Bridge Report:(2183)Linical the second quarter of fiscal year ending March 2023

Kazuhiro Hatano CEO | Linical Co., Ltd. (2183) |

|

Company Information

Market | TSE Prime Market |

Industry | Service |

CEO | Kazuhiro Hatano |

HQ Address | Shin-Osaka Brick Building, 6-1 Miyahara 1-chome, Yodogawa-ku, Osaka, Japan |

Year-end | End of March |

HP |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥708 | 22,586,436 shares | ¥15,991million | 12.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥14.00 | 2.0% | ¥38.56 | 18.4x | ¥289.69 | 2.4x |

* Stock price as of closing on December 7, 2022. Number of shares issued at the end of the most recent quarter excluding treasury shares.

* ROE and BPS are based on FY3/22 results. EPS and DPS are based on the estimates of FY3/23.

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2019 Act. | 11,313 | 1,212 | 1,253 | 568 | 25.09 | 12.00 |

March 2020 Act. | 10,935 | 1,005 | 918 | 482 | 21.38 | 14.00 |

March 2021 Act. | 10,279 | 453 | 588 | 539 | 23.91 | 14.00 |

March 2022 Act. | 11,555 | 1,085 | 1,183 | 790 | 35.00 | 14.00 |

March 2023 Est. | 12,440 | 1,224 | 1,204 | 871 | 38.56 | 14.00 |

*Unit: Million yen.

*Estimates are those of the company.

This Bridge Report reviews on the outlook of Linical Co., Ltd.’s earnings results for the second quarter of fiscal year ending March 2023 and its forecast of the fiscal year ending March 2023.

Table of Contents

Key Points

1. Company Overview

2. Management Strategy

3. Financial Results for the Second Quarter of Fiscal Year ending March 2023 Earnings Results

4. Fiscal Year ending March 2023 Earnings Forecasts

5. Conclusions

<Reference:Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year March 2023, sales grew 7.2% year on year and profit dropped 26.4% year on year. In terms of sales, the business in Europe saw a year-on-year sales growth, and the yen depreciation boosted the revenues of overseas subsidiaries. In terms of profit, an operating loss was posted in the first quarter, but profit recovered in the U.S. and Europe in the second quarter, and the profit in Europe increased from the previous term.

- As of the end of the second quarter, the earnings forecast for the fiscal year March 2023 is unchanged, calling for a 7.7% year-on-year increase in sales and a 12.7% year-on-year rise in operating income. The company will make efforts to increase sales by posting sales more swiftly through the thoroughgoing management of progress of projects ordered, concluding contracts and starting operations for projects more speedily, and making new deals, which are now under negotiation. The expected dividend amount is unchanged, being 14 yen/share for common dividends like in the previous term.

- In the second half of this term, the company will take measures for posting sales more swiftly through the thoroughgoing management of progress of projects ordered, concluding contracts and starting operations for projects more speedily, and making new deals, which are now under negotiation. In addition, by rigorously controlling personnel costs and other expenses according to projects ordered, they aim to reach their full-year earnings forecast. Their performance in the third quarter is noteworthy, to check whether their earning capacity will increase like in the second quarter (July-September) and how much they will increase profit to reach their full-year earnings forecast.

1.Company Overview

Linical Co., Ltd. provides contract research organization (CRO) services that support the drug development processes of pharmaceutical companies on an outsourced consignment basis, and sales and marketing functions for pharmaceutical products and post market launch clinical research and surveys on a consigned basis in the Contract Medical Affairs Business (CMA).

Pharmaceutical products are subject to approval of the Ministry of Health and Welfare prior to their sales, and efficacy and safety of pharmaceutical products must be confirmed through clinical trials prior to their approval. Companies providing clinical trial support services are known as contract research organization (CRO) service providers. In addition, there is a need to conduct surveys and clinical research after pharmaceutical products have been launched into the market and contract medical affairs is a service provided to support these efforts.

Linical has conducted various efforts to eradicate cancer, central nervous system and other diseases globally since its founding, and it has deployed its CRO Business in disease realms where there is strong demand for new drug development. These are highly difficult disease realms, and Linical is able to support high level clinical trials in these realms by the company’s knowledgeable and experienced experts. In addition, Linical focuses its efforts up the new drug development support and Contract Medical Affairs Business, approval application support and post approval marketing and clinical research, and post market survey support services, which exceed the traditional definition of outsourcing and is now considered to be part of a wider range of consulting services provided to customers as a "true clinical development partner". Furthermore, amidst the advance of globalization and large-scale pharmaceutical product development, the Linical Group can provide "one stop shopping" type comprehensive services for large scale global products. Consequently, Linical is able to play the role of a strategic business partner by providing total support to help raise the competitive advantage of customers in the market and to help pharmaceutical companies develop new future business opportunities.

Furthermore, Linical has a contract-based business style and is establishing a highly profitable structure. It is focusing on specific areas, specific clinical trials (i.e., Phase II and Phase III).

【Corporate History】

Linical Co., Ltd. was established in June 2005 by nine members who worked at Fujisawa Pharmaceutical Co., Ltd. (Currently known as Astellas Pharma Inc.) on the development of immunosuppressant drugs. Established with the objective of becoming the ideal drug development outsourcing (CRO) company from Osaka, Linical focused its efforts upon the realms of central nervous system diseases (CNS) and oncology since its founding, and received one of its first orders from Otsuka Pharmaceutical Company shortly after its establishment. Thereafter, the Company fortified its staffing as part of its efforts to strengthen its order taking capabilities. In addition, Linical is benefitting from the bountiful experiences of its employees in the realm of oncology pharmaceutical product development and experiences having worked at foreign pharmaceutical companies. Consequently, Linical is successfully expanding orders in the near term.

With its advance into the site management organization (SMO, clinical trial facility support organization) business, Aurora Ltd. was turned into a subsidiary in January 2006. However, all shares held in Aurora were later sold in May 2007 in order to focus management resources upon the CRO Business. In July 2008, Linical USA, Inc. was established in California, United States to provide support to Japanese pharmaceutical companies seeking to enter the United States market. Also, in October of the same year, Linical listed its shares on the Mothers Market of the Tokyo Stock Exchange, and subsequently moved its listing to the First Section of the Tokyo Stock Exchange in March 2013. In May 2013, Linical Taiwan Co., Ltd. and Linical Korea Co., Ltd. were established in Taiwan and Korea respectively. In April 2014, Linical teamed up with its Linical Korea to acquire the Korean CRO company P-pro. Korea Co., Ltd. On October 29, 2014, all of the shares of Nuvisan CDD Holding GmbH, which conducts CRO Business in Europe, were acquired and it was converted to a 100% owned subsidiary effective on November 30, 2014. In order to strengthen the collaboration within the Group, the company name of Nuvisan CDD was changed to Linical Europe GmbH on December 1, 2014. In addition, Linical U.K. Ltd. was established in March 2016, and a local subsidiary called Linical Poland SP. Z.O.O. was also established in October of the same year. Moreover, LINICAL Czech Republic s.r.o was established in September 2017. In addition, Accelovance, Inc. was acquired in April 2018 and its company name was changed to Linical Accelovance America, Inc. This acquisition has contributed to a strengthening of Linical's consignment structure for global jointly conducted clinical trials. In addition, Linical Hungary Kft. was established in March 2019, and Linical China Co., Ltd. was established in May 2019. Furthermore, the company further strengthened their system for undertaking global joint clinical trials, through the enhancement of their business in the European region by integrating the European subsidiary of Linical Accelovance America, Inc. (LAA) into LINICAL Europe GmbH in December 2019, and the establishment of a Shanghai branch in February 2020.

In April 2020, Linical Benelux BV and Linical Accelovance Europe BV were merged to form Linical Netherlands BV, and Linical China Co., Ltd. and Linical Accelovance China Ltd. are scheduled to be integrated in the fiscal year ending March 2023.

Despite the lingering effects of the spread of COVID-19 around the world, the company recorded record sales in the fiscal year ended March 2022 and operating income recovered to the level before the pandemic.

【Business Description】

Linical mainly conducts contract research organization (CRO) business, post market launches clinical trial and clinical research and marketing support activities in the Contract Medical Affairs Business, and new drug development support business.

As a true partner, the company contributes to the maximization of the value of the medical drugs by helping the procedure from the non-clinical tests to clinical development and after-release surveys and clinical trial, and making it possible to shorten the time needed to start selling the drugs and prolong the life-cycle of the products. On top of that, the company supports not only pharmaceutical companies but also the bio-ventures in various ways including exit strategies.

(Source: Linical)

CRO Business (Contract Research Organization)

The CRO business undertakes part of the clinical trial operations conducted by pharmaceutical companies, including monitoring, data management, medical writing, pharmacovigilance, statistical analysis, and quality control. The company has opened facilities in Asia (Korea, Taiwan, Singapore, China), Europe and the United States to be able to respond to growing demand for global studies. Linical provides "one stop shopping" services ranging from pharmaceutical affairs to planning, implementation plan creation, monitoring, data management, statistical analysis, and pharmacovigilance. With regards to jointly conducted global jointly conducted clinical trials, Linical headquarters operates a function where personnel within depth knowledge about various countries pharmaceutical product development work. These personnel are able to provide information necessary to establish a development environment that can enable jointly conducted global jointly conducted clinical trials to be conducted in Japanese. Among the new drug development projects spanning from 10 to 20 years, Linical is specialized in the processes of “Phase II” and “Phase III” that require 3 to 7 years targeting patients who are particularly important in clinical trials, and it provides “monitoring” services that are the core of the clinical trials in the contract-based business style in conjunction with “quality control” and “consulting.” It collects highly reliable data and supports the rapid and reliable development of new drugs. Furthermore, it focuses on major pharmaceutical companies with abundant drug development information and is specialized in the oncology and CSN disease realms with a strong demand for development from markets as well as the other challenging realms to respond to its customers’ needs (i.e., pharmaceutical companies).

In addition, the company offers high-quality services in the fields of schedule management, standard procedure documents for clinical trials, compliance with GCP, the reliability of data and case reports, etc.

* Global jointly conducted clinical trials

“Global jointly conducted clinical trials” refers to conducting clinical trials simultaneously in multiple countries or regions in order to develop new drugs on a global scale and aim for early launch.

*GCP (Good Clinical Practice)

“GCP” is the international rule the companies are supposed to obey when they conduct the clinical trial. It is enacted by Ministry of Health, Labor and Welfare as a ministerial ordinance so that they can conduct it properly in Japan.

Contract Medical Affairs Business

In the contract medical affairs business, the company provides support for the organizational structure and construction of corporate and doctors-led clinical research, as well as planning for surveys, monitoring, and auditing services for post-release clinical trials and investigations. The Clinical Trials Act is enacted, and the environment surrounding clinical research is changing drastically. Under this circumstance, to obtain information in a timely manner and be the best partner for the medical affairs department of pharmaceutical companies, Linical provides full-service support including data management and statistical analysis with a focus on monitoring and research administration works of clinical trials. It covers clinical trials that are compliant with J-GCP, ethical guidelines, the Clinical Trails Act and/or ICH-GCP, providing services for all regulations. Furthermore, it offers services in the realms of primary and CNS from the beginning of the company’s establishment. It has also strengthened the oncology realm, and more than half of the monitors are experienced in that realm. It has a policy to respond to the latest regulations and contribute to the creation of evidence in the challenging areas based on the know-how cultivated in the past development works.

Innovative Drug Development Business

Following the existing CRO Business and Contract Medical Affairs Business, Linical is cultivating the third business called Innovative Drug Development Business. In the innovative drug development business, the company conducts market analysis, pharmaceutical affairs support, design of development strategies, and partnering support. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided. With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

【Five Strengths】

(1) Comprehensive "One Stop" Services on a Global Scale

Linical is Japanese global CRO services provider with the ability to provide services in the three regions of Asia, Europe, and the United States. The company contributes to new drug development as a pharmaceutical development professional. Since the inauguration of their business, they have actively entered overseas markets, and currently, they are operating business in 18 countries/regions, with the ability to offer services in about 20 countries/regions around the world. Moreover, Linical boasts of highly skilled professionals with bountiful experience in a wide spectrum of comprehensive services ranging from planning, monitoring, data management, statistical analysis, medical writing, pharmaceutical affairs, pharmacology vigilance, and other various services who can respond to customers' needs, including the need for not only local but also multi-national clinical trials. Therefore, Linical is a comprehensive "one stop" service provider operating on a global scale.

LINICAL Global Base “Three Main Operating Regions of “Japan and Asia, United States, Europe”

(Source: Linical)

(Source: Linical)

The establishment of a tripolar structure based in Japan/Asia, the U.S., and Europe turned out to be effective, as new projects ordered are increasing steadily. In particular, the company made new large-scale transactions in Japan and the U.S., so the backlog of orders as of November 14, 2022 stood at 23.6 billion yen. When provisionally ordered projects that are under negotiation are taken into account, the backlog of orders is virtually over 25 billion yen.

(2) Innovative Drug Discovery Support to Clinical Development and Research

As a corporate social responsibility (CSR), the company wants to contribute to society by playing a role in developing pharmaceutical products. Linical also enables clients to promote efficient new drug development, extend life cycle management, shorten the time required to market launch (TTM), and maximize sales at an early stage (TTP). In Japan, the company supports the creation of medicines in the Innovative Drug Development Business, conducts clinical development in the Contract Research Organization (CRO) business, and supports clinical tests and research after production or release in the Clinical Research Support Business.

(Source: Linical)

(3) Focused upon oncology, central nervous system and immune system.

Pharmaceutical product development is currently focused upon the three realms of oncology, central nervous system and immune system. Founding members of Linical boast of bountiful experience in the realm of immune system and have provided services in the highly difficult realm of immune system since the Company's founding. Thereafter, Linical has expanded its realms of expertise to include central nervous system in 2006, and oncology in 2010. Currently, Linical's business is based upon the regions of unmet medical needs in these three main business realms of oncology, central nervous system and immune system. In addition, its overseas subsidiaries are also boast of a strong track record in oncology, central nervous system, and immune system related services, which are realms where unmet medical needs are high. Furthermore, in addition to the dermatology and ophthalmology fields, which are expected to grow in the future, the company is preparing to make the regenerative medical field, which has a high degree of difficulty, as a major pillar of its future services.

(Source: Linical)

The backlog of orders as of November 14, 2022 was record-high, but the expansion of other domains is remarkable, while the core domains of cancer and the central nervous system (CNS) remain significant.

(4) Global Collaboration

Linical is Japan's CRO services company that can provide clients with services on a global basis. Because of its ability to provide exceptionally high-quality services (Japan Quality), it has established its global business development center in Japan and maintains multilingual staff with the ability to communicate in Japanese, English and other languages including Korean, Chinese, German and others at its Osaka headquarters and Tokyo branch office. Overseas staff also understand Linical's advantage of having high quality services originating in Japan and provide these "Japan Quality" services throughout the Linical business globally.

The company offers proposals according to needs from clients, including a case in which a project manager and leaders from Japan, Taiwan, and South Korea are deployed in Japan and a case in which leaders are deployed at the footholds of respective countries for realizing a testing system in Asia, including Japan, Taiwan, and South Korea. In addition, the company has carried out many collaborative trials among enterprises in Japan, the U.S., EU, and other Asian countries, so it can give proposals on a global scale according to the development strategy of each client.

(5) High Quality Services

In order to provide high quality services that Linical is widely recognized for, the Company implements training of its staff in both aspects of quantity and quality of work. As a result, the Company has been able to maintain high passage rates of the GCP Support Certification Examinations administered by the Japan Society of Clinical Trials and Research (JSCTR) since the first examination and has been awarded with recognition awards for its high quality and passage rates, which in turn have contributed to promotion of clinical trials. In addition, Linical boasts of bountiful experience in GCP compatibility surveys and FDA inspection. In both instances, the Company has received high regard for its services from clients. Moreover, overseas subsidiaries have also received high regard for its bountiful experiences in dealings with the FDA, KFDA, ANVISA and other organizations. The company strongly believes that its greatest mission is to provide customers with the best service by combining high quality and speed.

2.Management Strategy

According to “The Global Use of Medicines 2022 OUTLOOK TO 2026” of IQVIA, the scale of the global pharmaceutical market is expected to grow from 1,423 billion US dollars in 2021 to 1,750 billion-1,780 billion US dollars in 2026 with an annual growth rate of 3-6% on average. It is projected that the U.S. market will account for 40.2% of the global market, the European market (UK, Germany, France, Italy, and Spain) 15.4%, the Chinese market 12.4%, and the Japanese market 5.2%. While the global pharmaceutical market will grow, the CRO market is expected to expand as well. Under these circumstances, only Japan is forecast to see negative growth among developed countries, so it is indispensable to expand business around the world, including the U.S., which has the largest market.

【Sales and the number of employees in each region (as of the end of March 2022)】

(Source: Linical)

【Second Goal】

(1) To build a system with more than 1,500 employees where there will be 500 in Japan, 400 in Asia, 400 in Europe, and 400 in the U.S.

(2) To maintain and improve profitability while making growth investments (including M&A) in all main business regions

(3) The company will expand its business to about 60 countries around the world. While taking time differences into consideration, the company will consider expanding its coverage area in each Japan, the U.S., and Europe. Having a base in the southern hemisphere will enable the company to conduct clinical trials for seasonal diseases all year round.

(Source: Linical)

(1) Strategy in Japan

In the Japanese market, the number of clinical trials is stagnant, and the ratio of international joint clinical trials is increasing.

In this situation, the company will concentrate on the following priority items.

◆To expand the global CRO business base, and acquire orders of Japanese trials in international joint clinical trials

◆Innovative Drug Development Business: To make it the third pillar

◆CRO business: To increase target customers and target diseases, and enrich services

◆Contract Medical Affairs Business: To grasp the changes in the business environment, and get back on a growth track

【CRO Business】

| Initial stage | Present |

Clients | Major domestic pharmaceutical companies | Major domestic pharmaceutical companies Major overseas pharmaceutical companies Domestic and foreign bio-ventures |

Disease areas | Oncology area CNS area Immunology area | Oncology area CNS area Immunology area Ophthalmology Dermatology area Regenerative medicine |

Services | Monitoring | Monitoring Project management Quality control and auditing Data management Medical writing Pharmacovigilance and others |

(From the reference material for the company’s financial results briefing)

Initially, the company’s clients were mainly major domestic pharmaceutical companies. However, by providing full services, the company aims to increase its market share among major overseas pharmaceutical companies and domestic and overseas bio-ventures. In addition to the domains of oncology, CNS, and immunology, the company will strengthen the domains of regenerative medicine, dermatology, and ophthalmology. Moreover, the company will evolve its business model in terms of customers, disease areas, and services, aiming to achieve medium- to long-term growth and improve profitability. Furthermore, the company plans to take a pioneering role in regenerative medicine, therapeutic applications, and other cutting-edge therapies that are expected to expand in the future.

【Contract Medical Affairs Business】

The company started supporting large-scale clinical research as a pioneer in supporting clinical research in 2011. It has accumulated the experience of various types of research, including large-scale intervention clinical research (specified clinical research) at over 250 facilities and global clinical research involving staff in Japan, Taiwan, and South Korea. Furthermore, it is possible to conduct clinical research with a system that can meet global needs, based on the cooperation with global organizations.

After the production and release of pharmaceutical products, post-marketing studies are conducted for investigating and studying their safety, efficacy, etc. while they are actually administered to patients. The studies use real-world data (RWD) taken from daily diagnosis of patients (electronic medical charts, medical insurance claims, health checkups, wearable devices, etc.) differing from clinical trials carried out in a controlled environment.

The merits of utilization of the real-world data include (1) the streamlining of the process for developing pharmaceutical products, (2) the reduction of burdens on medical institutions, and (3) the promotion of development in fields where it is difficult to conduct a randomized controlled trial (placebo) for rare diseases, intractable diseases, etc. It is expected that real-world data will be utilized for developing pharmaceutical products. On the other hand, the utilization of real-world data will be accompanied by issues, such as the limitation of access to medical data, the standardization of data, the linkage of data, and the securing of “quality of data” to be used in drug approval application.

The company assumes that through the changes in post-marketing studies, expectations toward the roles of CRO for securing the quality of data, which is an issue with the utilization of real-world data, will increase, expanding business chances.

<Activities of regulatory authorities in Japan, the U.S., and Europe regarding the utilization of RWD>

Europe (EMA) | The U.S. (FDA) | Japan (PMDA) |

◆For 40% of products available in the market, real-world evidence (RWE) was used for obtaining the approval for initial production and sale. ◆Activities for using RWE and establishing its value in regulatory authorities’ decision making about the development, approval, and supervision of pharmaceutical products in Europe by 2025 have progressed. | ◆The 21st Century Cures Act was adopted in 2016. ◆ Regulatory authorities put emphasis on the use of RWD and RWE for supporting their decision making regarding the addition of indications for medicines. ◆Guidelines for utilizing RWD have been enacted. | ◆ In 2021, RWD WG was established. They are discussing the basic policy for utilizing RWD and the policy for securing reliability. ◆They are developing a system for utilizing registry data, etc. for applying for approval for pharmaceutical products, re-examination, etc. (including giving advice about registry databases face to face) ◆ Recently, the addition of indications has been approved with the specific clinical research data of TS-1. |

Real-world data are increasingly utilized around the world.

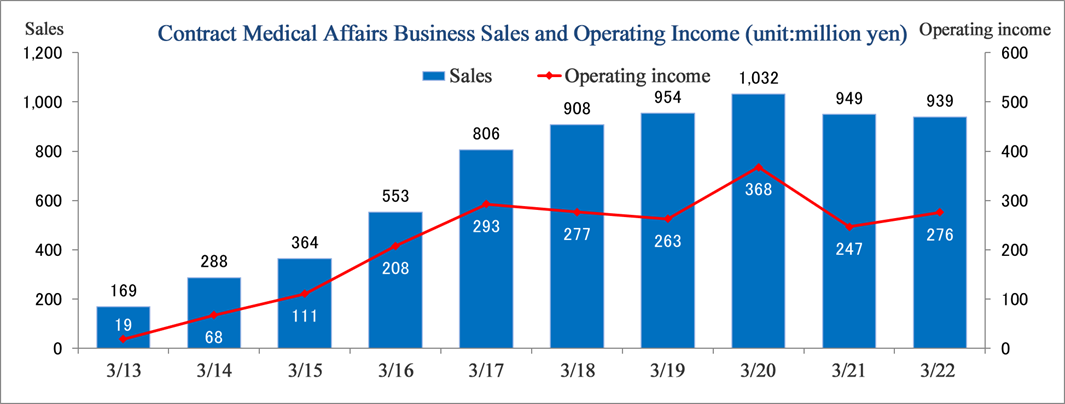

(Note) From the first quarter of FY 3/16, the name of the previous segment was changed from “CSO business” to “Contract Medical Affairs Business”.

In addition, the company is promoting the initiatives for decentralized clinical trials (DCTs) using e-Source, such as wearable devices, while increasing DCT partners inside and outside Japan.

(Source: Linical)

【Innovative Drug Development Business】

The company operates the third business, that is, the Innovative Drug Development Business, following the existing CRO Business and the Contract Medical Affairs Business. This business is mainly operated by employees who are involved with licensing, business development, clinical trials development, development pharmacy, and marketing at major domestic pharmaceutical companies and have abundant results and experiences in determining developed products, introduction and derivation negotiation, and clinical development. In the Innovative Drug Development Business, 3 types of consulting services: a) market analysis of developed products, b) support for PMDA consultations, and c) licensing support, are provided.

With these experiences as a weapon, Linical is currently supporting operations of domestic and overseas pharmaceutical companies and biotechnology companies from the early stages of development. It plans to strengthen the system to provide total support globally in cooperation with its international bases.

<3 types of consulting>

There are Japanese and overseas biotech venture companies and mid-sized pharmaceutical companies that want to enter the Japanese pharmaceutical market and distribute and release their products. However, they do not have sufficient knowledge of the Japanese market or pharmaceutical affairs and do not have adequate development and release functions, and need a strategic partner/licensee. Thus, the company provides these companies with the following services.

Market analysis/investigation | ・ Epidemiological survey of target diseases ・ Market value and trend forecast ・ Current treatment algorithm and guideline survey ・ Approved drugs and development pipeline survey ・ Target product performance (TPP) planning ・ Official drug price and peak sales forecast, profitability evaluation |

Pharmaceutical affairs/ Development strategies, PMDA consultation (MW) | ・ Development/pharmaceutical affairs strategy planning and proposal ・ Preparation of materials for PMDA consultation, application, attending meetings, and responding to inquiries ・ Preparation of drug study summary, protocols, consent documents, etc. ・ Clinical trial notification and responding to inquiries ・ Domestic administrator services for clinical trials ・ Registration application for orphan drugs ・ Common Technical Document (CTD) publish |

Strategic alliance/ license | ・ Investigation and analysis of potential partner companies/licensees ・ Interview with potential partner companies/licensees, explanation of products/technologies ・ Participation in a conference for partnering ・ Due Diligence support ・ Contract negotiation support |

<Measures against drug loss>

The drug lag means a problem of taking a lot of time in Japan to obtain approval for production and sale of a drug that has been already approved outside Japan. This has two aspects. One is the problem that it takes more time to obtain approval for production and sale of a drug in Japan than outside Japan. The other is the problem of drugs that are available outside Japan, but not in Japan. Regarding the latter problem, the number and ratio of pharmaceutical products not approved in Japan are increasing, and there is concern over the “drug loss,” which means that new drugs outside Japan will remain unavailable in Japan.

Various factors can be considered. One of them is the fact that start-up companies for producing bio-pharmaceutical products are emerging outside Japan and they account for increasing proportions of applications for approval for new active ingredients and sales of them. Most of these bio start-ups do not have an office in Japan. Like this, there are many foreign biotech venture companies and mid-sized pharmaceutical companies that hope to enter the Japanese pharmaceutical market and distribute and sell their products, and require strategic partners and licensees because they do not have sufficient knowledge of the Japanese market or pharmaceutical affairs or possess sufficient capabilities of developing and selling products in Japan. In order to solve these problems, Linical’s Innovative Drug Development Business division, which is composed of professionals who have long experience of a broad range of tasks for developing pharmaceutical products in leading pharmaceutical companies and academia will continuously engage in activities for preventing the drug loss in Japan as a global CRO originating from Japan.

(2) Strategy in Asia

In the medium term, the company aims to achieve sales of 1.5 billion yen and an operating income margin of 15%. In addition, the company will increase the number of employees from 131 at the end of the previous term to 200 early, and consider increasing it further and developing a system with 400 employees in the long term. As a concrete strategy, the company will cultivate the Chinese market.

(3) Strategy in Europe

In the medium term, the company aims to achieve sales of 30 million euro and an operating income margin of 15%. In addition, the company will increase the number of employees from 209 at the end of the previous term to 300 early, and consider increasing it further and developing a system with 400 employees based on its own human resources and M&A in the long term. As a concrete measure, the company plans to establish a foothold in Italy (completed in October 2022) and upgrade the base in UK.

(4) Strategy in the U.S.

In the medium term, the company aims to achieve sales of 30 million US dollars and an operating income margin of 15%. In addition, the company will increase the number of employees from 105 at the end of the previous term to 150 early, and consider increasing it further and developing a system with 400 employees based on M&A in the long term. As a concrete strategy, the company will target overseas emerging biopharma (EBP) companies.

3.Financial Results for the Second Quarter of Fiscal Year ending March 2023 Earnings Results

(1) Consolidated results

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY | |

Sales | 5,522 | 100.0% | 5,920 | 100.0% | +7.2% | |

Gross profit | 1,676 | 30.4% | 1,840 | 31.1% | +9.8% | |

SG&A | 1,169 | 21.2% | 1,467 | 24.8% | +25.5% | |

Operating Income | 507 | 9.2% | 373 | 6.3% | -26.4% | |

Ordinary Income | 496 | 9.0% | 614 | 10.4% | +23.9% | |

Parent Quarterly Net Income | 252 | 4.6% | 468 | 7.9% | +85.6% | |

*Unit: million yen

*The figures include figures calculated by Investment Bridge Co., Ltd., and may differ from actual figures. (Abbreviated hereafter)

Sales grew 7.2% year on year, while operating income dropped 26.4% year on year.

Sales grew 7.2% year on year to 5,920 million yen, while operating income dropped 26.4% year on year to 373 million yen.

In terms of sales, the business in Europe saw a year-on-year sales growth, and the yen depreciation boosted the revenues of overseas subsidiaries.

In terms of profit, an operating loss was posted in the first quarter as the ratio of projects in service decreased temporarily due to the delay in the start of large-scale international joint trials in the U.S. and Europe caused by the war between Russia and Ukraine, but profit recovered in the U.S. and Europe in the second quarter. Regarding delayed large-scale trials, it took time to adjust the clinical trial sites that were originally planned in Russia, to other European countries, but the trials started in late July, and are progressing steadily as a whole. Gross profit margin rose 0.7 points to 31.1%. On the other hand, SGA increased considerably by 25.5% year on year. Ordinary income increased 23.9% year on year to 614 million yen, as the company posted an exchange gain of 265 million yen (an exchange loss of 1 million yen in the same period of the previous year) from foreign currency deposits as a non-operating income. In addition, profit attributable to owners of parent increased 85.6% year on year to 468 million yen, as insurance money received amounting to 50 million yen was posted as an extraordinary income and arbitration-related expenses of 108 million yen, which were posted as an extraordinary loss in the same period of the previous year, were no longer posted in the first half of this term.

Sales and profit by segment

| FY 3/22 2Q | Ratio to sales Operating income ratio | FY 3/23 2Q | Ratio to sales Operating income ratio | YoY | |

CRO Business | 5,138 | 93.0% | 5,468 | 92.4% | +6.4% | |

Contract Medical Affairs business | 384 | 7.0% | 451 | 7.6% | +17.7% | |

Consolidated sales | 5,522 | 100.0% | 5,920 | 100.0% | +7.2% | |

CRO Business | 1,190 | 23.2% | 1,014 | 18.6% | -14.8% | |

Contract Medical Affairs business | 126 | 32.8% | 164 | 36.3% | +30.1% | |

Adjustment amount | -809 | - | -805 | - | - | |

Consolidated operating income | 507 | 100.0% | 373 | 100.0% | -26.4% | |

*Unit: million yen

In the CRO business, sales grew 6.4% year on year to 5,468 million yen, and operating income dropped 14.8% year on year to 1,014 million yen. The profit margin of this segment declined 4.6 points year on year to 18.6%.

In the Contract Medical Affairs Business, sales grew 17.7% year on year to 451 million yen, and operating income rose 30.1% year on year to 164 million yen. The profit margin of this segment increased 3.5 points year on year to 36.3%.

(2) Performance trend in each region

Earnings results by regions

| FY 3/23 1H | |||||

Sales | YoY | Operating income | YoY | Ordinary income | YoY | |

Japan | 2,912 | -4.8% | 341 | +25.8% | 537 | +83.4% |

U.S. | 1,407 | +17.8% | 42 | -78.4% | 25 | -86.2% |

Europe | 1,862 | +27.8% | 120 | +38.0% | 157 | +119.8% |

Korea | 408 | +20.9% | 36 | -42.5% | 67 | -15.8% |

Taiwan | 63 | +9.0% | -15 | - | -15 | - |

China | 201 | +6.4% | 21 | -39.8% | 14 | -46.2% |

Adjustment | -933 | - | -172 | - | -171 | - |

Total | 5,920 | +7.2% | 373 | -26.4% | 614 | +23.9% |

*Unit: million yen

*Amortization of goodwill is recorded as an adjustment

* “Sales” means the value before exclusion of internal transactions.

【Japan】

In Japan, sales decreased due to a change in the start of clinical trials for reasons attributable to the sponsor. On the other hand, income increased YoY due to strict control of personnel expenses, etc. by adjusting the number of recruits.

【the U.S.】

In the U.S., sales grew as the delay in large-scale international joint trials in the U.S. and Europe in the first quarter was improved in the second quarter and the yen weakened. Cumulative profit in the first half dropped year on year, due to the temporary decline in the ratio of projects in service due to the above-mentioned delay in trials and the augmentation of personnel costs through the increase of employees for starting new projects and increasing man-hours, despite the improvement in the ratio of projects in service in the second quarter.

【Europe】

In Europe, sales and profit grew year on year, as the favorable number of orders received in the previous term were handled, posting sales, and the above-mentioned large-scale international joint clinical trials, which were delayed in the U.S. and Europe, progressed significantly in the second quarter.

【Asia】

In South Korea, sales increased year on year, as the company received multiple orders for new projects and started them and the yen weakened. The profit in the second quarter was up year on year, but the cumulative profit in the first half declined, due to the posting of an operating loss due to the augmentation of personnel expenses through the increase of employees for dealing with new transactions in the first quarter.

In China, sales grew, but profit dropped year on year, due to the yen depreciation despite the delay in progress of some projects ordered due to the lockdowns based on the zero-COVID policy.In Taiwan, the sales in local currency decreased year on year, due to the delay in progress of clinical trials in some ongoing projects caused by the novel coronavirus, but the company curtailed expenses, so operating loss shrank considerably.

【Goodwill balance and remaining amortization period (at the end of FY2022/3)】

| Amount of money | Residual depreciation period | Annual depreciation*4 |

Korea | Depreciation ends in 19/3 | ||

Europe*1,2 | 1,349 | 11-12 years | 120 |

the U.S. *1,3 | 2,056 | 12 years | 171 |

* Unit: million yen

*1 Goodwill generated from the acquisition of Linical Accelovance America, Inc. (Hereinafter, “LAA”) was allocated to the European subsidiaries.

*2 The balance of intangible assets other than goodwill recognized by Purchase Price Allocation at the end of the fiscal year ended March 2022 is 84 million yen. The residual amortization period for these assets is 5 to 9 years.

*3 The balance of intangible assets other than goodwill recognized by Purchase Price Allocation at the end of the fiscal year ended March 2022 is 46 million yen. The residual amortization period for these assets is 5 years.

*4 Figures converted at the exchange rate at the end of the fiscal year ended March 2022.

(3) Change in order balance

| End of FY 3/22 (A) | End of FY 3/23 2Q | As of November, 14, 2022 (B) | Difference from the end of the previous term (B-A)/(A) |

Chugai Pharmaceutical | 3,786 | 3,045 | 2,875 | -24.1% |

Eisai | 2,795 | 1,833 | 1,727 | -38.2% |

Ono Pharmaceutical | 15,932 | 16,747 | 18,998 | +19.2% |

Others | 22,514 | 21,625 | 23,601 | +4.8% |

* Unit: million yen

In the CRO business, the total amount of clinical trials commissioned to the company, which has an implementation period of one to three years, is determined by the difficulty of the clinical trials due to the number of cases and the target disease. A consignment contract is concluded with the client for this implementation period, and sales are generated according to the contract. Also, in the contract medical affairs business, a consignment contract is concluded with the client for the same period, and sales are generated according to the agreement.

The order backlog is the balance of the order amount of the commissioned projects for which a contract has already been concluded. This shows the sales that will be generated in the next one to five years, which is the basis indicator for the company's future business forecasts.

The backlog of orders as of November 14, 2022 was as high as 23,601 million yen, up 4.8% from the end of the term ended March 2022, keep exceeding 20 billion yen.

In the U.S., the backlog of orders increased, as the company received orders for large-scale projects from biotech enterprises, etc., with which the company has good transaction relationships, and some contracts were revised. In addition, there are projects that are under negotiation for signing contracts after receiving provisional orders and not posted as above-mentioned orders, and the company also receives an increasing number of business inquiries for new transactions.

In Europe, the backlog of orders that is expected to increase sales in the next term or later decreased due to the revision to contracts through the changes in clinical trial plans, but the company received orders that would contribute to sales in this term or the following terms, for multiple new projects and revisions to contracts for extending a period, etc. In addition, the company has received some business inquiries about new projects, and continues marketing activities for receiving more orders.

In Japan and other Asian countries, the company signed a contract for a new large-scale project with a foreign-affiliated pharmaceutical company, and the backlog of orders increased through the receipt of some orders for new projects and contract revisions, so the number of business inquiries about new projects is increasing.

When projects under negotiation for signing contracts after receiving provisional orders are taken into account, the real backlog of orders exceeds 25 billion yen.

(4) Variation in performance in the second quarter (July to September)

In the second quarter (July to September) of the fiscal year March 2023, sales and profit increased year on year and from the previous quarter (April to June). The operating loss in the first quarter is attributable to the temporary decline in the ratio of projects in service due to the delay in start of large-scale international joint trials in Europe and the U.S. caused by the war between Russia and Ukraine, etc., but the performance in the U.S. and Europe recovered in the second quarter.

(5) Financial Conditions and Cash Flow(CF)

Financial Conditions

| March 2022 | September 2022 |

| March 2022 | September 2022 |

Cash | 5,985 | 6,303 | ST Interest-Bearing Liabilities | 1,139 | 1,139 |

Receivables and contract assets | 2,917 | 3,113 | Payables, Accrued Expenses | 936 | 1,133 |

Advance payment | 987 | 1,438 | Advances received | 2,147 | 2,411 |

Current Assets | 10,321 | 11,485 | LT Interest-Bearing Liabilities | 2,964 | 2,694 |

Tangible Assets | 664 | 664 | Liabilities | 9,173 | 10,095 |

Intangible Assets | 3,565 | 3,916 | Net Assets | 6,543 | 7,170 |

Investments and Others | 1,165 | 1,199 | Total Liabilities and Net Assets | 15,716 | 17,265 |

Noncurrent Assets | 5,395 | 5,780 | Total Interest-Bearing Liabilities | 4,103 | 3,834 |

* Unit: million yen

* Interest-bearing liabilities=Borrowings + Lease Obligations

The total assets as of the end of September 2022 stood at 17,265 million yen, up 1,549 million yen from the end of the previous term. In the section of assets, primary factors in increasing assets included cash & deposits, advances paid, and goodwill, while main factors in decreasing assets included investment securities. In the section of liabilities and net assets, primary factors in increasing them included accounts payable-other, advances received, deposits received, and foreign currency translation adjustment, while main factors in decreasing them included accrued expenses and long-term debt. The goodwill as of the end of September 2022 stood at 3,765 million yen. The goodwill at the time of acquisition of subsidiaries in Europe and the U.S. decreased in foreign currency through amortization, but increased 358 million yen from the end of the previous term in yen due to the yen depreciation. The capital-to-asset ratio as of the end of September 2022 was 41.5%, down 0.1 points from the end of the previous term.

Cash Flow

|

|

|

| |

| FY 3/ 22 2Q | FY 3/ 23 2Q | YoY | |

Operating cash flow(A) | 836 | 659 | -176 | -21.2% |

Investing cash flow(B) | -31 | -27 | +4 | - |

Free cash flow(A+B) | 804 | 631 | -172 | -21.4% |

Financing cash flow | -821 | -636 | +185 | - |

Cash and Equivalents at the end of quarter | 5,062 | 6,303 | +1,240 | +24.5% |

* Unit: million yen

Regarding cash flows, the cash inflow from operating activities shrank due to the expansion of exchange gain, the increase in advances paid, etc. The cash outflow from investing activities dropped due to the decrease in purchase of investment securities, etc., but the surplus of free cash flow shrank. On the other hand, the cash outflow from financing activities declined due to the decrease in repayment of long-term debt, etc. As a result, the term-end cash position increased 24.5% from the end of the previous term.

(6) Plan to Comply with the Listing Maintenance Criteria for the New Market Classification

The company has been listed on the Prime Market since April 2022. However, as of the transition reference date (June 30, 2021), the company did not meet the criteria for maintaining its listing on the market in terms of market capitalization of tradable shares, so it prepared a plan to comply with the criteria.

Specifically, the company intends to increase the market capitalization of tradable shares over the three-year period from the fiscal year March 2023 to the fiscal year March 2025 by (1) increasing profitability, (2) tightening corporate governance, and (3) improving accountability, in accordance with its medium-term management plan.

【Concrete efforts】

(1) Increasing Profitability | |

Expansion of the target customer base | Expansion of the customer base, which has been composed of mainly major Japanese pharmaceutical companies, to include major overseas pharmaceutical companies and domestic and overseas biotech companies. |

Expansion of target therapeutic areas | Expansion of services, which has been mainly in the fields of oncology, the central nervous system, and immunology, to cover ophthalmology, dermatology, rare diseases, etc. by adapting to treatment methods utilizing the latest modalities such as regenerative medicine, cellular medicine, nucleic acid medicine, and therapeutic applications. |

Expansion of service areas | To differentiate from competitors by strengthening consulting services that match client needs, such as market analysis, development strategy formulation, and regulatory compliance, for clients in Japan and overseas. |

Expansion of overseas business | To strengthen sales and marketing in the U.S. and Europe, which are large pharmaceutical markets, as key strategic areas, and promote the strengthening and expansion of our overseas business base with a view to expand M&A in the future. |

Strengthen financial base | In preparation for further M&A and other large-scale growth investments in the U.S. and Europe, they will reduce interest-bearing liabilities and improve equity ratio, while considering sale of treasury shares to strengthen the financial base and secure funds for growth investments. |

(2) Tightening Corporate Governance | |

Improve transparency and soundness of management | To further improve the transparency and soundness of management, the company is actively considering increasing the ratio of independent outside directors in its Board of Directors and transitioning to a company with an audit committee. |

Strategic diversification of human resources | To ensure diversity among employees, including women, mid-career hires, and non-Japanese, and develop core human resources that will contribute to the company's sustainable growth, while continuing to improve the personnel evaluation system and other personnel-related systems that will lead to fairer and more productive workforces. |

(3) Improving Accountability | |

Enhancement of information disclosure | To continue to enhance information disclosure to improve corporate value over the medium to long term, and promote the translation of notices of convocation and other disclosure documents into English. |

Promote dialogue with investors | In addition to existing financial results briefings for institutional investors, analysts, and individual investors, they will promote more opportunities for dialogue, such as individual meetings with domestic and overseas institutional investors. |

【Mid-term goal】

| March 2021 Act. | March 2022 Act. | March 2023 Est. | March 2024 Est. | March 2025 Est. |

Sales | 10,279 | 11,555 | 11,420 | 12,086 | 12,814 |

Operating income | 453 | 1,085 | 658 | 880 | 1,001 |

* Unit: million yen

The company achieved its mid-range targets for sales in the fiscal year ending March 2023 and operating income in the fiscal year ending March 2025, which were indicated in the plan for compliance with the criteria for maintaining listing, ahead of schedule in the fiscal year ended March 2022. The company intends to revise the mid-range targets and aim to increase its corporate value over the medium to long term through sustained growth and improved profitability.

4.Fiscal Year ending March 2023 Earnings Forecasts

(1) Consolidated results

| FY 3/22 Act. | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY |

Sales | 11,555 | 100.0% | 12,440 | 100.0% | +7.7% |

Operating Income | 1,085 | 9.4% | 1,224 | 9.8% | +12.7% |

Ordinary Income | 1,183 | 10.2% | 1,204 | 9.7% | +1.7% |

Parent Net Income | 790 | 6.8% | 871 | 7.0% | +10.2% |

*Unit: million yen

Sales up 7.7% year on year, operating income up 12.7% year on year

As of the end of the second quarter, the earnings forecast for the fiscal year March 2023 is unchanged, calling for a 7.7% year-on-year increase in sales to 12,440 million yen and a 12.7% year-on-year rise in operating income to 1,224 million yen. The company aims to reach the full-year earnings forecast by posting sales more swiftly through the thoroughgoing management of progress of projects ordered, concluding contracts and starting operations for projects more speedily, making new deals, which are now under negotiation, to increase sales, and rigorously controlling personnel costs and other expenses according to projects ordered.

Sales will increase year on year due to the steady receipt of orders for large-scale global projects in the U.S. and Europe. Operating income is also expected to increase year on year due to strict control of the cost of sales, mainly in the business in Japan, despite investments in human resources associated with business expansion in Europe and the U.S. and IT investments for digitization of operations and information security, etc.

The ratio of operating income to sales is expected to rise 0.4 points from the previous term to 9.8%. Ordinary income is expected to increase 1.7% year on year without the expected foreign exchange gains, which is less than the increase in operating income.

The company plans to pay a common dividend of 14 yen per share, unchanged from the previous term. The company intends to use retained earnings as a resource for growth, hiring employees and establishing overseas bases, to increase corporate value over the medium to long term, and plans to provide stable profit returns for the time being.

(2) Medium-term Management Vision

The company advocates being the strongest CRO, not the largest. To be the strongest CRO, the company must be knowledge-intensive rather than labor-intensive and achieve the highest profitability in the industry. To achieve this, each member of the team aims to outperform the competition in terms of revenue per capita.

In addition, the company's mid-term management vision is "to become a strategic partner for clients as a global CRO from Japan," and the company will concentrate on the following strategies:

Business Focus | ◆To provide a global, one-stop-shop for services related to clinical trials. ◆Covering all phases of clinical trials. ◆To provide high-quality and speedy services with a focus on diseases with high development difficulty such as oncology and central nervous system diseases. |

Client Focus | ◆To build long-term and strategic partnerships with a wide range of clients from major pharmaceutical companies to promising biotech companies in Europe and the U.S. ◆Commitment to quality, provision of speedy and flexible services, and pursuit of client satisfaction. |

Global Coverage | ◆Coverage of a wide range of countries and regions, with a focus on major markets (Japan, the U.S., and Europe) ◆To strategically expand service areas, including the southern hemisphere, and enhance global presence by establishing a system that enables prompt collection of data on all diseases. |

A map of possibility of further area expansion

(Source: Linical)

5.Conclusions

In the second quarter of the fiscal year March 2023, sales grew 7.2% year on year, but operating income dropped 26.4% year on year. Unfortunately, operating income declined year on year, but increased considerably quarter on quarter. In the first quarter (April to June), the company recorded an operating loss of 26 million yen, but in the second quarter (July to September), the company posted an operating income of 400 million yen. This is because the ratio of projects in service declined temporarily in the first quarter due to the delay in commencement of large-scale international joint trials in Europe and the U.S. caused by the war between Russia and Ukraine, but it recovered both in the U.S. and Europe in the second quarter. The progress rate of operating income in the first half of this term toward the full-year earnings forecast is about 30%, so it seems difficult to reach the full-year forecast. However, considering that the operating income forecast in the second half is 851 million yen and the operating income in the second quarter (July to September) was about 400 million yen, showing the rise in profitability, it cannot be said that it is difficult to reach the forecast for the second half. In the second half of this term, the company aims to reach the full-year earnings forecast, by posting sales more swiftly through the thoroughgoing management of progress of projects ordered, concluding contracts and starting operations for projects more speedily, making new deals, which are now under negotiation to increase sales, and rigorously controlling personnel costs and other expenses according to projects ordered. Their performance in the third quarter is noteworthy, to check how much they can increase profit to reach the full-year earnings forecast. In addition, the company achieved the target sales for fiscal year March 2023 and the target operating income for fiscal year March 2025, which were set in the mid-term plan, in fiscal year March 2022, so there is a high possibility that the goals in the mid-term plan will be revised upwardly. The new goals in the mid-term plan are noteworthy.

Recently, the company has been receiving orders healthily. The backlog of orders as of November 14, 2022 was as high as 23,601 million yen, up 4.8% from the end of the term ended March 2022, keep exceeding 20 billion yen. When projects under negotiation for signing contracts after receiving provisional orders are taken into account, the real backlog of orders exceeds 25 billion yen. It is noteworthy how much the company can increase the backlog of orders, which is a leading indicator for business expansion.

The active utilization of real-world data for developing pharmaceutical products is expected to bring big business chances to the company. This is a mid/long-term scenario, but we would like to see what kinds of benefits will be brought by the utilization of global real-world data to the CRO and Contract Medical Affairs businesses of the company with expectations.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎Corporate Governance Report

Last updated on June 30, 2022

<Basic Policy>

(1) Management Philosophy

Our management philosophy is “To promote the greater wellbeing of all our stakeholders — patients, business partners, shareholders, and employees — we strive constantly to offer professional, high-quality services to support all aspects of new drug development..” We aim to contribute to the development, evolution and diffusion of new therapeutic technologies including new pharmaceuticals, and ultimately to the healthy lives of human beings, by continuously developing and maintaining the knowledge and experience of our executives and employees, as well as the know-how and systems of our organization.

(2) Basic Approach on Corporate Governance

Based on the above management philosophy, our company will contribute to the birth and growth of new disease prevention and therapeutic technologies, including new pharmaceuticals, with our know-how and technologies in pharmaceutical development. As a partner of healthcare companies and medical institutions, including domestic and foreign bio-venture firms, pharmaceutical companies, and medical device manufacturers, our company will contribute to the development of healthcare and meet the expectations of patients and the entire society.

Since our business activities impact people's lives, our executives and employees are required to have high ethical standards as well as expertise. Thus, we thoroughly comply with the Corporate Code of Conduct, including strict compliance with laws. In addition, we strive to improve corporate value and business development by enhancing internal control and ensuring the soundness and transparency of management.

<Regarding the implementation of the principles of the corporate governance code>Major principles for not implementing and the reasons

Principles | Reasons for not implementing the principles |

[Supplementary Principle 1-2④ Exercise of rights at a general meeting of shareholders] | Our company recognize that it is necessary to develop an environment where shareholders can exercise voting rights easily. As for the development of an environment where voting rights can be exercised electronically (such as the use of an electronic voting rights execution platform) and the translation of convocation notices into English, we will discuss them while considering the ratios of institutional investors and overseas investors, etc. In addition, the English translation of the Notice of Convocation is available on our company’s website. URL: https://www.linical.co.jp/en/news/17thOrdinaryGeneralMeetingofShareholders.pdf |

[Principle 1-3 Basic policy for capital measures] | In order to enhance shareholder value in the medium/long term and actualize sustainable growth, our company will conduct strategic investment for securing financial soundness and sustainable growth. In detail, the basic policy for securing financial soundness is to maintain the level of shareholders’ equity that can tolerate growth investment and risk. As for the strategic investment for sustainable growth, we will allocate internal reserves to the investment for establishing systems for international joint clinical trials, which are indispensable for business development, the enrichment of footholds through M&A, etc. to improve the capital efficiency. As for dividends, which mean the return of profits to shareholders, the basic policy is to optimize the balance between the improvement in our corporate value through mid/long-term growth and return to shareholders, and we aim to return profits in a stable manner. Regarding the above basic policies for capital measures, we will consider providing explanations via our website, etc. |

[Supplementary Principle 2-4 (1) Ensuring diversity in the appointment of core human resources] | We have not set voluntary and measurable targets for ensuring diversity at this time. However, as stated in Supplementary Principle 2-4 (1) of [Disclosure Based on the Principles of the Corporate Governance Code], the group assume that ensuring diversity by employing women and mid-career hires has progressed to a certain extent. Going forward, we will continue to promote the active participation of diverse human resources to create an environment where each employee can maximize their abilities and characteristics and develop these human resources. |

[Supplementary Principle 3-1 (3) Sustainability Initiatives] [Supplementary Principle 4-2 ② Formulation, etc. of Basic Policies Regarding Our Company’s Sustainability Initiatives] | 1. Sustainability Initiatives We are committed to sustainable development together with society based on our management philosophy: "To promote the greater wellbeing of all our stakeholders — patients, business partners, shareholders, and employees — we strive constantly to offer professional, high-quality services to support all aspects of new drug development.” To achieve this, we conduct our business with two missions in mind: "Supporting the development of innovative pharmaceuticals" and "Ensuring the safety of pharmaceuticals. Specifically, as a company involved in clinical trials, we have established a corporate code of conduct based on the principle of respect for the human rights and personal dignity of all those involved, including test subjects. By adhering to this code, each and every director and employee is aware of their "social responsibility" and conducts corporate activities with integrity. In addition, since its establishment, the Company has adopted a policy of taking the lead in drug development in areas of high difficulty and high unmet medical needs, in pursuit of contributing to the health and well-being of people around the world through its business activities. Based on the above approach, we are currently studying the basic policy, information disclosure framework, and specific important issues regarding our efforts in sustainability. 2. Investment in human capital For our company, which provides various services as a professional in pharmaceutical development, we believe that our employees are the source of value creation. As stated in Supplementary Principle 2-4 (i), we have established an environment in which each employee can maximize his or her abilities and characteristics, and we have enhanced our education and training programs to acquire the necessary knowledge and skills, including pharmaceutical knowledge. In addition, in an environment where our business is expanding globally and international joint clinical trials are increasing, we are also focusing on developing human resources who can communicate with people from diverse cultural backgrounds, and as a prerequisite for this, we are strengthening English language training and conducting cross-cultural understanding training on a regular basis. We also provide opportunities for young employees to be stationed at overseas subsidiaries (in Europe, the U.S., China, etc.) to develop global human resources. 3. Climate Change Recognizing the importance and urgency of this issue, a working team of related departments has been collecting and analyzing data on climate change, and the results of Scope 2 as GHG emissions are disclosed below (Scope 1 is not applicable). In the future, we will enhance the disclosure of information in line with the framework of the TCFD (Task Force on Climate-related Financial Disclosure). The current status is as follows Governance The Board of Directors has received reports on climate change. The Board of Directors receives reports on climate change and will consider the structure to strengthen governance on climate change. Strategy The Board of Directors has received a report on climate change and will consider how to strengthen governance on climate change. Risk Management The process of integrating climate change risk into the company-wide risk management is under consideration and will be disclosed in the future. Indicators and Targets We will consider the indicators and targets for climate change assessment in the future. GHG emissions (Scope 2) 2021 2020 Non-consolidated (Japan) 290.5t-CO2 289.7t-CO2 Consolidated (Global) 345.9t-CO2 341.0t-CO2 Scope 2 is electricity purchased from external sources. Emission factors are adjusted emission factors by electric power company for Japan, and the latest IEA data for overseas. (emission coefficients are CO2 conversion factors based on the latest IEA data (2021edition). |

[Supplementary Principle 4-10 (1) Appropriate involvement and advice from independent outside directors by establishing an independent nominating/remuneration committee] | The company currently has two independent outside directors and has established a system for communication and coordination with all directors and management and a system for cooperation with corporate auditors. Thus, there are sufficient discussions at the board of directors regarding nominations and compensation. Therefore, we believe that we have been able to carry out highly effective deliberations and supervision in line with the purpose of the Corporate Governance Code. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Supplementary Principle 2-4 (1) Ensuring diversity in the appointment of core human resources] | 1. Concept of ensuring diversity In order to grow as a global company that can contribute to the development of pharmaceuticals around the world, our corporate group promotes the activities of diverse human resources to flexibly respond to the ever-changing society and diverse values, and is establishing a working environment and developing human resources so that each and every employee can maximize their abilities and characteristics. 2. Situation of promotion of the diversity of core human resources (1) Women The promotion of female managers is progressing at the headquarters in Japan as well as throughout the group, and we will further improve the working environment and provide career development support to develop female leaders at the executive officer level and above, who will play core management roles in the future. 【Headquarters (Japan)】 End of March 2022 End of March 2021 Ratio of Female Employees 61.6% 44.4% Ratio of Female Managers 42.6% 19.4% Ratio of Female Executive Officers 16.7% 16.7% 【Corporate Group】 Ratio of Female Employees 67.5% 58.6% Ratio of Female Managers 56.9% 36.5% Ratio of Female Executive Officers 28.6% 25.0%

(2) Foreign Nationals Approximately 50% of the group’s 843 employees (as of March 31, 2022) are locally hired employees residing overseas, and most of the key positions including CEO in the overseas group companies are occupied by highly qualified local human resources. In addition, our company is promoting the hiring of human resources regardless of nationality at our headquarters in Japan. As of the end of March 2022, the ratio of foreign nationals to all employees at the Japanese headquarters was 6.7%. In addition, the ratio of foreign employees in managerial positions was 3.0%. (3) Mid-career hires As of the end of March 2022, the ratio of mid-career hires to all employees at the Japanese headquarters was 41.5%. The ratio of mid-career hires for executive officers is 100%, and the ratio of mid-career hires for managers is 76.2%. As of the end of March 2022, the ratio of mid-career hires to all employees in the entire group was 66.9%. The ratio of mid-career hires for executive officers was 100%, and the ratio of mid-career hires for managers was 85.1%. 3. Human resources development policy for ensuring diversity, in-house environment improvement policy, and its status As a measure to maximize the characteristics and abilities of individual employees, our corporate group promotes the establishment of an environment in which it is easy for employees to work while maintaining balance between work and life even after various life events, and has formulated and is operating country-specific work-friendly systems such as four-day workweeks, flexible working hours, remote work, and shorter working hours. In addition, a universal sharing and learning system has been adopted to ensure thorough compliance with various policies and procedures, including provisions regarding the respect for human rights and prohibition of harassment. |