| Nakamura Choukou Co., Ltd. (6166) |

|

||||||||

Company |

Nakamura Choukou Co., Ltd. |

||

Code No. |

6166 |

||

Exchange |

TSE Mothers |

||

Industry |

Machinery (manufacturing) |

||

President |

Makoto Inoue |

||

Address |

27-27 Tsuruta-cho, Nishi-ku, Sakai-shi, Osaka prefecture |

||

Year-end |

End of March |

||

URL |

|||

* The share price is the closing price on June 16.

Number of shares issued on the latest earning summary. ROE and BPS are the value at the end of March 2017. |

||||||||||||||||||||||||

|

|

* The values for the term ending Mar. 2018 were estimated by the Company.

Net income is profit attributable to the stock owners of the parent Company. Hereinafter the same apply. This report introduces Nakamura Choukou Co., Ltd. and the fiscal year March 2017 earnings results and others. |

| Key Points |

|

| Company Overview |

|

Wafers (*)

A wafer is a flat functional part that is produced by thinly slicing ingots of electronic materials. It is made of various materials by purpose such as silicon, sapphire, SiC (silicon carbide) and GaN (gallium nitride). Silicon wafers are often used for IC chips and solar cells. Slicing business (*2) Business transferred to Nakacho Device Technology Corporation (an equity method affiliated company) in September 2013. Diamond nozzles (*)

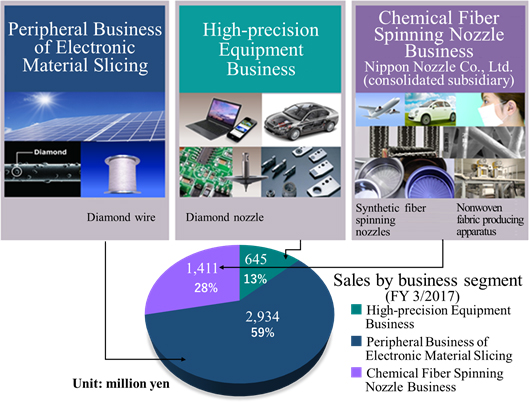

A nozzle with sintered diamond at the tip, which is used for mounting electronic components on a print circuit board. By using diamond, the lifespan of the nozzle, holding capacity of the electronic component, image recognition efficiency and mounting efficiency are improved.   Asahi Diamond Industrial Co., Ltd. (6140, First Section of Tokyo Stock Exchange) has the largest global share of diamond wire followed by Nakamura Choukou. Though Japanese corporations lead the global market share, Chinese manufacturers have been rising in recent years.  1. Segment

Nakamura Choukou's businesses consist of the three segments: Peripheral Business of Electronic Material Slice Periphery, High-precision Equipment, and Chemical Fiber Spinning Nozzle Businesses.

(1) Peripheral Business of Electronic Material Slice Periphery

The development, manufacturing, and distribution of diamond wire which is used in the slicing silicon ingot during the manufacturing process of solar cells.

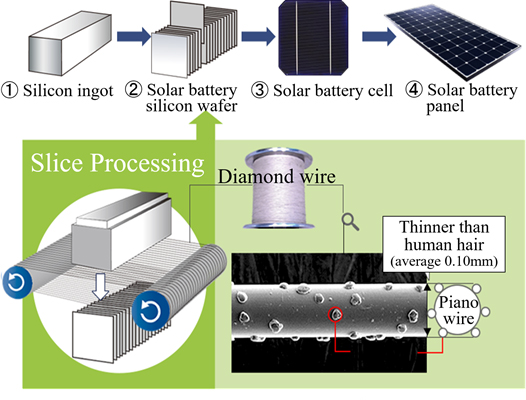

① What is Diamond wire?

Nakamura Choukou's diamond wire is used in the slicing process in manufacturing silicon wafers, which are used for the main part of a solar battery panel, that is, a solar cell.◎ Manufacturing Process of Silicon Wafer A "diamond wire" is a tool used to thinly slice rectangular silicon ingots that are pre-cut to the dimensions of each wafer. It is a threadlike slicing tool made with a thin piano wire with diamond granules firmly attached and is thinner than a human hair. The ingots are sliced by the diamond wires juxtaposed at short intervals and rotating at high speed over the guide rollers on a slicer. 2000 to 3000 silicon wafers are produced in 3 to 4 hours. The wafers are then cleaned and quality-inspected, treated to turn into cells, and incorporated into solar panel modules.  ②Diamond Wire Overview

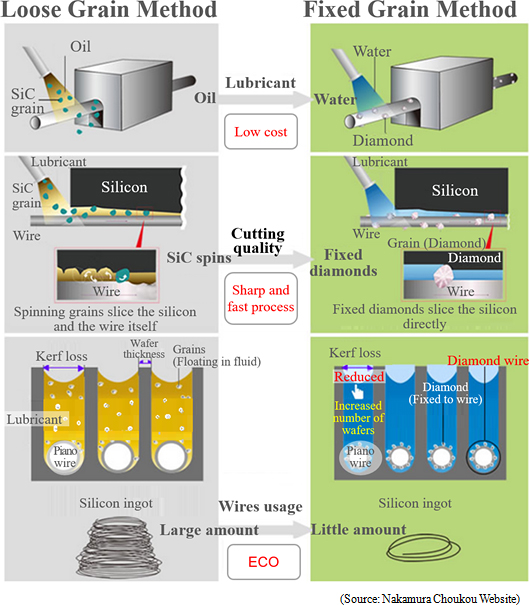

There are two methods of slicing silicon wafers; "loose grain method" and "fixed grain method (using diamond wires)."

*kerf loss

Amount of the waste silicon when slicing. Kerf loss means material waste, so it must be kept minimum in order to reduce the manufacturing cost of solar battery panels.  Nakamura Choukou had thinned the diamond wire to Φ (*) 80 μm from the conventional standard of Φ100 μm and continues to create Φ70 μm and Φ60 μm diamond wires. (*) Φ

A symbol to indicate the diameter. Phi. (2) High-precision Equipment Business

Conduct the development, manufacturing and sale of high-precision equipment made of hard and brittle materials with high abrasion resistance such as diamond, cemented carbide and ceramic. The main products are diamond parts used in the engineering machines for manufacturing automobile parts and bearings and diamond nozzles, which are used in industrial machines for mounting electronic parts onto LCD television sets, smartphones, tablets, etc. In addition to high-precision parts and equipment, the Company develops, manufactures and sells the cleaning machines for nozzles of the machines, etc. (3) Chemical Fiber Spinning Nozzle Business

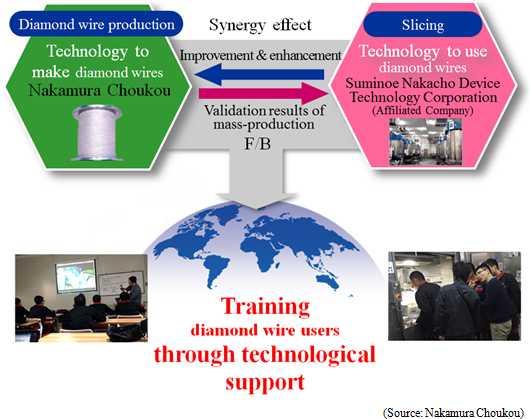

The designing, manufacturing and sale of chemical fiber spinning nozzles, the peripheral parts and nozzles and devices for nonwoven fabric.Nakamura Choukou started the domestic manufacturing of nozzles for chemical fibers (for production of rayon) and has been operating the business as a chemical fiber spinning nozzle manufacturer since its establishment in 1930. The spinning nozzle is a core manufacturing part which determines the quality of nonwoven and carbon fibers. The manufacturing of the nozzles requires delicate technologies in micro punching process and in the production of the devices, where Nakamura Choukou has provided for the market's needs with the technologies accumulated for many years in the same specialized industry. *The unique business model with the slicing business Suminoe Nakacho Device Technology provides Nakamura Choukou with the results of mass production tests as feedback. Nakamura Choukou then works on the improvement of the diamond wire based on the feedback. By combining the "technologies of diamond wire manufacturing" and "technologies of diamond wire usage" to create a synergy effect, the Company has made it possible to support its clients (silicon wafers manufacturers) in different technological perspectives and gain trust from them, which in turn has made its market expansion advantageous. This kind of business model is unique and makes Nakamura Choukou Group stand out.  |

| Fiscal Year March 2017 Earnings Results |

Sales dropped considerably, resulting in an operating loss.

Sales were 4,992 million yen, down by 27.0% year on year. The sale of diamond wires, which are the core products of Nakamura Choukou, was considerably affected by the decrease of transactions, which occurred during the negotiation with a major client about a unit selling price, the worsening of the Chinese market of silicon wafers for solar cells, the drop of prices due to the intensification of competitions, the yen appreciation, and others. As sales decreased, operating income and other incomes became negative. Following the revision in Aug. 2016, the Company revised downward the full-year earnings forecast again in Feb. 2017. The dividend amount will be zero.

Sales dropped, resulting in an operating loss. From the third quarter, the amount of orders received and sales of diamond wires, which are their core products, recovered, and monthly quantity sold from Jan. 2017 exceeded the previous peak, but it took time to start transactions with new major clients, failing to offset the decrease in sales from existing clients. Consequently, sales dropped significantly. In addition to the decline in sales, the Company conducted an inventory write-down amounting to 813 million yen for products that follow the old specifications, after the specifications of diamond wires were revised for improving their cutting performance. Consequently, the Company recorded an operating loss. <High-precision Equipment Business> Sales declined, resulting in an operating loss. The shipments of nozzles for mounters and wear-resistant components for machine tools were healthy. This business moved into the black, thanks to continuous cost reduction efforts. <Chemical Fiber Spinning Nozzle Business> Sales and profit grew. Inside and outside Japan, the number of orders for nozzles was favorable, and the reduction in fixed costs bore fruit. Consequently, both sales and profit exceeded those in the previous term.  Retained earnings declined as a loss was posted, but capital stock and capital surplus increased due to the issuance of new shares, and others. Accordingly, net assets were 5,014 million yen, nearly equal to those in the previous term. Consequently, equity ratio decreased 8.5 points from the end of the previous term to 41.1%  On the other hand, expenses for the acquisition of property, plant and equipment increased, decreasing investing CF further and making free CF negative. The surplus of financing CF expanded, due to the issuance of shares and the augmentation of long-term debts. The cash position degraded. |

| Fiscal Year March 2018 Earnings Estimates |

Rapid recovery expected

In contrast to the previous term, which witnessed a considerable drop in sales and a deficit, business performance is expected to recover rapidly this term.Sales are estimated to be 11.5 billion yen, up by 130.3% year on year, marking a record high. The demand for diamond wires is forecasted to keep growing especially in the market of polycrystalline wafers. Under this market environment, the Company will enhance productivity while curbing equipment investment by increasing the speed of diamond wire production. Operating income is estimated to be 700 million yen. The unit selling price, which apparently bottomed out in the previous term, is forecasted to recover gently as the demand for polycrystalline silicon wafers will grow rapidly. On the other hand, profit rate is expected to increase considerably through the challenging cost reduction measures. The dividend amount will remain zero, comprehensively considering the future business operation and financial strength. |

| Regarding business strategies |

|

(1) Regarding the sale of diamond wires

To sell ahead for diamond wires, the Company set the following 3 major strategies:① To distribute more diamond wires in the market of polycrystalline silicon wafers ② To sell Φ60μm wires with high added value ③ To expand production output and reduce costs through technological innovation ① To distribute more diamond wires in the market of polycrystalline silicon wafers

The most prioritized strategy. It has been said that diamond wires are mainly for processing monocrystalline silicon wafers and not suited for processing polycrystalline silicon wafers, but the technology for processing the surface of a wafer has been spread, and especially in China, equipment has been upgraded for handling diamond wires, rapidly increasing the number of facilities that can adopt diamond wires. From now on, it is expected that the demand for diamond wires for polycrystalline silicon wafers will grow than expected. This trend is very favorable to the Company, which is highly evaluated by clients as a high superiority. ② To sell Φ60μm wires with high added value

In the market of monocrystalline silicon wafers, where ingots are expensive, thinner wafers provide higher cost advantage. The clients that installed high-performance slicing equipment have a good environment for the use of fine wires, where Φ60μm wires can be used readily. The diamond wires of Nakamura Choukou are run ahead for thinning, and the technological support utilizing the experience at the consolidated subsidiary Suminoe Nakacho Device Technology Corporation is a great strength of the Company. Accordingly, the Company possesses significant advantage for selling Φ60μm wires. ③ To expand production output and reduce costs through technological innovation

Nakamura Choukou aims to multiply production speed while maintaining high quality, and expand production output by increasing equipment utilization rate through the considerable reduction in downtime. The Company will also reduce costs by decreasing material cost through the curtailment of the amount of wastes and input and by curbing fixed cost through factory operation acceleration and manpower saving. According to the Company, its goal of curtailment of the amount of wastes and input is about to be achieved. As for clients, the Company will prioritize leading wafer manufacturers that emphasize quality, and clients that has an advantageous environment for transactions, such as a tax-exempt district and a region outside China, and are expected to do sustainable transactions. In addition, the Company will increase the ratio of transactions with polycrystalline manufacturers, and promote the sales of Φ60μm wires to monocrystalline manufacturers, to choose a usage environment in which the strengths of the Company can be utilized. (2) Regarding new development business and R&D theme

In order to build a new earning pillar following diamond wires, the Company has strived to early commence two new businesses, and finally has decided to shift from R&D to the business operation stage.

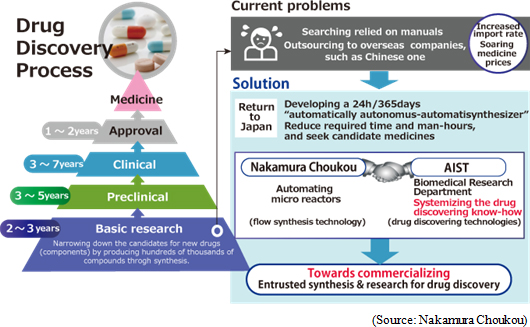

① Life science business

Commercialization of Microreactor system development.The conventional technology called the "batch type," which is used for producing the required chemical goods, produces chemical goods by mixing, heating, and cooling various materials. It can synthesize a large amount of products at the same time, but there are many problems, such as the difficulty in mixing materials homogeneously, danger, the consumption of an enormous amount of energy at a large-scale facility, and the discharge of a large amount of wastes. Meanwhile, the flow synthesis technology induces ideal chemical reactions in a microreactor, which has narrow flow channels with a width of tens or hundreds of micrometers that merge so that materials are mixed, heated, cooled, and separated, and produces chemical goods. This technology has the remarkable merits: energy saving and safety, and social demand for it is growing rapidly. In detail, Nakamura Choukou initiated the joint development of autonomous automatic synthesis device, which would streamline the creation of pharmaceutical products, with the Biomedical Research Division of the National Institute of Advanced Industrial Science and Technology (AIST). The creation of pharmaceutical products requires a great deal of time and labor at the stage of fundamental research, including the synthesis of hundreds of thousands of chemical compounds. This degrades the competitiveness of pharmaceutical manufacturers and increases medication cost considerably. This project is aimed at solving these issues by developing "autonomous automatic searching device," which can operate automatically to analyze, design, and synthesize candidate pharmaceutical products 24 hours a day, 365 days a year. The "autonomous automatic searching device", which they are setting out to develop, would create candidate pharmaceutical products at an overwhelming rate, and contribute to the shortening of the development period of a new drug and the strengthening of international competitiveness. In Sep. 2016, Nakamura Choukou established "Flow Synthesis Laboratory" as a new foothold, strengthening its development system. At the first stage, the Company will undertake the synthesis and research of chemical products from pharmaceutical companies and public institutions, starting the business of entrusted synthesis and research. At the second stage, the Company aims to create a medication venture by accumulating the knowledge of drug discovery.  ② Material science business

Commercialization of nano-size zeolite.Zeolite is composed of mainly silica (silicon dioxide) and alumina (aluminum oxide), and characterized by a microporous molecular structure, and has a large surface area equivalent to over one tennis court per gram. Because of this property, zeolite possesses the functions of "adsorption," "ion exchange," and "catalyst," and is used broadly in the chemical field, as a catalyst for purifying the exhaust gas from automobiles; in the environmental field, as an adsorbent for radioactive cesium; and in the daily-life field, as an antibacterial agent for masks, and others. Micron-size particles are currently distributed, but when the particle size reaches the nano level, the above basic functions will improve drastically, and they will be used for new purposes. However, the conventional method for producing nano-sized particles takes a lot of cost, and so concrete market evaluation has not progressed. In these circumstances, Nakamura Choukou commenced the development of an innovative process for producing nano-sized zeolite by utilizing the nano-technology nurtured by the Company for many years in parallel with the life science business and the "Crushing and Recrystallizing Process" technology owned by Tokyo University, and then succeeded in producing "nano-sized zeolite," whose particle size is one millionth of ordinary zeolite, at low cost. (This "Crushing and Recrystallizing Process" is patent-pending.) In Apr. 2016, the Company started pre-mass production, displayed the products at exhibitions in Japan and China, and received a lot of inquiries. In Aug. 2016, the collaborative research between Nakamura Choukou and Tokyo University titled "Method for producing fine zeolite and Particle size control technology" was adopted as Stage III (NexTEP-A type), one of "A-STEP," which is the program for supporting the optimization of research results offered by Japan Science and Technology Agency. A-STEP is a program for supporting technological transfer targeted at the R&D phase based on research progress regarding science and technology for putting the technology developed by universities, public institutes, and so on, which are important for the national economy, into practice. Multiple supports are offered according to the characteristics of phases, including the initial phase of R&D for practical application, in which candidate seeds are found from the research results of universities, etc. from the business viewpoint, the possibilities of seeds are examined, and brought out; the intermediate phase, in which the feasibility of obvious seeds is checked; and the late phase, in which enterprises take the initiative in developing products for corporate and conducting demonstrative tests. This is composed of the three stages: Stage I, Stage II, and Stage III. The objective of Stage III (NexTEP-A type), which adopts the research of Nakamura Choukou, has a purpose to "support enterprises in large-scale development using seeds based on the research results of universities which have a development risk, and to actualize a business based on the research results of universities by promoting practical application." The Company thinks that the above decision will get a boost to facilitate the collaborative research. It is also expected that it will mitigate the risk caused by the financial burden of the collaborative research, because an R&D subsidy will be granted (If the development is successful, it will be repaid in annual payments. If not, 10% will be repaid). From now on, the Company will accelerate the development for actualizing a business based on the collaboration among industry, government, and academia, by conducting public relations activities, early creation of markets, establishing a low-cost/ medium-output production system, and so on.  ③ New R&D theme: Development of regenerative medical devices

The Company started "developing devices for regenerative medicine," as a new R&D project after Microreactor system and nano-sized zeolite. In Mar. 2017, it was announced that Nakamura Choukou and its consolidated subsidiary, Nippon Nozzle Co., Ltd., signed a contract for collaborative research with Doshisha University, for the purpose of developing regenerative medical devices. Purpose

In each field of cardiovascular, digestive, and respiratory surgeries, and transplantation, the replacement surgery with artificial items utilizing the technology of regenerative medicine is attracting attention as the next-generation strategy for surgical treatment, and it is said that the number of people who require such treatment exceeds 10 million in the world. Professor Akeo Hagiwara of Regenerative Medicine Laboratory, Department of Medical Life Systems, Faculty of Life and Medical Sciences, Doshisha University engages in the research into regenerative medicine, in order to conduct the second surgery for correcting the size and functions of artificial items according to the growth of patients and solve the problems with conventional artificial items that need to be replaced after the functional degradation through long-time use. Nakamura Choukou and Nippon Nozzle decided to proceed with the joint research into regenerative medical devices by utilizing their possessed manufacturing technologies. If regenerative medical devices fulfill to develop in accordance with the contract for collaborative research, it may be possible to alleviate the physical and mental burdens due to repeated surgeries, and so this is raising great expectations. Roles of Nakamura Choukou and Nippon Nozzle

Through this joint research, Nakamura Choukou and Nippon Nozzle aim to develop a compact that has a continuous structure with bio-absorbable polymers and a scaffolding material that has a complex mechanism including non-woven and braided fabric structures, by utilizing the possessed technologies for precise processing and chemical fabrics, and put regenerative medical devices, which are taken down and absorbed by the living body and emerge as the congenital own cellular tissue, into practice.

|

| Conclusions |

|

We are wondering whether the Company will be able to regain the trust of investors and the market. Firstly, we would like to pay attention to their performance from the next first quarter, although it is a short-term perspective.  |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last updated: submitted on July 7, 2016<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)> The Company mentioned that "Our Company implements all of the basic principles of the corporate governance code as a Company listed in the Mothers." Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |