Bridge Report:(3778)Sakura internet the Fiscal Year ended March 2023

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Tokyo Tatemono Umeda Building 11F Umeda, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥691 | 35,662,556 shares | ¥24,642 million | 8.0% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥3.50 | 0.5% | ¥23.83 | 28.9 x | ¥234.10 | 2.9 x |

*The share price is the closing price on May 16.

*The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Act. | 20,622 | 1,093 | 965 | 666 | 18.29 | 3.50 |

March 2024 Est. | 22,800 | 1,450 | 1,300 | 850 | 23.83 | 3.50 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for end of the Fiscal Year ended March 2023 Earnings Results, along with estimates for the term ending March 2024.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2023 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2023, sales increased 3.0% year on year and operating income grew 43.2% year on year. Despite the expiration of contract periods for large-scale projects in physical base services during the transition to a cloud-focused structure, revenues from cloud services remained healthy, contributing to the increase in sales. Profit grew considerably through the improvement in efficiency of investment for a cloud-focused structure, as well as a decrease in rent owing to data center optimization and other factors. Profit attributable to owners of parent increased 142.0% year on year to 660 million yen. A term-end dividend of 3.50 yen/share was paid.

- For the fiscal year ending March 2024, the company forecasts a 10.6% year-on-year increase in sales and a 32.7% year-on-year rise in operating income. The company expects sales to increase due to the continued growth of the cloud business. Profit is expected to increase due to sales growth of highly profitable cloud services while the company will continue aggressive investment for mid- to long-term growth. At the end of the term, profit from spot projects and group companies is expected. Investments will be made in equipment and replacements in line with sales growth, mainly for cloud services. The company plans to invest 5.0 billion yen, mainly in servers and network equipment. In terms of hiring, the company will strengthen its human resources base to support medium- and long-term business growth, and expects to increase the number of hires by 100. The company plans to pay a term-end dividend of 3.50 yen per share, like in the previous year.

- The shift to cloud services, which are also highly profitable, is steadily progressing. In the fiscal year ended March 2023, profit grew substantially, although it fell short of its initial forecast due to unforeseen external factors such as an increase in electricity costs and domain acquisition costs. The company expects this trend to continue in the fiscal year ending March 2024, with further improvement in profit margin and consecutive large increases in profit. The company is also steadily making investments for medium- and long-term growth. Under these circumstances, we would like to pay attention to the company's efforts in the domestic public cloud market. Japanese companies do not have a strong presence in the rapidly expanding domestic cloud market. This is where the company is trying to break into the market as a domestic cloud service provider, and we will be keeping a close eye on the company's future developments.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. Currently, the company is shifting from physical base services, such as housing and exclusive servers, to cloud services. By owing its own infrastructure, Sakura internet pursues higher profitability and increases utilization rates and reduce fixed cost risk.

1-1Content Business

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), physical base services, domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year ended March 2023 is cloud services are 57.4% (of which cloud infrastructure and cloud application for 38.7%, and 18.7% respectively), physical base services are 17.6%, and other services are 24.9%.

2. The Fiscal Year ended March 2023 Earnings Results

2-1 Consolidated Results

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 20,019 | 100.0% | 20,622 | 100.0% | +3.0% | 20,350 | +1.3% |

Gross Profit | 4,708 | 23.5% | 5,367 | 26.0% | +14.0% | - | - |

SG&A | 3,944 | 19.7% | 4,274 | 20.7% | +8.4% | - | - |

Operating Income | 763 | 3.8% | 1,093 | 5.3% | +43.2% | 1,390 | -21.4% |

Ordinary Income | 649 | 3.2% | 965 | 4.7% | +48.7% | 1,230 | -21.5% |

Net Profit attributed to Parent Company Shareholders | 275 | 1.4% | 666 | 3.2% | +142.0% | 800 | -16.7% |

*Unit: million yen.

3.0% increase in sales and 43.2% increase in operating income, significant increase in income as a result of the progress of shift to cloud services

Sales stood at 20.62 billion yen, up 3.0% year on year. Although some contracts for large projects in the physical base service have expired while they were concentrating on cloud services, sales grew as the cloud service continued to perform favorably, spot sales of group companies were recorded, etc., exceeding the company’s forecast of 20.35 billion yen.

Operating income reached 1.09 billion yen, up 43.2% year on year. The main factors behind the increase in costs were improved investment efficiency due to a shift in investment policy toward a cloud-focused structure, and a decrease in rent due to data center optimization, etc. (total positive impact of 790 million yen). These factors offset the negative impact of increased investment in human resources (negative impact of 400 million yen), increased cost of services (350 million yen), increased domain procurement costs (120 million yen), and increased electricity costs (180 million yen). Gross profit increased from 4.7 billion yen (gross profit margin of 23.5%) to 5.36 billion yen (26.0%). SG&A expenses increased from 3.94 billion yen (19.7% of SG&A expenses) to 4.27 billion yen (20.7%), but the increase in gross profit was the main reason for the large increase in operating income. The reason for the lower-than-expected results was the impact of external factors that could not be foreseen at the time of budgeting, such as higher electricity costs due to surging crude oil prices and higher domain acquisition costs due to the weaker yen. Ordinary income increased 48.7% year on year to 960 million yen. Profit attributable to owners of parent rose 142.0% year on year to 660 million yen due to the absence of the head office relocation loss posted as an extraordinary loss in the same period of the previous fiscal year.

The company paid a term-end dividend of 3.50 yen per share, up 0.50 yen per share from the previous year, as forecast.

Status of Priority Initiatives

Reinforcement of cloud business | To promote measures to provide comprehensive cloud services that support DX | |

| Current Status | *Partner/Alliances: To accelerate development of new SaaS *Government: To strengthen activities to improve recognition | |

| Medium- to Long-Term | *Tellus: To expand satellite data for full-scale commercialization *Startups: Supporting major events and investing in funds | |

|

| |

Concentration of investment in core areas | To concentrate on investment in human resources and marketing for further growth in the mid- to long-term | |

| Human resources | Steadily recruiting to achieve the target of “+40 employees from the previous fiscal year” The number of consolidated employees increased by 45 from the end of the previous fiscal year. | |

| Marketing | Investment in digital marketing such as web advertising and owned media for sales promotion, and development of internal systems to consolidate and strengthen collaboration in data analysis, etc. | |

Sales by Service

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY |

Cloud services | 10,963 | 54.8% | 11,840 | 57.4% | +8.0% |

Physical base services | 4,497 | 22.5% | 3,638 | 17.6% | -19.1% |

Other services | 4,557 | 22.8% | 5,143 | 24.9% | +12.9% |

Total | 20,019 | 100.0% | 20,622 | 100.0% | +3.0% |

*Unit: million yen

Balance Sheet Summary

| End of March 2022 | End of March 2023 |

| End of March 2022 | End of March 2023 |

Current Assets | 9,776 | 8,930 | Current Liabilities | 11,309 | 9,840 |

Tangible Assets | 15,725 | 14,716 | Noncurrent Liabilities | 8,637 | 7,929 |

Intangible Assets | 426 | 508 | Shareholder Equity | 8,313 | 8,337 |

Investments and Other Assets | 2,468 | 2,100 | Net Assets | 8,449 | 8,486 |

Noncurrent Assets | 18,620 | 17,325 | Total Liabilities and Net Assets | 28,396 | 26,256 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

Total assets at the end of the term stood at 26,250 million yen, down 2,140 million yen from the end of the previous term. The decrease was caused mainly by reduction in tangible fixed assets brought about by depreciation, decrease in cash due to the payment of accounts payable and repayment of debt, decrease in accounts receivable, etc. Liabilities were 17,760 million yen, down 2,170 million yen, mainly due to the decrease in accounts payable and debt. Net assets were 8,480 million yen, up 30 million yen, mainly owing to the growth in retained earnings stemming from recording profit attributable to owners of parent, etc. Equity ratio stood at 31.8% (it was 29.3% at the end of the previous term).

3.Fiscal Year ending March 2024 Earnings Forecasts

3-1 Earnings Forecasts

| FY 3/ 23 Act. | Ratio to sales | FY 3/ 24 Est. | Ratio to sales | YoY |

Sales | 20,622 | 100.0% | 22,800 | 100.0% | +10.6% |

Operating Income | 1,093 | 5.3% | 1,450 | 6.4% | +32.7% |

Ordinary Income | 965 | 4.7% | 1,300 | 5.7% | +34.6% |

Net profit attributed to parent company shareholders | 666 | 3.2% | 850 | 3.7% | +27.5% |

*Unit: million yen

Plans 10.6% year-on-year sales growth and 32.7% year-on-year operating income growth for FY 3/24

For the fiscal year ending March 2024, the company forecasts a 10.6% year-on-year increase in sales to 22.8 billion yen. The company expects sales to increase due to continued growth in the cloud business. Sales are projected to increase 13.1% for cloud services, 0.9% for physical base services, and 11.6% for other services.

Operating income is forecast to rise 32.7% year on year to 1.45 billion yen, ordinary income is expected to increase 34.6% year on year to 1.3 billion yen, and profit attributable to owners of parent is projected to grow 27.5% year on year to 850 million yen. Profit is expected to increase due to sales growth of highly profitable cloud services while the company will continue aggressive investment for mid- to long-term growth. At the end of the term, profit from spot projects and group companies is expected.In terms of expenses, the company expects to increase expenses by 780 million yen for the investment in human resources, 330 million yen for electricity, 330 million yen for equipment, and 230 million yen for marketing reinforcement.

Continuing to strengthen marketing initiatives to further expand the customer base; advertising expenses are forecast to double.

●Digital marketing such as web advertising and owned media to promote sales and raise awareness of cloud services, holding events, etc.

●Holding events, sales promotion, etc. to increase awareness and promote utilization of the satellite data platform Tellus, etc.

Investments will be made in equipment and replacements in line with sales growth, mainly for cloud services. The company plans to invest 5.0 billion yen, mainly in servers and network equipment (4.6 billion yen).

For recruitment, the company plans to strengthen the human resource base for mid- to long-term business growth, increasing the number of employees by 100.

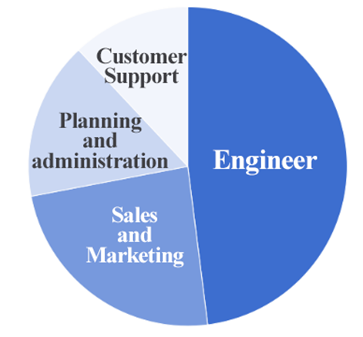

Accelerating the promotion of growth strategies, and considerably increasing engineers and sales personnel

●To focus on strengthening cloud services for adoption of cloud computing in governments and hiring engineers for new service development

●To expand sales and marketing staff to strengthen the system to handle the increase in DX support and co-creation projects

Breakdown of recruitment plans by job type

(from the company’s material)

The company plans to pay a term-end dividend of 3.50 yen/share, like in the previous year.

3-2 Priority Measures for the Fiscal Year Ending March 2024

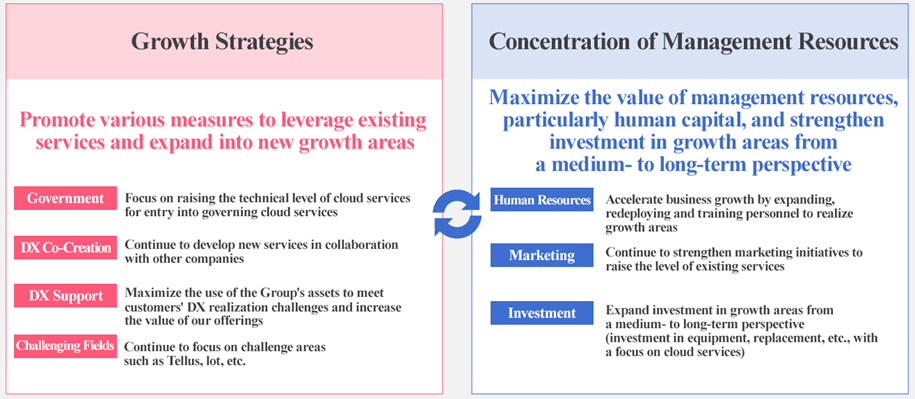

Priority policy

(from the company’s material)

Market size

Growing at a CAGR of 12.7% from FY 2021 in line with the progress of DX in society. The domestic public cloud market will reach a scale of 3.5 trillion yen in FY 3/2026.

(From the company's presentation material)

DX Co-Creation (Partner/Alliances)

The company is accelerating the development of new SaaS and PaaS services through alliances to support customers' DX and function as an entry point for IaaS.

Recent examples of service co-creation

(from the company’s material)

DX Support

Promoting DX for clients by leveraging the company's strength to respond immediately to the rapid development of large-scale language models and the growing demand for advanced computation in the expanding virtual economy

The company's strengths in meeting the demand for computing resources:

●In-house operation of Ishikari Data Center with excellent scalability, flexibility, and environmental friendliness

●Knowledge and experience in providing high-performance computing

| Ishikari Data CenterThe building is a multi-building type that can accommodate up to 1,280 racks per building and can be expanded up to five buildings/around 6,800 racks in total, on a vast site approximately 1.1 times the size of the Tokyo Dome. By making the building itself a multi-building type, it is possible to expand according to demand trends. The server room is also module-based, with an uninterruptible power supply (UPS) installed for each server room, allowing for expansion according to demand trends, just like the building.

|

(from the company’s material)

■Recent Initiatives and Current Situation:

●The increasing demand for new computing resources for AI, large-scale language models, and VR has led to an increase in inquiries from government agencies and manufacturers.

●Leveraging its knowledge and experience in providing high-performance computing for public projects and operating a highly scalable data center, the company is focusing on acquiring new projects.

Initiatives in the Government Secto

As a domestic cloud vendor, the company is focusing on raising the technical level of cloud services with the aim of adopting government cloud within a few years.

■Recent Initiatives and Current Situation:

●The size of the IT market for national and local governments in 2026 is expected to be 2 trillion yen, with the government cloud market size accounting for 250 billion yen.

●The company is expanding its workforce to prepare for the adoption of government cloud within a few years and is focusing on strengthening its cloud services.

●In the future, by entering the government cloud market, the company aims to strengthen its brand development and improve the technical level of its services, and expand its share in the domestic public cloud market.

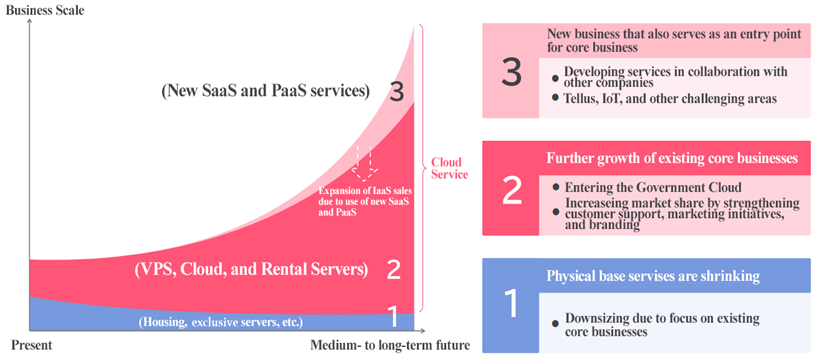

Future growth vision:

The company aims to expand its focus areas from IaaS to SaaS and PaaS services and steadily seize business opportunities in growing areas, aiming for non-continuous growth and maximizing profits.

(from the company’s material)

3-3 Efforts for Sustainable Growth

Approach to Sustainable Growth

To contribute to the environment and society through business activities that support the DX of society

(from the company’s material)

Environmentally Conscious Initiatives

Environmentally friendly data centers

Ishikari Data Center, one of Japan's largest suburban large-scale data centers optimized for cloud computing, has been actively working to enhance sustainability since its opening.

Appearance of Ishikari Data Center (front: Building 3, left: Buildings 1 and 2)

(from the company’s material)

■Efforts toward decarbonization

In June 22, the center changed its power contract to a practically 100% renewable energy contract utilizing non-fossil fuel certificates, achieving virtually zero CO2 emissions from electricity consumption at the Ishikari Data Center.

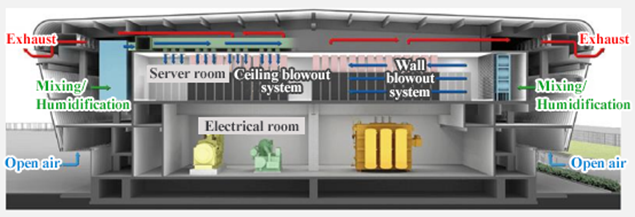

■Initiatives for air conditioning and power transmission methods that take advantage of the location

The center has been experimenting with power transmission methods such as outdoor air conditioning that takes advantage of Hokkaido's cold air and high-voltage direct current (HVDC.*) power supply. They have achieved significant reductions in power consumption for air conditioning and improvements in power supply efficiency.

*HVDC stands for High Voltage Direct Current and refers to a high-voltage direct current power supply system. The HVDC 12V system uses a centralized power supply to step down high-voltage direct current exceeding 300V to 12V, and then supplies power directly to the servers.

Conceptual diagram of the Ishikari Data Center outdoor air conditioning system

(from the company’s material)

Human Capital Management Initiatives

Toward sustainable corporate management that transforms "what you want to do" into "what you can do.”

(from the company’s material)

4. Conclusions

The transition to cloud services, which are also profitable, is steadily progressing. In the fiscal year ended March 2023, external factors that cannot be unexpected at the time of budget formulation such as an increase in electricity costs due to a surge in crude oil prices and an increase in domain acquisition costs due to a weaker yen caused the lower-than-expected results. However, the company secured a significant increase in profit. The trend of improving profitability is expected to continue in the fiscal year ending March 2024, leading to continuous significant profit growth. However, the forecast for the first half of the year shows a 42.7% decrease in operating income compared to the same period of the previous year, and the budget is heavily weighted toward the second half of the year compared to previous years. Therefore, the financial trend throughout the year may be somewhat uncertain, but the company is steadily executing investments for medium- to long-term growth.

One area to watch is the company's initiatives in domestic public cloud services. Japan's trade deficit is widening, with one major factor being the increase in payments for IT services. In particular, in the rapidly expanding domestic cloud market, the presence of Japanese companies is relatively weak, as the government has adopted four American companies for the government cloud that it jointly uses for cloud services. The company aims to tackle this issue by developing domestic public cloud services, and its future developments in this area are worth watching.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent directors) |

Auditors | 4 directors, including 4 outside ones (including 2 independent directors) |

◎Corporate Governance Report (Updated on July 1, 2022)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 2-4-1 【Ensuring diversity in the appointment of core personnel, etc.】

<View on ensuring diversity, voluntary and measurable goals and their status>

Under our belief that “diversity helps our company grow,” we strive to promote employment and promotion of core personnel that respect diversity, regardless of age, gender, nationality, or other attributes. However, we recognize our challenges that there are few female applicants due to the high employment ratio of IT engineers in the first place, and that the ratio of female managers is lower than the ratio of female employees to all employees, and we announce our target figures for the ratio of female employees and female managers in the Action Plan for General Business Owners.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In light of the significance of Human Resources Strategies for enhancing our corporate value over the medium/long term, our company has been making various improvements in the in-house environment that respect diversity in work styles, and individual employees can pursue “job satisfaction” in the comfortable work environment the company provides, while aiming to induce co-creation by leveraging the knowledge and experience obtained from both a broad career not tied to the company and private life.

Supplementary Principles 3-1-3 and 4-2-2 【Sustainability initiatives, formation of the basic policy for such initiatives, etc.】

<Sustainability initiatives>

The significance of data centers has been increasing every year as a social infrastructure that supports DX (digital transformation), and data center operations that consume a large amount of electricity are required to contribute to a sustainable society by reducing greenhouse gas emissions, from the perspective of the SDGs. Our company adequately recognizes the significance of initiatives for sustainability as a significant factor for our management strategies.

At the Ishikari Data Center our company operates in Ishikari City, Hokkaido, we have been actively carrying out initiatives to enhance sustainability by leveraging its location since the launch of the facility in 2011. In addition to achieving the highest energy efficiency standard in the world by reducing electricity consumption by about 40% in comparison with usual urban data centers through elevating energy efficiency based on outside air-cooling systems utilizing cold outside air, etc., we realized substantial elimination of yearly carbon dioxide (CO2) emissions in the Ishikari Data Center by switching to power with a non-fossil fuel energy certificate in June 2022, and thus succeeded in reducing about 12,861 tons of CO2 emissions per year. We will go beyond this substantial elimination of CO2 emissions and aim for the operation of the Ishikari Data Center powered fully by renewable energy.

In October 2021, in addition to endorsing the Recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD), we joined TCFD Consortium, a group of companies and institutions that endorse the recommendations of the TCFD. Moving forward, our company will prepare to make appropriate disclosures regarding the impact of climate change-related risks and profit opportunities on its own business activities, earnings, etc.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. We will supervise these activities to contribute to the sustainable growth of our company and actively disclose the information.

Principle 5-2, Supplementary Principle5-2-1 [Formulation and disclosure of management strategies and plans and others]

When formulating our management strategies and plans, we set goals regarding our profitability while fully taking into account capital costs. However, regarding indicators, such as capital efficiency, we do not disclose them as of now. We will keep discussing the level of indicators while considering the characteristics of our business, etc. and plan to carefully determine how to convey the information through the dialogue with shareholders at results briefing sessions, individual meetings, etc. We will continue to discuss the formulation of basic policies regarding our business portfolio.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 【Strategically held shares】

Our company does not hold any shares strategically.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established a department for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: