Bridge Report:(3916)Digital Information Technologies Fiscal Year Ended June 2024

President Satoshi Ichikawa | Digital Information Technologies Corporation (3916) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Information and Communications |

President | Satoshi Ichikawa |

HQ Address | FORECAST Sakurabashi, 4-5-4 Hatchobori, Chuo-ku, Tokyo |

Year-end | End of June |

Homepage |

Stock Information

Share Price | Number of shares issued | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,927 | 15,501,820 shares | ¥29,872 million | 26.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥60.00 | 3.1% | ¥120.70 | 16.0 x | ¥465.51 | 4.1 x |

*The share price is the closing price on September 9. All figures are from the brief financial report for the fiscal year ended June 2024.

Consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (yen) | DPS (yen) |

Jun. 2021 (Actual) | 14,444 | 1,722 | 1,730 | 1,196 | 78.47 | 24.00 |

Jun. 2022 (Actual) | 16,156 | 2,004 | 2,004 | 1,439 | 94.38 | 40.00 |

Jun. 2023 (Actual) | 18,149 | 2,039 | 2.059 | 1,447 | 95.18 | 36.00 |

Jun. 2024 (Actual) | 19,888 | 2,424 | 2,409 | 1,686 | 112.83 | 46.00 |

Jun. 2025 (Forecast) | 22,000 | 2,600 | 2,600 | 1,804 | 120.70 | 60.00 |

*Unit: million yen. The forecast is from the company. Net income is net income attributable to shareholders of the parent company. Hereinafter the same will apply. Dividends for fiscal year ended June 2022. include a commemorative dividend of 8.00 yen/share.

This Bridge Report introduces the earning results for the fiscal year ended June 2024, New Medium-term Management Plan, and other information of Digital Information Technologies Corporation.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended June 2024 Earnings Results

3. Fiscal Year Ending June 2025 Earnings Forecasts

4. New Medium-term Management Plan

5. Conclusions

<Reference 1: Vision for 2030>

<Reference 2: Regarding Corporate Governance>

Key Points

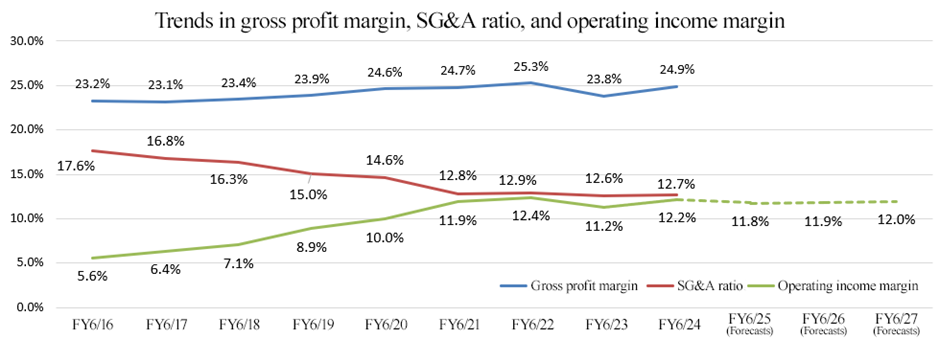

- In the fiscal year ended June 2024, sales and profit grew for the 14th consecutive fiscal year, hitting a record high. Sales increased 9.6% year on year to 19,888 million yen. The software development business, mainly the embedded solution business, performed well, and the original product business grew considerably. Operating income rose 18.9% year on year to 2,424 million yen. Due to the sales growth, gross profit rose 14.5% year on year, and gross profit margin increased 1.1% year on year, thanks to the rebound from the unprofitable transactions, which emerged in the previous fiscal year. The augmentation of costs for improving the treatment of employees and expanding their business scale (expenses for enlarging each business establishments and commissions for M&A for two companies) was offset by the sales growth, leading to a double-digit growth of profit.

- For the fiscal year ending June 2025, sales and profit are expected to rise for the 15th consecutive fiscal year. It is projected that sales will grow 10.6% year on year to 22 billion yen and operating income will rise 7.2% year on year to 2.6 billion yen. Sales and profit are forecast to increase in all business segments. Operating income margin is projected to decline 0.4 points from the previous fiscal year to 11.8%. Profit margin will decline in the short term due to the investment in R&D, the strengthening of human capital, etc. for medium/long-term growth, but there is no concern over the growth potential of their business. In the fiscal year ending June 2025, they will revise the target payout ratio from “40% or higher” to “50% or higher.” For the fiscal year ending June 2025, they plan to pay a dividend of 60.00 yen/share, up 14.00 yen/share from the previous fiscal year. The expected payout ratio is 50.1%.

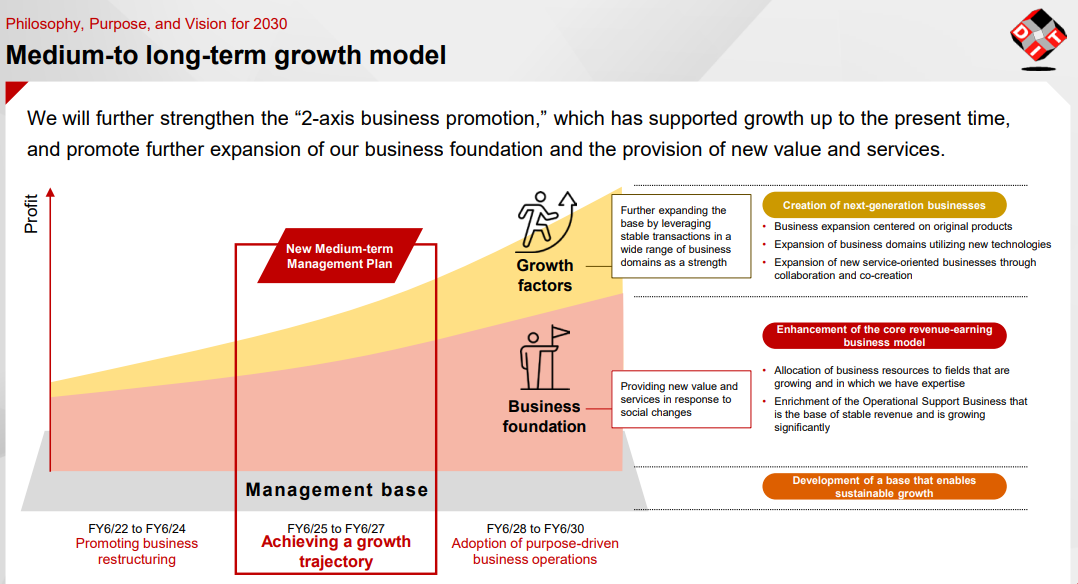

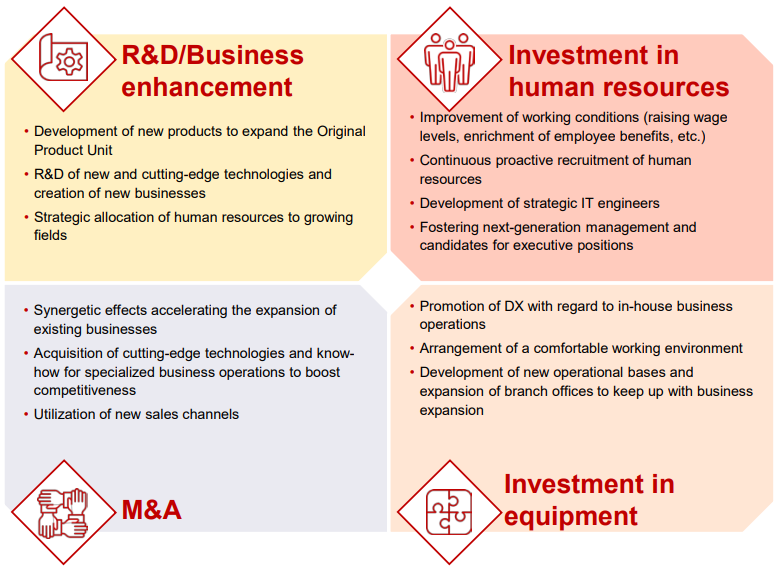

- In August 2024, they announced a new medium-term management plan. In “Vision for 2030,” they aim to develop a DIT brand that will be trusted and selected, and their medium/long-term growth model is to enhance “two-pronged business promotion” based on “further expansion of the business base,” which has supported their growth so far, and “provision of new value and services as elements for growth.” The theme of the new medium-term management plan (FY 6/2025 to FY 6/2027), which is the second step, is “to realize a growth path.” Under the new purpose “To enrich people's lives by supporting the digitalized society (change) that continues to "evolve" with the power of IT (responsiveness)” in addition to their “course of action,” “principles for business and management,” and “management policy,” they will promote the three strategies for the “business base,” “elements for growth,” and the “management base,” and pursue growth with company-wide efforts.

- In the fiscal year ended June 2024, sales and profit grew for the 14th consecutive fiscal year, while gross profit margin and operating income margin recovered from the fiscal year ended June 2023, in which their performance was affected by unprofitable projects. In the period of the new medium-term management plan, it is forecast that operating income margin will not reach the past peak at 12.4% in the fiscal year ended June 2022, due to the investment for growth, mainly the raise in salaries for strengthening human capital.

- While demand is strong, it is highly likely that the sales of the business solution business, the embedded solution business, and the product solution business will increase. We would like to pay attention to the progress of increase of transactions for undertaking projects and the growth of the product solution business, to check whether they will be able to further increase profit margin, which characterizes the company.

1. Company Overview

Digital Information Technologies Corporation is an independent information service company. Its sales are mostly from the undertaking of the development of business systems, embedded devices, etc. for clients mainly in the fields of finance, communications, etc. The company concentrates on the expansion of its products based on its original technologies, including "WebARGUS," a website security solution, and "xoBlos," an Excel work innovation platform. The company has a variety of characteristics, such as "multifaceted, diverse information technologies" and "organizational strategies of partial and total optimizations."

1-1 Corporate History

The late Norikazu Ichikawa (former Director and Chairperson) discovered a new world of computers and obtained programming qualifications while he was working at Nippon Telegraph and Telephone Public Corporation.

In 1996, he was appointed president of Toyo Computer System, Inc. as the successor to one of his acquaintances. He expanded its business area starting from business system development, and then computer sales business (current: system sales business), embedded product development validation business and operation support businesses turning Toyo Computer System Inc. into a multifaceted and diverse IT company.

In 2002, he established Toyo IT Holdings Corporation, which is the predecessor of current Digital Information Technologies Corporation, by separating several companies under the same group and establishing subsidiaries with 100% ownership. In 2006, he integrated four subsidiaries into one company and renamed it to the current company name.

In addition, in January 2011, he established DIT America, LLC in Kansas, U.S.A. Digital Information Technologies Corporation was listed on JASDAQ of Tokyo Stock Exchange (TSE) in June 2015, listed on the second section of TSE in May 2016 and listed on the first section of TSE in March 2017.

In July 2018, Mr. Satoshi Ichikawa, who used to be Representative Director and Senior Managing Officer, took up the office of Representative Director and President to rejuvenate the management structure under the business environment where change is accelerating and make a system to enable prompt decision-making.

In April 2022, the company was listed on the Prime Market of TSE, through the restructuring of the stock market.

1-2 Corporate Philosophy, etc.

|

Our logo is a collection of cubes with an infinite number of stairs. This collection is our company itself, and each cube represents each employee. The 6 facets of the cubes represent six values which all employees share and consider valuable. Our corporate identity represents these values in three tiers; clients, company and employees. |

(From the company's website)

(From the company's website)

The above diagram is the unfoldment of the cube. According to the president Ichikawa, it emphasizes “clients first; this is where it all starts." Furthermore, the logo represents “training employees” and “communication with clients and among employees.” These are important values to the company. Additionally, we implore employees to “improve its added values,” “have passion” and “have a sense of purpose.”

Employees are to uphold this company policy as their creed and follow these principles at all times.

In August 2024, they set a new “purpose,” which indicates the linkage between corporate ethos and the meanings of existence, when formulating a new medium-term management plan.

(Taken from the reference materials of Digital Information Technologies Corporation)

Recognizing the risk that the company will be left behind the times soon unless they take measures in response to changes in the world, they consider that it is not good to maintain the status quo and defined “responsiveness” as taking on challenges constantly, while positioning it as an important concept.

They believe that their company’s mission is to contribute to society by offering value tailored to changes in the times and achieving continuous growth and enrich the lives of various stakeholders.

1-3 Market environment

The outlines of the market environment and growth potential of each business unit of the company mentioned in Section 1-4 “Business Description” are as follows.

(1) Business Solution Unit

IT solutions that contribute to labor elimination and operational efficiency improvement, especially DX, are becoming increasingly important issues for companies, and according to a survey by Fuji Chimera Research Institute, Inc., active investment is being made in DX in every industry. The domestic DX market in 2030 is expected to expand to 5.2 trillion yen, 3.8 times the amount in fiscal year 2020.

(Source: Fuji Chimera Research Institute Inc. "The Future Prospects for Digital Transformation Market in 2022- Market Edition/Vendor Strategy Edition")

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

(2) Embedded Solution Unit

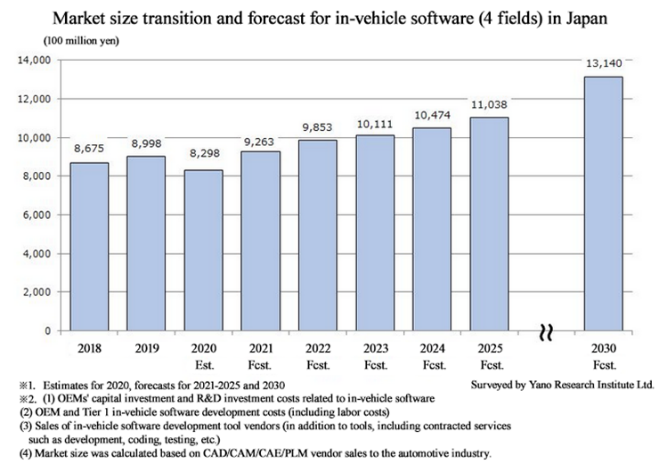

According to the Yano Research Institute Ltd., the market for domestic in-vehicle software continued to expand until 2019, but new car sales decreased in 2020 due to COVID-19. However, after that, capital investment and R&D investment, especially for CASE (Connected, Autonomous/Automated, Shared & Service, and Electric), are expected to continue to expand, and this growth is expected to continue at an upward trend until 2030. The in-vehicle software (in the four fields) market is predicted to reach 1,103.8 billion yen in 2025 and 1,314 billion yen in 2030.

(Source "In-Vehicle Software Market Research 2020," Yano Research Institute Ltd.)

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

(3) Original Product Unit

① WebARGUS

Due to the spread of COVID-19, corporate work styles have shifted from office work to remote working, and activities in the digital space have increased, resulting in the increase of security risks such as phishing attacks, malware infections, security breaches of corporate systems, and unauthorized ID use. International Data Corporation Japan, which specializes in IT research, estimates that the domestic security software market in 2021 was 370.3 billion yen (based on sales), up 17.2% from the previous fiscal year, and is expected to expand to 463.7 billion yen by 2026.

(Source "Latest Domestic Information Security Market Forecast, May 2022," IDC Japan K.K.)

*This material was provided by Digital Information Technologies Corporation and published by Investment Bridge Co., Ltd.

Additionally, as cybersecurity risks increase, damage caused by ransomware is rapidly rising.

Ransomware, a word coined by combining Ransom and Software, is malware that infects a computer with a virus and makes it unusable by locking it or encrypting its files and then demands a ransom in exchange for restoring the computer.

Every year, the Information-technology Promotion Agency, Japan (IPA) selects threat candidates from information security incidents that occurred in the previous year and are considered to have had a large impact on society and forms the “Top 10 Threats Selection Committee,” consisting of approximately 200 members including information security field researchers and business executives, which deliberates and votes on threat candidates, and then determines and announces the “Top 10 Information Security Threats.” In the “Top 10 Information Security Threats 2023,” based on the threats that occurred in 2022, “damage caused by ransomware” was ranked first in the organizational field for the third consecutive year from 2021. Thus, it is a major threat to society.

(From the website of the Information-technology Promotion Agency, Japan (IPA))

② xoBlos

RPA (Robotic Process Automation), which is a system for supporting the significant streamlining of business operations, is attracting attention.

RPA means the automation of processes using robots. By using technologies, such as artificial intelligence (AI) and machine learning, in which AI learns things through repetition, white-collar tasks, especially back-office ones, are handled. Just by registering procedures of human tasks on an operation screen, it is possible for them to handle the tasks using various apps, including software, browsers, and cloud.

It is expected to spread rapidly, as one mean for reforming the ways of working, which is an issue to be overcome by Japanese enterprises.

According to “Survey on the trend of utilization of RPA in Japan in 2024” conducted by MM Research Institute, Ltd. (as of March 2024), 15% of SMEs with annual sales of less than 5 billion yen adopted RPA. This percentage is up 3 points from the previous year. The ratio of such SMEs has been increasing, and 23% of enterprises are making preparations or thinking of adopting RPA. Accordingly, it is expected that “the growth will continue.”

Among medium-sized and leading enterprises with annual sales of 5 billion yen or over, 44% adopted RPA. This percentage is down 1 point from the previous survey, showing sluggish growth. Since it exceeded 40% in FY 2021, it has been flat. The ratio of enterprises that are thinking of adopting RPA was 18%, showing no significant change, but over half of medium-sized and leading enterprises are trying to actualize company-wide automation by utilizing all kinds of tools, including RPA. As part of such efforts, some enterprises that have adopted RPA are combining generative AI and RPA to automate a wider range of operations. The ratio of enterprises that started utilizing RPA on a full-scale basis is still as low as 10%, but 21% of enterprises have conducted tentative operation or partially started RPA, and 53% are making preparations or having discussions on RPA. Accordingly, there are significant expectations.

Like this, RPA has been adopted by all sorts of enterprises, including SMEs, and it is expected that the scope of application will expand when combined with generative AI.

1-4 Business Description

1. Segments

There are two segments: software development business and system sales business. The software development business consists of 3 business units: business solution unit, embedded solution unit and original product unit (renamed the product solution business in the first quarter of the fiscal year ending June 2025).

(1) Software Development Business

① Business Solution Unit

(Business system development unit)

The sales for this business unit is mostly from custom development for end-users and information systems companies which are clients’ subsidiaries in a wide variety of industries including finance, medicine/pharmacy, communications, distribution and transportation as well as for leading SI vendors.

Specifically, development for websites and key systems, front and back office operations, new system development and maintenance development with technologies developed in each area. The company has developed trustworthy relationships with leading companies in each area which enables them to secure stable orders.

(Operation support unit)

Main clients include communications carriers, total human service corporations and information system companies which are airlines subsidiaries.

This “business unit to support clients’ daily operations through IT” has stable revenue as it is an ongoing business in line with the business website domains of leading companies.

Specific business includes:

*Support desk operation for end-users who use various business systems.

*Build and maintain infrastructure (servers and networks).

*Efficient system operations in line with the latest technology trends.

② Embedded Solution Unit

(Embedded product development unit)

This business unit is trusted by leading manufacturers to directly develop custom software for in-vehicle devices, mobile devices, information home appliances and communication devices.

For in-vehicle devices, mobile devices and information home appliances, the unit develops custom software for overall systems including firmware, device business unit controls and applications.

It focuses on Auto-Drive related field with new technology, as well as infotainment for in-vehicle devices as the demand for this market is expected to grow. In addition, it undertakes software development for wireless base stations and communication module devices for communication devices.

(Embedded product verification unit)

This business unit verifies and makes suggestions to improve qualities and functions of products through its verification service.

It provides verification services domestically and internationally (North America, Asia, Europe, etc.) including laboratory tests using specialized devices to verify product operation and function, field tests to verify products in the actual environments, as well as overall system tests conducted as the final quality verification from the perspectives of the third party.

Some of the overseas field tests are designated to its subsidiary, DIT America, LLC, which provides fast service with verification of product usability from the perspective of local staff.

The range of products for verification includes in-vehicle devices, medical devices, communication devices and mobiles.

③ Product solution business (former Original Product Unit)

As a growth field, the business develops and sells products with unique technologies. It also handles products with high social needs through its alliances.

Currently, the company strongly focuses on the sales of two products, “WebARGUS,” a system security solution, which detects tampered website simultaneously as it occurs and instantly restores the original normal condition, “xoBlos,” an Excel work innovation platform, which features data decomposition and restoration as well as meeting various forms of data business processing needs, “DD-CONNECT,” electronic contract outsourcing service, etc.

There are other products such as “APMG (Anti Phishing Mail Gateway),” a solution to prevent damages from phishing and illegal use of brands by automatically adding electronic signatures on e-mails, and “Shield CMS” a CMS (content management system), which enables editing and updating websites easily.

The business title was renamed the “product solution business” in the first quarter of the fiscal year ending June 2025, in response to the growth of the original product business (increase of SI transactions linked to original products and services) and the addition of a subsidiary.

(2) System Sales Business

The company and its subsidiary, DIT Marketing Service Co., Ltd., sell “Rakuichi,” a business support mission-critical system, for small and medium enterprises, manufactured by Casio Computer Co., Ltd.

The sales area is started at Kanagawa first and expanded to Tokyo, Chiba, Gunma, Ehime, and Shizuoka successively. The Company provides substantial support for their users to increase the client retention rate. In addition, they set up a call center to attract and build a new client base. The number of sales for “Rakuichi” has been recorded to be the highest across all agencies for 18 consecutive years.

2. Main Strategic Products

(1) "WebARGUS," a server security solution

WebARGUS is a new security solution which detects tampered system instantaneously and immediately restores it to its original state. By detecting and restoring immediately when incident occurs, WebARGUS protects various corporate servers from damage caused by malicious and unknown cyber-attacks and simultaneously prevents the escalation of the damage from viruses spreading via the tampered server.

(Taken from the reference materials of Digital Information Technologies Corporation)

Increasing tampering of websites

According to the incident report published by “JPCERT Coordination Center (*)”, about 100 cases are reported every month, and websites including the ones of government agencies are constantly exposed to threats, whether the case is major or minor.

“JPCERT Coordination Center” (*): This center receives reports concerning computer security incidents including hacking via internet and service disturbance in Japan. It also supports measures, grasps how the problems are generated, analyzes the methods, investigates and advises on measures to prevent recurrences from a technical point of view.

The background of the development of "WebARGUS"

Under these circumstances, the company, which had already released a solution called “APMG” to prevent damage from phishing and illegal use of brand by automatically adding electronic signature in e-mails, started developing “WebARGUS,” based on a core security technology in the spring of 2013, after 2 years of research. Then in July 2014, it released “WebARGUS.”

The major characteristic and strength of the company is that it has a variety of rich IT related technologies and has a highly standardized core security technology. This is because its engineers have a mindset to embrace challenges and are not afraid to take risks. Thus, they are not satisfied with just developing custom products. This is strongly influenced by the company’s organization strategy represented by its corporate culture and in-house company system which will be explained later in this report.

The features and overview of the product

Instant detection and restoration for minimizing tampered system to nearly zero |

Provide protection from tampering by a fake identity posing as a registered member, internal attack and new methods which can be difficult to protect from. |

It detects with high accuracy and uses “electronic signature” technology which protects from even 1 bit of tampering. |

Protects from high level attacks aimed at applications and settings files. |

The CPU load (usage rate) on a server is less than 1% while it is monitoring on a regular mode. |

Equipped with preservation of evidence function which stores the tampered files as evidence. |

When a website has been tampered with, it can take an average of one month to restore. This is because the restoration process includes disabling the website, identifying the damaged files, strengthening protection, website restoration and re-enabling the website. For an e-commerce related website, the damage can be serious, including a drop-in sales, time and effort to announce the re-enabling of the website and the difficulties in re-attracting clients who left the website.

On the other hand, if “WebARGUS” is installed, because it instantly detects and restores websites when tampered with, the condition of a system can be maintained in the normal state. Thus, the website does not need to be disabled in a rush when the application detects a threat. Companies can concentrate on pursuing the cause and strengthening protection while its website is kept open to public.

Most of the detection software detects tampered website with a periodic monitoring on pre-configured, specified timing or intervals. With this method, there will be a time lag between when the website is tampered with and when it was detected, so it is inevitable for the website to be tampered. In addition, if the interval is shortened to reduce the time lag, there are other challenges such as increasing CPU load.

On the other hand, when some kind of event occurs (such as data deletion or addition excluding browsing), “WebARGUS” conducts real time scanning to detect the event.

The major feature of this product is that it is also equipped with an instant restoring function which enables restoration to the original state in less than 0.1 seconds after the detection (average time under the demo environment: 0.03 seconds per file). This instant restoration is its unique technology.

The annual license fee of “WebARGUS” is JPY528,000 (incl. tax) per OS with support.

This also includes free update modules for minor version updates.

Introduction and sales

When WebARGUS was released, the sales growth was rather slow because general understanding of website security was mainly about protection against hacking into a computer system and awareness about “tampering” was limited. However, the acknowledgment that “software for detection is needed as well as for protection” is growing rapidly due to the more frequent mentioning of the independent administrative agency, “IPA (Information Processing Association),” taking measures to prevent defacement. This agency is established to support the IT national strategy from a technical and personnel aspect perspective and is supervised by the Ministry of Economy, Trade and Industry.

In addition, the Ministry of Economy, Trade and Industry added "establishing mechanisms to respond to cybersecurity risks related to 'detection of attacks' and 'recovery'" as new important items in the revised points of the "Cybersecurity Management Guidelines" announced on November 16, 2017. Furthermore, there is a strong demand for stable operation of servers that support core business and business infrastructure in BCP (Business Continuity Planning) and BCRP (Business Continuity and Resiliency Planning) in recent years, and as a result, business inquiries about such mechanisms have increased even further.

Under these circumstances, the company has carried out promotion and marketing including organizing seminars for target users who recognize the necessity for a higher level of security, and participation in exhibitions.

It focuses on agency sales to strengthening marketability.

They have been actively involved in development collaborations with data centers and cloud service corporations.

Furthermore, the company is expected to expand its business overseas as well as product sales in Japan. The company is preparing to provide support for the tampering of systems across the globe.

Strengthening the feature of merchandise

Initially, WebARGUS was only available for Linux, but a Windows version was released in April 2016, and the enterprise edition, which was targeted at large-scale companies in September 2017. In February 2018, the company began offering a next-generation cloud WAF (WebARGUS Fortify), which dramatically strengthens the functionality of comprehensive web security. In particular, because of the release of the enterprise edition, which was targeted at large-scale companies, an increasing number of large companies (mainly listed companies) adopt WebARGUS.

The company also began offering “SaaS” in May 2018 to enhance user convenience and further popularize the products, and collaborated in full scale with With-Secure Corporation, a Finnish cyber security company, in June 2018. The company established a total security provision system using the complementary relationship between With-Secure’s “F-Secure RADAR,” a vulnerability scanning tool for IT system, and DIT’s “WebARGUS.”

It began collaboration with Secure Age, a cyber security company based in Singapore, on information leakage measures (encryption technology) in December 2019 and with SSH Communication Security, a cyber security company based in Finland, on access route optimization in January 2020. The company will continue to establish such alliances acively.

The company enhanced the varieties of the security solution products through various measures including the above alliance, and it is also considering expanding the range of applications of products in anticipation of needs for security measures for the IoT generation, including WebARGUS for embedded products.

For example, the spread and penetration of automatic driving have made the securement of safety an important mission for the companies providing automatic driving systems, and it is expected that the field where they work actively will grow further.

As for the embedded edition, the company started up an official project and is continuously carrying out discussions and technical investigation of concrete business plans for its commercialization. Although commercialization will take time, the company aims to realize it earlier through the accumulation of its steady business accomplishments.

◎ Expansion of the security domain: WebARGUS for Ransomware

A rapidly increasing number of people suffer from ransomware.

In this situation, the company released the Intel 64 version of "WebARGUS for Ransomware," in November 2022, followed by the ARM64 version in January 2023 which is equipped with the function to block the malicious programs to change or delete important data on a real-time basis and protect important data from various risks (such as cyberattacks, inside jobs, and encryption of data by ransomware), in addition to “WebARGUS,” which detects website falsification and repair the websites instantly.

As there are many command patterns of ransomware, “WebARGUS for Ransomware” can block about 30 command patterns. The company believes that there is no other product of its kind with such a wide range of control patterns. By combining it with the conventional "WebARGUS," it is possible to establish stronger server-side security.

First, the company announced to existing "WebARGUS" users, especially the current enterprise version users, that the data protection function has been added to the product, and the introduction of the product as a replacement for the existing "WebARGUS" has begun.

They plan to release a successor model in the fiscal year ending June 2025.

(From the company's website)

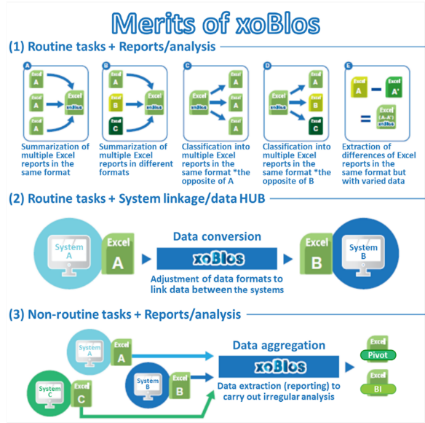

(2) “xoBlos,” an Excel® work innovation platform

Even in advanced corporations with a high level of IT, there are numerous Excel®-based tasks including manual operations in the office. Most non-routine tasks consist of repetitive manual operations such as processing Excel® reports by manually inputting data from paper reports, aggregating totals from multiple Excel® sheets and visualizing and analyzing CSV data extracted from packaged system.

The company's original-brand, "xoBlos," entirely automates these inefficient Excel®-based tasks and provides drastic improvements to workflow.

(From the company's website)

Background of development

Many corporations use Excel®, the major spreadsheet software, for generating quotations and invoices. However, in cases where they generate these documents in different formats for each client according to the clients’ requirements, manual input is mandatory because it is difficult to tally, sort and analyze in a systematic way.

For this, the company developed “xoBlos,” an Excel® work innovation platform, to automate tasks and significantly improve workflow efficiency.

Product feature, overview and an example of introduction

Enables management of different data formats for tallying and processing |

Enables increased efficiency with current Excel® spreadsheets. |

Process up to dozens of times faster than using macros. |

Can be embedded into other packaged products as an engine to output Excel® spreadsheets. |

xoBlos was released about ten years ago with the aim of drastically improving the efficiency of work using Excel®. It is now receiving considerably more attention due to its efficiency “to create a company-wide platform which covers everything from improving work efficiency to providing information useful in managerial decisions, while diverting workflow from areas currently using Excel®,” in addition to the convenience and relatively cheap introduction cost, because work-style reform trends centered on revising long work hours grow stronger. Indeed, the times have caught up with xoBlos and the company.

For further enhancement of product competitiveness, the company strengthened the automatic processing of Excel® work by providing a function linked with RPA* products and other systems in February 2018. This function can be operated on a PC client as well as a Web Server, leading to improvements in convenience for wider users.

The domestic RPA market is projected to double to 80,000 million yen in the next few years, and RPA-related services, which occupy 80% of the market, are expected to have a higher growth rate than RPA tool products, which occupy only 20%. Based on this, xoBlos, which can be considered as an RPA-related service, is anticipated to have high growth potential.

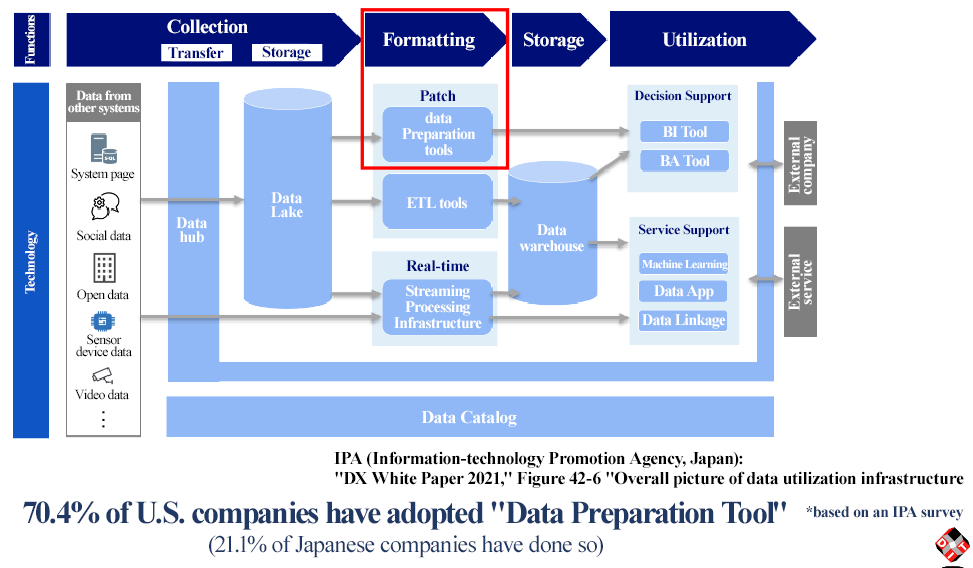

In addition, the company has recently clearly introduced the concept of an "Excel®-type data preparation tool.”

"Data Preparation Tool" is a tool that enables both IT department and business department users to easily and quickly confirm and format data. While about 70% of companies in the U.S. have adopted this tool, only 20% of companies in Japan have done so.

To effectively utilize collected data in the field, it is necessary to process and format data neatly for analysis and system integration. However, in reality, there are discrepancies in expression, erroneous conversions, missing values, and format differences scattered throughout the data, and 50-80% of the work is spent on correcting them. Some of these tasks have been streamlined through the use of macros and VBA, but since the settings depend on individuals, there is a possibility that ongoing work cannot be continued when there are personnel changes.

On the other hand, xoBlos, an "Excel®-type data preparation tool," can clean and format data that have different formats and styles automatically, allowing for output in the desired format. Additionally, since it is possible to design without code, it can prevent the drawbacks of personalization.

The company aims to promote the value of xoBlos as a "data preparation tool” in order to further increase the number of installations.

|

|

(Taken from the reference materials of Digital Information Technologies Corporation)

Toward further value improvement of the platform “xoBlos Plus-One Concept”

“xoBlos” is already highly rated as a work innovation platform that supports in bringing significant operational efficiency by fully automatizing the inefficient work based on Excel®, but the company started taking initiatives to make it a platform that offers more high-added value to clients to respond to the changing times and customer needs.

“xoBlos Plus-One Concept” is the result of the above initiatives.

The main concept of “xoBlos Plus-One Concept” is “improvement of data value.”

Companies carry out various activities, and they have different systems for the management of each activity.

For example, a company has a system for ERP, which drafts a plan for the appropriate distribution of resources including personnel, things, capital and information, and their effective utilization, at the top, and other systems for CRM for customer management, inventory management, management of acceptance & placement of orders, attendance data, personnel, and accounts.

A large amount of data is extracted from each system, and in recent years, there has been a skyrocketing need for enhancement of operational efficiency and visualization of a company’s own state by integrating and combining the data, instead of handling them individually.

However, realization of the above is not easy for a company as it requires a large number of work hours and involves huge costs.

In such a situation, clients who installed xoBlos, which processes data efficiently at high speed, achieved efficiency in reporting and are able to utilize the data of by integrating and combining the data easily at a reasonable cost.

Also, it is one of the major features of “xoBlos Plus-One Concept” that it allows the use of data in a desired format of each division and department, from the upstream management team to downstream departments of production, sales, general affairs and administration.

It plans to link various systems on xoBlos through tie-ups with manufacturers and propose a concrete image of “xoBlos Plus-One Concept” to its client companies.

Many companies, including the following case studies, have achieved significant improvements in operational efficiency.

*Summary based on Investment Bridge's excerpt from the company's material

*A sample use case: Shibukawa City Hall in Gunma Prefecture “Scheduled to install xoBlos aiming to improve the efficiency of administrative work”

(Background of installation of xoBlos)

With the progress of the information society, Shibukawa City Hall started actively using IT in 2007 to improve administrative services and enhance efficiency. In 2018, the City Hall formulated the “Shibukawa City Information Technology Promotion Basic Policy,” and in the following 2019, established the “Shibukawa City Information Technology Promotion Implementation Plan,” with the goal of improving administrative efficiency. Specifically, it is aiming to streamline administrative activities using AI, IoT and RPA.

(Reasons for choosing xoBlos)

Initially, the City Hall was considering installing RPA. However, after the vender interviewed the HR Department, it found that Microsoft Excel® is used in many work processes. Based on the result, the City Hall was advised that, for streamlining the work, tools such as xoBlos that is specialized for Excel® would be better for the staff, as they can be handled more easily and results can be obtained more easily, too, compared with other tools such as RPA that can handle general computer works.

Based on the advice, the City Hall compared the Excel® macro function, RPA, and xoBlos.

Macro function of Excel® has a disadvantage that maintenance cannot be performed if a staff member who has detailed knowledge on the function is transferred, and the City Hall actually experienced such an issue before.

Furthermore, although RPA can run applications and software other than Excel®, it requires a lot of man-hours and specialized skills to create automated programs and ensure stable operation.

Meanwhile, xoBlos is easy to use, even for people who are not familiar with IT and will also help the City Hall improve efficiency, as there are many work processes that require Excel® at the City Hall.

(How to use xoBlos)

The City Hall’s HR Department annually conducts a questionnaire called a staff survey, in which all 700 employees are asked about their request for transfer and their workplace. They used xoBlos for the calculation of this survey.

Before the installation of xoBlos, the employees filled in the designated survey form on a computer or by hand, and submitted it in a sealed envelope to the HR Department. The HR Department checked them one by one, transcribed the data of over 700 people onto a file using Excel®, and filed them as reference material for personnel transfer.

Because there were so many descriptive questions such as “Request of transfer (name of department)” and “Request for a workplace,” the data were huge. Furthermore, because sensitive information was contained in the answers, only 1 person at the HR Department was in charge of the transcription work. Due to confidentiality, the person needed to work at night or in the conference room.

According to the calculation by the City Hall, it took the person 78 man-hours to aggregate the data.

Upon using xoBlos, the City Hall, in collaboration with the vender, first revised the questionnaire survey format to make it compatible with xoBlos.

Next, they imported employees’ personal data such as email addresses and dates of birth to xoBlos, and set personal information of each employee in a questionnaire form in advance via xoBlos. The questionnaire was then sent by xoBlos to each employee by a batch email.

When the response was sent back by email, the files were saved in a specified folder and aggregated by xoBlos. The contents of the questionnaire were then automatically displayed in a list, which made it possible to check who has submitted and who has not at a glance.

Finally, as for printing and filing the questionnaire, using an extension application developed by the vendor, the City Hall was also able to print the data all at once from xoBlos and prepare for filing the report with one click.

As a result, the required time for finishing the task was reduced from 78 hours to 7 hours after the installation of xoBlos. The impact of efficiency improvement was extremely large.

(Comments on the use of xoBlos)

The use of xoBlos this time was experimental, and because most of the installation processes, such as formulating a new process, creating a new format, and configuring xoBlos, were conducted by the vendor, it was extremely easy for the City Hall to handle the set xoBlos.

Furthermore, because xoBlos is already installed and used on the existing client computers, there was no need for new capital investment associated with the installation.

The City Hall felt that it was very rare that a new IT initiative could be implemented so smoothly like this.

(Future policy and development)

Because the City Hall was able to confirm the effect of xoBlos in the demonstration experiment at the HR Department, they are willing to expand the use of xoBlos in other departments and other tasks in the future. Because there are so much work using Excel® in the City Hall, they believe that a significant efficiency improvement effect can be expected using xoBlos.

The City Hall also needs to visualize the current work process to streamline the work by xoBlos. In the process, they need to review work and identify which works are not necessary. In this regard, according to the City Hall, installation of xoBlos is a good opportunity not only for improving work efficiency, but also for raising awareness on work.

◎Customers and Sales Methods

Currently, the company promotes the value of xoBlos as a "data preparation tool" as previously mentioned to make xoBlos a more marketable product and is working on various sales initiatives.

*Target customer

Initially, the company was mainly making introductions to medium-sized companies, but as the need for efficiency in on-site work has increased, there have also been more introductions to large companies. Currently, about 70% of newly introduced companies are large companies. At present, the company made introductions to over 560 companies. In terms of new installations, the company is focusing not only on increasing the number of corporate customers, but also on introducing xoBlos to major companies where significant license increases can be expected internally.

In August 2020, it began using a subscription mode to expand sales stably and improve profitability.

Particularly, they are actively promoting the adoption of xoBlos, targeting mainly the industries of architecture, real estate, local government, and retail, which are facing challenges in DX while needing to improve efficiency and conduct work-style reform.

*OEM

The company is also focusing on OEM providing the powerful features of xoBlos as an option for project management tools and RPA products handled by other companies.

In December 2022, a new optional OEM service called "xoBlos for OBPM" was launched, which allows project management data accumulated in the integrated project management tool "OBPM Neo" developed and provided by System Integrator Co., Ltd. (TSE Standard, 3826) to be processed and formatted into Excel® reports.

"OBPM Neo" is a project management tool that can comprehensively manage project-related data, including costs and profits, progress, personnel, risks, obstacles, and issues. Although it has screens and functions that enable various analyses, customers faced the challenge of having to spend additional time aggregating and processing data and creating reports, especially for custom reports required for meetings. To address this issue, both companies conducted discussions and decided to offer "xoBlos for OBPM" as a new optional OEM service for OBPM Neo.

By using "xoBlos for OBPM," the manual collection and processing work can be automated, resulting in up to 90% reduction in work hours. Standard templates for frequently used reports (such as budget vs. actual analysis, quality analysis, and operational status) are prepared for OBPM Neo data, and additional templates will be added regularly.

Additionally, by using the xoBlos client, users can edit templates and create custom report templates that meet their specific information and formatting needs.

Moreover, several other projects, including RPA, are currently underway.

*Agencies

Regarding sales activities, the company is marketing products by utilizing a wide range of customers, bases, and sales capabilities of Dai-ko Electronic Communication Co., Ltd. (8023, TSE Standard), one of its main agencies, through joint seminars and other events. The company has built a network of about 30 agencies, including Dai-ko Electronic Communication.

The company plans to continue strengthening its agency network but will also aim to clarify its target audience for agency selection, focusing on agencies that have expertise in approaching local governments, experience with IT subsidy introduction, and have their own products that are easy to coordinate with xoBlos.

*Advertising and Promotion for Increased Awareness

In addition to conventional outbound sales, the company is also working to strengthen inbound sales, which increase customer inquiries while enhancing information dissemination.

As part of its information dissemination efforts, the company is conducting webinars and advertising and promotional activities, including the use of social media in conjunction with company’s other products such as WebARGUS and Shield CMS.

Regarding advertising and promotion, the planning and sales department, which is newly established in FY 6/23 under the Product Solutions Division, which is responsible for the company's products, including xoBlos, is working to optimize marketing and advertising activities.

(3) Electronic Contract Outsourcing Service, DD-CONNECT

In September 2020, the company signed a partnership agreement with NS Solutions Corporation to sell the electronic contract cloud CONTRACTHUB @absonne, which has had the largest share of sales in the electronic contract service market for six consecutive years.

In October 2020, the company started selling DD-CONNECT, an outsourcing system that handles a series of services from the introduction to operation and maintenance of CONTRACTHUB on behalf of customers.

(Overview of CONTRACTHUB and DD-CONNECT)

CONTRACTHUB has been deployed mainly by large companies in various industries since the service started in 2013 and is now a pioneer of electronic contract services used by more than 130,000 users.

Since it can be flexibly linked with ERP and sales systems, it can improve the productivity of various operations related to contracts, and both the vendor and the customer can review the electronic contract history, including its conclusion and revisions, on the cloud. Thus, it can improve the efficiency of contract management tasks.

DIT's DD-CONNECT is a series of services that offer testing support related to the introduction of CONTRACTHUB, operation support, and maintenance support. Since DD-CONNECT provides the necessary services collectively, it is easier to introduce than an electronic contract system software package alone. Therefore DD-CONNECT is expected to contribute to further cost reduction and labor-saving.

By regularly sharing human resources and knowledge with NS Solutions, the company provides a wide range of higher value-added electronic contract services, such as measures to improve the efficiency of domestic companies' contract operations and the promotion of going paperless and Hanko (Japanese stamp)-less.

(Taken from the reference materials of Digital Information Technologies Corporation)

(Strengths and Features)

"DD-CONNECT" can be easily and seamlessly linked with other systems for order receipt/placement and billing. This feature sets it apart from other electronic contract systems and is one of its forte.

(Successful Implementations)

Currently, the product is mainly used by major housing equipment manufacturers, construction, and real estate-related companies. The company's main target industries and customers include those with high potential for DX and digitalization, including local governments.

As the electronic contract system is suitable for construction contracts, the company has steadily met the needs for complying with the electronic bookkeeping law.

The company offers its customers added value in terms of support for the installation, operation and management of its cloud system, CONTRACTHUB, and this is highly valued by its customers.

Furthermore, product development, including functional improvements, is carried out by NS Solutions, which means that the company has a significant advantage as it requires little investment.

Initially, the company and its partner, Daiko Electronics Communication Inc. (TSE Standard, 8023), each conducted their own sales activities, but in order to better utilize each other's strengths, the company clarified the division of roles: Daiko Electronics Communication is responsible for sales, while the company is responsible for installation and maintenance operations, which require technical support.

(4) Highly Secure Website Creation Platform, “shield cms”

In September 2021, the company released shield cms, a website creation platform equipped with a cyber security function that instantly detects website tampering and restores the website in less than 0.1 seconds.

The company aims to introduce it to 100 companies in three years.

*CMS: Contents Management System. It is a broad term for a system that integrates and systematically manages digital content such as text and images that make up web content and performs necessary processing such as distribution.

(Background of the release)

Many website creation platforms are based on open-source models that can be used free of charge or their modified ones. Although they are easy to use and convenient, they are easily targeted by cyber-attacks because their mechanism is well known. Moreover, as cyber-attacks are becoming more diverse and complex, the needs for products that can automatically prevent them are increasing.

(The product's features)

Shield cms incorporates the company's security product WebARGUS as the standard equipment. It detects tampering simultaneously as it occurs and instantly restores the original condition. It also alerts the system administrator the occurrence of website tampering. The time from tampering to the recovery/alert notification is less than 0.1 seconds, and the actual damage can be reduced to zero.

In addition, as a CMS function, even beginners can easily create a website with the "Edit as you exactly see it" function that combines and arranges various design parts on the screen, and you can also add HTML input, CSS, and JavaScript so that you can create your own original design.

1-5 Characteristics and strengths

(1) Multifaceted and diverse IT company

The company has expanded its business areas by flexibly responding to the progress of information technology, from business system development business to computer sales (current: system sales), embedded product development and verification business, and operational support business as well as working on its original products based on its technical strengths which have been developed during the process of business expansion.

One of the major characteristics of the company is that it is a multifaceted and diverse IT company and has a wide range of business activities and provides own-brand product with originality.

In order to improve the strengths and characteristics of the company, it is essential to acquire new technology and improve the on-site capabilities. The company has been providing training and education to the employees; however, it is establishing a stronger education system, as it is important to have the latest knowledge ahead of customers in times of rapid changes.

From the perspective of diversity, the company is also working to create an environment in which female employees can easily demonstrate their abilities.

It is making efforts to provide not only on the job training, but also training on managerial skills to promote female employees from mid-level positions to managerial positions including executive positions.

(2) A wide range of customer base

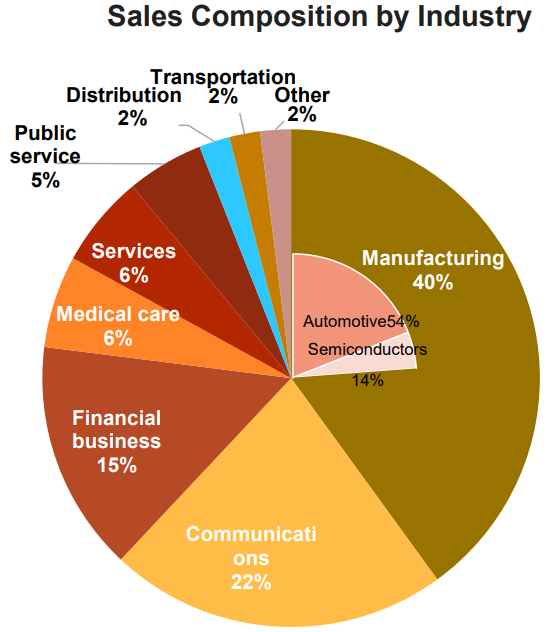

There are about 2,800 client companies. Main clients for the software development business are listed companies and their affiliates, while main clients for the system sales business are small and medium-sized enterprises. Since the business categories of clients are diverse as shown below and stable long-term business is mainly operated, its business base is stable.

The ratio of sales of end users, including information system subsidiaries, is about 80%.

Another characteristic of the company is that the sales in the in-vehicle system domain, which is expected to grow significantly thanks to autonomous driving, EVs, etc., in the manufacturing field account for over 50%.

(From the company's FY6/24 financial results presentation)

(3) Organizational strategies of partial and total optimization

Another significant characteristic of the company is that it has an organizational strategy with two opposite factors, partial and total optimization in a well-balanced manner.

For partial optimization, the company has specialized companies under an in-house company system which aim to be the best in each field. It also provides training and produces entrepreneurs with innovative spirits.

For total optimization, the company pursues synergy between companies while respecting independence of each in-house company; through scrap and build done by the headquarters, collaboration between each in-house company and development of new business areas.

(Overview of each in-house company)

Main business unit | Company name | Overview |

Business system development unit | Business Solution Company | This company develops a proposal style SI business to provide solutions for clients. Especially in the fields of finance, communications and distribution, this company undertakes design and development of a wide range of software such as general-purpose systems, website systems, mission-critical systems and information systems for leading companies in each industry. It also provides a new business area, ASP business for "Insurance Pharmacy Integrated Management System (Phant's)." |

e-business Services Company | This company provides website system architecture and maintenance for e-commerce websites and service websites for clients mainly for finance and major retail industries for many years. It provides a service to suit clients’ requirements with technologies which it has developed through experience. | |

Operation support unit | Support Business Company | This company’s engineers have a wide range of knowledge enabling it to provide one stop optimal IT environment (service) to suit clients' requirements including support for introducing systems, infrastructure-building, network operation management and middleware development. |

Embedded product development unit | Embedded Product Solution Company | This company specializes in control system development focused on embedded systems for in-vehicle devices, communication devices, industrial equipment and digital home appliances. It has many engineers with highly specialized skills for embedded system development. Because of the physical conditions of hardware, embedded systems development can be very restrictive, and requires a meticulous level of problem-solving that differs from general application development. |

Embedded product verification unit | Quality Engineering Company | This company has a wide range of software validation and verification businesses from in-vehicle devices such as car navigation systems to medical devices, communication infrastructure and mobile terminals. It gives priority to improving the quality of products and provides total service from planning, designing, implementing, operating, and analyzing tests to consulting. It has collaborated with DIT America, LLC, a local subsidiary in the U.S.A. since 2011. It also provides verification services overseas. |

(Combination) | Western Japan Company | Activities are based west of Nagoya, with a focus on Osaka. DIT takes part in three businesses: business system development and operational support, mobile and web application development, and embedded systems development (in-vehicle devices and security-related matters). Recently, the company is aiming to expand into the IoT and Web service businesses, taking advantage of multi-skilling. |

Ehime Company | This company is located in Ehime and provides a high added-value one stop service for product development to meet the regionally specific requirements for a variety of industries and businesses as well as sales of software and system devices, operation and system support, and contributes to local revitalization. It also employs engineers locally at a multi-purpose IT development center to tackle the engineer shortage in the other companies, which enables nearshore development. |

(4) Development and sales of original own-brand products

As mentioned above, the company has developed a variety of original own-brand products like “xoBlos” and “WebARGUS” with its unique technologies cultivated over many years.

The company has a rich lineup, including the electronic contract outsourcing service “DD-CONNECT” based on partnership contracts. The company will nurture it as a pillar of future profits.

2. Fiscal Year ended June 2024 Earnings Results

2-1 Consolidated business results

| FY 6/23 | Ratio to sales | FY 6/24 | Ratio to sales | YoY | Ratio to forecast |

Sales | 18,149 | 100.0% | 19,888 | 100.0% | +9.6% | +2.0% |

Gross Profit | 4,318 | 23.8% | 4,945 | 24.9% | +14.5% | - |

SG&A | 2,279 | 12.6% | 2,520 | 12.7% | +10.6% | - |

Operating Income | 2,039 | 11.2% | 2,424 | 12.2% | +18.9% | -3.0% |

Ordinary Income | 2,059 | 11.3% | 2,409 | 12.1% | +17.0% | -3.6% |

Net Income | 1,447 | 8.0% | 1,686 | 8.5% | +16.5% | -2.7% |

*Unit: million yen. Net income is quarterly net income attributable to shareholders of the parent company. Hereinafter the same will apply.

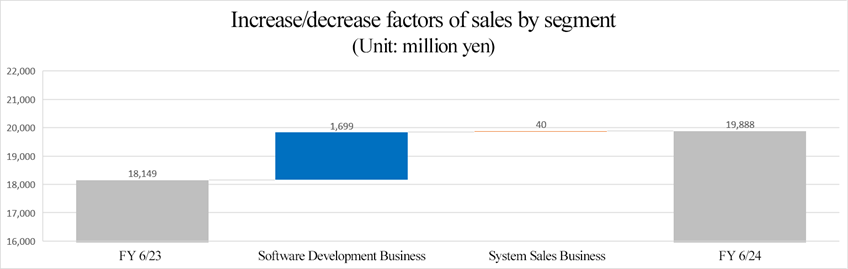

Sales and profit grew for the 14th consecutive fiscal year, hitting a record high.

Sales increased 9.6% year on year to 19,888 million yen. The software development business, mainly the embedded solution business, performed well, and the original product business grew considerably.

Operating income rose 18.9% year on year to 2,424 million yen. Due to the sales growth, gross profit rose 14.5% year on year, and gross profit margin increased 1.1% year on year, thanks to the rebound from the unprofitable transactions, which emerged in the previous fiscal year. The augmentation of costs for improving the treatment of employees and expanding their business scale (expenses for enlarging each business establishments and commissions for M&A for two companies) was offset by the sales growth, leading to a double-digit growth of profit. Sales and profits at each stage reached new record highs.

2-2 Trends by segment

| FY 6/23 | Composition ratio | FY 6/24 | Composition ratio | YoY | Ratio to forecast |

Software Development Business | 17,460 | 96.2% | 19,159 | 96.3% | +9.7% | +1.5% |

System Sales Business | 688 | 3.8% | 728 | 3.7% | +5.8% | +4.1% |

Total sales | 18,149 | 100.0% | 19,888 | 100.0% | +9.6% | +2.0% |

Software Development Business | 1,954 | 11.2% | 2,366 | 12.4% | +21.1% | - |

System Sales Business | 84 | 12.3% | 58 | 8.0% | -31.2% | - |

Adjustment | 0 | 0.0% | - | - | - | - |

Total operating income | 2,039 | 11.2% | 2,424 | 12.2% | +18.9% | - |

*Unit: million yen. Sales mean sales to external clients. The composition ratio of operating income means the ratio of operating income to sales.

*Created by Investment Bridge Co., Ltd. Based on disclosed materials.

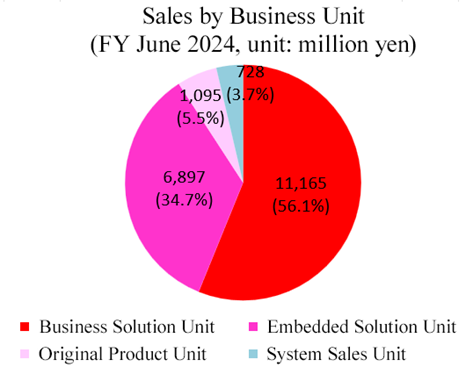

(Sales trends by business unit)

| FY 6/23 | Composition ratio | FY 6/24 | Composition ratio | YoY | Ratio to forecast |

Software Development Business | 17,460 | 96.2% | 19,159 | 96.3% | +9.7% | +1.9% |

Business Solution Unit | 10,350 | 57.0% | 11,165 | 56.1% | +7.9% | +1.5% |

Business System | 5,724 | 31.5% | 6,243 | 31.4% | +9.1% | - |

Operation Support | 4,625 | 25.5% | 4,922 | 24.7% | +6.4% | - |

Embedded Solution Unit | 6,253 | 34.5% | 6,897 | 34.7% | +10.3% | +1.4% |

Embedded Product Development | 4,592 | 25.3% | 5,098 | 25.6% | +11.0% | - |

Embedded Product Verification | 1,661 | 9.2% | 1,799 | 9.0% | +8.3% | - |

Original Product Unit | 856 | 4.7% | 1,095 | 5.5% | +27.9% | +9.5% |

System Sales Unit | 688 | 3.8% | 728 | 3.7% | +5.8% | +4.1% |

Total sales | 18,149 | 100.0% | 19,888 | 100.0% | +9.6% | +2.0% |

*Unit: million yen. Composition ratio to total net sales.

◎Software Development Business

Both sales and profit increased.

*Business solution unit

Both sales and profit increased due to strong demand and the rebound from losses from unprofitable projects in the previous fiscal year.

In business operation system development, the financial sector is on a recovery track. Public and telecommunications projects did well, but pharmaceutical and ERP projects decreased. Although it took time for engineer rotation after the conclusion of large-scale unprofitable projects, the company is ready to make a comeback in the fiscal year ending June 2025.

In the operation support business, sales and profit both reached record highs due to the expansion of the business domain and synergy effects with the subsidiary Simplism.

*Embedded solution unit

As a result of the strategic shift to in-vehicle systems, the company continues to perform well, resulting in increased sales and profits. The trends of EVs and autonomous driving have led to strong investment appetite, particularly among Japan's major vehicle manufacturers. The proportion of high-priced projects continues to increase, resulting in improvement in profitability.

In embedded system development business, sales and profit continue to increase. While the semiconductor-related market continues to be on a plateau, demand for in-vehicle systems, which are the mainstay of the company, remains strong, especially from vehicle manufacturers. Digitalization has also led to strong performance in IoT projects for home appliances.

The embedded system verification business also maintained steady growth in sales and profit. Verification projects for in-vehicle systems remain healthy.

*Original Product Unit

In addition to the increase in license sales, the contribution of Jungle, Inc., which became a subsidiary, led to a significant increase in both sales and profit. Even excluding the contribution of Jungle, sales increased by approximately 13%.

“WebARGUS”

Sales and profit both increased, thanks to an increase in license sales.

The number of business inquiries about the anti-ransomware version is healthy.

“xoBlos”

In addition to horizontal expansion and cross-selling to existing customers, the company made progress in receiving orders for projects from prospective customers that had increased since the previous fiscal year. Both sales and profit increased significantly.

“Other”

The electronic contract service “DD-CONNECT” saw a significant increase in both sales and profit thanks to its successful rollout that included comprehensive development of the service from launch to the peripheral development stage. DD-CONNECT moved from the introduction phase to the growth phase and began to contribute to business earnings.This type of cross-segment cooperation, customer support, and project creation are increasing, and synergies between businesses are expanding.

◎System Sales Business

Increase in sales and decrease in profit

The rush to buy due to the revision of the Electronic Bookkeeping Act and the introduction of a new invoice system has subsided, but the strengthening of the sales system has been successful, resulting in increased revenue. Still, profit declined slightly due to the increase of sales personnel to acquire new customers.

2-3 Financial condition and cash flow

◎Main BS

| End of June 2023 | End of June 2024 | Increase/ Decrease |

| End of June 2023 | End of June 2024 | Increase/ Decrease |

Current assets | 7,378 | 8,536 | +1,158 | Current liabilities | 1,980 | 2,673 | +693 |

Cash and deposits | 4,185 | 4,615 | +430 | Accounts payable | 615 | 733 | +118 |

Trade receivables | 2,953 | 3,579 | +626 | Fixed liabilities | 190 | 485 | +295 |

Noncurrent assets | 798 | 1,680 | +882 | Total labilities | 2,170 | 3,158 | +988 |

Tangible fixed assets | 138 | 207 | +68 | Net assets | 6,006 | 7,058 | +1,051 |

Intangible fixed assets | 172 | 862 | +690 | Retained earnings | 5,742 | 6,783 | +1,041 |

Investments and other assets | 487 | 610 | +123 | Total liabilities, net assets | 8,176 | 10,217 | +2,040 |

Total assets | 8,176 | 10,217 | +2,040 | Total interest-bearing debt | - | 243 | +243 |

*Unit: Million yen. Trade receivables include contract asset.

Both assets and liabilities increased due to M&A of two companies. Total assets increased 2,040 million yen from the end of the previous fiscal year to 10,217 million yen, mainly due to increases in accounts receivable and intangible fixed assets. Total liabilities augmented 988 million yen from the end of the previous fiscal year to 3,158 million yen, mainly due to an increase in interest-bearing debt. Net assets grew 1,051 million yen from the end of the previous fiscal year to 7,058 million yen due to an increase in retained earnings.

As a result, the equity ratio decreased 5.4 percentage points from the end of the previous period to 68.1%.

◎Cash Flow

| FY 6/23 | FY 6/24 | Increase/Decrease |

Operating Cash Flow | 1,427 | 1,741 | +314 |

Investing Cash Flow | -66 | -595 | -528 |

Free Cash Flow | 1,360 | 1,146 | -214 |

Financing Cash Flow | -1,031 | -804 | +226 |

Cash, Equivalents | 4,174 | 4,506 | +332 |

*Unit: Million yen

The cash inflow from operating activities grew due to the increase in net income before taxes and other adjustments. The cash outflow from investing activities augmented and free cash flow shrank, due to the expenditure for acquiring the shares of the subsidiary resulting in a change in the scope of consolidation.

Cash position increased.

(4) Topics

◎ Share buybacks

On August 9, 2024, the company announced a share buyback of up to 600 million yen in order to strengthen and expand shareholder returns.

The total number of shares to be acquired is up to 240,000, which is 1.61% of the total number of outstanding shares excluding treasury shares.

The total acquisition price is up to 600 million yen.

The buyback period is from August 13, 2024 to December 23, 2024.

3. Fiscal Year ending June 2025 Earnings Forecasts

3-1 Full-year earnings forecast

| FY 6/24 | Ratio to sales | FY 6/25 Est | Ratio to sales | YoY |

Sales | 19,888 | 100.0% | 22,000 | 100.0% | +10.6% |

Operating Income | 2,424 | 12.2% | 2,600 | 11.8% | +7.2% |

Ordinary Income | 2,409 | 12.1% | 2,600 | 11.8% | +7.9% |

Net Income | 1,686 | 8.5% | 1,804 | 8.2% | +7.0% |

*Unit: Million yen. The estimated values are from the company.

Sales and profit are expected to rise for the 15th consecutive fiscal year.

It is projected that sales will grow 10.6% year on year to 22 billion yen and operating income will rise 7.2% year on year to 2.6 billion yen. The company expects an increase in sales and profits for the 15th consecutive fiscal year with an increase in sales and profits across all businesses.

Operating income margin is projected to decline 0.4 points from the previous fiscal year to 11.8%. Profit margin will decline in the short term due to the investment in R&D, the strengthening of human capital, etc. for medium/long-term growth, but there is no concern over the growth potential of their business.

In the fiscal year ending June 2025, they will revise the target payout ratio from “40% or higher” to “50% or higher.” For the fiscal year ending June 2025, they plan to pay a dividend of 60.00 yen/share, up 14.00 yen/share from the previous fiscal year. The expected payout ratio is 50.1%.

3-2 Trend of each business unit.

(Trend of sales)

| FY 6/24 | Composition ratio | FY 6/25 Est | Composition ratio | YoY |

Software Development Business | 19,159 | 96.3% | 21,270 | 96.7% | +11.0% |

Business Solution Unit | 11,165 | 56.1% | 12,000 | 54.5% | +7.5% |

Embedded Solution Unit | 6,897 | 34.7% | 7,500 | 34.1% | +8.7% |

Product Solution Business | 1,095 | 5.5% | 1,770 | 8.0% | +61.6% |

System Sales Unit | 728 | 3.7% | 730 | 3.3% | +0.3% |

Total | 19,888 | 100.0% | 22,000 | 100.0% | +10.6% |

*Unit: Million yen

(1) Business Solution Unit

The company is ready to respond to strong demand, aiming for a new record high through further growth in the operation support business, in addition to the contribution from the performance of System Products, which has become a subsidiary.

■Business System Development

In addition to investing resources in financial services, where the company has a wealth of experience and a proven track record, and in the rapidly growing field of low-code development, the company will utilize generative AI and other technologies to provide highly productive, high-quality systems and increase added value.

■Operational Support

In addition to seeking to expand their market share among existing customers, the company will build a team skilled in cloud computing technology and Salesforce, and create a system that can meet demand regardless of industry.

(2) Embedded Solution Unit

The company expects to increase sales and profit in response to the ever-increasing demand. With a focus on in-vehicle systems, which is a growth driver, the company aims to increase its share of transactions by providing a set of development and verification services to its key customers, automobile manufacturers and major automotive parts manufacturers.

■Embedded system development

The company will focus resources on growing areas of advanced technology, such as in-vehicle CDC (Cockpit Domain Controller) and ADAS (Advanced Driver Assistance System). The company will also focus on server-side development by leveraging its knowledge of connected cars, which is one of its strengths. In the rapidly growing IoT field, the company will also work on next-generation IoT development, utilizing AI with a focus on home appliances.

■Embedded system verification

In addition to expanding the business by using standardized methods to improve quality, the company will fully automate verification operations using generative AI and RPA.

(3) Product Solution BusinessIn addition to the growth of the existing original product lineup, the company expects a substantial increase in both sales and profit with the full contribution of the newly acquired subsidiary, Jungle Inc.

This fiscal year, the company has changed its accounting method for the SI development portion of its business, which is linked to its original products and services (*).

* Change in accounting method Along with the change in business name (from the original products business to the product solutions business), the company also changed the method of recording sales.

Until the fiscal year ended June 2024, even SI development linked to original products and services, such as development for the electronic contract service “DD-CONNECT,” was recorded in the business solutions business (business system development), but from the fiscal year ending June 2025, it will be recorded in the product solutions business in line with the actual business situation.

* “WebARGUS”

The company aims to increase subscription license sales by acquiring new medium-sized enterprises.

Regarding the anti-ransomware version, a successor product with greatly enhanced anti-tampering functions is scheduled to be released in the near future.

* “xoBlos”

The company aims to increase the number of companies adopting the system, primarily large companies, and to expand sales of subscription licenses, while strengthening its approach to local governments.

* Other new productsThe electronic contract service “DD-CONNECT” aims to win large projects and expand recurring revenue by offering benefits such as reduced stamp costs and progress toward a paperless society, mainly in the construction and real estate industries where paper-based contracts are still the norm and digital transformation has not progressed.

By applying Jungle’s know-how, which will make a full contribution from this fiscal year, the company aims to exert synergies with existing products.

(4) System Sales Business

Although the rush for new systems such as the Electronic Bookkeeping Act and the invoice system will subside, the company expects sales and profit to remain unchanged from the previous fiscal year by leveraging its strengthened sales structure.

The company will continue to strengthen proposals to small and medium-sized enterprises that were slow to adopt new systems, and will strive to secure profits by providing after-sales services to companies that have already adopted the systems.

4. New Medium-term Management Plan

In August 2024, a new medium-term management plan was announced.

[4-1 Review of the previous medium-term management plan]

The average annual growth rate in the period of the previous medium-term management plan (from FY 6/2022 to FY 6/2024) was 11.2% for sales and 12.1% for operating income, achieving double-digit growth in both, while sales and profit increased for the 14th consecutive fiscal year. While they aimed to achieve "19 billion yen in sales and 2.5 billion yen in operating income,” sales were 19.8 billion yen, achieving the target, and operating income was 2.42 billion yen, slightly falling below the target, due to the emergence of unprofitable projects in FY 6/2023 and increased costs from aggressive investment in M&A.

Progress on the basic strategy was as follows.

Core business: strengthening on-site capabilities | ◎Achievements “Strengthened the project review function, completed verification methodology,” “Acquired skills and built up a track record in low-code development, agile development, etc.,” “Steady growth in all four segments, with sales and profit increasing for 14 consecutive fiscal years,” “Established Hakodate branch office,” etc.

◎Challenges Unprofitable projects have arisen and strengthening on-site capabilities needs to be addressed as an ongoing challenge. The shift to the type of proposing services to increase the value of each client’s business is progressing, but it needs to be strengthened in the future. |

Product Business: Strengthening Product Competitiveness | ◎Achievements “Released the anti-ransomware version of WebARGUS,” “Contribution to sales and profit through full-scale promotion of DD-CONNECT,” “Expanded e-contract services specializing in the construction and financial industries,” “Organized an in-house contest for new products and new business ideas,” etc.

◎ Challenges Although security products targeted large-scale customers, the increase of licenses remained modest, and a mental health business in collaboration with another company aiming for revenue sharing was withdrawn. Product development is ongoing, including a service platform scheme involving the automatic generation of control sheets in xoBlos and the launch of a co-creation business between the company's products and customers. |

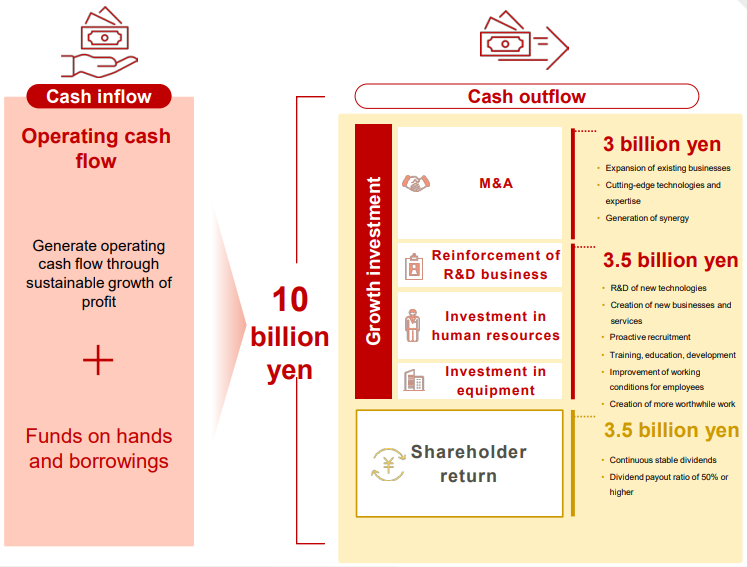

Strengthening the management base: creating a structure and an environment | ◎Achievements “Promoted telework during the COVID-19 pandemic, and work style reforms advanced,” “Increased use of paid leave through the establishment of paid leave promotion days (from 62.4% in FY 6/2021 to 74.5% in FY 6/2024),” “Continued active recruitment of both new graduates and mid-career workers, and the number of employees increased,” “Revision of qualification acquisition incentives has increased the number of qualifications acquired,” etc.