| Ferrotec Holdings Corporation (6890) |

|

||||||||

Company |

Ferrotec Holdings Corporation |

||

Code No. |

6890 |

||

Exchange |

JASDAQ |

||

Industry |

Electric Equipment (Manufacturing) |

||

President |

Akira Yamamura |

||

HQ Address |

Nihonbashi Plaza Building, Nihonbashi 2-3-4, Chuo-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

* Share price as of closing on December 3, 2018. Number of shares issued at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From the FY3/16, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated as parent net income).

|

| Key Points |

|

| Company Overview |

|

Ferrotec Holdings Corporation conducts various technological services and manufactures and sells semiconductor and FPD manufacturing equipment parts including consumable products and thermal element "thermoelectric modules" as core products of the Electronic Device Business Segment, and various products in the photovoltaic related business. Ferrotec Group consists of 42 subsidiaries (35 consolidated subsidiaries, 1 non-consolidated equity accounting method held subsidiary, 5 equity accounting method held affiliated companies, 1 non-equity accounting method held non-consolidated subsidiary).

Ferrotec was born as a company with highly unique technologies including thermoelectric modules with uses in thermal elements and vacuum technologies that respond to magnetic fluids that were born from the NASA space program in the 1980s. Over the course of its 30 year history of operations, the Company has developed a wide range of diverse technologies with applications in the automobile, electronics, next generation energy and other industries. As a transnational company, Ferrotec deploys its businesses in Japan, Europe, the Americas, China, and Asia, and boasts of marketing, development, manufacturing, sales, and management capabilities in various countries and regions. A holding company structure was implemented from April 2017.

<Corporate Philosophy and Code of Conduct>

Corporate Philosophy

Bringing Satisfaction to Customers

Caring About the Environment

Providing Dreams and Vitality to the World

Code of Conduct

Our Company and its employees will endeavor to harmonize with the global society, and act with sincerity firmly based upon our corporate philosophy and social common sense. In addition, we will observe the laws and ordinances of each country, as a company which supplies products and services which contribute to the lives of people around the world.

Ferrotec Group's goal is to offer high quality products and services in the realms of "new energy" and "electronics," and gain the trust of customers by satisfying them through the provision of price competitive products and services.

Ferrotec Group will proactively promote activities that take the global environment into consideration as one of our most important management tasks and to adapt to the latest environment control technologies to our products and services. In addition, we seek to develop material, products, and services that can be utilized in "new energy" applications and as part of our efforts to resolve various problems confronting the global environment.

Ferrotec Group seeks to contribute to society by leveraging our core technologies and to be a company which continuously satisfies the expectations of our customers, stockholders, employees, clients, communities, and other stakeholders. Furthermore, all of our activities will be conducted to remain in strict compliance with laws, ordinances, social orders, international rules and social common sense.

<Business Segments>

Ferrotec's operations can be divided between the Equipment Related business segment, where Vacuum Feedthrough, quartz products, and other ceramic products used in semiconductor, FPD, and LED related manufacturing equipment are produced, the Electronic Device Business Segment, where thermoelectric module application products are made, and the photovoltaic business segment, where silicon crystal, PV wafers, and crucibles used in crystal manufacturing devices are produced. In fiscal year March 2018, sales of the Equipment Related, electronic device, and Photovoltaic Related Business Segments accounted for 48.7%, 14.0% and 23.1% (FY3/17 = 43.7%, 17.1% and 25.4%) of total sales respectively, while saw blades, equipment part cleaning, machine tool, and other products not included in reported segments accounted for 14.1% (FY3/17 = 13.8%).

Equipment Related Business

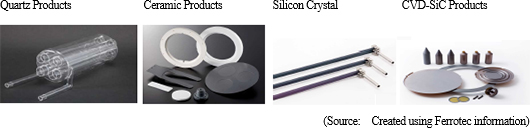

Ferrotec provides total engineering services in the Equipment Related business segment, including the manufacture and sale of Vacuum Feedthrough of equipment parts for solar power, semiconductor, FPD and LED applications, consumable products used in manufacturing of devices, quartz products, ceramic products, CVD-SiC products, silicon wafer processing and equipment cleaning services.

The main product of Vacuum Feedthrough boasts of top market share in the world, and is a functional part that insulates the interior of manufacturing equipment from gas and dust contamination while supporting rotating action of the above mentioned equipment. These Vacuum Feedthrough use magnetic fluids (Fluids that respond to magnetic fields), which has been a core technology of Ferrotec since its founding. Because of instability in these applications arising from their link with corporate capital investments cycles, the Company focuses its marketing efforts upon expanding sales to applications for which demand is more stable, including transportation equipment, precision robots, and general industry usages. In addition, Ferrotec has also focused its efforts upon assuming consigned manufacture of vacuum chambers that use Vacuum Feedthrough and gate valves (Both use vacuum related equipment).

At the same time, quartz, ceramic, and CVD-SiC products are critical elements in the process of semiconductor manufacturing. Quartz products are able to resist high temperature conditions that exist in the semiconductor manufacturing process, and are a high purity silica glass product that protects semiconductors from undergoing chemical reaction by preventing it from activating with gas. The Company boasts of semiconductor manufacturing equipment manufacturers as their main clients in Japan and overseas who purchase ceramic products, which are Ferrotec's core material and technology. At the same time, semiconductor inspection tools for machinable ceramics and fine ceramics used in semiconductor manufacturing equipment are two main products in this realm.

CVD-SiC products are the term used to describe SiC products manufactured by "CVD method (Chemical Vapor Deposition method)" (created from compounds of silicon and carbon gas). Currently, semiconductor equipment and structural parts are provided, and research and development for products used in aeronautics and space (Turbine, mirrors), automobile (Power semiconductors), energy (Nuclear power related), information technology (Semiconductor manufacturing equipment parts) and other applications are also being conducted. Ferrotec is leveraging its strengths and capabilities in six Inch diameter silicon wafer processing to expand into eight Inch wafers, and boasts of the top share of the manufacturing equipment parts cleaning market in China.

Electronic Device Business

Thermal element "thermoelectric modules" are products that can instantly raise or lower temperatures to a highly precise degree and are a core product of this business. Thermoelectric modules are used primarily in heated automobile seats, and also in a wide range of other applications including heated wafers in semiconductor manufacturing equipment, genetic analysis equipment, optical communications, and consumer electronics. Ferrotec is also working on developing new demand and expanding further applications through cost reduction and quality improvement through development of new products using high performance materials and introduction of automated lines. Earnings of magnetic fluids, including applications currently being developed for use in fishing reels (Water protecting internal seals) and speakers for 4K televisions, are also conducted.

Photovoltaic Business

Ferrotec entered the photovoltaic related business in 2005, and manufactures and sells silicon crystal manufacturing equipment, consumable products including quartz crucibles, and silicon products used in photovoltaic applications. Based upon the current needs of the market, the Company is conducting manufacture and sales of silicon-use multiple crystal vessels (Manufactured using quartz processing technologies), single crystal crucibles manufactured when making ingots, and consigned manufacturing of silicon crystal ingots and wafers used in photovoltaic substrates. The Company is promoting transfer of technologies cultivated in the photovoltaic product realm to high value added semiconductor applications.

|

| First Half of Fiscal Year March 2019 Earnings Results |

Sales and Operating Income Rose 5.2% and 12.7% Year-On-Year

Sales rose by 5.2% year-on-year to ¥45.230 billion during the first half of fiscal year March 2019. The factors influencing this performance include declines in sales of the photovoltaic related business arising from a deterioration in market conditions attributed to reviews of fixed purchase pricing of electricity by the Chinese Government and restraint in introduction of new electric generation facilities, and declines in electronic device business sales due to difficulties encountered by thermoelectric modules for automobile seat automated heating applications, which were offset by sales growth and profitability improvements in the semiconductor production device business on the back of quartz, fine ceramics and other materials products that allowed sales of the semiconductor production device business to rise by 24.6% year-on-year.

With regard to profits, improvement in profitability and an increase in sales of the semiconductor production device business were able to offset the influence of inventory evaluation loss arising from lower of cost or market accounting techniques and allowed gross income to rise by 12.9% year-on-year. Increases in sales, general and administrative expenses arising from increases in both sales and the number of subsidiaries (An increase of 8 from the end of the previous fiscal year) were also absorbed to allow operating income to grow by 12.7% year-on-year to ¥5.069 billion.

While non-operating income improved due to an increase in equity earnings in affiliated companies from ¥117 million in the previous first half to ¥294 million in the current first half and booking of foreign exchange translation gains (¥96 million in the current term compared with ¥312 million in the previous term), the disappearance of ¥147 million in extraordinary profit booked in the previous term and the increase in loss on disposal of aging noncurrent assets and interest on delayed payment associated with a litigation matter caused extraordinary loss to rise from ¥54 million in the previous term to ¥282 million in the current term. Sales and Operating Income Rose 5.2% and 12.7% Year-On-Year

Sales rose by 5.2% year-on-year to ¥45.230 billion during the first half of fiscal year March 2019. The factors influencing this performance include declines in sales of the photovoltaic related business arising from a deterioration in market conditions attributed to reviews of fixed purchase pricing of electricity by the Chinese Government and restraint in introduction of new electric generation facilities, and declines in electronic device business sales due to difficulties encountered by thermoelectric modules for automobile seat automated heating applications, which were offset by sales growth and profitability improvements in the semiconductor production device business on the back of quartz, fine ceramics and other materials products that allowed sales of the semiconductor production device business to rise by 24.6% year-on-year.

With regard to profits, improvement in profitability and an increase in sales of the semiconductor production device business were able to offset the influence of inventory evaluation loss arising from lower of cost or market accounting techniques and allowed gross income to rise by 12.9% year-on-year. Increases in sales, general and administrative expenses arising from increases in both sales and the number of subsidiaries (An increase of 8 from the end of the previous fiscal year) were also absorbed to allow operating income to grow by 12.7% year-on-year to ¥5.069 billion.

While non-operating income improved due to an increase in equity earnings in affiliated companies from ¥117 million in the previous first half to ¥294 million in the current first half and booking of foreign exchange translation gains (¥96 million in the current term compared with ¥312 million in the previous term), the disappearance of ¥147 million in extraordinary profit booked in the previous term and the increase in loss on disposal of aging noncurrent assets and interest on delayed payment associated with a litigation matter caused extraordinary loss to rise from ¥54 million in the previous term to ¥282 million in the current term.

Vacuum seals were negatively influenced by inventory adjustments arising from delays in manufacturing investments by major panel makers in China and Korea for organic EL panel applications. However, strong demand from metal products processing for semiconductor manufacturing equipment vacuum processes allowed sales to rise by 19.2% year-on-year. New projects for material products used in semiconductor wafer processing, memories, IoT and automobile related applications roes on the back of strong investments, and higher demand for consumable materials from semiconductor end-users allowed quartz product sales to rise by 41.7% year-on-year. At the same time, overseas applications of semiconductor inspection jig materials (Machinable ceramic "photoveel") and of etching equipment for fine ceramics remained strong and allowed ceramic product sales to rise by 29.7% year-on-year. Manufacturing equipment parts cleaning sales (Semiconductor manufacturing equipment, liquid crystal panel manufacturing equipment parts cleaning), which show are strongly correlated to semiconductor manufacturing equipment capacity utilization rates, rose by 50.4% year-on-year (Included in "others" business segment) due in part to increases in FAB facilities primarily by semiconductor manufacturing clients within China. At the same time, the selection of alternative materials contributed to a deterioration in demand for certain products contributed to a 21.4% year-on-year decline in CVD-SiC product sales, and wafer processing sales declined by a smaller margin of 3.2% year-on-year due to temporary halt of operations to respond to environmental issues.

Moreover, the fifth manufacturing equipment parts cleaning facility currently being constructed in Tongling City, Anhui Province in China is expected to begin operations after the start of the coming year. Furthermore, processing for eight Inch wafers was restarted in July and has reached a level of 80,000 units per month and is currently undergoing client evaluations. Six Inch wafer processing capability of 400,000 units per month was established during the first half.

Vacuum seals were negatively influenced by inventory adjustments arising from delays in manufacturing investments by major panel makers in China and Korea for organic EL panel applications. However, strong demand from metal products processing for semiconductor manufacturing equipment vacuum processes allowed sales to rise by 19.2% year-on-year. New projects for material products used in semiconductor wafer processing, memories, IoT and automobile related applications roes on the back of strong investments, and higher demand for consumable materials from semiconductor end-users allowed quartz product sales to rise by 41.7% year-on-year. At the same time, overseas applications of semiconductor inspection jig materials (Machinable ceramic "photoveel") and of etching equipment for fine ceramics remained strong and allowed ceramic product sales to rise by 29.7% year-on-year. Manufacturing equipment parts cleaning sales (Semiconductor manufacturing equipment, liquid crystal panel manufacturing equipment parts cleaning), which show are strongly correlated to semiconductor manufacturing equipment capacity utilization rates, rose by 50.4% year-on-year (Included in "others" business segment) due in part to increases in FAB facilities primarily by semiconductor manufacturing clients within China. At the same time, the selection of alternative materials contributed to a deterioration in demand for certain products contributed to a 21.4% year-on-year decline in CVD-SiC product sales, and wafer processing sales declined by a smaller margin of 3.2% year-on-year due to temporary halt of operations to respond to environmental issues.

Moreover, the fifth manufacturing equipment parts cleaning facility currently being constructed in Tongling City, Anhui Province in China is expected to begin operations after the start of the coming year. Furthermore, processing for eight Inch wafers was restarted in July and has reached a level of 80,000 units per month and is currently undergoing client evaluations. Six Inch wafer processing capability of 400,000 units per month was established during the first half.

Thermoelectric module demand from semiconductor manufacturing equipment wafer cooling, consumer equipment, and biomedical applications rose, but lower automobile sales in the North American market led to inventory adjustments which contributed to a decline in automobile seat automated heating applications. The lower automobile sales in North America also led to declines in sales of magnetic fluids for automobile audio speaker applications as well.

In addition, a new plant for power semiconductor substrates is currently being constructed in Dongtai City, Jiangsu Province in China to expand supply capacity and is scheduled to begin operation in July.

Thermoelectric module demand from semiconductor manufacturing equipment wafer cooling, consumer equipment, and biomedical applications rose, but lower automobile sales in the North American market led to inventory adjustments which contributed to a decline in automobile seat automated heating applications. The lower automobile sales in North America also led to declines in sales of magnetic fluids for automobile audio speaker applications as well.

In addition, a new plant for power semiconductor substrates is currently being constructed in Dongtai City, Jiangsu Province in China to expand supply capacity and is scheduled to begin operation in July.

Quartz crucibles benefitted from higher sales of single crystal crucibles used in semiconductor applications, but termination of manufacturing and sales of multiple crystal square tanks used in photovoltaic applications, and the negative influence of Chinese Government's subsidies reviews during the latter part of the first half caused sales of quartz crucibles to decline by 31.7% year-on-year. Also, photovoltaic use silicon suffered from weaker demand and lower pricing caused by reviews of subsidies by the Chinese Government and sales fell by 55.8% year-on-year. At the same time, product quality issues caused shipments of OEM applications of photovoltaic use silicon to be halted, and disposal of inventories caused this business to see a loss during the latter part of the first half. Photovoltaic cells also suffered a decline in pricing due to the Chinese Government subsidy reviews.

Quartz crucibles benefitted from higher sales of single crystal crucibles used in semiconductor applications, but termination of manufacturing and sales of multiple crystal square tanks used in photovoltaic applications, and the negative influence of Chinese Government's subsidies reviews during the latter part of the first half caused sales of quartz crucibles to decline by 31.7% year-on-year. Also, photovoltaic use silicon suffered from weaker demand and lower pricing caused by reviews of subsidies by the Chinese Government and sales fell by 55.8% year-on-year. At the same time, product quality issues caused shipments of OEM applications of photovoltaic use silicon to be halted, and disposal of inventories caused this business to see a loss during the latter part of the first half. Photovoltaic cells also suffered a decline in pricing due to the Chinese Government subsidy reviews.

Total assets rose by ¥22.042 billion from the end of the previous fiscal year to ¥140.5 billion at the end of the current first half. Cash and deposits rose on the back of assumption of long term debt and issuance of corporate bonds, and construction under progress for eight Inch wafer processing, quartz crucibles, and ceramic products facilities to expand production capacity rose. Intangible noncurrent assets grew on the back of an increase in land usage rights of subsidiaries in China. Capital adequacy ratio declined from 43.3% at the end of the previous fiscal year to 36.7% at the end of the current first half.

Total assets rose by ¥22.042 billion from the end of the previous fiscal year to ¥140.5 billion at the end of the current first half. Cash and deposits rose on the back of assumption of long term debt and issuance of corporate bonds, and construction under progress for eight Inch wafer processing, quartz crucibles, and ceramic products facilities to expand production capacity rose. Intangible noncurrent assets grew on the back of an increase in land usage rights of subsidiaries in China. Capital adequacy ratio declined from 43.3% at the end of the previous fiscal year to 36.7% at the end of the current first half.

Capital investments during the first half rose by 136.4% year-on-year to ¥11.114 billion due primarily to investments of subsidiaries in Shanghai, Hangzhou, Yinchuan, Dongtai subsidiaries in China of ¥0.954, ¥5.607, ¥1.453 and ¥1.542 billion respectively, and the land usage rights of Chinese subsidiaries amounting to ¥915 million. Depreciation rose by 38.4% year-on-year to ¥2.651 billion.

Capital investments during the first half rose by 136.4% year-on-year to ¥11.114 billion due primarily to investments of subsidiaries in Shanghai, Hangzhou, Yinchuan, Dongtai subsidiaries in China of ¥0.954, ¥5.607, ¥1.453 and ¥1.542 billion respectively, and the land usage rights of Chinese subsidiaries amounting to ¥915 million. Depreciation rose by 38.4% year-on-year to ¥2.651 billion.

|

| Fiscal Year March 2019 Earnings Estimates |

Ferrotec Estimates Call for Record Sales, Profits to Be Achieved in Full Year

Ferrotec estimates for the full year call for sales to rise by 1.5% year-on-year to ¥92.0 billion. Based upon the new outlook for pricing in the solar power generation panel market to decline, sales of the photovoltaic related business are now also expected to decline by a large 57.0% year-on-year. Also, sales of the electronic device business are expected to fall by 5.5% year-on-year. However, sales of the semiconductor production device business are expected to grow by 30.7% year-on-year on the back of strong sales of quartz and ceramic products.

Operating income is expected to rise by 16.2% year-on-year to ¥9.8 billion despite the downward revision to sales and because of the improvement in gross income margin by 1.4% points over its estimate at the start of the year of 28.5% which will allow for gross income to fall short of initial estimates by only a small margin of 1.5%. Reviews of various expenses are expected to allow sales, general and administrative expenses to be reduced from initial estimates, which in turn are expected to allow operating income to remain in line with its initial estimate.

Capital investments and depreciation are expected to rise by 225.2% and 19.4% year-on-year to ¥40.0 and ¥5.0 billion respectively. Ferrotec’s foreign exchange rate assumptions for the United States dollar is ¥105.00 and the Chinese yuan is ¥16.00 (Compared with ¥112.04 and ¥16.63 respectively in the previous term).

Ferrotec expects to pay a yearend dividend of ¥12 per share, for a full year dividend of ¥24 per share when combined with the first half dividend payment. Ferrotec Estimates Call for Record Sales, Profits to Be Achieved in Full Year

Ferrotec estimates for the full year call for sales to rise by 1.5% year-on-year to ¥92.0 billion. Based upon the new outlook for pricing in the solar power generation panel market to decline, sales of the photovoltaic related business are now also expected to decline by a large 57.0% year-on-year. Also, sales of the electronic device business are expected to fall by 5.5% year-on-year. However, sales of the semiconductor production device business are expected to grow by 30.7% year-on-year on the back of strong sales of quartz and ceramic products.

Operating income is expected to rise by 16.2% year-on-year to ¥9.8 billion despite the downward revision to sales and because of the improvement in gross income margin by 1.4% points over its estimate at the start of the year of 28.5% which will allow for gross income to fall short of initial estimates by only a small margin of 1.5%. Reviews of various expenses are expected to allow sales, general and administrative expenses to be reduced from initial estimates, which in turn are expected to allow operating income to remain in line with its initial estimate.

Capital investments and depreciation are expected to rise by 225.2% and 19.4% year-on-year to ¥40.0 and ¥5.0 billion respectively. Ferrotec’s foreign exchange rate assumptions for the United States dollar is ¥105.00 and the Chinese yuan is ¥16.00 (Compared with ¥112.04 and ¥16.63 respectively in the previous term).

Ferrotec expects to pay a yearend dividend of ¥12 per share, for a full year dividend of ¥24 per share when combined with the first half dividend payment.

As a result of the large reduction in estimates for the photovoltaic related business, total sales in the second half are now expected to decline by 1.8% year-on-year and fall below initial estimates by 10.1%. At the same time, the semiconductor production device business sales estimates have been revised upwards due to strong demand for consumable products within the quartz products category. With regard to profits, Ferrotec maintains its estimates for the full year despite the higher than expected first half profits, and now the full year estimates appear conservative given that the second half estimates have actually been revised downwards (Suggesting that there may be some potential for better profits in the second half).

As a result of the large reduction in estimates for the photovoltaic related business, total sales in the second half are now expected to decline by 1.8% year-on-year and fall below initial estimates by 10.1%. At the same time, the semiconductor production device business sales estimates have been revised upwards due to strong demand for consumable products within the quartz products category. With regard to profits, Ferrotec maintains its estimates for the full year despite the higher than expected first half profits, and now the full year estimates appear conservative given that the second half estimates have actually been revised downwards (Suggesting that there may be some potential for better profits in the second half).

While sales of vacuum seals in the second half are expected to rise above both the second half of the previous year and the first half of the current year, sales of to semiconductor manufacturing equipment, organic EL, and LCD applications are expected to trend weakly.

The quartz product category, with a high amount of consumable materials, is expected to trend favorably in the second half, supported by demand from increased production by Chinese semiconductor manufacturers and new FAB applications. Sales of Si board and Si parts used in high temperature processes of miniaturization are expected to grow and the outlook for the second half has been raised by a large margin. Ferrotec is taking steps to expand its manufacturing capacity in response to increased demand from major OEM manufacturers, and construction is progressing on its Changshan Plant in China. In addition, Ferrotec is planning to open a development and manufacturing facility in Yamagata Prefecture in Japan (Expected to begin operations in spring 2019 as a next generation product facility) as part of efforts to strengthen next generation product development. Demand for ceramic products for overseas semiconductor inspection jigs (Machinable ceramic "photoveel") and fine ceramic for overseas etching equipment applications in the second half is expected to exceed that of both the previous second half and the current first half.

Sales of CVD-SiC products, which also show a strong correlation to semiconductor manufacturing equipment capacity utilization rates, including high purity temperature resistant materials used in semiconductor manufacturing equipment inside and outside of Japan are expected to grow strongly during the second half over both the second half of the previous year and the first half of the current year. Efforts will also be made to strengthen collaboration for development and prototype creation between the various groups, along with facilitation of the manufacturing structure in response to increases in demand for semiconductor manufacturing equipment materials.

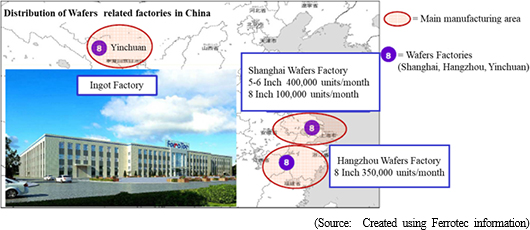

Against the backdrop of strong market conditions for wafer processing, strong capacity utilization rates for six Inch wafers is expected to continue during the second half. Capacity of eight Inch wafers, for which production was restarted in July, is expected to reach 100,000 units per month during the first half of fiscal year March 2020. Combined with the 100,000 unit per month capacity of the Shanghai Plant and the efforts to establish 350,000 units per month production capacity at the Hangzhou Plant within fiscal year March 2021, the total output capacity is expected to reach 450,000 units per month.

With a view to increases in capacity utilization of production lines at client semiconductor factories during the second half and the subsequent demand for parts cleaning services, Ferrotec expects operations to start operations of a plant being constructed in Tongling City, Anhui Province and at the second factory in Neijian City, Sichuan Province within fiscal year March 2020. The Company will also consider further additions to its capacity with a view to increases in demand from its semiconductor manufacturing and flat panel display manufacturing clients in China.

While sales of vacuum seals in the second half are expected to rise above both the second half of the previous year and the first half of the current year, sales of to semiconductor manufacturing equipment, organic EL, and LCD applications are expected to trend weakly.

The quartz product category, with a high amount of consumable materials, is expected to trend favorably in the second half, supported by demand from increased production by Chinese semiconductor manufacturers and new FAB applications. Sales of Si board and Si parts used in high temperature processes of miniaturization are expected to grow and the outlook for the second half has been raised by a large margin. Ferrotec is taking steps to expand its manufacturing capacity in response to increased demand from major OEM manufacturers, and construction is progressing on its Changshan Plant in China. In addition, Ferrotec is planning to open a development and manufacturing facility in Yamagata Prefecture in Japan (Expected to begin operations in spring 2019 as a next generation product facility) as part of efforts to strengthen next generation product development. Demand for ceramic products for overseas semiconductor inspection jigs (Machinable ceramic "photoveel") and fine ceramic for overseas etching equipment applications in the second half is expected to exceed that of both the previous second half and the current first half.

Sales of CVD-SiC products, which also show a strong correlation to semiconductor manufacturing equipment capacity utilization rates, including high purity temperature resistant materials used in semiconductor manufacturing equipment inside and outside of Japan are expected to grow strongly during the second half over both the second half of the previous year and the first half of the current year. Efforts will also be made to strengthen collaboration for development and prototype creation between the various groups, along with facilitation of the manufacturing structure in response to increases in demand for semiconductor manufacturing equipment materials.

Against the backdrop of strong market conditions for wafer processing, strong capacity utilization rates for six Inch wafers is expected to continue during the second half. Capacity of eight Inch wafers, for which production was restarted in July, is expected to reach 100,000 units per month during the first half of fiscal year March 2020. Combined with the 100,000 unit per month capacity of the Shanghai Plant and the efforts to establish 350,000 units per month production capacity at the Hangzhou Plant within fiscal year March 2021, the total output capacity is expected to reach 450,000 units per month.

With a view to increases in capacity utilization of production lines at client semiconductor factories during the second half and the subsequent demand for parts cleaning services, Ferrotec expects operations to start operations of a plant being constructed in Tongling City, Anhui Province and at the second factory in Neijian City, Sichuan Province within fiscal year March 2020. The Company will also consider further additions to its capacity with a view to increases in demand from its semiconductor manufacturing and flat panel display manufacturing clients in China.

Sales of automobile seat automated heating applications are expected to be negatively influenced by the outlook for slowing sales of automobiles in the North American market during the second half. Efforts are being made to develop products responding to next generation automobile applications. Also, Ferrotec expects favorable trends in optical communication applications and consumer assembly (Showcase use) applications. Furthermore, the Company is expanding sales activities globally to cultivate demand from power semiconductor substrate applications.

Sales of automobile seat automated heating applications are expected to be negatively influenced by the outlook for slowing sales of automobiles in the North American market during the second half. Efforts are being made to develop products responding to next generation automobile applications. Also, Ferrotec expects favorable trends in optical communication applications and consumer assembly (Showcase use) applications. Furthermore, the Company is expanding sales activities globally to cultivate demand from power semiconductor substrate applications.

Gross income is expected to grow on the back of efforts to increase value addition by expanding sales of semiconductor crucibles and large crucibles used for eight Inch wafer applications. The plant for semiconductor use crucibles (Environmentally friendly, automation process applications) is expected to begin operations within the current year, with development being promoted to allow for mass production of large 32 inch melting furnace applications to begin from the first half of fiscal year Mach 2020. Due to the outlook for photovoltaic use silicon pricing to continue to trend weakly, Ferotec will focus its efforts upon OEM applications and improving the profitability of OEM applications. At the same time, efforts will be made in the realms of low oxygen, thin line slicing, and other high-quality applications. The problems resulting from quality issues with some OEM products during the first half have been resolved, and shipments have been restarted. Also, adjustments to manufacturing activities are being made with the view to retreat from unprofitable product areas and inventory adjustments are progressing. Photovoltaic cell pricing is expected to continue to trend weakly, so the Company will focus upon OEM applications and conduct efforts to reduce costs by raising conversion efficiencies.

Gross income is expected to grow on the back of efforts to increase value addition by expanding sales of semiconductor crucibles and large crucibles used for eight Inch wafer applications. The plant for semiconductor use crucibles (Environmentally friendly, automation process applications) is expected to begin operations within the current year, with development being promoted to allow for mass production of large 32 inch melting furnace applications to begin from the first half of fiscal year Mach 2020. Due to the outlook for photovoltaic use silicon pricing to continue to trend weakly, Ferotec will focus its efforts upon OEM applications and improving the profitability of OEM applications. At the same time, efforts will be made in the realms of low oxygen, thin line slicing, and other high-quality applications. The problems resulting from quality issues with some OEM products during the first half have been resolved, and shipments have been restarted. Also, adjustments to manufacturing activities are being made with the view to retreat from unprofitable product areas and inventory adjustments are progressing. Photovoltaic cell pricing is expected to continue to trend weakly, so the Company will focus upon OEM applications and conduct efforts to reduce costs by raising conversion efficiencies.

|

| Medium to Long Term Growth Strategy Progress Conditions |

|

<Medium to Long Term Growth Strategy>

(1) Introduce Management Resources to Semiconductor Manufacturing Device Business:Material Products, Wafers, Cleaning Businesses

(2) Photovoltaic Related Business Structure Reforms:Future Policy of Shift towards Semiconductor Industry Applications

(3) Introduce Applied Products for Electric Vehicles:Focus on Applications Other than Automobile Seat Automated Heating

There have been no major changes to the above mentioned policies with a continued focus upon capital investments in realms where demand remains strong.

<Progress Conditions>

(1) Introduce Management Resources to Semiconductor Manufacturing Device Business:Material Products, Wafers, Cleaning Businesses

SEMI (International Semiconductor Manufacturing Equipment Materials Association) data compiled by Ferrotec indicates that the semiconductor manufacturing equipment market in China is expected to grow by 47% year-on-year during 2019 to become the largest market in the world. While concerns regarding trade frictions between China and the United States exist, the Company expects overall demand to trend favorably based upon its outlook for growth in domestic production and an increase in self reliance rates. At the same time, Ferrotec will conduct efforts to expand its output capacity for semiconductor material products, semiconductor wafers, and large diameter applications.

Expansion of Semiconductor Materials Manufacturing Capacity

Efforts are being made to expand manufacturing capacity at the eight newly constructed plants in China as outlined below. Plants will finish construction and begin operations from the latter half of 2018 to the spring of 2019, with a full contribution to earnings expected to be seen from fiscal year March 2020. Expansion of Semiconductor Materials Manufacturing Capacity

Efforts are being made to expand manufacturing capacity at the eight newly constructed plants in China as outlined below. Plants will finish construction and begin operations from the latter half of 2018 to the spring of 2019, with a full contribution to earnings expected to be seen from fiscal year March 2020.

The Relation between Material Products and Corporate Capital Investments

Semiconductor material products can be divided between products that are strongly correlated with capital investments and consumable materials. Ferrotec maintains exposure to both product realms and is focusing its efforts on expanding consumable materials production capacity. Therefore, the consumable materials are expected to support the Company's earnings during times when capital investments are in decline. Consequently, the materials product business can be expected to continue to grow on the Company's efforts to expand consumable materials manufacturing capacity even if capital investment related demand declines. The Relation between Material Products and Corporate Capital Investments

Semiconductor material products can be divided between products that are strongly correlated with capital investments and consumable materials. Ferrotec maintains exposure to both product realms and is focusing its efforts on expanding consumable materials production capacity. Therefore, the consumable materials are expected to support the Company's earnings during times when capital investments are in decline. Consequently, the materials product business can be expected to continue to grow on the Company's efforts to expand consumable materials manufacturing capacity even if capital investment related demand declines.

Semiconductor Wafer Strategy: Large Capital Investments in China

With a view to an expansion in China's semiconductor market, construction of new wafer plants is being promoted. Capital investments plans call for a large amount of ¥67.0 billion to be spent on facilities for eight and twelve Inch wafers. Specifically, ¥51.0 billion (Of which ¥24.0 billion will be spent in FY3/19) will be spent on eight Inch wafers, including investments in ingot manufacturing lines of the Yinchuan Plant and wafer processing lines of the Hangzhou Plant. With regard to twelve Inch wafers, Ferrotec expects to promote efforts to fortify its ingot lines at the Yinchuan Plant and wafer processing lines of the Hangzhou Plant, with investments of ¥16.0 billion expected (Source of funds have yet to be determined but will be announced once determined). The main structure of the Hangzhou Plant is expected to be completed in January 2019, with the remaining facilities there expected to be completed sometime between February to March, and the Yinchuan Plant is expected to be completed in March 2019. Also, evaluation of eight Inch wafers, for which mass production was restarted at the Shanghai Plant, was completed and production of 80,000 units per month was started in October. Furthermore, production levels are expected to be raised to 100,000 units per month at an early stage. Semiconductor Wafer Strategy: Large Capital Investments in China

With a view to an expansion in China's semiconductor market, construction of new wafer plants is being promoted. Capital investments plans call for a large amount of ¥67.0 billion to be spent on facilities for eight and twelve Inch wafers. Specifically, ¥51.0 billion (Of which ¥24.0 billion will be spent in FY3/19) will be spent on eight Inch wafers, including investments in ingot manufacturing lines of the Yinchuan Plant and wafer processing lines of the Hangzhou Plant. With regard to twelve Inch wafers, Ferrotec expects to promote efforts to fortify its ingot lines at the Yinchuan Plant and wafer processing lines of the Hangzhou Plant, with investments of ¥16.0 billion expected (Source of funds have yet to be determined but will be announced once determined). The main structure of the Hangzhou Plant is expected to be completed in January 2019, with the remaining facilities there expected to be completed sometime between February to March, and the Yinchuan Plant is expected to be completed in March 2019. Also, evaluation of eight Inch wafers, for which mass production was restarted at the Shanghai Plant, was completed and production of 80,000 units per month was started in October. Furthermore, production levels are expected to be raised to 100,000 units per month at an early stage.

Targets for Manufacturing Capacity after Capital Investments Are Completed

Small Diameter (5-6 Inch) 400,000 units/month (Currently operating)

Medium Diameter (8 Inch) 100,000 units/month (Currently operating)

Medium Diameter (Second Stage) 350,000 units/month

(After facilities completed in 2019)

Large Diameter (12 Inch pilot line) 30,000 units/month

(Expected from 2020 onwards) Targets for Manufacturing Capacity after Capital Investments Are Completed

Small Diameter (5-6 Inch) 400,000 units/month (Currently operating)

Medium Diameter (8 Inch) 100,000 units/month (Currently operating)

Medium Diameter (Second Stage) 350,000 units/month

(After facilities completed in 2019)

Large Diameter (12 Inch pilot line) 30,000 units/month

(Expected from 2020 onwards)

Sales Strategy

Wafers manufactured by Ferrotec are sold globally by Global Wafers Corporation, which is the world's third largest semiconductor wafer manufacturer. In addition, Ferrotec has begun external sales of its single crystal silicon pulling equipment used internally to manufacture products (Vacuum seals and quartz crucibles) with a goal of lightening the burden of wafer facility depreciation. Also, efforts are being made to sell quartz crucibles. Furthermore, the Company is also considering sales of twelve Inch ingot pulling equipment in the future.

Expansion of the Cleaning Business

Ferrotec is promoting construction of parts cleaning facilities in response to growing demands for manufacturing equipment parts cleaning services from its semiconductor and FPD clients. Two plants are expected to begin operating in Sichuan Province by the end of 2018, with another plant in Anhui Province expected to be completed in January 2019. Factories are currently operated in the major areas where clients exist, but further dispersion of plants is being considered as a means of reducing business risks. Sales Strategy

Wafers manufactured by Ferrotec are sold globally by Global Wafers Corporation, which is the world's third largest semiconductor wafer manufacturer. In addition, Ferrotec has begun external sales of its single crystal silicon pulling equipment used internally to manufacture products (Vacuum seals and quartz crucibles) with a goal of lightening the burden of wafer facility depreciation. Also, efforts are being made to sell quartz crucibles. Furthermore, the Company is also considering sales of twelve Inch ingot pulling equipment in the future.

Expansion of the Cleaning Business

Ferrotec is promoting construction of parts cleaning facilities in response to growing demands for manufacturing equipment parts cleaning services from its semiconductor and FPD clients. Two plants are expected to begin operating in Sichuan Province by the end of 2018, with another plant in Anhui Province expected to be completed in January 2019. Factories are currently operated in the major areas where clients exist, but further dispersion of plants is being considered as a means of reducing business risks.

(2) Photovoltaic Related Business Structural Reforms: Retreat from Solar Power Business Next Term, Focus on Semiconductor Applications

Ferrotec is considering a retreat from the photovoltaic related business in the next term. And while the Company may retreat from its own sales of products, for the time being, negotiations with OEM clients need to be conducted and supplies of photovoltaic use silicon and cell products on an OEM basis are expected to be continued. Along with these developments, facilities other than those devoted to OEM applications will be transferred for use by semiconductor silicon part structural materials. (2) Photovoltaic Related Business Structural Reforms: Retreat from Solar Power Business Next Term, Focus on Semiconductor Applications

Ferrotec is considering a retreat from the photovoltaic related business in the next term. And while the Company may retreat from its own sales of products, for the time being, negotiations with OEM clients need to be conducted and supplies of photovoltaic use silicon and cell products on an OEM basis are expected to be continued. Along with these developments, facilities other than those devoted to OEM applications will be transferred for use by semiconductor silicon part structural materials.

Transfer of facilities have already been completed and are being used as eight Inch silicon single crystal pulling equipment, with test operations being conducted for twelve Inch pulling equipment for semiconductor applications. About 70% of the quartz crucibles that are included in the photovoltaic related business segment are actually sold to semiconductor applications (Semiconductor silicon parts structural material pulling equipment facilities are also being expanded).

(3) Introduce Applied Products for Electric Vehicles

Ferrotec's products using its core technologies can be applied to a broad range of automobile product applications. Leveraging this strength, proposal based marketing to automobile parts manufacturers will be conducted centering on their thermoelectric modules, magnetic fluids, and power semiconductor substrates.

Transfer of facilities have already been completed and are being used as eight Inch silicon single crystal pulling equipment, with test operations being conducted for twelve Inch pulling equipment for semiconductor applications. About 70% of the quartz crucibles that are included in the photovoltaic related business segment are actually sold to semiconductor applications (Semiconductor silicon parts structural material pulling equipment facilities are also being expanded).

(3) Introduce Applied Products for Electric Vehicles

Ferrotec's products using its core technologies can be applied to a broad range of automobile product applications. Leveraging this strength, proposal based marketing to automobile parts manufacturers will be conducted centering on their thermoelectric modules, magnetic fluids, and power semiconductor substrates.

Strengthen Applications Other Than Automobile Seat Automated Heating to Grow Sales of Thermoelectric Modules

Ferrotec plans to strengthen applications for the 5G communications equipment realm, expand product realms responding to bio and medicine applications, develop semiconductor use cooling plates as means of strengthening and expanding applications of thermoelectric modules beyond automobile seat automated heating applications.

Power Semiconductor Substrate Applications Used in Electric Vehicles, Industrial Use Markets

According to Ferrotec documents, the power semiconductor substrate market, which amounted to ¥2.4239 trillion in 2016, is expected to continue to grow by over 30% over the near term on the back of demand from machine tools and automobile realms, and is expected to reach ¥3.1799 trillion in 2025. Ferrotec's power semiconductor substrate plant, constructed in July in Dongtai City, Jiangsu Province, has tripled its manufacturing capacity. Power semiconductor substrates applications will be used to cultivate business in electric vehicles and industrial use realms. Strengthen Applications Other Than Automobile Seat Automated Heating to Grow Sales of Thermoelectric Modules

Ferrotec plans to strengthen applications for the 5G communications equipment realm, expand product realms responding to bio and medicine applications, develop semiconductor use cooling plates as means of strengthening and expanding applications of thermoelectric modules beyond automobile seat automated heating applications.

Power Semiconductor Substrate Applications Used in Electric Vehicles, Industrial Use Markets

According to Ferrotec documents, the power semiconductor substrate market, which amounted to ¥2.4239 trillion in 2016, is expected to continue to grow by over 30% over the near term on the back of demand from machine tools and automobile realms, and is expected to reach ¥3.1799 trillion in 2025. Ferrotec's power semiconductor substrate plant, constructed in July in Dongtai City, Jiangsu Province, has tripled its manufacturing capacity. Power semiconductor substrates applications will be used to cultivate business in electric vehicles and industrial use realms.

|

| Conclusions |

|

While Ferrotec expects to achieve record high earnings during fiscal year March 2019, many investors fear a potential deterioration in earnings in the coming term arising from a slowing in semiconductor related investments sparked by trade frictions between the United States and China. However, Ferrotec maintains an optimistic overall outlook. While it expects sales of products linked to semiconductor manufacturing equipment related capital investments to decline by about 20% in the fiscal year March 2020, it also expects consumable products linked to semiconductor manufacturing activities to grow and allow overall sales to remain in line with the current fiscal year. As explained earlier, new plants and facilities for quartz products, ceramic products, wafers, silicon crystals, manufacturing equipment parts cleaning and other products and services responding to client needs are being constructed and beginning operations. With regard to wafers, transfer of competitors' facilities to other locations caused by tightening environmental restrictions are contributing to a tightening of supply and demand conditions for six Inch wafers, and the potential for higher pricing of eight Inch wafers is also apparent. In addition, pricing of wafers within the Chinese market is trending slightly higher than in other markets.

With regard to profits, a retreat from the photovoltaic related business, which has acted as a drag on profits, is expected to boost profitability. For the time being, Ferrotec will continue to conduct its photovoltaic related business on an OEM basis where it is possible to derive profits, but a complete retreat from this business is expected during fiscal year March 2020. In order to complete this retreat, time will be required as the Company needs to conduct deliberations with clients and other related parties, and determine the process of the sale of its facilities. And while an extraordinary loss of ¥2.4 to ¥3.2 billion is expected to be booked relating to the retreat from this business, retreat is expected to boost operating income margin to 15%.

At the current point in time, Ferrotec estimates call for capital investments of about ¥30.0 billion during fiscal year March 2019 (Including ¥20.0 billion for wafers and ¥10.0 for other products for a total of ¥40.0 billion according to plans), ¥40.0 billion in fiscal year March 2020 (Including ¥30.0 billion for wafers and ¥10.0 for other products), and ¥15.0 billion in fiscal year March 2021 (Including ¥15.0 billion for wafers and ¥10.0 for other products). Consequently, capital investment over the coming three years is expected to total ¥85.0 billion based upon expectations of achieving sales and operating and net incomes of ¥100.0, ¥15.0 (Operating income margin of 15%), and ¥10.0 billion respectively. During fiscal year March 2021, depreciation and free cash flow are expected to amount to about ¥8.0 and ¥18.0 billion respectively. Consequently, Ferrotec is expected to be able to recoup its investments in about five years.

|

| <Reference: Regarding Corporate Governance> |

Basic policy for

The company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

As of July 14, 2017, two out of eight directors are outside ones, and the term of each director is one year, so that the company can respond to the changes to the business environment swiftly. In addition to a monthly meeting of the board of directors, the company flexibly holds an extraordinary meeting of the board of directors every time an important transaction emerges.

As for business operation, ten operating officers (including 9 males and 1 female or 5 directors [who are all male]) are appointed as managers in charge of respective tasks or sections and assigned with clearly defined roles for business operation.

The company has the audit and supervisory board. As of July 14, 2017, the board of auditors is composed of 3 outside auditors (including a full-time one), and aims to strengthen corporate governance.

The company receives advice about legal affairs from Goto Law Office when this is necessary for business, in accordance with a legal consultancy contract.

The company also undergoes account audit by Ernst & Young ShinNihon LLC serving as comptroller in accordance with an audit contract, and tries to disclose information without delay as a company listed in the standard section of the JASDAQ market of Tokyo Stock Exchange, if an event specified in the provisions regarding disclosure occurs.

<Main Principles and Reasons for Non-Implementation>

The Company implements all of the basic principles defined by its corporate governance code.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Principle 5-1 Policies for constructive dialogue with shareholders】

With the aim of achieving sustainable growth and improving corporate value, the company will promote the constructive dialogue with shareholders and explain its managerial policy and status understandably so that shareholders will understand them.

Policies for constructive dialogue with shareholders

(1) A director in charge of IR and managerial plans is included in the management that manages the dialogue with shareholders.

(2) The president's office for the cooperation among divisions for supporting the dialogue with shareholders cooperates with the accounting department in supporting the dialogue with shareholders.

(3) For enriching the means of dialogue other than individual interviews, the company holds a session for briefing financial results, and a business briefing session after each general meeting of shareholders, and utilizes a variety of information transmission methods, including printed matters. At the sessions for briefing financial results and business, the representative director gives explanations.

(4) The information on each dialogue is managed rigorously in accordance with the regulations for the management of insider information.

Basic policy for

The company considers that it is important to improve its corporate value, emphasize the soundness of its business administration to become an enterprise that will be trusted and supported by stakeholders, including shareholders, customers, business partners, and local communities, and also establish a managerial system responding the rapid changes to the business environment swiftly and accurately.

As of July 14, 2017, two out of eight directors are outside ones, and the term of each director is one year, so that the company can respond to the changes to the business environment swiftly. In addition to a monthly meeting of the board of directors, the company flexibly holds an extraordinary meeting of the board of directors every time an important transaction emerges.

As for business operation, ten operating officers (including 9 males and 1 female or 5 directors [who are all male]) are appointed as managers in charge of respective tasks or sections and assigned with clearly defined roles for business operation.

The company has the audit and supervisory board. As of July 14, 2017, the board of auditors is composed of 3 outside auditors (including a full-time one), and aims to strengthen corporate governance.

The company receives advice about legal affairs from Goto Law Office when this is necessary for business, in accordance with a legal consultancy contract.

The company also undergoes account audit by Ernst & Young ShinNihon LLC serving as comptroller in accordance with an audit contract, and tries to disclose information without delay as a company listed in the standard section of the JASDAQ market of Tokyo Stock Exchange, if an event specified in the provisions regarding disclosure occurs.

<Main Principles and Reasons for Non-Implementation>

The Company implements all of the basic principles defined by its corporate governance code.

<Disclosure Based on the Principles of the Corporate Governance Code>

【Principle 5-1 Policies for constructive dialogue with shareholders】

With the aim of achieving sustainable growth and improving corporate value, the company will promote the constructive dialogue with shareholders and explain its managerial policy and status understandably so that shareholders will understand them.

Policies for constructive dialogue with shareholders

(1) A director in charge of IR and managerial plans is included in the management that manages the dialogue with shareholders.

(2) The president's office for the cooperation among divisions for supporting the dialogue with shareholders cooperates with the accounting department in supporting the dialogue with shareholders.

(3) For enriching the means of dialogue other than individual interviews, the company holds a session for briefing financial results, and a business briefing session after each general meeting of shareholders, and utilizes a variety of information transmission methods, including printed matters. At the sessions for briefing financial results and business, the representative director gives explanations.

(4) The information on each dialogue is managed rigorously in accordance with the regulations for the management of insider information.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

|