| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

1st Section of Tokyo Stock Exchange |

||

Industry |

Information, Communications |

||

President |

Kohei Antoku |

||

HQ Address |

39th Floor, Roppongi Hills Mori Tower, 6-10-1 Roppongi, Minato-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

*Stock price as of close on May 1, 2015.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. 20 for 1 and 2 for 1 stock splits were performed in September 2012 and October 2013 respectively.

* EPS has been adjusted to reflect these stock splits. |

|

| Key Points |

|

| Company Overview |

|

Native apps are those that can be enjoyed by users by downloading them to their smartphones. Browser applications, on the other hand, are not downloaded but can be accessed and enjoyed over various platforms like GREE, mixi, and Mobage. Both forms of applications are provided free of charge, but various items including tools (In the case of "Bokuno Restaurant II," recipes and items to decorate the interior of restaurants can be purchased to make the games more fun to use and more attractive to virtual customers within the game) used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a portion of the fees received is paid by enish to the platform providers as usage fees. <Management Policies: Creation of High Value Added Services, Provision of New Enjoyable Experiences>

First, in order to achieve the mission of "Creating enish Fans throughout the World" based upon the corporate slogan of "Link with Fun," enish's game designers, engineers, and art designers will create high value added services. Second, the Company maintains a fundamental management policy of "striving to be a company that always produces creators and specialists with skills that are recognized by the global market" and it will provide new enjoyable experiences through its social applications to users throughout the world. These two are the core management policies of enish.

<Company History>

<Business Description>

enish maintains only a single business segment entitled the social applications business (Games are considered as one type of application category). Based upon the Company's earnings foundation built up in the browser application business, enish is also fortifying its efforts in the newer native apps business. While games are provided free of charge, various items including tools used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a fee is paid by enish to the platform providers as usage fees. In addition, enish is cultivating the "Online to Offline (O2O) business where advertisements are posted within the games (Providing companies which seek to use games as opportunities to promote sales).

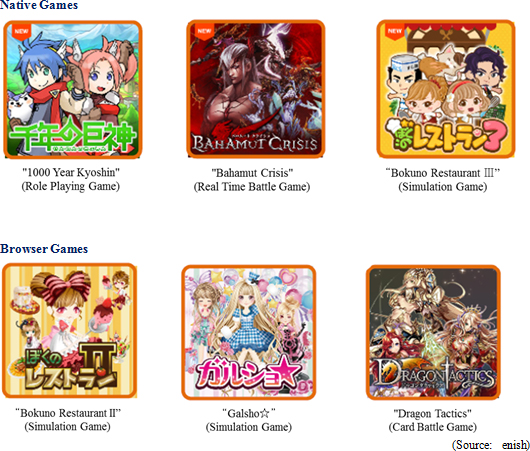

<Main Titles>

"Bokuno Restaurant II", "Galsho☆" and other management simulation games are long selling games that are popular with female users. In particular, sales of "Galsho☆"continue to grow despite the passage of four years since its release. The ratio of male to female users of browser based games is 39.1% to 60.9% respectively. enish is promoting a shift from browser games to native games and it has released three native games, namely "1000 Year Kyoshin", "Bahamut Crisis", and "Bokuno Restaurant III" during fiscal year December 2014.

<Growth Strategy>

Based upon the stable earnings derived from the long-selling browser based games, enish seeks to promote native games, global business deployment strategy (in Asia and English-speaking countries) and, furthermore, the O2O business as part of its strategy of expanding its overall business. During fiscal year December 2014, three native game titles were released along with the implementation of measures to strengthen hiring and training of human resources for the development structure of native games. Also, as part of its global business deployment, enish has set up locations in Korea, China, and Thailand and implemented preparation for content distribution.During fiscal year December 2015, enish will implement efforts to strengthen and fortify its overseas development structure in Asia and English-speaking countries. Furthermore, the Company will implement measures to create an organization of native game users within and outside of Japan and to invigorate this organization as part of the deployment of a full-scale O2O business.    |

| First Quarter of Fiscal Year December 2015 Earnings Results |

Anticipatory Investments Lead to ¥150 Million Operating Loss, in Line With Expectations

Sales fell by 13.8% year-on-year to ¥1.520 billion. Progression of the shift from browser games to native games led to a lull in demand due to bulk of new title launches being browser games and a lack of native game application new titles.With regards to profits, the lower sales accompanying a decline in commissions was compounded by a 10.9% year-on-year increase in cost of sales to ¥1.387 billion arising from labor and outsourcing fees for development of new titles. At the same time, sales, general and administrative expenses fell by 3.0% year-on-year to ¥283 million. Commissions associated with the strengthening of business in Korea and Thailand rose, but advertising expenses for updated existing titles and new title releases scheduled for the second quarter onwards were below budget. At the end of the first quarter, the number of employees rose by 18 from the end of the previous fiscal year to 196. Amongst these, 170 employees are employed in development and operation functions (An increase of 18 from the previous fiscal year end).   (2) Financial Conditions

At the end of the first quarter, total assets declined by ¥220 million from the end of the previous fiscal year to ¥3.235 billion. Deterioration in cash flow, and declines in cash and deposits, sales and accounts receivables were factors contributing to this decline. At the same time, the occurrence of a loss led to a decline in net assets. Equity ratio rose by 2.4% points from the end of the previous fiscal year to 85.3%.

|

| Fiscal Year December 2015 Earnings Estimates |

First Half, Full Year Earnings Estimates Remain Unchanged, Sales and Current Profit Expected to Rise 31.7% and 98.3% YY

enish estimates call for full year sales to rise by 31.7% year-on-year to ¥8.5 billion on the back of contributions from six new titles to be released during the summer, and from three native game titles launched last year which have been fine-tuned. The ratio of browser to native games during the first and second halves is expected to be 90% to 10%, and 40% to 60% respectively. With regards to profits, development expenses for new titles (Including those to be released in FY12/16) and other anticipatory investments are expected to continue to be under strict control. Also, ¥300,000 in advertising expense is expected to be paid per title with a flexible stance taken based upon the cost per acquisition (CPA) of users. Moreover, "1000 Year Kyoshin" and five other titles are expected to be launched in the overseas markets and their contribution to both sales and profits have not been factored into enish's estimates.

(2) Efforts to Expand Future Business

The introduction of new native games, the global expansion, and maintenance of a stable earnings structure are the three main themes of enish's business strategy. At the same time, measures will be implemented to improve the quality of both games and the development structure.

New Native Games Introductions

enish plans to develop a wide range of native games for both male and female users, with three original (In-house), two jointly developed and one publishing new titles (Four for male, and two for female users) are expected to be launched in fiscal year December 2015. The three original titles, namely "Valiant Soul" and "12 Odins" for male users, and a farming game for female users, are to be launched around the summer of 2015. "Valiant Soul" is a role playing game (RPG) that pits unique characters against each other in real time tactical battles. This title is widely expected to become a mid-core title in the major genre of games in the global market. "12 Odins" is one of the most typical RPGs that are based on the concept of linking people to each other and boasts of functions including real-time unified front battles and high levels of character creation (such elements can also command higher prices). The farming game is a light game that provides users the ability to manipulate cute characters to "experience farming."The two jointly developed titles are "Yurukami!" for male and an avatar game for female users. "Yurukami!" is expected to be released during summer 2015 and is an expanded version of a game developed by Square Enix Co., Ltd. This game is an RPG that allows users to search for and cultivate characters derived from various famous products and locations throughout Japan. The publishing title "Nekketsu Koha Kunio-kun" is also expected to be released during summer 2015. It is an action game featuring an ever-popular character "Kunio-kun." "Nekketsu Koha Kunio-kun" based upon "Kunio-kun" will be localized through the cooperation of a Based upon a product by a Korean manufacturer, with enish's participation in the planning, the game has been localized by featuring Kunio-kun, a familiar character in the Japanese market. Global Business Expansion

enish seeks to quickly establish a business foundation primarily in Asia to secure sales as part of its global business expansion. Currently, preparations for the distribution of "1000 Year Kyoshin" are in the final stages, and preparations are underway for the global launch of "Valiant Soul" and "12 Odins" in overseas markets shortly after their launch in the Japanese market is completed. In principle, enish will conduct distribution of titles on its own in regions where the Company maintains operations, but it will also collaborate with local partners depending upon the characteristics of titles and local regions. With regards to "1000 Year Kyoshin", distribution will be conducted in collaboration with Index Corporation for release in Thailand, while preparations are underway for distribution in Korea by Index's local office in Korea. Distribution in other regions are planned as well.

Maintenance of Stable Earnings Foundation

The earnings generating capability of existing browser and native games will be maintained by leveraging marketing capabilities. Management resources have been shifted from browser to native games, and operations have been outsourced with the goal of reducing costs (Shift completed during the first quarter). While important functions will continue to be managed internally, operational quality will be collateralized by conducting monthly reviews and ongoing quality checks with outsourcing partners to minimize potential declines in sales.In addition, ongoing fine-tuning of native games will also be performed. During the first quarter, efforts to fine-tune "1000 Year Kyoshin," "Bokuno Restaurant III," and "Bahamut Crisis" were conducted. As for "1000 Year Kyoshin" tuning efforts such as addition of a skill system and "player versus player" (PVP, capability of users to play each other) have been nearly completed. From an operations perspective, diversification of events to control consumption of contents will be conducted, along with the release of "Ver.2.0" as an updated version in May 2015. Furthermore, improvements in the game volume including events and action speed have been made in the full-scale renewal of "Bokuno Restaurant III". And PVP and GVG (Battle function where users can form teams) functions have been improved in the "Bahamut Crisis" game. Efforts to Improve Development Structure, Game Product Quality

In addition to reducing the risk of delays of releases by strengthening the progress management structure, efforts will be made to improve quality by fortifying the quality assurance and customer satisfaction (QA & CS) center. By strengthening the progress management structure, a new position of project management professional that is committed to strictly monitor progress in achievement of milestones has been established. Moreover, a structure that can confirm product quality at an early stage has been facilitated though prototyping.With regards to fortification of the QA & CS Center, enish's own QA & CS Center of the Thailand operations has been fortified. In addition, the development structure has been facilitated while collateralizing product quality by promoting quality assurance in the product development process. The internalization of customer satisfaction function is designed to increase customer satisfaction by being able to respond directly to customer inquiries. |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015, Investment Bridge Co., Ltd. All Rights Reserved. |