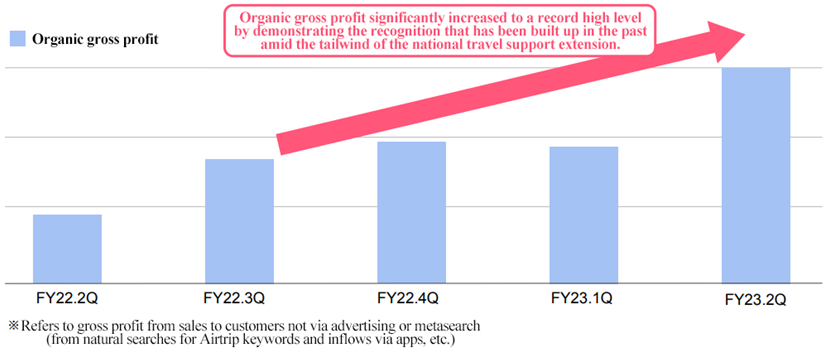

Utilizing the recognition acquired during the "advertising investment phase," the company strategically invested in advertisements to respond to the recent increase in demand for travel. Profit recovery is expected in the second half of the fiscal year due to an improvement in organic search ratio.

(From the company's material)

(2) Significant improvement in cross-selling rate due to an improvement in the number of customers attracted and average spending per customer Cross-selling rate grew significantly with the upsurge in travel demand. The number of customers attracted increased 318% year on year, and average spending per customer increased significantly, achieving a record-high gross profit while maintaining the same level of CVR.

(From the company's material)

(3) Significantly exceeded the previous highest level due to nationwide travel support and enhanced recognitionGross profit from organic search, the most important KPI, significantly exceeded its previous highest level due to nationwide travel support and enhanced recognition. Significantly increased by 150% from the previous highest level in the first quarter of the fiscal year ended March 2023.

(From the company's material)

(4) Airline ticket sales, which are the mainstay, recovered to the pre-pandemic level, and furthermore, the sales of other focused products grew substantially.

Airline ticket merchandise recovered to the pre-pandemic level. Meanwhile, the sales of other focused travel merchandise achieved significant growth exceeding that of the pre-pandemic level. Other focused travel merchandise achieved 167% growth from the pre-pandemic level in the second quarter of the fiscal year ended March 2020.

(From the company's material)

Overcoming the advertising control period and restarting the "profit recovery phase"

The domestic travel domain steadily met increasing demand and led the entire business portfolio. The other business areas continued to make steady business progress and earned a monthly profit throughout the year. Strategic marketing investments will lead to significant growth in gross profit in the domestic travel domain throughout the year.

(From the company's material)

5. Conclusions

Although the global infection status of the novel coronavirus and the government's response to it may have an impact, it is expected that the movement of people will become more active thanks to the relaxation of restrictions during various periods and the reclassification of the novel coronavirus from Category 2 to Category 5 on May 8. In addition, with the expected recovery of the number of foreign visitors to Japan, the company expects that the increase in transaction volume will lead to a further recovery in revenue.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 2 outside ones |

Auditors | 4 auditors, including 2 outside ones |

◎Corporate Governance Report

Last updated on Jan. 4, 2023.

<Basic policy>

Our company group considers the swift decision-making in response to the changes in the business environment, lasting business development, and gaining trust from stakeholders as the most significant business challenges. To improve the health, transparency and efficiency of the operations, all of us are striving to enhance the structure of corporate governance, thorough compliance, and timely and appropriate disclosure (of information).

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

Supplementary Principle 1-2-2 | The Company currently refrains from dispatching the notice of an annual general meeting of shareholders early for the purpose of thoroughly considering the contents before dispatching it, but we will plan to develop a system which enables early dispatch in the future. As for uploading of the notice of an annual general meeting of shareholders onto websites, it is currently disclosed on TDnet and the IR page of our company, and we will consider disclosure before dispatching the notice. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4

| Our company may hold shares strategically, if the shareholding is expected to strengthen business cooperation or contribute to the maintenance or improvement of our corporate value. |

Supplementary Principle 2-4-1

| <Our view on ensuring diversity> Our company acknowledges and respects diverse individuality of each employee, and strives to establish an environment where they can fully exert their abilities. Our corporate group promotes female advancement, while we carry out business activities with foreign human resources in the “IT Offshore Development Business” at the same time. Further, in “the Inbound Travel Business/the Wi-Fi Rental Business,” we run our operation to bring satisfaction through Japanese unique hospitality and production, have a global viewpoint acquired through working with non-Japanese human resources, and take in the needs from visitors traveling to Japan.

(1) Female Employees The ratio of female managers in our company is 9%. Moving forward, we aim to increase the ratio of female managers to 30%, which is the goal pursued by the government, and have been taking approaches for female employees to take significant roles and work in a responsible position. (2) Foreign Employees In the “IT Offshore Development Business,” one of our business portfolios, there are 175 employees employed by Evolable Asia Co., Ltd., a Vietnamese subsidiary outside Japan, accounting for approximately 30% of the total number of employees. The percentage of foreign employees is expected to increase, as the company continues to actively hire local workers, mainly the human resources for system development. (3) Mid-career Employees Our company takes initiatives to actively hire and utilize experienced workers (mid-career hires), and the ratio of mid-career hires in managerial positions is 26% as of April 2021. It is at the adequate level at this point, but we continue to work on proactive use of such workers. |

Supplementary Principle 3-1-3 | Please visit our website for more information about our views, policies and initiatives on sustainability. |

Principle 5-1

| Corporate strategy department is in charge of our IR activities, and the divisions of finance, accounting, publicity, general affairs, human resources, and management planning cooperate in promoting constructive dialogue with shareholders and investors. In addition, we hold results briefing session involving executives four times a year, and a company briefing session for individual investors, and deal with the request for individual interviews within a reasonable range. |

| This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |