| WADAKOHSAN CORPORATION (8931) |

|

||||||||||||||

Company |

WADAKOHSAN CORPORATION |

||

Code No. |

8931 |

||

Exchange |

JASDAQ |

||

Chairperson |

Norimasa Wada |

||

President |

Takero Takashima |

||

Address |

4-2-13, Sakaemachidori, Chuo-ku, Kobe-shi, Hyogo |

||

Year-end |

February |

||

URL |

|||

* The share price is the closing price on October 27. The number of issued shares is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company.

This Bridge Report presents Wadakohsan's earnings results for the first half of the fiscal year ending Feb. 2017 and the forecast for the full business year. |

| Key Points |

|

| Company Overview |

|

[Business philosophy - symbiosis (living together)

The corporate philosophy is "symbiosis," where your way of living contributes to the happiness of others, and values the connections between people and supporting one another. Based on this idea, the company holds up "PREMIUM UNIQUE" as its product concept, and aims to create unique places to live that fit each customer's own way of life, while responding to the feelings of each person who resides there.

Your way of living contributes to others' happiness] [Corporate history]

The real estate leasing business was established in Kobe, in January 1899. In December 1966, the business was incorporated under the name of Wadakohsan Ltd., and in September 1979 it was reorganized into Wadakohsan Co., Ltd. Having achieved success in selling condominiums wholesale, in March 1991, through the company's own brand, "WAKOHRE," the company regularized its condominium business. Following the Great Hanshin Earthquake in January 1995, the company engaged in projects developing superior buildings for earthquake recovery, and contributed to local reconstruction. In September 2004, the company began trading stocks over-the-counter (becoming listed on the JASDAQ in December). In June 2007 the company reached a milestone, having constructed 10,000 residences with the "WAKOHRE" series as the foundation, and in March 2008 it established a detached house business promotion office, and regularized its wooden detached housing business.

[Business segments]

The business segments are divided into sales of condominiums developed for the "WAKOHRE" brand, sales of detached houses developed for the "WAKOHRE-Noie" brand (the sales for both businesses are entrusted to external enterprises), other real estate revenue from dealing in the sale of residential land and rental condominiums, property leasing revenue from the lease of condominiums (the rental condominium brand "WAKOHRE-Vita" and others), stores, parking lots etc., and "other," including things like insurance agency fees not included in the report segment. The sales composition for the term ended Feb. 2016 puts the condominium sales at 80.8%, sales of detached houses at 6.1%, other real estate sales revenue at 5.1%, property leasing revenue at 7.8%, and other at 0.3% (the segment profit composition puts condominium sales at 66.6%, sales of detached houses at 1.3%, other real estate sales at 4.7%, property leasing revenue at 25.3%, and other at 2.1%).

Condominium sales business

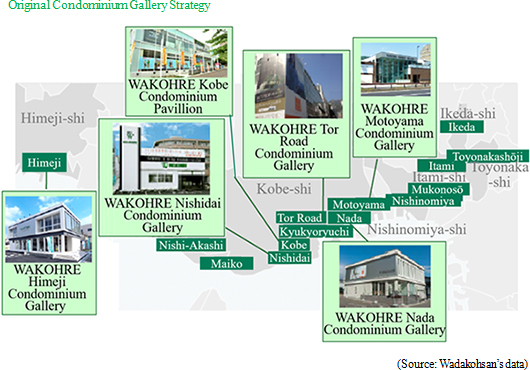

The main areas are the Kobe and Akashi areas (around Kobe-shi and Akashi-shi in Hyogo Prefecture), the Hanshin area (the cities of Ashiya, Nishinomiya and Amagasaki in Hyogo Prefecture) and the area around Itami-shi and Takarazuka-shi in Hyogo Prefecture, and the focus is on developing medium scale condominiums with 30-50 residences under the "WAKOHRE" brand, that do not compete with leading condominium businesses. In addition to community based strategies that focus on highly popular areas, supply different types of condominium to the same area, and take in the diverse needs of the consumers in order to realize high sales performance, the company also has strategies like the condominium gallery, where we push down the sales cost by dealing with multiple cases at the same time using its permanent condominium gallery. Like this, the company's strength is the effective business model it has established using its unique strategies. Furthermore, in recent years the company has been pursuing new possibilities by dealing with large-scale projects, and expanding the area of the business to the Hokusetsu area in Osaka Prefecture, adjoining Kobe and Hanshin, and Himeji-shi in Hyogo Prefecture.

Detached house sales business

Since 2007, the company has been developing around 10 houses with the "WAKOHRE-Noie" brand, in Kobe City and further west. From the large amount of site information the company is able to gather, there are many properties suitable for sale for detached house lots in terms of location, area, and site shape. In addition, where the business period for condominiums is just under two years, these projects can be as short as one year, meaning that they can be used to fill the gaps the period completed the condominium construction (which is also effective for turnover of capital). Utilizing design and planning abilities that take the surrounding environment into consideration, cultivated by the work in condominiums, the company aims to differentiate itself from traditional "power builders."

Other real estate sales business

The company handles planning, development and sales (of single buildings) of real estate for investment like rental condominiums, and the sale of residential land and land for industrial use. As well as shouldering the function of effective utilization of property information, revenue from selling off lease properties (inventory assets) that accompanies property handover is also included in this segment. In order to strengthen sales of single rental housing buildings aimed at investors, the company is carrying out a capital and business partnership with The Japan Living Service Co., Ltd. (8854) , which is listed on the second section of the Tokyo Stock Exchange, and whose specialty is mediation when acquiring sites or selling off property.

Property leasing business

The company mainly manages residential properties (75.5% of the company's asset holdings as of the end of February 2016), stores and offices (19.9%), parking lots (0.6%), and self-storage and other (3.9%). As a business that can maintain a stable cash flow, in an industry that tends to be strongly influenced by condominium market conditions, from its founding the company has continued to contribute to the stability of revenue. Its basic strategies are to assure stable revenue by improving the operating rate (the rate of tenants moving in), and to maintain and improve the quality of its portfolio through movement of property. With the residences that are its main business, keeping in mind the movement of property after a fixed period of time has expired, the asset composition is focused on 200-300 million yen properties, with many hopeful buyers amongst high net worth individuals. The company maintains an occupancy rate of 95%. In addition, by managing assets and liabilities appropriately, it also aims to reduce the risk of lengthening investment return periods, and the risks associated with assets becoming excessive. The yield of each property is high, at 9-10%, and in future, it aims to cover the burden of indirect expenses with the stable revenue from the leasing operations.

Japan's foremost residential area as their region of business

They meet the high demand for housing by making Japan's foremost residential area, between Kobe, Akashi, Hanshin, their main area of business while establishing a comparative advantage with their information capabilities; they even have a reputation for building a community entrenched in the region.

Prevailing WAKOHRE brand in Kansai

Their WAKOHRE brand is prevailing in Kansai, and the power of the brand lets them hold their own against other major condominium developers. In the 18th (2015) Condominium Brand Questionnaire Survey, conducted by the Osaka headquarters of Nihon Keizai Shimbun Inc., they were ranked 5th place in both the Individuality and Familiarity brand sections.

Maintaining sound finances via thorough risk management

They are maintaining sound finances via thorough risk management, have well-balanced suppliers of capital and remain stable. As a result, in their corporate history spanning over 110 years in the real estate industry, where many listed companies have gone out of business, they have only reported a deficit during fiscal year ended Feb. 2010 after being affected by the global financial crisis. They continue to have stable dividends.

Successful in differentiating themselves from major firms, and having room to expand their business areas

Small and medium condominium businesses were eliminated in the Kinki region due to the real-estate recession after the global financial crisis, and only major real estate companies and railway real estate companies survived, however since these real estate companies specialize in large-scale properties and properties along the railroads, there are not many cases where they compete in site acquisitions with Wadakohsan, who develop medium-scale condominium complexes that comprise around 30-50 units of condominium. Yet on the other hand, Wadakohsan have their sights on further expanding their operations, making efforts to develop large properties in the existing business area and expanding the area into Himeji-shi in Hyogo Prefecture and Osaka Prefecture, which are next to their existing business area.

|

| 1st Half of Fiscal Year February 2017 Earnings Results |

Sales double due to increase in the number of condominium deliveries, and operating income grows 4.2 fold yoy

Sales increase 102.9% yoy to 20,950 million yen. In addition to the leveling of sales continuing due to the facilitation of the business cycle, WAKOHRE City Kobe Sannomiya, a major project of 471 total condominium units, was completed in the previous term, and the delivery for the current fiscal year was carried out in the first quarter, thus the number of condominium units delivered was 548, growing 2.8 fold (condominium sales increased 141.1% yoy).In terms of profit, the contributions of units delivered increasing and highly profitable projects led to the gross profit rate of condominium sales increasing 1.7 points to 19.6%, as well as the gross profit rate of detached family housing unit sales recovering to 12.4%. Operating income grew 4.2 fold yoy to 2,584 million yen, offsetting the increase in promotional costs due to the supply of large-scale real estate. Non-operating income and loss also improved due to the reduction in interest expense after the repayment of debts, etc. Condominium sales, which are their primary business, are posted when condominiums are delivered to purchasers after completion. Therefore, quarterly results vary according to development time, construction period, etc. The delivery of WAKOHRE City Kobe Sannomiya was conducted between the fourth quarter of fiscal year ended Feb. 2016 and the first quarter of fiscal year ending Feb. 2017, thus deliveries intensified beyond normal years in the fourth quarter in fiscal year ended Feb. 2016 and in the first quarter in fiscal year ending Feb. 2017. Comparison with initial forecast

Amid the upswing of sales on the back of robust (contract) sales and deliveries mainly in the condominium business, promotional cost was curbed considering favorable sales and the payment of promotional costs was delayed until after the second half of the fiscal year, and so SG&A expenses did not reach initial projections for the term. Interest expenses were also below expectations, and the upswing in ordinary income was larger.

Condominium sales

Sales were 18,616 million yen (141.1% yoy increase) and segment income was 2,451 million yen (484.9% yoy increase). Main property deliveries consist of WAKOHRE City Kobe Sannomiya (147 units), WAKOHRE Fukae-Ekimae Gardens (88 units), and WAKOHRE KOBE Motomachidori (66 units). The number of units delivered in the same period of the previous year was less compared to normal years, and since the delivery of WAKOHRE City Kobe Sannomiya (147 units) was carried out in the first quarter, unit deliveries grew majorly by 183.9% yoy to 548. Meanwhile, the number of units on sale increased 77.8% yoy to 313 via WAKOHRE Oji-koen Harada Mori (3 minute walk from Oji-koen Station, on the Hankyu Kobe line in Nada-ku, Kobe-shi; 36 units in total; on sale in Apr. 2016 and sold), WAKOHRE Diarx Mukonoso (3 minute walk from Mukonoso, on the Hankyu Kobe line, in Amagasaki-shi, Hyogo Prefecture; 24 units in total; on sale in May 2016 and sold). The number of contracted units, which represent the sales situation, increased 21.8% to 357, and the number of units with concluded contracts awaiting delivery decreased 28.4% to 707. Furthermore, thoroughly conducting prudent purchases while considering the increase in site prices led to the number of purchased units decreasing 48.5% to 272. Complete inventory (unsigned) consists of 6 units.  Detached housing unit sales

Sales were 775 million yen (40.0% yoy increase), and segment income was 25 million yen (same period last year had a loss of 42 million yen). The previous period required time for building confirmation and adjustments to the neighborhood, however the number of units delivered in this first half of the fiscal year has increased by 5 to 22, compared to the same period in the previous year.

Other real estate sales

Sales were 351 million yen (61.6% yoy decrease), and segment losses were 2 million yen (same period last year had a profit of 111 million yen). Since fiscal year Feb. 2014, they have been making efforts to develop real estate for investment (small rental homes), and in addition to their wooden housing for investment, they started work on steel frame housing for investment in the current term. In this first half of the fiscal year, they sold 5 wooden housing for investment (11 units), exceeding the 4 in the same period in the previous year, such as WAKOHRE-Viano Kobe Umemotocho (in Chuo-ku, Kobe-shi; 4 units in total), however the backlash that occurred in reporting sales for a technical college dormitory in the same period last year led to a decrease of 61.6% yoy this term.

Property leasing revenue

Property leasing revenue was 1,165 million yen (6.2% yoy increase), and segment income was 483 million yen (6.5% yoy increase). Existing real estate, such as residences, stores and offices, continued to have a high occupancy rate, to which properties purchased in the last period contributed.

Underwrote the third-party allotment of new issued shares of Seikou ukou Co., Ltd., and signed capital and business alliance

In Mar. 2016, the company underwrote 33.3% of new issued shares allocated to a third party of Seikou ukou Co., Ltd., which manages condominiums and rental houses primarily within the Hanshin area, and signed a capital and business alliance.They plan to seek synergy between their development business and condominium management business by incorporating a part of their management duties, which had been delegated to an external source, into their group. They have already entrusted them with the management of their rental homes, and plan to delegate approximately 300 units for them to maintain in the future, along with condominium PJ (approximately 400 units) within the Hanshin area for them to manage. |

| Fiscal Year February 2017 Earnings Estimates |

|

(1) Business environment: market trends for condominiums in the Kinki region indicate average unit price and unit price per m2 will increase; condominium units on sale will drop

Influenced by the negative interest rate policy, finances for real estate are increasing to a large extent. The benchmark land price for commercial land has increased for the first time in 9 years, and residential land has had its range of reduction shortened for 7 consecutive years. Within this context, condominium units supplied in the Kinki region in the first half of fiscal year 2016 decreased 11.5% yoy to 8,941. Price per condominium increased 4.8% yoy to 38.1 million yen, and unit price per m2 rose 10.9% yoy to 623,000 yen; it was the fourth consecutive year to have both price and unit price increase.Expectations from JR opening a new station and re-opening Sannomiya Station in Wadakohsan's main area of business, the area between Kobe-shi and Hanshin, has caused benchmark land prices to rise, and a sense of caution towards high prices have led to new supplies of condominiums in the first half of fiscal year 2016 to decline for both Kobe-shi (50.2% yoy drop to 782) and Hyogo Prefecture (36.1% yoy drop to 881). Unit price per m2 for both Kobe-shi and Hyogo Prefecture increased 13.2% yoy to 624,000 yen and 12.9% to 614,000 yen, respectively.  No changes to earnings forecast for the full business year, with a 10.5% yoy increase in sales and 0.2% yoy decrease in ordinary income

Sales increased 10.5% yoy to 32 billion yen. Although the reshuffling of assets is expected to cause a drop in property leasing revenue, condominium and detached housing unit sales are projected to increase by over 10%. Since site prices and building costs remain at a high level after being affected by the price rise of real estate and labor shortage in the construction industry, and despite the cost rate having a rising trend centered around condominiums, highly profitable projects being included mean the cost rate is forecasted to stop rising at 79.5%, at a 1 point increase. However, increases in promotional costs are anticipated to cause SG&A expenses to rise 12.5% yoy to 3.7 billion yen and operating income to decrease 3.0% to 2.85 billion yen.The dividend amount is scheduled to be 26 yen per share for the year. Commemorative dividends will drop by 3 yen, while ordinary dividends will increase by 3 yen.  (3) Initiatives for each segment

Condominium sales

They plan to increase the number of delivered condominium units for the full business year by 12.2% to 770 (18 buildings; the progress rate at the end of the first half of the fiscal year is 71%). For the second half of the fiscal year, they plan to deliver 222 condominium units (5 buildings), such as WAKOHRE Kobe Kitano The Terrace (9 minute walk from Sannomiya Station on the JR Kobe line, in Chuo-ku, Kobe-shi; 97 condominium units in total; scheduled to be delivered and sold in Nov.) (225 condominiums were initially planned, however 3 were pushed ahead of schedule in the first half, and delivery completed.) Among these, 190 units have been signed to a contract by the end of the first half of the fiscal year (contracted rate of 85.6%).Meanwhile, they planned to purchase 750 condominium units in the full business year, however after prioritizing profitability in their screening of properties, they ended up purchasing 272 (progress rate of 36.3%). Since their lineup for the fiscal year ending Feb. 2018 is set up, they intend to proceed with expanding their area, such as continuing developing into the Hokusetsu area (Osaka Prefecture) in the second half of the fiscal year as well, while thoroughly conducting careful purchases. Moreover, they continue to make efforts to redevelop the "market" of urban shopping districts (area innovation). The "market" is a small community-based shopping district, however with traditional shops closing one after another, revitalizing the region and effective use of real estate is becoming an issue. While on the other hand, in recent years, Wadakohsan has shown that there are growing needs for relocation from suburbs to the city center, and they are making efforts to redevelop the "market" with their own corporate mission of building a community-based town in mind as well. In the Suidosuji area in Nada-ku, Kobe-shi, they have already constructed 3 buildings: WAKOHRE Oji-koen Agurea (delivered in Jan. 2007), WAKOHRE Oji-koen Station Stars (delivered in Feb. 2015), and WAKOHRE Oji-koen Grande (delivered in Aug. 2016).  Detached housing unit sales and other real estate sales

For detached family housing unit sales, they plan to deliver 60 units, exceeding the 45 of the previous term, and increase sales 14.1% yoy to 2 billion yen. Meanwhile, for other real estate sales, they will focus their attention on developing wooden and steel frame housing for investment; currently projects on wooden real estate for investment - 12 buildings and 97 condominium units - and steel frame real estate for investment - 5 buildings and 62 condominium units - are underway. Sales of 1.4 billion yen (4.3% yoy decrease) are projected for the full business year.

Property leasing revenue

They will make efforts into constructing a portfolio from a perspective of focusing on quality rather than quantity. Sales are projected to decrease 2.0% yoy to 2.2 billion yen due to the reshuffling of properties.

|

| Conclusions |

|

The contracted rate for properties delivered in the second half in their primary business already exceeds 85%, thus there is no concern for their earnings in the full business year. They plan to continue prudently making purchases while considering the increase in land prices, however how to further secure capital for growth while avoiding risk will be their challenge in the future. |

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report Updated May 27, 2016

The fundamental policy regarding the company's corporate governance is that establishing a highly transparent and sound, efficient business framework is believed to be an issue of utmost importance, and we are working to perfect it. Although we are a small organization, we are building a simple and efficient organizational framework that also takes mutual checking and balancing, and independence into account. To further strengthen the speeding up of decision making and realizing a highly transparent management, we are striving to strongly maintain the following 5 principles of the governance system.Fundamental way of thinking 1. The manifestation of supervisory functions based on substantial discussion at the board of directors' meeting. 2. Timely and adequate deliberation on important matters for managerial decision-making via the board of managing directors. 3. Implementation of highly effective auditing by the auditor. 4. Establishment of an internal control system via installing an internal auditing room, holding an internal integration committee, etc. 5. Collaboration with external agencies such as law firms to create a compliance structure. Wadakohsan has implemented all the Basic Principles of the corporate governance code. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |