Bridge Report:(4319)TAC Fiscal Year ended March 2024

Toshio Tada, President and CEO | TAC Co., Ltd. (4319) |

|

Company Information

Exchange | TSE Standard Market |

Industry | Service |

President | Toshio Tada |

HQ Address | Kanda-Misaki-cho 3-2-18, Chiyoda-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE(Act.) | Trading Unit | |

181 yen | 18,504,000 shares | 3,349 million yen | - | 100 shares | |

DPS(Est.) | Dividend yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Act.) | PBR(Act.) |

4.00 yen | 2.2% | 8.27 yen | 21.9 x | 323.28 yen | 0.6 x |

*The share price is the closing price on May 28th. All figures are from the financial results for the fiscal year ended March 2024.

Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

March 2021 Act. | 19,749 | 404 | 646 | 405 | 21.92 | 5.00 |

March 2022 Act. | 20,471 | 413 | 442 | 444 | 24.05 | 6.00 |

March 2023 Act. | 19,711 | 319 | 324 | 214 | 11.69 | 6.00 |

March 2024 Act. | 19,001 | -307 | -329 | -219 | - | 6.00 |

March 2025 Est. | 19,220 | 270 | 220 | 150 | 8.27 | 4.00 |

*Unit: Million yen. Forecasts are based on company estimates. These values are on an accrual basis. Net profit is profit attributable to owners of parent (the same applies for net profit hereinafter).

We present this Bridge Report reviewing financial results for the Fiscal Year ended March 2024 and other information about TAC.

Index

Key Points

1. Company Overview

2. Fiscal Year ended March 2024 Earnings Results

3. Fiscal Year ending March 2025 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2024, sales declined year on year and the company recorded an operating loss of 307 million yen (in the previous term, they recorded an operating profit of 319 million yen). Sales on a cash basis dropped 1.9% year on year. While the number of corporate course attendees increased, the number of individual course attendees has not picked up after the coronavirus crisis and decreased. In terms of profit, gross profit margin fell and operating loss worsened despite a decrease in SGA brought about by streamlining. The company provided a year-end dividend of 3.00 yen/share, so the annual dividend was 6.00 yen/share.

- For the fiscal year ending March 2025, the company is forecasting sales of 19,220 million yen, up 1.1% year on year, and an operating profit of 270 million yen. Moreover, they expect sales on a cash basis to grow 1.6% year on year. They will strive for (1) enhancement of existing businesses, (2) early recovery of Personal Education and (3) improvement of the price-book value ratio. With regard to existing businesses, they intend to reinforce the linkage between different segments. Regarding Personal Education, they will develop new course models, revising the cost structure and aiming for securing an appropriate level of profit. They plan to pay a dividend of 4.00 yen/share (including the interim dividend of 2.00 yen/share). The expected payout ratio is 48.4%.

- It can be said that the delay in the recovery of Personal Education was the major cause of the loss in the fiscal year ended March 2024. The company is responding to the transition to a new learning environment centered on online education while making progress in streamlining. We would like to observe the situation concerning streamlining as the company makes up for the delay in the recovery of Personal Education in the fiscal year ending March 2025. PBR has fallen significantly below 1.0 and it can be presumed that if they can regain their performance, it will directly improve stock price.

1. Company Overview

TAC Co., Ltd. is known as the “TAC, The Certification School” where university students and working people come to study to increase their chances of passing tests for various certifications and qualifications. The Company operates schools throughout Japan that educate students and adults in academic fields necessary to pass certification and Public Officer tests to become Certified Public Accountants, Certified Public Tax Accountants, Real Estate Appraisers, Labor and Social Security Attorney, Bar Examination, Judicial Scriveners, and other professional occupations. In addition, TAC also provides various training programs for corporate clients and conducts publishing business as well.

TAC Group (7 Consolidated Subsidiaries, 1 Equity Method Affiliated Company)

Company Type | Segment | Company Name | Business Description |

Consolidated Subsidiaries | Personal Education | TAC General Property Management Co., Ltd. TAC INFORMATION TECHNOLOGY (Dalian)Co., Ltd. Online School Co., Ltd. | School classroom building contracts, maintenance work Dalian operation center (Administrative task, instruction material monitoring check) Online instruction membership system over the Internet |

Corporate Training | LUAC Co., Ltd. | Insurance related corporate training | |

Publishing | Waseda Management Publishing Co., Ltd.

| “W Seminar” brand publishing business Marketing advertising related to the publishing business | |

Manpower Business | TAC Profession Bank Co., Ltd. | Human Resources introduction (headhunting), worker dispatch, job advertising business | |

Medical Office Staffing Kansai Co., Ltd. | Health insurance claims, medical-related staff dispatch business | ||

Equity Method Affiliated Company |

| Professional Network Co., Ltd. | Publishing of web magazines for professionals |

*As of the end of March 2024.

Target markets in each area

Licenses area | Main Programs | |

① | Finance & Accounting | Certified Public Accountant, Bookkeeping, The Japan Accounting and Financial Analysis Examination, Construction Industry Accountant |

② | Management & Taxation | Certified Public Tax Accountant, Small and Medium Enterprise Mgt. Consultant, IPO Practical Skill Examination, Financial Reporting Practical Skill Examination |

③ | Financial Services & Real Estate | Real Estate Appraiser, Architects and Building Engineers, First-Class Building Operation and Management Engineer, Real Estate Transaction Agent, Licensed Strata Management Consultant/Licensed Representative of Condominium Management Company, Property Manager, Financial Planner, DC Planner (*1), Securities Analyst (including CFA® (*2)), Securities Broker Representative, Business Management Advisor, Business School, Chiefs of Money Lending Operations, Souzoku Kentei |

④ | Law | Bar Examination, Judicial Scrivener, Patent Attorney, Certified Administrative Procedures Legal Specialist, The Japan Business Law Examination, Law-related qualifications, Registered Customs Specialist, The Proficiency Test in Trading Business (*3), Intellectual Property Management Skills Test |

⑤ | Public Officer & Labor | Labor and Social Security Attorney, Nenkin Kentei, Government officials((MCT&MOFA) (*4), Government officials (RS&LG) (*5), Government officials (science), Police officers & Fire dept. officials, Teacher’s Employment Exam, Courses for job seekers in mass communications |

⑥ | IT & International | IT Specialist (Information Technology Passport Examination, Registered Information Security Specialist Examination, etc.), USCPA, Enrolled Agent (EA), US Certified Management Accountant, CompTIA(*6), IT-related qualifications, Certified Internal Auditor (CIA), TOEIC® L&R TEST |

⑦ | Medical & Welfare | Introduction and dispatch business of Medical office staffing and nurses, etc. |

⑧ | Other | Licensed Electrical Engineer, Beneficial Course, Introduction and dispatch business of accounting personnel, miscellaneous revenue, etc. |

(*1) DC:Defined Contribution (*2) CFA®: Chartered Financial Analyst® (*3) The Proficiency Test in Trading Business is registered trademarks of Maunharf Japan Co., Ltd. (*4) MCT&MOFA: Main Career Track & Ministry of Foreign Affairs of Japan (*5) RS&LG: Regular Service & Local Government (*6) CompTIA:Computing Technology Industry Association

【1-1 Corporate History】

TAC was established in December 1980 as a school providing instruction to people seeking to obtain certifications and qualifications through examinations, including courses for the Certified Public Accountant, Bookkeeping, and Certified Public Tax Accountant. In October 2001, TAC listed its shares on the Over-The-Counter Market, and later moved its shares to the Second Section of the Tokyo Stock Exchange in January 2003 and then to the First Section in March 2004. TAC acquired KSS Co., Ltd. (formerly known as Waseda Management Publishing), which conducts certification and qualification acquisition support services including the provision of preparatory courses for Bar Examination, Judicial Scrivener, Patent Attorney, Level-1 Civil Service (Government officials in the Main Career Track), Special Personnel of the MOFA*, in September 2009. Through the addition of this company, TAC has been able to fortify its strengths in the accounting area by adding certification preparatory courses in the legal area, and to round out its service lineup with courses in the Public Officer area. In December 2013, the Company formed a collaborative agreement that included the sharing of capital with Zoshinkai Publishers Co., Ltd. for work in the development of a correspondence course education service for elementary, junior and senior high school students. Furthermore, other M&A activities were conducted in June 2014 to enter into the medical billing area. The company was listed on the Standard Market of TSE in April 2022.

【1-2 Strengths】

(1) Detailed Response to Changes, Revisions in Examination System, Laws

Since the founding of the Company, TAC instructors have made revisions to the text materials used in its courses every year, and this ability to respond to changes and revisions in the examination and legal systems is a distinguishing feature and strength of TAC. For a company like TAC with sales approaching 20.0 billion yen, absorbing the costs of updating text materials on an annual basis is possible. However, new entrants and smaller players in the market have a much more difficult time absorbing the costs of updating teaching materials. Other strengths of TAC include its knowhow and efficiency accumulated over the history of its operations in providing the most updated information to the students of its courses.

(2) Full-Scale Lineup and Active Course Development

TAC has risen to become the top player in the industry through its active efforts to develop courses in new areas, including those targeting university students, and it has become the first company within its industry to list its shares. Along with the acquisition of W Seminar’s certification and qualification acquisition support business in 2009, TAC has been able to fortify its weakness in the areas of legal and Public Officer related courses. Consequently, the Company now boasts of a strong business model comprised of the three main cornerstones of accounting (Certified Public Accountant, Certified Public Tax Accountant and Bookkeeping), legal, and Public Officer related certification and qualification acquisition support courses.

(3) Providing Innovative Services with a Focus upon Students

Innovative services are yet another strength of TAC. TAC was the first school in the certification and qualification acquisition support services market to introduce educational media and enable students to choose which instructor they would like to study under. This corporate focus upon satisfying the needs of students is reflected in the quality of the text materials offered and has contributed to the establishment of a strong brand reputation as “TAC, The Certification School.”

【1-3 ROE Analysis】

| FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 | FY 3/23 | FY 3/24 |

ROE(%) | 8.6 | 5.7 | 1.9 | 7.2 | 7.4 | 3.5 | -3.6 |

Net profit Margin (%) | 2.11 | 1.51 | 0.51 | 2.05 | 2.17 | 1.09 | -1.15 |

Asset Turnover | 0.96 | 0.95 | 0.97 | 0.97 | 0.98 | 0.93 | 0.91 |

Leverage | 4.27 | 4.00 | 3.81 | 3.60 | 3.49 | 3.41 | 3.45 |

2. Fiscal Year ended March 2024 Earnings Results

(1) Consolidated Earnings

| FY 3/23 | Share | FY 3/24 | Share | YoY Change | The company’s forecast | Compared to the forecast |

Sales | 19,711 | 100.0% | 19,001 | 100.0% | -3.6% | 19,113 | -0.6% |

Gross profit | 7,732 | 39.2% | 6,988 | 36.8% | -9.6% | - | - |

SG&A | 7,413 | 37.6% | 7,295 | 38.4% | -1.6% | - | - |

Operating profit | 319 | 1.6% | -307 | - | - | -210 | - |

Ordinary profit | 324 | 1.6% | -329 | - | - | -248 | - |

Net profit | 214 | 1.1% | -219 | - | - | -171 | - |

*Units: Million yen. Net profit is net profit attributable to owners of parent (the same applies for net profit hereinafter). The company’s forecast is the forecast announced in February.

Sales declined and recorded all kinds of losses

In the fiscal year ended March 2024, sales declined 3.6% year on year and the company recorded an operating loss of 307 million yen (in the previous term, they recorded an operating profit of 319 million yen). Furthermore, sales on a cash basis, on which the company places importance in terms of business management, dropped 1.9% year on year to 18,932 million yen. Although the number of corporate course attendees increased, the number of individual course attendees has not picked up after the coronavirus crisis and decreased. In terms of profit, gross profit margin fell from 39.2% in the previous fiscal year to 36.8% due to an increase in expenses for outsourcing, etc. and operating loss worsened significantly from the previous fiscal year despite a decrease in SGA costs brought about by streamlining. While the initial forecast stated sales of 19,620 million yen and an operating profit of 380 million yen, the company made a downward revision to both figures in February as shown in the chart above. Ordinary loss was 329 million yen (they recorded an ordinary profit of 324 million yen in the previous fiscal year) and net loss was 219 million yen (they recorded a net profit of 214 million yen in the previous fiscal year).

The company provided a year-end dividend of 3.00 yen/share, so the annual dividend was 6.00 yen/share.

Regarding Sales

In the certification and qualification acquisition support business conducted by the company, students applying for courses pay the entire amount of tuition fees (sales on a cash basis), which are booked on the liabilities side of the balance sheet as tuition advance. Then, these tuition advances are switched to sales every month that the educational services were provided to the student (sales on an accrual basis). Sales booked on the balance sheet represents sales on an accrual basis, and the company gives priority to the increase in sales on a cash basis as a key management indicator.

Sales on a cash basis in the fiscal year ended March 2024 stood at 18,932 million yen (down 1.9% year on year).

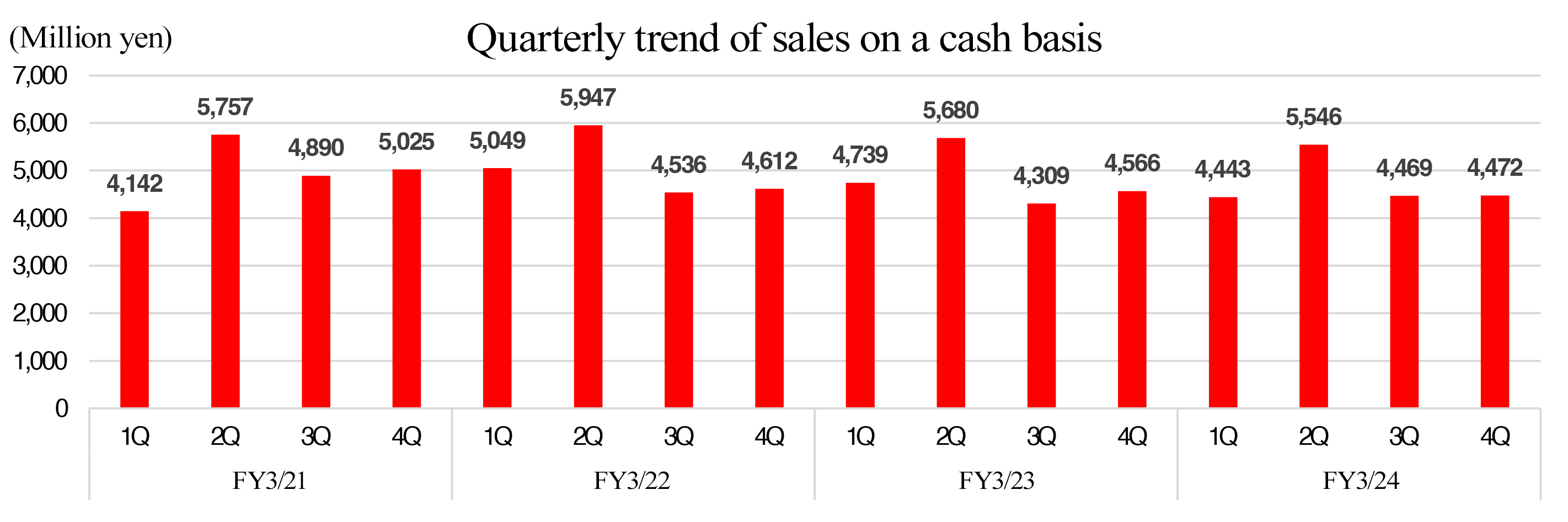

Regarding Seasonal Characteristics

The company’s quarterly trends are as follows. Sales on a cash basis (tuition advance pre-adjustment sales) refers to sales after aggregating tuitions, and sales on an accrual basis (tuition advance post-adjustment sales) refers to sales after allocating tuitions to the period in which the company provides education services.

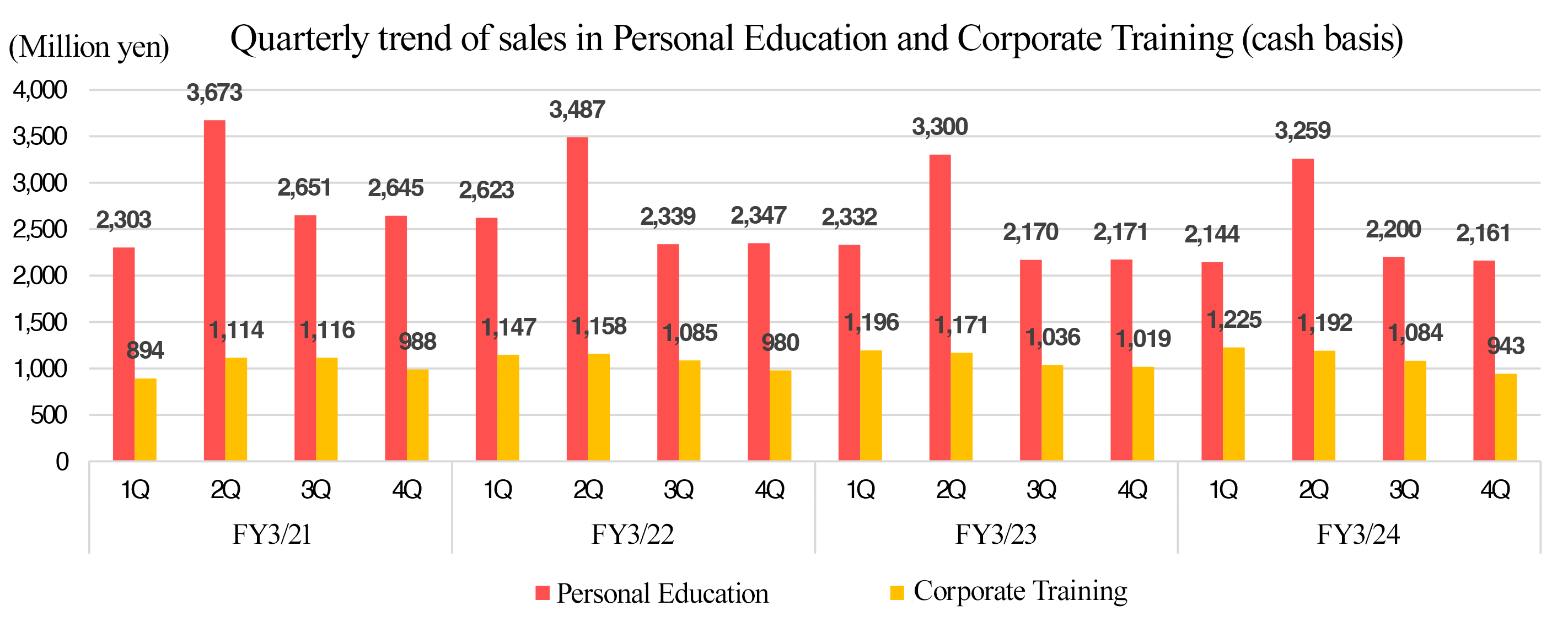

Examinations for the company’s main certification courses, such as Certified Public Accountants and Certified Public Tax Accountant, are held from spring to fall (Q1 to Q3), and applications for courses for mainly university students, such as public officer courses, are concentrated in the spring and summer (Q1 to Q2). Therefore, applications (sales on a cash basis) in the fourth quarter tend to be less than in other quarters. On the other hand, operating expenses, such as rent, instructor fees, and advertising expenses, are booked in a fixed amount each month, so there is no quarterly bias.

Variation in quarterly performance

| 1Q | YoY Change | 2Q | YoY Change | 3Q | YoY Change | 4Q | YoY Change |

Sales on a cash basis | 4,443 | -6.3% | 5,546 | -2.3% | 4,469 | +3.7% | 4,472 | -2.0% |

Sales on an accrual basis | 5,206 | -6.6% | 4,919 | -5.2% | 4,243 | +1.4% | 4,631 | -2.7% |

Gross profit | 2,050 | -15.6% | 1,943 | -12.1% | 1,225 | +1.1% | 1,767 | -5.8% |

Operating profit | 123 | -77.6% | 129 | -67.0% | -574 | - | 14 | - |

Ordinary profit | 106 | -80.1% | 120 | -69.1% | -580 | - | 23 | - |

Net profit | 83 | -76.3% | 90 | -65.6% | -410 | - | 16 | +57.3% |

*Units: Million yen. Net profit is net profit attributable to owners of parent (the same applies for net profit hereinafter).

(2) Business Segment Trends

The company has adopted a management approach for segment information, through the application of the “Accounting Standard for Disclosure of Segment Information,” etc., and shows sales in the following tables as sales “on a cash basis” (before advances received) in accordance with the corporate group’s management decision-making.

Sales on a cash basis by Business Segment

| FY 3/23 | Share | FY 3/24 | Share | YoY Change |

Personal Education | 9,974 | 51.7% | 9,765 | 51.6% | -2.1% |

Corporate Training | 4,423 | 22.9% | 4,445 | 23.5% | +0.5% |

Publishing | 4,426 | 22.9% | 4,246 | 22.4% | -4.1% |

Manpower Business | 517 | 2.7% | 510 | 2.7% | -1.5% |

Elimination of intersegment transactions | -46 | - | -36 | - | - |

Consolidated Sales | 19,295 | 100.0% | 18,932 | 100.0% | -1.9% |

*Units: Million yen

Operating profit on a cash basis by Business Segment

| FY 3/23 | Profit ratio | FY 3/24 | Profit ratio | YoY Change |

Personal Education | -1,074 | - | -1,029 | - | - |

Corporate Training | 966 | 21.8% | 1,011 | 22.8% | +4.7% |

Publishing | 1,216 | 27.5% | 847 | 20.0% | -30.3% |

Manpower Business | 70 | 13.5% | 63 | 12.4% | -9.5% |

Corporate expenses | -1,275 | - | -1,270 | - | - |

Consolidated Operating profit | -97 | - | -376 | - | - |

*Units: Million yen

【Personal Education】

Decline in sales and shrinkage of loss on a cash basis

When COVID-19 was reclassified into the Class 5 category, the number of applications for courses targeting mainly working adults from attendees who newly start a course and attendees who have previously taken an exam gradually picked up. As a result, sales on a cash basis in the second half grew year on year and operating loss on a cash basis in this period improved 252 million yen. Regarding the performance in each course, favorable performance throughout the year was noted in IT Specialist courses due to lasting demand stemming from the promotion of DX at enterprises and the Certified Public Tax Accountants course due to changes in the examination system, tax reforms, etc. Moreover, courses attended mainly by working adults, such as the S&M Enterprise Mgt. Consultant course, Labor and Social Security Attorney course, Real Estate Appraiser course, Real Estate Transaction Agent course, Architects and Building Engineers course and Judicial Scrivener course performed favorably. On the other hand, there were few applications for courses attended mainly by students as private enterprises are highly motivated to recruit due to labor shortage, etc., and sales on a cash basis of the Bookkeeping course, USCPA course, etc. also fell below the sales in the previous fiscal year. In terms of costs, operating expenses such as lecture fees, outsourcing costs for producing teaching materials and rent were 10,794 million yen (down 2.3% year on year).

Consequently, sales of Personal Education on a cash basis stood at 9,765 million yen (down 2.1% year on year) and operating loss on a cash basis was 1,029 million yen (operating loss was 1,074 million yen in the previous fiscal year).

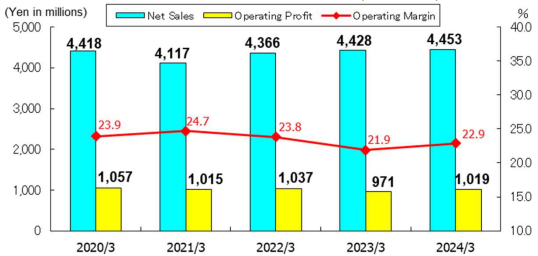

Trend in Personal Education *Sales and operating profit and loss are stated on an accrual basis.

【Corporate Training】

Increase in sales and in profit

Although the pace of Corporate Training slightly dropped in the fourth quarter, its performance was favorable throughout the fiscal year. Regarding the performance in each area, the performance of Financial Services & Real Estate, which is the mainstay, surpassed the performance in the previous year. In addition, training related to Finance and Accounting, Electricity and Facilities, etc. also performed favorably, surpassing the performance in the previous year. University seminars remained at the same level as in the previous year, while the sales of the affiliated school business, whose main clients are individuals in the countryside, declined 7.3% year on year, the sales from provision of content to vocational schools in the countryside dropped 8.5% year on year and the sales from drills commissioned by municipalities decreased 0.9% year on year. In terms of costs, operating expenses were 3,433 million yen (down 0.7% year on year).

Consequently, sales of Corporate Training on a cash basis stood at 4,445 million yen (up 0.5% year on year) and operating profit on a cash basis was 1,011 million yen (up 4.7% year on year).

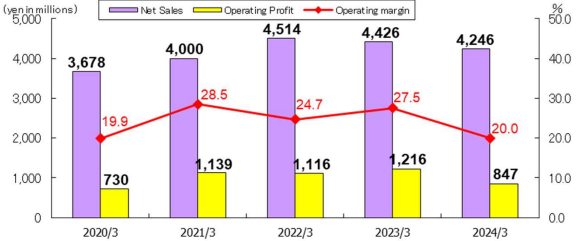

Trend in Corporate Training *Sales and operating profit and loss are stated on an accrual basis.

(From the company’s materials)

【Publishing】

Decrease in sales and in profit

The corporate group's publishing business is conducted under two brands: "TAC Publishing " operated by the company and "W Seminar" ("W Publishing") operated by its subsidiary, Waseda Management Publishing, Co., Ltd. While the performance of Publishing showed some recovery from the third quarter, it was not enough to offset the negative impact in the first and second quarters caused by the decline in demand from people staying at home, leading to a decrease in sales. With regard to books which are used to prepare for qualification exams, TAC publications for Certified Public Tax Accountant, Real Estate Appraiser, Architects and Building Engineers and Securities Analyst as well as W Publishing books for Patent Attorney, Certified Administrative Procedures Legal Specialist, etc. performed favorably, surpassing the performance in the previous year. However, sales of publications for Bookkeeping, Real Estate Transaction Agent, Licensed Strata Management Consultant, Financial Planner, Labor and Social Security Attorney, etc. ended up falling short of the sales in the previous year. Apart from the aforementioned, the company made significant revision to travel guides and published new series, and they sold well, also owing to the growth of demand for travelling as a result of lifting of restrictions on free movement. In terms of costs, operating expenses stood at 3,398 million yen (up 5.9% year on year).

Consequently, sales of Publishing on a cash basis stood at 4,246 million yen (down 4.1% year on year), while operating profit on a cash basis reached 847 million yen (down 30.3% year on year).

Trend in Publishing 【Breakdown of sales】 (prior to consolidated adjustments)

TAC Publishing: 3,899 million yen, W Publishing: 547 million yen

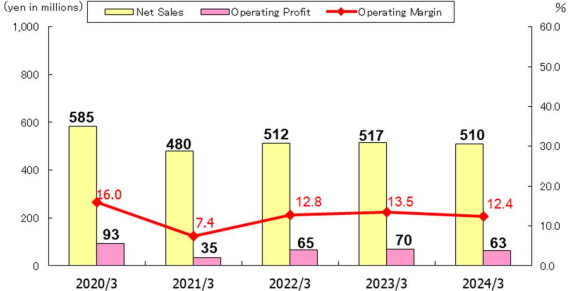

【Manpower Business】

Decrease in sales and in profit

Sales of advertising and personnel placement in the business of introduction and dispatch of accounting personnel managed by a subsidiary TAC Profession Bank Co., Ltd. remained favorable throughout the year owing to the high demand for accounting personnel at tax accounting firms and audit corporations, which are clients, as well as general companies. On the other hand, sales of temporary staffing fell below those in the previous year. Sales in the business of staffing medical personnel managed by Medical Office Staffing Kansai Co., Ltd. picked up from the second quarter due to demand caused by labor shortage at medical institutions, etc., exceeding the sales in the last year. However, operating profit decreased from the previous year as a result of an increase in operating expenses, such as personnel costs brought about by securing temporary staff.

Consequently, sales of the Manpower Business on a cash basis stood at 510 million yen (down 1.5% year on year), while operating profit on a cash basis was 63 million yen (down 9.5% year on year).

Trend in Manpower Business

(3) Trend by Certification Category

The company adopted the "Accounting Standards for Revenue Recognition" and other standards, the amount equivalent to expected product returns is directly deducted from net sales for transactions in the publishing business in which there is a possibility of return of goods. The amount equivalent to such returns is calculated based on an overall estimate based on past sales returns, etc., and the deductions for each field are not known. Therefore, the total sales in "FY 3/23" and "FY 3/24" in the table below do not match the sales in the consolidated profit-and-loss statements.

Sales on an accrual basis by Certification Category

| FY 3/23 | Share | FY 3/24 | Share | YoY Change |

Finance, Accounting | 3,852 | 19.5% | 3,313 | 17.3% | -14.0% |

Management, Taxation | 3,187 | 16.1% | 3,226 | 16.9% | +1.2% |

Financial Service, Real Estate | 4,615 | 23.4% | 4,657 | 24.4% | +0.9% |

Law | 1,276 | 6.5% | 1,300 | 6.8% | +1.9% |

Public Officer, Labor | 3,940 | 20.0% | 3,557 | 18.6% | -9.7% |

IT, International | 1,627 | 8.2% | 1,644 | 8.6% | +1.1% |

Medical, Welfare | 266 | 1.3% | 266 | 1.4% | -0.0% |

Others | 985 | 5.0% | 1,138 | 6.0% | +15.6% |

Total | 19,752 | 100.0% | 19,105 | 100.0% | -3.3% |

*Unit: Million yen

【Market Overview】

The number of students in the fiscal year ended March 2024 totaled 199,940 (up 1.6% from the previous consolidated fiscal year), of which 111,093 were individual students (down 1.4% or 1,535 students) and 88,847 were corporate students (up 5.7% or 4,769 students).

Student Number Trends

| FY 3/23 | Share | FY 3/24 | Share | YoY Change |

Individual | 112,628 | 57.3% | 111,093 | 55.6% | -1.4% |

Corporate | 84,078 | 42.7% | 88,847 | 44.4% | +5.7% |

Total | 196,706 | 100.0% | 199,940 | 100.0% | +1.6% |

*Units: Person

【Overview by Certification Sector】

While the number of both individual and corporate course attendees rose 4.0% year on year in the Certified Public Tax Accountant course, 5.1% year on year in the Real Estate Transaction Agent course, 17.1% year on year in the Financial Planner course, 10.7% year on year in IT Specialist courses, 5.67% year on year in CompTIA courses, etc., it fell 5.9% year on year in the Bookkeeping course, 5.7% year on year in the Certified Public Accountant course, 6.4% year on year in the Licensed Strata Management Consultant course, 10.4% in the Government officials (RS&LG)* course, etc. The number of corporate attendees grew 8.5% year on year in distance learning, while it declined 2.2% year on year at university seminars and 7.5% year on year at affiliated schools, and grew 1.3% year on year in commissioned training.

* Regular Service & Local Government

Number of students by Certification Category

| FY 3/23 | Share | FY 3/24 | Share | YoY Change |

Finance and Accounting | 26,113 | 13.3% | 24,756 | 12.4% | -5.2% |

Management and Taxation | 23,189 | 11.8% | 23,566 | 11.8% | +1.6% |

Financial Service and Real Estate | 53,009 | 27.0% | 57,805 | 28.9% | +9.0% |

Law | 10,481 | 5.3% | 10,814 | 5.4% | +3.2% |

Public Officer and Labor | 46,670 | 23.7% | 43,161 | 21.6% | -7.5% |

IT and International/ Medical and Welfare/ Others | 37,244 | 18.9% | 39,838 | 19.9% | +7.0% |

Total | 196,706 | 100.0% | 199,940 | 100.0% | +1.6% |

*Units: Person

(4) Financial Conditions

◎Main Balance Sheet Items

| End of March 2023 | End of March 2024 |

| End of March 2023 | End of March 2024 |

Cash and deposits | 6,103 | 5,745 | Notes and Accounts Payable - trade | 495 | 580 |

Notes and Accounts Receivable - trade | 3,835 | 4,259 | Provision for Loss on Abandonment of Sales Return | 333 | 377 |

Inventories | 878 | 936 | Advances Received | 5,483 | 5,462 |

Current Assets | 11,604 | 11,622 | Asset Retirement Obligation | 725 | 656 |

Property, Plant and Equipment | 4,973 | 4,855 | Interest Bearing Liabilities | 5,298 | 5,649 |

Intangible Assets | 231 | 303 | Liabilities | 14,591 | 14,918 |

Investments and Other Assets | 3,986 | 4,008 | Net Assets | 6,203 | 5,872 |

Non-current Assets | 9,190 | 9,168 | Total Liabilities, Net Assets | 20,795 | 20,790 |

*Units: Million yen

Current assets increased 18 million yen from the end of the previous term, due to an increase in notes and accounts receivable-trade, etc. Fixed assets decreased 22 million yen year on year due to a decrease in property, plant and equipment. Total assets decreased 4 million yen to 20,790 million yen.

Due to an increase in interest-bearing debt, total liabilities increased 326 million yen year on year to 14,918 million yen.

Net assets decreased 331 million yen to 5,872 million yen, due to a decrease in retained earnings, etc.

As a result, capital-to-asset ratio fell 1.6 points from the end of the previous fiscal year to 28.2%.

3. Fiscal Year ending March 2025 Earnings Estimates

(1) Consolidated Earnings

| FY 3/24 Act. | Share | FY 3/25 Est | Share | YoY Change |

Sales | 19,001 | 100.0% | 19,220 | 100.0% | +1.1% |

Gross profit | 6,988 | 36.8% | - | - | - |

SG&A | 7,295 | 38.4% | - | - | - |

Operating profit | -307 | - | 270 | 1.4% | - |

Ordinary profit | -329 | - | 220 | 1.1% | - |

Net profit | -219 | - | 150 | 0.8% | - |

*Units: Million yen. Estimates are those of the company.

Projecting an increase in sales and achievement of profitability

For the fiscal year ending March 2025, the company is forecasting sales of 19,220 million yen, up 1.1% year on year, and an operating profit of 270 million yen (in the previous fiscal year, they recorded an operating loss of 307 million yen). Moreover, they expect sales on a cash basis to grow 1.6% year on year to 19,230 million yen. In order to promote the group’s continuous business activities and growth in the medium/long term, they will strive for (1) enhancement of existing businesses, (2) early recovery of Personal Education and (3) improvement of the price-book value ratio. With regard to existing businesses, they will work toward the elevation of profitability in each segment and they intend to reinforce the linkage between different segments. Regarding the early recovery of Personal Education, they will develop new course models, revising the cost structure with the objective of securing an appropriate level of profit while aiming for the expansion of sales. They plan to pay a dividend of 4.00 yen/share (including the interim dividend of 2.00 yen/share). The expected payout ratio is 48.4%.

4. Conclusions

It can be said that the delay in the recovery of Personal Education was the major cause of the loss in the fiscal year ended March 2024. The company is responding to the transition to a new learning environment centered on online education while making progress in streamlining. We would like to observe the situation concerning streamlining as the company makes up for the delay in the recovery of Personal Education in the fiscal year ending March 2025. Moreover, they are engaging in new initiatives such as a marriage agency service and we hold expectations for the diversification of their revenue sources. Stock price is stagnant, as could be expected from the decline in sales and recording of a deficit. However, the achievement of profitability is forecast for the fiscal year ending March 2025 and the company managed to pay dividends although a decrease in dividend is forecast. PBR has fallen significantly below 1.0 and it can be presumed that if they can regain their performance, it will directly improve stock price.

<Reference: Regarding Corporate Governance>

◎Operating type, and the composition of directors and auditors

Operating type | Company with Audit and Supervisory Committee |

Directors who are not members of the Audit and Supervisory Committee | 12 directors, including 2 external ones |

Directors who are members of the Audit and Supervisory Committee | 3 auditors, including 3 external ones |

◎Corporate Governance Report

Updated on December 19, 2023

<Basic Policy>

The company's basic policy regarding corporate governance is to put importance on prompt decision-making. The company currently has ten internal directors. On the other hand, the company also assigned five outside directors to properly maintain the corporate governance and the legal compliance system required as a public company, and it operates them to function efficiently.

Japan is rapidly shifting from a mature industrial society to a knowledge society. In the knowledge society, knowledgeable specialists (professionals) are required in various fields, and the areas of their participation are expanding. "Professional" is derived from the word “profess” = "declare in front of God." Thus, in medieval Europe, knowledgeable specialists such as priests, doctors, accountants, and teachers were professionals who made a vow to God when employed. Since the company started the business of training Certified Public Accountants, it has been in charge of training many professionals required in modern times on behalf of universities.

The group has received support from a wide range of customers (university students, working people, and corporations) through its bases and media, with the management philosophy of "cultivating the professionals that society needs" and "being deeply involved in personal growth." The company aims to be a strong player in the education services and human resource training and supply markets. It believes that the most basic proposition required of a joint-stock company, "increasing shareholder value," can be achieved only by having a support base by its customers, who are stakeholders.

That kind of professionals' self-discipline is part of the organizational culture in the group's corporate governance. The directors of the company themselves also aspire to regulate themselves as "management professionals." The Companies Act stipulates that the term of each director shall be one year (two years for directors belonging to the audit and supervisory committee), and shareholders judge whether respective directors have served as “professionals in business administration” in each term at a general meeting of shareholders. Our company adopted the organizational structure as a company with an audit and supervisory committee, and strives to enhance the functions to oversee and audit business management and comply with laws and regulations thoroughly, with the aim of achieving highly transparent business management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has not followed the following principles in the Corporate Governance Code for the reasons described in the table below.

Principles | Reasons for not implementing the principles |

Supplementary principle 1-2 (4) | The great majority of our shareholders consist of individual Japanese shareholders, and the respective ratios of institutional and overseas investors are limited. At the present moment, therefore, our company does not use any electronic voting platforms, etc. or translate notices of convocation of shareholders’ meetings into English; however, we will consider working on them if the ratio of institutional or overseas investors increases in the future.

|

Supplementary Principle 2-4 (1) | Our company bases its assessments and appointments of core personnel on the individual’s abilities, regardless of their personal attributes. Therefore, there are no numerical targets based on personal attributes. Moreover, most of our business activities are conducted in Japan, and we do not have any appointment history of foreigners for the management positions. However, in terms of the appointment of core personnel, our company bases its assessments and appointments on individuals’ personal abilities, regardless of their attributes, thus, we consider an appointment whenever there is an appropriate person in accordance with our company’s future business development. Our company is actively employing mid-career employees in addition to the new graduate, with the aim to develop diverse human resources and establish a vibrant organization.

|

Supplementary Principle 4-11 (1) | Our company, with the aim to execute our company group’s management efficiently and effectively, to contribute to the company’s sustainable growth, and to maximize its corporate value, follows its policy to have the Board of the directors composed of diverse members with different backgrounds in abilities, knowledge, and experience. Furthermore, the upper limit of the number of the Directors is set at 15, with up to four Directors who also serves as the member of the audit and supervisory committee, as stated in the Articles of Incorporation, for a quick decision-making process. Moreover, we will discuss a disclosure of the skills matrix as our task in the future. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Our company’s policies pertaining to each principle whose disclosure is required by the Corporate Governance Code are as follows (except the principles stated in the above “Reasons for Non-compliance with the Principles of the Corporate Governance Code.”)

Principles | Disclosure |

Supplementary Principle 3-1 (3) | As initiatives for sustainability, our company is working on promoting paperless business operations, implementing Cool Biz and Warm Biz, and reducing CO2 emissions through saving air conditioning energy, in terms of the environment. Further, in the social aspect, our company promotes acquiring accounting knowledge required for businesspersons, and carries out events such as Bookkeeping Championship Tournament with the aim to contribute to the development of companies and Japan’s entire economy. Our company’s management philosophy is to “contribute to the society through our development of profession.” Our company runs educational service business to support students and working adults obtaining national qualifications, etc., and our development of educational contents including textbooks and development of curricula is nothing but an investment in intellectual properties. In addition, developing professions is indispensable for the educational content development, we require our employees to acquire the Official Business Skills Test in Bookkeeping, third grade, and encourage acquiring various qualifications, and proactively provide support for tuition for that purpose.

|

Principle 5-1 | Our company has established a department devoted to dealing with inquiries from investors including shareholders (IR Office). We appropriately handle each and every inquiry, except for any information that is deemed to be highly likely to go against the regulations for insider trading.

|

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on TAC Co., Ltd. (4319) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/