| Vision Inc. (9416) |

|

||||||||

Company |

Vision Inc. |

||

Code No. |

9416 |

||

Exchange |

TSE 1st Section |

||

Industry |

Information and telecommunications |

||

President |

Kenichi Sano |

||

Address |

Shinjuku i-Land Tower, 6-5-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock price as of the close on February 22, 2018. Number of shares issued at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company. From FY12/16, net income is profit attributable to owners of the parent company. Hereinafter the same shall apply.

* The company conducted a 100-for-1 share split in January 2015 and a 2-for-1 share split in July 2017. This Bridge Report outlines Vision's earnings results for the fiscal year ending December 2017 and the forecast for the fiscal year ending December 2018. |

| Key Points |

|

| Company Overview |

|

The company forms a group with its 14 consolidated subsidiaries, both inside and outside Japan. Of those, the two based in Japan are Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency). There are 12 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Singapore, UK, Hong Kong, Hawaii, Taiwan, China (Shanghai), France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development.  Global WiFi business

The company offers services including "Global WiFi" (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and "NINJA WiFi" (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea, Taiwan and California).  Advantages - the fixed-rate system and strong competitive pricing, the most comprehensive coverage amongst the competitors, smooth usage featuring high-speed Internet, safety/security, and substantial corporate sales capability

(1) The service's cost advantage could be as high as 89.9% compared to the flat rate overseas packet plan of domestic mobile companies (daily rental fees start from 300 yen depending on the locality), and (2) the coverage offered in over 200 countries/regions worldwide is one of the largest scales in the industry. (3) Its partnerships with operators worldwide have enabled a high-speed and smooth user environment (the number of countries/regions employing the high-speed telecommunications standard 4G-LTE is also one of the largest scales in the industry), while (4) the connection is highly secure as the telecommunications are encrypted with 51 service centers worldwide (24/7/365, as of August 2017). As mentioned above, the fact that roughly 50% of its clients are corporate customers promising stable demand is also an advantage of the company.

Information and Communications Service business

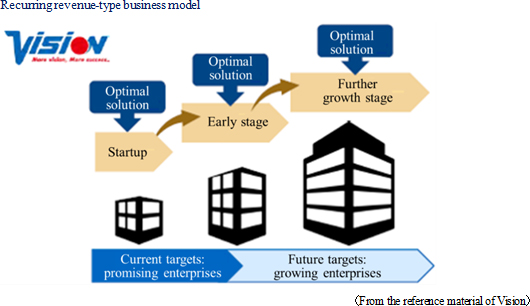

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 7 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunication services such as photocopier/MFP, telephone lines, business phones and corporate mobile phones, broadband lines, sales of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises. Through the agency operations for lines, the company can keep receiving commissions from the telecommunication operators unless services are canceled, and through the lease of photocopiers, the company can keep receiving maintenance fees. This means that in parallel with the growth of clients, the numbers of lines and devices are expected to grow (recurring revenue-type business).The company's feature is to establish a recurring revenue-type business model that will generate revenue by offering optimal services at the best timing according to the customers' growth stage (additional sale of products with high productivity through up/cross selling).  |

| Growth Strategy |

Profitability improvement

As part of profitability improvement, the company introduced "Cloud WiFi Router" mounted with "Cloud WiFi," the next-generation telecommunications technology for managing SIM in a cloud space. Since this makes it possible to allocate carriers around the world without physically inserting a SIM card into a device, it is possible to reduce cost related to shipping by streamlining the shipping operation. As of December 2017, it accounts for approximately 50% of Wi-Fi routers for shipping. The company launched "Global WiFi for Biz," a service exclusively for corporations, which does not require the procedures for application, receipt, or return and can be installed inside a company.

Fostering the travel-related service platform by pursuing synergy with "Global WiFi" and "NINJA WiFi"

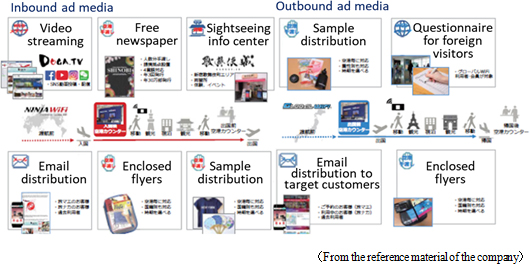

The two main pillars are "Useful Information (media)," which offers information for supporting activities in each travel destination by utilizing guidebooks, promotional gifts, video transmission, facilities, social networking services, emails, etc., and "Useful Service," which solves problems faced during traveling overseas through the rental of the wearable translation device "ili" and a foreign restaurants reservation service. "Useful Information (media)" is an advertisement business which collects advertising rates by targeting information providers to media as advertisers, or fees by sending customers in some cases. In "Useful Service," the company collects fees for the service."Useful Information (media)" can directly reach "Global WiFi (1.5 million users per year)," "NINJA WiFi (3.9 million users per year)," and services of overseas bases and partners (2 million users per year) as contact points. Since each contact point has various media prepared, users can pick what they would like and achieve the best communication in each scene (before the trip, during the trip and after the trip). As for overseas partners, the company started a capital and business partnership in August 2017 with UROAMEDIA LIMITED, which handles a marketing service in the group of China's largest enterprise of foreign Wi-Fi router rental service, Beijing Ulink Technology Co., Ltd.. As Korea's largest enterprise of a foreign Wi-Fi router rental service: WIDE MOBILE Co. Ltd. also has the partnership with the company, it is a business tie-up of the three groups. On the other hand, "Useful service" includes the wearable translation device "ili" (instant translation) rental service and the "POKETALK" (interactive translation) rental service. Both devices cover many languages (63 languages online and offline), and prevent users from losing various opportunities during traveling overseas. New services are bound to be launched as they are ready.  Efficient sales activities based on web-based marketing strategies and CRM utilizing the company's knowhow

The company reels in customers through web-based marketing, achieves a high rate of receiving orders, and promotes repeat orders through continuous contact through customer support, etc. Major targets are newly established corporations with high growth potential. The number of corporations that have been established less than 6 months and started transactions with the company each term is about 17,000. As the company offers optimal services at the best timing according to growth stage, and meets the additional demand for devices, it will further improve the business models through enhancement of sales channels, products and services. As part of this, the company launched the new power service "Haluene Denki" in April 2017. Its agency is increasing client companies by 700 per month. The company highly concentrates on this service.

"Vision business market," the integrated support website for companies

"Vision business market" will expand its major targets into not only start-up companies, small and medium-sized enterprises and venture companies, but also entrepreneurs. It will also offer opportunities to interact with others, such as seminars, in addition to Useful Information, the company's services and business partners' merchandise. The company is planning to meet various business-related demands such as "I would like to interact with many managers who established a corporation when I decide to start a business," "I would like to promote my company's products," "I would like to improve performance with the minimum cost," "I would like to relocate our office, which became too small after the business growth," and "I would like to start a new business."

|

| Fiscal Year December 2017 Earnings Results |

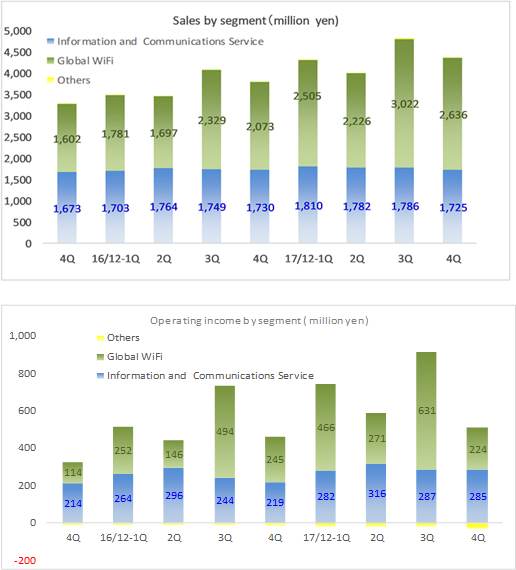

Sales and operating income grew 18.3% and 38.6%, respectively, year on year.

Sales grew 18.3% year on year to 17,554 million yen. Sales of the Global WiFi business increased by 31.8% year on year due to an increase in the number of rentals, and sales in the Information and Telecommunications Service business also grew 2.2%, along with improved profitability.In the Global WiFi business, acquisition of corporate customers and accumulation of repeat users have been promoted as priority measures, and customer acquisition pace has been accelerated also as a result of capturing the demand of individual travelers and inbound travelers. In the Information and Telecommunications Service business, it successfully captured major targets (new companies and venture companies) and accumulated continuing transactions by CRM. Operating income grew 38.6% year on year to 1,788 million yen. Profit margin of the Global WiFi business increased by 0.8% point (14.5% → 15.3%) due to decreased purchasing costs and improved operational efficiency, and profit margin of the Information and Telecommunications Service business increased by 1.8% points (14.7% → 16.5%) due to growth in highly profitable services. With the introduction of Cloud WiFi, for the Global WiFi business, line use efficiency improved, shipping process was reduced, and productivity improved. In addition, the company succeeded in responding to increasing orders while reducing personnel expenses by introducing FAQ using AI, increasing number of automatic delivery lockers, "Smart Pickup," and introducing self-registration KIOSK terminals including multilingual correspondence and settlement functions. Although the unit price (ARPU) declined because the cost reduction was partially reflected in the service price, it was absorbed by the increase in the number of rentals. Meanwhile, profit of the Information and Communications Service business, which handles a variety of products, grew 14.4% year on year, although sales increased only by 2.2% year on year as sales composition changed. Other reasons include relatively large sales growth of the previous term and appearance of the merit of scale.     Issued stock options with charge in order to enhance willingness and motivation and strengthen cohesiveness.

The company issued stock options with charge (stock acquisition rights) to the directors and employees of the company and the employees of the company's subsidiaries. The objective is to enhance motivation, improve morale and strengthen cohesiveness in seeking to expand business performance and corporate value over the medium to long term. They are issued at a fair price, and issue conditions are not particularly favorable. Also, underwriting is carried out based on individual's investment decisions, not as a reward for the persons to be granted (in addition to "issuance at fair value" and "underwriting based on investment decisions," the rights to exercise will be limited depending on the future performance.).

The day of allotment was November 30, 2017, and the due date for payment was December 29, 2017. The exercise price is 2,589 yen.

There were 13,560 stock acquisition rights as of November 30, 2017, and the number of granted shares per paid stock option is 100 shares of common stock (total number of granted shares was 1,356,000 shares). The issue price per paid stock option was 1,600 yen. The exercise price is 2,589 yen, and the exercise period is from April 1, 2019 to March 31, 2025 (7. 3 years for maturity). It is possible to exercise from the 1st day of the following month from the date of submission of the securities report in the period satisfying the performance condition.

Conditions for exercising the rights

Operating income in the fiscal year ending December 2018 should exceed 2.1 billion yen and operating income in the fiscal year ending December 2019 should exceed 2.6 billion yen. ⇒ Ratio of the rights that can be exercised: 30%Operating income in the fiscal year ending December 2020 should exceed 3.1 billion yen. ⇒ Ratio of the rights that can be exercised: 30% Operating income in any fiscal year between the fiscal year ending December 2018 to December 2021 should exceed 3.6 billion yen ⇒ Ratio of the rights that can be exercised:100% |

| Fiscal Year December 2018 Earnings Estimates |

Sales and operating income are estimated to grow 17.3% and 25.9%, respectively, year on year.

In the Global WiFi business, sales are estimated to grow 24.6% year on year due to expansion of channels (increase of sales commission agreements in partnership with travel agencies and corporate agreements, etc.) and incorporation of inbound travelers. Profit is expected to increase by 22.2% year on year, absorbing upfront investment in travel related service platform by sales increase and improvement in operation efficiency. Meanwhile, in the Information and Communications Service business, sales and profit are expected to grow 5.6% and 12.5%, respectively, year on year, as a result of strengthening sales channels and accumulating up/cross selling.

(2) Priority measures in the fiscal year ending December 2018

The key word is "Challenge for evolution." Under this, the company establish two priority measures, namely, to (1) differentiate by expanding business and monetizing peripheral business, and (2) realize to lead the industry overwhelmingly (productivity, market share, and profit).Looking at the priority measures from the viewpoint of "Expansion," "Utilization," and "Stability," as for "Expansion," in order to further expand the customer base, the company will work on diversifying the channels for sales and attracting customers and strengthening sales targeting corporate customers for the Global WiFi business. It will especially focus on increasing the number of registered corporations and corporations that use "Global WiFi for Biz," a standing-type service (the procedures for application, receipt, or return are not required) exclusively for corporations. For the Information and Communications Service business, the company will make efforts to expand customers' inflow channels by using, for example, "Vision Business Market." As for "Utilization," the company will focus on developing and strengthening new businesses that utilize the expanded customer base. Specifically, for the Global WiFi business, it will expand revenues related to advertisement media through travel-related platforms and increase related services. For the Information and Communications Service business, it will develop and sell in-house developed workflows and SFAs (sales support tools), etc. As for "Stability" (enhancing productivity), in addition to improving sales efficiency, further reducing costs and improving operation efficiency for the Global WiFi business, it will make efforts to improve productivity by actively utilizing AI, RPA (work automation by robots), and IoT throughout the company. |

| Conclusions |

|

Meanwhile, the strengths of the Information and Communications Service business, which is achieving steady growth and continuous profit margin improvement (17.6% in the fiscal year ended Dec. 2017, an improvement of 1.1 points), are the capacity to acquire new customers and the recurring revenue-type business model. As a matter of fact, because the customer assets have recently reached quite a large scale, the volume of up/cross selling with high sales efficiency is on an upward trend. Looking ahead, taking advantage of this customer base, the company intends to focus on sales of highly profitable solutions such as in-house developed workflows and SFA etc. For both businesses, "expansion and utilization of the customer base" and "continuous cost reduction and efficiency improvement" are the keys for the future. |

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report Updated on August 10, 2017

Basic policy

Our corporate group improves ourselves to change clients' expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

A new chief executive officer and others are selected by the board of directors from candidates while considering and discussing their personalities, knowledge, experiences, etc. while following its corporate ethos and strategies in the rapidly changing business environment. The company will discuss how to oversee the planning by a successor. <Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The basic policy of Vision is not to hold the shares of other companies strategically, unless it is considered beneficial for improving corporate value in the mid to long terms. As of now, there are no strategically held shares. (1) We disclose our management philosophy, management strategy, etc. on our website.

(2) Basic principles and basic policies regarding corporate governance are disclosed in the Corporate Governance Report and Securities Report.

(3) The amount of remuneration for each director is determined by the Board of Directors in consideration of the company's performance and the degree of contribution to the company, etc. within the limit of the total remuneration resolved at the general meeting of shareholders.

(4) The Board of Directors resolves appointment of management executives and candidates for directors and corporate auditors, by comprehensively taking into account knowledge, experience, ability, etc. of each person.

(5) The reasons for the appointment of each candidate for external officers are disclosed in the reference documents of the notice of convocation of general meeting of shareholders. In the future, we plan to disclose the reasons for appointing candidates for directors and corporate auditors.

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |