Bridge Report:(6183)BELLSYSTEM24 Fiscal Year ended February 2024

President Hiroshi Kajiwara | BELLSYSTEM24 Holdings, Inc. (6183) |

|

Company Information

Exchange | TSE Prime Section |

Industry | Service business |

Representative Director, President, Executive Officer, and CEO | Hiroshi Kajiwara |

Address | 6F Kamiyacho Trust Tower 4-1-1, Toranomon, Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Number of shares issued (Term-end) | Total market cap | ROE Act. | Trading Unit | |

¥1,525 | 73,753,310 shares | ¥112,473 million | 11.5% | 100 shares | |

DPS Est. | Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥60.00 | 3.9% | ¥109.14 | 14.0 x | ¥907.54 | 1.7 x |

*The share price is the closing price on April 10. All figures are taken from the financial results for FY2/24.

Earnings Trend(IFRS)

Fiscal Year | Sales Revenue | Operating Income | Income before Income Taxes | Net Income | EPS | DPS |

February 2021 Act. | 135,735 | 11,799 | 11,305 | 7,252 | 98.64 | 42.00 |

February 2022 Act. | 146,479 | 13,234 | 13,463 | 8,943 | 121.65 | 54.00 |

February 2023 Act. | 156,054 | 14,917 | 14,157 | 9,330 | 126.82 | 60.00 |

February 2024 Act. | 148,717 | 11,479 | 11,225 | 7,545 | 102.61 | 60.00 |

February 2025 Est. | 153,000 | 12,500 | 12,200 | 8,000 | 109.14 | 60.00 |

* The forecast was made by the company. Unit: million-yen, yen. Net income is profit attributable to owners of parent. Hereinafter the same applies.

This Bridge Report introduces the earning results for the fiscal year ended February 2024 and other information of BELLSYSTEM24 Holdings, Inc..

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended February 2024 Earnings Results

3. Fiscal Year ending February 2025 Earnings Forecasts

4. Market Environment and the Company’s Initiatives

5. Conclusions

<Reference : Medium-Term Management Plan 2025>

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended February 2024, sales revenue declined 4.7% year on year to 148.7 billion yen. The sales of basic operations increased 4.6% year on year. New and existing operations expanded as the demand for outsourcing increased amid the normalization of corporate business activities due to the subsiding of the novel coronavirus crisis. Sales of novel coronavirus and other national policy-related services declined 59.7% year on year due to a significant decrease in vaccine-related services. Operating income declined 23.0% year on year to 11.4 billion yen. Gross profit decreased 15.1% year on year due to a decrease in corona and other national policy-related services. On the other hand, SG&A expenses declined 3.7% year on year due to a reactionary decrease in personnel expenses (bonuses) and lower advertising expenses, but this was not enough to offset the decline in sales.

- Sales revenue fell short of the initial forecast by 5.3%. The number of clients increased in basic operations, but there were not as many large projects as expected. The sales of basic operations fell 4.1% short of the forecast. The sales of corona and other national policy-related services also fell short by 18.9%. Operating income fell 16.8% short of the forecast. This was mainly due to lower-than-expected sales revenue. Price revisions also did not proceed as expected, and the time taken to redeploy communicators due to a decrease in novel coronavirus-related projects also had an impact.

- Sales and profit are forecast to increase in the fiscal year ending February 2025. Sales revenue is expected to increase 2.9% year on year to 153 billion yen. The company expects an increase in sales of basic operations and a decrease in sales of the corona and other national policy-related services. Operating income is forecast to rise 8.9% year on year to 12.5 billion yen. Gross profit is expected to grow due to larger sales from basic operations and growth in the performance of consolidated subsidiaries. SG&A expenses are also expected to augment due to higher costs from higher commodity prices and increased expenses associated with business expansion at consolidated subsidiaries. Still, the company expects to absorb these costs and increase profits. The company plans to pay a dividend of 60.00 yen per share, like in the previous year. Dividend payout ratio is expected to be 55.0%. The company aims to maintain a stable and continuous dividend payment based on a basic policy of a payout ratio of 50%.

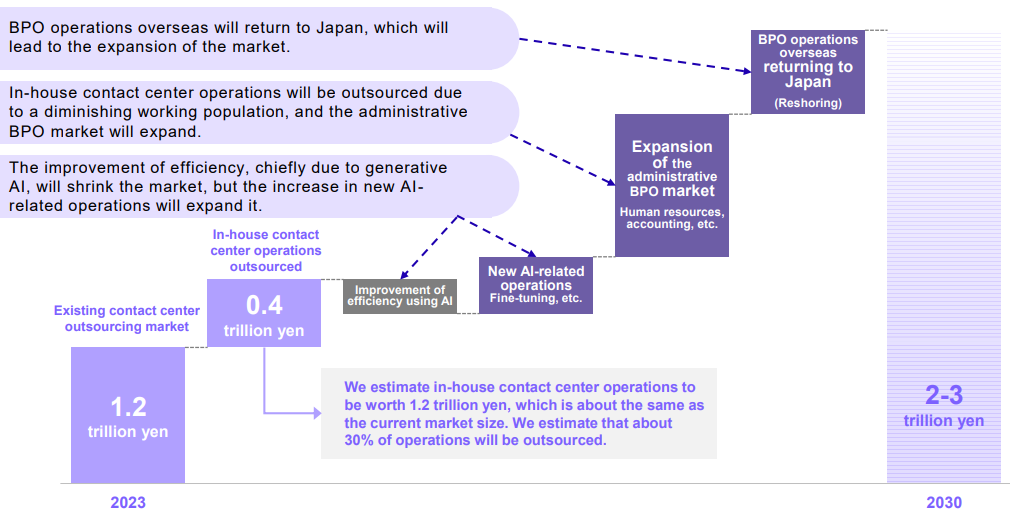

- The company expects the outsourcing market, including domestic contact centers, to expand from its current size of 1.2 trillion yen to 2-3 trillion yen by 2030, including new demand due to the reshoring of overseas BPO, the spread and penetration of generative AI, and the shrinkage of the working-age population. In this context, the company is accelerating its efforts to utilize generative AI in contact centers, and from the standpoint of "bridging the gap between the smooth installation of generative AI and operation management," it plans to promote new collaboration between customers, system vendors, generative AI vendors, and the company.

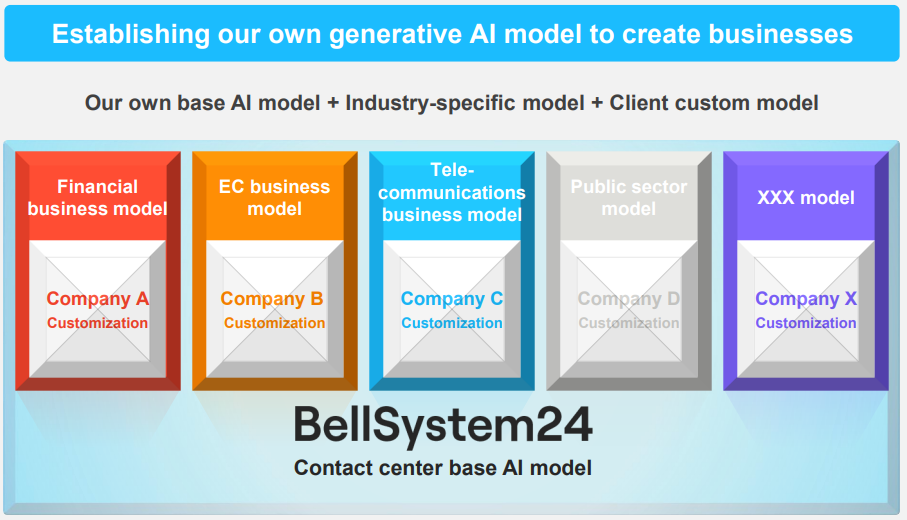

- In terms of utilization of generative AI, the company believes it is effective to utilize generative AI optimally for clients by building models specific to each industry, such as finance, EC, and telecommunications, and custom models for client companies, while using the "contact center-based AI model" targeted for use in contact centers, rather than LLM (large-scale language model), as a common foundation.

- Although the company is forecasting the growth of sales and profit for the fiscal year ending February 2025 compared to the decreases in sales and profit in the fiscal year ended February 2024, its initial forecast for sales revenue is 153 billion yen, falling short of its largest record of 156 billion yen in the fiscal year ended February 2023 and the initial forecast of the fiscal year ending February 2024, which was 157 billion yen. Amid a decline in corona and other national policy-related services, it remains to be seen how much recovery the company will achieve in the basic operations thanks to the growth of new client projects, where it did not receive orders for large projects as expected in the previous year. We would also like to keep an eye on the progress made in price revisions. On the other hand, there are many inquiries from clients and system vendors for the company's expertise in utilizing generative AI, as they are well-versed in field operations. Thus, their future releases are highly anticipated.

1. Company Overview

The company, which is the holding company, and its 6 subsidiaries form a corporate group. The main businesses include the Customer Relationship Management (CRM) business in which a focus is given to the outsourcing of contact center operations, technology services, and consulting services.

The subsidiaries are BELLSYSTEM24, Inc. (capital contribution rati 100.0%), which operates contact centers and related services, CTC First Contact Corporation (capital contribution rati 51.0%), which provides IT service desk and business process undertaking services, Horizon One Inc. (capital contribution rati 51.0%), a joint venture with Layers Consulting Co., Ltd., which undertakes business processes and offers various consulting, and human resource activity support services in the areas of human resources and accounting, THINKER Inc. (capital contribution rati 70.0%), which utilizes data generated at customer contact points for corporate marketing DX and also develops AI solutions led by data analysts and engineers, BellSoleil, Inc. (capital contribution rati 100.0%), a special subsidiary aimed at promoting the employment of people with disabilities, and BELLSYSTEM24 VIETNAM Inc. (capital contribution rati 80.0%), which operates contact center business in Vietnam.

There are two affiliated companies accounted for by the equity method: TB Next Communications Co., Ltd. (capital contribution rati 49.0%), a joint venture with TOPPAN Inc. that supports DX promotion and develops next-generation BPO services, and TrueTouch Co., Ltd. (capital contribution rati 49.9%), which operates a contact center in Thailand and provides services to customers in Japan and overseas.

ITOCHU Corporation holds 40.7% of the company’s voting rights and deems the company as a company accounted for using the equity method. In ITOCHU Corporation, which is focusing on business in non-resource sectors, especially the Consumer related Sector, the company, which engages in the call center business, plays a role as “the contact point between companies and consumers.” Since the capital alliance entered into in October 2014, the company has built a broad range of alliances and successfully expanded the volume of transactions with ITOCHU Corporation (the company makes transactions with ITOCHU Group under the same transaction conditions as other client companies, and will continue to follow the policy).

BELLSYSTEM24, Inc., the core of the group, has been developing a wide range of task-undertaking businesses focusing on contact centers that serve as the interface between companies and consumers for approximately 40 years since its establishment in 1982 and has created a standard model for the industry.

Based on the operational expertise cultivated by combining the power of people and technology, the company is actively developing new solutions in addition to the conventional service provision methods that use the telephone as the primary service channel, with the aim of improving its business value.

【1-1 Corporate Philosophy】

The company pursues the following PURPOSE and VALUES.

In order to define in a single word what we should be and our commitments, the company has established a CORPORATE VOICE and a MANIFESTO for further clarification.

PURPOSE

To sustain the prosperity of society, through innovation and communication

VALUES

・Dialogue: Engaging to better understand concerns and ideas, working together toward resolutions and success.

・Creativity: Fusing the competence of on-site workers with the evolving technology to create unmatched value

・Diversity: Creating workplaces that enable each employee to thrive as individuals and discover hidden potential

・Partners in success: Committing success for our customers by using accumulated experience to achieve optimal solutions

・Co-creating prosperity: Increasing the experiential value of products and services to support precious moments for all

【1-2 Business Contents】

(1) Business Description

The company’s business consists of the Customer Relationship Management (CRM) business, which is the segment to be reported, and other businesses, with the CRM business accounting for over 90% of consolidated sales.

Sales by segment

| FY2/24 |

CRM business | 148,107 |

Other | 610 |

Consolidated sales revenue | 148,717 |

* Unit: million yen

CRM Business

The CRM Business is the business field mainly of BELLSYSTEM24, Inc. and CTC First Contact Corporation. In addition to the conventional task of dealing with inbound and outbound calls, which use telephones as a major communication tool, in this business, a multitude of services that take advantage of Information Technology (IT), such as the Internet and social media, are offered to client companies. This is a stock business in which continuing operations make up around 90% of sales, and spot operations, such as election-related tasks, constitute the remaining portion. Furthermore, sales from Softbank Corp. (operations of BB Call, Inc.) account for around 10% of the total sales (continuing operations). The business is composed of the following 4 operations:

1) Customer support for client companies (mainly by dealing with inquiries about products and services of client companies)

2) Sales support for client companies (mainly by assisting client companies in promoting sales of their products and services)

3) Technical support for client companies (mainly by handling inquiries as to how to operate IT-based products of client companies)

4) BPO tasks (mainly by undertaking creation of websites, and data entry for client companies)

(2) Customers

The number of customers (basic services) at the end of February 2024 was 1,350, up 100 from the previous year.

The company's ability to respond to the needs of customers in diverse industries and business categories has been highly evaluated.

Industry Type | Overview |

Service | Introduction of personnel, Internet-related services, broadcasting, electronic money, code settlement, point services, etc. |

Transportation & Communication Industry | Communications carriers, providers, travel, transportation, etc. |

Finance and Insurance | Banking, securities, life and non-life insurance, credit cards, etc. |

Wholesale and Retail | Mail order, e-commerce, product sales services, etc. |

Manufacturing | Manufacturers, food production, printing, pharmaceuticals, etc. |

Other | Local governments, electricity, gas, water, housing, real estate, etc. |

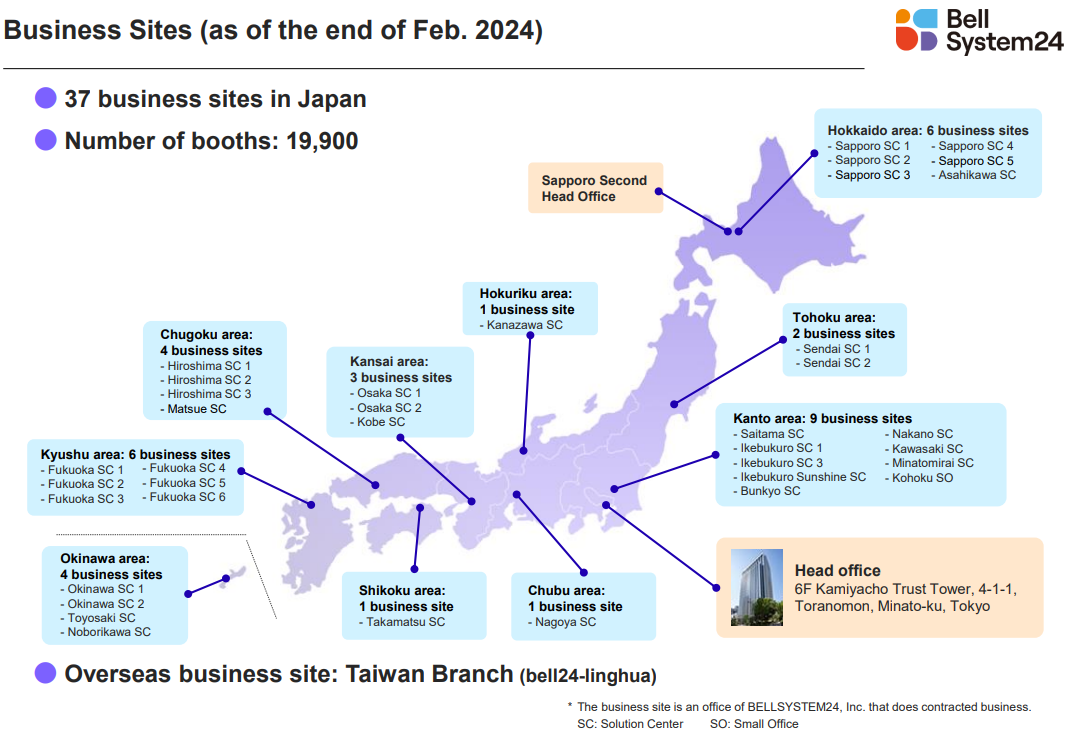

(3) Business establishments

As of the end of February 2024, the company had 37 offices and 19,900 booths in Japan. As overseas bases, the company has a branch in Taiwan and group companies in Vietnam and Thailand.

(From the company’s materials)

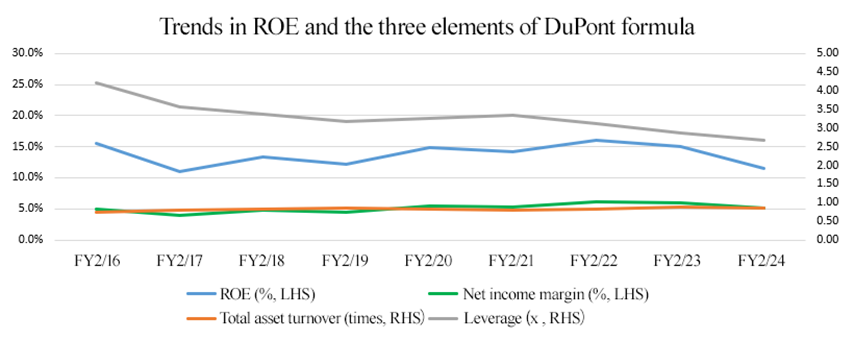

【1-3 ROE Analysis】

| FY 2/16 | FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 | FY 2/23 | FY 2/24 |

ROE (%) | 15.6 | 11.0 | 13.4 | 12.1 | 14.8 | 14.2 | 16.0 | 15.1 | 11.5 |

Net income margin (%) | 4.91 | 3.95 | 4.85 | 4.46 | 5.53 | 5.34 | 6.11 | 5.98 | 5.07 |

Total asset turnover (times) | 0.75 | 0.79 | 0.82 | 0.86 | 0.82 | 0.80 | 0.83 | 0.88 | 0.85 |

Leverage (x) | 4.22 | 3.56 | 3.37 | 3.16 | 3.25 | 3.34 | 3.13 | 2.88 | 2.69 |

Despite the downward trend in leverage, ROE has remained in the order of 10%, exceeding the 8% target that Japanese companies are generally considered to be aiming for. The company believes that there is significant room for further improvement in ROE through improved profitability.

【1-4 ESG】

(1) Initiatives

The company actively engages in activities for solving social issues, while considering its corporate ethos, important missions, and ESG.

E | * Adoption of renewable energy in the company's centers and data centers As the first step to become carbon neutral by 2040, the company has adopted renewable energy at two of its own contact centers and a data center as part of the facilities as the mid-term targets in the Climate Change Policy. The company will operate five sites in Japan as “sustainable centers” that do not generate greenhouse gases. |

S | * Awarded the grand prize at the “J-Win Diversity Awards 2023,” sponsored by the Cabinet Office and the Ministry of Health, Labor and Welfare. The company received the “Grand Prize” in the “Advanced Category,” the highest class, at the “J-Win Diversity Awards 2023,” organized by J-Win, a non-profit organization sponsored by the Cabinet Office, the Ministry of Health, Labor and Welfare, and other organizations.

* Sponsored LGBTQ+ events in Sapporo and Osaka The company sponsored “Sapporo Rainbow Pride 2023” (Sapporo) and “Rainbow Festa!” (Osaka). The company placed advertisements as an “LGBTQ+ friendly company*” and participated in the parade. *LGBTQ+ friendly company A company that is committed to creating an LGBTQ+-friendly workplace, regardless of whether employees have come out to others as LGBTQ+

* Sponsored “CHALLENGE COFFEE BARISTA,” a barista competition for people with disabilities The company continued to be the main sponsor of the event from last year. The company's staff members of “a cafe operated by employees with disabilities” formed a team and participated in the competition.

* Received the “D&I Award Prize (Large Company Category)” in the D&I Recognition System “D&I Award 2023" In the “D&I Award,” which recognizes LG diversity and inclusion initiatives, the company was recognized as the top-ranked “BEST WORKPLACE” for the third consecutive year and received the “D&I Award (Large Company Division),” which is given to companies that serve as role models. |

*Posted on the FY2/24 Explanatory Material

The company was selected as a component of the “FTSE Blossom Japan Index” and the “FTSE Blossom Japan Sector Relative Index,” which are stock price indices for Japanese companies that meet global ESG standards.

2. Fiscal Year ended February 2024 Earnings Results

【2-1 Consolidated Earnings】

| FY 2/23 | Ratio to sales | FY 2/24 | Ratio to sales | YoY | Compared with forecast |

Sales revenue | 156,054 | 100.0% | 148,717 | 100.0% | -4.7% | -5.3% |

Gross profit | 31,962 | 20.5% | 27,139 | 18.2% | -15.1% | - |

SG&A expenses | 17,231 | 11.0% | 16,598 | 11.2% | -3.7% | - |

Operating income | 14,917 | 9.6% | 11,479 | 7.7% | -23.0% | -16.8% |

Income before Income Taxes | 14,157 | 9.1% | 11,225 | 7.5% | -20.7% | -16.2% |

Net income | 9,330 | 6.0% | 7,545 | 5.1% | -19.1% | -14.3% |

*Unit: million yen. Net income is profit attributable to owners of the parent.

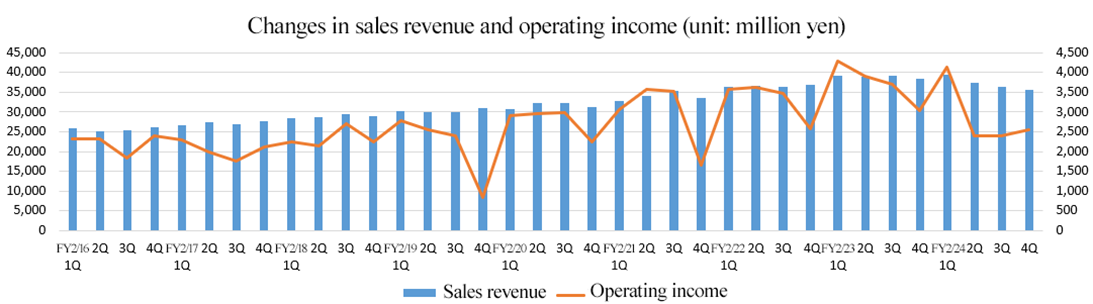

Revenue and profit down

Sales revenue declined 4.7% year on year to 148.7 billion yen.

The sales of basic operations increased 4.6% year on year. New and existing operations expanded as the demand for outsourcing increased amid the normalization of corporate business activities due to the subsiding of the novel coronavirus crisis. Sales increased thanks to the addition of sales revenue from a subsidiary in Vietnam. Sales of novel coronavirus and other national policy-related services declined 59.7% year on year due to a significant decrease in vaccine-related services.

Operating income declined 23.0% year on year to 11.4 billion yen. Gross profit decreased 15.1% year on year due to a decrease in corona and other national policy-related services. On the other hand, SG&A expenses declined 3.7% year on year due to a reactionary decrease in personnel expenses (bonuses) and lower advertising expenses, but this was not enough to offset the decline in sales.

Net income declined 19.1% year on year to 7.5 billion yen. Equity in earnings of affiliates improved from a loss of 290 million yen in the previous year to a profit of 140 million yen.

Sales revenue fell short of the initial forecast by 5.3%. The number of clients increased in basic operations, but there were not as many large projects as expected. The sales of basic operations fell 4.1% short of the forecast. The sales of corona and other national policy-related services also fell short by 18.9%.

Operating income fell 16.8% short of the forecast. This was mainly due to lower-than-expected sales revenue of basic operations and corona and other national policy-related services. Price revisions also did not proceed as expected, and the time taken to redeploy communicators due to a decrease in novel coronavirus-related projects also had an impact.

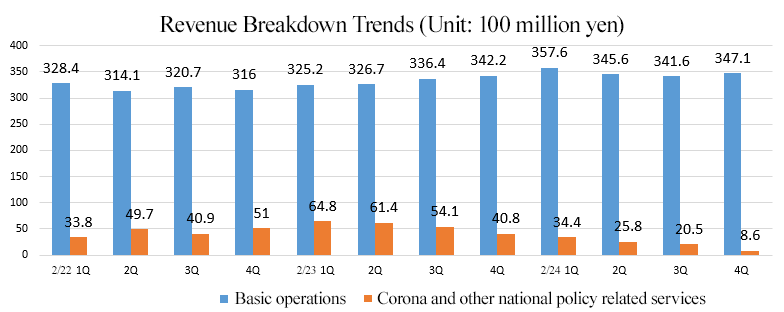

◎Revenue Breakdown

| FY 2/23 | FY 2/24 | YoY | Compared with forecast |

Sales revenue | 1,560.5 | 1,487.2. | -4.7% | -5.3% |

Basic operations | 1,330.5 | 1,391.9. | +4.6% | -4.1% |

Corona and other national policy-related services | 221.1 | 89.2 | -59.7% | -18.9% |

Others | 9.0 | 6.1 | -32.2% | -32.2% |

*Unit: 100 million yen.

◎Basic Operations

Sales increased. In addition to the steady expansion of new and existing operations, the growth of sales revenue of the new consolidated subsidiary contributed.

As mentioned above, the number of large projects was small and fell short of the company's initial forecast. Still, the number of new clients steadily increased, which the company believes will lead to future growth in the current fiscal year and beyond.

◎Corona and other national policy-related services

The sales revenue of vaccine-related operations fell below the amount in the previous fiscal year and the initial forecast.

【2-2 Business Topics】

(1) Sales revenue in each industry (Basic operations)

| FY 2/23 | FY 2/24 | YoY |

Service industry | 316 | 338 | +7.0% |

Transportation/communication | 323 | 306 | -5.3% |

Finance/insurance industry | 222 | 240 | +8.1% |

Wholesale/retail | 187 | 175 | -6.4% |

Manufacturing industry | 90 | 83 | -7.8% |

Other | 68 | 70 | +2.9% |

*Unit: 100 million yen. The sales revenue in each field indicates the sum of sales revenues from top 300 client companies of BELLSYSTEM24, Inc. (non-consolidated). The year-on-year percentage change is calculated by Investment Bridge based on the company’s data.

(Increase in sales)

Services: Sales increased despite a decrease in the sales of delivery-related services, mainly due to an increase in the sales of placement and recruiting services.

Finance/Insurance: Sales of insurance-related services, mainly life and non-life insurance, and credit card-related services were strong..

Othe The company promoted municipal DX initiatives, and sales of public services remained flat.

(Decrease in sales)

Transportation/Telecommunications: Sales of telecommunication carriers were almost flat, and sales of transportation services were down due to a reduction in recall transactions.

Wholesale and retail: Mail-order sales increased, but sales of general merchandise sales-related operations continued to decline.

Manufacturing: Sales of information services in the pharmaceutical business decreased due to the subsiding of the novel coronavirus crisis. Manufacturers also faced a decline in sales due to the termination of recall-related transactions.

*In human resources/education-related operations, steady growth was observed mainly in mid-career placement-related operations as the number of job openings continued to increase due to the increase in labor mobility.

*In non-face-to-face system related business, sales of insurance-related business continued to expand, but sales of delivery-related business and e-commerce-related business declined as the novel coronavirus crisis subsided.

*In cashless payment-related operations, in addition to an increase in sales of credit card-related operations, e-money and QR code payment-related operations are steadily expanded.

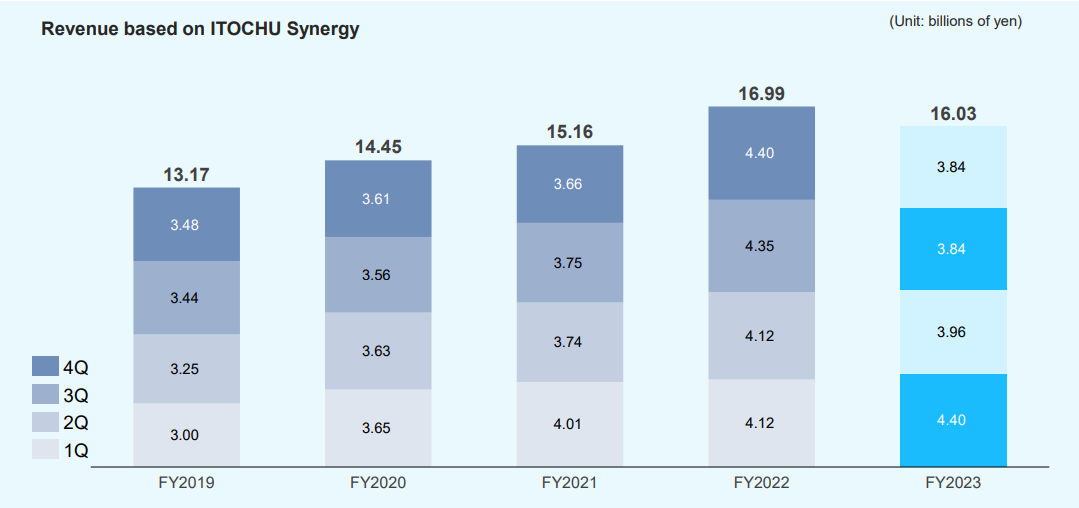

(2) ITOCHU Synergy

Sales decreased 5.7% year on year. Although sales of telecom carriers and finance-related services increased steadily, sales declined due to the completion of large projects in the previous fiscal year.

(From the company’s materials)

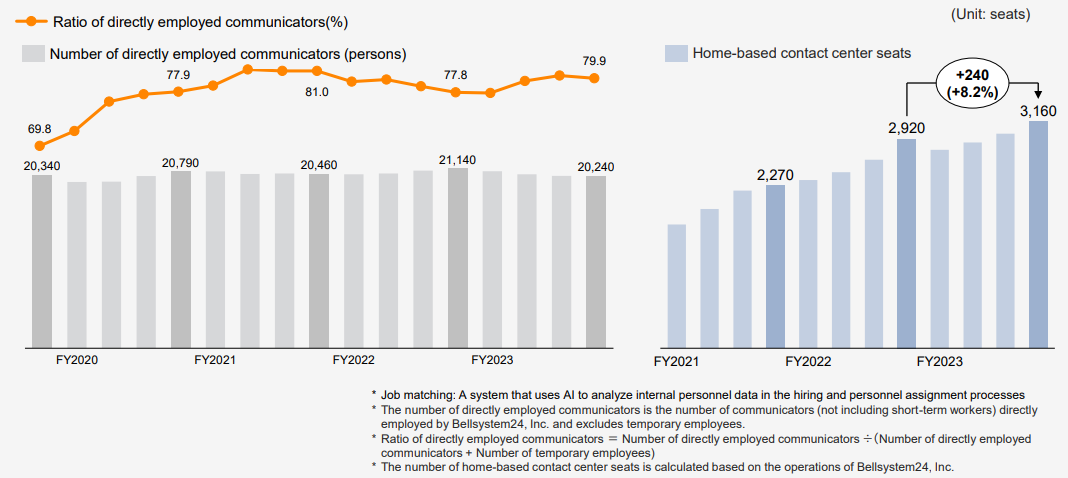

(3) Ratio of Directly-Hired CMs and Number of Home Contact Center Seats

In the fourth quarter of fiscal 2024 (December-February), the ratio of directly employed communicators (CMs) increased 2.1% year on year to 79.9%. The JOB matching system, which was fully adopted this fiscal year, is gradually expanding its scope of use and is contributing to the improvement of the ratio of directly employed CMs. In the future, it is expected to improve retention rate.

The number of home-based contact center seats at the end of February 2024 was 3,160, up 240 (8.2%) from the end of the previous fiscal year.

(From the company’s materials)

The number of BellCloud+ (Plus) seats, which form the foundation for DX using voice data, increased 1,090 from the end of the previous fiscal year to 7,240. While the pace of increase has slowed down from the previous fiscal year, the number of seats is steadily expanding.

The number of seats for the voice recognition system was 1,200 at the end of February 2024, showing a slight decrease from the end of the previous fiscal year due to the termination of some operations. However, the company aims to install more units of this system as a foundation for utilizing and promoting data analysis and generative AI technologies.

(4) Progress of the Investment in the Medium-term Management Plan

The total investment amount for the three years until the fiscal year 2025 announced in the Medium-Term Management Plan 2025 amounted to more than 15 billion yen. The investment is scheduled to be focused on the following areas:

1. Investment in equipment at business establishments, etc.

2. Business investment

3. Investment for data-based solutions and human capital enhancement

The total investment amount in the fiscal year ended 2023 was 4.01 billion yen. The details were as follows.

Category | Investment amount | Breakdown |

Capital investment | 2.2 billion yen | ・ Data utilization solutions: investment in voice infrastructure (Bellcloud, Bellcloud+, etc.) ・ IT infrastructure investment: Investment in IT equipment and software development ・ Facility investment: Expansion of regional offices and facility investment ・ ESG-related investment: adoption of LED-based vegetable gardens, etc. |

Business investment | 860 million yen | ・ M&A: New consolidated subsidiaries (BELLSYSTEM24 VIETNAM and THINKER, Inc.) ・ Venture investment: Small investment in business companies |

Investment expenses | 950 million yen | ・ Data utilization solutions: data analysis investment, AI and DX-related investment ・ Strengthening human capital: investment in human resources training, investment in improving the environment of business establishments and engagement |

Total | 4.01 billion yen | - |

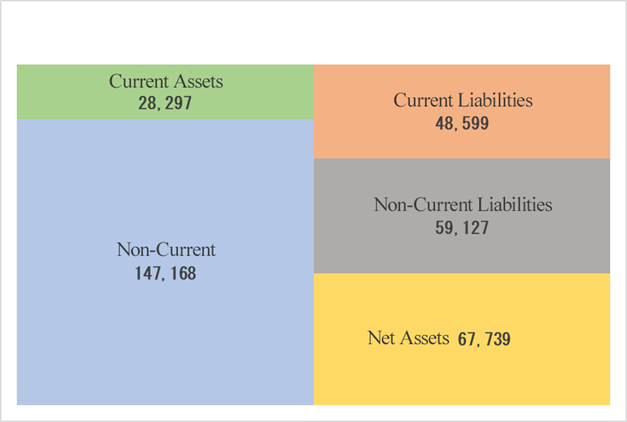

【2-4 Financial condition and Cash Flow (CF)】

Financial condition

| Feb. 23 | Feb. 24 | Increase/ decrease |

| Feb. 23 | Feb. 24 | Increase/ decrease |

Current assets | 30,673 | 28,297 | -2,376 | Current liabilities | 46,238 | 48,599 | +2,361 |

Cash and deposits | 6,998 | 7,213 | +215 | Trade debt | 7,634 | 5,531 | -2,103 |

Trade Receivables | 21,232 | 19,195 | -2,037 | Loans payable | 16,600 | 23,000 | +6,400 |

Noncurrent assets | 145,577 | 147,168 | +1,591 | Noncurrent liabilities | 65,101 | 59,127 | -5,974 |

Tangible assets | 37,007 | 35,828 | -1,179 | Long-term loans payable | 38,221 | 33,234 | -4,987 |

Goodwill | 94,900 | 96,772 | +1,872 | Total liabilities | 111,339 | 107,726 | -3,613 |

Total assets | 176,250 | 175,465 | -785 | Total capital | 64,911 | 67,739 | +2,828 |

|

|

|

| Equity capital(*) | 64,224 | 66,730 | +2,506 |

|

|

|

| Total loans payable | 54,821 | 56,234 | +1,413 |

*Unit: million yen. Equity capital is total equity attributable to owners of the parent.

Total assets decreased 700 million yen from the end of the previous fiscal year, mainly due to the decreases in trade receivables and fixed tangible assets. Total liabilities declined 3.6 billion yen, mainly due to the decline in trade payables.

Total capital increased 2.8 billion yen from the end of the previous term due to an increase in retained earnings. Capital-to-asset ratio increased 1.6 points from the end of the previous term to 38.0%.

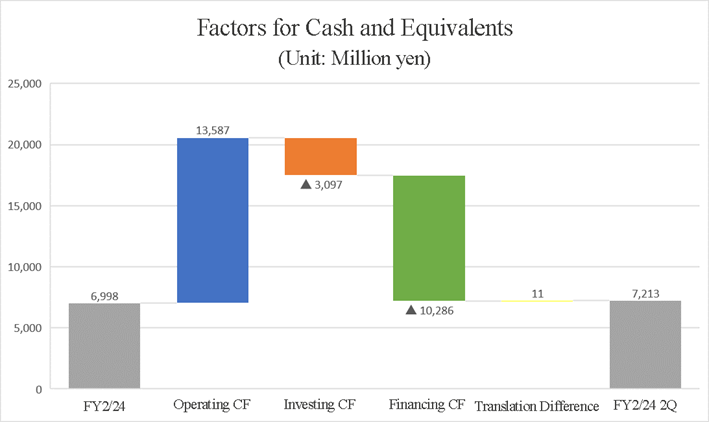

◎Cash Flow

| FY 2/23 | FY 2/24 | Increase/ decrease |

Operating Cash Flow | 18,172 | 13,587 | -4,585 |

Investing Cash Flow | -1,803 | -3,097 | -1,294 |

Free Cash Flow | 16,369 | 10,490 | -5,879 |

Financing Cash Flow | -15,583 | -10,286 | +5,297 |

Cash and Equivalents at Term End | 6,998 | 7,213 | +215 |

*Unit: million yen.

The surpluses in operating and free CFs shrank compared to the fiscal year ending February 2023 as income before income taxes decreased and there were no longer proceeds from sales of marketable securities, which were recorded in the previous fiscal year.

The cash positions have improved.

3. Fiscal Year ending February 2025 Earnings Forecasts

3-1 Consolidated Earnings forecast

| FY 2/24 | Ratio to sales | FY 2/25 Est. | Ratio to sales | YoY |

Sales revenue | 148,717 | 100.0% | 153,000 | 100.0% | +2.9% |

Gross profit | 27,139 | 18.2% | 29,800 | 19.5% | +9.8% |

SG&A expenses | 16,598 | 11.2% | 17,300 | 11.3% | +4.2% |

Operating income | 11,479 | 7.7% | 12,500 | 8.2% | +8.9% |

Income before Income Taxes | 11,225 | 7.5% | 12,200 | 8.0% | +8.7% |

Net income | 7,545 | 5.1% | 8,000 | 5.2% | +6.0% |

*Unit: million yen.

Forecast increase in sales and income.

Sales revenue is expected to increase 2.9% year on year to 153 billion yen. The company expects an increase in sales of basic operations and a decrease in sales of the corona and other national policy-related services.

Operating income is forecast to rise 8.9% year on year to 12.5 billion yen. Gross profit is expected to grow due to larger sales from basic operations and growth in the performance of consolidated subsidiaries. SG&A expenses are also expected to augment due to higher costs from higher commodity prices and increased expenses associated with business expansion at consolidated subsidiaries. Still, the company expects to absorb these costs and increase profits.

The company plans to pay a dividend of 60.00 yen per share, like in the previous year. Dividend payout ratio is expected to be 55.0%. The company aims to maintain a stable and continuous dividend payment based on a basic policy of a payout ratio of 50%.

◎Revenue Breakdown

| FY 2/24 | FY 2/25 Est. | YoY |

Revenue | 1,487.2 | 1,530.0 | +2.9% |

Basic operations | 1,391.9 | 1,493.0 | +7.3% |

Corona and other national policy-related services | 89.2 | 30.0 | -66.4% |

Other | 6.1 | 7.0 | +14.8% |

*Unit: 100 million yen.

*Basic operations

The company forecasts an increase in sales. Expansion of demand for outsourcing due to personnel shortages and new services such as DX solutions will contribute to sales growth.

The company will continue its price revision efforts periodically.

*Corona and other national policy-related services

A large decrease in sales is forecasted. In the previous fiscal year, large-scale novel coronavirus-related operations such as vaccination inquiries were almost completed. The company anticipates securing projects related to the disbursement of various subsidies by the national government and local governments.

4.Market Environment and the Company’s Initiatives

The market environment surrounding the company and the company's future initiatives are as follows.

【4-1 Contact Center Outsourcing Market】

Based on the following three main factors, the company believes that the scale of the contact center outsourcing market in Japan will expand from 1.2 trillion yen to 2-3 trillion yen by 2030.

(1) Return of overseas BPO to Japan

In the 2000s, many Japanese companies took their BPO operations overseas due to the strong yen and the wage gap between Japan and overseas. However, the depreciation of the yen and the narrowing wage gap have led to the return of these companies to the Japanese domestic market.

(2) Diffusion and penetration of generative AI

The market is expected to expand due to the increase in new AI-related operations, despite the market shrinking due to efficiency improvements from generative AI and other factors.

(3) Decline in the workforce

As the workforce shrinks, companies have been forced to outsource the operation of their contact centers, which were previously built and operated in-house.

In addition, while securing the workforce for core operations, the trend toward BPO in administrative operations such as human resources and accounting will further intensify.

The company estimates that the size of the in-house contact center is 1.2 trillion yen, which is comparable to the existing market, and estimates that about 30% of operations in the market will be outsourced.

(From the company’s materials)

【4-2 The Company’s Initiatives】

(1) Utilization of generative AI◎ Promotion of new partnerships

Since May 2023, the company has been using the contact center to demonstrate the use of generative AI using real data.

When generative AI is used, knowledge on how conventional contact center operations can be changed and made more efficient is accumulated.

When these results were provided to the client company, cooperating system vendors, system integrators, and generative AI vendors, not only did the client company comment, “We now have a concrete image for use in contact center operations,” but the vendors and system integrators also commented, “It is very useful to use actual data to understand the response level of each generative AI.

Vendors also highly evaluate the strength of owning and operating their own contact centers.

From the standpoint of “acting as a bridge for smooth introduction and operational management of generative AI,” the company intends to promote new collaboration among the four parties (client, system vendor, generative AI vendor, and the company) for the introduction of generative AI.

◎Generative AI models: generative AI model concept for the contact center industry

Regarding generative AI, the use of the LLM (large-scale language model) represented by OpenAI is attracting public attention. However, the company believes that it is effective to develop industry-specific models such as finance, EC, and telecommunications, as well as custom models for individual client companies, while using the “contact center-based AI model,” which is targeted for use in contact centers, as a common base instead of the so-called LLM, in order to provide optimal generative AI utilization for customers.

The company also believes that it needs to be flexible in its approach to generative AI, as new situations are emerging every day.

(From the company’s materials)

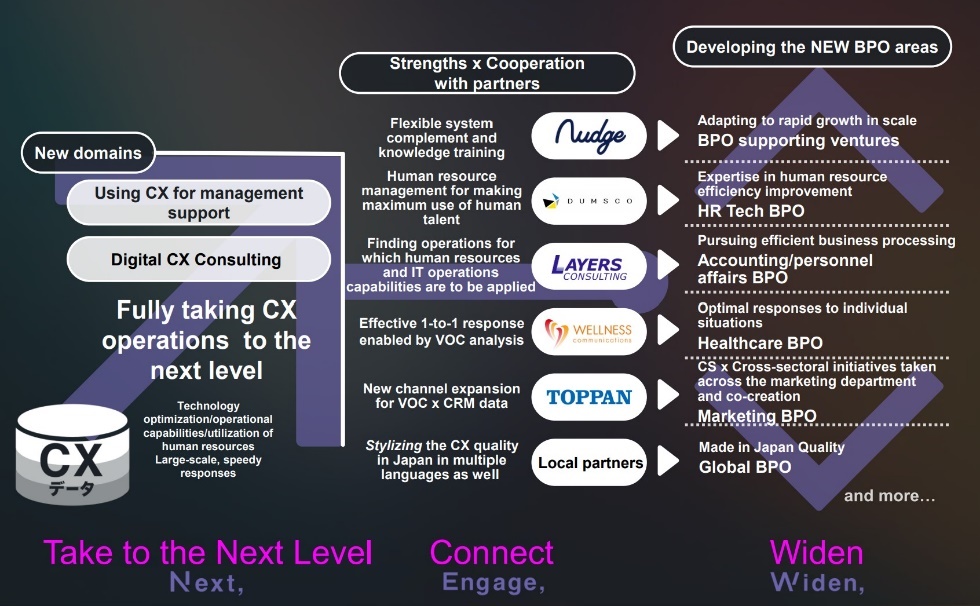

(2) Cultivation of new BPO markets

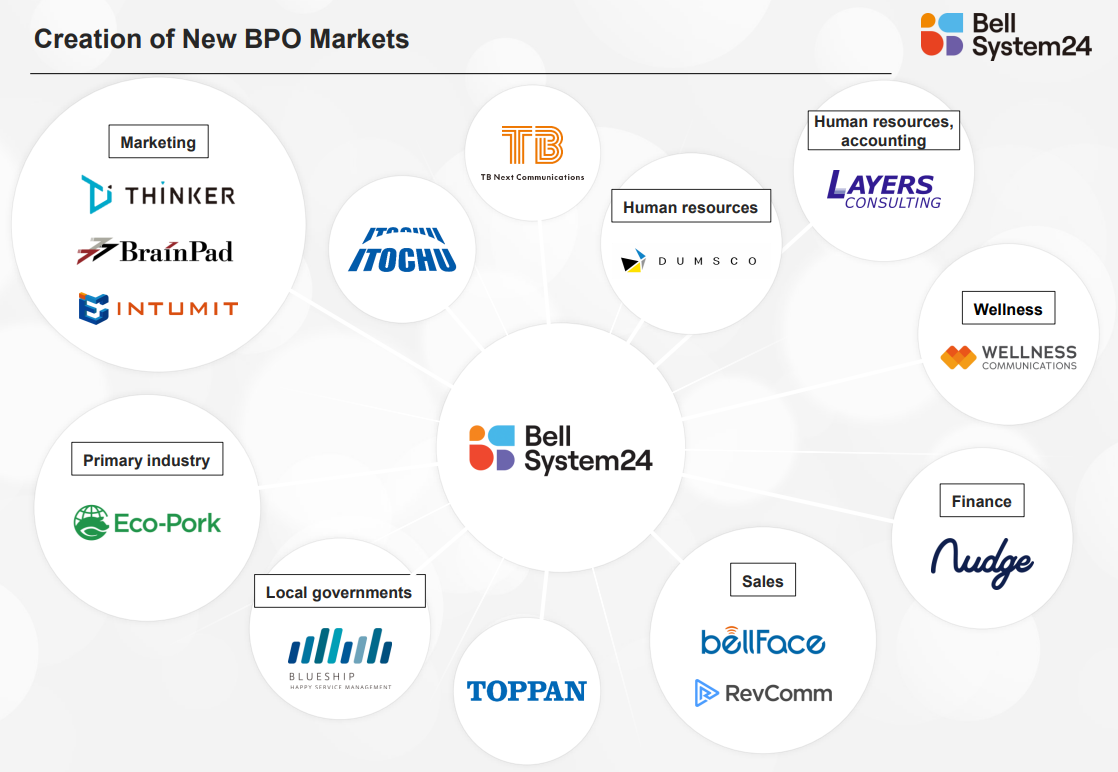

The company is strengthening its relationships with companies with unique strengths through M&A and alliances with THINKER Inc., Eco-Pork Co., Ltd., and Blueship Co., Ltd. In addition to the ITOCHU Group, it will use the resources of each company to develop new BPO markets by creating more structured and efficient operations, including marketing, human resources, personnel accounting, wellness, finance, sales, local governments, and primary industries.

Although there is competition with consulting companies, the company intends to leverage its strengths of being well versed in on-site operations to survive the competition.

(From the company’s materials)

5. Conclusions

Although the company is forecasting the growth of sales and profit for the fiscal year ending February 2025 compared to the decreases in sales and profit in the fiscal year ended February 2024, its initial forecast for sales revenue is 153 billion yen, falling short of its largest record of 156 billion yen in the fiscal year ended February 2023 and the initial forecast of the fiscal year ending February 2024, which was 157 billion yen.

Amid a decline in corona and other national policy-related services, it remains to be seen how much recovery the company will achieve in the basic operations thanks to the growth of new client projects, where it did not receive orders for large projects as expected in the previous year. We would also like to keep an eye on the progress made in price revisions.

On the other hand, there are many inquiries from clients and system vendors for the company's expertise in utilizing generative AI, as they are well-versed in field operations. Thus, their future releases are highly anticipated.

<Reference : Medium-Term Management Plan 2025>

(1) Overview

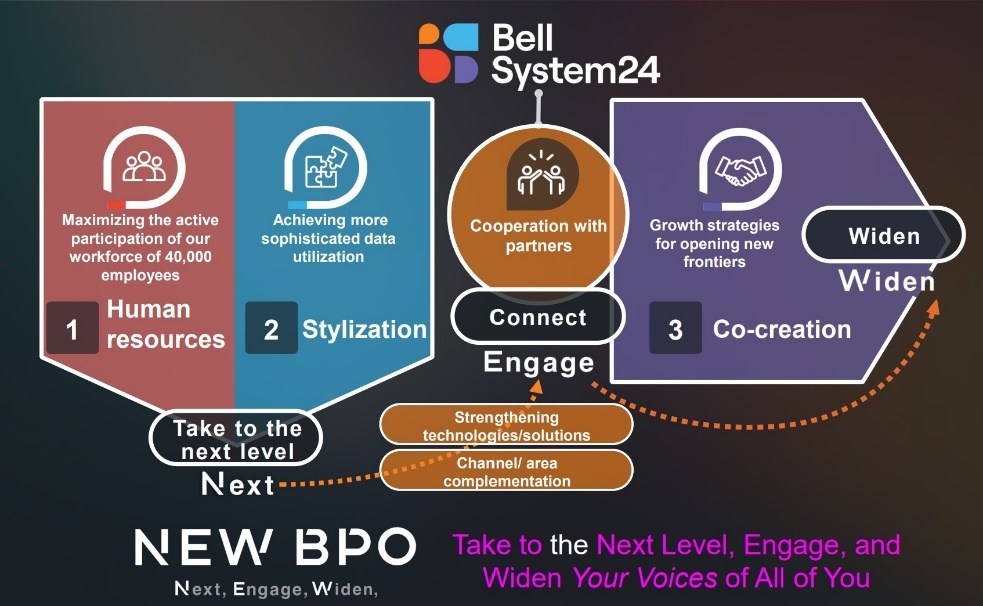

The theme of the Mid-Term Management Plan is NEW BPO-To Pursue, Connect, and Widen all “The Voices.”

After COVID-19 has subsided, society is seeing changes, such as “the normalization of economic activities and the resulting labor market tightening,” “the emergence of various management issues with an uncertain outlook arising from complex risks,” “the growth of marketing needs due to technological evolution and the complexity of customer contact points.”

In addition, the market is expected to see changes and increasing needs such as “rising labor costs due to a shortage of human resources and a shift toward automated customer service,” “increasing demand for effective BPO in both offensive and defensive areas amid various management challenges,” “marketing through the use of technology and the necessity to secure highly skilled professionals who can play an active role.”

In such a business environment, the company aims to provide new BPO services to its clients by listening to all voices (needs), including those of society, businesses, and consumers, and transforming them into value related to management decisions, process standardization, and data utilization for realizing optimal actions.

NEW also means “Next, Engage, Widen.”

(2) Priority Measures

The three priority measures are “Human resources: To have 40,000 employees exert their abilities to the maximum degree,” “Standardization: Advancement of data utilization,” and “Co-creation: Cultivating the BPO domain.”

Priority Measures | Summary/ Theme |

1. Human Resources | Systematizing growth opportunities and creating the next-generation working environment. *Evolve and expand to a complete home-based operation *Maximizing the capabilities of individuals through job matching *Promoting diverse and flexible workstyle reforms in all aspects |

Standardization | Pursuing and expanding CX operations to meet customer needs*Improving performance through pursuit of technology and analysis of voice data*Sophisticating data linkage to meet customer needs*Pursuing a hybrid operation of automation and human resources |

3. Co-creation | Creating a new BPO domain with mutually beneficial and operational capabilities *Discovering BPO areas with high demand for large scale/stable operation needs. *Establishing marketing BPO for the evolution of CX *Promoting R&D for next-generation BPO operations with the application of new technologies |

※CX:Customer eXperience

To Pursue “1. Human Resources” and “2. Standardization,” realize collaboration with partners, which the company have been working on since the previous medium-term plan (connect), and aim to develop a new BPO domain through “3. Co-creation” (widen).

(From the company’s materials)

① Human resources: To have 40,000 employees exert their abilities to the maximum degree

◎ Promotion of complete home-based operations

Building a workplace where employees “mutually” optimize diversity and efficiency to overcome place and time constraints.

Establishing a sustainable way of working that does not require going out and allows for the fulfilment of life and work with the goal of securing excellent human resources, reducing labour shortages, and promoting the efficiency of the canters.

Increasing the number of home-based seats from 3,000 at the end of the previous fiscal year to 10,000, which includes fully home-based seats.

◎ Enhancement of aptitude and job matching

To that end, the company, in collaboration with DUMSCO, Inc., a company that uses AI to analyse human resources data and develop applications, has developed a “business-matching recruitment model” that combines the use of an AI prediction model based on in-house HR data with a new company-wide unified recruitment standard and process and has begun operating it company-wide for the purpose of recruiting and retaining long-term employees.

The company believes that this will provide applicants with relevant and diverse employment opportunities to play an active role, and by streamlining the hiring process, it will further enhance follow-up services such as post-recruitment training and prevent resignation further.

DUMSCO, Inc. is a pioneering company in design and operation of AI that maximizes the performance of human resources, and Bellsystem24 Holdings has acquired 10.0% of DUMSCO's shares.

② Standardization: To pursue CX operations

◎Aim of CX operations

To advance CX operations by utilizing data and deliver new value

To build a system in which 40,000 employees can feel the pleasure of working and everyone can play an active role, and compile data on the voices of both consumers and clients.

To attend to consumers for meeting various needs to improve customers’ experience and optimize the business process of each client to contribute to their business growth

◎ Pursuit from two aspects

In addition to enhancing the utilization of voice data in existing contact center operations, CX will be extended in two aspects: IT utilization and business improvement that leads to management support.The first is to “standardize” the use of systems in the CX area through the utilization of IT. To offer digital CX consulting via IT optimized for customer response.The second is to “standardize” business performance improvement by utilizing CX. To provide management support through the DX Direct Center, which directly contributes to the financial figures by improving customer operations.

◎ Hybrid operations combining automation and human resources

With the spread of numerous automation technologies due to labour shortages, the company believes that it is important to achieve CX that impresses customers through hybrid operations of automation and manpower, as the evaluation and expectation of providing value filled with hospitality unique to humans will further increase.

③ Co-creation: Exploring a new domain

◎ New domain “NEW BPO”

The company aims to establish BPO businesses in promising fields, including venture support and HR tech.

(From the company’s materials)

◎ Marketing BPO where VOC* can be utilized

To create CX communications that maintain good relationships with consumers through co-creation with each partner, including Toppan Inc.

To achieve “moderate push” and “value enhancement” in all customer channels with advanced CX response and IT operational capabilities. To create a “two-way marketing” model that delivers sustained results.

※VOC: Voice Of Customer

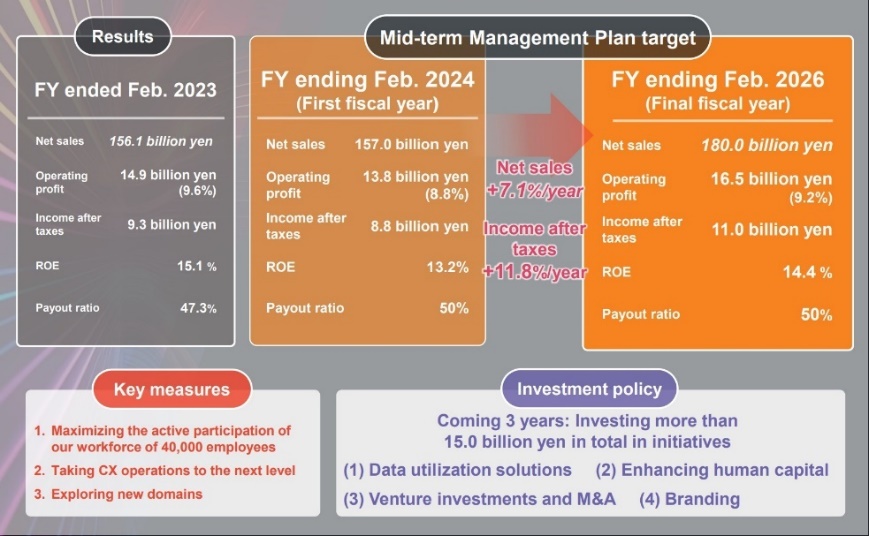

(3) Quantitative targets

(From the company’s materials)

For the fiscal year ending February 2026, the company targets “a sales revenue of 180 billion yen, an operating income of 16.5 billion yen, and an after-tax profit of 11 billion yen.”

The company aims to achieve an ROE of 14.4% and a dividend payout ratio of 50%.

(4) Human capital strategy

To achieve sustainable development, the company will aggressively invest in human capital for employees and the environment and build a company that attracts “professionals” and provides worthwhile jobs.

Specifically, RE-Skilling and UP-Skilling will be promoted through a career map, and the company will define more than 20 job categories, prepare a wide range of career paths, and carry out strategic training and placement.

In addition, the company will evolve its personnel system to bring out employees’ abilities to the maximum degree, review the compensation system to secure digital and other human resources, and promote contract employees to permanent employees.

To further promote D&I (diversity and inclusion) and health management.

(5) Sustainability

Material issues have been identified, and goals have been set for the year 2025.With regard to climate change, the company aims to reduce GHG emissions by 30% from the level in 2019.

In terms of strengthening human capital, the company aims to increase investment in training by 10% from the current level, so that it will account for 0.33% of sales, and increase the ratio of female executives to 10% or higher, and increase the ratio of female managers to 20% or higher.

(From the company’s materials)

<Reference : Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | company with corporate auditors |

Directors | 8 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on May 26, 2023

Basic Views

Our company is striving to enhance management efficiency and manage the company that ensures transparency and soundness based on the recognition that in order to maximize corporate value, it is indispensable to establish a good relationship with all stakeholders surrounding the company and the group companies (collectively referred to as the “Group”), including our shareholders, clients, business partners, and employees and gain their trust, and to achieve it, enhancement of corporate governance is one of the important management tasks.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code>

【Supplementary Principle 4-1-3 Appropriate supervision of succession plans for the CEO and other top executives】

Although our board of directors has not formulated any succession plan for the CEO and executive officer who concurrently serves as the president that is the highest managerial position, the board recognizes the importance of the roles that stakeholders expect the president to play.

The nominating committee exercises comprehensive judgment about such matters as whether candidates satisfy the criteria for selection of candidates for the president, which are specified in the criteria for the appointment and dismissal of directors, including the ability to make business decisions, courage as a corporate manager, multifaceted vision and foresight, and makes proposal to the board of directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

As a basic policy, when conducting any investment other than net investment, we discuss whether our group’s business will have synergetic effects through the business tie-up, information sharing, etc. with an invested company, and when reducing investment, we discuss whether there will be synergetic effects. Furthermore, on respective stock which does not have dividends or with sluggish performance, we examine whether we should keep holding or reduce their shares for capital efficiency improvement every year, by analyzing expected business performance and recoverability from the viewpoints of economic reasonability.

As for strategically held shares of listed companies, the Board of Directors discussed whether or not to keep holding the shares of a company (balance sheet amount 20 million yen) and decided to continuously hold it.

With regard to exercise of the voting rights for strategically held shares, our company basically makes comprehensive judgment for individual proposals about such matters as whether or not doing so will boost the corporate value and the shareholder return of the companies in which we invest for the medium- and long-term, and whether or not doing so will contribute to enhancing our corporate group’s value through maximization of synergy that is our company’s goal of investment.

【Supplementary Principle 2-4-1 Ensuring diversity in the promotion to core human resources】

(1) Ensuring diversity

Following our corporate philosophy (PURPOSE), our company respects the diversity in our employees and makes proactive efforts, including development of an environment that allows people with all attributes to work enthusiastically, establishment of a flexible personnel system, and provision of educational opportunities that support autonomous growth of our employees.

(2) Women

Our company has been taking proactive action for promoting active participation of women, and our efforts have gained recognition of outside organizations through various awards and certificates that we have received. We will continue our efforts, such as improvement of our workplace environment, provision of opportunities for broadening experience, and support for autonomous career development, and conduct activities aimed at building pipelines at each hierarchical level and increasing the ratio of female workers in various positions to raise the number of female workers who will be involved in business decision-making processes.

<<Target ratio of female workers in managerial positions: Database regarding Promotion of Women’s Participation and Advancement by the Ministry of Health, Labor and Welfare>>

Visit the following website concerning the general employer action plans pursuant to the Women’s Advancement Promotion La

https://positive-ryouritsu.mhlw.go.jp/positivedb/detail?id=11012

(3) Employment of Foreigners

Our company promotes employment of human resources from all over the world regardless of nationality, and about 200 regular and non-regular employees with foreign nationalities are currently working at our company inside and outside Japan. While we are doing business mainly in Japan, we will promote human resources to managerial positions based not on their nationalities or genders, but on their abilities and business performance according to our business expansion overseas in the future.

(4) Employment of mid-career workers

Our company proactively employs mid-career workers (including workers whose employment status is changed from the contract employee to the regular employee) so as to secure work-ready human resources, and mid-career workers account for about 73% of all of our employees and make up about 71% of the employees in managerial positions, playing active roles in every level and post. We will continuously endeavor to further expand diversity in our company through proactive mid-career employment.

【Supplementary principle 3-1-3 Initiatives on sustainability】

In the Basic Sustainability Promotion Policy, our company clearly states the identification of material issues, the resolution of social issues, and the role of the Board of Directors, and in the medium-term management plan disclosed on April 12, 2023, our company discloses medium-term targets for "material issues," which are common for us and society, based on risks and profit opportunities, in addition to our corporate philosophy (PURPOSE) and important themes in our management strategy.

Regarding human capital, to ensure the company's sustainable growth, we will maximize employees’ work engagement by proactively investing in the people we work with and the environment to create a workplace that attracts professionals and is rewarding to work in. By improving the number and quality of our human capital, we aim to realize our corporate philosophy (PURPOSE) by establishing a cycle of improving the quality of our services, providing them to our clients, improving our earnings, and giving back to society. As performance indicators, we collect and analyze the ratios of female directors and female managers, investment in training for human resource development, and the number of rotations to refine our human investment measures, thereby striving for long-term and sustainable improvement of corporate value.

Regarding investment in intellectual property, our medium-term management plan calls for deepening our CX (customer experience) operations, and it is making strategic investments in cutting-edge technologies such as AI.

We assume that risks and profit opportunities related to climate change will have a small impact on our business activities and profit and that the environmental impact of our business activities will also be small.

On the other hand, the issue of climate change is a common global challenge, and the company also regards it as one of its most important management issues. At the Board of Directors meeting held in April 2022, the company formulated and resolved specific targets for greenhouse gas (GHG) emission reduction rates for 2025, 2030, and 2040.

In the future, the company will monitor the established targets, strengthen the governance structure related to the planning and implementation of each measure, and reflect the results in the medium- and long-term strategies and roadmaps as appropriate.

【Principle 5-1 Policy for constructive dialogue with shareholders】

In order to achieve sustainable growth and improve mid/long-term corporate value, our company will conduct constructive dialogues with shareholders within an appropriate range and an appropriate method in accordance with the following policies.

(1) Directors in charge of IR will be designated and said Directors will manage all dialogues with shareholders.

(2) The IR division will be established under the supervision of Directors in charge of IR and promote the appropriate exchange of information and organic cooperation among the management planning division, the accounting/financial division, and other related divisions.

(3) In order to enrich the means of dialogues with shareholders, a session for briefing financial results will be held at the time of announcement of interim and full-year results.

(4) Shareholders’ opinions, etc. grasped through dialogues will be reported to the Directors in charge of IR and relevant divisions and shared with the Board of Directors when necessary.

(5) We will conduct dialogues with shareholders pursuant to the regulations for preventing insider trading, which stipulate the prohibition of information transmission and promotion of transactions, and necessary measures for limiting the forwarding of insider information

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back number of Bridge Reports (BELLSYSTEM24 Holdings, Inc.:6183) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/