| Nakamura Choukou Co., Ltd. (6166) |

|

||||||||

Company |

Nakamura Choukou Co., Ltd. |

||

Code No. |

6166 |

||

Exchange |

TSE Mothers |

||

Industry |

Machinery (manufacturing) |

||

President |

Makoto Inoue |

||

Address |

27-27 Tsuruta-cho, Nishi-ku, Sakai-shi, Osaka prefecture |

||

Year-end |

End of March |

||

URL |

|||

*The share price is the closing price on July 4. Number of shares issued on the latest earning summary.

ROE and BPS are the values at the end of March 2018. |

||||||||||||||||||||||||

|

|

*The values for the term ending Mar. 2019 were estimated by the Company.

Net income is profit attributable to the stock owners of the parent Company. Hereinafter the same applies. This report introduces Nakamura Choukou Co., Ltd.’s Fiscal Year March 2018 earnings results and others. |

|

| Key Points |

|

| Company Overview |

|

Nakamura Choukou's main businesses are development, manufacturing and sale of diamond wires, which are used in the slicing process to manufacture silicon wafers for solar cells. A diamond wire is a threadlike sawing tool with diamond grains firmly attached to a fine piano wire. Diamond wires are rapidly spreading as they reduce the cost in manufacturing silicon wafers (*1). The affiliated Company deals with slicing business using the diamond wires, which adds strength to the Company's business of manufacturing and sale of diamond wires. The Company is also focusing on the early launch of new businesses.

Wafers (*1)

A wafer is a flat functional part that is produced by thinly slicing ingots of electronic materials. It is made of various materials by purpose such as silicon, sapphire, SiC (silicon carbide) and GaN (gallium nitride). Silicon wafers are often used for IC chips and solar cells.

1-1 Corporate history 1-1 Corporate history "Nakamura Steel Works" (the predecessor of Nakamura Choukou) was established in October 1954 in Sakai City, Osaka Prefecture as a machine screw manufacturer for sewing machines. "Nakamura Choukou Co., Ltd." was established in December 1970, which mainly manufactured cutting tools and wear-resistant tools made of cemented carbide. The Company switched the main material from cemented carbide to diamond in 1988 and started the development, manufacturing and sale of diamond nozzles (*) in 1993. The Company supported the manufacturing innovation for the IT industry and its business expanded. In 2004 after the burst of the dot-com bubble, the Company started the research and development for the current main product, diamond wire, whose target was the energy industry and started distributing it in 2010. The Company overcame the impact of the financial crisis in 2008 by dealing with not only the manufacture and distribution of diamond wire but also the slicing business. The Company was listed on Mothers of Tokyo Stock Exchange in June 2015.

Diamond nozzles (*)

A nozzle with sintered diamond at the tip, which is used for mounting electronic components on a print circuit board. By using diamond, the lifespan of the nozzle, holding capacity of the electronic component, image recognition efficiency and mounting efficiency are improved.

"Nakamura Steel Works" (the predecessor of Nakamura Choukou) was established in October 1954 in Sakai City, Osaka Prefecture as a machine screw manufacturer for sewing machines. "Nakamura Choukou Co., Ltd." was established in December 1970, which mainly manufactured cutting tools and wear-resistant tools made of cemented carbide. The Company switched the main material from cemented carbide to diamond in 1988 and started the development, manufacturing and sale of diamond nozzles (*) in 1993. The Company supported the manufacturing innovation for the IT industry and its business expanded. In 2004 after the burst of the dot-com bubble, the Company started the research and development for the current main product, diamond wire, whose target was the energy industry and started distributing it in 2010. The Company overcame the impact of the financial crisis in 2008 by dealing with not only the manufacture and distribution of diamond wire but also the slicing business. The Company was listed on Mothers of Tokyo Stock Exchange in June 2015.

Diamond nozzles (*)

A nozzle with sintered diamond at the tip, which is used for mounting electronic components on a print circuit board. By using diamond, the lifespan of the nozzle, holding capacity of the electronic component, image recognition efficiency and mounting efficiency are improved.

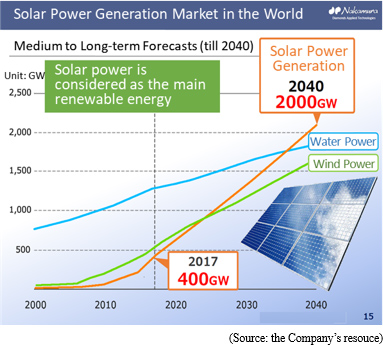

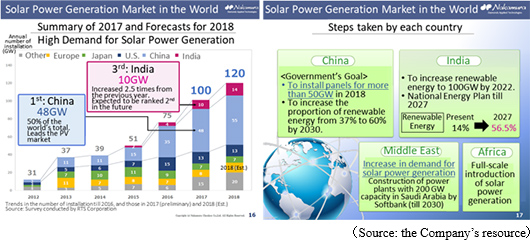

1-3 Market environment 1-3 Market environment (1) The continuous expanding demand for solar power energy

The use of renewable energy is promoted globally for the reduction of greenhouse gas emissions causing global warming. Among these kinds of renewable energy, solar power is regarded as central way of electric generation.

(1) The continuous expanding demand for solar power energy

The use of renewable energy is promoted globally for the reduction of greenhouse gas emissions causing global warming. Among these kinds of renewable energy, solar power is regarded as central way of electric generation.

The demand for solar power generation is strong in this situation and the installation amount has risen sharply mainly in China and India since 2015.

The demand for solar power generation is strong in this situation and the installation amount has risen sharply mainly in China and India since 2015.

(2) Expansion of the Polycrystalline Silicon Wafer Market and Diamond Wire

Along with the spread of solar power generation, the demand for silicon wafers used in solar panels is increasing.

Silicon wafers are roughly classified into monocrystalline silicon wafers and polycrystalline silicon wafers, but each of them has advantages and disadvantages. (2) Expansion of the Polycrystalline Silicon Wafer Market and Diamond Wire

Along with the spread of solar power generation, the demand for silicon wafers used in solar panels is increasing.

Silicon wafers are roughly classified into monocrystalline silicon wafers and polycrystalline silicon wafers, but each of them has advantages and disadvantages.

In the past, polycrystalline silicon wafers with good yield and of low price were mainly used, but monocrystalline silicon wafers are becoming mainstream due to the total cost performance including their high efficiency of energy conversion and their panel installation with excellent processing quality.

The diamond wire used for slicing silicon wafers are showing an explosive growth.

Japanese companies, including Asahi Diamond Industries Co., Ltd. (6140, the first section of Tokyo Stock Exchange (TSE)) and the Company, globally had the largest market share of diamond wires; however, Chinese manufacturers have been rising lately and, seemingly, their total market share has exceeded that of Japanese companies.

However, in order to take in the expanding demand for monocrystalline silicon wafers, the Company has been promoting technological innovation for thinning and drastic cost reduction and is proceeding with differentiation from a Chinese diamond wire.

In the past, polycrystalline silicon wafers with good yield and of low price were mainly used, but monocrystalline silicon wafers are becoming mainstream due to the total cost performance including their high efficiency of energy conversion and their panel installation with excellent processing quality.

The diamond wire used for slicing silicon wafers are showing an explosive growth.

Japanese companies, including Asahi Diamond Industries Co., Ltd. (6140, the first section of Tokyo Stock Exchange (TSE)) and the Company, globally had the largest market share of diamond wires; however, Chinese manufacturers have been rising lately and, seemingly, their total market share has exceeded that of Japanese companies.

However, in order to take in the expanding demand for monocrystalline silicon wafers, the Company has been promoting technological innovation for thinning and drastic cost reduction and is proceeding with differentiation from a Chinese diamond wire.

1-4 Business contents 1-4 Business contents 1. Segment

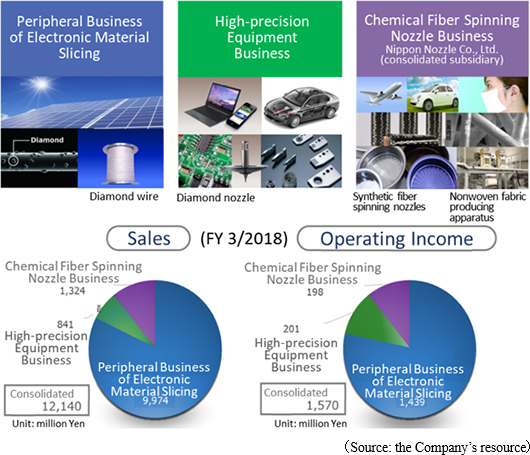

Nakamura Choukou's businesses consist of the three segments: Peripheral Business of Electronic Material Slicing, High-precision Equipment, and Chemical Fiber Spinning Nozzle Businesses.

1. Segment

Nakamura Choukou's businesses consist of the three segments: Peripheral Business of Electronic Material Slicing, High-precision Equipment, and Chemical Fiber Spinning Nozzle Businesses.

(1)Peripheral Business of Electronic Material Slicing

The development, manufacturing, and distribution of diamond wire which is used in the slicing silicon ingot during the manufacturing process of solar cells.

①What is Diamond wire?

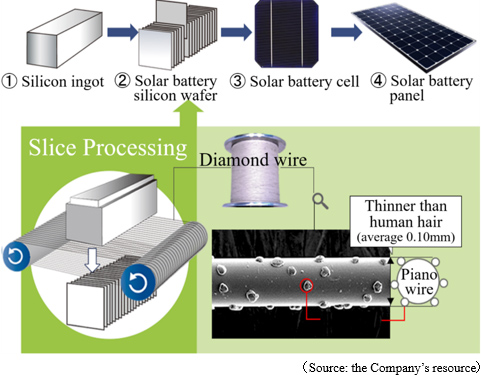

◎Manufacturing Process of Silicon Wafer

Nakamura Choukou's diamond wire is used in the slicing process in manufacturing silicon wafers, which are used for the main part of a solar battery panel, that is, a solar cell.

A "diamond wire" is a tool used to thinly slice rectangular silicon ingots that are pre-cut to the dimensions of each wafer. It is a threadlike slicing tool made of a thin piano wire with diamond granules firmly attached and is thinner than a human hair.

The ingots are sliced by the diamond wires juxtaposed at short intervals and rotating at high speed over the guide rollers on a slicer. 2000 to 3000 silicon wafers are produced in 2 to 3 hours. The wafers are then cleaned and quality-inspected, treated to turn into cells, and incorporated into solar panel modules. (1)Peripheral Business of Electronic Material Slicing

The development, manufacturing, and distribution of diamond wire which is used in the slicing silicon ingot during the manufacturing process of solar cells.

①What is Diamond wire?

◎Manufacturing Process of Silicon Wafer

Nakamura Choukou's diamond wire is used in the slicing process in manufacturing silicon wafers, which are used for the main part of a solar battery panel, that is, a solar cell.

A "diamond wire" is a tool used to thinly slice rectangular silicon ingots that are pre-cut to the dimensions of each wafer. It is a threadlike slicing tool made of a thin piano wire with diamond granules firmly attached and is thinner than a human hair.

The ingots are sliced by the diamond wires juxtaposed at short intervals and rotating at high speed over the guide rollers on a slicer. 2000 to 3000 silicon wafers are produced in 2 to 3 hours. The wafers are then cleaned and quality-inspected, treated to turn into cells, and incorporated into solar panel modules.

②Diamond Wire Overview

There are two methods of slicing silicon wafers; "loose grain method" and "fixed grain method (using diamond wires)." ②Diamond Wire Overview

There are two methods of slicing silicon wafers; "loose grain method" and "fixed grain method (using diamond wires)."

The facts about "improved processing speed," "low running cost," "reduced kerf loss" and "eco-friendliness with a reduced amount of required wires" mentioned above contribute to the expansion of transfer to and the demand for the "fixed grain method" using diamond wires.

The facts about "improved processing speed," "low running cost," "reduced kerf loss" and "eco-friendliness with a reduced amount of required wires" mentioned above contribute to the expansion of transfer to and the demand for the "fixed grain method" using diamond wires.

Additionally, Nakamura Choukou is making efforts to further thin the diamond wire since increasing the number of silicon wafers produced from an ingot is an important advantage for wafer manufacturers in terms of production efficiency and cost reduction.

Nakamura Choukou had thinned the diamond wire to Φ (*) 80 μm from the conventional standard of Φ100 μm and from this term, the Company made Φ60 μm diamond wires the main product while Φ70 μm diamond wires are the main stream currently in this field. Moreover, the Company is aiming to create Φ50 μm diamond wires for a practical use.

(*)Φ

A symbol to indicate the diameter. Phi.

Also, the Company operates the slicing business using diamond wires. (See

Additionally, Nakamura Choukou is making efforts to further thin the diamond wire since increasing the number of silicon wafers produced from an ingot is an important advantage for wafer manufacturers in terms of production efficiency and cost reduction.

Nakamura Choukou had thinned the diamond wire to Φ (*) 80 μm from the conventional standard of Φ100 μm and from this term, the Company made Φ60 μm diamond wires the main product while Φ70 μm diamond wires are the main stream currently in this field. Moreover, the Company is aiming to create Φ50 μm diamond wires for a practical use.

(*)Φ

A symbol to indicate the diameter. Phi.

Also, the Company operates the slicing business using diamond wires. (See

Characteristics and strengths Characteristics and strengths for details)

(2) High-precision Equipment Business

The development, manufacturing and sale of high-precision equipment made of hard and brittle materials with high abrasion resistance such as diamond, cemented carbide and ceramic.

The main products are diamond parts used in the engineering machines for manufacturing automobile parts and bearings and diamond nozzles, which are used in industrial machines for mounting electronic parts onto LCD television sets, smartphones, tablets, etc.

In addition to high-precision parts and equipment, the Company develops, manufactures and sells the cleaning machines for nozzles of the machines, etc.

(3) Chemical Fiber Spinning Nozzle Business

The designing, manufacturing and sale of chemical fiber spinning nozzles, the peripheral parts and nozzles and devices for nonwoven fabric.

Nakamura Choukou started the domestic manufacturing of nozzles for chemical fibers (for production of rayon) and has been operating the business as a chemical fiber spinning nozzle manufacturer since its establishment in 1930. The spinning nozzle is a core manufacturing part which determines the quality of nonwoven and carbon fibers. The manufacturing of the nozzles requires delicate technologies in micro punching process and in the production of the devices, where Nakamura Choukou has provided for the market's needs with the technologies accumulated for many years in the same specialized industry. for details)

(2) High-precision Equipment Business

The development, manufacturing and sale of high-precision equipment made of hard and brittle materials with high abrasion resistance such as diamond, cemented carbide and ceramic.

The main products are diamond parts used in the engineering machines for manufacturing automobile parts and bearings and diamond nozzles, which are used in industrial machines for mounting electronic parts onto LCD television sets, smartphones, tablets, etc.

In addition to high-precision parts and equipment, the Company develops, manufactures and sells the cleaning machines for nozzles of the machines, etc.

(3) Chemical Fiber Spinning Nozzle Business

The designing, manufacturing and sale of chemical fiber spinning nozzles, the peripheral parts and nozzles and devices for nonwoven fabric.

Nakamura Choukou started the domestic manufacturing of nozzles for chemical fibers (for production of rayon) and has been operating the business as a chemical fiber spinning nozzle manufacturer since its establishment in 1930. The spinning nozzle is a core manufacturing part which determines the quality of nonwoven and carbon fibers. The manufacturing of the nozzles requires delicate technologies in micro punching process and in the production of the devices, where Nakamura Choukou has provided for the market's needs with the technologies accumulated for many years in the same specialized industry.

1-5 Characteristics and strengths 1-5 Characteristics and strengths <Highly Competitive Diamond Wire>

Higher-load processing conditions than before are expected from a diamond wire, such as "a fewer amount of use," "faster processing" and "higher processing difficulty."

In these circumstances, the diamond wire of the Company satisfies the high-load conditions for both monocrystalline silicon processing and polycrystalline silicon processing in terms of the following.

(Amount of Use)

Comparing the amount of diamond wire used per wafer in customer evaluation, it is 20% less than the other companies' amount of use for both monocrystalline silicon processing and polycrystalline silicon processing, which is directly linked to cost reduction.

(Manufacturing Method)

In contrast with the Chinese manufacturers who produce six wires at the same time by the "six-line simultaneous production method," the Company produces one wire at a time while giving feedback on camera inspection and imaging, which is called the "single-line feedback control production method."

While the former has a disadvantage of variation in product quality despite the low cost, the Company has a big advantage that it can provide a stable quality. It has a weakness of high production costs, but recently, the Company is actively engaged in reforming production facilities aimed at high-speed production, and it is steadily reducing costs and improving productivity.

(Specifications)

The size of diamonds that are fixed in a wire is big in Chinese diamond wire and the friction of diamonds are also large because there are so many of them. It has a high cutting ability and is easy to operate, but the thickness of the wafers is uneven because it has a huge change in wire diameter, and the processing capacity is small. As a result, there are fewer benefits for users.

Although it is difficult to operate, the Company's diamond wire, on the other hand, uses small and fewer diamonds, so the friction at the time of processing is relatively small. Also, as the wire diameter is short, more wafers can be obtained. In addition, there is a large processing capacity, so the amount of wire used is less and benefits for users are significant.

(Thinning in Monocrystalline Wafers)

The Company's fine wire in the monocrystalline wafers, whose market is expected to expand further in the future, is highly competitive.

Firstly, on receiving a high evaluation from a top Korean manufacturer for giving the best cost performance, the Company started an exclusive supply of all Φ60μm wire.

Also, it began to supply Φ60μm wire for several monocrystalline users in China and Japan.

In addition, the Company received a high evaluation for samples of Φ50μm wire, which is more advanced than Φ60μm wire, from major Korean manufacturers and other top manufacturers in the world, so it is preparing to begin its sales in the current term.

In this manner, the Company aims to strengthen its position in the growing market based on three advantages it has, i.e., "High-performance Japanese wire whose stable procurement is difficult in China," "High-quality diamond fixation technology realizing highly difficult fixation in ultrafine wire zone" and "Challenging cost reduction realizing highly efficient production."

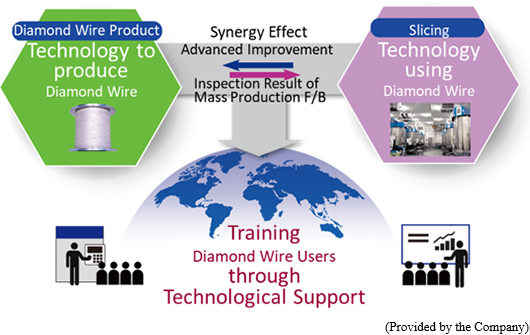

<The unique business model with the slicing business>

As mentioned above, Nakamura Choukou's slices silicon ingots using its own diamond wires, manufactures and sales silicon wafers for solar cells.

By making the results of mass production tests as feedback, Nakamura Choukou works on the improvement of the diamond wire based on the feedback.

By combining the "technologies of diamond wire manufacturing" and "technologies of diamond wire usage" to create a synergy effect, the Company has made it possible to support its clients (silicon wafers manufacturers) in different technological perspectives and gain trust from them, which in turn has made its market expansion advantageous.

This kind of business model is unique, which other companies do not have such examples, and this business model makes Nakamura Choukou stand out.

<Highly Competitive Diamond Wire>

Higher-load processing conditions than before are expected from a diamond wire, such as "a fewer amount of use," "faster processing" and "higher processing difficulty."

In these circumstances, the diamond wire of the Company satisfies the high-load conditions for both monocrystalline silicon processing and polycrystalline silicon processing in terms of the following.

(Amount of Use)

Comparing the amount of diamond wire used per wafer in customer evaluation, it is 20% less than the other companies' amount of use for both monocrystalline silicon processing and polycrystalline silicon processing, which is directly linked to cost reduction.

(Manufacturing Method)

In contrast with the Chinese manufacturers who produce six wires at the same time by the "six-line simultaneous production method," the Company produces one wire at a time while giving feedback on camera inspection and imaging, which is called the "single-line feedback control production method."

While the former has a disadvantage of variation in product quality despite the low cost, the Company has a big advantage that it can provide a stable quality. It has a weakness of high production costs, but recently, the Company is actively engaged in reforming production facilities aimed at high-speed production, and it is steadily reducing costs and improving productivity.

(Specifications)

The size of diamonds that are fixed in a wire is big in Chinese diamond wire and the friction of diamonds are also large because there are so many of them. It has a high cutting ability and is easy to operate, but the thickness of the wafers is uneven because it has a huge change in wire diameter, and the processing capacity is small. As a result, there are fewer benefits for users.

Although it is difficult to operate, the Company's diamond wire, on the other hand, uses small and fewer diamonds, so the friction at the time of processing is relatively small. Also, as the wire diameter is short, more wafers can be obtained. In addition, there is a large processing capacity, so the amount of wire used is less and benefits for users are significant.

(Thinning in Monocrystalline Wafers)

The Company's fine wire in the monocrystalline wafers, whose market is expected to expand further in the future, is highly competitive.

Firstly, on receiving a high evaluation from a top Korean manufacturer for giving the best cost performance, the Company started an exclusive supply of all Φ60μm wire.

Also, it began to supply Φ60μm wire for several monocrystalline users in China and Japan.

In addition, the Company received a high evaluation for samples of Φ50μm wire, which is more advanced than Φ60μm wire, from major Korean manufacturers and other top manufacturers in the world, so it is preparing to begin its sales in the current term.

In this manner, the Company aims to strengthen its position in the growing market based on three advantages it has, i.e., "High-performance Japanese wire whose stable procurement is difficult in China," "High-quality diamond fixation technology realizing highly difficult fixation in ultrafine wire zone" and "Challenging cost reduction realizing highly efficient production."

<The unique business model with the slicing business>

As mentioned above, Nakamura Choukou's slices silicon ingots using its own diamond wires, manufactures and sales silicon wafers for solar cells.

By making the results of mass production tests as feedback, Nakamura Choukou works on the improvement of the diamond wire based on the feedback.

By combining the "technologies of diamond wire manufacturing" and "technologies of diamond wire usage" to create a synergy effect, the Company has made it possible to support its clients (silicon wafers manufacturers) in different technological perspectives and gain trust from them, which in turn has made its market expansion advantageous.

This kind of business model is unique, which other companies do not have such examples, and this business model makes Nakamura Choukou stand out.

|

| Fiscal Year March 2018 Earnings Results |

Sales grew significantly and the business moved into the black, but sales did not reach the revised forecast due to the change in the market environment at the end of the term.

The sales for the term ended Mar. 2018 were 12,140 million yen, up approx. 2.4 times year on year. The sales of diamond wire, which is the Company's key products, continued to perform well due to a shift to the fixed abrasive grain method using diamond wire in the polycrystalline silicon wafer market. Due to cost reduction, etc., operating income, etc. became positive. However, the sales of diamond wire for polycrystalline in February and March fell short of the estimates due to major changes in the market environment (reduction in order quantity, price drops, etc.), which occurred in the fourth quarter (January - March). As a result, sales did not reach the revised forecast announced in November 2017. Sales grew significantly and the business moved into the black, but sales did not reach the revised forecast due to the change in the market environment at the end of the term.

The sales for the term ended Mar. 2018 were 12,140 million yen, up approx. 2.4 times year on year. The sales of diamond wire, which is the Company's key products, continued to perform well due to a shift to the fixed abrasive grain method using diamond wire in the polycrystalline silicon wafer market. Due to cost reduction, etc., operating income, etc. became positive. However, the sales of diamond wire for polycrystalline in February and March fell short of the estimates due to major changes in the market environment (reduction in order quantity, price drops, etc.), which occurred in the fourth quarter (January - March). As a result, sales did not reach the revised forecast announced in November 2017.

<Peripheral Business of Electronic Material Slicing>

Sales increased, resulting in a return to profitability.

Diamond wires, the Company's core product, gained in popularity on a rapid basis newly in the market of polycrystalline silicon wafers, in addition to the monocrystalline silicon wafer market which has been the conventional supply market. Furthermore, the number of orders received and the sales volume exceeded those of the second quarter of the previous term thanks to the increasing production amount achieved through a number of factors, including the start of a full-scale operation of Okinawa Factory.

The Company returned to profitability thanks not only to the effect of the sales growth but also to certain results in the cost reduction measures which the Company launched in the previous term.

However, the sales of diamond wire did not reach the estimate in January and February, 2018, because of the major changes in the market environment, such as escalation of competition among the manufacturers of solar panels to increase their shares in the global market, production adjustment in the polycrystalline wafer market due to the aggressive monocrystalline wafer market, decrease in order quantity of diamond wire resulting from the adjustment, and the fall in the market value of diamond wire due to the decreased price of wafers (fell by approx. 30% due to a forceful reduction in price), in the fourth quarter. As a result, sales and profit for the fourth quarter were down from the third quarter.

<High-precision Equipment Business>

Increase in Sales and Major Rise in Profit

Sales of nozzles for mounters and wear-resistant components for machine tools showed a healthy growth as, in addition to the rise in smartphone-related investment in China, demand for semiconductors and automobile-related demand increased. The Company focused on prospecting for new customers.

Profit rose significantly as a result of a rise in orders for high-value-added items with high processing difficulty, in which the Company excels, in addition to the increase in sales due to order expansion in the machine tool field.

<Chemical Fiber Spinning Nozzle Business>

Decline in Sales and Increase in Profit

Sales of nozzles for overseas were healthy, but sales in the domestic market were stagnant. On the other hand, the installation of automated equipment resulted in the rise in profitability.

<Peripheral Business of Electronic Material Slicing>

Sales increased, resulting in a return to profitability.

Diamond wires, the Company's core product, gained in popularity on a rapid basis newly in the market of polycrystalline silicon wafers, in addition to the monocrystalline silicon wafer market which has been the conventional supply market. Furthermore, the number of orders received and the sales volume exceeded those of the second quarter of the previous term thanks to the increasing production amount achieved through a number of factors, including the start of a full-scale operation of Okinawa Factory.

The Company returned to profitability thanks not only to the effect of the sales growth but also to certain results in the cost reduction measures which the Company launched in the previous term.

However, the sales of diamond wire did not reach the estimate in January and February, 2018, because of the major changes in the market environment, such as escalation of competition among the manufacturers of solar panels to increase their shares in the global market, production adjustment in the polycrystalline wafer market due to the aggressive monocrystalline wafer market, decrease in order quantity of diamond wire resulting from the adjustment, and the fall in the market value of diamond wire due to the decreased price of wafers (fell by approx. 30% due to a forceful reduction in price), in the fourth quarter. As a result, sales and profit for the fourth quarter were down from the third quarter.

<High-precision Equipment Business>

Increase in Sales and Major Rise in Profit

Sales of nozzles for mounters and wear-resistant components for machine tools showed a healthy growth as, in addition to the rise in smartphone-related investment in China, demand for semiconductors and automobile-related demand increased. The Company focused on prospecting for new customers.

Profit rose significantly as a result of a rise in orders for high-value-added items with high processing difficulty, in which the Company excels, in addition to the increase in sales due to order expansion in the machine tool field.

<Chemical Fiber Spinning Nozzle Business>

Decline in Sales and Increase in Profit

Sales of nozzles for overseas were healthy, but sales in the domestic market were stagnant. On the other hand, the installation of automated equipment resulted in the rise in profitability.

Cash and deposits increased due to increased sales and issuance of new shares, and current assets increased 4,353 million yen from the end of the previous term. The increase in property, plant and equipment due to the capital investment resulted in a rise in noncurrent assets by 1,072 million yen, and total assets increased 5,426 million yen from the end of the previous term to 17,621 million yen. Total liabilities rose 2,557 million yen from the end of the previous term to 9,738 million yen as long and short-term borrowings increased.

The increase in retained earnings caused net assets to grow 2,868 million yen from the end of the previous term to 7,882 million yen. As a result, the equity ratio rose 3.6 points from the end of the previous term to 44.7%

Cash and deposits increased due to increased sales and issuance of new shares, and current assets increased 4,353 million yen from the end of the previous term. The increase in property, plant and equipment due to the capital investment resulted in a rise in noncurrent assets by 1,072 million yen, and total assets increased 5,426 million yen from the end of the previous term to 17,621 million yen. Total liabilities rose 2,557 million yen from the end of the previous term to 9,738 million yen as long and short-term borrowings increased.

The increase in retained earnings caused net assets to grow 2,868 million yen from the end of the previous term to 7,882 million yen. As a result, the equity ratio rose 3.6 points from the end of the previous term to 44.7%

Profit moved into the black, and operating CF turned positive.

On the other hand, purchase of property, plant and equipment declined year on year, which caused the deficit of investing CF to shrink and free CF to turn positive. The surplus of financing CF shrank as proceeds from the issuance of common shares declined. The cash position improved.

(4) Topics

① Investment of 200 million yen for PeptiSter Co., Ltd., for the enhancement of the new business

As it was mentioned in the previous report, in April 2018, aiming for research and development, manufacturing, and distribution of special peptide drug substances, the Company undertook the third-party allocation of PeptiStar Co., Ltd., which is a combined company composed of PeptiDream Co., Ltd., (4587, the first section of Tokyo Stock Exchange (TSE)), Shionogi & Co., Ltd., (4507, the first section of TSE) and Sekisui Chemical Co., Ltd.,(4204, the first section of TSE) in September 2017, and made a capital investment of 200 million yen.

In addition to these three companies, several companies plan to participate with the aim of building a low-cost and stable supply system of high-quality special peptide drug substances by concentrating multifarious kinds of advanced technology through an all-Japan team structure, and Nakamura Choukou is striving to launch a life science business as a new business whose core technology is the "microreactor system."

The conventional so-called "batch type" technology used for manufacturing chemicals produces the required chemicals by mixing, heating and cooling a variety of materials. While the technology can synthesize a large volume all at once, there are a number of issues, such as difficulty in uniformly mixing materials, dangerousness, consumption of a massive amount of energy in large-scale facilities, and production of an enormous quantity of wastes.

In contrast, in the flow synthesis technology, chemicals are produced in a device called a microreactor with fine flow paths of dozens to hundreds of micrometers, in which the flow paths join together, materials are mixed, heated and cooled, and divided in a flow, and ideal chemical reaction occurs. Its great advantages include energy conservation and safety, and therefore, social demand for the technology is rapidly growing. The Company continues to carry out research and development of the technology related to the microreactor with the aim of entering the market as early as possible.

By making the best of the microreactor-related technology through the investment this time and playing a role in developing more efficient equipment for manufacturing special peptide drug substances, the Company will contribute to the establishment of a stable supply system in the special peptide ingredient manufacturing field, which is thought as a 4 trillion market.

Profit moved into the black, and operating CF turned positive.

On the other hand, purchase of property, plant and equipment declined year on year, which caused the deficit of investing CF to shrink and free CF to turn positive. The surplus of financing CF shrank as proceeds from the issuance of common shares declined. The cash position improved.

(4) Topics

① Investment of 200 million yen for PeptiSter Co., Ltd., for the enhancement of the new business

As it was mentioned in the previous report, in April 2018, aiming for research and development, manufacturing, and distribution of special peptide drug substances, the Company undertook the third-party allocation of PeptiStar Co., Ltd., which is a combined company composed of PeptiDream Co., Ltd., (4587, the first section of Tokyo Stock Exchange (TSE)), Shionogi & Co., Ltd., (4507, the first section of TSE) and Sekisui Chemical Co., Ltd.,(4204, the first section of TSE) in September 2017, and made a capital investment of 200 million yen.

In addition to these three companies, several companies plan to participate with the aim of building a low-cost and stable supply system of high-quality special peptide drug substances by concentrating multifarious kinds of advanced technology through an all-Japan team structure, and Nakamura Choukou is striving to launch a life science business as a new business whose core technology is the "microreactor system."

The conventional so-called "batch type" technology used for manufacturing chemicals produces the required chemicals by mixing, heating and cooling a variety of materials. While the technology can synthesize a large volume all at once, there are a number of issues, such as difficulty in uniformly mixing materials, dangerousness, consumption of a massive amount of energy in large-scale facilities, and production of an enormous quantity of wastes.

In contrast, in the flow synthesis technology, chemicals are produced in a device called a microreactor with fine flow paths of dozens to hundreds of micrometers, in which the flow paths join together, materials are mixed, heated and cooled, and divided in a flow, and ideal chemical reaction occurs. Its great advantages include energy conservation and safety, and therefore, social demand for the technology is rapidly growing. The Company continues to carry out research and development of the technology related to the microreactor with the aim of entering the market as early as possible.

By making the best of the microreactor-related technology through the investment this time and playing a role in developing more efficient equipment for manufacturing special peptide drug substances, the Company will contribute to the establishment of a stable supply system in the special peptide ingredient manufacturing field, which is thought as a 4 trillion market.

|

| Fiscal Year March 2019 Earnings Estimates |

Rise in Sales and Profit. Expects Recovery from the Second Half of the Fiscal Year

The sales for the term ending Mar. 2019 are estimated to mark a record high with 15 billion yen, up 23.5% year on year. Operating income is expected to rise by 5.1% year on year to 1.65 billion yen. Although the Company will promote the change in customer structure and a full-scale transition to ultrafine wire for monocrystalline wafer users from the beginning of the term, losses are expected in the first quarter and profitability is forecasted to remain low until the second quarter as the turmoil in the polycrystalline wafer market occurred at the end of the previous term will have a lasting impact in the first half of the term and the Company will continue the production of less profitable Φ70μm wire to maintain operating ratio. The Company anticipates the full-scale recovery of its performance and securing of stable profit from the third quarter when the process of switching to Φ60μm or less is completed and measures for cost reduction progress. Dividends will not be paid. Rise in Sales and Profit. Expects Recovery from the Second Half of the Fiscal Year

The sales for the term ending Mar. 2019 are estimated to mark a record high with 15 billion yen, up 23.5% year on year. Operating income is expected to rise by 5.1% year on year to 1.65 billion yen. Although the Company will promote the change in customer structure and a full-scale transition to ultrafine wire for monocrystalline wafer users from the beginning of the term, losses are expected in the first quarter and profitability is forecasted to remain low until the second quarter as the turmoil in the polycrystalline wafer market occurred at the end of the previous term will have a lasting impact in the first half of the term and the Company will continue the production of less profitable Φ70μm wire to maintain operating ratio. The Company anticipates the full-scale recovery of its performance and securing of stable profit from the third quarter when the process of switching to Φ60μm or less is completed and measures for cost reduction progress. Dividends will not be paid.

(2) Regarding the Sales Strategy for Diamond Wire Business

Under the market environment mentioned in the section "1-3 Market Environment," the Company will promote the following strategies for the diamond wire business.

<Basic Policy>

Although the business environment is tough with declined market value of diamond wire accompanying the escalation of competition among the manufacturers of solar panels to increase their shares in the global market, the Company will convert crisis into opportunities by promoting the differentiation of the product from that of the competitors further and spreading Φ60μm wire with the world's best cost performance.

<Specific Strategies>

(1) Strengthening sales to the monocrystalline wafer market

While the transition to the fixed abrasive grain method that uses diamond wire in the polycrystalline silicon wafer market progressed in the previous term, the superiority of the Company's product has been highly evaluated by many customers in the monocrystalline wafer market, which is expected to expand in the future.

The Company will use this strength to raise the sales distribution ratio of the monocrystalline diamond wire, which was 24% in the previous term, to 52% in the current term, and reverse the distribution ratio of the diamond wire for polycrystalline and that for monocrystalline.

(2) Actively promote ultrafine wire below Φ60μm

The Company will lead the market to the "ultrafine" wire zone, mainly Φ60μm wire, from the Φ70μm wire zone, where sales distribution ratio was approx. 90% and the price dropped causing profit margin to worsen.

It will also raise the distribution ratio of Φ60μm wire from 8% to 80%.

In addition, the Company aims to start the marketing of Φ50μm wire, whose samples have already been highly rated by customers, in the current term.

(3) Mass production of "ultrathin" wire at the world's lowest cost

With the increasing sales quantity of diamond wire, the Company will promote ultrafine wire to keep the selling price high and realize a challenging cost reduction and secure profits at the same time. (2) Regarding the Sales Strategy for Diamond Wire Business

Under the market environment mentioned in the section "1-3 Market Environment," the Company will promote the following strategies for the diamond wire business.

<Basic Policy>

Although the business environment is tough with declined market value of diamond wire accompanying the escalation of competition among the manufacturers of solar panels to increase their shares in the global market, the Company will convert crisis into opportunities by promoting the differentiation of the product from that of the competitors further and spreading Φ60μm wire with the world's best cost performance.

<Specific Strategies>

(1) Strengthening sales to the monocrystalline wafer market

While the transition to the fixed abrasive grain method that uses diamond wire in the polycrystalline silicon wafer market progressed in the previous term, the superiority of the Company's product has been highly evaluated by many customers in the monocrystalline wafer market, which is expected to expand in the future.

The Company will use this strength to raise the sales distribution ratio of the monocrystalline diamond wire, which was 24% in the previous term, to 52% in the current term, and reverse the distribution ratio of the diamond wire for polycrystalline and that for monocrystalline.

(2) Actively promote ultrafine wire below Φ60μm

The Company will lead the market to the "ultrafine" wire zone, mainly Φ60μm wire, from the Φ70μm wire zone, where sales distribution ratio was approx. 90% and the price dropped causing profit margin to worsen.

It will also raise the distribution ratio of Φ60μm wire from 8% to 80%.

In addition, the Company aims to start the marketing of Φ50μm wire, whose samples have already been highly rated by customers, in the current term.

(3) Mass production of "ultrathin" wire at the world's lowest cost

With the increasing sales quantity of diamond wire, the Company will promote ultrafine wire to keep the selling price high and realize a challenging cost reduction and secure profits at the same time.

|

| Conclusions |

|

Although the previous report mentioned "we would like to pay attention to how much the Company can increase sales and profit toward the fourth quarter as we watch the results of the improved productivity," the market turmoil in the fourth quarter caused a slump in revenues till the first half of this term. Amid the catch-up of Chinese manufacturers, we would like to pay attention to the progress and performance of their business strategy "Converting crisis into opportunities."

|

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last updated: submitted on July 3, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The Company mentioned that "our company implements all of the basic principles of the corporate governance code as a company listed on the Mothers." ◎ Corporate Governance Report

Last updated: submitted on July 3, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The Company mentioned that "our company implements all of the basic principles of the corporate governance code as a company listed on the Mothers."

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our Company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |