Bridge Report:(2317)Systena Fiscal Year Ended March 2024

Representative Director & Chairperson Yoshichika Hemmi |

President & Representative Director Kenji Miura | Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE Prime |

Industry | Information and communications |

Representative Director & Chairperson | Yoshichika Hemmi |

President & Representative Director | Kenji Miura |

Address | 14F・16FShiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥284 | 387,440,812 shares | ¥110,033 million | 20.0% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥12.0 | 4.2% | ¥15,23 - 18.84 | 15.1 - 18.6x | ¥98.34 | 2.9x |

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (yen) | DPS (yen) |

March 2021 (Actual) | 60,871 | 8,006 | 7,507 | 4,974 | 51.36 | 20.00 |

March 2022 (Actual) | 65,272 | 9,106 | 8,578 | 5,992 | 15.47 | -(*) |

March 2023 (Actual) | 74,526 | 9,844 | 9,955 | 7,317 | 18.89 | 8.00 |

March 2024 (Actual) | 76,940 | 9,713 | 9,942 | 7,232 | 18.67 | 10.00 |

March 2025 (Estimate) | 85,000 - 100,000 | 8,500 - 10,500 | 8,500 - 10,500 | 5,900 - 7,300 | 15.23 - 18.84 | 12.00 |

・The estimated values were provided by the company. Unit: Million yen

・With December 1, 2021, being the effective date, a 4-for-1 stock split was conducted. EPS in the fiscal year ended March 2022 takes the stock split in question into account. EPS for fiscal year 2022 takes this stock split into account. Both EPS and DPS were not retroactively adjusted for the stock split.

・DPS(*) in the fiscal year ended March 2022 was 10.00 yen for the interim period and 3.50 yen for the end of the term, but the simple total amounts are not shown due to the implementation of the stock split in question.

This Bridge Report reviews the summary of the financial results of fiscal year ended March 2024 and forecasts for the fiscal year ending March 2025 of Systena Corporation.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended March 2024 Earnings Results

3. Fiscal Year Ending March 2025 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2024, sales grew 3.2% year on year, and operating income declined 1.3% year on year. The Solution Design Business, which is the mainstay, struggled until the third quarter, and did not recover sufficiently, so its annual performance was stagnant, and the sales of the Overseas Business decreased slightly. On the other hand, the Framework Design Business, the IT Service Business, the Business Solution Business, and the Cloud Business performed well, supporting the growth of total sales. Overall profit was affected by the Solution Design Business, whose profit decreased 30.8% year on year, as it was significantly impacted both directly and indirectly by unprofitable projects.

- For the fiscal year ending March 2025, the company forecasts that sales will grow 10.5-30.0% year on year to 85-100 billion yen and operating income will be 8.5-10.5 billion yen, down 12.5%-up 8.1% year on year. Since the company upholds the policy of dynamically shifting to the three aspects: “securing sales,” “securing personnel,” and “investment,” there are many uncertainties arising out of active short-term investment. Accordingly, it is difficult to conduct reasonable forecasts, so the forecast figures are indicated with ranges. The dividend amount is forecast to increase 2 yen/share year on year to 12 yen/share per year, with an interim dividend of 6 yen/share and a year-end dividend of 6 yen/share.

- Mr. Yoshichika Hemmi, who founded the company, changed his post from Director & Chairperson to Representative Director & Chairperson, regaining the right to represent the company, on April 1, 2024. The reason for this post change is “to utilize the experience of the founder and make decision making swifter for further growth, reform their organization, and improve their corporate value.” In addition, at the briefing session, they mentioned that it was also intended for “adapting their business administration to the inflation.” As the two-pronged structure with the president Miura has made a comeback, we would like to see how their performance will change.

1. Company Overview

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Katena Corp. It forms a corporate group with 8 consolidated subsidiaries and 3 equity-method affiliates.

【Management goal - To become one of Japan's leading IT companies and support the Japanese economy from the ground up!】

In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation”, “stability and growth,” and “maintenance and innovation” as its basic policy.

【Target management indicators】

The company sets stably high dividends, high return on equity and high operating income rate as target managerial indicators. To achieve these goals, the company aims to develop a highly profitable structure under its basic policy for business administration.

1-1 Business description

The business of Systena Corporation is classified into the Solution Design Business, the Framework Design Business the IT Service Business, the Solution Sales, the Cloud Business, the Overseas Business, and the Investment & Incubation Business.

Involving all group companies, they offer comprehensive solution services for planning, designing, developing, installing, and maintaining systems and giving user support, including the development and quality check of software for automatic driving and in-vehicle systems, social infrastructure systems, online business systems, IoT-related systems, robots, AI, and mobile devices, the development of systems for financial institutions, system operation, help desk management, the sale of IT products, system integration, the provision of cloud services, and the development of game content.

◎Solution Design Business (accounting for 27.6% in FY 3/24)

The company concentrates its managerial resources on five business categories; “in-vehicle” items such as automatic driving technology and telematics where its know-how nurtured through the development of mobile terminals can be utilized, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development, testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on. Clients include telecommunications carriers, telecom equipment manufacturers, automobile manufacturers, Internet business enterprises, etc.

◎Framework Design Business (accounting for 9.0% in FY 3/24)

Systena Corporation develops financial systems and foundational systems for not only life and non-life insurance companies, but also banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. Previously, their tasks were mostly the development and operation of financial systems, but the projects for developing and operating public and corporate systems are increasing. They are promoting cross-selling to clients of two businesses through the linkage with the IT Service Business and solution marketing, and pursuing financial systems and applying them to other fields through the linkage with the Solution Design Business for solutions for smartphone apps, web apps, etc. like the Solution Design Business section, Systena Vietnam Co., Ltd. is functioning as an offshore foothold.

◎IT Service Business (accounting for 23.8% in FY 3/24)

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services including help desk operation, user support, data inputting, and large-volume output. Clients are mainly electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Business Solution Business (accounting for 37.0% in FY 3/24,) The former Solution Sales Business)

The company sells IT products including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. The company is shifting business model from selling hardware to offering services. The company aims to expand its business and improve its added value by meeting the changing demands from ownership to usage (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients are mainly electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business (accounting for 2.7% in FY 3/24)

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and “Google Workspace”, “Canbus.,” a cloud database service, which was launched in May 2017, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for offering the private cloud service. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “Google Workspace”, and management tools for administrators. Clients include medium to large-sized companies that conduct general business, etc.

◎Overseas Business (accounting for 0.2% in FY 3/24)

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the researching on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services. Clients include Japanese enterprises, American enterprises, telecommunications carriers, telecom equipment manufacturers, etc.

◎Investment & Incubation Business (accounting for 0.2% in FY 3/24)

GaYa Co., Ltd. develops game content for smartphones, offers the contents to leading SNS websites and undertakes the operation of video games developed and released by other companies.

*Adjustment -0.5%

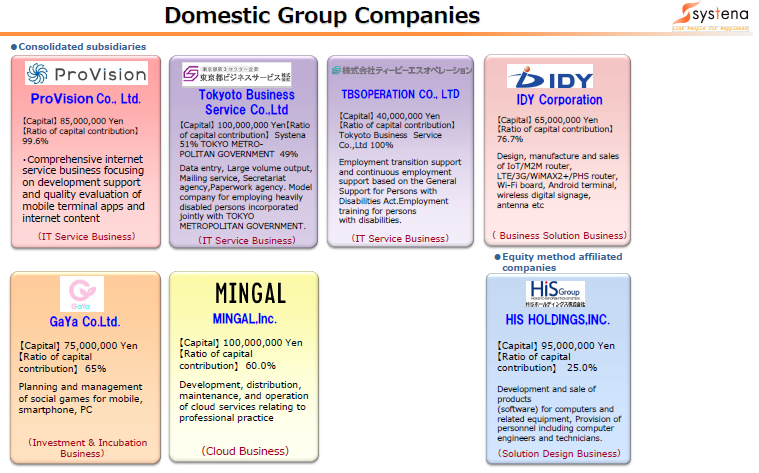

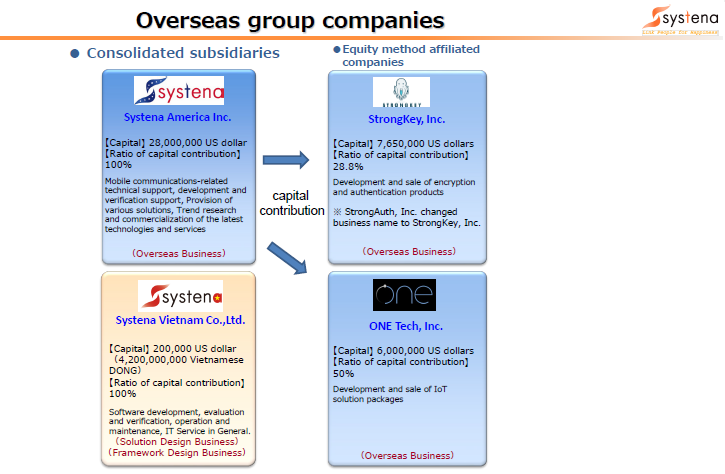

1-2 Group Companies

(Taken from the reference material of the company)

(Taken from the reference material of the company)

2. Fiscal Year Ended March 2024 Earnings Results

2-1 Result of the fiscal year ended March 2024

| FY 3/23 | Ratio to net sales | FY 3/24 | Ratio to net sales | YoY |

Net sales | 74,526 | 100.0% | 76,940 | 100.0% | +3.2% |

Gross profit | 18,393 | 24.7% | 18,078 | 23.5% | -1.7% |

SG&A expenses | 8,549 | 11.5% | 8,364 | 10.9% | -2.2% |

Operating income | 9,844 | 13.2% | 9,713 | 12.6% | -1.3% |

Ordinary income | 9,955 | 13.4% | 9,942 | 12.9% | -0.1% |

Profit Attributable to Owners of Parent | 7,317 | 9.8% | 7,232 | 9.4% | -1.2% |

*Unit: Million yen

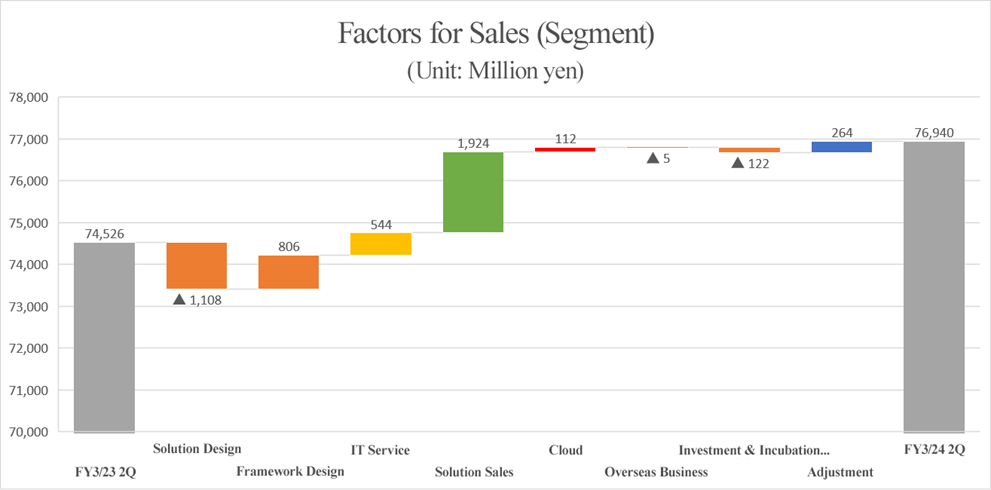

Sales grew 3.2% year on year, and operating income declined 1.3% year on year.

As the normalization of economic and social activities from the COVID-19 pandemic progressed, a gentle recovery trend was seen mainly in consumer spending, but there is a risk of an economic downturn due to the prolongation of global monetary tightening for curbing inflation, which was caused by the soaring of prices of resources and raw materials, and the overseas economic slowdown due to the uncertain international situation. Amid such situation, they concentrated on recurring revenue-based business further while recognizing that it is important to improve productivity in order to secure revenues amid inflation, and strove to expand businesses with high added value, such as consultancy and PMO projects for supporting promotion of DX in the Software Development business, etc. Moreover, they are making efforts to secure excellent human resources by continuing active investment in human resources and continuously improving the working conditions of employees.

Sales grew 3.2% year on year to 76,940 million yen. The Solution Design Business, which is the mainstay, struggled until the third quarter, and did not recover sufficiently, so its annual performance was stagnant, and the sales of the Overseas Business decreased slightly. In addition, the sales of the Investment & Incubation Business, too, dropped significantly. On the other hand, the Framework Design Business, the IT Service Business, the Business Solution Business, and the Cloud Business performed well, supporting the growth of total sales.

Overall profit was affected by the Solution Design Business, whose profit decreased 30.8% year on year, as it was significantly impacted both directly and indirectly by unprofitable projects. Meanwhile, the profit of the Framework Design Business increased 28.3% year on year, and the profit of the Business Solution Business rose 16.7% year on year. As a result, consolidated operating profit decreased 1.3% year on year. Gross profit margin was 23.5%, down 1.2 points from the previous fiscal year. On the other hand, the ratio of SG&A expenses to sales decreased 0.6 points to 10.9% year on year.

2-2 Trends by segment

| FY 3/23 | Composition ratio/Income margin | FY 3/24 | Composition ratio/ Income margin | YoY |

Solution Design | 22,375 | 30.0% | 21,267 | 27.6% | -5.0% |

Framework Design | 6,095 | 8.2% | 6,901 | 9.0% | +13.2% |

IT Service | 17,753 | 23.8% | 18,297 | 23.8% | +3.1% |

Solution Sales | 26,510 | 35.6% | 28,434 | 37.0% | +7.3% |

Cloud | 2,007 | 2.7% | 2,119 | 2.7% | +5.6% |

Overseas Business | 134 | 0.2% | 129 | 0.2% | -3.4% |

Investment & Incubation Business | 309 | 0.4% | 187 | 0.2% | -39.5% |

Adjustment | -660 | - | -396 | - | - |

Consolidated Sales | 74,526 | 100.0% | 76,940 | 100.0% | +3.2% |

Solution Design | 3,926 | 17.5% | 2,717 | 12.8% | -30.8% |

Framework Design | 1,279 | 21.0% | 1,642 | 23.8% | +28.3% |

IT Service | 2,521 | 14.2% | 2,922 | 16.0% | +15.9% |

Solution Sales | 1,760 | 6.6% | 2,054 | 7.2% | +16.7% |

Cloud | 386 | 19.3% | 372 | 17.6% | -3.7% |

Overseas Business | -29 | - | -27 | - | - |

Investment & Incubation Business | -0 | - | 33 | 17.7% | - |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 9,844 | 13.2% | 9,713 | 12.6% | -1.3% |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Solution Design Business - Sales: 21,267 million yen (-5.0% YoY), Operating Income: 2,717 million yen (-30.8% YoY)

The demand for the development of next-generation mobility in the in-vehicle device field remained healthy, contributing to this business. In particular, their relationships with tier 1 makers of automobiles deepened, so they will make continuous efforts to receive more orders. In the DX service field, they receive an increasing number of orders for upgrading mission-critical systems, developing systems with low-code or code-less tools, and in-house services. Accordingly, they indicated their policy of actively developing in-house services. An unprofitable project, which began in the Internet business field in the first half of the fiscal year, ended, but it resulted in the loss of business opportunities, and the loss of marketing opportunities because they had to allocate some resources to it. In the fourth quarter, they started full-scale measures for improving their organizational strength, and their business performance has been improving.

Framework Design Business - Sales: 6,901 million yen (+13.2% YoY), Operating Income: 1,642 million yen (+28.3% YoY)

Inquiries in the financial field have increased, especially for DX-related projects, leading to a growth in sales. In particular, projects for shifting to cloud computing, developing new services, etc. for life and non-life insurance companies contributed to business performance. In addition to the development of new services, the adoption of cloud computing, etc., they enhanced business operation in the fields of securities and settlement. In the public field, they received more inquiries about mainly projects related to social security and tax numbers and the government cloud. The company started offering to local municipalities in addition to central government ministries and agencies, receiving more orders, so the sales in the public field increased steeply by about 50% year on year. In addition, they are enhancing DX solutions mainly for low-code development, and made new transactions with services including development and maintenance utilizing a DX lab. In this field, sales grew considerably by 85% year on year, thanks to highly efficient operations using young staff.

IT Services Business - Sales: 18,297 million yen (+3.1% YoY), Operating Income: 2,922 million yen (+15.9% YoY)

The company concentrated on the expansion of hands-on PMO services for supporting the improvement in business operations through the installation of tools, the redevelopment of business processes, etc. to solve latent issues for clients. They engaged in the reinforcement of client analysis in order to grasp the IT investment plans and IT events of their clients, enhanced marketing activities toward divisions where they used to have no transactions and thus horizontally expanded the business among their existing clients. In addition, they concentrated on the increase of new clients for acquiring loyal clients for the future. In addition, they strove to improve profitability by optimizing staffing. These efforts bore fruit.

The Business Solution Business – Sales: 28,434 million yen (+7.3% YoY), Operating Income: 2,054 million yen (+16.7% YoY)

Despite the uncertain outlook due to the yen depreciation, rising prices of resources and commodity prices, the company enhanced marketing activities in response to the normalization of the economy. As a result, they recorded the growth of sales of hardware, such as servers, storage devices, and network products, and services after the end of life (EOL) of old servers. In the system integration business, they received orders for shifts to a cloud environment, system development and maintenance services necessary for digitalization. There has been a continuous increase in projects concerning their high value-added one-stop service which encompasses the grasping of roadmap, installation of IT devices, infrastructure construction, cloud utilization, system development, maintenance and operation.

The Cloud Business - Sales: 2,119 million yen (+5.6% YoY), Operating Income: 372 million yen (-3.7% YoY)

The company still receives many inquiries about DX utilizing generative AI and “Canbus.” There has been an increase of inquiries regarding PMO and integration for the reform of business operations from clients who are using “Canbus.” in order to promote DX. The demand for adaptation to DMARC* is strong, so inquiries about Google and Microsoft increased.

*DMARC (Domain-based Message Authentication, Reporting, and Conformance)

This is a system for giving instructions about how to handle emails from an organization that have not passed the screening of SPF or DKIM to email-receiving servers. It is possible to command email-receiving servers to “receive,” “quarantine,” or “reject” emails that have not passed the screening (according to the reference material of the DX design division of the company).

Overseas Business: Sales: 129 million yen (-3.4% YoY), Operating Loss: 27 million yen (loss of 29 million yen in the previous fiscal year)

The system development and inspection services in part of the manufacturing industry decreased, but the company stably received orders for the systems development and inspection services from other mobility-related enterprises. Furthermore, they have repeatedly received orders for PoC development and inspection services for the examination of start-up technologies of Japanese-affiliated enterprises. The group company StrongKey received more inquiries about FIDO and the unified standards of the unified standards for smart homes (Matter).

2-3 Financial Conditions

◎BS

| March 2023 | March 2024 |

| March 2023 | March 2024 |

Cash and deposits | 25,033 | 30,168 | Trade payables | 6,096 | 6,438 |

Trade receivables | 14,998 | 14,916 | Accounts payable and accrued expenses | 2,459 | 2,463 |

Inventories | 1,501 | 1,216 | Income taxes payable | 1,524 | 1,656 |

Current assets | 42,275 | 48,088 | Provision for bonuses | 1,460 | 1,872 |

Tangible Assets | 1,622 | 1,395 | Interest-Bearing Liabilities | 1,550 | 1,550 |

Intangible Assets | 317 | 254 | Liabilities | 14,228 | 15,437 |

Investments and Others | 4,663 | 4,299 | Net assets | 34,650 | 38,601 |

Noncurrent assets | 6,603 | 5,950 | Total Liabilities and Net Assets | 48,879 | 54,038 |

*Unit: Million yen. Trade receivables are the sum of notes, accounts receivable and contract assets.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

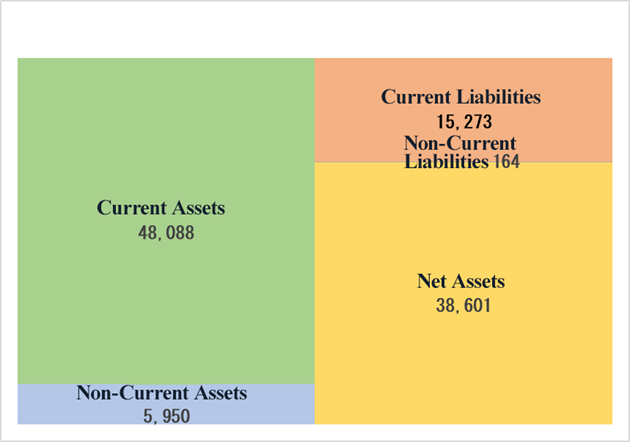

As of the end of March 2024, total assets stood at 54,038 million yen, up 5,159 million yen from the end of the previous fiscal year. In terms of current assets, cash and deposits increased. Liabilities increased 1,208 million year on year to 15,473 million yen. This is mainly due to the increases in provision for bonuses and accounts payable. Net assets increased 3,950 million yen year on year to 38,601 million yen. Equity ratio was 70.5%, up 0.6 points from the end of the previous fiscal year.

2-4 Recent Topics

◎FIDO Passkey, a security authentication technology of StrongKey, Inc., has been adopted by a major U.S. telecommunications carrier and a leading European pharmaceutical company.

On November 6, 2023, it was announced that FIDO Passkey, a new passwordless login authentication technology developed by StrongKey, Inc. (Head Office: Silicon Valley, California, the U.S.; Founder/CTO/CEO: Arshad Noor; hereinafter referred to as “StrongKey”), was adopted by a major U.S. telecommunications carrier and a leading European pharmaceutical company.

FIDO Passkey is a passwordless login authentication method developed by the FIDO Alliance that does not rely on passwords. It is more secure than conventional passwords and reduces the risk of phishing attacks and password leakage. For this reason, not only U.S. tech companies, but also telecommunications carriers, major online shopping sites, and automobile manufacturers in Japan have adopted this technology. In areas where security measures are particularly necessary, authentication technology compliant with the security level “AAL-3” is sometimes required. StrongKey's FIDO Passkey has been adopted for its high-security technology amid the competition with competing companies. The company plans to further accelerate business expansion in Japan and other Asian countries.

◎ “HENNGE One Adapter” for ASTERIA Warp has been released.

On February 1, 2024, the company announced the launch of “HENNGE One Adapter” as an adapter for the ASTERIA Warp series, which has held the largest share of the enterprise data-linked (EAI/ESB) product market in Japan for 17 consecutive years, to enable no-code ID management between “HENNGE One” and other systems.

The development of the “HENNGE One Adapter” exclusively for ASTERIA Warp enables the automation of the ID linkage between HENNGE One and the system that manages ID information without any code. In addition, it automates the entire process, ranging from the acquisition of ID information from the system to the linkage.

The smooth realization of integrated ID management will contribute significantly to quality improvement by reducing operational man-hours through automation and preventing human errors such as recording errors.

◎Signed a cooperation agreement on DX for local municipalities with Shima City

The company announced that it signed a cooperation agreement with Shima City, Mie Prefecture, on March 21, 2024, to promote DX (Digital Transformation) for local municipalities, revitalize local communities using ICT, and improve services for citizens in order to create sustainable communities and achieve the SDGs.

■Details of the cooperation agreement

Shima City has advocated the promotion of DX in local municipalities to achieve efficient administrative management in the second master plan of Shima City. In order to provide high-quality administrative services, it is necessary to improve efficiency and expedite operations through the use of ICT (Information and Communication Technology). Therefore, efforts are being made to improve the efficiency of administrative work by employees through the computerization of various procedures and paperless operations. Based on this agreement, the company will promote the streamlining of administrative work by employees, improve security in the use of cloud services, and realize sustainable DX in Shima City by utilizing its extensive experience in supporting the adoption and operation of cloud services and its in-house knowledge of developing the “Cloudstep Series,” a Google Workspace extension service, the “Canbus.,” a codeless platform, and the “Web Shelter,” a security service for financial institutions. It will also work on developing generative AI and consider advanced DX in the future.

Furthermore, Shima City accepted one of the company's employees on April 1, 2024, utilizing the Ministry of Internal Affairs and Communications (MIC)'s “Regional Revitalization Entrepreneur System.*” Through these initiatives, it will work more closely with Shima City to promote initiatives aimed at enhancing the unique attractiveness and value of the region.

■Cooperation matters

1) Improvement of services for citizens and smart administration by promoting DX in Shima City

2) Cooperation in improving security of the local government in utilizing generative AI and cloud systems

3) Dispatch of digital human resources to Shima City

* Regional Revitalization Entrepreneur System

A system under which local governments support initiatives to revitalize their regions by accepting employees of private companies located in the three major metropolitan areas for a certain period of time to engage in work related to enhancing the unique attractiveness and value of the region while utilizing their know-how and expertise through a special subsidy tax measure.

◎“Cloudstep Connect,” a cloud-based authentication service, supports passwordless authentication.

Partnered with “JCV Face Login” a facial authentication login service.

“Cloudstep Connect,” an authentication service that supports access control and single sign-on (SSO) for the “Cloudstep Series,” which is provided as an add-on tool for Google Workspace, and “JCV Face Login,” a facial authentication login service provided by Japan Computer Vision Corp. (JCV), have started SAML authentication integration. This enables “passwordless authentication” using facial authentication, which eliminates the need to manage and enter passwords.

■Background of the introduction of passwordless authentication

In the modern digital environment, both security and convenience are increasingly required. In this context, passwordless authentication reduces the burden of managing and remembering complicated passwords for users while providing a high level of security. Thus, companies and individuals are interested in passwordless authentication, so it is spreading all over the world. Passwordless authentication uses various methods such as biometrics (fingerprints, facial recognition, etc.) and security keys to identify users, which can be paired with multi-factor authentication to further enhance security.

Against this backdrop, “Cloudstep Connect,” a Google Workspace add-on tool provided by the company, supports passwordless authentication by providing SAML integration with “JCV Face Login,” provided by JCV, in addition to the “IP address restriction” and “device restriction” functions that have been provided up until now.

◎Certified as one of "Health & Productivity Management Outstanding Organizations Recognition Program 2024: Large Enterprise Category [White 500]"

On March 11, 2024, the company announced that it had been certified for the fourth consecutive year as one of "Health & Productivity Management Outstanding Organizations Recognition Program 2024: Large Enterprise Category [White 500]" by the Nippon Kenko Kaigi, sponsored by the Ministry of Economy, Trade and Industry (METI).

The Certified KENKO Investment for Health Outstanding Organizations Recognition Program honors corporations such as large enterprises and small and medium-sized enterprises that engage in especially outstanding health and productivity management based on Nippon Kenko Kaigi’s initiatives to advance health, and 2,998 corporations were certified in the large corporation category this time (high-ranking corporations receive the “White 500” title).

Based on the company's corporate philosophy, investment in employees' health is expected to revitalize the organization by increasing their energy and productivity, ultimately leading to improved mid- to long-term business performance. The company has upheld the “Systena Health Declaration” since 2017, elevating health awareness among staff, measuring health levels at the company and promoting the cultivation of a workplace environment which allows for working healthy and reassured. The company is committed to further developing its existing health measures and actively working to improve the health of its employees, thereby promoting their health and revitalizing the organization.

◎Recognized as a “Sports Yell Company 2024”

On January 23, 2024, the company announced that it had been certified as a “Sports Yell Company 2024” by the Japan Sports Agency.

The Japan Sports Agency certifies companies that actively promote sports activities to improve the health of their employees as a “Sports Yell Company.” The company has been certified as a “Sports Yell Company” for the fourth consecutive year, for its proactive efforts to help its employees work energetically and lively, both mentally and physically, by holding various events, supporting club activities, and disseminating information on exercises and physical training. Through these activities, the company will continue to improve the health of its employees in order to enhance their health and ensure the continued growth of its business.

◎Sponsored the INTLOOP Group Ladies Cup

The company co-sponsored the "INTLOOP Group Ladies Cup," a golf tournament held at Hirakawa Country Club (Chiba Prefecture) from February 18 to 19, 2024. The Group believes that improving the health of its employees leads to the sustainable growth of its business. As a Sports Yell Company, it is actively engaged in promoting sports activities to improve health. At the same time, the company believes that supporting the activities of athletes active in professional sports is also a major social role that raises interest in sports and leads to the promotion of sports activities.

The aim of the “INTLOOP Group Ladies Cup,” hosted by INTLOOP Inc., is to provide young professional female golfers who will be active in the future with an opportunity to grow and develop. The company believes that the INTLOOP group's approach to sports is similar to its own, leading to its decision to sponsor this tournament. The company will continue to provide various forms of support through sports to promote the health of its employees and help athletes progress further in their careers.

3. Fiscal Year Ending March 2025 Earnings Estimates

3-1 Consolidated Earnings Estimates

| FY 3/24 Results | Ratio to net sales | FY 3/25 Estimates | Ratio to net sales | YoY |

Net sales | 76,940 | 100.0% | 85,000 - 100,000 | 100.0% | +10.5% - +30.0% |

Operating income | 9,713 | 12.6% | 8,500 - 10,500 | 8.5% - 12.4% | -12.5% - +8.1% |

Ordinary income | 9,942 | 12.9% | 8,500 - 10,500 | 8.5% - 12.4% | -14.5% - +5.6% |

Profit Attributable to Owners of Parent | 7,232 | 9.4% | 5,900 - 7,300 | 5.9% - 8.6% | -18.4% - +0.9% |

*Unit: Million yen

Profit is expected to grow considerably, although the outlook is uncertain, so forecasts are indicated with ranges.

For the fiscal year ending March 2025, the company forecasts that sales will grow 10.5-30.0% year on year to 85-100 billion yen and operating income will be 8.5-10.5 billion yen, down 12.5%-up 8.1% year on year. Since the company upholds the policy of dynamically shifting to the three aspects: “securing sales,” “securing personnel,” and “investment,” there are many uncertainties arising out of active short-term investment. Accordingly, it is difficult to conduct reasonable forecasts, so the forecast figures are indicated with ranges. Considering that it is imperative to secure excellent personnel, they will continue measures for improving the treatment of employees, recruit highly skilled engineers, find subcontractors, conduct M&A, and invest in recurring-revenue business for securing revenues in an active manner. In addition to the improvement in productivity, they will concentrate on the expansion of businesses with high added value, such as consultancy and the establishment of PMO projects for supporting promotion of DX in the Software Development business, etc., and then establish a structure for reflecting the augmentation of costs in prices as soon as possible.

The dividend amount is forecast to increase 2 yen/share year on year to 12 yen/share per year, with an interim dividend of 6 yen/share and a year-end dividend of 6 yen/share.

3-2 Efforts for each segment

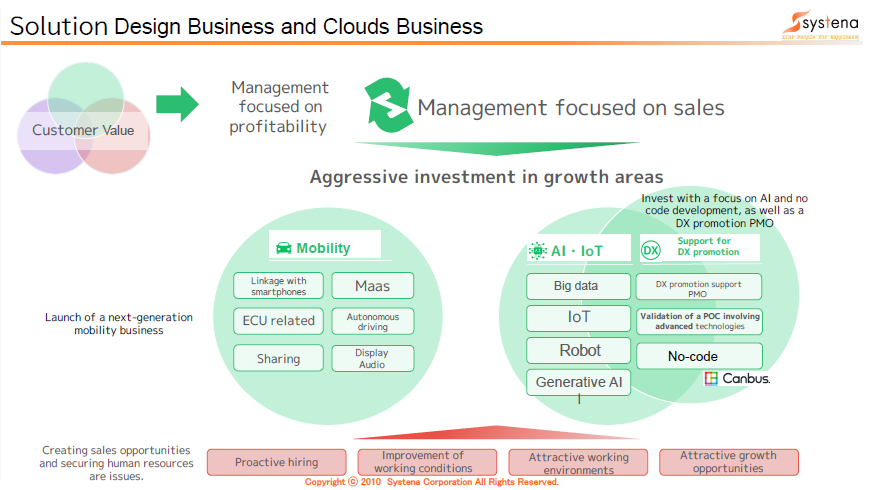

◎Solution Design Business and Cloud Business

Basic policy: Shift from profit-focused business administration to sales-focused one. Active investment in growing domains.

While fusing Solution Design and Cloud Businesses, the company will try to redevelop their business model in a cross-sectoral manner with the aim of meeting the client’s requests, realizing projects with high added value, and establishing an attractive environment. As a concrete measure, they will establish an independent business section for next-generation mobility, and operate business in a swift manner. In addition, they aim to receive more orders for low-code and code-less projects with the keywords: “AI, IoT, and DX” while cross-selling solution design and cloud services. Regarding the treatment of employees, they will adopt a new system linked with career paths, strengthen the system for receiving orders for projects so that they will look attractive, and cement cooperation with personnel introducing companies, to hire more mid-career workers.

(Taken from the reference material of the company)

◎Framework Design Business

Basic policy: To accelerate sales growth with managerial strategies amid inflation! To actively invest in cutting-edge fields to acquire new value!

The company will break away from the dependence on the financial domain, thanks to the trend of governmental policies for social security and tax numbers and the government cloud in addition to the growth of needs for human resources for DX. Sales have been growing, due to the improvement of their business portfolio in the field of services targeted at the public sectors and corporations. Meanwhile, there is a problem of the slowdown of growth of the top line, as personnel development cannot keep up with the growth of market needs. The company, too, sees the delay in recruitment of personnel becoming evident, so it is necessary to enrich resources by using methods other than the training of employees fresh out of college. Accordingly, the company will shift from the recruitment of mainly new graduates to the year-round recruitment of personnel, including experienced workers, for securing human resources. In addition, they will aim to expand their share in growing markets, by utilizing generative AI and promoting DX of mission-critical systems while fusing this business section with the solution design sector.

・ Active investment in growing markets to expand their share

→Active business administration focused on sales and value

・ Establishment of a recruitment scheme for securing IT personnel

→To improve the treatment of employees and secure personnel who can immediately deal with actual tasks

・ Maximization of the capability of giving proposals based on cooperation among departments

→To improve the value, they provide by dealing with “all-Systena”

・ Enhancement of competitiveness through the establishment of an organization with multiple skills

→To establish an organization that can offer one-stop services

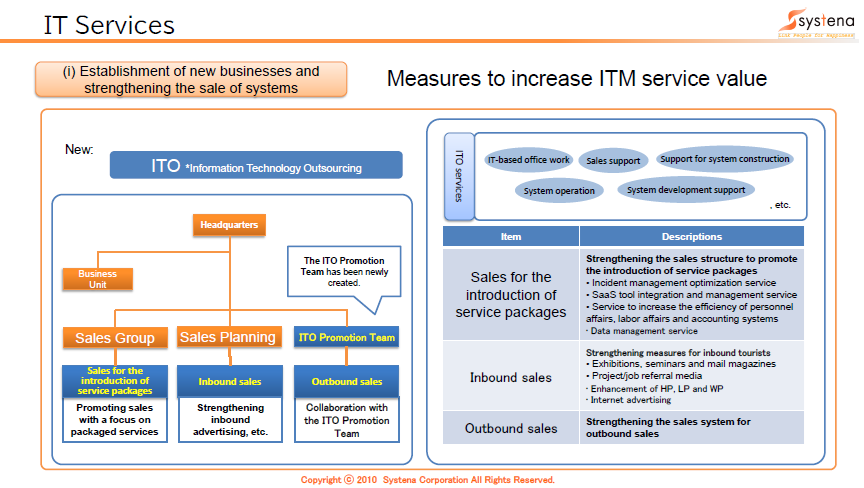

◎IT Services Business

Under department management focused on profit, they have so far concentrated on the increase in average spending per transaction. In this fiscal year, they will create a new service called Information Technology Outsourcing (ITO) and a team for this service as a new business. This team will strive to secure sales in cooperation with business partners. They will concentrate on the enhancement of the purchase function more diligently than other business sections.

① Establishment of a new business and strengthening of the marketing structure

→ To launch Information Technology Outsourcing (ITO) services and establish a team for this business

(Taken from the reference material of the company)

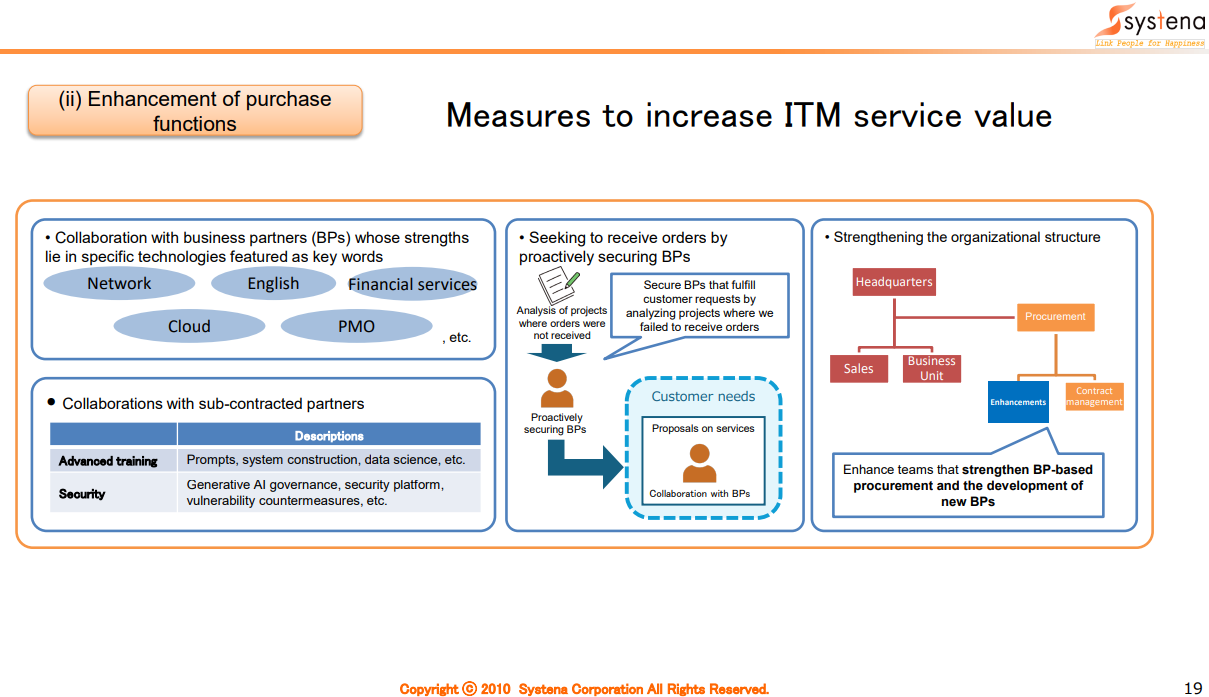

② Enhancement of the purchase function

・Cooperation with business partners versed in specific technical keywords

・Cooperation with subcontractors

・To receive orders by securing business partners in advance

・Strengthening of the structure (the enhancement of procurement of business partners and the strengthening of the team for cultivating new markets)

(Taken from the reference material of the company)

◎The Business Solution Business

Basic policy: To increase sales, profit, and value with the SI business-shifting from the business of selling products to the business of offering services

They plan to strengthen their marketing structure, in order to fortify each sector’s function to conduct comprehensive marketing.

①Expansion of DX-related services <30% growth of sales>

・In addition to system development, the company will strengthen the business of restructuring applications in a multi-cloud environment.

・Increase of government cloud projects

② To enhance measures for the hybrid environment <27% growth of sales>

・To reinforce measures for cloud business and enrich the lineup of services

・To bolster support for Win10 EOL

③Improving profitability by expanding sales of services <135% growth of sales>

・To enrich the lineup of services and conduct marketing targeted at profit sections

・To provide one-stop services for all services of All Systena.

4. Conclusions

In the fiscal year ended March 2024, the Solution Design Business still produced a negative effect on overall performance, but in the fourth quarter, the situation of the Solution Design Business improved. In the Business Solution Business, they set the goal of establishing a business model that does not rely on products, and showed a steady progress as the sales of the Azure business of Microsoft grew 50% year on year. This can be evaluated positively. In addition, they explained at a briefing session that turnover rate recovered to the normal level although the resignation of employees increased temporarily, affecting the progress of business. This is reassuring.

For the fiscal year ending March 2025, they mentioned that they would aim to first secure sales and recruit personnel in a swift manner. In addition, it seems that they will proactively generate sales in a cross-sectoral manner by switching from a vertically divided management structure to an “all-Systena” structure. Regarding the largest sales in the forecast range, it seems difficult to achieve it with normal business operation, so we would like to expect that they will announce something new that would boost sales in this fiscal year.

Mr. Yoshichika Hemmi, who founded the company, changed his post from Director & Chairperson to Representative Director & Chairperson, regaining the right to represent the company, on April 1, 2024. The reason for this post change is “to utilize the experience of the founder and make decision making swifter for further growth, reform their organization, and improve their corporate value.” In addition, at the briefing session, they mentioned that it was also intended for “adapting their business administration to the inflation.” As the two-pronged structure with the president Miura has made a comeback, we would like to see how their performance will change.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 9 directors, including 3 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report (Updated on April 1, 2024)

Basic policy

The Company intends to enhance corporate governance with the aim of responding to rapid changes in the business climate, to promote management emphasizing speed based on promote decision-making to increase management efficiency, to work toward sustainable growth of the business, increasing shareholder value and continuous shareholder returns, to harmonize the interests of shareholders, customers, business partners, employees, local communities and other stakeholders (interested parties) and to maximize general benefits as a whole while endeavoring to secure soundness in management and full regulatory compliance. To archive this, the Company intends to take very seriously the advice and suggestions of the audit corporation, other external experts and stakeholders and will work to enhance the fairness and transparency of management, to build systems appropriate to the size of the Company using its inherent mobility, to further promote self-improvement as a listed company in full awareness of stakeholders, to enhance corporate governance and to disclose information in a timely and appropriate manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

【Supplementary Principle 2-4-(1) Ensuring Diversity in the Promotion of Core human Resources, etc.】

The Company promotes employees to management positions regardless of attributes such as gender, age, race, nationality or whether they were hired mid-career or as a new graduate. The Company’s policy is to treat employees according to their abilities and to assign the right people to the right positions.

https://www.systena.co.jp/sustainability/esg_society/esg_diversity.html

【Supplementary Principle 3-1-3 Approaches to Sustainability】

The Company’s initiatives on sustainability are described on the webpage below. Here, the Company explains its disclosures based on the TCFD recommendations or an equivalent framework, which is mandatory only for companies listed on the Prime Market.

The Company engages in the business of providing IT service, and does not operate any business with high environmental impact, such as the manufacturing of goods. Accordingly, at present the climate change problem is not expected to affect the Company’s business significantly. However, the Company began to acquire ISO 140001 certification in 2004 and has since been striving to reduce resource consumption and waste emissions based on its understanding that the global environment is an asset held by all of mankind that is valuable and must be preserved for future generations. In addition, all IT-related climate change measures taken by companies are in the Company’s business domain. The increase of the Company’s helps increase the efficiency of customers' business and leads to their reduction of resources they consume and the waste they emit, which contributes to the protection of the global environment. Therefore, the Company believes that its growth leads to the ability to control climate change. Based on the above ideas, the Company has yet to disclose information based on the TCFD recommendations or an equivalent framework at present. The Company will consider the matter where necessary in the future. The Company’s environmental initiatives are described on the webpage below.

The Company’s sustainability initiatives

https://www.systena.co.jp/sustainability/

The Company’s environmental initiatives

https://www.systena.co.jp/sustainability/esg_environment.html

【Supplementary Principle 4-1-3 Succession plan for the CEO and others】

Our company has two representative directors: the founder, Representative Director & Chairperson, and the President & Representative Director, who is in his 50's. We are at the stage of development as an owner-operated company, with the Founder & Chairman of the Board directly steering the company's management under a management policy of selection and concentration. As the current succession plan depends on the future business environment and management policy, we believe that the best way for the development of the company is for the CEO to have the exclusive authority to make succession plans at this time. For this reason, the Board of Directors is not currently involved in the formulation and operation of a specific succession plan. We will consider this matter in the future as necessary.

【Supplementary Principle 4-3-3 Establishment of an objective, timely and transparent procedures for CEO dismissal】

As the founder and owner of the company, Representative Director & Chairperson steers the company in a major management direction as CEO and leads the company through appropriate evaluation of business performance. In addition, the Company structure is such that the Representative Director & Chairperson is kept in check by seven Outside Officers (three Outside Directors and four Outside Audit & Supervisory Board Members) who each meet the requirements of independent offices, and the Company believes that if a situation which might involve the dismissal of the Representative Director & Chairperson arose, the Board of Directors would come to a decision through discussion based on recommendation of the Independent Officers and would be able to deal with the situation. Accordingly, the Company has not, at present, established an objective, timely and transparent procedure for CEO dismissal. The Company will consider the matters where necessary in the future.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary non-mandatory Nomination Committee and Executive Compensation Committees】

All seven Independent Officers – the three Outside Directors plus four Outside Audit & Supervisory Board Members -- satisfy the requirements for independent officers determined by the Tokyo Stock Exchange and they each leverage their specialist knowledge and extensive experience to actively express opinions during deliberations of important matters at board meetings and the Company is afforded timely and appropriate advice and has, therefore, not currently established independent advisory committees. The Company will consider the matters where necessary in the future.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Principle 3-1 Enhancement of information disclosure】

(1) Management philosophy, management strategies and management plans of the Company

We have formulated and disclosed our management philosophy, management strategies, and medium-term management plan. For details, please refer to our website.

[Management Philosophy and Code of Conduct]

https://www.systena.co.jp/about/idea.html

[Management Goals and Basic Management Policies]

https://www.systena.co.jp/ir/management/business_plan.html

[Medium-term Management Plan]

https://www.systena.co.jp/ir/management/business_plan.html

(2) Basic Concepts and Policies Regarding Corporate Governance(As stated in “I.1. Basic Policy” of this report).

(3) Board policies and procedures in determining the remuneration of the senior management and directorsAs stated in “II. 1. [Directors' Remuneration]” of this report.

(4) Board policies and procedures for the appointment/dismissal of senior executives and the nomination of candidates for directors and corporate auditors

In selecting and nominating candidates for the Board of Directors, the President & Representative Director proposes candidates to the Board of Directors based on a comprehensive evaluation of their performance, personality, insight, and ability in accordance with the Rules for Employment of Directors, and the Board of Directors selects suitable candidates to ensure a personnel structure that enables accurate and prompt decision-making, appropriate risk management and supervision of business execution.

In the event of circumstances requiring the dismissal of a director, corporate auditor, or executive officer, the representative directors shall deliberate on the matter, and the Board of Directors shall consider the results of such deliberation and decide on the proposed dismissal of said director or corporate auditor, or the dismissal of the executive officer, respectively. Dismissal of directors and corporate auditors shall be conducted in accordance with the provisions of the Companies Act.

In selecting and nominating candidates for corporate auditors, the President & Representative Director proposes candidates to the Board of Directors based on a comprehensive evaluation of their performance, personality, insight and ability, and the Board of Directors selects candidates based on a balance of their knowledge of finance, accounting or law, and experience in management oversight. In addition, the Board of Corporate Auditors are required to consent to the nomination of candidates for corporate auditors.

(5) Explanations with respect to the individual appointments/dismissals and nominations of candidates for directors and corporate auditors by the Board of Directors based on (4)Reasons for the selection, dismissal and nomination of candidates for outside directors and outside corporate auditors, as well as their brief CV, positions and responsibilities of other directors and corporate auditors are disclosed in the Notice of Convocation of the General Meeting of Shareholders and in the Annual Securities Report. For details, please refer to the company’s website. In the event that circumstances necessitate the dismissal of an executive officer, the reason for such dismissal will be stated in the timely disclosure material.

https://www.systena.co.jp/ir/library/general_meeting.html

https://www.systena.co.jp/ir/library/securities.html

【Supplementary Principle 4-11-3: Analysis and Evaluation of Effectiveness of Board of Directors as a Whole, and Summary of the Results】

The Company's Board of Directors is composed of 13 members who attend Board meetings, of whom seven are Outside Directors or Outside Audit & Supervisory Board Members who are Independent Officers in accordance with the provisions of the Tokyo Stock Exchange. To conduct an analysis/evaluation of the effectiveness of the Board of Directors, the Company uses a "Questionnaire Survey for Evaluation of the Board of Directors" and all Directions and Audit & Supervisory Board Members conduct self-evaluations of the composition and operations of the Board of Directors and the results of analysis of this survey are discussed at a meeting of Outside Officers consisting of the three Outside Directors and four Outside Audit & Supervisory Board Members.

The results of analysis of self-evaluations based on the questionnaire survey and the results of discussion at the meeting of Outside Officers confirmed that the Company’s Board of Directors leverages the knowledge, experience and insights of each offices to engage in discussions which contribute to the sustainable growth and enhancement of shareholder value from a medium-to-long term perspective and that sufficient discussions for the supervision of management are held, and the Company, therefore, concluded from these findings that the effectiveness of the Board of Directors is ensured.

With reference to the self-evaluations of the Directors and Audit & Supervisory Board Members, the Company conducts an analysis and evaluation of the effectiveness of the Board of Directors every year, in principle, to maintain effectiveness and also pursues further improvement to ensure that effective discussions are held.

【Principle 5-1 Policy on Constructive Dialogue with Shareholders】

The Company establishes and discloses a disclosure policy to encourage constructive dialogue with shareholders. Please refer to the Company’s website for further details. https://www.systena.co.jp/ir/management/disclosure.html

Please refer to "2. Status of IR Activities" in "III. Implementation Status of Measures for Shareholders and Other Stakeholders" in this Report for information about the development of a framework and initiatives for this.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |