Bridge Report:(3998)SuRaLa Net Second Quarter of the Fiscal Year ending December 2024

President Takahiko Yunokawa | SuRaLa Net Co., Ltd. (3998) |

|

Company Information

Market | TSE Growth Market |

Industry | Information and communication |

President | Takahiko Yunokawa |

HQ Address | 7F, PMO Uchikanda, 1-14-10, Uchikanda, Chiyoda-ku,Tokyo |

Year-end | December |

Homepage | https://surala.jp/en/ |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥380 | 6,694,764 shares | ¥2,544 million | 14.3% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

0.00 | - | ¥13.60 | 27.9x | ¥338.44 | 1.1x |

* Share price as of closing on August 27. The number of outstanding shares, DPS, and EPS were taken from the brief report on financial results in the second quarter of the fiscal year ending December 2024. ROE and BPS are the results in the previous fiscal year.

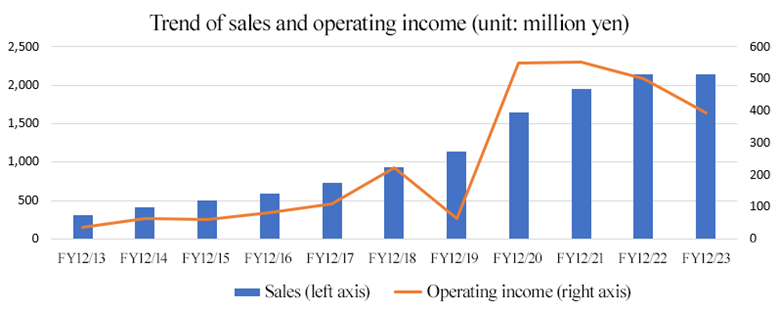

Earnings Trend

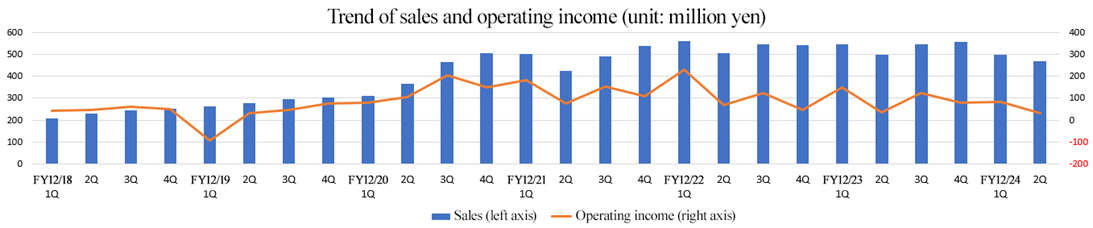

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2020 Act. | 1,649 | 540 | 548 | 379 | 59.67 | 0.00 |

December 2021 Act. | 1,952 | 521 | 552 | 399 | 60.09 | 0.00 |

December 2022 Act. | 2,147 | 475 | 501 | 355 | 53.10 | 0.00 |

December 2023 Act. | 2,145 | 387 | 392 | 304 | 46.30 | 0.00 |

December 2024 Est. | 1,954 | 160 | 167 | 88 | 13.60 | 0.00 |

* Estimates are those of the company. Unit: million yen, yen. The company adopted consolidated accounting from the fiscal year ended December 2022.

This report includes the earning results for the second quarter of the fiscal year ending December 2024 of SuRaLa Net Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending December 2024 Earnings Results

3. Fiscal Year ending December 2024 Earnings Forecasts

4. Medium-term Management Policy

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

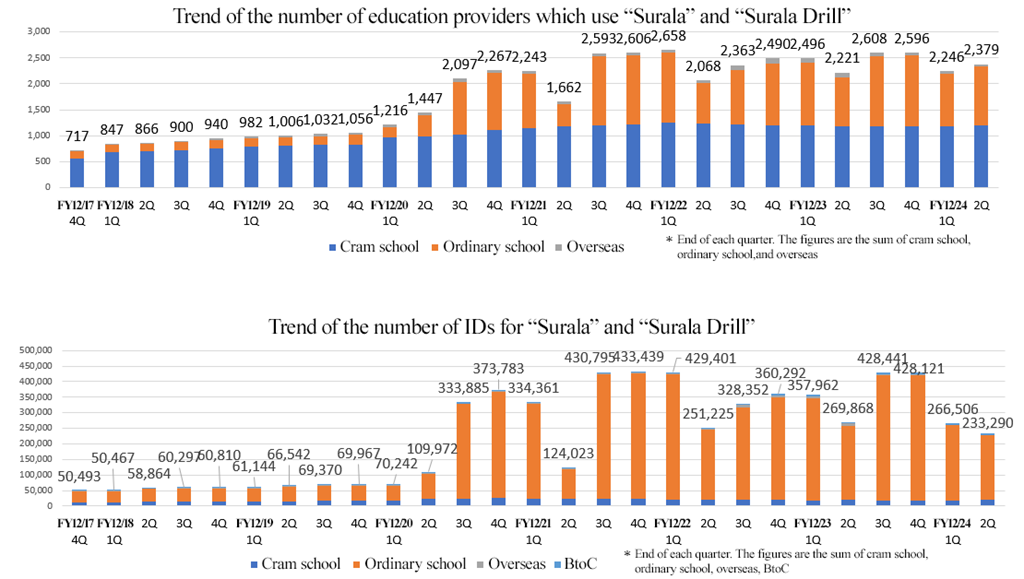

- Under the corporate ethos: “Bringing transformation to education and empowerment to children,” SuRaLa Net supplies “Surala” and “Surala Drill,” which are adaptive teaching tools based on AI and information & communication technology (ICT), to over 400,000 pupils and students of schools, cram schools, etc. The company also gives learning opportunities to children with developmental disabilities, truant children, and underprivileged pupils and students, etc. The company is pursuing growth by entering overseas markets, too, and solving more educational issues.

- In the second quarter of the fiscal year ending December 2024, the sales of the e-learning business dropped 6.4% year on year to 942 million yen. Sales declined in all markets. In the school market, large contracts with local governments expired in March, the number of new contracts with local governments fell below the target, and the number of cram school students in the cram school market decreased. Operating income declined 31.6% year on year to 144 million yen. Gross profit decreased 15.6% year on year, due to the augmentation of the cost of sales for investment in development for differentiating their company from competitors. SGA decreased, but profit dropped. A quarterly net loss of 63 million yen was posted. The impairment loss of goodwill of the consolidated subsidiary Fantamstick, Ltd. amounting to 76 million yen was posted as an extraordinary loss.

- The earnings forecast for the fiscal year ending December 2024 has been revised downwardly. The sales of the e-learning business are projected to decrease 8.3% year on year to 1,902 million yen. Sales are smaller than expected, as the large contracts with local governments in the school market expired in March, the number of new contracts with local governments did not reach the target, and the number of projects entrusted fell below the target in the commissioned development business. Operating income is forecast to drop 53.4% year on year to 206 million yen. In response to the decline in sales, they have revised the forecast downwardly, but they controlled the expenses for maintenance of servers, etc. to reduce the cost of sales, and changed the method for posting performance-based bonuses, so personnel expenses are expected to decrease.

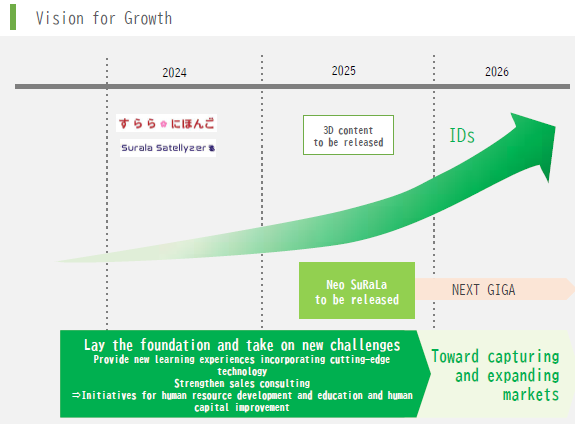

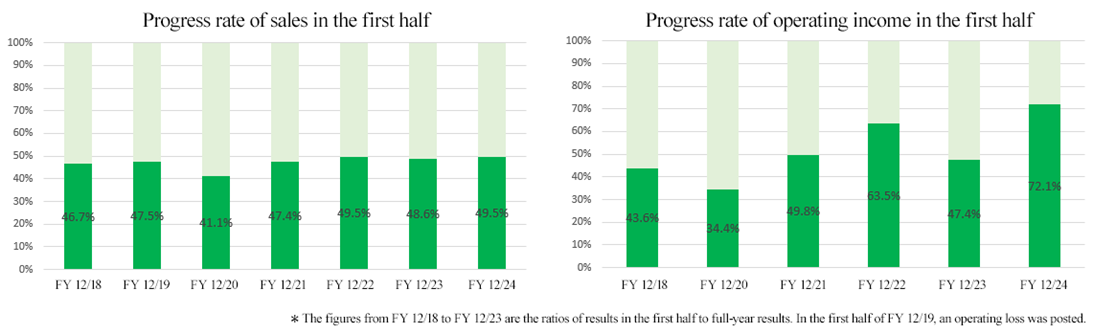

- The progress rates of sales and operating income toward the downwardly-revised forecasts were 49.5% and 72.1%, respectively, in the first half of the fiscal year. In particular, operating income was significantly higher than usual, so it is very likely that it will reach the full-year forecast. However, the number of schools that have adopted their services is unchanged and the number of user IDs is decreasing. Accordingly, it will take some time to grow their business with NEXT GIGA, after the scheduled release of “NEO Surala” in 2025. We would like to pay attention to the progress of establishment of a foundation for expanding the next revenue source.

1. Company Overview

Under the corporate ethos: “Bringing transformation to education and empowerment to children,” SuRaLa Net supplies “Surala” and “Surala Drill,” which are adaptive teaching tools based on AI and information & communication technology (ICT), to over 400,000 pupils and students of about 2,500 schools, cram schools, etc. While the use of the system is expanding in local governments, public high schools, school corporations, vocational schools, and major cram schools across the country, it also offers learning opportunities to students with developmental disabilities and learning disabilities, and truant students. The company is pursuing growth by entering overseas markets, too, and solving more educational issues.

[1-1 History]

When Mr. Takahiko Yunokawa (the current representative director and president of SuRaLa Net Co., Ltd.) was supporting the franchise business and direct management of tutoring schools in CatchOn Co., Ltd., which is a group company of C&I Holdings Co., Ltd. (the former Venture Link Co., Ltd.) in 2004, he was struggling to improve the academic skills of low-performing students although the marketing for attracting students progressed well. In 2005, the company started developing ideal e-learning tools.

During the development, he noticed that there were no effective solutions to improve the academic skills of low-performing students in the world, and started business operation on a full-scale basis, while believing that it is socially meaningful to improve the academic skills of such students and the market is a blue ocean where large companies had not yet started business.

In 2007, the “Surala” for junior high school students was released, targeting the cram and ordinary school markets. In 2008, SuRaLa Net Co., Ltd. was established mainly for the purposes of offering educational services with e-learning systems, supporting the operation of e-learning systems, marketing, promotion, and managing websites.

In the same year, the “Surala” for high school students was released, and in 2010, the number of students using “Surala” exceeded 10,000.

In the same year 2010, SuRaLa Net Co., Ltd. took over the e-learning business “Surala” for cram and ordinary schools throughout Japan from C&I Holdings Co., Ltd. through an absorption-type split contract, and all shares of SuRaLa Net Co., Ltd. were transferred from FC Education Co., Ltd., which is a subsidiary of C&I Holdings Co., Ltd., to Mr. Takahiko Yunokawa, as a management buyout (MBO).

Then, the company released “Surala” for entrepreneurs and home-learners (2011 and 2012), and obtained a patent with the “adaptive learning” function in 2013.

The company brushed up “Surala,” increased sales, and expanded its business domains, including the support for the opening and independence of cram schools. These activities accelerated its growth, raising sales and profit steadily. In 2017, the company got listed on Mothers of TSE. In 2022, it was listed on the Growth Market of TSE through stock market structuring.

[1-2 Corporate Philosophy]

Under the corporate ethos of “Bringing transformation to education and empowerment to children,” the company aims to offer optimal “educational opportunities” to all kinds of children without being swayed by the environment.

The mission and strategy of “SuRaLa Net” are to solve the global social problem of educational inequality for children suffering from poverty and disabilities and low-performing students with cutting-edge technologies and then eliminate the educational inequality.

[1-3 Market Environment & the Company's Initiatives]

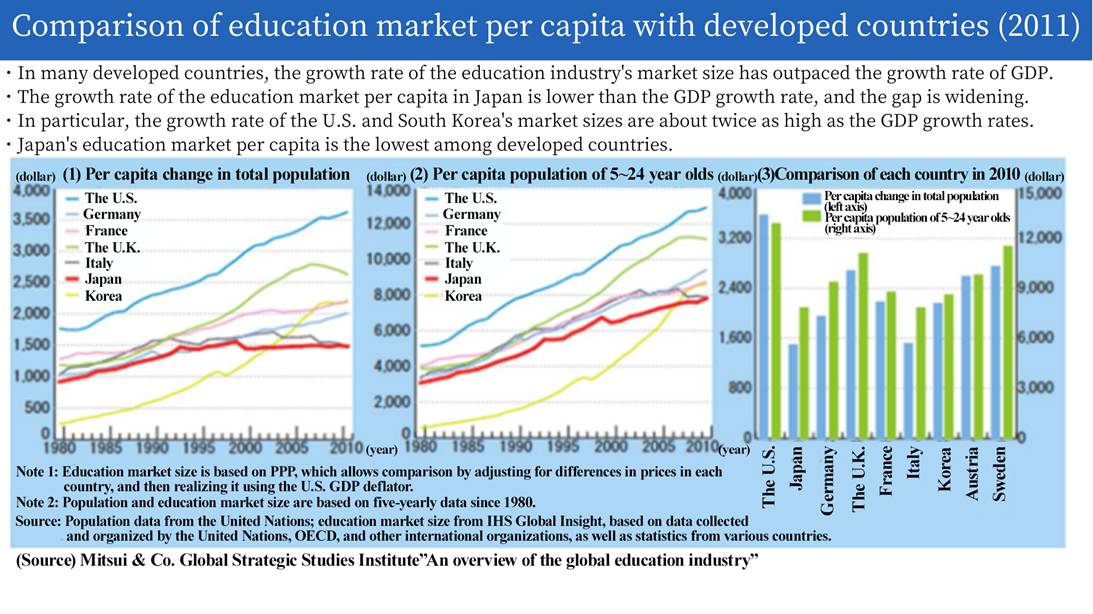

(1) The Japanese education market, which is inferior to those of other advanced countries

According to the reference material of the Ministry of Economy, Trade and Industry (Jan. 2018), “the scale of the Japanese educational industry in the private sector is around 2.5 trillion yen per year. As a whole, the market is shrinking due to the decline in birthrate.” “The difference in growth rate of the educational market between Japan and other advanced countries is increasing.” “In many advanced countries, the growth rate of the scale of the educational industry exceeds that of GDP. In particular, those in the U.S. and South Korea are about two times the GDP growth rate.” “Meanwhile, the educational market scale per capita is the lowest among advanced countries, and the market growth rate per capita is lower than that of GDP in Japan, and this gap is expanding.”

(Taken from the reference material of the Ministry of Economy, Trade and Industry)

(2) Edtech, which is indispensable for renovating the Japanese educational market

That reference material also mentions the growth potential of EdTech (Education × Technology), which is a business field aimed at innovating conventional educational scenes with technology, and introduces pioneering cases in Japan.

The company enumerated the following three concrete points to revise educational guidelines, etc., with the aim of “realizing educational curricula open to society” so that students can share the goal of creating a better society through better school education and acquire necessary qualities and skills for leading the future, while recognizing the problems with education in Japan that need to be dealt with for enhancing competitiveness and cooperating with society.

*What students will become able to d To nurture necessary qualities and skills for the new age and enrich learning assessment

*What students will learn: To establish new subjects, courses, etc. for acquiring necessary qualities and skills for the new age, and revise goals and contents

*How students will learn: To improve learning processes from the viewpoint of “active learning” (proactive, interactive, profound learning).

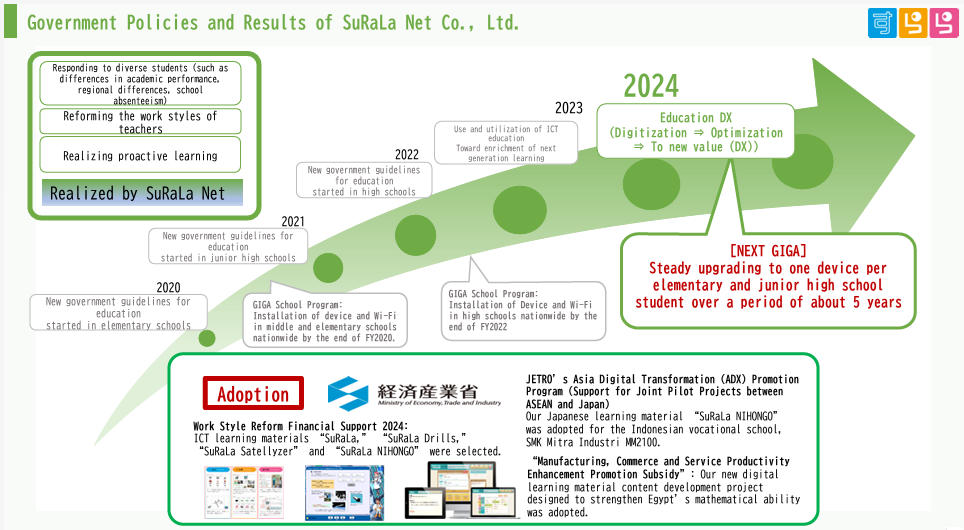

(3) “GIGA School Scheme” and “The fourth basic plan for the promotion of education”

Recognizing this status quo, the Ministry of Education, Culture, Sports, Science and Technology issued the new educational guidelines for “elementary schools” in 2020, those for “junior high schools” in 2021, and those for “high schools” in 2022.

In accordance with the “GIGA* School Scheme,” a five-year plan for adopting ICT in education, the terminals and Wi-Fi installation in elementary and junior high schools throughout Japan were completed by the end of fiscal year 2020, and installation in high schools throughout Japan is scheduled to be completed by the end of fiscal year 2023.

Furthermore, the Ministry of Economy, Trade and Industry partially subsidizes the costs for adopting EdTech tools for “EdTech providers,” so that schools can try ICT-based educational services through the “subsidy for installing EdTech,” and they are conducting a demonstration experiment of a “Future Classroom” in which students design their learning processes by themselves. They are also working on adopting subsidies to support for inquiry-based learning.

*GIGA: Abbreviation for Global and Innovation Gateway for All.

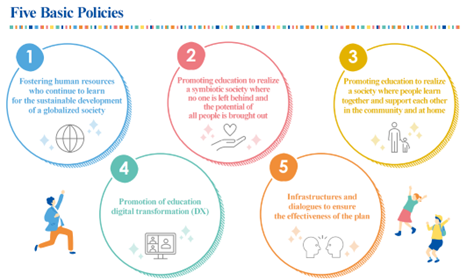

Furthermore, the Cabinet Office approved “the fourth basic plan for the promotion of education” in June 2023.

With the aim of “developing those who can create a sustainable society” and “improving the well-being rooted in the Japanese society,” this plan set the following five basic policies, and positions the promotion of DX with ICT as an important challenge.

(Source: The MEXT leaflet about the Fourth Basic Plan for the Promotion of Education)

In addition, in the beginning of 2023, the GIGA school scheme was concluded, and its widespread adoption in primary and junior high schools across the country was completed. Despite the variations between local governments and schools, the frequency of use has increased, and a movement known as “NEXT GIGA” has emerged, including the consistent update of devices in primary and junior high schools.

Like this, Japan hopes to reform and grow its educational environment and market by proactively adopting ICT.

In particular, it is expected that ICT will fulfill a significant role in the above-mentioned item “How students will learn: To improve learning processes from the viewpoint of active learning (proactive, interactive, profound learning),” and it is forecast that the Japanese EdTech market will keep growing amid the declining birthrate.

(Taken from the reference material of the company)

In response to the policies and measures of the Japanese Government mentioned above, the company has made a significant contribution to the transformation of the Japanese education system by addressing the needs of diverse students, transforming the working styles of teachers, and implementing independent learning.

At present, the company is still aiming to enhance its corporate value by expanding business opportunities and solving educational issues by developing next-generation LSM and strengthening the sales and client systems for the “NEXT GIGA.”

The adoption of the "Subsidy for Supporting Inquiry-Based Learning 2023" in the second supplementary budget for fiscal year 2022 by the Ministry of Economy, Trade and Industry (METI) has led to increased awareness of the company and its Edtech teaching materials at a low cost.

(4) Educational BtoB and BtoC markets

In the BtoB market, there is steady demand for e-learning for making up for the insufficiency of human resources, such as teachers, mainly in cram schools. On the other hand, the market growth is sluggish, due to the decline in average spending per client caused by the increase of small-scale orders, the intensification of competition, and the decrease of opportunities to use e-learning caused by the resumption of face-to-face education.

In the cram school market, too, the number of school buildings of local midsize and large cram school and the number of student IDs are recovering, but sales and KPIs have been stagnant, due to the decrease of students of existing client schools and the decline in the number of new contracts in the field of opening of independent businesses.

In the BtoC market, the company offers enriched support, including “Effective Praising Course” for those who face difficulty in learning, and its performance is healthy, despite negative factors, including the decline in children’s willingness to learn in the wake of the COVID-19 pandemic.

[1-4 Business Description]

(1)Outline

There are three business segments: e-learning, commissioned development, and app development.

In the e-learning business, the company offers services, including the online learning tools “Surala” and “Surala Drill,” etc. to mainly elementary school pupils and middle and high school students. In addition, the company gives proposals for educational curricula utilizing its services to clients adopting the services, supports the clients in starting business, various management support services, and also provides contents in collaboration with other companies.

In the commissioned development business, the company undertakes the entrusted development of educational contents and offers maintenance services.

In the app development business, the company develops learning contents based on gamification by itself, and provides intellectual training apps, which can be downloaded from Apple Store, etc.

*The e-learning business accounts for over 90% of total sales and profit, while the commissioned development and app development businesses make up only small percentages, so they are not significant as information to be disclosed. Accordingly, the company omits the results of each segment in disclosed material, etc.

(2) Product Line

①AI × adaptive learning tool “Surala”

The following section describes the outline, strengths, and features of the AI × adaptive learning* tool “Surala,” which is the mainstay of the e-learning business.

*Adaptive learning

This is a method of providing individuals with optimal learning contents for more efficient learning. It enables meticulous teaching and guidance, and leads to the enrichment of learning activities based on the comprehension level, interest, etc. of each learner.

◎ Basic concept for product development

With the aim of changing students’ comments from “I cannot understand” to “I understood,” from “I cannot finish it” to “I finished it,” and from “I hate studying” to “I can enjoy studying,” they engage in product development based on the following five basic concepts.

① Realization of systematic learning

② To stick to the basics

③ To enable students to “understand” subjects one after another

④ To support students in overcoming failure

⑤ Visualization of growth

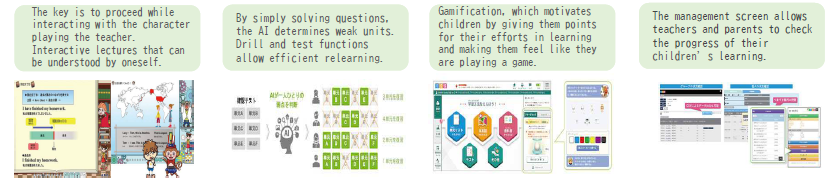

◎ Outline

The AI × adaptive learning* tool “Surala” is an adaptive AI tool that helps pupils and students learn 5 major subjects (the Japanese language, arithmetic/mathematics, the English language, science, and social studies) from elementary to high school together with animated characters serving as their teachers according to the comprehension level of each child.

(Taken from the reference material of the company)

(Taken from the reference material of the company)

The lecture, drill, and test functions provide a cycle of “understanding, retention, and utilization” through which basic academic skills are acquired and the learning process enables students to understand, retain and utilize the content.

Due to its unique feature of facilitating independent learning even in areas that are being studied for the first time, the system is increasingly used in elementary, junior high, and high schools, cram schools, after-school day care services, etc., as well as in learning at home.

Based on the “Surala” series, the company also offers “Surala Drill,” which specializes in drill and test functions, and “Surala Ninja!” an international version that allows users to enjoy learning Japanese-style arithmetic, in addition to “Surala Satellyzer” and “SuRaLa NIHONGO” as solutions to social issues and initiatives aimed at new markets.

“Surala Drill” | AI-based teaching materials for public elementary, junior high, and high schools specializing in drill and test functions with the automatic question composition and grading functions in accordance with the academic ability of each student. |

Surala Ninja! | Developed for primary school children as an international version of “Surala.” It is an e-learning material that enables students to enjoy learning arithmetic and mathematics, focusing on the four arithmetical operations of addition, subtraction, multiplication, and division through interactive animations. It is being used in schools and other institutions in India, Sri Lanka, Indonesia, Egypt, Myanmar, and the Philippines. |

Surala Satellyzer | It was developed in collaboration with NEC Space Technologies, Ltd. over a period of two years, and is the first ICT-based teaching materials for high school students on SURARA Net, which ensures that students acquire the basic skills necessary for inquiry-based learning through the theme of space in the course of their activities. |

SuRaLa NIHONGO | Adaptive ICT-based teaching materials designed for foreigners working in Japan, Japanese language schools in Japan and overseas, and students of foreign origin, enabling them to learn Japanese up to the level required for working, studying, and living in Japan, with the help of animated characters, while enjoying learning according to the level of understanding of each individual student. |

Basic math course for business | As an increasing volume of big data have been utilized in various fields in recent years, this ICT-based teaching material is used by individuals, vocational schools, and colleges for acquiring basic math skills for retrieving necessary information from data, analyzing it, discussing it, and utilizing the results for daily tasks. It was developed in collaboration with the Mathematics Certification Institute of Japan. It was released in 2024. |

◎ Mission/Strengths

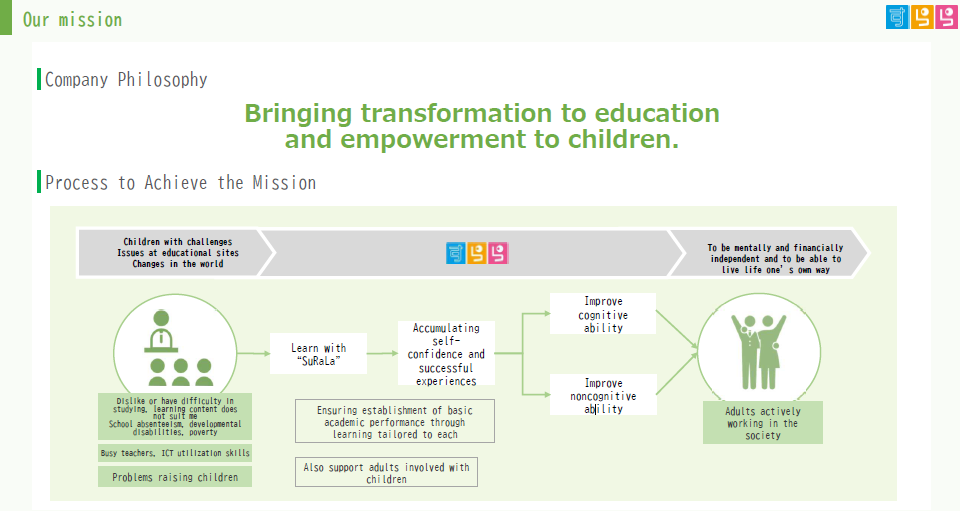

Under the corporate ethos: “Bringing transformation to education and empowerment to children,” the company aims to help solve social issues and achieve corporate growth. The company envisions the process of achieving its mission as follows:

(Taken from the reference material of the company)

(Taken from the reference material of the company)

◎ Growth potential and future developments of “Surala”

As mentioned in Section "1-3 Market Environment & the Company's Initiatives," the Japanese EdTech market is expected to keep growing despite the declining birthrate. As of the end of December 2023, the market penetration rates for cram schools and schools are 2.3% (adopted by 1,177 schools) and 4.0% (adopted by 1,366 schools). The company is also actively cultivating overseas markets, so there is significant room for growth.

(4) Business model

◎ Clients/users of the company’s products

The company's market consists of four fields: cram schools, ordinary schools, and BtoC (individual learners), and overseas.

Users | Outline |

Cram School

| The company offers services in various ways according to the scale, style, etc. of each cram school.

<Entrepreneurs> The company provides clients who aim to start their own business with “support for procurement of real estate and funds, interior finishing, and promotion of enrollment,” “sharing successful cases and the know-how to operate cram school,” “charge-free promotional flyers,” consulting for cram school management, including the opening of a cram school and the promotion of enrollment, and also supports the entry to the educational business market from other industries.

<Local medium-sized cram schools> The company offers plans for transforming the existing business models and proposals for new cram schools.

<Afterschool day-care centers> Providing learning opportunities to support facilities aimed at helping elementary to high school students with developmental and other disabilities learn the actions and social skills necessary for everyday life.

<Support for the entry to the educational business market from other industries > It supports the entry of other industries and sectors, such as drugstores, into the education industry. |

School (school corporations, local governments)

| Responsible for a wide range of areas where children can receive education, including local governments, public high schools, school corporations, vocational schools, and higher education. Providing “Surala” to school corporations and “Surala Drill” to local governments or public elementary and junior high schools. In addition to improving the academic performance of students through the operation of ICT-based teaching materials, the company provides support for comprehensive school management and implementation, including how to engage with teachers in schools and transform their working style.

|

BtoC | The company provides students learning at home with “Surala.”

Learners include truant students and children with developmental and learning disabilities. As many of their families are deeply worried about such children, the company aims to give comprehensive support to their guardians, and offers coaching for guardians via “Surala Coach,” training for guardians, and mental and educational assessment services. In addition, the company gives comprehensive support to distressed families, to solve their trouble by holding seminars and giving advice for utilizing the system in which truant students can be deemed to have attended classes by using ICT-based teaching materials. |

Overseas | As a result of various projects adopted by the Japan International Cooperation Agency (JICA), “Surala Ninja!” is being offered in Sri Lanka, Indonesia, Egypt, and other countries. The company has participated in many government-affiliated and independent demonstration projects and has been engaged in activities through pilot projects. |

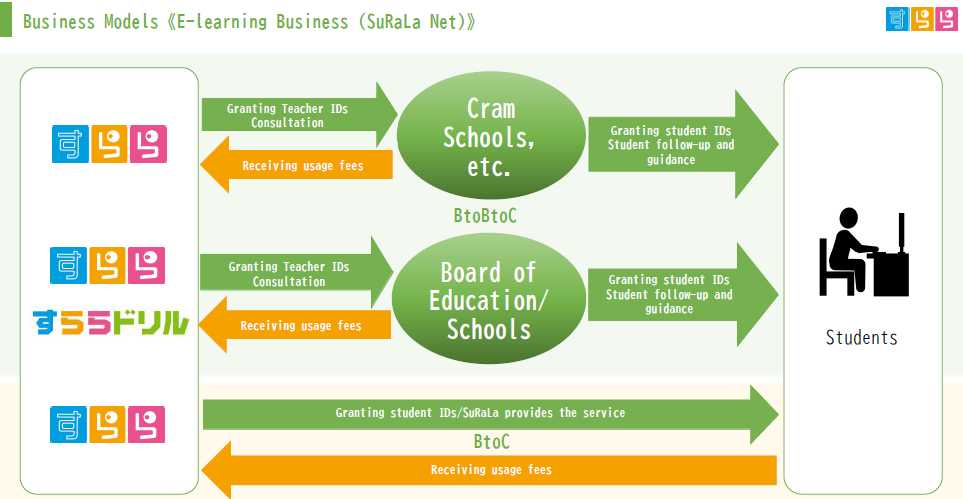

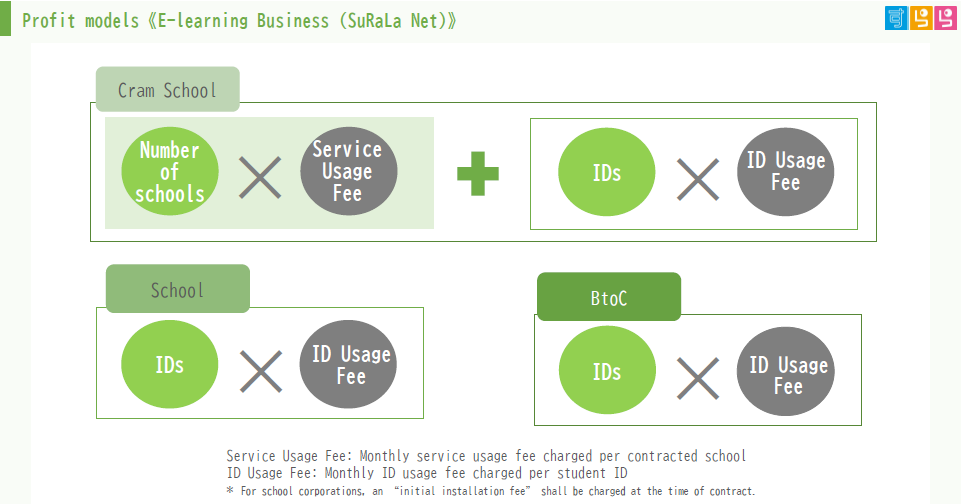

◎ Revenues

The company collects service usage fees from schools, cram schools, and individual learners.

(Taken from the reference material of the company)

*Business model targeted at cram and ordinary schools (BtoBtoC)

The company issues administrative IDs (teachers’ IDs) for using “Surala” at schools that have adopted it, and students’ IDs for students of the schools. Students use “Surala” via their schools.

The schools give follow-up lectures to students by using the functions of “Surala,” which curtails personnel expenses and management costs.

<Cram School>

The company earns revenues mainly from a monthly “serve usage fee” charged for each building of schools using this service and a monthly “ID usage fee” charged for each student ID registered by the schools that have adopted it.

<School>

The company earns revenues mainly from the “initial installation fee” at the time of conclusion of a contract and a monthly “ID usage fee” charged for each student’s ID registered in the Surala system.

*(BtoC) business model targeted at individual learners

The company issues students’ IDs for “Surala” to individual learners. The cram school teachers (Surala coaches), which have cooperative relationships with the company, “set monthly goals” for learning and conduct “follow-up activities, such as the check of progress by contacting students by telephone or email about once a week,” for students who have IDs.

The company earns revenues mainly from a monthly “ID usage fee” charged for each student ID. In addition, the company pays the remuneration for follow-up lectures to school teachers so that the revenues of cram schools will grow in parallel with the increase of end users. Like this, the company has established a business model based on win-win relationships with schools.

(Taken from the reference material of the company)

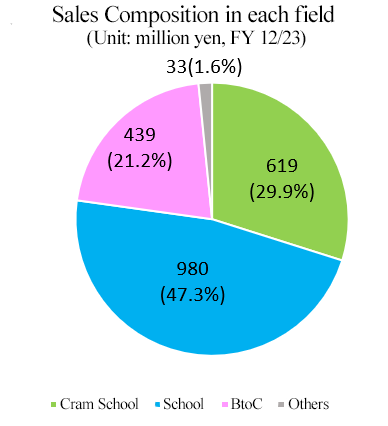

The number of clients, the number of IDs, and the sales composition in the fiscal year ended December 2023 are as follows.

| No. of clients | No. of IDs |

Cram School | 1,177 | 18,571 |

School | 1,366 | 402,045 |

Overseas | 53 | 3,204 |

BtoC | - | 4,301 |

Total | 2,596 | 428,121 |

*As of the end of December 2023

(5) Active formation of alliances

The company is striving to improve contents by actively forming alliances with external enterprises.

Alliance partners | Purpose of alliance | Outline |

AIed, Inc. | Development of new contents of pronunciation tests | By incorporating the speaking AI “CHIVOX” of AIed, Inc., which checks the speaking skill and give feedback about improvement points into “Surala” English, which has helped students obtain “reading,” “listening,” and “writing” skills with its lecture, exercise, and test functions, they will develop and offer “Surala” for improving the “speaking” skill in addition to the above three skills, and then contribute to the English education in Japan. |

NEC Space Technologies, Ltd. | Joint development of “Surala Satellyzer”, profound learning tools focused on space, targeted at high school students | “Surala Satellyzer” is for discussing solutions to attain SDGs by utilizing space technology. Students will discuss social issues they want to solve in groups, and seek solutions utilizing artificial satellites. In this joint development, they will combine the knowledge of space technology, including the satellites owned by NEC Space Technologies, and the know-how to design effective learning contents and technology for developing teaching software of SuRaLa Net, which have been accumulated through “Surala” and “Surala Active Learning.” |

Fantamstick, Ltd. | To acquire Fantamstick, which develops intellectual training apps and learning contents for children, as a subsidiary (holding 52.2% of voting rights as of Jan. 2022) | The track record and technologies in the field of commissioned development for educational institutions and the knowledge in the design field are expected to lead to the further improvement and growth of services of SuRaLa Net. In addition, they are expected to generate synergetic effects, such as the increase of overseas users and the expansion of the customer base. |

SuRaLa Net plans to cooperate with Fantamstick in developing new services, and aims to increase personnel for strengthening the system for commissioned development, whose transactions are increasing, increase users of existing app services by enhancing marketing and brand development activities, and release new services utilizing gamification.

[1-5 Features and Strengths]

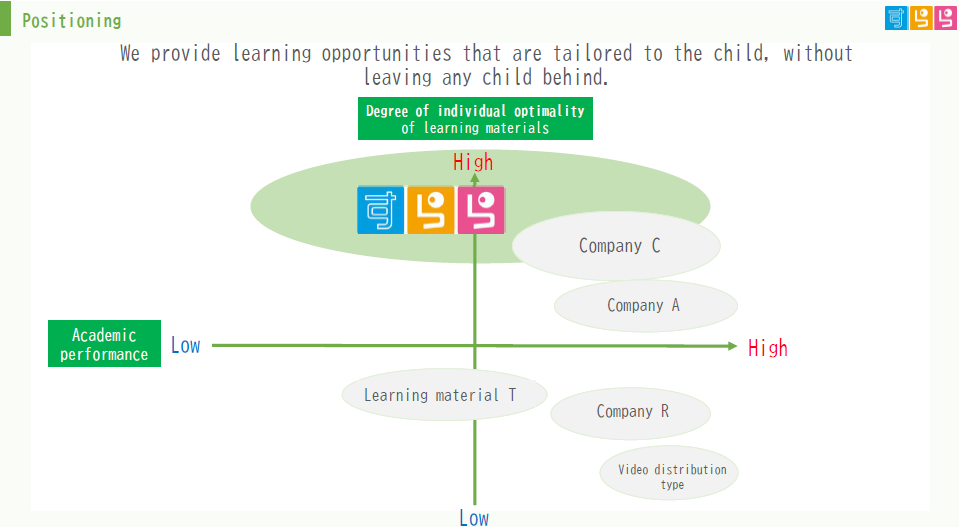

(1)Positioning

The company has established a unique, non-competitive position by providing customized learning opportunities for a wide range of children, including those with low academic ability, through its advanced digitalized teaching material, “Surala.”

(Taken from the reference material of the company)

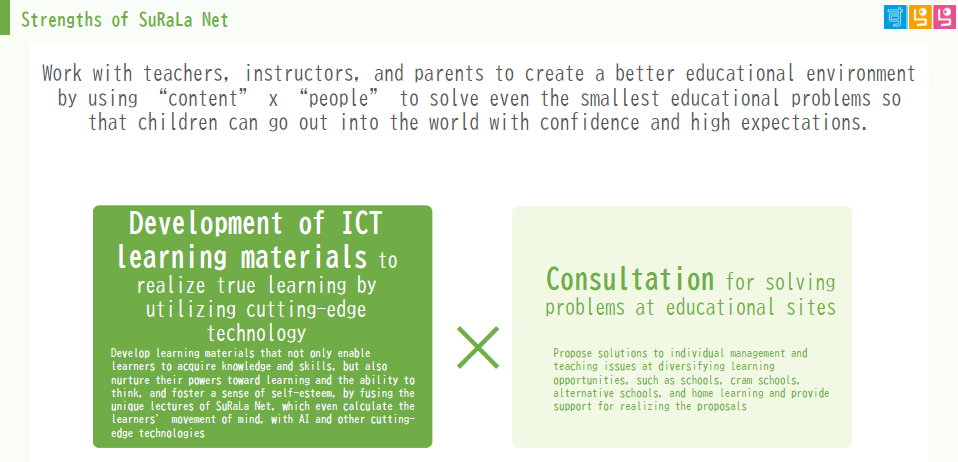

(2)Source of competitiveness: Ability to develop ICT-based teaching materials × consultation skills

The competitive advantage of the company is mainly attributable to the “capability of developing ICT-based teaching materials,” which can be observed in the development and provision of “Surala,” based on AI and adaptive learning and has significant advantages over competing teaching materials. In addition to them, the company possesses “consultation skills” to propose solutions to the problems with the management and affairs of cram and ordinary schools and support them in adopting the solutions. This is their primary characteristic that cannot be imitated by competitors.

Also, “Surala” equipped with patented functions has the AI functions of cutting-edge enterprises, such as AI chatbots and AI speaking functions. By utilizing the big data, including accumulated an enormous volume of learning data, the company evolves and upgrades teaching materials. The adoption of such cutting-edge technologies has contributed to the competitive advantage.

[1-6 ROE Analysis]

| FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 | FY 12/21 | FY 12/22 | FY 12/23 |

ROE (%) | 14.8 | 17.8 | 5.1 | 34.9 | 26.7 | 17.5 | 14.3 |

Net income margin (%) | 10.68 | 14.72 | 3.85 | 23.04 | 20.47 | 16.55 | 14.18 |

Total asset turnover [times] | 1.10 | 1.00 | 1.11 | 1.17 | 1.00 | 0.80 | 0.80 |

Leverage [times] | 1.26 | 1.21 | 1.19 | 1.29 | 1.30 | 1.32 | 1.27 |

*ROE was taken from the brief financial report. The figures until fiscal year ended December 2021 are nonconsolidated, while the figures in fiscal year ended December 2022 are consolidated. Until fiscal year ended December 2021, total asset turnover and leverage were calculated from the average of values of total assets and equity capital at the beginning and end of each term. In fiscal year ended December 2022, the values at the end of the term were used, as consolidated accounting was adopted. For the fiscal year ended December 2023, the average of the values at the beginning and end of the fiscal year was used again.

The ROE of SuRaLa Net, which is an ICT enterprise, has been high, but it is considered that there remain room for further improvement in profitability, asset efficiency, and leverage.

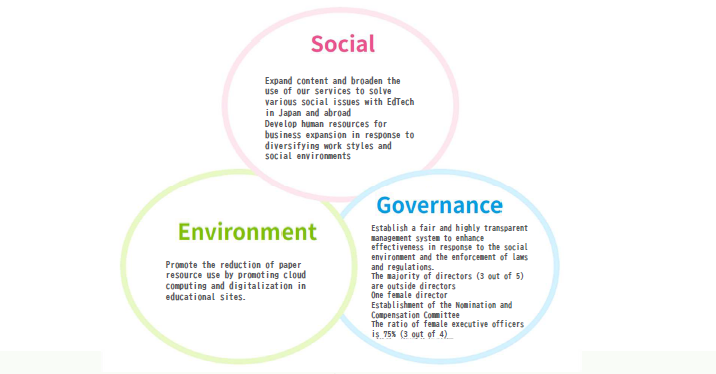

[1-7 Sustainability]

In response to the diversifying educational environment, the company continues to address social issues through its business and to improve sustainable corporate value through its management activities.

(Taken from the reference material of the company)

Society: in Japan | The company offers learning opportunities to a broad range of children with ICT “Surala,” which enables learning suited for the comprehension level of each student.

*To provide truant children with opportunities to learn at home and advance to higher education, so that they will be deemed to have “attended classes” in accordance with the rules of the Ministry of Education, Culture, Sports, Science and Technology *To offer optimized learning contents to children with developmental and learning disabilities *To offer voluntary learning optimized for combined classes in remote islands and mountain areas *To offer learning opportunities to relatively poor children in cooperation with NPOs

Initiatives to transform working styles *Introduction of a flexible working system for all employees and a remote working system for two days a week from 2021 *The ratio of employees returning to work after childcare leave is 100%. Activities to promote the childcare leave system for fathers, and implementing measures to enhance the work-life balance and increase motivation for work *In November 2023, the J-ESOP-RS system was adopted as part of the welfare package. Creating an environment in which employees are highly interested in improving the share price and business performance and are motivated to work

Improving human resources development and in-house training *Implementing a broad range of measures, with an emphasis on communication within and between departments *Promoting a one-on-one system in each department and introducing a mentoring system for new employees, where senior employees provide one-on-one supervision to junior employees * Organizing an annual Medium-term Management Plan development camp involving all employees to ensure that all employees have a sense of participation in management, a perspective of company-wide optimization, and a high level of insight into their own work *Providing necessary training based on legal compliance when necessary |

Society: outside Japan | The company offers the arithmetic e-learning program “Surala Ninja!” for elementary school pupils in developing countries, including Sri Lanka and Indonesia.

*To operate “Surala JUKU” for giving lectures on arithmetic to children of low-income families in cooperation with the microfinancing institution for women. *Providing services free of charge through NGOs such as “SOS Children's Villages” and “Child Fund,” which take in orphans and children who have been affected by domestic violence ・Supporting the development of systems to provide high-quality education to children who require a wider range of support through demonstration projects by international and governmental organizations *To create employment opportunities by proactively hiring local women as facilitators (lecturers) |

Environment | *To reduce the consumption of resources, such as paper, by utilizing ICT-based teaching materials *To streamline business operations, and reduce costs for printing and resources through DX |

Governance | *One out of five directors (including 3 outside directors) is female *Three out of four executive officers are female *To hold company-wide training regularly, to enrich systems for having an audit committee and complying with laws and regulations *Establishing an appointment and remuneration committee |

(Taken from the reference material of the company)

The company started issuing “impact management reports,” including impact assessment, to logically visualize the social issues they want to solve through their business and the outcomes they hope to achieve.

These reports cover the four social issues: “truancy,” “developmental and learning abilities,” “poverty,” and “low academic skills,” and try to qualitatively and quantitatively evaluate the impact of the company’s business on them.

The company considers that its endeavor to assess the impact is quite unique and new among IT venture firms.

Impact Management Report 2022

https://surala.co.jp/Portals/0/images/sustainability/impact-management/SuRaLaNet_ImpactReport2022.pdf

2. Second Quarter of the Fiscal Year ending December 2024 Earnings Results

[2-1 Consolidated Business Results]

| FY 12/23 2Q | Ratio to sales | FY 12/24 2Q | Ratio to sales | YoY |

Sales | 1,043 | 100.0% | 967 | 100.0% | -7.3% |

Gross Profit | 724 | 69.4% | 619 | 64.0% | -14.6% |

SG&A | 541 | 51.9% | 503 | 52.1% | -6.9% |

Operating Income | 183 | 17.6% | 115 | 11.9% | -37.1% |

Ordinary Income | 186 | 17.9% | 117 | 12.2% | -37.0% |

Net Income | 135 | 13.0% | -7 | - | - |

*Unit: million yen. Net income is the net income attributable to owners of parent, same as below.

(Profit and loss of the e-learning business)

| FY 12/23 2Q | Ratio to sales | FY 12/24 2Q | Ratio to sales | YoY |

Sales | 1,006 | 100.0% | 942 | 100.0% | -6.4% |

Gross Profit | 716 | 71.2% | 605 | 64.2% | -15.6% |

SG&A | 505 | 50.2% | 460 | 48.9% | -8.9% |

Operating Income | 211 | 21.0% | 144 | 15.3% | -31.6% |

Ordinary Income | 214 | 21.3% | 146 | 15.6% | -31.6% |

Net Income | 148 | 14.7% | -63 | - | - |

*Unit: million yen.

Sales and profit dropped.

The sales of the e-learning business dropped 6.4% year on year to 942 million yen. Sales declined in all markets. In the school market, large contracts with local governments expired in March, the number of new contracts with local governments fell below the target, and the number of cram school students in the cram school market decreased.

Operating income declined 31.6% year on year to 144 million yen. Gross profit decreased 15.6% year on year, due to the augmentation of the cost of sales for investment in development for differentiating their company from competitors. SGA decreased, but profit dropped.

A quarterly net loss of 63 million yen was posted. The impairment loss of goodwill of the consolidated subsidiary Fantamstick, Ltd. amounting to 76 million yen was posted as an extraordinary loss.

【2-2 Trends in the E-learning Business】

(1) Variations in sales and KPIs

(Sales in each market)

| FY 12/23 2Q | FY 12/24 2Q | YoY |

Cram school market | 307 | 297 | -3.1% |

School market | 464 | 417 | -10.0% |

BtoC market | 219 | 218 | -0.3% |

*Unit: million yen.

(Trends of KPIs)

*Number of clients

| FY 12/23 2Q | FY 12/24 2Q | YoY |

Cram School | 1,182 | 1,190 | +0.7% |

School | 944 | 1,142 | +21.0% |

Overseas | 95 | 47 | -50.5% |

Total | 2,221 | 2,379 | +7.1% |

*Number of IDs

| FY 12/23 2Q | FY 12/24 2Q | YoY |

Cram School | 19,564 | 19,744 | +0.9% |

School | 237,827 | 206,864 | -13.0% |

Overseas | 8,128 | 2,492 | -69.3% |

BtoC | 4,349 | 4,190 | -3.7% |

Total | 269,868 | 233,290 | -13.6% |

*Number of schools and IDs of Surala Net public schools

| FY 12/23 2Q | FY 12/24 2Q | YoY |

Public schools |

|

|

|

Client schools | 702 | 885 | +26.1% |

IDs | 186,298 | 153,885 | -17.4% |

|

|

|

|

Support for inquiry-based learning |

|

|

|

Client schools | - | 94 | - |

IDs | - | 23,542 | - |

*The number of schools and the number of user IDs for "support for inquiry-based learning exclude the number of existing affiliated schools which introduced this support and the number of user IDs at these schools.

(2) Initiatives

① Cram school market

Sales dropped.

The number of midsize and large cram school students was on a recovery track.

The after-school daycare service market remained strong.

Though contracts associated with independent startups increased, a decline in the number of cram school student user IDs pushed down sales.

As a new measure, further support was provided to existing cram schools in opening alternative schools.

②School market

Sales dropped.

While the large contracts with local governments expired in March 2024, the acquisition of new contracts with local governments did not go as expected.

As in the previous year, SuRaLa Net was adopted as a demonstration project of the Ministry of Economy, Trade and Industry's "Work Style Reform Support Subsidies 2024." However, the amount of subsidy approved was short of the target, unable to achieve the initial budget.

Private schools and vocational schools, other than public schools, showed strong growth.

③BtoC market

Sales dropped.

The “Effective Praising and Parenting Course,” a service for parents who have concerns about raising their children, was released.

Inquiries from companies were on the increase about using SuRaLa at overseas offices as a corporate welfare program.

An increase in competitors in the market of truant students and children with developmental disabilities resulted in a slight fall in sales.

④Overseas market

Sales dropped.

For the new fiscal year starting in July, sales channels will be expanded in Sri Lanka, while contracts on “SuRaLa Nihongo” will be extended in Indonesia.

In Indonesia, a sales license contract with a local agency will take effect in July. This will likely reduce not only sales, but also outsourcing cost, which will leave profit unchanged.

A trial project will start at public schools in Cambodia.

⑤Development

As a reskilling material geared for a new market, the “Basic Mathematics Course Useful for Work” was released.

UI/UX were continuously revised to incorporate customer needs.

The content for the upper secondary school equivalency examination test “Science and Our Daily Life” subject was added.

[2-3 Financial Condition and Cash Flow]

◎Financial Condition (Consolidated)

| End of December 2023 | End of June 2024 | Increase/ Decrease |

| End of December 2023 | End of June 2024 | Increase/ Decrease |

Current assets | 1,591 | 1,530 | -60 | Current liabilities | 445 | 449 | -3 |

Cash and deposits | 1,154 | 1,260 | +105 | Accounts payable | 150 | 122 | -27 |

Trade receivables | 401 | 238 | -163 | Fixed liabilities | 11 | 11 | 0 |

Noncurrent assets | 1,117 | 1,125 | +7 | Total labilities | 457 | 460 | +3 |

Intangible assets | 974 | 973 | -0 | Net assets | 2,251 | 2,195 | -56 |

Investments and other assets | 115 | 125 | +10 | Retained earnings | 1,746 | 1,739 | -7 |

Total assets | 2,708 | 2,656 | -52 | Total liabilities, net assets | 2,708 | 2,656 | -52 |

*Unit: million yen.

Total assets decreased 52 million yen from the end of the previous fiscal year to 2,656 million yen, due to the decrease in accounts receivable.

Total liabilities were almost unchanged. Net assets declined 56 million yen from the end of the previous fiscal year to 2,195 million yen, due to the drop in retained earnings.

Equity ratio at the end of June 2024 was 81.4%, down 0.6% from the end of the previous fiscal year.

◎Cash Flow (Consolidated)

| FY 12/23 2Q | FY 12/24 2Q | Increase/Decrease |

Operating Cash Flow | 388 | 365 | -23 |

Investing Cash Flow | -203 | -207 | -4 |

Free Cash Flow | 184 | 157 | -27 |

Financing Cash Flow | -217 | -51 | +165 |

Cash, Equivalents | 1,300 | 1,260 | -40 |

*Unit: million yen.

The cash position was almost unchanged.

[2-4 Topics]

◎ Start of a business alliance with Withus Corp.

In April 2024, we formed a business alliance with Withus Corp. (Standard Market of TSE; 9696).

(Outline of Withus Corp. and the Withus Group)

The Withus Group, centered around Withus Corp., upholds the corporate vision of “aiming to become the best educational institution for realizing the ‘development of personnel who can flourish in society’,” under the belief that “education should contribute to the happiness of people,” and conducts all of its business activities for achieving the vision while concentrating on personnel development. Since April 2023, the Withus Group has established companies in charge of the business for high schools and colleges, the business for cram schools, the global business, the increase of successful cases among customers of the corporate group, and the business for supporting the development of skills and careers. Under the policy of “business administration involving all employees,” the Withus Group strives to improve business performance and profitability and exert the synergy among group companies by diffusing the ethos among subsidiaries, enhancing the capability of leading group companies, and accelerating the optimization of management costs while respecting the proactive business administration of each subsidiary.

(Background and outline of the business alliance)

*Background

Through this alliance, SuRaLa Net and the Withus Group will mutually utilize their accumulated managerial resources, including knowledge and know-how, mainly for business, and meet educational needs of a wider range of people, to revitalize the entire educational business, and also pursue the realization of a sustainable society with education and the improvement in corporate value of the two companies.

*Outline

As the Withus Group, which offers services to a variety of clients, will utilize SuRaLa Net’s ICT-based teaching materials: “Surala,” “Surala Drill,” “SuRaLa NIHONGO,” and “Surala Ninja!,” they will work on

(1) the expansion of sales channels for the two companies’ services and content, the improvement in customer satisfaction level, and the maximization of lifetime value (LTV),

(2) the collaborative development of new educational content and service models, and

(3) the survey and research on educational effects and creation and visualization of evidence through the analysis of users and usage of the ICT-based teaching material “Surala.”

(As of now, concrete business and services are still to be determined.)

3. Fiscal Year ending December 2024 Earnings Forecasts

[3-1 Earnings Forecast]

| FY 12/23 | Ratio to sales | FY 12/24 Est | Ratio to sales | YoY | Revision Rate | Rate of Progress |

Sales | 2,145 | 100.0% | 1,954 | 100.0% | -8.9% | -14.9% | 49.5% |

Operating Income | 387 | 18.1% | 160 | 8.2% | -58.7% | -50.6% | 72.1% |

Ordinary Income | 392 | 18.3% | 167 | 8.5% | -57.5% | -49.4% | 70.5% |

Net Income | 304 | 14.2% | 88 | 4.5% | -71.1% | -54.9% | - |

*Unit: million yen. Estimates are those of the company.

(Forecast of profit and loss of the e-learning business)

| FY 12/23 | Ratio to sales | FY 12/24 Est | Ratio to sales | YoY | Revision Rate | Rate of Progress |

Sales | 2,073 | 100.0% | 1,902 | 100.0% | -8.3% | -11.9% | 49.5% |

Gross Profit | 1,483 | 71.6% | 1,201 | 63.1% | -19.1% | -15.8% | 50.4% |

SG&A | 1,041 | 50.3% | 993 | 52.2% | -4.7% | -7.3% | 46.4% |

Operating Income | 441 | 21.3% | 206 | 10.8% | -53.4% | -41.8% | 70.2% |

*Unit: million yen. Estimates are those of the company. Gross profit was calculated by Investment Bridge with reference to the material of the company.

The earnings forecast has been revised downwardly.

The earnings forecast has been revised downwardly. The sales of the e-learning business are projected to decrease 8.3% year on year to 1,902 million yen. Sales are smaller than expected, as the large contracts with local governments in the school market expired in March, the number of new contracts with local governments did not reach the target, and the number of projects entrusted fell below the target in the commissioned development business.

Operating income is forecast to drop 53.4% year on year to 206 million yen. In response to the decline in sales, they have revised the forecast downwardly, but they controlled the expenses for maintenance of servers, etc. to reduce the cost of sales, and changed the method for posting performance-based bonuses, so personnel expenses are expected to decrease.

[3-2 Trends in each field]

(Sales in each field)

| FY 12/23 | FY 12/24 Est | YoY | Revision Rate | Rate of Progress |

Cram School | 619 | 602 | -2.8% | -2.3% | 49.5% |

School | 980 | 861 | -12.2% | -18.6% | 48.5% |

BtoC | 439 | 421 | -4.3% | -6.7% | 52.0% |

*Unit: million yen.

(Overview and Initiatives)

*Cram Schools

Though the number of contracted schools and the number of user IDs held by midsize and large cram school students increased, sales declined due to the opening of independent businesses and a decrease in the number of students of existing cram schools.

Provide support and management consulting to existing cram schools in setting up attached alternative schools, and continue to strengthen such support to midsize local and large cram schools.

Introduction of after-school daycare service centers is expected to grow.

*Schools

The issues include acquisition of large contracts with municipalities, and the impact of a natural decrease in the number of students due to the declining birthrate.

Advance proposals to vocational schools, correspondence high schools and other diverse learning spaces (metaverse and municipality programs for truant children), by taking advantage of the features of our ICT-based teaching materials.

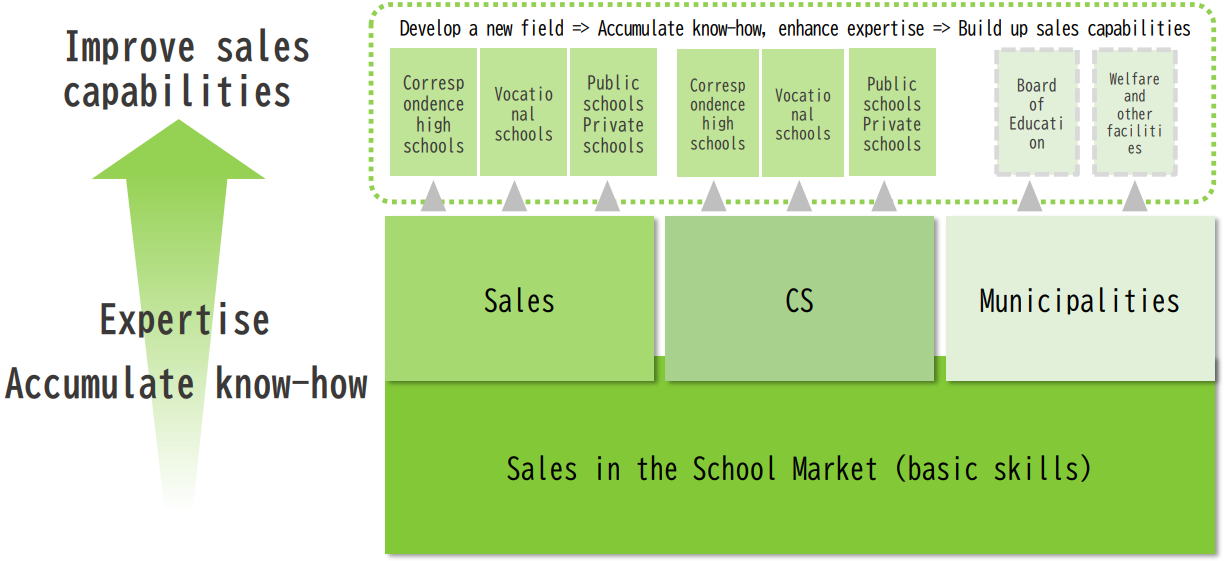

Leverage know-how by channel in the school market to strengthen the development of salespersons with high levels of expertise.

*BtoC

With more competitors, take advantage of our multiple channels and strengthen SEO services, while reinforcing cooperation with other divisions to promote the increase of users.

Continue to expand support for parents who have concerns about raising their children (the Effective Praising Course service).

4. Medium-term Management Policy

[4-1 Business Environment]

As mentioned in Section “1-3 Market Environment and the Company’s Initiatives,” there has been a progress in the “popularization of EdTech” on the educational market in Japan. However, from now on, it will be necessary to utilize data and produce results to firmly establish it.

The provision of subsidies for the “GIGA School Program,” launched in 2020, has ended and the market is growing at a slow pace. However, another market revitalization is projected over the span of about 4-5 years after 2024 owing to “NEXT GIGA” as devices will be updated.

It can be expected that the company with its abundant achievements, experience and high capability concerning EdTech will be successful.

In addition, the following changes are occurring:

“Possibility of utilizing generative AI in the education field as it gains prominence”

“Changes in the objectives of education”: From academic performance to qualities and abilities (more than a half of students advance to university through AO (admission offices) and recommendations)”

“Diversification of learning opportunities”: Increase of alternative schools and correspondence high schools caused by the increase in the number of truant students and pupils with developmental disorders

Regarding AI, the company has conducted various in-house discussions and research and is preparing for incorporating AI.

Overseas, there are circumstances, including “growing needs for and popularization of Japanese EdTech in emerging countries and developing countries after the COVID-19 pandemic” and “overseas development as a national policy (export of Japanese-style education).”

[4-2 Vision for Growth and Management Policies]

(1) Vision for Growth

Taking this kind of business environment into account, the company intends to utilize their strengths and competitive advantages to take new initiatives and work on acquiring and expanding market shares while further raising the market penetration rate to firmly establish their foundation.

Concretely, they are going to expand “SuRaLa NIHONGO” and “Surala Satellyzer,” released in 2023. Furthermore, they plan to release 3D content and “Neo Surala,” a next-generation LMS, as a step toward NEXT GIGA by 2025.

They will also focus on the enhancement of human capital, such as the training and education of personnel, in order to reinforce their foundations.

(Taken from the reference material of the company)

(2) Management Policies

The management policies of each business department toward “firmly establishing the foundation and taking new initiatives” are as follows.

① Development

・ Improve and expand existing content, reflecting user feedback

・ Provide individualized optimization of learning with big data to “develop experiential learning content incorporating 3D and other latest technologies” and “develop functions that allow learners to feel their growth and boost their self-esteem”

・ Develop next-generation learning management systems

② Marketing

Market | Initiatives |

School | ・Promote data utilization and enhance support for producing results at schools which have adopted Surala ・Upgrade new proposals for NEXT GIGA ・Expand sales channels to diverse learning opportunities (the metaverse, high schools offering a correspondence course, and municipal undertakings for supporting truant students) ・Cultivation of new markets (inquiry-based learning content and enhancement of marketing targeted at vocational schools) |

Cram School | ・Strengthen approach to old-fashioned middle-sized and major schools in the countryside ・Enhance proposals for new styles of cram school operation ・Offer assistance with post-graduation opportunities through cooperation with employment support companies |

BtoC | ・Enhance brand development for truant students and children with developmental disorders ・Strengthen support for parents (release new psychological services) |

Overseas | ・Expand sales channels from those for elementary school pupils to those for middle school students by boosting development of the content for middle school students ・Enter the Japanese language education market by selling “SuRaLa NIHONGO” ・Expand the number of IDs by promoting the adoption by NGOs and participating in projects by international institutions, etc. *Promote cross-sectional marketing of new content utilizing multi-channel development |

③ Corporate

・Develop human resources to elevate corporate value, enhance corporate brand development

・Keep up initiatives for upgrading human capital to achieve sustainability-oriented management

For the enhancement of human capital, they plan to enhance personnel development to improve expertise by accumulating the know-how in each field, endeavor to cultivate new domains, and hone the expertise in each field and their marketing capability.

(Taken from the reference material of the company)

5. Conclusions

The progress rates of sales and operating income toward the downwardly-revised forecasts were 49.5% and 72.1%, respectively, in the first half of the fiscal year. In particular, operating income was significantly higher than usual, so it is very likely that it will reach the full-year forecast.

However, the number of schools that have adopted their services is unchanged and the number of user IDs is decreasing. Accordingly, it will take some time to grow their business with NEXT GIGA, after the scheduled release of “NEO Surala” in 2025. We would like to pay attention to the progress of establishment of a foundation for expanding the next revenue source.

<Reference: Regarding Corporate Governance>

Organizational structure and composition of directors and auditorsOrganizational structure | Company with an audit and supervisory committee |

Directors | 5 including 3 outside directors (including 3 independent officers) |

Audit committee members | 3 including 3 outside directors (including 3 independent officers) |

In order to further enrich the corporate governance structure by improving the objectivity and transparency of procedures for nominating directors and determining their remuneration amounts, the company established a nomination and remuneration committee as a discretionary advisory body of the board of directors. The committee is composed of 3 or more members selected through a resolution of the board of directors, and no less than half of them shall be independent outside directors.

◎Corporate Governance Report (Update date: March 27, 2024)

Basic policy

The company believes that in order for an enterprise to keep growing and advancing amid the rapidly changing business environment, it is indispensable to enhance the efficiency and effectiveness of business administration and develop a fair, transparent management structure, and considers thoroughgoing corporate governance as an important mission. In addition, the company plans to enhance risk control and supervision function to realize more effective corporate governance, in response to the changes in the social environment, the enforcement of laws, regulations, and so on.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The company follows all of the basic principles of the Corporate Governance Code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |