Bridge Report:(3778)Sakura internet Fiscal Year ended March 2024

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Tokyo Tatemono Umeda Building 11F Umeda, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥5,660 | 35,708,858 shares | ¥202,112 million | 7.5% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥4.00 | 0.1% | ¥35.01 | 161.7 x | ¥255.82 | 22.1 x |

*The share price is the closing price on May 20.

*The number of shares issued is obtained by subtracting the number of treasury shares and shares held by the Stock Compensation Trust (J-ESOP) from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Act. | 20,622 | 1,093 | 965 | 666 | 18.29 | 3.50 |

March 2024 Act. | 21,826 | 884 | 764 | 651 | 18.26 | 3.50 |

March 2025 Est. | 28,000 | 2,000 | 1,960 | 1,250 | 35.01 | 4.00 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for the Fiscal Year ended March 2024 , along with estimates for the Fiscal Year ending March 2025.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2024 Earnings Results

3. Fiscal Year ending March 2025 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2024, sales increased 5.8% year on year, while operating income decreased 19.1% year on year. Strong sales performance in cloud infrastructure services offset the decline in the sales of physical base services, resulting in sales growth. The launch of GPU cloud services and the company becoming the first domestic enterprise to receive government cloud certification were seen as opportunities for discontinuous growth, prompting proactive investment in talent acquisition. However, external factors such as the continued rise in crude oil price and the depreciation of the yen since last year led to increased costs, causing sales and all kinds of profits to fall short of the company’s forecasts. The company paid a year-end dividend of 3.50 yen/share, like in the previous fiscal year.

- For the fiscal year ending March 2025, the company anticipates a 28.3% increase in sales and a 126.1% increase in operating income from the previous fiscal year, aiming for further growth in cloud services. The GPU cloud service for generative AI is expected to generate 5 billion yen in sales from the operation of all 2,000 units, which are part of the first phase of GPU investment starting in June. In terms of profit, the company will continue proactive recruitment of engineers, sales, and marketing personnel for medium- to long-term growth, resulting in increased investment in human resources. Additionally, the full-scale launch of GPU cloud services will lead to higher depreciation and electricity costs. The profits from the GPU cloud service are expected to cover these investment costs, leading to a significant increase in profits, hitting a record high. They plan to pay a year-end dividend of 4.00 yen per share.

- The company became the first domestic enterprise to receive government cloud certification and started providing cloud services equipped with NVIDIA GPUs for generative AI. The fiscal year ended March 2024 was a very active year for the company. Further expansion of sales from the fiscal year ending March 2025 is expected to boost profit margin. Rapid sales growth is projected for both the GPU cloud service and government cloud until the fiscal year ending March 2027. High sales growth with higher profit margin is expected over the next few years, and this is likely to be a driver of the stock price increase. By practicing human capital management, the company can smoothly carry out the increasingly challenging task of talent acquisition.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. It began offering GPU cloud services in January 2024. It is also the only government cloud-certified company in Japan, although there are some conditions. By owing its own infrastructure, Sakura internet pursues higher profitability and increases utilization rates and reduce fixed cost risk.

1-1 Content Business

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), physical base services, domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year ended March 2024 is cloud services are 58.5% (of which cloud infrastructure and cloud application for 40.4%, and 18.1% respectively), physical base services are 16.4%, and other services are 25.0%.

2. Fiscal Year ended March 2024 Earnings Results

2-1 Consolidated Results

| FY 3/23 | Ratio to sales | FY 3/24 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 20,622 | 100.0% | 21,826 | 100.0% | +5.8% | 22,800 | -4.3% |

Gross Profit | 5,367 | 26.0% | 5,735 | 26.3% | +6.9% | - | - |

SG&A | 4,274 | 20.7% | 4,851 | 22.2% | +13.5% | - | - |

Operating Income | 1,093 | 5.3% | 884 | 4.1% | -19.1% | 1,450 | -39.0% |

Ordinary Income | 965 | 4.7% | 764 | 3.5% | -20.9% | 1,300 | -41.2% |

Net Profit attributed to Parent Company Shareholders | 666 | 3.2% | 651 | 3.0% | -2.2% | 850 | -23.3% |

*Unit: million yen.

Sales Increased 5.8%, Operating Income Decreased 19.1%, and Steady Growth in Cloud Services was Observed.

Sales increased 5.8% year-on-year to 218.2 billion yen. The strong sales performance of cloud infrastructure services, which grew by 10.4%, offset the decline in the sales of physical base services, resulting in an overall sales growth.

Operating income decreased 19.1% to 8.8 billion yen. The launch of GPU cloud services and the company becoming the first domestic enterprise to receive government cloud certification were seen as opportunities for discontinuous growth, prompting proactive investment in talent acquisition. These investments led to a decrease in profit by 640 million yen due to increased spending on human resources and by 140 million yen due to the renovation of Ishikari Data Center facilities, etc. To ensure further medium- to long-term growth of cloud services, the company strengthened the recruitment of engineers, sales, and marketing personnel and invested actively in service equipment. Advertising expenses also increased. Additionally, external factors such as the continued rise in crude oil price and the depreciation of the yen since last year increased costs (including electricity and domain acquisition costs). Sales and all kinds of profits fell short of the company's forecast. The company paid a year-end dividend of 3.50 yen/share, like in the previous fiscal year.

Status of Key Initiatives

By focusing on cloud services, the company has progressed in laying the groundwork for their future growth phase.

Priority measures | Actions and Results |

Growth Strategies Strengthening of cloud services, and co-creation and support for DX for customers | Cloud Services The company became the first domestic enterprise to receive government cloud certification (conditionally, with the assumption that all functional requirements will be met by the end of FY 2025). The company focuses on development and securing talent to meet these requirements. GPU Cloud Services The company launched the first phase of exclusive physical GPU cloud services with the release of the high-performance "Koukaryoku PHY" (in January). Future plans include expanding the service lineup to accommodate various budget ranges and purposes of use, such as hourly billing. Co-creation and Support for DX The company strengthens relationships with partner companies through the development of new SaaS and PaaS services in collaboration with other companies and through onboarding support by the company's engineers. |

Concentration of Management Resources Focus on investment in human resources and marketing to realize the growth strategy | Human resources The company focused on strengthening its recruitment system and activities to achieve its goal of hiring 100 personnel, primarily engineers, sales, and marketing staff. As of the end of March 2024, the number of employees in the corporate group was 839, up 84 from the previous fiscal year. Marketing The company made proactive investments in digital marketing, including online advertising, and event hosting to increase brand awareness and acquire new customers. The company also worked on strengthening internal systems for data analysis and coordination. Capital Investment The first phase of investment in GPU cloud services for generative AI (totaling 13 billion yen, with a subsidy of 6.8 billion yen) was accelerated, allowing for the provision of all 2,000 GPUs from June 2024. |

Other | ●Ishikari Data Center switched to renewable energy, achieving zero CO2 emissions. (In June) ●The company established a new base in Okinawa as part of efforts to acquire and train DX talent and promote open innovation. (In September) ●Tellus Corporation*, a 100% subsidiary, concluded an absorption-type split agreement and began full-scale operations in April 2024. |

* It operates Japan's first satellite data platform, "Tellus," under the vision of "creating new value with space and IT.”

Sales by Service

| FY 3/23 | Composition ratio | FY 3/24 | Composition ratio | YoY | |

Cloud services | 11,840 | 57.4% | 12,773 | 58.5% | +7.9% | |

Breakdown | Cloud infrastructure | 7,991 | 38.7% | 8,823 | 40.4% | +10.4% |

Cloud application | 3,849 | 18.7% | 3,949 | 18.1% | +2.6% | |

Physical base services | 3,638 | 17.6% | 3,589 | 16.4% | -1.3% | |

Other services | 5,143 | 24.9% | 5,463 | 25.0% | +6.2% | |

Total | 20,622 | 100.0% | 21,826 | 100.0% | +5.8% | |

*Unit: million yen

GPU cloud service sales of 201 million yen in FY 3/24 are recorded in "Others.”

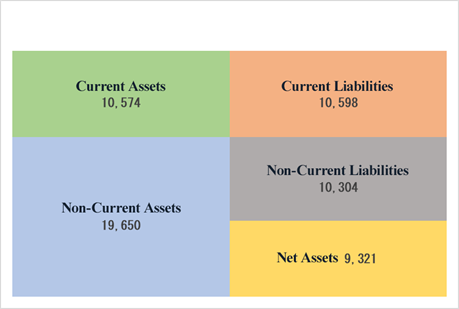

Balance Sheet Summary

| End of March 2023 | End of March 2024 |

| End of March 2023 | End of March 2024 |

Current Assets | 8,930 | 10,574 | Current Liabilities | 9,840 | 10,598 |

Tangible Assets | 14,716 | 16,656 | Noncurrent Liabilities | 7,929 | 10,304 |

Intangible Assets | 508 | 505 | Shareholder Equity | 8,337 | 8,989 |

Investments and Other Assets | 2,100 | 2,488 | Net Assets | 8,486 | 9,321 |

Noncurrent Assets | 17,325 | 19,650 | Total Liabilities and Net Assets | 26,256 | 30,224 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

Total assets at the end of the fiscal year stood at 30,220 million yen, up 3,960 million yen from the end of the previous fiscal year. The main factors were the increase in tangible fixed assets due to the procurement of service equipment for GPU cloud services and the increase in accounts receivable related to government projects. Liabilities augmented 3,130 million yen from the end of the previous fiscal year to 20,900 million yen, due mainly to growth in lease obligations related to equipment for services and increase in debts. Net assets stood at 9,320 million yen, up 830 million yen from the end of the previous fiscal year, owing chiefly to an increase in retained earnings resulting from recording of profit attributable to owners of parent. Equity ratio was 30.2% (31.8% at the end of the previous fiscal year).

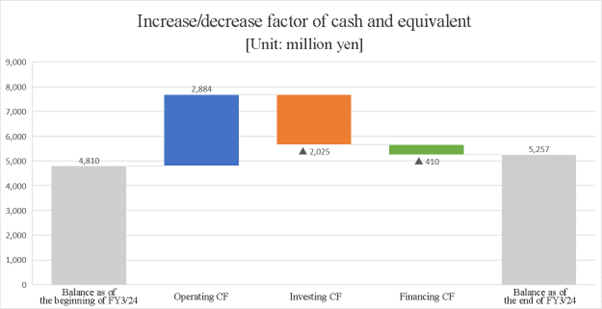

Cash Flow

| FY 3/23 | FY 3/24 | Increase/decrease | |

Operating CF (A) | 3,963 | 2,884 | -1,079 | -27.2% |

Investing CF (B) | -606 | -2,025 | -1,419 | - |

Free CF (A+B) | 3,357 | 858 | -2,498 | -74.4% |

Financing CF | -3,999 | -410 | +3,588 | - |

Cash and equivalent | 4,810 | 5,257 | +447 | +9.3% |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

At the end of FY 3/24, cash and cash equivalents stood at 5.25 billion yen, up 440 million yen from the end of the previous fiscal year.

The cash inflow from operating activities decreased 1.07 billion yen year-on-year to 2.88 billion yen. The main factor was the increase in accounts receivable.

The cash outflow from investing activities increased 1.41 billion yen from the end of the previous fiscal year to 2.02 billion yen. The main factor was the increased spending on tangible fixed assets, such as service equipment for GPU cloud services.

The cash outflow from financing activities decreased 3.58 billion yen from the end of the previous fiscal year to 410 million yen. The main factor was income from borrowing for GPU cloud services.

Capital Investment and Human Resources

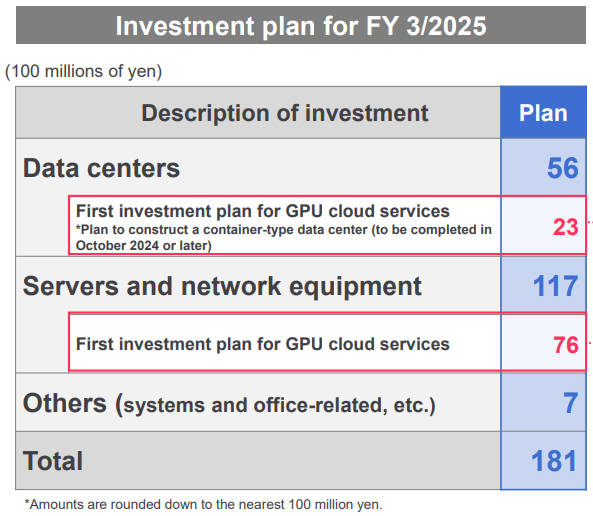

In terms of investment, the actual investment was 7.2 billion yen against the budget of 5 billion yen. The breakdown is as follows: 1.2 billion yen for data centers (budget: 300 million yen), 5.8 billion yen for servers and network equipment (budget: 4.6 billion yen), and 0 billion yen for other items, such as systems and office-related (budget: 100 million yen). The actual breakdown of servers and network equipment is 1.7 billion yen for cloud services, 300 million yen for physical base services, and 3.7 billion yen for other services. Included in the "other" category is an investment of 3.4 billion yen in GPU cloud services, which is before a 1.6 billion yen depreciation entry.

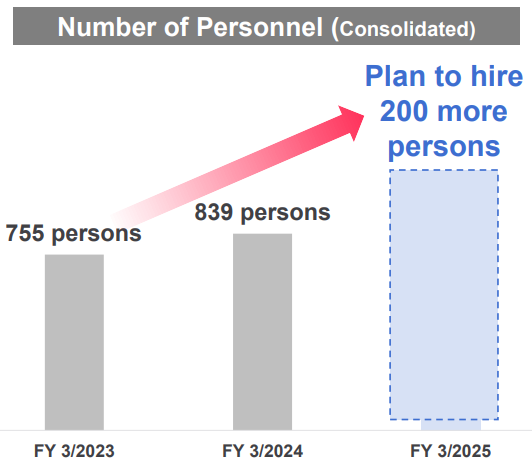

As of the end of FY 3/24, the number of group employees was 839, up 84 from the end of the previous fiscal year. This includes an increase of 74 engineers, 5 in sales, promotion, and new projects, and 8 in management. The number of group company employees decreased by 3.

3.Fiscal Year ending March 2025 Earnings Forecasts

3-1 Consolidated Earnings Forecasts

| FY 3/ 24 Act. | Ratio to sales | FY 3/ 25 Est. | Ratio to sales | YoY |

Sales | 21,826 | 100.0% | 28,000 | 100.0% | +28.3% |

Operating Income | 884 | 4.1% | 2,000 | 7.1% | +126.1% |

Ordinary Income | 764 | 3.5% | 1,960 | 7.0% | +156.5% |

Net profit attributed to parent company shareholders | 651 | 3.0% | 1,250 | 4.5% | +91.8% |

*Unit: million yen

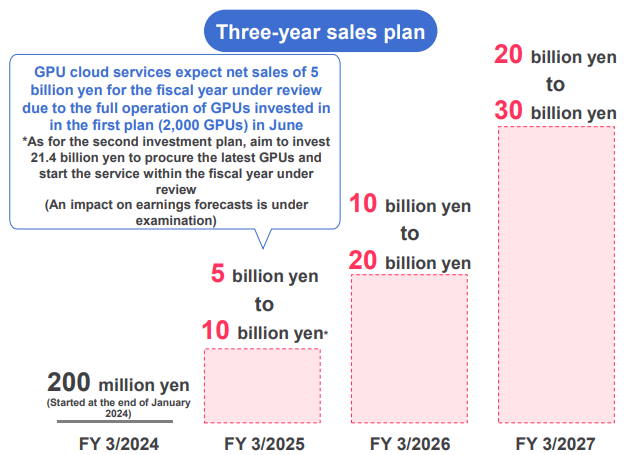

For the fiscal year ending March 2025, the company forecasts a 28.3% increase in sales and a 126.1% increase in operating income from the previous fiscal year.

28.3% Sales Increase, 126.1% Profit Increase

For the fiscal year ending March 2025, the company forecasts a 28.3% increase in sales, reaching 28 billion yen. The goal is to further grow cloud services. The GPU cloud service for generative AI is expected to generate 5 billion yen in sales from the operation of all 2,000 units, which is the first investment phase for the GPU cloud service. Additionally, for the second phase of the plan of investment of 100 billion yen, the company received approval in April from the Ministry of Economy, Trade and Industry for the "Cloud Program" supply assurance plan. This includes 21.4 billion yen for the procurement and service provision of NVIDIA's latest GPU, the "NVIDIA HGX B200 system," during this fiscal year. The impact on performance forecasts is currently being examined.

Operating income is expected to increase by 126.1% to 2 billion yen, ordinary income by 156.5% to 1.96 billion yen, and net profit attributed to parent company shareholders by 91.8% to 1.25 billion yen. In terms of profit, the company will continue proactive recruitment of engineers, sales, and marketing personnel, resulting in increased investment in human resources. Additionally, with the full-scale launch of GPU cloud services, depreciation and electricity costs will increase. The profits from the GPU cloud service are expected to absorb these investment costs, leading to a significant increase in operating income and the highest profit in the company's history.

The company plans a year-end dividend of 4.00 yen per share, up 0.50 yen per share from the previous fiscal year.

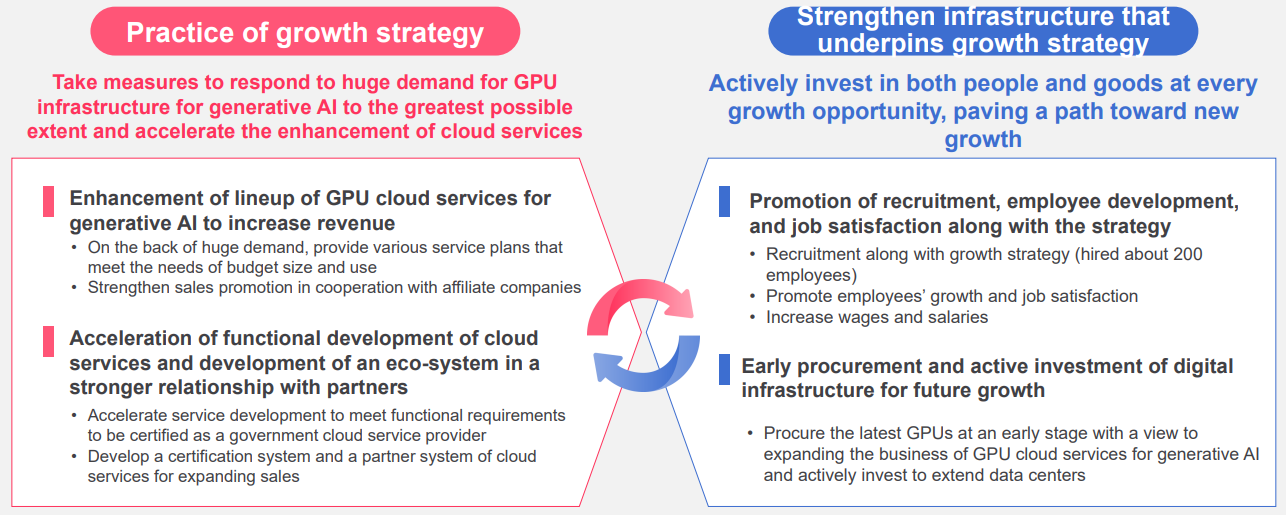

3-2 Key Initiatives

The company focuses all its resources on its strong cloud business to promote growth.

It aims to expand its business through focused investment in key areas and the acquisition and development of talent that drives transformation.

(Taken from the company’s explanatory material)

Implementation of Growth Strategies

1. GPU Cloud Services

〇Domestic AI Infrastructure Market Size

・In 2023, investment in generative AI surged, rapidly expanding the scale of the domestic AI infrastructure market to over 100 billion yen.

・The demand for computing and storage resources for AI is expected to grow further with the increased use of AI and the development of multimodal technologies for generating images and videos. AI servers are projected to drive this growth.

・The compound annual growth rate (CAGR) from 2022 to 2027 is expected to be 16.6%, with expenditures predicted to reach 161.55 billion yen by 2027.

〇Schedule

The company plans to invest 100 billion yen in GPU infrastructure for generative AI and expects to receive approximately 50 billion yen in subsidies from the Ministry of Economy, Trade, and Industry.

• For the second phase of investment in GPU cloud services for generative AI, the company received approval for the "Cloud Program" supply assurance plan from the Ministry of Economy, Trade, and Industry and is expected to receive subsidies covering half of the project costs from the government.

• The company will start with NVIDIA's latest GPU, the "NVIDIA HGX B200 system," and will continue to procure next-generation GPUs.

〇Sales Plan

With strong demand, the company aims to secure a leading position in the domestic AI platform market and expand revenues by enhancing its service lineup.

| ■ Future Sales Strategies ● Expansion of Service Lineup The company aims to attract smaller use cases and customer segments with smaller budget sizes by refining the provision units through software-based resource partitioning and the introduction of hourly billing. ● Strengthening Sales through Collaboration with Related Companies The company has agreed to collaborate with Sojitz Corporation and concluded a business partnership agreement to cooperate in the digital and AI domains and GPU cloud services. In generative AI cloud services, the company will leverage Sojitz’s extensive network of clients in various business fields to jointly develop and sell new business models and use cases utilizing Sakura Internet's computing resources. |

(Taken from the company’s explanatory material)

2. Government Cloud Strategy

The company is accelerating service development to meet the functional requirements for government cloud certification as soon as possible.

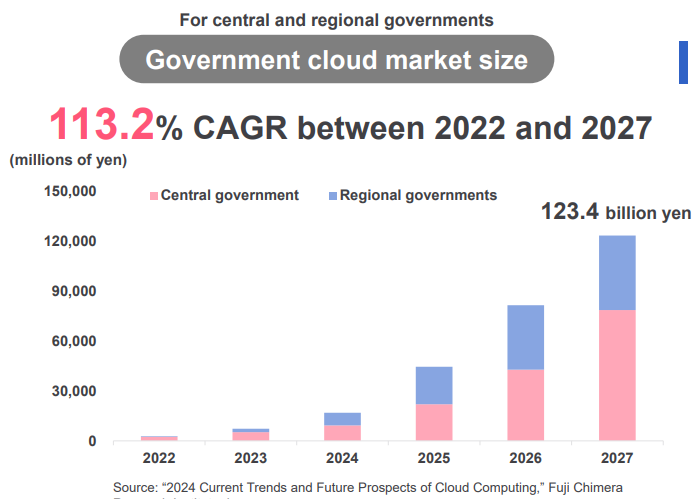

| ■Market Size and Future Initiatives ●The scale of the government cloud market is expected to grow at a CAGR of 113.2% from 2022 to 2027, reaching 123.4 billion yen, with 500 municipalities using systems transitioned to government cloud by the end of FY 2025. ●The company’s cloud service became the first in the country to receive government cloud certification in November 2023. (*on the condition that all functional requirements are met by the end of FY 2025). ●The company is accelerating the development of services and the expansion of personnel to meet these functional requirements as soon as possible. |

(Taken from the company’s explanatory material)

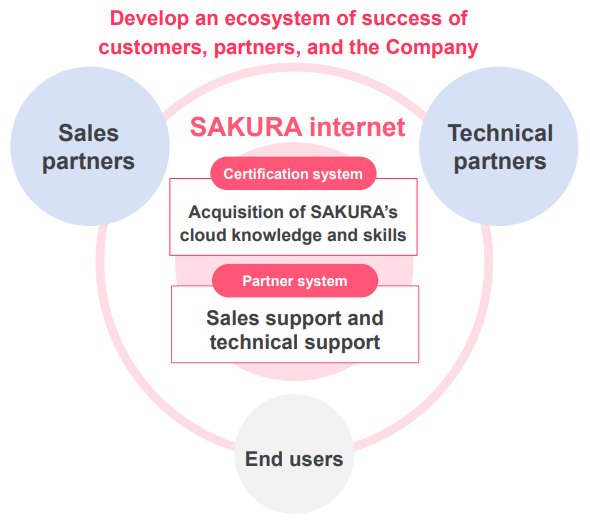

③ Certification and Partner System Strategy

To strengthen sales, the company is establishing and organizing a certification system and a partner system for cloud services.

| ■Initiatives ●The company plans to launch the "Sakura Cloud Certification" Plans to launch the Sakura Cloud Certification Test, a certification system to measure knowledge of digital technology and the company's cloud services. Through this certification system, the company aims to increase the number of partners and cloud engineers who have mastered the knowledge and skills of its cloud services, contributing to future customer development. ●Expanding sales channel by strengthening the partner system Expand partners and drive sales through onboarding and educational support • Sales Partners (starting in April): Selling their own services on the company’s cloud. • Technical Partners: Developing functions for the company’s cloud (system development/MSP). |

(Taken from the company’s explanatory material)

Strengthening the Foundation for Growth Strategies

① Securing and Training Talent to Accelerate Change and Growth

The company aims to enhance the recruitment of talent and organizational structure to support common foundation underpinning its key business areas and services, thereby accelerate change and growth and improve future profitability.

| ■Initiatives ●Strengthening the recruitment system to achieve the hiring of 200 personnel, doubling the recruitment compared to the previous year. ・Implementing recruitment with a team of 12, including external partners. ・Enhancing channels for referrals, alumni, and direct recruiting, achieving twice the recruitment compared to the fiscal year 2023. ●Strategic Talent Acquisition 73% of the total recruitment will be aimed at strengthening the common foundation that supports key business areas and their services. ●Promoting Employee Growth and Engagement ・Actively involve employees in increasingly sophisticated businesses and projects to help them gain skills and experience. ・Support growth by restructuring the education and training system to ensure employees acquire the necessary skills. |

(Taken from the company’s explanatory material)

② Proactive Investment in Digital Infrastructure

Proactive Investment in Digital Infrastructure for Future Growth

| ■Initiatives Seizing growth opportunities driven by strong demand, the company is making proactive investments in digital infrastructure to pave the way for future growth. The first phase of the investment plan for expanding the business of GPU cloud services for generative AI involves an investment of approximately 10 billion yen. Plans include procuring GPUs and constructing a container-type data center at the site of the planned fourth building of the Ishikari Data Center. ●In addition to the investment plan for the fiscal year ending March 2025, the second phase plan for investment of 100 billion yen received approval in April from the Ministry of Economy, Trade and Industry under the "Cloud Program" supply assurance plan. This includes 21.4 billion yen for the procurement of GPUs, including the "NVIDIA HGX B200 system," within this fiscal year (not included in the investment plan and performance forecast for the fiscal year ending March 2025). ●The company also plans equipment investments and replacements in line with the sales growth of cloud services. |

(Taken from the company’s explanatory material)

3-3 ESG Management Initiatives

ESG management initiatives are introduced on the company's website. https://www.sakura.ad.jp/corporate/work/

4. Conclusions

The company became the first domestic enterprise to receive government cloud certification and started providing cloud services equipped with NVIDIA GPUs for generative AI. The fiscal year ended March 2024 was a very active year for the company. The efforts toward the domestically produced public cloud, which were highlighted in the previous report, have materialized. During this transition period from physical base services to cloud services, the increase in investment in talent for growth may have caused some performance figures to fall short. However, for the fiscal year ending March 2025, the company expects that sales will increase by double digits and operating income will increase over two times, despite the heavy burden of upfront investments. Further expansion of sales will likely improve profit margin. Both GPU cloud services and government cloud services are expected to experience rapid sales growth until the fiscal year ending March 2027. Specifically, GPU cloud services are anticipated to achieve high profit margin and absorb the significant investment costs effectively.

The company's activity has also been notable in the stock market. Although valuations are quite high, significant sales growth accompanied by improved profit margin over the next few years is expected to boost stock price. Another perspective worth noting is the company's efforts in ESG management, customer success (CS), and employee success (ES). The energy used at Ishikari Data Center is now 100% renewable, and the practice of human capital management is expected to facilitate smoother acquisition of increasingly scarce talent. These initiatives reflect the company’s substantial potential for growth.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent executives) |

Auditors | 4 directors, including 4 outside ones (including 2 independent executives) |

◎Corporate Governance Report (Updated on July 3, 2023)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size.

There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 2-4-1 【Ensuring diversity in the appointment of core personnel, etc.】

<View on ensuring diversity, voluntary and measurable goals and their status>

We believe that all employees generate diversity with diverse values, and we aim to provide value to our customers and contribute to the growth of our group as a whole by taking advantage of the diversity in attributes, careers and skills. Therefore, in the recruitment and appointment of core personnel, we are committed to promoting recruitment and appointment with respect for diversity, regardless of age, gender, nationality, or other attributes.

We also believe that innovation comes from employees with diverse attributes having diverse values and co-creating with each other based on mutual recognition of each other's values. Therefore, our goal is to have the percentage of women in all management positions be equal to the percentage of women among all employees by March 2026. To achieve this goal, we will identify the causes of the low ratio of female employees in managerial positions after conducting a career awareness survey of female employees, take steps to eliminate the causes, and continue our efforts to encourage female employees to aim for managerial positions in a more positive manner, including the formulation of role models.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In our group, we have adopted “ES (Employee Success)” as our policy for talent development and creating an inclusive internal environment that fosters diversity. This approach aims to elevate the value of our human resources, who are the cornerstone of delivering value to society and our customers. We focus on realizing each employee's growth and success (ES) by fostering a cycle of learning and hands-on practice that bolsters their abilities, providing opportunities for diverse talents to gather and embark on challenges, and building a long-term, secure foundation for their continued engagement and development.

We are making various efforts to respect diversity in the way we work, based on the ideal that the company provides a "comfortable" work environment and that individual employees can pursue "job satisfaction" within that environment. In terms of the internal environment, we are working to create a corporate culture that maximizes the individuality and willingness to grow of each and every employee, and that allows them to maximize their abilities, by creating opportunities that lead to an understanding of diversity, equity and inclusion, an environment that allows diverse employees to play an active role, and a career and learning structure that allows them to feel a sense of growth.

Supplementary Principles 3-1-3 and 4-2-2 【Sustainability initiatives, formation of the basic policy for such initiatives, etc.】

<Sustainability initiatives>

In our group, we provide cloud and Internet infrastructure services utilizing our domestic data centers, recognizing the essential role of both the Internet and data centers. Given that data center operations consume a significant amount of electricity, our company is advancing efforts to address climate change and decarbonization, which are closely related to energy issues. Recognizing that the effective use of the Internet is crucial for maintaining social infrastructure and securing essential services, we place a special emphasis on our cybersecurity efforts.

(1) Initiatives for Climate Change and Decarbonization

As a social infrastructure supporting DX (Digital Transformation), the importance of data centers is increasing year by year. However, data centers inherently consume a large amount of electricity for server operation and cooling. Furthermore, with the rapid development of large-scale language models and the commercialization of VR technology in recent years, the power consumption of high-performance servers in operation has also increased. From the perspective of global environmental conservation such as preventing global warming and SDGs, we fully recognize the need to manage and reduce energy consumption and strive to contribute to a sustainable society through initiatives for carbon neutrality.

In November 2011, we opened and have been operating an environmentally friendly suburban large-scale data center (Ishikari Data Center) in Ishikari City, Hokkaido. Besides operating data centers utilizing the cool outside air at the location, we have been actively engaged in environmental conservation activities in data center operations. These include the establishment of the Ishikari Solar Power Plant in 2015 for our use of renewable energy, reduction of CO2 emissions by switching to LNG/gas-fired power generation in 2021, achieving virtually zero CO2 emissions through non-fossil certificates in 2022, and as of June 2023, achieving zero CO2 emissions by utilizing 100% renewable energy sources mainly from hydropower.

In 2021, we endorsed the “Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)” and joined the TCFD Consortium of companies and organizations that endorse these recommendations. Although our current information organization is not primarily focused on climate change, we continue to prepare for appropriate disclosure regarding the impact of climate change-related risks and revenue opportunities on our business activities and earnings.

(2) Initiatives for Cybersecurity

In recent years, as corporate activities have become increasingly digitalized, the exchange of personal and confidential corporate information over the Internet has become commonplace. At the same time, as in the real world, a variety of problems have arisen, including nuisance activities, various rights violations, and the distribution of illegal and harmful content. Therefore, ensuring and improving the safety and quality of the Internet is increasingly important. As a cloud service provider, we review our services daily and implement multifaceted measures to ensure and enhance safety and quality.

We also recognize it as our duty as a cloud and Internet infrastructure service provider to establish systems that enable us to collect a wide range of information through affiliated and sponsoring organizations about legal and administrative issues related to advancements in Internet technologies such as AI and cybersecurity, respond accurately, and express our opinions as needed. As a specific example, personnel in charge of specialized teams for responding to and taking countermeasures against nuisance activities, etc. and legal affairs staff participate in the Administrative Law Subcommittee, a subcommittee of the Japan Internet Providers Association (JAIPA), to exchange opinions with relevant ministries and agencies on the sound use of the Internet.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. At our company, we believe that each employee represents our capital and their growth and success are essential in providing value to our business and customers. In order to transform "what you want to do" into "what you can do.” and realize sustainable corporate management and Employee Success (ES), our efforts in this direction include a variety of initiatives as described below, the details of which are disclosed in our securities report.

・Cultivating a culture of talent development and collaborative learning

・Fostering mental and physical health

・Promoting the success of a diverse workforce

・Creating a culture where diverse talents and skills converge, fostering new values through leadership

・Promoting flexible work arrangements

Moreover, we consider investing in intellectual property as essential for our business growth. We actively support in-house creative activities and are committed to appropriately protecting, managing, and utilizing our intellectual property. By communicating within the company the importance of respecting third-party intellectual property rights, we diligently work to prevent any infringements. Although we are not a content creation and provision company, we are a member of the Association of Copyright for Computer Software (ACCS). We participate in various study groups organized by the ACCS to enhance our knowledge, facilitate information exchange, and engage in activities to protect copyright rights.

We continue to oversee these initiatives, which contribute to our company's sustainable growth, and are committed to proactive information disclosure.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 【Strategically held shares】

(1) Philosophy regarding strategic shareholding

Our company generally does not hold listed shares as strategically-held shares unless their significance and rationality are recognized.

We annually assess the significance and rationality for holding each stock, considering potential corporate collaboration or business synergy with the issuing company and whether the benefits and risks associated with holding these shares justify the capital cost. Shares deemed to lack sufficient significance and rationality are sold, taking into account stock prices, market trends, and other relevant factors.

(2) Regarding the exercise of voting rights

While considering the purpose of holding listed shares, we exercise voting rights based on whether it aligns with the sustainable growth and medium to long-term enhancement of corporate value for both our company and the invested entities.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established a department for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: www.bridge-salon.jp/