| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

1st Section of Tokyo Stock Exchange |

||

Industry |

Information, Communications |

||

President |

Kouhei Antoku |

||

HQ Address |

Roppongi Hills Mori Tower 39F 6-10-1, Roppongi Minato-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock price as of close on November 14, 2014.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. 20 for 1 and 2 for 1 stock splits were performed in September 2012 and October 2013 respectively.

* EPS has been adjusted to reflect these stock splits. |

|

| Key Points |

|

| Company Overview |

|

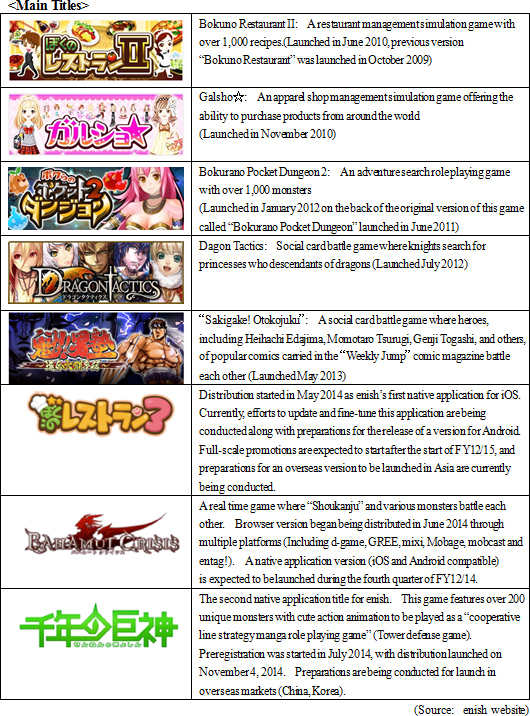

Native applications are applications which can be enjoyed by users by downloading them to their smartphones. At the same time, browser applications are not downloaded but can be accessed and enjoyed over various platforms like GREE, mixi, and Mobage. Both forms of applications are provided for free, but various items including tools (In the case of "Bokuno Restaurant II," recipes and items to decorate the interior of restaurants can be purchased to make the games more fun to use and more attractive to virtual customers within the game) used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a portion of the fees received is paid by enish to the platform providers as usage fees. <Business Description>

enish maintains only a single business segment entitled social applications business (Games are considered as one type of application category). Based upon foundation of the Company's earnings foundation built up in the browser application business, enish is also fortifying its efforts in the newer native applications business. While games are provided free of charge, various items including tools (In the case of "Bokuno Restaurant II," recipes and items to decorate the interior of restaurants can be purchased to make the games more fun to use and more attractive to virtual customers within the game) used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and fees are paid by enish to the platform providers as usage fees.

|

| Third Quarter of Fiscal Year December 2014 Earnings Results |

Decline in Existing Title Sales Halted, Sales and Profits Rise Over 2nd Quarter

Sales during the third quarter rose by 5.3% quarter-on-quarter to ¥1.569 billion. Effective operational restructuring efforts allowed sales of existing titles (Browser applications) to rise. The introduction of a browser version of "Bahamut Crisis" and efforts to expand the multi-platform strategy contributed to this increase in sales. Operating profit rose from ¥10 million in the second quarter to ¥63 million in the third quarter. A 1.8% point quarter-on-quarter rise in cost of sales margin to 81.1% during the third quarter resulting from increases in commissions paid (Variable costs) accompanying higher sales was offset by higher sales and reductions in sales, general and administrative expenses, including advertising expenses, and allowed operating profits margin to improve. The decline in advertising expenses is attributed to the lack of promotions for new titles.

Sales, Current Profit Decline 0.5%, 72.3% Year-On-Year

While resilient demand for existing titles allowed sales to remain basically in line with the same term of the previous fiscal year, developmental expenses associated with titles to be newly introduced in the current and the coming terms contributed to a 21.0% year-on-year increase in cost of sales. Higher labor and hiring expenses contributed to an 11.1% year-on-year rise in sales, general, and administrative expenses and impacted profits. However, the increases in labor, outsourcing, personnel and hiring expenses remained within expectations in reflection of enish's effective cost control function.At the end of the third quarter (September 2014), the total number of staff stood at 190, including 17 consigned staff. By category of workers, engineers, designers, directors, and administrative staff accounted for 28%, 33%, 24% and 15% of the total staff numbers respectively. In addition to optimized allocation of staff with the goal of achieving higher efficiencies in each work application, enish will continue to hire highly qualified staff (Previously, the Company has relied upon headhunting and human resources companies, but internal programs of introductions from existing staff have been effective in helping to hold down hiring costs).   |

| Fiscal Year December 2014 Earnings Estimates |

Anticipatory Investments Increased in Fourth Quarter to Secure Growth from Coming Term Onwards

While the sales of existing titles are expected to decline on a quarter-on-quarter basis due to a contraction in the browser application segment of the market, positive contributions from stronger than expected sales of browser versions of "Bahamut Crisis", full-scale promotion of "Sennen no Kyoshin" (Grand Gods of the Millennium) and the start of distribution of native versions of "Bahamut Crisis" are anticipated. With regards to profits, continued efforts to control costs will be implemented, but anticipatory investments are also expected to be made to ensure growth from the following term onwards. Specifically, developmental and advertising expenses (Primarily for new titles) are expected to rise between ¥0.1 to ¥0.2 billion and ¥0.2 to ¥0.3 billion respectively for a total increase of about ¥0.5 billion (Actual spending will be flexibly adjusted up or down depending upon the effectiveness of each).

(2) Outlook for Various Titles during the Fourth Quarter

enish will attempt to improve profitability by fortifying its operational structure for its existing browser applications business, but a gradual decline in sales is anticipated due to contraction in the market. At the same time, preregistration for distribution of the new title "Sennen no Kyoshin" was launched in July 2014 (Preregistrations exceeded 100,000). Furthermore, distribution of native application versions of "Bahamut Crisis", which was launched as a browser version in June 2014, for iOS and Android are expected to start in the fourth quarter. At the same time, large-scale updates and fine-tuning of the native application "Bokuno Restaurant 3", which was launched for iOS in May 2014, are currently being implemented. After completion, distribution of Android versions will be started along with full scale sales promotion for this title. Full scale contribution is anticipated from fiscal year December 2015 onwards.

With the goal of achieving offshore development and local distribution and operations of applications, enish established a subsidiary in Seoul, Korea in November 2013 and another in Shanghai, China in April 2014. Currently, the Korean subsidiary is developing two titles and the Chinese subsidiary one title. Moreover, the three markets of Japan, China and Korea are expected to account for over half of the total worldwide mobile game market within the next several years. The Thai subsidiary was established in July 2014 with the goal of improving product quality through the implementation of CSQA (CS = Customer Service, QA = Quality Assurance) and reducing costs. While the three subsidiaries are not yet consolidated, they are expected to be considered as consolidated subsidiaries in the future based upon the "principle of materiality".  |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015 Investment Bridge Co., Ltd. All Rights Reserved. |