| Cybernet Systems Co., Ltd. (4312) |

|

||||||||

Company |

Cybernet Systems Co., Ltd. |

||

Code No. |

4312 |

||

Exchange |

TSE 1st Section |

||

Industry |

Information and communications |

||

President & CEO |

Kuniaki Tanaka |

||

Address |

FUJISOFT Bldg. 3 Kanda-neribeicho, Chiyoda-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* The share price is the closing price on March 8. The number of shares issued was calculated by subtracting the treasury shares from the number of outstanding shares at the end of the latest quarter.

|

||||||||||||||||||||||||

|

|

* The forecasted values are from the Company. *From FY 12/16, net income is profit attributable to shareholders of the parent company. Hereinafter the same shall apply.

This bridge report presents fiscal year ended December 2017 earnings results, fiscal year ending December 2018 earnings estimates, progress of medium-term business plan (2015 to 2020) and an interview with President Tanaka of Cybernet Systems Co., Ltd. listed on TSE First Section. |

| Key Points |

|

| Company Overview |

|

The Group is composed of the Company and its 13 consolidated subsidiaries. Its business is operated in North America, the UK, France, Germany, Belgium, and Asia. Among the main consolidated subsidiaries, there are 3 development subsidiaries: Sigmetrix, L.L.C. (US), which develops and sells tolerance analysis (the permissible range of variation in a dimension set at the time of design) software with technical support; Waterloo Maple Inc. (Canada) for formula manipulation systems; and Noesis Solutions NV (Belgium), which develops and sells the Process Integration and Design Optimization (PIDO) tools with technical support. The Group also has 3 distributor subsidiaries of CAE Solutions: CYBERNET SYSTEMS (SHANGHAI) CO., LTD. (Shanghai), CYBERNET SYSTEMS TAIWAN CO., LTD. (Taiwan, 57% ownership), and CYFEM Inc. (South Korea, 65% ownership).   CAE Solution Services

In addition to Distributor Business and Vendor Business, both of which sell CAE software and hardware for analysis and simulation in conjunction with a Computer Aided Design (CAD) system, CAE Solution Services manage Consulting Business that provides solutions to respond to advanced demands from customers, design of electronic circuits and boards, model-based development (MDB, to be described later), engineering (consignment) services such as PIDO, and user education and support services such as holding seminars, user conferences, and case presentations.

6 CAE application areas and development/sales subsidiaries

The trend in this segment is described separately in the 6 application areas in which the Company (non-consolidated) utilizes CAE, as well as in development subsidiaries and sales subsidiaries.6 CAE application areas: (1) Mechanical CAE (MCAE) After completing the designing process using CAD, it provides software and services that support analysis of structure, heat transfer, electromagnetic, and thermal fluid. The main product is the multiphysics (multiple physical forces) analysis tool "ANSYS," a product of ANSYS, Inc. (US) (2) Optical Design It provides optical analysis such as lens design, illumination analysis, optical communication system analysis and measurement tools related to organic EL and optical member characteristics, and solutions and services. Main products include "CODE V" (optical design evaluation program) and "LightTools" (analytical software for lighting design) manufactured by Synopsys, Inc. (US) (3) Electronic Design Automation (EDA) It provides software that automates electronic devices and semiconductors, and operation proposal/design analysis services in the process through design, analysis and manufacture/installation of a printed-circuit board (PCB). Main products include "Xpedition Enterprise" and "HyperLynx" manufactured by Mentor Graphics, Inc. (US) (4) Model Based Development (MBD) MBD is a design methodology that implements a development process of plan, design, and verification based on formula models. Major products are provided by Maplesoft, a subsidiary of the Group. The products include the STEM computing platform "Maple" and the system-level modeling and simulation tool "MapleSim." (5) Test and Measurement, Others In the area of test and measurement, the Company provides Flat Panel Display (FPD) Inspection System developed by the Company itself. In the area of others, it provides products of the Group: 3D tolerance management tools (optimization of cost and quality based on variation evaluation of sizes and sites of assembly parts) and optimized design support tools (analysis automation, robust control/reliability evaluation, application of quality engineering, etc.), as well as CAE technical education services. Development subsidiaries

The 3 development subsidiaries are Sigmetrix, L.L.C. (US), which develops, sells and provides technical support for the 3D tolerance analysis software "CETOL 6σ;" Waterloo Maple Inc. (Canada), which develops, sells and provides technical support for the formula manipulation software "Maple" to formulate (visualize) various physical phenomena and 1D CAE software "MapleSim;" and Noesis Solutions NV (Belgium), which develops, sells and provides technical support for "Optimus id8" for Process Integration and Design Optimization (PIDO).

Sales subsidiaries

The 3 sales subsidiaries are CYBERNET SYSTEMS TAIWAN CO., LTD. (Taiwan), CYBERNET SYSTEMS (SHANGHAI) CO., LTD. (Shanghai) and CYFEM Inc. (Korea), of CAE Solutions.

IT Solution Services

IT Solution Services are composed of IT Solution Business and Data Solution Business. As for the IT Solution Business, the Company offers a wide range of solutions that support various companies' IT infrastructures including Symantec's endpoint security products that prevent computer virus infections and information leaks in the servers and client PCs, as well as "SKYSEA Client View" (SKY Inc.) and "ISM CloudOne" (Quality Software Inc.) designed for IT asset management solutions, database development support and application performance management. Meanwhile, in the Data Solution Business, the Company offers digital solutions that support manufacturing of goods, including visualization solutions which visualize CAE analysis data plainly as well as AR (Augmented Reality)/VR (Virtual Reality), and big data. AR related solutions include AR application development tools and AR content distribution systems. VR related solutions include VR design review support systems and 3D application composite display software. The big data related solutions include the Company's original big data visualization tool "BIGDAT @ Viewer (big data viewer)." In addition, the Company provides services such as operation consulting, introduction support, and user education support, according to the customers' environment.  In the latter half of the 1980s, with the advent of minicomputers, workstations, personal computers, etc., demand shifted from a remote service to software license purchase. The Company therefore acquired the sales agency right of the analysis (CAE) software that had been provided by a remote service and changed the business model. It focused more on localization (making menus and manuals in Japanese), technical support and consulting, instead of being a trading company that sells imported software, which led to subsequent growth of the Company. In April 1989, Kobe Steel, Ltd. acquired all outstanding shares of Cybernet, and then in October 1999, FUJISOFT ABC Co., Ltd. (currently FUJISOFT INCORPORATED) acquired them. In October 2001, Cybernet listed shares on JASDAQ, and through the listing on TSE 2nd Section in August 2003, it changed the market to TSE 1st section in September 2004. Thereafter, the Company expanded its business by actively establishing subsidiaries and implementing M&A both inside and outside of Japan. In Japan, it incorporated visualization and network related technologies, etc. (an absorption-type merger after making a subsidiary). For overseas strategies, it expanded its business to China in December 2004, and established the current Shanghai sales subsidiary in August 2006 and Taiwan sales subsidiary in July 2008. From 2009 to 2010, it acquired vender companies that had unique technologies in the US and Europe as subsidiaries, with the purpose of developing Vendor Business. Subsequently, it acquired Sigmetrix, L.L.C. (US) in July 2009, Waterloo Maple Inc. (Canada) in September 2009, and Noesis Solutions NV (Belgium) in July 2010 as subsidiaries. As of the end of December 2017, FUJISOFT INCORPORATED (TSE 1st Section 9749) owns 51.88% of the voting rights, and three out of nine executives are from FUJISOFT INCORPORATED. However, as the FUISOFT Group stated in its charter that "the group respects the dignity, autonomy, and independence of each group company as an independent entity," and "based on the principle of coexistence, mutual prosperity and cooperation, the Group companies will unite to strengthen the Group's management," each Group company has developed their businesses based on its own policy under this charter. Therefore, independence from FUJISOFT INCORPORATED and the FUJISOFT Group is secured.  |

| Fiscal Year Ended December 2017 Earnings Results |

Sales increased by 12.2 % YoY and operating income grew 46.4% YoY.

Sales increased by 12.2% YoY to 17,987 million yen. Sales of the CAE Solution Services increased to 14,910 million yen, up 13.2% YoY due to steady sales of mainstay products and business expansion of the development and sales subsidiaries. Sales of the IT Solution Services also increased to 3,262 million yen, up 8.6% YoY mainly due to sales of security related solutions such as the products of Symantec (US). As for profit, the gross profit rate remained at a high level of 42.9%, although it fell below the previous year's result due to changes in product composition. Despite increased personnel costs because of recruitment on schedule along with payment of performance achievement bonuses, the increase of overall SG&A expenses was minimum, and operating income grew 46.4% YoY to 1,504 million yen. The Company achieved the operating income margin of 8%, which was the target for FY 2017 in the medium-term business plan. Operating income before amortization of goodwill increased by 32.9% YoY to 1,790 million yen, while EBITDA increased by 31.8% YoY to 2,064 million yen. Because goodwill amortization of a subsidiary in the US was completed in FY 2016, total amortization of goodwill decreased from 320 million yen to 286 million yen (amortization of goodwill of subsidiaries in Belgium and in Canada will be done in 2020 and 2024, respectively). Non-operating income improved due to an increase in a subsidy and a decrease in foreign exchange loss, and tax burden ratio decreased. As a result, the net income increased by 102.9% YoY to 937 million yen. While sales were much higher than the estimate, SG&A fell below the estimate because the renewal of the core system (ERP) of 100 million yen was postponed for a year and advertising promotion expenses and campaign sales promotion expenses of about 50 to 60 million yen were not spent. The year-end dividend was ¥7.83 per share, which became a total of 15.05 yen per year, together with the dividend at the end of the first-half.   CAE Solution Services

Sales were 14,910 million yen (up 13.2% YoY) and operating income was 2,732 million yen (up 21.3% YoY). Sales increased mainly in the areas of Mechanical CAE (MCAE) and Electronic Design Automation (EDA), and profit increase rate exceeded 20%. By industry, transportation equipment grew in the automobile-related field that the Company is focusing on. In addition, electric equipment is on a recovery trend due to strong onboard equipment related demand.

Mechanical CAE (MCAE) area Up 11.1% YoY on a non-consolidated sales basis

The Company's core product, multiphysics analysis software "ANSYS" (product of ANSYS, Inc.), is broadly classified into three fields, "structural analysis," "thermal fluid analysis," and "electromagnetic field and circuit/system analysis." In FY 2017, sales of the "electromagnetic field and circuit/system analysis" required for analysis of electromagnetic field and high frequency (sensor related) grew based on the demand related to IoT, automobile communication and 5G. However, the cost rate of the products in "electromagnetic field and circuit/system analysis" is higher (70%) than that of products in other areas (about 50%), so the cost rate of "ANSYS" as a whole has increased by 1.8% points. The Company has been negotiating purchase price since February, because the "electromagnetic field and circuit/system analysis" is expected to grow in the future. An improvement in cost rate from the second half to the next term is expected.

Optical Design area Up 5.9 % YoY on a non-consolidated sales basis

Although new licensing sales of the core products, the analysis software for lighting design "Light Tools" and the optical design evaluation software "CODE V," declined, they were offset by increased sales of strategic conversion products such as the automotive lighting (headlight) analysis software "LucidShape" and software for analysis of communication (both are the products of Synopsys).

Electronic Design Automation (EDA) area Up 30.2 % YoY on a non-consolidated sales basis

In addition to large-scale orders from the electrical equipment industry, sales of electronic circuit board design software "Xpedition Enterprise" and "HyperLynx" (both are the products of Mentor Graphics Co., Ltd., US) increased. Sales of the printed-circuit board (PCB) engineering service also increased mainly in the machinery and precision machinery industries.

Model Based Development (MBD) area Up 7.4 % YoY on a non-consolidated sales basis

While sales of the 1D CAE tool "MapleSim," which is one of the Group products, seem to have passed the peak, delivery of the model-based development engineering services, which the Company is focusing on, has shifted from the end of December to January of the following year. As a result, sales growth rate rose only by about 7% YoY. In the model-based development engineering services, orders are on track for autonomous driving, such as Advanced Driver-Assistance Systems (ADAS), from the automobile industry.

Test and Measurement area Up 129.6 % YoY on a non-consolidated sales basis

The sales of the Company's new version of Flat Panel Display (FPD) Inspection System "FPiS" which corresponds to organic EL panel, increased mainly among Chinese companies. The measurement platforms targeting organic EL and solar cells also increased for the electrical equipment industry, reflecting the growing need for organic EL inspection.

Other area Up 20.0 % YoY on a non-consolidated sales basis

Sales of the optimized design support software "Optimus id8" increased thanks to large-scale orders from the electrical equipment industry. Sales of the 3D tolerance analysis software "CETOL 6σ" (both are products of its subsidiaries) that contributes to yield improvement also increased.

IT Solution Services

Sales were 3,262 million yen (up 8.6% YoY) and operating income was 324 million yen (down 10.1% YoY). Sales in the IT Solution Services (on a non-consolidated basis) increased by10.8% YoY, due to favorable performance of CYBERNET Cloud, which provides IT asset management software and Symantec products, etc. via cloud. Sales in the Data Solution Services (on a non-consolidated basis), which handles analysis tools of big data, also increased by 4.2% YoY and maintained a trend for an increase in sales, although sales of visualization solutions and big data analysis tools were lower than expected. In the IT asset management solution, the strategy of acquiring sales rights (agency) of all IT asset management software sold in Japan and providing solutions that meet customer needs was successful and contributed greatly to the increase in the segment sales. On the other hand, that of encryption software for mobile products such as notebook computers (Check Point Software Technologies Inc. in the US and Israel) decreased due to delay in response to Windows 10 (a downward factor of about 100 million yen). On the sales side, the Company managed to cover the declined sales of the encryption software. On the profit side, however, the encryption software could not cover the decrease in profit because of its low cost and high profitability.

Development subsidiaries

Although Waterloo Maple Inc. (Canada) won large-scale OEM projects just like the previous term, its sales were unchanged from the previous fiscal year due to a decline in sales in North America and Japan (local currency base: 100.4%, yen-base: 105.5%). It plans to sell businesses for nonmanufacturing industries and concentrate the management resources on the model-based development (MBD) area targeting the manufacturing industry. Noesis Solutions NV (Belgium), which develops and sells the optimized design support software "Optimus id8," struggled in Europe, but it was offset by an increase in other regions (local currency base:118.8%, yen-base: 123.3%). In Europe, the Company is intending to switch from agency sales to direct sales in Germany, the mainstay sales region, but development of the system is lagging due to a delay in recruitment of personnel. Sales of 3D tolerance analysis software by Sigmetrix, L.L.C. (US) increased worldwide. It also acquired large-scale OEM projects, and large orders continued in China (local currency base: 134.9%, yen-base: 138.8%).

Sales subsidiaries

Sales of CYBERNET SYSTEMS (SHANGHAI) CO., LTD. (China) increased due to increased sales of the mainstay optical software (local currency basis: 107.3%, yen basis: 107.7%), but it recorded operating loss due to loss of received orders or failure to receive orders towards the end of the term as well as shifting of multiple projects to the next term. For CYBERNET SYSTEMS TAIWAN CO., LTD. (Taiwan), sales of the Group's products were sluggish, but the sales of mainstay optical software and multiphysics analysis software for which it acquired sales agency right in Taiwan two years ago increased (local currency basis: 122.3%, yen basis: 133.0%).In South Korea, where operations began in October 2017 (a subsidiary was established in September), the subsidiary will take over the customers of the former optics related agency. Therefore, in FY 2018, it is expected to contribute to profits, even if it is the first year of the establishment.  Current ratio is 324.5% (333.5% at the end of the previous fiscal year), fixed ratio is 26.5% (28.5% at the end of the previous fiscal year), capital ratio is 67.6% (69.0% at the end of the previous fiscal year), and return rate on invested capital is 6.6% (3.8% at the end of the previous fiscal year).  |

| Fiscal Year Ending December 2018 Earnings Estimates |

Sales is estimated to increase by 8.5% YoY and operating income is estimated to increase by 3.7% YoY.

FY 2018 is considered as the "period of upfront investment" to achieve the targets of the medium-term business plan. It will focus on HR investment, improving the Group's products, and on development of new products. The estimates include an increase in personnel expenses (an increase of about 20 employees both inside and outside of Japan), development expenses (an increase of slightly over 100 million yen), and cost increase of more than 100 million yen associated with renewal of the core system (ERP). On the sales side, although the pace of sales growth has been over 10% mainly in the field of electrical equipment and transportation equipment since the second quarter of FY 2017, the estimates are conservative.The annual dividend is scheduled to be 16.52 yen per share (8.26 yen/share at the end of the first half and 8.26 yen/share at the end of the year) (dividend payout ratio 50.0%). It is to be an increase of 1.47 yen/share. The Company's basic principle of profit allocation is to make a comprehensive judgement, using a dividend payout ratio of 50% or a net asset (shareholders' equity) dividend rate of 3.0%, whichever is higher, as a reference indicator for dividend determination, together with medium and long-term investment amounts to enhance its corporate value in the future. |

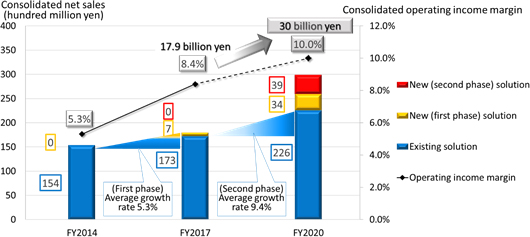

| Progress of the Medium-Term Business Plan (2015 to 2020) |

Provide value unique to Cybernet

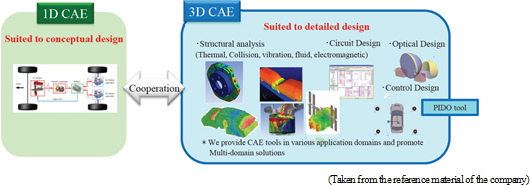

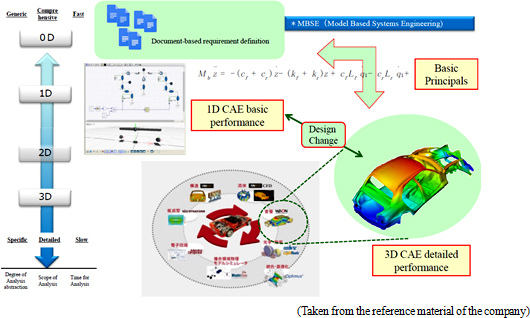

CAE software virtually reproduces and simulates(analyzes) phenomena on a computer, decreasing the number of prototypes (or eliminating them) and contributing to shorten development time and reduction of development cost. There is software for each specialized field such as structural analysis, circuit design, and optical design. Furthermore, in the case of structural analysis, for example, software is available for each area such as "structural analysis," "thermal fluid analysis," "electromagnetic field and circuit/system analysis." There is no software that simultaneously covers all fields or areas, and each piece of software is independent. However, in the process of product development, analysis needs to be performed across multiple fields. For this reason, the Company provides a solution that links the optical design software "CODE V" with the multiphysics analysis software "ANSYS" (optical characteristics by temperature change can be analyzed without developing prototypes).This is the Multi-domain Solutions that the Company was working on in the first phase of the medium-term business plan. It is leveraging the strengths of Noesis Solutions NV (Belgium), which handles the optimized design support software "PIDO tool," and has Multi-domain technologies that combine various CAEs for full optimization, in addition to the strengths of the Company that sells and supports more than 50 world-class CAE software products and can simultaneously handle unlimited combination of the fields and physical domains.  If "1D CAE" and "3D CAE" are linked, the Company will be able to design a function (determine the specification) with "1D CAE," send the data to "3D CAE," and carry out circuit design, optical design, structural analysis, etc. (Multi-domain Solution). After that, the Company can return the results of "3D CAE" to "1D CAE" and verify the function as a product. This means, in theory, the solution will make it possible to analyze without prototypes.  Focus on automotive field

In the field of automobiles in which development of Advanced Driver-Assistance Systems (ADAS), EV, and Connected Car is advancing, technical challenges are welcomed. For this reason, the Company will provide solutions in various technical fields. Specifically, the fields include sensors, controllers, structural function design, and telecompunications. It will also focus on proposing "Optimus id8," an optimized design support software that automates and integrates the analysis process in each field, for realizing effective utilization of internal resources and shorten development period.

Strengthen cooperation with partners

The Company will work on building sales and support systems globally and locally and promote OEM. Specifically, it will build a global agency network in North America, Europe and Asia to expand the subsidiaries' businesses and build an agency network to increase sales of new products in Japan. It will also work on strengthening partnerships with overseas consulting companies that have expertise in CAE solutions. Meanwhile, as for OEM, although it had been focusing on OEMs targeting the companies in the same industry, it will also put emphasis on the end-users by expanding OEM to the field of IoT (Digital Twin). More and more manufacturers in the fields of electronics, electricity, transportation, machinery etc. are seeking profit-making opportunities not only in sales of their products but also in a maintenance and follow-up service, which leads to a possibility that CAE can be used for both development and maintenance. Specifically, it is a service that utilizes both IoT and CAE to build a platform and analyze the causes of failure or malfunction in advance. The Company is paying attention to the Digital Twin field. Digital Twin is a concept or system that reproduces physical events into a digital field and predicts and analyzes causes of failure and malfunction in advance. Preliminary analysis of causes of failure or malfunction using IoT predicts occurrence of faults and malfunctions based on sensor information. In parallel with this, Digital Twin reproduces the same environment as the actual usage situation on a computer and carries out preliminary analysis of the causes of failure or malfunction. The Company will develop OEM targeting the Digital Twin users. Strategies by Business Domain, Global Strategies and Strategies by Application Area

Under the basic strategies, the Company will implement the Strategies by Business Domain, Global Strategies and Strategies by Application Area.

Strategies by Business Domain

The Company will increase the highly profitable Vendor Business and Consulting. As for the Distributor Business, it will improve sales by its expanding sales territory while reducing the sales component ratio. Specifically, it will increase the sales component ratio of the Vender Business and Consulting, which accounted for 32 % (5.8 billion yen) in FY 2017 to 36% (10.8 billion yen) in FY2020 and reduce the component ratio of the Distributor Business from 68% (12.2 billion yen) to 64% (19.2 billion yen). In the Distributor Business, it will further strengthen its relationship with vendors, pursue added value by Multi-domain Solutions and technical support, and expand its sales territory.For the Distributor Business, it will focus on Asia where there is much room for business expansion. In terms of market, it will focus on the automotive field where demand for ADAS, EV, and Connected Car can be expected and IoT field including Digital Twin. It is intending to differentiate itself through development of MBSE. Global Strategies

While expanding businesses in Japan, the Company will expand the businesses from 10% (1.8 billion yen) to 14% (4.2 billion yen) in North America, from 4% (700 million yen) to 6% (1.8 billion yen) in Europe, from 7% (1.3 billion yen) to 11% (3.3 billion yen) in Asia. The CAE market share by region is 40% in North America, 30% in Europe and 30% in Asia including Japan, and in the case of the Company, there is large room for overseas business expansion, considering its performance in Japan.The Company will acquire sales agency rights and develop the Distributor Business by expanding its sales territory to Asia, ASEAN and India. In North America and Europe, it will cultivate local sales partners or strengthen partnerships with consulting companies through alliances and capital tie-ups, and expand sales of subsidiary products with a focus on OEM. In Europe, it will especially focus on the German market. Meanwhile, in Japan, it will make efforts to provide products of the subsidiaries using OEM and promote the MBSE business by strengthening collaboration among the Group companies. It will also strengthen collaboration between CAE Solution and IT Solution (security, asset management, big data visualization, etc.).  In IT Solution Services, in addition to the existing 3-pillar strategies based on "security, IT asset management, and cloud solution," the Company will strengthen the linkage with CAE for the CYBERNET Cloud, which provides various functions such as asset management, security measures, and work efficiency improvement, for computers, smart phones and tablet devices. Currently, provision of CAE software on a cloud-basis is not common, but the Company believes that it will become popular in the future. In Data Solution, it will promote the Medical Visualization Business as a new business in addition to strengthening the on-going project to link AR(Augmented Reality), VR(Virtual Reality) and big data with CAE. The Medical Visualization Business is a national project in collaboration with Olympus, Showa University School of Medicine and Nagoya University, which oversees AI, and it is developing the image processing software for colonoscopy. (It is aiming at commercialization in 2020). |

| Interview with President Tanaka |

Born on January 13, 1963 in Hiroshima Prefecture. 55 years old. Graduated from the School of Business Administration, Meiji University in March 1985. Mr. Tanaka joined the company in August 1998, and after serving as director of the Technical Sales Division and general manager of the Applied Systems Division 1, director general, and executive vice president, he became the president in June 2006. He is currently the president, executive officer and chief executive officer (CEO).

The Results of M&A are Gradually Becoming Apparent. Expansion of New Business that Utilizes the Products and Technology of Subsidiaries.

The three basic strategies set forth in the medium-term business plan produced certain results with sales and profits growing greatly in FY 2017. The results of the M&A implemented from 2009 to 2010 are also starting to be apparent. Considering the development of Multi-domain Solutions and MBSE that offer the Company's unique values, it is easy to see the strategic significance of the M&A. Your foresight, or more precisely your judgement, is amazing.

President Tanaka: Before the acquisition of the three development subsidiaries, the Company totally relied on a distributor business with an exceedingly high level of dependency on control system design tools. However, because those design tools began being sold directly and the licensing agreement ended in June 2009, we lost approximately 40% of our sales and over 70% of our profits. Disributor businesses don't need large investments at the time of entry into the market, but there is the risk of a change to direct sales after the business becomes large. Because of this, we are always thinking about trying to lessen the risk by having several main products, having some in-house products, then enhancing our consulting and support based on those, evaluating the Company's consulting and support, and working hard in order to have people purchase our company's solutions. In fact, as well as acquiring the sales agency rights for competitive products in parallel with developing our own promising products, we have been working to improve customer satisfaction levels via support and consulting that manage them.

All three of the companies we acquired had high potential. We have been involved in the CAE business for over 30 years. Based on that experience, when we considered the next direction of the CAE business, we expected the importance of tolerance analysis and optimization to rise. tolerance analysis is used for yield calculation (note: business domain of US Sigmetrix, L.L.C.). Also, as we thought that it would be necessary to link multiple CAEs to pursue overall optimization, we focused on optimization tools (note: business domain of Belgium's Noesis Solutions NV). Simulations that can be substituted for experiments cannot be done with one piece of CAE software. Since it is necessary to use multiple CAEs, we expected that optimization tools would be required for the next step. We also focused on a formula model-based development (MBD) and methods of deepening development. In the upstream of product development, the degree of abstraction is high, and as development progresses, that degree of abstraction decreases (note: shape and structure are considered in a diagram). To shorten development time and cut development costs, it is necessary to streamline from the upstream to the downstream (linking of the upstream and downstream), but 3D CAE used at the step of shape and structure formation cannot be used in upstream processes that have a high degree of abstraction. To streamline, together with formula manipulation, data analysis, optimization, process integration and other technologies, MBSE solutions would be required.   President Tanaka: That's right. Although we had assumed that each field would grow a little faster, still each of the three companies has been steadily growing. Formula manipulation will become extremely important in the fields that we will enter in second phase of the medium-term business plan, and tools for full optimization will also be needed. With those as a base, we are working to develop new products that mix in our more than 30 years' worth of CAE know-how. The development process uses not only 3D CAE fields such as structural analysis and optical design, but also 2D, 1D, and even 0D. We are trying to make a platform that combines all these fields. Although I say "new products development," we are not making simulation software, but establishing a platform that links 1D, 2D, and 3D software. Within the process of manufacturing goods, there is 0D, 1D, 2D, and 3D, but for efficient development, there needs to be a link between 0D and 1D, and "3D CAE." The vertical line that leads from the upstream to the downstream cannot be made without integrating CAE know-how, formula manipulation know-how, and optimization know-how. We have all of those, which is why we are making it.

President Tanaka: Yes. It means we plan to make use of it from now on. Up until now, we have focused on launching products to get the management on track for the companies we purchased, but since that's been done to a certain degree, next we are going to create our own unique added value. That means we will be moving onto the next mode, which is the establishment of a platform for streamlining from the upstream to the downstream. However, because there are some points where we don't have the technology for streamlining from the upstream to the downstream, we are considering new M&As and business partnerships to cover them.

Continuation of a Favorable Business Environment with New Demands.

I'm looking forward to the establishment of the manufacturing platform. In implementing the medium-term business plan, it seems that the business environment will continue to be favorable for the foreseeable future.

President Tanaka: The rise of new demands is the reason behind it. One of those is the automotive field. Even now the automotive field is a leading field of CAE, and there is already a large market in CAE for engines and chassis, in which our company does not particularly excel, but there is barely any room in that market for our company to expand its operations into. However, the demand for CAE in the automotive field in electronics and electricity, for which demand has been low in the past, has been expanding in the course of digitization and electrification, such as ADAS (Advanced Driver-Assistance Systems), EV, and Connected Cars. Because of this, our business, which excels at electronics and electricity, is expanding.

Another would be the IoT environment. The IoT system requires a large number of sensors, but if the sensors receive interference, they become unable to acquire correct data, so it's necessary to analyze the effects of interference between the sensors. That's a high frequency and electromagnetic field analysis. The same can be said for the automotive field, where many sensors and microcomputers must be installed within limited space under severe conditions, such as heat and vibrations. Strict simulations are necessary as car accidents are a matter of life and death. Additionally, a new market that uses IoT called "Digital Twin" is also emerging. Although CAE has started being used in development, it is said that its use in after-sales service will begin in earnest in the following 3 to 5 years. Message to Investors

In the explanation of the financial results, you explained that electronics and electricity are making a comeback. I now see the real reason behind this is the digitization and electrification of automobiles. Do you have any last words for investors?

President Tanaka: Our message is "Energy for your Innovation." We would like Japan to continue to be a big manufacturing-of-goods nation and would also like to support manufacturing of goods not only in Japan, but in the world. For that purpose, we believe that we need to continue to be a company passionate about supporting engineers. We are never on the front lines, but we would like to think that behind the scenes of the creation of great products, we are making our own contribution with our support. For example, I heard that various corporations providing CAE, including ours, supported engineers and succeeded in greatly shortening the development time of the iPhone, which has made life convenient.

In order to create new value, we will continue to aim to be the "First Contact Company" for our customers. We appreciate your understanding in this regard and look forward to your continued support. |

| Conclusions |

|

|

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

The Latest Update: March12, 2018

Basic policy

Our company will thoroughly observe all applicable laws and regulations in all corporate activities and take actions that conform to social ethics as we have set forth in the "Cybernet Group Compliance Policy Guidelines" (hereinafter referred to as "Cybernet Policy Guidelines"). This is our basic attitude towards all shareholders. In addition, we respect the Cybernet Policy Guidelines as our company's basic policy in regard to corporate governance and we strive to ensure the soundness of our management, clarify accountability, and disclose impartial and timely information. We are also aiming to expedite management decisions and improve supervisory functions of business execution, as well as endeavoring to create organizations with effective risk management and screening functions.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

We have implemented all the principles of corporate governance code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 "Strategically-held shares"As a general rule, our company does not hold listed stocks as "strategically-held shares." However, in the event of holding for business partnerships or other logical business reasons, we verify that the holding is for a goal related purpose and regularly confirm the rationality of it. Principle 1-7 Transactions between related parties Regarding important transactions with related parties, the board of directors makes decisions after sufficient deliberation concerning the rationality and validity of the transaction details. Also, as necessary, the legal department will conduct a review based on the opinions of external experts. Furthermore, for transactions with controlling shareholders, please refer to "I. 4. Guidelines on Measures to Protect Minority Shareholders in Transactions with Controlling Shareholders." Principle 5-1 Policy on constructive interaction with shareholders The Company has established a department in charge of IR, and the director in charge of that department is working as the director in charge of the administrative department to design an organic collaboration within the administration department. In addition, the department will report IR activity to the representative director or director in charge once a quarter. Furthermore, regarding the management of insider information, please refer to the following "V.2 (3) Disclosure Policy" and the "Information Disclosure Standard (Disclosure Policy)" listed on our website via the URL below. (Information Disclosure Standard (Disclosure Policy)) http://www.cybernet.jp/ir/ir_policy/standard/ The Company's main IR activities are as follows: (1) Financial results briefing (once a year) (2) Medium-Term Business Plan briefing (once a year) (3) General shareholders meeting (once a year) (4) Briefing for individual investors (irregular) (5) Personal meetings for institutional investors (6) Information provision by e-mail Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |