| Broadleaf (3673) |

|

||||||||

Company Name |

Broadleaf Co., Ltd. |

||

Securities Code |

3673 |

||

Market |

TSE 1st Section |

||

Business Type |

Information/Communications |

||

President and CEO |

Kenji Oyama |

||

Head Office Location |

4-13-14, Higashi-Shinagawa, Shinagawa-ku, Tokyo |

||

Fiscal Year End |

End of December |

||

HP |

|||

*Share price is the closing price for March 1. Shares issued excludes treasury shares from shares issued at the end of the most recent quarter.

ROE and BPS use the results from the end of the last fiscal year. |

||||||||||||||||||||||||

|

|

* Forecast provided by Broadleaf. The company started the voluntary application of IFRS in the term ending December 2017.

This Bridge Report presents Broadleaf's earnings results for the fiscal year ending December 2016 and so on. |

| Key Points |

|

| Company Overview |

|

[Company History]

The company is the formal surviving company of a merger and, with support by American private equity fund the Carlyle Group, was established in September 2009 with the name CB Holdings Co., Ltd. as the receiving company for a management buy-out (MBO) by management of the effective surviving company, the former Broadleaf Co., Ltd.CB Holdings Co., Ltd. then made the former Broadleaf Co., Ltd. a wholly-owned subsidiary through stock transfer in November of the same year. On January 1, 2010, the former Broadleaf Co., Ltd. was absorbed with its entire business activities succeeded, the company name was changed to Broadleaf Co., Ltd. The former Broadleaf Co., Ltd., the effective surviving company of the merger, was a subsidiary of ITX Corporation, in December 2005, carrying out the "packaged software business" transferred from Tsubasa Systems Co., Ltd., which conducted system sales to automotive aftermarket businesses such as automobile parts sellers, automotive maintenance services, and automotive bodywork services. With the global financial crisis triggered by the bankruptcy of Lehman Brothers in 2008, the MBO was carried out to respond to the sudden change in the automobile industry climate and to build a sustainable growth base and expand overseas, without worrying about short-term fluctuations in business results. The chart below shows the history of the company since establishment.  [Corporate Philosophy]

The company has a corporate philosophy of "joy and gratitude."

We work with our customers to develop successful businesses, based on the spirit of "joy and gratitude". We believe that is an essential part of forming close relationships between people and companies. When you see how our products and services contribute to your business, we hope that you will be happy that you chose Broadleaf.

(From the company website)

We hope you will also rejoice as you see your business grow day by day. Those positive feelings give us joy and gratitude, too, and inspire us to create even better products and services. Our aim is to grow hand in hand with our customers, based on this shared sense of joy and gratitude. That is our corporate philosophy and the guiding principle behind our business here at Broadleaf. All employees carry a credo* card with them at all times, and everyone recites the code of conduct at daily morning meetings. Employees who understand and exemplify the corporate philosophy are also awarded based on employee voting, creating a system for employees to indicate their gratitude to each other as well. *Credo: A term originating from Latin, referring to the company's beliefs and policies in brief. Many companies use it as a tool to encourage spontaneous action by employees. Creed. Broadleaf trees are supported by the earth, which enables them to give nutrients back and enrich the earth through their leaves. In much the same way, we are able to contribute to industry thanks to the support we have received from countless customers across various different sectors.

(From the company website)

Having accumulated information thanks to our customers' support, our aim here at Broadleaf is to feed that information back into industry, to make our customers happy. That's the sort of cycle we want to create as a company, so that we can repay our customers. That is why we named the company Broadleaf. [Market Environment]

-Overview

The target market of the company is the automotive aftermarket, with a market size of approximately ¥10 trillion. The "automotive aftermarket" covers all products and services after a vehicle has been purchased, including gasoline, automotive accessories, maintenance checks, safety inspections, spare parts, resale and disposal. (From the company website)

1) Number of Automobiles Owned

The number of automobiles owned including light vehicles was 60.83million at the end of March 2016, and is continuing to grow. With the average years of car usage increasing, the stock of automobiles is expected to continue to grow.

2) Average Number of Years Cars Are Used

The average number of years from when a passenger car is first registered to when its registration is removed was 12.76 years at the end of March 2016, an increase of over 2 years from 10.40 years at the end of March 2001.With the change in automobile users' opinions, long-term use of cars is increasing, which means demand for repairs/inspections and for replacement/consumable parts is increasing in the automobile repair market and parts market. 3) Number of Certified Workshops and Designated Workshops

"Certified Workshops" are workshops certified by the District Transport Bureau Chief, and can conduct automobile repair and modifications that require removing the motor, drivetrain or running gear in "dismantling maintenance."Of certified workshops, those that meet certain standards for facilities, skills, and organization, and are designated for automobile maintenance by the District Transport Bureau Chief are referred to as "Designated Workshops." The number of certified and designated workshops tends to remain the same or increase slightly, but in recent years the ratio of certified workshops that are designated has been increasing. This is probably because small workshops being absorbed into medium or large workshops and groups, due to issues such as economic trend and a lack of successors to take over. According to Broadleaf, there are approximately 70,000 workshops not associated with dealers in Japan, and of those 40,000 are small workshops with three or fewer mechanics, and the other 30,000 are medium- and large-scale workshops that Broadleaf is targeting, as workshops polarize to one extreme or the other. The number of medium- and large-scale workshops that have sufficient financial resources and use Broadleaf's system for parts orders is still only 2,041 at the end of December 2016, so there is still a lot of room for expansion. 4) Recycled Parts Market

The Automobile Recycling Law went into effect in 2005, and markets for automobile dismantling and recycled parts have gradually been developed. With the diversification of group shared recycle inventory systems and expanded use of internet auctions, the recycled parts market is expanding.Recycled parts use helps limit CO2 emissions and may have positive effects on the environment, and is expected to continue to expand due to its social importance. Also, automobile insurance fees being updated in October 2012 should give a boost to the recycled market. As seen above, the market environment facing the company is mostly positive. [Business Outline]

In addition to providing network work applications specialized for customer industries, maintenance service and supply products to mainly the automotive aftermarket industry, Broadleaf also carries out network services for its industry platform, consisting of the following three fields: 1) Business AP Software, 2) System Support and 3) Network Service.Since it is a single segment of the IT service business, the divisions shown below are carried out.  The sales composition for December 2016 had Business AP Software account for the majority with 65.2%, but attempts are being made to increase the share of stock income. (Composition of Sales Sectors) [Business AP Software] -Development and sales of specialized business applications -Development and sales of information security and other packaged software -Acquisition and sales of PCs, printers and other equipment [System Support] -Provision of maintenance services to clients that purchased Broadleaf's system -Acquisition and sales of ledger sheets and OA supplies, etc. [Network Service] -Provision of database services to clients that purchased Broadleaf's system -Provision of server services to clients that purchased Broadleaf's system -Provision of clearing house service for recycled auto parts. -Provision of electronic order functions for auto parts -Provision of tablet-based work support tools, etc.  1) Business AP Software

Broadleaf conducts development and sales of specialized business applications used in industry platform for businesses in the automotive aftermarket industry as well as travel agencies, cellular phone dealers, and machine tool dealers.Broadleaf's specialized business applications improve usability by catering to specific industries for their unique business flows, as well as addressing general client needs such as estimate and invoice management. The company also carries out sales of computers with applications installed, as well as LCD monitors, tablets, printers, peripherals and other hardware. It also carries out system development under commission, in response to client needs. As for procedures for sales of systems, they were initially "one-off" sales, but from 2004 on, the process was changed to allow Broadleaf to sell system rights to a lease company, and then the lease company to sell it to customers with a 6-year lease contract. 2) System Support

To maintain an optimum business environment for customers, a support system has been made to respond rapidly to network, hardware and server problems, with a customer help desk open 365 days a year and specialized staff working in 35 locations (as of the end of December 2014) throughout Japan. This support system consists of "maintenance" section, which provides business application maintenance services and hardware maintenance services, and "supply" section, which conducts sales of ledger sheets and other supplies used by the business applications.

3) Network Service

A contingent service using Broadleaf's network for customers that purchased network specialized business applications.Network Service consists of "stock" section, with database and server services essential for the use of the business applications, and "transaction" section with the marketplace provided for distributing recycled parts in the automotive aftermarket industry and carrying out electronic transactions for auto parts between dealers. <Main Services in the Network Service Section>

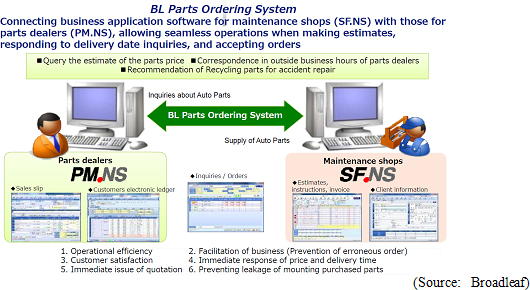

-Parts Dealers and Maintenance Shops Platform Service with System Connections

Using the BL Parts Ordering System, the maintenance shops business system and parts dealer system are linked, to provide seamless service for estimate/delivery response and ordering.Until now, to order necessary parts maintenance shops would have to call or fax parts dealers they already had done business with to order parts, the procedure that had more than enough trouble with regard to the inevitable hassle, incorrect orders, delivery time, etc. The BL Parts Ordering System improved this situation by greatly enhancing work efficiency, facilitating transactions, and enabling immediate responses for price/delivery dates. The System provides links between parts dealers seeking more maintenance shop clients and maintenance shops in need of necessary parts in time. Parts dealers pay a network usage fee, and maintenance shops are charged fees on a per-use basis.  -Settling Payment for Recycled Parts Service

The company operates "Parts Station NET," which is a network for distributing recycled parts with shared inventory information of recycled parts. Recycling companies, which sell recycled parts, register their products in "Parts Station NET"; maintenance shops and sheet-metal factories, which use recycled parts, retrieve necessary products; and parts traders and recycling enterprises, which mediate transactions, check compatibility. At present, recycled parts worth about 240 billion yen per year are traded in Japan. Parts Station NET involves about 13,000 enterprises, and distributes about 10,000 parts per day, which accounts for about 17% (about 41.5 billion yen) of total sales in Japan. In the case where parts are traded between distributors and brokers, "Parts Station Factoring NET," an online payment settlement agent for recycled parts, collects commissions. For the term ended December 2016, it settled payment for recycled parts worth about 10 billion yen, and earned fee collection agency commissions amounting to about 660 million yen.   In the financial statement's "Management Index Goals" section, ROE is mentioned (at this point, no specific numbers are given as a goal), and the company aims to continue to increase ROE. [Characteristics and Strengths]

1) The Only IT Company That Can Lead the Automotive Aftermarket

Based on the Declaration to be the World's Most Advanced IT Nation, adopted at a Cabinet Meeting on June 2013, the Ministry of Land, Infrastructure, Transport and Tourism created the Investigative Commission for Future Vision of Effective Use of Automobile-related Information to consider how to create new services and industry innovation by using automobile information held by the country, such as car registration information (including owner information), car location and car speed information, and accident and maintenance history.According to the Commission's Future Vision of Effective Use of Automobile-related Information announced in January 2015, current situation of use of automobile-related information in Japan is as follows:  Under such circumstances, Broadleaf believes that it is the only company that can lead the future automotive aftermarket, based on tens of thousands of its client companies and its expertise backed with its maintenance data on tens of millions of cars. *OBD: On-board diagnostics. Diagnostics performed by computers installed in automobiles to detect faults. 2) Overwhelming Share

Of the 2,200 parts dealers said to exist in Japan, around 1,500 or 70% already use Broadleaf's business system. For maintenance workshops, of the 30,000 non-dealer medium- and large-scale workshops that are the company's target, 13,000 use Broadleaf's system, demonstrating the overwhelming market share it has.In addition, there is no company other than Broadleaf that can provide a variety of systems using a platform. There do exist several distributors dealing in limited range of systems, but their sales amount to no more than one-tenth of Broadleaf's, so the company essentially has no competitors. 3) Ample Experience

Sales of the first automobile parts system, called Partsman, started in 1983. Partman was sold by Tsubasa Systems Co., Ltd., a company established in 1983, but Tsubasa transferred its packaged software business to Broadleaf in 1983, the same year. Therefore, if counted from then, Broadleaf can boast of over 30 years of experience. Ever since, the company has been making databases of parts information for the approximately 30,000 parts in a single automobile, and the parts codes created by their unique know-how have become the industry standard.With the vast amount of data collected, their database is overwhelmingly No. 1 in both quality and quantity.  4) Trusting Relationship with Clients

With a direct sales system to accurately determine client needs and carry out dedicated service, Broadleaf has formed relationships of deep trust with its clients, which is a valuable hidden asset of the company.Despite the 6-year term of the license contract with clients, the ratio of contract renewals is from 80% to 90%, with high customer satisfaction. |

| Fiscal Year December 2016 Earnings Results |

Sales and profit decreased, and did not reach the estimated.

Sales were ¥16,851 million, up 0.2% from the previous term. The sales of the network service segment grew. However, the number of subscription renewals was sluggish in the system sales segment, which accounts for more than 60% of total sales. Gross margin rate dropped 1.9% due to the increased sales cost caused by the boost in equipment procurement, etc. SG&A, too, dropped from the same period of the preceding year thanks to cost control, but couldn't offset the decline in gross margin rate, and resulted in an operating income of ¥2,227 million, down 11.4% YOY. As a result of posting the compensation payment received amounting to ¥250 million as extraordinary income, and ¥159 million of the loss on the valuation of investments in the capital of subsidiaries and affiliates as extraordinary loss, net income decreased 8.7%. Neither sales nor profit reached the initial estimates.    As for transactions, the number of maintenance facilities connected to the BL parts system was 2,041 at the end of the previous term, and the number of ordered systems of CarpodTab was 3,054, showing steady growth. The company aims to increase profitability further by selling the "BL parts system" and "CarpodTab" combined.  Due to the increase of trade payables and unpaid corporate tax payments, etc., current liabilities increased ¥622 million. On the other hand, fixed liabilities decreased ¥636 million due to the drop in long-term debt, and total liabilities dropped ¥14 million to ¥6,165 million. Net assets decreased ¥1,472 million to ¥17,913 million, because of the decrease in retained earnings and the increase of treasury shares. As a result, equity ratio decreased 1.3% from the end of the previous term to 74.4%. The balance of interest-bearing debt decreased ¥655 million to ¥1,727 million.  There is no income from long-term debt anymore and the deficit in financial CF augmented. The cash positon dropped. (4) Topics

The company brought an action to Tokyo District Court in 2009, claiming that "the database produced and sold by Azesta Corporation was developed by illegally copying the database of Broad Leaf and therefore they violated the copyright thereof." ◎ The complete victory of Broad Leaf affirmed in the lawsuit for the infringement on the copyright of the database for the travel industry Although Broad Leaf won the first and second trials, Azesta Corporation filed a petition for a final appeal and for acceptance of their final appeal, but the complete victory of Broad Leaf became firm on this copyright infringement suit when the Supreme Court announced their decision that "We deny the petition for a final appeal. We won't accept this case in an appeal hearing" on December 15th, 2016. Regarding this, President Oyama commented as follows: "I think this unprecedented decision from the Supreme Court became a very important precedent for the companies like us who are in the information system industry because they fully accepted the decision from the Intellectual Property High Court, which for the first time gave recognition to the violation of the copyright of a database, and also accepted our claim for compensation against the former employee, who competed with us by wrongly taking our database despite fully knowing the importance of information asset, such as the development information and client information for corporate business operation. The data held by a company is an important asset in industries such as the information system industry. The database that manages important data is also an asset because we put in a wide range of technical know-how, labor and cost in order to protect the information and for its effective utilization. This decision from the Supreme Court is highly meaningful for us because it means that the effort of our employees applied to development was recognized and it will serve as a precedent. We will continue dealing in a firm manner with those companies and individuals who violate copyrights and illegally use it, and will continue working on the protection of our intellectual assets." |

| Fiscal Year December 2017 Earnings Estimates |

Sales to stay flat, and profit to drop due to increased investment

Sales for the term ending Dec. 2017 are forecasted to be ¥17 billion, nearly equal to those for the previous term. System sales is expected to remain sagging like the previous term, however, the sales from their network service will be healthy, as the company concentrates on this service. Operating income is predicted to decrease 10.2% YOY to ¥2 billion. The investments in human capital for the mid to long term growth, such as securing excellent human resources, will be increased. The dividend amount is to be ¥11.00/share for both the mid-term and term-end dividends. Taking into account the stock split that was conducted in December 2016, it indicates a ¥0.75/share increase from the previous term. The predicted payout ratio is 79.2%. (Since the company adopted the Japanese standards in the term ending December 2016, and started the voluntary application of IFRS in the term ending December 2017, increase/decrease rate is not included in the earnings summary.)   |

| Future business operation |

|

◎Review of the "2016-2017" medium-term management plan

The concept of the medium-term management plan is the expansion of the business domain by offering the data driven services. In order to improve the earning capacity, they are planning major changes in the charging system for system sales from fiscal year 2018. Therefore the goals for business performance and sales composition in fiscal 2017 were set with that in mind. Under the above concept, they are working on the following measures as their priority, with "Expansion of the customer base" and a "Shift in earnings structure" as their base strategy.

1. Popularize and standardize the electronic ordering service in this industry.

2. Development and release of new services and products 3. Development and release of the next generation system. 4. Reinforcement of the management base  ◎Awareness of the environment and the key strategy

There are no main competitors in the current automotive aftermarket. At the same time, the big change to the industrial structure including the maturity of the industry, the tendency away from system owning to using systems such as the cloud and the improvement in automatic driving technology, is giving the company attractive business opportunities and the company thinks it is a great chance to establish entry barriers for the future. With this as a backdrop, the company recognizes that proceeding with the changeover of the profit structure, and creating a new market which can sense the subtle shift, are important. Therefore, from this term through the next term, the company will push ahead with "Increasing new customers for the profit structure changeover" and "Active investments to create a new market" as their key strategy. In the term ending December 2018, while the renewal by their existing users goes into a gaining cycle, the company will continue doing active investment, including M&A, in order to expand their business domains and to create a new market, and forecasted that sales will be ¥19 billion (a 11.2% increase from the previous term) and operating income will be ¥3.2 billion (a 60% increase from the previous term). Operating income rate will dramatically go up from 11.8% to 16.8%. There will be no big change in the sales composition from the term ending December 2017. They are considering not only direct sales but also using distributors for reeling in new customers. As for the "expansion of the target market" that the company has been aspiring after, their plan is to create the value of their big data based on their massive client base by using the cloud, and create new services and new markets. |

| Interview with President Oyama |

|

"Our strength is the database that is unparalleled in not only quantity, but also quality. Our system will become the best in the world with the UI improvement."

"Overseas expansion in China and the Philippines is steadily progressing. First, we will develop a system for distributing parts."

"We are the only company that can establish a network with IT, using the strength of being neutral and independent in the automotive aftermarket. I want investors to support us with a mid to long term view."

|

| Conclusions |

|

These are important indicators as we monitor the company, which strives to establish the de facto standard in electronic ordering services, and we would like to keep watching their progress in this term. Also, we would like to pay attention to their progress of overseas expansion. |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Updated on Apr. 28, 2016 The company implements all principles of the Corporate Governance Code.  Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |