| Digital Information Technologies Corporation (3916) |

|

||||||||

Company |

Digital Information Technologies Corporation |

||

Code No. |

3916 |

||

Exchange |

TSE 1st Section |

||

Industry |

Information and communications |

||

President |

Norikazu Ichikawa |

||

Address |

FORECAST Sakurabashi, 4-5-4 Hatchobori, Chuo-ku, Tokyo |

||

Year-end |

End of June |

||

URL |

|||

* The share price is the closing price on March 27. The number of shares issued was taken from the latest brief financial report.

ROE and BPS are the values for the previous term. PBR was calculated while taking into account the share split (2-for-1) implemented on October 1, 2016. |

||||||||||||||||||||||||

|

|

* The forecast is from the company. EPS and BPS were retroactively recalculated.

* From the FY 6/16, net income is profit attributable to owners of the parent. Hereinafter the same apply. This report introduces the first half of fiscal year June 2017 earnings results of Digital Information Technologies Corporation. |

| Key Points |

|

| Company Overview |

|

In 1996, he was appointed president of Toyo Computer System, Inc. as the successor to one of his acquaintances. He expanded its business area starting from business system development, and then computer sales business, embedded product development validation business and operation support businesses tuning Toyo Computer System Inc. into a multifaceted and diverse IT company. In 2002, he established Toyo IT Holdings Corporation, which is the predecessor of current Digital Information Technologies Corporation, by separating several companies under the same group and establishing subsidiaries with 100% ownership. In 2006, he integrated four subsidiaries into one company and renamed it to the current company name. In addition, in January 2011, he established DIT America, LLC in Kansas, U.S.A. Digital Information Technologies Corporation was listed on JASDAQ of Tokyo Stock Exchange (TSE) in June 2015, listed on the second section of TSE in May 2016 and listed on the first section of TSE in March 2017. The details of the development and sales business for own-brand products are as follows:   Employees are to uphold this company policy as their creed and follow these principles at all times. 1. Segments

There are two segments: software development business and computer sales business. The software development business consists of 3 business units: business solutions unit, embedded product solution unit and other business unit.

(1) Software Development Business

The sales for this business unit is mostly from custom development for end-users and information systems companies which are clients' subsidiaries in a wide variety of industries including finance, communications, distribution and transportation as well as for leading SI vendors.1) Business Solution Unit (Business system development unit) Specifically, development for websites and key systems, front and back office operations, new system development and maintenance development with technologies developed in each area. The company has developed trustworthy relationships with leading companies in each area which enables them to secure stable orders. (Operation support unit)

Main clients include communications carriers, total human service corporations and information system companies which are airlines subsidiaries.This "business unit to support clients' daily operations through IT" has stable revenue as it is an ongoing business in line with the business website domains of leading companies. Specific business includes: 2) Embedded Product Solution Unit

This business unit is trusted by leading manufacturers to directly develop custom software for in-vehicle devices, mobile devices, information home appliances and communication devices. For in-vehicle devices, mobile devices and information home appliances, the unit develops custom software for overall systems including firmware, device business unit controls and applications.(Embedded product development unit) It focuses on a new power system (*1) with new technology, running safety, ITS (Intelligent Transport System) and auto-drive as well as infotainment for in-vehicle devices as the demand for this market is expected to grow. In addition, it undertakes software development for wireless base stations, communication module devices and virtual networks (*2) for communication devices. New power system (*1): power for hybrid, plug-in hybrid and fuel cell vehicles.

Virtual network (*2): software control technology to rebuild network flexibly without making any changes to the physical network. (Embedded product verification unit)

This business unit verifies and makes suggestions to improve qualities and functions of products through its verification service. It provides verification services domestically and internationally (North America, Asia, Europe, etc.) including laboratory tests using specialized devices to verify product operation and function, field tests to verify products in the actual environments, as well as overall system tests conducted as the final quality verification from the perspectives of the third party. Some of the overseas field tests are designated to its subsidiary, DIT America, LLC, which provides fast service with verification of product usability from the perspective of local staff. The range of products for verification includes in-vehicle devices, medical devices, communication devices and mobile devices. 3) Other business units

Other business units include development and sales of own-brand products. Currently, the company strongly focuses on the sales of two products, "WebARGUS," a website security solution, which detects tampered website simultaneously as it occurs and instantly restores the original normal condition, and "xoBlos," an Excel work innovation platform, which features data decomposition and restoration as well as meeting various forms of data business processing needs. There are other products such as "APMG (Anti Phishing Mail Gateway) ," a solution to prevent damages from phishing and illegal use of brands by automatically adding electronic signatures on e-mails, and "Rakuraku page," a CMS (content management system), which enables editing and updating websites easily. (2) Computer Sales Unit

The company and its subsidiary, Toyo Infonet Co., Ltd, sell "Rakuichi," a business support mission-critical system, for small and medium enterprises, manufactured by Casio Computer Co., Ltd. as its one of agencies.The sales area is started at Kanagawa first and expanded to Tokyo, Chiba, Gunma and Ehime successively. The Company provides substantial support for their users to increase the client retention rate. In addition, they set up a call center to attract and build a new client base. The number of sales for "Rakuichi" has been recorded to be the highest across all agencies for 12 consecutive years. 2. Main Strategic Products

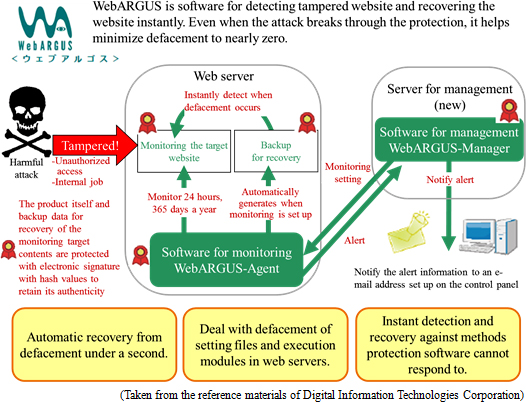

1) "WebARGUS," a new website security solution

WebARGUS is a new security solution which detects tampered websites instantaneously and immediately restores it to its original state. By detecting and recovering immediately when incident occurs, WebARGUS protects corporate websites from damage caused by malicious and unknown cyber-attacks and simultaneously prevents the escalation of the damage from viruses spreading via the tampered website.

◎ Increasing tampering of websites

According to the research conducted by "JPCERT Coordination Center," (*) tampered websites reported to the center was 3,335 in fiscal 2015 (April 2015 to March 2016), smaller than 7,724 cases in 2013, but it is still at a high level following 2014.

"JPCERT Coordination Center" (*): This center receives reports concerning computer security incidents including hacking via internet and service disturbance in Japan. It also supports measures, grasps how the problems are generated, analyzes the methods, investigates and advises on measures to prevent recurrences from a technical point of view.

◎ The background of the development of "WebARGUS"

Under these circumstances, the company, which had already released a solution called "APMG" to prevent damage from phishing and illegal use of brand by automatically adding electronic signature in e-mails, started developing "WebARGUS," based on a core security technology in the spring of 2013, after 2 years of research. Then in July 2014, it released "WebARGUS."The major characteristic and strength of the company is that it has a variety of rich IT related technologies, and has a highly standardized core security technology. This is because its engineers have a mindset to embrace challenges and are not afraid to take risks. Thus, they are not satisfied with just developing custom products. This is strongly influenced by the company's organization strategy represented by its corporate culture and in-house company system which will be explained later in this report.  On the other hand, if "WebARGUS" is installed, because it instantly detects and recovers websites when tampered with, the condition of a website can be maintained in the normal state. Thus, the website does not need to be disabled in a rush when the application detects a threat. Companies can concentrate on pursuing the cause and strengthening protection while its website is kept open to public. Most of the detection software detects tampered website with a periodic monitoring on pre-configured, specified timing or intervals. With this method, there will be a time lag between when the website is tampered with and when it was detected, so it is inevitable for the website to be tampered. In addition, if the interval is shortened to reduce the time lag, there are other challenges such as increasing CPU load. On the other hand, when some kind of event occurs (such as data deletion or addition excluding browsing), "WebARGUS" conducts real time scanning to detect the event. The major feature of this product is that it is also equipped with an instant recovery function which enables restoration to the original state in less than 0.1 seconds after the detection (average time under the demo environment: 0.003 seconds per file). This instant restoration is its unique technology. The annual license fee of "WebARGUS" is JPY480,000 (excl. tax) per OS with support. This also includes free update modules for minor version updates. ◎ Introduction and sales

When WebARGUS was released, the sales growth was rather slow because general understanding of website security was mainly about protection against hacking into a computer system and awareness about "tampering" was limited. However, the acknowledgment that "software for detection is needed as well as for protection" is growing rapidly due to the more frequent mentioning of the independent administrative agency, "IPA (Information Processing Association)," taking measures to prevent defacement. This agency is established to support the IT national strategy from a technical and personnel aspect perspective and is supervised by the Ministry of Economy, Trade and Industry.Under these circumstances, the company has carried out promotion and marketing including organizing seminars for target users who recognize the necessity for a higher level of security, and participation in exhibitions. It also focuses on agency sales to strengthening marketability. There are currently a total of 24 companies with agency contracts. They have been actively involved in development collaborations with data centers and cloud service corporations. Furthermore, the company is expected to expand its business overseas as well as product sales in Japan. The company is preparing to provide support for the tampering of websites across the globe. ◎ Strengthening the feature of merchandise

In April 2016, a Windows version was released in addition to the Linux version.Also, the development of an enterprise version for large-scale users is underway, and the company aims to release it in summer 2017 Additionally, it is considering the release of products in a series including WebARGUS which can be used with embedded products for a security measure in the IoT age. For the embedded version, an official project has started product development and has been reviewing to provide specific business capabilities and researching relevant technology. 2) "xoBlos," an Excel work innovation platform

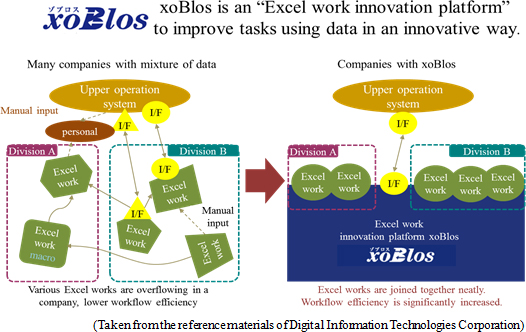

Even in advanced corporations with a high level of IT, there are numerous Excel-based tasks in the office. Most non-routine tasks consist of repetitive manual operations such as generating Excel reports by manually inputting data from paper reports, aggregating totals from multiple Excel sheets and visualizing and analyzing CSV data extracted from packaged system.The company's original-brand, "xoBlos," entirely automates these inefficient Excel-based tasks and provides drastic improvements to workflow in a short term.  ◎ Background of development

Many corporations use Excel, the major spreadsheet software, for generating quotations and invoices. However, in cases where they generate these documents in different formats for each client according to the clients' requirements, manual input is mandatory because it is difficult to tally, sort and analyze in a systematic way.For this, the company developed "xoBlos," an Excel work innovation platform, to automate tasks and significantly improve workflow efficiency.  One recent case is that "xoBlos" was chosen for "Disaster Information Management System" developed by IBM Japan which was provided for free, jointly with IBM Japan in the Kumamoto earthquake. The system was used for correspondence of relief supplies between shelters and national and local governments as well as exchanging information about action statuses * A sample use case: Automated quotation and invoicing operations enabled a company to process over 30,000 tasks per month without overtime.

Yakult Support Business Co. Ltd. has implemented "xoBlos." Its business is to issue invoices on behalf of sales companies and management of business activities such as sales and revenue management for 11 companies including other Yakuruto subsidiaries. They issue 33,000 invoices monthly. During the period when the most billing tasks occur, at the end and the beginning of each month, all employees except management had been engaged in billing by working overtime every day. In addition, mistakes and issues were common because they were pressed for time. This was caused by the fact that there was a different invoice format for each client. The process of billing operation mainly consist of each sales company inputting sales data into a mission-critical system developed by Yakult HQ, and then Yakult Support Business Co., Ltd outputting the data and mailing them to each client. However, because the invoice formats are different for each client, they had to output the raw billing data from the mission-critical system and input them into Excel spreadsheets manually to generate invoices. There were hundreds of invoice formats, and the operation was extremely inefficient. They implemented "xoBlos" to improve this situation, and soon the workflow become drastically more efficient. There have been no confusions during the billing period, and the company's credibility has increased. While the workload increased, it managed to eliminate 180 hours of overtime per month without increasing the number of employees. ◎ Introduction and sales

Currently, there are over 220 companies with "xoBlos."The company has been expanding sales including hosting seminars jointly with one of its major agencies, Daiko Denshi Tsushin, Ltd (8023, the second section of TSE), by taking full advantage of its wide variety of clients, branches and marketability. As the demand for the product from large companies increases, there are more cases where they can showcase examples of implementation of the system to the public. In addition, as sales have increased, there are more agencies that started selling its products utilizing the resources of the whole company rather than just one section. ◎ Strengthening the features of merchandise

The company has promoted solutions in collaboration with other products developed by other companies. For example, "xoBlos" collaborates with "X-point" developed by ATLED Corporation, which has been the best software in the workflow system market for 5 consecutive years. As for the product itself, the company is aiming to strengthen the features of its website-based integrated version "xoBlos Corabo" to accommodate broader requirements. 1) Multifaceted and diverse IT company

The company has expanded its business areas by flexibly responding to the progress of information technology, from business system development business to computer sales, embedded product development and verification business, and operational support business as well as working on its original products based on its technical strengths which have been developed during the process of business expansion.One of the major characteristics of the company is that it is a multifaceted and diverse IT company and has a wide range of business activities and provides own-brand product with originality. 2) Organizational strategies of partial and total optimization

Another significant characteristic of the company is that it has an organizational strategy with two opposite factors, partial and total optimization in a well-balanced manner.For partial optimization, the company has specialized companies under an in-house company system which aim to be the best in each field. It also provides training and produces entrepreneurs with innovative spirits. For total optimization, the company pursues synergy between companies while respecting independence of each in-house company; through scrap and build done by the headquarters, collaboration between each in-house company and development of new business areas.  3) Development and sales of original own-brand products

As mentioned above, the company has developed a variety of original own-brand products like "WebARGUS" with its unique technologies. Although the sales ratio of its own-brand products is still low currently, they are growing to be the primary source of revenue in the future.

|

| First half of Fiscal Year June 2017 Earnings Results |

Increased sales and profit.

Sales were 4,858 million yen, up 5.4% YoY. Although the computer sales business was sluggish, the software development business showed steady growth, resulting in a sales increase. Even though SG&A expenses including labor, research and development costs increased, the costs were absorbed by the sales growth, and operating income was 304 million yen, up 3.4% YoY. While refund for insurance cancellation decreased, lawsuit-related costs were recorded. As a result, ordinary income and net income declined.  ◎ Software Development Business

Sales and profit increased. The system development in the field of finance and operation support business grew steadily in the business solution business segment, with a focus on existing customers. In the field of the embedded solution business segment, the large-scale business transaction to verify in-vehicle devices has shifted to the third quarter. In the own-brand business segment, the awareness on "WebARGUS" has grown, leading to improved business performance. xoBlos and CMS showed healthy growth. ◎ Computer Sale Business

The sales strategies targeted at the new market of "Rakuichi" did not fully function. As a result, sales and profit declined.

Current liabilities rose by 73 million yen from the end of the previous term as a result of including provision for bonuses. The total liabilities increased by 69 million yen to 1,337 million yen. Net assets increased by 143 million yen to 2,101 million yen as a result of the increase in retained earnings. Consequently, equity ratio rose by 0.4 points from 60.7% at the end of the previous term to 61.1%. The balance of short and long-term debts dropped by 16 million yen from the end of the previous term to 54 million yen. (4) Topics

The Tokyo Stock Exchange Market Company approved the listing of the Company on the first section on February 24, 2017.◎ Listed on the first section of Tokyo Stock Exchange DIT moved to the first section of Tokyo Stock Exchange on March 17, 2017. ◎ The Company announced the dividend forecast.

On February 24, 2017, the Company announced the dividend forecast for the fiscal year ending June 2017. It will distribute the year-end dividend of 12.00 yen/share based on the comprehensive examination of business forecast and financial status. In addition, it will distribute commemorative dividend of 3.00 yen/share for the fiscal year ending June 2017 to commemorate the listing on the first section of Tokyo Stock Exchange. As a result, the year-end dividend will be a total of 15.00 yen/share (ordinary dividend: 12.00 yen/share, commemorative dividend: 3.00 yen/share). Estimated payout ratio is 25.6% for the ordinary dividend only and 32.0% together with the commemorative dividend. ◎ Sales of shares

The Company sold the shares. Sales price: 2,020 yen, Number of shares sold: 530,000, Delivery date: March 17. ◎ Changes to the use of funds procured by issuing new shares

The Company will make changes to the use of funds procured by issuing new shares when it got newly listed in June 2015. (Reasons for the changes) The Company underwent its public stock offering when it was newly listed in order to invest in training facilities for employment and development of human resources, open local business establishments associated with business expansion, purchase office equipment and update software to enhance business efficiency, and invest in new product development to expand sales. To adapt to changes in a business environment, it decided to shift its investment priority to the own-brand product development, which is a growth factor. It will carry out investment in facilities when the time for good utilization of the facilities comes.  Out of remaining 204,000,000 yen, 9,000,000 yen will be used for purchasing office equipment and updating software, 75,000,000 yen will be used for developing own-brand products such as WebARGUS, and the remaining will be used to establish training facilities for employment and development of human resources. The specific schedule is to be determined. ◎Status of the own-brand products

*Sales status

<WebARGUS> <xoBlos>

*Sales promotion status

|

| Fiscal Year June 2017 Earnings Estimates |

No change in the earnings forecast. Continued growth in sales and profits.

There is no change in the earnings forecast. Sales are estimated to be 10,012 million yen, up 7.2% YoY, and operating income is projected to be 570 million yen, up 8.7% YoY. Each business segment is expected to have steady growth. Operating income growth rate will decrease because the Company will invest in new businesses with high added-value. However, it will make efforts to increase sales and profit by stabilizing business foundation and strengthening growth elements. As described earlier, the ordinary dividend will be 12.00 yen/share and the commemorative dividend will be 3.00 yen/share (a total of 15.00 yen/share).  Both system development business in the field of finance and operation support business will show healthy growth. *Embedded solution business The number and amount of orders for development and verification of in-vehicle devices business will increase, and it will cover the drop of mobile-related products business. *Other businesses The own-brand products business (i.e. WebARGUS, xoBlos, CMS) will grow towards the end of the fiscal year. *Computer sales business The Company will work hard to achieve better results than the first half of the year. |

| Conclusions |

|

Because the Company is only in the third term after it got listed in the stock market, we can only compare the quarter progress with the previous term. Sales remained the same as the previous term. Operating income also shows only slight growth in the second quarter due to slow start in the first quarter. It is noteworthy that the progress rate of the second quarter for the own-brand products, "WebARGUS" and "xoBlos", which did not reach 20% in the first quarter, went up to around 50% in the second quarter. The performance in the third quarter, which gained one third of operating income last year, is a point of interest. In the medium term, we would like to pay attention to automotive equipment for which the market is expected to grow through advances in self-driving technology.  |

| <Reference 1 : Growth Strategy> |

|

◎Overview of Midterm Business Development

The company's medium-term business goals are: 1) to establish solid business foundations through stable business in a wide range of business fields, and 2) to provide new values with a focus on own-brand products based on the foundations. The company is aiming to grow substantially with these two wheels.The company will focus its management resources on the promising fields in order to establish the business foundations. The company will proceed with strengthening of sales, for example, by forming of business tie-ups, and improving products, including other companies' ones. The company set the goals of "development" for previous term ended Jun. 2016, "strengthening and establishment" for this term ending Jun. 2017, and "great strides" for the term ending Jun. 2018. Its goal is to achieve triple 10s ("Sales of 10 billion yen, operating income of 1.0 billion yen, and 10% of operating margin ratio") within 5 years.  ◎Growth Strategies and Progress

The solid business foundations are consisted of "business solutions," "embedded solutions" and "computer sales." Their growth strategies and progress being made so far are described in the tables below.

[Development of Business Foundations]    [Growth Elements]

"WebARGUS" and "xoBlos" are the growth elements on which the company focuses its greatest efforts. The growth strategies and the progress are as follows.

|

| <Reference 2 : Regarding corporate governance> |

◎ Corporate Governance Report

Last Update: January 30, 2017

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |