Bridge Report:(6089)WILL GROUP Fiscal Year ended March 2024

Yuichi Sumi Representative director and President | WILL GROUP, INC. (6089) |

|

Company Information

Exchange | TSE, Prime Market |

Industry | Services |

Chairman | Yuichi Sumi |

HQ | 1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act.) | Trading Unit | |

¥960 | 22,786,836 shares | ¥21,875 million | 17.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER(Est.) | BPS (Act.) | PBR (Act.) |

¥44.00 | 4.6% | ¥72.20 | 13.3x | ¥768.35 | 1.2x |

*Stock prices as of the close on May 27, 2024. The number of shares issued is obtained by deducting the number of treasury shares from the number of shares issued as of the end of fiscal year ended March 2024. ROE and BPS are the actual values in the previous term.

*DPS and EPS are the company’s forecasts for this term.

Transition in Consolidated Performance (Voluntary adoption of IFRS)

Fiscal Year | Sales | Operating Income | Ordinary Income, Pretax Profit | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2021(Act.) | 118,249 | 4,030 | 3,788 | 2,363 | 106.35 | 24.00 |

March 2022(Act.) | 131,080 | 5,472 | 5,293 | 3,286 | 147.03 | 34.00 |

March 2023(Act.) | 143,932 | 5,318 | 5,146 | 3,236 | 143.20 | 44.00 |

March 2024(Act.) | 138,227 | 4,525 | 4,417 | 2,778 | 122.37 | 44.00 |

March 2025(Est.) | 140,400 | 2,290 | 2,190 | 1,640 | 72.20 | 44.00 |

*Estimated by the Company. (Unit: Million yen or yen)

This Bridge Report reviews of fiscal year ended March 2024 earnings results and fiscal year ending March 2025 earnings estimates.

Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2024 Earnings Results

3. Fiscal Year ending March 2025 Earnings Estimates

4. Revision of Medium-Term Management Plan “WILL-being 2026”

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2024, sales revenue decreased 4.0% year on year to 138,227 million yen. Operating income dropped 14.9% year on year to 4,525 million yen. In terms of sales, the sales of the domestic business remained flat, but the sales in the construction engineer field were healthy. The overseas business saw decreases in both temporary staffing sales and introduction sales. Profit grew, as the income from sale of shares of consolidated subsidiaries* was posted although the company conducted upfront investment for recruitment, the increase of marketing staff, brand promotion, etc. The profit of the overseas business declined, due to the shrinkage of gross profit caused by the decrease in personnel introduction sales, and the augmentation of personnel expenses, etc.(*Borderlink, Inc. and for Startups, Inc.)

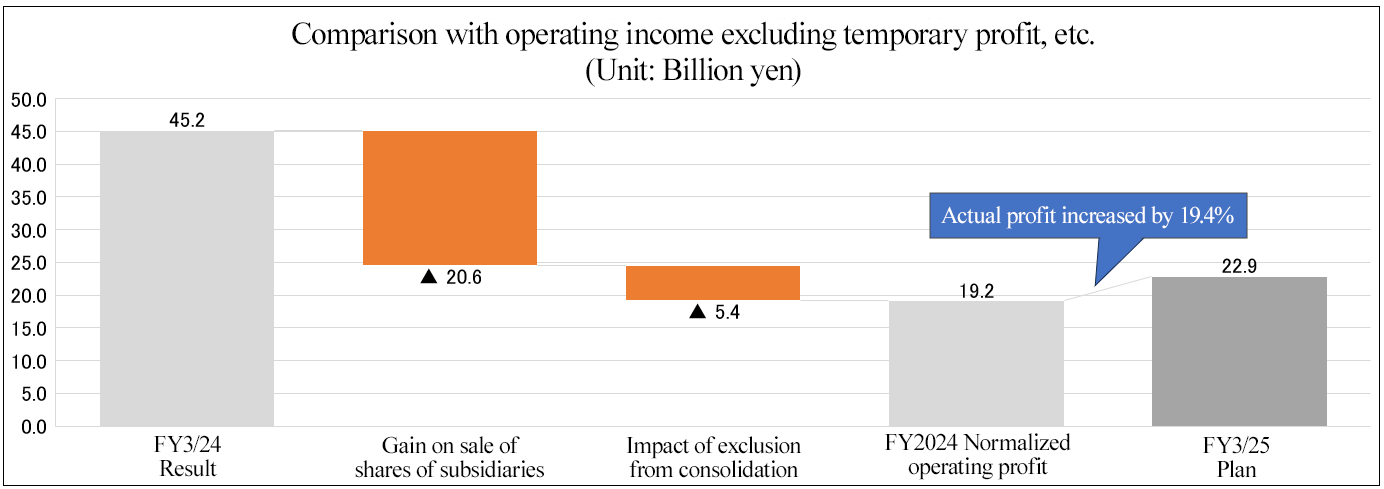

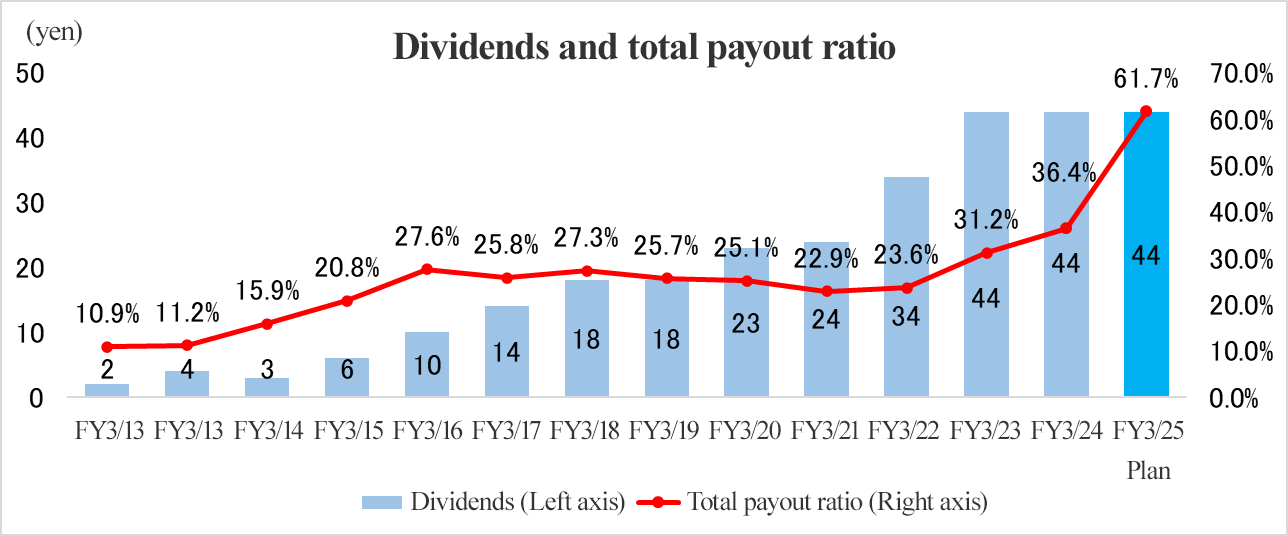

- The company's plan for the fiscal year ending March 2025 forecasts that sales revenue will rise 1.6% year on year to 140.4 billion yen and operating income will decrease 49.4% year on year to 2,290 million yen. Sales revenue is expected to grow in the domestic and overseas businesses, although the business environment will remain harsh. Operating income will be affected by the fact that the operating income in the fiscal year ended March 2024 includes the gain on sale of shares of subsidiaries amounting to 2,063 million yen and the fact that through the sale of said subsidiaries, the company will no longer post their sales revenue (amounting to 3,420 million yen in the fiscal year ended March 2024) and operating income (amounting to 543 million yen in the fiscal year ended March 2024). When such temporary profits, etc. are excluded, it is expected that sales revenue will grow 4.1% year on year and operating income will rise 19.4% year on year. The company plans to pay a dividend of 44 yen/share like in the previous fiscal year. The payout ratio is expected to be 60.9%. The expected total payout ratio is 61.7%.

- In the construction engineer field in the domestic Working business, the recruitment of inexperienced personnel, including new graduates, is progressing steadily, so it is highly likely that it will move into the black in the fiscal year ending March 2025. The business of undertaking the contracted management of foreign personnel is recovering more significantly. On the other hand, the domestic Working and overseas Working businesses excluding the construction engineer field are struggling. Accordingly, the company will apply the recruitment know-how nurtured in the construction engineer field and the sales support field to the factory segment for the dispatch of full-time employees in the domestic Working business. In addition, they will promote their brands to strengthen them. In the overseas Working business, they will strive to expand the sales of the service of introducing personnel after the demand recovery while securing excellent consultants, reduce downside risk, increase the sales of the service of dispatching personnel in the stable fields, such as the governmental sector, control costs, and tighten governance. We would like to pay attention to the outcomes of these priority measures.

1. Company Overview

WILL GROUP, INC. is a holding company that provides HR services specialized at each category such as dispatching sales support staff, call center operators and manufacturing line staff primarily to food manufacturing, supporting nursing facilities’ personnel recruitment, dispatch of workers, such as construction engineers, temporary staffing and category-specific human resources services. The main feature of the Company is the “hybrid placement service,” by which permanent employees of Will Group called "field supporters" are stationed at the dispatched workplace. Will Group differentiates itself from its competitors by implementing its hands-on policy as it endeavors to develop new businesses.

There are group companies, including WILLOF WORK, Inc., which deals with the outsourcing of sales, call center operation and nursing care, WILLOF CONSTRUCTION, Inc., which offers construction engineer human resource services, and overseas subsidiaries that offer staffing services mainly in Asia and Oceania.

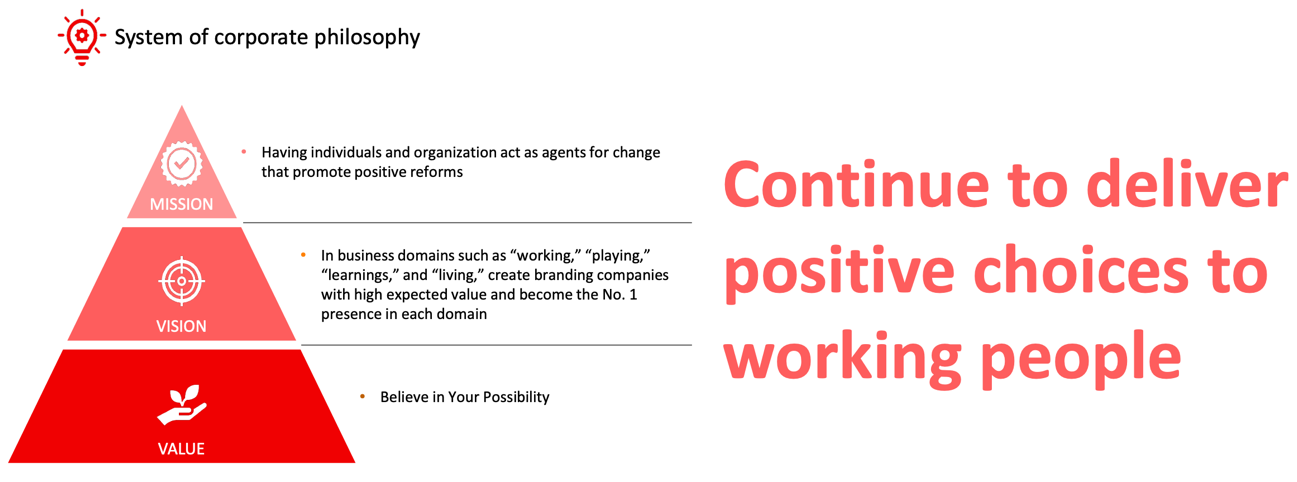

【1-1 WILL Vision and Management Philosophy】

The corporate group's management philosophy is to continue delivering positive choices to workers.

◆The MISSION is to be a Change Agent Group that positively transforms individuals and organizations.

◆VISION is to create a brand developing company with high expected value in the "Working,” "Interesting,” "Learning" and "Living" domains, and to be the best in each domain.

Working | Business field to support “Working” |

Interesting | Business field to support “Interesting” |

Learning | Business field to support “Learning” |

Living | Business field to support “Living” |

◆VALUE is Believe in Your Possibility

(Source: The company's Medium-Term Management Plan)

【1-2 Business Content】

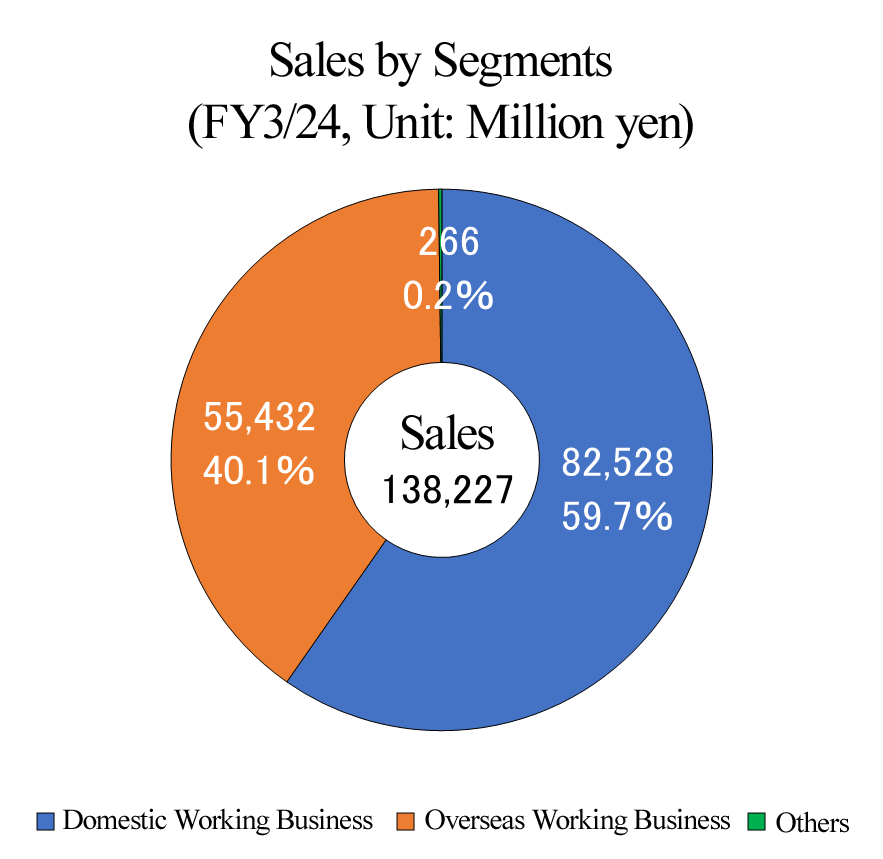

The business has been classified into three segments: domestic Working business, overseas Working business, and others.

With the start of the new medium-term management plan "WILL-being 2026" from April 2023, the names of domestic WORK business and overseas WORK business were changed to domestic Working business and overseas Working business, respectively, in Q1 of FY 3/2024.

*External revenues before deduction of intersegment revenues.

Domestic Working business

The company dispatches and introduces personnel and undertakes tasks in each of the sales support, call center, factory, nursing care, and construction engineer field in Japan.

◎Sales support field: WILLOF WORK, Inc., and CreativeBank INC.

This section mainly provides mass consumer electronics retailers with sales support to help them expand the sales of their products and services and assist leading IT companies in planning and managing product promotion campaigns. Regarding sales support for mass consumer electronics retailers, the company supports the sale of smartphones, manages store staff, places staff to collect and communicate sales information, assembles teams (through its hybrid temporary staffing), undertakes sales tasks, and introduces personnel. In addition, the company offers services such as the temporary staffing in the apparel industry and sales outsourcing.

◎Call center field: WILLOF WORK, Inc.

This section provides client companies that operate call centers and client companies that offer telemarketing services with support in building trust with end users. The company mainly specializes in communication companies, BPO (continuously outsourcing part of the business process to an external company), and financial institution to which it dispatches human resources who engage in after-sales service, consultation, receiving complaints, etc., dispatches teams (hybrid temporary staffing), and introduces personnel. It also has its own call center and undertakes telemarketing operations.

◎Factory segment: WILLOF WORK, Inc.

This section offers technologies and HR management know-how in the production process to its clients in the manufacturing industry, to improve their productivity. The company focuses on the food manufacturing industry, which is relatively unaffected by economic changes, to which it dispatches workers who perform light work such as production, inspection, quality control, sorting, and packing. It also dispatches teams (through its hybrid temporary staffing), undertakes production tasks, and introduces personnel.

◎Nursing care and childcare field: WILLOF WORK, Inc.

This section dispatches nursing care staff to companies that operate nursing care facilities and provides services that ensure the stable operation of nursing care facilities. The company offers employment services for facilities with high direct employment needs by dispatching experienced nursing care staff, undertaking facility operations, and introducing workers.

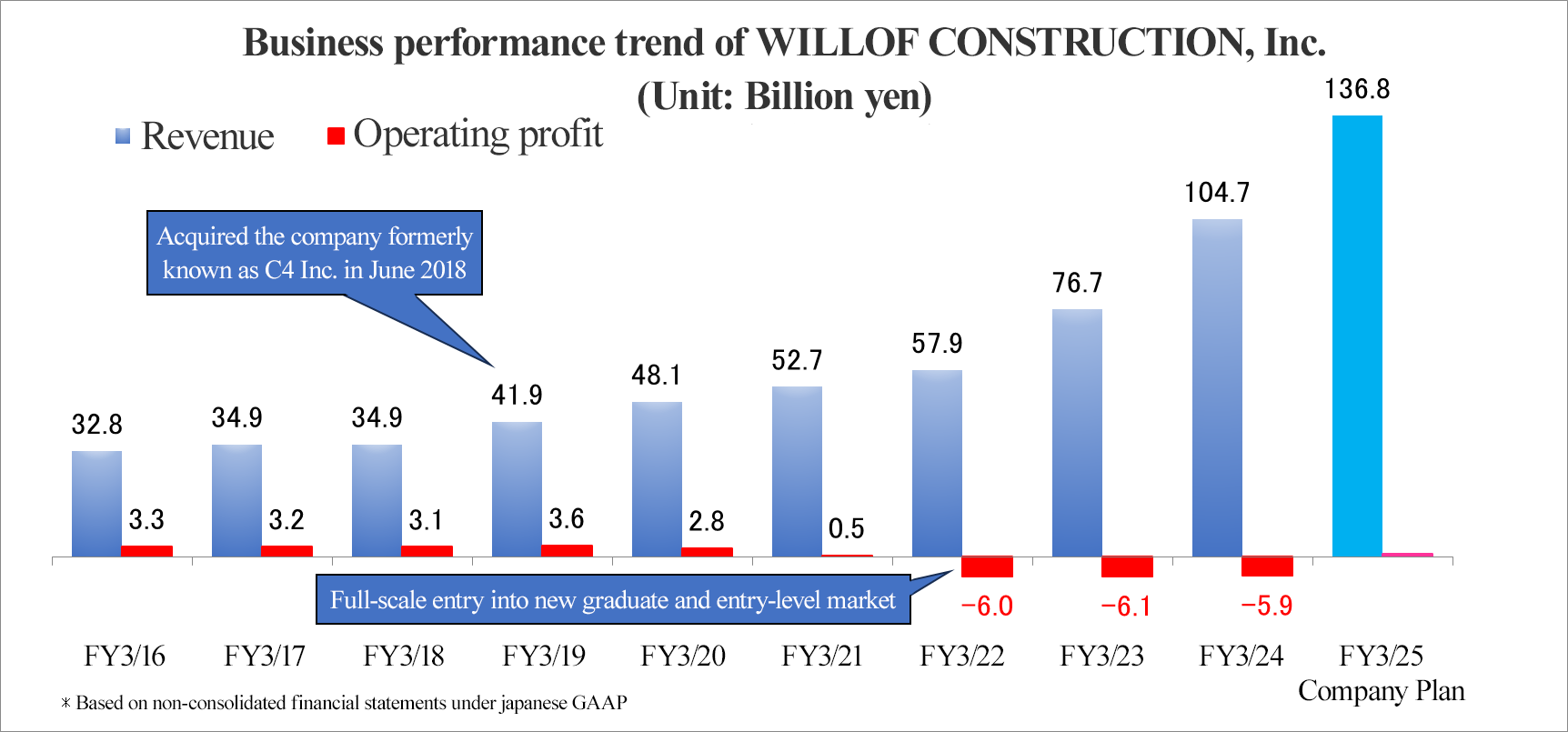

◎Construction engineer field: WILLOF CONSTRUCTION, Inc.,

The company dispatches construction management engineers and introduces personnel to the construction industry in Japan, especially to general contractors and subcontractors.

◎Other fields: BORDERLINK, INC., etc.

The company provides temporary staffing and placement services for IT engineers and other professionals.

Overseas Working Business

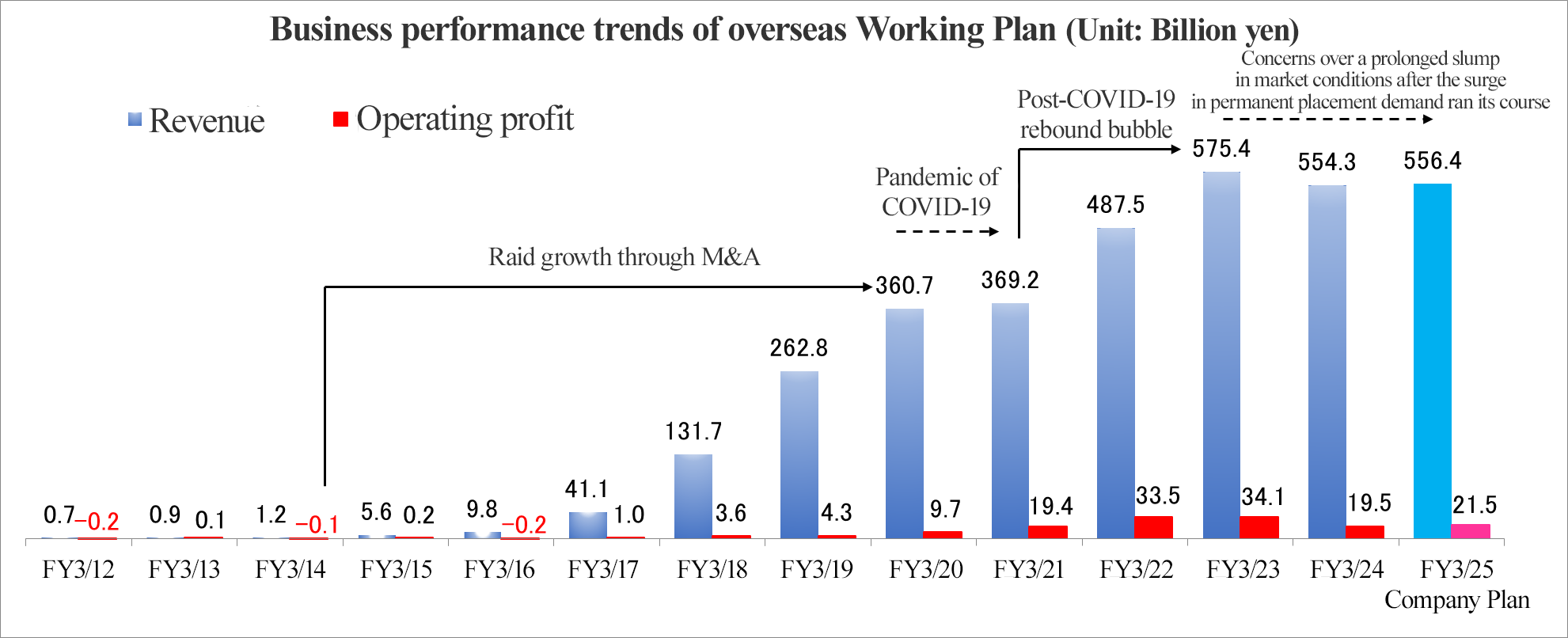

The company offers HR services, including the dispatch and introduction of personnel, mainly in Singapore and Australia. Regarding the dispatch of personnel, they dispatch workers to mainly governments, municipalities, etc., which are not easily affected by economic swings. Regarding the introduction of personnel, they operate business in a broad range of fields, including information and telecommunications.

WILL GROUP Asia Pacific Pte. Ltd.、 Good Job Creations (Singapore) Pte. Ltd.、 Scientec Consulting Pte. Ltd.、

The Chapman Consulting Group Pte. Ltd.、 Oriental Aviation International Pte. Ltd.、 Ethos BeathChapman、

Quay Appointments Pty. Ltd.、 u&u Holdings Pty. Ltd.、 DFP Recruitment Holdings Pty. Ltd、

Asia Recruit Holdings Sdn. Bhd.、WILLOF Vietnam Company Limited

Others

While conducting the rental housing business (TECH RESIDENCE) for IT engineers and creators, they engage in the expansion of the HRTech domain for developing and strengthening a new platform.

WILLOF WORK, Inc.

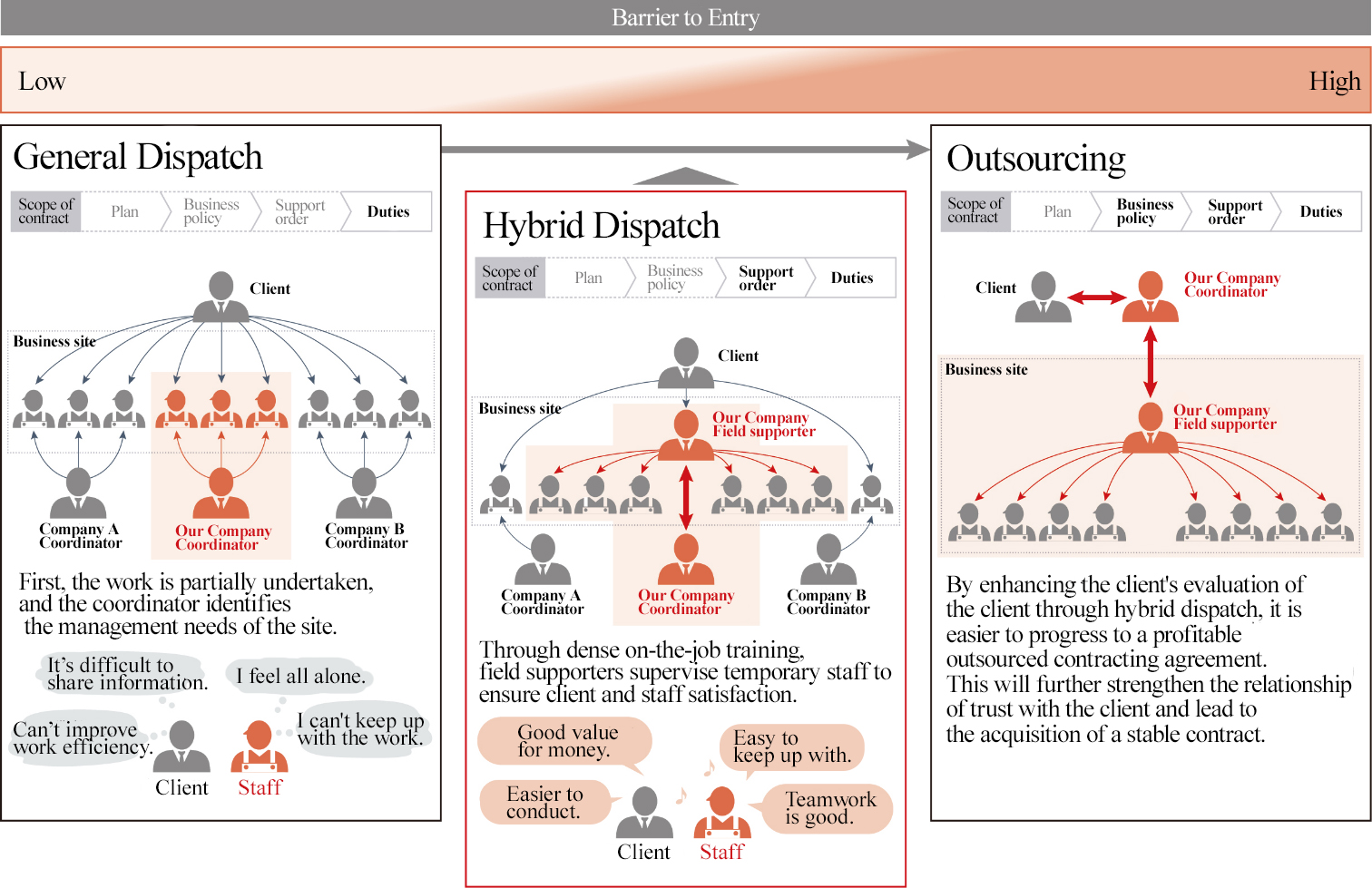

【1-3 Strengths and Characteristics】

Hybrid temporary staffing

To progress from providing general dispatch services to offering highly profitable task-undertaking services, the corporate group has strategically introduced a unique service called "Hybrid temporary staffing." Hybrid temporary staffing is a service that allows the company's employees (field supporters) and temporary staff to work together as a team to respond to customer needs quickly and accurately. The company is increasing profitability and expanding its market share in three main businesses: sales, call centers, and light work in factories.

(Reference material of the company)

Category-specific temporary staffing

The corporate group operates businesses offering human resources services in industries including telecommunications, call centers, light work in factories, and nursing care. Specializing in such specific categories allows the company to provide high-quality services as a specialist in these fields. By grasping the business needs of each category and creating a system that can respond flexibly to them, the company has won the trust of both clients and staff.

【1-4 Business performance】

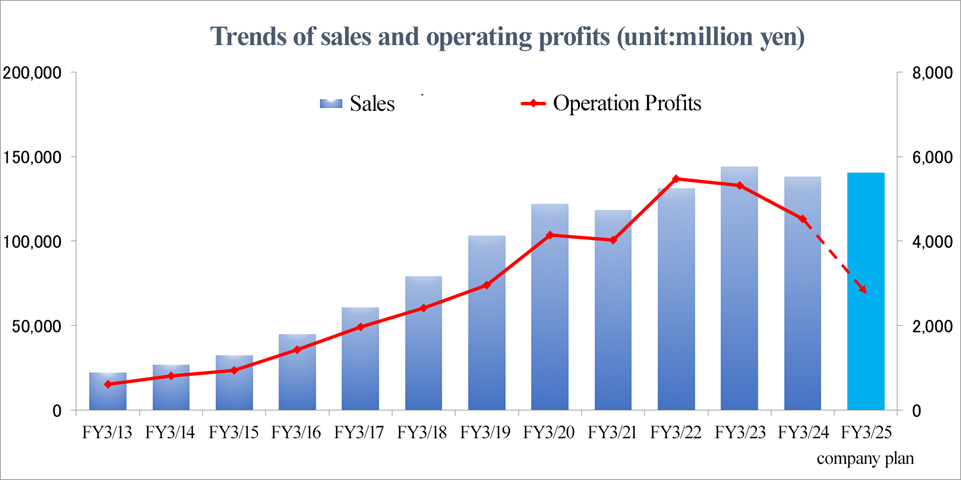

*The Japanese standards had been applied until fiscal year ended March 2018, and IFRS has been applied since fiscal year ended March 2019.

The company, founded in Osaka in 1997, started by offering human resources services and has gradually expanded its business domain. In 2006, the company shifted to a holding company system. In the second half of 2008, sales temporarily declined due to the Lehman Brothers collapse, but the company achieved a V-shaped recovery in 2011 through aggressive sales activities in Japan. Two years later, in 2013, the company went public and was designated to the First Section of the Tokyo Stock Exchange in just one year. Despite the impact of the COVID-19 pandemic, the company's performance has been on an upward trend since its establishment. The decrease in profit in the fiscal year ending March 2025 is forecast to be significant, because the result in the fiscal year ended March 2024 includes the temporary profit from the gain on sale of shares of subsidiaries.

2. Fiscal Year ended March 2024 Earnings Results

【2-1 Consolidated earnings results (IFRS)】

| FY 3/23 | Ratio to sales | FY 3/24 | Ratio to sales | YoY |

Sales | 143,932 | 100.0% | 138,227 | 100.0% | -4.0% |

Gross Profit | 31,737 | 22.0% | 30,446 | 22.0% | -4.1% |

SG & A | 27,169 | 18.9% | 28,314 | 20.5% | +4.2% |

Operating Income | 5,318 | 3.7% | 4,525 | 3.3% | -14.9% |

Pretax Profit | 5,146 | 3.6% | 4,417 | 3.2% | -14.2% |

Net Income | 3,236 | 2.2% | 2,778 | 2.0% | -14.2% |

*Unit: Million yen.

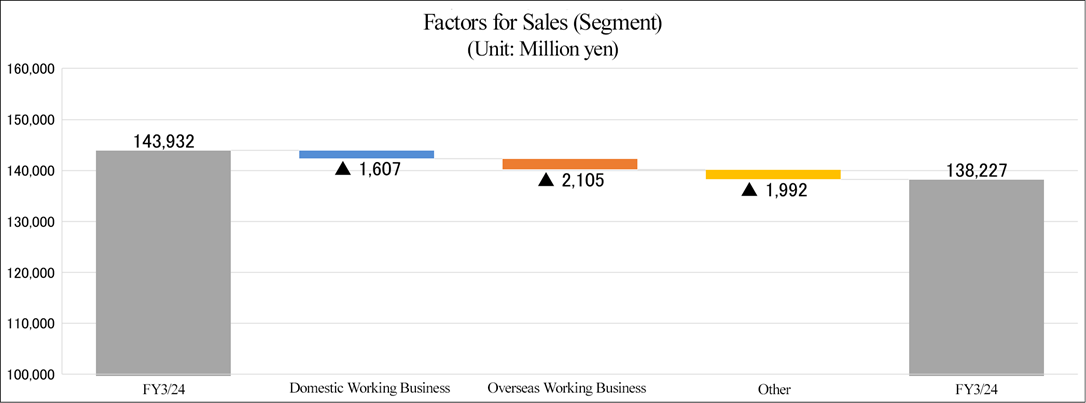

Sales dropped 4.0% year on year, and operating income decreased 14.9% year on year.

Sales revenue declined 4.0% year on year to 138,227 million yen, and operating income dropped 14.9% year on year to 4,525 million yen.

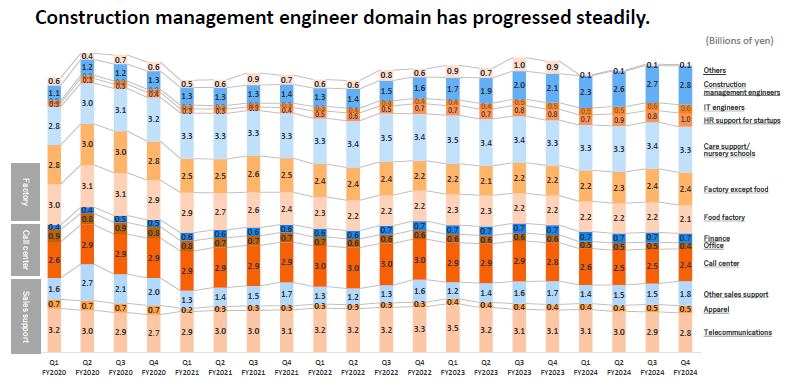

The corporate group worked on the expansion of the construction engineer field, the business of dispatch of full-time employees, and the undertaking of contracted management of foreign personnel, for the regrowth of the domestic Working business, which is the basic policy set in the medium-term management plan “WILL-being 2026,” which will end in the fiscal year ending March 2026.

Sales revenue was healthy in the construction engineer field on which they concentrate the most, although the domestic business saw the sluggish increase of new projects in the sales support field and the call center field. In the overseas business, the sales of the service of dispatching personnel declined due to the decrease of dispatched workers caused by the curtailment of recruitment by some clients in Australia, and the sales of the service of introducing personnel, too, decreased, as the demand for personnel introduction subsided after steeply growing in the post-pandemic period.

Regarding operating income, the company posted other revenues, including 786 million yen from the transfer of shares of Borderlink, Inc. in the first quarter of fiscal year ended March 2024 and 1,277 million yen from the sale of shares of for Startups, Inc. in the fourth quarter of fiscal year ended March 2024, and this contributed. Gross profit margin was unchanged from the previous fiscal year, and gross profit declined 4.1% year on year like sales. In addition, SG&A cost-to-sales ratio rose 1.6 points year on year to 20.5%. Therefore, operating income margin dropped 0.4 points year on year to 3.3%. Borderlink, Inc. and for Startups, Inc. were excluded from the scope of consolidation.

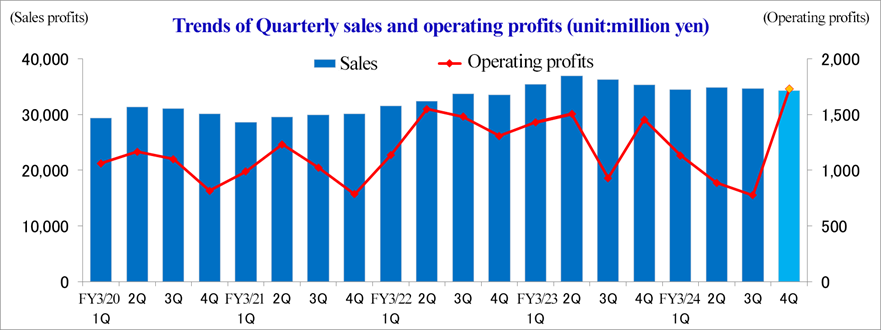

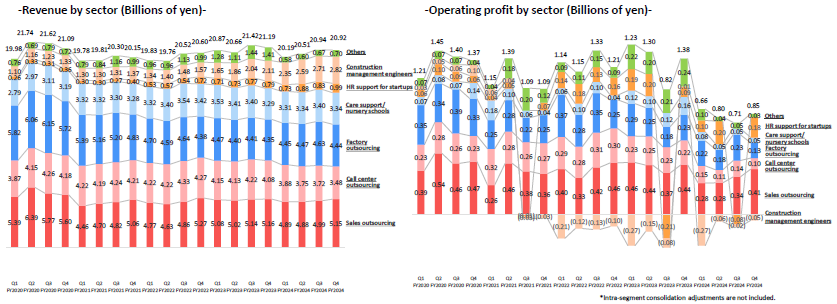

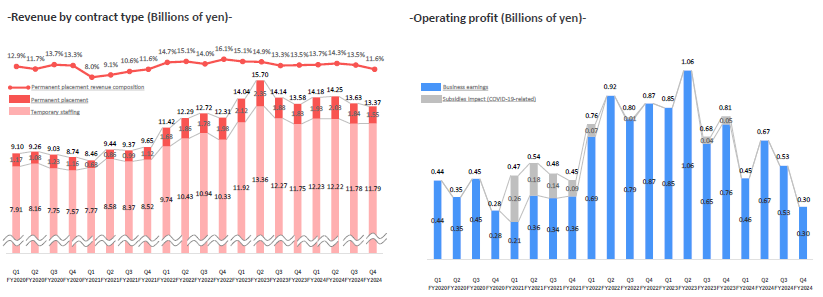

【2-2 Trend of quarterly results】

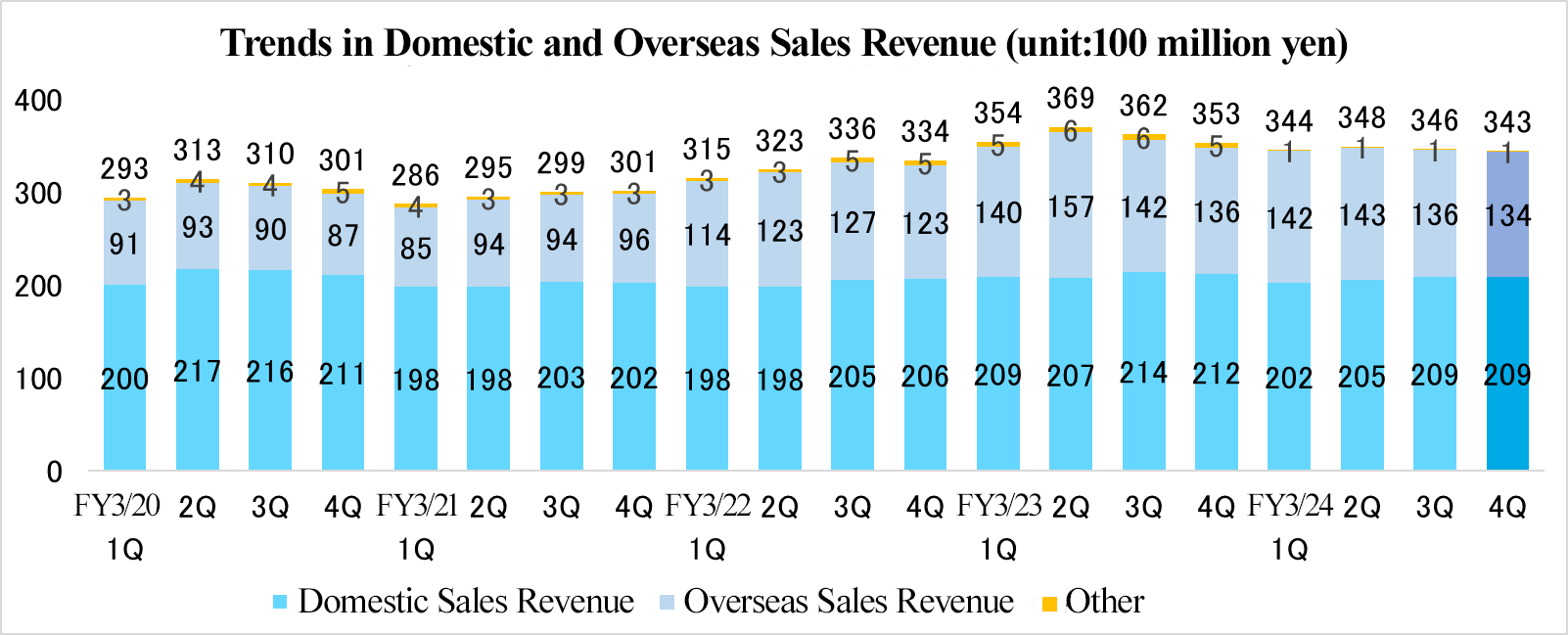

In the fourth quarter (Jan. - Mar.) of fiscal year ended March 2024, sales declined and profit grew from the previous quarter (Oct. - Dec.) and also from the same period of the previous fiscal year. The gain on sale of the subsidiaries contributed to the profit growth.

In the fourth quarter (Jan. - Mar.) of fiscal year ended March 2024, sales decreased 300 million yen from the previous quarter (Oct. - Dec.). Domestic sales revenue was unchanged, but overseas sales revenue decreased for both the dispatch and introduction of personnel.

【2-3 Trend by Segment】

| FY 3/23 | Ratio to sales | FY 3/24 | Ratio to sales | YoY |

Domestic Working business | 84,135 | 58.5% | 82,528 | 59.7% | -1.9% |

Overseas Working business | 57,537 | 40.0% | 55,432 | 40.1% | -3.7% |

Other | 2,258 | 1.6% | 266 | 0.2% | -88.2% |

Revenue | 143,932 | 100.0% | 138,227 | 100.0% | -4.0% |

Domestic Working business | 4,451 | 58.9% | 5,038 | 74.5% | +13.2% |

Overseas Working business | 3,406 | 45.0% | 1,946 | 28.8% | -42.9% |

Others | -296 | -3.9% | -225 | -3.3% | - |

Adjustments | -2,243 | - | -2,235 | - | - |

Operating Profit | 5,318 | - | 4,525 | - | -14.9% |

*Unit: Million yen.

* With the start of the new medium-term management plan "WILL-being 2026" from April 2023, the names of domestic WORK business and overseas WORK business were changed to domestic Working business and overseas Working business, respectively, in the first quarter of fiscal year ended March 2024.

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

【Domestic Working Business】

Sales revenue decreased 1.9% year on year to 82,528 million yen, while profit grew 13.2% year on year to 5,038 million yen.

Regarding the domestic Working business, which dispatches and introduces personnel and undertakes tasks in each of the sales support, call center, factory, nursing care, and construction engineer field in Japan, the performance in the construction engineer field, on which the company concentrate the most, was healthy, despite the sluggish increase of new projects in the sales support field and the call center field. The dispatch of full-time employees and the undertaking of contracted management of foreign personnel in fields other than the construction engineer field, which are the priority strategies set in the medium-term management plan, fell behind schedule, but in the construction engineer field, the number of workers in service increased, as over 1,200 people, including new graduates, joined the company in the fiscal year ended March 2024. In addition, profitability improved, as the company increased the charges for workers dispatched to existing clients and concentrated on negotiations for unit prices when concluding new contracts.

In terms of profit, the company posted recruitment expenses in the construction engineer field, sales support field, and factory segment, increased marketing staff for the business of contracted management of foreign personnel, and conducted upfront investment in brand promotion, etc. The company posted other revenues, including 786 million yen from the transfer of shares of Borderlink, Inc. in the first quarter of fiscal year ended March 2024 and 1,277 million yen from the sale of shares of for Startups, Inc. in the fourth quarter of fiscal year ended March 2024, and these companies were excluded from the scope of consolidation.

(Reference material of the company)

(Reference material of the company)

【Overseas Working Business】

Sales revenue decreased 3.7% year on year to 55,432 million yen, while profit dropped 42.9% year on year to 1,946 million yen.

Regarding the overseas Working business, which is operated in mainly Singapore and Australia, the sales revenue from the introduction of personnel decreased from the previous fiscal year, as the demand for personnel, which grew steeply in the post-pandemic period, subsided and clients’ willingness to recruit weakened in Singapore and Australia, and the sales revenue from the dispatch of personnel declined, as the company received a steady number of orders from governmental and administrative institutions in Singapore, but some clients in mainly the financial industry in Australia refrained from recruitment, decreasing the number of workers dispatched. In the fourth quarter (Jan. - Mar.), the sales from the introduction of personnel decreased from the previous quarter (Oct. - Dec.), as some clients refrained from recruitment in response to the downturn of the personnel introduction market, but the sales from the dispatch of personnel were unchanged.

Profit decreased, due to the shrinkage of gross profit through the decrease in sales from the introduction of personnel, and the augmentation of personnel expenses, etc.

(Reference material of the company)

(Reference material of the company)

Other

Sales revenue decreased 88.2% year on year to 266 million yen, while a loss of 225 million yen was posted (a loss of 296 million yen was posted in the previous fiscal year).

The sales of other business decreased as the shares of HiBlead Inc. were transferred at the end of fiscal year ended March 2023, and HiBlead was excluded from the scope of consolidation. In March 2024, the company transferred the business of supporting the management of employment of non-Japanese people to another company by means of an absorption-type split.

【2-4 Progress toward forecast KPIs】

The performance of dispatch of full-time employees and entrusted management of contracted management of foreign personnel except construction engineers significantly fell below the forecast, but the construction engineer field, on which the company concentrates the most, is healthy.

Priority strategy | KPI | Evaluation | |||||

Item | Full-year forecast | Result | Ratio to the forecast | ||||

Domestic Working | Strategy I | Further growth and monetization of the construction engineer field | No. of recruits per year | 1,270 | 1,424 | 112.1% | 〇 |

Retention rate | 71.0% | 71.2% | - | 〇 | |||

Strategy II | Regrowth of the domestic Working business except the construction engineer field | No. of newly dispatched full-time employees | 600 (Number of dispatched workers as of the end of the fiscal yea 3,052) | 350 (Number of dispatched workers as of the end of the fiscal yea 2,802) | 58.3% | × | |

Increase in the number of non-Japanese employees for which the company supports employment | 1,100 (No. of non-Japanese employees for which the company supports employment as of the end of the fiscal yea 2,850) | 591 (No. of non-Japanese employees for which the company supports employment as of the end of the fiscal yea 2,341) | 53.7% | × | |||

Overseas Working | Strategy Ⅲ | Stable growth of the overseas Working business | Ratio of sales from the introduction of personnel | 16.0% | 11.6% | - | × |

The sales revenue in the construction engineer field increased steadily, due to the increase of workers in service. In the fiscal year ended March 2024, the company recruited 1,424 people, achieving the full-year goal (1,270). Utilization rate was high. The company will make continuous efforts to improve retention rate. The number of dispatched full-time employees did not reach the forecast, because the recruitment of mid-career workers in the sales support field was sluggish, but the number of recruits in the factory segment and IT engineers field increased steadily. The number of contracted management of foreign personnel was healthy in the nursing care field, but fell below the forecast in the factory field, due to the delay in the first half, although it was recovering gradually.

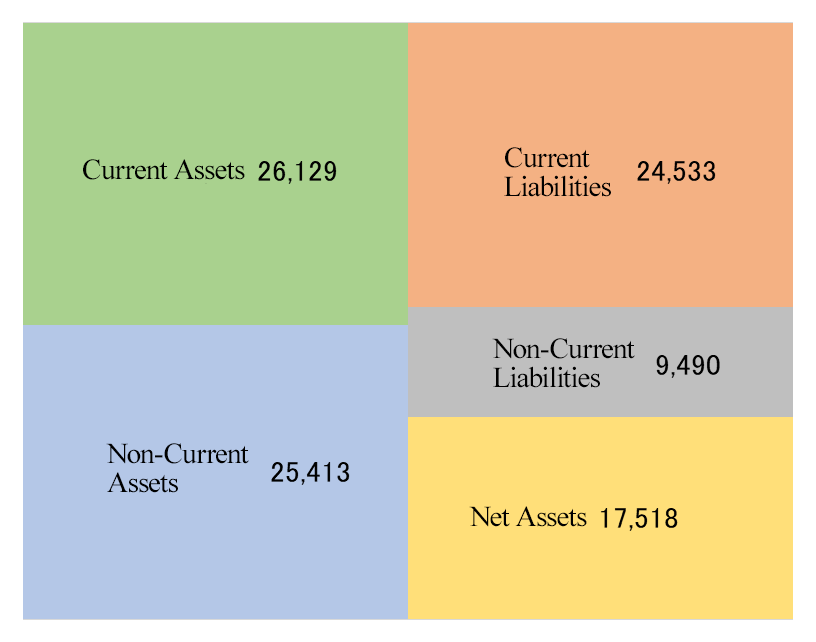

【2-5 Financial Position and Cash Flow】

◎Balance Sheet

| Mar. 23 | Mar. 24 |

| Mar. 23 | Mar. 24 |

Current Assets | 28,666 | 26,129 | Current liabilities | 28,414 | 24,533 |

Cash | 9,590 | 7,106 | Operating debts, other debts | 16,151 | 16,485 |

Receivables, other receivables | 17,928 | 17,512 | Other current liabilities | 3,109 | 2,437 |

Non-Current Assets | 26,272 | 25,413 | Non-current liabilities | 10,648 | 9,490 |

Tangible fixed assets | 1,139 | 1,275 | Other financial debts | 5,950 | 4,837 |

Right-of-use assets | 6,349 | 5,071 | Total liabilities | 39,062 | 34,024 |

Goodwill | 8,120 | 8,737 | Total equity | 15,877 | 17,518 |

Other Intangible Assets | 5,996 | 6,109 | Equity attributable to owners of the parent augmented | 14,638 | 17,508 |

Other Financial Assets | 1,475 | 1,158 | Total liabilities and equity | 54,939 | 51,543 |

Total assets | 54,939 | 51,543 | Borrowings | 10,146 | 5,930 |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

The total assets as of the end of March 2024 stood at 51,543 million yen, down 3,396 million yen from the end of the previous fiscal year. In the assets side, major factors in decreasing assets were cash & deposits, operating receivables & other receivables, and the rights of use, and major factors in increasing assets were other current assets, tangible fixed assets, and goodwill due to the exchange conversion amid the yen depreciation. In the side of liabilities and net assets, major factors in decreasing them were debts and other current liabilities and other financial liabilities in non-current liabilities, and major factors in increasing them were current liabilities & other financial liabilities, operating payables & other payables, retained earnings, and the effect of exchange rate changes on overseas businesses. The ratio of equity attributable to owners of the parent company rose 7.4% from the end of the previous fiscal year to 34.0%.

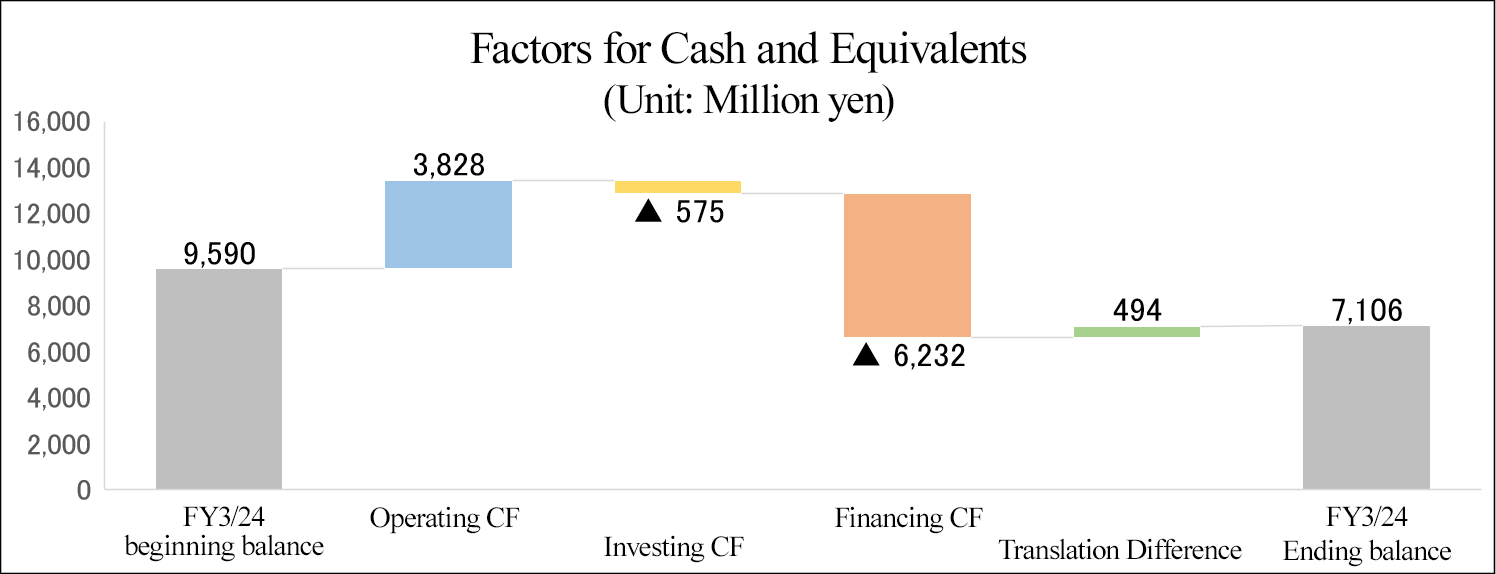

◎Cash Flow

| FY 3/23 | FY 3/24 | Increase/decrease | |

Operating cash flow (A) | 4,816 | 3,828 | -988 | -20.5% |

Investing cash flow (B) | -1,761 | -575 | +1,186 | - |

Free cash flow (A+B) | 3,055 | 3,253 | +198 | +6.5% |

Financing cash flow | -2,783 | -6,232 | -3,449 | - |

Cash, equivalents at term-end | 9,590 | 7,106 | -2,484 | -25.9% |

*Unit: Million yen

*Created by Investment Bridge Co., Ltd. with reference to disclosed material.

In terms of cash flows, the cash inflow from operating activities shrank due to the decline in pretax profit, operating activities, etc. although the payment of income tax decreased. On the other hand, the cash outflow from investment activities shrank due to the decline in expenditure for acquiring shares of subsidiaries that lead to a change in the scope of consolidation, so the surplus of free cash flow expanded. In addition, the cash outflow from financial activities increased due to the decrease in short-term debt, the augmentation of dividend payment, etc. Accordingly, the cash position at the end of the fiscal year was down 25.9% from the previous fiscal year.

(6) Outcomes of the promotion of WILLOF

The company aired terrestrial TV commercials featuring entertainers in the Kansai, Chukyo, Fukuoka, and Okinawa areas for promoting the WILLOF brand in the domestic Working business, for the purpose of strengthening their recruitment capacity in Japan. In addition, they streamed online ads via YouTube, etc. After the start of promotion, the number of searches for WILLOF increased, and it is expected that more clients will adopt it via owned media, so the company continued the promotion.

Popularity of WILLOF | No. of searches for WILLOF per month | Degree of the willingness to use WILLOF |

Up about 340% *Aided recall rate among men and women aged 20 to 59 years in the regions where the commercials were aired | Up about 230% | Up about 450% *Men and women aged 20-59 years who have the willingness to change jobs in the regions where the commercials were aired |

3. Fiscal Year ending March 2025 Earnings Estimates

【3-1 Consolidated Earnings Estimate】

| FY 3/24 | Ratio to sales | FY 3/25 (Est.) | Ratio to sales | YoY |

Sales | 138,227 | 100.0% | 140,400 | 100.0% | +1.6% |

Gross Profit | 30,446 | 22.0% | 30,470 | 21.7% | +0.1% |

Operating Income | 4,525 | 3.3% | 2,290 | 1.6% | -49.4% |

Pretax Profit | 4,417 | 3.2% | 2,190 | 1.6% | -50.4% |

Profit attributable to owners of parent | 2,778 | 2.0% | 1,640 | 1.2% | -41.0% |

*Unit: Million yen.

Sales revenue remained unchanged, and operating income decreased 49.4% year on year.

The company's plan for the fiscal year ending March 2025 forecasts that sales revenue will be 140.4 billion yen, unchanged year on year, and operating income will decrease 49.4% year on year to 2,290 million yen.

In Japan, the company is struggling to increase workers in service in the business of dispatching full-time employees and the existing business of dispatching workers for a specified period, so sales revenue is projected to be flat. In Australia and Singapore, where the corporate group is operating business, it is projected that clients will keep refraining from hiring workers, due to the worsening of economic confidence caused by the inflation and the rise in interest rate in the wake of large-scale measures for stimulating economy amid the coronavirus pandemic and the excessive number of employees in some enterprises that have rapidly increased recruits after the pandemic.

Under these circumstances, they will work on the expansion of the construction engineer field, the undertaking of contracted management of foreign personnel, and the dispatch of more full-time employees, which are priority measures set in the medium-term management plan, in the domestic Working business. For expanding the construction engineer field, they will enhance the recruitment of inexperienced workers and implement measures for maintaining or improving retention rate and raising the average contract price. For dispatching more full-time employees, they carry out measures for brushing up their recruitment capacity by continuing the promotion of the WILLOF brand and strive to maintain or increase the number of workers in service.

For undertaking the contracted management of foreign personnel, they will keep receiving orders from clients in the factory segment and nursing care fields, and recruit more workers in each region. In addition, in order to actualize the scenario in the medium-term management plan, they plan to conduct upfront investment in the recruitment of construction engineers and marketing staff. In the overseas Working business, there are the risk of economic downturn in each country and the concern over the prolongation of stagnation in markets of dispatch and introduction of personnel, so the company will conduct strategic cost management, such as the securing of excellent consultants, within a range where business value will not be damaged, and adjust the business of introduction and dispatch of personnel before the business expansion after the recovery of demand.

Gross profit margin is projected to decline 0.3% from the previous fiscal year to 21.7%, while operating income margin is expected to drop 1.7 points from the previous fiscal year to 1.6%. The operating income in the fiscal year ended March 2024 includes the temporary gain on sale of shares of subsidiaries amounting to 2,063 million yen, and there will be no longer the sales revenue (3,420 million yen in fiscal year ended March 2024) and operating income (543 million yen in fiscal year ended March 2024) of said subsidiaries, so profit margin will drop due to the sale of said subsidiaries. Excluding such temporary profit, etc., it is expected that sales revenue and operating income will grow 4.1% and 19.4%, respectively, year on year.

The dividend is expected to be 44 yen/share, like in the previous fiscal year. The payout ratio is expected to be 60.9%. The expected total payout ratio is 61.7%.

【3-2 Estimate in Each Segment】

【Revenue】

| FY 3/24 | FY 3/25 Company Plan | YoY (Increase/ Decrease) | YoY (Increase/ Decrease Ratio) |

Domestic Working Business | 825.2 | 845.0 | +19.7 | +2.4% |

Overseas Working Business | 554.3 | 556.3 | +2.0 | +0.4% |

Other | 2.6 | 2.6 | -0.0 | -2.0% |

Revenue | 1,382.2 | 1,404.0 | +21.7 | +1.6% |

*Unit: 100 million yen.

【Operating Profit】

| FY 3/24 | FY 3/25 Company Plan | YoY (Increase/ Decrease) | YoY (Increase/ Decrease Ratio) |

Domestic Working Business | 50.3 | 28.0 | -22.3 | -44.3% |

Excluding temporary profit, etc. | 24.3 | 28.0 | +3.7 | +15.4% |

Overseas Working Business | 19.4 | 21.5 | +2.0 | +10.7% |

Other | -2.2 | -2.6 | -0.4 | - |

Adjustments | -22.3 | -24.0 | -1.6 | - |

Operating profit | 45.2 | 22.9 | -22.3 | -49.4% |

Excluding temporary profit, etc. | 19.2 | 22.9 | +3.7 | +19.4% |

*Unit: 100 million yen.

The company forecasts that the operating income in the fiscal year ending March 2025 will be up 19.4% from the operating income excluding temporary profit, etc. in the fiscal year ended March 2024.

【3-3 Dividend Forecast】

As the shareholder return policy set in the medium-term management plan (fiscal year ended March 2024 to fiscal year ending March 2026), they will not decrease the dividend amount and achieve a total payout ratio of 30% or higher. Without decreasing the dividend amount, they will maintain or increase the dividend amount from the previous fiscal year. In addition, they will discuss the acquisition of treasury shares in a flexible manner according to the progress of business, while aiming to achieve a total payout ratio of 30% or higher.

4. Revision of Medium-Term Management Plan “WILL-being 2026”

The company has revised the management targets of its medium-term management plan (WILL-being 2026), which was announced on May 11, 2023 and will end in fiscal year ending March 2026 (hereinafter referred to as “the medium-term management plan”).

【Background of the revision of management targets】

A year has passed since the announcement of this medium-term management plan, and in the construction engineer field in the domestic Working business, which is the company's main focus, the recruitment of inexperienced workers and new graduates is progressing steadily, and the company is certain to move into the black in fiscal year ending March 2025. In addition, although there have been delays in the plan for undertaking the contracted management of foreign personnel, the results have been close to the quarterly plan since the third quarter of fiscal year ended March 2024, and the trend is gradually improving. On the other hand, the company is struggling to increase the dispatching of both permanent employees and fixed-term employees outside of the construction engineer field, and sales and earnings in the domestic Working business have remained flat. The outlook for the overseas Working business also remains uncertain, as major clients have continued to hold off on hiring employees for a longer period of time since the demand for personnel, which had grown rapidly in the post-pandemic period, has subsided. In addition, the company has been actively reviewing and revising its business portfolio and has sold shares of listed subsidiaries that were not included in this medium-term management plan, resulting in the exclusion of profits of these subsidiaries from fiscal year ending March 2025 onward, and a deviation from the assumptions made at the time of formulating this medium-term management plan. Under these circumstances, in order to prevent management decisions for sustainable growth from being impeded by an excessive focus on profitability and restrained investment leading to future growth due to the company's excessive focus on achieving the management targets for fiscal year ending March 2026, they have decided to withdraw revenue, operating income, and operating income margin from the management targets set forth in this medium-term management plan, and to revise KPIs to reasonable levels and give priority to the achievement of KPIs. In addition, they have revised the KPI to a reasonable level and decided to pursue the achievement of the KPI as a priority. However, the basic policy and three key strategic objectives of this medium-term management plan remain unchanged, and the company will continue to work toward realizing sustainable growth.

【Basic policy (no revisions)】

In order to achieve sustainable growth for the group, it is important to regrow the stagnant domestic Working business. Therefore, the basic policy will be to regrow the domestic Working business, and proactively make upfront investment for regrowth, change the profit structure during this medium-term management plan period, and establish a foundation for achieving dramatic growth in the future.

【Management Goals (revised)】

Among the management targets, revenue, operating income and operating income margin will be abandoned, KPIs will be revised to reasonable levels, and the achievement of KPIs will be pursued as a priority.

| FY 3/23 Act. | FY 3/24 Act. | FY 3/26 Goals (Before revision) | FY 3/26 (After revision) | |

Target | Sales revenue | 143.9 billion yen | 138.2 billion yen | 170 billion yen | Abandon |

Operating income | 5.31 billion yen | 4.52 billion yen | 6.5 billion yen | Abandon | |

Operating income margin | 3.7% | 3.3% | 3.8% | Abandon | |

KPI | Number of permanent employees recruited/year (Construction engineer field) | 1,022 | 1,424 | 2,000 | 1,500 |

Retention rate of permanent employees dispatched (Construction engineer field) | 71.3% | 71.2% | 73.0% | 71.5% | |

Number of permanent employees dispatched (Domestic Working business (other than the construction engineer field)) | 2,791 | 3,254 | 4,700 | 3,500 | |

Number of contracted management of foreign personnel (Domestic Working business) | 1,750 | 2,341 | 6,800 | 3,500 | |

Ratio of sales of personnel introduction (Overseas Working business) | 13.5% | 11.6% | 17.0% | Abandon | |

* For targets that have been withdrawn, quarterly results are disclosed.

* The number of permanent employees dispatched (domestic Working business other than the construction engineer field) includes the number of permanent employees in the call center field and the nursing care field, in addition to the sales support field, factory segment, and IT engineer field.

【Key Strategies (no revisions)】

In order to achieve the management goals of this medium-term management plan, the following three strategies (Strategies I and II are for the domestic Working business, and Strategy III is for the overseas Working business) are the key strategies.

Strategy I (Domestic Working Plan) | Achieving further growth and profitability in the construction engineer field |

・In the construction engineer field, in light of the recent severe recruiting environment, the company will revise the recruitment target to a reasonable range, but by increasing productivity, it aims to achieve profitability in fiscal year ending March 2025 and to make it one of the pillars of business in fiscal year ending March 2026. | |

Strategy II (Domestic Working Plan) | Regrowth of the domestic Working business (other than the construction engineer field) |

・The company will work to expand its business of undertaking the management of fiscal year ending March 2025 and the business of dispatching permanent employees. Regarding the expansion of the business of undertaking the management of contracted management of foreign personnel, the company will strengthen efforts to receive new orders by increasing sales staff, and for local recruitment, the company will strengthen alliances with local corporations and schools. Regarding the dispatching of permanent employees, the company will apply the recruiting know-how it has accumulated in the sales support and construction engineer fields to the factory segment. In addition, in anticipation of a more difficult recruitment environment, the company will implement brand promotions to strengthen its brand. | |

Strategy III (Overseas Working Plan) | Stable growth in the overseas Working business |

・In both Singapore and Australia, major clients have continued to hold off on hiring employees for a longer period of time since the demand for personnel, which grew rapidly in the post-pandemic period, has subsided, and the outlook for the recruitment market is unclear. Under these circumstances, while securing excellent consultant staff, the company will work to expand personnel introduction sales after demand recovers, and will also work to increase personnel dispatch sales, control costs, and strengthen governance in stable areas such as government projects to reduce downside risk and enhance business stability. | |

* Business performance trends in the construction engineer field (WILLOF CONSTRUCTION, Inc.)

Sales revenue in the construction engineer field (WILLOF CONSTRUCTION, Inc.) has grown four-fold (CAGR: +22%) from the fiscal year immediately prior to the acquisition (fiscal year ended March 2018). Operating income is expected to move into the black in fiscal year ending March 2025, and the business is expected to become one of the pillars of the company's business in the future.

* Business performance trend in the overseas Working business

Although the overseas Working business's sales revenue has been affected by the worsening market conditions after the subsiding of the demand that grew rapidly in the post-pandemic period, CAGR has grown rapidly to 67% since fiscal year ended March 2015, when full-scale M&A activities began.

5. Conclusions

The company's plan for the fiscal year ending March 2025 forecasts that operating income will drop 49.4% year on year, although sales will grow 1.6% year on year, indicating a grim outlook. This is because the operating income in the fiscal year ended March 2024 includes the temporary gain on sale of shares of subsidiaries amounting to 2,063 million yen and there will be no longer the sales revenue (3,420 million yen in the fiscal year ended March 2024) and operating income (543 million yen in the fiscal year ended March 2024) of said subsidiaries. Excluding such temporary profit, etc., operating income is expected to grow 19.4%, so the outlook is not as bad as it seems. In the construction engineer field in the domestic Working business, the recruitment of inexperienced personnel, including new graduates, is progressing steadily, so it is highly likely that it will move into the black in the fiscal year ending March 2025. The business of undertaking the contracted management of foreign personnel fell behind schedule, but from the third quarter of the fiscal year ended March 2024, the results were almost in line with the quarterly forecasts, showing a gradual recovery trend. It is noteworthy whether the construction engineer field and the contracted management of foreign personnel will grow further.

On the other hand, the company has revised the management goals set in the medium-term management plan (WILL-being 2026), whose final fiscal year is the fiscal year ending March 2026. In the domestic Working business, they are struggling to increase workers in service in the business of dispatching full-time employees and the existing business of dispatching workers for a specified period of time in fields other than the construction engineer field. In the overseas Working business, major clients still refrain from recruiting workers in both Singapore and Australia after the subsiding of the rapid growth of demand for personnel in the post-pandemic period, so the outlook remains uncertain. In addition, the profits of the listed subsidiaries the company sold will no longer be posted from the fiscal year ending March 2025. Since there emerged a significant gap from the assumption made at the time of formulation of the medium-term management plan, the company abandoned the targets of sales revenue, operating income, and operating income margin set in the medium-term management plan, and revised target KPIs to reasonable levels. In the sluggish business of dispatching full-time employees, the company will apply the recruitment know-how nurtured in the construction engineer field and sales support field to the factory segment. While expecting that recruitment will become more difficult, they will promote their brands to strengthen them. In the overseas Working business, they will strive to increase the sales from the introduction of personnel after the recovery of demand while securing excellent consultants, and work on the increase in sales from the dispatch of personnel, cost control, and the tightening of governance in stable fields, such as administration, in order to reduce downside risk and improve the stability of business. It is noteworthy when these efforts will lead to the recovery of the domestic Working business and the overseas Working business in fields other than the construction engineer field.

<Reference: Regarding Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with auditor(s) |

Directors | 5 directors, including 3 external ones |

Auditors | 3 auditors, including 3 external ones |

Corporate Governance Report Updated on June 26, 2023

Basic policy

In order to make our business administration transparent and compliant with law, our company will develop a structure for swiftly and flexibly responding to the changes in the business environment of the entire group of our company, while enriching corporate governance. We will implement a variety of company-wide measures for diffusing our corporate ethics, philosophy, etc. among all employees of our corporate group.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Supplementary Principle 2-4-1① Ensuring Diversity Within the Company, Including Promotion of Women’s Activities】

In an era where market conditions are rapidly changing and a future is difficult to predict, the company recognizes the importance of utilizing diverse perspectives and values in corporate management, in order to create new business opportunities without being bound by the current business domain. Therefore, the corporate group actively and continuously hires and promotes diverse human resources, including women, non-Japanese nationals, and mid-career workers with a variety of work experiences, and promotes initiatives such as development of a working environment that makes the most of individual characteristics and abilities, as well as management-level education. They will continue to work to have a ratio of core personnel equal to respective employee ratios by 2030.

(1) Promotion of Female Core Personnel.

In recent years, the company has been actively promoting the advancement of women, and has conducted career development training for young employees, as well as management training for managers. While the percentage of female employees among full-time employees is 43.1%, the percentage of female managers is 30.4%, falling below the percentage of female employees. Aiming to increase the ratio of female managers to 40% by 2030, the company will continue to improve the workplace environment, foster career awareness, etc., and increase the number of female employees who will be involved in management decision-making in the future.

(2) Promotion of non-Japanese employees as core personnel

Our corporate group not only owns 34 overseas consolidated subsidiaries, but also offers staffing services with non-Japanese personnel in Japan, so many non-Japanese employees belong to our company. The ratio of non-Japanese employees to regular employees is 28.9% and the ratio of non-Japanese managers is as high as 39.5%. We will keep promoting non-Japanese employees actively inside and outside Japan.

(3) Promotion of mid-career workers as core personnel (in Japanese enterprises only)

Our corporate group actively recruits mid-career workers with various work records, and promotes them to managerial positions. The ratio of mid-career workers to regular employees is 73.3%, and the ratio of managers promoted from mid-career hires is 77.1%, securing the same level. We will continue the recruitment, training, and promotion of new graduates and mid-career workers.

【Principle 3-1 Enhancement of Disclosure of Information】

(i) Management philosophy, management strategy, and the mid-term management plan are disclosed on the company’s website.

(Management Philosophy: https://willgroup.co.jp/profile/policy/)

The Mid-term Management Plan:

https://willgroup.co.jp/ir/strategy/

(ii) It is as stated in I-1 “Basic Approach” of this report. For specific policies and initiatives based on this, please refer to each section of this report.

(iii) The company’s policy for determining the remuneration for directors is described in II-1 “Matters Relating to Institutional Structure and Organizational Operation, etc. [Relating to Remuneration of Directors]” of this report.

(ⅳ) The election and appointment of executives and nomination of candidates for directors are comprehensively reviewed from the viewpoint of the right personnel for the right position, in accordance with internal rules, taking into consideration accurate and prompt decision making, appropriate risk management, monitoring of execution of duties, and the balance that can cover each function of the company and each business division of the group companies. Furthermore, in nominating candidates for corporate auditors, they are comprehensively reviewed from the viewpoint of the right personnel for the right position, while ensuring the balance between their knowledge in finance and accounting, knowledge in the company’s business areas, and their diverse perspectives on corporate management. Based on these policies, the Nominating Committee, which includes independent outside directors, deliberates in advance, and the Board of Directors makes a resolution. Similarly, the dismissal of executives is discussed in advance by the Nominating Committee, which includes independent outside directors, in accordance with internal rules, and is resolved at the Board of Directors meeting.

(v) Candidates for directors and corporate auditors as well as the reason for their election and their career are stated in the reference material for the General Meeting of Shareholders on a case-by-case basis. For reference material for each General Meeting of Shareholders, please refer to the Notice of Convocation of the General Meeting of Shareholders posted on the company’s website. In the event of dismissal, appropriate disclosure will be made in a timely manner in accordance with policies and procedures. (Notice of Convocation of the General Meeting of Shareholders: https://willgroup.co.jp/ir/stock_info/general_meeting/)

【Principle 5-1 Policies related to Constructive Interaction with Shareholders】

Our company has formulated a disclosure policy composed of “Basic Policy regarding Information Disclosure,” “Standards for Information Disclosure,” “Methods of Information Disclosure,” “Regarding Future Prospects” and “About the Quiet Period,” which we have publicly announced on our website. (Disclosure policy: https://willgroup.co.jp/ir/disclosure/)

Further, the following are our policies aimed at promoting constructive interaction with our shareholders.

(1) In our company’s IR activities, the representative director, and executive officers in charge of the management headquarters aggressively take part in dialogues and aim for communication that is favorable to both sides while focusing on fairness, accuracy, and continuity with regard to management and business strategies, financial information etc.

(2) The management headquarters takes a central role, and the management planning, general affairs, financial affairs, accounting, legal affairs department and the people in charge of each business shall work in coordination with each other and carry out the disclosure of information in a timely, fair, and suitable fashion.

(3) As a means of dialogue, the company holds company briefings for individuals, as well as financial results briefings for institutional investors. In addition, the company will continue to enhance IR activities by posting video clips of briefings, contents of question-and-answer sessions, and other information on the company’s website.

(4) Individual meetings with shareholders will be conducted, with the IR Group of Corporate Secretariat as the point of contact. Based on the shareholder’s request and the purpose of the meeting, executives, directors including outside directors, or corporate auditors will meet with the shareholders and provide appropriate responses within a reasonable scope.

(5) In addition to setting up a quiet period based on our disclosure policies, we shall also apply and enforce regulations regarding the management of insider information.

(6) In addition to establishing a quiet period in accordance with the Disclosure Policy, the Company will operate and thoroughly implement rules and regulations regarding the management of insider information.

*The disclosed documents relating to the above items can be found on the company’s website (https://willgroup.co.jp/ir/news/).

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |