| LIKE Co., Ltd. (2462) |

|

||||||||

Company |

LIKE Co., Ltd. |

||

Code No. |

2462 |

||

Exchange |

Tokyo Stock Exchange, First Section |

||

Industry |

Service |

||

President |

Yasuhiko Okamoto |

||

HQ Address |

Umeda Hankyu Building Office Tower 19F, Kakudamachi 8-1, Kita-ku, Osaka-shi |

||

Year-end |

May |

||

Home Page |

|||

* Stock price as of the close on January 28, 2019. Number of shares at the end of the most recent term excluding treasury shares.

* BPS is the actual value from the figures are rounded off. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From FY5/16, the definition for net profit has been changed to net profit attributable to parent company stockholders (Abbreviated as parent net profit).

* FY5/18 EPS reflects the change made after a 2 for 1 stock split was conducted in September 2017. This Bridge Report presents details of the First Half of fiscal year May 2019 earnings results and full fiscal year May 2019 earnings estimates for LIKE Co., Ltd. |

| Key Points |

|

| Company Overview |

|

Based upon its corporate management philosophy of "Planning the Future - Leveraging Human Resources to Create the Future," LIKE endeavors to create a corporate group structure that is capable of providing vital services at all stages of life in the operating realms of child and nursing care, human resources and other services.

<Business Segments and LIKE Group Companies>

LIKE's business segments are divided into the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, hiring and training support services, the childcare support services business, which includes consigned operation of public and private childcare facilities, the nursing care services business, which includes nursing facility operations, and the multimedia services business, which includes cellular telephone carrier shop operations.

The LIKE Group is comprised of the holding company LIKE Co., Ltd., five consolidated subsidiaries and one non-equity accounting method affiliate. The consolidated subsidiaries include LIKE Staffing, which provides worker dispatch and business process consignment services to cellular telephone shops within its comprehensive human resources services business, LIKE Works Co., Ltd. providing comprehensive human resources services to the logistics and manufacturing industries, LIKE Kids Next Co., Ltd and its subsidiary LIKE Academy which provides consigned childcare and public childcare operations (i.e. licensed nurseries), and LIKE Care Next Co., Ltd., which provides nursing care facility operation services. In addition to these, a joint venture company called Career Design Academy Co., Ltd., has been created to provide corporate training services with LIKE Staffing Co., Ltd. and T-GAIA Co., Ltd. (Tokyo Stock Exchange, First Section, Stock code: 3738) providing 20% and 80% of the capital, respectively.

In the final year of the current medium term business plan of fiscal year May 2019, LIKE seeks to achieve its targets for sales and current profit of ¥51.0 and ¥3.5 billion respectively. And while current profit targets remain unchanged, the sales target have been revised down by ¥4.2 billion due to the outlook for a loss of sales arising from the prioritization of improvements in profitability by raising operational efficiency of the comprehensive human resources services business. The LIKE Group will endeavor to achieve the dramatic growth called for by the medium term business plan in fiscal year May 2020 and beyond by focusing upon hiring and cultivating staff who can become a driving force for the Company.

<Shareholder Benefit Program>

LIKE offers a shareholder benefit program including issuance of QUO Card prepaid cards in value of ¥1,000 to holders of between 100 and 500 shares and ¥2,000 to holders of over 500 shares as of the term end in May. Also, discounts on admission to nursing care facilities operated by LIKE Care Next amounting to ¥300,000 (valid for one room per ticket, until the end of August 2020) will be given to holders of over 100 shares.

In the final year of the current medium term business plan of fiscal year May 2019, LIKE seeks to achieve its targets for sales and current profit of ¥51.0 and ¥3.5 billion respectively. And while current profit targets remain unchanged, the sales target have been revised down by ¥4.2 billion due to the outlook for a loss of sales arising from the prioritization of improvements in profitability by raising operational efficiency of the comprehensive human resources services business. The LIKE Group will endeavor to achieve the dramatic growth called for by the medium term business plan in fiscal year May 2020 and beyond by focusing upon hiring and cultivating staff who can become a driving force for the Company.

<Shareholder Benefit Program>

LIKE offers a shareholder benefit program including issuance of QUO Card prepaid cards in value of ¥1,000 to holders of between 100 and 500 shares and ¥2,000 to holders of over 500 shares as of the term end in May. Also, discounts on admission to nursing care facilities operated by LIKE Care Next amounting to ¥300,000 (valid for one room per ticket, until the end of August 2020) will be given to holders of over 100 shares.

|

| First Half of Fiscal Year May 2019 Earnings Results |

Sales increased 5.5% year on year and ordinary profit dropped 29.9% year on year.

Sales grew 5.5% year on year to 23,450 million yen. While the comprehensive human resources services business showed a slight sales decrease, sales from the child-rearing support services grew 16.7% year on year following the increased number of childcare facilities and the review of contracts for consigned childcare services. Sales rose 6.3% year on year in the nursing care-related services business as well.

With regard to profit, gross profit margin stood at 16.6%, down 1.3 points year on year. The margin shrank 2.1 points in the comprehensive human resources services business because of the shortage in operational power at some consigned facilities and 4.1 points in the nursing care-related services business mainly due to the upfront investments in opening new facilities. The ratio of selling, general and administrative (SG&A) expenses decreased 0.4 points year on year to 12.0%, which improved as a result of streamlining of tasks at the headquarters and cost review through cooperation among the group companies. LIKE received additional subsidies for operating child-rearing support services (recorded as sales); however, operating profit shrank 10.2% year on year to 1,086 million yen due to a failure to offset a decrease in profit caused by the restructuring of the comprehensive human resources services business and the expenses spent on opening new facilities in the nursing care-related services business. In the child-rearing support services business, the Company plans to open licensed childcare facilities intensively in April, and the number of facilities opened in the first half of the current term is 1, which is fewer than the same period last year when 4 facilities were irregularly opened. This resulted in a reduction in the income from facility-related subsidies, which are to be recorded as non-operating profit, from 537 million yen in the first half of the previous term to 95 million yen, and a 29.9% year-on-year drop in ordinary profit to 1,238 million yen. Net profit stood at 466 million yen, down 34.9% year on year. Sales increased 5.5% year on year and ordinary profit dropped 29.9% year on year.

Sales grew 5.5% year on year to 23,450 million yen. While the comprehensive human resources services business showed a slight sales decrease, sales from the child-rearing support services grew 16.7% year on year following the increased number of childcare facilities and the review of contracts for consigned childcare services. Sales rose 6.3% year on year in the nursing care-related services business as well.

With regard to profit, gross profit margin stood at 16.6%, down 1.3 points year on year. The margin shrank 2.1 points in the comprehensive human resources services business because of the shortage in operational power at some consigned facilities and 4.1 points in the nursing care-related services business mainly due to the upfront investments in opening new facilities. The ratio of selling, general and administrative (SG&A) expenses decreased 0.4 points year on year to 12.0%, which improved as a result of streamlining of tasks at the headquarters and cost review through cooperation among the group companies. LIKE received additional subsidies for operating child-rearing support services (recorded as sales); however, operating profit shrank 10.2% year on year to 1,086 million yen due to a failure to offset a decrease in profit caused by the restructuring of the comprehensive human resources services business and the expenses spent on opening new facilities in the nursing care-related services business. In the child-rearing support services business, the Company plans to open licensed childcare facilities intensively in April, and the number of facilities opened in the first half of the current term is 1, which is fewer than the same period last year when 4 facilities were irregularly opened. This resulted in a reduction in the income from facility-related subsidies, which are to be recorded as non-operating profit, from 537 million yen in the first half of the previous term to 95 million yen, and a 29.9% year-on-year drop in ordinary profit to 1,238 million yen. Net profit stood at 466 million yen, down 34.9% year on year.

Comprehensive Human Resources Services Business

Sales and operating profit shrank to 10,471 million yen (by 2.3% year on year) and 811 million yen (by 20.9% year on year), respectively. Amid serious manpower shortages in all the industries, businesses, and jobs, the Company's subsidiaries, LIKE Staffing, Co., Ltd., and LIKE Works Co., Ltd., strived to expand business with a focus on the service industry, such as mobile communications and apparel realms that are suffering from the insufficient number of salespersons, call centers and the logistics industry where online shopping, which is surging in popularity, is driving ever-increasing demand, and the childcare and nursing care industries which has been beset with a thorny social problem of a shortage in childcare providers and certified care workers. Taking advantage of its one-site capabilities cultivated by specializing in specific fields, such as knowledge and know-how, LIKE continued efforts to raise the working population by fortifying matching services, follow-ups on workers after they started working, training programs, and proposal for diverse work styles to client companies in hopes of allowing all job seekers, including those with no or less work or real-world experience and those who hope to be employed as part-time workers, to occupy active roles in the society. LIKE has been prioritizing restructuring of this segment since the previous term in order to resolve the lack of operational capabilities so that more job seekers from diverse backgrounds can flourish in response to the enormous external demand, and therefore, it saw declines in both sales and profit.

By type of contract, a lack of human resources that has been becoming more acute fueled demand for all businesses and jobs. Thanks to the Company's scheme that is designed to enable workers to bloom even without specific work experience or skill in a wide range of jobs and industry applications, sales from the contract for the temporary staffing service (which accounts for 69.7% of sales of this segment) went up by 8.0% year on year. On the other hand, regarding the contract for the outsourcing service (making up 29.7% of this segment's sales), as the Company restrained receipt of orders and prioritized restructuring of this segment, which it has been propelling forward since the previous term in order to iron out the issue of an operational power shortage, sales declined 21.1% year on year although there was strong external demand. Sales from the contract for the employment agency service (accounting for 0.6% of this segment's sales) shrank by 1.8% year on year, which remained almost flat owing to the increasing number of job seekers who choose to work as temporarily dispatched workers.

By industry, external demand for the mobile communications industry (making up 71.1% of sales of this segment), which is the Company's mainstay, was escalating; however, as the Company decided to receive fewer orders because it prioritized restructuring of this segment that it has forged ahead with since the previous fiscal year in order to clear up the issue of a shortage of operational capabilities, it saw a year-on-year 10.5% sales decline. Sales from the logistics industry (which accounts for 9.8% of this segment's sales) and the call center realm (accounting for 6.3% of this segment's sales) jumped 64.0% and 39.3%, respectively, year on year, which exceeded the Company's estimates. For the apparel sector (which makes up 7.6% of this segment's sales) where demand is spurred by online shopping that is gaining in popularity, the Company saw a 2.5% year-on-year sales growth. Furthermore, although the business scale is modest or small, serving as driving forces, LIKE Kids Next Co., Ltd. and LIKE Care Next Co., Ltd. brought significant sales rises of 48.6% and 222.4%, respectively, for the child-rearing support services business (which makes up 2.0% of sales of this segment) and the nursing care-related services business (accounting for 0.8% of this segment' sales). Comprehensive Human Resources Services Business

Sales and operating profit shrank to 10,471 million yen (by 2.3% year on year) and 811 million yen (by 20.9% year on year), respectively. Amid serious manpower shortages in all the industries, businesses, and jobs, the Company's subsidiaries, LIKE Staffing, Co., Ltd., and LIKE Works Co., Ltd., strived to expand business with a focus on the service industry, such as mobile communications and apparel realms that are suffering from the insufficient number of salespersons, call centers and the logistics industry where online shopping, which is surging in popularity, is driving ever-increasing demand, and the childcare and nursing care industries which has been beset with a thorny social problem of a shortage in childcare providers and certified care workers. Taking advantage of its one-site capabilities cultivated by specializing in specific fields, such as knowledge and know-how, LIKE continued efforts to raise the working population by fortifying matching services, follow-ups on workers after they started working, training programs, and proposal for diverse work styles to client companies in hopes of allowing all job seekers, including those with no or less work or real-world experience and those who hope to be employed as part-time workers, to occupy active roles in the society. LIKE has been prioritizing restructuring of this segment since the previous term in order to resolve the lack of operational capabilities so that more job seekers from diverse backgrounds can flourish in response to the enormous external demand, and therefore, it saw declines in both sales and profit.

By type of contract, a lack of human resources that has been becoming more acute fueled demand for all businesses and jobs. Thanks to the Company's scheme that is designed to enable workers to bloom even without specific work experience or skill in a wide range of jobs and industry applications, sales from the contract for the temporary staffing service (which accounts for 69.7% of sales of this segment) went up by 8.0% year on year. On the other hand, regarding the contract for the outsourcing service (making up 29.7% of this segment's sales), as the Company restrained receipt of orders and prioritized restructuring of this segment, which it has been propelling forward since the previous term in order to iron out the issue of an operational power shortage, sales declined 21.1% year on year although there was strong external demand. Sales from the contract for the employment agency service (accounting for 0.6% of this segment's sales) shrank by 1.8% year on year, which remained almost flat owing to the increasing number of job seekers who choose to work as temporarily dispatched workers.

By industry, external demand for the mobile communications industry (making up 71.1% of sales of this segment), which is the Company's mainstay, was escalating; however, as the Company decided to receive fewer orders because it prioritized restructuring of this segment that it has forged ahead with since the previous fiscal year in order to clear up the issue of a shortage of operational capabilities, it saw a year-on-year 10.5% sales decline. Sales from the logistics industry (which accounts for 9.8% of this segment's sales) and the call center realm (accounting for 6.3% of this segment's sales) jumped 64.0% and 39.3%, respectively, year on year, which exceeded the Company's estimates. For the apparel sector (which makes up 7.6% of this segment's sales) where demand is spurred by online shopping that is gaining in popularity, the Company saw a 2.5% year-on-year sales growth. Furthermore, although the business scale is modest or small, serving as driving forces, LIKE Kids Next Co., Ltd. and LIKE Care Next Co., Ltd. brought significant sales rises of 48.6% and 222.4%, respectively, for the child-rearing support services business (which makes up 2.0% of sales of this segment) and the nursing care-related services business (accounting for 0.8% of this segment' sales).

Childcare Support Services Business

Sales stood at 9,820 million yen (up 16.7% year on year) and operating profit was 627 million yen (up 55.3% year on year). The issues of the large number of children on nursery school waiting lists and a lack of childcare providers are taking a toll on the Japanese society. In these circumstances, the Company's subsidiaries, LIKE Kids Next Co., Ltd. and LIKE Academy Co., Ltd., continued operating a variety of facilities, including licensed childcare facilities and after-school clubs for schoolchildren, and on-site childcare facilities in companies, hospitals, and universities on a consignment basis as part of the company-led childcare business program. LIKE gave its focus on establishing new facilities that continue to be chosen by parents, guardians, and children through provision of high-quality childcare services, advantageous equipment, and highly convenient locations, and putting forward proposals to business operators who have difficulty in securing human resources that childcare services be opened within their organizations. In addition, the Company not only boosted a recruitment function in collaboration with LIKE Staffing, but also improved the job retention rate by arranging a working environment friendly to childcare providers. As LIKE plans to open new certified childcare facilities intensively in April, only one facility was opened in the first half of this term; however, it recorded additional subsidies for operating licensed childcare facilities as sales, which resulted in a sales increase, and new facilities opened in the previous term, including licensed nursery schools and after-school clubs for schoolchildren, also contributed to a rise in profit. Childcare Support Services Business

Sales stood at 9,820 million yen (up 16.7% year on year) and operating profit was 627 million yen (up 55.3% year on year). The issues of the large number of children on nursery school waiting lists and a lack of childcare providers are taking a toll on the Japanese society. In these circumstances, the Company's subsidiaries, LIKE Kids Next Co., Ltd. and LIKE Academy Co., Ltd., continued operating a variety of facilities, including licensed childcare facilities and after-school clubs for schoolchildren, and on-site childcare facilities in companies, hospitals, and universities on a consignment basis as part of the company-led childcare business program. LIKE gave its focus on establishing new facilities that continue to be chosen by parents, guardians, and children through provision of high-quality childcare services, advantageous equipment, and highly convenient locations, and putting forward proposals to business operators who have difficulty in securing human resources that childcare services be opened within their organizations. In addition, the Company not only boosted a recruitment function in collaboration with LIKE Staffing, but also improved the job retention rate by arranging a working environment friendly to childcare providers. As LIKE plans to open new certified childcare facilities intensively in April, only one facility was opened in the first half of this term; however, it recorded additional subsidies for operating licensed childcare facilities as sales, which resulted in a sales increase, and new facilities opened in the previous term, including licensed nursery schools and after-school clubs for schoolchildren, also contributed to a rise in profit.

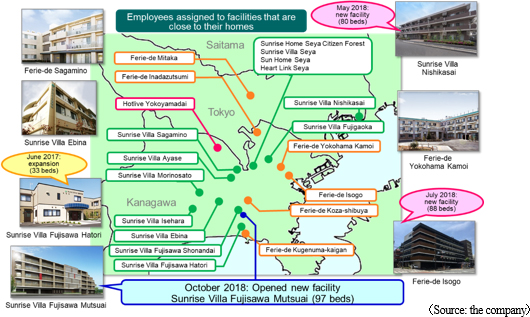

Nursing Care Services Business

Sales were 2,972 million yen (up 6.3% year on year) and operating loss stood at 32 million yen (which was operating profit of 113 million yen in the same period last year). A subsidiary of the Company, LIKE Care Next Co., Ltd., will continue to operate paid nursing homes, where care is provided by nurses stationed for 24 hours 365 days, in the Tokyo metropolitan area, including Kanagawa, Tokyo, and Saitama prefectures. The Company focused on offering high-quality services that are chosen by users and their families on a continuous basis. The occupancy rate for Sunrise Villa Nishikasai, which was opened in May 2018, is increasing steadily. It is also successfully securing residents for Ferie-de Isogo that was opened in July and Sunrise Villa Fujisawa-Mutsuai that was opened in October. While operating loss was posted due to the expenses arising from opening new facilities, the Company is making a steady progress with securing residents at those newly opened facilities, achieving sales growth at a rate exceeding the forecasts.

Other

In the multimedia services business, the Company operated 2 mobile phone shops as showrooms of services targeted at the mobile communications industry, which is the mainstay for the comprehensive human resources services business; however, it closed one of the 2 shops in March 2018 because no appreciable synergy effect was produced at the business scale, which resulted in sales of 184 million yen (down 37.4% year on year) and operating profit of 14 million yen (up 77.6% year on year). Nursing Care Services Business

Sales were 2,972 million yen (up 6.3% year on year) and operating loss stood at 32 million yen (which was operating profit of 113 million yen in the same period last year). A subsidiary of the Company, LIKE Care Next Co., Ltd., will continue to operate paid nursing homes, where care is provided by nurses stationed for 24 hours 365 days, in the Tokyo metropolitan area, including Kanagawa, Tokyo, and Saitama prefectures. The Company focused on offering high-quality services that are chosen by users and their families on a continuous basis. The occupancy rate for Sunrise Villa Nishikasai, which was opened in May 2018, is increasing steadily. It is also successfully securing residents for Ferie-de Isogo that was opened in July and Sunrise Villa Fujisawa-Mutsuai that was opened in October. While operating loss was posted due to the expenses arising from opening new facilities, the Company is making a steady progress with securing residents at those newly opened facilities, achieving sales growth at a rate exceeding the forecasts.

Other

In the multimedia services business, the Company operated 2 mobile phone shops as showrooms of services targeted at the mobile communications industry, which is the mainstay for the comprehensive human resources services business; however, it closed one of the 2 shops in March 2018 because no appreciable synergy effect was produced at the business scale, which resulted in sales of 184 million yen (down 37.4% year on year) and operating profit of 14 million yen (up 77.6% year on year).

Total assets at the end of the first half of the current fiscal year shrank 2,053 million yen from the end of the previous term to 25,657 million yen.

Current assets were 10,012 million yen, down 2,342 million yen from the end of the previous term, mainly because cash and deposits dropped 1,608 million yen following repayment of debts.

Noncurrent assets grew 289 million yen from the end of the previous term to 15,644 million yen, because tangible assets grew 430 million yen following the opening of new facilities in the child-rearing support services business and dropped 292 million yen through amortization of goodwill.

Current liabilities stood at 8,311 million yen, down 1,989 million yen from the previous term, chiefly because of decreases by 938 million yen in debts, 303 million yen in outstanding payments, and 352 million yen in unpaid corporate income taxes.

Noncurrent liabilities were 6,940 million yen, down 505 million yen from the end of the previous term, resulting mainly from a decrease in debts by 549 million yen.

Net assets were 10,405 million yen, up 441 million yen from the end of the previous term, owing chiefly to the net profit of 466 million yen recorded and dividend payment of 358 million yen.

Capital adequacy ratio rose 3.0 points from the end of the previous term to 31.1% this period.

Total assets at the end of the first half of the current fiscal year shrank 2,053 million yen from the end of the previous term to 25,657 million yen.

Current assets were 10,012 million yen, down 2,342 million yen from the end of the previous term, mainly because cash and deposits dropped 1,608 million yen following repayment of debts.

Noncurrent assets grew 289 million yen from the end of the previous term to 15,644 million yen, because tangible assets grew 430 million yen following the opening of new facilities in the child-rearing support services business and dropped 292 million yen through amortization of goodwill.

Current liabilities stood at 8,311 million yen, down 1,989 million yen from the previous term, chiefly because of decreases by 938 million yen in debts, 303 million yen in outstanding payments, and 352 million yen in unpaid corporate income taxes.

Noncurrent liabilities were 6,940 million yen, down 505 million yen from the end of the previous term, resulting mainly from a decrease in debts by 549 million yen.

Net assets were 10,405 million yen, up 441 million yen from the end of the previous term, owing chiefly to the net profit of 466 million yen recorded and dividend payment of 358 million yen.

Capital adequacy ratio rose 3.0 points from the end of the previous term to 31.1% this period.

|

| Fiscal Year May 2019 Earnings Forecast |

Estimates Call for Sales to Rise 11.7%, Current Profit to Fall 10.0% Year-On-Year

he full-year earnings estimates are left unchanged, with sales forecasted to grow 11.7% year on year to 51.0 billion yen and ordinary profit projected to decrease 10.0% year on year to 3.5 billion yen. However, sales growth of the comprehensive human resources services business is expected to remain subdued due to restraint in order taking activities caused by prioritization of improvements in operational strengths. At the same time, the LIKE Group will see limited growth in operating profit as it opens new childcare and nursing care facilities, and makes anticipatory investments in new staff hiring and training to become the leaders of the Group in order to achieve the dramatic growth called for by the new medium term business plan to begin from fiscal year May 2020.

The ¥5 per share commemorative dividend is expected to be eliminated, bringing the full year dividend payment to ¥24 per shares (¥12 per share dividends paid at the ends of the first half and full year, for a dividend payout ratio of 32.3%). Estimates Call for Sales to Rise 11.7%, Current Profit to Fall 10.0% Year-On-Year

he full-year earnings estimates are left unchanged, with sales forecasted to grow 11.7% year on year to 51.0 billion yen and ordinary profit projected to decrease 10.0% year on year to 3.5 billion yen. However, sales growth of the comprehensive human resources services business is expected to remain subdued due to restraint in order taking activities caused by prioritization of improvements in operational strengths. At the same time, the LIKE Group will see limited growth in operating profit as it opens new childcare and nursing care facilities, and makes anticipatory investments in new staff hiring and training to become the leaders of the Group in order to achieve the dramatic growth called for by the new medium term business plan to begin from fiscal year May 2020.

The ¥5 per share commemorative dividend is expected to be eliminated, bringing the full year dividend payment to ¥24 per shares (¥12 per share dividends paid at the ends of the first half and full year, for a dividend payout ratio of 32.3%).

(2) Strategy by Business Segments

Comprehensive Human Resources Services Business

The securing of human resources has become an important management issue for companies in all industries. In this circumstance, LIKE will focus on expanding the working population using its Corporate Group's unique know-how of developing job seekers into full-fledged workers regardless of their initial work experience and skills.

As for the matching services, as the work conditions and environments that job seekers prefer, such as part-time jobs for 3 days a week and short working hours, have been diversifying, the Company will put forth efforts to fulfill such needs by presenting a variety of proposals to clients. In addition, it meticulously interviews each job seeker in order to introduce him or her to jobs that are well suited to them and satisfy their desires.

The Company offers job seekers training and education sessions where a well-experienced person in charge of the session not only provides classroom lectures but also works together with job seekers in order to turn inexperienced workers into fully contributing ones, and it also follows up job seekers from an on-site perspective after they have started working in an attempt to maintain a high job retention rate. The Company is capable of fulfilling the needs to train and educate human resources from overseas nations, who are expected to be accepted in large numbers into Japan in the future, as committed workers through skill evaluation and training programs. Regarding the training session, trainees are allowed to take them at their own pace. Lecturers, who are well familiar with the actual working environments of the relevant occupational category they specialize in, teach job seekers skills required by client companies for any work styles, including "part-time jobs for 2-3 days a week" and "short working hours." The Company not just explains industries and job contents, but takes job seekers to the actual working site to describe the appeal of working there and emotional reward brought by the job, in order to increase the working population and improve the job retention rate. (2) Strategy by Business Segments

Comprehensive Human Resources Services Business

The securing of human resources has become an important management issue for companies in all industries. In this circumstance, LIKE will focus on expanding the working population using its Corporate Group's unique know-how of developing job seekers into full-fledged workers regardless of their initial work experience and skills.

As for the matching services, as the work conditions and environments that job seekers prefer, such as part-time jobs for 3 days a week and short working hours, have been diversifying, the Company will put forth efforts to fulfill such needs by presenting a variety of proposals to clients. In addition, it meticulously interviews each job seeker in order to introduce him or her to jobs that are well suited to them and satisfy their desires.

The Company offers job seekers training and education sessions where a well-experienced person in charge of the session not only provides classroom lectures but also works together with job seekers in order to turn inexperienced workers into fully contributing ones, and it also follows up job seekers from an on-site perspective after they have started working in an attempt to maintain a high job retention rate. The Company is capable of fulfilling the needs to train and educate human resources from overseas nations, who are expected to be accepted in large numbers into Japan in the future, as committed workers through skill evaluation and training programs. Regarding the training session, trainees are allowed to take them at their own pace. Lecturers, who are well familiar with the actual working environments of the relevant occupational category they specialize in, teach job seekers skills required by client companies for any work styles, including "part-time jobs for 2-3 days a week" and "short working hours." The Company not just explains industries and job contents, but takes job seekers to the actual working site to describe the appeal of working there and emotional reward brought by the job, in order to increase the working population and improve the job retention rate.

Various Efforts

Amidst the demographic trends of the ninth consecutive year of declines in the Japanese population, and the fall in the share of the Japanese population between the ages of 15 to 64 to below 60% (As of January 1, 2018 Population Survey), there is a need to promote diversification of work styles where jobs applicants of various backgrounds regardless of education, work experience, life experience, job format, working hours, nationality and other factors can be hired for various jobs. Furthermore, there is an absolute need for operations that allow for companies to provide detailed human resources services that match the needs of both the job applicants and hiring companies. A number of efforts to allow every job seeker to play an active role enabled LIKE to realize diverse work styles and elevate the customer satisfaction level. In the Oricon Customer Satisfaction Survey 2019, LIKE Staffing was ranked 5th in the sales and marketing section of the "Temporary Staffing Agency Services" category.

In anticipation of a drastic business growth as set forth in the medium-term business plan scheduled to be launched in fiscal year May 2020, the Company downgraded the sales growth rate for the term ending May 2019 from the initial forecast in order to put profitability improvement through enhancement of operational capabilities before anything else.

Strengthening Services Provided to Logistics, Manufacturing Industries

The services provided to the logistics and manufacturing industries were spun off from LIKE Staffing Co., Ltd. in June 2018 to become an independent company called LIKE Works Co., Ltd. with a goal of expanding these services. This new company provides a wide range of services matching customers' needs, including human resources dispatching services to the logistics and manufacturing industries in response to the rapid rise in demand for parcel picking and packaging applications, and provides business process consignment for call center services that the Company has cultivated through business of warehouse operation entrusted for many years by major companies operating electronic-commerce websites, and storefront sales applications leveraging its experiences with major electronic commerce operating companies. Furthermore, the Company will strive not only to provide staff but also to arrange a worker-friendly environment by setting up childcare facilities through cooperation with LIKE Kids Next Co., Ltd.

Childcare Support Services Business

LIKE operates 153 childcare facilities within companies, hospitals, and universities nationwide on a consignment basis, including ones established as part of the company-led childcare business program in the outsourced childcare business. This term, it opened several new facilities, including Brandear TRC Kid's room. The Company also operates 180 publicly owned childcare facilities, such as licensed nursery schools, after-school clubs for schoolchildren, and children's centers, in the public childcare business (as of the end of October 2018). In the first half of the fiscal year May 2019, 3 facilities (2 outsourced childcare facilities and 1 public childcare facility (certified nursery school)) were newly opened.

Shortages in childcare facilities and childcare providers have made the problem of the huge number of children on nursery school waiting lists thornier and the roles that the child-rearing support services business serves more substantial. In these circumstances, LIKE aims to become the top childcare services provider in Japan that continues to offer high-quality childcare services and thrive in terms of both sales and profit.

Increase in Childcare Facilities

In the outsourced childcare business, taking advantage of its Group's long list of client companies, LIKE will put forth efforts to increase the number of facilities that it operates on a consignment basis at reasonable profits for the company-led childcare business program. Meanwhile, in the public childcare business, the Company will seek to raise the number of facilities with favorable hardware conditions, which will continue to be chosen by users even after the problem of children who cannot gain entrance to publicly operated nursery schools or preschools has been resolved. Furthermore, it will endeavor to enrich the contents of its childcare services.

Securing Childcare Providers

LIKE will endeavor to boost its hiring capabilities and improve the job retention rate by utilizing the know-how regarding hiring and post-hiring follow-up training of childcare providers that LIKE Staffing has accumulated. It will share know-how and strengthen the matching power through proactive interactions between workers within the Corporate Group. In addition, the Company will strive for creating human resources by sharing training contents within the Group.

Facilitation of a pleasant working environment for childcare providers

LIKE has joined the non-profit organization "Iku-Boss Kigyo Domei" (Literally "Childcare Conscious Boss Corporate Alliance") in February 2016 as part of its efforts to facilitate an environment that makes working easier for parents and childcare providers. "Iku-Boss" is a concept that calls for companies to create a work environment with a favorable work-life balance, allowing for support of both career and private lifestyles while at the same time allowing workers to realize results in the workplace and enjoying their private life (Non-profit Organization Fathering Japan). Accelerating the effort to establish an "attractive workplace that kindles workers' willingness to continue working," LIKE will aim to contribute to improvement and development of childcare services and preschool education throughout Japan.

Adoption of "Miraikuru Nursery Teachers," childcare providers pursuing a managerial career path

LIKE has set up a new job title for childcare providers who hope to work as the management. Career development of such workers will be backed up with higher salaries and more in-depth training than general childcare providers. Childcare providers are usually employed as general or part-time workers, and establishment of a unique managerial title is a rare case in the industry. LIKE supports nursery teachers hoping to serve as the management for pursuing their respective career paths by newly developing a pay structure and training programs. These approaches will help those workers assume managerial positions as early as possible while cultivating extensive and vast experiences.

Nursing Care Services Business (Operating 24 Facilities with 1,443 Rooms including 3 Day Care Facilities as of end of October 2018)

Paid-for nursing care facilities including end-of-life care nursing facilities are operated in the Tokyo, Kanagawa, and Saitama regions. Characteristics and strengths of this business include facilities staffed with helpers and nursing care staff 24 hours a day, 365 days a year, an established track record of high quality nursing care service provision, and daily provision of high quality food services that are offered with carefully selected, fresh ingredients. On October 1, 2018, Sunrise Villa Fujisawa-Mutsuai was newly opened.. Various Efforts

Amidst the demographic trends of the ninth consecutive year of declines in the Japanese population, and the fall in the share of the Japanese population between the ages of 15 to 64 to below 60% (As of January 1, 2018 Population Survey), there is a need to promote diversification of work styles where jobs applicants of various backgrounds regardless of education, work experience, life experience, job format, working hours, nationality and other factors can be hired for various jobs. Furthermore, there is an absolute need for operations that allow for companies to provide detailed human resources services that match the needs of both the job applicants and hiring companies. A number of efforts to allow every job seeker to play an active role enabled LIKE to realize diverse work styles and elevate the customer satisfaction level. In the Oricon Customer Satisfaction Survey 2019, LIKE Staffing was ranked 5th in the sales and marketing section of the "Temporary Staffing Agency Services" category.

In anticipation of a drastic business growth as set forth in the medium-term business plan scheduled to be launched in fiscal year May 2020, the Company downgraded the sales growth rate for the term ending May 2019 from the initial forecast in order to put profitability improvement through enhancement of operational capabilities before anything else.

Strengthening Services Provided to Logistics, Manufacturing Industries

The services provided to the logistics and manufacturing industries were spun off from LIKE Staffing Co., Ltd. in June 2018 to become an independent company called LIKE Works Co., Ltd. with a goal of expanding these services. This new company provides a wide range of services matching customers' needs, including human resources dispatching services to the logistics and manufacturing industries in response to the rapid rise in demand for parcel picking and packaging applications, and provides business process consignment for call center services that the Company has cultivated through business of warehouse operation entrusted for many years by major companies operating electronic-commerce websites, and storefront sales applications leveraging its experiences with major electronic commerce operating companies. Furthermore, the Company will strive not only to provide staff but also to arrange a worker-friendly environment by setting up childcare facilities through cooperation with LIKE Kids Next Co., Ltd.

Childcare Support Services Business

LIKE operates 153 childcare facilities within companies, hospitals, and universities nationwide on a consignment basis, including ones established as part of the company-led childcare business program in the outsourced childcare business. This term, it opened several new facilities, including Brandear TRC Kid's room. The Company also operates 180 publicly owned childcare facilities, such as licensed nursery schools, after-school clubs for schoolchildren, and children's centers, in the public childcare business (as of the end of October 2018). In the first half of the fiscal year May 2019, 3 facilities (2 outsourced childcare facilities and 1 public childcare facility (certified nursery school)) were newly opened.

Shortages in childcare facilities and childcare providers have made the problem of the huge number of children on nursery school waiting lists thornier and the roles that the child-rearing support services business serves more substantial. In these circumstances, LIKE aims to become the top childcare services provider in Japan that continues to offer high-quality childcare services and thrive in terms of both sales and profit.

Increase in Childcare Facilities

In the outsourced childcare business, taking advantage of its Group's long list of client companies, LIKE will put forth efforts to increase the number of facilities that it operates on a consignment basis at reasonable profits for the company-led childcare business program. Meanwhile, in the public childcare business, the Company will seek to raise the number of facilities with favorable hardware conditions, which will continue to be chosen by users even after the problem of children who cannot gain entrance to publicly operated nursery schools or preschools has been resolved. Furthermore, it will endeavor to enrich the contents of its childcare services.

Securing Childcare Providers

LIKE will endeavor to boost its hiring capabilities and improve the job retention rate by utilizing the know-how regarding hiring and post-hiring follow-up training of childcare providers that LIKE Staffing has accumulated. It will share know-how and strengthen the matching power through proactive interactions between workers within the Corporate Group. In addition, the Company will strive for creating human resources by sharing training contents within the Group.

Facilitation of a pleasant working environment for childcare providers

LIKE has joined the non-profit organization "Iku-Boss Kigyo Domei" (Literally "Childcare Conscious Boss Corporate Alliance") in February 2016 as part of its efforts to facilitate an environment that makes working easier for parents and childcare providers. "Iku-Boss" is a concept that calls for companies to create a work environment with a favorable work-life balance, allowing for support of both career and private lifestyles while at the same time allowing workers to realize results in the workplace and enjoying their private life (Non-profit Organization Fathering Japan). Accelerating the effort to establish an "attractive workplace that kindles workers' willingness to continue working," LIKE will aim to contribute to improvement and development of childcare services and preschool education throughout Japan.

Adoption of "Miraikuru Nursery Teachers," childcare providers pursuing a managerial career path

LIKE has set up a new job title for childcare providers who hope to work as the management. Career development of such workers will be backed up with higher salaries and more in-depth training than general childcare providers. Childcare providers are usually employed as general or part-time workers, and establishment of a unique managerial title is a rare case in the industry. LIKE supports nursery teachers hoping to serve as the management for pursuing their respective career paths by newly developing a pay structure and training programs. These approaches will help those workers assume managerial positions as early as possible while cultivating extensive and vast experiences.

Nursing Care Services Business (Operating 24 Facilities with 1,443 Rooms including 3 Day Care Facilities as of end of October 2018)

Paid-for nursing care facilities including end-of-life care nursing facilities are operated in the Tokyo, Kanagawa, and Saitama regions. Characteristics and strengths of this business include facilities staffed with helpers and nursing care staff 24 hours a day, 365 days a year, an established track record of high quality nursing care service provision, and daily provision of high quality food services that are offered with carefully selected, fresh ingredients. On October 1, 2018, Sunrise Villa Fujisawa-Mutsuai was newly opened..

LIKE pursues the provision of high quality nursing care services that are highly differentiated, and seeks to secure adequate nursing care providers. LIKE also seeks to differentiate its services by stationing nursing care providers at its facilities 24 hours a day, and collaborates with medical institutions for end-of-life nursing care (Provision of responses meeting nearly 100% of clients' requirements) to become the nursing care facility operator of choice. Collaboration will also be conducted with LIKE Staffing to turn inexperienced workers into productive nursing care providers as part of its efforts to secure adequate nursing care staff numbers, and to raise the working population by improving job retention rates. Taking into account "Basic Policies for Economic and Fiscal Management and Structural Reform," and "Revised Immigration Control and Refugee Recognition Law" that were approved by the Cabinet of Japan in 2018, the Company will focus on enriching training contents in preparation for employment of workers from overseas nations.

LIKE pursues the provision of high quality nursing care services that are highly differentiated, and seeks to secure adequate nursing care providers. LIKE also seeks to differentiate its services by stationing nursing care providers at its facilities 24 hours a day, and collaborates with medical institutions for end-of-life nursing care (Provision of responses meeting nearly 100% of clients' requirements) to become the nursing care facility operator of choice. Collaboration will also be conducted with LIKE Staffing to turn inexperienced workers into productive nursing care providers as part of its efforts to secure adequate nursing care staff numbers, and to raise the working population by improving job retention rates. Taking into account "Basic Policies for Economic and Fiscal Management and Structural Reform," and "Revised Immigration Control and Refugee Recognition Law" that were approved by the Cabinet of Japan in 2018, the Company will focus on enriching training contents in preparation for employment of workers from overseas nations.

|

| Conclusions |

|

The respective progress rates of sales, operating profit, ordinary profit, and net profit to the full-year earnings forecasts are 46.0%, 56.0%, 35.4%, and 33.3%. Demand is strong in the comprehensive human resources services business while the segment has been showing sluggish growth as the Company is curtailing receipt of orders, and the Company is striving to make a foray into various other fields than the mobile communications industry that has been its mainstay. Therefore, improvement in LIKE's operational capabilities are eagerly awaited. Since the issue of a manpower shortage has been serious, the Company is expected to thrive in the medium term. Meanwhile, the child-rearing support services business, which turned into the black in the previous term through a 20.7% year-on-year sales increase, continued to grow steadily with the double-digit sales and profit rises. Looking ahead of the next term, we project that the child-rearing support services business will continue thriving on a steady basis. We would like to await improvement in the operational capabilities in the comprehensive human resources services business.

|

| <Reference: Regarding Corporate Governance> |

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of "…planning the future - Developing people and creating the future -" and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

1. Ensuring the rights and equality of shareholders

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured.

2. Appropriate cooperation with stakeholders excluding shareholders

On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action.

3. Appropriate disclosure of information and ensuring transparency

We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances.

4. Responsibilities of the Board of Directors and others

The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further.

5. Dialogue with shareholders

We put importance on dialogue with shareholders to maximize the corporate value of the group, and respond to requests for dialogue from shareholders at any time. The dialogue with shareholders is carried out by the department in charge of IR, executives in charge of IR and the management executives as necessary.

Implementation Status of Principles of Corporate Governance Code

<The number of principles of Corporate Governance Code the Company does not comply with: 3, including the following>

【Supplementary principle 1-2-4】

Our company currently does not have any infrastructure that allows the exercise of electronic voting; however, we will consider using electronic voting by taking into account the proportion of institutional and overseas investors to the total number of shareholders.

【Supplementary principle 4-10-1】

Although we have not set up any independent advisory committee, our company explains nomination of candidates for directors and remuneration of directors to independent outside directors and obtain appropriate advice from them prior to a resolution by the board of directors. Since we obtain appropriate involvement and advice of independent outside directors regarding nomination of candidates for directors and directors’ remuneration as mentioned above, we consider that the independence, objectivity, and accountability of the functions of our board of directors pertaining to the aforementioned matters have been sufficiently secured.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

We will consider strategically holding shares of any listed company only when synergy of corporate value improvement has been recognized. Our company has confirmed the significance of the strategically held shares that we are currently possessing. Furthermore, with regard to the exercise of our voting rights as to those strategically held shares, we will declare our intention to approve or disapprove a case by taking into account whether the relevant company’s corporate value is improved and whether the exercise impacts our company.

【Principle 2-6】

Our company has not adopted a corporate pension plan.

【Principle 5-1】

・Our company has designated a director and established a department, both of which are in charge of overall IR activities for our corporate group, in order to encourage constructive dialogue with shareholders.

・Our company exerts ourselves to disclose information in a fair, timely, and proper manner in accordance with "Disclosure Policy" that we have set forth to organize our basic ideas.

・Our company discloses Disclosure Policy on our website (https://www.like-gr.co.jp/ir/policy.html).

・The details of our IR activities are as described in the second section of "Implementation Status of Policies regarding Shareholders and Other Stakeholders" in this report.

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of "…planning the future - Developing people and creating the future -" and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

1. Ensuring the rights and equality of shareholders

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured.

2. Appropriate cooperation with stakeholders excluding shareholders

On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action.

3. Appropriate disclosure of information and ensuring transparency

We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances.

4. Responsibilities of the Board of Directors and others

The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further.

5. Dialogue with shareholders

We put importance on dialogue with shareholders to maximize the corporate value of the group, and respond to requests for dialogue from shareholders at any time. The dialogue with shareholders is carried out by the department in charge of IR, executives in charge of IR and the management executives as necessary.

Implementation Status of Principles of Corporate Governance Code

<The number of principles of Corporate Governance Code the Company does not comply with: 3, including the following>

【Supplementary principle 1-2-4】

Our company currently does not have any infrastructure that allows the exercise of electronic voting; however, we will consider using electronic voting by taking into account the proportion of institutional and overseas investors to the total number of shareholders.

【Supplementary principle 4-10-1】

Although we have not set up any independent advisory committee, our company explains nomination of candidates for directors and remuneration of directors to independent outside directors and obtain appropriate advice from them prior to a resolution by the board of directors. Since we obtain appropriate involvement and advice of independent outside directors regarding nomination of candidates for directors and directors’ remuneration as mentioned above, we consider that the independence, objectivity, and accountability of the functions of our board of directors pertaining to the aforementioned matters have been sufficiently secured.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

We will consider strategically holding shares of any listed company only when synergy of corporate value improvement has been recognized. Our company has confirmed the significance of the strategically held shares that we are currently possessing. Furthermore, with regard to the exercise of our voting rights as to those strategically held shares, we will declare our intention to approve or disapprove a case by taking into account whether the relevant company’s corporate value is improved and whether the exercise impacts our company.

【Principle 2-6】

Our company has not adopted a corporate pension plan.

【Principle 5-1】

・Our company has designated a director and established a department, both of which are in charge of overall IR activities for our corporate group, in order to encourage constructive dialogue with shareholders.

・Our company exerts ourselves to disclose information in a fair, timely, and proper manner in accordance with "Disclosure Policy" that we have set forth to organize our basic ideas.

・Our company discloses Disclosure Policy on our website (https://www.like-gr.co.jp/ir/policy.html).

・The details of our IR activities are as described in the second section of "Implementation Status of Policies regarding Shareholders and Other Stakeholders" in this report.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |