| SHOEI Co., Ltd. (7839) |

|

||||||||

Company |

SHOEI Co., Ltd. |

||

Code No. |

7839 |

||

Exchange |

First Section, TSE |

||

Industry |

Other Products (Manufacturing) |

||

President |

Kenichiro Ishida |

||

Headquarters |

Ueno 5-8-5, Taito-ku, Tokyo |

||

Year End |

September |

||

Website |

|||

*Share price as of close on December 9, 2016. Number of shares outstanding at end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From the current fiscal year, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated as Parent Company Net Income)

This Bridge Report discusses the earnings results for fiscal year September 2016 and estimates for fiscal year September 2017 for SHOEI Co., Ltd.

|

| Key Points |

|

| Company Overview |

|

Management Policy: Achieve World Top in Three Realms

<Business Description>

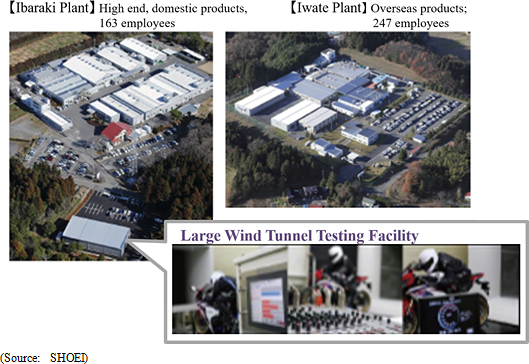

Motorcycle use helmets account for about 90% of total sales. SHOEI focuses upon high value added "premium helmets" that are manufactured at its two plants in Ibaraki (Inashiki City) and Iwate (Ichinoseki City) Prefectures in Japan. The Company is able to maintain high quality levels and prevent the leakage of its technology by maintaining manufacturing facilities within Japan.

<Basic Maintaining Basic Policy for Medium and Long Term Stable Growth and Stable Profit Profitability>

(1) Protect Own Company by Ourselves(2) Made in Japan and maintaining constant employment (Transmission of Manufacturing) (3) Maintain healthy financial positions (4) Continuation of Investment (Development of new products, Cost saving, Improvement of quality, Firm safety) (5) Targeting #1 in All Premium Helmet Markets in the World (6) Development of New Markets and Deepening of Existing Markets (7) Fair distribution of retained earnings (50% dividend of profit after tax, distribution to employees and distribution to company (proper retained earnings kept)) At the end of fiscal year September 2016, current ratio, which reflects the Company's ability to meet its short-term payment commitments, stood at 533.5%,; fixed ratio, which reflects the Company's long-term financial safety, stood at 21.3%; and capital adequacy ratio stood at 78.0% with no outstanding debt. SHOEI's balance sheet proves that its management philosophy is successful in achieving its goals of (1) defending our own Company and (3) maintaining healthy financial conditions. With the manufacture of all its products at two domestic plants, one each located in Ibaraki and Iwate Prefectures, SHOEI (5) strives to achieve the number one position in the global premium helmet market by (2) maintaining manufacturing functions and high levels of employment in Japan (Carrying on the craftsmanship tradition), (4) conducting ongoing investments (New product development, cost reductions, product quality improvements, higher levels of safety), and (6) developing new markets and strengthening its positioning in existing markets' through the coordinated effort with its overseas subsidiaries. <Focus Upon Craftsmanship to Maintain Top Market Share - Two Domestic Plants in Ibaraki and Iwate Manufacture 100% of Products>

SHOEI produces premium brand helmets that are recognized as the highest quality products by motorcycle riders around the world. Their helmets boast of extremely intricate designs that provide not only superb functionality with superior wind resistance characteristics, but are also very fashionable looks. SHOEI's persistence in its pursuit of helmet designs that are "comfortable to their users" is the driving force behind its top market share.SHOEI has two manufacturing bases in Japan, namely the Ibaraki Plant and the Iwate Plant. Safety regulations for life-saving helmets vary in each market, whether it is Japan, Europe or North America. Therefore, the Ibaraki Plant chiefly produces helmets for Japan, while the Iwate Plant mostly for overseas markets. The Company, in principle, maintains consistency between each of the plants and its targeted market, and thus has been successful in keeping each plant's productivity high.    |

| Fiscal Year September 2016 Earnings Results |

Sales Decline 0.7%, Ordinary Income Rise 4.9%

Sales declined by 0.7% year-on-year to ¥14.138 billion. The strengthening of the yen caused sales in Europe and North America to decline, but sales within Japan remained strong (Up 14.2% year-on-year) and growth derived from efforts to fortify sales channels in China absorbed most of the decline. In addition to 6.2% year-on-year growth in sales volumes of premium helmets, sustained introduction of new products with higher value addition contributed to an increase in average product pricing.Profits were significantly affected by the stronger yen (a factor contributing for a ¥521 million decline in profit), but economies of scale, increases in pricing, and improvements in productivity kept the decline of gross profit at a relatively small margin of 2.9% down year-on-year. The overall reductions in expenses caused sales, general and administrative expenses to decline by 3.9% year-on-year, and exceeded the estimate at the beginning of the term by slightly less than 26%. Non-operating income improved due to the booking of profit from foreign exchange gains of ¥89 million (Compared with a loss of ¥117 million in the previous term) and allowed ordinary income to rise by 4.9% year-on-year to ¥3.244 billion. Declines in extraordinary loss and tax burden allowed net income to rise by 9.8% year-on-year to ¥2.192 billion. SHOEI's average exchange rate assumptions for sales were ¥109.57 per United States dollar (¥120.04 in the previous term) and ¥125.15 per euro (¥137.48 in the previous term). Foreign exchange rate assumptions for overseas subsidiaries were ¥102.91 per United States dollar (¥122.45 in the previous term) and ¥114.39 per euro (¥137.23 in the previous term). Moreover, SHOEI was able to beat its profit estimates by a large margin despite its upward revision to full year earnings estimates upon the announcement of its third quarter earnings results (Sales, and operating, ordinary and net incomes of ¥14.1, ¥2.860, ¥2.970 and ¥2.0 billion respectively). SHOEI is expected to raise dividend by ¥7 to ¥79 per share, which is in keeping with the Company's target of maintaining a consolidated dividend payout ratio of 50%.  Markets for helmets in other regions expanded overall. With regards to SHOEI, an expansion in both the medium to large sized motorcycle sales and the helmet market in China contributed to strong growth in sales volume and value of 52.9% and 62.5% year-on-year respectively. While SHOEI had relied solely upon a single distributor in Beijing, China, aggressive marketing conducted by a new distributor in Xiamen, China, with which a sales agreement has been newly formed, contributed to invigorated activities by the Beijing distributor and favorable sales growth. In addition, SHOEI's sponsorship of sales campaigns held by major Japanese motorcycle manufacturers, which are seeing strong growth in medium to large sized motorcycles, is also acting as a tailwind for sales in China.     Total capital investments amounted to ¥848 million (¥923 million in the previous term) including ¥171, ¥89 and ¥57 million spent on molds, laser processing equipment and open pre-forming equipment respectively. Depreciation amounted to ¥614 million (Compared with ¥509 million in the previous term). |

| Fiscal Year September 2017 Earnings Estimates |

|

<Change in President, Other Managers>

Kenichiro Ishida assumed the position of President of SHOEI effective from October 1, 2016. Mr. Ishida originally joined Mitsubishi Corporation in April 1983. He then became Senior Advisor to SHOEI in May 2013. Mr. Ishida was appointed as the managing director of overseas sales in December of the same year. He was responsible for directing overseas sales in various regions including Europe. Masaru Yamada resigned from his position as Chairman on December 21, 2016 to become an advisor to SHOEI.

Estimates Call for Sales to Rise 1.9%, Ordinary Income to Fall by 25.4% Year-On-Year

Despite the influence of the stronger yen, sales volumes are expected to rise in all geographic regions except North America. At the same time, introduction of new high value added products are expected to contribute to a rise in the average unit price of products. In addition, SHOEI will endeavor to raise its output capacity through further increases in productivity and improvements in the work environment. As part of these measures, the renewal of molding equipment will be conducted ahead of schedule. Consequently, capital investment is expected to rise from ¥848 million in the previous term to ¥1.157 billion in the coming term (Depreciation is also expected to rise from ¥614 to ¥658 million over the same period).The main factors contributing to the anticipated decline in operating income include foreign exchange and higher cost of sales, and sales, general and administrative expenses amounting to ¥375, ¥100 (Including ¥30 million for labor expenses) and ¥120 million respectively. SHOEI bases its estimates on assumptions for foreign exchange of ¥105.00 per United States dollar (¥109.57 in the term just ended), and ¥116.00 per euro (¥125.15 in the term just ended). Overseas subsidiaries base their earnings estimates (June 30, 2017) upon foreign exchange assumptions of ¥105.00 and ¥116.00 for the United States dollar and euro respectively (¥102.91 and ¥114.39 respectively). While SHOEI had booked euro foreign exchange reservations at the start of the term, the Company is considering using reservations on a shorter term monthly basis in light of the large fluctuations in the foreign exchange rates recently (Because much of the dollar based business is paid in dollars, the use of reservations will be limited to a minimum amount). A ¥60 per share dividend is expected to be paid at the end of the term.  (3) New Products Introduced in 2016 and 2017

New Products Introduced in 2016

The most premium grade on-road full-face type helmet (Flagship racing model) "X-Spirit III (Europe)" and "X-14 (North America and Japan) models were newly introduced to the three geographic regions of Japan, North America and Europe. The "J・O" products were introduced in Japan and Europe to help create a new product category for SHOEI, as the "J・O" model helmet introduced in Europe and Japan represents a new product category that is an open face type helmet with an inner compartment shield that targets riders of custom and classic motorcycles (The introduction of this product has been limited to Europe and Japan because of differing regulations in other markets).

X-14 (North America, Japan), X-Spirit III (Europe)

J・O

New Products To Be Launched in 2017

RYD (Europe, Japan),

RF-SR (North America)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conclusions |

|

At the same time, SHOEI is implementing efforts to address the issue of restructuring its sales network in the United States. The SHOEI brand is strong and its share of the United States premium helmet market is high, but its sales have thus far been affected more largely by the intention of the local sales distributor than by market conditions due to its reliance upon this single sales distributor in the United States. Along with that the current contract with this distributor will end in September 2017, the Company is considering rebuilding the sales network. Consequently, results of new potential opportunities in North America and continued growth in China and other Asian markets should be watched closely from fiscal year September 2018 onwards. |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report Updated on Jun. 17, 2016

Basic Views

Our company considers it as the most important issue in corporate management to increase shareholder value not only by recognizing the importance of corporate ethics based on compliance with laws and regulations but through expeditious management decision-making in response to the changing society and economic environment as well as improvement of management soundness.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

In our company, the executives are all put on a level playing field, resulting in a circumstance that does not interfere with any proposal. The management (in our company, "counselors and general managers") builds an awareness of issues in executing duties they are in charge of and proposes problems and solutions for them at meetings such as management meetings. Freewheeling and fair discussion is held among a proposer, the directors and the management. In addition, considering various factors including subsistence wages, the management is paid a fixed remuneration determined based on the gradational salaries assessed according to their competence, their contribution to business performance in the previous year, and the like. <Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Our company does not strategically hold any shares, or does not invest in any high-risk securities.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. |