Bridge Report:(2317)Systena 2Q of Fiscal Year Ending March 2025

President Kenji Miura | Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE Prime |

Industry | Information and communications |

Representative Director & Chairperson | Yoshichika Hemmi |

President & Representative Director | Kenji Miura |

Address | 14F・16FShiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥351 | 358,228,045 shares | ¥125,738 million | 20.0% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥12.0 | 3.4% | ¥21.04 - 22.95 | 15.3 - 16.7x | ¥98.34 | 3.6x |

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (yen) | DPS (yen) |

March 2021 (Actual) | 60,871 | 8,006 | 7,507 | 4,974 | 51.36 | 20.00 |

March 2022 (Actual) | 65,272 | 9,106 | 8,578 | 5,992 | 15.47 | -(*) |

March 2023 (Actual) | 74,526 | 9,844 | 9,955 | 7,317 | 18.89 | 8.00 |

March 2024 (Actual) | 76,940 | 9,713 | 9,942 | 7,232 | 18.67 | 10.00 |

March 2025 (Estimate) | 85,000 - 90,000 | 11,000 - 12,000 | 11,000 - 12,000 | 7,700 - 8,400 | 21.04 - 22.95 | 12.00 |

This Bridge Report reviews the summary of the financial results of the second quarter of the fiscal year ending March 2025 and forecasts for the fiscal year ending March 2025 of Systena Corporation.

Table of Contents

Key Points

1. Company Overview

2. 2Q of Fiscal Year Ending March 2025 Earnings Results

3. Fiscal Year Ending March 2025 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year ending March 2025, sales increased 6.9% year on year and operating income grew 27.6% year on year. All segments, excluding the solution design business, saw a sales growth. The next-generation mobility business, which was separated as a new independent segment this fiscal year, continued to perform well, serving as a growth driver, and DX & recurring-revenue business increased the rate of sales growth from the first quarter. In terms of profit, the solution design business recovered significantly from the previous fiscal year, in which it struggled due to the augmented impact of unprofitable projects, and the next-generation mobility business contributed to the growth of not only sales, but also profit, so their profits increased 81.2% and 300.9%, respectively, showing a favorable performance.

- Following the revision to the full-year forecast on July 31, 2024, they announced further revision on October 31. The full-year earnings forecast for the fiscal year ending March 2025 calls for sales growing 10.5-17.0% to 85-90 billion yen, operating income rising 13.3-23.6% to 11-12 billion yen, ordinary income increasing 10.6-20.7% to 11-12 billion yen, and profit attributable to owners of parent growing 6.5-16.2% to 7.7-8.4 billion yen. Namely, they decreased the upper limit of the forecast range of sales, and increased the lower limits of the forecast ranges of all kinds of profits. Regarding the outlook for dividends, the initial forecast has not been revised, and it is assumed that the company will pay an interim dividend of 6 yen/share and a year-end dividend of 6 yen/share for a total of 12 yen/share per year, up 2 yen/share from the previous fiscal year.

- It is reassuring to see projects for realizing “All Systena,” which attracted our attention in the previous report. Furthermore, we would like to highly evaluate the fact that the interim financial results include multiple factors in producing positive effects on future growth of their business performance. For example, the business solution business received orders for replacement projects in the wake of the discontinuation of support for Windows 10 as expected, and it is projected to receive such orders on a full-scale basis in the second half of the fiscal year. In addition, they are drawing a new blueprint for expanding revenues based on “Canbus.,” whose performance seemed sluggish.

1. Company Overview

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Katena Corp. It forms a corporate group with 8 consolidated subsidiaries and 3 equity-method affiliates.

【Management goal - To become one of Japan's leading IT companies and support the Japanese economy from the ground up!】

In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation”, “stability and growth,” and “maintenance and innovation” as its basic policy.

【Target management indicators】

The company sets stably high dividends, high return on equity and high operating income rate as target managerial indicators. To achieve these goals, the company aims to develop a highly profitable structure under its basic policy for business administration.

1-1 Business description

The business of Systena Corporation is classified into the Solution Design Business, the Framework Design Business, the IT Service Business, the Business Solution Business (former Solution Sales Business), the Cloud Business, the Overseas Business, and the Investment & Incubation Business. Involving all group companies, they offer comprehensive solution services for planning, designing, developing, installing, and maintaining systems and giving user support, including the development and quality check of software for automatic driving and in-vehicle systems, social infrastructure systems, online business systems, IoT-related systems, robots, AI, and mobile devices, the development of systems for financial institutions, system operation, help desk management, the sale of IT products, system integration, the provision of cloud services, and the development of game content. The segment information is for the segments used until the fiscal year ended March 2024. In the fiscal year ending March 2025, they changed the segments to be reported while renaming some segments (see Section 1-2 New Segments), in response to the changes in tasks in each segment and major domains.

◎Solution Design Business (accounting for 27.6% in FY 3/24)

The company concentrates its managerial resources on five business categories; “in-vehicle” items such as automatic driving technology and telematics where its know-how nurtured through the development of mobile terminals can be utilized, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development, testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on. Clients include telecommunications carriers, telecom equipment manufacturers, automobile manufacturers, Internet business enterprises, etc.

◎Framework Design Business (accounting for 9.0% in FY 3/24)

Systena Corporation develops financial systems and foundational systems for not only life and non-life insurance companies, but also banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. Previously, their tasks were mostly the development and operation of financial systems, but the projects for developing and operating public and corporate systems are increasing. They are promoting cross-selling to clients of two businesses through the linkage with the IT Service Business and solution marketing, and pursuing financial systems and applying them to other fields through the linkage with the Solution Design Business for solutions for smartphone apps, web apps, etc. like the Solution Design Business section, Systena Vietnam Co., Ltd. is functioning as an offshore foothold.

◎IT Service Business (accounting for 23.8% in FY 3/24)

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services including help desk operation, user support, data inputting, and large-volume output. Clients are mainly electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Business Solution Business (accounting for 37.0% in FY 3/24,) The former Solution Sales Business)

The company sells IT products including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. The company is shifting business model from selling hardware to offering services. The company aims to expand its business and improve its added value by meeting the changing demands from ownership to usage (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients are mainly electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business (accounting for 2.7% in FY 3/24)

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and “Google Workspace”, “Canbus.,” a cloud database service, which was launched in May 2017, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for offering the private cloud service. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “Google Workspace”, and management tools for administrators. Clients include medium to large-sized companies that conduct general business, etc.

◎Overseas Business (accounting for 0.2% in FY 3/24)

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the researching on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services. Clients include Japanese enterprises, American enterprises, telecommunications carriers, telecom equipment manufacturers, etc.

◎Investment & Incubation Business (accounting for 0.2% in FY 3/24)

GaYa Co., Ltd. develops game content for smartphones, offers the contents to leading SNS websites and undertakes the operation of video games developed and released by other companies.

*Adjustment -0.5%

1-2 New business segments

From the fiscal year ending March 2025, the business segments of Systena Corporation are Solution Design Business, Next-Generation Mobility Business, Framework Design Business, IT & DX Service Business, Business Solution Business, DX & Recurring-revenue Business, and Other Businesses.

◆ Solution Design Business

The segment name remains unchanged. In the fiscal year ending March 2025, however, out of the former five categories that are in-vehicle systems, social infrastructure, Internet business, smart devices/robots/AI, and business systems, Systena made the in-vehicle category an independent segment named Next-Generation Mobility Business and transferred DX services to the DX & Recurring-revenue Business, a newly established segment that specializes in businesses related to the company’s own services. In this Solution Design Business, the company engages in planning, design, development, and verification support for Internet businesses, apps for business use, online services, social infrastructure-related systems, IoT, artificial intelligence, robot-related services as well as planning, design, development, and verification support for various products and telecommunications carrier services.

◆ Next-Generation Mobility Business

While this business was part of the Solution Design Business before the business segment reclassification, the company has made it a new independent segment. This business is intended primarily to provide the company’s original services, such as engineering and Mobility as a Service (MaaS), targeting the automobile industry, especially original equipment manufacturers (OEMs) and suppliers.

◆ Framework Design Business

No significant change has been made to this business. While principally focusing on development of apps for business use, the company offers a host of services ranging from development of mission-critical systems to support for adoption of cloud-based and digital transformation (DX) solutions and technical consulting regarding various advanced technologies to clients including financial businesses (non-life and life insurance companies and banks), public institutions, and corporations.

◆ IT & DX Service Business

As orders for DX-related projects are noticeably growing in number, the company has renamed the conventional IT Service Business the IT & DX Service Business. It engages chiefly in multitudinous outsourcing services related to IT, such as operation, maintenance, and monitoring of systems, help desk and user support services, and project management office (PMO) services.

◆ Business Solution Business

No significant change has been made to this business. In this business, the company sells IT-related products, including servers, computers, computer peripherals, and software, mainly to corporations and offers system integration services (such as provision of services relating to IT equipment, including infrastructure construction and virtualization, and robotic process automation (RPA) solutions) primarily to foreign-affiliated companies and leading medium-sized companies.

◆ DX & Recurring-revenue Business

The company has added the business related to its own services in the DX service category of the Solution Design Business to the existing Cloud Business and renamed the Cloud Business the DX & Recurring-revenue Business. With a principal focus on Canbus., which is its original service, Systena provides such cloud-based services as Google Workspace and Microsoft 365 and helps clients adopt them, as well as offers various services including Cloudstep and Web Shelter

◆ Other Businesses

This segment consists of the former Overseas Business and the former Investment & Incubation Business. In the Overseas Business, the company offers technical support related to mobile communications, development and verification support, solutions, and trend research and commercialization regarding state-of-the-art technologies and services. Furthermore, in the field of investment and incubation, it plans, develops, and sells game content for smartphones and tablets.

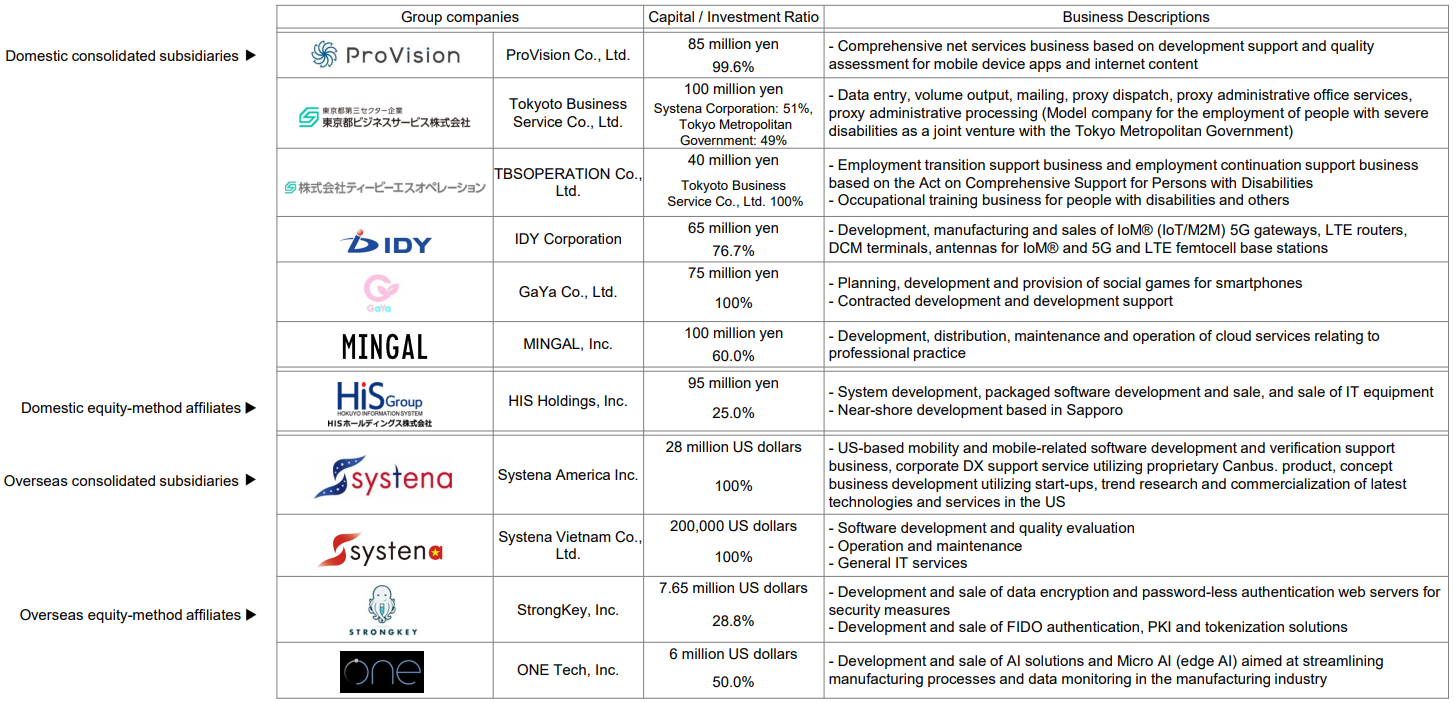

1-3 Group Companies

(Taken from the reference material of the company)

2. 2Q of Fiscal Year Ending March 2025 Earnings Results

2-1 Consolidated business performance

| FY 3/24 2Q | Ratio to net sales | FY 3/25 2Q | Ratio to net sales | YoY |

Net sales | 37,521 | 100.0% | 40,092 | 100.0% | +6.9% |

Gross profit | 8,745 | 23.3% | 9,952 | 24.8% | +13.8% |

SG&A expenses | 4,377 | 11.7% | 4,378 | 10.9% | +0.0% |

Operating income | 4,368 | 11.6% | 5,573 | 13.9% | +27.6% |

Ordinary income | 4,334 | 11.6% | 5,410 | 13.5% | +24.8% |

Profit Attributable to Owners of Parent | 2,976 | 7.9% | 3,726 | 9.3% | +25.2% |

*Unit: Million yen

Sales and operating income grew 6.9% and 27.6%, respectively, year on year.

While the employment and income environments have been improving, the economy has been recovering gently. However, the future outlook remains uncertain, due to the skyrocketing of energy costs and raw material costs caused by the global situation and the fluctuations in exchange rates. Under these circumstances, the Systena group reallocated managerial resources, improved productivity, concentrated on recurring-revenue business to secure revenues, and promoted the expansion of businesses with high added value, such as the consultancy for supporting DX in software development business, etc. and PMO projects. As mentioned above, they changed the segments to be reported, while renaming some segments.

Sales grew 6.9% year on year to 40,092 million yen. All segments, excluding the solution design business, saw a sales growth. The next-generation mobility business, which was separated as a new independent segment this fiscal year, continued to perform well, serving as a growth driver, and DX & recurring-revenue business increased the rate of sales growth from the first quarter.

In terms of profit, the solution design business recovered significantly from the previous fiscal year, in which it struggled due to the augmented impact of unprofitable projects, and the next-generation mobility business contributed to the growth of not only sales, but also profit, so their profits increased 81.2% and 300.9%, respectively, showing a favorable performance. As a result, operating income increased 27.6%, and gross profit margin rose 1.5 points year on year to 24.8%. The ratio of SGA to sales dropped 0.8 points year on year to 10.9%.

2-2 Trends by segment

| FY 3/24 2Q | Composition ratio/Income margin | FY 3/25 2Q | Composition ratio/ Income margin | YoY |

Solution Design | 9,341 | 24.9% | 8,957 | 22.3% | -4.1% |

Next-Generation Mobility | 1,064 | 2.8% | 2,229 | 5.6% | 109.3% |

Framework Design | 3,314 | 8.8% | 3,869 | 9.7% | 16.7% |

IT&DX Service | 8,949 | 23.9% | 9,489 | 23.7% | 6.0% |

Business Solution | 13,302 | 35.5% | 13,812 | 34.5% | 3.8% |

DX & Recurring-revenue Business | 1,239 | 3.3% | 1,494 | 3.7% | 20.5% |

Other | 514 | 1.4% | 428 | 1.1% | -16.7% |

Consolidated Sales | 37,521 | 100.0% | 40,092 | 100.0% | 6.9% |

Solution Design | 803 | 8.6% | 1,457 | 16.3% | 81.2% |

Next-Generation Mobility | 202 | 19.0% | 812 | 36.5% | 300.9% |

Framework Design | 806 | 24.3% | 804 | 20.8% | -0.2% |

IT&DX Service | 1,367 | 15.3% | 1,187 | 12.5% | -13.1% |

Business Solution | 967 | 7.3% | 1,081 | 7.8% | 11.7% |

DX & Recurring-revenue Business | 159 | 12.9% | 224 | 15.0% | 40.5% |

Other | 60 | 11.8% | 6 | 1.6% | -88.8% |

Consolidated Operating Income | 4,368 | 11.6% | 5,573 | 13.9% | 27.6% |

*Unit: Million yen

Solution Design Business – Sales were 8,957 million yen (down 4.1% year on year) and operating income amounted to 1,457 million yen (up 81.2% year on year).

Staffing and operation management processes in Systena became partially cumbersome due to changes in major clients’ demand for development and a bloated organizational structure resulting from expansion of the company’s business operations; however, the company optimized its business and improved its structure by reallocating and effectively utilizing its personnel (specifically, by transferring projects to other business segments that share a strong affinity for them). In addition, the company stimulated new demand by taking more proactive approaches to clients through improvement brought by cooperation with other headquarters of the company and organizational restructuring while following the trend toward X-Tech (an initiative of integrating cutting-edge technologies into existing industries and businesses) in the fields of social infrastructure, products, and DX services.

Next-Generation Mobility Business – Sales stood at 2,229 million yen (up 109.3% year on year) and operating income was 812 million yen (up 300.9% year on year).

The company increased the number of orders received through reallocation of its business resources, such as proactive investment in its own services that support Software-Defined Vehicles (SDVs) and relevant activities. It proactively recruited human resources that excel in this field while making use of its resources in order to fulfill clients’ demand regarding the key words in the automobile industry, which are electrification, automation, connected, and sharing, and the company received a growing number of orders while demand rose for development of in-vehicle cockpits and information display systems, such as IVI*1, HUD*2, and CDC*3, which are the strengths of Systena Corporation. Furthermore, the company not only enhanced its system for giving a shape to clients’ requests by setting up development bases in Utsunomiya City, Tochigi Prefecture, and Toyota City, Aichi Prefecture, but also started a collaborative project with Systena America Inc.

*1 IVI: In-Vehicle Infotainment (an integrated in-vehicle system that provides both information and entertainment)

*2 HUD:Head-Up Display (a display device that provides a person who uses it with information superimposed over the scenery around the user in a way that allows information to blend in with the surrounding scenery)

*3 CDC: Cockpit Domain Controller (a system with various cockpit functions that have been integrated into a single electronic control unit)

Framework Design Business – Sales amounted to 3,869 million yen (up 16.7% year on year) and operating income stood at 804 million yen (down 0.2% year on year).

The business performance of this segment was strong in the financial field because the number of inquiries went up for DX-related projects, such as cloud migration and development of new services for improving customer experience (CX), as well as because it engaged in long-term projects of developing such systems as ones for contract management and accounting while a large-scale project for a leading life and non-life insurance company was closed. In the public sector, the company steadily received orders for projects related to the central government ministries and agencies with the Individual Number system as a starting point, and the business areas of system update, infrastructure construction, operation and maintenance grew considerably. Inquiries for DX projects for local municipalities also increased in number. Regarding corporate clients, the company received a rising number of orders for technical support services using low-code development tools and system development aimed at renovating systems for digital transformation. Systena boosted its competitive edge by offering comprehensive system support through its lab system that can cover all the phases ranging from system planning to post-development operation and maintenance and expanded its track record of system development using generative AI. While costs escalated because about 90 employees were transferred to this segment from the Solution Design Business, profit was almost at the same level as that of the same period of the previous fiscal year.

IT & DX Service Business – Sales were 9,489 million yen (up 6.0% year on year) and operating income amounted to 1,187 million yen (down 13.1% year on year).

While receiving an increasing number of inquiries for standardization and automation of business operations from companies that create new business models, the company focused on expanding the accompanying PMO services that help clients improve their business operations, such as promotion of operation of various tools after installation and reconstruction of business processes, by accurately grasping potential issues that clients are facing, and this provided the source that virtually supported the growth of this business. Furthermore, it started to propose new service menus regarding clients’ IT investment plans and IT events and strove to develop new departments in clients’ organizations. In the DX verification services business, while the situations of the clients in the field of Internet businesses and gaming are difficult, Systena endeavored to broaden the existing client base and find new clients by taking advantage of its knowledge and proactively recruiting work-ready human resources with the aim of shifting their focus to clients in the enterprise domain. With regard to promotion of active participation of people with disabilities, the company achieved improvement in staffing and expanded occupational fields that enable people with disabilities to fully use their talents and skills by focusing on developing systems and environments in which they can experience their personal growth. This allowed the company to receive orders for a wide range of service projects, including Business Process Outsourcing (BPO) services.

Business Solution – Sales were 13,812 million yen (up 3.8% year on year) and operating income was 1,081 million yen (up 11.7% year on year).

While there are still uncertainties due mainly to the weakened yen and soaring prices of raw materials and commodities, enhanced sales activities (strategic promotion of sales activities targeting mainly the small and medium-sized businesses (SMBs) with an inactive relationship with Systena with the aim of re-establishing sales channels) bore fruit, allowing the company to gradually raise the number of orders that it received for projects aimed at productivity enhancement, cost reduction, and competitiveness improvement through DX and AI. Specifically, the company received a number of orders for such projects as ones regarding Lift & Shift, which is one of the cloud migration methods, in the cloud-related system integration business. It also got a myriad of inquiries for system development, maintenance and operation, security services, and support services with an eye toward digitization of corporations using RPA and data coordination tools, and orders for one-stop services with high value added grew in number. In addition, regarding replacement projects in preparation for the end of support for Windows 10 (scheduled for October of 2025), although such projects overall had been pushed back, proposals made by the company and orders that the company received began to increase significantly in number in the second quarter of this fiscal year.

DX & Recurring-revenue Business – Sales amounted to 1,494 million yen (up 20.5% year on year) and operating income was 224 million yen (up 40.5% year on year).

The company put effort into presenting proposals in which the accompanying direction services that help clients with DX promotion according to their needs relating to shortages in DX-related personnel are combined with the no-code DX platform, Canbus., and it received a growing number of inquiries. It intends to create a recurring revenue-based business by utilizing Canbus. and AI for solving clients’ issues that become apparent during the course of its DX promotion support services and moving forward with service planning in order to widen the lineup of Canbus. with a particular focus on specific industries and use.

Other Business – Sales stood at 428 million yen (down 16.7% year on year) and operating income amounted to 6 million yen (down 88.8% year on year).

In the overseas field, the company’s subsidiary in the United States received orders for new projects through sales activities in cooperation with the Next-Generation Mobility Business targeting mainly businesses related to in-vehicle infotainment. Furthermore, Systena expanded the verification business for Proof of Concept (PoC) development that verifies the effectiveness of underlying technologies possessed by startup companies. ONE Tech Inc., one of the companies in which the American subsidiary has invested, focused on producing MicroAI, an edge AI solution that it developed independently, and selling it to telecommunications carriers, and StrongKey Inc., the other U.S.-based company that the American subsidiary has invested in, newly provided security measures services based on Fast Identity Online (FIDO) authentication to payment companies located in the United States. In addition, the Public Key Infrastructure (PKI) service that complies with Matter, the new communications standard covering home automation, was adopted increasingly in smart device companies in Europe.

GaYa Inc. in the investment and incubation field focused on revitalizing a horse racing game for smartphones, Keiba Densetsu PRIDE, by continuously hosting events and releasing new horses in the game. In development of games that it was entrusted with, it offered PMO support and managed overall man-hours for the projects that it took part in. It steadily receives orders for commissioned development projects from the existing clients in other fields than the gaming field and will continue striving to increase the number of orders it receives.

2-3 Financial Conditions

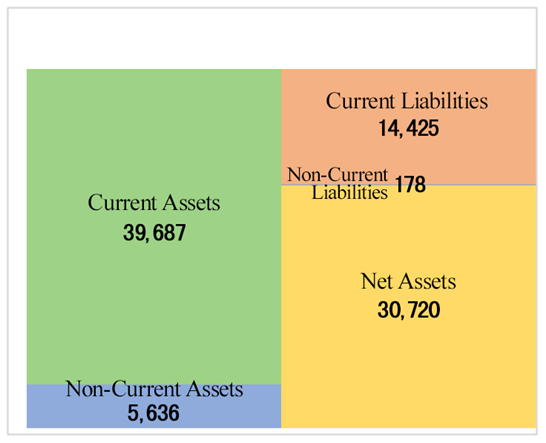

◎BS

| March 2024 | September 2024 |

| March 2024 | September 2024 |

Cash and deposits | 30,168 | 20,993 | Trade payables | 6,438 | 5,989 |

Trade receivables | 14,917 | 15,108 | Accounts payable and accrued expenses | 2,463 | 2,464 |

Merchandise | 1,216 | 947 | Income taxes payable | 1,656 | 1,737 |

Current assets | 48,088 | 39,687 | Provision for bonuses | 1,872 | 1,735 |

Tangible Assets | 1,395 | 1,368 | Interest-Bearing Liabilities | 1,550 | 1,550 |

Intangible Assets | 254 | 206 | Liabilities | 15,437 | 14,604 |

Investments and Others | 4,299 | 4,061 | Net assets | 38,601 | 30,720 |

Noncurrent assets | 5,950 | 5,636 | Total Liabilities and Net Assets | 54,038 | 45,324 |

*Unit: Million yen. Trade receivables are the sum of notes, accounts receivable and contract assets.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

The total assets as of the end of September 2024 stood at 45,324 million yen, down 8,714 million yen from the end of the previous fiscal year. In the side of assets, cash and deposits decreased in the section of current assets. Liabilities dropped 833 million yen from the end of the previous fiscal year to 14,604 million yen, mainly due to the decline in accounts payable and reserve for bonuses. Net assets decreased 7,880 million yen from the end of the previous fiscal year to 30,720 million yen. Equity ratio was 66.7%, down 3.8 points from the end of the previous fiscal year.

Cash Flow (CF)

| FY 3/24 2Q | FY 3/25 2Q | YoY | |

Operating CF (A) | 3,976 | 3,457 | -519 | -13.1% |

Investing CF (B) | -286 | -305 | -19 | - |

Free CF (A + B) | 3,690 | 3,152 | -538 | -14.6% |

Financing CF | -1,562 | -11,541 | -9,979 | - |

Balance of cash and cash equivalents as of the end of 2Q | 26,938 | 21,681 | -5,257 | -19.5% |

*Unit: Million yen.

In terms of cash flows, investing CF was almost unchanged, but operating CF declined year on year, so free CF shrank. On the other hand, the cash outflow from financial activities augmented significantly, mainly due to the acquisition of treasury shares. Accordingly, the balance of cash and cash equivalents as of the end of the interim period was down 19.5% year on year.

2-4 Recent Topics

◎Opening of Kita-Kanto Office

On September 12, 2024, they opened Kita-Kanto Office (2-4-3 Higashishukugo, Utsunomiya-shi, Tochigi Prefecture), for the purpose of expanding business in the northern Kanto area. At that office, they plan to contribute to the development of regional economies and create jobs by developing mobility software, etc.

3. Fiscal Year Ending March 2025 Earnings Estimates

3-1 Consolidated Earnings Estimates

| FY 3/24 Results | Ratio to net sales | FY 3/25 Estimates | Ratio to net sales | YoY |

Net sales | 76,940 | 100.0% | 85,000 - 90,000 | 100.0% | +10.5% - +17.0% |

Operating income | 9,713 | 12.6% | 11,000 - 12,000 | 12.2% - 14.1% | +13.3% - +23.5% |

Ordinary income | 9,942 | 12.9% | 11,000 - 12,000 | 12.2% - 14.1% | +10.6% - +20.7% |

Profit Attributable to Owners of Parent | 7,232 | 9.4% | 7,700 - 8,400 | 8.6% - 9.9% | +6.5% - +16.2% |

*Unit: Million yen

The full-year forecast has been revised again, increasing the forecast sales and decreasing the forecast profit.

For the fiscal year ending March 2025, the company forecasts that sales will grow 10.5-30.0% year on year to 85-100 billion yen and operating income will be 8.5-10.5 billion yen, down 12.5%-up 8.1% year on year. On July 31, 2024, they announced an upward revision. The forecast range of sales is unchanged, but they increased the upper and lower limits of the forecast ranges of all kinds of profits, and it was projected that operating income would rise 3.0-23.6% year on year to 10-12 billion yen, ordinary income would increase 0.6-20.7% to 10-12 billion yen, and profit attributable to owners of parent would grow -3.2-16.2% to 7-8.4 billion yen.

On October 31, 2024, they announced another revision to the full-year forecast. It is now forecast that sales will rise 10.5-17.0% year on year to 85-90 billion yen, operating income will grow 13.3-23.6% to 11-12 billion yen, ordinary income will increase 10.6-20.7% to 11-12 billion yen, and profit attributable to owners of parent will grow 6.5-16.2% to 7.7-8.4 billion yen. Namely, they have decreased the upper limit of the forecast range of sales, and increased the lower limits of the forecast ranges of all kinds of profits.

Since the company upholds the policy of dynamically shifting to the three aspects: “securing sales,” “securing personnel,” and “investment,” there are many uncertainties arising out of active short-term investment. Accordingly, it is difficult to conduct reasonable forecasts, so the forecast figures are indicated with ranges. Considering that it is imperative to secure excellent personnel, they will continue measures for improving the treatment of employees, recruit highly skilled engineers, find subcontractors, conduct M&A, and invest in recurring-revenue business for securing revenues in an active manner. The upward revision was conducted again, because productivity improved, managerial resources were reallocated to growing businesses, so average revenue per contract improved, and they received more orders for high value-added projects, and mainly the solution design business and the next-generation mobility business saw an improvement in profit margin.

The dividend forecast is unchanged from the initial one. The company plans to pay an interim dividend of 6 yen/share and a year-end dividend of 6 yen/share for a total of 12 yen/share per year, up 2 yen/share from the previous fiscal year.

3-2 Efforts for each segment

◎Solution Design Business

Policy: To aim to create a business domain with high added value

1. Active business operation in growing fields

・ To operate business actively while brushing up the capability of giving proposals by reforming systems for domains with high added value in the fields of “social infrastructure,” “Internet business,” and “products”

2. Enhancement of organizational competitiveness

・To summarize the features of growing industries and clients and create added value to offer as the entire Systena group through the transfer to the headquarters

・To offer digital consulting services for contributing to the DX and productivity improvement in client companies

3. Active investment for digital consulting

・To actively recruit personnel for offering digital consulting, and invest in a platform for providing cost-effective services

◎ Next-Generation Mobility Business

Policy: To fulfill their missions as a Tier-1 software provider amid the distribution of software-defined vehicles (SDVs)

1. To proactively adapt to SDVs

・To concentrate on the development of in-vehicle cockpits and in-vehicle information systems, such as IVI systems and CDCs, by utilizing the experience accumulated through the development of mobile devices

2. Investment in in-house services for supporting SDVs

・To actively invest in in-house services for supporting SDVs based on the experiences of mobile and vehicle services

3. Start of peripheral services, such as sharing

・To not only support the development of SDVs, but also actively offer peripheral services, such as sharing and mobility services

◎Framework Design Business

Policy: To actively operate business in growing fields for the financial sector, the public sector, and corporations, and aim to maximize the number of orders received by utilizing the development know-how and cutting-edge technologies.

1. Maximization of the existing business and a foray into growing fields

・To continue projects, mainly “the development of insurance/financial systems” and “the establishment of a foundation,” and actively expand business for the public sector and corporations, to build a robust revenue base

2. To receive orders for DX projects

・To strengthen marketing and technological systems for receiving orders for DX projects, by upgrading their mission-critical system (migration) and utilizing cloud services

3. To further expand projects with high added value

・To strengthen their DX lab and enrich services for “low-code development” and “DX solutions”

・To increase competitiveness through the improvement in added value, with the aim of raising profitability further

◎ IT & DX Service business

Policy: To aim to strengthen services for supporting the growth of each client’s business while expanding their field for each service

1. To concentrate on the provision of services for digital business of each client

・To further expand PMO services, including conventional IT support, the migration and installation of systems, and the improvement and redevelopment of business processes

2. To support the adoption of tools for standardization and automation

・To support the adoption of SaaS tools for meeting the needs for standardization and automation in back-office sections

3. To expand DX evaluation services for agile development

・To approach existing client enterprises and increase new clients, by utilizing the knowledge of agile test services for Internet business and video games

◎ Business Solution Business

Policy: To shift focus from the business of products to the business of services

1. To invest for expanding the solution domain

・To enrich the menu of services and conduct marketing targeted at profit-earning sections

2. To enhance initiatives for the hybrid environment

・To enhance initiatives for the hybrid environment and alliances with cloud service producers

・To enrich the menu of services for Win10EOL (End Of Life)

3. To expand DX-related services

To improve the business of rebuilding an app under the multi-cloud while developing systems

4. To improve profitability by expanding the range of services

・To offer all services of ALL Systena in a one-stop manner

◎ DX & Recurring-revenue Business

Policy: To actively conduct upfront investment in in-house services, mainly “Canbus.,” with the aim of operating business in the DX field

1. To enhance the sales promotion of Canbus.

・To improve services with generative AI, add the direction for DX, and meet the demand from clients, with the aim of increasing new clients

2.To improve the popularity of Canbus.

・To conduct a variety of advertisement activities, including exhibiting it at events, holding joint events with business partners, and marketing through social media

3. Upfront investment for service improvement

・To plan services for specific business categories or specific purposes of use and conduct sales promotion for the “Canbus.” series

4. Conclusions

Automobile makers, including Toyota Motor and Nissan Motor, have announced unfavorable recent business results, as forecast as a whole. The next-generation mobility business, which is the growth driver of the company, will certainly grow further in the medium/long term, as a joint project with Systena America finally began, but the outlook remains uncertain.

Meanwhile, it is reassuring to see projects for realizing “All Systena,” which attracted our attention in the previous report. Furthermore, we would like to highly evaluate the fact that the interim financial results include multiple factors in producing positive effects on future growth of their business performance. For example, the business solution business received orders for replacement projects in the wake of the discontinuation of support for Windows 10 as expected although it seems that the company consider that it is insufficient, and it is projected to receive such orders on a full-scale basis in the second half of the fiscal year. In addition, they are drawing a new blueprint for expanding revenues based on “Canbus.,” whose performance seemed sluggish. Furthermore, there is a possibility that their framework design business section will undertake projects for the public sector and infrastructure, amid the trend of regional revitalization.

At their session for briefing financial results, they revealed, “our practical business skills are highly evaluated, and the ratio of winning competition has increased” and “the importance of tuning based on proto engineering for further improving the precision of answering of AI models has grown and there are an increasing number of projects for incorporating confidential information into the large language model (LLM)” in the framework design business, and “We will proceed with our business while considering the cooperation with clients who possess attractive services and tools” in the IT & DX service business.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 10 directors, including 4 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report (Updated on June 21, 2024)

Basic policy

The Company intends to enhance corporate governance with the aim of responding to rapid changes in the business climate, to promote management emphasizing speed based on promote decision-making to increase management efficiency, to work toward sustainable growth of the business, increasing shareholder value and continuous shareholder returns, to harmonize the interests of shareholders, customers, business partners, employees, local communities and other stakeholders (interested parties) and to maximize general benefits as a whole while endeavoring to secure soundness in management and full regulatory compliance. To archive this, the Company intends to take very seriously the advice and suggestions of external experts (audit firms, lead underwriters, lawyers, social insurance and labor consultants, judicial scriveners, etc.) and stakeholders and will work to enhance the fairness and transparency of management, to build systems appropriate to the size of the Company using its inherent mobility, to further promote self-improvement as a listed company in full awareness of stakeholders, to enhance corporate governance and to disclose information in a timely and appropriate manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

【Supplementary Principle 2-4-(1) Ensuring Diversity in the Promotion of Core human Resources, etc.】

The Company promotes employees to management positions regardless of attributes such as gender, age, race, nationality or whether they were hired mid-career or as a new graduate. The Company’s policy is to treat employees according to their abilities and to assign the right people to the right positions. Please refer to the Company’s website for further details.

“Policy for securing the diversity of central personnel” https://www.systena.co.jp/sustainability/esg_society/

【Supplementary Principle 3-1-3 Approaches to Sustainability】

The Company’s initiatives on sustainability are described on the webpage below. Here, the Company explains its disclosures based on the TCFD recommendations or an equivalent framework, which is mandatory only for companies listed on the Prime Market.

The Company engages in the business of providing IT service, and does not operate any business with high environmental impact, such as the manufacturing of goods. Accordingly, at present the climate change problem is not expected to affect the Company’s business significantly. However, the Company began to acquire ISO 140001 certification in 2004 and has since been striving to reduce resource consumption and waste emissions based on its understanding that the global environment is an asset held by all of mankind that is valuable and must be preserved for future generations. In addition, all IT-related climate change measures taken by companies are in the Company’s business domain. The increase of the Company’s helps increase the efficiency of customers' business and leads to their reduction of resources they consume and the waste they emit, which contributes to the protection of the global environment. Therefore, the Company believes that its growth leads to the ability to control climate change. The Company plans to start initiatives for measuring Scope 1, 2, and 3 GHG emissions in the fiscal year ending March 2025, and launch projects to achieve a target reduction amount of GHG emissions by the end of the fiscal year ending March 2026, while considering the disclosure based on the TCFD or the like when necessary. The Company’s environmental initiatives are described on the webpage below.

[The Company’s Sustainability Initiatives] https://www.systena.co.jp/sustainability/

[The Company’s Environmental Initiatives] https://www.systena.co.jp/sustainability/esg_environment.html

【Supplementary Principle 4-1-3 Succession plan for the CEO and others】

We are at the stage of development as an owner-operated company, with the Founder & President directly steering the company's management under a management policy of selection and concentration. As the current succession plan depends on the future business environment and management policy, we believe that the best way for the development of the company is for the CEO to have the exclusive authority to make succession plans at this time. For this reason, the Board of Directors is not currently involved in the formulation and operation of a specific succession plan. We will consider this matter in the future as necessary.

【Supplementary Principle 4-3-3 Establishment of an objective, timely and transparent procedures for CEO dismissal】

As the founder and owner of the company, Representative Director & Chairperson steers the company in a major management direction as CEO and leads the company through appropriate evaluation of business performance. In addition, the Company structure is such that the Representative Director is kept in check by eight Outside Officers (four Outside Directors and four Outside Audit & Supervisory Board Members) who each meet the requirements of independent offices, and the Company believes that if a situation which might involve the dismissal of the Representative Director & Chairperson arose, the Board of Directors would come to a decision through discussion based on recommendation of the Independent Officers and would be able to deal with the situation. Accordingly, the Company has not, at present, established an objective, timely and transparent procedure for CEO dismissal. The Company will consider the matters where necessary in the future.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary non-mandatory Nomination Committee and Executive Compensation Committees】

All eight Independent Officers – the four Outside Directors plus four Outside Audit & Supervisory Board Members -- satisfy the requirements for independent officers determined by the Tokyo Stock Exchange and they each leverage their specialist knowledge and extensive experience to actively express opinions during deliberations of important matters at board meetings and the Company is afforded timely and appropriate advice and has, therefore, not currently established independent advisory committees. The Company will consider the matters where necessary in the future.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Principle 3-1 Enhancement of information disclosure】

(1) Management philosophy, management strategies and management plans of the Company

We have formulated and disclosed our management philosophy, management strategies, and medium-term management plan. For details, please refer to our website.

[Management Philosophy and Code of Conduct]

https://www.systena.co.jp/about/idea.html

[Management Goals and Basic Management Policies]

https://www.systena.co.jp/ir/management/business_plan.html

[Medium-term Management Plan]

https://www.systena.co.jp/ir/management/business_plan.html

(2) Basic Concepts and Policies Regarding Corporate Governance(As stated in “I.1. Basic Policy” of this report).

(3) Board policies and procedures in determining the remuneration of the senior management and directorsAs stated in “II. 1. [Directors' Remuneration]” of this report.

(4) Board policies and procedures for the appointment/dismissal of senior executives and the nomination of candidates for directors and corporate auditors

In selecting and nominating candidates for the Board of Directors, the President & Representative Director proposes candidates to the Board of Directors based on a comprehensive evaluation of their performance, personality, insight, and ability in accordance with the Rules for Employment of Directors, and the Board of Directors selects suitable candidates to ensure a personnel structure that enables accurate and prompt decision-making, appropriate risk management and supervision of business execution.

In the event of circumstances requiring the dismissal of a director, corporate auditor, or executive officer, the Board of Directors shall deliberate on the matter and decide on the proposed dismissal of said director or corporate auditor, or the dismissal of the executive officer, respectively. Dismissal of directors and corporate auditors shall be conducted in accordance with the provisions of the Companies Act.

In selecting and nominating candidates for corporate auditors, the President & Representative Director proposes candidates to the Board of Directors based on a comprehensive evaluation of their performance, personality, insight and ability, and the Board of Directors selects candidates based on a balance of their knowledge of finance, accounting or law, and experience in management oversight. In addition, the Board of Corporate Auditors are required to consent to the nomination of candidates for corporate auditors.

(5) Explanations with respect to the individual appointments/dismissals and nominations of candidates for directors and corporate auditors by the Board of Directors based on (4)Reasons for the selection, dismissal and nomination of candidates for outside directors and outside corporate auditors, as well as their brief CV, positions and responsibilities of other directors and corporate auditors are disclosed in the Notice of Convocation of the General Meeting of Shareholders and in the Annual Securities Report. For details, please refer to the company’s website. In the event that circumstances necessitate the dismissal of an executive officer, the reason for such dismissal will be stated in the timely disclosure material.

[Reference Material Related to General Meetings of Shareholders] https://www.systena.co.jp/ir/library/general_meeting.html

[Annual Securities Report and Quarterly Reports] https://www.systena.co.jp/ir/library/securities.html

(6) Measures for realizing business administration conscious of capital cost and share price

The Corporate Group considers that business administration conscious of capital profitability is essential for achieving sustainable growth and improving corporate value in the medium/long term. The Company will allocate managerial resources appropriately, by implementing some measures, including the investment in human capital and the reform of the business portfolio. In addition, the Company aims to improve corporate value in the medium/long term, by achieving a good balance among growth potential, capital profitability, and financial soundness and optimizing the balance sheet.

【Supplementary Principle 4-11-3: Analysis and Evaluation of Effectiveness of Board of Directors as a Whole, and Summary of the Results】

The Company's Board of Directors is composed of 14 members who attend Board meetings, of whom eight are Outside Directors or Outside Audit & Supervisory Board Members who are Independent Officers in accordance with the provisions of the Tokyo Stock Exchange. To conduct an analysis/evaluation of the effectiveness of the Board of Directors, the Company uses a "Questionnaire Survey for Evaluation of the Board of Directors" and all Directions and Audit & Supervisory Board Members conduct self-evaluations of the composition and operations of the Board of Directors and the results of analysis of this survey are discussed at a meeting of Outside Officers consisting of the Outside Directors and Outside Audit & Supervisory Board Members.

The results of analysis of self-evaluations based on the questionnaire survey and the results of discussion at the meeting of Outside Officers confirmed that the Company’s Board of Directors leverages the knowledge, experience and insights of each offices to engage in discussions which contribute to the sustainable growth and enhancement of shareholder value from a medium-to-long term perspective and that sufficient discussions for the supervision of management are held, and the Company, therefore, concluded from these findings that the effectiveness of the Board of Directors is ensured.

With reference to the self-evaluations of the Directors and Audit & Supervisory Board Members, the Company conducts an analysis and evaluation of the effectiveness of the Board of Directors every year, in principle, to maintain effectiveness and also pursues further improvement to ensure that effective discussions are held.

【Principle 5-1 Policy on Constructive Dialogue with Shareholders】

The Company establishes and discloses a disclosure policy to encourage constructive dialogue with shareholders. Please refer to the Company’s website for further details.

[Disclosure Policy] https://www.systena.co.jp/ir/management/disclosure.html

Please refer to "2. Status of IR Activities" in "III. Implementation Status of Measures for Shareholders and Other Stakeholders" in this Report for information about the development of a framework and initiatives for this.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |