Bridge Report:(3538)WILLPLUS Second Quarter of Fiscal Year ending June 2024

President Takaaki Naruse | WILLPLUS Holdings Corporation (3538) |

|

Company Information

Market | TSE Standard |

Industry | Retail (Commercial) |

President | Takaaki Naruse |

HQ Address | 5-13-15, Shiba, Minato-ku, Tokyo, Shiba Mita Mori Building 8th Floor |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥1,137 | 10,327,580 shares | ¥12,063 million | 14.0% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥43.51 | 3.8% | ¥174.04 | 6.5 x | ¥1,005.48 | 1.1 x |

* The share price is the closing price on March 29. The number of outstanding shares, EPS, and DPS are based on financial results for the second quarter of fiscal year ending June 2024. ROE and BPS are the results in the previous fiscal year.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

June 2020 Act. | 35,068 | 1,160 | 1,196 | 802 | 85.32 | 14.00 |

June 2021 Act. | 40,776 | 2,290 | 2,301 | 1,533 | 161.47 | 28.26 |

June 2022 Act. | 39,696 | 2,366 | 2,377 | 1,550 | 162.84 | 34.90 |

June 2023 Act. | 44,115 | 1,867 | 1,943 | 1,302 | 135.45 | 41.17 |

June 2024 Est. | 48,821 | 2,312 | 2,303 | 1,692 | 174.04 | 43.51 |

*Unit: million yen or yen. Estimates are those of the company.

This report includes Willplus Holdings Corporation's financial results for the second quarter of fiscal year ending June 2024 and other information.

Table of Contents

Key Points

1. Company Overview

2. Mid- to Long-Term Strategy

3. Growth Strategy

4. Second Quarter of Fiscal Year ending June 2024 Earnings Results

5. Fiscal Year ending June 2024 Earnings Forecasts

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Willplus Holdings Corporation is a holding company with five consolidated subsidiaries that operate dealers handling 11 brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

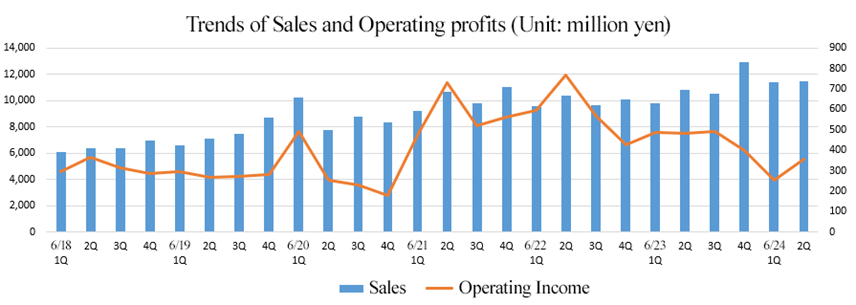

- The sales in the second quarter of the fiscal year ending June 2024 were 22,881 million yen, up 10.7% year on year. The sales of new cars, used cars and recurring revenue-type business have all increased. Operating income was 610 million yen, down 37.2% year on year. Although sales grew, consumers have been cautious due to rising prices of new cars. Furthermore, the increase in sales was not sufficient to offset the augmentation of costs such as the increase in depreciation costs for mainly demo cars procured in step with the recovery of new car supply, the increase of staff and the increase in personnel costs caused by expenses for promoting human capital management. In terms of quarterly performance, sales were almost at the same level in the first and second quarters. However, owing to the recovery of the gross profit margin of both new cars and used cars, in the second quarter, operating income grew 39% quarter on quarter (from the first quarter), although it dropped 27% year on year.

- The earnings forecast remains unchanged. The sales forecast for the fiscal year ending June 2024 is 48,821 million yen, up 10.7% year on year, while the forecast for operating income is 2,312 million yen, up 23.8% year on year. Sales are projected to hit a record high, just like in the previous fiscal year. Regarding new car sales, brand manufacturers are expected to discuss price policies to cope with the soaring prices and sluggish sales. Therefore, the number of cars sold is projected to recover. With regard to the recurring revenue-type business such as car maintenance and insurance agency business, the company will further enhance the connection with each customer and aim to build an even more solid revenue foundation. Regarding selling, general and administrative (SG&A) expenses, personnel costs, costs related to sale and costs related to store maintenance are projected to increase in step with the expansion of business. Moreover, the company plans to continue investments in human capital such as the improvement of working conditions, reduction of menial work through DX and training for reskilling to allow all employees to fully utilize their abilities.

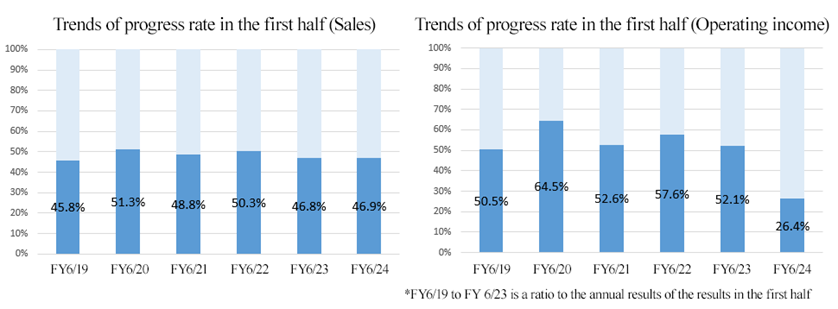

- The progress rate of the results in the first half of the fiscal year to the full-year forecast is 46.9% for sales and 26.4% for operating income. While it is almost unchanged from the previous years for sales, it is significantly lower than before for operating income. We would like to keep an eye on how much they can increase sales and profit in the second half of the fiscal year as the number of new cars sold recovers.

- While the company, too, is affected by the downturn of the domestic market of imported cars caused by the soaring prices of new cars, competitors in this industry, especially small and medium-sized dealers with weak management foundations, are faced with even harsher conditions. We would like to pay attention to whether the company’s M&A strategy, which has been on hold for the past three years, can gain significant momentum.

1. Company Overview

Willplus Holdings Corporation is a holding company with five consolidated subsidiaries that operate dealers handling 11 brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

[1-1 Corporate History]

In January 1997, the father of President Takaaki Naruse established Sunflower CJ Co., Ltd., an imported car sales company, in Kitakyushu City, Fukuoka Prefecture. The company was the first official Chrysler dealer in western Japan.

In October 2004, President Naruse acquired all of the company's shares and started business activities as the Willplus Group.

Although it was a small dealer with a few staff members, including President Naruse, it achieved excellent results nationwide in sales of Chrysler cars and received high acclaim, which led him in 2005 to take over Chrysler's directly managed store in Ohta-ku, Tokyo, and advance to Tokyo. In 2006, the company opened a store in Kurume City, Fukuoka Prefecture. It also started a dominant strategy in Tokyo and Fukuoka.

Willplus Holdings Corporation was established in October 2007 to flexibly acquire dealers through optimal allocation of management resources and prompt management decision-making.

Under the holding company structure, the company actively expanded its business scope and was listed on the JASDAQ of the Tokyo Stock Exchange in March 2016. In September 2017, as the market changed, it shifted to the Second Section of the Tokyo Stock Exchange, and then it was listed on the First Section of the Tokyo Stock Exchange in February 2018. The company got listed on the Prime Market of Tokyo Stock Exchange in April 2022 in step with the market restructuring, and then listed on the Standard Market in October 2023.

[1-2 Corporate Philosophy]

In this section, we state the company's significance and core values.

Our Significance (MISSION STATEMENT) We propose a life with imported cars, share affluence, fun, and joy with more people, and continue to take on the challenge of drawing warm smiles on the face of everyone involved. |

Core Values ・Love our cars, love our colleagues, and work with pride. ・Always take on challenges and break through our limits. ・Achieve great results through teamwork. ・Make sure we reach our goal on time. ・Never give up until the end, and do our best. ・Provide richness, enjoyment, and joy. ・Never forget to be sincere and grateful. |

[1-3 Market Environment]

The business environment, which is essential in understanding the company, is as follows.

Regarding the business environment related to the M&A strategy, which is the company's growth driver, see “2. Medium- to long-term strategy”.

◎ The share of imported cars in the domestic passenger car market continues to increase, and the number of imported cars owned in Japan is growing steadily.

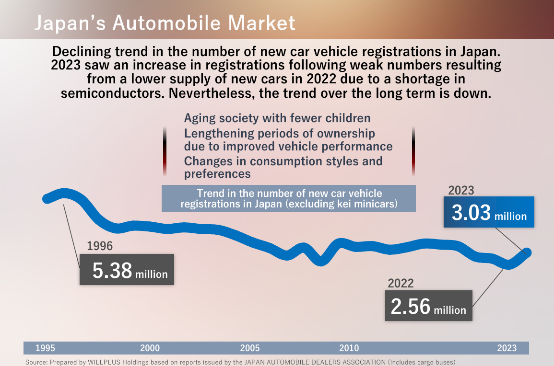

The number of new cars registered in Japan shows a decreasing trend due to the declining birth rates and aging population, the prolongation of the period of owning a car due to the elevation of functionality, changes in consumption styles and preferences (decrease of young people who own automobiles), etc.

(From the reference material of the company)

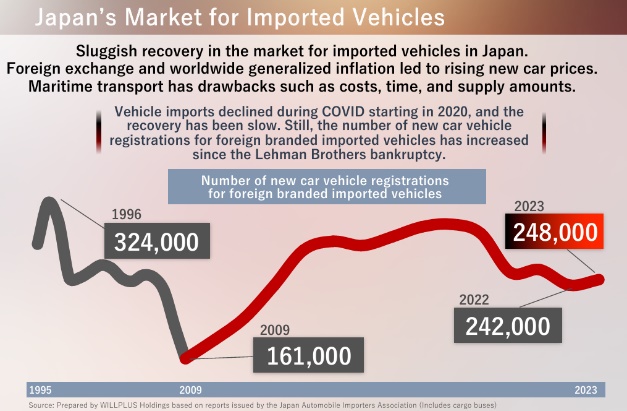

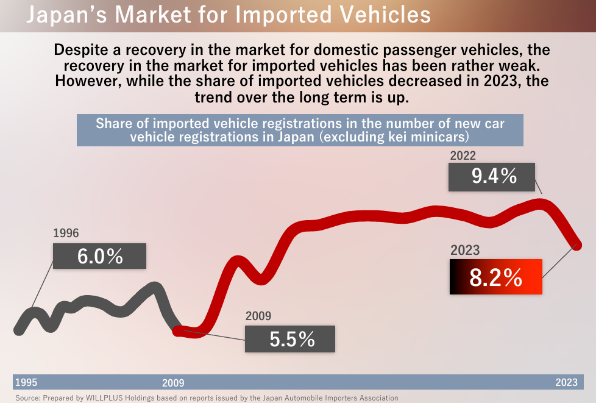

Amid such situation, although the number of new imported cars (made by overseas manufacturers) registered in Japan has been decreasing after 2020 due to the impact of COVID-19, and is recovering slowly, it has grown since the bankruptcy of Lehman Brothers. The recovery of the imported car market is sluggish, unlike the recovery of the domestic passenger car market, and the share of imported cars registered in Japan declined in 2023. However, in the long term, the share of imported cars registered in Japan shows a rising trend.

|

|

(From the reference material of the company)

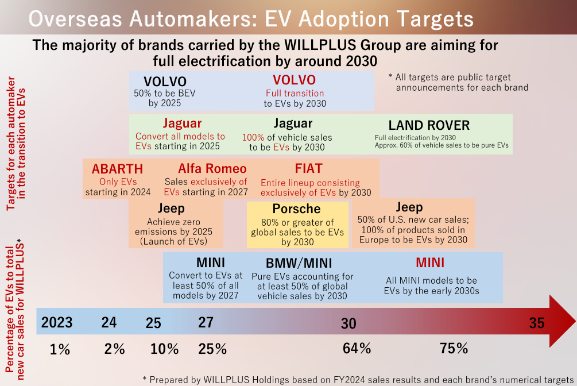

The imported car manufacturers are proactively addressing environmental issues and the majority of brands in which the company deals have announced plans aiming for complete electrification by 2030.

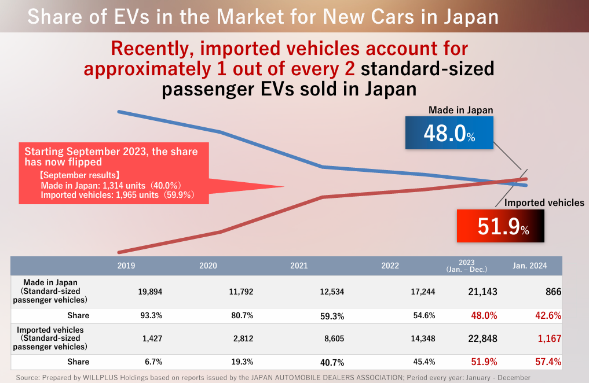

While the market share of EVs still accounts for just 1.6% of automobiles in Japan, there are more imported cars than cars manufactured in Japan among the EVs for personal use sold in Japan, which indicates that EVs are increasingly recognized as imported cars.

Moreover, active investment in Japan, such as establishing and expanding sales networks, has also increased the imported car manufacturers' market share.

|

|

(From the reference material of the company)

◎ Comparison with other companies in the same industry

Code | Company | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income margin | ROE | Market Capitalization | PER | PBR |

3184 | ICDA HLD | 31,000 | +1.7 | 1,383 | +0.8 | 4.5 | 11.2 | 5,943 | 6.5 | 0.7 |

3538 | Willplus HLD | 48,821 | +10.7 | 2,312 | +23.8 | 4.7 | 14.0 | 10,379 | 5.8 | 1.0 |

7593 | VT HLD | 300,000 | +12.6 | 13,000 | +1.1 | 4.3 | 12.4 | 62,197 | 7.7 | 0.9 |

8291 | Nissan Tokyo Sales HLD | 150,000 | +9.0 | 7,800 | +21.9 | 5.2 | 6.8 | 35,116 | 5.0 | 0.7 |

9856 | KU HLD | 142,000 | -7.4 | 8,200 | -15.3 | 5.8 | 12.1 | 51,803 | 6.7 | 0.7 |

* Units: million yen and %. Sales and operating income are company forecasts for this term. ROE is the result of the previous fiscal year. Market capitalization is the number of shares at the end of the most recent quarter × the closing price on March 8, 2024. PER (forecasted figures) and PBR (actual figures) are based on the closing price on March 8, 2024.

The company expects double-digit increase in both sales and profit. If the market highly evaluates the company's high business revitalization capabilities through M&A, raising its dividend payout ratio to 30%, and an aggressive shareholder return policy aiming for dividend growth that exceeds profit growth, the valuation level will likely change.

[1-4 Business Description]

◎Overview

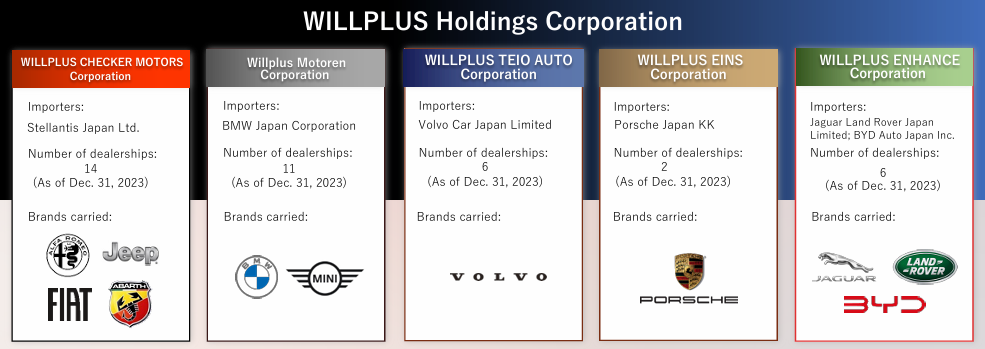

Under the holding company Willplus Holdings Corporation, five consolidated subsidiaries engage in sales of imported new and used cars, vehicle maintenance, and non-life insurance agency business. The company handles 11 brands. The company has an official dealer contract with an importer (a company that handles imported cars in Japan) for each brand it handles.

(From the reference material of the company)

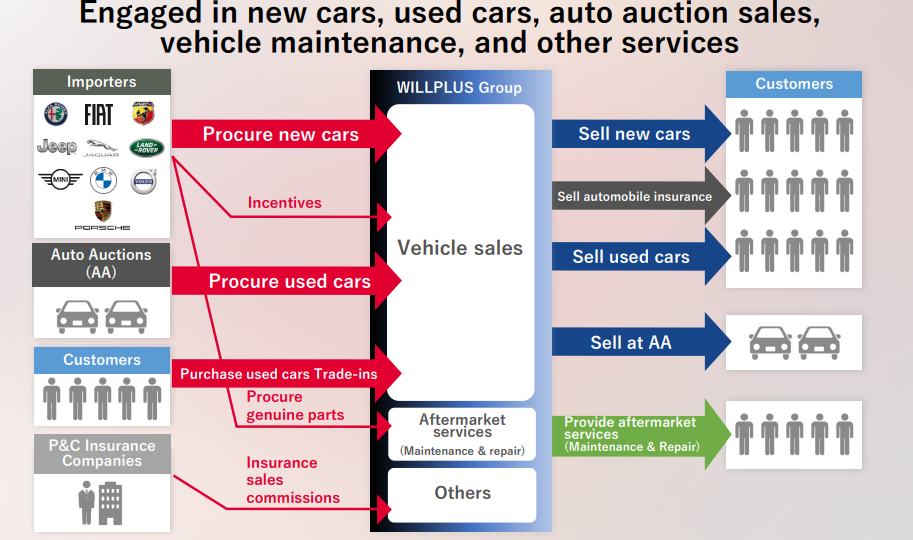

◎ Products and services (business description)

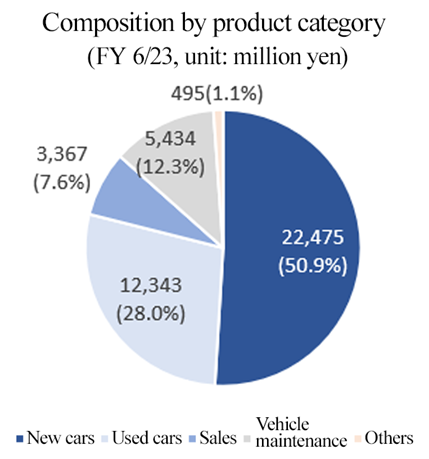

The company discloses sales classified into the categories of new cars, used cars, auto auction sales, vehicle maintenance and other services.

(From the reference material of the company)

Products and Services | Description |

|

New cars | As authorized dealers, the companies sell all new car brands procured from each importer. | |

Used cars | It mainly sells certified used cars of recent models of each brand with a short travel distance. Products are purchased through trade-ins at the time of selling new cars, purchases, and automobile auctions. | |

Sales | It sells trade-in used cars of other brands at automobile auctions. In addition, at the request of dealers of other companies, it may sell new and used vehicles owned by the corporate group. | |

Vehicle maintenance | The main services are maintenance, repair, and inspection of the sold vehicles. With the exception of some stores, service centers are set up alongside showrooms. | |

Others | It sells compulsory automobile liability insurance and voluntary insurance as an agent for non-life insurance companies. Incentive income related to new car sales from importers is also included. |

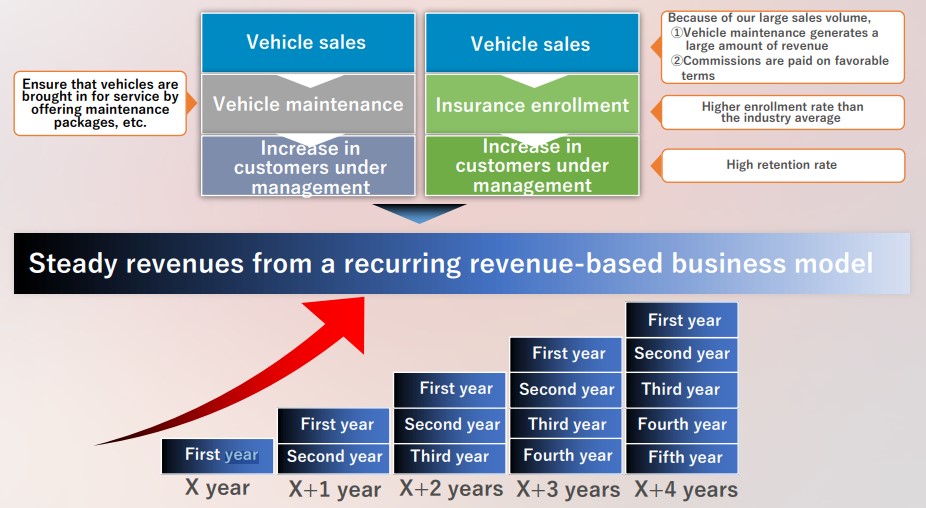

Although the sale of new cars is the main business, the company is focusing on the sale of used cars and strengthening customer relationships by providing services that customers need after purchasing a car, such as vehicle maintenance and car insurance sales.

Regarding vehicle maintenance, maintenance packages are provided to ensure maintenance after sale. As for insurance sales, the provision of detailed information on insurance products has been highly evaluated, and the enrollment and retention rates are higher than the industry average.

In this way, “the increase in sales quantity = expansion of retailer business model earnings” leads to the expansion of recurring revenues through the increase in the number of vehicle maintenance and insurance purchases.

◎ Number of stores

As of the end of December 2023, the number of stores is 19 in Fukuoka, 16 in Tokyo and Kanagawa, 2 in Yamaguchi, 1 in Miyagi, and 1 in Fukushima, for a total of 39 stores.

[1-5 Characteristics, Strengths, and Competitive Advantages]

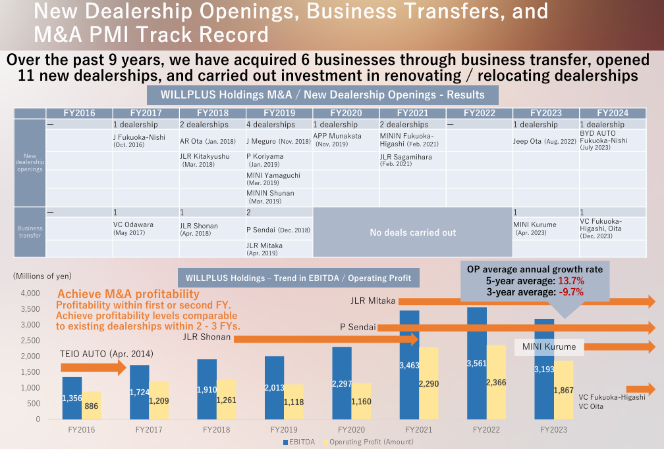

(1) Advanced capability to revitalize business through M&A

From the perspective of "purchasing time," many companies currently use M&A strategies as a pillar of their growth strategies. It goes without saying that finding excellent deals and executing them at appropriate prices are essential for a successful M&A. However, the post-M&A process called PMI (Post Merger Integration) to create the expected synergy effect is seen as more important.

There are countless cases of M&A failing due to a lack of prior assessment of factors that impede integration and the inability to manage differences in corporate culture.

Under such circumstances, investors should pay attention to the company's business revitalization ability.

Since the establishment of Willplus Holdings in October 2007, the company has carried out 11 M&A deals to date. All deals have turned profitable.

(From the reference material of the company)

The key to a successful M&A is sharing philosophies, such as pursuing the improvement of customer satisfaction and clarifying the evaluation criteria, which includes respecting challenges to the maximum extent possible. The company believes these key factors can drastically change companies and has great confidence in its ability to revitalize its business.

(2) The only listed company whose main business is being an authorized dealer of imported cars

While there are many companies that are authorized dealers of imported cars while mainly relying on selling used cars, the company is the only listed company that mainly sells new cars.

Believing that the share of imported cars in the domestic passenger car market (excluding mini cars) shows an increasing trend in the long term, the company intends to pursue further growth of revenues by expanding their market share based on an M&A strategy.

(3) Stable revenue structure based on the recurring revenue-type business

The stable revenue structure based on car maintenance and insurance sales, which are recognized as recurring revenue-type businesses, represents another significant characteristic and forte of the company.

While a significant increase of owned cars in Japan can hardly be expected, a rising trend can be seen in the average number of years of using a car due to the changes in the economic situation, elevation of awareness concerning the environment, etc., inevitably making maintenance more important.

In addition, with the development of “CASE,” maintenance work is expected to become more complex, and maintenance work for imported vehicles is expected to be concentrated at authorized dealers.

Given these factors, the company believes that opportunities for earnings in the vehicle maintenance business will continue to increase, and it will seek to strengthen the foundation of this business by increasing the percentage of vehicles that come in for maintenance by adding maintenance packages and extended warranties for new vehicles.

In addition, the company will continue to brush up its staff's insurance knowledge to further improve customer satisfaction with regard to insurance commission income, which has been growing at double-digit rates every fiscal year, and further strengthen the foundation for stable growth in the stock-type business of insurance sales and vehicle maintenance.

(From the reference material of the company)

2. Mid- to Long-Term Strategy

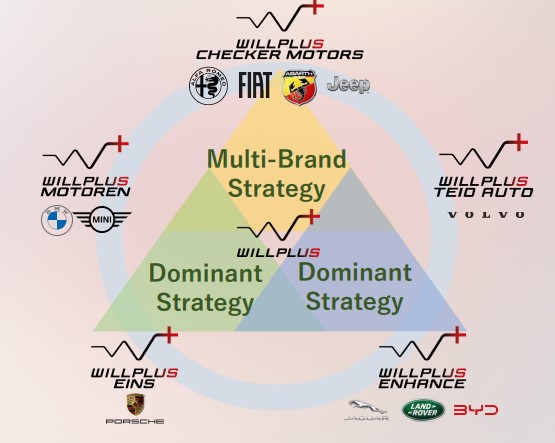

While today’s companies are required to improve their social significance and corporate value to solve social issues, the company formulated and implemented a mid- to long-term strategy based on its basic growth strategies (multi-brand strategy, dominant strategy, M&A strategy).

[2-1 Willplus Group Policy]

The company aims to enhance social value and corporate value. In other words, the company aspires to solve social issues and achieve corporate growth.

The company will strive to “contribute to the realization of a sustainable society” and “create social value” as a step toward the elevation of their social value.

Concretely, they will forge ahead with making their stores greener and decarbonizing the store areas, aiming for an enterprise that is needed by society.

They aim for “sustainable growth” and “elevation of corporate value in the medium term” as a step toward the elevation of their corporate value.

Concretely, they will promote their growth strategy, centered on M&A, and engage in solving issues through corporate revitalization in the car sales industry, where many small and medium-sized enterprises exist, by resolving the challenge of finding a successor, reusing assets (resources), improving profitability, and reeducating and stimulating human resources (human capital) while aiming for the maximization of sales and profit, as described below.

They view “the solving of issues concerning climate change” as an “opportunity,” aim for acquiring “new areas” and “new brands,” make proactive efforts to expand their business through “M&A” and work toward the “maximization of market capitalization” through the elevation of their social value and corporate value.

[2-2 Goal]

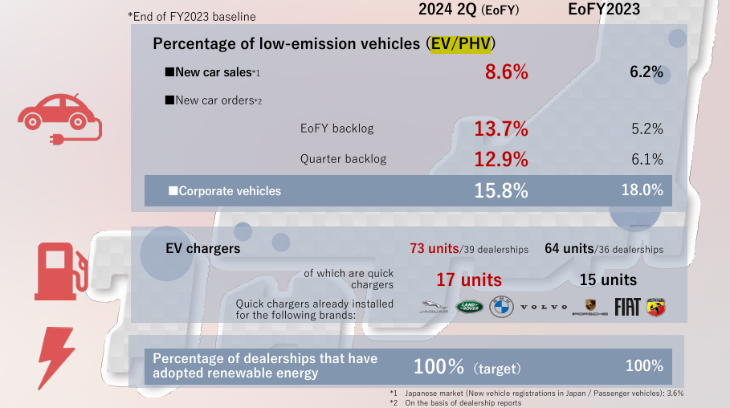

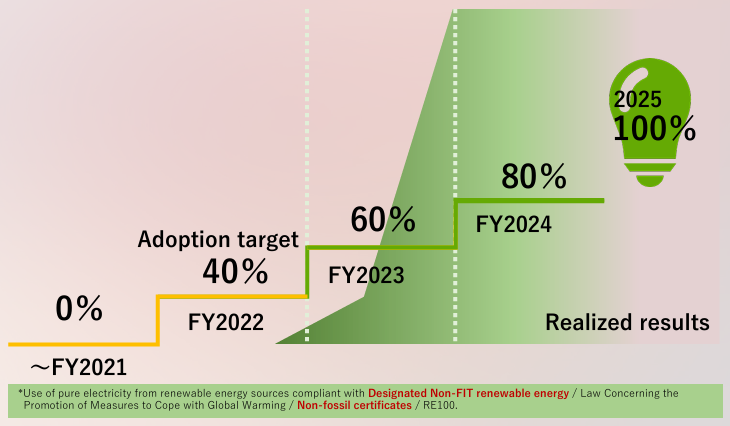

As the commitment to issues concerning climate change including the supply chain is sought, brand manufacturers are starting to demand the accurate grasping of GHG emissions from store operation, setting of goals for the reduction of GHG emissions and concrete initiatives to achieve these goals (ratio of EVs among demo cars, ratio of renewable energy use, ratio of recycled waste, etc.) from official dealers.

The company, which aims to be a leading company in solving climate change issues, has set the following GHG emission reduction targets.

To reduce Scope 1 + Scope 2 GHG emissions by 50% in FY 2030 compared to FY 2022 (6.3% reduction per year).

Concretely, we set goals of “increasing the ratio of low-carbon vehicles to company vehicles (including test-vehicles) to 80% or higher by FY 2030” and “adopting renewable energy at all stores by FY 2025.”

[2-3 Initiatives of the Willplus Group]

The company’s initiatives for realizing “the elevation of social value” and “elevation of corporate value” at the same time are outlined below.

(1)Social Value Enhancement

①Contribute to the realization of a decarbonized society by promoting green store operations

In addition to setting the above reduction targets, the company intends to make capital investments to promote the spread of EVs in its store areas as an imported car dealer striving to be one of the first to promote green store operations, thereby contributing to the decarbonization of its store areas and the domestic automobile industry.

The achievements they have made so far are as follows.

(From the reference material of the company)

While the ratio of low-carbon cars has risen in new car sales from the end of the previous fiscal year, it dropped with regard to company-owned cars as the number of cars increased in step with the expansion of the business area.

Regarding EV charging facilities, the company has added two more quick chargers since the end of the previous fiscal year. They have already installed quick chargers for seven brands.

22 stores have switched to renewable energy by the end of fiscal year 2023. 24 out of 39 stores are currently using renewable energy, as “Volvo Car Fukuoka-Higashi” and “Volvo Car Oita,” the two stores that joined the group in this fiscal year, have already switched to renewable energy.

15 stores have yet to switch, but the company achieved 100% renewable energy at an earlier stage in fiscal year ended 2023, by purchasing tradable green certificates.

(From the reference material of the company)

②Other Initiatives Responses

◎Obtained the score B in the CDP “Climate Change” questionnaire for two consecutive years

In response to requests from institutional investors and purchasing companies around the world, we answered the questionnaire regarding climate change conducted by the international organization Carbon Disclosure Project (CDP), which promotes companies to disclose environmental information, in 2023 like in 2022, and obtained Score B for two consecutive years.

The CDP questionnaire is aimed at evaluating each organization’s disclosure of environmental information with the grades A to F as a global standard regarding “E” of ESG (environment, society, and governance). As of 2023, about 23,000 companies, which account for over two thirds of the global market cap, disclosed environmental information through CDP, and institutional investors and purchasing companies around the world refer to such information when making decisions. In Japan, about 2,000 companies, including over 1,000 companies listed on the Prime Market, answered the questionnaire.

The score B corresponds to about 24% high-ranking companies out of respondents around the world, and the company ranked at a top position this time again among the ten companies in related industries, which are listed on the Prime Market of TSE, alongside NEXTAGE (Prime Market of TSE, 3186) and USS (Prime Market of TSE, 4732). They have acquired the same rating as companies that represent Japan, such as Suzuki, Lawson, Calbee, JR Central and ORIX.

The company aims to obtain an "A" or "A-" rating, which corresponds to the top 0.08% of companies worldwide, by 2026.

(2) "Enhancement of social value" and "enhancement of corporate value" through promotion of M&A

M&A is an important measure for quickly entering new areas, acquiring new brands, and expanding the market shares of existing brands. In the saturated domestic automobile market, the company believes that M&A is the most appropriate and priority strategy from the perspectives of customer acquisition, early return on investment, and securing profits.

Armed with the "advanced capability to revitalize business through M&A" mentioned in [1-5 Characteristics, Strengths, and Competitive Advantages,] they will strive to expand their sales and profit through M&A and steady PMI.

◎ Recent trends in M&A

In 2023, a total of 13 instances of capital movement took place for BMW, MINI and VOLVO, brands in which the company deals, and the number of operating companies (capital) decreased by 10.

The company also implemented two M&A projects, taking over the three stores of “MINI Kurume,” “Volvo Car Fukuoka-Higashi” and “Volvo Car Oita,” but competitors in this industry, too, are proactively carrying out M&A, making the competition fierce.

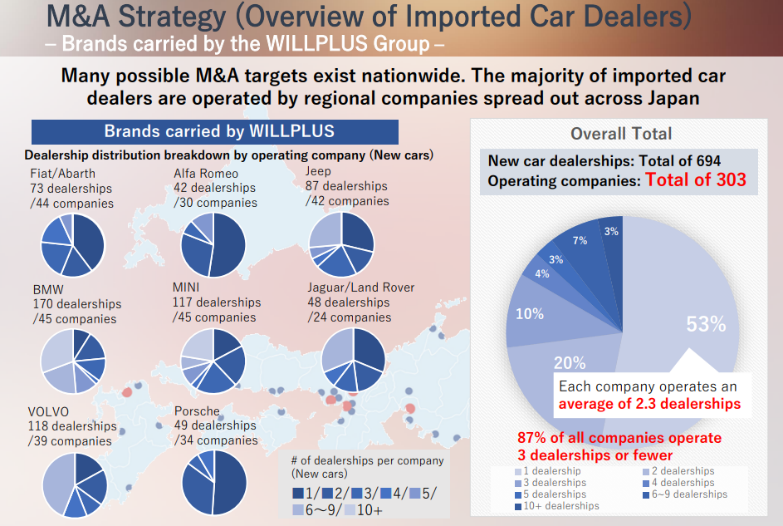

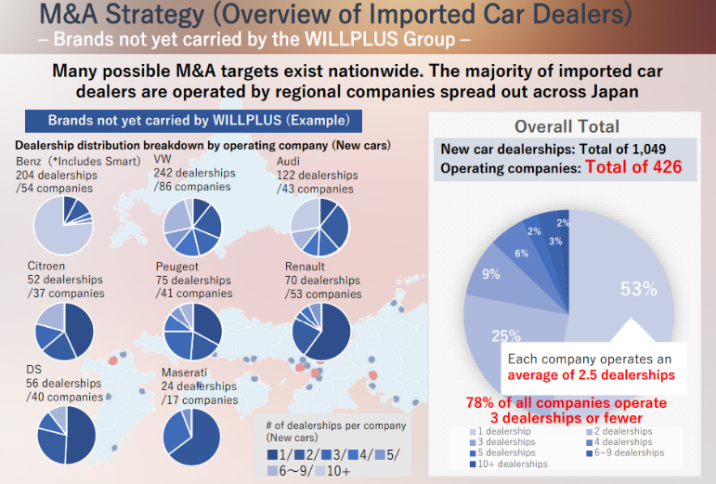

◎Business Environment for M&A Promotion

According to the company's assessment, there will be 633 imported automobile dealers operating throughout Japan by the end of 2023, with a total of 1,514 new car sales offices. Each company had an average of 2.4 shops, while small and medium-sized businesses with three or fewer shops accounted for over 90% of the total number of dealers.

Store operation varies from brand to brand, and some brands are consolidating capital.

In addition, many dealers are struggling with the difficulty in finding successors, a common problem for small and medium-sized companies in Japan.

|

|

(From the reference material of the company)

For these imported car dealers, the "CASE" of automobiles, of which "Electric Vehicle" and "Connected" are the most important management issues for the future.

"CASE" stands for Connected, Autonomous, Shared & Services (which may refer to car sharing and services/sharing only), and Electric. They are drastically changing the conventional concept of a "car" and creating new demand and markets in each of these areas.

◎ Enhanced Environmental Awareness and the Progress of the Shift to EVs

With heightened awareness of the global warming crisis, efforts to reduce greenhouse gas emissions and realize a decarbonized society are progressing rapidly.

One of the most significant concerns is reducing automotive emissions, and as governments try to attain carbon neutrality by 2050, automobile manufacturers are shifting from traditional gasoline and diesel engine cars to electric vehicles (EVs) in order to survive.

As mentioned in [1-3 Market Environment], manufacturers headquartered in Europe, which has long had a high degree of environmental awareness, have been particularly engaged in the transition to EVs.

On the other hand, while Japanese manufacturers set targets for the number and ratio of sold EVs, the expansion pace is sluggish in comparison with overseas competitors and there is a high possibility that the shares of imported cars will continue growing in regard to the sale of EVs in Japan.

At the same time, brand car manufacturers must commit to developing a firm understanding of emissions throughout their supply chains and to reducing them, so they are increasingly urging dealers to not only understand their current emissions, but also to make appropriate capital investments and responses to climate change issues, such as increasing EV purchases, installing quick chargers, and disclosing emission reduction targets.

Many dealers, however, face financial and human resource limits that make it difficult for them to respond adequately, and some analysts predict that brand car manufacturers may take the lead in further combining and restructuring vendors who can respond appropriately to such demand.

◎ Complication of car maintenance through the spread of connected systems and EVs

The term "connected" refers to the usage of communication equipment in automobiles to enable continuous external contact. Equipping vehicles with a SIM card will allow for grasping the state of a car and the situation on a road, exchange of information between cars and between a car and infrastructure, remote control, etc.

The connected automobile will evolve into smartphone-like devices, improving convenience while potentially complicating maintenance work in the case of a breakdown or vehicle inspection.

Furthermore, the previously noted shift to EVs will have a significant influence on car maintenance. Through the distribution of EVs, high-voltage battery and generator failures will increase, and vehicle maintenance will need to manage high-voltage systems, prompting substantial investment in high-voltage equipment and special training for safety reasons. Because the shift to connected systems and electric cars will need greater investment in both hardware and software, maintenance work for imported vehicles is likely to be concentrated in the hands of authorized dealers and large capital organizations with substantial investment capacity.

◎ The company's policy on M&A

While responding to EVs and connected automobile is an urgent task for imported car dealers, the company intends to differentiate itself by building stores that are preferred by brand car manufacturers and by acquiring dealers who find it challenging to address these issues through M&A. By doing so, it hopes to expand into new areas and pick up new brands in order to grow and boost its corporate value. Additionally, the company wants to help with social issues by creating new brands and working to make its stores greener.

The company will not only decarbonize the neighboring area and turn the stores green, but it will also reinvigorate the social capital that already exists by repurposing resources and assets including stores, retraining personnel, and enhancing productivity by streamlining processes using DX.

As imported vehicle dealers confront succession concerns and increase their attention to tackling climate change issues, it is anticipated that the company's primary strategy, M&A, will accelerate in the future.

[2-4 Medium- to Long-term Shareholder Return Strategy]

The company, which has increased dividends consecutively since its listing, has established the following policy.

☆ | To target a medium- to long-term ROE of 15% or higher (14.0% in the fiscal year ended June 2023). |

☆ | The company will gradually raise its dividend payment ratio to 30% by fiscal year ending 2026 in order to "keep sufficient capital" and "further boost shareholder return" at the same time. |

☆ | In order to sustain and increase consistent and ongoing returns to shareholders, the company will continue to pay out dividends at a payout ratio of 30% from fiscal year ending 2027, with a DOE of 4.5% or higher. |

In the term ended June 2023, the dividend remained 41.17 yen/share as forecast, while the company raised payout ratio from 21.4% in the fiscal year ending June 2022 to 30.4%, and achieved a dividend growth exceeding profit growth for the third consecutive term.

They are forecasting a dividend of 43.51 yen/share and a payout ratio of 25.0% for this fiscal year ending in June 2024.

In order to demonstrate its extremely aggressive profit growth policy and shareholder return stance, the company aims to achieve ROE that significantly exceeds the cost of shareholders' equity, increase the dividend payout ratio gradually, and increase dividends in excess of profit growth over the next four years.

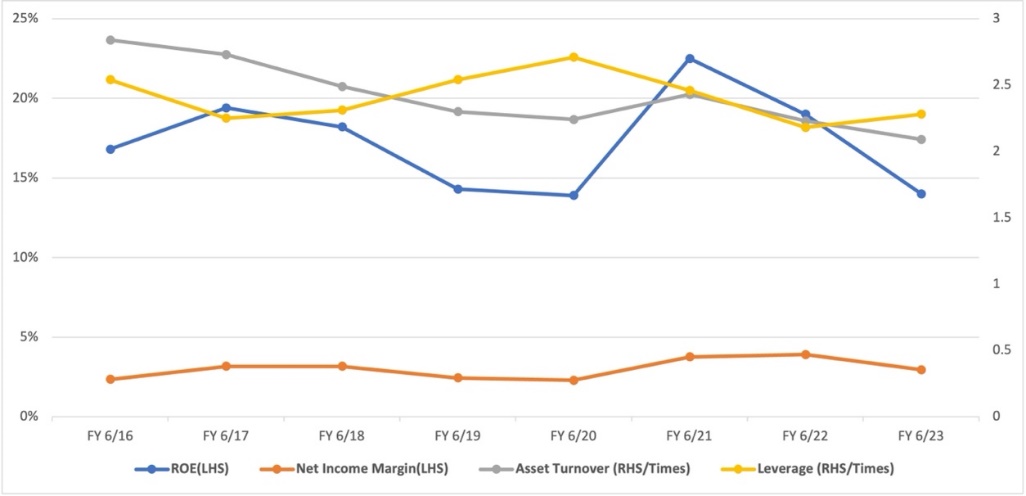

(ROE Analysis)

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 | FY 6/22 | FY 6/23 |

ROE (%) | 16.8 | 19.4 | 18.2 | 14.3 | 13.9 | 22.5 | 19.0 | 14.0 |

Net income margin (%) | 2.34 | 3.16 | 3.16 | 2.44 | 2.29 | 3.76 | 3.91 | 2.95 |

Total asset turnover (times) | 2.84 | 2.73 | 2.49 | 2.30 | 2.24 | 2.43 | 2.23 | 2.09 |

Leverage (x) | 2.54 | 2.25 | 2.31 | 2.54 | 2.71 | 2.46 | 2.18 | 2.28 |

Although ROE has been on a decline in the past two years, it is above 8%, which is said to be the general target for Japanese enterprises.

3. Growth Strategy

Three strategies promote the company's growth: "multi-brand strategy," "dominant strategy," and "M&A strategy."

(From the reference material of the company)

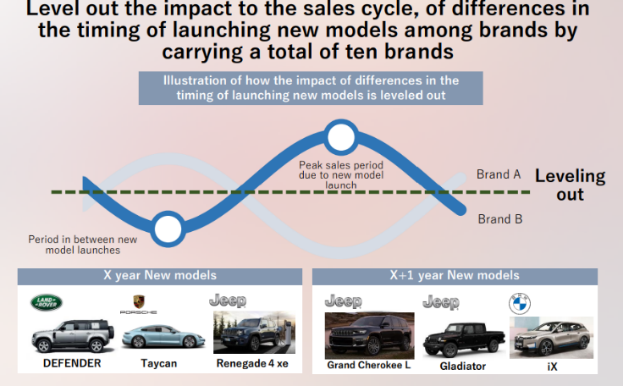

[3-1 Multi-brand strategy: Expansion of earnings and leveling of the sales cycle]

By handling multiple brands without relying on a specific brand, the company aims to even out the impact of the sales cycle caused by differences in the timing of new model launches among brands.

The company currently handles 11 brands and aims to expand the number of brands through M&A strategies.

(From the reference material of the company)

[3-2 Dominant strategy: Increase the market share and maximize profit in the same trade area]

The company is opening new stores in cities with a population of 1 million and surrounding cities as specified areas in order to increase its market share by attracting customers in the same trade area, improve productivity through efficient personnel allocation among stores, and maximize profit.

Currently, the company focuses on Tokyo, Kanagawa, and Fukuoka, which are Japan's top markets in terms of new car registrations and ownership of imported cars (passenger cars), but it is also aiming to expand into other areas through the M&A strategy.

[3-3 M&A Strategy: Speed Up]

M&A is an important measure for quickly entering new areas, acquiring new brands (multi-brand strategy), and expanding the market share of existing brands.

Following the acquisition of a huge number of stores, trade areas, and new brands via M&A, the company has been extending its business by building additional stores in neighboring regions to complement its trade areas.

The company targets more than ten brands, including Mercedes-Benz, Volkswagen, and Audi, and there is a tremendous opportunity for growth through the M&A acquisition of additional brands.

Aside from direct approaches from the company to the target companies and direct contact from the target companies back to the company, the company searches out deals through introductions from importers, financial institutions, and M&A brokerage firms.

The company will carry out due diligence and only engage in negotiations with those agreements that satisfy the company's investment recovery requirements following internal discussions that focus on prospects for future development and synergies.

Since their founding in October 2007, WILLPLUS Holdings has implemented 11 projects of M&A. They have achieved profitability in all these projects by injecting their know-how, etc. in addition to opening new stores and making investments in stores, including relocation and renovation, and the high level of their PMI capability is attracting attention.

4. Second Quarter of Fiscal Year ending June 2024 Earnings Results

[4-1 Overview of Financial Results]

| 2Q of FY 6/23 | Ratio to sales | 2Q of FY 6/24 | Ratio to sales | YoY |

Sales | 20,661 | 100.0% | 22,881 | 100.0% | +10.7% |

Gross Profit | 4,173 | 20.2% | 4,341 | 19.0% | +4.0% |

SG&A | 3,199 | 15.5% | 3,730 | 16.3% | +16.6% |

Operating Income | 973 | 4.7% | 610 | 2.7% | -37.2% |

Ordinary Income | 977 | 4.7% | 671 | 2.9% | -31.3% |

Net Income | 633 | 3.1% | 441 | 1.9% | -30.4% |

*Unit: million yen. Net income is net income attributable to owners of the parent.

Increase in sales, but decrease in income

The company reported a 10.7% year on year increase in sales to 22,881 million yen.

The sales of new cars, used cars and recurring revenue-type business have all increased.

Operating income declined 37.2% year on year to 610 million yen.

Although sales grew, consumers have been cautious due to rising prices of new cars. Furthermore, the increase in sales was not sufficient to offset the augmentation of costs such as the increase in depreciation costs for mainly demo cars procured in step with the recovery of new car supply, the increase of staff and the increase in personnel costs caused by expenses for promoting human capital management.

In terms of quarterly performance, sales were almost flat in the first and second quarters. However, due to the recovery of the gross profit margin of both new cars and used cars, in the second quarter, operating income grew 38.8% quarter on quarter (from the first quarter), although it dropped 26.6% year on year.

[4-2 Market Environment]

While the domestic passenger car market (the number of registered new cars, small and standard size) is favorable, growing 14.3% year on year in the second quarter (October-December), the market of imported cars is sluggish, declining 4.8%, due to prices that remain high.

Fewer new cars of the brands in which the company deals were registered in Japan than last year. Users continue to wait and see due to “the increased supply of new cars” in addition to “a sudden rise in the price, which then remains high.”

Some brands in which the company deals are affected by temporary factors such as the stagnation of the supply of new cars in the second quarter, continuing from the first quarter.

[4-3 Trend of each business]

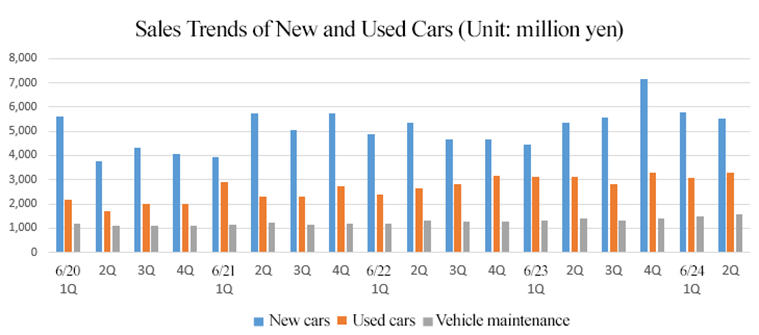

| 2Q of FY 6/23 | Composition ratio | 2Q of FY 6/24 | Composition ratio | YoY |

New cars | 9,776 | 47.3% | 11,321 | 49.5% | +15.8% |

Used cars | 6,238 | 30.2% | 6,384 | 27.9% | +2.3% |

Sale by distributors | 1,658 | 8.0% | 1,818 | 7.9% | +9.6% |

Subtotal of sales of cars | 17,674 | 85.5% | 19,524 | 85.3% | +10.5% |

Car maintenance | 2,729 | 13.2% | 3,060 | 13.4% | +12.2% |

Other | 257 | 1.2% | 296 | 1.3% | +15.0% |

Total | 20,661 | 100.0% | 22,881 | 100.0% | +10.7% |

*Unit: million yen.

*Sale of new cars

The number of cars sold declined year on year for some brands as consumers refrained from the purchase due to the ending of the model cycle and opportunities for sale were lost because shipment was stopped, in addition to the impact of the revision of selling prices on order receiving activities.

On the other hand, sales grew as the product supply was mostly stable, cars were steadily delivered, and selling prices rose.

Although the new car sales of the company grew 3.7% year on year in the second quarter (October-December), they declined quarter on quarter (from the first quarter).

*Sale of used cars

Sales grew as a result of efforts for securing products through measures such as encouraging customers to trade in their old cars when selling new cars, especially in regard to offered brands where the supply of new cars was insufficient in the first half of the term.

* Recurring-revenue business

Even when new car sales were sluggish, sales of car maintenance grew 12.2% year on year in the first half of the fiscal year due to a steady increase of customers who continuously have their cars serviced in addition to a rise in the number of stores.

While the company has kept forging ahead with acquiring new contracts in the agency business of insurance, they further enhanced the connection with their clients and worked toward contract period extensions. As a result, the insurance fee in the first half of the fiscal year increased 13.4% year on year even while new car sales showed little progress. The overall number of insurance contracts also shows a steady growth, increasing 6.9% year on year.

[4-4 Financial Standing and Cash Flows]

◎Main Balance Sheet

| End of June 2023 | End of December 2023 | Increase/ Decrease |

| End of June 2023 | End of December 2023 | Increase/ Decrease |

Current Assets | 15,620 | 15,359 | -260 | Current Liabilities | 9,533 | 10,254 | +721 |

Cash and Deposits | 4,290 | 3,987 | -302 | Payables | 3,829 | 3,317 | -512 |

Inventories | 9,551 | 9,277 | -273 | ST Borrowings | 2,615 | 3,515 | +900 |

Noncurrent Assets | 8,024 | 8,913 | +889 | Noncurrent Liabilities | 4,364 | 4,042 | -321 |

Tangible Assets | 7,038 | 7,971 | +932 | LT Borrowings | 3,818 | 3,418 | -399 |

Buildings and Structures | 3,757 | 4,615 | +857 | Total Liabilities | 13,898 | 14,297 | +399 |

Intangible Assets | 97 | 64 | -33 | Net Assets | 9,746 | 9,975 | +229 |

Investment, Others | 887 | 877 | -9 | Retained Earnings | 8,435 | 8,621 | +185 |

Total Assets | 23,644 | 24,273 | +628 | Total Liabilities and Net Assets | 23,644 | 24,273 | +628 |

*Unit: million yen.

While cash and deposits decreased, total assets grew 600 million yen from the end of the previous fiscal year to 24.2 billion yen due to an increase in tangible fixed assets such as the acquisition of stores. Total liabilities augmented 300 million yen year on year to 14.2 billion yen due to a decline in accounts payable caused by a decrease in product procurement, the augmentation of short-term borrowings, etc.

Net assets increased 200 million yen from the end of the previous fiscal year to 9.9 billion yen due to an increase in retained earnings.

Capital-to-asset ratio fell 0.1 points from the end of the previous fiscal year to 41.1%.

◎CF

| 2Q of FY 6/23 | 2Q of FY 6/23 | Increase/decrease |

Operating Cash Flow | -1,341 | 590 | +1,932 |

Investing Cash Flow | -183 | -1,156 | -973 |

Free Cash Flow | -1,524 | -565 | +959 |

Financing Cash Flow | 310 | 260 | -49 |

Cash and Equivalents | 4,323 | 3,985 | -338 |

*Unit: million yen.

A decline in the increase in inventory assets brought about a cash inflow from operating activities. Despite expenditures for taking over business, the deficit of the free cash flow shrank.

The company's cash position decreased.

[4-5 Topics]

(1) Partially taking over the Volvo Car dealership

In December 2023, Willplus Teio Auto partially took over the Volvo Car dealership from NEXTAGE Co., Ltd. (Prime Market of TSE, 3186). This is the 11th project of M&A for the company.

Then, the company acquired “Volvo Car Fukuoka-Higashi” and “Volvo Car Oita,” taking over part of their tangible fixed assets as well as staff.

The management results (sales) of the acquired business for fiscal year ended November 2022 were about 2.6 billion yen and the value was about 1.07 billion yen.

Willplus Teio Auto is now the official dealer for all Volvo cars in Fukuoka and Oita Prefectures, further advancing the “dominant strategy” for four brands (Jeep, Volvo, MINI and BYD) in the Fukuoka area.

The company projects further expansion of their business range as well as the reinforcement of their revenue foundation.

(2) Installing solar panels at a store

In February 2024, solar panels were installed at the MINI Hakata service center, which was the first time for the company.

In addition to “using” green power, which they have been doing, they will not only reduce their own CO2 emissions, but also contribute to generating non-fossil electricity in Japan by engaging in “power generation.”

They will keep considering further installations.

5. Fiscal Year ending June 2024 Earnings Forecasts

[5-1Earnings Forecast]

| FY 6/23 | Ratio to Sales | FY6/24(Est) | Ratio to Sales | YoY | Progress rate |

Sales | 44,115 | 100.0% | 48,821 | 100.0% | +10.7% | 46.9% |

Operating Income | 1,867 | 4.2% | 2,312 | 4.7% | +23.8% | 26.4% |

Ordinary Income | 1,943 | 4.4% | 2,303 | 4.7% | +18.5% | 29.2% |

Net Income | 1,302 | 3.0% | 1,692 | 3.5% | +29.9% | 26.1% |

*Unit: million yen. Estimates are those of the company.

Earnings forecast remains unchanged, sales and profit are expected to grow by double digits, and sales are projected to hit a record high.

The earnings forecast remains unchanged. It is forecast that sales will increase 10.7% year on year to 48,821 million yen and operating income will grow 23.8% year on year to 2,312 million yen. Sales are expected to reach a record high following the previous fiscal year.

Regarding new car sales, brand manufacturers are expected to discuss price policies to cope with the soaring prices and sluggish sales. Therefore, the number of cars sold is projected to recover.

With regard to the recurring revenue-type business such as car maintenance and insurance agency business, the company will further enhance the connection with each customer and aim to build an even more solid revenue foundation.

Regarding selling, general and administrative (SG&A) expenses, personnel costs, costs related to sale and costs related to store maintenance are projected to increase in step with the expansion of business. Moreover, the company plans to continue investments in human capital such as the improvement of working conditions, reduction of menial work through DX and training for reskilling to allow all employees to fully utilize their abilities.

The company plans to pay a dividend of 43.51 yen/share, up 2.34 yen/share. The expected payout ratio is 25.0%.

[5-2 Change in the environment surrounding the M&A strategy-Subsiding of COVID-19 and acceleration of M&A]

The company considers that a tail wind has begun to blow around the company’s M&A strategy, as COVID-19 has subsided.

(1) 2020-2023: Business environment in which M&A (sale of business) is unlikely to be conducted

In the wake of the outbreak and spread of COVID-19, the demand for automobiles as a safe transportation means or for domestic travel as an alternative to overseas travel grew rapidly from 2020 to 2021.

In 2022, the prices of new automobiles skyrocketed due to the shortage of supply caused by the global shortage of semiconductors and the rise in material prices, and the shortage of new automobiles led to the growth of demand for used automobiles, and the prices of used automobiles rose significantly.

In such business environment, the sale and order receipt of automobile dealers were healthy. Inventory declined, working capital shrank, and order backlog increased steeply, so even dealers with weak marketing capabilities and small capital stock were able to operate business without trouble.

On the other hand, dealers thinking of selling their businesses decreased in that situation. It was unfavorable for the M&A strategy of the company, but the company’s growth and operating income margin exceeded the average in the industry, and the company concentrated managerial resources onto M&A in the next phase.

(2) 2023-2024: Acceleration of M&A in parallel with the recovery of supply of new automobiles

The environment has been changing from 2023 to 2024.

The prices of new cars have been high since they were raised considerably in 2022. Meanwhile, the supply of new cars recovered due to the elimination of shortage of semiconductors, the prices of used cars are soft.

Due to the hovering prices of new cars, costs augmented through the increases in investment in company-owned cars and depreciation, decrease in the number of customers visiting the store, and inventory and working capital increased, making cash management difficult and squeezing small and medium-sized dealers.

In addition to these changes in the business environment, the profitability of automobile dealers is trending downward due to the augmentation of costs for enhancing corporate governance and tackling environmental issues.

From now on, it is expected that M&A (sale of business) projects for mainly small and medium-sized dealers with a weak management foundation will increase, and the company believes that its M&A strategy, which has been suspended in the past 3 years, will be accelerated considerably.

6. Conclusions

The progress rate of the results in the first half of the fiscal year to the full-year forecast is 46.9% for sales and 26.4% for operating income. While it is almost unchanged from the previous years for sales, it is significantly lower than before for operating income. We would like to keep an eye on how much they can increase sales and profit in the second half of the fiscal year as the number of new cars sold recovers.

While the company, too, is affected by the downturn of the domestic market of imported cars caused by the soaring prices of new cars, competitors in this industry, especially small and medium-sized dealers with weak management foundations, are faced with even harsher conditions. We would like to pay attention to whether the company’s M&A strategy, which has been on hold for the past three years, can gain significant momentum.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside directors (4 of which are independent executives) |

Audit committee members | 4 members, including 4 outside directors (4 of which are independent executives) |

◎ Corporate Governance Report

Last update date: September, 28, 2023

<Basic Policy>

Our company’s basic approach on corporate governance is to establish a sound management system that can respond to rapid changes in society and is efficient and compliant with laws and regulations, for maximizing our corporate value. To achieve this, we continue to strive to ensure transparent management and appropriate and prompt disclosure, by strengthening our relationships with stakeholders and further enhancing management governance functions.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Our company follows all principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

■ Principle 1-4 [Strategic Shareholding]

(1) Policies concerning strategic shareholding

Our company does not hold shares strategically. Unless such shareholding is necessary to maintain and strengthen relationships for capital tie-ups and collaboration with our business partners and it is determined that their business benefits are worth the risk and cost of capital from the medium/long-term perspective, we shall adhere to our company’s policy of not holding shares strategically.

(2) Review process concerning strategic shareholding, and criteria for exercising voting rights related to strategically held shares

If it is considered appropriate to hold shares strategically, we will establish a method to review the reasonableness of continued holding of such shares as well as specific criteria for the exercise of voting rights on such shareholding.

■ Supplementary Principle 2-4 ① [Ensuring Diversity in Appointment of Core Personnel, etc.]

< Our view on ensuring diversity >

Our company aims to provide an environment where every and each staff member can utilize their ability to the maximum extent, and our basic policy is to promote human resources based on individual ability, aptitude, achievements and motivation, regardless of gender, nationality and attributes.

<Voluntary and measurable targets for ensuring diversity>

Regarding ensuring the diversity of core human resources, we have set targets for the ratio of female directors and managers and the ratio of male employees who have taken childcare leave, which serve as indices for ensuring diversity. The targets and results for each category are shown in the chart below.

| Result in FY 6/23 | FY 6/25 (target) | FY 6/30 (target) |

Ratio of female directors | 10.0% | 12.5% | 30.0% |

Ratio of female managers | 4.2% | 7.0% | 10.0% |

Ratio of male employees who have taken childcare leave | 31.6% | 40.0% | 50.0% |

*As of the date on which this report was submitted, the ratio of female directors was 12.5%.

We have not set concrete numerical targets for the promotion of foreigners to managerial positions as there are few employees of foreign nationality at our company, but we shall keep discussing the necessity of setting such targets for ensuring further diversity.

Furthermore, as the proportion of highly specialized and experienced mid-career recruits is high in our corporate group, mid-career recruits account for 93.75% of managers (as of the end of June 2023). We have therefore not set any targets for the ratio of mid-career recruits in managerial positions.

■ Supplementary Principle 3-1③ and Supplementary Principle 4-2② [Issues related to Sustainability]

Our company has formulated basic sustainability policies, and established a Sustainability Committee and a Risk Management Committee to strengthen our corporate group’s sustainability initiatives and proactive risk management platform, and to focus on expanding our business scope by promoting growth strategies, responding to technological innovations including EVs in the automotive industry, and promoting DX, in order to achieve a sustainable society and enhance corporate value through our corporate activities. Details concerning concrete activities centered on these committees and investments in human capital, etc. for elevating the corporate value in the medium/long term are disclosed in our financial results presentation materials, annual security reports, etc.

(https://contents.xj-storage.jp/xcontents/AS01236/64ab2dc2/2bd7/4aa8/a1e2/476e214a2c86/140120230821544726.pdf)

In addition, our efforts to address climate change issues are disclosed through CDP.

■ Principle 5-1 [Policies concerning the establishment of a system to promote constructive dialogue with shareholders and the initiatives for it]

Our company believes that clearly explaining our management policies and growth strategies to shareholders and institutional investors and deepening their understanding through active and constructive dialogue (interviews) with them will contribute to enhancing our company’s medium/long-term corporate value.

Dialogue with shareholders and institutional investors is conducted reasonably through visits, office visits, telephone calls, etc. by representative directors and IR staff, with the IR Office of the Corporate Strategy Division as a point of contact. In addition to individual interviews, in order to provide opportunities for direct dialogue with many investors, our company holds financial results briefings for investors and analysts as well as briefings for individual investors at which representatives themselves give explanations, and uses such opportunities to promote mutual understanding between our company and investors. Furthermore, we broadly disseminate information by video streaming of the meetings or posting material on our website.

When engaging in dialogue, we take all necessary precautions to ensure that there is no leakage of unpublished important information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |