| Nippon Piston Ring (6461) |

|

||||||||

Company |

Nippon Piston Ring Co., Ltd. |

||

Code No. |

6461 |

||

Exchange |

TSE First Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Akira Yamamoto |

||

HQ Address |

5-12-10, Honmachi Higashi, Chuo-ku, Saitama City, Saitama, Japan |

||

Year-end |

March |

||

URL |

|||

* The share price is the closing price on November 22. The number of shares outstanding was taken from the latest brief financial report.

ROE is the value for the previous term. BPS is the value for the second quarter of the fiscal year 2017. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. The definition for net profit is net profit attributable to parent company shareholders (Hereinafter the same apply). EPS and DPS have been adjusted to reflect the reverse stock split of 1 for 10 conducted on October 1, 2015.

A commemorative dividend of ¥1.00 per share in addition to the normal dividend of ¥5.00 was conducted to commemorate the 80th year of Nippon Piston Ring's operations in FY 2014, |

| Key Points |

|

| Company Overview |

|

Nippon Piston Ring boasts of strengths in metallic materials, surface quality improvement and precision processing technologies. New products are being developed to expand the range of its businesses into the metal injection molding products, medical products, and other realms not related to automobile engine parts. <Corporate History>

Nippon Piston Ring was founded by Tomonori Suzuki in 1931 in Kawaguchi City, Saitama Prefecture just prior to the start of mass domestic production of automobiles by manufacturers such as Toyota and Nissan, following the Government program for "establishment of an automobile industry" adopted in August 1935. The company name Nippon Piston Ring Co., Ltd. was officially adopted along with the establishment of the factory in Kawaguchi City in 1934.During the Second World War, the Company began mass production of chrome plated rings for airplanes. At the end of the War in 1945, the factory was temporarily closed, but the company began operations along with the listing of its shares on the Tokyo Stock Exchange in 1949. Nippon Piston Ring's earnings expanded rapidly along with the rapid expansion in Japanese automobile exports, and the strong demand for vehicles due to economic growth in the post-war reconstruction within Japan. Beginning to provide products to German and American motor vehicle manufacturers in the 1970s, the Company has continued organizing a global manufacturing and sales structure, establishing overseas production bases in Thailand, Indonesia, China and India since 2000. The metal injection molding products business and dental implants business were acquired in 2014 as part of the strategy of expanding its product lineup outside of the motor vehicle engine parts realm, and the Company has started to operate the business by its own facility since 2015.  <Market Environment>

◎ Global Automobile Production Volume

The global production volume of vehicles of less than six tons in gross weight is expected to continue to increase from 93.00 million units in 2016 to over 100 million in 2020 and to eventually reach 109 million in 2024.Looking at the details of these estimates, vehicles of less than six tons manufactured in Europe, North America, Japan and other developed economic regions are expected to see only slight increases. However, stronger growth in China, ASEAN countries, South America, India and other developing economic regions is expected to allow their share of vehicles of less than six tons to rise from 51% in 2016 to 58% in 2024.  ◎ Production Volume by Powertrain (Drive System)

It is projected, regarding the production volume forecast by powertrain (drive system), that the growing environmental awareness will result in a slight reduction in the market share of gasoline and diesel engines, while the share of hybrid vehicles (HVs) or plug-in-hybrid vehicles (PHVs), which are driven both by gasoline engines and electricity, will increase. Currently, pieces of news about a worldwide growth in the number of electric vehicles (EVs) are coming in; however, it is expected that EVs will account for only 4.1% of 109 million vehicles in 2024, which means that gasoline and diesel engines will still be in the mainstream. Demand for piston rings and valve seat inserts is expected to continue to show healthy growth.   Nippon Piston Ring's stock price index or its operating profit margin is the lowest among these three companies. Improvement of both market awareness and profitability needs to be tackled. <Business Description>

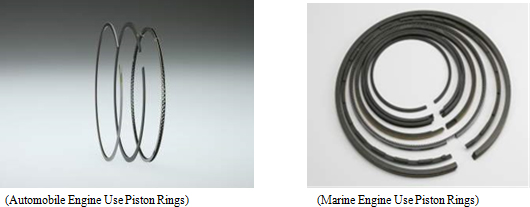

◎ Main Products

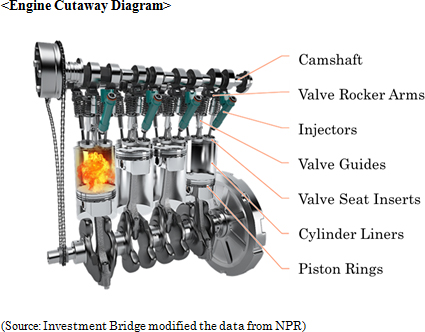

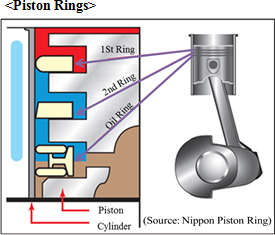

As reflected in the Company name, piston rings are one of the main products manufactured. In addition, valve seat inserts and various other automobile parts are manufactured and sold. In fiscal year 2016, automobile related parts accounted for 87.0% of total sales.At the same time, metal injection molding products business and the dental implant products business were acquired in 2014. New product development is being promoted as a means of expanding its business in the non-automobile engine components realm.     Piston rings are fitted in grooves that run around the circumference of pistons and have spring-like characteristics to act as a seal for ideal combustion within the combustion chamber of the engine cylinders and control lubrication of the piston and cylinder walls by forming precise circles. Moreover, three piston rings are normally used, to form a seal to prevent leakage of oil, allow heat to escape and reduce both friction wear and baking.

Smooth movement of pistons will be impeded and fuel consumption will be negatively impacted should the tensional force of the piston ring placed on pistons be too high. Conversely, loss of power and increased oil consumption will result if the tensional force of the piston ring placed on pistons is too low.Consequently, optimization of the tensional forces of piston rings is crucial in ensuring the optimum performance of internal combustion piston engines. An oil film is formed between the cylinder wall and pistons to reduce friction wear and baking, which could be caused by the high-speed movement of pistons within a high-heat condition of cylinders. However, it's not thicker the better; piston oil rings need to be designed to ensure that an optimal thickness of oil film is formed. Piston rings are required to provide wear resistance, material strength, heat resistance, heat conductivity, and oil retention capacity to ensure the optimal performance and durability of engines. In recent years, with the rapid rise in awareness of environment issues, a swift response is vital to adjust to a system that certifies vehicles with low output levels of nitrous oxides and hydrocarbons, and regulations to enforce reductions in a carbon dioxide emission. Consequently, the need for high-performance piston rings that respond to these developments and the need for improvements in fuel consumption are on the rise. With regards to the characteristics required to piston rings, development of piston rings with low friction construction, thinner width, new surface treatment processes, highly durable and low-cost materials is being conducted. At the same time, development and proposal of optimal design technologies using its tuning technic are also being promoted. Nippon Piston Ring is one of only few companies that have the ability to stably manufacture and supply piston rings, which, as you may see, require extremely advanced technological capabilities, and are able to consistently develop revolutionary technologies.  <Valve Seat Inserts>

Valve seat inserts are parts which are press-fitted into the valve seating portion of cylinder heads. Valve seat inserts are a very important part made from sintered alloys that boast of high resistance to wear and deterioration under high heat conditions and ensure that a tight seal is formed for clean and efficient combustion. Nippon Piston Ring boasts of quality valve seat inserts that meet the needs of automobile manufacturers at a high level, using a wide range of material variation, leveraging its superior materials development capabilities. Consequently, the Company boasts of a top share of slightly less than 40% of valve seat inserts provided to Japanese automobile manufacturers and it is expanding its sales to overseas motor vehicle manufacturers.

<Camshafts>

Camshafts are a part designed to open and close the valves for each cylinder in piston engines. Nippon Piston Ring has the original technology for a special camshaft called assembled sintered camshafts, which are lightweight, highly resistant to contact pressure and capable of adopting a wide variety of designs. They are used by SUBARU in all of its self-manufactured engines, as well as used by truck manufacturers, which require highly durable products.

◎ Customers

Nippon Piston Ring supplies piston rings and valve seat inserts to all Japanese automobile manufacturers.The products supplied by the Company are extremely important in improving the performance of engines and require high levels of technical expertise. In recent years, the need to improve fuel consumption and to seek alternative fuels due to the growing importance of environmental issues has contributed to expanded sales to non-Japanese automobile manufacturers such as European, American and Chinese local automobile manufacturers.  <Manufacturing and Sales Facilities>

<Japan>

Nippon Piston Ring maintains four manufacturing facilities and seven sales offices (Tokyo [head office: Saitama City],Nagoya, Osaka, Hiroshima, Fukuoka, Sendai, Sapporo) within Japan.

<Overseas>

Nippon Piston Ring maintains both manufacturing and sales bases for piston rings, valve seat inserts and other products in the United States, China, ASEAN countries, and India. The company has sales bases in Germany, Singapore and Malaysia , too.

<Characteristics and Strengths>

Nippon Piston Ring's highly advanced technologies and ability to consistently supply highly reliable functional automobile parts maintained throughout its history over 80 years of operations has allowed it to become the choice of both Japanese and overseas automobile manufacturers. In recent years, development of major products, which can contribute to reductions in exhaust gases, low output levels of carbon dioxides and the achievement of "over 50% thermal efficiency rates" in internal combustion engines, is being conducted.

In addition, automobile manufacturers, to whose business the Company's high levels of technological expertise are critical, are what the Company calls its "client assets," which are an important part of its corporate value.  |

| The First Half of Fiscal Year 2017 Earnings Overview |

Sales and profit increased, both exceeding the initial forecasts.

Sales were 27.5 billion yen, up 7.1% year on year, hitting a record high for the first half of a fiscal year. Domestic sales were 10.5 billion yen, down 0.4billion yen year on year. Overseas sales stood at 17.0 billion yen, up 2.2 billion yen year on year. The ratio of overseas sales rose 4.8% from 57.0% in the fiscal year 2016 to 61.8%. Operating profit was 1,509 million yen, up 2.5% year on year. Despite several negative impacts, such as a rise in material costs, the company realized profit growth thanks to the effect of increased production, and other positive factors. Ordinary profit was 1,682 million yen, up 33.5% year on year due to gain on foreign exchange. Both sales and profit exceeded their respective initial forecasts.  In addition, the composition ratio of valve seat inserts and assembled sintered camshafts both rose 4.4% year on year.  While interest-bearing debts grew, the company paid capital expenditures, resulting in total liabilities of 36,723 million yen, up 470 million yen from the end of the previous term. Total interest-bearing debts were 18,090 million yen, up 1,143 million yen from the end of the previous term. Net assets stood at 30,999 million yen, up 116 million yen from the end of the previous term, because foreign currency translation adjustment decreased 434 million yen while the rise in retained earnings increased shareholders' equity by 621 million yen. Consequently, the equity ratio was 44.9%.   (4) Topics

On December 22, 2017, NPR and Daido Metal Co., Ltd. (7245, first section of Tokyo Stock Exchange (TSE)) signed a "Memorandum of Understanding (MOU)" with the aim of holding discussion with each other about partial transfer of the equity interest of NPR of Europe Gmbh (NOE; located in Germany), a subsidiary which is owned fully by NPR, to Daido Metal.◎ Signed a Memorandum of Understanding for partial transfer of the equity interest of NPR's subsidiary in Germany (Backgrounds to signing the MOU) NPR and Daido Metal have cooperated with each other through NOE in the European market in selling the products of Daido Metal, such as engine bearings, to European manufacturers of automobiles and automobile engines. As both companies have determined that further improvement of their cooperative relationship will make their respective business foundations more solid and improve corporate value, as well as further increase their presence in the European market, they decided to hold discussion and therefore signed a MOU for partial transfer of the equity interest of NOE.  ◎Exhibited at "Tokyo Motor Show 2017"

The company exhibited its products at Tokyo Motor Show held from October 27 to November 5, 2017 in Tokyo Big Sight (Ariake, Koto-ku). This year, it presented Diamond Like Carbon (DLC) coated piston rings and cylinder liners with fine dimples on their inner surfaces as "environmentally-friendly" products at its exhibition booth, which, by taking into account opinions of the company's female employees, was established with green and light blue that are associated with nature as base colors. A number of visitors expressed their interest in the DLC surface treatment technology that improves fuel consumption efficiency by reducing the frictional force. In addition, the company introduced metal injection molding products which are high quality and can be used for multifarious purposes, including ones for electric power steering and electric brakes. Furthermore, the company explained to visitors its efforts to develop new products, such as motor cores, in anticipation of a growth in the number of EVs.  |

| Fiscal Year 2017 Earnings Forecast |

The full-year earnings forecast is unchanged. Although sales will stay almost the same due to impacts of foreign exchange rates, profit will grow thanks to the cost reduction effects.

The full-year earnings forecast is unchanged. Sales are estimated to be 52.5 billion yen, up 0.7% year on year. Exchange rates for the second half are assumed to be 108 yen/US dollar and 115 yen/euro. Operating profit is forecasted to be 3.3 billion yen, up 1.9% year on year. The company will continue to put forth strenuous efforts at an increase in business with both Japanese and overseas automobile manufacturers, and cost reduction through Revolutionary Manufacturing progressing for major products. It is estimated that ordinary profit will stand at 3.1 billion yen, up 6.9%, and net profit will be 2.1 billion yen, down 13.0% year on year. The dividend amount is projected to be 70 yen/share, up 5 yen year on year. Payout ratio is estimated to be 27.4%. |

| Interview with President Yamamoto |

|

Q: "How do you think your company has performed in the first half of the fiscal year 2017?"

A: "Sales increased steadily. Although accumulation of operating profit was somewhat insufficient, we will recover in the second half."

Due to the favorable order environment, sales made a record high in the first half and were on track. Although sales and profit increased in the first half, in the second quarter, operating profit declined 17.8% despite an increase in sales of 4.3% compared with the same quarter of the last year. The factors that we could not accumulate operating profit in the second quarter include a rise in the cost of raw materials as an external environmental factor, but more than that, cost reduction did not progress. As a result, our stock price fell by about 10% immediately after the announcement of the settlement of accounts. At present, improvements for cost reduction in factories are underway. Although not all of them will immediately lead to operating profit, we will again focus on cost reduction activities. The factories are almost fully in operation. Although we will invest in automation and flexible manpower production line, "manpower"-required tasks are still necessary in delicate processes, etc. We need to keep on increasing the number of multi-skilled workers, and thus, we will continue to provide education and training opportunities. Q: "There are six months until the end of the Sixth Medium Term Business Plan. What are the progresses?"

A: "We aim at the largest possible increase in sales and operating profit margin. Main initiatives are making steady progress."

At the moment, the forecast for fiscal year 2017 is "sales of 52.5 billion yen and an operating profit margin of 6.3%", while the target values of the Sixth Medium Term Business Plan are "sales of 55 billion yen or more, and an operating profit margin of 7% or more". It is difficult to attain the target. This is due to the fact that the yen is higher than the exchange rate at the time of setting plans, the delay in mass production by automobile manufacturers, and the decrease in demand compared to the planned number of vehicles. We are promoting sales expansion to Japanese automobile manufacturers and increase sales to be close to the target value. The overseas sales ratio in the first half, which was 61.8%, exceeded the target value of 59.0%. Although operating profit margin will also not reach the target value, 2.5 points of improvement were made from the fiscal year 2014, which should be recognized. We also try to recover by further promoting cost reduction actions with determination. With regard to "Acquiring strategic models through differentiation of products", our continuous focuses on development has led to solid sales growth and improved customer trust. For piston rings, we gained many sales opportunities thanks to Diamond Like Carbon (DLC) surface treatment technology which realizes improvement in fuel economy of the engine by reducing the frictional force. For valve seat inserts, we were able to proceed with the development of new materials. Moreover, for cylinder liners, we commercialized cylinder liners with fine dimples on the inner circumferential surface which reduce the friction with piston rings and realize improvement in fuel economy of the engine. With regard to "Promoting revolutionary manufacturing", we are organizing production lines under the new concept for our main products including piston rings, valve seat inserts and assembled sintered camshafts. With regard to "Commercialization of new products", metal injection molding products (METAMOLD) are spreading to the field of non-automotive engine parts, leading to the acquisition of new customers. METAMOLD realizes low cost and complicated shape by integral molding. Especially ball screws are adopted not only in the automotive field, including electric brakes and electric power steering, but also in the field of industrial machinery. Q: "What are the points in the next Medium Term Business Plan?"

A: "We will continue to work on expanding our primary products, expanding overseas sales, and improving profitability."

The next Medium Term Business Plan (7th) is currently being formulated for announcement this May. I believe that "expansion of primary products", "expansion of overseas sales" and "improvement of profitability" will be the key points. Specific measures will include expansion of sales to Japanese and non-Japanese automobile manufacturers in overseas countries and cost reduction based on new ideas. As for "expansion of overseas sales", we will expand sales functions that can make technical proposals in major markets such as China, Europe and the United States. To achieve that, I think it is necessary to increase the number of foreign sales engineers (SEs). With regard to production, we will improve productivity taking into account the balance of production volume between domestic bases and overseas bases. Furthermore, we will pursue expansion of the global market share of our primary products as a major goal. Although the market share of both piston rings and valve seat inserts is rising, there is still much room for sales expansion. We will expand our sales among overseas Japanese automobile manufactures by entering into overseas developed engines of Japanese automobile manufacturers as well as expand our global market share by expanding transactions with non-Japanese automobile manufacturers. |

| Conclusions |

|

While fully grasping the reasons for the profit decline as internal factors, the company is striving to take countermeasures so that the decline will be offset in the second half. We would like to pay attention to how much the company can increase operating profit in the latter half of the final fiscal year for the Sixth Medium Term Business Plan.  In addition to engaging in its existing businesses, the company will expand its businesses to the field of non-automotive engine parts and develop new products. We would like to give our attention to the Seventh Medium Term Business Plan, which is scheduled to be announced this May. |

| <Reference1: The Sixth Mid-Term Business Plan> |

|

① Outline of the sixth mid-term business plan

As Nippon Piston Ring commemorated the 80th anniversary of its establishment in December 2014, it is "establishing the foundations for Nippon Piston Ring to prosper for 100 years," and engaging in the sixth mid-term business plan, whose final term is the fiscal year 2017, with the aim of promoting the sales of existing products and cultivating new markets.

However, since the global production volume of automobiles is increasing and the global measures for coping with environmental issues have been tightened, it is expected that the needs for good mileage and emissions control will grow, and so there is plenty of room for promoting sales toward Japanese and overseas automobile manufacturers. Revolutionary manufacturing pursuing rationalization is progressing, so it can be said that the company is reducing cost further to achieve goals.   The amount of equipment investment for fiscal year 2017 is projected to be 6.7 billion yen. The amount is considerable, but this is indispensable for securing the future position of the company. In fiscal year 2017, the production capacity of piston rings inside Japan is equal to that outside Japan, while the production capacity of valve seat inserts outside Japan accounts for 70%.   |

| <Reference2: Corporate Governance> |

◎ Corporate Governance Report

Last modified: June 29, 2017.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and/or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018, All Rights Reserved by Investment Bridge Co., Ltd. |