The Company's major customers are in the broadcast/communication, housing/living and medical/health industries and it provides one stop services for companies including development of strategies for problem solving, promotion design, production/development and execution/operation. It has successfully achieved a position with high competitive advantage by using "comprehensive capability," "flexibility" and "detailed services."

The Company is focusing on expanding the digital domain such as online advertising and customer support using virtual reality (VR) technologies, etc. It is aiming at early achievement of "sales of 10 billion yen, an ordinary income of 1 billion yen, and a digital area composition ratio of 30%."

1-1 Corporate history

1-1 Corporate history

President Yuji Otsu's grandfather, Kenjiro Otsu, who was aiming to be a Japanese painter, worked at a high-class art printing company in Kobe as a designer. Later, he went to the Pacific War, and after being demobilized in April 1947, he founded an advertising company, Senden Goyo Company, which became the predecessor of the Company, in Kobe city.

In addition to general advertising business, it coordinated launching ceremonies carried out by shipbuilders due to the characteristics of Kobe city, organized events and made posters for department stores. It also expanded its customer base in the textile industry, which was the central industry of postwar economic recovery.

The Company also handled the high-class packaging for the launch of "Hong Kong shirt (short sleeve shirt)" which became a major hit product of Teijin Ltd. in the 1960s. The Company's excellent design and creative capabilities, product promotion capabilities, and convenience of one stop services including printing were highly appreciated by the costumers. The Company's characteristic of providing excellent plans and creativity through direct transactions with good industries and customers has been inherited from its founding time till now.

In 1955, Tokyo office was established with a view to expanding the businesses.

While pursuing customer development in Tokyo, it began business in 1972 with Asahi Kasei Homes, one of its current major customers. After that, it expanded the customer base to the broadcast/communication industry and medical/health industry, and sales and profits steadily grew.

In February 2017, it got listed on the Tokyo Stock Exchange JASDAQ market.

1-3 Environment surrounding NISSEN INC.

1-3 Environment surrounding NISSEN INC. ◎ Change in the advertising market

◎ Change in the advertising market

In the conventional advertising market, especially in the advertising business using the media such as television and newspaper, monopolistic and exclusive inventory of stocks was the most important factor for businesses development for the media and advertising agencies that were on the supply side.

Major advertising agencies have been gaining significant profits by capturing almost all of the limited advertisement spots of TV and newspapers and holding price leadership against the advertisers.

However, the demand for mass media advertising is on a downward trend due to the end of rapidly growing economy and the advent of online advertising, which is characterized by inexpensiveness of the cost compared to conventional media and interactivity which is its essence.

According to "Advertising Expenditure in Japan in 2017" by Dentsu Inc., as the graph below shows, the total advertising expenditure in Japan has remained almost unchanged in the past 12 years. The CAGR (compound annual growth rate) of so-called four mass media including newspapers, magazines, radio and TV decreased 2.4% while online advertising expenditure, which was 377.7 billion yen in 2005, continued to grow at the CAGR of 12%, and it reached 1 trillion yen in 2014 and was 1.5 trillion yen in 2017.

Advertising through promotional media such as newspaper inserts, free papers, and direct mails (DMs) also declined 2.0% in the past 12 years.

However, looking at the trend of promotional media advertising expenditure since 2012, while it is on a negative trend for newspaper inserts and DMs, it is steadily increasing for exhibitions, images, and outdoor advertising. POP production cost also increased about 7% compared with 2012. This indicates that as the cost-effectiveness awareness rises among the advertisers, utilization of promotional media for advertising using the characteristics of each medium for targeted marketing is advancing.

As consumers' tastes and behavior diversify, the need for marketing and promotion, which will lead to "increased sales" by advertisers, is expected to grow in the future.

* Sales and operating income are forecasts made by the Company for this term. Market capitalization is the latest end-of-quarter stock number × closing price on April 23, 2018. PER (forecast) and PBR (actual) are based on the closing price of April 23, 2018.

* Sales and operating income are forecasts made by the Company for this term. Market capitalization is the latest end-of-quarter stock number × closing price on April 23, 2018. PER (forecast) and PBR (actual) are based on the closing price of April 23, 2018.

NISSEN realizes a high operating income margin due to insourcing of creative teams even though its sales and market capitalization scale are small.

However, both PER and PBR remain at low levels. Along with improving recognition, it will be necessary to show the investors more specific ways to expand the digital territory and paths to achieve sales of 10 billion yen.

1-4 Business contents

1-4 Business contents 1. Business Segment

1. Business Segment

The business segments comprise "Advertising business" and "Others." (Report segment is Advertising business only.)

① Advertising business

The Company determines an industry to focus on and deals directly with client companies. It provides one-stop advertisement solutions from developing strategies/marketing for a challenge, promotion design, production/development and execution/operation by using its own service, own media and own contents.

At this point in time, the Company provides services to the following 3 industries.

≪Broadcast/communication≫

≪Broadcast/communication≫

The Company provides sales promotion services to acquire new subscribers and promote viewing to the nationwide CATV stations, major communication carriers, and program supply companies.

The core of the business is the planning and production of the television program listings information magazine called "Channel Guide" (monthly magazine) for the subscribers of about 100 CATV stations nationwide, and the circulation is about 1.5 million copies per month.

The CATV stations have about 130 channels including communication satellite (CS), broadcast satellite (BS), terrestrial and terrestrial BS, and the Company needs to write articles to introduce each program as well as prepare each TV guide for 100 stations monthly and make them easy to read and accurate, through editing.

To undertake this type of work, a certain investment is necessary for system construction, and accumulation of sufficient know-how is required for the operation. These are becoming high entry barriers, and currently there is only one competitor, although there were about 5 before.

There are about 300 CATV stations across Japan. About 240 of them develop TV guides, and the Company's market share is 40 percent. It is an essential existence for the CATV stations.

In addition, the Company operates the recommendation site of video distribution service operated by a major telecommunications carrier and provides various sales promotion.

≪Housing/living≫

(Housing)

For more than 40 years, the Company is involved in sales promotion of a major housing manufacturer "Asahi Kasei Homes Co., Ltd."

The Company's services include the general design of nationwide campaigns, individual advertisement promotion planning, development of catalogs, DMs, leaflets and housing exhibition tools, event planning and management, website/video production, and space design. As for catalogues and sales tools, it also handles inventory control.

In recent years, it offers the "geo-targeting" service that sends pinpoint information to the target using geographic information and attracts customers. It also offers new digital related services such as the latest interactive theater room using 360 ° video and VR.

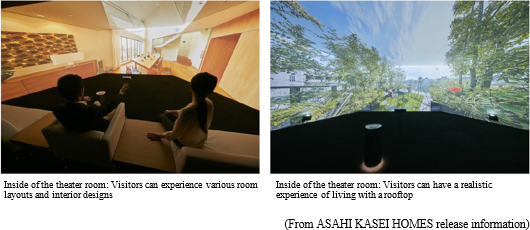

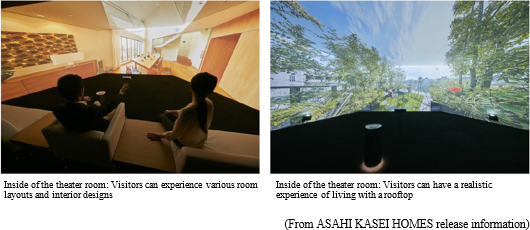

The latest interactive theater room by Asahi Kasei Homes "HEBEL HAUS TOKYO PRIME SQUARE"

The latest interactive theater room by Asahi Kasei Homes "HEBEL HAUS TOKYO PRIME SQUARE"

In January 2017, Asahi Kasei Homes opened the interior and facility showroom "Design Studio Tokyo" and the studio "HEBEL HAUS TOKYO PRIME SQUARE "with the interactive theater room "THE VISION HEBEL HAUS" in Tokyo Sales Headquarters (Shinjuku NS Building, 2-4-1 Nishi Shinjuku, Shinjuku-ku, Tokyo)

Overview of "THE VISION HEBEL HAUS"

With 360° expressive image on a continuous large screen installed on the walls and ceiling in 4 directions (front, right, left, top), the visitors can experience virtual housing space of about 20 cases including new HEBEL HAUS products and the latest exhibition halls. The visitors can easily experience many exhibition halls with fun without having to actually visit.

With 360° expressive image on a continuous large screen installed on the walls and ceiling in 4 directions (front, right, left, top), the visitors can experience virtual housing space of about 20 cases including new HEBEL HAUS products and the latest exhibition halls. The visitors can easily experience many exhibition halls with fun without having to actually visit.

It is based on an interactive operation in which the users move the images by moving the palm toward the screen while sitting on the sofa. Unlike virtual reality videos for which the users must wear specified goggles, all visitors can share the same experiences, so the entire family can have fun together and communicate with each other.

<The Vision HEBEL HAUS>

Theater room: Approximately 60m2, Up to 10 people can experience at the same time

Video contents: Housing space virtual experiences of new products and the latest models with 360° image, movie on storage techniques

It is based on an interactive operation in which the users move the images by moving the palm toward the screen while sitting on the sofa. Unlike virtual reality videos for which the users must wear specified goggles, all visitors can share the same experiences, so the entire family can have fun together and communicate with each other.

<The Vision HEBEL HAUS>

Theater room: Approximately 60m2, Up to 10 people can experience at the same time

Video contents: Housing space virtual experiences of new products and the latest models with 360° image, movie on storage techniques

(Home improvement stores, etc.)

(Home improvement stores, etc.)

The Company plans and issues free information magazine "Pacoma" (monthly magazine) for visitors of home improvement stores nationwide. The circulation is about 300,000 copies.

Main sales are generated from collecting advertisements from manufacturers and selling the magazine to the companies owning home improvement stores.

In addition to offering various sales promotion tools to the companies mainly in the lifestyle industry, the Company is also offering online promotion/PR measures through the online magazine "Pacoma" by utilizing its content capacity.

≪Medical/health≫

(Pharmaceutical companies)

≪Medical/health≫

(Pharmaceutical companies)

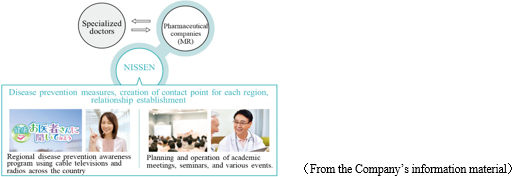

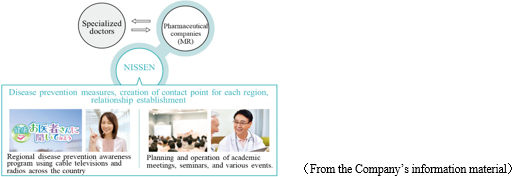

The Company is planning and developing disease prevention awareness programs in which doctors appear (televised on cable TV and radio nationwide) to support the activities of pharmaceutical companies' MRs (medical information staff). About 700 programs have been produced so far.

In addition, the Company is also entrusted with planning and operation of seminars sponsored by pharmaceutical companies and academic meetings.

(Drug stores)

(Drug stores)

The Company plans and issues free information magazine "KiiTa" (quarterly magazine) for visitors of drug stores. The magazine is distributed to about 10,000 stores nationwide.

Also since December 2016, it has been releasing the free information magazine "Re: KiiTa" (quarterly magazine), targeting salespeople of drug store companies.

Both magazines are official information magazines recognized by the Japan Association of Chain Drug Stores, and sales are generated from collection of advertisements from pharmaceutical companies, etc.

≪Others≫

≪Others≫

The Company is also actively working on increasing customers in other industries.

Particularly, it is strengthening the approach to companies that have store networks, using its customer attraction capabilities and store-front promotion planning capabilities, which are the Company's strengths gained by working with the companies that operate home improvement stores and drug stores.

Most recently, for Japanese Subway that operates the sandwich restaurant chain "SUBWAY," the Company obtained an account from a major general advertising agency. It is now handling all of their marketing measures ranging from media handling, advertising work to production of storefront tools.

The Company is offering integrated services including planning, attracting customers and purchasing promotion from planning of the concept of a campaign, customer attraction using web advertising to the development of storefront tools such as flyers, posters and menus.

Furthermore, for Japan Pizza Hut which operates the pizza shop chain "Pizza Hut," in order to expand the fans of Pizza Hut and increase the awareness of the movie "Spiderman" by taking advantage of the fun aspect and the fan base of the movie content, the Company undertook the overall designing of the campaign that included "dissemination of self-shooting images with Spiderman via social networking services, making use of augmented reality (AR)," "production of pizza box," and "operation of events for the fans," etc. and executed the plan.

② Others

NISSEN Printing Co., Ltd., the Company's subsidiary, receives orders for various types of commercial printing. It also receives orders and manufactures catalogs, pamphlets, leaflets, direct mails, posters, etc.

In addition, NISSEN Printing owns a unique machine to print and stick images on fans. They are called "Eco paper fans," for which it owns the manufacturing patent. It receives orders from various industries across the country as their "sales promotion tools" and manufactures them.

1-5 Characteristics and strengths

1-5 Characteristics and strengths ◎ To determine good industries to target, build a unique service model, and expand its scale

◎ To determine good industries to target, build a unique service model, and expand its scale

As mentioned in the history above, the Company has been developing by targeting growing and excellent industries of the era as major customers. For example, it worked with the textile industry in the 1960s, the housing industry in the 1970s, and, broadcast/communication and medical/health industries thereafter. The needs and challenges for advertising and SP are different for each industry.

The Company can provide highly unique one-stop solutions combining various approaches for attracting customers and expanding sales by grasping unique issues and needs of each industry. The Company calls it the "unique service model."

The Company is expanding the size by repeating the cycle of accumulating know-how in providing services, increasing the profitability by promoting insourcing of making core products, expanding the volume and creating profits, and

defining a new target industry and entering there.

◎ Internal system that supports the unique service model

◎ Internal system that supports the unique service model

The internal system that supports the "unique service model," which is the Company's unique characteristic, is also a major feature.

Because the Company does not involve agents with customers and all businesses are handled directly with the customers, it can directly identify issues of the industries and companies to which the customers belong.

For the identified issues, the in-house specialized teams consisting of creative directors, planners, copywriters, web designers, and video directors create optimal solutions.

In the past, the Company was mainly outsourcing. However, based on the policy of President Otsu, who is aiming at strengthening competitiveness, the Company began to develop in-house creative teams about 10 years ago. Currently it has about 30 staff who gained extensive experiences at major advertising agencies, etc.

The Company is accumulating know-how by internalizing production of the core parts for creating the optimal solution, while, for the other parts, it builds and utilizes close and strong relationships with excellent external partner companies (website production, SP production, paper, printing, logistics, etc.). It provides one-stop optimal solutions for customers.

◎ It has achieved a position with high competitive advantage in the advertisement/SP industry based on the "comprehensive capability."

Although there are various players in the advertising industry depending on the scale and specialty fields, the Company has succeeded in achieving a position with high competitive advantage through its unique "comprehensive capability."

As mentioned in the market environment section, major advertising agencies, which follow the business model with an oligopolistic control of advertisement spaces, are beginning to focus on online advertising, as the negative growth of mass media such as TV and newspapers continues. However, to maintain their corporate size, they need to efficiently earn income using the mass media. Even if there are needs of POP and SP among the customers, the major advertising agencies need to outsource the work in these fields where flexibility is required. This makes it difficult for them to gain sufficient customer satisfaction.

Meanwhile, advertising agencies specializing in the Internet have grown significantly with the expansion of online advertising and many of them have gotten listed, but they do not have analog solutions for "sales floors" such as POP and SP. They are less likely to choose internalization of producing solutions from their corporate culture.

Under these circumstances, the Company's comprehensive capability to offer a wide range of one stop solutions from planning, production to execution of advertisement/SP, including analog and digital, is extremely attractive to the customers.

The Company recognizes that being in a position to offer solutions based on "comprehensive capability," "flexibility" and "detailed service" is their strong competitive advantage in a field where it is difficult for both major advertising agencies and Internet specialized advertising agencies to provide adequate services, and it will continue to strengthen this position.

1-1 Corporate history

1-1 Corporate history President Yuji Otsu's grandfather, Kenjiro Otsu, who was aiming to be a Japanese painter, worked at a high-class art printing company in Kobe as a designer. Later, he went to the Pacific War, and after being demobilized in April 1947, he founded an advertising company, Senden Goyo Company, which became the predecessor of the Company, in Kobe city.

In addition to general advertising business, it coordinated launching ceremonies carried out by shipbuilders due to the characteristics of Kobe city, organized events and made posters for department stores. It also expanded its customer base in the textile industry, which was the central industry of postwar economic recovery.

The Company also handled the high-class packaging for the launch of "Hong Kong shirt (short sleeve shirt)" which became a major hit product of Teijin Ltd. in the 1960s. The Company's excellent design and creative capabilities, product promotion capabilities, and convenience of one stop services including printing were highly appreciated by the costumers. The Company's characteristic of providing excellent plans and creativity through direct transactions with good industries and customers has been inherited from its founding time till now.

In 1955, Tokyo office was established with a view to expanding the businesses.

While pursuing customer development in Tokyo, it began business in 1972 with Asahi Kasei Homes, one of its current major customers. After that, it expanded the customer base to the broadcast/communication industry and medical/health industry, and sales and profits steadily grew.

In February 2017, it got listed on the Tokyo Stock Exchange JASDAQ market.

President Yuji Otsu's grandfather, Kenjiro Otsu, who was aiming to be a Japanese painter, worked at a high-class art printing company in Kobe as a designer. Later, he went to the Pacific War, and after being demobilized in April 1947, he founded an advertising company, Senden Goyo Company, which became the predecessor of the Company, in Kobe city.

In addition to general advertising business, it coordinated launching ceremonies carried out by shipbuilders due to the characteristics of Kobe city, organized events and made posters for department stores. It also expanded its customer base in the textile industry, which was the central industry of postwar economic recovery.

The Company also handled the high-class packaging for the launch of "Hong Kong shirt (short sleeve shirt)" which became a major hit product of Teijin Ltd. in the 1960s. The Company's excellent design and creative capabilities, product promotion capabilities, and convenience of one stop services including printing were highly appreciated by the costumers. The Company's characteristic of providing excellent plans and creativity through direct transactions with good industries and customers has been inherited from its founding time till now.

In 1955, Tokyo office was established with a view to expanding the businesses.

While pursuing customer development in Tokyo, it began business in 1972 with Asahi Kasei Homes, one of its current major customers. After that, it expanded the customer base to the broadcast/communication industry and medical/health industry, and sales and profits steadily grew.

In February 2017, it got listed on the Tokyo Stock Exchange JASDAQ market.

1-3 Environment surrounding NISSEN INC.

1-3 Environment surrounding NISSEN INC. ◎ Change in the advertising market

In the conventional advertising market, especially in the advertising business using the media such as television and newspaper, monopolistic and exclusive inventory of stocks was the most important factor for businesses development for the media and advertising agencies that were on the supply side.

Major advertising agencies have been gaining significant profits by capturing almost all of the limited advertisement spots of TV and newspapers and holding price leadership against the advertisers.

However, the demand for mass media advertising is on a downward trend due to the end of rapidly growing economy and the advent of online advertising, which is characterized by inexpensiveness of the cost compared to conventional media and interactivity which is its essence.

According to "Advertising Expenditure in Japan in 2017" by Dentsu Inc., as the graph below shows, the total advertising expenditure in Japan has remained almost unchanged in the past 12 years. The CAGR (compound annual growth rate) of so-called four mass media including newspapers, magazines, radio and TV decreased 2.4% while online advertising expenditure, which was 377.7 billion yen in 2005, continued to grow at the CAGR of 12%, and it reached 1 trillion yen in 2014 and was 1.5 trillion yen in 2017.

◎ Change in the advertising market

In the conventional advertising market, especially in the advertising business using the media such as television and newspaper, monopolistic and exclusive inventory of stocks was the most important factor for businesses development for the media and advertising agencies that were on the supply side.

Major advertising agencies have been gaining significant profits by capturing almost all of the limited advertisement spots of TV and newspapers and holding price leadership against the advertisers.

However, the demand for mass media advertising is on a downward trend due to the end of rapidly growing economy and the advent of online advertising, which is characterized by inexpensiveness of the cost compared to conventional media and interactivity which is its essence.

According to "Advertising Expenditure in Japan in 2017" by Dentsu Inc., as the graph below shows, the total advertising expenditure in Japan has remained almost unchanged in the past 12 years. The CAGR (compound annual growth rate) of so-called four mass media including newspapers, magazines, radio and TV decreased 2.4% while online advertising expenditure, which was 377.7 billion yen in 2005, continued to grow at the CAGR of 12%, and it reached 1 trillion yen in 2014 and was 1.5 trillion yen in 2017.

Advertising through promotional media such as newspaper inserts, free papers, and direct mails (DMs) also declined 2.0% in the past 12 years.

However, looking at the trend of promotional media advertising expenditure since 2012, while it is on a negative trend for newspaper inserts and DMs, it is steadily increasing for exhibitions, images, and outdoor advertising. POP production cost also increased about 7% compared with 2012. This indicates that as the cost-effectiveness awareness rises among the advertisers, utilization of promotional media for advertising using the characteristics of each medium for targeted marketing is advancing.

Advertising through promotional media such as newspaper inserts, free papers, and direct mails (DMs) also declined 2.0% in the past 12 years.

However, looking at the trend of promotional media advertising expenditure since 2012, while it is on a negative trend for newspaper inserts and DMs, it is steadily increasing for exhibitions, images, and outdoor advertising. POP production cost also increased about 7% compared with 2012. This indicates that as the cost-effectiveness awareness rises among the advertisers, utilization of promotional media for advertising using the characteristics of each medium for targeted marketing is advancing.

As consumers' tastes and behavior diversify, the need for marketing and promotion, which will lead to "increased sales" by advertisers, is expected to grow in the future.

As consumers' tastes and behavior diversify, the need for marketing and promotion, which will lead to "increased sales" by advertisers, is expected to grow in the future.

* Sales and operating income are forecasts made by the Company for this term. Market capitalization is the latest end-of-quarter stock number × closing price on April 23, 2018. PER (forecast) and PBR (actual) are based on the closing price of April 23, 2018.

NISSEN realizes a high operating income margin due to insourcing of creative teams even though its sales and market capitalization scale are small.

However, both PER and PBR remain at low levels. Along with improving recognition, it will be necessary to show the investors more specific ways to expand the digital territory and paths to achieve sales of 10 billion yen.

* Sales and operating income are forecasts made by the Company for this term. Market capitalization is the latest end-of-quarter stock number × closing price on April 23, 2018. PER (forecast) and PBR (actual) are based on the closing price of April 23, 2018.

NISSEN realizes a high operating income margin due to insourcing of creative teams even though its sales and market capitalization scale are small.

However, both PER and PBR remain at low levels. Along with improving recognition, it will be necessary to show the investors more specific ways to expand the digital territory and paths to achieve sales of 10 billion yen.

1-4 Business contents

1-4 Business contents 1. Business Segment

The business segments comprise "Advertising business" and "Others." (Report segment is Advertising business only.)

1. Business Segment

The business segments comprise "Advertising business" and "Others." (Report segment is Advertising business only.)

① Advertising business

The Company determines an industry to focus on and deals directly with client companies. It provides one-stop advertisement solutions from developing strategies/marketing for a challenge, promotion design, production/development and execution/operation by using its own service, own media and own contents.

① Advertising business

The Company determines an industry to focus on and deals directly with client companies. It provides one-stop advertisement solutions from developing strategies/marketing for a challenge, promotion design, production/development and execution/operation by using its own service, own media and own contents.

At this point in time, the Company provides services to the following 3 industries.

At this point in time, the Company provides services to the following 3 industries.

≪Broadcast/communication≫

The Company provides sales promotion services to acquire new subscribers and promote viewing to the nationwide CATV stations, major communication carriers, and program supply companies.

The core of the business is the planning and production of the television program listings information magazine called "Channel Guide" (monthly magazine) for the subscribers of about 100 CATV stations nationwide, and the circulation is about 1.5 million copies per month.

The CATV stations have about 130 channels including communication satellite (CS), broadcast satellite (BS), terrestrial and terrestrial BS, and the Company needs to write articles to introduce each program as well as prepare each TV guide for 100 stations monthly and make them easy to read and accurate, through editing.

To undertake this type of work, a certain investment is necessary for system construction, and accumulation of sufficient know-how is required for the operation. These are becoming high entry barriers, and currently there is only one competitor, although there were about 5 before.

There are about 300 CATV stations across Japan. About 240 of them develop TV guides, and the Company's market share is 40 percent. It is an essential existence for the CATV stations.

≪Broadcast/communication≫

The Company provides sales promotion services to acquire new subscribers and promote viewing to the nationwide CATV stations, major communication carriers, and program supply companies.

The core of the business is the planning and production of the television program listings information magazine called "Channel Guide" (monthly magazine) for the subscribers of about 100 CATV stations nationwide, and the circulation is about 1.5 million copies per month.

The CATV stations have about 130 channels including communication satellite (CS), broadcast satellite (BS), terrestrial and terrestrial BS, and the Company needs to write articles to introduce each program as well as prepare each TV guide for 100 stations monthly and make them easy to read and accurate, through editing.

To undertake this type of work, a certain investment is necessary for system construction, and accumulation of sufficient know-how is required for the operation. These are becoming high entry barriers, and currently there is only one competitor, although there were about 5 before.

There are about 300 CATV stations across Japan. About 240 of them develop TV guides, and the Company's market share is 40 percent. It is an essential existence for the CATV stations.

In addition, the Company operates the recommendation site of video distribution service operated by a major telecommunications carrier and provides various sales promotion.

≪Housing/living≫

(Housing)

For more than 40 years, the Company is involved in sales promotion of a major housing manufacturer "Asahi Kasei Homes Co., Ltd."

The Company's services include the general design of nationwide campaigns, individual advertisement promotion planning, development of catalogs, DMs, leaflets and housing exhibition tools, event planning and management, website/video production, and space design. As for catalogues and sales tools, it also handles inventory control.

In recent years, it offers the "geo-targeting" service that sends pinpoint information to the target using geographic information and attracts customers. It also offers new digital related services such as the latest interactive theater room using 360 ° video and VR.

In addition, the Company operates the recommendation site of video distribution service operated by a major telecommunications carrier and provides various sales promotion.

≪Housing/living≫

(Housing)

For more than 40 years, the Company is involved in sales promotion of a major housing manufacturer "Asahi Kasei Homes Co., Ltd."

The Company's services include the general design of nationwide campaigns, individual advertisement promotion planning, development of catalogs, DMs, leaflets and housing exhibition tools, event planning and management, website/video production, and space design. As for catalogues and sales tools, it also handles inventory control.

In recent years, it offers the "geo-targeting" service that sends pinpoint information to the target using geographic information and attracts customers. It also offers new digital related services such as the latest interactive theater room using 360 ° video and VR.

The latest interactive theater room by Asahi Kasei Homes "HEBEL HAUS TOKYO PRIME SQUARE"

In January 2017, Asahi Kasei Homes opened the interior and facility showroom "Design Studio Tokyo" and the studio "HEBEL HAUS TOKYO PRIME SQUARE "with the interactive theater room "THE VISION HEBEL HAUS" in Tokyo Sales Headquarters (Shinjuku NS Building, 2-4-1 Nishi Shinjuku, Shinjuku-ku, Tokyo)

Overview of "THE VISION HEBEL HAUS"

The latest interactive theater room by Asahi Kasei Homes "HEBEL HAUS TOKYO PRIME SQUARE"

In January 2017, Asahi Kasei Homes opened the interior and facility showroom "Design Studio Tokyo" and the studio "HEBEL HAUS TOKYO PRIME SQUARE "with the interactive theater room "THE VISION HEBEL HAUS" in Tokyo Sales Headquarters (Shinjuku NS Building, 2-4-1 Nishi Shinjuku, Shinjuku-ku, Tokyo)

Overview of "THE VISION HEBEL HAUS"

With 360° expressive image on a continuous large screen installed on the walls and ceiling in 4 directions (front, right, left, top), the visitors can experience virtual housing space of about 20 cases including new HEBEL HAUS products and the latest exhibition halls. The visitors can easily experience many exhibition halls with fun without having to actually visit.

With 360° expressive image on a continuous large screen installed on the walls and ceiling in 4 directions (front, right, left, top), the visitors can experience virtual housing space of about 20 cases including new HEBEL HAUS products and the latest exhibition halls. The visitors can easily experience many exhibition halls with fun without having to actually visit.

It is based on an interactive operation in which the users move the images by moving the palm toward the screen while sitting on the sofa. Unlike virtual reality videos for which the users must wear specified goggles, all visitors can share the same experiences, so the entire family can have fun together and communicate with each other.

<The Vision HEBEL HAUS>

Theater room: Approximately 60m2, Up to 10 people can experience at the same time

Video contents: Housing space virtual experiences of new products and the latest models with 360° image, movie on storage techniques

It is based on an interactive operation in which the users move the images by moving the palm toward the screen while sitting on the sofa. Unlike virtual reality videos for which the users must wear specified goggles, all visitors can share the same experiences, so the entire family can have fun together and communicate with each other.

<The Vision HEBEL HAUS>

Theater room: Approximately 60m2, Up to 10 people can experience at the same time

Video contents: Housing space virtual experiences of new products and the latest models with 360° image, movie on storage techniques

(Home improvement stores, etc.)

The Company plans and issues free information magazine "Pacoma" (monthly magazine) for visitors of home improvement stores nationwide. The circulation is about 300,000 copies.

Main sales are generated from collecting advertisements from manufacturers and selling the magazine to the companies owning home improvement stores.

In addition to offering various sales promotion tools to the companies mainly in the lifestyle industry, the Company is also offering online promotion/PR measures through the online magazine "Pacoma" by utilizing its content capacity.

(Home improvement stores, etc.)

The Company plans and issues free information magazine "Pacoma" (monthly magazine) for visitors of home improvement stores nationwide. The circulation is about 300,000 copies.

Main sales are generated from collecting advertisements from manufacturers and selling the magazine to the companies owning home improvement stores.

In addition to offering various sales promotion tools to the companies mainly in the lifestyle industry, the Company is also offering online promotion/PR measures through the online magazine "Pacoma" by utilizing its content capacity.

≪Medical/health≫

(Pharmaceutical companies)

The Company is planning and developing disease prevention awareness programs in which doctors appear (televised on cable TV and radio nationwide) to support the activities of pharmaceutical companies' MRs (medical information staff). About 700 programs have been produced so far.

In addition, the Company is also entrusted with planning and operation of seminars sponsored by pharmaceutical companies and academic meetings.

≪Medical/health≫

(Pharmaceutical companies)

The Company is planning and developing disease prevention awareness programs in which doctors appear (televised on cable TV and radio nationwide) to support the activities of pharmaceutical companies' MRs (medical information staff). About 700 programs have been produced so far.

In addition, the Company is also entrusted with planning and operation of seminars sponsored by pharmaceutical companies and academic meetings.

(Drug stores)

The Company plans and issues free information magazine "KiiTa" (quarterly magazine) for visitors of drug stores. The magazine is distributed to about 10,000 stores nationwide.

Also since December 2016, it has been releasing the free information magazine "Re: KiiTa" (quarterly magazine), targeting salespeople of drug store companies.

Both magazines are official information magazines recognized by the Japan Association of Chain Drug Stores, and sales are generated from collection of advertisements from pharmaceutical companies, etc.

(Drug stores)

The Company plans and issues free information magazine "KiiTa" (quarterly magazine) for visitors of drug stores. The magazine is distributed to about 10,000 stores nationwide.

Also since December 2016, it has been releasing the free information magazine "Re: KiiTa" (quarterly magazine), targeting salespeople of drug store companies.

Both magazines are official information magazines recognized by the Japan Association of Chain Drug Stores, and sales are generated from collection of advertisements from pharmaceutical companies, etc.

≪Others≫

The Company is also actively working on increasing customers in other industries.

Particularly, it is strengthening the approach to companies that have store networks, using its customer attraction capabilities and store-front promotion planning capabilities, which are the Company's strengths gained by working with the companies that operate home improvement stores and drug stores.

Most recently, for Japanese Subway that operates the sandwich restaurant chain "SUBWAY," the Company obtained an account from a major general advertising agency. It is now handling all of their marketing measures ranging from media handling, advertising work to production of storefront tools.

The Company is offering integrated services including planning, attracting customers and purchasing promotion from planning of the concept of a campaign, customer attraction using web advertising to the development of storefront tools such as flyers, posters and menus.

≪Others≫

The Company is also actively working on increasing customers in other industries.

Particularly, it is strengthening the approach to companies that have store networks, using its customer attraction capabilities and store-front promotion planning capabilities, which are the Company's strengths gained by working with the companies that operate home improvement stores and drug stores.

Most recently, for Japanese Subway that operates the sandwich restaurant chain "SUBWAY," the Company obtained an account from a major general advertising agency. It is now handling all of their marketing measures ranging from media handling, advertising work to production of storefront tools.

The Company is offering integrated services including planning, attracting customers and purchasing promotion from planning of the concept of a campaign, customer attraction using web advertising to the development of storefront tools such as flyers, posters and menus.

Furthermore, for Japan Pizza Hut which operates the pizza shop chain "Pizza Hut," in order to expand the fans of Pizza Hut and increase the awareness of the movie "Spiderman" by taking advantage of the fun aspect and the fan base of the movie content, the Company undertook the overall designing of the campaign that included "dissemination of self-shooting images with Spiderman via social networking services, making use of augmented reality (AR)," "production of pizza box," and "operation of events for the fans," etc. and executed the plan.

Furthermore, for Japan Pizza Hut which operates the pizza shop chain "Pizza Hut," in order to expand the fans of Pizza Hut and increase the awareness of the movie "Spiderman" by taking advantage of the fun aspect and the fan base of the movie content, the Company undertook the overall designing of the campaign that included "dissemination of self-shooting images with Spiderman via social networking services, making use of augmented reality (AR)," "production of pizza box," and "operation of events for the fans," etc. and executed the plan.

② Others

NISSEN Printing Co., Ltd., the Company's subsidiary, receives orders for various types of commercial printing. It also receives orders and manufactures catalogs, pamphlets, leaflets, direct mails, posters, etc.

In addition, NISSEN Printing owns a unique machine to print and stick images on fans. They are called "Eco paper fans," for which it owns the manufacturing patent. It receives orders from various industries across the country as their "sales promotion tools" and manufactures them.

② Others

NISSEN Printing Co., Ltd., the Company's subsidiary, receives orders for various types of commercial printing. It also receives orders and manufactures catalogs, pamphlets, leaflets, direct mails, posters, etc.

In addition, NISSEN Printing owns a unique machine to print and stick images on fans. They are called "Eco paper fans," for which it owns the manufacturing patent. It receives orders from various industries across the country as their "sales promotion tools" and manufactures them.

1-5 Characteristics and strengths

1-5 Characteristics and strengths ◎ To determine good industries to target, build a unique service model, and expand its scale

As mentioned in the history above, the Company has been developing by targeting growing and excellent industries of the era as major customers. For example, it worked with the textile industry in the 1960s, the housing industry in the 1970s, and, broadcast/communication and medical/health industries thereafter. The needs and challenges for advertising and SP are different for each industry.

The Company can provide highly unique one-stop solutions combining various approaches for attracting customers and expanding sales by grasping unique issues and needs of each industry. The Company calls it the "unique service model."

The Company is expanding the size by repeating the cycle of accumulating know-how in providing services, increasing the profitability by promoting insourcing of making core products, expanding the volume and creating profits, and

defining a new target industry and entering there.

◎ To determine good industries to target, build a unique service model, and expand its scale

As mentioned in the history above, the Company has been developing by targeting growing and excellent industries of the era as major customers. For example, it worked with the textile industry in the 1960s, the housing industry in the 1970s, and, broadcast/communication and medical/health industries thereafter. The needs and challenges for advertising and SP are different for each industry.

The Company can provide highly unique one-stop solutions combining various approaches for attracting customers and expanding sales by grasping unique issues and needs of each industry. The Company calls it the "unique service model."

The Company is expanding the size by repeating the cycle of accumulating know-how in providing services, increasing the profitability by promoting insourcing of making core products, expanding the volume and creating profits, and

defining a new target industry and entering there.

◎ Internal system that supports the unique service model

The internal system that supports the "unique service model," which is the Company's unique characteristic, is also a major feature.

Because the Company does not involve agents with customers and all businesses are handled directly with the customers, it can directly identify issues of the industries and companies to which the customers belong.

For the identified issues, the in-house specialized teams consisting of creative directors, planners, copywriters, web designers, and video directors create optimal solutions.

In the past, the Company was mainly outsourcing. However, based on the policy of President Otsu, who is aiming at strengthening competitiveness, the Company began to develop in-house creative teams about 10 years ago. Currently it has about 30 staff who gained extensive experiences at major advertising agencies, etc.

The Company is accumulating know-how by internalizing production of the core parts for creating the optimal solution, while, for the other parts, it builds and utilizes close and strong relationships with excellent external partner companies (website production, SP production, paper, printing, logistics, etc.). It provides one-stop optimal solutions for customers.

◎ It has achieved a position with high competitive advantage in the advertisement/SP industry based on the "comprehensive capability."

Although there are various players in the advertising industry depending on the scale and specialty fields, the Company has succeeded in achieving a position with high competitive advantage through its unique "comprehensive capability."

As mentioned in the market environment section, major advertising agencies, which follow the business model with an oligopolistic control of advertisement spaces, are beginning to focus on online advertising, as the negative growth of mass media such as TV and newspapers continues. However, to maintain their corporate size, they need to efficiently earn income using the mass media. Even if there are needs of POP and SP among the customers, the major advertising agencies need to outsource the work in these fields where flexibility is required. This makes it difficult for them to gain sufficient customer satisfaction.

Meanwhile, advertising agencies specializing in the Internet have grown significantly with the expansion of online advertising and many of them have gotten listed, but they do not have analog solutions for "sales floors" such as POP and SP. They are less likely to choose internalization of producing solutions from their corporate culture.

Under these circumstances, the Company's comprehensive capability to offer a wide range of one stop solutions from planning, production to execution of advertisement/SP, including analog and digital, is extremely attractive to the customers.

The Company recognizes that being in a position to offer solutions based on "comprehensive capability," "flexibility" and "detailed service" is their strong competitive advantage in a field where it is difficult for both major advertising agencies and Internet specialized advertising agencies to provide adequate services, and it will continue to strengthen this position.

◎ Internal system that supports the unique service model

The internal system that supports the "unique service model," which is the Company's unique characteristic, is also a major feature.

Because the Company does not involve agents with customers and all businesses are handled directly with the customers, it can directly identify issues of the industries and companies to which the customers belong.

For the identified issues, the in-house specialized teams consisting of creative directors, planners, copywriters, web designers, and video directors create optimal solutions.

In the past, the Company was mainly outsourcing. However, based on the policy of President Otsu, who is aiming at strengthening competitiveness, the Company began to develop in-house creative teams about 10 years ago. Currently it has about 30 staff who gained extensive experiences at major advertising agencies, etc.

The Company is accumulating know-how by internalizing production of the core parts for creating the optimal solution, while, for the other parts, it builds and utilizes close and strong relationships with excellent external partner companies (website production, SP production, paper, printing, logistics, etc.). It provides one-stop optimal solutions for customers.

◎ It has achieved a position with high competitive advantage in the advertisement/SP industry based on the "comprehensive capability."

Although there are various players in the advertising industry depending on the scale and specialty fields, the Company has succeeded in achieving a position with high competitive advantage through its unique "comprehensive capability."

As mentioned in the market environment section, major advertising agencies, which follow the business model with an oligopolistic control of advertisement spaces, are beginning to focus on online advertising, as the negative growth of mass media such as TV and newspapers continues. However, to maintain their corporate size, they need to efficiently earn income using the mass media. Even if there are needs of POP and SP among the customers, the major advertising agencies need to outsource the work in these fields where flexibility is required. This makes it difficult for them to gain sufficient customer satisfaction.

Meanwhile, advertising agencies specializing in the Internet have grown significantly with the expansion of online advertising and many of them have gotten listed, but they do not have analog solutions for "sales floors" such as POP and SP. They are less likely to choose internalization of producing solutions from their corporate culture.

Under these circumstances, the Company's comprehensive capability to offer a wide range of one stop solutions from planning, production to execution of advertisement/SP, including analog and digital, is extremely attractive to the customers.

The Company recognizes that being in a position to offer solutions based on "comprehensive capability," "flexibility" and "detailed service" is their strong competitive advantage in a field where it is difficult for both major advertising agencies and Internet specialized advertising agencies to provide adequate services, and it will continue to strengthen this position.

Sales were leveling and income decreased. They were lower than the initial forecast.

Sales increased 0.4% YoY to 4,711 million yen. The businesses in the broadcast/communication industry were solid, but orders from the core customer, Asahi Kasei Homes, were sluggish. The Company also did not implement any campaigns for a large customer of the medical/health industry.

Cost of sales increased as a result of an increase in outsourcing expenses due to a change in sales mix and an increase in personnel expenses due to the strengthening of the digital domain. The Company managed to control overall SG&A expenses while promoting the recruitment of employees with expertise. However, operating income decreased 8.7% YoY to 342 million yen.

As the former headquarter building was sold, gain on sales of noncurrent assets was posted as extraordinary income of 617 million yen, resulting in a substantial increase in net income.

The full year forecast was revised downwards in January 2018. Although it did not reach the initial forecast, income exceeded the revised forecast.

Sales were leveling and income decreased. They were lower than the initial forecast.

Sales increased 0.4% YoY to 4,711 million yen. The businesses in the broadcast/communication industry were solid, but orders from the core customer, Asahi Kasei Homes, were sluggish. The Company also did not implement any campaigns for a large customer of the medical/health industry.

Cost of sales increased as a result of an increase in outsourcing expenses due to a change in sales mix and an increase in personnel expenses due to the strengthening of the digital domain. The Company managed to control overall SG&A expenses while promoting the recruitment of employees with expertise. However, operating income decreased 8.7% YoY to 342 million yen.

As the former headquarter building was sold, gain on sales of noncurrent assets was posted as extraordinary income of 617 million yen, resulting in a substantial increase in net income.

The full year forecast was revised downwards in January 2018. Although it did not reach the initial forecast, income exceeded the revised forecast.

Due to weak performance in the second quarter (June - August), sales remained flat and income decreased for the full year. However, personnel enhancement in the housing/living industry and new customers developed in the second half of the previous FY began to contribute. As a result, sales in the third quarter (September - November) and the fourth quarter (December - February) were up 2.2% and up 9.7%, respectively.

Due to weak performance in the second quarter (June - August), sales remained flat and income decreased for the full year. However, personnel enhancement in the housing/living industry and new customers developed in the second half of the previous FY began to contribute. As a result, sales in the third quarter (September - November) and the fourth quarter (December - February) were up 2.2% and up 9.7%, respectively.

*Broadcast/communication industry

Orders from major telecommunication carriers were strong.

*Housing/living industry

Business with the mainstay Asahi Kasei Homes was sluggish. Businesses with other customers, which were strong, could not augment it.

*Medical/health industry

Although promotions for drug store related companies increased, sales declined due to the lack of large-scale campaigns by the mainstay pharmaceutical company.

*Others

There was a significant increase in sales due to the increase of new customers, centered around major restaurant chains.

*Broadcast/communication industry

Orders from major telecommunication carriers were strong.

*Housing/living industry

Business with the mainstay Asahi Kasei Homes was sluggish. Businesses with other customers, which were strong, could not augment it.

*Medical/health industry

Although promotions for drug store related companies increased, sales declined due to the lack of large-scale campaigns by the mainstay pharmaceutical company.

*Others

There was a significant increase in sales due to the increase of new customers, centered around major restaurant chains.

Due to an increase in cash and deposits, current assets increased 304 million yen from the end of the previous fiscal year. Noncurrent assets decreased 329 million yen from the end of the previous fiscal year due to sales of the former headquarter building, etc. Total assets decreased 25 million yen from the end of the previous fiscal year to 4,431 million yen.

Total liabilities decreased 610 million yen from the end of the previous fiscal year to 1,849 million yen due to a decrease in long-term and short-term debts.

Net assets increased 585 million yen from the end of the previous fiscal year to 2,582 million yen due to an increase in retained earnings, etc.

As a result, equity ratio rose 13.5% from the end of the previous fiscal year to 58.3%.

Due to an increase in cash and deposits, current assets increased 304 million yen from the end of the previous fiscal year. Noncurrent assets decreased 329 million yen from the end of the previous fiscal year due to sales of the former headquarter building, etc. Total assets decreased 25 million yen from the end of the previous fiscal year to 4,431 million yen.

Total liabilities decreased 610 million yen from the end of the previous fiscal year to 1,849 million yen due to a decrease in long-term and short-term debts.

Net assets increased 585 million yen from the end of the previous fiscal year to 2,582 million yen due to an increase in retained earnings, etc.

As a result, equity ratio rose 13.5% from the end of the previous fiscal year to 58.3%.

Investing CF turned positive because of decrease in purchase of property, plant and equipment and increase in income by selling the same assets, and the surplus of free CF expanded.

Financing CF turned negative as repayment of long-term debts was advanced.

The cash position has risen.

Investing CF turned positive because of decrease in purchase of property, plant and equipment and increase in income by selling the same assets, and the surplus of free CF expanded.

Financing CF turned negative as repayment of long-term debts was advanced.

The cash position has risen.

Increases in both sales and income are expected.

Sales are expected to increase 13.3% YoY to 5,340 million yen, and operating income is estimated to grow 9.9% YoY to 376 million yen.

Along with a flow from the second half of the previous term, the Company is anticipating sales increases in all industries. However, due to increasing efforts in the digital domain, SG&A expenses will increase, while profit margins will decline. The dividend is to be 42.00 yen/share as in the previous term. The expected dividend payout ratio is 31.8%.

(In the previous fiscal year, the cash related to the transfer of noncurrent assets was used for repayment of debts etc. So, the dividends were paid from profit excluding gains on transfer)

Increases in both sales and income are expected.

Sales are expected to increase 13.3% YoY to 5,340 million yen, and operating income is estimated to grow 9.9% YoY to 376 million yen.

Along with a flow from the second half of the previous term, the Company is anticipating sales increases in all industries. However, due to increasing efforts in the digital domain, SG&A expenses will increase, while profit margins will decline. The dividend is to be 42.00 yen/share as in the previous term. The expected dividend payout ratio is 31.8%.

(In the previous fiscal year, the cash related to the transfer of noncurrent assets was used for repayment of debts etc. So, the dividends were paid from profit excluding gains on transfer)

*Broadcast/communication industry

The Company is expecting healthy growth by stably providing the "Channel Guide" to cable TV stations, strengthening digital measures and expanding orders for sales promotion from major telecommunication carriers.

*Housing/living industry

The Company will continue making efforts to increase orders from client companies other than Asahi Kasei Homes as well as promote integration of sales and production, strengthen capabilities to provide services to client companies, to restore and expand sales.

*Medical/health industry

The Company is anticipating substantial increases in sales.

It will continue providing services to existing pharmaceutical companies. In addition, it is newly entrusted to create communication brochures (monthly) which will be published by a major drug store chain. It will also continue strengthening proposals for sales promotion measures that utilize the expenditures for distribution measures of the drugstore industry.

*Other industries

In addition to significantly expanding businesses with the major restaurant chains that became new customers in the previous fiscal year, it will work with existing customers and development of new customers.

The Company began expanding the business in China as a new initiative. It will also continue focusing on strengthening services in the digital domain.

*Broadcast/communication industry

The Company is expecting healthy growth by stably providing the "Channel Guide" to cable TV stations, strengthening digital measures and expanding orders for sales promotion from major telecommunication carriers.

*Housing/living industry

The Company will continue making efforts to increase orders from client companies other than Asahi Kasei Homes as well as promote integration of sales and production, strengthen capabilities to provide services to client companies, to restore and expand sales.

*Medical/health industry

The Company is anticipating substantial increases in sales.

It will continue providing services to existing pharmaceutical companies. In addition, it is newly entrusted to create communication brochures (monthly) which will be published by a major drug store chain. It will also continue strengthening proposals for sales promotion measures that utilize the expenditures for distribution measures of the drugstore industry.

*Other industries

In addition to significantly expanding businesses with the major restaurant chains that became new customers in the previous fiscal year, it will work with existing customers and development of new customers.

The Company began expanding the business in China as a new initiative. It will also continue focusing on strengthening services in the digital domain.

Specifically, it will focus on the following 3 efforts using its strengths.

Development into "sales floors"

The Company has many clients that have "sales floors" such as Asahi Kasei Homes which has exhibition halls nationwide, drug stores, home improvement stores and car dealers, and it has been providing excellent services for customer attraction and purchasing support. Even currently, using the advertisement distribution system based on geographic information of smartphones, it offers geo-marketing measures to attract customers to real stores.

Like the interactive theater room using VR which the Company provided to Asahi Kasei Homes, it will keep up with the evolution of technologies and provide measures that utilize the latest advertising technology to lead to an increase in sales in the digital domain.

Capturing major clients

Even among the major clients, the importance of mass media has been declining year by year, while the needs for promotional media and online advertising are increasing.

Also, unlike online advertising agencies, the Company can receive orders from upstream. It is planning to expand sales in the digital domain by collectively providing all promotional measures not just by promotion on the Internet.

Expansion outside of the Tokyo metropolitan area

While advertising agencies that are strong with online advertising are concentrated in the Tokyo metropolitan area, the Company offers web marketing, Home Page production, etc. to local cable TV stations across the nation as a measure to support them to obtain viewers. In addition to this, home improvement stores and drug stores, which are the Company's core clients, also have the business base outside of Tokyo as they are operating businesses nationwide.

Taking advantage of this, the Company will strengthen sales activities outside of Tokyo, mainly through its branches in Osaka and Nagoya.

Priority measure (2): Strengthening efforts in the new industries

In the "medical/health industry" and "other industries" which are the major pillars following the "broadcast/ communication industry" and "housing/living industry," the Company is making efforts to obtain major customers and develop businesses in the inbound area.

(Medical/health industry)

The new media "Re: KiiTa," which was launched at the end of 2016, had a good start thanks to the approval of the Japan Association of Chain Drug Stores.

Together with free information magazine "KiiTa" for consumers, the Company's media capabilities and content capabilities to the drug store storefront have been improving, and advertisements collected for both magazines are steadily increasing. It will further strengthen its marketing activities to the drugstore industry.

(Other industries)

It is receiving orders for promotion projects from new major client companies such as Japan Pizza Hut and Japan Subway. It will expand the business in the industries and companies that have store networks including the restaurant industry.

(Japan/China business)

As mentioned in the previous report, the Company intends to work on expanding the Japan-China business. The following specific movements were observed.

In January 2018, the Company concluded a business alliance contract with Shanghai's leading advertising company "Shanghai Yiwei Information Technology Co., Ltd." for the purpose of supporting Japanese companies to enter the Chinese market and Chinese companies to enter the Japanese market as well as to strengthen inbound advertising in the Japan-China business.

Shanghai Yiwei Information Technology Co., Ltd. has strengths in collaboration with Chinese airlines, content holders (China IP) and web platforms.

Through this comprehensive business alliance, NISSEN can increase the handling media for the inbound marketing in China that can be proposed to client companies.

In addition, by leveraging the strengths of the network with various Japanese content holders through the "Channel Guide" TV program information magazine for cable TV subscribers, which is one of the main services of NISSEN, they will collaboratively support rapidly growing Chinese companies to enter Japan as well as disseminate attractive Japanese products to the Chinese market.

Furthermore, it will work on promoting the outbound distribution of Japanese content. For example, as a partner of Shanghai's largest media "SMG (SHANGHAI MEDIA GROUP)," it will support the performance of the Japanese stage "Musashi" in Shanghai and support the opening of the Japanese animation exhibition "AnimeJapan" in China in collaboration with Tencent's subsidiary "CHINA LITERATUR" and 3D animation production company in China "kaca."

It will also support the expansion of Chinese contents in Japan.

Priority measure (3): Strengthening recruitment and HR development

In the past, the Company was mainly hiring experienced and mid-carrier people. However, as it is necessary to enhance organizational capabilities mainly with young people to strengthen marketing and solution capabilities in the digital age, it is currently strengthening recruitment and training of new graduates, and recruitment of full-time employees is proceeding smoothly.

In the previous fiscal year, the Company changed the status of part-time employees who were involved in the work of "Channel Guide" in broadcast/communication business to full-time employees. In the fiscal year ending February 2019, it strengthened the recruitment of new graduates. Three employees joined in April 2017, while nine employees joined in April 2018. In the future, it is planning to employ about ten people every year.

Meanwhile, the Company is also working on mid-career recruitment of people with advertisement business experiences from major advertising agencies, etc., people in the digital field and management staff.

Specifically, it will focus on the following 3 efforts using its strengths.

Development into "sales floors"

The Company has many clients that have "sales floors" such as Asahi Kasei Homes which has exhibition halls nationwide, drug stores, home improvement stores and car dealers, and it has been providing excellent services for customer attraction and purchasing support. Even currently, using the advertisement distribution system based on geographic information of smartphones, it offers geo-marketing measures to attract customers to real stores.

Like the interactive theater room using VR which the Company provided to Asahi Kasei Homes, it will keep up with the evolution of technologies and provide measures that utilize the latest advertising technology to lead to an increase in sales in the digital domain.

Capturing major clients

Even among the major clients, the importance of mass media has been declining year by year, while the needs for promotional media and online advertising are increasing.

Also, unlike online advertising agencies, the Company can receive orders from upstream. It is planning to expand sales in the digital domain by collectively providing all promotional measures not just by promotion on the Internet.

Expansion outside of the Tokyo metropolitan area

While advertising agencies that are strong with online advertising are concentrated in the Tokyo metropolitan area, the Company offers web marketing, Home Page production, etc. to local cable TV stations across the nation as a measure to support them to obtain viewers. In addition to this, home improvement stores and drug stores, which are the Company's core clients, also have the business base outside of Tokyo as they are operating businesses nationwide.

Taking advantage of this, the Company will strengthen sales activities outside of Tokyo, mainly through its branches in Osaka and Nagoya.

Priority measure (2): Strengthening efforts in the new industries

In the "medical/health industry" and "other industries" which are the major pillars following the "broadcast/ communication industry" and "housing/living industry," the Company is making efforts to obtain major customers and develop businesses in the inbound area.

(Medical/health industry)

The new media "Re: KiiTa," which was launched at the end of 2016, had a good start thanks to the approval of the Japan Association of Chain Drug Stores.

Together with free information magazine "KiiTa" for consumers, the Company's media capabilities and content capabilities to the drug store storefront have been improving, and advertisements collected for both magazines are steadily increasing. It will further strengthen its marketing activities to the drugstore industry.

(Other industries)

It is receiving orders for promotion projects from new major client companies such as Japan Pizza Hut and Japan Subway. It will expand the business in the industries and companies that have store networks including the restaurant industry.

(Japan/China business)

As mentioned in the previous report, the Company intends to work on expanding the Japan-China business. The following specific movements were observed.

In January 2018, the Company concluded a business alliance contract with Shanghai's leading advertising company "Shanghai Yiwei Information Technology Co., Ltd." for the purpose of supporting Japanese companies to enter the Chinese market and Chinese companies to enter the Japanese market as well as to strengthen inbound advertising in the Japan-China business.

Shanghai Yiwei Information Technology Co., Ltd. has strengths in collaboration with Chinese airlines, content holders (China IP) and web platforms.

Through this comprehensive business alliance, NISSEN can increase the handling media for the inbound marketing in China that can be proposed to client companies.

In addition, by leveraging the strengths of the network with various Japanese content holders through the "Channel Guide" TV program information magazine for cable TV subscribers, which is one of the main services of NISSEN, they will collaboratively support rapidly growing Chinese companies to enter Japan as well as disseminate attractive Japanese products to the Chinese market.

Furthermore, it will work on promoting the outbound distribution of Japanese content. For example, as a partner of Shanghai's largest media "SMG (SHANGHAI MEDIA GROUP)," it will support the performance of the Japanese stage "Musashi" in Shanghai and support the opening of the Japanese animation exhibition "AnimeJapan" in China in collaboration with Tencent's subsidiary "CHINA LITERATUR" and 3D animation production company in China "kaca."

It will also support the expansion of Chinese contents in Japan.

Priority measure (3): Strengthening recruitment and HR development

In the past, the Company was mainly hiring experienced and mid-carrier people. However, as it is necessary to enhance organizational capabilities mainly with young people to strengthen marketing and solution capabilities in the digital age, it is currently strengthening recruitment and training of new graduates, and recruitment of full-time employees is proceeding smoothly.

In the previous fiscal year, the Company changed the status of part-time employees who were involved in the work of "Channel Guide" in broadcast/communication business to full-time employees. In the fiscal year ending February 2019, it strengthened the recruitment of new graduates. Three employees joined in April 2017, while nine employees joined in April 2018. In the future, it is planning to employ about ten people every year.

Meanwhile, the Company is also working on mid-career recruitment of people with advertisement business experiences from major advertising agencies, etc., people in the digital field and management staff.

(Future growth outlook)

In addition to achieving a stable earnings base of the broadcast/communication industry and the housing/living industry, the Company will also work on developing and deepening businesses in the medical/health industry and new industries as growth areas.

Furthermore, it will focus on the development of services in the digital domain in all industries and across the Company, to accelerate growth speed.

It will also consider implementing M&A activities and establishing business alliances to strengthen speedy service capabilities and acquire human resources.

(Future growth outlook)

In addition to achieving a stable earnings base of the broadcast/communication industry and the housing/living industry, the Company will also work on developing and deepening businesses in the medical/health industry and new industries as growth areas.

Furthermore, it will focus on the development of services in the digital domain in all industries and across the Company, to accelerate growth speed.

It will also consider implementing M&A activities and establishing business alliances to strengthen speedy service capabilities and acquire human resources.

◎ Corporate Governance Report

Last update date: May 30, 2017

<Basic idea>

Under the corporate philosophy of "By providing unique communication services, we will contribute to the management of our customers" and management philosophy of "We pursue the happiness of both sides of all employees,", the Company believes that continuous enhancement of corporate value are the most important management challenges for all stakeholders including shareholders, business partners and employees. Therefore, in addition to the sustainable development of the company group and maximization of the corporate value, the Company is working to strengthen corporate governance through the supervisory functions of the Board of Directors and Board of Corporate Auditors and the internal control system.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

It is stated that "We are implementing all the basic principles of corporate governance code."

◎ Corporate Governance Report

Last update date: May 30, 2017

<Basic idea>

Under the corporate philosophy of "By providing unique communication services, we will contribute to the management of our customers" and management philosophy of "We pursue the happiness of both sides of all employees,", the Company believes that continuous enhancement of corporate value are the most important management challenges for all stakeholders including shareholders, business partners and employees. Therefore, in addition to the sustainable development of the company group and maximization of the corporate value, the Company is working to strengthen corporate governance through the supervisory functions of the Board of Directors and Board of Corporate Auditors and the internal control system.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

It is stated that "We are implementing all the basic principles of corporate governance code."