Bridge Report:(3608)TSI Second quarter of the Fiscal Year ending February 2025

President Tsuyoshi Shimoji | TSI HOLDINGS CO., LTD. (3608) |

|

Company Information

Market | TSE Prime Market |

Industry | Textile (Manufacturing) |

President | Tsuyoshi Shimoji |

HQ Address | 8-5-27 Akasaka Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Share Outstanding | Total Market Cap. | ROE (Act.) | Trading Unit | |

¥938 | 80,327,993 shares | ¥75,347 million | 5.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥19.00 | 2.0% | ¥53.04 | 17.7x | ¥1,287.25 | 0.7x |

*The share price is the closing price on October 23. The number of outstanding shares, DPS, and EPS were taken from the brief report on financial results in the second quarter of the fiscal year ending February 2025. ROE and BPS are the actual results of the previous fiscal year.

Earnings Trends

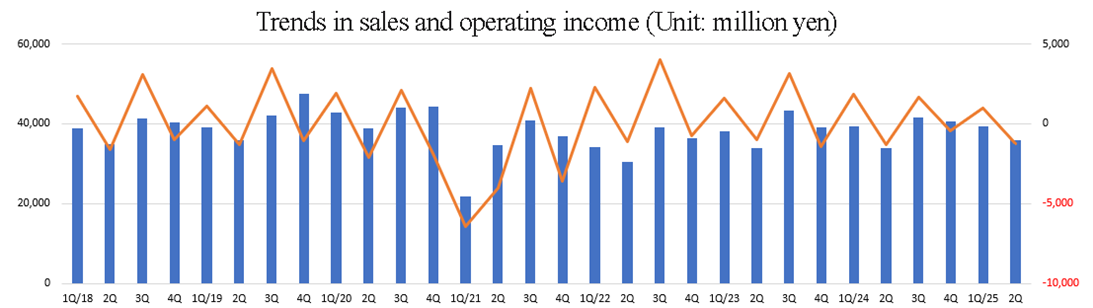

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2021 Act. | 134,078 | -11,843 | -10,359 | 3,861 | 42.64 | 0.00 |

Feb. 2022 Act. | 140,382 | 4,440 | 5,834 | 1,022 | 11.32 | 5.00 |

Feb. 2023 Act. | 154,456 | 2,329 | 3,859 | 3,063 | 35.21 | 10.00 |

Feb. 2024 Act. | 155,383 | 1,760 | 3,758 | 4,849 | 59.97 | 15.00 |

Feb. 2025 Est. | 160,000 | 2,000 | 2,500 | 4,000 | 53.04 | 19.00 |

* Unit: million-yen, yen. The forecasted values are from the company.

This report provides the overview of TSI Holdings Co., Ltd.’s financial results for the second quarter of the fiscal year ending February 2025.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of the Fiscal Year ending February 2025 Earnings Results

3. Fiscal Year ending February 2025 Earnings Forecasts

4. Progress of the Medium-term Management Plan

5. Conclusions

<Reference1: Medium-term Management Plan “TSI Innovation Program 2027”>

<Reference2: Regarding Corporate Governance>

Key Points

- TSI Holdings is an apparel enterprise operating over 50 brands. It clearly specifies targets (gender, age, preference, etc.) for each brand, and provides a broad range of customers with its products. They set out the purpose: “We create empathy and social value across the world through the power of fashion entertainment.”

- In the second quarter of the fiscal year ending February 2025, sales grew 2.7% year-on-year to 75.2 billion yen. Both domestic and overseas sales increased. Inside Japan, physical stores performed well, but the sales of EC (e-commerce) dropped year-on-year, due to the termination of a brand. Outside Japan, physical stores struggled, but EC performed well thanks to successful measures. An operating loss of 200 million yen was posted (while an operating income of 500 million yen was posted in the same period of the previous year). Gross profit declined 0.7% year-on-year and gross profit margin dropped 1.8% year-on-year, due to the rising raw material prices caused by unfavorable exchange rates and soaring energy prices, the augmentation of impairment loss caused by the increase of inventory, and discount sale for inventory optimization. SG&A expenses rose slightly due to the temporary expenses for structural reform and the augmentation of personnel costs. The company is projected to incur a loss in the first half of the fiscal year, but the loss shrank thanks to streamlining, and both sales and profit exceeded the initial forecasts.

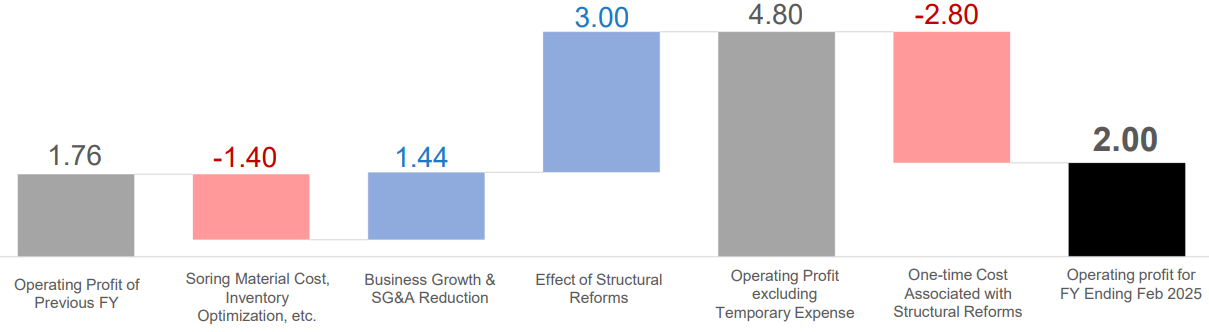

- For the fiscal year ending February 2025, sales and operating income are expected to grow. Sales are projected to increase 3.0% year-on-year to 160 billion yen, and operating income is forecast to rise 13.6% year-on-year to 2 billion yen. In the first fiscal year of structural reform, sales are expected to keep growing, and gross profit is projected to decline due to soaring raw material prices and the rationalization of inventory management, but they aim to increase profit by improving profitability by growing business, reducing SG&A expenses, and reforming their business structure. The company plans to pay a dividend of 19.00 yen/share, up 4.00 yen/share from the previous fiscal year. The expected payout ratio is 35.8%.

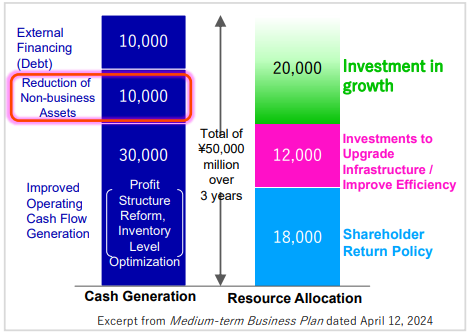

- In April of this year, they worked on structural reforms, marking a new start with the fiscal year ending February 2025, and announced TSI Innovation Program 2027 (TIP27), which is not an extension of the previous plan, while clearly describing the generation of cash amounting to 50 billion yen and capital allocation in three years and their measures for realizing a PBR of over 1. Those were well-received by investors, and the share price of the company rose considerably.

- As the company announced the acquisition of up to 3.4 million treasury shares at up to 3 billion yen, the share price skyrocketed, reaching the highest price since it was listed. It seems that achieving “an operating income margin of 6% or higher and an ROE of 8% or higher” is definitely not easy, but attaining these targets is indispensable for sustainably increasing the share price. President Shimoji resolved to achieve these target figures through unflagging group-wide efforts, so we expect steady progress in their endeavor.

1. Company Overview

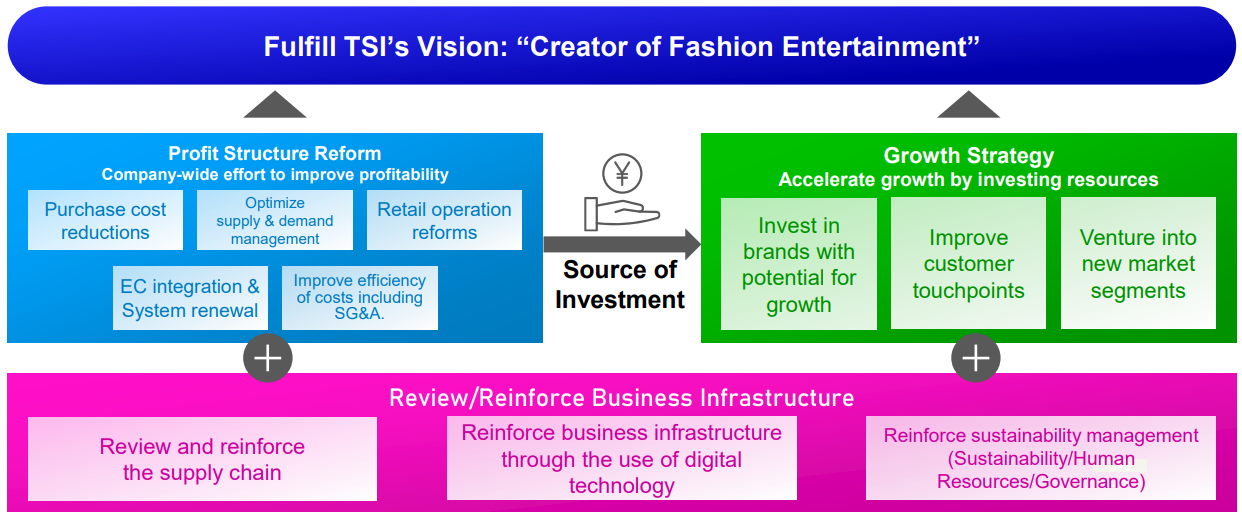

TSI Holdings is an apparel enterprise operating over 50 brands. It clearly specifies targets (gender, age, preference, etc.) for each brand, and provides a broad range of customers with its products. They aim to proceed with transformation, evolve from an enterprise that conducts apparel business only, and become a “creator of fashion entertainment” that links social value to its corporate growth and not only provides products but also creates original value with the fashion entertainment, from the viewpoints of “the environment and society,” “markets,” and “residents.”

[1-1 Corporate history]

While the environment surrounding the apparel field was becoming severe, Tokyo Style Co., Ltd. and Sanei-International Co., Ltd. established TSI Holdings Co., Ltd. through the transfer of shares in June 2011, with the aim of achieving sustainable growth by utilizing their respective strengths. It was listed on the Tokyo Stock Exchange (TSE). After the market restructuring, it was listed on the Prime Market of TSE in April 2022.

[1-2 Corporate philosophy]

With the following corporate philosophy, vision, purpose, and group’s code of conduct, they aim to become a “creator of fashion entertainment.”

Corporate philosophy | We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society. |

Vision | We aim to become the world’s most beloved global group through the best and a step- ahead-of-the-times creation and lifestyle proposal. |

Purpose | We create empathy and social value across the world through the power of fashion entertainment. |

Group's code of conduct | 1. We value our spirit of fairness/impartiality and honesty and work with passion and responsibility. 2. We always have problem consciousness, strive for self-study, and actively challenge with flexibility. 3. We respect each person's individuality, communicate well, and contribute to the team by running our own roles. 4. We deliver excitement and pleasure to our customers with sincere hospitality and strive to improve customer satisfaction. 5. We respect each stakeholder's position to realize mutual benefit and contribute to the sustainable growth of the company. 6. We sincerely appreciate society and the natural environment and contribute to social development through our business. |

[1-3 Business description]

The TSI Group consists of TSI Holdings, which is a holding company, 26 consolidated subsidiaries, and one equity-method affiliate.

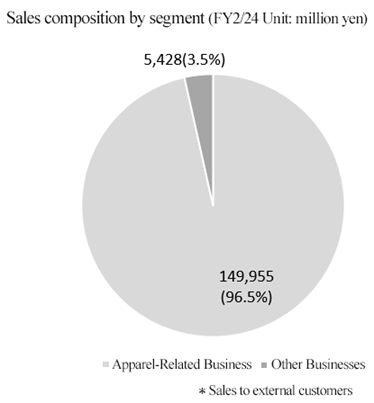

In the “apparel-related business,” the main activities include planning, manufacturing, and selling mainly clothes, as well as licensing brand operations and production/logistics businesses. The “other business” includes sales agency and staffing services, synthetic resin-related business, store design/management, and restaurant operations.

(1) Brands

Currently, they operate over 50 brands. They set clear targets (according to gender, age, preference, etc.) for each brand and provide products to a broad range of customers.

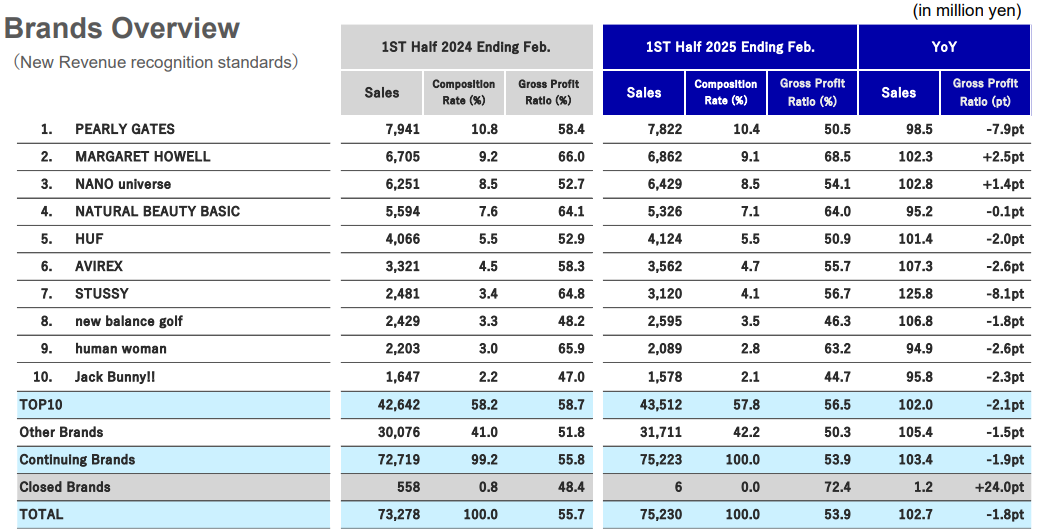

The top 10 brands account for about 60% of total sales. The gross profit margin is about 50-65%.

*Outline of major brands

Brand | Targets | Concept |

Pearly Gates

| Women and men |

OUT ON THE WEEKEND (leaving urban areas on weekends) Under the concept: “Let’s play golf more casually and more enjoyably,” it proposes moderately fashionable golf clothing beyond the bounds of age, gender, etc. |

Nano Universe

| Women and men |

Under the concept of “glamour yourself up,” this brand brings out the attractive points of each customer and gives them confidence, with refined designs and high-quality functional materials. |

|

|

|

Margaret Howell

| Women and men |

In 1970, the British designer Margaret Howell started producing clothes at home. Clothing is not a passing fad but part of daily life, so she puts importance on materials, craftsmanship, and styles. This brand operates a broad range of businesses, including the sale of clothing and home-use products and the operation of cafes. |

Natural Beauty Basic

| Women |

Based on the intrinsic natural beauty of each woman, this fashion store brand is for women who live each day beautifully, elegantly, and simply embracing their own unique femininity. |

HUF

| Men |

Started as an original brand of the shop dealing in products from various brands, opened by legendary skater Keith Hufnagel in 2002. Lifestyle brand that designs products with his unique style and artistic sense inspired by skating and street cultures. |

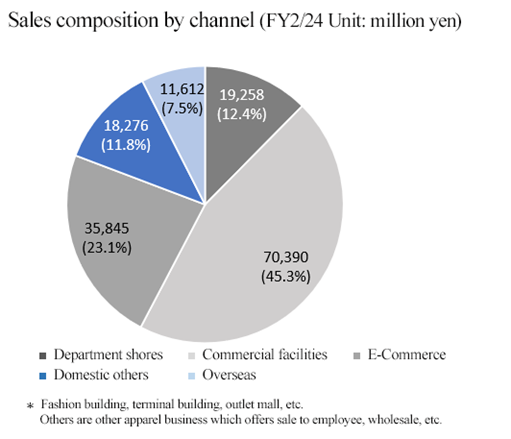

(2) Sales channels

They sell apparel via physical stores and EC inside and outside Japan.

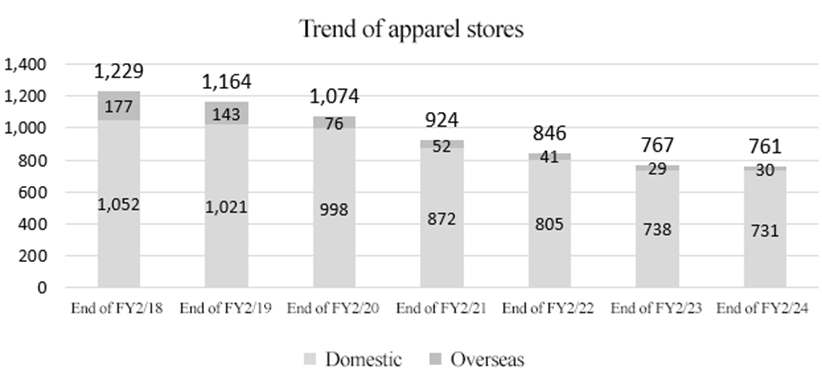

The number of physical stores was 798 (including overseas) as of the end of the fiscal year ended February 2024. Among them, 761 stores sell apparel.

While closing unprofitable stores as part of its business restructuring, the company, described as a "fashion entertainment company," believes that physical stores remain important for articulating brand narratives and providing entertainment to customers. The company will continue to develop stores focused on brands popular with customers while implementing a “scrap and build” approach to update the image. By opening stores with large floor sizes and/or in prime locations, they will reform the revenue structure of their physical store business.

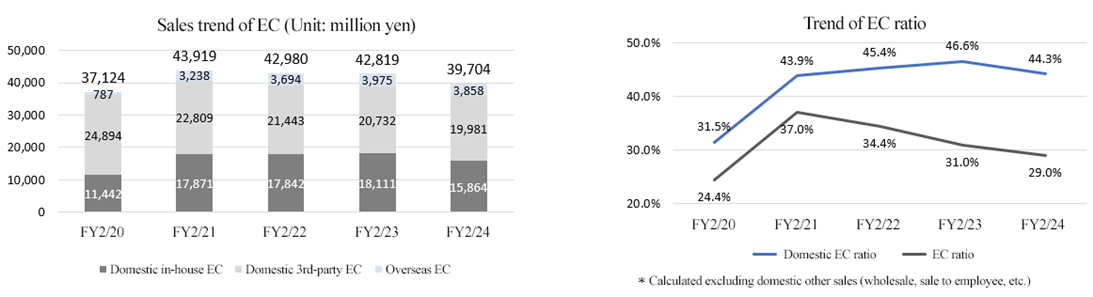

The ratio of sales via their own websites to domestic EC sales had been rising but dropped in the fiscal year ended February 2024 due to the withdrawal from some businesses. Due to discount-curbing measures, sales via other domestic companies’ EC sites declined, making regrowth a key challenge.

[1-4 Characteristics, strengths, and competitive advantages]

According to President Shimoji, the company excels at seeking, finding, and developing categories and brands that are in line with the trends of the times.

The domains of athleisure, wellness, outdoor, and streetwear are thriving, partially because people became interested in outdoor activities and health enhancement amid the COVID-19 pandemic, and “PEARLY GATES” earns one of the largest sales as a golf wear brand in Japan.

The company has successfully found brands through its networks in the U.S., U.K., and beyond. In the past decade, few companies have introduced new brands and made them successful, like TSI Holdings.

The company’s competitive advantages come from its base and experience in taking risks, as well as its know-how and track record of developing brands.

[1-5 ROE analysis]

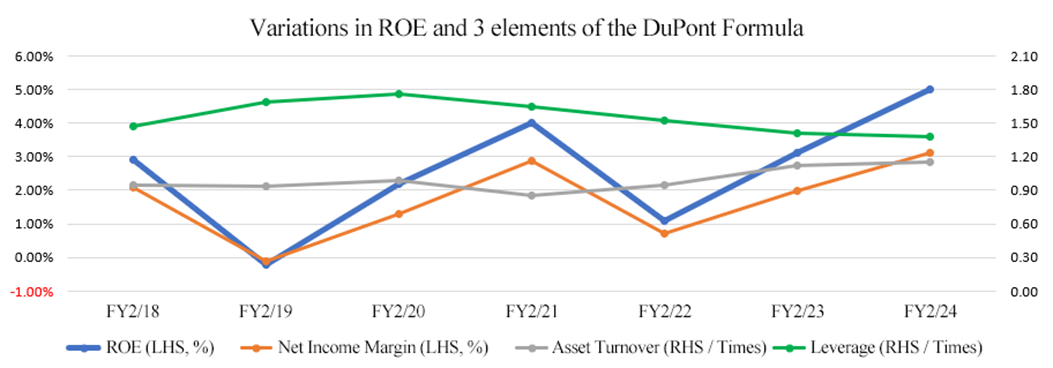

| FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 | FY 2/23 | FY 2/24 |

ROE (%) | 2.9 | -0.2 | 2.2 | 4.0 | 1.1 | 3.1 | 5.0 |

Net income margin (%) | 2.07 | -0.12 | 1.28 | 2.88 | 0.73 | 1.98 | 3.12 |

Total asset turnover (times) | 0.95 | 0.93 | 0.99 | 0.85 | 0.95 | 1.12 | 1.16 |

Leverage (times) | 1.47 | 1.68 | 1.76 | 1.64 | 1.52 | 1.41 | 1.37 |

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

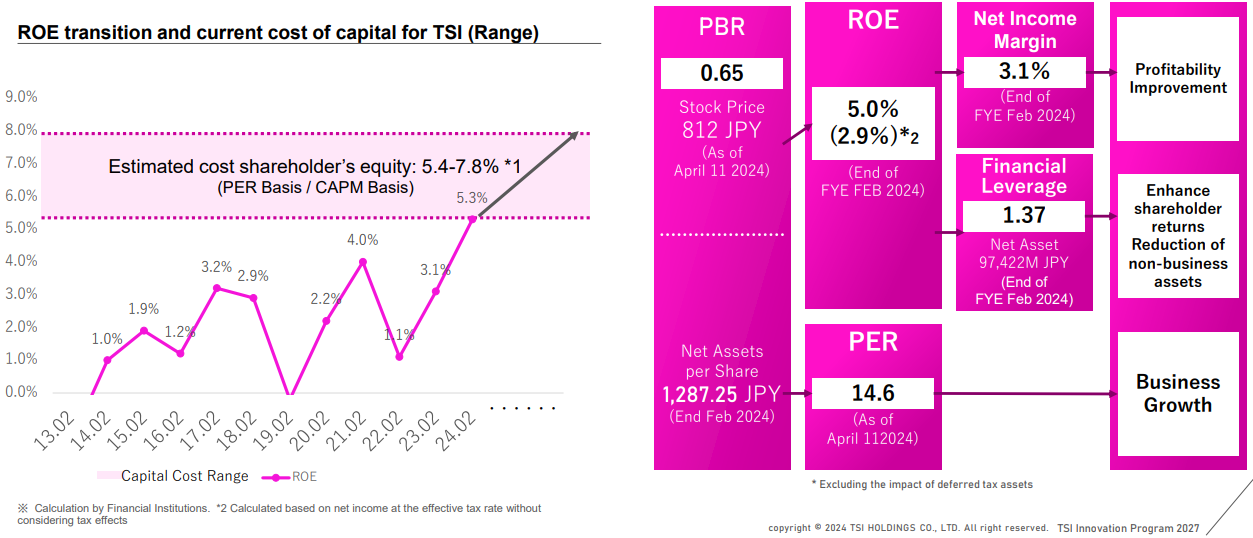

In the medium-term management plan “TIP 27,” the company aims to increase ROE to 8.0% or higher by the end of the fiscal year ending February 2027. The key is how they will improve profitability.

2. Second Quarter of the Fiscal Year ending February 2025 Earnings Results

[2-1 Overview of business results]

| 2Q of FY 2/24 | Ratio to sales | 2Q of FY 2/25 | Ratio to sales | YoY | Initial forecast | Revised forecast |

Sales | 73,278 | 100.0% | 75,230 | 100.0% | +2.7% | 74,500 | 75,200 |

Gross profit | 40,841 | 55.7% | 40,554 | 53.9% | -0.7% | - | - |

SG&A | 40,308 | 55.0% | 40,776 | 54.2% | +1.2% | - | - |

Operating income | 532 | 0.7% | -221 | - | - | -900 | -170 |

Ordinary income | 1,608 | 2.2% | -167 | - | - | -500 | -75 |

Quarterly net income | 1,472 | 2.0% | -791 | - | - | -900 | -900 |

*Unit: million yen.

Sales increased, but loss was posted. Both sales and profit exceeded the initial forecasts.

Sales grew 2.7% year-on-year to 75.2 billion yen. Both domestic and overseas sales increased. Inside Japan, physical stores performed well, but the sales of EC dropped year-on-year, due to the termination of a brand. Outside Japan, physical stores struggled, but EC performed well thanks to successful measures.

An operating loss of 200 million yen was posted (while an operating income of 500 million yen was posted in the same period of the previous year). Gross profit declined 0.7% year-on-year, and gross profit margin dropped 1.8% year-on-year, due to rising raw material prices caused by unfavorable exchange rates and the soaring energy prices, the augmentation of impairment loss caused by the increase of inventory, and discount sales for inventory optimization. SG&A expenses rose slightly due to the temporary expenses for structural reform and the augmentation of personnel costs.

The company is projected to incur a loss in the first half of the fiscal year, but the loss shrank thanks to streamlining, and both sales and profit exceeded the initial forecasts.

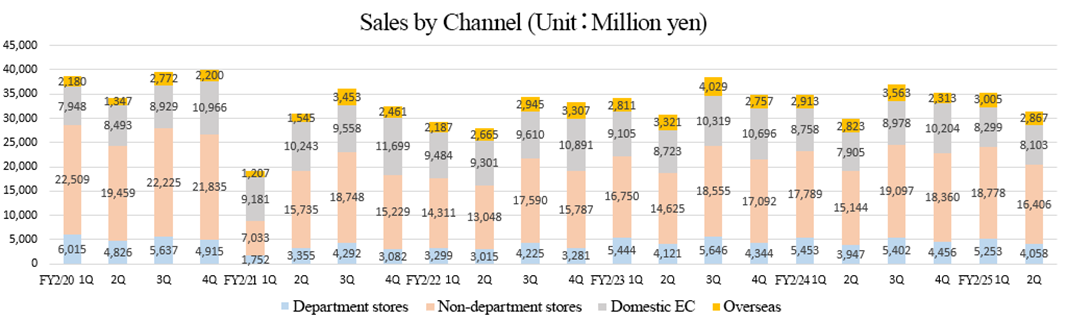

[2-2 Trend in each channel]

| 2Q of FY 2/24 | 2Q of FY 2/25 | YoY |

Department stores | 9,400 | 9,311 | -0.9% |

Non-department stores | 32,933 | 35,184 | +6.8% |

Domestic EC | 16,663 | 16,402 | -1.6% |

Other domestic channels | 8,543 | 8,459 | -1.0% |

All domestic channels | 67,541 | 69,357 | +2.7% |

Overseas | 5,736 | 5,872 | +2.4% |

Total | 73,278 | 75,230 | +2.7% |

*Unit: million yen.

*Non-department stores: fashion malls, station buildings, outlet stores, etc. Othe other apparel businesses, including wholesale and sale to employees and non-apparel businesses of group companies.

* | The sales of physical stores in Japan grew 5.1% year-on-year. The sales at department stores dropped from the previous year due to the decrease in stores, but the performance of physical stores as a whole was healthy, thanks to consumers’ motivation to go out and the demand from foreign visitors to Japan. |

* | The sales of domestic EC declined 1.6% year-on-year, due to the termination of a brand. |

* | Outside Japan, physical stores struggled, but EC performed well thanks to successful measures. Sales rose 2.4% year-on-year, partially thanks to exchange rates. |

◎EC Sales Trends

| 2Q of FY 2/24 | 2Q of FY 2/25 | YoY |

Domestic EC | 16,663 | 16,402 | -1.6% |

In‐house EC | 7,845 | 7,159 | -8.7% |

Other | 8,818 | 9,242 | +4.8% |

Overseas EC | 1,793 | 1,968 | +9.8% |

Total amount for EC | 18,457 | 18,371 | -0.5% |

*Unit: million yen.

In terms of the domestic EC, they are proceeding with the unified management of inventory for their own EC and 3rd-party EC, and the improvement in efficiency of inventory management has contributed to sales. The performance of their own websites is unchanged from the previous year, except for the impact of the termination of the distributorship contract for UNDEFEATED in the previous year.

For overseas EC, the V-shaped recovery of HUF due to hit collaborative products and the successful utilization of customer data contributed to overall performance.

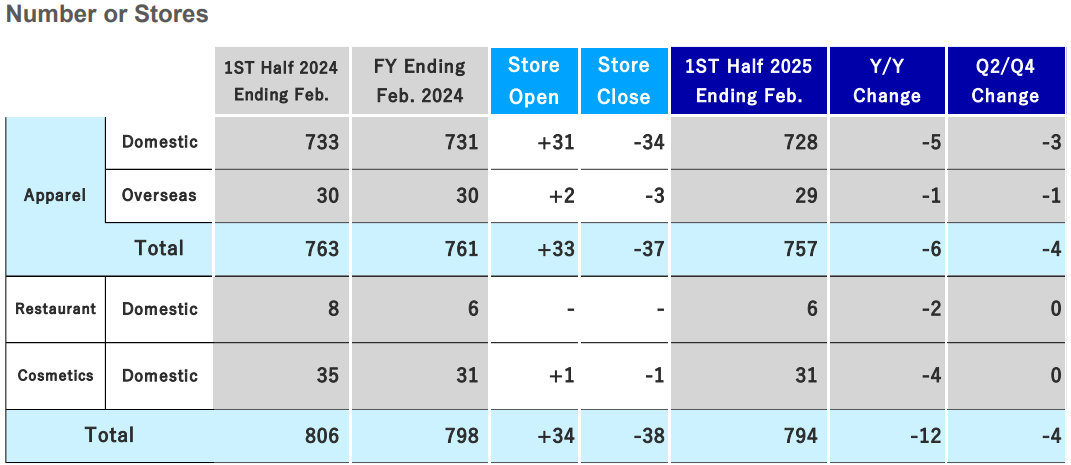

[2-3 Number of Stores and Brand Overview]

(1) No. of stores

(Taken from the reference material of the company)

The company continued to close domestic apparel stores.

(2) Sales and gross profit margin of each brand

(Taken from the reference material of the company)

◎Status of each major brand

* | PEARLY GATES Year-on-year growth rate: -1.5%. Although it was difficult to control the balance between old products and new products, sales remained unchanged from the previous year. The brand will continue to strive to achieve a precise balance between the "elimination of old products to optimize inventory" and "growth through new products." |

* | MARGARET HOWELL Year-on-year growth rate: 2.3%. Sales were driven by mainstay stores located in central Tokyo. MARGARET HOWELL GINZA SIX store and MHL. Daikanyama store maintained strong sales, up over 30% year-on-year. |

* | NANO universe Year-on-year growth rate: 2.8%. The brand achieved continuous sales growth across all channels by improving its product lineup and enhancing sales control precision. Having addressed the previously challenging issue of profitability improvement, the company will now focus on further expanding its sales. |

* | NATURAL BEAUTY BASIC Year-on-year growth rate: -4.8%. Although some stores were closed due to renovations, strong sales at mainstay stores and renovated stores helped narrow the gap in the first quarter. |

Outside of the mainstay brands, there are a number of brands that achieved double-digit or higher year-on-year growth.

Sales at YLEVE grew 43.5% year-on-year. While all stores continued to record double-digit growth, its Isetan Shinjuku store, which reopened after renovation last September, performed exceptionally well, achieving over 200% year-on-year growth. The brand is entering a growth phase and is considering aggressive store openings and events.

SEVEN BY SEVEN has seen a remarkable 131.1% year-on-year growth. Currently operating two physical stores and an e-commerce platform, SEVEN BY SEVEN has been steadily gaining recognition and experiencing rapid sales growth. Moreover, the designers launched the SSS MARKET to strengthen its worldview, featuring curated vintage clothing and personal items from stylists.

In addition, hueLe Museum, which offers a unique worldview that goes beyond clothing under the concept of "fashion × flower × art," recorded a 50.9% year-on-year growth. Meanwhile, ETRE also continued to perform well, with a 47.0% year-on-year increase.

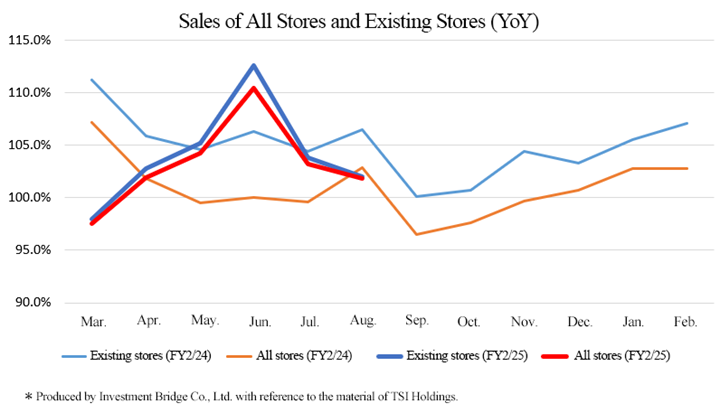

(3) Domestic Sales of All Stores and Existing Stores

In the first half of the fiscal year ending February 2025, the sales of existing stores grew 3.9% year-on-year, while the sales of all stores rose 3.0% year-on-year.

[2-4 Financial statement and cash flow]

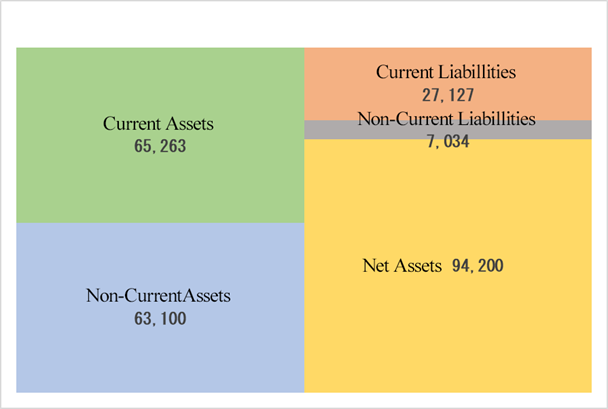

◎ Major BS

| End of Feb. 2024 | End of Aug. 2025 | Increase/ decrease |

| End of Feb. 2024 | End of Aug. 2025 | Increase/ decrease |

Current assets | 70,877 | 65,263 | -5,614 | Current liabilities | 28,388 | 27,127 | -1,261 |

Cash and deposits | 27,472 | 21,680 | -5,792 | Accounts payable | 9,615 | 9,737 | +122 |

Accounts receivable | 11,681 | 12,264 | +583 | Short-term interest-bearing liabilities | 8,322 | 7,050 | -1,272 |

Inventory assets | 28,051 | 28,375 | +324 | Non-current liabilities | 7,653 | 7,034 | -619 |

Non-current assets | 62,586 | 63,100 | +514 | Long-term interest-bearing liabilities | 1,630 | 1,016 | -614 |

Property, plant and equipment | 6,560 | 7,221 | +661 | Total liabilities | 36,041 | 34,162 | -1,879 |

Intangible assets | 7,159 | 7,043 | -116 | Net assets | 97,422 | 94,200 | -3,222 |

Investments and other assets | 48,866 | 48,835 | -31 | Retained earnings | 60,052 | 58,117 | -1,935 |

Total assets | 133,464 | 128,363 | -5,101 | Total liabilities and net assets | 133,464 | 128,363 | -5,101 |

*Unit: million yen.

Total assets stood at 128.3 billion yen, down 5.1 billion yen from the end of the previous fiscal year, due to the decrease in cash and deposits, etc. Total liabilities stood at 34.1 billion yen, down 1.8 billion yen from the end of the previous fiscal year, due to the decrease in interest-bearing liabilities, etc. Total net assets stood at 94.2 billion yen, down 3.2 billion yen from the end of the previous fiscal year, due to the decreases in capital surplus, retained earnings, etc.

The equity ratio rose 0.4 points from the end of the previous fiscal year to 73.1%.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

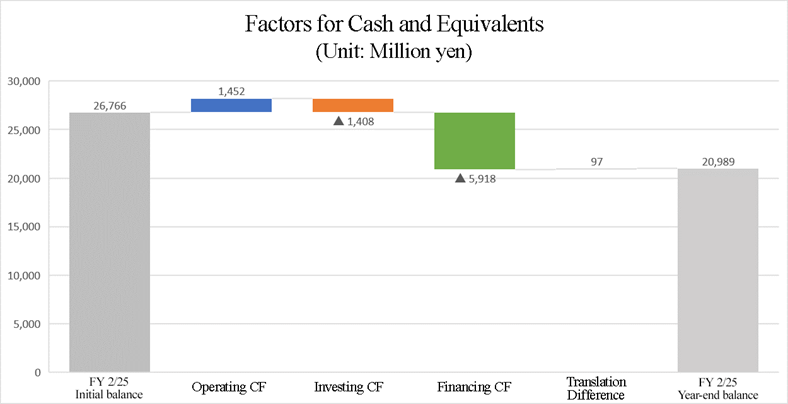

◎ Cash Flow

| 2Q of FY 2/24 | 2Q of FY 2/25 | Increase/ decrease |

Operating CF | -3,145 | 1,452 | +4,597 |

Investing CF | 940 | -1,408 | -2,348 |

Free CF | -2,205 | 44 | +2,249 |

Financing CF | -4,963 | -5,918 | -955 |

Cash and cash equivalents | 23,866 | 20,989 | -2,877 |

*Unit: million yen.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

Operating cash flow and free cash flow turned positive, as accounts payable increased after decreasing in the same period of the previous year, and the increase in inventory assets shrank year-on-year, while the company posed an interim net loss before taxes and other adjustments.

The cash position declined.

[2-5 Topics]

(1) Debut of new Sub-brands

This fall, four new lines debuted under the following brands: PINKY & DIANNE, human woman, ADORE, and Jack Bunny!! The company will accelerate the provision of new value and expansion into the peripheral fashion markets by maximizing each brand's unique edge and worldview.

(2) Exclusive Import and Distribution Agreement with Alpha Industries, Inc.

The company entered into an exclusive import and distribution agreement for Japan with Alpha Industries, Inc., a long-established U.S. military supply manufacturer that develops authentic military wear and casual wear, garnering support from fans worldwide.

In the fall of 2025, the company will begin sales through domestic wholesalers, directly operated stores, and e-commerce, aiming to expand its share in the military and casual fashion markets.

(3) ESG Management

1) E (Environment)

The company aims to eliminate the use of plastic shopping bags and start using FSC-certified paper by the end of this fiscal year.

FSC-certified paper is made from wood sourced from forests that are managed according to the standards set by the Forest Stewardship Council (FSC®).

With the goal of achieving carbon neutrality by 2050, the company has set a Key Goal Indicator (KGI) for 2050 of "reducing environmental impact through material selection" and included "reducing paper consumption" as a target in its medium-term management plan.

To reduce environmental impact, the company will start charging for shopping bags by the fiscal year ending February 2025, discontinue ordering plastic shopping bags, and gradually switch to FSC-certified paper bags as soon as the existing stock runs out. On October 1, 2024, the company started the gradual transition to FSC-certified paper for cardboard boxes used to ship products from its warehouse to customers.

By the end of the fiscal year ending February 2027, it aims to reduce shopping bag usage by 40% compared to the fiscal year ended February 2024 and increase the use of FSC-certified paper to over 90%.

Furthermore, the company plans to reduce shopping bag usage by 60% compared to the fiscal year ended February 2024 by the end of the fiscal year ending February 2031.

2) S (Society)

*NANO universe and Bunka Fashion College have collaborated on a T-shirt production project using Made by ZOZO as a hands-on learning opportunity.

As part of the company's commitment to "Nurturing the Next Generation," one of its material issues, the SDGs Promotion Division has been developing an educational curriculum at Bunka Fashion College since April 2023.

As part of this initiative, lectures have been held on the work processes of corporate designers and social issues such as mass production and mass disposal. In these lectures, students collaborated with NANO universe to produce T-shirts using Made by ZOZO, a made-to-order platform that only produces what is necessary.

This initiative aimed not only to convey the environmental issues facing the apparel industry to the next generation of designers and to consider solutions together but also to provide an opportunity to experience environmentally friendly manufacturing.

*The company jointly developed MOVE WEAR, a pioneering universal design initiative that provides clothing support for the artificial robotic arms developed by Ory Yoshifuji.

Currently, the field of neuroscience is researching the impact of people's minds and emotions on the brain, and the company is exploring the possibility of using the power of fashion to generate positive feelings and emotions.

As part of this initiative, the company launched MOVE WEAR, a joint development project with Ory Yoshifuji, a robot developer and representative of Ory Laboratory, and they have been working together across different fields to tackle social challenges.

The company created universal design clothing, focusing on clothing to be worn with the robotic arm developed for Masatane Muto, a patient with ALS (amyotrophic lateral sclerosis).

Muto will be hosting the MOVE FES 2024 music festival on November 24, 2024, to raise awareness of ALS, and he plans to wear MOVE WEAR on the day.

3. Fiscal Year ending February 2025 Earnings Forecasts

[4-1 Earnings forecast]

| FY 2/24 | Ratio to sales | FY 2/25 Est. | Ratio to sales | YoY |

Sales | 155,383 | 100.0% | 160,000 | 100.0% | +3.0% |

Operating income | 1,760 | 1.1% | 2,000 | 1.3% | +13.6% |

Ordinary income | 3,758 | 2.4% | 2,500 | 1.6% | -33.3% |

Net income | 4,849 | 3.1% | 4,000 | 2.5% | -17.4% |

*Unit: million yen. This forecast was made by the company.

No revision to the earnings forecast calling for increases in sales and operating income

Sales are projected to increase 3.0% year-on-year to 160 billion yen, and operating income is forecast to rise 13.6% year-on-year to 2 billion yen.

Although both sales and profits for the first half of the year exceeded the plan, the company has decided to maintain its full-year earnings forecast due to the need to promote inventory reduction for optimization, as well as the inability to estimate additional costs associated with business withdrawals and streamlining of head office personnel. In the first fiscal year of structural reform, they aim to secure profit growth by maintaining sales growth and improving profitability through business expansion, SG&A expense reduction, and structural reforms. The company plans to pay a dividend of 19.00 yen/share, up 4.00 yen/share from the previous fiscal year. The expected payout ratio is 35.8%.

(Taken from the reference material of the company)

4. Progress of the Medium-term Management Plan

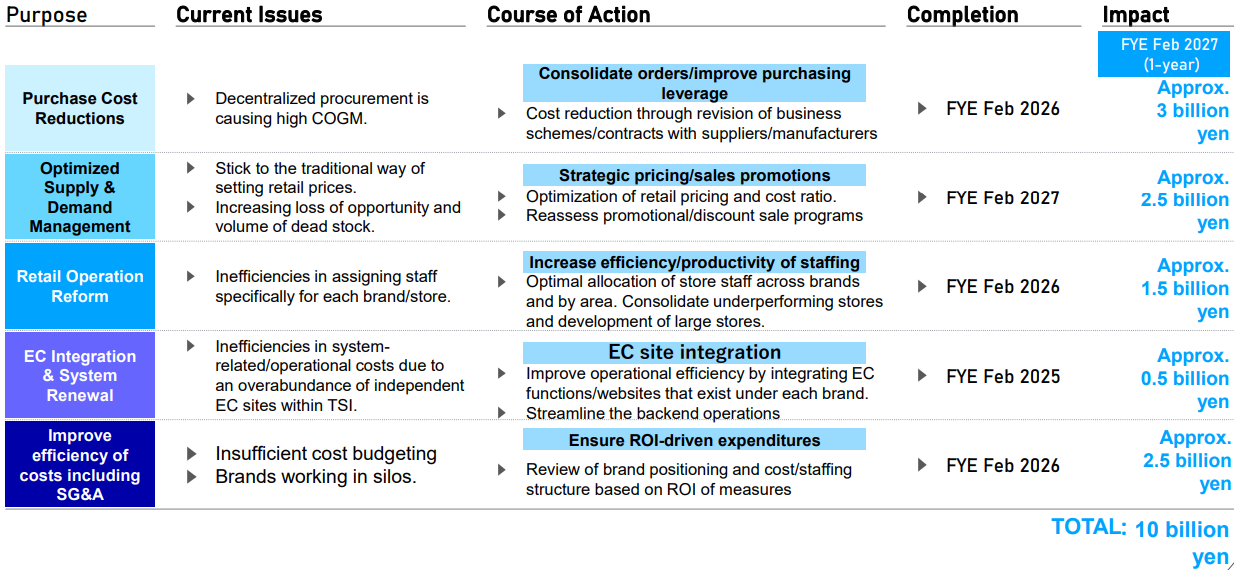

In the medium-term management plan “TSI Innovation Program 2027,” they uphold five reform initiatives: “purchase cost reductions,” “optimization of supply and demand management,” “retail operation reforms,” “EC integration and system renewal,” and “improvement of efficiency of costs, including SG&A.” In the fiscal year ending February 2027, they aim to improve revenues by about 10 billion yen. The details of each initiative, progress, and measures are as follows.

(1) Purchase cost reductions

They started measures, including the integration of Chinese factories and the transfer of the manufacturing function in ASEAN countries, mainly for the brands whose production lead time is short, while focusing on reducing FOB through the integration of suppliers and local payment settlement. These measures were started for some brands’ spring and summer 2025 products and will be conducted for most brands of autumn and winter 2025 products.

(2) Optimization of supply and demand management

They configured architecture for optimizing prices by utilizing data inside and outside the company from the viewpoints of competitors, their own company, and clients.

In the autumn and winter of 2024, they plan to first apply this method to pricing in multiple major brands.

(3) Retail operation reforms

They engage in developing a scheme to improve the ratio of store staff expenses by optimizing personnel through the revision of working shifts, staffing, etc.

In a sales role, new career paths will be developed to further enhance the utilization of human resources.

They offer diverse career paths, including a track for promotion within a single brand and another for excelling across multiple brands as an expert sales professional by honing specific skills, allowing employees to pursue their interests and leverage their specialties.

(4) EC integration and system renewal

Around February 2025, they plan to integrate 13 independent EC sites and membership services and launch the new “Mix. Tokyo.”

From the fiscal year ending February 2026, they will reduce costs by standardizing operations.

(5) Improvement of efficiency of costs, including SG&A

To maximize growth potential and profitability through optimal allocation of resources, they redefined their brand portfolio and set goals, including “clarifying the position of each brand,” “establishing the basic revenue standards,” “reaching agreements on goals and strategies for each brand,” and “reviewing, withdrawing, or downsizing certain brands.”

While aiming for revenue growth, they will also establish a foundation for pursuing new challenges using the resources generated. To solve the structural problem unique to the company, which caused the SG&A ratio to remain high, they improved their structures and systems, evaluated them with reference to other companies, and engaged in the improvement of their cost management methods.

In detail, they will develop processes to devise measures that maximize sales and profits for each brand and business section within budgetary and financial constraints. They aim to curtail inefficient expenditure, create a streamlined cost structure and standardized criteria that have varied across business sections, and share effective measures developed by specific brands across the entire corporate group. The funds generated will be reinvested in important domains for further growth.

(6) Other

① Cash allocation

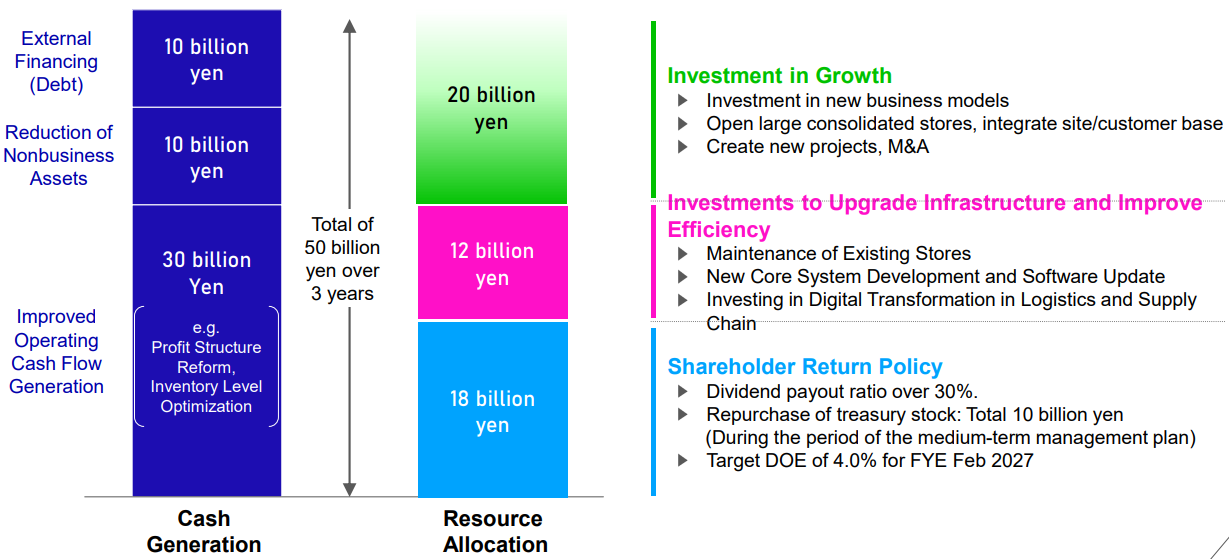

Based on the cash allocation plan: “20 billion yen to investment for growth, 12 billion yen to investment for infrastructure and efficiency improvement, and 18 billion yen for shareholder returns,” they are reducing non-business assets for “carving out cash of 10 billion yen in 3 years” by selling investment securities and investment real estate. They plan to accelerate such sales in the second half of the fiscal year.

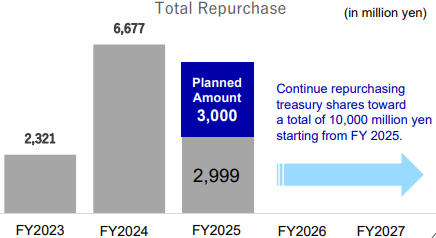

② Acquisition of treasury shares

The activities for acquiring treasury shares, which were started in April 2024, ended in September. They plan to retire about 3.38 million acquired shares at the end of October 2024.

In October 2024, they announced an additional acquisition of treasury shares.

The number of treasury shares to be acquired is up to 3.4 million, and the acquisition price is up to 3 billion yen. The acquisition period is from October 15, 2024, to March 31, 2025. They plan to retire the acquired treasury shares on April 30, 2025.

|

|

(Taken from the reference material of the company)

5. Conclusions

In April of this year, they worked on structural reform, marking a new start with the fiscal year ending February 2025, and announced the TSI Innovation Program 2027 (TIP27), which is not an extension of the previous plan, while clearly describing the generation of cash amounting to 50 billion yen and capital allocation in three years and their measures for realizing a PBR of over 1. Those were well-received by investors, and the share price of the company rose considerably.

As the company announced the acquisition of up to 3.4 million treasury shares at up to 3 billion yen, the share price skyrocketed, reaching the highest price since it was listed.

It seems that achieving “an operating income margin of 6% or higher and an ROE of 8% or higher” is definitely not easy, but attaining these targets is indispensable for sustainably increasing the share price. President Shimoji resolved to achieve these target figures through unflagging group-wide efforts, so we expect steady progress in their endeavor.

<Reference1: Medium-term Management Plan “TSI Innovation Program 2027”>

The company announced its medium-term management plan, “TSI Innovation Program 2025 (TIP25),” in April 2022. However, it had significantly failed to meet its objectives in the fiscal year ended February 2024, which was the second year of the plan.

Recognizing that it is due to not only the company's poor performance in some of its businesses amid the unfavorable external environment, but also the company's delay in responding to changes in the business environment, the company has adopted a new strategy for structural reforms beginning in the fiscal year ending February 2025, and formulated the new TSI Innovation Program 2027 (TIP27) in the form of a rolling plan, which is not an extension of the previous plan.

| TIP25 Target | FY 2/24 Results |

Sales | 172.3 billion yen | 155.4 billion yen |

EC ratio | 35% | 28% |

Operating income (Operating income margin) | 4.7 billion yen (2.8%) | 1.7 billion yen (1.1%) |

ROE | 5.3% (Target for FY 2/25) | 5.0% (*Effective 2.9%) |

*Effective ROE: When net income excluding the effect of tax effect accounting is used

[1-1 Background to the formulation of TIP27, formulation policy, outline of the plan, and vision]

(1) Background to the formulation and analysis of the current situation

Following the merger and integration of Tokyo Style and Sanei International in 2011, the TSI group has grown by emphasizing the autonomy of each brand and strengthening each brand. However, while the management foundation was established, efforts to unify business operations were still underway, resulting in performance often falling significantly below goals.

Current status and challenges faced by TSI Holdings

* Sales remain flat due to delay in recovery after COVID-19

* Low profitability due to inefficiency resulting from delayed organization integration

* Capital inefficiency

(2) Formulation policy

In order to actually generate large revenues as TSI Holdings, TIP27 was designed to accelerate fundamental structural reforms aimed at optimizing company-wide business operations, focusing on “cross-brand profit structure reforms” and “growth strategies based on core brands.”

(3) Outline of the plan

In order to increase corporate value, the company will promote both fundamental reform of its profit structure and investments aimed at accelerating growth.

In addition to strengthening the management foundation, the company will allocate the cash generated by the profit structure reform to growth investments and fulfill its goal of becoming a “creator of fashion entertainment.”

(Taken from the reference material of the company)

(4) Vision

By promoting the medium-term management plan, and through “building a community,” “fashion that leads to health and happiness,” and “self-realization through beauty and individual characteristics,” the company aims to contribute to society with fashion, design, and hospitality at its core.

[1-2 Profit structure reform and growth strategies]

(1) Profit structure reform

Traditionally, each brand has independently sourced materials and managed production based on its unique designs, shaped by individual experiences and sensibilities. They have set prices according to their own rules, and sold products through independently operated stores and e-commerce platforms, all in pursuit of an optimization strategy that highlights each brand's individuality. However, in the future, the company will integrate the processes for planning and designing products and sourcing materials, which have been conducted by respective organizations or systems, set prices under uniform guidelines based on structured supply and demand management, and streamline its operational bases through strategic personnel allocation and area selection while enhancing its e-commerce operations by consolidating over 30 independent e-commerce sites to achieve optimized, company-wide business operations.

Specifically, the company plans to increase revenues by approximately 10 billion yen by the fiscal year ending February 2027 through five reform initiatives: “purchase cost reductions,” “optimization of supply and demand management,” “retail operation reforms,” “EC integration and system renewal,” and “improvement of efficiency of costs, including SG&A.”

(Taken from the reference material of the company)

(2) Growth strategy

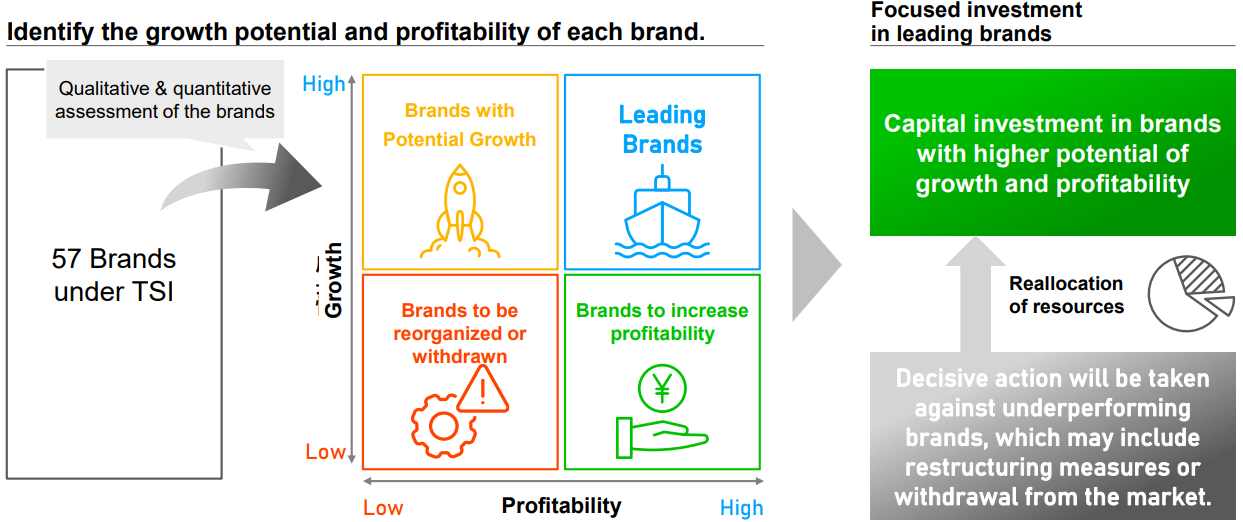

① Selection of brands to strengthen: Assessment of the brand portfolio

The company currently has 57 brands, which will be assessed both qualitatively and quantitatively to clarify the role of each brand based on growth potential and profitability.

In addition, the company will focus its investments on strengthening brands with high growth potential and profitability. For brands with low growth potential and profitability, the company will take decisive action, which may include restructuring measures or withdrawal from the market.

(Taken from the reference material of the company)

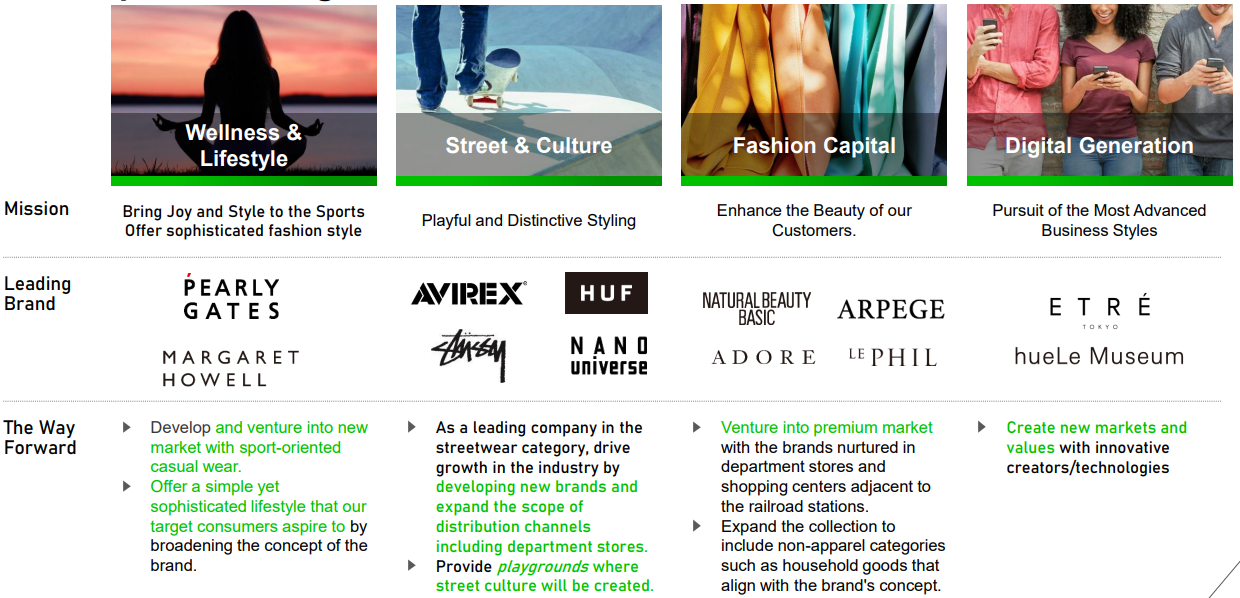

② Investment in leading brands: Expanding existing brands

In the four business domains (divisions) set out in “TIP25,” the company aims to provide value to customers by focusing on the following brands.

(Taken from the reference material of the company)

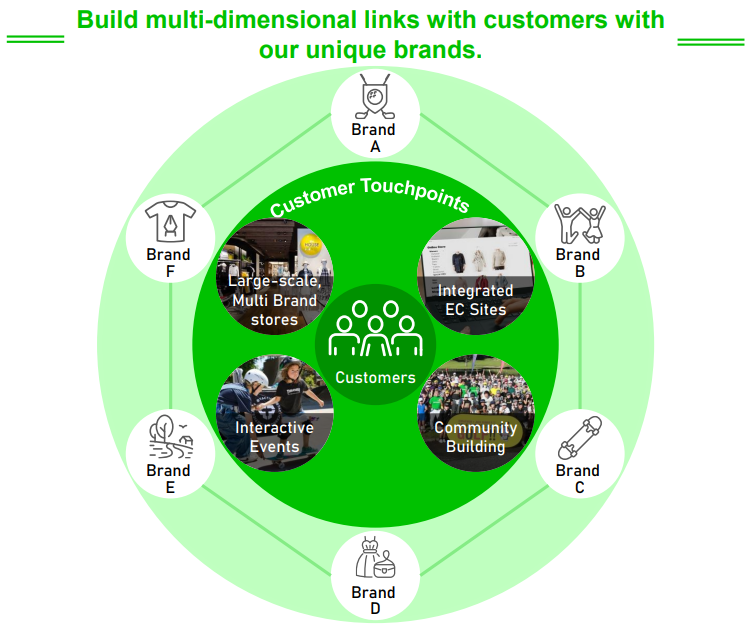

③ Improvement of customer touch points: Proposing new value tailored to customers across brands

The company aims to build multi-dimensional links with customers through its unique brands.

Based on the premise of consolidating stores and e-commerce platforms, the customer touch points that each unique and diverse brand has built will be extended to the entire TSI brand.

The company will propose new entertainment value across brands in line with customer preferences and backgrounds.

The company will offer experiences and new discoveries that will make people fall in love with the brand even more, not only through stores and e-commerce but also through communities and interactive events.

(Taken from the reference material of the company)

④ Venturing into new fields

* Entering new fields based on market trends and TSI's strengths

The market is experiencing polarization of prices.

In this environment, the company will leverage its strengths, which include high fashion creativity and a large number of unique brands, to enter the high-end market with its existing “high-priced” and “basic” brands, as well as the mid to low-priced market, which offers both fashion and affordability.

The latter is an area where the company can leverage its fashion creativity and is considering launching a new brand, including through M&A.

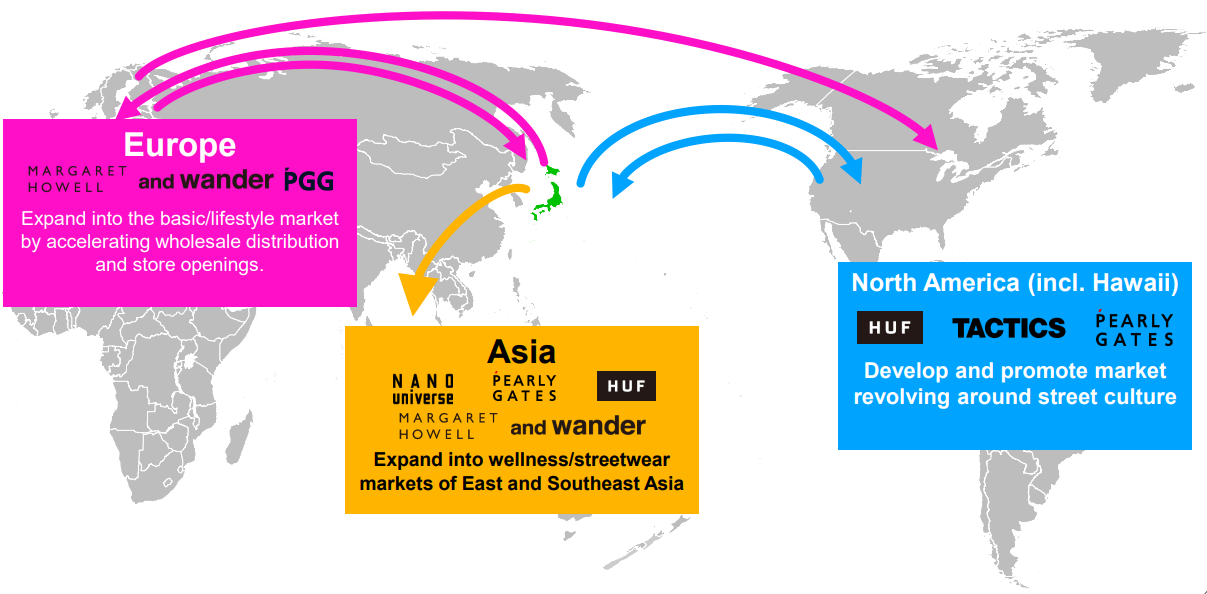

* Venturing into overseas markets

The company aims to increase revenues in overseas markets, including the U.S., Asian, and European markets, based on the preferences and needs of each market.

(Taken from the reference material of the company)

[1-3 Quantitative targets]

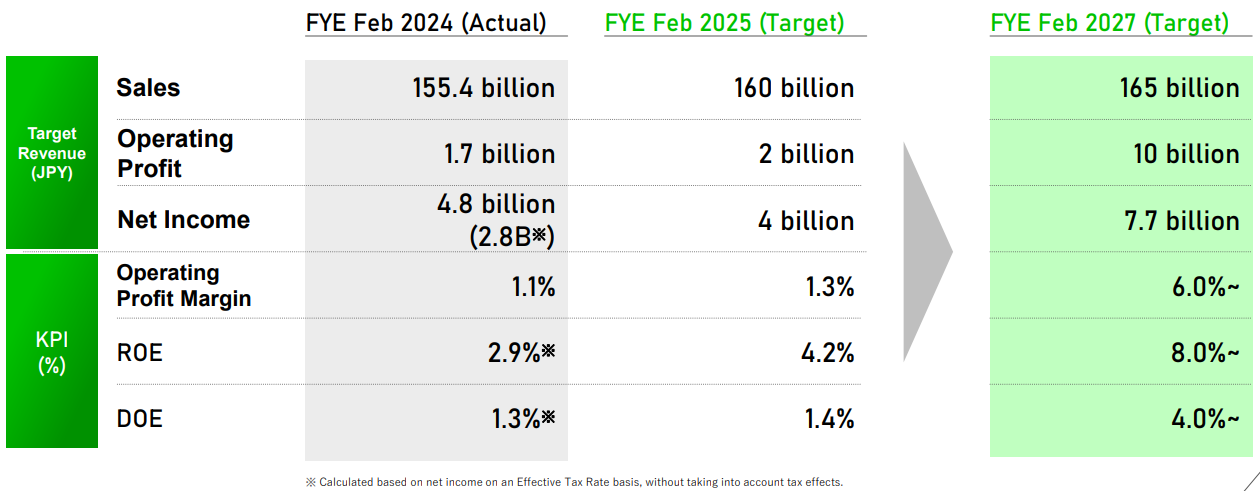

For the fiscal year ending February 2027, the company aims to achieve sales of 165 billion yen, an operating profit of 10 billion yen, an operating profit margin of at least 6.0%, and an ROE of at least 8.0%.

(Taken from the reference material of the company)

[1-4 Financial strategy and capital policy]

(1) Cash generation and capital allocation

Cash generation and capital allocation for a total of 50 billion yen over the three-year period is as follows:

The company will improve its cash generation capabilities through profit structure reforms, reduce inefficient assets, and then invest in strengthening its business foundation to accelerate growth.

(Taken from the reference material of the company)

(2) Achieving a PBR of over 1

The company estimates the cost of shareholders’ equity to be between 5.4% and 7.8%.

By achieving an ROE that exceeds this target and expanding equity spread, they will achieve a PBR of 1.

In order to improve ROE, the company will improve profitability, enhance shareholder returns, and improve asset efficiency by reducing non-business assets.

(Taken from the reference material of the company)

The company's shareholder return policy has been to maintain a stable dividend level while enhancing corporate value over the long term. However, in order to further enhance shareholder returns by improving profitability and promoting financial and capital policies based on management that is conscious of capital costs, share price, and PBR, the company has revised its shareholder return policy, specifying that “dividend payout ratio shall be 30% or higher as an indicator of the level of shareholder returns.”

In addition, to improve capital efficiency and clearly demonstrate its commitment to shareholder returns, the company announced plans to acquire additional treasury shares worth 10 billion yen during the “TIP27” period and set a target to achieve a dividend-on-equity ratio (DOE) of 4% or higher by the fiscal year ending February 2027.

[1-5 Sustainability]

*The following is a summary. For details, please refer to the company's securities report (FY 2/24).

(1) Basic understanding

The corporate group operates its business with the purpose “We create empathy and social value across the world through the power of fashion entertainment” under the corporate philosophy: “We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society.”

The challenges facing the world include serious risks of global warming, human rights violations, and war. The company believes that a healthy global environment and a society in which human rights are respected are the foundations for conducting business and that without these, sustainable corporate growth cannot be achieved. The corporate group sees the rapid changes in society as an opportunity for growth and will make sustainability-oriented management the core of its business activities, integrating both financial and non-financial aspects of the company's operations.

Based on this concept, the company announced its medium-term management plan, “TSI Innovation Program 2025 (TIP25),” in April 2022 and revised it to “TSI Innovation Program 2027 (TIP27)” in April 2024.

(Taken from the securities report of the company)

(2) Material issues

The corporate group has identified the following material issues that it will prioritize in each of the areas of “global environment,” “human,” and “society.”

Global environment | Human | Society |

Energy Raw materials Waste Water resources Bio-diversity | Diversity Health and safety Employees’ happiness Fair labor | Co-creation with local communities Nurturing the next generation Supporting society |

* For a detailed description of each material issue, please refer to the following URL.

Global environment (https://sustainability.tsi-holdings.com/materiality/environment/index.html)

Human (https://sustainability.tsi-holdings.com/materiality/human/index.html)

Society (https://sustainability.tsi-holdings.com/materiality/social/index.html)

(3) Major initiatives and approaches

①Governance

Toward sustainability-oriented management, the company is promoting the establishment of a business operation system suitable for a global fashion company by integrating its E (Environment), S (Society), and G (Governance) initiatives with its business activities and making material issues the backbone of all its activities. The company is working to maintain soundness and transparency, develop a system for rapid decision-making, and strengthen internal control, including thorough compliance and risk management.

In addition, indicators and targets for each material issue are set as part of the management strategy, and the status of their achievement is quantitatively reflected in the evaluation of the executive directors and executive officers of each group company, including TSI Holdings. In order to realize the purpose, the TSI group will address issues that it needs to address on its own in order to continuously promote sustainability-oriented management. By complying with social norms, laws, and regulations throughout the value chain and acting with high ethical standards, the company will live up to the “trust” of all stakeholders, including customers, business partners, shareholders, employees, and local communities.

The sustainability committee was established as an advisory body to the President and CEO to expand efforts to promote sustainability-oriented management and strengthen governance to ensure its diffusion. The committee is responsible for formulating and implementing sustainability strategies linked to management policies and the medium-term management plan and developing management systems.

② Human capital

The goal of creating value that brightens people's hearts lies at the core of the company's business operations. Therefore, people, who form the backbone of value creation, are the group's most important management resource and source of competitiveness. In order to realize its purpose of providing fashion entertainment, the group respects the diversity of all personnel involved in the business and strives to develop personnel and create an environment in which they can thrive, ensuring their mental and physical well-being and enhancing their creativity.

In order to create a working environment that promotes employees’ well-being and mental health, the company has implemented legally regulated systems, such as occupational safety and health committees and stress assessments. In addition, the company is actively working on workstyle reforms, reducing working hours, and promoting remote work as ways to achieve a work-life balance.

③ Climate change and natural capital

The apparel industry is said to account for 4-10% of the total CO2 emissions of all industries, and its reduction is a top priority. Therefore, in April 2022, the company set a long-term objective to achieve carbon neutrality by 2050. In October of the same year, the company endorsed the TCFD recommendations and disclosed its CO2 emission reduction targets. In October 2023, the company obtained “SBT (Science Based Targets) Initiative” certification, which states that its CO2 and other greenhouse gas reduction targets are based on scientific grounds. In addition, the company received the score “B,” the third highest score in the “Climate Change” section of the 2023 CDP questionnaire, and the score “C,” the average for the apparel industry, in the “Water Security” section.

<Actual CO2 emissions and reduction targets>

| Sum of Scopes 1 to 3 | Scopes 1 and 2 | Scope 3 |

Actual CO2 Emissions FY 2/20 (tons) | 305,000 | 9,000 | 295,000 |

CO2 emission reduction target (tons) FY 2/31 | -35% (-108,000) | -48% (-4,000) | -35% (-103,000) |

CO2 emission reduction target setting standard in SBT | - | Annual reduction of 4.2% in line with the 1.5°C climate commitment | Annual reduction of 2.5% in line with a well-below 2°C commitment (WB2℃) |

* Reduction targets for Scopes 1 and 2 are in line with the 1.5°C target. Scope 3 is in line with the 2050 carbon neutrality target. Emissions are rounded down to the nearest thousand tons.

* Progress data on emission reduction is available at the following URL.

https://sustainability.tsi-holdings.com/materiality/environment/climate-change.html

<Reference2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditors |

Directors | 7 directors, including 3 external ones (including 3 independent executives) |

Auditors | 4 auditors, including 3 external ones (including 3 independent executives) |

◎ Corporate Governance Report

The latest update: May 27, 2024

<Basic concept>

The Company seeks to enhance its internal control, including rigorous compliance with laws and regulations and risk management, and develop a structure that enables decision-making that is highly sound, transparent, and swift in order to build a business operation system befitting a fashion and apparel company engaged in business globally, under the corporate philosophy that “we create value that lights up people’s hearts through fashion and share the happiness of living tomorrow together with society.” Through these initiatives, we will make efforts to keep our corporate value growing, which is our basic business policy, to enhance our corporate governance further while building good relationships with our stakeholders.

<Reasons for not following the principles of the Corporate Governance Code (excerpt)>

[Principle 1-4. Strategic shareholding]

To run our operations smoothly and maintain and improve our business relationships, the Company strategically holds shares that would contribute to enhancing our corporate value after comprehensively considering the medium/long-term economic rationality and future prospects.

The appropriateness of strategic shareholding will be periodically examined and reported to the Board of Directors. For shares whose effects are fading, we will reduce the number of shares held after taking into consideration the situation of the target companies, such as dividends.

When exercising voting rights, the Company comprehensively decides to vote in favor or against each of the proposals based on whether it is consistent with the purpose of strategic shareholding and whether it contributes to the maintenance and improvement of the corporate value of the target company and the shareholder value.

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

[Principle 2-3. Issues related to sustainability, mainly social and environmental issues]

[Supplementary Principle 2-3-1]

[Principle 3-1.-Enhancement of information disclosure]

[Supplementary Principle 3-1-3]

[Principle 4-2. Roles and responsibilities of the Board of Directors (2)]

[Supplementary Principle 4-2-2]

(1) The Company’s Sustainability Efforts

We uphold the sustainability policy: “We sincerely work on sustainable fashion while respecting the dialogue with all stakeholders and continue our endeavor to realize a society in which people will remain happy through our business activities.” We identify material issues and set KGIs as the foundation for bringing happiness for a long period of time in a sustainable manner through the business activities of our corporate group.

We set up the SDGs Promotion Office in September 2021 to promote sustainability activities while proactively working to build in-house systems and raise awareness of employees.

For reports on specific activities, please see TSI Holdings Sustainability Website

(https://sustainability.tsi-holdings.com/index.html)

Additionally, the company's response to the TCFD, as well as its sustainability, human rights, governance, environmental, and social policies, are disclosed on the company's website.

“Information Disclosure Based on the TCFD Recommendations” (https://www.tsi-holdings.com/pdf/221012_TCFD.pdf)

“Sustainability Policy” (https://sustainability.tsi-holdings.com/management.html#policy)

“Human Rights Policy” (https://sustainability.tsi-holdings.com/materiality/human/index.html#policy)

“Governance Policy” (https://sustainability.tsi-holdings.com/materiality/governance/index.html#policy)

“Environmental Policy” (https://sustainability.tsi-holdings.com/materiality/environment/index.html#policy)

“Social Policy” (https://sustainability.tsi-holdings.com/materiality/social/index.html#policy)

(2) Investment in human capital and intellectual property, etc.

(i) Investment in human capital

People are the source of value in our business activities and our greatest asset.

By setting diversity, employee wellbeing, health and safety, and fair labor conditions as part of our essential material issues, we will strive to improve the environment to enable all staff working together to thrive happily both physically and mentally.

Furthermore, to deal with the era of change, the Company will invest in employee education, training, and development. We will establish programs through which employees acquire needed skills, by enhancing job rotations, training schemes, and self-learning systems to develop a multi-skilled workforce.

(ii) Investment in intellectual property

For the Company that operates brand businesses, intellectual property, including trademark rights and copyrights, is crucial for business administration. Intellectual property constitutes the foundation of creative value to be delivered to customers as we seek to achieve the goal “We create empathy and social value across the world through the power of fashion entertainment,” which was established as the purpose of the medium-term management plan “TSI Innovation Program 2025 (TIP 25).” We will not only develop superior designs and brands but also proactively invest in expertise, such as business models and communication design know-how, to deliver a customer experience that exceeds their expectations.

[Principle 2-4. Ensuring diversity within the Company by promoting the active participation of women, etc.]

[Supplementary Principle 2-4-1]

(1) Ensuring diversity

The TSI Group will create a diverse environment where anyone can thrive by actively promoting initiatives to realize diversity and flexibility in work and life for all in a manner that suits each one of them.

(2) Voluntary and measurable goals for ensuring diversity, and their statuses

(i) Promotion of women to managerial positions

While female managers accounted for 30.9% of the total number of managers in the Group at the end of February 2024, we have set a goal of raising the ratio to 40% by the end of February 2025.

(ii) Promotion of employees of foreign nationalities to managerial positions

Although we have yet to set any goal for promoting employees of foreign nationalities to managerial positions, we will continue to review this subject internally.

(iii) Voluntary and measurable goals for the promotion of mid-career hire employees to managerial positions and their status

There are no goals for the promotion of mid-career employees to managerial positions. Still, we have established diverse work systems (a flextime system, a reduced working hours system, and a second job system) and various training programs to accommodate individuality within the TSI Group, which brings together companies with different organizational climates and cultures. We operate our personnel system appropriately while introducing internal recruitment and job rotation schemes and flexibly accepting diversity in work duties, job categories, and work experience.

(3) Human resources development and in-house environment improvement policies to ensure diversity, and their statuses

(i) Human resources development policy to ensure diversity

To ensure diversity in promoting core personnel, we evaluate and promote employees solely based on their skills regardless of gender, age, and nationality.

Moreover, in addition to hiring new graduates, we actively hire highly skilled mid-career professionals, including those from other industries. As for promoting female employees to managerial positions, we will proactively work to raise the ratio of female employees in managerial positions further, which is already over 30% of all managers in the Group.

Moreover, while more than 100 foreign national employees already work for the Group as a whole, mainly at overseas subsidiaries, we intend to avidly conduct recruitment activities to further secure highly skilled professionals as we focus on expanding the overseas business in the coming years.

(ii) Improving the environment to enable diverse employees to thrive further

To allow diverse employees to exert their skills fully in accordance with their own lifestyles, the TSI Group takes measures, such as applying flexible work hours and work formats, revising pay levels, and easing the burdens related to shop work attire, among other employee welfare initiatives, and it will continue to improve its measures in the future.

(iii) Promotion of diversity and inclusion

We aim to enable each of our employees of different backgrounds varying in gender, age, nationality, and physical and mental conditions to thrive according to their characteristics, skills, and conditions. Thus, we will work to reform the awareness of all our employees to create a culture that respects diversity and an environment where diverse employees can grow, be motivated, and thrive.

(iv) Status of efforts to ensure diversity

The following efforts are in progress to ensure diversity in accordance with employees’ characteristics.

◎ Promotion of active engagement of women

While female managerial positions accounted for 30.9% of all managerial positions in the Group at the end of February 2024, we set the goal of raising the ratio to 40% by the end of February 2025 and strive to recruit and promote employees to increase the ratio of female managerial positions among highly senior positions.

◎ Further employment of workers of foreign nationalities

Employment of workers of foreign nationalities by the Group has been growing year after year, and we are now in the process of employing workers of foreign nationalities in a more planned manner.

◎ Utilization of elderly professionals with experience and past achievements

The Group is working to proactively employ personnel up to age 65 and continues to recruit and promote employees irrespective of age. Thus, the number of employees aged 65 or above actively contributing is increasing.

◎ Empowerment of people with disabilities

To date, the Group, mainly through its special subsidiaries, has avidly promoted the participation of people with disabilities. Its employees with disabilities accounted for 2.62% of the total workforce as of the end of February 2024. We will continue to work on creating opportunities for them to find fulfillment directly linked to operations.

◎ Promotion of understanding of LGBT

To date, the Group has a culture with a high level of understanding of LGBT, different surnames for married couples, and common-law marriage and is now in the process of eliminating gender-based discrimination by comprehensively reviewing and amending various packages, such as the congratulatory/condolence cash gift rules (including congratulatory allowances for marriage).

Moreover, the Group is working on the following initiatives that focus not only on employee characteristics but also on workstyle diversity.

◎ Developing diverse workstyle systems such as reduced working hours and remote work

The Group has developed rules and systems to realize more diverse work styles than before. These include developing work systems that allow working hours to be reduced by 30 minutes to up to four hours, a staggered working hours system that allows employees to start working at any time from 8:00 to 13:00, a flextime system, and lifting the ban on second jobs as well as providing subsidies for remote work environment maintenance. In addition, we are working on reviewing and amending these systems and establishing new ones.◎ Creation of a work environment and systems that accommodate pregnancy, giving birth, and child-rearing

We achieved a 100.0% childcare leave uptake rate and a 97.4% return-to-work rate after childcare leave for women (both as of the fiscal year ended February 2024) through the above-mentioned reduced working hour system that allows employees to working hours to be reduced by 30 minutes to up to four hours, supportive measures including offering the reduced working hours system for childcare until the child graduates from elementary school, and thorough communication when employees return to work. We are constantly making improvements to maintain and enhance such an environment.

◎ Creating a system for balancing nursing care and work

We work to address anticipated increases in work restrictions due to nursing care, hospital visits, and medical treatment by extending the legally stipulated total number of caregiving days from 93 days to a maximum of 365 days and by implementing flexible policies.

[Principle 5-1. Policy for constructive dialogue with shareholders]

As a policy regarding system development and initiatives to promote a constructive dialogue with shareholders, the director overseeing investor relations, general affairs, and finance will be responsible for the overall dialogues with shareholders and will cooperate actively with relevant internal divisions that assist the dialogue by sharing information properly. To promote a constructive dialogue with shareholders, we will not only arrange for opportunities to have one-on-one meetings but also hold briefing meetings. Furthermore, as a means of managing important matters in dialogue with shareholders, we will work to prevent the leakage of insider information by ensuring that the internal information and insider trading management rules are widely understood and strictly enforced.

[Principle 5-2. Establishing and Disclosing Business Strategies and Business Plans]

The Company establishes its business strategy based on an understanding of its own capital cost and discloses and explains its outline at the general shareholder meetings and the financial results briefing meetings. To achieve our strategy, we regard various measures, such as capital investments, as crucial factors in the decision-making process.

Furthermore, following the Tokyo Stock Exchange's announcement on March 31, 2023, regarding “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” the company recognizes that improving its PBR, which is currently below the level requested by the Tokyo Stock Exchange, is a critical management issue. On April 12, 2024, we issued a notification on the revision to the shareholder return policy, setting a target dividend payout ratio of at least 30%. Additionally, we plan to repurchase 10 billion yen worth of our own shares from the fiscal year ending February 2025 to the fiscal year ending February 2027, and a DOE of 4% or more by the fiscal year ending February 2027.

[Supplementary Principle 5.2.1]

In the medium-term management plan, TSI Innovation Program 2027 (TIP27), we have disclosed the entire program, including the basic policy on the business portfolio.

“Medium-Term Management Plan: TSI Innovation Program 2027”

(https://www.tsi-holdings.com/pdf/TIP27.pdf)

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (TSI HOLDINGS CO., LTD.: 3608) and the contents of the Bridge Salon (IR Seminar) can be found at: www.bridge-salon.jp/ for more information.