Bridge Report:(2317)Systena the 2nd Quarter of Fiscal Year March 2020

Yoshichika Hemmi, Chairman |

Kenji Miura, President

| Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Information and communications |

Representative Director | Yoshichika Hemmi, Kenji Miura |

Address | 14F Shiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,516 | 97,541,789 shares | ¥147,87 million | 24.6% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥20.00 | 1.3% | ¥52.70 | 28.8 times | ¥225.34 | 6.7times |

*The share price is the closing price on November 8. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE are the values as of the end of the previous term. BPS is from the first half of the fiscal year ending March 2020.

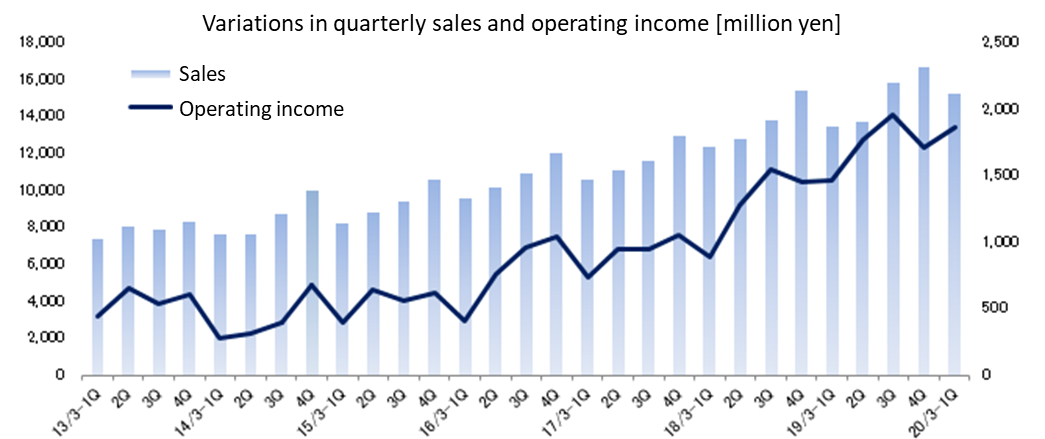

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

March 2016 (Actual) | 42,695 | 3,172 | 3,208 | 2,249 | 22.65 | 32.00 |

March 2017 (Actual) | 46,255 | 3,693 | 3,407 | 2,197 | 22.42 | 36.00 |

March 2018 (Actual) | 54,320 | 5,170 | 5,147 | 3,542 | 36.32 | 46.00 |

March 2019 (Actual) | 59,742 | 6,902 | 6,706 | 4,584 | 47.00 | 16.00 |

March 2020 (Estimate) | 63,147 | 7,865 | 7,622 | 5,140 | 52.70 | 20.00 |

* The estimated values were provided by the company. Unit: Million yen

* In June 2018, a 4-for-1 stock split was conducted. (EPS is revised retroactively.)

This Bridge Report overviews the financial results of Systena Corporation for the 2nd quarter of the term ending March 2020 and provides the full-year outlook.

Table of Contents

Key Points

1. Company Overview

2. 2Q of Fiscal Year March 2020 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of FY 3/20, sales and operating income grew 15.4% and 27.0%, respectively, year on year. All of the core businesses saw double-digit sales growth; the sales of the Solution Design Business, mainly in-vehicle systems and Internet services, increased by 13.6% year on year, the sales of IT services, whose business range expanded to the high value added field, increased by 11.2% year on year, and the sales of the Solution Sales rose by 20.5% year on year, as the shift from goods sale to a system integrator progressed. Profitability improved thanks to sales growth and high added value, offsetting the augmentation of SGA caused by the increase of employees, etc.

- There is no revision to the full-year forecast, and it is estimated that sales and operating income will increase by 5.7% and 14.0%, respectively, year on year. The sales of the Solution Design, Framework Design, and IT Service Businesses are projected to grow through the improvement in profitability, while the sales of the Solution Sales are forecasted to decline slightly due to the decrease in product sales, but the number of orders received is better than expected. The Cloud Business is projected to see sales growing thanks to the “reform of ways of working,” but profit declining due to upfront investment. As for the Overseas Business, sales are estimated to rise through the technical support for Japanese enterprises in the U.S., IoT solutions, and the full-scale sale of security products of StrongKey, and profit/loss is projected to improve. The term-end dividend is to be 10 yen/share, and the annual dividend amount, including the dividend at the end of 2Q, is to be 20 yen/share, up 4 yen/share (estimated payout rati 38%).

- The progress rate toward the full-year forecast is 49.7% for sales (the progress rate toward actual results in the same period of the previous yea 45.5%), 52.2% for operating income (the rate in the previous yea 46.9%), 52.0% for ordinary income (the rate in the previous yea 46.7%), and 52.1% for net income (the rate in the previous yea 45.7%). These rates are higher than those in the same period of the previous year (the earnings forecast for the first half not disclosed). While the Solution Design Business is expanding, structural reform is progressing in the core businesses: the Framework Design Business, where new services, including business operation automation solutions, are burgeoning, the IT Solution Business, where the shift to high value added transactions is progressing, and the Solution Sales, which is shifting from product sale to SIer. This is a reason for the favorable business performance. The annual sales of the Solution Sales are estimated to decline, but there is a high possibility that actual sales will increase because there are plentiful backlogs of orders.

1. Company Overview

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Kanena Corp. It forms a corporate group with 9 consolidated subsidiaries and 3 equity-method affiliates.

【Management goal - To become one of Japan's leading IT companies and support the Japanese economy from the ground up】

In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation”, “stability and growth,” and “maintenance and innovation” as its basic policy.

【Target management indicators】

The company sets stably high dividends, high return on equity and high operating income rate as target managerial indicators. To achieve these goals, the company aims to develop a highly profitable structure under its basic policy for business administration. As for its near-term goals (mid-term management goals), the company declares to generate consolidated sales of 101 billion yen, operating income of 15.2 billion yen (an operating income rate of 15%), per-capita operating income of 2.6 million yen, and 25% ROE in the term ending March 2024.

1-1 Business description and the Systena Group

The business of Systena Corporation is classified into the Solution Design Business (accounting for 36.2% of total sales in the 2nd quarter of FY 3/20), the Framework Design Business (accounting for 8.9%), the IT Service Business (13.1%), the Solution Sales (39.5%), the Cloud Business (2.2%), the Overseas Business (0.2%), and the Investment & Incubation Business (0.3%) (adjustment amount: -0.4%).

In FY 3/20, the company changed their business segments by eliminating the Consumer Service Business and dividing it into the Solution Design Business segment and the Investment & Incubation Business segment.

◎Solution Design Business: Systena Corporation, ProVision Co., Ltd., IDY Corporation, HIS HOLDINGS, INC., Systena Vietnam Co., Ltd.

The company concentrates its managerial resources on five business categories; “in-vehicle” items such as automatic driving technology and telematics where its know-how nurtured through the development of mobile terminals can be utilized, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development, testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on.

◎Framework Design Business: Systena Corporation, ProVision Co., Ltd., Systena Vietnam Co., Ltd.

Systena Corporation develops financial systems and foundational systems for not only life and non-life insurance companies, but also banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. As for banking tasks, the company has developed a variety of systems for sales branches and external channels in the field of open systems, while handling main frames. In the past, development and operation of financial systems accounts for most parts of the work, but nowadays, new businesses such as robotic process automation (RPA), cloud services, data analysis, voice recognition, and image recognition have grown to make up 30% of total sales. The company is further cultivating the financial market and expanding its business horizontally to other business fields, through cross-selling to customers of the IT Service Business and the Solution Sales or the cooperation with the Solution Design Business in solutions, such as smartphone apps and online apps. Like the Solution Design Business section, Systena Vietnam Co., Ltd. is functioning as an offshore foothold.

◎IT Service Business: Systena Corporation, Tokyoto Business Service Co., Ltd.

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services including help desk operation, user support, data inputting, and large-volume output. Clients are mainly electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Solution Sales Business: Systena Corporation

The company sells IT products including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. The company is shifting business model from selling hardware to offering services. The company aims to expand its business and improve its added value by meeting the changing demands from ownership to usage (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients are mainly electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business: Systena Corporation

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and G Suite, “Canbus.,” a cloud database service, which was launched in May last year, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for offering the private cloud service. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “G Suite,” and management tools for administrators.

◎Overseas Business Systena America Inc., Systena Vietnam Co., Ltd.

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the researching on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services.

◎Investment & Incubation Business: Internet of Things, Inc., GaYa Co., Ltd.

The strategic subsidiary “Internet of Things, Inc.” conducts the planning, development, sale, and service provision in the fields of IoT, robots, FinTech, and social media. GaYa Co., Ltd. develops game content for smartphones, offers the contents to leading SNS websites and undertakes the operation of video games developed and released by other companies.

Systena group

Consolidated subsidiary | Capital contribution ratio | Business description |

ProVision Co., Ltd. | 100% | Support for development and evaluation of quality of apps for mobile terminals and Internet contents |

Tokyoto Business Service Co., Ltd. | 51% | Date inputting, large volume output, etc. (a model enterprise employing severely disabled people, which was jointly established with the Tokyo Metropolitan Government) |

IDY Corporation | 76.7% | Sale of communications devices and software, mainly wireless infrastructure, including mobile terminals, and development of wireless communications |

GaYa Co., Ltd. | 65% | Planning, development, and provision of social games for smartphones, entrusted development, support for development, etc. |

Internet of Things, Inc. | 100% | Provision of services, including the planning, development, and sale in the fields of IoT, robots, FinTech, and social media |

Systena America Inc. | 100% | A subsidiary in the U.S. Support for development and testing and provision of solutions for mobile and communications-related items. Survey on trends of the latest technologies and services, and commercialization. |

Systena Vietnam Co.,Ltd. | 100% | A subsidiary in Vietnam. Development, testing, evaluation, operation, and maintenance of software. All kinds of IT services. |

Equity-method affiliate | Capital contribution ratio | Business description |

HIS HOLDINGS, INC. | 25.36% | Establishment of systems, development and sale of packaged software (near-shore development based in Hokkaido) |

StrongKey, Inc. | 28.84% | Development and sale of encoding and authentication products *The corporate name changed from StrongAuth, Inc. |

ONE Tech, Inc. | 50% | A joint venture with Plasma, Inc., which possesses one of the largest PFs in the U.S. Development and sale of IoT solution packages. |

*In addition to the above, the company has a consolidated subsidiary: TBS Operation Co., Ltd., which is a subsidiary of Tokyoto Business Service Co., Ltd. The company invests in the equity-method affiliates: StrongKey, Inc. and ONE Tech, Inc. via Systena America Inc.

1-2 New mid-term management plan (FY 3/20 to FY 3/24)

The 5-year mid-term plan aimed at consolidated sales of 101 billion yen and an operating income of 15.2 billion yen in FY 3/24 is ongoing. The company plans to increase operating income rate to 15% and ROE to 25% by boosting profitability by 20%. In order to achieve these goals, the company plans to enhance marketing, enrich its products and services, invest in mainly promising fields, abolish and rebuild some existing businesses under the management policy of “improving production based on data-based management,” and actively operate overseas business, including the IoT business and encryption security business, which are Investment & Incubation Business in the U.S.

The company also plans to concentrate its managerial resources on the fields of automotive items, cashless settlement, robots, IoT, RPA, and cloud services, which are expected to grow the most in the coming decade, and also on the domains of its products and services.

| FY 3/19 Results | Composition ratio/ Income margin | FY 3/20 Estimates | Composition ratio/ Income margin | FY 3/24 Plan | Composition ratio/ Income margin |

Solution Design | 21,214 | 35.5% | 23,450 | 37.1% | 40,950 | 40.6% |

Framework Design | 5,294 | 8.9% | 5,770 | 9.1% | 9,400 | 9.3% |

IT Service | 7,827 | 13.1% | 8,692 | 13.8% | 11,060 | 11.0% |

Solution Sales | 24,032 | 40.2% | 24,000 | 38.0% | 36,580 | 36.2% |

Cloud | 1,129 | 1.9% | 1,230 | 2.0% | 1,970 | 1.9% |

Overseas Business | 120 | 0.2% | 150 | 0.2% | 640 | 0.6% |

Investment & Incubation Business | 397 | 0.7% | 305 | 0.5% | 400 | 0.4% |

Adjustment | -272 | -0.5% | -450 | -0.7% | - | - |

Consolidated Sales | 59,742 | 100.0% | 63,147 | 100.0% | 101,000 | 100.0% |

Solution Design | 3,666 | 17.3% | 4,408 | 18.8% | 8,100 | 19.8% |

Framework Design | 841 | 15.9% | 968 | 16.8% | 1,600 | 17.0% |

IT Service | 1,067 | 13.6% | 1,220 | 14.0% | 2,350 | 21.2% |

Solution Sales | 1,155 | 4.8% | 1,242 | 5.2% | 2,300 | 6.3% |

Cloud | 197 | 17.5% | 64 | 5.2% | 500 | 25.4% |

Overseas Business | -31 | - | -15 | - | 250 | 39.1% |

Investment & Incubation Business | 5 | 1.3% | -22 | - | 100 | 25.0% |

Consolidated Operating Income | 6,902 | 11.6% | 7,865 | 12.5% | 15,200 | 15.0% |

*Unit: Million yen

2.2Q of Fiscal Year March 2020 Earnings Results

2-1 Consolidated Business Results for the 2nd quarter

| 1H FY 3/19 | Ratio to net sales | 1H FY 3/20 | Ratio to net sales | YOY |

Net sales | 27,210 | 100.0% | 31,411 | 100.0% | +15.4% |

Gross profit | 6,047 | 22.2% | 7,128 | 22.7% | +17.9% |

SG&A expenses | 2,811 | 10.3% | 3,019 | 9.6% | +7.4% |

Operating income | 3,235 | 11.9% | 4,109 | 13.1% | +27.0% |

Ordinary income | 3,131 | 11.5% | 3,961 | 12.6% | +26.5% |

Profit Attributable to Owners of Parent | 2,096 | 7.7% | 2,680 | 8.5% | +27.9% |

*Unit: Million yen

Sales grew 15.4% and operating income rose 27.0% respectively, year on year.

Sales were 31,411 million yen, which increased 15.4% year on year. All of the core businesses show double-digit sales growth; the sales of the Solution Design Business, mainly in-vehicle systems and Internet services, increased by 13.6% year on year, the sales of IT services, whose business range expanded to the high value added field, increased by 11.2% year on year, and the sales of the Solution Sales rose by 20.5% year on year, as the shift from goods sales to a system integrator progressed.

Operating income was 4,109 million yen, which increased 27.0% year on year. Profitability of core businesses improved thanks to sales growth and high added value, and gross profit rate increased by 0.5 points to 22.7%, offsetting the augmentation of SGA caused by the increase of employees, etc.

2-2 Trends by segment

| 1H FY 3/19 | Composition ratio/ Income margin | 1H FY 3/20 | Composition ratio/ Income margin | YOY |

Solution Design | 10,012 | 36.8% | 11,373 | 36.2% | +13.6% |

Framework Design | 2,546 | 9.4% | 2,804 | 8.9% | +10.2% |

IT Service | 3,701 | 13.6% | 4,117 | 13.1% | +11.2% |

Solution Sales | 10,299 | 37.8% | 12,407 | 39.5% | +20.5% |

Cloud | 545 | 2.0% | 682 | 2.2% | +25.0% |

Overseas Business | 53 | 0.2% | 55 | 0.2% | +4.3% |

Investment & Incubation Business | 194 | 0.7% | 109 | 0.3% | -44.1% |

Adjustment | -143 | -0.5% | -137 | -0.4% | - |

Consolidated Sales | 27,210 | 100.0% | 31,411 | 100.0% | +15.4% |

Solution Design | 1,709 | 17.1% | 2,153 | 18.9% | +25.9% |

Framework Design | 386 | 15.2% | 503 | 17.9% | +30.1% |

IT Service | 496 | 13.4% | 564 | 13.7% | +13.7% |

Solution Sales | 571 | 5.5% | 810 | 6.5% | +41.8% |

Cloud | 100 | 18.3% | 111 | 16.3% | +11.4% |

Overseas Business | -20 | -38.9% | -24 | -44.4% | - |

Investment & Incubation Business | -8 | -4.3% | -8 | -8.0% | - |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 3,235 | 11.9% | 4,109 | 13.1% | +27.0% |

*Unit: Million yen

Solution Design Business

Sales were 11,373 million yen, up 13.6% year on year, while operating income was 2,153 million yen, up 25.9% year on year. The solution design business focuses on five growing fields: In-vehicle systems, Social infrastructure, Internet services, AI & robots, and Business operation systems. In the first half term, in-vehicle systems and Internet services contributed to sales growth, while the development of business operation systems for enterprises grew through digital transformation (DX) and the work style reforms.

The sales of in-vehicle systems grew thanks to the development of apps related to the company’s specialty area, in-vehicle infotainment, and cultivating new business domain in mobility services as well as developing new application service of intelligent transport systems (ITS), for which communications technologies can be utilized. The sales of Internet services increased thanks to the development and evaluation of systems related to cashless payment in response to the consumption tax hike and the upgrade, development, and evaluation of 5G services. As for business operation systems, the company met the demand for improvement in productivity and streamlining of business operation and offered more solutions for reducing turnaround time and cost by utilizing open source software (OSS).

Framework Design Business

Sales were 2,804 million yen, up 10.2% year on year, while operating income was 503 million yen, up 30.1% year on year. For this business, the company is striving to increase the number of orders while targeting mainly existing clients in the financial field and offering business operation automation solutions in the new service field. In the existing financial field, the development of large-scale insurance systems, which has been conducted from last term, and the development of new systems for finance, insurance, and business operation progressed healthily. In the new service field, the sale of licenses for business operation automation solutions, which has been conducted by the company since last term, grew thanks to the expansion of the product lineup, and increase of support service for installation, development as well as some other services.

IT Service Business

Sales were 4,117 million yen, up 11.2% year on year, while operating income was 564 million yen, up 13.7% year on year. The shift from conventional worker dispatch services, including help desk and system operators, for which the company’s staffing capacity is exerted, to the undertaking of IT support and IT infrastructure development is progressing. The company enhanced sales promotion targeted at the profit divisions of client companies, increased transactions form high added value projects such as the installation of smart devices for the shifting demand to Windows 10 from Windows 7 along with ending the services on Windows 7 by the IT divisions.

As a result, sales grew and the profitability gets improved. In addition, the company increased new clients by introducing AI, chatbots, and IT training for the work style reforms.

Solution Sales Business

Sales were 12,407 million yen, up 20.5% year on year, while operating income was 810 million yen, up 41.8% year on year. The transactions for systems increased as the support for Windows 7 and Windows Server 2008 will end, and the measures for stirring demand for mobile devices, security and cloud services for supporting the reform of ways of working produced good results. The company expanded one-stop services with high added value, including the comprehension of roadmaps, the installation of IT equipment, the development of infrastructure, system development, maintenance and operation, and met the rush increased demand before the consumption tax hiked.

Cloud Business

Sales were 682 million yen, up 25.0% year on year, while operating income was 111 million yen, up 11.4% year on year. For the work style reforms, the sales of system integration related to G Suite and the groupware “Cloudstep” increased. In addition, the measure for stirring demand while focusing on DX and data-based management worked well, subsequently increased the sales of the business app platform “Canbus.”

Overseas Business

Sales were 55 million yen, up 4.3% year on year, while operating loss was 24 million yen (an operating loss of 20 million yen posted in the same period of last year). The sales of the U.S. subsidiary increased, as the company received more orders for software development from existing clients that are leading manufacturers and conducted additional orders for technical support from Japanese enterprises in the East Coast, with which the company started transactions at the end of last term. In addition, ONE Tech, a joint venture between the U.S. subsidiary and Plasma in the U.S., received a new IoT-related order from a Japanese enterprise in California.

In addition, the company engaged in the Japanese translation work of Tellaro, a solution for encryption and next-generation authentication security of StrongKey which has been adopted by central banks, leading financial institutions, military organizations, and some other prestigious institutions around the world (the full-scale sale in Japan from the second half of this term). The company also took part in project for its additional development for Japanese specs, the preparation of manuals, and the design of marketing strategies. In addition, the company is planning the collaborative business for Tellaro in Asia and the U.S. where inquiries are increasing before the enforcement of CCPA (which will be described later) in January 2020.

CCPA stands for the California Consumer Privacy Act, which is a state law of California for providing consumers with the right to control the handling of their own personal information. This act applies to not only enterprises in California, but also enterprises that earn a certain amount of sales ($25 million) and have ever obtained personal information (including business cards and email addresses) of citizens in California.

2-3 Financial Conditions and CF

Financial Conditions

| March 2019 | September 2019 |

| March 2019 | September 2019 |

Cash and deposits | 14,376 | 14,740 | Trade payables | 6,056 | 4,978 |

Trade receivables | 13,486 | 12,766 | ST Interest-Bearing Liabilities | 1,547 | 1,556 |

Inventories

| 906 | 660 | Income taxes payable | 1,853 | 1,279 |

Current assets | 29,166 | 28,606 | Provision for bonuses | 1,494 | 978 |

Tangible Assets | 588 | 643 | Interest-Bearing Liabilities | 1,550 | 1,550 |

Intangible Assets | 307 | 302 | Liabilities | 13,312 | 11,026 |

Investments and Others | 3,842 | 3,722 | Net assets | 20,592 | 22,248 |

Noncurrent assets | 4,738 | 4,669 | Total Liabilities and Net Assets | 33,904 | 33,275 |

*Unit: Million yen

The total assets of the end of the second quarter were 33,275 million yen, down 629 million yen from the end of the previous term. Cash & deposits and net assets increased, while trade receivables and payables decreased due to seasonal factors. Capital-to-asset was 66.1% (the end of the last term was 59.9%).

CF

| 1H FY 3/19 | 1H FY 3/20 | YOY | |

operating CF(A) | 3,602 | 1,666 | -1,936 | -53.7% |

Investing CF(B) | -527 | -363 | +164 | - |

Free CF(A+B) | 3,075 | 1,303 | -1,772 | -57.6% |

Financing CF | -610 | -926 | -316 | - |

Cash and Equivalents at the end of term | 11,838 | 14,544 | +2,706 | +22.9% |

*Unit: Million yen

An operating CF of 1,666 million yen was secured, as pretax profit was 3,961 million yen (3,124 million yen in the same period of the previous year), accounts receivable decreased 732 million yen (2,414 million yen in the same period of the previous year), accounts payable dropped 1,078 million yen (1,136 million yen in the same period of the previous year), and tax expenses were 1,692 million yen (701 million yen in the same period of the previous year). Investing CF mainly changed due to the acquisition of investment securities, while financing CF is attributable to the payment of dividends.

3.Fiscal Year March 2020 Earnings Estimates

3-1 Full-year Consolidated Earnings Estimates

| FY 3/19 Results | Ratio to net sales | FY 3/20 Estimates | Ratio to net sales | YOY |

Net sales | 59,742 | 100.0% | 63,147 | 100.0% | +5.7% |

Operating income | 6,902 | 11.6% | 7,865 | 12.5% | +14.0% |

Ordinary income | 6,706 | 11.2% | 7,622 | 12.1% | +13.7% |

Profit Attributable to Owners of Parent | 4,584 | 7.7% | 5,140 | 8.1% | +12.1% |

*Unit: Million yen

No revision for the full-year forecast, and it is estimated that sales and operating income will increase by 5.7% and 14.0%, respectively, year on year.

The sales of the Solution Design, Framework Design, and IT Service Businesses are projected to grow with the improvement in profitability. Solution Sales are forecasted to decline slightly due to the decrease in product sales, but the number of orders received is favorable, and the number of order backlogs at the end of the first half was better than expected. The Cloud Business is projected to see sales growing thanks to the “reform of ways of working,” but profit is considered to decline due to upfront investment for expanding sales of original services, mainly Canbus. As for the Overseas Business, sales are estimated to rise through the technical support for Japanese enterprises in the U.S., IoT solutions, such as LoRa WAN devices, and the full-scale sale of security products of StrongKey, and profit/loss is projected to improve.

As for dividends, the company plans to pay an interim dividend of 10 yen/share and a term-end dividend of 10 yen/share, for a total of 20 yen/share, up 4 yen/share (payout ratio estimated to be 38%).

3-2 Outlook for each segment

| FY 3/19 Results | Composition ratio/ Income margin | FY 3/20 Estimates | Composition ratio/ Income margin | YOY |

Solution Design | 21,214 | 35.5% | 23,450 | 37.1% | +10.5% |

Framework Design | 5,294 | 8.9% | 5,770 | 9.1% | +9.0% |

IT Service | 7,827 | 13.1% | 8,692 | 13.8% | +11.0% |

Solution Sales | 24,032 | 40.2% | 24,000 | 38.0% | -0.1% |

Cloud | 1,129 | 1.9% | 1,230 | 2.0% | +8.9% |

Overseas Business | 120 | 0.2% | 150 | 0.2% | +24.8% |

Investment & Incubation | 397 | 0.7% | 305 | 0.5% | -23.3% |

Adjustment | -272 | -0.5% | -450 | -0.7% | - |

Consolidated Sales | 59,742 | 100.0% | 63,147 | 100.0% | +5.7% |

Solution Design | 3,666 | 17.3% | 4,408 | 18.8% | +20.2% |

Framework Design | 841 | 15.9% | 968 | 16.8% | +15.1% |

IT Service | 1,067 | 13.6% | 1,220 | 14.0% | +14.2% |

Solution Sales | 1,155 | 4.8% | 1,242 | 5.2% | +7.5% |

Cloud | 197 | 17.5% | 64 | 5.2% | -67.6% |

Overseas Business | -31 | - | -15 | -10.0% | - |

Investment & Incubation | 5 | 1.3% | -22 | -7.2% | -520.4% |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 6,902 | 11.6% | 7,865 | 12.5% | +13.9% |

*Unit: Million yen

* From FY 3/20, Consumer Service Business will be included in Investment & Incubation.

Solution Design Business

It is estimated that sales will be 23,450 million yen, up 10.5% year on year, and operating income will be 4,408 million yen, up 20.2% year on year. The domain for improving the comfort of in-vehicle space (infotainment) is expected to keep growing. Projects in the field of safety of passenger vehicles, route buses, etc. (automated driving) are estimated to increase, and the company will make efforts to accumulate know-how. In addition, the company will enter the MaaS field on a full-scale basis by joining MONET Consortium. The activities of MONET Consortium include the development of MaaS Open Platform in Japan, the promotion of distribution of MaaS, the settlement of social issues regarding transportation, and the creation of new value. As for robots and AI, the company will concentrate on solution development and consulting by utilizing service robots, and launch robot utilization projects with keywords being 5G, IoT, and AI. As for the Internet Service Business, transactions for developing services for cashless payment and for online business utilizing smart devices are estimated to increase, and the company will upgrade the lab for entrusted development related to cashless payment. As for business operation systems, services utilizing OSS are estimated to increase, and the company receives an increasing number of inquiries about the development of business operation systems from enterprises that pursue DX.

Framework Design Business

It is projected that sales will be 5,770 million yen, up 9.0% year on year, and operating income will be 968 million yen, up 15.1% year on year. The company will horizontally expand its existing businesses to have promising and profitable transactions, and strive to receive orders in new businesses. In detail, the company will make efforts to increase promising and profitable transactions based on insurance systems, payment settlement, and foundations, and receive orders related to DX, for the purpose of accumulating know-how and establishing sales routes for establishing a next growth engine. In addition, the company will try to increase orders for licenses and installation support, by improving services, such as robotic process automation (RPA), cloud services, data analysis, voice recognition, and image recognition and cementing the cooperation among departments and with manufacturers and distributors.

IT Service Business

It is forecasted that sales will be 8,692 million yen, up 11.0% year on year, and operating income will be 1,220 million yen, up 14.2% year on year. The company will pursue more profitable business models by allocating management resources to the field of high added value, while “expanding its market share, market scale, and sales.” In detail, the company will concentrate on the undertaking of tasks for IT support, IT infrastructure, PMO, and LABO with high added value based on the know-how and English skills nurtured through previous projects, and expand services directly linked to the business expansion of clients. Furthermore, the company will strive to increase clients and sales by promoting new products and services, including AI & chatbots, RPA, and security enhancement support.

Solution Sales Business

It is estimated that sales will be 24 billion yen, down 0.1% year on year, and operating income will be 1,242 million yen, up 7.5% year on year. It was first forecasted that sales will decline slightly year on year due to the decrease in product sales, but there is a high possibility that sales will rise, considering plentiful backlogs of orders. For the expansion of the solution domain, the company will concentrate on the enrichment of its service lineup, strengthening of resources, and marketing targeted at profit sections. In addition, the company will fortify the alliance with cloud partners, in order to adapt to the hybrid environment, which evolved from the on-premise one (possession and operation by each company). The company will work on the provision of new one-stop services based on all of its services and apps, and sell IoT-related products while emphasizing security based on the cemented cooperation with Systena America Inc.

Cloud Business

It is projected that sales will be 1,230 million yen, up 8.9% year on year, and operating income will be 64 million yen, down 67.6% year on year. Sales are estimated to grow, as the company will meet the demand related to the work style reforms, but the company will bear upfront investment for popularizing, improving product competitiveness, and increasing customer satisfaction level of its services, mainly Canbus. In detail, the company targets specific fields with online promotion, and so on related to DX and the work style reforms, with the aim of popularizing Canbus. and enhancing its brand. The company will also improve product competitiveness to actualize a variety of tasks and strive to increase its support capacity by training personnel, to enhance customer satisfaction level.

Overseas Business

Sales will be 150 million yen, up 24.8% year on year, and operating loss will be 15 million yen (an operating loss of 31 million yen posted in the same period of the previous year). The transactions for technical support for Japanese enterprises in the U.S. are expected to increase, thanks to the contribution of continuous transactions and the increase of new transactions, and the company will make efforts to improve profitability by reducing costs by utilizing offshore bases in Vietnam. One Tech, Inc. will promote the sales of LoRa WAN devices, sensors, and IoT Gateway in cooperation with Internet of Things, Inc. One Tech, Inc. plans to showcase end-to-end IoT solutions at some exhibitions in the U.S. On the other hand, StrongKey, Inc. will enhance the sale of Tellaro targeting enterprises in California, as CCPA will be enforced in 2019, in parallel with the release in Japan.

4.Conclusions

According to a newspaper’s survey on 40,000 suppliers for 16 major companies of the Toyota Motor Group, the number of software companies have exceeded the number of manufacturers of parts, such as engines, for the first time. This was reportedly caused by the big trend of CASE, including automated driving and electrification. CASE was coined by using the 4 initials of “C = Connected,” “A = Autonomous,” “S = Sharing,” and “E = Electricity.” It is expected to bring a great change, which would occur once a century, to the automobile industry. According to a research firm, the scale of the global market of electrically driven vehicles, including electric vehicles (EVs), hybrid vehicles (HVs), and plug-in hybrid vehicles (PHVs), is projected to increase about 10 times from 2018 to 40.9 million vehicles by 2035.

The Solution Design Business, which is the mainstay of the company, is focused on five growing fields: “In-vehicle devices,” “Social infrastructure,” “Internet services,” “AI & robots,” and “Business operation systems.” The sales of “In-vehicle devices” account for about 13% of sales of this business segment. For “In-vehicle devices,” the company takes advantage of the capability of development with LinuxC, which has been nurtured through the development of conventional cell phones and built-in devices, and the capability of development with Android Java, which is based on the experience of developing Android smartphones. As mentioned above, the markets of automated driving and electrification are expected to grow considerably. Needless to say, technologies for communications and interfaces are indispensable for services utilizing IoT, robots, and artificial intelligence (AI). From now on, the strengths of Systena Corporation are expected to shine furthermore.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 2 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report (Updated on June 25, 2019)

Basic policy

Our company will promote speedy business administration based on swift decision making to keep up with the rapid changes in the business environment and enhance the efficiency of business administration, and achieve sustainable business development, the increase in shareholder value, and the continuous return of profit to shareholders. In addition, our company will tighten our corporate governance in order to harmonize the interests of stakeholders, including shareholders, customers, business partners, employees, and local communities, maximize overall profit, secure the soundness of business administration, and comply with laws and regulations thoroughly. To do so, we will sincerely accept instructions and suggestions from external experts (audit corporations, lead-managing securities firms, lawyers, labor and social security attorneys, judicial scriveners, and others) and stakeholders, and strive to improve the fairness and transparency of our business administration. Then, we will develop a structure suited for our corporate scale by utilizing our inherent flexibility and make efforts to brush up ourselves as a listed company that always cares for stakeholders, including shareholders, strengthen corporate governance, and disclose appropriate information in a timely manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-1-3 Plan for finding successors to CEO and others】

Our company has two representative directors, namely, the representative director and chairperson, who is the founder, and a representative director and president in his early 50s. Our company is still an owner-led enterprise in which the representative director and chairperson, who founded our company, conducts business administration as chief executive officer under the managerial policy of selection and concentration. The plan for finding successors will depend on the future business environment and managerial policies, so we think that to leave it to the discretion of the chairperson is the best way for the growth of our company. Accordingly, the board of directors is not involved in the formulation or operation of concrete plans for finding successors, as of now. From now on, we will discuss this matter if necessary.

【Supplementary Principle 4-3-3 Establishment of objective, timely, transparent procedures for dismissing the CEO】

In our company, the representative director and chairperson, who is the founder and owner of our company, leads our business administration as CEO, and the representative director and president marshals employees based on appropriate evaluation of their performance, etc. as chief operating officer (COO). In addition, each representative director is monitored by 6 outside executives (2 outside directors and 4 outside auditors) who satisfied the requirements for becoming independent executives. If an event which would lead to the dismissal of a representative director occurs, the board of directors will have discussions and make decisions based on suggestions from independent executives, to cope with said event. Therefore, the board of directors has not yet established objective, timely, transparent procedures for dismissing the CEO. We will discuss this matter, when necessary.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary nominating committees and compensation committees】

Two out of nine directors of our company are independent outside ones, who do not form a majority of the board of directors, but 6 outside executives, including them and 4 outside auditors, satisfy the requirements for independent executives specified by Tokyo Stock Exchange. Each independent executive actively expresses their opinions and gives timely, appropriate advice during deliberations about important matters at meetings of the board of directors, by utilizing their expertise and plenty of experience. Accordingly, we have not yet established an independent advisory committee. We will discuss this matter, when necessary.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

Our policy is not to strategically hold shares of listed companies, and there are no shares we hold strategically.

【Principle 1-7 Transactions among related parties】

In our company, conflict-of-interest and competing transactions shall be discussed and reported at a meeting of the board of directors. The board of directors approves each of such transactions in advance and reports on results.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (Systena Corporation: 2317) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/