Bridge Report:(2884)Yoshimura Food Fiscal Year ended February 2024

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE(Actual) | Trading Unit | |

¥1,402 | 23,876,621 shares | ¥33,475 million | 12.7% | 100 shares | |

DPS(Estimate) | Dividend Yield(Estimate) | EPS(Estimate) | PER(Estimate) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥47.02 | 29.8x | ¥367.67 | 3.8x |

*The share price is the closing price on April 16. Each value is taken from the brief report on results of the fiscal year ended Feb. 2024.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2021 (Actual) | 29,289 | 523 | 787 | 417 | 18.59 | 0.00 |

February 2022 (Actual) | 29,283 | 655 | 993 | 500 | 21.03 | 0.00 |

February 2023 (Actual) | 34,937 | 678 | 1,323 | 613 | 25.77 | 0.00 |

February 2024 (Actual) | 49,781 | 2,429 | 3,052 | 1,028 | 43.43 | 0.00 |

February 2025 (Estimate) | 58,215 | 2,744 | 2,671 | 1,113 | 47.02 | 0.00 |

*Unit: Million yen. The estimated values were provided by the company.

This Bridge Report presents Yoshimura Food Holdings K.K.’s earnings results for the Fiscal Year ended February 2024.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended February 2024 Earnings Results

3. Fiscal Year ending February 2025 Earnings Estimates

4. Growth Strategies

5. Interview with CEO Yoshimura

<Reference: Regarding Corporate Governance>

Key Points

- Ssales in the fiscal year ended February 2024 totalled 49,781 million yen, up 42.5% year on year. Sales grew both domestically and overseas owing to the contribution of companies that joined the group through M&A in the fiscal years ended February 2023 and February 2024. Operating income increased 257.9% year on year to 2,429 million yen. Although SG&A expenses augmented 25.0% year on year, this increase was offset and profit grew significantly. Regarding domestic business, price revisions in response to the soaring prices of raw materials, suspension of unprofitable transactions, and narrowing down production items have been effective in addition to the inclusion of MARUKICHI and YS Foods in the corporate group. The improvement ofcompetition environment for some companies also contributed to this growth. Profits increased in the overseas business as sales grew owing to the recovery from the COVID-19 pandemic.

- For the fiscal year ending February 2025, the company forecasts sales of 58,215 million yen, up 16.9% year on year, an operating income of 2,744 million yen, up 12.9% year on year, and an EBITDA of 4,889 million yen, up 13.9% year on year. In addition to the organic growth of existing companies, the profit and loss of YS Foods will be incorporated in the annual results from this fiscal year. Regarding ordinary income, the company is not recording temporary profits that were recorded in the previous fiscal year, such as gains on foreign currency exchange, income from subsidies and gain on sale of investment securities.

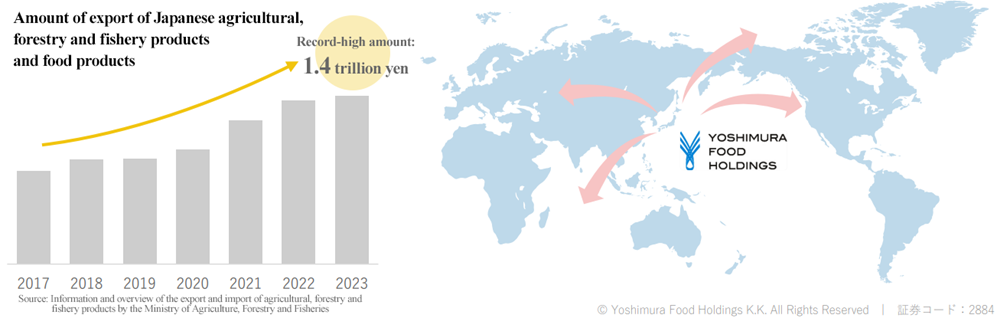

- In August 2023, China suspended all imports of Japanese fishery products due to the discharge of ALPS-treated water from Tokyo Electric Power Company (TEPCO)’s Fukushima Daiichi Nuclear Power Plant into the ocean, and import remains prohibited in China. Amid such circumstances, a partner company of Sin Hin Frozen Food Private Limited--a subsidiary which engages in the wholesale of fishery products in Singapore--started processing in Thailand and Vietnam and YS Foods began shipping frozen shelled scallops. Inquiries for frozen shelled scallops to YS Foods and MARUKICHI from other business partners have also been increasing.

- To further satisfy shareholders, the company increased the price of benefits received depending on the number of shares held. In order to receive such benefits, the company requires shares to be held for at least a year, thereby encouraging shareholding in the medium/long term. Moreover, they have newly established a premium benefit system for shareholders who have been holding 10,000 shares or more for a year or longer.

- In the fiscal year ended February 2024, both sales and profit significantly grew due to the addition of MARUKICHI and YS Foods to the corporate group, etc. President Yoshimura believes that these financial results reflect the knowledge, skill, and achievements the company has built up throughout almost 15 years. Even through times of hardship when the selling of a company was not widely-accepted, the company has always worked for the future of small and medium-sized food companies in Japan. It can be assumed that they will be able to increase the pace and scale of M&A even more from this fiscal year on. We look forward to the company’s releases.

1. Company Overview

Yoshimura Food Holdings conducts M&A of food-related small and medium-sized enterprises that, regardless of their quality products or unique manufacturing techniques, are facing various issues such as the difficulty in finding successors. It also facilitates the growth of the entire corporate group by solving problems with their core service, which is to build “a platform for supporting small and medium-sized enterprises (SME Support Platform).” and energizing each group company. Its strengths lie in the overwhelming advantage it has towards investment funds or large companies and the high barrier to entry. The company aims to accelerate its growth through further alliances. As of the end of February 2024, there are 28 main consolidated subsidiaries.

【1-1 Corporate History】

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd.

Mr. Yoshimura took on this food company and established L Partners Co., Ltd.-- the predecessor of Yoshimura Food Holdings K.K.--on his own in March 2008 because he strongly felt that Japan could be more appreciated through its food since his MBA days in the United States while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he successfully turned a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning of his work. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. They are praised for their unique position of not competing with major food companies or investment funds as well as their policy of not selling off the companies. They received financing from INCJ, Ltd. (Innovation Network Corporation of Japan) and Japan Tobacco Inc. (JT) and expanded their business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange. In April 2022, it was transited to the Prime Market of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Malaysia, and more.

【1-2 Target Social Image】

For the social responsibility of the enterprise, the company decided to pursue the mission: "A society where we can enjoy this 'delicious taste' forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜," and set its vision (roles to be fulfilled) and values (values they cherish) as such.

Mission A society where we can enjoy this “delicious taste” forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜 | *We believe that a society in which people can choose from various options freely according to their respective preferences and a society in which those choices are respected is affluent and happy. *We aim to achieve an affluent society in which consumers around the world can choose from a wide array of high-quality “delicious foods” freely and enjoy them. |

Vision Protect and nurture regional “delicious foods” and distribute them around the world | *In order to realize a society where we can enjoy this “delicious taste” forever, we will discover “delicious foods” that have been cherished in Japan and around the world, protect and nurture them, and deliver them to people around the world. *To do so, we will develop our own ability to find “delicious foods”, a business base for protecting “delicious foods”, functions to support the growth of “deliciousness”, and sales networks to deliver “delicious foods” to people around the world. *As a result, our company will become a global producer that promotes the cultures and diversification of foods around the world and the invigoration of local communities. |

Values “Cherish individuality” | *We cherish the individuality of everyone related to us. *We value the “individuality”, “new ideas”, and “desire to take on new challenges” of each employee working in our corporate group. *We value the “history”, “culture”, “employees”, “business partners”, and “local communities” of each of our group companies. *We brush up the “strengths” of our group companies, mutually make up for their “weaknesses,” and grow together. *We will contribute to the development of an affluent society with a variety of options available, by cherishing the individuality of everyone related to us. |

【1-3 Market Environment and the Background of the Company’s Establishment】

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings views the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized, and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

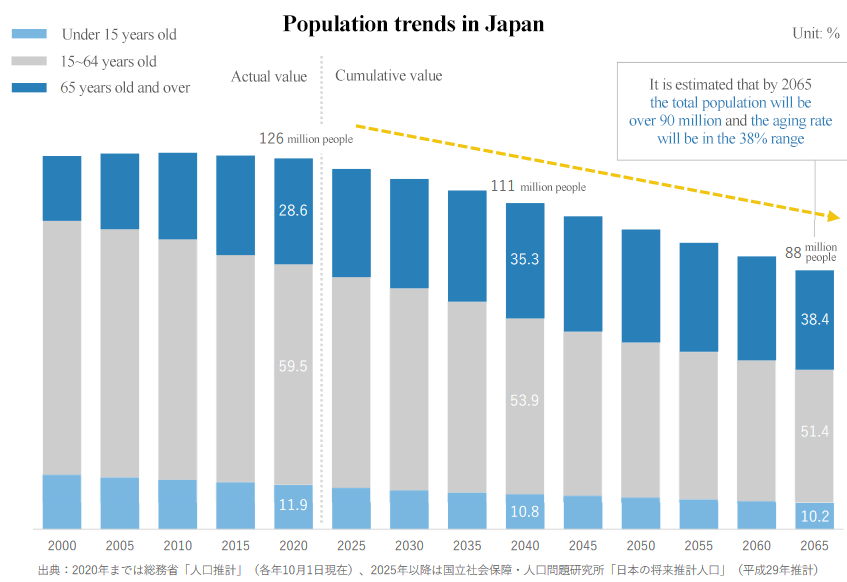

*Japanese cuisine has been highly appreciated worldwide and is attracting increasing attention. On a national scale, the food manufacturing industry has also been one of Japan’s largest and proudest largest industries based on its number of business establishments, number of employees and GDP since the 1990s.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

*However, the domestic market is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to falling birthrates and an aging population.

*Therefore, many companies give up on continuing their businesses and end up shutting down or suspending their business.

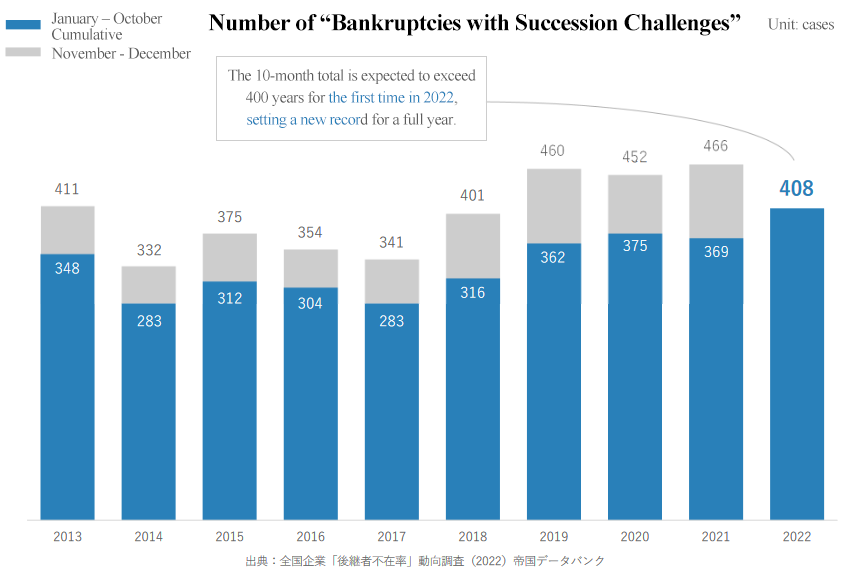

(Conditions of the SMEs’ Business Succession)

*The average age of managers is 63.76, and it is expected that around 50% of the managers will reach the average retirement age in the upcoming 7 years as the average retirement age of managers is around 70.

*Meanwhile, 53.9%, more than 50% of domestic enterprises are suffering from a lack of successors, and the ratio of enterprises that plan to conduct business succession is only 33% across all industries.

*Moreover, in 2020, the number of SMEs that suspended or discontinued business reached 49,698 and have increased rapidly for 13 years in comparison to in 2007 when that number was around 21,000.

(Information from SME Agency “White Paper on Small and Medium Enterprises” (2023 Edition), Teikoku Databank, Ltd. “Analysis of the age of company presidents in Japan (2023),” Teikoku Databank, Ltd. “Survey of Trends on ‘Companies without a Successor’ in Japan” (2023), SME Agency “Basic Survey on the Actual Situation of SMEs” (Report in fiscal year 2022 [Financial results in fiscal year 2021])

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire, and for investment funds’ whose primary aim is to rapidly grow independent companies and sell them off within a few years, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

【1-4 Business Description】

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 28 main consolidated subsidiaries in February 2024.

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales and marketing, production management, procurement and manufacturing, distribution, product development, quality control, and business management.

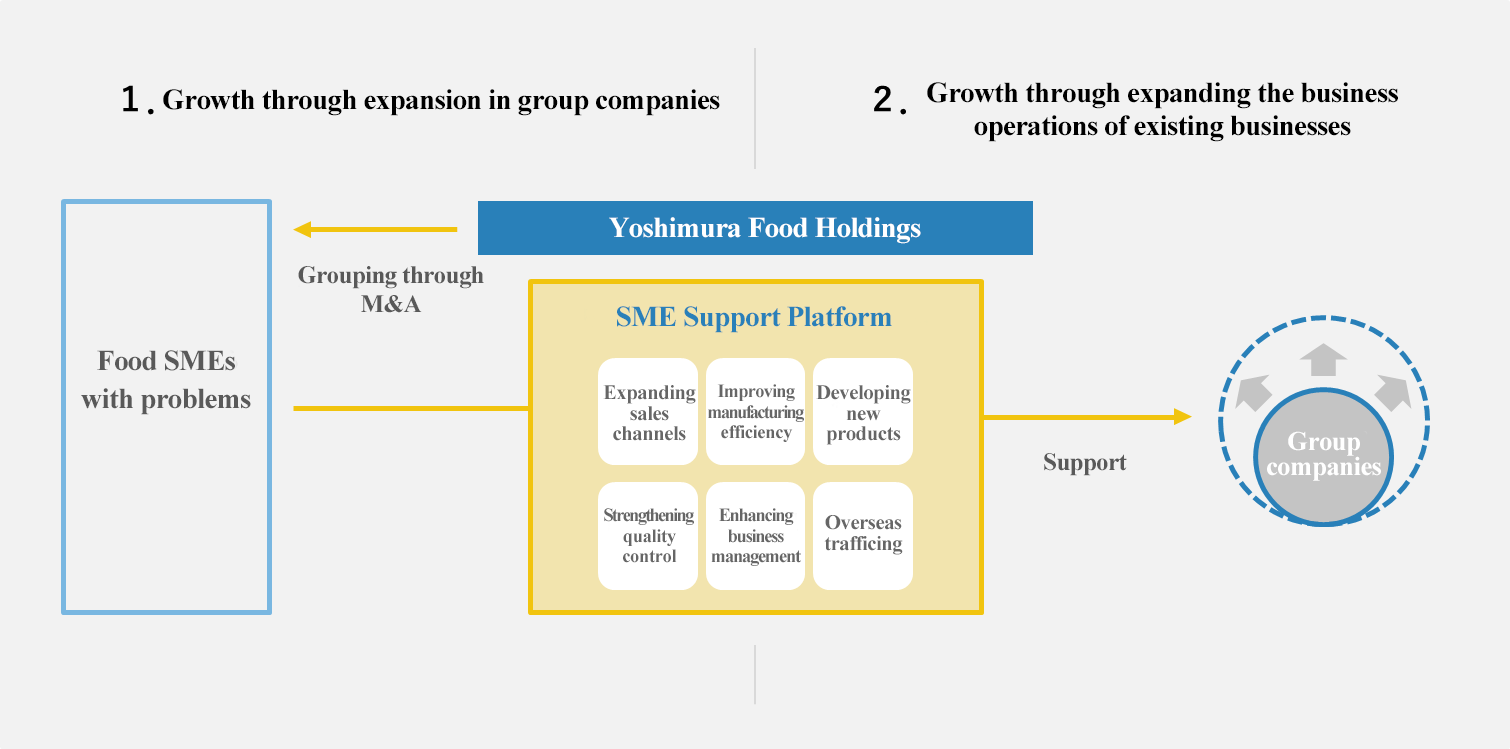

①Business Model

The company develops a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies through M&A.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Projects sourcing have been so far found (discovered) mainly with an "indirect approach" through introductions from M&A brokerage firms, regional financial institutions (mainly local banks), lawyers, and accountants. In order to speed up the process, the company intends to strengthen its “direct approach” to build relationship for future M&A and to more proactively and aggressively seek out new projects. This will be done by creating a target list and approaching the companies independently as well as by utilizing the network of KOKUBU GROUP CORP.

The other goal is the expansion of business for existing group companies.

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each of the company’s functions. The “SME Support Platform” is applied to these companies which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels, labor shortage or poor business management.

(Taken from the reference material of the company)

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of skill, knowledge, and achievements through its specializing in food manufacturing and sales.

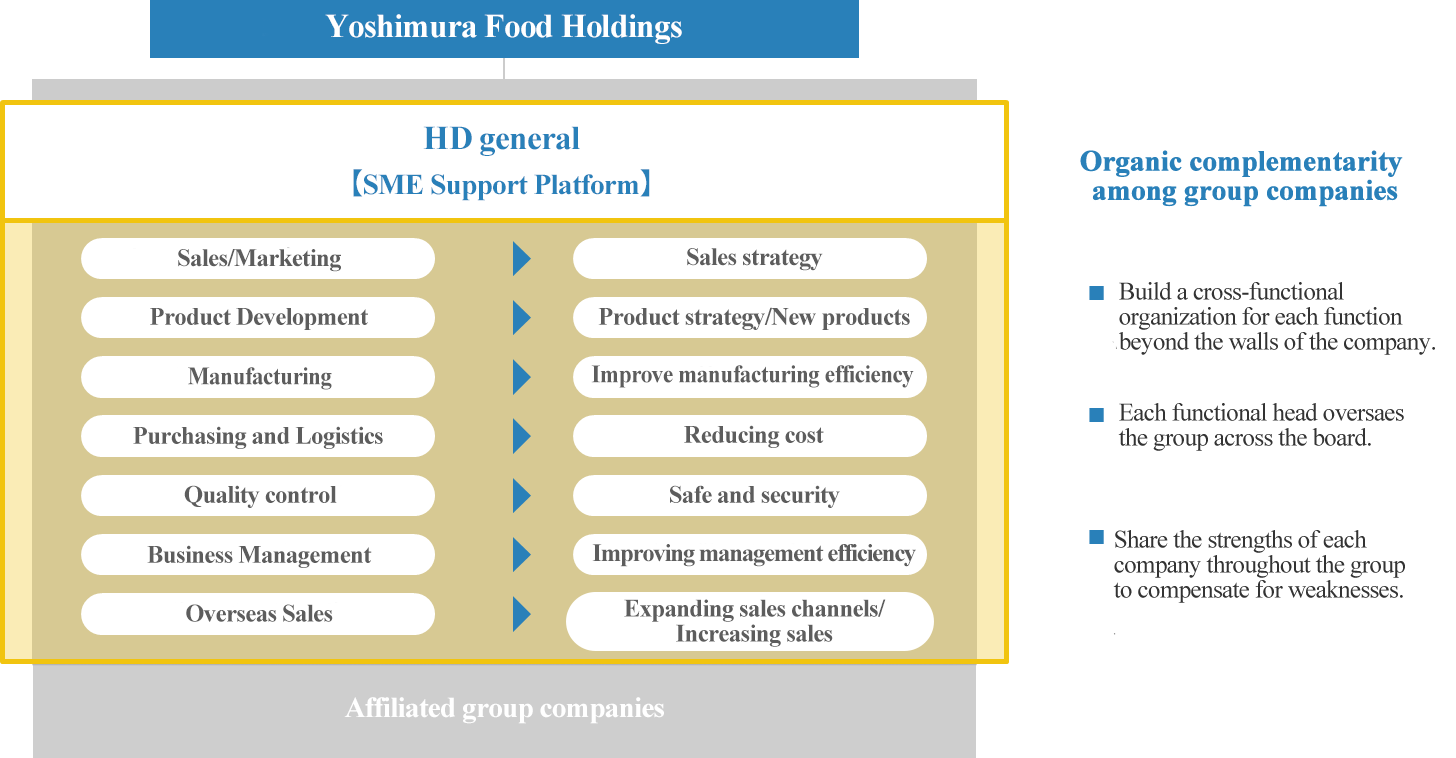

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales and marketing, production management, procurement and distribution, product development, quality control, business management, and securing personnel) in a manner that goes beyond the company barriers and by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and skills of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing skills are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

The “SME Support Platform” is functioning effectively under the current structure, but as subsidiaries will increase further, their s skills will be added as a new strength, and the managerial resources of the corporate group will be accumulated, bringing out a new synergy so that existing subsidiaries will be able to seize opportunities to grow their business and acquire the skills necessary to streamlining their production processes.

Such scalability of the platform will fortify the business foundation of Yoshimura Food Holdings.

(Taken from the reference material of the company)

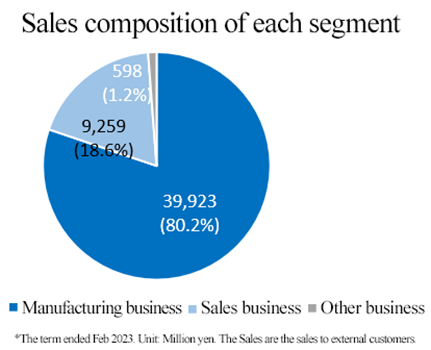

②Segments

The company has two main segments: the “manufacturing business segment” and “sales business segment.” “Other businesses” are composed of the rental and management of real estate, event media marketing, etc.

◎ Manufacturing Business Segment

Each company develops and manufactures their own unique products. Domestic enterprises sell these products mainly to supermarkets, convenience stores, drugstores, restaurants, etc. throughout Japan through wholesalers, while marine products, predominantly scallops, are sold mainly to exporting companies.

Overseas enterprises sell products to hotels, restaurants, supermarkets, etc. in Singapore and Malaysia. As of the end of February 2024, there are 25 group companies as tabulated below.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

Raku-you Food Co., Ltd. (Adachi-ku, Tokyo) | With five factories in Japan, the company manufactures and sells chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. |

Ohbun Co., Ltd (Shikokuchuo City, Ehime Prefecture)

| The company has a unique route to procure oysters from the rare supplies of Hiroshima Prefecture and produces and sells fried oysters as its main product. They also sell fried chicken cartilage, fried chicken meat, and other items. |

Shiroishi Kosan, Inc. (Shiroishi City, Miyagi Prefecture) | It was established in 1886, the company’s main product is Shiroishi Umen, a specialty of Shiroishi City, Miyagi Prefecture. It manufactures and sells dried noodles and other products made using traditional methods. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | The company was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. The sake is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, and has a high reputation for its fruity taste. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | The company is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since when it was first sold in 1985. |

Yuhoku Suisan Co., Ltd. (Oi-machi, Ashigarakami-gun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees Celsius as soon as it is caught. |

Junwa Food Corporation (Kumagaya City, Saitama Prefecture) | The company manufactures and sells jellies. It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP certification. Although it is still a start-up company in jelly production, it has an established reputation within major hypermarkets for its products’ quality and technological capabilities. |

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | The company mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. It also conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan Co.,Ltd. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers with unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | Located in Singapore, the company manufactures and sells sushi, makimono, rice balls, etc. |

Omusubikororin Honpo Co., Ltd. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, the company manufactures ingredients for confectionery, emergency food, etc. Its “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. The company manufactures and sells dumplings at the store, using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | The company processes and wholesales chilled and frozen seafood products in Singapore.

|

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | The company harvests the highest quantity of farmed ayu (sweetfish). It has nurtured an original technique for collecting and incubating roe to grow and ship a stable supply of fish. In addition, it possesses the technology to make fish give birth to male or female fish. |

NKR CONTINENTAL PTE. LTD. (Singapore) | Located in both Singapore and Malaysia, the company manufactures, imports, sells, designs, installs, and maintains kitchen equipment. |

Kaorime Honpo Co., Ltd. (Izumo City, Shimane Prefecture) | The company produces a wide array of high-quality products that is both original and by OEM orders, including soft dried seaweed for seasoning rice, dried hijiki for seasoning rice, seaweed soup, ochazuke with seaweed, etc. |

Junido Co., Ltd. (Dazaifu City, Fukuoka Prefecture) | The company manufactures and sells soft furikake (rice seasoning) such as Umenomi-hijiki. It has many fans all over the country and is very popular. |

K.K. Odakishouten (Kasama-shi, Ibaraki Prefecture) | The company manufactures and sells products made mainly from Iwama Chestnuts in Ibaraki Prefecture. |

Hosokawa Foods, Co., Ltd. (Kanonji-shi, Kagawa Prefecture) | The company manufactures and sells frozen delicatessen products such as kakiage and chijimi using domestic vegetables, as well as frozen rice products such as sekihan (red bean rice). |

Kobayashi Noodle Co.,Ltd. (Sapporo-shi, Hokkaido) | The company is mainly engaged in producing and selling fresh noodles (ramen), producing gyoza (dumpling) skins, and selling seasonings including sauce. |

Hayashi-Kyuemon-Shoten Co.,Ltd. (Fukuoka City, Fukuoka Prefecture) | The company produces, processes, and sells flaked bonito and broth, with its main product being Monaka Osuimono (lightly seasoned broth placed inside rice wafers), which was originally developed by the company. |

Marukichi Co.,Ltd. (Abashiri City, Hokkaido) | The company manufactures, processes and sells mainly large and meaty scallops caught in the Sea of Okhotsk, as well as salmon, salted salmon roe, crab, etc. |

YS Foods Co., Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | The company manufactures, processes and sells mainly scallops caught in the Funka Bay, which is regarded as a prominent fishing zone in Hokkaido, as well as salmon, salted salmon roe, squid, etc. |

Matatsu Suisan Co., Ltd. (Oshamambe-cho, Yamakoshi-gun, Hokkaido) | The company sells mainly scallops and salmon caught in Oshamambe, Hokkaido and processed with advanced technologies at cutting-edge facilities. |

Seidou Suisan Co.,Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | The company processes fresh shelled scallops caught in the Funka Bay by removing a half of the shell, and sells them, boasting an overwhelming market share in the domestic production amount of half-shelled scallops. |

◎ Sales Business Segment

Companies whose strengths are sales capability and planning skills. Domestic enterprises sell products to mainly industrial catering companies, consumer cooperatives, etc., while overseas enterprises sell products to mainly supermarkets, hotels, restaurants, etc. As of the end of February 2024, group companies are the following four.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

KK Yoshimura・Food (Koshigaya City, Saitama Prefecture) | The company mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products K.K. (Koshigaya City, Saitama Prefecture) | The company conducts the planning and sales of frozen foods. It also has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | The company procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

YS Kaisyo Co., Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | In addition to careful selection of ingredients from Hokkaido, which is called “the treasure trove of food,” and the sale at shops and online, the company operates a hot spring facility and a restaurant. |

◎ Other segments

As of the end of February 2024, the group companies are the following two companies.

(Other Segment Group Companies)

Company | Characteristics |

SHARIKAT NATIONAL FOOD PTE. LTD. (Singapore) | The Company owns a food factory and a cold storage warehouse for food products in Singapore and is engaged in the real estate leasing business. |

ONESTORY Inc. (Minato-ku, Tokyo) | The company conducts event businesses. It rediscovers and restructures the food and culture hidden in the local region and produces them as premium content. |

【1-5 Characteristics and Strengths】

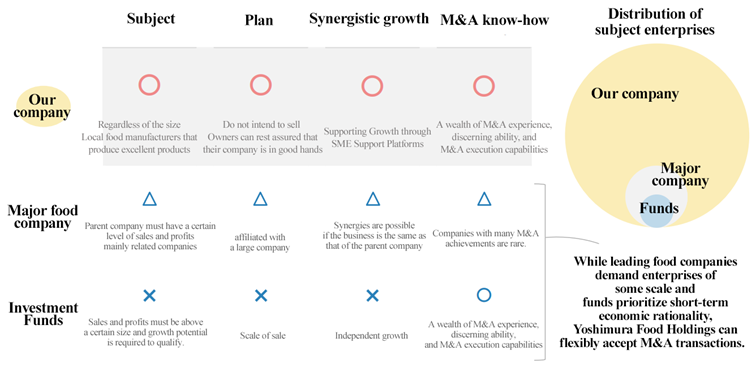

①The Advantage in Business Succession through Acquisition

There are leading strong buyers in M&A in the food industry, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth. This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, the company’s specialization in the food industry and the reassurance that the company is not aiming to sell are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

②Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

③Contribution to regional vitalization

The company has actively implemented the business succession, etc. of local food SMEs, including Sakuragao Shuzo K. K. (Iwate Prefecture), Shiroishi Kosan Co., Ltd. (Miyagi Prefecture), and Ohbun Co., Ltd. (Ehime Prefecture), which are subsidiaries.

By utilizing the SME Support Platform, it is possible to distribute attractive products that have been available only in some regions to all around Japan (and overseas) and invest in new equipment by using the funds of the corporate group. Through this, the company contributes to the regrowth of local small and medium-sized food enterprises and the vitalization of local economies.

【1-6 Dividend Policy and Shareholders’ Benefit System】

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

To further satisfy shareholders, the company increased the price of benefits received depending on the number of shares held. In order to receive such benefits, the company requires shares to be held for at least a year, thereby encouraging shareholding in the medium/long term.

Moreover, they have newly established a premium benefit system for shareholders who have been holding 10,000 shares or more for a year or longer.

(Outline of the new benefit system for shareholders)

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 - 499 shares | Once a year (shareholders as of the end of February who have been holding shares for a year or longer) | Products worth 1,500 yen from the group companies |

500 - 2,499 shares | Once a year (shareholders as of the end of February who have been holding shares for a year or longer) | Products worth 2,500 yen from the group companies |

2,500 - 9,999 shares | Twice a year (shareholders as of the end of February and August who have been holding shares for a year or longer) | Seafood set including scallops and salted salmon roe worth 10,000 yen |

(Outline of the newly established benefit system for shareholders)

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

10,000 - 49,999 shares | Twice a year (shareholders as of the end of February and August who have been holding shares for a year or longer) | Premium Hokkaido set worth 40,000 yen |

50,000 shares or more | Four times a year (shareholders as of the end of February, May, August, and November who have been holding shares for a year or longer) | Premium Hokkaido set worth 40,000 yen |

The Premium Hokkaido set is expected to include rare products unavailable in the market, which are specially manufactured or handled mainly by the group companies MARUKICHI and YS Foods.

The new benefit system for shareholders will apply to shareholders written or recorded in the shareholder list as of the end of February 2025.

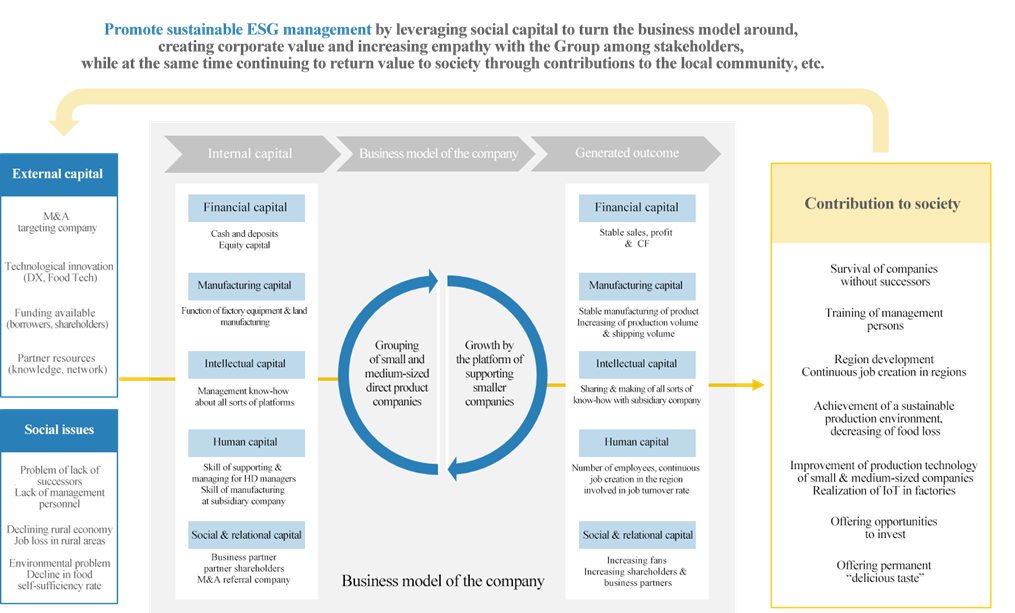

【1-7 ESG Management】

The company is working on its ESG management based on the goal mentioned above, "A society where we can enjoy this 'delicious taste' forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜."

Items | Main Initiatives |

E (Environment) | Production of environmentally friendly, sustainable products *To hold the technology and skill to produce sustainable products that do not depend on environmental changes or produce environmental burdens *To utilize a limited amount of food resources and conduct efficient production

Mori Yougyojou: It supplies farmed ayu (sweetfish) stably with its original technology, while the natural resources of ayu are decreasing due to climate changes, water pollution in the rivers, etc. Yamani Noguchi Suisan: It helps reduce food loss by developing products using residue and food that do not satisfy size specs. Yuhoku Seafood Processing: It produces and sells negitoro (minced tuna and green onion) and nakaochi (tuna meat scraped from the backbone) efficiently, by effectively utilizing ingredients.

Recycling of industrial waste from the manufacturing process *Group companies: To utilize food waste by offering the waste produced during the manufacturing process to local livestock breeders and others

Reduction of power consumption *Group companies: To install LED lighting, highly efficient boilers, etc. for reducing power consumption at factories |

S (Society) | Contribution to the business continuity by involving enterprises that have loyal fans in each region

Contribution to the diversity of food in local communities *To develop products with rigorously selected ingredients and recipes, which are strongly demanded by local consumers

Kaorime Honpo: It has a dominating share in the rice seasoning market in the Chugoku region. Marukawa Shokuhin: It uses rigorously selected ingredients, such as fresh pork and locally grown cabbage, and secret recipes Omusubikororin Honpo: It develops local specialties by taking advantage of its location of Shinshu-azumino and their freeze-drying technology Daishow: It does not use preservatives or colorants. This creates a smooth texture and taste you will never get tired of. Ohbun: It procures oysters harvested in the clean sea areas of Hiroshima and conditional clean sea areas

* Participating in a free lunch support project for students (Omusubikororin Honpo) and providing field trips for elementary school students and gifts (Mori Yougyojou and Junwa Food)

Diversity of employees *Group companies: To prepare opportunities for female employees to flourish, and take measures for recruiting disabled and foreign workers |

G (Governance) | Support with the SME Support Platform *To design business plans and get involved in progress management according to situations while securing the autonomy of each group company *To establish the control section for each function, support business and manage progress as a corporate group

Support for managerial resources *To support the management of group companies, by procuring funds and training next-generation employers for them |

The company recognizes that taking over companies that have no successors and revitalizing it as their group companies is ESG management itself.

Also, the company believes that contributing to local communities and providing value to consumers by promoting ESG management, as well as increasing the number of good companies that sympathize with the group and want to participate, and the companies and consumers that sympathize with the group and support them as shareholders, will lead to the realization of sustainable growth.

(Taken from the reference material of the company)

2. Fiscal Year ended February 2024 Earnings Results

【2-1 Consolidated results】

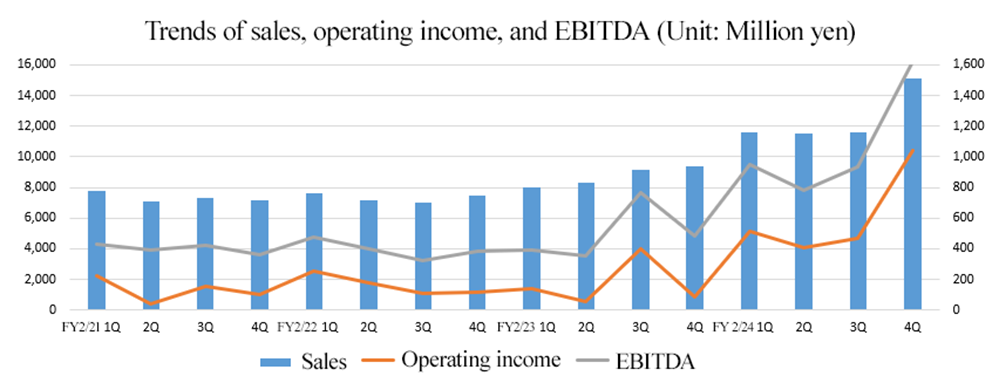

| FY 2/23 | Ratio to sales | FY 2/24 | Ratio to sales | YoY | Expected ratio |

Net sales | 34,937 | 100.0% | 49,781 | 100.0% | +42.5% | +6.6% |

Gross profit | 6,964 | 19.9% | 10,288 | 20.7% | +47.7% | - |

SG&A expenses | 6,285 | 18.0% | 7,858 | 15.8% | +25.0% | - |

Operating income | 678 | 1.9% | 2,429 | 4.9% | +257.9% | +54.4% |

Ordinary income | 1,323 | 3.8% | 3,052 | 6.1% | +130.7% | +93.8% |

Net income | 613 | 1.8% | 1,028 | 2.1% | +67.7% | +37.3% |

EBITDA | 1,994 | 5.7% | 4,291 | 8.6% | +115.2% | +57.9% |

*Unit: Million yen. Net income is the net profit attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill), Covid-19-related subsidy income and acquisition costs associated with M&A to operating income.

Sales increased and profit increased significantly

Sales were 49,781 million yen, up 42.5% year on year. Sales grew both domestically and overseas. In addition to MARUKICHI and YS Foods becoming a group company in the fiscal year ended February 2024, three companies added to the corporate group through M&A in the fiscal year ended February 2023 (Hosokawa Foods, Kobayashi Noodle, and Hayashi Kyuemon Shoten) contributed to full-year sales.

Operating income increased 257.9% year on year to 2,429 million yen. Although SG&A expenses augmented 25.0% year on year, this increase was offset and profit grew significantly.

Regarding the domestic business, price revisions in response to the soaring prices of raw materials, suspending unprofitable transactions and narrowing down production items have been effective in addition to the inclusion of MARUKICHI and YS Foods in the corporate group. The improvement of the competitive environment for some companies also made a contribution. Profit increased in the overseas business as sales grew owing to the recovery from the COVID-19 pandemic.

As the market price of scallops fell due to the discharge of wastewater from TEPCO’s Fukushima Daiichi Nuclear Power Plant, the company conservatively revaluated the inventory of MARUKICHI to fair value, recording a revaluation loss of 1,012 million yen. They plan to cover this loss with compensation from TEPCO. From the fourth quarter (December-January) of the fiscal year ended February 2024 on, both operating income and profit before taxes have shown a trend of recovery as the market prices have picked up, and it is projected that this trend is going to last in the fiscal year ending February 2025.

Both sales and profit exceeded the forecast owing to the inclusion of YS Foods in the corporation group through M&A, price revisions and continuous streamlining of production at domestic companies, the recording of a gain on foreign currency exchange of 379 million yen due to fluctuations in foreign currency exchange rates, etc.

【2-2 Results of each region】

| FY 2/23 | FY 2/24 | YoY |

Domestic | 25,156 | 38,643 | +53.6% |

Overseas | 9,781 | 11,138 | +13.9% |

Singapore | 7,534 | 8,804 | +16.9% |

Malaysia | 2,247 | 2,333 | +3.8% |

Total | 34,937 | 49,781 | +42.5% |

*Unit: Million yen.

◎ Domestic Business

Regarding domestic sales, revenue increased due to the enhancement of marketing targeted at existing customers. In the manufacturing business, sales increased due to the effect of price revision.

Profits grew due to the changes in the competitive environment for some companies in addition to the effects of price revisions, the suspension of unprofitable transactions and reduction of production items based on a profit-oriented strategy.

◎ Overseas Business

Sales continued to increase in both the sales and manufacturing business due to a decrease in the impact of the COVID-19. In particular, sales of Pacific Sorby increased significantly due to a recovery in the number of tourists in Singapore and increased demand from hotels and restaurants. Profit increased in step with the sales growth.

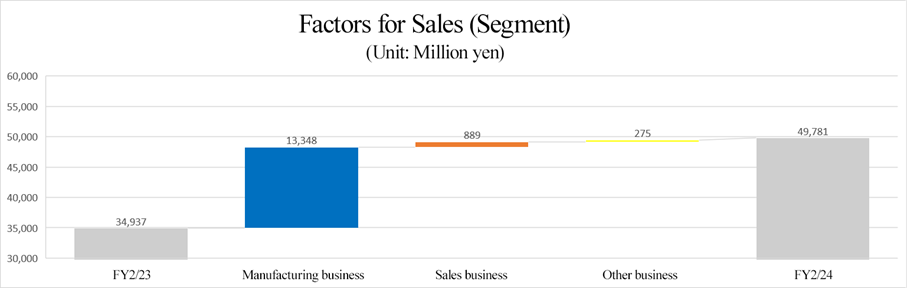

【2-3 Results of each segment】

| FY 2/23 | Composition ratio | FY 2/24 | Composition ratio | YoY |

Net sales |

|

|

|

|

|

Manufacturing business | 26,575 | 76.1% | 39,923 | 80.2% | +50.2% |

Sales business | 8,370 | 24.0% | 9,259 | 18.6% | +10.6% |

Other businesses | 323 | 0.9% | 598 | 1.2% | +84.9% |

Total | 34,937 | 100.0% | 49,781 | 100.0% | +42.5% |

Operating income |

|

|

|

|

|

Manufacturing business | 910 | 3.4% | 2,661 | 6.7% | +192.3% |

Sales business | 373 | 4.5% | 518 | 5.6% | +38.8% |

Other businesses | -95 | - | 23 | 3.9% | - |

Adjusted amount | -510 | - | -773 | - | - |

Total | 678 | 1.9% | 2,429 | 4.9% | +257.9% |

*Unit: Million yen. Sales are sales to external clients. The composition ratio of operating income means the ratio of operating income to sales.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

*Manufacturing business segment

Sales and profit increased.

Sales and profit significantly grew due to the inclusion of MARUKICHI and YS Foods in the corporate group. They can also be attributed to the price revisions published in response to soaring prices of raw materials and the enhancement of production streamlining at domestic manufacturing subsidiaries.

Overseas manufacturing subsidiaries recorded an increase in sales and profits as sales to hotels and restaurants recovered as restrictions on social and economic activities due to the COVID-19 were eased.

*Sales business segment

Sales and profit increased.

Sales and profit of domestic sales subsidiaries grew due to the increase in sales to industrial catering companies owing to proactive marketing activities.

Sales and profit of overseas sales subsidiaries rose as they now handle more products, including scallops from MARUKICHI, in addition to promoting approach to new clients.

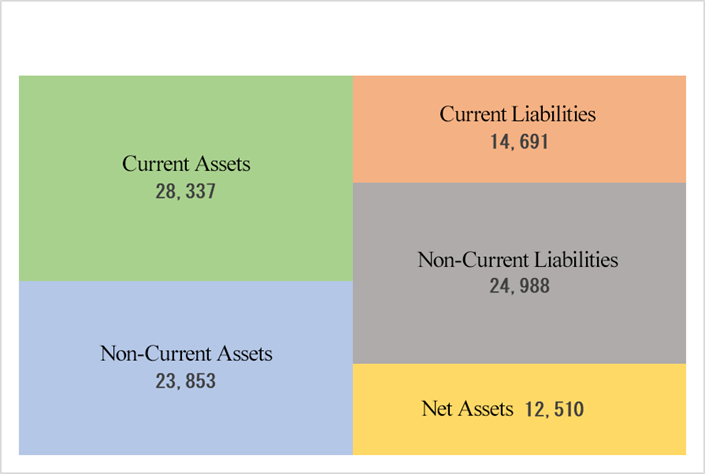

【2-4 Financial conditions and cash flow】

◎Main balance sheet

| End of FY 2/23 | End of FY 2/24 | Increase/ Decrease |

| End of FY 2/23 | End of FY 2/24 | Increase/ Decrease |

Current assets | 18,381 | 28,337 | +9,956 | Current liabilities | 11,176 | 24,988 | +13,812 |

Cash and deposits | 5,000 | 10,225 | +5,224 | Notes and accounts payable - trade | 3,890 | 2,921 | -968 |

Notes and accounts receivable - trade | 5,493 | 7,131 | +1,638 | Short term interest-bearing liabilities | 4,966 | 18,486 | +13,519 |

Inventories | 7,314 | 10,193 | +2,878 | Non-current liabilities | 10,963 | 14,691 | +3,728 |

Non-current assets | 13,608 | 23,853 | +10,244 | Long term interest-bearing liabilities | 9,918 | 13,126 | +3,207 |

Property, plant and equipment | 6,917 | 10,842 | +3,925 | Liabilities | 22,139 | 39,680 | +17,540 |

Intangible assets | 5,258 | 10,149 | +4,891 | Net assets | 9,850 | 12,510 | +2,660 |

Investments and other assets | 1,433 | 2,860 | +1,427 | Retained earnings | 3,728 | 4,757 | +1,028 |

Total assets | 31,989 | 52,190 | +20,200 | Total liabilities and net assets | 31,989 | 52,190 | +20,200 |

|

|

|

| Total interest-bearing liabilities | 14,885 | 31,612 | +16,727 |

*Unit: Million yen

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets increased 20.2 billion yen from the end of the previous fiscal year to 52.1 billion yen, due to a rise in inventories and tangible fixed assets (buildings and structures) in step with the inclusion of MARUKICHI and YS Foods in the group.

Total liabilities augmented 17.5 billion yen year on year to 39.6 billion yen, due to an increase in interest-bearing debt, also brought about by the inclusion of MARUKICHI and YS Foods in the group and by new M&A.

Net assets grew 2.6 billion yen year on year to 12.5 billion yen, due to an increase in retained earnings and foreign currency translation adjustments.

Equity ratio dropped 6.7 points from the previous fiscal year to 16.7%.

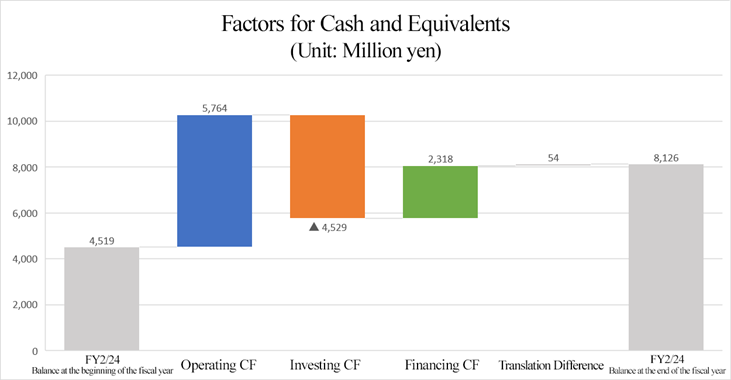

◎Cash flows

| FY 2/23 | FY 2/24 | Increase/Decrease |

Operating CF | 79 | 5,764 | +5,684 |

Investing CF | -2,021 | -4,529 | -2,508 |

Free CF | -1,941 | 1,234 | +3,175 |

Financing CF | 3,491 | 2,318 | -1,173 |

Balance of cash and cash equivalents | 4,519 | 8,126 | +3,607 |

*Unit: Million yen

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

The cash inflow from operating activities augmented due to an increase in net income before taxes and other adjustments. The cash outflow from investing activities grew due to an increase in purchase of shares of subsidiaries resulting in change in scope of consolidation, but free CF recorded a surplus.

The cash position risen.

【2-5 Topics】

◎Status of response to China's import regulations on Japanese seafood products

(1) Utilizing the group’s collective strength to start the shipment of shelled scallops

In August 2023, China suspended all imports of Japanese fishery products due to the discharge of ALPS-treated water from TEPCO’s Fukushima Daiichi Nuclear Power Plant into the ocean.

Although the scallop stock in China has been depleted until March 2024, import remains prohibited in China.

Amid such circumstances, a partner company of Sin Hin Frozen Food Private Limited, a subsidiary which engages in the wholesale of fishery products in Singapore, started processing in Thailand and Vietnam and YS Foods began to ship frozen shelled scallops.

Inquiries for frozen shelled scallops to YS Foods and MARUKICHI from other business partners have also been increasing.

As mentioned in the previous report, China is the largest export destination, which accounts for over 20% of Japanese fishery product exports, and 50% of scallop exports are bound for China. However, if we look at the countries to which the scallops imported by Chinese companies are sold, the United States account for about 50% and no more than 20-30% of scallops are consumed in China. Therefore, the degree of dependence on China is by no means high.

Moreover, Japanese scallops are highly regarded all over the world for their large size and high quality. The company thus believes that the impact in the medium/long term will be extremely limited.

MARUKICHI and YS Foods own a total of four certified facilities for the export of scallops to EU and a total of two certified facilities (final processing facilities) for the export of seafood to the United States. It is thought that as the stock at Chinese companies runs out, the superiority of the corporate group’s sales capability will relatively grow.

(2) Concerning compensation from TEPCO

TEPCO has announced that it will pay compensation to companies that have been damaged by the discharge of wastewater based on the following overview.

Eligible business owners | Damage to be taken into account | Method for calculating compensation |

Owners of export-related business (business owners suffering damage in export) | Cases where sales decreased due to actual disposal, resale or inevitable abandonment of production and manufacturing due to the refusal of import, etc. at export destinations caused by the discharge of wastewater | Lost profits + examination expenses + additional expenses – subsidies, money from non-life insurance, etc. |

Fishery product processors and wholesalers | Lost profits and additional expenses brought about by harmful rumors caused by the discharge of wastewater | Lost profits + additional expenses |

Lost profits are “the amount obtained by subtracting the difference between expenses that would have been borne in case the wastewater had not been discharged and actual expenses (expenses which did not have to be borne as a result of the discharge of wastewater) from the difference between revenues that would have been gained in case the wastewater had not been discharged and revenues actually gained.”

It is projected that MARUKICHI and YS Foods will be eligible for receiving the compensation and based on the explanation of lost profits stated on the application for compensation to be sent to TEPCO, the company believes that the damage caused by the discharge of wastewater will be covered by the compensation.

3. Fiscal Year ending February 2025 Earnings Estimates

【Earnings estimates】

| FY 2/24 | Ratio to sales | FY 2/25 (Estimate) | Ratio to sales | YoY |

Net sales | 49,781 | 100.0% | 58,215 | 100.0% | +16.9% |

Operating income | 2,429 | 4.9% | 2,744 | 4.7% | +12.9% |

Ordinary income | 3,052 | 6.1% | 2,671 | 4.6% | -12.5% |

Net income | 1,028 | 2.1% | 1,113 | 1.9% | +8.2% |

EBITDA | 4,291 | 8.6% | 4,889 | 8.4% | +13.9% |

*Unit: Million yen. Net profit is net income attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill) and acquisition costs associated with M&A to operating income.

Expected to increase in both sales and income.

The company forecasts sales of 58,215 million yen, up 16.9% year on year, an operating income of 2,744 million yen, up 12.9% year on year, and an EBITDA of 4,889 million yen, up 13.9% year on year.

In addition to the organic growth of existing companies, the profit and loss of YS Foods will be incorporated in the annual results from this fiscal year.

Regarding ordinary income, the company is not recording temporary profits that were recorded in the previous fiscal year, such as gain on foreign currency exchange, income from subsidies and gain on sale of investment securities.

4. Growth Strategies

【4-1 Background and Results up to now】

The company's mission is "A society where we can enjoy this 'delicious taste' forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜"; its vision is "Protect and nurture regional 'delicious foods' and distribute them around the world," and its value is "Cherish individuality." In the food industry, the company is creating its own unique business model centered on an SME support platform. Since its establishment, the company has pursued growth through two engines: "growth through the expansion of the number of group companies through M&A" and "growth through expansion of the business of existing group companies."

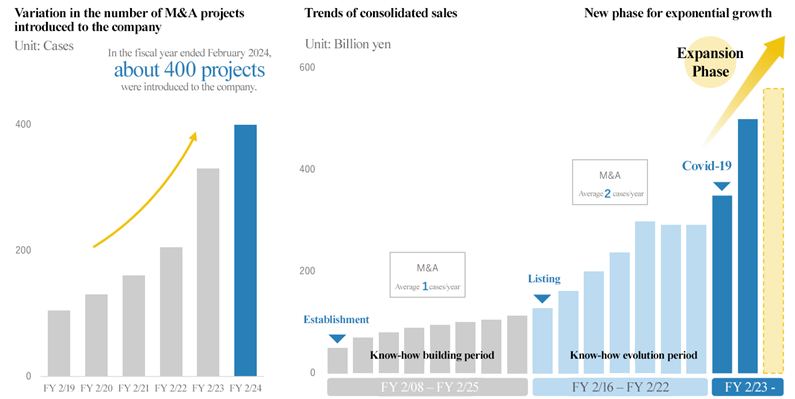

The company uses a wide variety of referral channels to find M&A deals, including business partners of existing group companies, M&A brokerage firms, and financial institutions.

The number of referrals has increased with each passing year, and in the term ending February 2024, when the impact of the COVID-19 pandemic subsided, the number of referrals increased significantly to over 400.

This increase is due to the company’s extensive M&A track record--which has grew since going public--and the trust it has built since its founding.

With this expansion in the number of referrals, the average number of M&A deals concluded in the first eight years since the company’s establishment was one per year and two in the following seven years. However, in the fiscal year ended February 2023, the number of executed M&A deals reached a record high of five per year. The company implemented the largest M&A in their history with MARUKICHI and YS Foods in the fiscal year ended February 2024.

The company believes that they have entered a new phase, heading toward rapid growth, in which it can acquire companies with higher growth potential and higher profit margins that are stronger in terms of corporate size, business foundation, and product quality as the system for accepting companies that the company has built over the years has begun to stabilize its management base, expand its team, accumulate expertise in project decision making, improve its fund-raising capabilities, and expand overseas sales channels.

(Taken from the reference material of the company)

【4-2 Challenges in the Domestic Food Industry】

In the domestic food industry, as the domestic market inevitably shrinks due to the declining population, an aging society and falling birth rate, companies are also facing the challenges of an aging population and an increasing number of companies are going out of business due to the lack of successors.

|

|

(Taken from the reference material of the company)

The company's five projects in the fiscal year ended February 2023 and the MARUKICHI and YS Foods project in the fiscal year ended February 2024 all faced challenges regarding succession.

【4-3 The Company's Business Model】

The company is pursuing growth through two systems: "1. expansion of group companies" by executing new M&A projects, and "2. expansion of existing businesses" by utilizing its SME support platform.

【4-4 The Company's Competitive Advantages】

Unlike investment funds, the company does not assume sale of acquired companies, making it easier to gain the trust of target company owners. In addition, the company has a wealth of M&A expertise compared to other large food companies and also a significant advantage in terms of growth support through its SME support platform.

The company is uniquely positioned to conduct M&A of companies with superior products, technologies, and brands, regardless of size or industry, and is capable of conducting M&A of small- and medium-sized food companies, which other prominent buyers are unlikely to target. Thus, the company believes it can realize high ROI through appropriate acquisition pricing and synergy effects.

(Taken from the reference material of the company)

【4-5 Strategy】

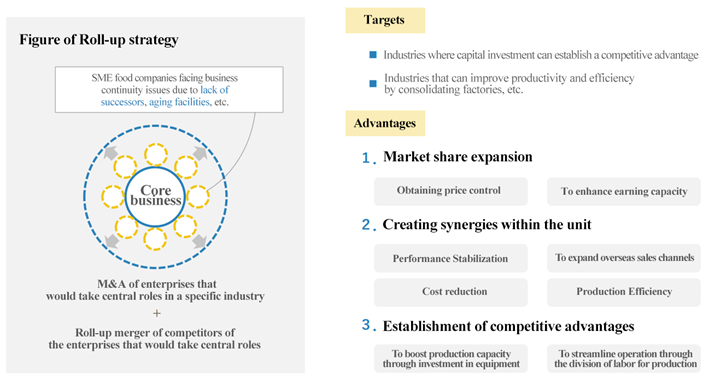

The company aims to achieve medium to long-term growth by pursuing a "Roll-Up Strategy" and "Niche Market Strategy" with respect to new M&A projects and an "Organic Growth Strategy" with respect to existing companies.

(1) Strategy 1: Roll-up strategy

In order to achieve rapid growth in the new phase, that is, the expansion phase, Yoshimura Food Holdings will acquire core companies from a specific industry where they expect to gain a significant advantage, and then acquire industry peers of these core companies. To roll up the companies in the same industry around the core companies to increase market share and improve performance through synergies.

(Taken from the reference material of the company)

【Examples of the roll-up strategies】

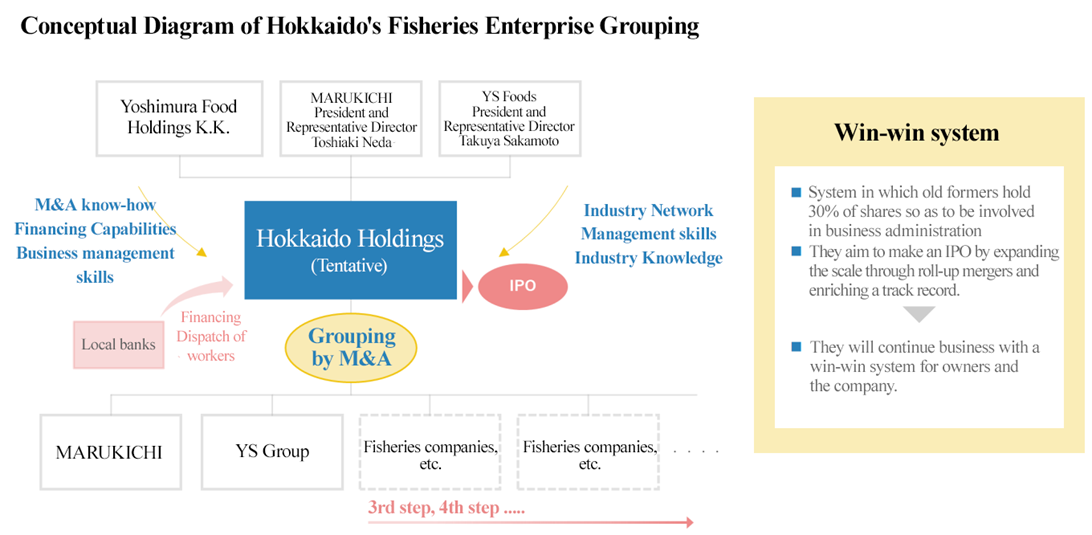

The company has forged ahead with roll-up strategies centered on MARUKICHI and YS Foods, which are both large and highly profitable in the scallop industry with many small and medium-sized companies, and they are aiming for a further expansion of revenues by generating synergy.

Procurement | To utilize the procurement network of both companies to engage in stable procurement from the Sea of Okhotsk and the Funka Bay, the largest production sites in Japan, and acquire the advantage of volume. |

Sales channels | To share the sales channels of both companies, which stretch out to overseas, to work toward further enhancement of their sales capability and elevate profitability. |

Production | To promote the effective utilization of mechanical equipment and human resources to elevate productivity by processing and selecting scallops procured by YS Foods at MARUKICHI from winter to spring, which is the peak season in the Funka Bay. |

Regarding further future initiatives, the company plans to establish Hokkaido Holdings (tentative name), with MARUKICHI and YS Foods as its core companies, promote the adding of Hokkaido seafood companies to the group, and aims to conduct an IPO.

(Purpose in Establishing Hokkaido Holdings)

Hokkaido Holdings (tentative name) will promote adding Hokkaido’s marine products companies to the group and will combine the strengths and advantages of each company, including Yoshimura Food Holdings’ M&A know-how, fund-raising capabilities, and business management capabilities as well as the industry networks, management capabilities, and industry knowledge of MARUKICHI and YS Foods’ management teams. In addition, using loans and staffing from regional banks, the company aims to “reduce costs, improve production efficiency, expand overseas sales channels, and stabilize business performance by creating synergies among group companies,” “streamlining operations and establishing competitive advantage through factory consolidation and capital investment,” and “expand profitability by increasing market share through a roll-up strategy.”

The former owners will continue to hold 30% of the shares of both MARUKICHI and YS Foods and will continue to be responsible for the management of both companies. The IPO of Hokkaido Holdings (tentative name), due to its increased scale and performance, will be highly beneficial to both Yoshimura Food Holdings and the former owners. Thus, they intend to build a win-win relationship for further development.

(Taken from the reference material of the company)

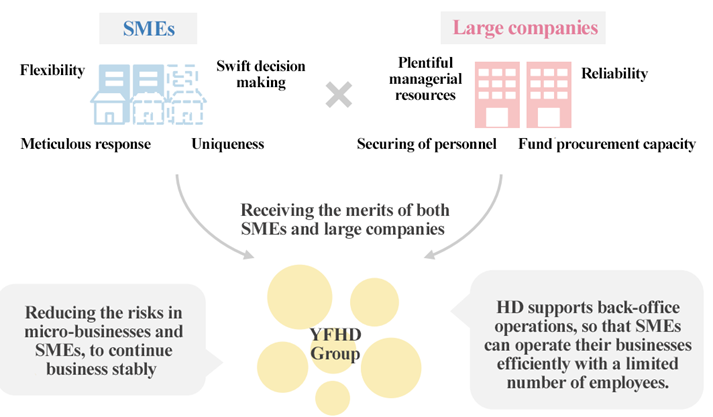

(2) Strategy 3: Organic growth strategy

*Advantages

The company will establish robust business foundations like those of a major enterprise and work toward the enrichment of management resources through M&A.

At the same time, they will strive for the survival of outstanding small and medium-sized food companies based on the maximum utilization of the advantages of small and medium-sized enterprises, which allow for speedy decision-making.

(Taken from the reference material of the company)

*Creation of synergy

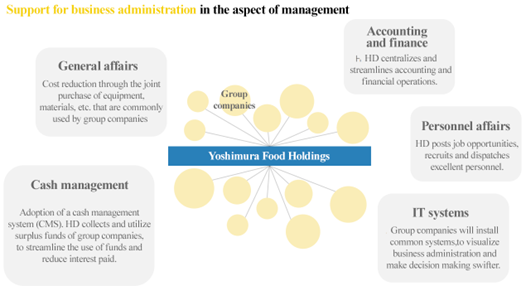

(1) Operational support in management

Following M&A, the business foundations of each company will be reinforced through operational support from Yoshimura Food Holdings, which is the holding company. The organizational structure will be arranged in every field including “general affairs,” “accounting and finance,” “human resources,” “IT systems” and “funding” to allow each company to feel at ease and focus on their business, further elevating corporate value.

(2) Operational support in business

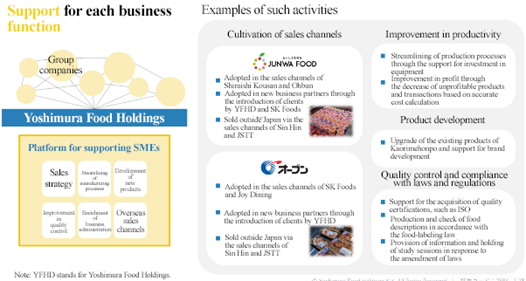

Synergy will be generated within the group through support for each function provided mainly by Yoshimura Food Holdings.

Acceleration of growth will be promoted through mutual support within the group instead of only depending on the individual strength of each company.

|

|

(Taken from the reference material of the company)

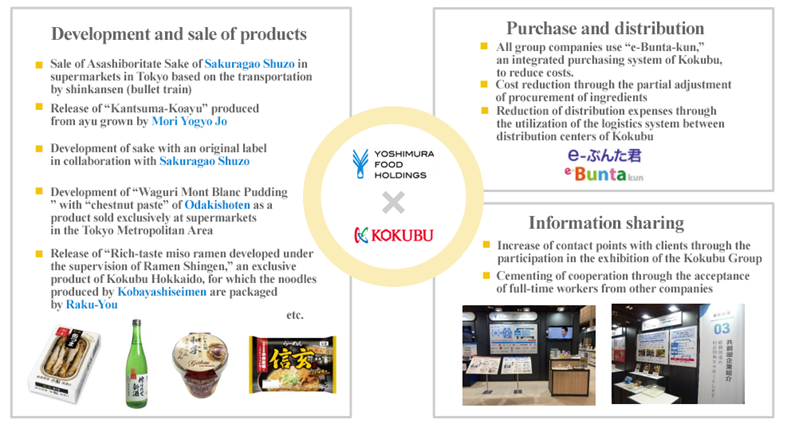

*Situation of the partnership with KOKUBU GROUP

The partnership with KOKUBU GROUP CORP., with which the company formed a capital and business alliance in February 2021, has shown steady developments.

In addition to accumulating achievements in the development and sales of products of each group company, Yoshimura has been making use of KOKUBU’s centralized purchasing system “e-Buntakun,” striving to reduce costs in purchasing and logistics. They are also exploring cost reduction by switching a part of raw material procurement to KOKUBU and improving logistics cost by utilizing KOKUBU’s logistics of collecting goods instead of having them delivered.

They are also proactively participating in KOKUBU GROUP’s exhibitions and sharing information by cementing cooperation through constant acceptance of loan employees.

They intend to keep utilizing KOKUBU GROUP’s resources and know-how to work toward the elevation of the corporate value of each group company.

(Taken from the reference material of the company)

【4-6 Future vision】

The company will accept small and medium-sized food companies faced with the issue of having no successor, etc. and acquire them as subsidiaries. As the demand for Japanese cuisine stretches out to overseas, they will expand abroad instead of focusing only on demand in Japan, where population keeps decreasing, and thus boost the corporate value of each company.

Their vision is to become a global producer that promotes the culture and diversification of food in the world and the revitalization of local societies.

(Taken from the reference material of the company)

5. Conclusions

In the fiscal year ended February 2024, both sales and profit significantly grew, owing to the inclusion of MARUKICHI and YS Foods in the corporate group, etc. President Yoshimura believes that these financial results show the knowledge, skills, and achievements the company has built up throughout almost 15 years for the future of small and medium-sized food companies in Japan, persevering through times of hardship even when the sale of a company was not easily acceptable. It can be assumed that they will be able to increase the pace and scale of M&A even more from this fiscal year on. We look forward to the company’s releases.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, of which 2 are external (Both are designated as independent executives) |

Auditors | 3 auditors, of which 3 are external (All three are designated as independent executives) |

◎Corporate Governance Report

The latest update: May 31, 2024

<Basic Policy>

Our company believes that our sustainable growth and creation of mid/long-term corporate value can be achieved especially through the trusting relationships and cooperation with our stakeholders, including shareholders, clients, business partners, employees, and local communities.

Accordingly, we consider that the most important mission in management is to keep tightening corporate governance as a base for securing the soundness, transparency, and efficiency of business administration. We will strive to secure the transparency and fairness of our company and timely disclose information to all stakeholders by streamlining the decision-making process, improving the supervisory function for business execution, strengthening the function to oversee directors, and developing an internal control system.

<Reason for not implementing the principles of the Corporate Governance Code (excerpt)>

Principle | Reason for not following the principle |

(Supplementary Principle 5-2-1 Basic Policy on Business Portfolio) | We will strive to present our basic policy on business portfolios and the status of business portfolio reviews to our shareholders in an easy-to-understand manner after discussions at the meetings of the Board of Directors. |

(Principle 5-2 Formulation and Announcement of Management Strategies and Management Plans) | Our company has disclosed our mid/long-term growth strategies via the reference material for briefing financial results, etc. We will discuss methods for giving understandable explanations on concrete goals, execution measures, etc. to shareholders. |

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

Principle | Disclosed information |

(Principle 1-4 Strategically held shares) | For the purpose of maintaining and strengthening transaction relations, we hold shares strategically to a limited extent. In this case, we judge whether or not to invest, while comprehensively considering the benefits, risks, capital costs, etc. arising out of the maintenance and strengthening of transaction relations, and whether they would contribute to the increase in our corporate value. The board of directors examines economic rationality of individual strategically held shares every year, such as whether the benefits and risks arising out of strategic holding of each stock will recoup capital cost and whether it will increase our corporate value from the mid/long-term viewpoint. We try to reduce the number of shares we hold if we determine that the significance of holding of that stock is not sufficient. We exercise voting rights appropriately with the criteria considering whether it will lead to the increase in corporate value from the mid/long-term viewpoint or whether it will degrade the significance of shareholding. We will not agree with any proposals by the company or a shareholder that would degrade the share value.

|

(Supplementary Principle 2-4-1 Ensuring diversity in the appointment of core human resources, etc.) | Our company believes that ensuring and fostering diversity in human resources will lead to medium- to long-term improvements in corporate value, and we are committed to the fair recruitment and promotion of human resources, regardless of gender, age, or nationality, with an emphasis on ability and performance. The percentage of female workers in managerial positions was 18.6% as of the end of February 2024, and we are working to further support female workers in flourishing with the goal of increasing this percentage to over 30% by the fiscal year 2035. With regard to non-Japanese core human resources, we have promoted non-Japanese nationals to managerial positions in our overseas subsidiaries. We will continue to promote diversity in Japan by considering appointment without distinction based on nationality. Furthermore, to enhance our medium- to long-term corporate value and achieve sustainable growth, we will establish a human resource system and an education and training system in order to realize appropriate staffing for the purpose of improving organizational strength and to build a system that will lead to the development of the next generation of human resources for the management of subsidiaries. |

(Supplementary Principle 3-1-3 Sustainability Initiatives) | With the mission of “A society where we can enjoy this “delicious taste” forever ‘delicious taste’ forever,” we aim to contribute to solving social issues in Japan through our business activities based on the corporate philosophy of “Protect and nurture regional ‘delicious foods’ and distribute them around the world” and aim to enhance our medium- to long-term corporate value and achieve a sustainable society. We believe that our business of consolidating companies with issues such as lack of successors through M&A, revitalizing and developing them using our SME support platform, and contributing to local communities is ESG management itself, and we aim to make our business more sustainable by strengthening our efforts on sustainability and continuing our activities. Specific information on sustainability initiatives is disclosed on our website (https://www.y-food-h.com/business/sustainability/). In addition, with regard to investment in human capital, we are committed to creating an environment in which each and every employee can maximize his or her abilities by ensuring diverse human resources regardless of gender, age, nationality, etc., in line with our mott "Cherish individuality." We believe that this will lead to the enhancement of our corporate value and sustainable growth over the medium/long term, and we are actively recruiting personnel and strengthening our human resources system and personnel development. Specific initiatives regarding investment in human capital are disclosed in “financial statements.” |

(Principle 5-1 policy For promoting constructive dialogue with shareholders)

| In order to conduct constructive dialogue and communication with shareholders and investors, our company will develop a system with the business management headquarters in charge of IR. Regarding interviews with shareholders and investors, the business management headquarters discusses the best way to carry them out with the CEO, CFO, chief of business management headquarters, and others, and conducts them up to a reasonable extent, and also holds quarterly briefing sessions on financial results, which are distributed in a video format. The opinions, etc. received in the dialogue with shareholders and investors are reported to directors and other executives every time. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/