Bridge Report:(3937)Ubicom second quarter of the fiscal year ending March 2023

President Masayuki Aoki | Ubicom Holdings, Inc. (3937) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Information and communications |

CEO | Masayuki Aoki |

HQ Address | Joko Bldg., 9F, 2-23-11, Koishikawa, Bunkyo-Ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥2,202 | 11,856,480 shares | ¥26,107 million | 24.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

Undecided | - | ¥78.41 | 28.1x | ¥322.44 | 6.8x |

*The share price is the closing price on November 24. Number of shares outstanding, DPS, and EPS are from the consolidated financial results for the second quarter of the fiscal year ending March 2023. ROE and BPS are from the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 (Act.) | 3,555 | 564 | 591 | 368 | 32.57 | 5.00 |

March 2020 (Act.) | 4,038 | 707 | 715 | 533 | 46.17 | 5.00 |

March 2021 (Act.) | 4,198 | 919 | 877 | 623 | 53.25 | 7.00 |

March 2022 (Act.) | 4,726 | 1,033 | 1,055 | 832 | 70.38 | 9.00 |

March 2023 (Est.) | 5,446 | 1,254 | 1,271 | 925 | 78.41 | Undecided |

*Unit: million yen, yen. Forecasts are those of the company. The definition for net income means net income attributable to owners of parent.

The company has adopted the "Accounting Standard for Revenue Recognition" etc. at the beginning of the first quarter of the fiscal year ending March 2022.

This Bridge Report overviews the financial results of Ubicom Holdings, Inc. for the second quarter of the fiscal year ending March 2023 and more.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of the Fiscal Year ending March 2023 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Efforts and progress toward realizing the medium-term vision

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending March 2023, sales increased 14.7% year on year to 2,602 million yen. The global business achieved double-digit sales growth as a result of the continued strong demand. The medical business, too, performed well. Operating income grew 15.1% year on year to 501 million yen. Although gross profit margin fell 1.2 points due to strategic investments, etc., gross profit increased 11.4% year on year. The company recorded double-digit profit growth absorbing human investment costs. Ordinary income increased 3.5% year on year to 494 million yen. The foreign exchange gain recorded in the same period of the previous year disappeared, and a foreign exchange loss of 25 million yen was recorded. Operating and ordinary incomes hit record highs for the first half.

- There is no change in the earnings forecast. For the term ending March 2023, it is expected that sales will grow 15.2% year on year to 5,446 million yen, operating income will rise 21.4% year on year to 1,254 million yen, and ordinary income will increase 20.5% year on year to 1,271 million yen. Operating income and ordinary income are projected to hit record highs this term, again. The company will continue strategic investment, but aim to recoup it and increase profit by double digits. The dividend amount is still to be determined, but they plan to return profit to shareholders according to their profit level this term, too.

- In the term ending March 2023, the company will implement measures for fortifying its business base for driving the second growth, while checking the profit balance. The key points are (i) the enrichment of resources of experts contributing to the “Go Global Strategy”, (ii) the enhancement of recruitment and training of Filipino engineers, (iii) the strengthening of medical investment strategy, and (iv) execution of M&A.

- The progress rate in the first half was 47.8% for sales and 40.0% for operating income. In the second half, sales and profit are expected to increase from the previous fiscal year's second half and the first half of this fiscal year. The global business continues to record double-digit year-on-year sales growth due to strong demand. However, we would like to focus on how much the highly profitable medical business, which has posted single-digit year-on-year sales growth in the last five quarters, would be able to increase profit from the third quarter.

1. Company Overview

Ubicom Holdings is a one-of-a-kind business innovation company that creates IT solutions to social issues, such as the shortage of manpower and a medical crunch. It recognizes the medical, financial/public, automobile, and manufacturing/robotics etc. markets as strategic markets, and offers a broad range of IT solutions and services.

It has about 1,000 engineers mainly at the development center in the Philippines and operates two core businesses. One is the global business that solves the shortage of IT personnel and promotes digital transformation (DX) in Japan, by developing software and advanced solutions including AI. The other is the medical business that offers healthcare optimization solutions, such as medical claims inspection, support for medical safety, and cloud services, as a leading company that offers IT solutions for supporting the management of medical institutions. It established a highly profitable business model through business restructuring by implementing scrap and build. Furthermore, the company will promote a win-win investment model for accelerating its business through strategic alliances and M&A with leading companies and burgeoning enterprises, and quickly aims to establish new businesses with different approaches from the existing businesses, such as the platform business.

1-1 Corporate History

Mr. Masayuki Aoki, who had entrepreneurial ambition all along, took the position of President and CEO at WCL Co., which was a new business subsidiary of WORLD CO., LTD. in March 2005, and then found out that there are many young talented engineers who work vigorously in the Philippines when he visited there during his domestic and international search for seeds of various new businesses. As the adoption of IT on internal operations of companies progressed in Japanese companies, he thought that conducting the system development in the Philippines will open the possibilities to offer a wide array of system solutions globally at high performance and capture the demand and decided to commercialize the idea. In December 2005, He founded Advanced World Solutions, Ltd. (currently: Ubicom Holdings, Inc.)

Following the trend of ICT adoption, the increase of new clients progressed well, and the business expanded thanks to the competitive advantage of having a development center in the Philippines, which possesses many capable top-class engineers. In 2012, the company acquired AIS Co., Ltd., which is the largest company in the field of systems for medical claims, as a subsidiary. In June 2016, the company was listed on Mothers of Tokyo Stock Exchange. After it changed its name to Ubicom Holdings, Inc. In July 2017, it was listed on the First Section of the Tokyo Stock Exchange in December of the same year.

In April 2022, the company got listed on the Prime Market of TSE after the restructuring of the market.

1-2 Corporate Ethos and Vision

The company advocates the following three management visions as the one and only business innovation company that creates innovative IT solutions combining people and technology.

1. Unique beyond comparison To remain a one-of-a-kind business innovation company that looks ahead to the future and creates IT solutions to social issues |

2. Go Global To use the business scheme of the Ubicom group globally mainly in the U.S. and Asian countries |

3. Win-Win To increase the “fellows” of the Ubicom group, by prospering together with customers, collaboration partners, and all other stakeholders |

Based on five core assets: technology, human resources, intellectual property (IP), foresight, and partnerships, the company creates business innovations aimed at solving issues such as Japan’s aging society, healthcare crunch, a lack of IT personnel, and digital transformation (DX), which it sees as its social responsibility and raison d’être.

(From the company’s website)

1-3 Business Description

1-3-1 Overview

With more than 20 years of experience in embedded software development, application development, testing, and quality assurance services, the company perceives social structure changes such as globalization and the decreasing birthrate and aging population, as well as technological advances in the field of Medical Life Sciences, Cybernetics, and Robotics, as an opportunity to develop new businesses. In the medical, financial/public, automotive, and manufacturing/robotics sectors, which are strategic markets, the company has developed its own core solutions in the field of mainly AI (Artificial intelligence), Analytics and Automation/RPA (Automation of the running and management of software testing etc.), and is now working to develop and implement them, and provides services for many client companies.

1-3-2 The business environment surrounding the company

The business environment of Ubicom Holdings, which pursues the growth by offering IT solutions to social issues, such as the support for solving the shortage of manpower and the support for healthcare optimization, is as follows. The environment surrounding the global business and the medical business (which will be described in detail later) is favorable.

(From company documents)

1) Nationwide promotion of digitalization、Worsening labor shortage in the IT field

With the government's flag-waving for digitization in full swing, according to “Survey on the demand and supply of IT personnel” published by the Ministry of Economy, Trade and Industry in March 2019, it is important to secure IT personnel who can contribute to the improvement in productivity by creating added value and streamlining business operations in an innovative fashion, but it is difficult to secure them, due to the declining birthrate and the aging population. When the growth of IT demand is classified into “minor,” “medium,” and “significant” ones, it is estimated that Japan will be 584,000 engineers shortage in 2025 and 787,000 engineers shortage in 2030 in the case of “significant” growth.

2) Augmentation of national medical expenditure and tightening of examination of Medical Claims, Crunch in medical institution management, work-style reforms for healthcare providers

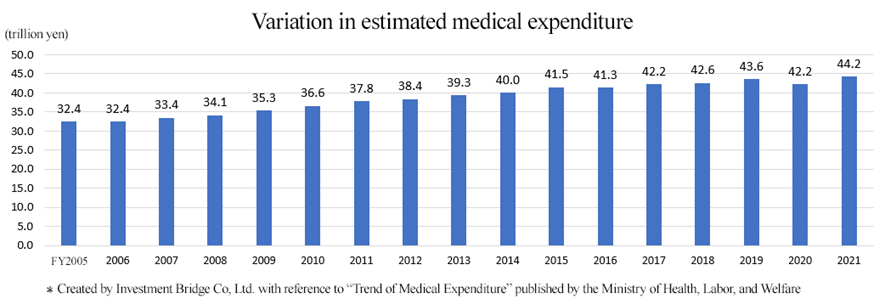

The estimated medical expenditure (excluding expenses such as workers’ accident compensation insurance and payments when the full payment is covered with own expenses. It accounts for about 98% of the national medical care expenditure, which is the overall estimate of all expenses required for treating injuries or diseases after examinations by doctors in medical institutions) has marked a record high in 2021 at 44.2 trillion yen. As medical expenses are in an increasing trend due to the progression of the aging population, the financial situation of medical insurances keeps getting worse. In order to reduce insurance costs, the national government is implementing a measure for rationalizing medical expenses by tightening the examination of Medical Claims,etc.

(What are the medical claims?)

Under the current system of health care services provided by health insurance, medical institutions receive up to 30% from patients and the other 70% or more from the health insurance association, mutual aid associations, city or ward offices, etc.

Medical institutions define the detailed statement of diagnosis and treatment, which is required to claim the amount covered by insurance from these public institutions, a Medical Claim; and the tasks performed to issue the Medical Claim are a very important procedure, which makes up most of the revenue of medical institutions.

The submitted Medical Claims are meticulously scrutinized by the Examination and Payment institutions. In case there is a mistake in its content, the Medical Claim may be sent back (returned) by the Examination and Payment institution, or the scores of medical fees may be reduced. In case the Medical Claim is returned, it must be carefully examined, revised, and resubmitted. Submitting appropriate Medical Claims is an extremely important task for the efficient management of medical institutions.

In 2009, medical institutions were obligated to make online requests for Medical Claims, as a general principle.

(Workstyle reform for doctors, etc.)

While Japan's medical needs are rapidly expanding, diversifying, and becoming more sophisticated with the progress of a super-aging society, the problems of shortage and uneven distribution of medical doctors and workloads such as long working hours are becoming apparent.

In order to alleviate the ever-increasing burden on doctors and promote reforms in the way doctors work in the medical field, a cap on overtime work for doctors with penalties will come into effect in April 2024. As a result, medical institutions are faced with the urgent task of streamlining and optimizing the work of doctors and others.

The crunch in medical care provision systems and deterioration of hospital management caused by the COVID-19 pandemic are becoming serious social issues. Against this backdrop, examination and payment institutions are moving to tighten the examination of medical claims, and work-style reforms are in progress for health care providers. Accordingly, it is now essential for the management of medical institutions to improve revenues through better operational efficiency for medical claim checks, etc., ensure the safety and quality of medical care, and deal with work-style reforms.

(3) Medical cloud market that is expected to grow rapidly

Thanks to the notice of the Ministry of Health, Labor and Welfare titled “Regarding places for storing medical records” partially revised in February 2010, it became possible to store medical information at data centers owned by private enterprises, which made it easier for private enterprises to offer medical cloud services.

It is expected that application platforms and cloud services in which servers exist in networks will be utlized in the medical field for electronic charts, medical image management systems, regional medical cooperation systems, and various services for home care support, remote image diagnosis, clinical trials, and dispensaries.

Especially, as the volume of data in today’s medical instiutions increased steeply and networks are used more widely, expectations toward medical cloud services are growing, as cloud services have merits, such as “It is easy to cooperate with other facilities,” “It is unnecessary to maintain and manage data by yourself,” and “They are inexpensive,” and they turned out to be useful for anti-disaster measures after many medical charts were lost in areas devastated by the Great East Japan Earthquake in March 2011. Furthermore, the medical crunch due to the spread of COVID-19 made us strongly aware of the necessity of online diagnosis and electronic charts.

Some point out the problem of safety from the viewpoint of protection of personal information, but the medical cloud market is expected to grow considerably for offering solutions to social issues while keeping a balance between the tightening and easing of regulations.

1-3-3 Strategic business domains

The company focuses its efforts to expand its business based on the strategic business domains of the “3As” fields, which will usher in the new age.

Field | Current situation and future plans |

AI | After the practical use of AI chatbots in the Global Consulting Group, a leading auditing corporation’s group, and the support for installation of AI in product appearance inspection equipment for a manufacturer, they aim to expand the AI-related business in more diverse fields by enhancing the development of cutting-edge personnel. After finishing development for audio AI and chatbots (automatic conversation programs), the company is promoting cross-sectoral application. |

Analytics | The company finished the development phase of Japan’s number one Medical Claims Inspection Software, the Mighty series, and analysis tools, and will proceed to a phase of achieving a new monetization model by building an engine that analyzes medical-related fields to improve the quantity and quality of the data. In addition, the company provides solutions for predictive maintenance for factories and shipping companies. |

Automation/RPA | The company has established an engine for software testing automation and is pursuing robotics and RPA (automation of business operations with robots). It aims to expand its market reaching leading robotics and FA manufacturers. |

1-3-4 Segments

The company reports 2 business segments; one is a global business that provides IT solution services to diverse markets such as Finance/Public, Medical, Automotive, Manufacturing and Robotics, and management improvement solutions etc for medical institutions such as the Medical Claims Inspection Software.

(From the company’s website)

1) Global business

- Overview

Its wholly owned subsidiaries, Advanced World Systems, Inc. and Advanced World Solutions, Inc. are the major development centers in the Philippines, where it focuses on Finance, Public, Medical, Automotive, Manufacturing, and Robotics fields and delivers embedded software development, business application development, maintenance, and testing services.

The company defines “3As” (AI, Analytics and Automation/RPA) as a strategic business domain, and develops its own core solutions, utilizing these 3As technologies. The advanced capability of developing solutions is derived from its development centers in the Philippines, which has a top-class engineering group composed of about 1,000 engineers. This gives it a strong competitive advantage. (Refer to 【1-4 Characteristics and Strengths】 for more details.)

- Clients

Its client companies range broadly from finance, public, medical, automotive, manufacturing, to service industry-related ones. As mentioned above, in addition to the worsening IT personnel shortage, there have been strong needs for the reduction of costs for development and operation, but the company, which has 1,000 IT person who are proficient in Japanese and English, is steadily meeting such needs.

On top of that, the rich experience of development for numerous big domestic clients over many years has further earned their trust and built its reputation.

2) Medical business

- Overview

AIS Co., Ltd., which is a 100% subsidiary, engages in the development and sale of packaged solutions for medical institutions, cloud services, data analysis solutions, development support, and consulting services, contributing to the reform of workstyles of medical professionals and staff in medical institutions, the improvement of revenues at medical institutions, and the improvement in safety and quality of healthcare.

The “Mighty Series,” which improves the management quality and increases the work efficiency in medical fields, is well-received thanks to its user-oriented and cost-effective features. Sales were positively affected by work style reforms as of the end of March 2022, the Mighty series occupied the top market share and was being used by approximately 42.0% of hospitals with a patient capacity of 20 or more (3,434 facilities), and 14.0% of clinics with a patient capacity of 19 or less (15,041 facilities), for a total of about 18,475 facilities.

- Mainstay products and services

(1) The Medical Claims Inspection Software (Mighty Checker®)

As improvement in efficiency and precision of Medical Claims Inspection were required, the company was ahead of competitors in releasing Medical Claims Inspection Software (Mighty Checker®) in 1999; it was well-received for its usability and it managed to establish its position as a leading maker of “Medical Claims Inspection Software.” In FY 2019, it released “Mighty Checker® EX,” an AI-based new-generation Medical Claim check system and reaffirmed its market position.

Mainly, the company strongly supports the Medical Claim issuing process with the following features:

Product name | Features |

Mighty Checker® EX | - Top-end product in the Mighty Checker series released in the autumn of 2018 - Next-generation system for checking Medical Claims, which was developed by upgrading the highly evaluated functions and usability of the conventional product “Mighty Checker PRO” and incorporating AI for Medical Claims Inspection |

Mighty Checker® PRO Analyze | - An advanced version of Medical Claims inspection software - Analyzes inspection results and suggests an efficient inspection process. - In addition to the assessment and return measures, it can use inspection results more efficiently by utilizing the result of checking medical claims. - It makes it easier to modify the database by importing the assessment and return data; thus, it helps curb assessments and returns. |

Mighty Checker® PRO Advance | - A standard version of Medical Claims inspection software. - Validates the disease name, medicines, and medical care of the indication. - Inspects the measures for assessment and return (cross-check inspection, general inspection, calculation day check, etc.) - Validation by the claims support functions (checks items that can be calculated as consultation fees, etc.) |

Mighty Checker® Cloud | - A cloud service for inspecting medical claims, which can be linked with electronic charts in the cloud - Can be used for adopting the cloud for in-hospital systems, streamlining operations, realizing remote work, BYOD with any terminals, and BCPs, as it is easy to install and operate - Collaborations with cloud-type electronic medical record systems to be pursued |

(Benefits of adopting the Mighty Checker)

Adopting Mighty Checker can reduce the time required for health insurance claim inspection by approximately 60% and the inspection cost by about 55% and can increase revenues through its calculation support function.

As staff get used to operating it, work time will be further shortened, and the accumulation of past data and AI detection will further improve inspection accuracy.

(2) Medical Ordering check software, “Mighty QUBE® PRO”

This system utilizes the database of Mighty Checker® to immediately check appropriateness of treatment and medication with disease, dosage, number of days and administration at the time of ordering prescriptions, and report errors when there is any inappropriate treatment, or any disease name is missed. By preventing the erroneous input of medical instructions and mis operation, it can avoid medical accidents (near-miss accidents) and assessment (reduction of claimed amount), so that medical doctors can concentrate on their primary task, that is, healthcare. It is highly evaluated because it supports the financial and managerial improvement of hospitals through the pursuit of the safety and quality of medical treatment and the streamlining of business operation, and it also brings benefits to both hospital and patients, so many medical institutions have adopted it.

(Benefits of adopting Might QUBE)

It reduces the working hours of outpatient doctors by about 28 hours (per month/doctor) to reduce excessive stress.

The company estimates that annual profit will improve 66 million yen due to the sales growth impact of Might QUBE as it reduces overtime pay for doctors and other related costs and assessments due to the omission of disease names.

In addition, it supports the prevention of input errors by supporting electronic medical record input, support for naming diseases, and efficiency of non-clinical work so that doctors can concentrate on patients.

In the term ending March 2023, the company started taking pre-orders for the New Mighty QUBE (provisional name). Several public hospitals installed the system in the second quarter (July-September) of the term ending March 2023, and it is off to a good start.

*Features of the new Mighty QUBE

・ | Responding to 2024 Work Style Reforms for Doctors |

・ | Hybrid model for cloud and on-premises systems |

・ | Equipped with a real-time calculation support function (improving the added value of the electronic medical record system) |

・ | Commercialized by laboratory-type development by medical engineers in the Philippines |

・ | Business talks are underway with multiple cloud-based electronic medical record manufacturers to incorporate the new MQ |

・ | Received pre-orders from multiple major medical institutions and many inquiries |

・ | The direct sales price is scheduled to be about 1.2 times or higher than that of the old model (MQ PRO) |

(3) SonaM, a medical cloud in preparation for disasters

This is a cloud service for supporting BCPs and preservation of medical data in medical institutions with one of the most advanced security bases in Japan.

Due to the spread of COVID-19, the necessity of online diagnosis and treatment attracted public attention, the diversification of diagnosis and treatment methods is progressing, and the demand for security in digital and cloud healthcare services is growing.

In addition, at medical institutions that take more important roles at the time of disasters, it is imperative to secure safe, reliable places and methods for storing in-hospital medical data.

“SonaM,” which was developed for the purpose of supporting healthcare systems suffering the lack of resources under these circumstances, is used for preserving medical data, including medical claims, medical charts, and examination images, with the security cloud.

In order to handle medical data in the cloud, it is necessary to comply with the three medical information security guidelines (the generic term is Three Guidelines from Three Ministries) suggested by the three ministries: the Ministry of Health, Labor and Welfare, the Ministry of Economy, Trade and Industry, and the Ministry of Internal Affairs and Communications, but the company covered all of them, by adopting the advanced cloud security base of NTT East.

Multiple step-by-step plans are prepared for meeting various needs from individual medical institutions with different scales.

This is a new profitable subscription model following the Mighty series, and the company aims to increase the average spending per user by cross-selling it with the Mighty series and increasing direct transactions.

(4) Insurance Knowledge Platform

As a DX solution for the insurance industry, it helps streamline the procedure for claiming insurance money (assessment for payment), shorten the period until the receipt (payment) of insurance money, and popularize simplified procedures for insurance claim.

(Overview and features)

Until now, insurance companies have needed to exert a great deal of effort to cover the scattered information in examinations of insurance claims from clients, such as medical practices, medical products, names of injuries and illnesses, advanced medical care, and law revisions.

The company estimates that a major life insurance company processes about 300,000 documents related to insurance claims annually, and the annual cost, including personnel expenses, is about 1 billion yen.

The insurance knowledge platform, which uses a unique medical database backed by the company's track record of providing services to more than 18,000 medical institutions, can greatly streamline cumbersome screening operations.

After the insured person is discharged from a hospital, it currently takes 2-4 weeks to receive benefits after completing paperwork with the insurance company and the hospital, and the insurance company also takes about 2-3 weeks to complete the processes from payment examination to payment. By introducing a medical information search system, the company aims to improve the efficiency of insurance payment operations made by individuals. In addition, the introduction of the DX program, "Yuragi Hosei" (Fluctuation Correction), which specializes in improving the reading accuracy of medical documents using OCR, promotes the popularization of simple billing, which is considered challenging in terms of cost and technology, for example, by supporting the partial automation of insurance payment operations.

(Monetization concept)

The company is aiming to achieve a high-priced, high-profit subscription model that surpasses the Mighty series.

Revenue consists of basic initial costs, basic connection usage fees, optional initial costs, and optional connection usage. The company has developed multiple options to meet diverse needs, planning to secure high profits by offering a wide range of solutions.

(Strengths of the platform)

1. Intellectual Property (IP)

Utilizing the company’s own medical database backed by a track record of providing solutions to more than18,000 medical institution users for over 20 years, the platform is equipped with medical treatment, drug codes, advanced medical information, etc., used for insurance examinations.

The platform also benefits from the knowledge of AI development.

2. Business model

The platform is operated via a cloud-based, next-generation service model with a high unit price and monthly subscription.

In addition, as the platform can be rolled out from the next year of development with only the burden of maintenance costs, its potential future value is enormous.

Also, the utilization of IT should reduce the burden of insurance claim procedures and shorten the number of days until insurance benefits are received. We also expect the company’s participation in the "Life Insurance Ecosystem Concept,” which aims to significantly reduce the administrative burden of insurance companies, to accelerate the platform’s market penetration.

Another big advantage is that the company can utilize its development resources in the Philippines to brush up its services.

3. Marketability

The company believes it is the first industry player to foray into an uncontested market space.

There is a potential client base/market of approximately 100 companies, with an annual usage fee of several millions to tens of millions of yen per company.

(Future developments)

The company aims to expand the Insurance Knowledge Platform across the entire insurance industry in the form of a new subscription-type solution in the medical business, as well as develop and implement a new menu equipped with AI and other advanced technologies geared toward further evolution of solutions for the insurance industry. Furthermore, it is focusing on capturing development demand associated with digital transformation and increased use of AI technology across financial services (including the insurance industry), boosted by the need to switch from "face-to-face services" to "non-face-to-face services" due to recent measures to prevent the spread of the coronavirus.

In addition, in November 2020, it was decided that the company would participate in the Life Insurance Ecosystem Concept for expanding the Insurance Knowledge Platform.

The life insurance ecosystem concept aims to reduce the burden of insurance claim procedures and shorten the time required to receive insurance benefits, as well as significantly reduce the administrative workload of insurance companies by utilizing IT.

IRRC Corporation (1st section of TSE, 7325), a company that has atypical AI-OCR technology and engages in insurance sales, solutions, and system businesses, as well as Assist Corporation, a company engaged in software sales and technical support, forms the core of the concept.

In order to develop and expand this concept, the company's insurance payment automation technology in the "Insurance Knowledge Platform" was highly acclaimed, and the company decided to participate as the first company to strengthen the concept.

Against the backdrop of many business inquiries for the "Insurance Knowledge Platform," the company is preparing to implement multiple functions as an option in addition to the "medical information search engine" for insurance payment examination operations, which is a basic function, in order to expand the user-oriented functions and strengthen the appeal of the platform.

In order to develop the provision of a subscription-based platform for the insurance industry, which is a new initiative for Ubicom, as one of its new core businesses, the company will create mutual benefits for insurance companies and their clients, synergies with collaborating companies, and establish technological innovations and business models.

In addition, from the third quarter of FY 3/21, the company will expand the use of its approximately 1,000 global IT personnel to develop advanced solutions for the insurance industry, including the Insurance Knowledge Platform, and to further strengthen its DX promotion.

Furthermore, the company plans to invest in human resource development to train the next-generation engineers specializing in advanced fields such as AI, to further increase its corporate value with an eye on the future.

1-4 Characteristics and Strengths of Ubicom

1-4-1 Training and utilizing approximately 1,000 engineers, mainly at its development sites in the Philippines

As was touched upon in the corporate history section, the president Aoki had inspected the site several times, and considered the Philippines as an optimum location for IT development. It not only is the source of the company's competitive advantage, but also plays an extremely important role for driving the future growth strategy.

The development center in the Philippines and its predecessor have about 30 years of development experience, and their main characteristics are as follows:

1) The optimum location for global IT development: the Philippines

The Philippines enjoys the demographic dividend period, where a long-term population growth, especially in young age groups, continues. It maintains an economic growth rate of roughly 6% on average. Moreover, young citizens are full of vigor and strive for upward mobility.

In addition, the fact that English is the official language plant the seeds for engagement in global activities, the high IT literacy, its easily accessible location at the center of ASEAN countries, etc. make it an optimum location as a global base for IT development.

2) Employing elite staff

As many as about 1,000 engineers enrolled mainly in development centers in the Philippines, but it does not only boast of the quantity (number of people), but also the quality (their aptitude), which is unrivaled.

Backed by a long track record, the engineers who seek employment at the company highly value the development center in the Philippines, and the group receives a few thousand applications for engineer positions almost every year. However, only top 4% of applicants are accepted.

3) Human resources development with original education and training

Building a top-class engineering group cannot be achieved just by hiring elite personnel.

One of the differentiating factors that make it hard for competitors to catch up with the company is, in fact, its educational system and training, which turn staff into capable top engineers.

In April 2003, the corporate group established its own training center ACTION in the Philippines and started in-house developed training programs. It is constituted by 4 categories: basic concept for IT, advanced technologies, interpersonal skills, and the Japanese language. The training is conducted aiming employees to pass the PhilNITS (The Philippine National Information Technology Standards exam) and the Japanese Language Proficiency Test level 4.

After completing the training, the trainees present their achievements to the board members, and after going through interview assessments, they are finally assigned to projects. Even for elite students, the journey up to the point of being able to handle job assignments is not an easy one. The program graduates who overcome such hurdles acquire the skills needed for fulfilling their duties in an advanced technical field and a Japanese-speaking environment, hence they are overwhelmingly superior in the Japanese IT market, and they are the engine driving the company’s growth.

Furthermore, the company is always handling numerous challenging cutting-edge projects, giving highly motivated staff chances to shine. This is also one of the reasons why the corporate group is so popular as an employer in the Philippines.

4) Further upgrading and reinforcing of solution development capabilities

The company is already outshining competitors with its advanced solution development capabilities, but as it aspires to make robust use of this advantage, the company established the “Advanced Technologies Development Center” in 2017.

About tens of the center’s advanced engineers specialize in AI and big data analysis. By taking advantage of their native English to connect with top-class researchers globally, the company established a system that gives access to the latest cutting-edge technologies.

With this, it became possible to produce a prototype with highly added value that matches clients’ needs in a short period of time at low cost and directly offer it to major clients in Japan. Accordingly, the company’s capability of giving a proposal is improving considerably.

5) Receiving external acclaim

The work of its top engineers, who had overcome high hurdles and managed to participate in projects, has received high external acclaim, which led to the winning of numerous awards.

* In 2020, its Philippine subsidiary was awarded the Export Excellence Award for Software Development Services by the country’s Department of Trade and Industry (DTI).

* In 2020, two engineers were selected as Asian top guns, who are outstanding among top passers of Asia’s common standardized version exam of the Japanese Information-Technology Engineers Examination.

* In 2017, its Philippine subsidiary, Inc. was awarded as the best software company across the Philippines in the “International ICT Award.”

* Its training program “ACTION” has been consecutively awarded the Outstanding Company Program award at the "e-Services Philippines Award” for 6 years.

1-4-2 A robust customer base

Armed with a strong competitive advantage of having both a global division and a medical division, the company has established a robust customer base.

The robust client assets are considered to play a big role for the expansion of the recurring-revenue business, which is based on subscriptions in the growth strategies, and matching the win-win investment model partners (growing corporations) with client enterprises, etc.

1-4-3 Feeling of partnership inside and outside the Group, and a corporate culture with a sense of ownership

The president Aoki considers all the employees, including those who work overseas, and their family members as "fellows." He thinks that one of the Group's strengths is that it achieves leaping growth thanks to all the employees who positively work with a cheerful never fading smile yet are never satisfied with status quo; each and everyone has a sense of ownership and thus pioneer the new times.

This feeling of partnership that values harmonious relationships extends to even outside the Group.

“The win-win investment model,” which is one of important growth strategies of the company, promotes the collaboration and strategic alliances with leading companies and growing enterprises, to accelerate the growth of existing businesses and create new businesses. The mindset that investors and investees aim to grow together as “fellows” regardless of business scale and the relationship between shareholders and portfolio companies is expected to motivate alliance partners further. This is probably the big difference from general VC (venture capital) and CVC (corporate venture capital).

1-5 ROE analysis

| FY 3/2016 | FY 3/2017 | FY 3/2018 | FY 3/2019 | FY 3/2020 | FY 3/2021 | FY 3/2022 |

ROE (%) | - | 12.2 | 17.7 | 24.7 | 27.3 | 24.2 | 24.6 |

Net Income to Sales Ratio (%) | -0.16 | 3.76 | 6.63 | 10.37 | 13.21 | 14.86 | 17.61 |

Asset Turnover Ratio (x) | 1.46 | 1.44 | 1.36 | 1.27 | 1.17 | 1.02 | 0.94 |

Leverage (x) | 2.62 | 2.25 | 1.96 | 1.87 | 1.76 | 1.60 | 1.49 |

*The asset turnover ratio and leverage are calculated with the average amount between the beginning and the end of the term. Calculated by Investment Bridge Co, Ltd. based on annual securities reports and brief financial statements.

*Created by Investment Bridge Co., Ltd. based on disclosure material.

Total asset turnover and leverage are on a downward trend, but margins continue to improve. The projected net income to sales ratio for the current fiscal year is 17.0%.

The company is likely to maintain a high level of ROE.

1-6 Shareholder Return

While the company recognizes returning profits to shareholders as one of the management priorities, it has been prioritizing expansion of its internal reserves for future business development and reinforcing the management quality. However, in FY03/19, the company paid a dividend of 5.00 yen per share for the first time considering the recent increase of orders received, robust business performance, and the establishment of the foundation for a profitable recurring-revenue business model. In the previous fiscal year March 2021, the company also paid a dividend of ¥7.00 per share, an increase by 2 yen, and the payout ratio was 13.1%.

From now on, the company will concentrate on the improvement of measures for returning profits to shareholders with the aim of achieving a payout ratio of 30% or higher in the future, while considering the balance between the improvement in business performance and strategic investment, based on the creation of stable cash flows through the shift to the subscription business model.

1-7 ESG-related initiatives

The company believes that it has a social responsibility and raison d'etre to create business innovation based on its five core assets: technology, human resources, intellectual property, foresight, and partnerships, and solve issues such as the declining birthrate and aging population, the shortage of medical care, the depletion of IT human resources, and DX. The company's ESG initiatives are as follows.

Global Business | * Client DX (Business process reforms for clients through advanced technology support such as AI/Analytics/Automation/cloud) * Improvement of Japan’s global competitiveness through globalization support for domestic companies |

Medical Business | * Pursuing the Three Way Satisfaction (insurer/insured/medical institution) through the Platformization of non-competitive areas as represented by the new business for the insurance sector * Workstyle reform for doctors, medical healthcare DX (improvement of healthcare safety and quality, improvement in revenues and business operations of medical institutions, shift to paperless and cloud operations, and support for diversification of medical care, including remote diagnosis) |

Group as a whole | * Resilient business management (reinforced business continuity structure including remote working) * Strategic alliances with companies with a high social impact that contribute to the SDGs * Providing education and opportunities to young talent in Asia * Diversity in employees and management positions * Enhancement of incentives for employees |

2. Second quarter of the Fiscal Year ending March 2023 Earnings Results

2-1 Earnings Trends

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY |

Net Sales | 2,268 | 100.0% | 2,602 | 100.0% | +14.7% |

Gross profit | 920 | 40.6% | 1,025 | 39.4% | +11.4% |

SG&A | 485 | 21.4% | 524 | 20.1% | +8.1% |

Operating Income | 435 | 19.2% | 501 | 19.3% | +15.1% |

Ordinary Income | 478 | 21.1% | 494 | 19.0% | +3.5% |

Net Income | 350 | 15.4% | 337 | 13.0% | -3.7% |

*Unit: million yen

*Created by Investment Bridge Co., Ltd. based on disclosure material.

*A ▲ in the expense item indicates an increase in expenses.

Sales and profit increased, and operating and ordinary incomes hit record highs

Sales increased 14.7% year on year to 2,602 million yen. The global business achieved double-digit sales growth as a result of the continued strong demand. The medical business, too, performed well.

Operating income grew 15.1% year on year to 501 million yen. Although gross profit margin fell 1.2 points due to strategic investments, etc., gross profit increased 11.4% year on year. The company recorded double-digit profit growth absorbing human investment costs. Ordinary income increased 3.5% year on year to 494 million yen. The foreign exchange gain recorded in the same period of the previous year disappeared, and a foreign exchange loss of 25 million yen was recorded. Operating and ordinary incomes hit record highs for the first half.

2-2 Trend of Segments

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY |

Global Business | 1,528 | 67.4% | 1,846 | 70.9% | +20.8% |

Medical Business | 740 | 32.6% | 756 | 29.1% | +2.2% |

Consolidated Sales | 2,268 | 100.0% | 2,602 | 100.0% | +14.7% |

Global Business | 198 | 13.0% | 216 | 11.7% | +8.6% |

Medical Business | 399 | 53.9% | 443 | 58.7% | +11.2% |

Adjustment | -162 | - | -158 | - | - |

Consolidated Operating Income | 435 | 19.2% | 501 | 19.3% | +15.1% |

*Unit: million yen. Sales is the sales toward external customers. Ratio to sales in Operating Income is profit margin.

*Created by Investment Bridge Co., Ltd. based on disclosure material.

(Global Business)

Sales and profit increased.

Sales from pillar customers and orders for solutions remain healthy. The company has started active recruitment of new graduates and the new graduate training program ACTION to develop DX human resources and further strengthen efforts to make them sub-pillars.

The company has promoted the "Ubicom Development Partnership" in Japan to strengthen the alliance-type laboratory development model further. In the enterprise business department, in response to the trend of offshore promotion and globalization, the company has expanded human investment, advanced projects other than IBM, and showed a steady start, mainly in major real estate tech. A steady expansion is expected in the second half.

The company has strengthened negotiations for collaboration in developing AI solutions with overseas technology companies and marketing. In addition to the regular investment, the company is expanding investment for the second growth phase, and the number of prospective pillar customers is steadily increasing as well as newly acquired customers. In response to changes in the external environment, including exchange rates, the company will promote measures swiftly and strategically, such as pricing measures to absorb the costs of yen depreciation and leveling out the impact of exchange rates over the medium term by revising its settlement currency portfolio. Foreign currency payments, which were around 30% in the previous fiscal year, are expected to exceed 40% in the second half of this fiscal year, and the goal is to raise them to 50% in the term ending March 2025.

In anticipation of an increase in global demand for IT human resources centered on advanced AI human resources, the company is moving to a high average spending model that raises the rate of all engineers by 10% or higher from the first quarter of this term.

Negotiations with all customers will be completed by the second quarter, and the price is expected to be reflected in the second half of the year.

(Medical Business)

Sales and profit increased.

The highly profitable base continues to expand through the subscription model.

The recurring revenue ratio of products such as the Mighty series in the medical business reached about 90%, and operating income margin rose to 58.7% in the first half of this term.

As the new product Mighty Checker EX contributed, the number of medical institutions that have purchased the packaged products of the Mighty Series has been increasing healthily.

While continuing to narrow down commissioned projects with a low profitability, the profit margin of this segment reached 58.7%, the highest level ever, due to establishing a highly profitable subscription model and cross-selling solutions.

The adoption of the next-generation check systems for health insurance claims, "Mighty Checker EX" and "MC Cloud," is also steadily increasing.

The company started taking pre-orders for the New Mighty QUBE (provisional name), a strategic solution that contributes to reforming the way doctors work, and it has received many inquiries, mainly from public medical hospital groups.

The new solution for insurance companies, "Insurance Knowledge Platform," is making steady progress in monetization and verification tests with multiple insurance companies.

The company will promote a new pricing policy from the second half. The company will enhance its efforts to establish a firm position as the No. 1 solution that contributes to the management improvement of medical institutions and the quality and safety of medical care.

2-3 Investments

The company made strategic investments mainly in the second quarter (July-September) to promote the second growth phase. The business is expected to expand from the second half to the next term.

(From the company’s material)

In addition, as a foundation for the entire group's medium- to long-term growth strategy, the company has begun to strengthen development resources, mainly in global business.

(From the company’s material)

2-4 Financial position and cash flow

Main Balance Sheet

| End of 3/22 | End of 9/22 | Increase /Decrease |

| End of 3/22 | End of 9/22 | Increase /Decrease |

Current Assets | 4,509 | 4,760 | +250 | Current liabilities | 1,464 | 1,435 | -29 |

Cash and Deposits | 3,377 | 3,665 | +287 | ST Interest Bearing Liabilities | 100 | 100 | 0 |

Receivables | 938 | 862 | -76 | Advances received/Contract liability | 691 | 706 | +14 |

Noncurrent Assets | 1,114 | 1,105 | -8 | Noncurrent liabilities | 347 | 342 | -5 |

Tangible Assets | 53 | 59 | +6 | Liabilities | 1,811 | 1,777 | -34 |

Intangible Assets | 260 | 218 | -42 | Net Assets | 3,812 | 4,088 | +276 |

Investment, Others | 800 | 828 | +27 | Retained earnings | 2,270 | 2,501 | +230 |

Total assets | 5,624 | 5,866 | +242 | Total Liabilities and Net Assets | 5,624 | 5,866 | +242 |

*Unit: million yen

*Created by Investment Bridge Co., Ltd. based on disclosure material.

Total assets increased 242 million yen from the end of the previous year to 5,866 million yen mainly due to an increase in cash and deposits.

Total liabilities remained almost unchanged at 1,777 million yen.

Net assets increased 276 million yen to 4,088 million yen due to an increase in retained earnings.

As a result, capital adequacy ratio rose 1.9 points from the end of the previous term to 69.7%.

◎Cash flow

| FY 3/22 2Q | FY 3/23 2Q | Increase and Decrease |

Operating cash flow | 498 | 498 | -0 |

Investing cash flow | -47 | -33 | +14 |

Free cash flow | 450 | 464 | +14 |

Financing cash flow | -96 | -234 | -137 |

Cash, equivalents at term-end | 3,101 | 3,630 | +528 |

*Unit: million yen

*Created by Investment Bridge Co., Ltd. based on disclosure material.

Operating cash flow and free cash flow were virtually unchanged.

The cash position improved.

3. Fiscal Year ending March 2023 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/22 | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY | Progress rate |

Net Sales | 4,726 | 100.0% | 5,446 | 100.0% | +15.2% | 47.8% |

Operating Income | 1,033 | 21.9% | 1,254 | 23.0% | +21.4% | 40.0% |

Ordinary Income | 1,055 | 22.3% | 1,271 | 23.3% | +20.5% | 38.9% |

Net Income | 832 | 17.6% | 925 | 17.0% | +11.2% | 36.5% |

*Unit: million yen. The forecasted values were provided by the company.

No change in earnings forecast. Sales and Profit increase. Profit to achieve record highs for consecutive years.

There is no change in earnings forecast. The company forecasts net sales of 5,446 million yen, up 15.2% from the previous fiscal year, an operating income of 1,254 million yen, up 21.4%, and an ordinary income of 1,271 million yen, up 20.5%. Operating income and ordinary income are expected to reach record highs this fiscal year too.

The company will continue to make "strategic investments," but by absorbing these investments, it aims to achieve double-digit profit growth.

The company has not decided on a dividend at present but intends to continue to provide appropriate shareholder returns in line with profit levels this fiscal year.

(2) Priority measures

While checking the profit balance, the company will implement measures for fortifying the base for promoting the second growth phase.

These are the following four key points.

1.Enrichment of resources of experts contributing to the Go Global Strategy

The company will strive to increase young expert personnel who will lead the next-generation business.

2.Enhancement of recruitment and training of Filipino engineers

The company plans to strengthen recruitment, especially of new graduates, and will conduct AI education based on the alliances with enterprises in digitally advanced countries.

3.Strengthening of medical investment strategy

The company will develop new solutions for medical institutions, regarding cloud computing, DX, and reform of workstyles.

The company will further develop medical engineers in the Philippines.

4.Execution of M&A

The target companies are as follows.

☆ | ☆ Companies that promote business in strategic areas and are expected to generate synergies with customers in Europe and the United States, as well as nearshore and offshore personnel. |

☆ | ☆ Companies that have overwhelming strengths in a niche area and have package solutions that can become a platform provider. |

☆ | ☆ In addition, companies that can leverage Ubicom's intellectual property strategy in the healthcare field and companies that are expected to promote the expansion of business with Ubicom that contribute to the social impact that the group is aiming for. |

4. Efforts and progress toward realizing the medium-term vision

4-1 Trend of each business

(1) Global business

◎Direction of the global business: Promoting the “GO GLOBAL Strategy”

The company believes that the potential market for software development in Japan is about 10 trillion yen, of which the current offshore utilization rate is only about 2%, and that there is room for increasing it to 10% in the future.

Moreover, we assume that there is a global potential market over 10 times larger than the Japanese potential market.

On the other hand, it is said that we will be 545,000 DX workers short in 2030.

In order to meet such demand, the company is improving its business strategy with an eye on the global market.

Specific initiatives are as follows.

(1) Promotion of global M&A, investments, and business alliances

(2) To strengthen overseas marketing (the U.S. and Israel)

(3) AI education through alliances with companies in advanced digital countries

(4) Further improving the high added value of the Philippine base

In particular, regarding the base in the Philippines, which is the source of the company's competitive advantage, the company aims to

・Realize projects using English skills

・Strengthen recruitment of university graduates and human resources with science backgrounds

・Provide services to European and U.S. countries by utilizing geographical advantages

・Meet vast demand through offshore promotion in multiple countries

◎Customer pillarization

The company defines its pillar clients ("mainstay clients") as market leaders in their respective industries with whom it has an ongoing business relationship and sales of several hundred million yen.

For new clients, 1-5 people are initially dispatched to the client's site for on-site development, but as sales expand, the number of engineers assigned to the client's site increase, and the company begin to shift to an offshore development system. The goal is to eventually have a big-pillar clients with more than 50 people working on development on a continual basis.

In the process of reaching this stage, an increase in profitability is expected, owing to the advantage of scale, the elevation of development productivity based on the accumulated industrial knowledge, the development of their original solutions for test automatization, etc.

◎Expansion of AI-related business based on the cultivation of advanced human resources

After the COVID-19 crisis, business related to computer manufacturers is rapidly growing due to a rise in demand brought about by the workstyle reform. While the sales of mainly computer manufacturer clients accounted for about 20% before the COVID-19 crisis, the percentage increased to about 40% in the previous term.

They will keep incorporating this kind of demand while they focus on the cultivation of advanced human resources and expansion of orders in the AI field for the fiscal year ending March 2025.

(2) Medical Business

◎Direction of the medical business: No.1 niche platform in the medical field

As mentioned in the "Business Description" section, Japan is facing a serious shortage in medical care.

Under these circumstances, the company estimates the target market scale of the Mighty Series for supporting both the reform of doctors’ workstyles and the medical care system and management to be 10 billion yen and the scale of the same market for the Insurance Knowledge Platform for DX in the insurance industry to be 4 billion yen.

With the "Mighty Series" as a catalyst, the company will promote cross-sectoral development through the "Insurance Knowledge Platform." For enhancing cross-sectoral development, the company will operate new businesses that promote the development of medical solutions/platforms in line with the medical healthcare DX policy of governments both in Japan and overseas. The target market size is currently assumed to be 20 billion yen.

Moreover, in the medical field there are not only doctors, but also various key players, such as the heads of administration, medical affairs division, hospital directors or agents, and their respective communities.

The company estimates that the potential market size for this community is 300 billion yen. The company aims to realize a huge market and raise the target market size from 20 billion yen, and will develop new solutions in addition to the new platform in order to create a new market.

The engagement of the sales team in consulting, development of medical engineers, reinforcement of direct customer support, and development of a platform for providing new intellectual property and information are actions necessary for the creation of a new market.

Through these initiatives, the company aims to develop the No. 1 niche platform in the medical field, using its position as the market leader in DX solutions specializing in medical institutions.

(From the company’s material)

(Development of New Mighty QUBE)

As mentioned in the "Company Overview" section, the company has started taking pre-orders for the New Mighty QUBE (provisional name). Several public hospitals adopted the system in the second quarter (July-September) of the term ending March 2023, and it is off to a good start.

(Insurance Knowledge Platform)

Of the approximately 50 companies in the life insurance market, talks are underway with seven companies. PoC verification is underway with three of these companies for adoption in the fiscal year 2022. In addition, two second-tier companies aim to adopt it in the fiscal year 2023.

As for the PoC, the company is verifying "Yuragi Hosei" (Fluctuation Correction) and the search system and is proceeding with developing and cross-selling a new DX program following Yuragi Hosei (Fluctuation Correction).

◎ To strengthen sales strategy

The company will improve sales strategies to promote sales of the Mighty series.

From the second half of the term ending March 2023 onward, customer support will focus on building a user community, and marketing will focus on strengthening communication of cost-effectiveness as a priority policy, and feedback will be given to pricing and product development.

In terms of pricing, the "promotion of a new price based on cost-effectiveness" policy will be a priority policy, leading to enhancing the sales strategy and expanding sales.

◎ Growth potential of each solution

Each solution in this business is characterized by high profitability with a gross profit margin of 75% or higher. The company will promote further improvement of unit price per customer and the capacity of earning recurring revenues through up-selling, cross-selling and direct sales.

For Mighty QUBE and the New Mighty QUBE, the company has identified nearly 1,000 new targets (medium-sized hospitals) for "workstyle reform for doctors in 2024" and will improve consulting and proposals to medical institutions by leveraging the company's strengths; its "uniqueness in the market" and "high price."

For Mighty Checker EX, the company will encourage existing users to switch (up-sell) from the standard product "PRO" to the top-end product "EX" and will promote cross-selling the menu through direct accounts after acquiring new users through direct sales (price).

◎Promotion of M&A strategy

The company has been successful in the expansion of sales and profit and the improvement of profit ratio in M&A of this business section by going through the steps of implementation of the reform of awareness, elevation of profit ratio, and success of taskforces in the Group. They are aiming for the realization of new M&A contributing to the platformer strategy, utilizing their post-merger integration (PMI) know-how.

4-2 Growth Vision

The company will maximize synergies between existing businesses and M&A, and promote the accumulation of new recurring/SaaS models.

The company will implement strategic investments to realize the growth visions of each business and promote the “Niche No. 1 Platformer Strategy.”

(From the company’s material)

5. Conclusions

The progress rate in the first half was 47.8% for sales and 40.0% for operating income. In the second half, sales and profit are expected to increase from the previous fiscal year's second half and the first half of this fiscal year.

The global business continues to record double-digit year-on-year sales growth due to strong demand. However, we would like to focus on how much the highly profitable medical business, which has posted single-digit year-on-year sales growth in the last five quarters, would be able to increase profit from the third quarter.

*Created by Investment Bridge Co., Ltd. based on disclosure material.

<Reference: Regarding Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with corporate auditor |

Directors | 5, out of which 2 are outside directors. (including 2 independent executives) |

Corporate auditors | 3, out of which 2 are outside auditors. (including 2 independent executives) |

◎ Corporate Governance Report

Last updated: September 22, 2022

*Basic Policy

The corporate ethos of our company is “to remain a one-of-a-kind business innovation company,” “global business operation,” and “co-prosperity based on a win-win model.” We recognize that it is essential to enrich and tighten our corporate governance, in order to improve our corporate value and maintain our global competitiveness under this ethos. In detail, our basic policy is “to aim to enhance our profitability and maximize the profits for shareholders by conducting more efficient, sound business activities” and put importance on compliance. Under this policy, we strive to strengthen our corporate governance, while considering that it is essential to fulfill our social responsibilities toward all kinds of stakeholders, including shareholders, employees, business partners, and local communities, and achieve sustainable growth and expansion.

<Reasons for Non-compliance with each Principles of the Corporate Governance Code (Excerpts)>

Principle | Reasons for not following |

[Supplementary Principle 2-4-1 Ensuring Diversity in the Promotion of Core Human Resources, etc.] | Our company expands business through mid-career recruitment based on experience, ability, etc. regardless of sex and nationality. That is why we do not set any policies or goals regarding the promotion to managerial positions tailored for women, foreigners, and mid-career recruits. Furthermore, while we do not have any female or non-Japanese executives, we are pushing forward with the promotion of personnel with outstanding personalities, opinions, and management skills, regardless of sex and nationality. Moreover, currently one female executive (of foreign nationality) has a successful career as a director at an overseas subsidiary, and we will make endeavors in the promotion of diverse human resources from now on as well. We will consider a human resources strategy for the medium- to long-term improvement of the corporate value, including the policy for cultivating human resources and policy for arranging an in-house environment to ensure further diversity. |

[Supplementary Principle 3-1-3 Initiatives Regarding Sustainability] | While our company disclos es initiatives regarding sustainability so that they may be viewed on the company website, in the future, we will work to disclose the impact of climate change-related risks and opportunities on our business activities and earnings based on the TCFD (Task Force on Climate-related Financial Disclosure) or an equivalent framework, and to disclose specific and easy-to-understand information that is consistent with our management strategies and issues.https://www.ubicom-hd.com/ja/sustainability.html |

[4-2-2 Initiatives Pertaining to Sustainability (Formulation of the Basic Policy)] | Our company discloses the basic policy (Basic ESG Policy) for initiatives pertaining to sustainability so that it may be viewed on the company website. https://www.ubicom-hd.com/ja/sustainability.html In the future, we will consider having the Board of Directors debate on strategies concerning the allotment of management resources such as investment in human capital and intellectual property, and the business portfolio including the effectiveness thereof, and supervise it at the point of formulating a mid-term management plan and a single-year plan. |

<Disclosure Based on each Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 【The strategically held shares】 | Our company may hold shares strategically, if they are considered to contribute to the enhancement of the value of our corporate group from the mid/long-term viewpoint. Our policy is to hold such shares, as long as we can secure the rationality of shareholding purposes, such as the maintenance and cementing of transaction relations through business alliance, collaboration, etc. For exercising the voting rights of the shares, we discuss whether or not a bill is consistent with our shareholding policy. Moreover, there are no strategically held shares as of the day of the submission of this report. |

Principle 5-1 【Policy for constructive dialogue with shareholders】 | We positively respond to shareholders’ application for dialogue. The Corporate Planning Division is in charge of our IR activities, and have developed an IR system based on their daily close cooperation, so that they can accept the phone interviews from investors, small meetings, etc. In addition, we hold a result briefing session involving the representative director and distribute a result briefing video twice or more times every year. In addition, our company discloses information and manages insider information in accordance with our disclosure policy. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |