| SHOEI Co., Ltd. (7839) |

|

||||||||

Company |

SHOEI Co., Ltd. |

||

Code No. |

7839 |

||

Exchange |

First Section, TSE |

||

Industry |

Other Products (Manufacturing) |

||

President |

Kenichiro Ishida |

||

Headquarters |

Ueno 5-8-5, Taito-ku, Tokyo |

||

Year End |

September |

||

Website |

|||

*Share price as of close on December 11, 2018. Number of shares outstanding at end of the most recent quarter excluding treasury shares. ROE is from the last year end.

|

||||||||||||||||||||||||

|

|

*Estimates are those of the Company. From the fiscal year September 2016, the definition for net income has been changed to net income attributable to parent company shareholders ( Abbreviated as Parent Company Net Income)

This Bridge Report reports the earnings results for fiscal year September 2018 and full year estimates for fiscal year September 2019 for SHOEI Co., Ltd.

|

| Key Points |

|

| Company Overview |

|

SHOEI is the world's largest helmet manufacturer in the premium helmet market. As for motorcycle helmets, which account for about 90% of total sales, the company specializes in "premium helmets," which have high quality and high added value, and manufactures them in two domestic factories: Ibaraki Factory in Inashiki City, Ibaraki Prefecture and Iwate Factory in Ichinoseki City, Iwate Prefecture. By clinging to domestic manufacturing, the company maintains high quality and prevents its technologies from being leaked. Meanwhile, its sales network covers not only Japan, but also over 70 countries, including European countries and the U.S. The safety, functionality, and beautiful shapes of SHOEI's helmets are highly evaluated around the world, and the SHOEI brand is now synonymous with "premium helmets." The SHOEI group is composed of SHOEI and 5 consolidated subsidiaries in the U.S., Germany (two subsidiaries), France, and Italy.

|

| Fiscal Year September 2018 Earnings |

Sales and operating income grew 9.6% and 7.9%, respectively, year on year.

Sales were 17,148 million yen, up 9.6% year on year. While SHOEI increased sales by 4.4% in Europe, which is the primary market of the company, thanks to the favorable performance of new products, and rose sales by 29.4% in North America, due to the strengthening of its sales network and the healthy performance of new products, the company boosted sales in Japan by 12.9%. In other regions (Asia, Oceania, and South America) where sales dropped in the first half, sales increased in the second half.

Operating income was 3,734 million yen, up 7.9% year on year. The increase in unit prices as well as sales volume contributed, absorbing the augmentation of material costs and SG&A. Since the exchange rate as of the end of the term of the subsidiary (the end of Jun.) was nearly unchanged from the fiscal year September 2017, there was little effect of the exchange rate on profit.

The exchange rates for the sales of SHOEI were 1 US dollar = 109.78 yen (1.14-yen appreciation from the previous term) and 1 euro = 132.03 yen (9.67-yen depreciation from the previous term). The exchange rates for overseas subsidiaries (as of Jun. 29, 2018) were 1 US dollar = 110.54 yen (1.46-yen appreciation from the previous term) and 1 euro = 127.91 yen (0.06-yen appreciation from the previous term).

On Jul. 27, the earnings forecast was revised upwardly, and the results were in line with the forecast as a whole.

The company raised the dividend amount by 8.00 yen/share, paying a term-end dividend of 93.00 yen/share. Sales and operating income grew 9.6% and 7.9%, respectively, year on year.

Sales were 17,148 million yen, up 9.6% year on year. While SHOEI increased sales by 4.4% in Europe, which is the primary market of the company, thanks to the favorable performance of new products, and rose sales by 29.4% in North America, due to the strengthening of its sales network and the healthy performance of new products, the company boosted sales in Japan by 12.9%. In other regions (Asia, Oceania, and South America) where sales dropped in the first half, sales increased in the second half.

Operating income was 3,734 million yen, up 7.9% year on year. The increase in unit prices as well as sales volume contributed, absorbing the augmentation of material costs and SG&A. Since the exchange rate as of the end of the term of the subsidiary (the end of Jun.) was nearly unchanged from the fiscal year September 2017, there was little effect of the exchange rate on profit.

The exchange rates for the sales of SHOEI were 1 US dollar = 109.78 yen (1.14-yen appreciation from the previous term) and 1 euro = 132.03 yen (9.67-yen depreciation from the previous term). The exchange rates for overseas subsidiaries (as of Jun. 29, 2018) were 1 US dollar = 110.54 yen (1.46-yen appreciation from the previous term) and 1 euro = 127.91 yen (0.06-yen appreciation from the previous term).

On Jul. 27, the earnings forecast was revised upwardly, and the results were in line with the forecast as a whole.

The company raised the dividend amount by 8.00 yen/share, paying a term-end dividend of 93.00 yen/share.

The performance of premium helmets remained healthy in all regions of Europe, including Germany, France, and Italy, thanks to robust consumer spending. In North America, the sales of new motorcycles were still sluggish, and the helmet market was on a plateau. In Japan, the sales of new motorcycles of 126 cc or larger displacement were on a plateau, due to robust consumer spending. However, the helmet market expanded, as seniors tend to own more than one high-grade helmet. As the entire Asian economy is growing, the sales of medium and large-sized motorcycles are increasing in China, although the increase rate is lower than before. The helmet market has been healthy as a whole since Aug., although there were some effects of the revision to the helmet specifications.

In this situation, the total sales volume in the world increased 3% year on year to 521,000 products, although some shipments were delayed until the next term due to the typhoon at the end of Sep. In Europe, sales volume declined 5% year on year to 235,000 products, as new products sold well, but the inventory of leading distributors was adjusted. In North America, the company shifted from a 1-distributor system to a 2-distributor system in Oct. last year. Sales volume rose 27% to 90,000 products, as the existing distributor reduced stocks before the shift and the sales of new products, whose shipment began in Mar., were favorable. In Japan, sales volume was firm partially thanks to the release of new products, and increased 9% to 132,000 products. In Asia, total sales volume rose 7% year on year, while in China, sales volume declined 1%, because the helmet specifications were revised in Aug.

"NEOTEC II," a sun visor-attached helmet compatible with an intercom, is highly evaluated for its unorthodox design and intercom function, and became a record-breaking hit.

The performance of premium helmets remained healthy in all regions of Europe, including Germany, France, and Italy, thanks to robust consumer spending. In North America, the sales of new motorcycles were still sluggish, and the helmet market was on a plateau. In Japan, the sales of new motorcycles of 126 cc or larger displacement were on a plateau, due to robust consumer spending. However, the helmet market expanded, as seniors tend to own more than one high-grade helmet. As the entire Asian economy is growing, the sales of medium and large-sized motorcycles are increasing in China, although the increase rate is lower than before. The helmet market has been healthy as a whole since Aug., although there were some effects of the revision to the helmet specifications.

In this situation, the total sales volume in the world increased 3% year on year to 521,000 products, although some shipments were delayed until the next term due to the typhoon at the end of Sep. In Europe, sales volume declined 5% year on year to 235,000 products, as new products sold well, but the inventory of leading distributors was adjusted. In North America, the company shifted from a 1-distributor system to a 2-distributor system in Oct. last year. Sales volume rose 27% to 90,000 products, as the existing distributor reduced stocks before the shift and the sales of new products, whose shipment began in Mar., were favorable. In Japan, sales volume was firm partially thanks to the release of new products, and increased 9% to 132,000 products. In Asia, total sales volume rose 7% year on year, while in China, sales volume declined 1%, because the helmet specifications were revised in Aug.

"NEOTEC II," a sun visor-attached helmet compatible with an intercom, is highly evaluated for its unorthodox design and intercom function, and became a record-breaking hit.

The number of orders was healthy, and the backlog of orders increased 11.0% from the end of the previous term.

The number of orders was healthy, and the backlog of orders increased 11.0% from the end of the previous term.

The balance of assets as of the end of the fiscal year September 2018 was 16,755 million yen, up 1,752 million yen from the end of the previous term. This is mainly because cash and deposits increased 884 million yen, receivables rose 384 million yen, inventories grew 290 million yen, and noncurrent assets increased 202 million yen.

The balance of liabilities was 3,096 million yen, up 348 million yen from the end of the previous term. This is mainly because outstanding taxes augmented 161 million yen, payables rose 49 million yen, outstanding payments increased 48 million yen, and net defined benefit liability augmented 43 million yen, while other payables dropped 50 million yen.

The balance of net assets was 13,659 million yen, up 1,403 million yen from the end of the previous term. This is mainly because retained earnings rose 1,407 million yen. Equity ratio was 81.5% (81.7% as of the end of the previous term).

The balance of assets as of the end of the fiscal year September 2018 was 16,755 million yen, up 1,752 million yen from the end of the previous term. This is mainly because cash and deposits increased 884 million yen, receivables rose 384 million yen, inventories grew 290 million yen, and noncurrent assets increased 202 million yen.

The balance of liabilities was 3,096 million yen, up 348 million yen from the end of the previous term. This is mainly because outstanding taxes augmented 161 million yen, payables rose 49 million yen, outstanding payments increased 48 million yen, and net defined benefit liability augmented 43 million yen, while other payables dropped 50 million yen.

The balance of net assets was 13,659 million yen, up 1,403 million yen from the end of the previous term. This is mainly because retained earnings rose 1,407 million yen. Equity ratio was 81.5% (81.7% as of the end of the previous term).

The balance of cash and cash equivalents as of the end of the fiscal year September 2019 was 8,114 million yen, up 884 million yen from the end of the previous term.

Operating CF was 3,304 million yen, up 1,545 million yen from the end of the previous term. The main factors in increasing operating CF were net income before taxes and other adjustments amounting to 3,747 million yen and a depreciation of 952 million yen, while the main factors in decreasing operating CF were receivables increasing 384 million yen, inventories growing 291 million yen, and the payment of corporate income tax, etc. amounting to 1,007 million yen.

Investing CF was 1,214 million yen, down 175 million yen from the end of the previous term. This is mainly because the company invested 1,114 million yen for purchase of fixed assets, in order to maintain and upgrade production equipment.

Free CF was 2,089 million yen, up 1,370 million yen from the end of the previous term.

Financing CF was 1,172 million yen, down 83 million yen from the end of the previous term. This is mainly because the company paid 1,169 million yen for dividends.

The balance of cash and cash equivalents as of the end of the fiscal year September 2019 was 8,114 million yen, up 884 million yen from the end of the previous term.

Operating CF was 3,304 million yen, up 1,545 million yen from the end of the previous term. The main factors in increasing operating CF were net income before taxes and other adjustments amounting to 3,747 million yen and a depreciation of 952 million yen, while the main factors in decreasing operating CF were receivables increasing 384 million yen, inventories growing 291 million yen, and the payment of corporate income tax, etc. amounting to 1,007 million yen.

Investing CF was 1,214 million yen, down 175 million yen from the end of the previous term. This is mainly because the company invested 1,114 million yen for purchase of fixed assets, in order to maintain and upgrade production equipment.

Free CF was 2,089 million yen, up 1,370 million yen from the end of the previous term.

Financing CF was 1,172 million yen, down 83 million yen from the end of the previous term. This is mainly because the company paid 1,169 million yen for dividends.

|

| Fiscal Year September 2019 Earnings Estimates |

For the fiscal year September 2019, sales are estimated to grow 5.8% while operating income is projected to decline 7.9% year on year.

For the fiscal year September 2019, it is forecasted that sales will grow 5.8% year on year to 18,150 million yen and operating income will drop 7.9% year on year to 3,440 million yen.

As for the premium helmet market, the sales of new motorcycles are healthy in Europe, so the sales of helmets are expected to be firm like in the fiscal year September 2018, unless there is extremely bad weather. In the U.S., the sales of new motorcycles are stagnant, and the helmet market is estimated to be on a plateau, but as the company upgraded its distribution network to a 2-distributor system in Oct. last year, sales volume is projected to be healthy. In Asia, excluding China, business performance is expected to be firm as a whole. In China, sales are forecasted to decrease, because it will take time to respond to the revision to the helmet specs in Aug. In Japan, there is concern over the aging of riders, but the sales mainly to seniors are expected to be healthy like in the fiscal year September 2018, as the employment and income environments are improving before the Olympics. In addition, the company plans to release new primary products one after another in each market, and is expected to maintain or expand its market share.

It is assumed that the exchange rates for SHOEI will be 1 US dollar = 110.00 yen (0.22-yen depreciation from the previous term) and 1 euro = 125.00 yen (7.03-yen appreciation from the previous term) while the exchange rates for overseas subsidiaries will be 1 US dollar = 110.00 yen (0.54-yen appreciation from the previous term) and 1 euro = 125.00 yen (2.91-yen appreciation from the previous term). Foreign exchange sensitivity is 29 million yen per US dollar for sales, 12 million yen per US dollar for net income, 54 million yen per euro for sales, and 23 million yen per euro for net income (per year; the yen depreciation would increase all of them).

The dividend is estimated to be 86.00 yen/share (down 7.00 yen/share from the previous term), which is 50% of the estimated net income per share (173.55 yen/share).

Outlook for the financial position: At the end of the fiscal year September 2019, total assets are estimated to be 17,446 million yen, up 690 million yen from the end of the fiscal year September 2018; liabilities are projected to be 3,454 million yen, up 358 million yen; and net assets are forecasted to be 13,992 million yen, up 332 million yen.

Outlook for cash flow: It is estimated that operating CF will grow 3,183 million yen, investing CF will decrease 1,288 million yen, financing CF will drop 1,280 million yen, and the balance of cash and cash equivalents as of the end of the fiscal year September 2019 will be 8,729 million yen, up 614 million yen. For the fiscal year September 2019, sales are estimated to grow 5.8% while operating income is projected to decline 7.9% year on year.

For the fiscal year September 2019, it is forecasted that sales will grow 5.8% year on year to 18,150 million yen and operating income will drop 7.9% year on year to 3,440 million yen.

As for the premium helmet market, the sales of new motorcycles are healthy in Europe, so the sales of helmets are expected to be firm like in the fiscal year September 2018, unless there is extremely bad weather. In the U.S., the sales of new motorcycles are stagnant, and the helmet market is estimated to be on a plateau, but as the company upgraded its distribution network to a 2-distributor system in Oct. last year, sales volume is projected to be healthy. In Asia, excluding China, business performance is expected to be firm as a whole. In China, sales are forecasted to decrease, because it will take time to respond to the revision to the helmet specs in Aug. In Japan, there is concern over the aging of riders, but the sales mainly to seniors are expected to be healthy like in the fiscal year September 2018, as the employment and income environments are improving before the Olympics. In addition, the company plans to release new primary products one after another in each market, and is expected to maintain or expand its market share.

It is assumed that the exchange rates for SHOEI will be 1 US dollar = 110.00 yen (0.22-yen depreciation from the previous term) and 1 euro = 125.00 yen (7.03-yen appreciation from the previous term) while the exchange rates for overseas subsidiaries will be 1 US dollar = 110.00 yen (0.54-yen appreciation from the previous term) and 1 euro = 125.00 yen (2.91-yen appreciation from the previous term). Foreign exchange sensitivity is 29 million yen per US dollar for sales, 12 million yen per US dollar for net income, 54 million yen per euro for sales, and 23 million yen per euro for net income (per year; the yen depreciation would increase all of them).

The dividend is estimated to be 86.00 yen/share (down 7.00 yen/share from the previous term), which is 50% of the estimated net income per share (173.55 yen/share).

Outlook for the financial position: At the end of the fiscal year September 2019, total assets are estimated to be 17,446 million yen, up 690 million yen from the end of the fiscal year September 2018; liabilities are projected to be 3,454 million yen, up 358 million yen; and net assets are forecasted to be 13,992 million yen, up 332 million yen.

Outlook for cash flow: It is estimated that operating CF will grow 3,183 million yen, investing CF will decrease 1,288 million yen, financing CF will drop 1,280 million yen, and the balance of cash and cash equivalents as of the end of the fiscal year September 2019 will be 8,729 million yen, up 614 million yen.

(2) Important theme for the fiscal year September 2019

① To enhance productivity by increasing the capability of manufacturing (equipment installation and manpower increase), JIT (improvement) activities, etc.

SHOEI will pursue the original goal of increasing production output from 500,000 products to 600,000 products per year between the fiscal year September 2018 and the fiscal year September 2020. In order to attain this goal, the company will enhance productivity and sales single-mindedly by investing in equipment, increasing manpower, developing new promising models, and improving the Just-in-Time (JIT) system. In the fiscal year September 2019, the company plans to produce 548,000 products (working on 10 holidays). (2) Important theme for the fiscal year September 2019

① To enhance productivity by increasing the capability of manufacturing (equipment installation and manpower increase), JIT (improvement) activities, etc.

SHOEI will pursue the original goal of increasing production output from 500,000 products to 600,000 products per year between the fiscal year September 2018 and the fiscal year September 2020. In order to attain this goal, the company will enhance productivity and sales single-mindedly by investing in equipment, increasing manpower, developing new promising models, and improving the Just-in-Time (JIT) system. In the fiscal year September 2019, the company plans to produce 548,000 products (working on 10 holidays).

② To analyze the needs of customers thoroughly, fuse electronics and IT, and release new attractive models.

By doing so, the company aims to raise unit prices of its products.

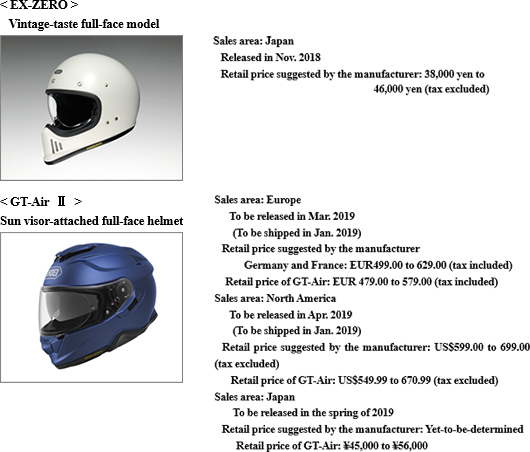

New products to be released in the fiscal year September 2019

② To analyze the needs of customers thoroughly, fuse electronics and IT, and release new attractive models.

By doing so, the company aims to raise unit prices of its products.

New products to be released in the fiscal year September 2019

③ Brand strategy

Under the recognition that it is difficult to expand the market considerably in advanced countries, the company aims to strengthen its brand power and retain consumers and leading retailers, by promoting the personal fitting system (PFS), utilizing the Internet, and pursuing effective advertisement.

The period of the contract with Mr. Marc Marquez, a famous racer, will end in 2020.

In the personal fitting system (PFS), each part of the head is measured meticulously, to obtain the optimal helmet size, and by using a dedicated pad, the company will produce the inner parts that fit each user perfectly like a custom-made product.

④ Sales promotion in promising markets

Development of products that satisfy the new safety standards for helmets in the Chinese market

State Council of China changes certification standards for manufactured products

Currently, in terms of safety standards, helmets sold to China are exported under the Japanese Industrial Standards (JIS), but due to the State Council of China announcing a change in certification standards for manufactured products last September (items subject to the change were released on Oct. 11), there will be new safety standards (*GB 811-2010) in China (excluding Hong Kong) effective from Aug. 1, 2018. Because some helmets currently on sale would be difficult to obtain certification from the Chinese authorities under the new standard, the company is considering changing specifications and is reviewing product strategy.

Main features of the GB811-2010 standard

③ Brand strategy

Under the recognition that it is difficult to expand the market considerably in advanced countries, the company aims to strengthen its brand power and retain consumers and leading retailers, by promoting the personal fitting system (PFS), utilizing the Internet, and pursuing effective advertisement.

The period of the contract with Mr. Marc Marquez, a famous racer, will end in 2020.

In the personal fitting system (PFS), each part of the head is measured meticulously, to obtain the optimal helmet size, and by using a dedicated pad, the company will produce the inner parts that fit each user perfectly like a custom-made product.

④ Sales promotion in promising markets

Development of products that satisfy the new safety standards for helmets in the Chinese market

State Council of China changes certification standards for manufactured products

Currently, in terms of safety standards, helmets sold to China are exported under the Japanese Industrial Standards (JIS), but due to the State Council of China announcing a change in certification standards for manufactured products last September (items subject to the change were released on Oct. 11), there will be new safety standards (*GB 811-2010) in China (excluding Hong Kong) effective from Aug. 1, 2018. Because some helmets currently on sale would be difficult to obtain certification from the Chinese authorities under the new standard, the company is considering changing specifications and is reviewing product strategy.

Main features of the GB811-2010 standard

Penetration resistance test: In the 3 kg × 3 m penetration test, the striker should not come in contact with the dummy's head. Penetration resistance test: In the 3 kg × 3 m penetration test, the striker should not come in contact with the dummy's head.

Helmet weight limit: All sizes of full face or jet helmets (A type) should weigh less than 1,600 g.

Japan Industrial Standard (JIS) Helmet weight limit: All sizes of full face or jet helmets (A type) should weigh less than 1,600 g.

Japan Industrial Standard (JIS)

Penetration resistance test: In the 3 kg × 2 m penetration test, the striker should not come in contact with the dummy's head. Penetration resistance test: In the 3 kg × 2 m penetration test, the striker should not come in contact with the dummy's head.

Helmet weight limit: None in particular.

In Asia, excluding China, such as Taiwan, Thailand, and Malaysia, the company will allocate its managerial resources into mainly promising fields.

Its market share is low in Thailand, whose market is relatively large. Accordingly, the company will strive to expand sales there, by reviewing distributors, etc. Helmet weight limit: None in particular.

In Asia, excluding China, such as Taiwan, Thailand, and Malaysia, the company will allocate its managerial resources into mainly promising fields.

Its market share is low in Thailand, whose market is relatively large. Accordingly, the company will strive to expand sales there, by reviewing distributors, etc.

|

| Conclusions |

|

In the fiscal year September 2018, new products sold well. Furthermore, the new products to be released in the fiscal year September 2019 are estimated to contribute considerably. The backlog of orders as of the end of the term was up 11.0% year on year, and the number of orders until Nov. 2018 reportedly exceeded the production capacity of the company. Since the figures in financial statements strongly depend on exchange rates, its business performance is affected by exchange rates, but we would like to evaluate the company highly, because it has been increasing sales volume and unit prices steadily. In addition, the streamlining of business operation has been progressing soundly. Since exchange rates are estimated while assuming the yen appreciation, if exchange rates do not change, financial results will improve accordingly.

In China, the company is struggling to cope with the tightened local regulations, but in Europe, the company is forecasted to keep performing well. In the U.S. and Thailand, the reform of sales systems is estimated to contribute to revenue. The company has been successful, but there is a great potential for expanding sales in the U.S., Thailand, etc. Its business is promising.

At the latest briefing session, they mentioned the possibility of utilizing cash and deposits, which seem to be somewhat excessive.

|

| <Reference: Regarding Corporate Governance> |

Basic Views

Our company considers it as the most important issue in corporate management to seek steady growth and profit in mid-long term, improving the company value. To realize this, we think it is important to build good relationships between us and our shareholders, client companies, employees, and each stakeholder and supply good products that can make our clients satisfied. This view is written on "World's Top Levels in Three Realms ( World's Top Product Quality, World's Top Cost Competitiveness, World's Most Delightful Company" and "Basic Policy" to let all of us know. We are going to carry out various measures to enhancing our corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 4-2】 Roles and duties of the Board of Directors (2)

At SHOEI, the positions of executives and staff are always fair, and the company environment does not impede proposals. The executives (called "advisors" or "directors" at the company) in the management team recognize issues in the workplace for which he or she was responsible, and present those issues and their possible solutions during discussion venues such as management meetings. At these venues, honest and open-minded discussions are held between the proposer, director, and executives. Remuneration for senior executives is a fixed annual salary based on ability, contribution to the previous year's performance, etc., while taking lifestyle factors into consideration.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】 Strategically held shares

We do not hold the shares of other companies in a strategic manner or conduct any risky securities investment.

【Principle 1-7】 Transactions among parties concerned

Our company has no plans to make transactions with parties concerned other than the transactions for distributorship, outsourcing of distribution and marketing with subsidiaries and related transactions, and has not made such transactions so far. In addition, the "action guidelines" in the compliance regulations stipulate that personal matters shall be distinguished from business matters in the transactions with the company that are handled by executives, employees, or related personnel. We will not make any transactions among parties concerned other than the transactions with subsidiaries.

【Principle 5-1】 Policy for constructive dialogue with shareholders

Our company always tries to communicate with shareholders and investors in a fair manner, and promote active dialogues with them through one-on-one meetings, including the briefing sessions for individual investors and the financial results briefing sessions for institutional investors, the mass media and financial institutions, which are held by executives and the section in charge of IR (the business administration division).

In addition, the shareholding ratio of foreign investors is 32.3% (the term ended Sep. 2015). We continue highly transparent, sincere dialogues with foreign investors, and IR activities. In addition, the ratio of foreign shareholders is around 33%, and the company continues to conduct IR activities and open sincere, transparent dialogue with foreign investors.

Basic Views

Our company considers it as the most important issue in corporate management to seek steady growth and profit in mid-long term, improving the company value. To realize this, we think it is important to build good relationships between us and our shareholders, client companies, employees, and each stakeholder and supply good products that can make our clients satisfied. This view is written on "World's Top Levels in Three Realms ( World's Top Product Quality, World's Top Cost Competitiveness, World's Most Delightful Company" and "Basic Policy" to let all of us know. We are going to carry out various measures to enhancing our corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 4-2】 Roles and duties of the Board of Directors (2)

At SHOEI, the positions of executives and staff are always fair, and the company environment does not impede proposals. The executives (called "advisors" or "directors" at the company) in the management team recognize issues in the workplace for which he or she was responsible, and present those issues and their possible solutions during discussion venues such as management meetings. At these venues, honest and open-minded discussions are held between the proposer, director, and executives. Remuneration for senior executives is a fixed annual salary based on ability, contribution to the previous year's performance, etc., while taking lifestyle factors into consideration.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】 Strategically held shares

We do not hold the shares of other companies in a strategic manner or conduct any risky securities investment.

【Principle 1-7】 Transactions among parties concerned

Our company has no plans to make transactions with parties concerned other than the transactions for distributorship, outsourcing of distribution and marketing with subsidiaries and related transactions, and has not made such transactions so far. In addition, the "action guidelines" in the compliance regulations stipulate that personal matters shall be distinguished from business matters in the transactions with the company that are handled by executives, employees, or related personnel. We will not make any transactions among parties concerned other than the transactions with subsidiaries.

【Principle 5-1】 Policy for constructive dialogue with shareholders

Our company always tries to communicate with shareholders and investors in a fair manner, and promote active dialogues with them through one-on-one meetings, including the briefing sessions for individual investors and the financial results briefing sessions for institutional investors, the mass media and financial institutions, which are held by executives and the section in charge of IR (the business administration division).

In addition, the shareholding ratio of foreign investors is 32.3% (the term ended Sep. 2015). We continue highly transparent, sincere dialogues with foreign investors, and IR activities. In addition, the ratio of foreign shareholders is around 33%, and the company continues to conduct IR activities and open sincere, transparent dialogue with foreign investors.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018 Investment Bridge Co., Ltd., All Rights Reserved |