Bridge Report:(4290)Prestige International Fiscal Year Ended March 2024

Shinichi Tamagami, CEO | Prestige International Inc.(4290) |

|

Company Information

Market | TSE Prime |

Industry | Provision of services |

CEO | Shinichi Tamagami |

HQ address | 2-4-1 Kojimachi, Chiyoda-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued (End of the Fiscal Year) | Total Market Cap | ROE Act. | Trading Unit | |

¥723 | 127,356,992shares | ¥92,079 million | 13.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥24.00 | 3.3% | ¥41.62 | 17.4x | ¥345.65 | 2.1x |

*Stock price as of closing on August 16. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the previous quarter.

*BPS and ROE are the actual results for the FY 2024 ended March. The figures are rounded off.

*DPS and EPS are the company’s estimates for FY 2025 ending March

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Profit Attributable to Owners of Parent | EPS | DPS |

March 2021 Act. | 40,617 | 5,233 | 5,453 | 2,968 | 23.18 | 7.00 |

March 2022 Act. | 46,744 | 6,842 | 7,151 | 4,357 | 34.02 | 8.50 |

March 2023 Act. | 54,562 | 7,840 | 8,378 | 5,318 | 41.62 | 11.00 |

March 2024 Act. | 58,738 | 7,921 | 8,458 | 5,791 | 45.34 | 12.00 |

March 2025 Est. | 63,000 | 8,000 | 8,500 | 5,300 | 41.62 | 24.00 |

* The estimated figures are based on the disclosure material made by the Company. Units: million yen. In October 2019, a 2-for-1 stock split was conducted (EPS and DPS were adjusted retroactively).

* The company has adopted the “Accounting Standard for Revenue Recognition (ASBJ Statement No. 29)” etc. at the beginning of the fiscal year ended March 2022.

This report outlines the financial results of Prestige International Inc. for the fiscal year ended March 2024, etc.

Table of Contents

Key Points

1. Corporate Overview

2. New Medium-Term Business Plan

3. Fiscal Year Ended March 2024 Earnings Results

4. Fiscal Year Ending March 2025 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

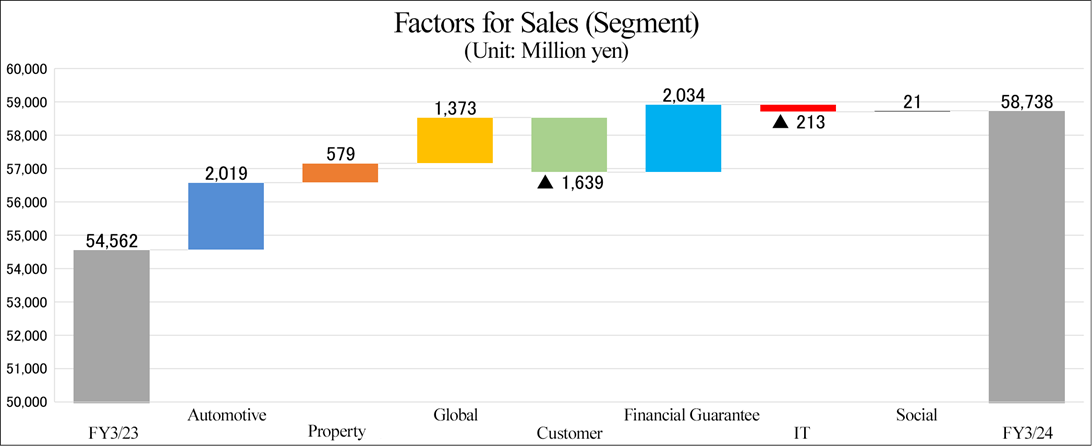

- In the fiscal year ended March 2024, sales were 58,738 million yen, up 7.7% year on year. Although impacted by the subsiding of vaccine-related business, the decrease in sales was offset by the growth of the Financial Guarantee Business, Automotive Business and Global Business, so sales grew 4,175 million yen. Operating profit grew 1.0% year on year to 7,921 million yen. Although costs rose due to the temporary decline in revenues stemming from the subsiding of vaccine-related business, revisions to the salary table, etc., operating profit increased 80 million yen owing to the growth in sales.

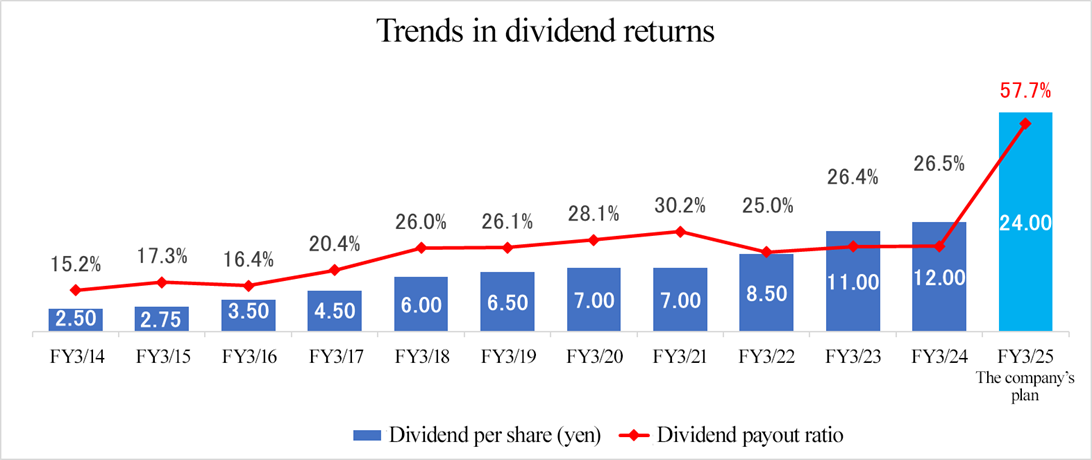

- For the fiscal year ending March 2025, they forecast that sales will be 63 billion yen, up 7.3% year on year, and operating profit will be 8 billion yen, up 1.0% year on year. Sales are expected to increase as the Automotive Business, which is the mainstay, will see the expansion of services in the fields of EVs and connected cars and streamlining achieved by utilizing technology to promote the automatization of some business operations, and the Financial Guarantee Business will see the steady performance of the core Rent Guarantee Business. Despite the growth in sales, operating profit is projected to increase only marginally as they will continuously work on increasing the number of personnel to enhance the system for addressing healthy demand, raising wages, etc.They plan to double the dividend, which was 12.00 yen/share in the previous fiscal year, to 24.00 yen/share (an interim dividend of 12.00 yen/share and a year-end dividend of 12.00 yen/share). The expected payout ratio is 57.7%.

- The new three-year medium-term business plan, which starts in the fiscal year ending March 2025, has started. In the Automotive Business, which is the mainstay, the automobile industry is undergoing significant changes such as the shift to EVs and the development of many new services is scheduled as the ways of using automobiles become increasingly diverse, including CASE and MaaS. In addition, they plan to provide service platforms for accident assessment by AI, automatic systems for operation, etc. Furthermore, in the Property Business, they plan to launch Home Assist at apartments for rent on a full scale and offer a next-generation model of management service which combines patrols of apartments and IT. Moreover, in the Global Business, they are going to expand services for expatriates before they leave Japan and when they temporarily return to Japan, and forge ahead with arranging service platforms such as Japanese Help Desks (support in Japanese language) set up at medical institutions and opening directly managed clinics in foreign countries. In the Financial Guarantee Business, they plan to expand the financial guarantee field centered on the steady Rent Guarantee service for apartments for rent while also focusing on Medical Expense Guarantee, Nursing Care Guarantee, etc. Attention will be paid to the progress of these new services, scheduled for the period of the new medium-term business plan.

1. Corporate Overview

They operate the BPO (Business Process Outsourcing) Business in Japan and overseas under the management philosophy: “To listen to end-user (consumer) inconveniences and troubles, engage in business creation that will lead to solutions, and grow as a company that contributes by providing solutions to social issues through that development.” Their main services include a roadside assistance service provided to automobile insurance subscribers (executing everything in a one-stop basis, receiving trouble reports and providing on-site services to solve problems), a healthcare program dealing with injuries and illnesses which Japanese nationals suffered during their overseas stay (https://www.hcpg.jp/), a house maintenance service provided to condominium residents based on a contract with the management company of the property, etc. (stopping water leakage, lock opening, housecleaning, etc.) and a parking area assistance service for companies managing parking lots. Although all these services are familiar, the company operates in the form of B2B2C business, which in other words means that they do business using the name of a client enterprise (a non-life insurance company, an automobile-related company, a real estate management company, or the like) when providing the service, and the company name “Prestige International” is thus not often heard.

(1) Group Philosophy and Group Operating Policy

Group Philosophy

To listen to end-user (consumer) inconveniences and troubles, engage in business creation that will lead to solutions, and grow as a company that contributes by providing solutions to social issues through that development.

Group Operating Policy

Prestige International Group strives to become a necessary part of our community, trusted by client enterprises and offering solutions that end users appreciate. While their desire is to continually contribute to society, they also aim to become a global company, prospering together with client enterprises, shareholders, employees, and local communities.

(2) Outline of business segments

Segment | Business outline |

Automotive | Automobile-related services: roadside assistance, accident reception, customer support, automobile extended warranty, emergency call service, etc. |

Property | Services for real estate management companies: on-site responses to housing equipment issues, housing equipment extended warranty service, housing services, pet assistance service, etc. Services for parking lot operations: regular patrol service, device maintenance, etc. |

Global | Overseas-related services: Japanese-language support services on a 24-hour, claim agent services, healthcare program, credit card business denominated in U.S. dollars etc. for Japanese expatriates and overseas travelers, etc. |

Customer | Contact center-related services: customer relationship management, product warranty business and arrangements for the repair of products, municipal-related business etc. |

Financial Guarantee | Financial guarantee services: rent guarantee, medical expense guarantee, child support payment guarantee, nursing care guarantee etc. |

IT | IT-related services: SCM solutions, various IT solution business, etc. |

Social | Social contribution projects: sports project “Aranmare”, childcare project “Orangery”, regional revitalization projects, etc. |

(3) History

The motive for founding the company in October 1986 lay in the CEO, Tamagami’s wish for “being able to have access to high-quality and heartfelt services like in Japan even while staying overseas,” coming from his experience of inconveniences due to the differences in language and culture when he lived overseas for seven years. In the following year, the company started business in New York and launched a service for 24-hour response in Japanese to inquiries from Japanese travelers who encountered trouble. After that, the company widened its scope of the services while broadening the network to major cities in Asia and Europe. The company also developed their business in Japan and expanded their range.

Prestige International Inc. was listed on the NASDAQ Japan market in July 2001 and opened a contact center attending to emergency requests 24 hours a day, 365 days a year in Akita City, Akita Prefecture (current “Akita BPO Main Campus” WEST Wing, approx. 650 seats) in October 2003. The BPO bases, opened with the philosophy of “long-term and stable securing of human resources is what makes it possible to provide a stable service to customers,” grew in scale, having the EAST Wing (approx. 550 seats) in 2007 and the Satellite Wing (approx. 300 seats) in 2012. The high-quality infrastructure is highly regarded by clients and the center also plays a part in generating new employment opportunities in Akita in addition to its role as a showroom. Following the listing on the Second Section of the TSE in December 2012, the company’s stock was listed on the First Section of the TSE in December 2013. In April 2022, the company was listed on the Prime Market of TSE in the wake of the TSE market restructuring.

(4) Strengths

The strengths of the company lie in the stable recurring-revenue business, service operational bases which support their high-quality service, and consequently the achievement of high profitability and management efficiency.

Moreover, the company offers not only response to phone inquiries, but also one-stop solutions based on assistance services such as on-site response. On-site response by the company itself and the countrywide network are high barriers to entry, so those are competitive advantages of the company.

① Stable recurring-revenue business

As the company offers mainly value-added services (special insurance contracts) to the existing customers of their client enterprises, such as non-life insurance companies, the fluctuation of revenues due to the external environment is relatively insignificant. The fee set under the outsourcing contract with a client company is calculated by multiplying the number of service users by the unit price of the service. If the number of service users or the utilization rate per service user increases, it will be reflected in the outsourcing contract fee for the next fiscal year. The numbers of participating enterprises and users grew especially in regard to the response to automobile-related trouble owing to better recognition of the company, bringing about a continuous increase of users eligible for the service and elevation of the usage rate. They also provide similar roadside assistance services to warranty services that automobile manufacturers and dealers attach to new car sales. The fact that each company is actively expanding its service revenue is also a tailwind. In the real estate-related service, condominium developers, etc., who used to be dependent on the pay-per-product service of selling off the properties, are enhancing recurring-revenue business in the same way, also bringing tailwind. Furthermore, the Healthcare Program (medical support for employees assigned to overseas workplaces), which the company operates as an overseas business, is supported by the global development of enterprises aiming for the remarkably growing overseas market.

② Service operation bases which support high-quality services

In order to offer high quality services, the company operates contact centers and on-site assistance teams in Japan. In addition, the company has a global network of 28 operational bases in 18 countries mainly to provide services of the Global Business.

③ BPO operation bases in Japan

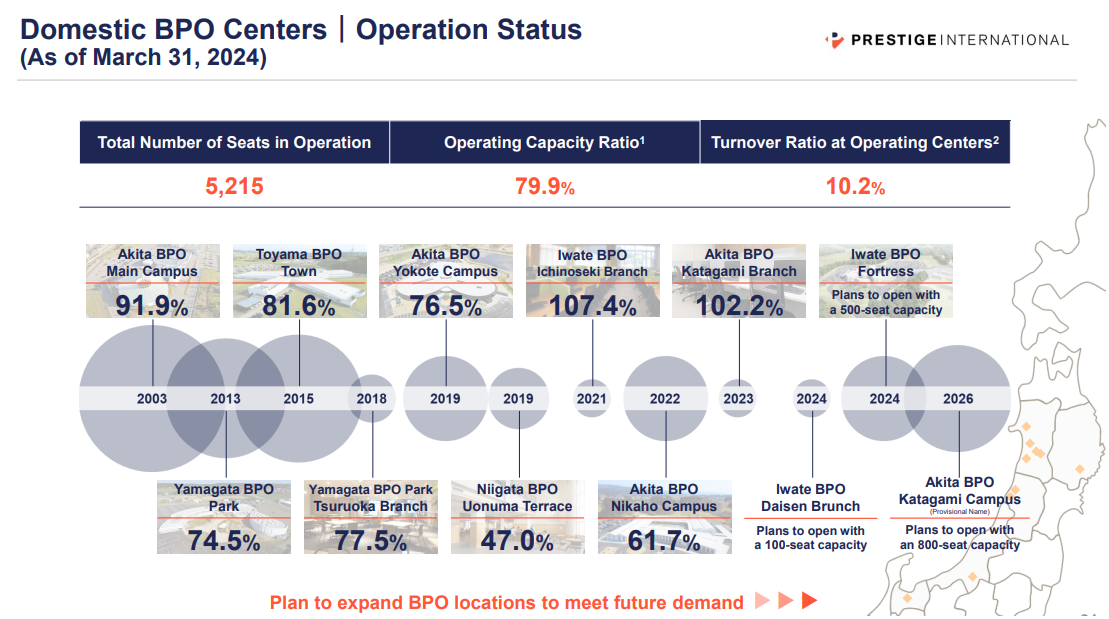

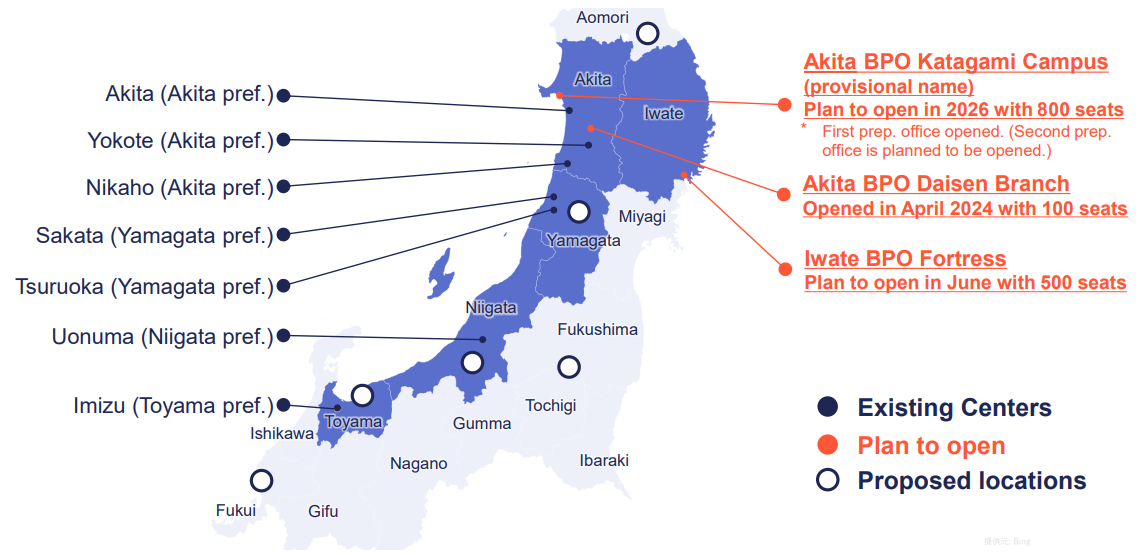

(Source: the company’s presentation materials)

The company has nine contact centers (already opened, as of the end of March 2024), which are BPO operation bases – Akita BPO Main Campus (Akita City, Akita Prefecture), Yamagata BPO Park (Sakata City, Yamagata Prefecture), Toyama BPO Town (Imizu City, Toyama Prefecture), Yamagata BPO Park Tsuruoka Branch (Tsuruoka City, Yamagata Prefecture), Akita BPO Yokote Campus (Yokote City, Akita Prefecture), Niigata BPO Uonuma Terrace (Uonuma City, Niigata Prefecture), Iwate BPO Ichinoseki Branch (Ichinoseki City, Iwate Prefecture), Akita BPO Nikaho Campus (Nikaho City, Akita Prefecture) and Akita BPO Katagami Branch (Katagami City, Akita Prefecture). In addition, Iwate BPO Fortress was completed in June 2024. They were opened in cities in the countryside, placing importance on personnel stability. Furthermore, the centers currently operate at an occupancy rate of 79.9 %. The company assumes that an occupancy of approx. 80% is the best in order to respond to the BCP at the operational bases in case of emergency and accept orders, etc. of irregular business, and so forth. As the current situation is close to this, construction of Akita BPO’s Katagami Campus (provisional name) is scheduled to be completed in 2026 in Katagami City, Akita Prefecture, and engage in stable and proactive recruitment “focused on the area” when viewed from the overall perspective by recruiting in each region.

④ Providing in-house operated on-site response in major cities throughout Japan

On-site response for the Road Assist (automobile-related), Home Assist (real estate-related), and Park Assist (parking lot-related) are operated and managed wholly by Premier Assist Inc., a group company, in major cities throughout Japan.

Staff who assist clients with trouble on the site are full-time employees, all wearing crisp clean uniforms, and the company regularly gives lectures on manners, etc., sparing no effort in initiatives for elevating the service quality. The on-site response by full-time employees of Premier Assist Inc. is highly regarded and constitutes the source of the company’s competitiveness.

(Source: the company's presentation materials)

⑤ Offering services globally

They provide support services for non-life insurance companies offering overseas travel insurance and companies with expatriate staff for overseas operations in the event that a traveler suffers an injury or illness. The business provides insured persons, such as overseas travelers, expatriates, and their accompanying family members, with a 24-hour telephone consultation service, functions as claim agent services, medical support such as a “cashless medical service,” and credit card operations with settlement in US dollars. Through its global network of 29 offices in 18 countries and cooperation with medical institutions, they are able to respond to the different circumstances in each country and the specific needs of each market.

(Source: the company’s website)

2. New Medium-Term Business Plan

On May 10, 2024, the company announced its three-year medium-term business plan started in FY 2025.

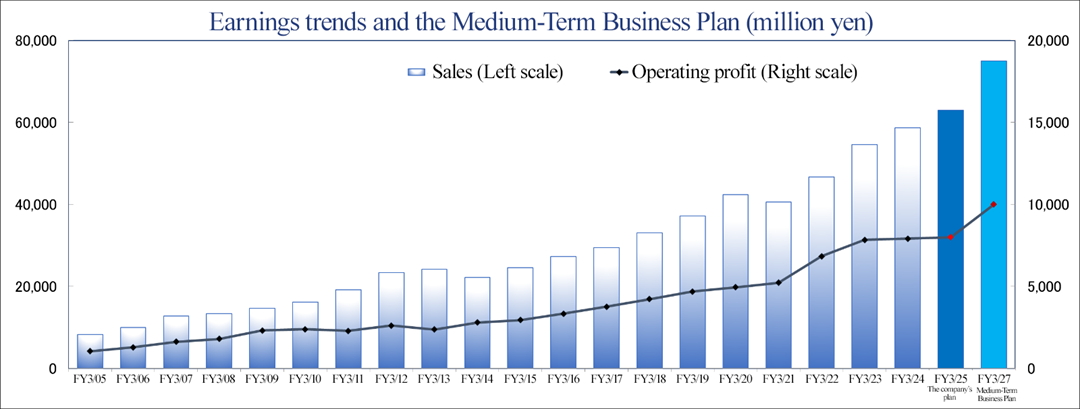

[Looking back on the previous Medium-Term Business Plan]

| FY 3/21 Act. | Targets for FY 3/24 in Medium-Term Business Plan | FY 3/24 Act. | CAGR during Three-year Medium-Term Business Plan |

Sales | 40,617 | 60,000 | 58,738 | +13.1% |

Operating profit | 5,233 | 8,000 | 7,921 | +14.8% |

ROE | 10.0% | 13% | 13.9% | - |

Payout ratio | 30.2% | 30% or more | 35.1% | - |

*Unit: million yen

Sales were generally in line with the forecast, when a change in the method of recording sales in the Automotive Business due to a change in some contracts is considered. Operating profit was also generally in line with the forecast despite factors that raised costs, such as a sharp rise in wages and prices.

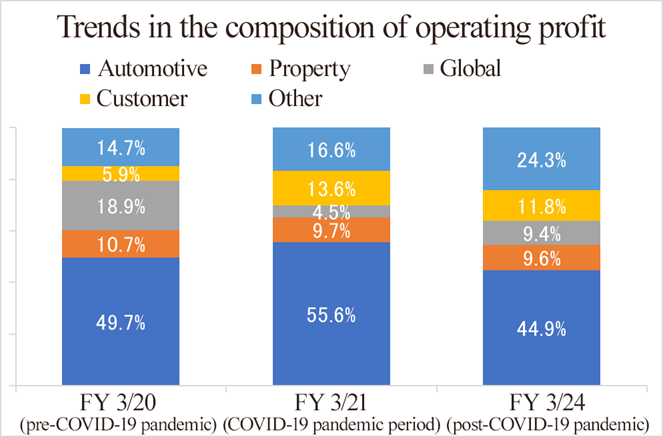

Although global business was severely affected by the decrease in the number of people traveling overseas due to the COVID-19 pandemic, the solid performance of the Automotive Business in Japan and the increase of orders for vaccine-related business from local governments made up for the weak performance of the global business. Diversification of business, one of their strengths, was successful, and they avoided a major impact on earnings.

Major investments included 5 billion yen for BPO construction, 0.9 billion yen for vehicles and EVs, and 1.2 billion for systems and IT.

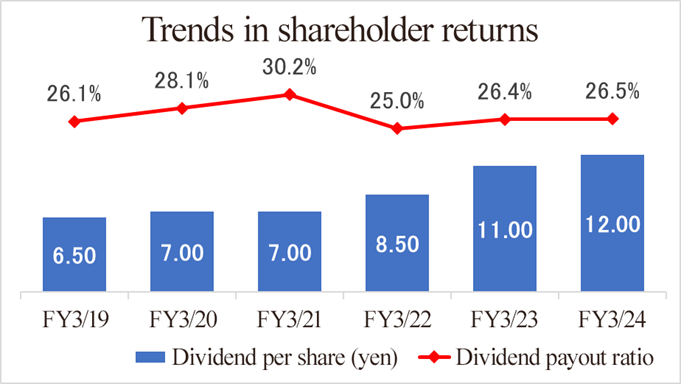

In parallel with the profit growth, they steadily increased dividends over the long term, and ROE increased from 10.0% in the fiscal year ended March 2021 to 13.9% in the fiscal year ended March 2024. Moreover, they repurchased a total of 1 billion yen in treasury stock during the period of the medium-term business plan.

New Medium-Term Business Plan (8th Medium-Term Business Plan)

◎Positioning

They have launched a three-year medium-term business plan, “Origin/Next 50,” starting in the fiscal year ending March 2025 and continuing through the fiscal year ending March 2027, which marks the 40th anniversary of the founding of the company. “Origin/Next 50” is the first half of the plan to move beyond the 40th anniversary of the company’s founding to become a 50-year company. The new medium-term business plan is intended to serve as a “Nexus Point = Bridge between the Past and the Future.” Based on its “Starting Point,” “Strengths,” and “Vision for the Future,” they will pursue niche, unique, and edgy business developments over the next decade in a manner that is true to the corporate group’s identity.

◎Future business environment

Industry | Future industry environment | Initiatives that customers will need to address |

Automotive industry | ◆ A once-in-a-century period of industry transformation ◆ Widespread adoption of connected cars and automated driving ◆ Changes in vehicle usage, such as CASE and MaaS | ◆Labor shortages

◆Rising wages

◆Higher prices

◆Advances in IT

◆Environmental initiatives |

Real estate industry | ◆ Rising real estate prices and polarization ◆ Delay in IT/DX in an industry ◆ Lack of condominium management staff | |

Warranty-related industry | ◆ Due to an aging population and the shift to nuclear families, rent guarantees are increasingly in demand. ◆ Continued expansion of product warranties, extended warranties, etc. due to growing interest in SDGs and awareness of using products for a long time. | |

Call center industry | ◆ Increased demand due to labor shortages across all industries ◆ Recruitment difficulties, rising labor costs ◆ AI diffusion |

◎ Management goals and earnings trends

| Results for FY 3/24 | Medium-term goals for FY 3/27 | CAGR for the three years of the medium-term business plan |

Sales | 58,738 | 75,000 | +10.0% |

Operating profit | 7,921 | 10,000 | +9.6% |

Dividend payout ratio | 26.5% | 60% or more | - |

Total return ratio | 35.1% | 70% or more | - |

ROE | 13.9% | 15% or more | - |

*Unit: million yen

The basic policy of the new medium-term business plan is to increase the volume of existing subscription-based business contracts, capitalize on peripheral businesses where outsourcing is increasing amid labor shortages, and cultivate new businesses.

◎ Overall strategy

① Creating Business Potential

<Thorough improvement of quality and profitability of existing businesses>

Overall measures | Revenue management for each BPO site/project |

Selection and concentration of existing consigned projects and appropriate pricing | |

Common infrastructure for operation systems |

② Development of a service platform-based revenue model

<Development and provision of a one-time-pay-type service platform that does not require human intervention, including systems>

The current business model in which client companies outsource their operations to the contact center of Prestige International involves such issues as a lack of system coordination between the client company and the contact center, a lack of real-time data sharing, and increased operating costs. They plan to develop a service that integrates operations by incorporating the client company’s telephone network into Prestige International’s contact center system. By charging per ID, the client company can curtail installation costs (because existing business phones can be used and there is no need to alter the Internet environment). The service also allows for the coexistence of internal and external telephones, real-time data sharing, and the integration of multiple communication methods, such as handheld phones used in stores and wireless devices to streamline their operations.

In addition, as a future one-time-pay-type revenue model, they will also work to build a revenue model that does not rely on human resources by providing a system that can automate and streamline business processes, for example, building a system that uses AI to calculate the amount of damage from a car accident based on images taken at the scene when staff are dispatched to a car accident. They also plan to introduce a service in which AI automatically estimates the amount of damage to a car from the images and charges for each case.

③ Flexible expansion of the sites

<Meeting the growing demand by opening satellite BPO bases (approximately 100-150 seats)>

Overall measures | Establish satellites to connect large BPO sites and promote employment by expanding the area as a whole rather than just a single point. |

Targeting areas where commuting is long and recruiting is difficult, and where female participation in the workforce is high. | |

Rapidly expand contract capacity |

(Source: the company’s medium-term business plan)

◎ Individual business strategies

① Automotive Business

(1) The automobile industry is undergoing a once-in-a-century period of transformation, and they will actively seek to capture new demand.

Working on CASE & MaaS |

Respond to changes in EVs, connected, online sales, automated driving, etc. and take a holistic approach to new demands and changes. |

Accident assessment using AI (pay-per-use business model)) |

Revenue from recurring business model for roadside assistance + Revenue from pay-per-use and recurring business model for accident response. |

Provide service platforms such as automated operating systems (pay-per-use business model) |

Prevent lost opportunities and increase revenue from new customers. |

(2) To develop new services in the automotive field

| Existing services | Developing services |

Complete Vehicle Manufacturers | Customer center | Autonomous driving, online show room |

Non-life insurance | Road assistance, accident reception, emergency call | Autonomous driving, accident assessment |

Rent-a-car | Roadside assistance | CASE |

Passenger transport | - | MaaS, autonomous driving |

Gas station | - | EV charging equipment maintenance |

Dealer/Retailer | Extended warranty, maintenance program | Integrated customer centers, online sales, battery recycling for EV vehicles, land transportation and delivery of vehicles |

(3) The conventional approach of providing three-pronged services with contact centers, IT/DX, and field operations will be replaced by a new approach that offers services based on individual functions tailored to specific needs.

② Property Business

(1) Foray into the field of rental apartments, Provision of next-generation management services and integrated management services

They have focused on providing on-site repairs (for leaks and clogging) and housing equipment inspections as its main business for condominiums. However, it now plans to actively expand its on-site repair services to rental apartments as well. Additionally, to address the shortage of condominium management personnel and the decline in management quality, they will introduce next-generation management services that combine patrol management with IT, primarily for condominiums. Furthermore, they plan to offer integrated customer services that comprehensively provide these services to both rental apartments and condominiums.

(2) Implementation of on-site repairs of large home appliances

The on-site repair service for condominium units, which has been their main business, targeted a market of approximately 680,000 households. However, they will expand this service to include on-site repairs of large home appliances for a fee. In addition, since the number of units targeted for on-site repairs in rental apartments, which they will focus on in the future, is larger than the number of units targeted for on-site repairs in condominium units, their business opportunities will expand.

(3) To provide next-generation management services to condominium developers and management companies

They will actively promote its next-generation management service, Smart Desk Smart Call (Smart Management), which combines patrol management and IT, to condominium developers and management companies. This Smart Desk Smart Call (Smart Management) is a solution to the shortage of building managers. Users who introduce it will be able to adopt the IoT for condominium management tasks such as guidance, reception, and attendance through smartphone apps, tablets, and touch-screen signage. In addition, they will be able to provide a new condominium management service by adding on-site services, regular patrols, inspections, cleaning, and garbage disposal, which are management tasks that can only be done by people.

③ Global Business

(1) Expanding services in the markets for expatriates and travelers in processes from pre-departure to returning home

Their Global Business focuses on providing services to clients traveling overseas who use Overseas Travel Insurance Assistance Services (OTAI), the Healthcare Program for Expatriates (HCP), the Medical Support Program (MSP), the Japanese Help Desk (JHD), the Premier Health Clinics (PHC), and Credit Cards (*US only (CARD)). In the future, they will work with HCPs to promote its brand even before customers depart and are assigned to work and create opportunities to collaborate with local solutions such as JHD, HCP, and MSP and provide touchpoints at the time of customers’ travel before departure or when temporarily returning home. By doing so, they aim to establish an economic zone for global business centered on medical-related businesses.

(2) To expand the Japanese Help Desk and Premier Health Clinic.

JHD (Japanese Help Desk) | Set up a help desk for Japanese patients in the hospital to assist them in every step of the process related to their medical treatment (Commissions will be paid for each case of support.) | 53 locations in Southeast Asia (As of the end of March 2024) |

PHC (Premier Health Clinic) | The clinic specializes in medical care for Japanese people, including transparency in reimbursement and explanation of medical treatments and medicines in Japanese. | 2 clinics in India 1 clinic in Mexico (As of the end of March 2024) |

④ Financial Guarantee Business

They will strengthen the Rent Guarantee Business, which is a pillar of growth and earnings, and expand it. They will also nurture the medical and nursing care expense guarantee business to reach its full potential. They will enhance the Rent Guarantee Business, a pillar of growth and earnings, by expanding and evolving its strengths. They will invest for growth, strengthen its products, services, and technological capabilities, and discuss mergers and acquisitions. Medical and nursing care expense guarantees will be positioned as the next pillar of growth and nurtured to its full potential. They will continue to make upfront investments to improve their popularity, access potential customers, and increase sales frequency. In addition, they will create new businesses to make up for the shortage caused by social changes. In new businesses, they will make investments to take on new challenges, search for business opportunities, and acquire local knowledge and know-how through trials.

⑤ IT and DX

1) They will build a development system in Vietnam, Myanmar, and Thailand, using Singapore as a hub.

2) They will promote the standardization, labor saving, and automation of service platforms.

As of the end of the fiscal year ending March 2024, the development and maintenance structure for IT and DX has a total of 200 employees: 100 in Japan and 100 overseas. They plan to increase the number of development and maintenance staff members for IT and DX to a total of 300 by the end of the fiscal year ending March 2025 (100 in Japan and 200 overseas) and to a total of 400 by the end of the fiscal year ending March 2027 (100 in Japan and 300 overseas).

In addition, they will strengthen development using AI, which will be utilized for voice and natural language dialogue services to improve call routing and optimize the process of handling incoming calls. AI will also be utilized in the application of image recognition technology to help assess accidents and will also be used to support intellectual operations such as information entry/registration and back-office operations.

◎ Financial Strategy

① Changes in invested capital

(1) They will change the ratios of equity and interest-bearing debt in its invested capital and lower equity ratio from 64.9% to the 50% level in three years. Thereafter, they will continue efforts to maintain an appropriate level of equity capital.

(2) They will use interest-bearing debt in a well-balanced manner and limit the increase in equity, based on the premise that they will continue to invest while simultaneously strengthening shareholder returns.

② Capital Allocation

(1) They will implement an aggressive growth investment of 12 billion yen over the three years of the new medium-term business plan, centered on the development of new business bases.

(2) They intend to increase the dividend payout ratio in line with business expansion and enhance shareholder returns to achieve a total of 13 billion yen in shareholder returns in the three years of the new medium-term business plan.

Operating CF 25 billion yen | Growth investment | IT and DX investment 3 billion yen | ◆IT investment for DX and labor-saving, standardizing the system infrastructure, AI, etc. |

Capital investment 9 billion yen | ◆Opened a BPO branch with 100 seats in Daisen City, Akita Prefecture in April 2024 ◆Second Preparation Room with 160 seats opened in June 2024 in Katagami City, Akita. (130 seats in the first preparation room opened in June 2023) ◆Opened BPO center with 800 seats (provisional name) in Katagami City, Akita Prefecture in 2026 ◆ Flexible expansion of business bases (5 to 6 locations) | ||

Shareholder return | Shareholder Return 13 billion yen | ◆To raise dividend payout ratio from the current level of approximately 30% to 60% or over by the second year ◆Balanced approach of dividends and share buybacks (up to 3 billion yen) in consideration of stock price, etc. |

③ Improvement of ROE

(1) They will raise ROE from 13.9% in the fiscal year ended March 2024 to 15% in the fiscal year ending March 2027. They will further increase ROE in the fiscal year ending March 2027 and beyond through medium-term initiatives.

(2) They will reduce equity ratio from 64.9% in the fiscal year ended March 2024 to the 50% level in the fiscal year ending March 2027.

<Medium-term initiatives to improve ROE>

◆Securing free cash

◆Continuously increasing the dividend amount

◆Preventing capital accumulation

◆Reducing equity through increased return

◆Increasing profitability through business growth

◎Sustainability

① Succession Plan for CEO

They plan to adopt a management structure under a new CEO in or after 2027, the 40th anniversary of the company’s founding. In preparation for this, they have designated the period from 2024 to 2025 as a period for evaluating, identifying, and narrowing down succession candidates, and will submit individual reports from senior executive officers and executives at higher positions and conduct individual interviews with senior executive officers. The Nomination and Compensation Committee will report on the results of the evaluation. The plan is to nominate and announce successors in or after 2026 through approval of successors by the Nomination and Compensation Committee and the Board of Directors.

② SDGs

SDGs | With the goal of achieving the SDGs, they aim to create a sustainable society through its business. |

Environment | Promote initiatives for a decarbonized and resource-efficient society. <Solar panels installed at BPO sites (Iwate BPO Fortress), Commenced EV Recharging Service, etc.> |

Employees | Create an organizational climate and structure that allows all employees to work and play an active role in the company. <Gathering for mothers on maternity leave, Improve employee benefits, etc.> |

Local Communities | Create employment environments in local cities where youth and women can continue to pursue their dreams or goals. < Organizing local community events, Holding sports clinics, etc.> |

Governance | Promote the development of corporate structures and training for employees to understand the basic framework of corporate governance in relation to all stakeholders and to improve shareholder returns and corporate value. |

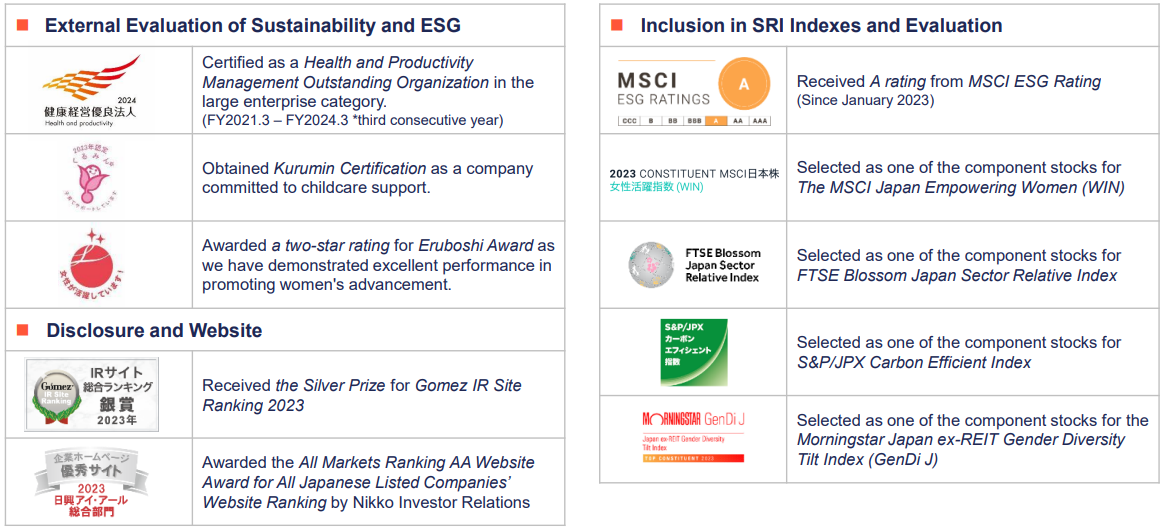

③ ESG Initiatives for Achieving the SDGs

Environment | Environmental Initiatives Aim to reduce CO2 emissions by50% by 2030 and 100% (net zero) by 2050. Implementing initiatives to achieve these targets. ◆Implementation of renewable energy. ◆Installing solar panels at BPO centers. ◆Converting company vehicles to EVs, business investment in EV energy saving services, etc. |

Community | Regional Revitalization ◆Contribute to regional revitalization by creating and maintaining employment through the establishment of a large-scale BPO center and satellite centers in the surrounding area. ◆By establishing new satellite centers, we will strengthen recruitment in a wide area, prevent the outflow of youth, etc. for job opportunities, and contribute to creating a community where people can take root. |

Employee & Diversity Continue to set a target of 50% female managers and implement initiatives to create a comfortable working environment for all, regardless of age or gender. ◆Utilization of diverse human resources Employment of 100 foreigners in the next 3 years and employment of 30 individuals with disabled people per year. ◆Improve engagement Clarify job responsibilities, establish a training system, provide opportunities for skill development (Encourage and support skills acquisition, idea competitions, etc.), expand allowances and incentives | |

Governance | Governance Beyond the 40th anniversary of the Company’s founding, we will strengthen the foundation and ensure compliance for the next 50 years of the company and realize the succession plan of the current management team. ◆Improve disclosure of information. ◆Building a plan for developing the next management team. ◆Review and strengthen BCP measures.. |

④ External evaluation

(Source: the company’s medium-term business plan)

3. Fiscal Year Ended March 2024 Earnings Results

(1) Consolidated Business Results

| FY 3/23 | Ratio to Sales | FY 3/24 | Ratio to Sales | YoY | Company’s estimates | Difference from the estimates |

Sales | 54,562 | 100.0% | 58,738 | 100.0% | +7.7% | 56,500 | +4.0% |

Gross Profit | 13,299 | 24.4% | 13,757 | 23.4% | +3.4% | - | - |

SG&A | 5,458 | 10.0% | 5,835 | 9.9% | +6.9% | - | - |

Operating Profit | 7,840 | 14.4% | 7,921 | 13.5% | +1.0% | 8,200 | -3.4% |

Ordinary Profit | 8,378 | 15.4% | 8,458 | 14.4% | +1.0% | 8,700 | -2.8% |

Profit Attributable to Owners of Parent | 5,318 | 9.7% | 5,791 | 9.9% | +8.9% | 5,200 | +11.4% |

*Unit: million yen

*The figures include the figures calculated by Investment Bridge Co., Ltd. as reference values and may differ from the actual figures. (The same applies below.)

Sales increased 7.7% year on year and operating profit grew 1.0% year on year.

Sales were 58,738 million yen, up 7.7% year on year. Although impacted by the subsiding of vaccine-related business, the decrease in sales was offset by the growth of the Financial Guarantee Business, Automotive Business and Global Business, so sales grew 4,175 million yen.

Operating profit grew 1.0% year on year to 7,921 million yen. Although costs rose due to the temporary decline in revenues stemming from the subsiding of vaccine-related business, revisions to the salary table, etc., operating profit increased 80 million yen due to the growth in sales. Gross profit margin declined 1.0 points year on year to 23.4%, while the ratio of SGA to sales fell 0.1 points year on year. Consequently, operating profit margin dropped 0.9 points year on year to 13.5%. Furthermore, although interest on securities and investment gain on equity method, posted as non-operating profit, increased year on year, the increase rate of ordinary profit was equal to the increase rate of operating profit due to an augmentation of foreign exchange loss posted as a non-operating expense, etc. Moreover, profit attributable to owners of parent grew 8.9% year on year due to the recording of gain on sale of investment securities, the application of tax incentives to encourage wage increases, etc.

While sales and profit attributable to owners of parent exceeded the initial forecast, operating and ordinary profits fell slightly short of the initial forecast.

(2) Trends by Segment

| FY3/23 | Composition ratio/profit margin | FY3/24 | Composition ratio/profit margin | YoY |

Automotive Business | 23,281 | 42.7% | 25,300 | 43.1% | +8.7% |

Property Business | 6,482 | 11.9% | 7,061 | 12.0% | +8.9% |

Global Business | 6,732 | 12.3% | 8,105 | 13.8% | +20.4% |

Customer Business | 9,588 | 17.6% | 7,949 | 13.5% | -17.1% |

Financial Guarantee Business | 6,937 | 12.7% | 8,971 | 15.3% | +29.3% |

IT Business | 878 | 1.6% | 665 | 1.1% | -24.2% |

Social Business | 662 | 1.2% | 683 | 1.2% | +3.3% |

Consolidated Sales | 54,562 | 100.0% | 58,738 | 100.0% | +7.7% |

Automotive Business | 2,861 | 12.3% | 3,542 | 14.0% | +23.8% |

Property Business | 429 | 6.6% | 502 | 7.1% | +17.0% |

Global Business | 694 | 10.3% | 805 | 9.9% | +16.0% |

Customer Business | 2,392 | 25.0% | 1,218 | 15.3% | -49.1% |

Financial Guarantee Business | 1,501 | 21.7% | 2,073 | 23.1% | +38.1% |

IT Business | 183 | 20.9% | 133 | 20.0% | -27.5% |

Social Business | -224 | - | -366 | - | - |

Consolidated Operating Profit | 7,840 | 14.4% | 7,921 | 13.5% | +1.0% |

*Unit: million yen

*Produced by Investment Bridge Co., Ltd. Based on disclosed material.

Automotive Business (accounting for 43.1% of sales in FY 2024)

Sales and profit grew 8.7% and 23.8%, respectively, year on year.

Although sales decreased 2,271 million yen due to the change in the type of contracts with some clients (meaning that actual expenses for procurement were posted in sales), this decrease did not have any impact on profit.

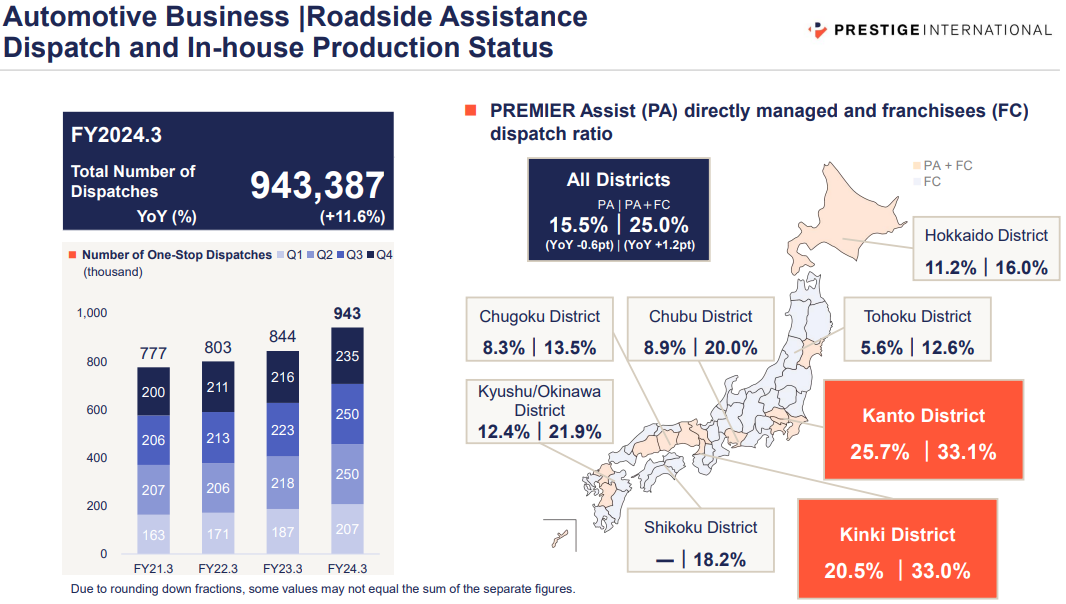

Sales of the Automotive Business, which offers mainly roadside services for non-life insurance companies and automobile manufacturers, increased mainly owing to the growth of existing and new businesses, such as roadside services for bicycles, accident reception services and services for Japanese and overseas manufacturers of automobiles. Furthermore, the total number of Road Assist cases in the fiscal year ended March 2024 stood at 943,387, up 11.6% year on year.

In addition to increases in towing rate and distance, personnel costs for increasing staff to enhance the system, raising wages, etc. rose and procurement augmented. Nevertheless, operating profit increased owing to price revision and the growth of existing and new businesses. Furthermore, operating profit margin rose 1.7 points year on year to 14.0%.

In addition, the number of bases directly operated by Premier Assist in the fiscal year ended March 2024 was 34, increasing by 3 from the end of the previous fiscal year.

Road Assist by PREMIER Assist | FY 3/22 | FY 3/23 | FY 3/24 | FY 3/24 (forecast) |

No. of bases directly managed by PREMIER Assist | 31 | 31 | 34 | 31 |

No. of franchised companies of PREMIER Assist (No. of franchised companies equipped with portable EV chargers) | 63 - | 85 - | 107 73 | 110 73 |

No. of staff members at bases directly managed by PREMIER Assist | 235 | 254 | 278 | 280 |

No. of vehicles owned by PREMIER Assist | 210 | 222 | 236 | 260 |

Tow trucks | 51 | 56 | 68 | 68 |

Tow trucks capable of supplying power to EVs | 2 | 45 | 56 | 56 |

Car-carrying vehicles | 72 | 80 | 79 | 95 |

Service cars | 78 | 78 | 85 | 89 |

Special vehicles* exclusively for motorcycles | 2 | 2 | 0 | 2 |

Motorcycles | 7 | 6 | 4 | 4 |

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

Property Business (accounting for 12.0% of sales in FY 2024)

Sales and profit grew 8.9% and 17.0%, respectively, year on year.

In the Property Business, which offers the services of repair of condominiums, apartments for rent and detached houses, maintenance of paid parking lots, etc., sales increased owing to the growth of Park Assist through the expansion of covered areas, despite the shrinkage and changes of some existing Home Assist services.

Although costs rose due to the appropriate placement of operation staff in Home Assist, etc., operating profit grew due to the effects of upfront investments made in the previous fiscal year, such as the construction of new bases for on-site Park Assist services. Furthermore, operating profit margin rose 0.5 points year on year to 7.1%. In the fiscal year ended March 2024, the total number of Home Assist cases declined 8.0% year on year to 145,750, while the total number of Park Assist cases increased 9.4% year on year to 349,362.

Material items regarding the house maintenance service of Premier Assist | FY 3/22 | FY 3/23 | FY 3/24 | FY 3/24 (forecast) |

No. of bases | 14 | 14 | 14 | 14 |

No. of staff members | 129 | 136 | 141 | 166 |

No. of cases [thousand] | 155 | 156 | 145 | - |

Share in Premier Assist | 35.9% | 34.2% | 35.9% | - |

Materials items regarding the parking area assistance service of Premier Assist | FY 3/22 | FY 3/23 | FY 3/24 | FY 3/24 (forecast) |

No. of bases | 11 | 11 | 10 | 10 |

No. of staff members | 247 | 263 | 264 | 272 |

No. of cases [thousand] | 291 | 319 | 349 | - |

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

Global Business (accounting for 13.8% of sales in FY 2024)

Sales and profit grew 20.4% and 16.0%, respectively, year on year.

In the Global Business, which offers claim agent services for overseas travel insurance and medical care support services for expatriates (Healthcare Program), sales grew due to an increase in the number of members of the Healthcare Program and an expansion of areas covered by claim agent services in addition to an increase in the use of the Overseas Travel Accident Insurance and Japanese Help Desks, capitalizing on demand stemming from the increase in the number of overseas travelers, although personal consumption in the U.S. credit card business declined due to inflation, etc.

Although payment fees paid to local partner banks in the U.S. credit card business remained high, operating profit grew owing to the increase in the use of other existing services. Nonetheless, operating profit margin dropped 0.4 points year on year to 9.9%.

Customer Business (accounting for 13.5% of sales in FY 2024)

Sales and profit decreased 17.1% and 49.1%, respectively, year on year.

In the Customer Business, which offers customer relationship management, sales declined due to the subsiding of vaccine-related business.

Operating profit fell, due to the rise in costs through the increase of staff, etc. in step with an increase in business operations in projects, which had decreased during the COVID-19 pandemic, in addition to the decline in sales. Moreover, operating profit margin dropped 9.7 points year on year to 15.3%.

Financial Guarantee Business (accounting for 15.3% of sales in FY 2024)

Sales and profit increased 29.3% and 38.1%, respectively, year on year.

In the Financial Guarantee Service, which provides financial guarantee services related to daily life, such as rent or medical expenses, sales grew owing to the significant increase in new guarantee fees and guarantee renewal fees in step with the rise in the number of new contracts for the Rent Guarantee Business operated by the group company Entrust Inc.

Despite the augmentation of fees for business operation, bad dept expenses, etc., operating profit increased as they managed to keep other costs at a certain level while sales grew. Furthermore, operating profit margin rose 1.4 points year on year to 23.1%.

IT Business (accounting for 1.1% of sales in FY 2024)

Sales and profit decreased 24.2% and 27.5%, respectively, year on year.

In the IT Business, which offers IT solutions, sales saw a reactionary decrease after many acceptance inspections were conducted in the previous fiscal year, while there were cancellations of licenses for the supply chain management system.

Operating profit dropped, due to the decline in sales. Moreover, operating profit margin declined 0.9 points year on year to 20.0%.

Social Business (accounting for 1.2% of sales in FY 2024)

Sales increased 3.3% year on year, and operating loss expanded 142 million yen year on year.

In the Social Business, which manages the women’s sport team “Aranmare” and operates childcare and regional revitalization businesses, sales grew owing to an increase in income from sponsors of “Aranmare.”

Regarding operating profit, deficit expanded due to the augmentation of personnel costs in the childcare business “Orangery” as well as expenses for the enhancement of team assets and expenses for activities of each “Aranmare” team.

(3) Financial Condition and Cash Flows

◎Financial Condition

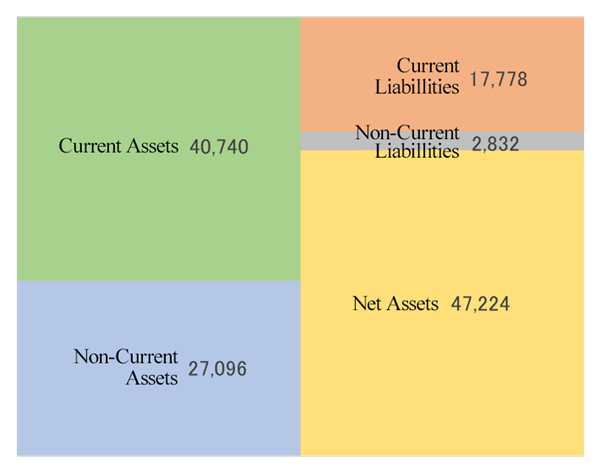

| Mar. 2023 | Mar. 2024 |

| Mar. 2023 | Mar. 2024 |

Cash and deposits | 21,671 | 22,790 | Trade payables | 1,349 | 1,422 |

Trade receivables | 5,304 | 6,404 | Short-term borrowings | 125 | 125 |

Advances paid | 6,549 | 9,572 | Current liabilities | 15,701 | 17,778 |

Inventories | 306 | 473 | Long-term borrowings | 250 | 125 |

Current assets | 35,892 | 40,740 | Asset retirement obligation | 1,885 | 1,956 |

Buildings and structures | 11,085 | 10,993 | Noncurrent liabilities | 2,753 | 2,832 |

Tangible Assets | 13,697 | 14,941 | Liabilities | 18,455 | 20,611 |

Intangible Assets | 2,025 | 2,134 | Net assets | 41,817 | 47,224 |

Investments and Others | 8,657 | 10,019 | Total liabilities and net assets | 60,273 | 67,836 |

Noncurrent assets | 24,380 | 27,096 | Total Interest-bearing liabilities | 375 | 250 |

*Unit: million yen

*Interest-bearing liabilities = Borrowings (excluding lease obligations)

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

Total assets at the end of the fiscal year ended March 2024 stood at 67,836 million yen, growing 7,563 million yen from the end of the previous fiscal year. Assets increased mainly due to a rise in cash and deposits, advances paid, investment securities, construction in progress, etc., while liabilities and net assets grew mainly due to an augmentation in other current liabilities and retained earnings brought about by the increase in profit attributable to owners of parent, even though dividends were paid. The liquidity of assets is high, as current assets account for approx. 60% of total assets. Capital-to-asset ratio remains as high as 64.9%.

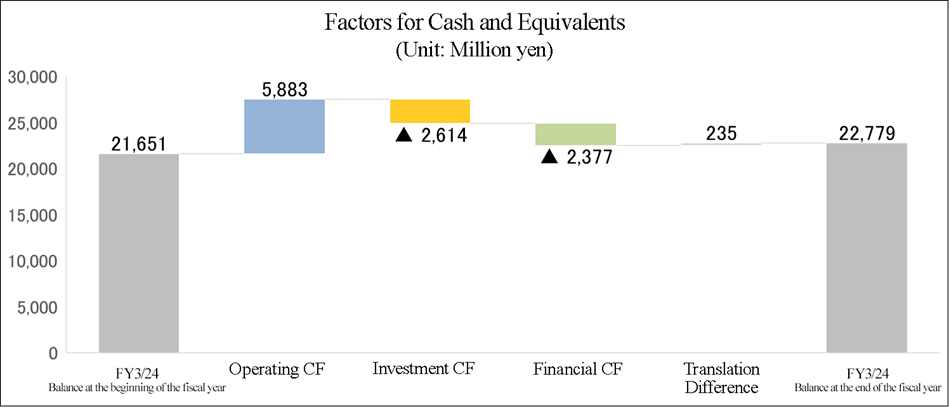

◎Cash Flow

| FY 3/23 | FY 3/24 | Increase/ decrease | YoY |

Operating Cash Flow | 7,888 | 5,883 | -2,004 | -25.4% |

Investment Cash Flow | -2,637 | -2,614 | +23 | - |

Free Cash Flow | 5,250 | 3,269 | -1,981 | -37.7% |

Financial Cash Flow | -2,152 | -2,377 | -224 | - |

Cash and Equivalents at Year End | 21,651 | 22,779 | +1,127 | +5.2% |

*Unit: million yen

*Produced by Investment Bridge Co., Ltd. based on disclosed material.

In terms of cash flows, cash inflow from operating activities shrank due to an increase in gain on sale of investment securities, trade receivables, advances paid and other assets as well as the decrease in contract liabilities. Moreover, the surplus of free cash flow also shrank as the cash outflow from investment activities remained almost unchanged from the previous fiscal year. Cash outflow from financial activities grew due to the increase in the amount of dividend payments, etc. Accordingly, the cash position as of the end of the fiscal year ended March 2024 increased by 5.2% year on year.

(4) Sustainability

◎Initiatives for promotion of women’s advancement

Viewing the creation of an employment environment where young people and women can work while having a dream and contribute to the local society as an important basic strategy, they launched WEPRO (Woman Excite Project) in FY 2018. They completely changed the activity policy in FY 2023 and enhanced activities to allow for further growth of all employees through WEPRO, regardless of sex.

① Aiming to increase the ratio of female managers to 50% by FY 2023 ② A company that enables employees to pursue job satisfaction by making the most of their individual abilities, regardless of age and gender ③ Promotion of working-style transformation in response to lifestyles |

Initiatives and Achievements in FY 3/24 | ||

Project for supply of sanitary products | Regarded as a “good initiative” by more than 99% of female employees. | |

One-on-one interviews | 368 employees held a direct dialogue with a director (for the promotion of women’s advancement) between April and June. | |

Ratio of female managers | 40.5% in the first half of the fiscal year. | |

Ratio of male employees who took childcare leave | 58.3% in the first half of the fiscal year. Rose 34.8 points from fiscal year ended March 2023. | |

Start of the “Part Model Project” serialization | Launched the “Part Model Project,” which introduces the workstyles of employees at a managerial or higher position who balance nursing care, childcare, re-education, etc. and work as one option of career support to undergo the aforementioned one-on-one interview and work in a way that suits the individual. | |

Selected as a “G20 EMPOWER” Best Practice | The WEPRO initiative was included in the “Best Practices Playbook 2023” as one of 151 best practices selected from 19 countries in the world by “G20 EMPOWER,” a private sector alliance aiming to promote the participation of women in decision-making at enterprises, which was approved at the G20 Osaka Summit in 2019 and clearly supported and instructed to launch activities in the Leaders’ Declaration. | |

Event held for the International Women’s Day 2024 on March 8th | International Women’s Day was established by the United Nations in 1975. In Italy, it is known as Mimosa Day, when men send beautiful mimosa flowers to women as a token of their appreciation. To commemorate this day, Arigato Week was held from March 7 to March 14, 2012, and message cards and candy were delivered to both men and women to show appreciation for their support every day. | |

Certified as a Diamond Company in the Yamagata Smile Company Program | Yamagata Smile Company is a system in which Yamagata Prefecture certifies companies that promote a healthy work-life balance and the advancement of women to make Yamagata a place where everyone can work actively and live comfortably. Companies and offices in Yamagata Prefecture that meet the certification criteria are eligible for the program. On march 1st,2024, Yamagata BPO Park received the Diamond Award, the highest of the program’s three levels. . | |

Material issues regarding the empowerment of women | ||

Ratio of female employees | End of Mar. 2024 | 73.8% |

End of Sep. 2023 | 73.3% | |

Ratio of female managers | End of Mar. 2024 | 40.9% |

End of Sep. 2023 | 40.5% | |

Ratio of female employees who took childcare leave | End of Mar. 2024 | 94.9% |

End of Sep. 2023 | 120.0% | |

Ratio of eligible male employees who took childcare leave | End of Mar. 2024 | 61.9% |

End of Sep. 2023 | 58.3% | |

Ratio of female employees who returned to work after childcare leave | End of Mar. 2024 | 97.5% |

End of Sep. 2023 | 97.8% | |

Ratio of male employees who returned to work after childcare leave | End of Mar. 2024 | 100.0% |

End of Sep. 2023 | 100.0% | |

*The subjects are the employees of Prestige International.

*Produced by Investment Bridge Co., Ltd. with reference to the company’s presentation materials

◎ Regional revitalization

Main initiatives and achievements in the fiscal year ended March 2024 are as follows.

* | In June 2023, they opened Akita BPO Katagami Branch (134 seats), aiming for creating further employment in Akita Prefecture and contributing to the region. |

* | In September 2023, Akita BPO Nikaho Campus won the “Tohoku New Office Promotion Award” and “The Chief of Tohoku Bureau of Economy, Trade and Industry Ministry Award” at the 36th Nikkei New Office Awards. |

* | In April 2024, they opened “Akita BPO Daisen Branch,” the fifth site in Akita Prefecture (approx. 100 seats). They are aiming for comprehensive growth in Akita area, offering opportunities for creating new employment for potential job seekers who have given up on applying to both sites until now due to long travelling times when commuting, etc. |

4. Fiscal Year Ending March 2025 Earnings Estimates

(1) Consolidated Earnings Estimates

| FY 3/24 Act. | Ratio to Sales | FY 3/25 Est. by the Company | Ratio to Sales | YoY |

Sales | 58,738 | 100.0% | 63,000 | 100.0% | +7.3% |

Operating Profit | 7,921 | 13.5% | 8,000 | 12.7% | +1.0% |

Ordinary Profit | 8,458 | 14.4% | 8,500 | 13.5% | +0.5% |

Profit Attributable to Owners of Parent | 5,791 | 9.9% | 5,300 | 8.4% | -8.5% |

*Unit: million yen

Sales and operating profit are expected to rise 7.3% and 1.0%, respectively, year on year.

In the fiscal year ending March 2025, which is the first year of the new medium-term business plan, the whole group will work as one toward achieving their targets, aiming for a company that will last for 50 years in accordance with “Connecting Growth – Origin/Next 50,” which is the theme of the medium-term business plan. For the fiscal year ending March 2025, they forecast that sales will be 63 billion yen, up 7.3% year on year, and operating profit will be 8 billion yen, up 1.0% year on year. Sales are expected to increase as the Automotive Business, which is the mainstay, will see the expansion of services in the fields of EVs and connected cars and streamlining achieved by utilizing technology to promote the automatization of some business operations, and the Financial Guarantee Business will see the steady performance of the core Rent Guarantee Business.

Despite the growth in sales, operating profit is projected to increase only marginally as they will continuously work on increasing the number of personnel to enhance the system for addressing healthy demand, raising wages, etc. Operating profit margin is projected to drop 0.8 points year on year to 12.7%. Meanwhile, profit attributable to owners of parent is projected to decline 8.5% year on year as there will no longer be extraordinary profit from the sale of investment securities posted in the fiscal year ended March 2024 and as they do not expect the application of tax incentives to encourage wage increases at the moment.

They plan to double the dividend, which was 12.00 yen/share in the previous fiscal year, to 24.00 yen/share (an interim dividend of 12.00 yen/share and a year-end dividend of 12.00 yen/share). The expected payout ratio is 57.7%.

(2) Outlook and major strategies in each segment (million yen)

| FY 3/24 Act. | Composition ratio/profit margin | FY 3/25 Est. by the Company | Composition ratio/profit margin | YoY |

Automotive Business | 25,300 | 43.1% | 27,960 | 44.4% | +10.5% |

Property Business | 7,061 | 12.0% | 7,750 | 12.3% | +9.7% |

Global Business | 8,105 | 13.8% | 8,620 | 13.7% | +6.4% |

Customer Business | 7,949 | 13.5% | 7,080 | 11.2% | -10.9% |

Financial Guarantee Business | 8,971 | 15.3% | 10,230 | 16.2% | +14.0% |

IT Business | 665 | 1.1% | 500 | 0.8% | -24.9% |

Social Business | 683 | 1.2% | 860 | 1.4% | +25.7% |

Consolidated Sales | 58,738 | 100.0% | 63,000 | 100.0% | +7.3% |

Automotive Business | 3,542 | 14.0% | 3,610 | 12.9% | +1.9% |

Property Business | 502 | 7.1% | 710 | 9.2% | +41.3% |

Global Business | 805 | 9.9% | 960 | 11.1% | +19.1% |

Customer Business | 1,218 | 15.3% | 710 | 10.0% | -41.7% |

Financial Guarantee Business | 2,073 | 23.1% | 2,320 | 22.7% | +11.9% |

IT Business | 133 | 20.0% | 80 | 16.0% | -39.9% |

Social Business | -366 | - | -390 | - | - |

Consolidated Operating Profit | 7,921 | 13.5% | 8,000 | 12.7% | 1.0% |

*Unit: million yen

【Automotive Business】

The company estimates that sales and profit will increase 10.5% and 1.9%, respectively, year on year.

Sales are expected to grow as they project an expansion in peripheral administrative activities such as the handling of reports on accidents and support for insurance claims while they forge ahead with the reflection of costs in prices in Road Assist for non-life insurance companies. On the other hand, operating profit is projected to increase only marginally as they expect a reactionary decrease in the work volume of Road Assist services for bicycles and services for automobile manufacturers, which performed favorably in the previous fiscal year. Operating profit margin is forecast to drop 1.1 points year on year.

【Property Business】

The company estimates that sales and profit will increase 9.7% and 41.3%, respectively, year on year.

Regarding sales, contribution is expected from the start of operation of comprehensive call centers, which handle on-site services for real estate companies and various inquiries, in addition to the expansion of services for properties for rent in Home Assist. Furthermore, they are expecting an increase in business operations related to car sharing and the installation of EV chargers at parking lots, while planning to expand areas covered by the Park Assist service. Operating profit is expected to grow significantly owing to the increase in sales. Operating profit margin is projected to rise 2.0 points year on year.

【Global Business】

The company estimates that sales and profit will increase 6.4% and 19.1%, respectively, year on year.

Sales are projected to grow due to the increase in work volume caused by the labor shortage in the non-life insurance field as well as the rise in the number of new clients in the Healthcare Program for expatriates. The growth in sales will contribute to operating profit. Operating profit margin is expected to rise 1.2 points year on year.

【Customer Business】

The company estimates that sales and profit will drop 10.9% and 41.7%, respectively, year on year.

Sales are expected to decline as vaccine-related business has completely ended, despite the plans to expand existing CRM-related business and launch customer services for household appliances. Operating profit is projected to significantly drop due to the decrease in sales. Operating profit margin is expected to fall 5.3 points despite efforts to improve revenues.

【Financial Guarantee Business】

The company estimates that sales and profit will increase 14.0% and 11.9%, respectively, year on year.

The expansion of services in the Medical Expense Guarantee business and Nursing Care Guarantee business is projected to contribute in addition to the growth of the Rent Guarantee Business at the group company Entrust Inc. The increase in sales will make a contribution to operating profit. Operating profit margin is expected to drop 0.4 points year on year.

【IT Business】

The company estimates that sales and profit will drop 24.9% and 39.9%, respectively, year on year.

The decrease in the delivery of systems is expected to impact both sales and operating profit. Operating profit margin is projected to decline 4.0 points year on year.

【Social Business】

The company estimates that sales will increase 25.7% year on year and operating loss will augment 24 million yen year on year

Sales are forecast to grow owing to the increase in income from sponsors and income from campaign products and tickets in the Sport Business.

An expansion in operating loss is projected due to an augmentation in expenses for enhancing team assets and operational costs stemming from the participation in the SV League.

(3) Shareholder returns

They originally stated that their target total return ratio is 30% or higher, taking into consideration the level of profit on a consolidated basis and the situation of cash flows while considering the business plan and enrichment of funds for expanding the business scale. In the newly launched new medium-term business plan, they plan to double the dividend for the fiscal year ending March 2025 from the previous fiscal year to 24 yen per share as part of management focused on capital efficiency, while they keep making proactive investments in facilities to achieve growth. Moreover, their policy is to raise payout ratio to 60% by the fiscal year ending March 2026 and achieve a total return ratio of 70% or higher including treasury stock acquisition of maximum of 3 billion yen by the fiscal year ending March 2027.

5. Conclusions

The previous medium-term business plan ended in the fiscal year ended March 2024. Sales in the last fiscal year ended up mostly in line with the forecast, when it is considered that the method of posting sales changed in step with changes to some contracts in the Automotive Business. Operating profit also ended up reaching the forecast as a whole despite factors that led to an increase in expenses, such as the rapid rise in wages and prices of commodities. Although the Global Business was significantly impacted by the decrease in people travelling overseas during the COVID-19 pandemic, the steady performance of the Automotive Business in Japan and increase in the entrustment of vaccine-related business by municipalities offset the sluggish performance of the Global Business. The diversification of businesses, which is their strength, proved successful as they managed to avoid severe impact on performance, making the period of the previous medium-term business plan very fruitful.

Amid such situation, the new medium-term business plan started in the fiscal year ending March 2025. The overall strategy consists of “(1) Creating growth potential,” “(2) Development of a service platform-based revenue model” and “(3) Flexible expansion of the sites.” With regard to creating growth potential, they are going to work toward the improvement of the quality and profitability of existing businesses through 1) revenue management for each BPO site/ entrusted project, 2) the selection and concentration of existing commissioned projects and appropriate pricing, and 3) the establishment of common infrastructure for operation systems. Regarding the development of a service platform-based revenue model, they will develop and provide a pay-per-use service platform which includes the system and does not require human assistance. Furthermore, with regard to flexible expansion of the sites, they will proactively open satellite BPO sites (on the scale of approx. 100-150 seats). Attention will be paid to the progress of these overall strategies of the new medium-term business plan.

Moreover, various priority measures were indicated in strategies for each business. The development of many new services is scheduled in the mainstay Automotive Business, as the ways of using automobiles become increasingly diverse, such as CASE and MaaS. In addition, they plan to provide service platforms for accident assessment by AI, automatic systems for operation, etc. Furthermore, in the Property Business, they plan to launch Home Assist at apartments for rent on a full scale and offer a next-generation model of management service, which combines patrols of condominiums and IT. In the Global Business, they are going to expand services for expatriates before they leave Japan and when they temporarily return to Japan, and forge ahead with arranging the service platform such as Japanese Help Desks (support in Japanese language) set up at medical institutions and opening directly managed clinics in concerned foreign countries. In the Financial Guarantee Business, they plan to expand the service line-up for Medical Expense Guarantee, Nursing Care Guarantee, etc. We would like to keep an eye on and hold expectations for the progress of these new services, scheduled to be launched during the period of the new medium-term business plan.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organizational Type | Company with auditors |

Directors | 6 directors, including 3 external ones |

Auditors | 4 auditors, including 2 external ones |

◎Corporate Governance Report (Latest Update: December 22, 2023)

Basic PolicyIn our company, we understand corporate governance as the basic framework of corporate management in relation to respective stakeholders including end-users, client companies, shareholders, employees, and local communities.

We believe that enhancing and strengthening corporate governance is our responsibility to increase shareholder profits and corporate value, and have set the following policies

1. Respect the rights of shareholders and ensure their equality.

2. Cooperate with each stakeholder in an appropriate manner.

3. Ensure transparency through appropriate disclosure of corporate information.

4. Work to build a board of directors and other structures that enable fair, transparent, swift, and decisive decision-making.

5. Engage in appropriate dialogue with shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company is fully compliant with the Principles of Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure content |

■Principle 1-4 (Policy for Strategic Shareholding) | (1) Policy for strategic shareholding In cases where our group holds shares for purposes other than pure investment, we target those that enable us to maintain a medium/long-term relationship, expand transactions, and create synergies with business partners. We hold shares with the policy of enhancing the corporate value of our group as a result of holding the shares of the issuing company, which we believe will lead to the benefit of shareholders and investors. Following this policy, we examine the medium/long-term economic rationality and future prospects every quarter at the board of directors’ meeting, and proceed with the reduction of shares that do not have sufficient significance or do not match the policy. We also examine and verify individually whether the benefits and risks of holding shares are in line with the capital cost, and disclose the outline of those that are highly important.

(2) Exercise of voting rights for strategically held shares In cases where our group holds shares for purposes other than pure investment, we believe that the appropriate exercise of voting rights will promote the strengthening of corporate governance and lead to long-term value improvement and sustainable growth of the company. Therefore, we exercise voting rights for all strategically held shares as a principle. In addition, when exercising voting rights, we judge the pros and cons of each proposal based on the situation of the invested company and the trading relationship with that company. |

■Supplementary Principle 2-4-1 (Ensuring Diversity in the Appointment of Core Personnel) | Our group considers contributing to local communities by creating employment environments in regional cities where young people and women can work and live with dreams to be an important basic strategy. We are continuing our efforts to respect the diversity of every working employee and to create an inclusive work environment that enables the realization of diverse workstyles.

(1) Percentage of Female Employees As of March 31, 2023, our group’s ratio of female employees was 65.3% and the ratio of female managers was 34.5%. In FY 2018, our company launched a project to promote the advancement of women (Woman Exciting Project), elected a director in charge of promoting the advancement of women from among its employees, actively promoted female managers, and implemented other measures within our corporate group. It intends to continue these measures.

(2) Percentages of Mid-career Hires and Non-Japanese Employees Our corporate group has a high ratio of mid-career hires, with 83.2% of new hires in FY 2022 (1,211) being mid-career hires. In particular, 100% of new hires at our overseas offices are mid-career hires, and we employ not only Japanese nationals, but also a diverse range of nationalities, including local nationals. Thus, we have not set a specific target for the future, as we have always striven to secure excellent human resources regardless of whether they are new graduates, mid-career hires, or nationalities, and we intend to continue to do so. For details of our company’s employee ratio, please refer to Appendix 3 of this report.

(3) Status of internal environment development for ensuring diversity With the aim of reforming workstyles to accommodate life stages and creating a comfortable work environment that makes the most of individual abilities, the following initiatives are being implemented. ・Establishment of an in-house childcare facility “Orangerie” ・Adoption of a “New Life Support System” that provides various support for both men and women when major life events such as marriage, childbirth, and nursing care occur ・Adoption of a “Job Return System” that allows employees who have been forced to resign due to reasons such as not having the qualification to take childcare leave within one year of joining the company to return to work ・Adoption of a “Time-Off System by the Hour” that allows employees to take paid leave in one-hour increments, enabling flexible work styles ・Adoption of a system that regards same-sex partners as spouses in the application of employment rules and various regulations. |

■Supplemental Principle 3-1-3 (Sustainability Initiatives, etc.) | <Efforts on Sustainability> Our corporate group has established a Sustainability Policy and, in accordance with the Group's Management Philosophy, aims to be a company that contributes to society by solving social problems and that can prosper together with society and local communities. We believe that efforts for a sustainable society are a responsibility placed on companies, and that it is important to achieve both growth as a company and fulfill our social responsibilities. In order to realize these goals, our corporate group has established the “Material Issues for Sustainability” as a driving force to create new value based on “empathy born from human relationships,” and as a company trusted by society under proper corporate governance, we will work together as a group to realize a sustainable society through a variety of services. For details, please refer to Appendix 2 of this report.

<Investment in Human Capital, etc.> As an investment in human capital, we have adopted a system aimed at creating an environment where employees can demonstrate their strengths in a safe and secure environment, and we will strengthen our human capital by building an environment where employees are empowered to voice their opinions and ideas to their managers. We will create a corporate culture in which each employee can demonstrate their own strengths and establish a system that enables them to work with a sense of fulfillment.

<Investment in Intellectual Property, etc.> Our group operates a BPO business that provides “services that only people can provide” to end-users on behalf of client companies, based on our management philosophy of “solving end-users' inconvenience and trouble.” To create service areas that can only be realized by our group, which respond to changes in the times and values such as the “Contact Center (BPO base)” that receives feedback from end-users, the “Field” that provides services directly to end-users on-site, and the “IT” that supports services that only people can perform, we position the “business model” that utilizes talented human resources, which is essential to our BPO business, and the “trust and reputation” as a good partner with client companies, end-users, and local communities, as important intellectual property and intangible assets for our group’s value creation. To respond to growing customer needs, we are investing in the creation of the PI-DX model as a “value creation company” that responds to changes in the times.

Step 1: Unify the systems used in the contact center

Step 2: Provide PI knowledge utilization services using a common system to new fields

Step 3: Aim to provide new customer value through knowledge sharing

<Addressing Climate Change> On May 13, 2022, our corporate group announced its endorsement of the TCFD recommendations. In order to accurately understand how the risks and opportunities associated with climate change will affect our corporate management, including our finance, we are collecting and analyzing data and disclosing climate-related information based on the TCFD framework.

For details, please refer to “Sustainability - Environmental Initiatives.” Sustainability-Environmental Initiatives URL:https://ssl4.eir-parts.net/doc/4290/tdnet/2194078/00.pdf |

■Principle 5-1 (Policy on Constructive Dialogue with Shareholders) | In order to achieve sustainable and stable growth and increase corporate value, our corporate group engages in constructive dialogue with investors to provide them with opportunities to deepen their understanding of our business activities and our group’s management philosophy. We strive to proactively disclose information that is required by laws and regulations, as well as information deemed important to investors, with the department in charge of IR taking a central role, in cooperation with related internal departments. In addition to holding the General Meeting of Shareholders at BPO bases, our company conducts tours of BPO locations for institutional investors. We also hold company briefing sessions for individual investors as appropriate. Our company’s basic policy regarding systems and initiatives to promote constructive dialogue with shareholders and investors is as follows.

1. The CEO or IR officer attends face-to-face meetings with shareholders as a fundamental approach to establishing constructive dialogue.

2. The IR officer establishes a cross-functional structure that can collaborate with other departments.

3. We strive to understand the shareholder structure and implement measures to promote constructive dialogue with shareholders, for example, by sending shareholder newsletters and holding earnings briefings after financial results are announced.

4. The CEO and IR officer regularly provide feedback on the dialogue status to the board of directors. They also provide regular feedback to the management of group companies, such as Prestige Core Solutions, which handles domestic BPO businesses, and Prestige Global Solutions, which handles overseas BPO businesses.

5. As necessary measures to ensure fairness among shareholders, the health of the market, and the freedom of shareholders to buy and sell shares, during earnings briefings and meetings with shareholders, we explain already disclosed information in greater detail and do not provide explanations about facts that correspond to important information that has not been disclosed. |

■ Principle 5-2 (Management Focused on Capital Cost) | Following the accurate grasping of capital cost, we state our targets in the medium-term business plan, etc. and consider actual measures for achieving these targets as required. 【Measure for realizing management focused on capital cost and stock value (under consideration)】 As time is required for further analysis of the current situation and consideration of measures for realizing management focused on capital cost and stock value, concrete details had not been disclosed by the date on which this report was submitted. Disclosure of concrete details is planned during the fiscal year ending March 2025. |